Abstract

The meteoric rise of mobile banking technologies in Africa is a result of an increasing penetration of smartphones and internet. Although successful studies have covered a set of themes around mobile banking and recognized the great potential existing in Africa, very few of them have examined the motivations related to its adoption and its daily use by consumers in developing countries. To fill this research gap, this study investigates on the adoption of mobile banking by consumers in sub-Saharan Africa. It is based on several theoretical models such as TAM and DeLone and McLean IS success Model to better assess the acceptance of mobile banking on African consumers. The proposed research model was assessed and supported by a data collection from 479 mobile banking users. The last section of the paper focuses on the formulation of practical implications for future work and studies in mobile banking.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Following an exponential penetration of smartphones and internet in Sub-Saharan Africa, Mobile Banking (M-Banking) has emerged as a powerful technology capable of reversing economic, financial and social trends for stakeholders. This technology could transform virtually the entire decision-making financial chain, in particular in the reduction of the costs of financial services, the reduction of the process of purchase/payment of a good or services, or the security of transactions by end-to-end encryption [1, 2].

Although several empirical studies have recognized the value and strategic position of M-Banking for low income consumers, few of them have assessed the real impact in developing countries. As a result, several questions are emerging such as the consumer’s attitude and impact of M-Banking in low-income African households as well as the influence on small businesses and informal sector activities, which account for the vast majority of employment in many cities in low-income countries in Africa [3]. The African development Bank revealed that low income countries in Africa have 16.6% of the penetration rate of deposit institution penetration, which is the lowest rate in the world, compared to 63.5% in other countries [4]. The M-Banking is therefore a solution that can stimulate the economy and facilitate access to finance for many low-income households in sub-Saharan Africa. For this reason, this study aims to fill the knowledge gap by modeling an extended approach of the Technology Acceptance model (TAM) that includes the DeLone McLean model along with Social Influence to assess the degree of acceptance and use of mobile banking in low-income African countries.

We rely on successful studies on M-Banking and challenges faced by banks in Africa due to the explosive penetration of technology in the financial system to meet our research objective. After having established the cutting edge of M-Banking in sub-Saharan Africa at the introduction, the first section describes the theoretical development and highlights the results of studies that have been conducted on M-Banking. The following sections of this study are devoted to our research methodology and the presentation of results and various related discussions.

The last part of the paper highlights the implications that emerge from our studies, and limitations that results, following the research perspectives of the study.

2 Background Study

2.1 Mobile Banking in Developing Economies in Africa

Sub-Saharan African Countries are facing several challenges in Technological Infrastructures. In spite of efforts and investments made by governments to harmonize the technological environment, Mobile Banking Services (MFS) are largely unexplored yet promising in the face of growing economic forces. While access to financial services is still a mystery for 2.7 billion people, more than a billion of potential consumers do not have a bank account [4]. Most of Banks in Sub-Saharan Africa are facing the definition of a sometimes-high cost model, which excludes the heavily impacted low-income category. The Consulting firm McKinsey revealed that by 2017, Bank penetration was only 38% of gross domestic product in Africa. This relatively low rate is only the average of the world average for emerging economies [5]. While the proportion of users with a bank account has increased by 4% in Sub- Saharan Africa, the one with a mobile money account has doubled in recent years, up to 21% [6]. Most low-income countries in Africa have the highest mobile money penetration rate in the world, exceeding 10% [6]. In East Africa, where the proportion of mobile money penetration is the highest on the continent with a 34% increase, the penetration of banks and other financial institutions remains constant at 24% [7]. Many Fintech digital ecosystem startups that have access to important investment funds are leaning more and more towards the mobile financial services (MFS) [8] (Fig. 1).

2.2 Related Work

M-Banking in Africa has already proven itself as a reliable, viable and cost-effective system, capable of providing a myriad of inclusive development benefits. Empowering migrant women entrepreneurs in Ghana, its influence in promoting financial inclusion in Kenya [9,10,11], or in improving and facilitating access to health services by poor people from South Africa and Swaziland [12, 13]. M-Banking has largely contributed to a redistribution of wealth, thus helping to reduce income inequality in several African countries [14]. In sales and marketing, it has facilitated business opportunities and the dematerialization of financial transactions [15] (p. 505).

In Education, [16] used the usual TAM constructs to assess the use of mobile banking services among university students. Further, the work of [17] condensed the TAM and UTAUT models to better examine Generation Y’s intention to adopt M-Banking services. In agriculture, M-Banking has confirmed to be a technology that reduces agricultural prodigality while significantly improving household management in Nigeria and Kenya [18, 19]. In Kenya, mobile banking has brought about a revolution in the financial stability of low-income households. The study of [20] revealed that households related to the use of M-PESA were able to significantly increase their income by overcoming problems such as job loss, poor harvests, without reducing their daily consumption. Contrarily, the same study reported that financial difficulties led non-users of the M-PESA banking system to drastically reduce their spending in households by 7%. Mobile Banking Services can therefore be seen as shortcuts to financial inclusion in several low-income countries in Africa [21]. Developed countries, unlike low-income countries, have strong financial institutions that provide widespread financial services. They can rely on this notoriety and ease of access to offer consumers online financial services with upstars like Google Wallet, Stripe, Venmo, Amazon Payment, WePay, Square, Pauline that pushes the envelope.

Following these previous works, it is undeniable not to recognize the strategic position that occupies mobile banking in Sub-Saharan Africa. All sectors of daily life are affected, and the impacts are socially, culturally and financially measurable.

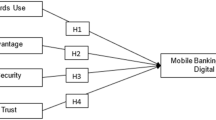

2.3 Theoretical Development

The research model (Fig. 2) proposed in this study is an appendage of the TAM [22, 23] tailored to mobile banking adoption in low income countries in Africa. TAM has been proposed for the first time by Davis to gauge the degree of use or non-use of a technology by an individual. Davis argues that the TAM assists in providing a general answer of the factors contributing to the acceptance of a technology. this answer would therefore be a response to the behavioral analysis of users following the use of a range of computer technologies [22] (p. 985). The TAM has been used and customized in many areas of information systems by several scholars. [24] has extended the TAM with the DeLone and McLean IS success Model to measure the acceptance of M-Banking services in the Jordanian banking system. [25] united the TAM with Innovation and Diffusion Theory to estimate hindrances to M-Banking adoption among young German consumers. [26] linked the TAM with the TPB model in order to understand Emiratis motivations and perceptions in the acceptance of M- Banking. [27] developed and tested several versions of TAM in order to explore the intentions that users can adopt when it comes to M-Banking. [28] schematized a research model hinged on the TAM along with the task-technology fit model (TTF) and perceived risk, all in the expectance-confirmation model (ECM). Furthermore, [29] extended the traditional TAM with social image, trust and perceived risk to evaluate the intention to use mobile banking apps among Spanish customers.

Based on the previous of research, we suggest a set of hypotheses in the context of M- Banking daily usage by consumers in Sub-Saharan Africa:

-

H1: System Quality (SQ) has a significant positive impact on Perceived Credibility (PC).

-

H2: System Quality has a significant positive impact on Perceived Ease of Use (PEOU).

-

H3: Information Quality (IQ) has a significant positive impact on Perceived Usefulness (PU).

-

H4: Information Quality (IQ) has a significant positive impact on Perceived Ease of Use (PEOU).

-

H5: Perceived Usefulness (PU) has a significant positive impact on Attitude (ATT).

-

H6: Perceived Ease of Use (PEOU) has a positive impact on Perceived Usefulness (PU).

-

H7: Perceived Ease of Use (PEOU) has a positive impact on Attitude (ATT).

Besides, [30] argued that Perceived Credibility (PC) plays a leading role in the context of M-Banking technology in low-income countries.. It is a digest of trust, caution and privacy evoking an individual’s perception of believing that another individual has the ability to perform a task reliably [30]. Verily, previous studies have shown the importance of credibility when referring to a technological system, moreover, in relation to its bank account [2, 31, 32].

In addition, social influence (SI) is also considered in several works as being a decisive construct in the adoption of mobile banking. Yu’s empirical study on 441 respondents in Taiwan reported that social influence is the most important predictor of acceptance of M-Banking. It mainly contributes to the explanation of the use of an accounting computer system by young entrepreneurs [33]. Many technology enthusiasts among whom the students give a great interest to the new technological inventions because of their curiosity in the use, and their enthusiasm in the handling of the tool. They find themselves being influenced by their peers in the use of mobile banking applications that are usually installed on smartphones [16].

We therefore build on these previous studies and suggest that, with respect to the banking environment in relation to mobile technologies, PC between stakeholders in the M-Banking system will play a key role. This role is not only in mobile banking use, but also in the adoption, continuous use, satisfaction and even for recommendations. Thus, we suggest that:

-

H8: Perceived Credibility (PC) has a significative positive impact on Attitude (ATT).

-

H9: Social Influence (SI) has a positive impact on Mobile Banking Adoption (MBA).

-

H10: Attitude (ATT) has a significant positive impact on Mobile Banking Adoption (MBA).

3 Research Approach

3.1 Instrument

To carry out our investigations, a questionnaire of 24 items was set up. It was divided into two components. The first component was the measurement elements of the eight constructs defining the research model (SQ, IQ, PU, PEOU, SI, ATT, MBA). Each construct contains between two and four questions. These questions correspond to items measured following a Likert Scale graduated from 1 - “strongly disagree” to 7 - “strongly agree”. The second component contains 05 questions that concern exclusively descriptive statistics data including sex, age, educational level, place of residence, as well as experience in the use of a smartphone (Table 1).

A pilot test was run with 50 mobile banking consumers in order to improve the understanding of the items/questions. This pilot test also helped to modify the structure of the questionnaire to eliminate any ambiguities. Subsequently, the survey was inserted on google forms and adapted to match the different ones where it will be open and filled.

3.2 Data Collection

For this study, the data collection was conducted from April to July 2019. The questionnaire was shared according to various web 2.0 platforms such as social media (Facebook, twitter, WhatsApp, Instagram, Telegram), as well as by email. It has also been distributed in banks where there is a high rate of use of mobile banking services. With the purpose of diversifying the type of respondents, the survey was sent to people from various activities, so that we could have a real actual perception and thus better identify the factors contributing to the acceptance of M-Banking.

3.3 Data Assessment Methods

Following the recommendations of [34], we adopted the dual approach for structural equation modeling (SEM). This method has been successfully adopted in several works in the field of Information Systems, where the TAM was used [35,36,37,38,39]. The PLS-SEM method is the most suitable in this study because it takes into account path and factor analysis [40, 41]. SmartPLS v. 3.2.8 was used to conduct the data analysis. According to several aspects of measurements and assessments, PLS-SEM method consider the reliability and the validity of the measuring instruments and the hypotheses of a quantitative study [41]. This method is also used to test the causal model and integrating several latent variables [42]. Its widespread use in quantitative studies is explained by the fact that it jointly estimates the structural coefficients and factors of the measurement elements of the research model [43].

4 Results

4.1 Data

Following the data collection process, we obtained 479 respondents. Since the form was filling out via Google forms, we did not have any missing data in view of the obligation to answer each question. Respondents’ descriptive characteristics, including age, gender, education level, and experience with mobile phone use, are recorded in Table 2. We have a high rate of male respondents with a percentage of 57%, compared with 43% of women. In addition, most of our respondents are between 26–35 years old, followed by those between 18 and 25 years old. We also note that many of them went to school and have good experience in the use of smartphones.

4.2 Reliability of the Measurement Model

The reliability of internal consistency can be measured using composite reliability [41, 44]. Furthermore, we observe a composite reliability varying between 0.812 and 0.862, well above the acceptable threshold of 0.7 [45,46,47]. The same observation is made on the loadings varying between 0.700 and 0.842, being thus higher than the acceptable threshold. In order to better measure the discriminant validity, [48] suggests using the Average Variance Extracted (AVE) following a threshold above 0,5. It’s the distributed variance between the measurement elements of a construct [49]. In view of the results recorded in Table 3, the AVEs of all our constructs are between 0.570 and 0.747 (Table 4).

4.3 Hypothesis Testing

Tables 5 and 6 show the results of our structural model. All the assumptions of our research model were supported. The results of the study thus argue that social influence in a neutral economic environment, has a significant positive effect on the M-Banking adoption. In other words, regardless of the economic situation of a developing country, the fact M-Banking is welcomed, used and adopted by a group of individuals influences people who are close to this group to use and adopt mobile banking services.

The results also showed the key role of perceived credibility in M-Banking usage. Indeed, for a technology system coupled with finance to be adopted, it must be considered credible. Not only by the people who use it, but also by its ability to secure information, its relationship of trust with user.

5 Discussion

This study finds a strong endorsement of the Technology Acceptance model coupled with M-Banking in a low-income context. Our results corroborate the assertion that PEOU and PU indirectly influence the adoption of M-Banking through attitude (H1), which is in line with the work of [50,51,52]. Additionally, our results show that there is a direct positive influence of the SQ and IQ on PEOU and PU. Furthermore, we noticed that all the hypotheses proposed in our study are significant at 0.001 except SI → MBA which is significant at 0.05. Thus, all the suggested hypotheses in this study are supported.

6 Limitations and Future Research Directions

The measurement model developed in this study revealed preliminary analysis of the structural model with respect to the acceptance of M-Banking services by consumers in emerging economies within sub-Saharan Africa. The next step will be to improve the proposed research model and the survey. This improvement will concern the items/questions that will be increased in order to better evaluate the constructs of the research model and therefore the scales of measures of reliability. We also want to investigate potential differences in perceptions that may arise in the use of mobile banking among the groups of respondents. We will therefore distinguish young people from old people, people with strong experience in the use of ICTs and novices in the use of ICT.

Moreover, future studies could extend this research model by incorporating new constructs such as Perceived Risk, or Perceived Privacy in view of the importance of these constructs when it comes to financial transactions [53]. The Task–Technology Fit model (TTF) could also be combined with this research model in future studies to better explain and understand the acceptance of M-Banking not only from an adoption perspective, but also according to adjustments between the features offered by mobile banking applications, and the actual tasks to be performed by users when using mobile banking technologies. Besides, this study will serve as a point of departure in case future longitudinal studies could be conducted to better describe the acceptance of M-Banking within low income countries. Future studies could also focus on the unobserved discrepancy in the use of SEM regarding the acceptance of M-Banking in Sub-Saharan Africa.

7 Conclusion

In this study, we refined a research model regarding the acceptance and use of M- banking by citizens of emerging economies in Africa. Initially, we proceeded to an extension of the original TAM by incorporating new constructs that are prerequisites for a strong acceptance of M-Banking in developing countries: the quality of the banking system, the quality of the information that is diffused as well as other constructs such as the social influence and perceived risk. Subsequently, we’ve designed a measurement model that was used to complete a survey to better assess the perception of mobile banking users. The survey was sent to 479 consumers of mobile banking system following several channels of communication such as social media, emails. At the end of this data collection, the PLS algorithm on SmartPLS 3.2.8 allowed us to evaluate the reliability and validity of our measurement model. After this step, we obtained the evaluation of the structural model proposed by the Bootstrapping method of Structural Equation modeling. The results of the study show that the adoption of a M-Banking system is subject to a good quality of the system and the good quality of the information that must be disseminated. This means that, for widespread acceptance and efficient use of a mobile banking system in developing countries, banking institutions and even governments should increase their efforts towards a better quality of the proposed system, and better quality of information. In addition, the results also showed that social influence dominates the adoption of mobile banking in Low income economies within Africa. This demonstrates the importance of external pressure when it comes to touting the merits of a technological system to potential users. Financial institutions can use their influencers’ strengths to get potential customers to use their products. At the same time, the pressure put on by those close to a potential consumer of mobile banking services also plays a key role in the ambition to make him adopt a mobile banking service. To conclude, the study highlights a number of items to consider when it comes to M-Banking in sub-Saharan African countries.

References

Sharma, S.K.: Integrating cognitive antecedents into TAM to explain mobile banking behavioral intention: a SEM-neural network modeling. Inf. Syst. Front. 21, 815–827 (2019). https://doi.org/10.1007/s10796-017-9775-x

Priya, R., Gandhi, A.V., Shaikh, A.: Mobile banking adoption in an emerging economy: an empirical analysis of young Indian consumers. Benchmarking Int. J. 25, 743–762 (2018)

Sparks, D.L., Barnett, S.T.: The informal sector in Sub-Saharan Africa: out of the shadows to foster sustainable employment and equity? Int. Bus. Econ. Res. J. (IBER) 9 (2010)

Ondiege, P.: Mobile banking in Africa: taking the bank to the people. Afr. Econ. Brief 1, 1–16 (2010)

Chironga, M., Cunha, L., De Grandis, H.: Roaring to Life: Growth and Innovation in African Retail Banking. McKinsey & Company, New York (2018)

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., Hess, J.: The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. The World Bank, Washington, D.C. (2018)

Demirguc-Kunt, A., Klapper, L., Singer, D., Van Oudheusden, P.: The Global Findex Database 2014: Measuring Financial Inclusion Around the World. The World Bank, Washington, D.C. (2015)

Pasti, F.: State of the Industry Report on Mobile Money: 2018 (2019)

Buku, M.W., Meredith, M.W.: Safaricom and M-PESA in Kenya: financial inclusion and financial integrity. Wash. J. Law Technol. Arts 8, 375 (2012)

Donovan, K.: Mobile money for financial inclusion. Inf. Commun. Dev. 61, 61–73 (2012)

Asongu, S., De Moor, L.: Recent advances in finance for inclusive development: a survey (2015)

Leon, N., Schneider, H., Daviaud, E.: Applying a framework for assessing the health system challenges to scaling up mHealth in South Africa. BMC Med. Inform. Decis. Mak. 12, 123 (2012)

Kliner, M., Knight, A., Mamvura, C., Wright, J., Walley, J.: Using no-cost mobile phone reminders to improve attendance for HIV test results: a pilot study in rural Swaziland. Infect. Dis. Poverty 2, 12 (2013)

Asongu, S.A., Kodila-Tedika, O.: Is poverty in the African DNA (Gene)? S. Afr. J. Econ. 85, 533–552 (2017)

Mishra, V., Bisht, S.S.: Mobile banking in a developing economy: a customer-centric model for policy formulation. Telecommun. Policy 37, 503–514 (2013)

Govender, I., Sihlali, W.: A study of mobile banking adoption among university students using an extended TAM. Mediterr. Ean J. Soc. Sci. 5, 451 (2014)

Boonsiritomachai, W., Pitchayadejanant, K.: Determinants affecting mobile banking adoption by generation Y based on the Unified Theory of Acceptance and Use of Technology Model modified by the Technology Acceptance Model concept. Kasetsart J. Soc. Sci. (2017). https://doi.org/10.1016/j.kjss.2017.10.005

Oluwatayo, I.: Banking the unbanked in rural southwest Nigeria: showcasing mobile phones as mobile banks among farming households. J. Financ. Serv. Mark. 18, 65–73 (2013)

Kimenyi, M., Ndung’u, N.: Brookings Institution. Expanding the Financial Services Frontier: Lessons from Mobile Phone Banking in Kenya. Brookings Institution, Washington, D.C. (2009)

Jack, W., Suri, T.: Risk sharing and transactions costs: evidence from Kenya’s mobile money revolution. Am. Econ. Rev. 104, 183–223 (2014)

Rosengard, J.K.: A quantum leap over high hurdles to financial inclusion: the mobile banking revolution in Kenya (2016)

Davis, F.D., Bagozzi, R.P., Warshaw, P.R.: User acceptance of computer technology: a comparison of two theoretical models. Manag. Sci. 35, 982–1003 (1989)

Venkatesh, V., Davis, F.D.: A theoretical extension of the technology acceptance model: four longitudinal field studies. Manag. Sci. 46, 186–204 (2000)

Alsamydai, M.J.: Adaptation of the technology acceptance model (TAM) to the use of mobile banking services. Int. Rev. Manag. Bus. Res. 3, 2039 (2014)

Koenig-Lewis, N., Palmer, A., Moll, A.: Predicting young consumers’ take up of mobile banking services. Int. J. Bank Mark. 28, 410–432 (2010)

Aboelmaged, M., Gebba, T.R.: Mobile banking adoption: an examination of technology acceptance model and theory of planned behavior. Int. J. Bus. Res. Dev. 2 (2013)

Gu, J.-C., Lee, S.-C., Suh, Y.-H.: Determinants of behavioral intention to mobile banking. Determ. Behav. Intent. Mob. Bank. 36, 11605–11616 (2009)

Yuan, S., Liu, Y., Yao, R., Liu, J.: An investigation of users’ continuance intention towards mobile banking in China. Inf. Dev. 32, 20–34 (2016)

Munoz-Leiva, F., Climent-Climent, S., Liébana-Cabanillas, F.: Determinants of intention to use the mobile banking apps: an extension of the classic TAM model. Span. J. Mark. ESIC 21, 25–38 (2017)

Crabbe, M., Standing, C., Standing, S., Karjaluoto, H.: An adoption model for mobile banking in Ghana. Int. J. Mob. Commun. 7, 515–543 (2009)

Luarn, P., Lin, H.-H.: Toward an understanding of the behavioral intention to use mobile banking. Comput. Hum. Behav. 21, 873–891 (2005)

Amin, H., Hamid, M.R.A., Lada, S., Anis, Z.: The adoption of mobile banking in Malaysia: the case of Bank Islam Malaysia Berhad (BIMB). Int. J. Bus. Soc. 9, 43 (2008)

Yu, C.-S.: Factors affecting individuals to adopt mobile banking: empirical evidence from the UTAUT model. J. Electron. Commer. Res. 13, 104 (2012)

Anderson, J.C., Gerbing, D.W.: Structural equation modeling in practice: a review and recommended two-step approach. Psychol. Bull. 103, 411 (1988)

Rauniar, R., Rawski, G., Jei, Y., Johnson, B.: Technology acceptance model (TAM) and social media usage: an empirical study on Facebook. J. Enterp. Inf. Manag. 27, 6–30 (2014). https://doi.org/10.1108/JEIM-04-2012-0011

Hsu, M.-W.: An analysis of intention to use in innovative product development model through TAM model. Eurasia J. Math. Sci. Technol. Educ. 12, 487–501 (2016). https://doi.org/10.12973/eurasia.2016.1229a

Venkatesh, V., Davis, F.D.: A theoretical extension of the technology acceptance model: four longitudinal field studies. Manag. Sci. 46, 186–204 (2000). https://doi.org/10.1287/mnsc.46.2.186.11926

Schneberger, S., Amoroso, D.L., Durfee, A.: Factors that influence the performance of computer-based assessments: an extension of the technology acceptance model. J. Comput. Inf. Syst. 48, 74–90 (2008). https://doi.org/10.1080/08874417.2008.11646011

Watat, K., Fosso Wamba, S., Kamdjoug, K., Robert, J.: Use and influence of social media on student performance in higher education institutions in Cameroon (2018)

Henseler, J., et al.: Common beliefs and reality about PLS: comments on Rönkkö and Evermann (2013). Organ. Res. Methods 17, 182–209 (2014)

Chin, W.W.: The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 295, 295–336 (1998)

Chou, C.-P., Bentler, P.M.: Estimates and tests in structural equation modeling (1995)

Hair Jr., J.F., Sarstedt, M., Hopkins, L., Kuppelwieser, V.G.: Partial least squares structural equation modeling (PLS-SEM) an emerging tool in business research. Eur. Bus. Rev. 26, 106–121 (2014)

Tenenhaus, M.: L’approche PLS. Revue de statistique appliquée 47, 5–40 (1999)

Fornell, C., Larcker, D.F.: Structural equation models with unobservable variables and measurement error: algebra and statistics. J. Mark. Res. 18, 382–388 (1981). https://doi.org/10.1177/002224378101800313

Nunnally, J.C.: Psychometric Theory. McGraw-Hill, New York (1978)

Ab Hamid, M., Sami, W., Sidek, M.M.: Discriminant validity assessment: use of Fornell & Larcker criterion versus HTMT criterion. In: Proceedings of Journal of Physics: Conference Series, p. 012163 (2017)

Fornell, C., Larcker, D.F.: Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18, 39–50 (1981)

Valentini, F., Damásio, B.F.: Average variance extracted and composite reliability: reliability coefficients. Psicologia Teoria e Pesquisa 32 (2016)

Karjaluoto, H., Riquelme, H.E., Rios, R.E.: The moderating effect of gender in the adoption of mobile banking. Int. J. Bank Mark. 28, 328–341 (2010)

Püschel, J., Afonso Mazzon, J., Hernandez, J.M.C.: Mobile banking: proposition of an integrated adoption intention framework. Int. J. Bank Mark. 28, 389–409 (2010)

Akturan, U., Tezcan, N.: Mobile banking adoption of the youth market: perceptions and intentions. Mark. Intell. Plan. 30, 444–459 (2012)

Baabdullah, A.M., Alalwan, A.A., Rana, N.P., Kizgin, H., Patil, P.: Consumer use of mobile banking (M-Banking) in Saudi Arabia: towards an integrated model. Int. J. Inf. Manag. 44, 38–52 (2019)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Watat, J.K., Madina, M. (2020). Towards an Integrated Theoretical Model for Assessing Mobile Banking Acceptance Among Consumers in Low Income African Economies. In: Themistocleous, M., Papadaki, M. (eds) Information Systems. EMCIS 2019. Lecture Notes in Business Information Processing, vol 381. Springer, Cham. https://doi.org/10.1007/978-3-030-44322-1_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-44322-1_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-44321-4

Online ISBN: 978-3-030-44322-1

eBook Packages: Computer ScienceComputer Science (R0)