Abstract

Cooperation between competing firms called coopetition has increasing relevance to business practice. However, firms and their managers who want to enjoy the benefits of coopetition are also aware of the risks that it entails. The key questions need to be answered: under which circumstances firms are willing to coopete and to keep the arrangement, what factors are decisive, and when benefits are most significant. In the paper, we are looking for answers to these questions on the basis of coopetitive real options games. We consider the case of two firms that can establish a coopetition arrangement to implement an investment project (each firm possesses a shared investment option). In the paper, we point out conditions under which coopetition between companies is easy, tough or impossible. The key factors are the project risk and the size of market shares. In particular, it is worth noting that for high-risk projects, the area of tough coopetition is larger than for low-risk projects. A large disproportion in market shares makes coopetition rather impossible.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Codes

9.1 Introduction

Competition and cooperation are two basic forms of relationships between companies on the market. However, the main strategic challenge for many firms is not to choose between competition and cooperation, but to find a balance between them. Cooperation between competing firms called coopetition has increasing relevance to business practice. It is one of essential ways to create value and competitive advantage on a market. Value creation, which requires combining complementary resources and unique competences of both partners and sharing its value, is a hallmark of coopetition. If pure competition is a zero-sum game between parties, where a single winner takes all, and cooperation is a positive-sum game, where both firms benefit and it is a win–win situation, then coopetition is a positive-sum game and it could be even a win–win–win situation, where the third beneficiary is a consumer (Walley 2007).

In general, previous studies have shown that coopetition between potential competitors really matters in their strategies and performance. However, the intensity of this impact depends on the characteristics of the sector in which firms operate. Previous studies suggested that coopetition occurs in knowledge-intensive sectors in which rival firms collaborate in creating interoperable solutions and standards, in sharing R&D costs and efforts, and in sharing risks. On the other hand, coopetition is not a necessary factor for success in sectors that are less knowledge-intensive, such as manufacturing (examples are given by Ritala 2012). However, systematic study of coopetition still requires many aspects to consider.

Strategies built on a coopetition arrangement are rarely stable (Das and Teng 2000). The coopetition agreement can be broken at any moment by any partner-rival. Managers of these partner-rival firms must create strategies and develop processes that are not fully controllable (Dagino and Padula 2002). Managers must also manage with different tensions arising on many levels (Fernandez et al. 2014).

So, one of the questions that managers face is: are there any chances to successfully complete the project under a coopetition agreement? And: how substantial is the risk that the partner will withdraw from the contract? How much will the firm benefit from this agreement? And if at all?

This is a business problem on one side and an academic challenge on another. One of the paths considered to face this problem in the field of academic research is the game theory approach. Nalebuff and Brandenburger (1996) were the first who proposed game theory to describe the interactive process of cooperation and competition. Next, a hybrid noncooperative–cooperative game model called a biform game was proposed by Brandenburger and Stuart (2007). And, as authors say, the biform model is a formalization of the idea that business strategies shape the competitive environment—and thereby the fortunes of the players. David Carfi (2010) proposed an analytical model of coopetitive games and its feasible solutions. Coopetitive games’ applications to economics and finance were developed e.g. by Carfi and Schiliro (2012, 2013). Rychłowska-Musiał (2017) proposed the real options games approach to analyze a coopetition relationship.

The main aim of the paper has been built on the crucial managerial questions formulated in an academic way. The paper aims to provide a framework to analyze the proneness to coopetition between firms which market shares are substantially different or almost equal, benefits that rival-partner firms may achieve, and influence of crucial factors on firms’ decisions/strategies. It addresses: (1) under which circumstances firms are willing to coopete, (2) what is the impact of the degree of asymmetry between companies and the risk of the project on the proneness to coopetition, (3) under which circumstances companies are willing to keep the cooperation agreement, and when they may be tempted to break it.

The paper also provides a contribution to the existing literature on real options and coopetitive games by combining these two areas in order to more suitable analysis of relationship between firms sharing an investment option.

9.2 Firms’ Decisions and Payments

Let us assume that two parties A and B operate on a competitive market and each of them holds a real option to invest in a project. The project requires an investment outlay \( I \), \( I > 0 \) (this may be both financial as well as non-financial contribution). The two competitors share the same investment opportunity, it is a shared option (Smit and Trigeorgis 2004). We assume that the lifetime of the investment project is infinite. The investment project generates a cash flow \( (Y_{t} ) \), which evolves in accordance with the geometric Brownian motion, with drift \( \alpha \), \( \alpha > 0 \) and volatility \( \sigma \), \( \sigma > 0 \) under the risk-neutral measure. A risk-free asset yields a constant rate of return r, δ is a convenience yield \( (\delta > 0) \) and it reflects an opportunity cost of delaying construction of the project, and instead keeping the option to invest alive. The present value of the project benefits is determined by the discounting and accumulating of its future cash flows. It is equal to \( V\left( {Y_{0} } \right) = \frac{{Y_{0} }}{\delta } \) (Dixit and Pindyck 1994).

According to Dixit and Pindyck (1994) we assume the following links between model parameters:

where \( r_{m} \) is the expected return on the market on which the financial asset perfectly correlated with \( Y_{t} \) is listed, \( \sigma_{m} \) is the standard deviation of \( r_{m} , \) and \( \rho_{m} \) is the correlation of this financial asset with the market portfolio.

When a firm is considering implementation of the project there are three basic strategies for it to choose from: Wait, Invest, or Abandon. The primary criterion for making investment decisions is the comparison between the investment option value, the benefits of instantaneous investment, and zero. However, in the case of the shared option, a firm has to include its rival’s decision into its decision-making process. A firm has to take into account the way its investment decision affects competitors, and how it itself may be impacted by rival’s reaction.

When both firms are active on a market there may be a market power asymmetry between them. Without any loss of generality, we will assume that firm A has \( u \) market share \( (0.5 \le u < 1) \), firm B is left with \( (1 - u) \) share. If only one of the firms decides to invest—it obtains the whole market. The firm which deferred its investment loses its market share in favor of the investing firm.

The logic of coopetition is that cooperation and competition merge together to form a new kind of strategic interdependence between firms, giving rise to a coopetitive system of value creation (Dagino and Padula 2002). With this type of agreement, firms can reach more customers, which would be impossible individually (e.g. Nike and Apple described by Rodrigues et al. 2009). Moreover, firms often need access to the others’ firms know-how to collectively use this knowledge to produce benefits to them all (Liu 2013). Coopetitve agreement may also help firms avoid a cut-throat price war. Therefore, a coopetition agreement can cause enlarging the total market value (“market pie”).

Coopetition can help firms combine complementary resources in developing new products and allow firms to reduce costs, risks and uncertainties associated with innovation or product development (Luo 2007, Gnyawali and Park 2009). Thus, another distinctive feature of coopetition in the paper will be cost sharing.

Therefore, we are going to consider three types of coopetition between firms:

Partial coopetition: market enlarging \( (m = 1.2) \), no cost-sharing \( (n_{A} = 1,\,n_{B} = 1) \). The impact of the degree of market enlarging on the proneness to coopetition. Scopes of easy, tough, or impossible coopetition. Ranges of coopetitive real options games between firms. Panel a low risk \( \sigma = 20\% \), panel b high risk \( \sigma = 60\% \)

-

1.

Partial coopetition (market enlarging)—the underlying market value is enlarged but both firms bear the whole costs of investment \( ({\text{coop}}\_1) \),

-

2.

Partial coopetition (costs sharing)—the underlying market value remains unchanged but firms share project expenditures in parts proportional to their market shares \( ({\text{coop}}\_2) \),

-

3.

Full coopetition—the underlying market value is enlarged and firms share project expenditures in parts proportional to their market shares \( ({\text{coop}}\_3) \), and one case of pure competition,

-

4.

Pure competition—the underlying market value remains unchanged and both firms bear the whole costs of investment \( ({\text{comp}}) \).

Because each of the firms has three basic strategies to choose from: Wait, Invest, or Abandon. Firms’ choices lead to the following payments:

-

1.

Firms A and B invest immediately and simultaneously. They may invest under a coopetition arrangement or on the basis of pure competition. The underlying market value may be enlarged or may remain unchanged. Firms share project benefits in parts proportional to their market shares. They may share project expenditures in parts proportional to their market shares or bear the whole costs. The payoff for each firm is the net present value of the project taking into account these enlarged and divided benefits and (possibly) reduced expenditures of the project:

\( m \)—a cooperation mode multiple (a multiplier, which enlarged the underlying market value): \( m \ge 1 \) if \( i = {\text{coop}}\_1,{\text{coop}}\_3 \), or \( m = 1 \) if \( i = {\text{coop}}\_2,{\text{comp}} \).

\( n_{A} \)—a reduction factor of firm A investment expenditures: \( n_{A} = u, 0 < u < 1 \) if \( i = {\text{coop}}\_2,{\text{coop}}\_3 \), or \( n_{A} = 1 \) if \( i = {\text{coop}}\_2,{\text{comp}} \).

\( n_{B} \)—a reduction factor of firm B investment expenditures: \( n_{B} = 1 - u, 0 < u < 1 \) if \( i = {\text{coop}}\_2,{\text{coop}}\_3 \), or \( n_{B} = 1 \) if \( i = {\text{coop}}\_2,{\text{comp}} \).

-

2.

Firm A(B) invest immediately and firm B(A) defers the investment project execution. Consequently, firm A(B) appropriates the whole market and bears all the investment expenditure, and firm B(A) is left with nothing. Payoff for firm A(B) is the net present value of the total project:

$$ \left. {{\text{NPV}}: = {\text{NPV}}\left( {Y_{t} } \right)} \right|_{t = 0} = V\left( {Y_{0} } \right) - I = V_{0} - I, $$and the payoff for firm B(A) is zero.

-

3.

Firms A and B make (and keep) a coopetition agreement to defer the investment project execution and keep the investment option open. In this case, the payoff for each of them is the call option value determined on the Black–Scholes–Merton formula (the underlying asset is the present value of the project determined with the use of an adequate part of (possibly enlarged) project benefits (\( u \cdot m \cdot Y_{t} \) for firm A or \( \left( {1 - u} \right) \cdot m \cdot Y_{t} \) for firm B), and the exercise price is an adequate part of the investment expenditure (\( n_{A} \cdot I \) for firm A or \( n_{B} \cdot I \) for firm B):

\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \).

\( m \), \( n_{A} , n_{B} \) as in the previous case.

To visualize values of these payments and to analyse games, let us assume a base set of parameters: investment expenditure \( I = 6 \) (in monetary unit), expiration date \( T = 2 \) (years), risk free rate \( r = 2.10\% \) (YTM of treasury bonds with maturity date equal to expiration date of investment option (DOS0321)), the expected percentage rate of change of project cash flows \( \alpha = 1\% \) (own assumption), volatility of the project’s benefits \( \sigma = 20\% \) (low risk), \( \sigma = 60\% \) (high risk), the expected return on the market \( r_{m} = 8.38\% \) (rate of return on market index WIG 2016–2018), the standard deviation of \( r_{m} \), \( \sigma_{m} = 14.28\% \), the correlation of the asset with the market portfolio \( \rho_{m} = 0.5 \) (own assumption). Additionally we assume in the base case the firm A’s market share is \( u = 0.75 \) (so \( 0.25 \) of the market pie is left for firm B). And the cooperation mode multiple \( m = 1.2 \) (according to Trigeorgis and Baldi 2017, a market value pie is enlarged by 20%). Assumptions about the parameters reflect a situation of a real company (a similar approach is used by authors of cited papers).

9.3 Analysis of Coopetitive Real Options Games

We consider a situation in which each of two companies possesses an investment option. The investment option is a shared one. Therefore, it is reasonable that they calculate values of their investment options and consider the benefits of possible cooperation during the implementation of the project.

Notice at first that for these values of the project benefits \( (V_{0} ) \) for which \( F_{A}^{i} < {\text{NPV}}_{A}^{i} \) and \( F_{B}^{i} < {\text{NPV}}_{B}^{i} \), \( (i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}}) \) the optimal strategy for each firm is Invest.

However, when the option value exceeds the benefit of immediate investment, i.e. when \( F_{A}^{i} > {\text{NPV}}_{A}^{i} \) and \( F_{B}^{i} > {\text{NPV}}_{B}^{i} \), \( (i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}}) \) the classic concept of real options (ROA) recommends retaining the investment option and postponing the investment decision. However, the option game concept (ROG) indicates the weakness of such an approach and recommends considering jointly the decisions of both companies and their mutual influence on each other.

Consider, therefore, the situation as a game option. Because firms can choose non-cooperative or cooperative strategies, we are dealing with a family of games. As Carfi (2010) has said: any coopetitive game could be defined as a family of normal-form games and the examination of a coopetitive game should be equivalent to the examination of a whole family of normal-form games.

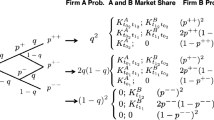

Games considered in the paper have one general normal form presented in Table 9.1.

By establishing a coopetition arrangement, companies determine the type of game in which they participate.

Let us notice that when the value of the investment option for each firm exceeds the net present value of the project for the only investor, i.e. when \( F_{A}^{i} > {\text{NPV}} \) and \( F_{B}^{i} > {\text{NPV}} \), then the game described in Table 9.1 for each \( i \) \( (i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}}) \), has the only one unique Nash equilibrium in dominant strategies \( \left( {W,W} \right) \). Both players achieve the highest possible payoffs.

Thus, the project values at which \( F_{A}^{i} > {\text{NPV}} \) and \( F_{B}^{i} > {\text{NPV}} \) or \( F_{A}^{i} < {\text{NPV}}_{A}^{i} \) and \( F_{B}^{i} < {\text{NPV}}_{B}^{i} \) (\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \)) lead to a situation in which coopetition is a natural form of relationship between companies. There is no incentive to break the agreement. In these cases, we are going to talk about easy coopetition.

The analysis of the game indicates one more scope of the project values, at which coopetition is easy because there are no incentives to withdraw from the contract. This is the case when \( {\text{NPV}}_{A}^{\text{comp}} > 0 \) and \( {\text{NPV}}_{B}^{\text{comp}} > 0 \) simultaneously. Then the dominant strategy for firm A is the strategy Invest, and the B’s best response to this A’s strategy is the strategy Invest, as well. However, in this case, establishing cooperation in the implementation of the project and taking advantage of the benefits of coopetition is a better solution because \( {\text{NPV}}_{A}^{\text{comp}} < {\text{NPV}}_{A}^{i} \) and \( {\text{NPV}}_{B}^{\text{comp}} < {\text{NPV}}_{B}^{i} \), for \( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3 \).

Therefore, taking into account the relationship between all values, we can talk about easy coopetition for these projects in which values meet the following conditions \( F_{A}^{i} > {\text{NPV}} \) and \( F_{B}^{i} > {\text{NPV}} \) (\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \)), or \( {\text{NPV}}_{A}^{\text{comp}} > 0 \) and \( {\text{NPV}}_{B}^{\text{comp}} > 0 \) simultaneously.

We can, therefore, formulate the first conclusion. There are two ranges of project values at which coopetition between firms is easy and there is no problem to keep an arrangement: when the project NPV for both companies (excluding the benefits of coopetition) is positive (very high-value projects) or if the value of the investment option is higher than benefits of instantaneous investment (even in the case of being the only investor). In both cases, there are dominant strategies for each party (Invest or Wait) and these dominant strategies give firms the highest possible payoffs. Their goals and interests are allied. This finding is in line with Liu’s (2013) empirical observation that rivals cooperate when common interests are higher than private benefits, and compete on other occasions.

These “other occasions” in our model are investment projects, which present values that lead to relationships: \( F_{B}^{i} < {\text{NPV}} \) (\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \)), and \( {\text{NPV}}_{B}^{\text{comp}} < 0 \) (\( B \) is the firm with smaller market shares). In this area, games between companies take different forms. In these games, dominant strategies may either not exist or lead to suboptimal payouts (often the worst possible). There are incentives to break the coopetition agreement. This is the area of though or impossible coopetition.

We can distinguish the following games (the general form of the payout matrix for each game is described in Table 9.1):

Game I. It occurs between firms if the present value of the project benefits \( (V_{0} ) \) leads to the following relationships between the real option values and the net present value of the project: \( {\text{NPV}}_{A}^{i} < 0 < {\text{NPV}} < F_{A}^{i} \) and \( {\text{NPV}}_{B}^{i} < 0 < F_{B}^{i} < {\text{NPV}} \) (\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \)). Therefore, in such cases, a dominant strategy for firm A is Wait, and the B’s best response is the strategy Invest. However, if they both invest, they both suffer losses. This is an area for negotiations between companies. Both parties should be interested in cooperation. Support for this cooperation may be other tools of game theory (Rychłowska-Musiał 2018). This is an area of tough coopetition between firms.

Game II. It ensue between firms if the present value of the project benefits \( (V_{0} ) \) leads to the following relationships between the real option values and the net present values of the project: \( {\text{NPV}}_{A}^{i} < 0 < F_{A}^{i} < {\text{NPV}} \) and \( {\text{NPV}}_{B}^{i} < 0 < F_{B}^{i} < {\text{NPV}} \) (\( i = {\text{coop}}\_1, {\text{coop}}\_2,{\text{coop}}\_3, {\text{comp}} \)). There is no dominant strategy for any player in this game and a few equilibria. Without coordination, their decisions may lead to the strategy profile \( \left( {I, I} \right) \). Obviously \( \left( {I,I} \right) \) is the worst possible solution, since both A and B could be better off at strategy \( \left( {W,W} \right) \) getting positive payoffs instead of negative ones. This is an area of tough coopetition between firms and reasons for lose–lose situation. However, Liu (2013) revealed that fear of lose–lose situation was vital to drive firm cooperation. We are going to study this issue in the next section.

Game III. It occurs between firms if the present value of the project benefits \( (V_{0} ) \) leads to the following relationships: \( {\text{NPV}}_{A}^{i} > 0 \) and \( {\text{NPV}}_{B}^{i} < 0 \) (\( i = {\text{coop}}_{1} , {\text{coop}}_{2} ,{\text{coop}}_{3} , {\text{comp}} \)) (regardless of the relationship between the remaining values). Firm A gains benefits regardless if it is the only investor or both firms invest simultaneously on the market. Firm B bears losses or has to abandon the project. The dominant strategy for firm A is Invest and the B’ best response is Wait what means Abandon in this case. It seems that from the perspective of market benefits, the dominant firm has no incentive to cooperate. In accordance with the criteria adopted in the study, coopetition is impossible in this case. As Liu (2013) empirically proved firms would never sacrifice their private benefits for common interests despite rich common benefits from cooperation with rivals.

9.4 Easy or Tough Coopetition. Ranges of Investment Project Values

The analysis in the previous section shows that the value of the project for the weaker company is the important determinant of easy, tough or impossible coopetition between firms. Therefore, the degree of asymmetry between firms market shares is going to be the key factor determining the type of relationship between firms. The second such factor is project risk, which affects the value of the project and the value of the investment option.

We will then carry out a sensitivity analysis that will answer the question of what is the impact of the degree of asymmetry between companies and the risk of the project on the willingness of companies to coopetition. We are going to consider three types of coopetition.

9.4.1 Partial Coopetition: Market Enlarging, no Costs Sharing

When firms benefit only from the market enlarging (\( m = 1.2 \), e.g. due to more customers or no price war) and there is no other agreements (e.g. investment expenditures sharing) their situation does not much differ from the case of pure competition \( (m = 1) \). In this case, we can only talk about the coordination of activities to achieve optimal payments (Fig. 9.1).

Compatible optimal strategies (easy coopetition) will only be taken for very low or very high-value project. For the majority of investment projects, strategies coordination will be either tough (Game I and Game II) or impossible (Game III). Note also that with large disparities in market shares, strategy coordination is either easy or impossible (Game III).

9.4.2 Partial Coopetition: Costs Sharing, no Market Enlarging

Cost-sharing is very beneficial for companies. As we can see in Fig. 9.2, the range of project values, for which the coopetition between companies is easy, is very wide. In the small scope of the project’s value, we can talk about difficult coopetition, which requires additional solutions/mechanisms to ensure that both parties have the motivation to keep the contract. With the growing difference in market shares, the strategic importance of the weaker company is weakening. The dominant market firm has no incentives to initiate cooperation with a weaker partner. Similarly, to the previous case, when disparities in market shares are very large, coopetition is either easy or impossible (Game III). This result is consistent with the observations of Gast et al. (2017) who are researching small family firms discovered that coopetition among them (if it happens) tends to be cooperation-dominated.

Partial coopetition: Cost-sharing \( (n_{A} = u, n_{B} = 1 - u) \), no market enlarging \( (m = 1) \). The impact of the degree of asymmetry between firms’ market shares on the proneness to coopetition. Scopes of easy, tough, or impossible coopetition. Ranges of coopetitive real options games between firms. Panel a low risk \( \sigma = 20\% \), panel b high risk \( \sigma = 60\% \)

Full coopetition: market enlarging \( (m = 1.2) \), costs sharing \( (n_{A} = u, n_{B} = 1 - u) \). The impact of the degree of asymmetry between firms’ market shares on the proneness to coopetition. Scopes of easy, tough, or impossible coopetition. Ranges of coopetitive real options games between firms. Panel a low risk \( \sigma = 20\% \), panel b high risk \( \sigma = 60\% \)

9.4.3 Full Coopetition: Market Enlarging, Costs Sharing

This is, of course, the most advantageous form of cooperation, which gives both rival-partners the greatest benefits. In this case, for low-risk projects, \( (\sigma = 20\% ) \) there are conditions for easy coopetition for all project values, and it takes a form or sharing investment options (\( \left( {W, W} \right) \) strategy), or joint investment (\( \left( {I, I} \right) \) strategy).

If the investment project that is considered by firms is a high-risk project \( (\sigma = 60\% ) \), there is a slight risk that the cooperation between partners may be difficult (for a small range of project values). And a very small risk that cooperation is impossible (in the case of very large disproportion between firms market shares) (Fig. 9.3).

9.5 Benefits of Coopetition

Benefits that the company can achieve as a result of coopetition determine its willingness to this form of cooperation. The tough coopetition is the area of the value of the project, where the lack of an agreement between companies puts them at risk. However, even reaching the agreement is not a guarantee of achieving benefits, because there are strong incentives that encourage both parties to break the contract and seek their own benefits at the expense of the other party.

We will determine the benefits that firms can get as a result of cooperation in areas identified as tough coopetition. We will examine the links between the benefits and the size of the firm’s market share and the risk of the project. On this basis, we will try to answer the question, what factors may encourage companies to coopete.

Let’s define benefits of coopetition (in the range of tough coopetition) as a percentage share of the difference between \( F_{A}^{i} \) (or \( F_{B}^{i} \)) (both firms keep an arrangement and keep their investment options) and \( {\text{NPV}}_{A}^{\text{comp}} \) (or \( {\text{NPV}}_{B}^{\text{comp}} \)) (both firms invest without agreement—pure competition) in adequate firm’s share of the present value of the project \( u \cdot V_{0} \) (or \( \left( {1 - u} \right) \cdot V_{0} \)) (Table 9.2):

If an investment project value qualifies it for the tough coopetition area, establishing coopetition agreements is advantageous for both companies. Both companies benefit if they establish cooperation and adhere to the terms of the contract. For both rival-partners, the benefits are all the greater, the greater the risk of the project. It may indicate that the greater the risk of the project, the more willing to cooperate are firms, due to the losses accompanying the lose–lose strategy.

A weaker company with small market share is benefiting more from the cooperative agreement. However, given the large disparity in market shares, as shown in Sect. 9.4, a stronger company has no incentive to negotiate terms of cooperation and coopetition is not possible.

9.6 Conclusions and Final Remarks

Increasing interdependence between firms operating on competitive markets and the growing necessity for common operations, expenditures and risk sharing, and strategic flexibility are roots of the growing importance of coopetition. Coopetition combines the advantages of both competition and cooperation. Firms and their managers who want to enjoy the benefits of coopetition are also aware of the risks that it entails. They want and need to know what are the chances to meet terms of contract by their partner, or how much will the firm benefit from the coopetition agreement. In the paper, we were looking for answers to these questions on the basis of coopetitive real options games. We considered the case of two firms that can establish a coopetition arrangement to implement an investment project for which they have no exclusivity. The relationships between firms were described as a family of coopetitive real options games.

The analyses carried out in the paper can be summarized in a few findings:

-

1.

If there is no agreement between firms on the investment expenditures sharing, and they can only benefit from the market enlarging as a result of coordination of their strategies, achieving this coordination is almost always either difficult or impossible.

-

2.

If the companies establish a coopetition agreement on sharing the expenditures of the investment project, for the majority of investment projects it will be easy to keep these findings, especially, if projects are low-risk ones or a coopetition agreement provides for the sharing of investment expenditures, and companies also benefit from the market enlarging. Then, none of the parties benefits from breaking of the agreement, there is no incentive to break it.

The risk of breaking the coopetition arrangement arises if the net present value of the entire project is not much smaller or slightly higher than zero. Then the area of though coopetition appears. This area is all the larger, the higher the risk of the project. There is a temptation to break the agreement and achieve benefits at the expense of rival-partner firm. However, the higher the project risk, the greater benefits are achieved by each firm by keeping coopetition agreement. The fear of lose–lose situation may encourage companies to keep their agreements.

-

3.

Disproportion in market shares is also a factor affecting the firm’s willingness to coopetition. If the difference in market shares is significant, the strategic position of a company with small market share is very weak and if coopetition between firms is not easy, it is impossible.

References

Brandenburger, A. M., & Nalebuff, B. J. (1996). Co-opetition. New York: Doubleday.

Brandenburger, A. M., & Stuart, H. (2007). Biform games. Management Science, 53(4), 537–549.

Carfi, D. (2010). A model for coopetitive games (p. 59633). No: MPRA paper.

Carfi, D., & Schiliro, D. (2012). A model of coopetitive game for the environmental sustainability of a global green economy (p. 38508). No: MPRA paper.

Carfi, D., & Schiliro, D. (2013). A model of coopetitive game and the Greek Crisis. Contributions to Game Theory and Management, 6, 35–62.

Dagnino, G. B., & Padula, G. (2002). Coopetition strategy. A new kind of interfirm dynamics for value creation, second annual conference. Stockholm: Innovative Research in Management, 9–11 May, 2002.

Das,T. K., & Teng, B. S. (2000). Instabilities of strategic alliances: An internal tensions perspective. Organization Science, 11(1), 77–101.

Dixit, A. K., & Pindyck, R. S. (1994). Investment under uncertainty. Princeton, New Jersey: Princeton University Press.

Fernandez, A. S., Le Roy, F., & Gnyawali, D. R. (2014). Sources and management of tension in co-opetition case evidence from telecommunications satellites manufacturing in Europe. Industrial Marketing Management, 43, 222–235.

Gast, J., Kallmünzer, A., Kraus, S., Gundolf, K., & Arnold, J. (2017). Coopetition of small- and medium-sized family enterprises: Insights from an IT business network. International Journal of Entrepreneurship and Small Business.

Gnyawali, D. R., & Park, R. (2009). Co-opetition and technological innovation in small and medium-sized enterprises: A multilevel conceptual model. Journal of Small Business Management, 47(3), 308–330.

Liu, R. (2013). Cooperation competition and coopetition in innovation communities. Prometheus: Critical Studies in Innovation, 31(2), 91–105.

Luo, Y. (2007). A coopetition perspective of global competition. Journal of World Business, 42, 129–144.

Ritala, P. (2012). Competition strategy—when is it succesful? Empirical Evidence on Innovation and Market Performance, British Journal of Management, 23, 307–324.

Rodrigues, F., Souza, V., & Leitao, J. (2009). Strategic coopetition of global brands: A game theory approach to ‘Nike +iPod Sport Kit’ co-branding (p. 16146). No: MPRA paper.

Rychłowska-Musiał, E. (2017). Value creation in a firm through coopetition. Real options games approach. In K. Jajuga, L. T. Orlowski & K. Staehr (Eds.), Contemporary Trends and Challenges in Finance, proceedings from the 2nd wroclaw international conference in finance (pp. 285–295). Springer Proceedings in Business and Economics, Springer.

Rychłowska-Musiał, E. (2018) Real options games between asymmetric firms on a competitive market. In N. Tsounis & A. Vlachvei (Eds.), Advances in panel data analysis in applied economic research. 2017 International Conference on Applied Economics (ICOAE) (pp. 299–310). Springer Proceedings in Business and Economics, Springer.

Smit, H. T. J., & Trigeorgis, L. (2004). Strategic Investment. Real options and games. Princeton and Oxford: Princeton University Press.

Trigeogris, L., & Baldi, F. (2017). Dynamic hybrid patent strategies: Fight or cooperate? Working paper.

Walley, K. (2007). Coopetition: An Introduction to the subject and an agenda for research. International Studies of Management & Organization, 37(2), 11–31.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Rychłowska-Musiał, E. (2020). Easy or Tough Coopetition? Perspective of Coopetitive Real Options Games. In: Tsounis, N., Vlachvei, A. (eds) Advances in Cross-Section Data Methods in Applied Economic Research. ICOAE 2019. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-38253-7_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-38253-7_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-38252-0

Online ISBN: 978-3-030-38253-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)