Abstract

In1930 Keynes famously predicted that 100 years later—i.e. in 2030—the “economic problem” would be solved and we would be living in an “age of leisure and of abundance” working only 3 h a day. In the same text, Keynes stated that there are absolute and relative needs (“in the sense that we feel them only if their satisfaction lifts us above, makes us feel superior to, our fellows”), but he thought that relative needs are of minor importance. Richard Easterlin’s work, on the other hand, suggests that relative needs are pervasive and that wellbeing depends much more on one’s relative income than Keynes once thought.

It will be argued in this text that Richard Easterlin’s findings, in spite of proving Keynes off the mark in his understatement of relative needs, strengthens the case for working time reductions: the larger the proportion of goods subject to the relative-income effect, the greater are the benefits of working fewer hours. Perhaps the main explanation for why we are still sticking to the 40-h work-week is that the Easterlin paradox has not been widely understood yet.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In 1930, John Maynard Keynes famously predicted that 100 years later—i.e. in 2030—“the economic problem” (Keynes 1978, 326) would be solved and we would be living in an “age of leisure and of abundance” (p. 328), working only 3 h a day. Keynes guessed that “the standard of life in progressive countries” would grow between four and eightfold (p. 325–26) until the year 2030 and that this would satisfy our needs “in the sense that we prefer to devote our further energies to non-economic purposes.” (p. 326).

Keynes prediction of economic growth is turning out to be astonishingly correct: if we take per capita real GDP—a concept yet to be invented at the time Keynes wrote his essay—as an indicator for the “standard of life”, a little more than a decade before his target year the standard of life in the United Kingdom has grown more than fourfold and that in the USA fivefold since 1930 (The Maddison Project 2013; Bolt and van Zanden 2014). However, his prediction of our working time is far off the mark: despite substantial reductions of working hours in many countries since 1930, the typical employed person in the high-income countries still works about 40 h per week rather than only 15 h per week or 3 h per day. How could Keynes get it so wrong?

Satisfaction was not being measured in Keynes’ times, so he must have relied for his prediction on the extrapolation of observation and introspection and, perhaps, on the fundamental assumption of economic theory that consumption has diminishing marginal utility. Given that leisure time competes with consumption in the classical utility function, a world in which utility maximizing individuals use real wage increases to buy both more consumption and more leisure time is perfectly consistent with standard economic theory, even though the result depends on the relative magnitudes of the substitution effect and of the income effect (see below for a further discussion of these two effects).

Shortly after Keynes died in 1946, the systematic collection of life satisfaction data began in a few countries and then gradually expanded across the world. Richard Easterlin was the first economist to seize the opportunity that these new data offered: one could finally test the fundamental assumption of economic theory that happiness depends positively on the material standard of living. His famous 1974 paper and the subsequent research that gained momentum in the 1990s seem to be key to understanding Keynes’ mistake and to developing reasonably realistic scenarios for a happiness-augmenting reduction of working hours.

In addition to Keynes’ prudential case for working-hour reductions, more recently a strong moral case for reducing working hours in high-income countries has been added: since rising consumption contributes to environmental damages, ceteris paribus,Footnote 1 limiting consumption can be seen as a moral obligation towards the victims of environmental deterioration, including future generations. While working time reductions are probably not the most directly targeted instrument for reducing the environmental impact—people could theoretically make more ecologically sustainable consumption choices or they could reduce consumption without earning less—, reducing working hours can be seen as a particularly effective way of lowering environmental damages, and one that does not risk leading to rising unemployment as would a one-sided reduction of aggregate demand that is not accompanied by a reduction in aggregate supply. What makes it particularly attractive, however, is precisely the prudential case made by Keynes: working fewer hours may make us happier and more responsible at the same time.

In the following, I will contrast Keynes’ prediction regarding working hours with the data. I will then take a closer look at the explanations he offered (or implied), discussing some potential sources for his misprediction. Next I will turn to Richard Easterlin’s work and show how his more than four decades old interpretation of the early data covered almost all plausible explanations of Keynes’ misprediction. Easterlin’s later writings and those of some other authors will also be explored in order to arrive at a better understanding of the role of aspirations and how they are shaped—one of the central themes in Easterlin’s argument.

2 Secular Trends in Working Hours: Evidence and Explanations

Keynes’ piece was a short essay that was first presented in 1928 and which he then expanded into a lecture,Footnote 2 but it was not an elaborate piece of meticulous research. We therefore are not told what his prediction of a 3-h workday exactly meant in terms of annual or lifetime work hours because he said nothing about vacation days or retirement age. It is important to be rather specific because there is a world of difference between 3 h of work from Monday to Friday for each fully employed person and 3 h on average across the entire adult population and across 365 days of the year. One might even argue, as Jeffrey Sachs (2017, 6) does, that Keynes was almost exactly right if he had the latter interpretation in mind. Based on rough estimates, Sachs arrives at 3.2 working hours per day on average on each of the 365 days of the year averaging across all American adults, which compares to an average of 7.8 h in 1900. However, Keynes clearly did not have such a gross average number in mind since he himself talked about “[t]hree-hour shifts or a fifteen-hour week”: he was not averaging across a wide population and 365 days, but was rather talking about actual workdays of working adults.

How did the actual number of working hours develop and what is the trend for Keynes’ target year 2030? Anyone who has ever tried to analyze working time data will know that there is a large variety of specifications and quite some methodological difficulties. What can be said, using UK figures as an example, is the following: since 1930 the number of years that men work during their lifetime has declined by about 5 years to around 47 years, which was also roughly the duration of the working life in the middle of the nineteenth century. Yet, the average number of hours per week and the number of weeks per year at work have decreased substantially. In sum, the total number of hours that British men work over their lifetime is estimated to have decreased from 123,000 h in 1931 to 88,000 h in 1981, or by about 28% (Ausubel and Grübler 1995, 198). However, the duration of the work week for the full-time employed has stayed at around 40 h since the 1990s in most European countries (Messenger 2011, 298), and data for the US even show a 12% increase from 1973 to 2000 in total hours worked per year per employed person (Schor 2003, p. 7) and a 20% increase for joint hours of paid work per week for married couples from 1970 to 1997 (Jacobs and Gerson 2001, 51).

The big picture therefore shows that it is safe to say that Keynes’ prediction will not come true until 2030 in any country, and not even close. Rather than 15 h per week, full-time workers typically work more than twice as much. The increase in part-time work has started to reduce average hours per employed person in a few countries, but nowhere to less than 30 h (as of 2006; Messenger 2011), and this trend also reflects an increase in female labor force participation, implying a simultaneous increase in joint working hours for couples.

Through the lens of microeconomic theory, one can speculate that Keynes was misled in his prediction by the erroneous inference that continuous labor productivity growth combined with the diminishing marginal utility of consumption must make leisure more attractive. In fact, however, economic theory predicts that increasing labor productivity (assuming it translates into higher real wages) has two contrary effects: on the one hand the income effect raising demand for leisure, consistent with Keynes’ conclusion. On the other hand, however, increasing hourly wages also mean that the opportunity cost of leisure goes up, implying a substitution effect in the opposite direction, and it is not a priori clear which of the two effects will prevail (Stiglitz 2010).

Another explanation for Keynes’ mistake might be that he did not anticipate how much people would intrinsically like spending time on the job in the twenty-first century. Maybe he did not sufficiently envision the improvement of working conditions and the positive role of mechanization and automation in making paid work less of a burden and, at least for some workers, even enjoyable. This argument is not easy to verify because there seem to be no data on work satisfaction from the early twentieth century, and it is certainly not consistent with the neoclassical economics assumption that work is a source of disutility. Still, just going by historical accounts, it does not seem implausible to assume that for many people work is less arduous and more often even gratifying today than at the time Keynes wrote his essay (cf. Sachs 2017).

Any effect of an improvement in working conditions on people’s leisure preference should be expected to be gradual: it would make people less eager to take more leisure time, but of course not unwilling to spend any time away from work.

We thus have a couple of possible effects working in both directions that are difficult or impossible to ascertain individually. If we could trust that actual working hours reflect a labor market equilibrium in which every worker works exactly the desired number of hours, then we could at least say that the joint effect of these forces is the rather stable pattern we have been observing over the last decades. However, labor markets are inherently inflexible and unlikely to come close to an ideal welfare maximizing equilibrium (cf. Golden and Gebreselassie 2007, p. 19), so a revealed preference approach would be misleading.

A more promising way to find out if people preferred to work fewer hours as incomes go up even if they do not actually have that choice is to ask them directly. Fortunately, various surveys ask such a question, all of them asking respondents in one or another way to take the effect of changes in working hours on income into account. Unfortunately, however, the results vary widely, apparently because the wording of the question and context make a decisive difference (Golden 2014), even though the exact pattern is still poorly understood (Holst and Bringmann 2017).

For example, in the 2004 wave of the German Socio-Economic Panel (GSOEP), 54% of employed people said they wanted to work fewer hours than they actually worked while 18% said they wanted to work more (cf. also Bell and Freeman 2001, p. 184; Grözinger et al. 2008, p. 10). Similarly, an EU-wide survey of 1998 asking a similar question confirmed this picture: on average across all countries surveyed, employed workers would prefer to work almost 10% fewer hours per week, namely 34 instead of 37.7 h (Bielenski et al. 2002, p. 67; quoted in Grözinger et al. 2008, p. 11).

On the other hand, according to data from the International Social Survey Programme reported by Bell and Freeman (2001, p. 185), in 1997 21% of German workers said they would rather work more hours than currently and only 10.3% said they would rather work fewer hours (the difference was even larger in the US). The German Micro Census data produce a similar picture, even though with lower percentages (Holst and Bringmann 2017, p. 1).

While the evidence does not settle the question if people would work fewer hours if they could choose freely, even those surveys suggesting people would prefer to work less come up with a value more than twice as high than what Keynes predicted. Yet, this does not necessarily mean that he was fundamentally wrong about the welfare maximizing consumption-leisure tradeoff before the backdrop of further increases in labor productivity. Perhaps he simply underestimated an important aspect that became apparent when Richard Easterlin studied the relationship between happiness and income.

3 Easterlin’s Paradox

In his essay, Keynes noted in passing that there are two different kinds of needs, one of which is insatiable. It is worthwhile to quote this paragraph in full:

Now it is true that the needs of human beings may seem to be insatiable. But they fall into two classes—those needs which are absolute in the sense that we feel them whatever the situation of our fellow human beings may be, and those which are relative in the sense that we feel them only if their satisfaction lifts us above, makes us feel superior to, our fellows. Needs of the second class, those which satisfy the desire for superiority, may indeed be insatiable; for the higher the general level, the higher still are they. But this is not so true of the absolute needs—a point may soon be reached, much sooner perhaps than we all of us are aware of, when these needs are satisfied in the sense that we prefer to devote our further energies to non-economic purposes (Keynes 1978, p. 326).

Here Keynes is clearly up to something, but he does not pursue the role of relative needs any further in his essay. One reason for this neglect is probably that he sees “relative needs” as limited to situations where people want to feel superior to others, even though the scope of relative needs is much wider than that (cf. Frank 2010). Another reason is probably that Keynes did not have the benefit of happiness data that allowed Richard Easterlin and others to empirically estimate the role of relative needs.

The first such study was of course Easterlin’s famous 1974 paper in which he found no positive happiness trend in a time series for the US from 1946 to 1970 despite real per capita GDP growth of 63% over that period (The Maddison Project 2013). He was well aware of the limitations of a single short time series and concluded carefully that “it seems safe to say that if income and happiness go together, it is not as obvious as in the within-country cross-sectional comparisons” (Easterlin 1974, p. 111). This prima facie contradiction—a positive within-country cross-section correlation between income and happiness but no correlation between average income and average happiness over time—is now known as the Easterlin paradox.

What is remarkable, though, is that in his original study, Easterlin already provided an interpretation of the paradox that included the two general effects that summarize almost all subsequent theoretical explanations: relative-income effects and hedonic adaptation.

Making reference to James Duesenberry (1949) and citing several lines of sociological and economic research as evidence, including two of his own earlier papers (Easterlin 1969, 1973), Easterlin argued that the satisfaction value of individual consumption depends negatively on other people’s consumption. The consumption of others within one’s society constituted a “frame of reference” or “consumption norms” (p. 112), and a person’s happiness would depend on own consumption relative to this consumption norm. This interpretation was not entirely novel—Adam Smith already clearly saw this when he wrote in his Wealth of Nations that “[b]y necessaries I understand … whatever the custom of the country renders it indecent for creditable people, even of the lowest order, to be without” (Smith 1776, 869–870). In fact, the idea can be traced all the way back to Roman and Greek ancient philosophy (Schneider 2007).

Easterlin, just as Adam Smith, did not commit Keynes’ mistake of believing that the only reason for which relative income mattered is people’s desire to feel superior. Instead, Easterlin’s interpretation allowed for any number of unspecific mechanisms mediating between rising consumption standards and subjective (as well as objective) well-being, notably those highlighted by Robert Frank (1989, 1997, 2010, 2012) that do not necessarily have to do with a desire to feel superior, with envy or even with social comparison in a wider sense. In other words, relative-income may matter even when people are not at all concerned about favorable comparisons but merely about their objective quality of life because that happens to also depend on relative consumption. Moreover, even where comparison plays a role, one need not assume a desire for superiority—a desire to merely “keep up with the Joneses”, rather than to “surpass the Joneses”, is all it takes for SWB to depend on relative income (Lichtenberg 1996).

Easterlin’s second point was that people get used to improved living conditions. As economic growth raises the material standard of living, people come to take historical improvements for granted and derive less and less satisfaction from a given standard of living. This effect later came to be called hedonic adaptation (cf. Frederick and Loewenstein 1999) and, in contrast to the relative-income effect, does not depend on comparisons with others but rather on one’s own past experience.

In any specific setting or in empirical studies, it is often difficult to separate both effects. For some purposes this distinction is also not very important because their effects are similar: the higher the consumption standard in a given society, the more people consumption it takes for people to be satisfied with their lives.

4 Relative Income, Hedonic Adaptation and Working Time

A key concept that Easterlin used to describe and analyze both effects, the relative-income effect and hedonic adaptation, is aspirations (e.g. Easterlin 1974, p. 90, 2001). A given person’s aspirations can be expected to increase when others around her consume more or when she experienced an increase in consumption in the past. An increase in aspirations would mean that satisfaction for any given level of consumption would decrease.

To back up his hypothesis, Easterlin’s 1974 paper cited from qualitative research—something few economists do and many regard with skepticism. Re-reading the quotations (which he took from Cantril 1965), however, makes one wish that qualitative research were more accepted in economics because the statements by Indian and American survey respondents are uniquely compelling and provide more explanatory depth to the rather sterile econometric evidence that is now abundantly available. Easterlin (1974, p. 114–15) quoted Indian respondents describing as their aspirations to “have a cow for milk and ghee”, “to own a fan and maybe a radio”, and one of them states that “[i]f the food and clothing problems were solved, then I would […] be satisfied.” American respondents, in contrast, often mentioned a new car as one central aspiration and also “better furniture […] and more vacations”, “a boat”, to have “all my bills […] paid, […] play more golf and to hunt more than I do.” Clearly, the satisfaction obtained from a particular standard of living by a given person is not independent of context as economic theory would have one believe.

An instructive way to look at this picture is to take seriously another axiom of the economic theory of consumer behavior: the axiom of the stability of preferences over time. This is just another way of reconciling the utility-maximization view of the homo economicus with the evidence of more or less stagnant life satisfaction over time. While the first way assumes that preferences (and therefore aspirations) change over time (which may be called the endogenous-preferences approach, cf. e.g. Pollak 1978), the second assumes that preferences and aspirations remain fundamentally stable over time because they are defined on a different conceptual level. What changes over time in this view is the amount or the quality of goods required to satisfy those preferences, meaning that preferences are not defined over goods but over inner states or relevant outcomes. To take a straightforward example (and one unrelated to the relative-income effect or to adaptation), when the sale of air conditioning appliances increases over the years because summers get hotter, this would be interpreted not as a change in preferences for air conditioning appliances but as a change in the amount of goods required to achieve a constant relevant outcome, such as a tolerable room temperature. This interpretation is sometimes framed in terms of (stable) meta-preferences (Jonsson 1996) and has been put forward most prominently by Gary Becker (1976, p. 99–103). A methodological benefit of this approach is that changes in observed preferences would have to be non-arbitrary, i.e. a preference change itself can be explained as an exercise in utility maximization along stable meta-preferences.Footnote 3

In the case of the relative-income effect and of hedonic adaptation, the increase in the amount of goods required to achieve a constant relevant outcome (i.e., utility) is triggered by an increase in consumption itself, either that of others or that of oneself in the past. A classic example is that of increasing car ownership leading to deteriorating public transport, fewer neighborhood shops and changing social norms (cf. Frank 1989, p. 82). As a consequence of these changes, people will have to get a car just to avoid a deterioration of their life in terms of relevant outcomes and life satisfaction. Their new car may end up simply restoring the original level of life satisfaction rather than lifting it above the situation in which nobody owned a car.Footnote 4

As Easterlin noted, this process works in essentially the same way as inflation: just as rising prices mean that people need more nominal income to afford a given consumption basket, “real income is being deflated by rising material aspirations, in this case to yield essentially constant subjective economic well-being” (Easterlin 1996, p. 153). To highlight the close analogy between the relative-income effect and hedonic adaptation on the one hand and monetary inflation on the other, this effect can be labeled “secondary inflation” (Hirata 2011, p. 46): whereas monetary inflation stands for the increase in the monetary units required to purchase a given basket of goods and service, secondary inflation stands for the increase in goods and services required to attain a given level of satisfaction or utility, be it due to the relative-income effect or to hedonic adaptation.

5 Explaining Labor Supply in Terms of Income and Substitution Effects

Secondary inflation may help explain Keynes’ misprediction in the following way: As mentioned earlier, according to standard microeconomic theory, rising hourly wages will only make people choose fewer working hours if the positive income effect outweighs the negative substitution effect (“positive” and “negative” referring to the effect of wage increases on the desired amount of leisure time). The dominant interpretation of the empirical evidence, however, seems to be that both effects are of about the same absolute size (Kimball and Shapiro 2008, p. 1–4). While it is inherently difficult to infer “pure” labor supply preferences from labor market data (because the observed data reflect the interaction of supply with demand at going wages and also of institutional influences), this interpretation would be consistent with the relatively small observed correlation over time between wage levels and hours worked as reported above (see also Kimball and Shapiro 2008). In this view, starting from a short-term optimum of, say 40 h of work per week where the marginal utility of one extra hour of work equals that of one extra hour of leisure, the additional utility of that amount of consumption to be had from working one extra hour would be unaffected by changes in hourly wage rate (and therefore remain equal to the additional utility of one more hour of leisure time). Thus, as one’s hourly wage increases, the reduced benefit from an additional unit of consumption (because of diminishing marginal utility per unit of consumption) is exactly offset by the additional “consumption reward” per hour of labor (or, equivalently, by the increased opportunity cost of leisure). As a result, people do not find it worthwhile to forgo even a part of the additional income to “buy” more leisure time.

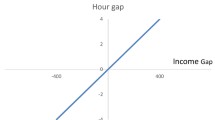

Figure 13.1 sketches this interpretation: the length of the horizontal axis represents total available time (such as 8760 h per year) where time spent working (L) is measured from left to right and leisure time (H, defined as time not spent working for pay) from right to left, and any point along that axis represents a certain division of that time budget between paid work and leisure. The downward-sloping curve A shows the marginal utility of consumption with respect to changes in the number of hours worked, L, where consumption is given by the number of hours worked times the hourly wage rate (assuming no savings). The right-hand curve J, to be read from right to left, shows the marginal utility of leisure. (This graphical representation is based on the simplifying assumption that utility from consumption and utility from leisure are additively separable in order to isolate the effects under consideration.) The individual maximizes utility at that allocation of hours where marginal utilities of consumption (with respect to hours of work) and of leisure are equal, i.e. L1. If the hourly wage goes up but the observed labor supply remains at the same number of hours because the substitution effect offsets the income effect, this must mean that curve A became steeper in such a way that it still intersects curve J at L1, such as curve B.

In this conceptual framework, the relative-income effect and hedonic adaptation could mean that an increase in consumption standards (of others and of one’s past self) has the same effect as a decrease in one’s real hourly wage, once again exactly as monetary inflation. If the effect of secondary inflation is sufficiently large, a gradual increase in wages may be offset entirely by secondary inflation, leaving people treading in the same place as far as the utility-value of leisure and consumption is concerned.Footnote 5 Graphically, this would mean that an increase in consumption standards tilts a person’s marginal utility of consumption curve to make it flatter.

In this interpretation, the failure of labor supply to go down over time as much as Keynes predicted would not reflect an offsetting substitution effect. Instead, the explanation for the continually large labor supply choices would lie in the devaluation of the utility-value of goods and services through rising consumption standards due to the relative-income effect and hedonic adaptation. We do not know how a person’s labor supply would change in the absence of secondary inflation—perhaps Keynes was right in believing that the income effect of rising wages outweighs the substitution effect, but he drew the wrong conclusions because he underestimated the relevance of secondary inflation. Graphically speaking, in the absence of secondary inflation, a wage increase may shift the marginal utility of consumption curve from A to D in Fig. 13.2, resulting in a reduced labor supply L2. However, secondary inflation induced by rising consumption standards would have the effect of tilting curve D back to A. Curve D would stay in place if other people’s wages remained constant, or, importantly, if they cut their working hours as their wages go up, leaving consumption levels stationary.

The relative-income effect implies a straightforward game-theoretical explanation for our failure to further reduce our working hours: we are trapped in the Nash-equilibrium of a prisoners’ dilemma because even though we would all collectively be better off working fewer hours, everyone individually would be worse off working fewer hours if others do not cut their working hours at the same time.Footnote 6 The obvious welfare-maximizing solution to this prisoners’ dilemma is to have a collective agreement enforcing a reduced number of working hours, or some kind of disincentive or Pigou tax. Indeed, working time laws, labor union agreements and mandatory retirement saving schemes can be interpreted as (partial) solutions to this prisoners’ dilemma (Frank 1999, p. 159–170). However, as discussed above, progress in this direction has stalled a few decades ago and has not covered all high-income countries equally, and if my reading of the news is any guide, this is not so much due to resistance by employers or lawmakers to demands for working time reductions, but primarily reflects a low priority of working time reductions on the wish list of workers and labor unions.

A particularly interesting case study provides at least some anecdotal evidence for explaining the limited interest on the side of unions in working time reductions. In the wake of the financial crisis, Amador County in California responded to a shrinking budget in 2009 by cutting salaries and working hours of county employees by 10%, thus avoiding layoffs and having employees come in from Monday to Thursday for 9 h each day, giving them Fridays off. Workers and the union protested because the pay cut was deemed unacceptable, but the union eventually agreed to the scheme for a limited period of two years in order to prevent immediate layoffs. In 2011, the 40 h work week was restored, but union members insisted on a vote on sticking with the 4-day (36 h) week which won with a clear margin of 71–29%, and the four-day week was restored, also saving 16 jobs that would otherwise have been lost. One county employee explained that “I was at first very concerned about losing the 10%, but I found that I could make it work without a huge hardship. And I found that what I gained in time actually outweighed what I lost in money” (Graaf et al. 2014, p. 206).

This case study suggests that people either overestimate the benefits of consumption or underestimate the benefits of increased leisure time or both. The problem is that, if people mispredict the satisfaction they get from different leisure-consumption bundles, we can no longer rely on their observed choices to be utility maximizing even from an individual’s own perspective. This also implies that it is not hedonic adaptation as such that poses a problem, but the fact that hedonic adaptation to consumption is not correctly anticipated (Loewenstein and Schkade 1999). We would expect fully rational utility maximizers to learn from past hedonic adaptation and to factor that experience into forward looking choices, but that may not be an accurate description of how people think about work and consumption choices.

People may underestimate the value of additional collective leisure time for another reason. An individual pondering whether to cut his work week down to 4 days may see limited benefit in having Fridays off if none of his friends are available for leisure activities on Fridays. The benefit of having Fridays off would be larger if many others also don’t have to work on Fridays. A collective move to a 4-day week will likely have Friday or Monday as a focal point, and empirical evidence supports the notion that the utility of “synchronous leisure” (Hallberg 2003) may be larger than that of asynchronous leisure due to a social multiplier effect (Hamermesh 1999; Glaeser et al. 2003; Jenkins and Osberg 2004; cf. also Alesina et al. 2006). In other words, an individual’s decision to take more leisure time may have a positive externality on the value of other people’s leisure time or, equivalently, a person’s decision to spend more hours on the job may have a negative externality, giving rise to multiple working time equilibria, not all of which are welfare maximizing (Jenkins and Osberg 2004, 114). If all workers take Fridays off at the same time, the positive externality might shift each worker’s marginal utility of leisure curve upward, such as from J to K in Fig. 13.3. Thus, in the presence of positive leisure externalities and secondary inflation effects, a collective move to more leisure will lead to an even lower equilibrium number of working hours such as L3. If people fail to anticipate the shift in the marginal utility of consumption associated with the shift from A to D (reflecting stationary consumption standards) and the shift in the marginal utility of leisure associated with the shift from J to K, they may be locked in the equilibrium L1 even though a collective transition to L3 would increase welfare.

The Amador County experience does not shed much light on the impact of the relative-income effect because the scheme did not affect the consumption patterns of the entire socio-economic environment of the county employees concerned. In fact, since the relative-income effect predicts that an individual’s utility from consumption will depend on the consumption standards of thousands or even millions of people, it is difficult to think of any case study, let alone a controlled experiment, to test for the effect of relative income on work-leisure preferences. However, econometric approaches are suggestive of a positive relationship between income inequality on labor supply, which is exactly what the relative-income effect would predict (Bowles and Park 2005, F405). Another piece of suggestive evidence comes from an analysis of US data of the 1980s showing that a woman is more likely (by about 20%) to take on a job when her husband earns less than her sister’s husband (Neumark and Postlewaite 1998, p. 180).

6 Conclusion

It is safe to say that Keynes prediction will not come true: 15 h will not be the typical work week in any country a decade hence. While the trend in many European countries seemed to be almost on track to validate Keynes until the 1980s, working times have not decreased much since then.

A temptingly simple explanation for this pattern would be to conclude that people simply value additional consumption sufficiently to prefer using wage increases for additional consumption rather than for additional leisure and that therefore current working time patterns express individual and social preferences and maximize welfare. Yet this view assumes that there is no interaction between work-leisure choices and consumption standards, and there is quite some evidence to suggest that this view needs to be discarded.

A more plausible view would take advantage of the long tradition of theories that explain why the value of one’s own consumption also depends on others people’s consumption and on one’s own past consumption. These theories boil down, as Richard Easterlin recognized, to relative-income effects and hedonic adaptation, and their combined effect is very similar to that of monetary inflation, which should make it rather easy for economists to incorporate these effects into standard theory.

Since it is difficult to estimate the size of the effects in question, it is not possible to determine the welfare maximizing number of working hours per person. There is some anecdotal evidence that people might benefit from working fewer hours even if they do not expect that ex ante, but that is of course too weak a basis for substantive predictions.

To end on a positive note, the preceding considerations suggest that a collective reduction of working hours is a much less costly way of reducing our environmental impact than standard theory would have it (taking the future benefits of less environmental damage into account, one should expect a substantial welfare gain). Maybe selfish utility maximization would make people prefer a 40 h work week, but working only 30, 20 or, at some point, even 15 h may turn out not to be so bad if working hours are reduced collectively. Even if Keynes prediction is off the mark, there are good reasons to welcome further progress towards the 15 h work week.

Notes

- 1.

This ceteris paribus clause is meant to take continuous technological progress for granted, including innovations that improve resource efficiency. Even if technological progress leads to absolute decoupling (cf. UNEP 2011) between consumption growth and total environmental costs, rising consumption will entail more environmental costs than stationary consumption levels for any given technology. Absolute decoupling as such does not settle the moral debate around consumption restraint.

- 2.

See the editors’ note introducing Keynes’ essay in the “Collected Writings, Vol. 9” edited by Elizabeth Johnson and Donald Moggridge.

- 3.

I am not endorsing this approach for the purposes Becker had in mind—I rather agree with Amartya Sen (1978) that the utility maximization paradigm is deeply flawed. Nevertheless, Becker’s method can be illuminating for better understanding the relative-income effect and hedonic adaptation.

- 4.

Of course, a given individual may derive additional benefits from car ownership that end up raising her utility above the original situation. Determining the size of these two effects—restoring lost satisfaction or gaining additional satisfaction—will be difficult or impossible in any practical setting, but for conceptual clarity I will assume that these two effects can be observed and analyzed separately.

- 5.

I am making the simplifying assumption here that secondary inflation simply downscales the utility-value of consumption in a proportionate manner, even though this is not necessarily the case. For example, cutting back on public transport because of increasing car ownership may affect low-income earners more than high-income earners, thus having an asymmetric effect on the marginal utility of consumption of different groups of people. Bowles and Park (2005) argue that an asymmetric Veblen effect where utility depends on upward comparison only is a more plausible model than a symmetric relative-income effect that depends on average earnings.

- 6.

Since the simple prisoners’ dilemma is a perfectly symmetric game, this is only true if all players have the same preferences for more leisure. In reality, of course, there will always be some workers who would prefer to work longer hours. This means that the suggested “solution” is of course no Pareto improvement. Rather, any solution will be a political arbitration between conflicting interests, as in all real-world collective choice exercises.

References

Alesina, A., Glaeser, E., & Sacerdote, B. (2006). Work and leisure in the United States and Europe: Why so different? NBER Macroeconomics Annual 2005, 20, 1–64.

Ausubel, J. H., & Grübler, A. (1995). Working less and living longer: Long-term trends in working time and time budgets. Technological Forecasting and Social Change, 50(3), 195–213.

Becker, G. S. (1976). The economic approach to human behavior (EPUB-edition) (Reprint 2013). Chicago: University of Chicago Press.

Bell, L. A., & Freeman, R. B. (2001). The incentive for working hard: Explaining hours worked differences in the US and Germany. Labour Economics, 8(2), 181–202.

Bielenski, H., Bosch, G., & Wagner, A. (2002). Wie die Europäer arbeiten wollen: Erwerbs- und Arbeitszeitwünsche in 16 Ländern. Frankfurt: Campus Verlag.

Bolt, J., & Van Zanden, J. L. (2014). The Maddison Project: Collaborative research on historical national accounts. The Economic History Review, 67(3), 627–651.

Bowles, S., & Park, Y. (2005). Emulation, inequality, and work hours: Was Thorsten Veblen right? The Economic Journal, 115(507), F397–F412.

Cantril, H. (1965). The pattern of human concerns. New Brunswick: Rutgers University Press.

De Graaf, J., Wann, D., & Naylor, T. H. (2014). Affluenza: How overconsumption is killing us—and how to fight back. San Francisco: Berrett-Koehler Publishers.

Duesenberry, J. S. (1949). Income, saving and the theory of consumer behavior. Cambridge: Harvard University Press.

Easterlin, R. A. (1969). Towards a socio-economic theory of fertility. In S. J. Behrman, L. Corsa, & R. Freedman (Eds.), Fertility and family planning: A world view (pp. 127–156). Ann Arbor: University of Michigan Press.

Easterlin, R. A. (1973). Relative economic status and the American fertility swing. In E. B. Sheldon (Ed.), Family economic behavior: Problems and prospects (pp. 170–227). New York: Lippincott.

Easterlin, R. A. (1974). Does economic growth improve the human lot? Some empirical evidence. In P. A. David & M. W. Reder (Eds.), Nations and households in economic growth: Essays in honour of Moses Abramovitz (pp. 89–125). New York: Academic Press.

Easterlin, R. A. (1996). Growth triumphant (Reprint 2009). Ann Arbor: University of Michigan Press.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. The Economic Journal, 111(473), 465–484.

Frank, R. H. (1989). Frames of reference and the quality of life. The American Economic Review, 79(2), 80–85.

Frank, R. H. (1997). The frame of reference as a public good. The Economic Journal, 107(445), 1832–1847.

Frank, R. H. (1999). Luxury fever: Why money fails to satisfy in an era of excess. Princeton: Princeton University Press.

Frank, R. H. (2010). Context is more important than Keynes realized. In L. Pecchi & G. Piga (Eds.), Revisiting Keynes. Economic possibilities for our grandchildren (pp. 143–150). Cambridge, MA: The MIT Press.

Frank, R. H. (2012). The Easterlin paradox revisited. Emotion, 12(6), 1188–1191.

Frederick, S., & Loewenstein, G. (1999). Hedonic adaptation. In D. Kahneman, E. Diener, & N. Schwarz (Eds.), Well-being: The foundations of hedonic psychology (pp. 302–329). New York: Russel Sage Foundation.

Glaeser, E. L., Sacerdote, B. I., & Scheinkman, J. A. (2003). The social multiplier. Journal of the European Economic Association, 1(2–3), 345–353.

Golden, L., & Gebreselassie, T. (2007). Overemployment mismatches: The preference for fewer work hours. Monthly Labor Review, 130, 18.

Golden, L. (2014). Measuring Long, Overtime, and Un-Preferred Hours of Work. Working Paper for the EINet Measurement Group, University of Chicago School of Social Service Administration.

Grözinger, G., Matiaske, W., & Tobsch, V. (2008). Arbeitszeitwünsche, Arbeitslosigkeit und Arbeitszeitpolitik (No. 103). SOEP papers on multidisciplinary panel data research.

Hallberg, D. (2003). Synchronous leisure, jointness and household labor supply. Labour Economics, 10(2), 185–203.

Hamermesh, D. S. (1999). The timing of work over time. The Economic Journal, 109(452), 37–66.

Hirata, J. (2011). Happiness, ethics, and economics. London: Routledge.

Holst, E. & Bringmann, J. (2017). Arbeitszeitwünsche von Beschäftigten: eine Black Box? Zu Unschärfen der Ermittlung von Unter- und Überbeschäftigung. DIW. DIW Roundup 106.

Jacobs, J. A., & Gerson, K. (2001). Overworked individuals or overworked families? Work and Occupations, 28(1), 40–63.

Jenkins, S. P., & Osberg, L. (2004). Nobody to play with? In D. S. Hamermesh & G. A. Pfann (Eds.), The economics of time use (pp. 113–145). Bingley: Emerald Group Publishing Limited.

Jonsson, P. O. (1996). On meta-preferences and incomplete preference maps. International Advances in Economic Research, 2(2), 112–119.

Keynes, J. M. (1978). Economic possibilities for our grandchildren. In J. M. Keynes (Ed.), Collected writings vol. 9: Essays in persuasion (pp. 321–332). London: Royal Economic Society/Macmillan Press.

Kimball, M. S., & Shapiro, M. D. (2008). Labor supply: Are the income and substitution effects both large or both small? (No. w14208). National Bureau of Economic Research.

Lichtenberg, J. (1996). Consuming because others consume. Social Theory & Practice, 22(3), 273–297.

Loewenstein, G., & Schkade, D. (1999). Wouldn’t it be nice? Predicting future feelings. In D. Kahneman, E. Diener, & N. Schwarz (Eds.), Well-being: The foundations of hedonic psychology (pp. 85–105). New York: Russel Sage Foundation.

Messenger, J. C. (2011). Working time trends and developments in Europe. Cambridge Journal of Economics, 35(2), 295–316.

Neumark, D., & Postlewaite, A. (1998). Relative income concerns and the rise in married women’s employment. Journal of Public Economics, 70(1), 157–183.

Pollak, R. A. (1978). Endogenous tastes in demand and welfare analysis. The American Economic Review, 68(2), 374–379.

Sachs, J. D. (2017). Man and machine: The macroeconomics of the digital revolution. Mimeo from a conference organized by the Centre for Economic Performance and the International Growth Centre.

Schneider, M. (2007). The nature, history and significance of the concept of positional goods. History of Economics Review, 45, 60–81.

Schor, J. (2003). The (even more) overworked American. In J. de Graaf (Ed.), Take back your time. Fighting overwork and time poverty in America (pp. 6–11). San Francisco: Berrett-Koehler Publishers.

Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations (Reprint 1979). Oxford: Oxford University Press.

Stiglitz, J. E. (2010). Toward a general theory of consumerism: Reflections on Keynes’s economic possibilities for our grandchildren. In L. Pecchi & G. Piga (Eds.), Revisiting Keynes. Economic possibilities for our grandchildren (pp. 41–85). Cambridge, MA: The MIT Press.

The Maddison Project. (2013). The Maddison project database, version 2013. (cf. Bolt & van Zanden 2014). Groningen Growth and Development Centre. http://www.ggdc.net/maddison/maddison-project/home.htm

UNEP. (2011). Decoupling natural resource use and environmental impacts from economic growth. A report of the working group on decoupling to the international resource panel. In M. Fischer-Kowalski, M. Swilling, E.U. von Weizsäcker & Y. Ren. Nairobi: UNEP.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Hirata, J. (2019). Keynes’ Grandchildren and Easterlin’s Paradox: What Is Keeping Us from Reducing Our Working Hours?. In: Rojas, M. (eds) The Economics of Happiness. Springer, Cham. https://doi.org/10.1007/978-3-030-15835-4_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-15835-4_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-15834-7

Online ISBN: 978-3-030-15835-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)