Abstract

This paper addresses the real-world supply chain network design problem with a strategic multi-commodity and multi-period inventory-location problem with stochastic demands. The proposed methodology involves a complex non-linear, non-convex, mixed integer programming model, which allows for the optimization of warehouse location, demand zone’s assignment, and manufacturing settings while minimizing the fixed costs of a distribution center (DC), along with the transportation and inventory costs in a multi-commodity, multi-period scenario. In addition, a genetic algorithm is implemented to obtain near-optimal solutions at competitive times. We applied the model to a real-world industrial case of a Colombian rolled steel manufacturing company, where a new, optimized supply chain distribution network is required to serve customers at a national level. The proposed approach provides a practical solution to optimize their distribution network, achieving significant cost reductions for the company.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Supply chain network design

- Inventory location problems

- Facility location problems

- Genetic algorithms

- Safety stock

- Cycle stock

- Explicit enumeration

- Stochastic modelling

1 Introduction and Problem Statement

Logistics costs have a high impact on a product’s final price, and also on the firm’s revenue, with an average cost contribution of between 10 and 20%. However, in Latin America, due to its complex geography, infrastructure, and technological gaps, this percentage is higher than in the United States or the European Union, where logistics costs do not exceed 12% of the final product price [23]. For instance, the average ratio between logistics costs and product price in Latin America is 14.7%, while in Colombia it is 14.9% [4], which is one of the highest values in the region. Among logistics costs, transportation and distribution (37%) and storage (20%) are the costliest. This is a marked tendency in Latin American countries, where storage and transportation costs are almost 60% of total logistics costs. These facts denote an excellent opportunity for improving operational efficiency and reducing costs.

The presence of high logistics costs has become a critical issue for large enterprises, particularly for low-density-value goods, that is, those with low price-weight ratios (i.e. coal, steel, corn, clinker), where supply chain optimization is one of the best ways to reduce the final product cost while increasing the customer service level. A usual and recommended strategy for addressing these shortcomings is to broaden or reconfigure the distribution network, to achieve an improved and quicker response for its retailers, while reducing transportation costs by consolidating cargo to take advantage of economies of scale. However, this strategic decision implies a high capital investment (if new distribution centers need to be installed) and a thorough economic analysis.

In this work, an inventory location model (ILM) is proposed and applied to a laminated steel company in Colombia, allowing for it to optimize its distribution network and analyze whether it should install more distribution centers (DCs) or not. The current distribution network consists of a production plant and a DC located in the city of Barranquilla (northern Colombia) and a small warehouse in Bogotá (center of Colombia), but all retailers are served directly from the plant, missing scale economies, generating higher logistics costs and offering a low service level. The solution approach involves integrating inventory, transportation and fixed costs into the objective function, considering different product categories and demand periods of the company. It was applied to a real-world industrial problem, developing a sensitivity analysis of several variables of the problem. The proposed model optimizes the last two stages of the supply chain, DC locations, and retailer allocation.

The structure of the paper starts with a literature review, followed by the modeling approach and presentation of the case study and results. Finally, we present the relevant conclusions obtained from this work.

2 Literature Review: Inventory-Location Models

The supply chain network optimization problem includes several strategic decisions such as location, number and type of manufacturing factories or DCs; the set of suppliers to select; the choice of transportation modes; the amount of raw materials and products to produce and distribute to the factories, DCs or customers; and the amount of raw materials and products to be held at each inventory location [25]. According to the literature on supply chain management [2, 14, 22] the distribution of supply chain network decisions can be divided into three levels: strategic, tactical, and operational. The first defines the number of facilities and their locations; the second defines the inventory location and inventory availability policies, and the third includes routing, transportation flow and level of inventory at each DC.

In particular, strategic decisions may have long-term effects. These decisions include the location, number and size of each warehouse or manufacturing facility [15]. In most cases, these issues imply a significant amount of capital, hence, it is necessary to make these decisions based on the results of a validated facility location model [10].

Usually, executive directors of a company make strategic decisions, while lower-level managers make tactical and operational decisions. Accordingly, strategic decisions are addressed by specific strategic optimization models that do not include tactical and operational level decisions. This fact might generate incompatibilities and sub-optimality. Tactical and operational decisions are relevant in supply chain management (SCM) for inventory or route planning but are not usually integrated with strategic decisions such as facility locations [9]. Some examples of these decisions are inventory control politics, selection of transportation mode/capacity, facility design and management, and vehicle route planning, among others.

Tactical and operational decisions are often made independently due to their level of complexity which includes different variables at each level to make a joint decision. However, several previous studies integrate both strategic and tactical/operational decisions [3, 5, 6, 11,12,13, 21, 26].

If the facility location problem (FLP) does not consider capacity constraints at the facilities as in the p-median problem, it is always optimal to allocate each retailer to the closest installed DC [18]. However, due to the safety and cycle stock variables, integrating inventory decisions is not always optimal for closest-facility-allocation. Managing stock inventory consist of two critical tasks: (i) determining the necessary number of DCs, and (ii) calculating the amount of inventory to keep at each DC. Often these tasks are performed separately, resulting in a degree of sub-optimization [3].

The literature concerning inventories tends to focus on finding an optimal resupply strategy for DCs, given a set of spatially distributed facilities. For instance, Daskin et al. [3] concluded that for these types of models, when fixed costs of ordering are reduced in a significant manner, the number of DCs needed increases. Meanwhile, Jamshidi and Esfahani [7] considered the problem of designing a distribution network, transportation planning and allocation model in a supply chain with simultaneous determination of the optimal allocation for supplying and transportation while reaching a minimum cost. Recently, Perez et al. [19] presented a model for designing a supply chain network that involved the relationship between supplier selection, location decisions, and inventory control policy.

Most of the literature considers a supply chain network with a single product, a single stage location, and a single planning horizon. Such simplification does not represent the reality of modern companies, where the increasing variety of products with different sizes, forms, weights or shipping precautions increase logistics times and costs. More advanced models consider the multi-product facility location problem. Also, with the purpose of evaluating the modifications that present themselves to the parameters over time, the multi-period location problem considers a planning horizon divided into several time periods [9]. This study considers both multi-product and multi-period parameters in the model to provide a better approximation to reality.

The major issue with these kinds of approaches is that even those that have a linear programming formulation (basic FLP) result in an NP-hard problem [17]. This issue escalates, even more, when the inventory decisions are included, turning it into a mixed nonlinear programming problem. In response to this, different approaches have multiplied by going from exact methods to heuristics, metaheuristics, and hybrid heuristics. Over the last couple of years, a new focus on the resolution based on the creation of hybrid heuristics has been developed. Kaya and Urek [8] used three hybrid heuristic models among three widely-used heuristics like tabu search, genetic algorithm and simulated annealing with variable neighbor searches also known as TBVNS, GAVNS, SAVNS, obtaining the best results with the TBVNS approach regarding profitability. Soleimani and Kannan [24] developed a hybrid algorithm between particle swarms and genetic algorithms obtaining much better results than only using genetic algorithms.

This paper proposes a facility location model to optimize the supply chain or distribution network for addressing a real-world industrial case in Colombia, the model integrates several variables addressed in the recent relevant literature. In particular, the model integrates both safety and cycle inventory costs, and multi-period and multi-product decision variables. The problem was solved using both heuristic and meta-heuristic approaches, which makes it different than most of the papers found in literature where models are applied using simulated or non-real data. This case study made it possible to prove consistency between the model and reality, closing the gap found regarding this topic concerning theory and practice.

3 Modeling Approach

This study proposes a mixed integer nonlinear programming model, considering stochastic demands, DC locations, zone demand assignments, a number of planning periods (different demand levels), and different types of products, based on the latest research mentioned in the previous section. The proposed model involves DC operational and fixed costs, transportation costs both between the production plant and the DC, and between the DC and the retailer, and safety and cycle stock costs for each DC, meaning it considers the main variables affecting distribution networks, which differentiates it from other models. The decision variables are the number of locations of proposed DCs and their varieties and the inventory cost of each facility [16].

Integrating both safety and cycle stock in the model may (unlike traditional FLP) generate an optimal solution where retailers may not be assigned to the nearest DC that can serve the demand. Considering the inventory may result in remote allocations due to the reduction of costs by consolidating products into a single DC.

The objective function contains four terms. The first and second terms are the primary FLP costs which are the operational and fixed costs (first term) related to the DC setting, as well as transportation costs (second term) between DCs and customers. The third term refers to safety stock costs and the last to the cycle stock inventory and order costs, both cost terms at the DCs. Inventory costs are not deterministic but are the average values of the distribution (expected values).

The proposed model has five sets of restrictions. Restrictions (1) guarantee that all retailers will be served; while the set (2) prevent the model from assigning a retailer to a non-existing DC. Meanwhile, (3) makes the demand of each DC for each product category and demand period equal to the aggregate requirements of the retailers assigned to the DC so it can supply them. On the other hand, (4) states that the variance of a DC will be equal to the sum of the variances of its retailers. Finally, set (5) guarantees the binary values by limiting Xi and Yij to 0 or 1. The main model assumption is that the variance of the demand of each retailer is independent.

Notation:

-

Fi: Fixed and operational costs of a DC installed in the location i.

-

N: Number of potential DCs to be installed.

-

M: Number of retailers.

-

Xi: Binary variable that has the value of one if a DC is installed in the location i and zero otherwise.

-

Yij: Binary variable that has the value of one if retailer j is serviced by DC i and zero otherwise.

-

Cij: Total transportation cost from DC i to retailer j.

-

Cij: is given by: \( (Tc_{ij} + Pw) \cdot \varphi_{j} \).

Tcij is the transportation cost per unit from DC i to retailer j, Pw is the transportation cost from the production plant to the DC and φj is the total demand per year of retailer j. The demand of each DC is the sum of the requests of the retailers allocated to it.

-

K: Number of product categories.

-

k: Product category

-

HC k i : Holding cost associated with each product category in location i.

-

LT k i : Lead time to supply DC i, for each product k.

-

Vitk: DC i variance of daily demand, for each product k and each demand period t.

-

v tk j : Retailer j variance of daily demand, for each product k and each demand period t.

-

Qi: Lot size for location i.

-

OCi: Fixed cost per order in location i.

-

D tk i : Average daily demand of DC i, for each product k and each demand period t. The demand of each DC is the sum of the demand of the retailers allocated to it.

-

d tk j : Average daily demand of retailer j, for each product k and each demand period t.

-

rt: Number of days for each demand period.

-

T: Number of demand periods.

-

t: Demand period.

The stochastic, multi-commodity and multi-period inventory-location model proposed is:

The proposed model is an extension of a classic facility location model, and also of widely-studied inventory location models; therefore, it is also a nonlinear, nonconvex, NP-hard problem. This denotes the high complexity in solving these types of problems, especially with large instances, which is frequent in the real world. The non-linearity, size, and complexity of these kinds of models prohibit researchers from obtaining optimal solutions by exact approaches. Thus, heuristics and metaheuristics are an alternative strategy for solving these problems, providing fast and near-optimal results [11].

Although the model shows inventory levels for the network’s warehouse location, these may not be considered the exact levels required for each facility, since the scope of the approach is a strategic decision rather than a tactical one. The products are grouped into categories. Therefore, the resulting levels of the application of the model can be considered as an order of magnitude or as a reference for estimating the costs associated with inventory. To define the necessary inventory for each item, a separate, detailed analysis should be made.

4 Case Study

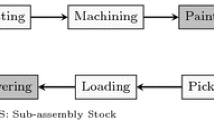

The model was applied to a laminated steel company in Barranquilla, Colombia. The company has a strategic location for transportation due to its access to the Magdalena River, the Caribbean Sea, and a broad road network that connects Barranquilla with the rest of the country, making it a desirable place for companies to install DCs. Currently the company ships all the products from its production plant, which also serves as DC (DC1) but the transportation is outsourced in an inefficient way. The explanation for this is that truck drivers and transportation companies in the city send their vehicles to the production and plant and get in queue, waiting their turn to be loaded, this means, the company ignores which company or truck will carry their product until the moment the vehicle is getting loaded.

The base scenario had twenty-eight (28) retailers (coded as zones), seven (7) potential DCs, twelve (12) product categories and two (2) different demand periods. The problem was solved using two approaches: a genetic algorithm (GA), and an explicit enumeration procedure, the problem could not be solved using GAMS software due to its capacity, so both methods were coded in Matlab and solved using an Asus ROG with core i7 processor and 8 Gb RAM, taking 1 min and 10 s to solve it, respectively.

4.1 Data

The company used for the study has more than two thousand retailers located within every department of the country. To reduce complexity, we grouped these retailers into 28 zones per their location, possible routes, and demand characteristics. For the location of potential DC installation sites, we developed a geographical analysis considering network characteristics, accessibility, multi-modal transportation suitability, distance to major retailers, truck restrictions, toll booths, and fixed costs, among others.

The laminated steel company provided transportation fee data for each of its contractor’s type of vehicles; retailers demand by type of product; fixed costs of existing DCs; and the desired inventory reliability. Freight charges vary widely, ranging from 8 USD/ton/km for retailers located in cities near DC1 (Northern region of Colombia) to 100 USD/ton/km for retailers located in the Amazon region (Fig. 1) with an average of 40 USD/ton/km for all the zones/retailers. To consider different types of trucks, we established truck mixes from the company´s shipping database and defined the truck type used according to the retailer distance from DC1 as shown in Table 1.

The company had more than two thousand different products that were grouped into twelve categories: Gutters, Claddings, Steel strappings, Hot Rolled pickled shells, Hot rolled unpickled shells, Galvanized shells, Master 100, Metaldeck, profiles, Coils, Zinc Roofing, Painted Coils.

Holding costs vary due to product price. The range was from 0.002 USD/day to 0.0006 USD/day for the twelve categories created. These values are low because steel is a low-density value good. Finally, fixed costs were obtained from market research in the cities of potential DC locations, focusing on suitable warehouses for each case and its costs, then the square meter cost for each location was calculated.

Figure 1 shows the geographical location of potential DCs and distribution zones in Colombia. Most of the potential DCs are in the central region of the country, where most of the economic activities and the inhabitants of Colombia are. DC1, DC5, and DC6 have ports on the Magdalena River, the largest, most important river in the country, these were included to consider intermodal distribution.

4.2 Explicit Enumeration

Initially, a reduced explicit enumeration was used to give the model a practical solution approach, as the complete review requires more computational and analysis time, plus intensive database management, considering the combinatorial problem. Given the dimension of the problem, the solution area was limited by discarding unreasonable results to reduce its complexity. For analysis purposes, ten scenarios were considered. The results suggested that the optimal solution was to open two DCs; DC1 and DC5 with a global cost of 8.25 million dollars per year.

The cost of each scenario according to the results are shown in Table 2. The scenario with the lowest total cost is scenario 9 which includes the installation of both DC1 and DC5, in Barranquilla and Puerto Berrio, respectively. This scenario was planned to supply DC5 from DC1 (which is both the production plant and a distribution center) by the Magdalena River and then supply the retailers by road transportation. For the best scenario (Scenario 9) the distribution network would be as is shown in Fig. 2, where the shaded area denotes the retailers served by DC1 and DC5 respectively.

The results show the importance of multimodal transport, allocating all zones/retailers south of DC5 to DC5 and north all the way to DC1. This way, DC1 supplies DC5 by the river while retailers are supplied by road.

In order to analyze the influence of the inventory costs in strategic decision-making, a sensitivity analysis was made, modeling the same scenario with products with a holding cost of 50% of its value.

The results allocate all zones/retailers to DC1, which means only this DC should be installed. This shows that high holding costs imply higher inventory costs and because it is necessary to have a safety stock for each DC, the impact of the high holding cost in the objective function is higher than the savings from economies of scale if several DCs were installed. Therefore, in this case, the best option as the model suggests, is to install only one DC.

This scenario shows the importance of scale economy in transportation, because in the high holding cost scenario having only one DC, it must supply each retailer directly, unlike the first result where we have two DCs and freight consolidation which results in lower transportation costs. It is evident why the model suggests installing only one DC if the safety stock costs are observed, as these costs would increase for each new DC to be installed.

4.3 Genetic Algorithm

A binary coding was applied, where each gene represents a DC, with the value of 1 if the DC should be installed and 0 otherwise. In this problem, the DC’s capacity constraint was relaxed, so it is not necessary to code the retailers inside each chromosome; instead, an internal algorithm allocates each retailer optimally to the DC with the lowest cost.

The parameters of the proposed GA were: (1) Initial population size = 20, (2) Crossover type = roulette (3) Mutation probability = 5%. If \( CT\left( {i,j} \right) \) represents the partial total cost associated with the fact that DC i supplies retailer j, we have the following equation:

This function searches the DC with the lowest partial cost for each retailer and makes the respective allocation. The chromosome fitness is given by the following equation:

Fitness is the basis for determining the algorithm’s crossovers, which will lead to the final solution. The methodology of the model starts by creating twenty (20) random solutions, represented as chromosomes, which are composed of chains. The first chain represents the DC results, and the other chains represent the retailers. At the same time, genes form chains, which take binary values (1 or 0).

The problem statement has twenty-nine (29) chains; the first one represents the DCs to be installed and the rest the retailers. The number of zones of the problem defines the number of the retailer’s chains.

The initial population of the first chain is generated by filling the chromosomes with binary values (1 or 0). Then, each retailer (each of the 28 chains remaining of each chromosome) is assigned to the DC with the lowest transportation costs between the available DCs. Each chromosome goes through the same process, obtaining the initial population. The next step is to apply the algorithm’s operators, which are selection, crossover and mutation. In this methodology, the chromosome with the highest total cost is the one with the lowest probability of being selected for the crossover and the one with a lower cost is the one with the highest probability. This way we guarantee a low-cost solution to the problem.

The final step consists of generating a random number between i positions. This number determines the gene candidate (the position inside the chromosome) for mutation. This algorithm was created with a mutation probability of 5%. To define whether the gene mutates or not, a random number between 0 and 1 is generated. If the number is lower or equal to 0.005, the gene mutates which means the gene changes its value from 0 to 1 or vice versa if the number is higher than 0.005 the gene will not mutate. The procedure is applied to each chromosome.

This process must obtain a population of 20 chromosomes in each generation. Once all three operators are applied, a new generation with new chromosomes is obtained. The algorithm used in this process creates 40 generations. In the last one, the chromosome with the higher fitness value is chosen and showed as the optimal solution of the problem, indicating which DCs should be installed, the retailer allocation and the costs associated with this solution.

5 Results and Discussion

A sensitivity analysis was made by modifying the key parameters such as holding cost (HC) and transportation costs. We created three possible scenarios. The first is the original problem, in which we applied the algorithm to model the real-world industrial case of the company, with the data provided by the managers and all its supply chain characteristics. In the second, we wanted to prove the impact of ignoring inventory policies in facility locations. In this case, we used the real data but applied the algorithm without safety and cycle inventory. The last scenario, with lower transportation costs and lower holding costs, evaluates the sensitivity that the holding and transportation costs have on facility locations.

For the original problem, the algorithm suggests installing two DCs, DC1 and DC6, supplying DC6 by river directly from the production plant and then supplying retailers by road from there. This result is associated with the use of intermodal transportation. (shaded areas denote the retailers served by each DC). The associated costs of this solution are shown in Table 3 and the retailer’s allocation is shown in Fig. 3.

In the second scenario, ignoring inventory costs, the algorithm suggests installing two DCs, DC1 and DC5. Table 4 presents the associated costs of this result. In this scenario DC1 supplies all the retailers located on the northern coast of the country and DC5 to the rest of the country. In this situation, DC5 receives the products shipped from the production plant by the Magdalena River and distributes them by truck.

In the last analyzed scenario, we reduced the transportation costs of waterways by 70% and holding costs by 50%; this is a valid scenario given the current project to restore the Magdalena river’s navigability. The result suggested installing three DCs (DC1, DC5, and DC6). The associated costs of this configuration are shown in Table 5. DC5 and DC6 are both cities with river ports, basically these results suggest having a main DC (DC1) and serve retailers located in the northern coast from it and ship products through the river to DC 5 and 6 and serve the rest of the country from them.

The result of the explicit enumeration methodology suggests installing two DCs (DC1-DC5) with a global cost of 8.2 million dollars, while the GA suggests installing DC1 and DC6 with a global cost of 8.2 million dollars for the same problem. This difference could be a result of the fact that the first methodology is initially based on prefixed matrixes created by the researcher´s criteria. It substantially reduces the computational time, but it lowers the algorithm effectiveness.

6 Conclusions

This paper develops and applies an inventory location model to optimize a real distribution network of a laminated steel company located in Colombia. The model considers different manufacturing facilities or factories, inventory policies at DCs for various product categories with stochastic demands, in a multi-period scenario. Unlike some previous research, in which authors apply their models to unreal or simulated data, this approach is applied to a real-world industrial case to study the model’s effectiveness and validate its usefulness.

The results show the impact on each logistics cost within overall company performance and both underlying and network configuration. In this case, the transportation costs become the most relevant component for strategic-tactical network configuration decision-making. Nevertheless, building new DCs results in substantial savings when the company consolidates shipment but will increase other costs such as fixed and inventory costs. It should be clarified that this would happen if they have low-density value goods, like steel. Inventory costs depend directly on the value of the product. On the contrary, in the case of high-density value goods, the inventory costs have a larger value and may turn into the most important cost for facility location decisions. In these cases, it is better to install less DCs than when we are dealing with low-density value goods.

The problem was solved by applying two strategies: explicit enumeration and a genetic algorithm, both methods proved to be valid to solve problems with this size. Therefore, the use of one or the other depends on the researcher or consultant’s needs, if there is an important amount of obvious allocation, then explicit enumeration may be used. On the other hand, if there are few, or no apparent allocations and the programming complexity is not relevant, the GA gives a nearly optimum solution.

Different scenarios were evaluated, where some of these consider intermodal transportation processes, by using Colombia’s most important waterway, the Magdalena River, complementing the road transportation system. The intermodal network reduces transportation fees by achieving economies of scale, due to the higher capacity of cargo ships compared to trucks, even considering that river transportation requires a higher travel time and therefore higher floating inventory costs, the overall costs of this intermodal network are lower, improving the company’s competitiveness, which is an important reason to favor projects that improve the river´s navigability.

A sensitivity analysis was performed regarding the holding cost where it shows the importance of making joint inventory-location decisions. When comparing scenarios, the impact of ignoring inventory costs could not be significantly observed due to the low holding costs of laminated steel. However, in the scenario with high holding costs, the model suggests installing only one DC. This means that products with high holding costs or high-density value (e.g. computers, jewelry) should consolidate inventory in as few DCs as possible. For low holding cost products, the inventory cost is not relevant directly, but it has an indirect impact because the quantity of the inventory defines the size of the facility, which factors into fixed costs. Therefore, under these circumstances, it is better to analyze if the fixed costs generated by maintaining multiple facilities are paid back with savings in transportation costs obtained by the freight consolidation, considering an increased service level that they offer to the customers by reducing times of delivery. Naturally, this last concept is hard to quantify. There is still a need for reviewing each case and companies should utilize a methodology as the analytic hierarchy process [20] or another multi-criteria approach, to study the importance of this service level for the enterprise, to make the correct decisions, such as in [1].

This research is developed under the assumption that the variances between zones were independent. Future research may investigate on how spatial correlation may influence the results. The proposed approach may be enhanced by considering joint production plants and DC location decisions as an extension of the inventory location model.

References

Alberto, P.: The logistics of industrial location decisions: an application of the analytic hierarchy process methodology. Int. J. Logist. Res. Appl. 3(3), 273–289 (2000)

Berman, O., Krass, D., Tajbakhsh, M.M.: A coordinated location-inventory model. Eur. J. Oper. Res. 217(3), 500–508 (2012)

Daskin, M.S., Coullard, C.R., Shen, Z.J.M.: An inventory-location model: Formulation, solution algorithm and computational results. Ann. Oper. Res. 110(14), 83–106 (2002)

DNP, Encuesta nacional de logística “Colombia es logística.” http://www.colombiacompetitiva.gov.co/prensa/2015/Paginas/Colombia-es-Logistica-La-Encuesta-Nacional-de-Logistica-2015.aspx. Accessed 29 July 2019

Escalona, P., Ordóñez, F., Marianov, V.: Joint location-inventory problem with differentiated service levels using critical level policy. Transp. Res. Part E Logist. Transp. Rev. 83, 141–157 (2015)

Guerrero, W.J., Prodhon, C., Velasco, N., Amaya, C.A.: Hybrid heuristic for the inventory location-routing problem with deterministic demand. Int. J. Prod. Econ. 146(1), 359–370 (2013)

Jamshidi, R., Esfahani, M.M.S.: A novel hybrid method for supply chain optimization with capacity constraint and shipping option. Int. J. Adv. Manuf. Technol. 67(5), 1563–1575 (2013)

Kaya, O., Urek, B.: A mixed integer nonlinear programming model and heuristic solutions for location, inventory and pricing decisions in a closed loop supply chain. Comput. Oper. Res. 65, 93–103 (2016)

Melo, M.T., Nickel, S., Saldanha-da-Gama, F.: Facility location and supply chain management – a review. Eur. J. Oper. Res. 196(2), 401–412 (2009)

Melo, M.T., Nickel, S., Saldanha-da-Gama, F.: An efficient heuristic approach for a multi-period logistics network redesign problem. TOP 22(1), 80–108 (2014)

Miranda, P.A., Garrido, R.A.: Incorporating inventory control decisions into a strategic distribution network design model with stochastic demand. Transp. Res. Part E Logist. Transp. Rev. 40(3), 183–207 (2004)

Miranda, P.A., Garrido, R.A.: A simultaneous inventory control and facility location model with stochastic capacity constraints. Netw. Spat. Econ. 6(1), 39–53 (2006)

Miranda, P.A., Garrido, R.A., Ceroni, J.A.: e-Work based collaborative optimization approach for strategic logistic network design problem. Comput. Ind. Eng. 57(1), 3–13 (2009)

Mourits, M., Evers, J.J.M.: Distribution network design: An integrated planning support framework. Int. J. Phys. Distrib. Logist. Manag. 25(5), 43–57 (1995)

Olivares-Benitez, E., González-Velarde, J.L., Ríos-Mercado, R.Z.: A supply chain design problem with facility location and bi-objective transportation choices. TOP 20(3), 729–753 (2012)

Orozco-Fontalvo, M., Cantillo, V., Miranda, P.: A meta-heuristic approach to a strategic mixed inventory-location model: Formulation and application. Transp. Res. Procedia 25, 729–746 (2017)

Owen, S.H., Daskin, M.S.: Strategic facility location: a review. Eur. J. Oper. Res. 111(3), 423–447 (1998)

Ozsen, L., Daskin, M.S., Coullard, C.R.: Facility location modeling and inventory management with multisourcing. Transp. Sci. 43(4), 455–472 (2009)

Perez Loaiza, R.E., Olivares-Benitez, E., Miranda Gonzalez, P.A., Guerrero Campanur, A., Martinez Flores, J.L.: Supply chain network design with efficiency, location, and inventory policy using a multiobjective evolutionary algorithm. Trans. Oper. Res. 24(1–2), 251–275 (2017)

Saaty, T.L.: How to make a decision: The analytic hierarchy process. Eur. J. Oper. Res. 48(1), 9–26 (1990)

Shen, Z.-J.M., Coullard, C., Daskin, M.S.: A joint location-inventory model. Transp. Sci. 37(1), 40–55 (2003)

Simchi-Levi, D., Kaminsky, P., Simchi-Levi, E.: Designing and managing the supply chain: concepts, strategies, and case studies, 2nd edn. McGraw-Hill/Irwin, Boston, Mass (2003)

Sintec: Transporte, el verdadero reto en latinoamerica y Colombia. http://www.il-latam.com/wp-content/uploads/2018/08/infografia-transporte-Latam-Colombia.pdf. Accessed 29 July 2019

Soleimani, H., Kannan, G.: A hybrid particle swarm optimization and genetic algorithm for closed-loop supply chain network design in large-scale networks. Appl. Math. Model. 39(14), 3990–4012 (2015)

Vidal, C.J., Goetschalckx, M.: Strategic production-distribution models: A critical review with emphasis on global supply chain models. Eur. J. Oper. Res. 98(1), 1–18 (1997)

Zhang, Y., Qi, M., Miao, L., Liu, E.: Hybrid metaheuristic solutions to inventory location routing problem. Transp. Res. Part E Logist. Transp. Rev. 70, 305–323 (2014)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Orozco-Fontalvo, M., Cantillo, V., Miranda, P.A. (2019). A Stochastic, Multi-Commodity Multi-Period Inventory-Location Problem: Modeling and Solving an Industrial Application. In: Paternina-Arboleda, C., Voß, S. (eds) Computational Logistics. ICCL 2019. Lecture Notes in Computer Science(), vol 11756. Springer, Cham. https://doi.org/10.1007/978-3-030-31140-7_20

Download citation

DOI: https://doi.org/10.1007/978-3-030-31140-7_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-31139-1

Online ISBN: 978-3-030-31140-7

eBook Packages: Computer ScienceComputer Science (R0)