Abstract

Externalities take place when an economic operator does not experience all costs (in case of negative externalities) or benefits (in case of positive externalities) involved in his activities, which are passed on to other economic operators. Specific challenge to economists is posed by negative technological externalities, which have also triggered experimental research studies using the declared (stated) preference method. The aim of the experiment was to find the most preferred solution geared towards the elimination of the source of air pollution in a village and to learn about respondents’ willingness to pay (WTP) for the public good supplied as a result of such elimination. Out of the five proposed options, one of the most preferred by respondents was a voluntary fundraising initiative to collect money for the construction of the neighbour’s connection that would go on until they collect PLN 10 k but not longer than for a year. By using the WTP method, we arrived at an unambiguous valuation of the good expressed in terms of money. The most preferred tax rate revealed as a result of the survey suggests that the valuation of the public good was underestimated. As a result, the situation described in the case study cannot be resolved successfully.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Today, quite rightly, attention is clearly being paid to the role of human behaviour as a significant source of environmental pollution. In Poland, we used to blame industry for air pollution and for the contamination of groundwater and soil. Currently, as a result of restrictive environmental policy equipped with legal and economic instruments, industry has lost its top position of the major polluter. Poor quality of the environment and, above all, air pollution is caused by individual human activities. Low emission linked with suburbanisation and many years of lagging behind when it comes to the standards of heat and electricity supply systems available to households are the main reasons why all users of the environment experience tangible negative effects. Due to air pollution, all people who breathe it become victims of the polluters while, looking from the opposite perspective, those who are working to eliminate air pollution provide benefits to other individuals who become covered by their protection activities. Air pollution and its protection are externalities with the range of impact covering all users of the environment. No one may be easily excluded from the circle of either victims or beneficiaries.

More precisely, externalities take place when an economic operator does not experience all costs (in case of negative externalities) or benefits (in case of positive externalities), which are passed on to other economic operators. The division into positive and negative externalities is normative by nature. Negative externalities manifest the presence of public anti-goods (public bads), such as, e.g., air pollution. On the other hand, positive externalities are sources of public goods, such as, e.g., protection of the atmosphere. Common features of public bads and goods are: non-rivalry nature of their consumption and inability to exclude anyone from their consumption. Assuming that overall benefits prevail over the disadvantages, we may say that the carrying out protection activities is a kind of public good linked with positive externalities. However, when trying to ensure adequate supply of protection efforts, we may face two serious economic problems: the free rider problem, i.e. using the good for free and the prisoner’s dilemma, which in environmental context means that the lack of communication and ability to agree on a common strategy leads to a situation when all parties make a rational choice of not pursuing any protection activities although working in polluted environment deteriorates their individual performance and reduces the welfare.

Specific challenge to economists is posed by negative technological externalities. They have also triggered experimental research studies using the declared (stated) preference method. Usually, the declared preference method was used in connection with the polluter pays principle and the willingness to pay environmental costs, when the market does not generate adequate information about the issue. The proposed experiment concerns “pollution elimination at source” principle and civic support to an environmentally friendly investment project launched to produce common good, i.e., clean air.

The main objective of the undertaken research was to identify the tendency of environmental users, members of the local community to bear the costs of environmental protection investments and to determine the level of declared expenditures. This hypothetical case concerns members of a local community exposed to negative externalities of activities pursued by one of their neighbours. The undertaken research in the field of experimental economics is an attempt to search for effective solutions for environmental protection and to determine the dependence between the effectiveness of undertaken actions and the declared willingness to pay for a good. An important aspect and background of these considerations were also the issue of the co-responsibility of citizens for the quality of the environment.

2 Public Goods and Issues of Demand and Supply: Literature Review

How to identify the size of output of a public good is a theoretical but also practical question. Problems arise when we want to measure preferences and have to deal with congestion. For public goods, equilibrium is achieved when the overall willingness to pay for the good equals the price for which the producer is willing to supply this good and different individuals are willing to pay different prices for a certain output of the good. These individual prices are referred to as Lindahl pricing (or Lindahl taxes). Effective valuation of a public good assumes that the sum of individual prices equals the marginal cost [14]. In literature, we may come across diverse ways of finding the demand curve for public good. According to Musgrave, the sum of individual prices equals the marginal cost [8]; Bowen [2] and Samuelson [15] argue that the sum of marginal rates of substitution equals the marginal cost while Buchanan [6] claims that the sum of marginal values equals marginal cost. Musgrave assumed that public and private needs are “individual wants.” The principal difference between the two needs consists in the fact that “goods and services supplied to satisfy public needs must be consumed in equal amounts by all” [13]. There are two implications of such an approach. Firstly, if a voluntary solution was available, the aggregate demand curve for inseparable good would be the effect of vertical addition of the individual demands. The result may in a way be obtained from the Lindahl model and was identified against these categories by Bowen [2], and repeated by Samuelson [15]. Secondly, “because the same amount will be consumed by all, everybody knows they cannot be excluded from the benefits stemming from that.” Thus, people are not forced to reveal their preferences by offering their bids in the market. The “exclusion principle,” which is crucial for the exchange, may not be applied and the market mechanism does not work. To a consumer, it is always more attractive to hide or falsify her/his true preferences not to reveal her/his actual willingness to pay for public good. In accordance with Lindahl concept, anyone may be asked to specify her/his demand for public good at a hypothetical price or when faced with the distribution of tax burden involved in its supply. Prices for the same amount of a given public good may differ. It allows, at least theoretically, arriving at equilibrium. In practice, every consumer wishes to pass the costs of the supply of the good on to others by declaring demand lower than the actual one because (s)he assumes the good will be supplied to her/him anyway. Lindahl model does not eliminate the problem of a free rider. By being unable to exclude anyone from consumption, we may not find out the real value of the public good to individuals expressed in the price they are willing to pay. Investigating into preferences is a complex exercise but it does not mean that economists are totally helpless. Literature provides a number of examples of mechanisms that force consumers to reveal their true preferences and prices linked with them. Vickrey–Clarke–Groves mechanism (VCG) is one of such examples. This auction mechanism helps in achieving a socially optimal solution through its strategy consisting in bidding for a realistic valuation. It is assumed that the cost of a project is given. The project should be launched if the sum of values declared by all citizens is higher than the cost or equal to it. In case of the VCG mechanism with the Clarke pivot rule, it means that a citizen pays a non-zero tax for the project if and only if it is pivotal, i.e. without her/his declaration the total value is less than the given cost and with this declaration, the total value is more than the cost. This mechanism is designed to discourage making unreliable declarations. The pivotal subject is charged with tax burden. Such tax is referred to as motivational [16]. An alternative solution is offered by Groves–Ledyard mechanism. In this case, the output of public good is decided by a central agency (authority) while expectations of individual subjects either increase or reduce it. Everybody sends their choices as to the amounts of the good without knowing declarations made by other participants. Tax paid by an individual depends on how much his expectations concerning the amount of the good in question deviate from the mean of other players’ bids [4]. A real problem consists in the fact that as a result of the willingness to lower the declared prices, demand will be underestimated meaning the output of the public good will be insufficient or will not take place at all.

To learn if we are able to supply a given public good, it is worth conducting an experiment, which explores human behaviour in a near real-life environment. For that purpose, we may conduct a survey in laboratory conditions (on an isolated group). For questions about the valuation of a public good, it is justified to apply the conditional valuation method, in which we either want to learn about the willingness to pay (WTP) or the willingness to accept (WTA) [10, 11]. The willingness to pay is measured through the deployment of diverse techniques, among which the most popular include questionnaire studies or interviews. Account is taken of social and economic aspects of the examined population, such as, e.g.: types of households, domicile, education, age, gender and income per person in a household. It enables matching the answer to the question concerning the valuation with other features typical of the respondent. In the case of the WTP/WTA method, we want to arrive at a clear-cut valuation expressed in money, which helps in drawing the demand curve for the good covered by the survey. By using the declared preference method, we may also ask about the most desired ways, in which the public good in question could be provided and/or about the internalisation of negative externalities. It was applied in the experiment discussed in this chapter.

3 Methodology and Data

Consumer preferences can be measured based on historical observations of consumer behaviour in the market, i.e. on real decisions taken by consumers faced with a choice or based on data that describe consumer intentions. Because of these two sources of information about preferences, we may distinguish two methods, one of the analyses revealed preferences while the other one focuses on declared (stated) preferences (Table 26.1). Despite a wide spectrum of applications for both methods, measuring preferences of natural environment users, in which we analyse the environment and its quality, is a special case. The use of declared preferences method, its conditions and limitations have been widely discussed in literature [1, 5] also in the context of their stability [3].

Based on a formalised questionnaire, the participants to the research experiment are expected to find a solution to the problem described in Fig. 26.1. Their choices made within the framework of hypothetical scenarios help us draw conclusions about their preferences and value of non-market goods. By making a decision, the participants allocate a particular degree of utility to each attribute. Thus, we assume that they select an option representing the maximum total utility to them. It is presumed that the questionnaire developed for the experiment covers all factors that respondents might consider when making a decision. As a result of the experiment, we will learn about preferred solutions and how they link with respondents’ socio-economic attributes.

For the sake of reliability of the experiment, we validated the research tool by conducting a pilot survey. A survey on a group of 15 people helped us to fine-tune the experiment, to precisely set border conditions and to develop the final version of the questionnaire.

Finally, the experiment covered all first-year students of full-time undergraduate and graduate courses at Spatial Economics (Polish: Gospodarka Przestrzenna) at the Faculty of Economics and Sociology of the University of Lodz. We purposefully selected the students of this particular course as respondents. Over the time of their studies, these students will improve their knowledge and skills because the teaching content includes, inter alia, environmental economics, environmental protection, eco-innovation, local development policy, spatial development and legal framework for environmental protection. It means they will be able to validate results of the experiment in the future when they will have completed their education. The research study was anonymous and organised as a paper-based questionnaire study. Questionnaires were handed out directly to students who were asked to fill them out. We managed to collect back 90 questionnaires. The ultimate rate of return was 70% (N = 86 individuals). Some questionnaires were invalidated because they were filled out incorrectly or incompletely.

Collected research material helped us to process and analyse data in three stages (Fig. 26.2). All results of analyses were carried out using graphic and statistical tools available in the IBM SPSS Statistics software.

4 Results of the Survey

4.1 Declared Preference Ranking (Including Social Circumstances)

Students in a research sample represent small cities—up to 20 k residents (13%); average cities—between 20 k and 100 k residents (21%); large cities—a population over 100 k residents (24%) and rural areas (42%). Among respondents, 60% were women and 40% men.

According to respondents, an optimal solution to the problem in question would be a fundraising initiative through which local residents would voluntarily donate money to build a connection for their neighbour. This solution was preferred by most respondents, 34%, with 30% believing in its effectiveness (Option 1.5). About 30% students preferred to give time to the new owner to himself raise resources for building the connection (Option 1.1). This solution is seen as the second most effective to the problem. Another top-ranking way of helping the neighbour in funding the investment is self-taxation where all residents would pay the same amount (per household) to collect the remaining PLN 10 k (1.4). About 35% students decided it is an effective solution and 16% believed it is very effective. In turn, only 13% respondents declared they would force surveillance authorities to continuously monitor the situation and intensify pressure on building the connection (1.2). According to respondents making the new neighbour aware that without changing the source of heating, he will not be liked by the rest of the community was the least promising idea (1.3), 7% respondents assessed it as very effective (Fig. 26.3).

Ranking of options in terms of their effectiveness. 1.1—We give time to the new owner to raise funds for the construction of the connection; 1.2—We force surveillance authorities to constantly monitor the situation and intensify pressure on the connection to geothermal installation; 1.3—We make the new owner aware that without changing the source of heating for his house, he will not be liked by other residents; 1.4—Residents of the village impose a tax on themselves, equal for all households, to collect the remaining PLN 10 k; 1.5—Households organise a voluntary fundraising initiative to collect money for their neighbour’s collection. They will go on until they collect PLN 10 k but not longer than for a year; N = 86

Statistically, significant differences have been observed (p = 0.10) in the number of men and women who decided that a voluntary fundraising initiative was the best solution to the problem (35% female students and 32% male students gave preference to this option). Moreover, 2% female and 12% male students considered the above solution little effective (Fig. 26.4). 27% female students and 35% male students would give time to the new owner to raise funds for the construction of the connection (p = 0.72). No significant differences were reported in the number of women (19%) and men (24%) who believed the above solution is ineffective. At the same time, the assessment of effectiveness of self-taxation option is significantly different for women and men (p = 0.09). Statistically, more women (54%) than men (27%) preferred this solution as a way of preventing air pollution. Besides, significantly more men (15%) than women believe self-taxation is ineffective with only 2% women decisively not supporting the initiative (Fig. 26.4).

Relationship between effectiveness assessments of the most preferred solutions and respondent gender. Female, n = 52, men, n = 34; we conducted the Chi-square tests of independence for significance level α = 0.10 [7]

Results of the experiment show that residents of middle-sized cities assessed the solution consisting in giving time to the new owner to raise funds for the construction of the connection as significantly less effective (p = 0.03). Half of the students permanently domiciled in cities whose population ranges from 20 to 100 k inhabitants consider this option moderately effective and 28% believe it is not effective. Only 22% respondents claim such assistance could be effective in the struggle for air quality protection. On the other hand, clear majority of respondents from small and large cities as well as rural areas argue that the new owner should be given time to raise funds for the construction of the connection. Residents of medium-sized cities assessed the effectiveness of self-taxation, equal amount per household, to collect PLN 10 k significantly higher (p = 0.10). About 40% students from cities with population ranging between 20 and 100 k believe this is an effective solution and only 9% respondents permanently residing in small and large cities as well as in rural areas would prefer this solution (Fig. 26.5). No statistically significant differences were reported between respondents’ domicile and the assessment of effectiveness of the solution providing for a voluntary fundraising initiative to collect money for the neighbour’s connection (p = 0.60). The smallest group of respondents from small cities, 18%, considered this form of assistance to the new owner highly effective. A clear majority, 44% students from large cities, preferred this very option. In turn, on average, 7% respondents permanently residing in locations indicated in the questionnaire assumed the solution is ineffective (Fig. 26.5).

Relationship between assessment of effectiveness of a solution and place of permanent residence. Rural area, n = 36; small city, n = 22; average city, n = 18; large city, n = 21. Detailed Fisher independence tests were carried out for the level of significance α = 0.10, because over 20% cells have expected counts lower than five and the minimum expected count is smaller than one [9]

4.2 Analysis of the Willingness to Pay for a Public Good and Socio-economic Aspects

Assuming that residents decided to impose a tax on themselves to financially support the construction of their neighbour’s connection, the majority, as many as 41% respondents, were willing to contribute PLN 20. Slightly fewer, 37% respondents (out of 86), declared to pay PLN 30 per household. The rest of students (22%) opted for a tax amounting to PLN 40 (Fig. 26.6). Moreover, to the question, if self-taxation payment should depend on per capita income in a household, most respondents answered “yes” (66% out of 86 in the sample).

We also observed that significantly more male students (35% out of 34 respondents) than female students (13% out of 52 female respondents) are willing to pay PLN 40 (p = 0.01). In turn, clearly more women than men who were willing to pay the tax would like to pay PLN 30 (48% female students and 21% male students). Also, slightly more men than women declared the willingness to pay PLN 20 to subsidise the construction of their neighbour’s connection (44% male students and 38% female students). Nevertheless, the difference in amounts amongst respondents is clearly the smallest (6% points) compared to the other two declared tax rates (Fig. 26.7).

Moreover, independently of the declared tax rate (20 PLN, 30 PLN or 40 PLN), a clear majority of respondents opted for the rate to be adjusted to per capita income (p = 0.15) (Fig. 26.8).

Tax rate declared by respondents is independent of their domicile (p = 0.37). Circa 40% students were willing to pay PLN 20 in the form of tax to help the neighbour to construct the connection independently of their permanent place of residence. We also observed that a similar number of students from rural areas, small and large cities declared to pay the tax of PLN 30 (ca. 40% respondents). The majority, 39% students residing permanently in medium-sized cities, opted for tax rate PLN 40. Nevertheless, the latter amount was the least often declared. This is why despite differences between the place of residence and this category of tax, they were not statistically significant (at adopted level of significance) (Fig. 26.9).

4.3 Assessment of Decisions Efficiency Understood as an Ability to Achieve the Goal

Results of the experiment suggest significant differentiation in amounts declared in the self-taxation exercise intended to subsidise the construction of neighbour’s connection stems from the assessment of the effectiveness of the tool (p = 0.08), Fig. 26.10. Amongst respondents who declared the highest tax rate (40 PLN) as many as 47% believe, it is an effective tool and 32% consider it very effective (in total as many as 79% opt for this solution). At the same time, the group of respondents who declared the lowest tax rate (20 PLN) and believe this is an effective solution is significantly smaller, i.e. 43% (out of them only 9% claim this is the most effective solution and 34% believe it is effective). Similarly, 44% respondents who declared PLN 30 assessed this option as effective and very effective, and 16% out of this group believe self-taxation is the best solution to the problem (Fig. 26.10).

5 Discussion

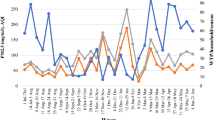

Together with the increase in the tax rate, respondents’ willingness to pay decreases (Fig. 26.6). However, the bigger the willingness to pay, the more likely the goal will be achieved (Fig. 26.10), which finally translates into increased willingness to pay more for clean air, i.e. demand for the good in question (Fig. 26.11). Thus, more effective methods of working out the common public good encourage respondents to pay higher rates (the value of β parameter is the highest in the function describing respondents’ willingness to pay the highest declared rate, Fig. 26.11).

Relationship between the effectiveness of proposed activities and declared willingness to pay for the good. Note The chart presents estimated equations of the linear trend models expressed in general terms as: \( y = \alpha + \beta x \), where positive β represents a continuous increase in the value of analysed variable [12]

Considering assumptions adopted for the experiment and information collected from respondents, we made an attempt to extrapolate the results to the population (250 households sharing the cost of thermo-modernisation). By the same token, we estimated the subsidy offered to the construction of the neighbour’s connection (Table 26.2). The willingness to pay a specific amount declared by the residents, their preferences and socio-economic circumstances would bring in PLN 7025. It means the investment was underestimated to the amount of PLN 2975 (10,000 PLN-7025 PLN).

6 Conclusions

The experiment was designed to find the most preferred solution to the problem consisting in the elimination of the source of air pollution in a village and to learn about residents’ willingness to pay for the public good supplied as a result of such elimination. The most preferred option was a voluntary fundraising initiative to collect money for the construction of the neighbour’s connection that would go on until they collect PLN 10 k but not longer than for a year (1.5). Next was option 1.1 We give time to the new owner (e.g., a year) to raise funds (a borrowing, a loan, etc.) for building the connection, followed by options: 1.4 Local residents voluntarily impose a tax on themselves, equal for all households, to collect the remaining PLN 10 k.; 1.2 We force surveillance authorities to continuously monitor the situation and intensify the pressure on getting him connected to geothermal energy network, and 1.3 We make the new owner aware of the fact that without changing the heating system in his house he will not be liked by the rest of the community (Fig. 26.3).

As a next step, to arrive at more unambiguous value of the good expressed in terms of money, we used the WTP method. We need to bear in mind that if all households joined the self-taxation initiative, tax rate of PLN 40 would bring the lacking PLN 10 k and solve the problem. However, it turned out that the lowest rate, PLN 20, was the most preferred one (Fig. 26.6; Table 26.2), meaning the valuation of the public good was underestimated. It may mean that the project will not be accomplished in the voluntary taxation option.

References

Baker, R., Ruting, B.: Environmental policy analysis: a guide to non-market valuation. In: Productivity Commission Staff Working Paper, Canberra. Available via Media and Publications. https://www.pc.gov.au/research/supporting/non-market-valuation/non-market-valuation.pdf. Accessed 04 Apr 2019 (2014)

Bowen, H.R.: The interpretation of voting in the allocation of economic resources. Q. J. Econ. 58, 27–48 (1943). https://doi.org/10.2307/1885754. Accessed 04 Jan 2019

Brouwer, R.: Constructed preference stability: a test–retest. J. Environ. Econ. Policy 1, 70–84 (2012). https://doi.org/10.1080/21606544.2011.644922. Accessed 04 Jan 2019

Brown, C.V., Jackson, P.M.: Public Sector Economics. Blackwell, London (1992)

Brown, T.C.: Introduction to stated preference methods. In: Champ, P.A., Boyle, K.J., Brown, T.C. (eds.) A Primer on Nonmarket Valuation. The Economics of Non-market Goods and Resources, vol. 3, pp. 99–110. Springer, Dordrecht (2003)

Buchanan, J.: The demand and supply of public goods. In: Buchanan, J.M. (ed.) The Collected Work, vol. 5, p. 32. Liberty Fund, Indianapolis (1999)

Cochran, W.G.: The chi-square goodness-of-fit test. Ann. Math. Stat. 23(3), 315–345 (1952)

Desmarais-Tremblay, M.: On the Definition of Public Goods. Assessing Richard A. Musgrave’s contribution. Documents available via. de travail du Centre d’Economie de la Sorbonne. https://halshs.archives-ouvertes.fr/halshs-00951577/document. Accessed 04 Apr 2019 (2014)

Fisher, R.A.: Statistical Methods for Research Workers. Oliver and Boyd, Edinburgh (1934)

Hanemann, W.M.: Valuing the environment through contingent valuation. J. Econ. Perspect. 8(4), 19–43 (1994)

Loomis, J., Brown, T., Lucero, B., Peterson, G.: Improving validity experiments of contingent valuation methods: results of efforts to reduce the disparity of hypothetical and actual willingness to pay. Land Econ. 72(4), 450–461 (1996)

Maddala, G.S.: Introduction to Econometrics. Macmillan, New York (1992)

Musgrave, R.A.: A multiple theory of budget determination. Finanzarchiv 17(3), 333–343 (1957)

Roberts, D.J.: The Lindahl solution for economies with public goods. J. Public Econ. 3(1), 23–42 (1974)

Samuelson, P.A.: Diagrammatic exposition of a theory of public expenditure. Rev. Econ. Stat. 37(4), 350–356 (1955)

Żylicz, T.: Ekonomia środowiska i zasobów naturalnych (Economics of the environment and natural resources) [in Polish]. PWE, Warszawa (2004)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Burchard-Dziubińska, M., Antczak, E., Rzeńca, A. (2020). Declared Preference Method—Research Experiment Concerning Air Quality. In: Nermend, K., Łatuszyńska, M. (eds) Experimental and Quantitative Methods in Contemporary Economics. CMEE 2018. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-30251-1_26

Download citation

DOI: https://doi.org/10.1007/978-3-030-30251-1_26

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-30250-4

Online ISBN: 978-3-030-30251-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)