Abstract

Consider the air-cargo service chain which comprises a carrier and multiple forwarders. The carrier and each of the forwarders may establish an allotment contract at the start of the season. We formulate the contract design problem as a Stackelberg game, in which the carrier is the leader and offers a contract to a forwarder. The contract parameters may include the discount contract price and the penalty cost for the unused allotment as well as the minimum allotment utilization. The carrier’s contract is accepted, if the forwarder earns at least its reservation profit. Given the carrier’s offer, the forwarder decides how much to book as an allotment, in order to maximize its own expected profit. We show that the two-parameter contract suffices to coordinate the service chain, and the carrier earns the maximum chain’s expected profit less the total reservation profits of all forwarders. If the penalty cost is not imposed, then the minimum allotment utilization is needed to construct an efficient contract. On the other hand, if the penalty cost is strictly positive, then there is no need to impose the minimum allotment requirement.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Air-cargo operations inarguably play a crucial role in the modern supply chain, since they improve efficiency in logistics and increase competitive advantages. Despite the 1% world trade by volume, airfreight represents more than 35% of global trade by value [23]. The air-cargo growth is driven by global liberalization, cross-border e-commerce, and the implementation of supply chain/logistics management strategies, which emphasize on short lead times, e.g., lean/agile management and just-in-time (JIT) production systems. With e-commerce boom, airfreight has become a de facto mode of cross-border transportation, for the customer centric businesses with fast delivery times. Air cargo consists of various commodity types, e.g., pharmaceutical products, live animals, electronic devices, human remains, dry ice, and gold bullion; some fastest-growing air-cargo perishables in 2017 include seafood from Scotland, smoked meat and wines from Australia, clotted cream from the U.K., blueberries from Ukraine and medicinal plants from Afghanistan [40]. Despite the sluggish growth in 2015 due to the economy slowdown worldwide, air-cargo traffic is expected to gradually accelerate. The largest average annual growth rate is found in Asia-Pacific freight market [11].

In an air-cargo service chain, a shipper can receive services directly from an air-cargo carrier or delegate to a freight forwarder. A large portion of air cargo volume is handled through freight forwarders. A freight forwarder acts as an intermediary party, who connects a shipper to an airline. The forwarder consolidates shipments and handles various aspects of the shipping process, e.g., pickup and delivery services, insurance, customs clearance, import and export documentation, cargo tracking and tracing, and interacting with multi-modal carriers. Most forwarders do not own an airplane and obtain cargo space on ad hoc basis or through a medium- or long-term capacity agreement, also known as the allotment, with the carrier. The airline carries consolidated cargo in the belly of a passenger plane or a freighter. Freighters are critical to compete in air cargo markets, since they carry more than half of air-cargo traffic and airlines operating freighters generate 90% of the industry revenues [11]. Capacity utilization is one of the top operational problems, faced by the majority of the cargo carriers [1]. The carrier offers a contract to the forwarder, hoping to increase its capacity utilization. The forwarder wants to establish the contract, in order to receive volume discounts or lower freight charges. The discount may depend on the size of the allotment and the actual volume tendered by the forwarder [34].

Air-cargo spaces are perishable in the sense that they cannot be sold after the flight departure. They are sold in two stages: In the first stage which happens a few months before a season starts, a carrier allocates spaces to forwarders either as part of a binding contract or as part of goodwill [10]. Each year comprises two seasons, Winter and Summer schedules, specified by the International Air Transport Association [35]. Through the allotment contract, the forwarder achieves a more economical rate, compared to the so-called spot rates for ad hoc shipments. The forwarder pre-books a certain amount of capacity at a pre-specified rate, based on its anticipated demand on a given route and the contract terms. The demand is forecasted based various factors such as the economic condition, the competitors’ action, and the projected trend and seasonal patterns. About 50–70% of air-cargo space is sold to forwarders through a “hard” block space agreement (BSA) at a negotiated price, a “soft” block permanent booking (PB) or other forms of capacity agreements [33]. Carriers in Asia Pacific typically allocate a large fraction, whereas those in North America allocate a small fraction of their capacity [19]. After the forwarder collects and consolidates shipments from its customers, and the actual allotment usage becomes known, the payment is transferred between the carrier and the forwarder. If the forwarder’s customer demand is smaller than previously anticipated, the allotment utilization by the forwarder may be low. The carrier may impose some cancellation fee for the unused allotment by the forwarder, or it may impose the minimum allotment utilization and offer the refund up to a pre-specified portion, not all unused portion of the allotment. Nevertheless, for the airline’s most important forwarders, the cancellation clause is rarely enforced; these powerful forwarders pay only for their actual allotment usages. After the unused allotment is released by the forwarder a few weeks before a flight departure, the carrier re-sells the remaining capacity on a free-sale or ad hoc basis to direct shippers.

In this article, we develop a formulation for the study of contracts with three parameters: (1) a discount contract price, (2) a refund (or penalty cost) for the unused portion of the allotment, and (3) the minimum allotment utilization. Our objective is to determine an optimal contract scheme, which allows the air-cargo service chain to be efficient. To this end, we formulate a Stackelberg game, in which the carrier is the leader and proposes a contract to each of the multiple freight forwarders. Based on its anticipated demand and the contract parameters, the forwarder determines the best allotment size, which maximizes its own expected profit. Based on the forwarder’s best response, the carrier determines the contract parameters in order to maximize its own expected profit. We analyze the sequential game of the allotment contract problem and identify sufficient conditions under which the equilibrium contract is efficient. Our model benefits the carrier by identifying a possible contract structure that it should strive for in negotiating with the forwarders. The contract with only two parameters (either the positive penalty cost or the minimum allotment utilization) is sufficient to coordinate the air-cargo service chain.

Air-cargo capacity is perishable and can be sold at different prices to heterogeneous customers with different willingness to pay. Thus, it is a prime candidate for applying revenue management (RM) strategies. Overview of RM theory and practice can be found in textbooks, e.g., [21, 31, 36, 43], and journal articles, e.g., [13, 27, 30]. Literature on air-cargo RM is fairly limited, in comparison to the extensive literature on passenger RM. [16] provides a literature review on air-cargo operations. [10, 24] are among the early descriptive overview papers on air-cargo RM. [8] describes the air-cargo system in the Asia Pacific. [35] describes the implementation of air-cargo RM system at KLM and highlights key factors that critically affect its performance. Air-cargo operations are presented in [33], and air-cargo RM from business perspective is discussed in [9, 14]. The air-cargo industry outlook can be found in, e.g., [11, 23]. Air-cargo training courses are provided by several professional associations such as International Air Transport Association (IATA), British International Freight Association (BIFA) and International Association of Airport Executives Canada (IAAEC).

Key short-term air-cargo operations include aircraft loading (e.g., [37, 41]), shipment routing (e.g., [32, 42]) and booking control (e.g., [3, 7, 20, 45]). Allotment contracts are medium-term decisions. Articles which combine both short-term booking control and medium-term allotment decisions are, e.g., [25, 28, 44]. [25] considers an airline which operates parallel flights between a given origin and destination pair; the carrier’s medium-term decision is to choose allotment contracts among available bids from forwarders, whereas the short-term decision corresponds to the booking control problem, from which the expected contribution from the spot market can be determined. In [28], the carrier’s medium-term decision is to determine how much of the total weight and volume capacity to sell as allotments. Unlike ours, these articles take the carrier’s perspective and are concerned with a single decision maker.

In contrast to having a carrier as the single decision maker, the contract design problem considers two or more decision makers, which typically include the carrier and one or more forwarders, and the game theoretic approach is often employed to find an optimal allotment contract scheme. [18] proposes an options contract, similar to supply chain contracts in, e.g., electricity generation and semiconductor manufacturing, and investigates the suitability of options contracts in the air-cargo industry. Under certain contract parameters and a suitable spot market environment, the options contract outperforms the fixed-commitment contract. The buy-back scheme is another prevalent contract in supply chain (see, e.g., [12] for a review of supply contracts): [26] applies this buy-back concept in the air-cargo service chain and shows that the buy-back policy improves revenues of both players, namely the carrier and the forwarder. [4] considers the carrier’s mechanism design problem, in which the other player, namely the freight forwarder, possesses some private information on, e.g., its customer demand and operating cost. An optimal allotment scheme, which maximizes the total contribution of the air-cargo service chain, is attainable via a contract with an appropriate upfront and cancellation fees. [17] provides conditions such that flexible contract schemes maximize the total profit in the service chain. [2] proposes an allotment contract, which includes a discount contract price, a penalty cost for an unused portion of the allotment, and an allotment utilization requirement, and derives a sufficient condition for an optimal contract.

This article extends [2] to include multiple freight forwarders. The carrier’s capacity allocation problem with multiple forwarders is studied in [5]. The expected contribution given a fixed allotment is obtained using a discrete Markov chain, and the maximization of the total expected is formulated as a Markov decision process. [5] derives the optimal allotment from the carrier’s viewpoint, given that the contractual agreement is exogenously given. [15] proposes the tying capacity allocation mechanism, in which multiple routes with different capacity utilization are included in the contract. The carrier allocates capacities to multiple forwarders using their performances on different routes in the previous year. [38] considers a multiple-forwarder setting and proposes an options contract to mitigate the carrier’s capacity utilization risk. [15] solves for an optimal solution using a dynamic programming, and [38] provides a numerical example to show how to obtain an optimal contract, whereas we analytically derive a sufficient condition for an optimal contract. With the exception of [6, 39], which consider risk-adverse party, these articles including ours assume that each player is rational, risk-neutral and maximizes its expected profit. These papers employ a mechanism design approach to find an optimal contract. Ours contributes to this literature: We consider a different scheme and provide a sufficient condition such that a two-parameter contract coordinates the chain.

The rest of this article is organized as follows. Section 2 presents the Stackelberg game of the interaction between the carrier and multiple freight forwarders. A sufficient condition for an equilibrium of the game is derived in Sect. 3. We also provide an analysis for the centralized chain, in which all decision makers are assumed to be owned by one single company. Section 4 provides some numerical examples to illustrate our approach, and Sect. 5 gives a summary and a few extensions.

2 Formulation

Consider an air-cargo service chain, which consists of an air-cargo carrier endowed with cargo capacity of \(\kappa \) and m freight forwarders, referred to as \(1, 2,\dots , m\). At the beginning of the season, each forwarder and the carrier independently negotiate the allotment contract. The freight forwarder wants to pre-book capacity in bulk with the carrier to achieve the discount rate, which is less than or equal to the spot rate. Let \(v_i\) denote the spot rate that forwarder i obtains on ad hoc shipments (without the allotment contract). Assume that the forwarders are labeled such \(v_1 \ge v_2 \ge v_3 \cdots \ge v_m\). In the strategic level, the air-cargo capacity is assumed to be a one-dimensional quantity. In the operational level, the carrier charges the forwarder based on the chargeable weight, which is the maximum between the volume weight and the gross weight. If the shipment is measured in centimeter, then the volume weight is equal to the shipment’s cubic centimeter divided by 6000. We concern with the carrier’s strategic decisions, not operational.

The interaction between the carrier and the forwarders is modeled as a Stackelberg game. The sequence of events is as follows: The carrier offers forwarder i, the three-parameter contract \(\varOmega _i = (w_i, h_i, u_{ri})\) where \(0 < w_i \le v_i\) is the discount rate, \(h_i\) the penalty cost for unused portion of the allotment and \(u_{ri}\) is the required expected allotment utilization rate. Forwarder i either rejects or accepts the contract proposal. If the contract \(\varOmega _i\) is accepted, then forwarder i determines the size of the allotment, denoted by \(x_i\). The allotment decision takes place before demands materialize. For each \(i = 1, 2, \dots , m\), let \(D_i\) denote the stochastic demand to forwarder i. During the season, forwarder i accepts all demand \(D_i\) at the per-unit price \(p_i\) where we assume that \(p_i \ge v_i\). Given the allotment \(x_i\), the expected contribution of forwarder i is as follows:

where the transfer payment from forwarder i to the carrier is

In (1), the first term is revenue forwarder i earns from its customer demand \(D_i\), the second term the contract payment, and the third term the forwarder’s spot purchase for the excess demand. In (2), the contract payment is the sum of the payment for the actual allotment usage and the penalty cost associated with the unused allotment.

The first two contract parameters \((w_i, h_i)\) can be interpreted differently as follows: The transfer payment from forwarder i to the carrier can be written as

In (3) and (4), we can interpret \(w_i\) as the wholesale price for the entire allotment \(x_i\), paid upfront by the forwarder. If \(h_i >w_i\), then the forwarder pays for the allotment \(x_i\) upfront at the wholesale price of \(w_i\), and after its demand is realized, the penalty rate of \((h_i-w_i)\) is charged for the unused portion of the allotment; see (3). If \(h_i < w_i\), then the forwarder pays for the allotment \(x_i\) upfront at the wholesale price of \(w_i\) as before, but after its demand is realized, the refund rate of \((w_i-h_i)\) for the unused portion of the allotment is returned from the carrier to the forwarder; see (4). In particular, the contract parameter \(h_i = 0\) corresponds to the full refund; the forwarder pays for the allotment \(x_i\) upfront at the wholesale price \(w_i\) and it gets a full refund rate of \(w_i\) for the unused portion of the allotment. Finally, if \(h_i=w_i\), then the forwarder pays for the entire allotment \(x_i\) at the wholesale price \(w_i\) upfront, and there are no additional monetary transfers. Since the air-cargo selling season is so short that monetary discount can be ignored, the expected profit is not affected by the timing in which the payment is collected. Our formulation subsumes both refund \((h_i < w_i\)) and penalty \((w_i < h_i)\) rates for the unused portion of the allotment. Furthermore, the full-refund contract (\(h_i = 0\)) is not uncommon, especially when the freight forwarder is very powerful and holds a large market share on a route.

The third contract parameter \(u_{ri}\) ensures that forwarder i maintains the allotment utilization of at least \(u_{ri}\); specifically,

where the allotment utilization is defined as the ratio of the expected actual allotment usage to the allotment size x:

In practice, the forwarder generally needs to maintain the high utilization; otherwise, the carrier may choose not to continue with this forwarder in the future or may not offer a favorable contract term to the forwarder.

Forwarder i accepts the contract if the expected contribution exceeds the forwarder’s reservation profit, denoted by \(\epsilon _i\). Let \(x^*_i(\varOmega _i)\) denote forwarder i’s best response to the contract parameter \(\varOmega _i\); i.e.,

The contract \(\varOmega _i\) is accepted if \(\pi _i(x^*_i(\varOmega _i), \varOmega _i) \ge \epsilon _i\). If the reservation profit were thought of as the expected contribution if the forwarder did not have an allotment contract, then we could set \(\epsilon _i = E[(p_i -v_i)D_i]\), the contribution margin in the spot market multiplied by the expected demand. This quantity can be viewed as the lower bound on the forwarder’s reservation profit.

Let \(\mathbf {H}= ((w_i, h_i, u_{ri}): i = 1, 2,\dots , m)\) denote the contract parameters offered by the carrier to forwarders \(1, 2, \dots , m\), respectively, and \(\mathbf {x}= (x_i: i = 1, 2, \dots , m)\) the allotments chosen by the forwarders. After all forwarders release their unused allotments, the carrier re-sells this to direct shippers. Let \(p_0\) be the carrier’s price charged to the direct-ship demand, denoted by \(D_0\). The carrier’s expected profit is defined as:

In (7), the first term is the carrier’s revenue from selling the remaining cargo space to its own direct-ship customers, and the second term the sum of all forwarders’ transfer payments.

At the equilibrium, the carrier anticipates the forwarders’ best responses \(\mathbf {x}^*(\mathbf {H}) = (x^*_i(\varOmega _i); i=1,2,\dots ,m)\) and chooses the best contract parameters, in order to its own expected profit:

In Sect. 3, we will determine the equilibrium of the game, in which each party maximizes its own expected profit. We refer to this as the decentralized chain.

Finally, we consider the entire air-cargo service chain: Suppose that all forwarders and the carrier are owned by the same firm, called the integrator. This is referred to as the centralized chain. The total chain’s expected profit is defined as the sum of the forwarders’ expected profits and that of the carrier:

In (10), the first term is the total contribution from customers in need of dedicated services as offered by the forwarder, and the second term the contribution from the direct-ship customer. Note that in the integrator’s profit, there are no contract payment terms, because we assume that the forwarders and the carrier belong to the same firm, and their transfer payments cancel out when we analyze the entire service chain.

Assume that \(p_i> p_0 > v_i\) for each \(i =1, 2, \dots , m\). The first inequality follows from the fact that the forwarder offers value-added service, e.g., customs clearance and door-to-door service, whereas the carrier does not. The second inequality follows from the observation that the direct-ship customer is typically the last-minute customer, who could not obtain cargo space in the spot market. Since \(p_i > p_0\), we assume in (10) that the integrator accepts all demands for dedicated services, \(\sum _{i=1}^m D_i\). The integrator could handle this demand using either its cargo capacity or the space elsewhere. Since \(p_0 > v_i\), the integrator wants to reserve some capacity for the last-minute direct-ship customer \(D_0\); i.e., it handles \(x_i\) units of demand \(D_i\) using its own capacity and purchases from the spot market for the excess demand \((D_i - x_i)^+\) at the rate of \(v_i\). Specifically, the expected contribution from demand \(D_i\) to the carrier can be written as:

In (11), the margin for the portion handled by the carrier itself is \(p_i\), whereas that by the spot market is \(p_i - v_i\). It can be seen from (12) that the larger the allotment \(x_i\), the greater the contribution from demand \(D_i\), but the smaller the remaining capacity for the direct-ship demand \(D_0\) which generates higher margin (since \(p_0 > v_i\)). In (10), the integrator needs to determine the allotment \(x_i\) for the demand i in order to maximize the expected total contribution from both direct-ship customer and customers in need of dedicated services.

The service chain is said to be efficient if the total expected contribution of the chain (the integrator’s expected profit) is equal to the sum of the profits of all parties. The contract which allows the efficiency to occur is said to coordinate the service chain [12]. The coordinating contract is desirable, since the service chain risk is shared appropriately, and there is no efficiency loss in the decentralized chain. In the analysis, we will find an equilibrium coordinating contract, if exists.

3 Analysis

For each \(i =0,1,2,\dots , m\), assume that demand \(D_i\) is a nonnegative continuous random variable and is independent of one another. Let \(F_i\) be the distribution function of \(D_i\), \(\bar{F}_i\) the complementary cumulative distribution function, \(F^{-1}_i\) the quantile function, and \(\xi _i\) the density function. Define \(\upsilon ^{-1}_i: (0,1) \rightarrow (0,\infty )\) as the inverse function of the utilization function; i.e., \(u_i(x) = t\) if and only if \(\upsilon ^{-1}_i(t) = x\).

3.1 Centralized Chain

The integrator endowed with cargo capacity \(\kappa \) wants to choose allotments \(\mathbf {x}= (x_1, x_2, \dots , x_m)\) for demands \((D_1, D_2, \dots ,D_m)\) so that the total expected profit of the chain \(\tau (\mathbf {x})\) is maximized. The integrator’s problem can be formulated as the finite-horizon Markov decision process (MDP). There are m periods, and the integrator decides an allotment \(x_n\) for demand \(D_n\) in period n. As in most revenue management literature, we assume that the time periods are backward from \(m, m-1, m-2, \dots , 3,2,1\). In period n, let the state be the cumulative allotment usage s up to now, and let \(g_n(s)\) denote the value function. At the beginning of the period, the integrator observes the state s and chooses an allotment \(x_n\). The optimality equation is as follows:

for \(n = 1, 2, \dots , m\). An allotment chosen by the integrator cannot be greater than the remaining capacity, \(\kappa - s\). In period n, the integrator wants to choose an allotment \(x_n\), which maximizes the sum of the expected contribution from demand \(D_n\) and the value function \(g_{n-1}\), the revenue to go from period \((n-1)\) to the end of the horizon. Recall from (12) that the contribution from demand \(D_n\) is \(E[(p_i -v_i)D_i + v_i \min (D_i, x_i)]\): In the optimality Eq. (13), we ignore the first term and account only for the second term, since the first term is constant and does not depend on the allotment.

The boundary conditions are as follows:

In (14), the value function remains constant when the entire capacity \(\kappa \) has been used as the allotment. In (15), the terminal value function corresponds to the expected contribution from the direct-ship customer, when the remaining capacity is

Note that in the MDP, we assume that demands are materialized sequentially and that the cumulative allotment usage is known at the beginning of each period. Since the horizon is so short that there is no monetary discount, finding the value function given that there is no initial allotment, \(g_m(0)\), is equivalent to maximizing the expected profit of the integrator, \(\max \{ \tau (\mathbf {x}): \sum _{i=1}^m x_i \le \kappa \}\).

The MDP formulation (13)–(15) for the integrator’s problem is similar to the MDP formulation of the capacity allocation problem for the passenger airline, where the spot price \(v_n\) corresponds to the class-n fare, and the allotment \(x_n\) the protection for class-n demand; see [36] Section 2.2.2 for the multi-class capacity allocation problem for the passenger airline. If the capacity is large, directly solving the MDP may be computationally intensive, and several efficient heuristics, e.g., EMSR-A (expected marginal seat revenue-version A) and EMSR-B, are reviewed in Section 2.2.4 in [36].

Consider the special case when there is one forwarder. The integrator’s expected profit becomes:

The integrator’s problem of choosing an allotment \(x_1\) in order to maximize the expected profit (16) is presented in Proposition 1.

Proposition 1

-

1.

If \(v_1 > p_0\), then \(x_1^0 = \kappa \).

-

2.

If \(v_1 < p_0\), then

$$\begin{aligned} x_1^0 = \left[ \kappa - F_0^{-1}\left( 1 - \frac{v_1}{p_0} \right) \right] ^+. \end{aligned}$$(17)

Proof

Proof can be found in Theorem 4 [2].

Recall that we assume \(p_0 > v_1\). Without this assumption, the integrator’s problem becomes trivial; see the first result in Proposition 1.

The optimal allotment (17) can be found using the marginal analysis. The integrator wants to find a protection for the direct-ship demand, \(D_0\). Suppose that y units of capacity have been reserved for \(D_0\) and that at the beginning of the season, there is a request from \(D_1\) for an allotment. If the integrator sells now as an allotment, then it earns \(v_1\); see (12). On the other hand, if the integrator does not sell now and reserves for the direct-ship customers, then it earns the expected margin of \(p_0 P(D_0 \ge y)\). The integrator continues to protect for the direct-ship customer until \(v_1 = p_0 P(D_0 \ge y)\). Re-arranging the previous term, we find that the optimal protection for the direct-ship customer is \(F_0^{-1}(1-v_1/p_0)\); thus, the optimal allotment for \(D_1\) is given in (17).

3.2 Decentralized Chain

Given that the carrier offers the contract \(\varOmega _i = (w_i, h_i, u_{ri})\), forwarder i chooses an optimal allotment \(x_i^*(\varOmega _i)\) in (6), which maximized its own expected profit.

Lemma 1

Given the contract proposal \(\varOmega _i\), the forwarder’s best response allotment \(x^*_i(\varOmega _i)\) is as follows:

-

1.

If \(w_i \ge v_i\), the forwarder’s expected profit is decreasing and maximized at \(x^*_i(\varOmega _i) = 0\).

-

2.

If \(w_i < v_i\) and \(h_i=0\), the forwarder’s expected profit is increasing and maximized at \(x^*_i(\varOmega _i) = \upsilon ^{-1}_i(u_{ri})\).

-

3.

If \(w_i < v_i\) and \(h_i > 0\), the forwarder’s expected profit is concave, unimodal and maximized at

$$\begin{aligned} x^*_i(\varOmega _i) = \min \{ F^{-1}_i\left( 1- \frac{h_i}{v_i - w_i + h_i} \right) , \, \upsilon ^{-1}_i(u_{ri}) \}. \end{aligned}$$(18)

Proof

See the proof in [2].

The first part of Lemma 1 asserts that if the discount contract price is greater than or equal to the spot price, the forwarder would not pre-book any allotment at all. On the other hand, suppose that the contract price does not exceed the spot price. If the carrier imposes no penalty cost or gives full refund for the unused allotment (i.e., \(h_i=0\)), the forwarder’s expected profit is increasing, and the forwarder would choose the largest allotment that satisfies the required allotment utilization. The last part asserts that if there is a positive penalty cost or a partial refund is given (i.e., \(h_i>0\)), the forwarder should pre-book the allotment, which balances the cost associated with the unused allotment and the opportunity cost from not having enough allotment. An optimal allotment in Lemma 1 bears a striking resemblance to the optimal order quantity in the newsvendor (single-period) inventory model. In the newsvendor model, an optimal order quantity is chosen such that the expected total cost \(E[c_u (D-q)^+ + c_o (q-D)^+]\) is minimized: \(q^* = F^{-1} (1-c_o/(c_u+c_o))\) where \(c_u\) (resp., \(c_o\)) is the unit underage (resp., overage) cost from ordering less (resp., more) than demand, and F is the distribution of demand D; see a standard textbook in operations management for the newsvendor model, e.g., chapter 5 in [29]. In ours, the overage corresponds to the penalty cost for the unused allotment \(h_i\), and the underage is the saving forgone \(v_i-w_i\) if the forwarder purchases from the spot market instead of using the allotment. The critical ratio \(1-c_o/(c_u+c_o)\) becomes as in (18).

Let \(\mathbf {x}^0 = (x^0_i; i = 1, 2, \dots , m)\) be the integrator’s optimal allotment, which maximizes the expected profit of the centralized chain. Recall that \(\mathbf {x}^*(\mathbf {H}) = (x^*_i(\varOmega _i); i = 1, 2,\dots , m)\) denotes the optimal allotments chosen by the forwarders, in order to maximizes their own profits. Below, we will determine the equilibrium of the game, in which each party maximizes its own expected profit. For shorthand, denote \(\varLambda _i = 1/F_i(x_i^0)-1\).

Theorem 1

Suppose that \(\bar{u}_{ri} = 0\) for each \(i=1,2,\dots , m\) and that there exists \(0< \bar{h}_i < v_i\varLambda _i\) such that \(\pi _i(x^0_i, \bar{\varOmega }_i) = \epsilon _i\) where

Then, the contract \(\bar{\mathbf {H}} = (\bar{\varOmega }_i; i =1, 2,\dots , m) \) where \(\bar{\varOmega _i} = (\bar{w}_i, \bar{h}_i, \bar{u}_{ri})\) is an equilibrium of the game and coordinates the service chain.

Proof

In the decentralized chain, the carrier wants to find \(\mathbf {H}\) which maximizes

The Karush-Kuhn-Tucker (KKT) conditions that are necessary for a point \(\bar{\mathbf {H}} = ((\bar{w}_i, \bar{h}_i, 0); i = 1,2,\dots , m)\) to solve (20)–(21) are as follows: There exists a multiplier \(\bar{\lambda }_i \ge 0\) for \(i =1,2,\dots , m\) satisfying

Suppose that \(\bar{\lambda }_j > 0\). It follows from (24) that

for each \(j=1,2,\dots , m\). The contract parameters are chosen such that the forwarder earns exactly its reservation profit. Recall that \(\psi = \tau - \sum _i \pi _i\). Note that

Equation (22) becomes

The contract parameter (19) is chosen such that

(In other words, after terms are re-arranged, (26) becomes (19).) It follows from (26) and Lemma 1 that the forwarders’ best responses also maximize the integrator’s expected profit: The necessary conditions are as follows:

Applying the (multivariable) chain rule to (25) and invoking the necessary conditions (27), we conclude that (22) holds. Similarly, we can show that (23) holds. The KKT conditions are satisfied.

At the point \(\bar{\mathbf {H}} = ((\bar{w}_i, \bar{h}_i, 0):i=1,2,\dots , m)\), the carrier receives the maximum chain’s expected profit less the total reservation profits of all forwarders:

The carrier cannot do better than this; thus, the point \(\bar{\mathbf {H}}\) is an equilibrium solution to our sequential game.

At the equilibrium, the carrier offers a contract parameter \(\bar{\mathbf {H}}\) so that the forwarder’s best response is equal to the integrator’s optimal allotment. The forwarder earns exactly its reservation profit. In this sequential game, the carrier is the leader, and there is a so-called leader’s first-mover advantage.

In Theorem 1, the carrier imposes a strictly positive penalty cost for the unused portion of the allotment. Theorem 2 presents an equilibrium coordinating contract, in which no penalty cost is imposed.

Theorem 2

Suppose that \(\bar{h}_i = 0\) for each \(i=1,2,\dots , m\) and that there exists \(0< \bar{w}_i < v_i\) such that \(\pi _i(x^0_i, \bar{\varOmega }_i) = \epsilon _i\) where

Then, the contract \(\bar{\mathbf {H}} = (\bar{\varOmega }_i; i =1, 2,\dots , m) \) where \(\bar{\varOmega _i} = (\bar{w}_i, \bar{h}_i, \bar{u}_{ri})\) is an equilibrium of the game and coordinates the service chain.

Proof

Recall from Lemma 1 that if \(\bar{w}_i < v_i\), then \(x^*_i(\bar{\varOmega }_i) = \upsilon _i^{-1}(\bar{u}_{ri})\). From the assumption that \(D_i\) is continuous, we have that \(\upsilon _i^{-1}\) is a one-to-one function and conclude that \(x^*_i(\bar{\varOmega }_i) = x^0_i\). The rest of the proof is similar to that in Theorem 1.

Theorem 2 states that if the penalty cost for the unused allotment is zero and that the contract price is less than the spot price, then the forwarder chooses the largest allotment which satisfies the required utilization. In the carrier’s problem, the required utilization becomes the decision variable. Setting the required utilization equal to the expected utilization evaluated at the integrator’s optimal allotment, the chain becomes efficient.

In practice, it is uncommon to a full-refund contract (i.e., \(h_i=0\)). To ensure its high customer service level, the forwarder may ask for a very large allotment (much greater than its anticipated customer demand) and release the unwanted allotment so late that the carrier might not have enough time to re-sell to direct-ship customers. To prevent the forwarder to pre-book a large allotment, Theorem 2 suggests that the carrier needs to impose the minimum utilization requirement.

In Theorems 1 and 2, we present two contract schemes that can coordinate the service chain, and the optimal contract has two parameters. The discount contract price is included in the two optimal schemes. In Theorem 1, the other contract parameter is the positive penalty cost, whereas in Theorem 2, the other parameter is the required allotment utilization. We do not need to have a three-parameter contract in order for the air-cargo service chain to be efficient. Our result provides some managerial insights that can help the carrier to negotiate the contractual terms with the forwarders.

4 Numerical Examples

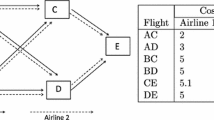

We provide a numerical example to illustrate our approach of finding an equilibrium in the air-cargo contract game. As an illustration, assume that there are \(m=2\) forwarders and that demands are independent. For each \(i=0,1,2\), demand \(D_i\) (in kilogram) follows the gamma distribution with the shape parameter \(\alpha _i\) and the rate parameter \(\beta _i\), shown in Table 1. The carrier’s cargo capacity is assumed to be \(\kappa = 800\) kg. The per-unit price (in THB/kilogram) the forwarder charges its customer, the per-unit price the carrier charges its direct-ship customer and the spot prices observed by the forwarders are also given in Table 1. These parameters are similar to those on the Bangkok-Dublin (BKK-DUB) route in the medium season in 2014.

Calculation details are provided below. Recall the forwarder i’s expected profit (1)

For the first term in (29), the forwarder’s mean demand \(E[D_i]\) is the expected value of the gamma distribution:

For the second term in (29), we evaluate the expected allotment usage \(E[\min (D_i,x)]\) using the limited expected value (LEV) function. The LEV function for gamma random variable, Y, with the shape parameter \(\alpha \) and the scale parameter \(\theta \) is

where \(\varGamma (\alpha ; x)\) is the incomplete gamma function defined by

and \(\varGamma (\alpha )\) is the gamma function, defined by

(For the gamma distribution, the scale parameter is equal to the reciprocal of the rate parameter.) For the last two terms in (29), we use the following

where the expected allotment usage is calculated previously using the LEV function. Recall the carrier’s expected profit (7):

To calculate the first term, we again make use of the LEV.

The integrator’s expected profit (10) can be found similarly. Throughout our numerical examples, calculations are done in R. For instance, the cubature package is used for numerical integration over simplexes, qgamma, dgamma and pgamma return the quantile, density and cumulative distribution functions of the gamma distribution.

4.1 Centralized Chain

Suppose that we use the variant of EMSR algorithm given in Section 5.2 [22]. The allotment \(x_i\) for demand \(D_i\) is given as follows:

where \(v_0 = p_0\) is the per-unit price to the direct-ship customer. Using (30)–(31), we obtain that

and the integrator’s expected profit is \(\tau (\mathbf {x}^0) = 42458\). The integrator would allocate \(x^0_1 =243\) kg to demand \(D_1\) and \(x^0_2 = 494\) to \(D_2\). The remaining capacity of \(x^0_0=63\) is reserved for the direct-ship customer. The expected utilizations by demands \(D_1\) and \(D_2\) are \(u_1(x^0_1) = 97.99\%\) and \(u_x(x^0_2) = 66.30\%\), respectively.

4.2 Decentralized Chain

Assume that the reservation profits are \(\epsilon _1 = 12000\) and \(\epsilon _2 = 10000\). (Note that these two values are greater than the lower bounds, \(E[(p_1-v_1)D_1] =7140\) and \(E[(p_2 -v_2)D_2] = 4320\), when the forwarders use only the spot markets.) We illustrate how to find an equilibrium coordinating contract using Theorem 1 in Example 1 and Theorem 2 in Example 2

Example 1

Consider the contract C1: The carrier offers the contract price \(w_1 = 49.50\) (resp., \(w_2 = 49.00\)) and the penalty cost \(h_1 = 55.00\) (resp., \(h_2 = 1.33\)) to forwarder 1 (resp., 2). Note that the penalty cost is chosen such that \(h_i = \lambda _i v_i \varLambda _i\) where \(\lambda _i \in (0,1)\) is given in Table 2, and that the contract price \(w_i\) is given by (19). (We want \(\lambda _i < 1\) since we are trying to find \(\bar{h}_i < v_i \varLambda _i\); see Theorem 1.) If forwarder i were to accept the contract proposal, it would choose \(x^*_i(\varOmega _i) = x^0_i\). Nevertheless, both forwarders reject this contract C1, because their expected profits given the contract parameters are less than their reservation profits. On the other hand, both forwarders accept contract C2 in Table 2, since their expected profits are greater than their reservation profits. Note that in contract C2 when the larger discount is given to the forwarder (i.e., \(w_1\) decreases from 49.50 to 27.50), the penalty cost for the unused portion of the allotment also becomes larger (i.e., \(h_1\) increases from 55 to 275). Both contracts C1 and C2 coordinate the chain; i.e., \(x^*_i(\varOmega _i) = x^0_i\), and the total profit in the chain is maximized and equal the optimal integrator’s profit, Contract C1 is rejected by the forwarders, whereas C2 is accepted: The expected profits of forwarders 1 and 2 are 12342 and 11407, respectively, and the carrier’s expected profit is 18709, which is about 44% of the chain’s optimal profit. Contract C2 is not an equilibrium solution in our sequential game, since the carrier can still improve its profit while giving the forwarders at least their reservation profits.

Theorem 1 states that at the equilibrium, the forwarders earn exactly their reservation profits. Note that

We can use a bisection method to search for an optimal contract with \((\lambda _1, \lambda _2)\)

such that the forwarders’ expected profits are equal to their reservation profits. If we stop when \(|\pi _i - \epsilon _i| \le \delta _i\) where \(\delta _i\) is a pre-specified tolerance, say 100 THB, then we obtain contract C3 in Table 2. The discount contract price for forwarder 1 (resp., 2) is 28.88 THB/kg (resp., 29.75 THB/kg), and the penalty cost for the unused portion of the allotment is 261.25 THB/kg (resp., 5.38 THB/kg). The forwarders earn (approximately) their reservation profits, and the carrier earns the rest, about of 48% of the optimal integrator’s expected profit.

At the equilibrium contract with strictly positive penalty cost, the carrier does not need to impose the minimum utilization requirement. At the equilibrium, the two-parameter contract is sufficient to coordinate the chain. The two contract parameters \((w_i, h_i)\) can be interpreted differently using (3)–(4). For forwarder 1, \(\bar{\varOmega }_1=(\bar{w}_1, \bar{h}_1) = (28.88, 261.55)\), the wholesale price for the allotment \(x^*_1(\bar{\varOmega }_1)=243\) is 28.88, and the payment upfront is 7014.90; after demand \(D_1\) materializes, the unused allotment is charged at the penalty rate of 232.38. For forwarder 2, \(\bar{\varOmega }_2=(\bar{w}_2, \bar{h}_2) = (29.75, 5.38)\), the wholesale price for the allotment \(x^*_2(\bar{\varOmega }_1)=494\) is 29.75, and the payment upfront is 14704.32; after demand \(D_2\) materializes, the unused allotment is returned at the refund rate of 24.37.

Example 2

The equilibrium coordinating contract found in Theorem 1 corresponds to the positive penalty cost (or partial refund payment) for the unused allotment. In Example 2, we illustrate how to use Theorem 2 to find an equilibrium coordinating contract with no penalty cost (or full refund payment), \(h_i =0\) for \(i=1,2\). By solving for \(\pi _i(x^0_i, (\bar{w}_i, 0, \bar{u}_{ri})) = \epsilon _i\) as specified in Theorem 2, we find the contract price as follows:

Substituting all input parameters and the integrator’s optimal allotments into (32), we obtain the equilibrium coordinating contract C4 in Table 3. With contract C4, the carrier imposes no penalty cost on the unused allotment but needs to impose the required allotment utilization of 97.99% and 66.30% for forwarders 1 and 2, respectively. Also, observe that when the carrier imposes no penalty cost, the discount terms in C4 are not as generous as those in C3.

Our numerical examples illustrate how to construct equilibrium coordinating contracts. Using Theorem 1, we construct a two-parameter contract C3 with the discount contract price and the positive penalty cost. Using Theorem 2, we construct another two-parameter contract C4 with the discount contract price and the minimum allotment utilization requirement.

5 Concluding Remark

We consider the air-cargo service chain, which consists of the carrier and multiple freight forwarders. Each of the forwarders and the carrier may enter into an allotment contract before the selling season starts. We formulate the contract design problem as the Stackelberg game, in which the carrier is the leader and proposes the contract. The proposed contract in this article has three parameters, namely the discount contract price, the penalty cost for the unused portion of the allotment and the required allotment utilization. Each of the forwarders responses by choosing the best allotment, which maximizes its expected profit, given the carrier’s offered contract. We show that the two-parameter contract is sufficient to coordinate the chain. At the equilibrium, the forwarders’ optimal allotments correspond to the integrator’s optimal allotments that maximize the total expected profit in the chain, and the forwarders receive exactly their reservation profits.

A few extensions are as follows: When forwarders’ services are similar and substitutable, the demand to a particular forwarder depends on both its price and the competitors’ prices. Along the same lines, the carrier’s direct-ship demand may depend on the carrier’s direct-ship price and the forwarders’ prices. We can extend ours to include the price competition. For instance, suppose that the pricing decision is made before the contract process begins. Then, the equilibrium prices and the corresponding demands become our input parameters (i.e., \(p_i\) and \(D_i\) for \(i=0, 1,2,\dots , m\)) in this article. Another extension is to capture asymmetric information between the carrier and the forwarder. The forwarder may possess some private information, e.g., its customer demand, its spot price and its reservation profit. We can study how to design an optimal contract. For instance, the carrier may offer a menu of possible contracts, and the forwarder optimally selects from the menu. Finally, we can apply our approach to other RM industry, in which a portion of the perishable capacity is sold through a medium- or long-term contract. For instance, in the passenger airline industry, the airline usually blocks a pre-specified number of seats to a wholesaler/agent or other airlines under the interline or codeshare agreements, which are agreed upon prior to the start of the selling season. We hope to pursue these or related problems.

References

Accenture: 2015 air cargo survey: taking off for higher profitability (2015). www.accenture.com. Accessed 3 July 2016

Amaruchkul, K.: Game-theoretic analysis of air-cargo allotment contract. In: International Conference on Operations Research and Enterprise Systems (ICORES 2018), Funchal, Portugal (2018)

Amaruchkul, K., Cooper, W., Gupta, D.: Single-leg air-cargo revenue management. Transp. Sci. 41(4), 457–469 (2007)

Amaruchkul, K., Cooper, W., Gupta, D.: A note on air-cargo capacity contracts. Prod. Oper. Manage. 20(1), 152–162 (2011)

Amaruchkul, K., Lorchirachoonkul, V.: Air-cargo capacity allocation for multiple freight forwarders. Transp. Res. Part E 47(1), 30–40 (2011)

Barz, C.: Risk-Averse Capacity Control in Revenue Management. Springer, Heidelberg (2007). https://doi.org/10.1007/978-3-540-73014-9

Barz, C., Gartner, D.: Air cargo network revenue management. Transp. Sci. 50(4), 1206–1222 (2016)

Bazaraa, M., et al.: The Asia Pacific air cargo system. Research Paper No: TLI-AP/00/01. The Logistics Institute-Asia Pacific. National University of Singapore and Georgia Institute of Technology (2001). http://www.tliap.nus.edu.sg/Library/default.aspx. Accessed 06 Jan 2007

Becker, B., Dill, N.: Managing the complexity of air cargo revenue management. J. Revenue Pricing Manage. 6(3), 175–187 (2007)

Billings, J., Diener, A., Yuen, B.: Cargo revenue optimisation. J. Revenue Pricing Manage. 2(1), 69–79 (2003)

Boeing Company: World air cargo forecast 2016–2017 (2016). http://www.boeing.com/commercial/market/cargo-forecast/. Accessed 13 Apr 2018

Cachon, G.: Supply chain coordination with contracts. In: de Kok, A., Graves, S. (eds.) Handbooks in Operations Research and Management Science: Supply Chain Management. Elsevier, Amsterdam (2003)

Chiang, W., Chen, J., Xu, X.: An overview of research on revenue management: current issues and future research. Int. J. Revenue Manage. 1(1), 97–128 (2007)

DeLain, L., O’Meara, E.: Building a business case for revenue management. J. Revenue Pricing Manage. 2(4), 368–377 (2004)

Feng, B., Li, Y., Shen, H.: Tying mechanism for airlines’ air cargo capacity allocation. Eur. J. Oper. Res. 244, 322–330 (2015)

Feng, B., Li, Y., Shen, Z.: Air cargo operations: literature review and comparison with practices. Transp. Res. Part C 56, 263–280 (2015)

Gupta, D.: Flexible carrier-forwarder contracts for air cargo business. J. Revenue Pricing Manage. 7(4), 341–356 (2008)

Hellermann, R.: Options contracts with overbooking in the air cargo industry. Decis. Sci. 44(2), 297–327 (2013)

Hendricks, G., Elliott, T.: Implementing revenue management techniques in an air cargo environment. (2010). www.unisys.com/transportation/insights. Accessed 3 Mar 2010

Hoffmann, R.: Dynamic capacity control in cargo revenue management-a new heuritic for solving the single-leg problem efficiently. J. Revenue Pricing Manage. 12(1), 46–59 (2013)

Ingold, A., McMahon-Beattie, U., Yeoman, I.: Yield Management: strategies for the service industries. South-Western Cengage Learning, Bedford Row, London (2000)

International Air Transport Association: Airline Revenue Management: Course eTextbook. International Aviation Training Program, Montreal, Quebec (2012)

International Air Transport Association: IATA cargo strategy (2016). www.iata.org. Accessed 3 July 2016

Kasilingam, R.: Air cargo revenue management: characteristics and complexities. Eur. J. Oper. Res. 96(1), 36–44 (1996)

Levin, Y., Nediak, M., Topaloglu, H.: Cargo capacity management with allotments and spot market demand. Oper. Res. 60(2), 351–365 (2012)

Lin, D., Lee, C., Yang, J.: Air cargo revenue management under buy-back policy. J. Air Transp. Manage. 61, 53–63 (2017)

McGill, J., van Ryzin, G.: Revenue management: research overview and prospects. Transp. Sci. 33(2), 233–256 (1999)

Moussawi-Haidar, L.: Optimal solution for a cargo revenue management problem with allotment and spot arrivals. Transp. Res. Part E 72, 173–191 (2014)

Nahmias, S.: Production and Operations Research. McGraw-Hill Inc., New York (2009)

Netessine, S., Shumsky, R.: Introduction to the theory and practice of yield management. INFORMS Trans. Educ. 3(1), 34–44 (2002)

Phillips, R.: Pricing and Revenue Optimization. Stanford University Press, Stanford (2005)

Prior, R., Slavens, R., Trimarco, J.: Menlo worldwide forwarding optimizes its network routing. Interfaces 34(1), 26–38 (2004)

Sales, M.: The Air Logistics Handbook: Air Freight and the Global Supply Chain. Routledge, New York (2013)

Sigworth, D.: Contracting: making the rate case. Traffic World 268(17), 32–33 (2004)

Slager, B., Kapteijns, L.: Implementation of cargo revenue management at KLM. J. Revenue Pricing Manage. 3(1), 80–90 (2004)

Talluri, K., van Ryzin, G.: The Theory and Practice of Revenue Management. Kluwer Academic Publishers, Boston (2004)

Tang, C.: A scenario decomposition-genetic algorithm method for solving stochastic air cargo container loading problems. Transp. Res. Part E 45(6), 725–739 (2011)

Tao, Y., Chew, E., Lee, L., Wang, L.: A capacity pricing and reservation problem under option contract in the air cargo freight industry. Comput. Ind. Eng. 110, 560–572 (2017)

Wada, M., Delgado, F., Pagnoncelli, B.: A risk averse approach to the capacity allocation problem in the airline cargo industry. J. Oper. Res. Soc. 68(6), 643–651 (2017)

Woods, R.: Top 5 perishables with the fastest-growing demand for air cargo (2017). https://aircargoworld.com/allposts/top-5-perishables-with-the-fastest-growing-demand-for-air-cargo/. Accessed 13 Apr 2018

Wu, Y.: Modelling of containerized air cargo forwarding problems under uncertainty. J. Oper. Res. Soc. 62(7), 1211–1226 (2011)

Yang, S., Chen, S., Chen, C.: Air cargo fleet routing and timetable setting with multiple on-time demands. Transp. Res. Part E: Logist. Transp. Rev. 42(5), 409–430 (2006)

Yeoman, I., McMahon-Beattie, U.: Revenue Management and Pricing: Case Studies and. Thomson Learning, Bedford Row (2004)

Yeung, J., He, W.: Shipment planning, capacity contracting and revenue management in the air cargo industry: a literature review. In: Proceedings of the 2012 International Conference on Industrial Engineering and Operations Management, Istanbul, July 2012

Zhang, C., Xie, F., Huang, K., Wu, T., Liang, Z.: MIP models and a hybrid method for the capacitated air-cargo network planning and scheduling problems. Transp. Res. Part E 103, 158–173 (2017)

Acknowledgements

This research was supported in part by the Thailand Research Fund and Office of the Higher Education Commission, Thailand (Grant RSA58- Kannapha-Amaruchkul). The views expressed in this paper are that of the author and do not necessarily reflect the views of the Thailand Research Fund and Office of the Higher Education Commission, Thailand. Data collection and in-depth interviews were partially conducted by the Ms. Apinya Theppanomrat, one of the full-time master students in the logistics management (LM) program at NIDA, and Ms. Narisara Lueang-orn, one of the part-time master LM students, who has been working at the freight forwarder company (in the numerical example) for several years.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Amaruchkul, K. (2019). Optimal Air-Cargo Allotment Contract with Multiple Freight Forwarders. In: Parlier, G., Liberatore, F., Demange, M. (eds) Operations Research and Enterprise Systems. ICORES 2018. Communications in Computer and Information Science, vol 966. Springer, Cham. https://doi.org/10.1007/978-3-030-16035-7_10

Download citation

DOI: https://doi.org/10.1007/978-3-030-16035-7_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-16034-0

Online ISBN: 978-3-030-16035-7

eBook Packages: Computer ScienceComputer Science (R0)