Abstract

Power producers with flexible production systems such as hydropower may sell their output in the day–ahead and balancing power markets. We present how the coordination of trades across multiple markets may be described as a stochastic program. Focus is on how the information structure inherent in the multi–market setting is represented through the scenario tree and mathematical modelling. In the model, each market is represented by a price or premium and an upper limit on the volume that can be traded at the given price. We illustrate our modelling by comparing coordinated versus sequential bidding strategies.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Most European power markets are organized as day–ahead auctions where expected production and consumption for the next day is traded. However, due to unforeseen events that may happen between closure of the day–ahead market and real–time, the transmission system operator (TSO) is responsible for maintaining the instantaneous balance between supply and demand. To accomplish this, the TSO procures several types of reserves from the agents in the power system. Usually, reserve products are defined based on response time, and referred to as frequency containment (primary), frequency restoration (secondary) and replacement (tertiary) reserves. In this paper, the term balancing market will be used to describe the market where the TSO procures replacement reserves. The TSO is the only buyer in the balancing market and the supply side are producers or consumers with flexible portfolios. To participate in the balancing market, agents must be able to ramp up or down a given minimum amount in a short time interval. Approved participants submit their willingness to ramp up/down, and the TSO chooses the most cost–efficient bids as need arises.

Hydropower is well suited for participating in the balancing market because of low start–up cost and the possibility of storing water in reservoirs. The question raised in this paper is how a flexible hydropower producer may maximize its revenues from participating in both the day–ahead and balancing market. Several works have investigated optimization models for multi–market trade of electricity, see for instance [1] that uses stochastic programming [2]. The reason why stochastic optimization is appropriate, is that the trading strategy must be determined prior to market clearing, i.e. when prices are still unknown.

In this work, we present a stochastic program for a hydropower producer that coordinates its trades between the day–ahead and the balancing market. We focus on the information structure inherent in the multi–market setting and how this is represented through the scenario tree and mathematical modelling. The optimization model is an extension of [4] which showed how optimal bids for the day–ahead market may be determined using the production scheduling model that is used by the Nordic hydropower industry today [5]. In this work, multi–market trade is modelled by including several sale variables in the model, and by letting let each market be represented by a price or premium and an upper limit to the volume that can be traded at the given price. To generate scenario trees for this paper, we use the forecast–based scenario generation method described in [3], and use a set of time–series models to generate the forecasts required as input. The optimization model, however, is general and may be used with any type of scenario–generation method that creates scenarios for the stochastic parameters, i.e. prices and the volume limit.

2 Modelling the Markets

The forecast–based scenario generation method presented in [3] generates scenario trees based on point–forecasts combined with historical forecast errors. We therefore develop a set of time–series models that generates a daily point forecast for the most important properties of the day–ahead and the balancing market. Each market is characterized by a price and a maximum quantity that may be traded at this price. The full presentation of how the markets are modelled by time–series is given in [6], but the most important aspects are repeated here for clarity.

When it comes to the characteristics of each market, the day–ahead market is a daily, centrally cleared auction. Due to the daily clearing of the day–ahead market, the hourly day–ahead market prices cannot really be represented as a pure time–series process. In normal time series, the information set is assumed to be updated when moving from one time step to the next. This is not the case for day–ahead prices because the information set is updated on a daily rather than an hourly basis. Thus, it is more correct to model the day–ahead prices, \(p_{t}^{D}\), as a time series of 24–h panel data rather than a single time series. Our method is based on [7], but in addition we account for seasonal variations. Treating the hourly day–ahead prices as panel data allows for modelling correlations between consecutive hours as well as correlations to the same hour on consecutive days.

In regards to the volume limit in the day–ahead market, we assume that the day–ahead market has perfect competition, and that the producer may sell all its output to the market at the given price. The limit on the maximum volume that can be traded is therefore set to be so large that it is never binding for the producer’s problem. No separate time–series model is therefore developed for the volume limit in the day-ahead market, it is simply a very large constant for all hours, \(V^D\). The optimization model can take either a deterministic parameter or a stochastic series as input for the volume limit, depending on assumptions on perfect competition or limited liquidity.

Turning to the balancing market, we observe that this market is event–driven, i.e. there is only a demand in the balancing market if there is an imbalance between supply and demand of power. An event is here taken to mean any random event that could not be accurately predicted before closing of the day–ahead market, from power plant failures to line outages to smaller events such as forecasting errors or even structural imbalances. In terms of modelling, the balancing market is described by three properties, namely (i) the balancing state, (ii) the balancing volume and (iii) the balancing price or premium. The balancing state is determined by the real–time balance of supply and demand. If demand exceeds supply the system will need up regulation and vice versa. In fact, the balancing market may be seen as two markets: one for up regulation where the producer offers to ramp up production, and one for down regulation where the producer offers to ramp down. The price for up regulation will be higher than the day–ahead market price, while the price for down regulation will be lower. In an optimization model for multi–market trade, it is the difference between the market prices that are important for the trading strategy. We therefore consider balancing market premiums, \(\rho _{t}^{B+}\) and \(\rho _{t}^{B-} \), rather than prices. Another benefit of modelling the premiums rather than prices, is that, as found in [6], the premiums may be modelled as independent from the day-ahead prices.

There is demand in the balancing market only if there is an imbalance between supply and demand, and the size of demand is given by the amount of power needed to bring the system back in balance. Due to this limited demand, we model the balancing market by stocahstic trade limits as well as premiums. That is, for each time step, the maximum volume that may be traded is limited by upper bounds, \(v_{t}^{B+}\) and \(v_{t}^{B-} \). These upper bounds are stochastic parameters in the multi–market optimization problem, and are zero in hours where there is no imbalance.

We thus need a total of four time series to describe the balancing market: premiums and volumes in each direction. However, all of the models for the balancing market are based on one of the models found to have good performance in [8], namely the model based on [9]. This model considers the event-driven nature of the balancing market by using unevenly spaced time–series. In our model, the timing between balancing events is modelled by a moving–average process that is updated every time an event occurs. The balancing volume (i.e. the size of the balancing event if it occurs) is modelled as an autoregressive stationary unevenly spaced time series of order 1. The same type of series is fitted to the balancing market premiums.

The historical data used to fit the time–series for the balancing market describes the total volume of activated power in the balancing market. We must make assumptions on how much of the total volume that can be supplied by an individual agent or hydropower system. One approach is to assume that the individual producer may take a percentage of the total market volume, e.g., 10%, in every hour where there is demand. Another approach is to assume that in each hour, the total market volume may be activated from a single producer with a given probability, e.g., one in ten times. The probability may be related to the number of agents in the power market. In the case studies in Sect. 4, these two approaches are denoted “Percentage” and “Probability”.

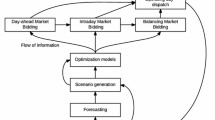

The process of using the time–series models and the forecast–based scenario–generation method to create input to the optimization model is illustrated in Fig. 1. To develop the time–series models, we use data from Nord Pool’s ftp server for the years 2014–2016. For each day of 2017, we then generate a daily forecast with a 72–h forecast horizon. We then use realized data from 2017 to determine historical forecast errors by comparing our daily forecast to historical realized values. This gives us a “database” of historical forecast errors made over a year for forecasting lengths up to 72 h. We only need to initialize this database once before the start of the test period which are the first 18 weeks of 2018. For test instance, the historical forecast errors are used together with new daily point forecasts to generate scenarios. We generate a set of scenarios for the day–ahead market prices and another set of scenarios for the balancing market premiums and volumes. This is because the balancing market premiums and volume are independent of the day–ahead price as explained above. The two set of scenarios are then combined all against all to generate a total scenario tree that describes all the possible outcomes for the day–ahead and balancing market. This total scenario tree is used as input to the stochastic optimization model.

3 Problem Formulation

This section presents the basic mathematical modellig of the stochastic optimization model that coordinates multi–market trades for a power producer. The producer must determine the trade volumes that maximizes the value of trades made in the day–ahead and the balancing market. This may be expressed as

where \(x_{ts}^{D}\), \(x_{ts}^{B+}\), \(x_{ts}^{B-}\) are the volumes sold in the day–ahead and the up balancing and down balancing market for delivery at time t in scenario s, and \(\pi _s\) is the probability of scenario s. The need for coordination across markets arises because the final commitment, i.e. the actual volume to be produced in a specific hour, \(y_{ts}\), is the summation over the position made in each market,

In addition, the volumes sold in any market must be less than the demand in the market, i.e.,

The above model assumes that any volume \(y_{ts}\) may be produced. Actual production systems are much more complex. Details of hydropower production are however omitted from the presentation here. In fact, the above model may be used by any producer that participates in the day–ahead and balancing market as long as it is combined with a representation of the specific production system. In our case, the multi–market model is implemented within the framework of models that is used for short–term production scheduling by most large hydropower producers in the Nordic region [5]. The volume to be produced, \(y_{ts}\), is thus determined by this more complex model that includes all technical, hydrological and environmental constraints relevant for hydropower production, e.g., minimum production levels, forbidden operating zones, start/stop, discharge dependent losses in tunnels and penstocks, minimum and maximum reservoir levels, minimum and maximum river or tunnel flows and more.

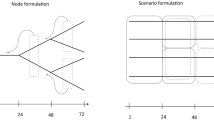

The simple model formulation above is however not complete without modelling the information structure in the multi–market setting. The day–ahead prices are revealed once every day when the market clears. This means that the scenario tree for day–ahead prices must have a new stage every 24 h. For a 72–h horizon where the scenario tree branches into two new scenarios at each branching step, daily branching would yield \(2^2 = 4\) scenarios, see the left part of Fig. 2 for an illustration. In the balancing market, however, prices and volumes are revealed in real–time, which would lead to a scenario tree with hourly branching. This would quickly lead to a very large problem, especially considering that more than two new scenarios at each branching point is necessary to represent the full uncertainty of prices. To avoid this curse of dimensionality, we choose to have daily branching also for the balancing market, i.e., that both the day–ahead prices and the balancing market premiums and volumes are revealed together when the day–ahead market clears. This assumption means that the models sees no uncertainty in the balancing market during each day. This will likely cause an overestimation of the profits obtained by participating in the balancing market because the producer can determine its sales in the balancing market based on known prices and volumes within each day.

In the stochastic program, we use a scenario representation rather than a node formulation, see the right part of Fig. 2. This means that we must explicitly include non–anticipativity constraints stating that if two scenarios s and \(s'\) are indistinguishable at time t on the basis of information available at time t, then the decisions made in scenario s must be equal to the decisions made in scenario \(s'\). In our case, this means that the produced volume must be equal between all scenarios belonging to the same node,

The same is true for the traded volumes \(x_{ts}^{D}\), \(x_{ts}^{B+}\), \(x_{ts}^{B-}\). The non–anticipativity constraints are illustrated by the fully drawn grey boxes in Fig. 2. In addition to non–anticipativity related to the daily clearing of the markets, the optimization model also needs to know that trades must be done prior to market clearing and that day–ahead trades must be made prior to balancing market trades. This means that the day–ahead trades cannot depend on any particular realization of prices for the next day. We call this the market non–anticipativity constraints and formulate them as

The market non–anticipativity constraints are illustrated by the dotted grey boxes in Fig. 2. Similar constraints may also be applied to the balancing market trades, \(x_{ts}^{B+}\) and \(x_{ts}^{B-}\), depending on whether the trades in the balancing market are to be decided in real–time or not. If the constraint is imposed on the balancing trades, it means that the trades must be determined prior to clearing of the day–ahead market. If the constraints are not imposed, the balancing trades may be determined after clearing of the day–ahead market, i.e. when the producer has knowledge of the realized balancing market prices and volumes. This is of course not possible in reality, but we include it in our case study to measure the value of having perfect information of the balancing market.

(Left) Node representation of a scenario tree with daily branching. The dotted grey boxes illustrate that the traded volumes must be determined before prices are revealed. (Right) Scenario representation of a scenario tree with daily branching. The fully drawn grey boxes illustrate the normal non–anticipativity constraints, while the dotted grey boxes represent the market non–anticipativity constraints.

Some cases in Sect. 4 also consider the case when the producer is allowed to submit a price–dependent bid curve to the day–ahead market instead of just a single quantity. How the model for short–term hydropower scheduling is extended to also include decisions for optimal bids to the day–ahead market is explained in [4]. In the current framework, determining optimal bids translates to inequality constraints on the volumes traded in the day–ahead market,

instead of the market non–anticipativity constraints in Eq. (5).This means that the equality constrainst in the dotted grey boxes in Fig. 2 are relaxed to inequality constraints.

4 Results

In this section, we illustrate how the multi–market model is applied to a simple hydropower system. The system has one reservoir connected to a plant with two generators. The total capacity is 90 MW. We test the optimization model for 30 instances corresponding to initial conditions of 30 different days in the first 18 weeks of 2018. The results given in Tables 1 and 2 are average numbers over the 30 instances. For each instance we use a 72–h horizon with branching in the scenario tree after hour 24 and 48. We use 5 new scenarios at each branching point for the day–ahead prices and 3 scenarios for the balancing market. This results in \(5*5*3*3 = 225\) scenarios in total for each instance.

We first consider the case when the producer participates in the day–ahead market only. The next case is when the producer participates in both the day–ahead and balancing market, but consider the two markets sequentially and determines the volumes in the day–ahead market without seeing the balancing market. This is called sequential bidding [1]. In the first case of sequential bidding, we assume that the producer determines all trades in the balancing market at once right after clearing of the day–ahead market. In the second case, we assume that trades in the balancing market may be done in real–time. In the next set of cases, the producer can coordinate its trades in the two markets, that is, the producer may determine the day–ahead bids while also seeing the balancing market. For the coordinated case we also consider cases when balancing market decisions are done only once or in real–time. The different cases are summarized in Table 1, showing the percentage increase in objective function value compared to the base case of participating in the day–ahead market only. We also use different assumptions on the volumes available in the balancing market. Columns 2 and 3 of Table 1 show results when the volume available to the individual producer is 10% and 5% of the total market volume. This means that a low volume is available in most hours. In Columns 4 and 5, however, the total market volume is available to the producer 1 in 10 and 1 in 20 times. This means that large volumes are available in just a few hours. We see that for the 10% and 5% cases, there is a gain in profits from participating in the balancing market. The gain is larger if trades may be coordinated, and even larger if balancing market trades may be done in real–time. The gain of real–time trading is higher than the gain of coordination. The option of trading in real–time corresponds to having perfect information about the balancing market, which is not possible in reality. For the 1/10 and 1/20 cases, there is a gain of real–time trading but not from coordinating trades. This is because balancing markets volumes are so rare that they do not influence the trading strategy if they are to be determined prior to operations.

We repeat the same cases as above, but now we assume that the producer can submit a price–dependent bid curve to the day–ahead market. The results are summarized in Table 2. In general, we see similar results as in the case without bidding: there is a gain from coordinating trades and an even larger gain if balancing markets trades may be done in real–time, i.e. with perfect information. Another result, although not evident from the tables, is that the objective function value when submitting bids is higher than when the producer submits just a single quantity, i.e., the base case of participating in only the day–ahead market is 0.88% higher in Table 2 than in Table 1. This is because the market non–anticipativity constraints (equality constraints between scenarios) are relaxed to inequality constraints in the bidding problem.

5 Conclusions

This paper has presented a stochastic program that illustrates how the information structure in a multi–market setting may be modelled for a power producer participating in the day–ahead and balancing power market. The formulation includes normal non–anticipativity constraints that represents the daily clearing of the markets. We also include market non–anticipativity constraints which represents that trades must be made prior to market clearing and that day–ahead trades must be made prior to balancing market trades. Similar restrictions may be applied to the balancing market trades, depending on whether they are to be determined in real–time or not. We find that there is a gain from coordinating trades across markets, and an even larger gain from bidding in the balancing market in real–time. The option of trading in real–time corresponds to having perfect information about the balancing market, which is not possible in reality. We also use two different methods for representing the balancing market volume that is available to an individual producer: either the producers see a small percentage of the total market volume in all hours, or the entire market volume is available for the producer with a given probability. The probability may be based on the number of agents in the market and may thus be a realistic representation of the balancing market volume.

References

Boomsma, T.K., Juul, N., Fleten, S.-E.: Bidding in sequential markets: the Nordic case. Eur. J. Oper. Res. 238(3), 797–809 (2014). https://doi.org/10.1016/j.ejor.2014.04.027

Birge, J.R., Louveaux, F.: Introduction to Stochastic Programming. Springer, New York (2011)

Kaut, M.: Forecast–based scenario–tree generation method. Optimization Online (2017)

Aasgård, E.K., Naversen, C.Ø., Fodstad, M., Skjelbred, H.I.: Optimizing day-ahead bid curves in hydropower production. Energy Syst. (2017). https://doi.org/10.1007/s12667-017-0234-z

SINTEF Energy Research SHOP. https://www.sintef.no/en/software/shop/. Accessed 4 Apr 2018

Aasgård, E.K.: Modelling prices in sequential electricity markets, working paper at NTNU (2018)

Huismann, R., Huurmann, C., Mahieu, R.: Hourly electricity prices in day-ahead markets. Energy Econ. 29, 916–928 (2007). https://doi.org/10.1016/j.eneco.2006.08.005

Klæboe, G., Eriksrud, A.L., Fleten, S.-E.: Benchmarking time series based forecasting models for electricity balancing market prices. Energy Syst. 6(1), 43–61 (2015). https://doi.org/10.1007/s12667-013-0103-3

Croston, J.D.: Forecasting and stock control for intermittent demands. Oper. Res. Q. 23, 289–303 (1972). https://doi.org/10.2307/3007885

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Aasgård, E.K. (2019). Coordinated Hydropower Bidding in the Day-Ahead and Balancing Market. In: Helseth, A. (eds) Proceedings of the 6th International Workshop on Hydro Scheduling in Competitive Electricity Markets. HSCM 2018. Springer, Cham. https://doi.org/10.1007/978-3-030-03311-8_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-03311-8_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-03310-1

Online ISBN: 978-3-030-03311-8

eBook Packages: EnergyEnergy (R0)