Abstract

We present a literature survey and research gap analysis of mathematical and statistical methods used in the context of optimizing bids in electricity markets. Particularly, we are interested in methods for hydropower producers that participate in multiple, sequential markets for short-term delivery of physical power. As most of the literature focus on day-ahead bidding and thermal energy producers, there are important research gaps for hydropower, which require specialized methods due to the fact that electricity may be stored as water in reservoirs. Our opinion is that multi-market participation, although reportedly having a limited profit potential, can provide gains in flexibility and system stability for hydro producers. We argue that managing uncertainty is of key importance for making good decision support tools for the multi-market bidding problem. Considering uncertainty calls for some form of stochastic programming, and we define a modelling process that consists of three interconnected tasks; mathematical modelling, electricity price forecasting and scenario generation. We survey research investigating these tasks and point out areas that are not covered by existing literature.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Wholesale electricity markets have, over the last 20 years, become a cornerstone in modern power systems. While the specifics of market arrangements vary around the world [39], pool-type markets where supply and demand is matched by auctions is the norm. In Europe, the electricity market is organized as day-ahead auctions where producers and consumers submit a set of price-volume bids indicating their willingness to sell and buy power for the next operating day. The day-ahead market seeks to arrange a balance between supply and demand well ahead of the operating hour, allowing thermal plants with long start-up times to be ready when needed. In other regions of the world, the primary energy market might have a shorter time horizon, e.g. 2 h before the delivery hour, but still have the aim of arranging most of supply and demand prior to operations due to safety or technical considerations. As demand for electricity cannot be known until it occurs, the day-ahead or primary energy market must be complemented with shorter term markets where energy may be traded closer to real-time. Typically, these include markets for intraday trade, real-time balancing, and for procurement of reserves.

Hydropower producers may participate in these additional markets due to their storage capacity and flexible, fast-ramping generating units. Hydro storage reservoirs give flexibility in the timing of production—hydro producers may store their water for production at peak prices. For this reason, optimizing revenues across multiple markets is a more relevant challenge for hydro producers than for traditional thermal generators, which have less flexible production systems. This is, however, only true for reservoir hydro, i.e. producers with some degree of reservoir storage. Run-of-river hydro does not have the same temporal flexibility, although they still have fast-ramping units. The rest of this paper is concerned with reservoir hydro.

With the current trend towards higher shares of renewable electricity sources (such as wind and solar power), the demand for short-term balancing services is expected to increase due to the intermittent nature of renewables [8]. Balancing services have traditionally been provided by fossil fuel generation resources, but a sustainable alternative for the future may be that balancing services are supplied by hydropower. This is especially true for hydropower units that are close (in terms of grid availability) to the relevant intermittent resources. Under this assumption, operators of reservoir hydropower will eventually shift their focus from providing energy in the day-ahead market to providing adjustments and balancing services in the intraday and balancing markets, becoming key players in several markets. Being able to optimize their bidding strategy across several markets will therefore be a competitive advantage for hydropower producers.

However, the products sold in these multiple markets are either the same, or linked so that commitments in one market limit the flexibility and opportunities in others. In our opinion, hydro producers should therefore consider their bidding strategy in all markets as a joint problem. As the markets have different time horizons and closing times over the operating day, bids in one market might need to be made before having full knowledge of prices in other markets. Even bidding in a single market requires consideration of uncertain prices, as bidding is done before market clearing when prices are still unknown. Thus, even the single market bidding problemFootnote 1 requires some form of stochastic programming, which again calls for forecasting and scenario generation. Moving to a multi-market setting then leads to more complex stochastic models where consistency of forecasts and the information structure described by the scenario trees make up an even more important part of the problem formulation.

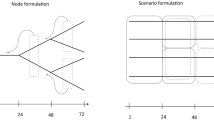

In order to provide hydropower producers with decision support for multi-market trade, we need information on the present and future state of the markets, reservoir inflow, and other uncertain factors. This means having (a) reliable forecasting methods to describe both the expected developments and the uncertainty regarding such estimates, and (b) methods to structure and refine the resulting forecasts and forecast information, so that they can be used efficiently by (c) stochastic-programming models which provide advice regarding bidding and, secondarily, production or investments. Fig. 1 shows the multi-market bidding process, identifying markets and bid decisions along time, as well as how the modelling process inform, or get information, from these stages. We define the modelling process as the tree interconnected tasks of modelling, forecasting and scenario generation. This paper surveys research investigating these tasks and point out areas that are not covered by existing literature.

The market setting faced by a Nordic power producer. The top part illustrates the sequential nature of the energy markets, where time flows from left to right. The lower part of the figure illustrates the modelling process involved in the development of mathematical models for bid optimization. Full-drawn lines indicate flow of information from one modelling task to the next, or from operations to modelling

It should be clarified that we consider literature on the hydropower bidding problem that relate to numerical optimization models, i.e., we focus on papers that take the perspective of an individual producer participating in the electricity markets. A related area of research consider economic analyses of electricity markets where hydropower plays a dominant role. For instance, [50] analyze productive inefficiency of the New Zealand wholesale electricity market from a system perspective.

Note that our focus is mainly on the market aspect of the hydropower bidding problem, which makes price the most important random variable. For hydropower producers, inflow is of course also an important random variable and should be taken into account when scheduling the hydropower resources. However, inflow uncertainty adds further complexity to the already intricate multi-market bidding problem. The field of hydrology deals with forecasting future inflows, but such methods are considered outside the scope of this paper. Another remark is that our focus is generally on price-taking producers. The game-theoretic aspects involved in strategic bidding adds yet another layer of complexity.

The rest of the paper is organized as follows: Sect. 2 presents the multi-market bidding process in detail and explains our integrated view on the three tasks in the modelling process. Section 3 review models that have been formulated to plan day-ahead, intraday and/or balancing market bids from the point of view of a hydropower producer. Section 4 discusses relevant forecasting techniques and their usefulness within the context of stochastic optimization of multi-market bidding. For models using stochastic programming, Sect. 5 presents ways to generate scenario trees. In Sect. 6, we summarize our findings and discuss the value of considering bids in multiple markets as a joint problem. Section 7 offers some conclusions.

2 The multi-market bidding process

Figure 1 shows the markets as organized in the current Nordic setting, and we will use this terminology in the rest of the paper. We focus on markets where the commodity traded is energy, i.e., on short-term markets for physical delivery of energy to the power system. Producers may also sell reserves or ancillary services to the power system, and commitments for such products may give added constraints for trade in the energy markets. In addition, there are financial markets and contracts that trade energy or energy derivatives over longer time horizons. We do not consider such markets further, although they may be important for managing risk. Longer term contracts may also limit the production available for trade in the short-term markets. The top part of Fig. 1 shows the sequential nature of the physical, short-term energy markets.

The Day-ahead Market (DAM) is a daily, centrally cleared auction market where producers and consumers/wholesalers bid their production and consumption, one day before operations. The Nordic day-ahead market is cleared within different price zones based on transmission constraints. The deadline for day-ahead bidding is right before noon; after a short time (e.g., an hour), the market operator has solved the market-clearing problem and announces prices in each zone. Notice that the bids for all trading periods of the day ahead are sent to the market operator at the same time, i.e. the DAM is a one-shot game that repeats every day. Bids may be sent as different bid types: piecewise-linear or piecewise-constant hourly bids; or blocks that combine several hours’ bids; or more complex configurations. Some of these contain conditions (e.g. on minimum revenue and load gradients) that make the bidding and clearing problems computationally challenging.

After clearing of the day-ahead market, accepted bids become legally binding contracts for physical delivery or consumption on price-zone level.

The Intraday Market (IDM) serves as a possibility to make adjustments to the commitments from the DAM. The IDM operates on a timescale after the closing of the day-ahead market and up to an hour before the operating hour. In the Nordics, it is organized as continuous double auctions. As opposed to the one-shot nature of the day-ahead auction, intraday trading may occur any time from the closing of the day-ahead market until market closure for individual hours. The IDM is an opportunity for producers to make adjustments to ‘unfortunate’ commitments from the day-ahead market. Unforeseen events may happen between the closure of the day-ahead market and the operating hour, making it infeasible or very costly for the producer to deliver the contracted volumes. The IDM is a possibility to change production by buying or selling additional energy.

In the Nordic region, the day-ahead and intraday markets are operated by NordPool, which is the market operator. The transmission system operator (TSO) is responsible for the safe operation of the transmission grid and maintaining the instantaneous balance between supply and demand. TSOs may be national or regional entities, and may or may not also be the market operator. As delivery time approaches, the TSO requires flexibility to ramp up or down power production at short notice.

Balancing markets (BM) are organized by the TSO for procurement of ramping flexibility. These markets are also called ‘real-time markets’, as activation happens in real time. Bidding in these markets, however, must be done 45 min before the operating hour, or earlier. The balancing market is aimed at restoring balance, i.e. restoring the system frequency and replacing (used) reserves. In the context of this paper, balancing markets will refer to real-time markets where energy (rather than capacity) is traded, with the TSO as single buyer. In the Nordics, there are balancing markets that close both prior to and after the day-ahead market; we focus on the latter type. To be allowed to participate, a generator must be able to ramp up or down a given minimum amount in a short time interval. Participants submit their willingness to ramp up/down according to the market rules, and the TSO chooses the most cost-efficient bids as need arises.

To summarize, the Nordic short-term physical energy markets are made up of the DAM, where the largest volumes are traded, the IDM, where the position of market participants may be refined on a continuous basis, and finally, real-time BMs, controlled by the TSO. As stated above, other countries or jurisdictions may have arrangements where the timing and definitions of markets is different. However, the need for a joint view of transactions in all markets still remains, as well as integrating the tasks of forecasting, scenario generation and optimization. More general definitions of various markets may be found in [35], which again builds on [55].

2.1 An integrated view on modelling, forecasting and scenario generation

We define the modelling process as the three interconnected tasks of modelling, forecasting and scenario generation. This section gives an overview of challenges within each task.

From the perspective of a power producer, it is important to know how much production can be dedicated to the day-ahead market, and how much to dedicate to the intraday or balancing markets. This involves modelling the production system and its flexibility and limitations. Even without the added complexity of determining bids, hydropower production scheduling involves modelling challenges in its own right. Cascading reservoirs, environmental constraints and head-variation effects are among the features that needs to be accounted for in efficient hydropower operations. For price-taking producers, it is optimal to bid according to the marginal costs of production, but calculating marginal costs for hydro is challenging as they reflect an opportunity cost of delayed releases from reservoirs. Water therefore needs to be strategically managed in long-term models covering a time horizon determined by the storage capacity of the reservoirs, which may be several years. Examples include Pereira and Pinto [46] and Pritchard et al. [51].

Planning bids in several short-term markets requires some degree of knowledge of the future prices and price variability for each of these markets. This is best described as stochastic processes. Different markets may require different forecasting techniques, due to their own dynamics, time resolution, inherent stability, and timing.

The usual way of describing uncertain variables for stochastic programming is by scenario trees. There is no universally accepted optimal way of building such trees. Instead, there are several approaches, each with its own strengths and weaknesses and different requirements on input data, and therefore in their applicability. We look into methods to build scenario trees, and, if needed, reduce their complexity while considering the size/exactness of the optimization problems which use said trees. In a multi-market setting, the scenario trees need to reflect the information structure inherent in the market dynamics. This means that the scenario trees must describe what information is available to producers at what time, so that the consequences of decisions taken at each stage can be properly taken into account by the optimization model.

Works such as Weron [58] or Steeger et al. [54] also present good literature reviews, but largely focus on individual parts of the modelling process, looking at either forecasting for one or another market, or the bidding problem. Our paper contribute with a more integrated view on the full chain of tasks involved in optimizing multi-market bidding strategies for hydropower.

3 Bid optimization methods

The existing literature on optimal power scheduling and bidding is quite extensive. However, focus is generally on thermal generation, which is characterized by high start-up costs, slow ramping times, and large generation volumes. Hydropower systems generally have lower start-up costs and high ramping flexibility. However, challenges that are due to the inventory problem of scheduling optimal releases of water over long time horizons are important. Hydropower scheduling has thus been studied by many researchers, including [21, 40, 46, 51, 53, 60]. With the emergence of wholesale power markets in many areas around the world, the hydropower scheduling problem has been augmented with the need for determining bids to these markets. General presentations of the bidding process in electricity markets may be found in Anderson and Philpott [4] and the review paper by Li et al. [39]. Steeger et al. [54] present a comprehensive literature survey on methods for the bidding problem, but limit their attention to works concerned with the day-ahead market. Our focus, on the other hand, is on studies where day-ahead bidding is seen in connection with either IDM or BMs.

3.1 Long time horizons and dynamic programming

The complexity of hydropower scheduling stems from the combinational nature of unit commitment and the potentially long time horizon needed for reservoir management; some reservoirs may store water over several years. Releasing water for production has practically zero marginal cost, so producers must rather consider the opportunity cost of selling energy today that could have been stored for the future. This opportunity cost may only be calculated by optimally scheduling production over the time horizon given by the reservoir size.

The balance between decisions taken now and decisions taken in the future is often modelled through variants of dynamic programming. Dynamic programming solves complex problems by solving a number of smaller subproblems. The subproblems often describe the value of being in a certain state at a certain time, for instance the value of having a given reservoir level at the start of a week. The solution to the initial problem is then constructed from the solutions of the subproblems. Stochastic dual dynamic programming (SDDP) is extensively used in hydropower scheduling models such as Pereira and Pinto [46].

The dynamic programming model in Pritchard et al. [51] addresses the bidding problem for producers with large reservoirs that replenish over seasonal periods. The work proposes a two-step dynamic model in which the first step calculates bids for several mean and variances for electricity prices. In the second step, the values from the first problem are used to choose the mean and variance to maximize revenue in the current stage plus the expected revenue in all future stages. The detailed planning for each step is decoupled from reservoir levels, which simplifies the problem but makes it impossible to observe dependencies among the reservoirs levels in the decision making.

Dynamic programming models are limited by the curse of dimesionality when considering long time horizons, several state variables and large state spaces. The hydropower scheduling problem is therefore often solved by separate models that operate on different time scales, from years and months/weeks to days and hours. Long-term models use aggregate system descriptions to find the optimal reservoir management strategy over time and give boundary conditions to shorter term models. These boundary conditions may be in the form of target reservoir levels, or, more often, the opportunity cost of releasing water that could have been stored for the future. This opportunity cost is interpreted as the marginal cost of production and is a very important input to short-term models. In the short-term, accuracy and details of the production system are more important, as the results should be feasible, readily implementable production schedules.

In this work, we study the bidding problem, which is normally defined as a short-term problem, i.e. we consider a time horizon of about one week, and determine bids for the next day’s operation. Some works depart from this framework due to the set-up of the market for which the model is intended, or due to different theories on how long and short term decisions are linked. However, a common feature of most bidding models is that marginal costs of production are calculated by some form of longer term hydropower scheduling model.

3.2 Unit-commitment, nonlinearities, and mixed-integer programming

Aside from the long horizons involved in reservoir management, the unit commitment problem is also an important aspect of the hydropower bidding problem. The unit commitment problem determines which units should be producing during a given time step. Unit commitment is important also for thermal producers.

It should be clarified here that we use the term “unit commitment” to describe the individual producer’s decision to turn on or off its generating units. This is sometimes also called the self-scheduling problem. In the Nordic electricity market, bidding takes place at the firm level and not on unit or plant level. Each firm must thus schedule its production portfolio to minimize the total cost of meeting its total production bid. In other markets, particularly in the U.S., units may be offered individually into the market. It is then up to the market operator to clear the market and thereby determine unit commitment. This system perspective is the traditional meaning of the term unit commitment. Bidding based on self-scheduling substantially simplifies the optimization problem of the market operator compared to unit commitment.

The binary on/off decision of generating units necessitates the use of integer variables in the self-scheduling problem. In addition, hydropower production scheduling is in general a nonlinear problem, due to an efficiency of production that depends on both discharge and pressure height. Pressure height depends on the reservoir level, which depends on discharge, which depends on efficiency, so there is a three-dimensional relationship between decision variables in the model. Nonlinear models, and especially integer-nonlinear models, are however difficult to work with, so nonlinear effects are often either neglected, linearized or handled in some other way like the two-step procedure in Séguin et al. [52]. To our knowledge, nonlinear formulations of the hydropower bidding problem are few.

However, the nonlinear algorithm proposed in Lu et al. [42] uses a two-step iterative optimization routine for electricity arbitrage, while market clearing prices are modelled by a discrete, composite curve defined from weekly averages. The first step runs an unconstrained problem to find optimal reservoir limits, while a second step checks if the solutions obtained from the first stage are acceptable. These results are returned to the first step, iterating until a solution is obtained. In this model, prices are modelled as deterministic.

Unit-commitment is most intuitively described by mixed-integer programs. Integer variables may also be used for approximating nonlinear or nonconvex relationships in the description of the production system.

The mixed-integer program in Fleten and Kristoffersen[18] considers a price-taking hydropower producer who participates in both the day-ahead and balancing markets in the NordPool system. The proposed model handles future prices via a scenario tree. A case study is provided in which the stochastic model solutions appear to be more robust than those obtained with a deterministic version of the same model. The model also includes block bids where the same volume is bid for a given number of consecutive hours. In the case study, they find that block bids tend to support production schedules with fewer start-ups.

Block bids are a way to shield against unfortunate production schedules for systems where there are intertemporal dependencies between reservoirs. Production volumes from different reservoirs may be linked in time as water released from upstream ends up in downstream reservoirs after a certain river flow time delay. Large production volumes for the entire river chain in hours of peak prices may force production in downstream parts a few hours later when prices are lower. Block bids may be used to secure a steady amount of production for longer periods of time. However, the usefulness of block bids is not widely discussed in existing literature. In what situations will block bids increase profits or flexibility for producers? What are the relative amounts of volumes offered as hourly and block bids? Is the ratio the same for cleared volumes? Are there other bids types that are more/less relevant in a multi-market setting?

In the mixed-integer program in Aasgåard et al. [1], both reservoir inflows and day-ahead prices are considered as stochastic variables. The problem deals with both bidding and actual dispatch during the operational phase. A case study where bid optimization based on stochastic programming is compared to heuristics used in the industry in a rolling-horizon simulation is presented. The stochastic mixed-integer program keeps reservoirs in a full state less often, which is desirable, and also limit the number of times when a unit is started for only a few hours.

De Ladurantaye et al. [14] formulates a model that optimizes bids for the 2-h ahead market in Canada. The model considers uncertainty in inflow and prices, and combine bidding with sales of reserves. Physical and operational constraints that are important for cascaded rivers are described in detail in this work. When compared to a formulation that does not consider the bidding aspect, the proposed formulation is found to give superior results.

Aasgåard et al. [2] presents how support for bids is implemented in the framework of models used by most large Nordic hydropower producers. Bids are calculated from the optimal production schedules for a set of scenarios for prices. As the bid curve has to be non-decreasing, a constraint is added stating that the volume produced in any scenario has to be lower than the volumes produced in scenarios with higher prices. This links the production decisions across scenarios. Similarly to [14], this model includes a detailed description of hydropower production for a range of river chain topologies.

The use of mixed-integer models is common in existing literature, but the combination of stochasticity and integer variables leads to difficult models, even when only one market is included. Such complex models may be too computationally depending to be solved within the time limits dictated by current market rules. The question then arises of how these models may be simplified to allow fast solution times without sacrificing too much quality in the solution. Input in the form of marginal costs are already calculated from more aggregate models, so how much is lost by determining bids based on simpler formulations? One could for instance approximate start-ups by continuous decisions. Existing literature does not answer the question of how important very detailed production system descriptions are when determining bids.

We think the answer to this will be case-specific, as it will depend on the size and number of generating units in the system. If a producer controls a large portfolio of differently sized units, it is more likely that he will be able to divide his commitments among the units without approaching infeasible or low efficiency operating zones. For smaller, or more constrained, systems, getting the bidding strategy right for each unit might be of more importance. The day-ahead bid curve should be a monotone non-decreasing curve from minimum to maximum production, and should result in a feasible operating schedule after market clearing. So if it is impossible or unwanted to produce in certain ranges, the price over these ranges should be increased. The non-decreasing nature of the overall bid curve must however be maintained. Participating in the IDM or BM offers opportunities for trading away unfortunate commitments. The importance of good bid strategies and multi-market participation should be assessed for different production portfolios.

3.3 Multi-market formulations

The models presented so far are limited to sales of energy to the DAM. We want to extend such formulations to consider participation in multiple markets.

Two mixed-integer models which generate bids for both the day-ahead and the balancing markets are given in Olsson [43]. The first model is a stochastic program for the balancing market, in which capacity has been committed from the day before as part of a day-ahead market bidding. Prices for these past day-ahead bids are therefore known. In a second model, both day-ahead and balancing market bids are decided jointly. Prices for both are assumed stochastic according to a given scenario-tree generation method. Reservoir levels are not explicitly modelled, but rather taken as exogenous parameters; deviations from these levels are penalized in the objective function. Risk-management measures are also considered.

The formulation in Löhndorf et al. [41] consider bids in the day-ahead and intraday market by dividing the problem into short-term intraday and long-term inter-day decisions stages. The first stage uses a stochastic program to plan bids and unit commitment in the day-ahead and the intraday market, while the latter stage simulates a Markov decision process using Approximate Dynamic Programming, and then integrates SDDP to form what the authors call Approximate Dual Dynamic Programming, which samples the Markov state transitions instead of using the whole process. This greatly reduces complexity and achieves tractability. Results from its application in EPEX SPOT indicate a good fit for the approximated Markov process, and a near optimal solution in spite of the approximation.

A model that include trade in both the day-ahead and the intraday market is described in Faria and Fleten [17]. The problem is described by a two-stage mixed-integer stochastic program where the first stage concerns day-ahead bidding and the second stage involves trades in the intraday market and hydropower production. Their results show that considering the intraday market when bidding in the day-ahead market does not significantly change neither the profits nor the bid strategy. However, this model does not adequately describe the continuous nature of intraday trade; in the model, the intraday prices for the entire operating day simply become known together with the day-ahead market prices. This is not the case in real operations, where the intraday price for a given hour may change continuously until the market is closed an hour before delivery. To our knowledge, no model has been formulated in the literature to adequately describe the continuous nature of intraday trade. A possible approach would be to consider the cost of changing production from the current schedule and compare this to offers available in the intraday market. Production should be ramped up/down whenever power can be sold/bought for a higher/lower intraday price. A similar approach could be used also for balancing market bids.

Both day-ahead and balancing bids are modelled in the multi-stage, mixed-integer stochastic problem in Boomsma et al. [9]. The potentially high complexity of the model is handled with a carefully designed scenario tree. In this model, thermal generation is included. An extension in which the generator is not a price taker is also implemented, which takes the price response as linear for the sake of manageability. Finally, the way in which joint DAM/BM bidding improves the producer’s profits is explicitly studied.

3.4 Marginal costs and the integration of long and short-term models

Determining bids is, at least in the price-taking case, essentially the same as determining marginal costs, which for hydropower is the opportunity cost. It is exactly this opportunity cost that is transferred between the long- and short-term scheduling problems. When determining bids in multiple markets, how important is it that the input marginal cost reflects the opportunities in multiple markets? Participation in multiple markets gives the producer a chance to trade its way to higher profits and more efficient production. This would in principle lead to a higher opportunity cost, as the value of storing water for optimal use in the future is increased. Is it possible to formulate long-term models that include an adequate description of opportunities in several short-term markets? What is the gain from consistent multi-market modelling through the chain of hydropower scheduling models?

Consider the situation of determining bids from a single reservoir. Using the marginal cost from a long-term model as input, we would decide to produce as long as the (expected) market price is higher than the marginal cost. The marginal cost estimate is thus the single basis of our decision. If this estimate is too low due to inadequate representation of future opportunities, we would offer more power to the market than optimal. Over time, this would result in a lower than optimal reservoir level.

The quality of the marginal cost estimate is very important for the long term effects of our bidding strategy. One way to amend this could be to integrate long-term scheduling and bid optimization, which is done in Fleten et al. [19]. The model uses a fine time resolution on near term and a coarser resolution going forward, but has consistent assumptions on market opportunities and trades for the entire horizon: only the day-ahead market is considered.

However, as we have already mentioned, very detailed bidding models might be too computationally demanding in an operational setting, even when considering short-term and one market only. So it seems rather unlikely that extending such formulations both in terms of including additional markets and longer time horizons is at all possible. Instead, a formulation with a less detailed system description, but that includes all market opportunities, may be used to calculate bids or improved estimates of the marginal cost used as input to the bid-optimization model. This new model would be a bridge between traditional, i.e. single-market, long-term models and the very detailed, short-term models used in operations. The bidding problem could thus be redefined as an intermediate term model that is the last step of the marginal cost calculation for hydropower.

3.5 Further considerations on bid optimization models

Most of the models cited have some sort of stochasticity included in them, either in the day-ahead prices, and/or IDM or BM prices. It is clear that managing uncertainty, at least to a certain degree, is considered important for optimal bidding, as is also corroborated by many of the works that compare deterministic and stochastic versions of the same model. However, joint modelling of multiple markets is often not undertaken at all, or described with too much simplification. The value of joint modelling for multiple markets is discussed in Sect. 6.

A note should be given here on joint modelling of uncertainty of prices and inflows. Inflow uncertainty most definitely affects the long term reservoir management strategy and thus the marginal costs. However, the effect of short-term inflow uncertainty on the bidding strategy is rarely explored by existing literature. The effect will depend on the level and variation of local inflow compared to the size and flow constraints of the reservoir, as well as the how pressure height changes as the storage level changes. For large, ‘flat’ reservoirs there will likely be a limited effect of considering short-term inflow uncertainty, but for smaller, ‘narrow’ reservoirs where the pressure height changes considerably with the storage content, short-term variations in inflow might be very important. Taking into account river chain dynamics (such as time delays and flow constraints), sensitivity to inflow uncertainty for a small, bottleneck reservoir might dictate the bidding strategy for an entire river chain. If uncertainty of both inflow and prices is to be considered in the bidding process, forecasting and scenario generation must aim to describe any dependencies between these variables. The aggregated amount of inflow over time is an important driver for prices in hydro-dominated power markets, but this dependency might be much weaker if we consider local inflow to a reservoir or river chain, and the price. Of course, local inflow might be correlated with total inflow, but how strongly will depend on local factors such as geography and weather conditions. Depending on these factors, inflow uncertainty might be safely disregarded within the one week horizon typically used for short-term scheduling. However, if simulation setups for validation or benchmarking of models is undertaken, one should perform these tests on long periods to cover various inflow states and detect trends over time.

Many important results have been established in existing literature for the hydropower bidding problem. Questions that remain are very much related to multi-market modelling; we find only a few works that include two or more markets. Another question is how much detail it is necessary to include in order to obtain a good bidding strategy. How will this differ from the optimal strategy found from a more accurate model? What are the consequences of using less-than-optimal strategies, and does the effects depend on size and other properties of the production portfolio? Finally, how important is consistent modelling of multi-market opportunities in all steps of the marginal cost calculation?

4 Forecasting methods

Electricity price forecasting can be done in a number of different ways. The immediateness of the forecast period, the amount of available historical data and the volatility of the market in question all come into play when trying to create point- or interval-forecasts. A natural split is between models that may be used to forecast prices in the day-ahead and intraday market, and methods for balancing market prices. This is because the balancing market per definition is for unforeseeable events; unbalances occur because something happens during real-time that could not be predicted. We therefore present models for forecasting DAM and IDM prices in one section, and BM prices in the next.

4.1 Day-ahead and intraday market prices

Forecasting methods for day-ahead prices are by far most widely discussed and analysed in the literature. Balancing and intraday markets have received less attention, likely because of their so far limited turnover and relatively low extra profit potential. A method that so far mostly have been applied for forecasting day-ahead prices, might also be suited for forecasting IDM prices.

According to Weron [58], one can classify models for day-ahead electricity prices into five different types: fundamental models, multi-agent/simulation models, reduced form models, statistical models, and artificial intelligence (AI) models. The methods vary not only in the mathematical tools used, but also the data they use as input, their ability to calculate outputs at different time resolutions, and whether or not they give punctual or interval information useful for stochastic scenario generation or other techniques to generate robustness.

Fundamental models attempt to capture a variety of the most relevant physical and economic factors that influence the prices in a system, like load, temperature, reservoir levels, fuel prices, and so on. An example for the Nordic markets is found in Wolfgang et al. [59]. Fundamental models rich in parametric data are often proprietary or confidential, thus few literature references exist for them in spite of their wide practical use, according to [58]. Meaningful and complex fundamental models is an important research gap in the open scientific community. As renewable resources like wind and solar make up a larger share of electricity production, their effects on prices should also be included in fundamental models. Wind and solar are in general related to weather data, which presents large uncertainties. For hydro, inflow uncertainty is also of key importance, as it describes future resource availability. Coordination of the forecasts for inflow, wind and solar needs better coverage.

Multi-agent and simulation models aim to capture the interactions in the relevant market. They rely on assumptions of the behaviours of the participants, and model these actions using game theory or similar tools, either in an exact way or through simulation analysis.

Reduced-form and statistical methods are both based on time series modelling. Reduced-form models are inspired by financial analyses and are rather successful when it comes to capturing trends in the data, seasonality, mean reversion events, jumps, and so on. They can be further classified into jump-diffusion models [11], and Markov regime-switching models [45]. Both try to identify states in which prices can be easily forecast, and either identify jump elements which disrupt those states and their forecast, or model several states with different inherent characteristics (baseload, peak), and their transitions.

Statistical methods rely on historical observation of parameters, along with additional exogenous factors, to generate a forecast. Statistical models range from the very simple same-day approaches (naive, but useful for benchmarking, according to [13], to clear, easily interpretable regression analysis (like that in [28], often used in conjunction with other tools), to more complex AR models. The latter have wide use and applications given their ability to incorporate exogenous factors beyond just the time series in question. AR-type variants appear in [20, 23, 38], with successful applications in the Nordpool, Californian and Spanish markets.

Finally, AI methods, which for electricity are mostly based on Artificial Neural Networks, are specially good for highly non-linear systems and short-term predictions. Force-feed neutral networks [22] and Recurrent Neural Networks [3] are both tested and, while not consistently better than the more refined, state-of-the-art approaches, the trade-off between fast processing speed and accuracy in the forecasts is arguably something to look into.

4.2 Balancing market prices

Klæboe et al.[36] note the abundance of sources on day-ahead price forecasting, but nowhere near as many when it comes to forecasting intraday and balancing markets.

The nature of the balancing markets makes it difficult to specify information which, if available, would not have already been included in the day-ahead forecast. The sources of variation in the balancing markets, by the very nature of these markets, are not easily incorporated in prediction models. However, there is usefulness in forecasting balancing market prices, specially when more than point-estimates are needed. Evidence suggests that models that incorporate more than just statistical information produce narrower forecasting intervals, though point-estimates of the balancing prices are no better than a constant zero time series, same as with the purely statistical methods.

In [36], we have a method in which both the system’s state and volume information are considered as exogenous factors for a regression which provides forecasts for balancing prices. While this method does not necessarily perform better than purely statistical methods to obtain point-estimates for electricity prices, it does provide better forecast bands, tighter than the ones in the Markov Regime-switching process presented in Olsson and Söder [44]. Another fundamental modelling application, a comparison of a mean-reverting jump diffusion model for prices and a Markov regime-switching model is shown in Wang et al. [57]. The effectiveness of these approaches, however, is questioned by Kosater and Mosler [37], who state that there is little evidence that regime-switching methods, even when combined with further statistical forecasting methods, provide added information or forecasting power.

Brolin and Söder [10] propose a non-linear time series model is used to predict real-time Swedish electricity prices coupled with simulation to generate a stochastic scenario tree. The histograms for the simulated data are deemed similar enough to the historical values, so the method has arguably satisfying results for this particular instance.

4.3 Further considerations on forecasting methods

Considering the day-ahead market, we can say that statistical methods, like SARFIMA or AR-X forecasts, are widely used in the research community either alone or as a part of a combined approach, the former when seasonal information is clear, the later when exogenous data series are available. These statistical approaches can be combined with reduced-form or Artificial Intelligence models, both of which are good in capturing non-linear trends, such as violent spikes, which are the norm in electricity pricing. The results can be benchmarked with an easily implemented same-day approach.

In general, the literature seem to favour ARMA, ARIMA and AR-X methods for short-term forecasts, whereas other authors claim Artificial Intelligence models are better suited to cover the non-linear aspects of the short-term variations [58]. Methods for the day-ahead market might also be suitable for the intraday market.

For the balancing market, however, there are few sources of price forecasting, and it is difficult to justify forecasts for the balancing market when they use exactly the same information as the DAM forecast. On the other hand, while producers might not obtain much information from later market’s prices per se, these can inform them on the TSO’s intentions when it comes to real-time regulation. In a sort of two-level game, the producers could forecast balancing market prices and, based on historical TSO’s decisions, make their DAM, IDM and BM offers concurrently in a way that maximize their profits in view of the possible offers from other producers. Kiesel and Paraschiv [33], for example, study IDM prices and their impact on day-ahead prices, using a reduced form model which includes weather data. They acknowledge, however, a lack of similar multi-market analyses.

We find significant challenges and gaps in the literature regarding multi-market price forecasting. These can roughly be summarized in two, interlinked narratives: (a) the increasing dominance of intermittent renewable sources increase uncertainty, making forecasting and the development of models taking this into account both more relevant and challenging, and (b) market integration raises the question of how relevant and profitable is it for smaller producers to study this in a coordinated way, not just from the bidding point of view, but also when it comes to forecasting prices.

The value of multi-market price forecasting is intrinsically liked to the value of managing bids in multiple markets. Klæboe and Fosso [35], while recognizing only modest gains in their literature overview, seem to think increased intermittent generation in a system will increase the relevance of coordinated bids, and, consequently, forecasting of BM prices. Whether or not new information is available to a producer after DAM and IDM commitment, and how this new information can be used to change a producer’s behaviour when it comes to balancing market dispatch, presents a conceptual challenge.

5 Scenario-tree generation methods

Many of the papers cited in Sect. 3 are based on stochastic programming and therefore require scenario trees [16, 34]. While most papers provide information about the employed scenario generation process, this section presents a more systematic overview of available methods. As there is a significant qualitative difference between two- and multi-stage models, we will treat them separately.

5.1 Two-stage models

Two-stage models have only one branching point and therefore only two stages; one before information is revealed and the second after. Consequently, the scenario tree is usually in the form of independent scenarios, connected together in the root of the tree, which represents the first stage. Such trees are often referred to as fans.

Since the second-stage part of the scenario tree consists of a set of independent paths, two-stage models are well suited for forecasting methods able to simulate multiple paths, such as time-series models. Scenarios in the tree are drawn as a sample of possible paths. Of the papers presented in the previous section, this approach is used in [17, 18].

A word of warning, though: while sampling-based methods usually guarantee optimality in the limit, they do not provide good approximations with few scenarios. Without further post-processing, they do not even guarantee that the scenarios have correct expected values, something that is known to be important for stochastic-programming models [12]. A popular way of avoiding this problem is to generate a large scenario tree and then reduce it, using scenario-reduction techniques. By the law of large numbers, the expected value in the large tree should be close to the specified values. Unfortunately, not all scenario-reduction methods guarantee preservation of the means. However, one can expect the results to be better than if we sampled the small number of scenario directly.

In the case of optimizing bids, it is natural to have the bid decisions in the first stage and everything after market clearing in the second stage. This implies that there is no uncertainty in the operating part of the model, i.e., for unit commitment and dispatch—which is a correct description as long as the producer operates only in the day-ahead market and we ignore other uncertainties such as inflow and intermittent electricity sources. However, a two-stage model for multi-market bidding would represent the intraday and balancing markets without uncertainty, possibly overestimating the profit obtainable in these markets. Jointly considering bids in several markets therefore require scenario trees that have multiple branching points. This will reflect how information on prices and commitments is gradually revealed to producers as different markets clear over time.

5.2 Multi-stage models

Multi-stage scenario trees are qualitatively different from the two-stage case, because multi-stage trees involve conditional probability distributions. If the single branching point of the two-stage tree is right after the first period, there is only one distribution to handle and it depends only on the history, so we can use forecasts and sampling as described above. Multi-stage trees, on the other hand, include consecutive branchings that require the knowledge of conditional distributions: the distribution seen from any node in the scenario tree depends not only on the history up to now, but also on the values in the given node.

Such conditional distributions are readily available if we use methods based on time-series, but not for other forecasting techniques. Moreover, time-series models make it easy to sample any number of successors for a given node, so one can build the whole scenario tree. A potential problem with such an approach is that the number of branches at each node must be kept low to avoid exponential growth in the number of scenarios. This makes pure sampling unsuitable, as expected values may not be preserved by small samples. One could, in principle, address the issue in the same way as in the two-stage case, namely by generating the tree with more branches at each branching point and then reduce it, but such a tree would likely be too large to handle. Instead, we can do the generation and reduction step at each branching node of the tree; this approach has been used in [14], employing a mean-preserving reduction technique from De Ladurantaye et al. [15], and in [9], using k-medoids clustering for the reductions. An alternative is to replace sampling by a discretization method that provides better control of the statistical properties, such as the copula-based method from Kaut [29] or the moment-matching method from Høyland et al. [27]. This approach has been used in Kaut et al. [32].

The above approach works only for forecasting methods that provide conditional distributions at any point of the tree, such as time-series modelling. For other methods, one usually generates a two-stage tree and then use some clustering or reducing technique to transform it into a multi-period tree. The most common way of doing this is the scenario reduction methods from Heitsch and Römisch [25, 26], which aim to find a reduced tree that is close to the starting tree in terms of the sum of \(L_r\)-distance and a so-called filtration distance [24]. There, the \(L_r\)-distance measures the difference between values in the scenario trees, while the filtration distance measures the difference between structures of the trees. While popular, there is a potential problem with using this method: the main reason for reducing a fan to a tree is that the fan is not a good approximation of the process, since there is no new information after the first stage. However, the theory supporting the methods measures only how much worse the solution of the reduced problem is, compared to the one based on the initial tree. Hence, if the fan is not a good approximation of the stochastic process, there is no guarantee that the reduced tree will be better. Of the papers presented in Sect. 3, this approach is used in [1, 2, 43].

An alternative approach is based on a nested distance, introduced in Pflug [47] as a distance between nested distributions, also introduced there. Pflug and Pichler [48] presents several such scenario generation algorithms, based on the assumption that we can sample unlimited number of paths from the underlying process. Finally, Pflug and Pichler [49] present a related method that can be used for reducing a fan to a multi-stage tree. For this, the method estimates the conditional distributions using techniques from kernel estimation. Once we have the conditional distributions, we can build the multi-stage tree as described earlier in this section. This approach has been used in [52] for generating scenarios for short-term reservoir inflows.

Until now, we have discussed situations where a forecast method can either sample future values, or at least produce a collection of forecasted paths. However, some forecasting methods, such as fundamental and AI models, produce only a single forecast; or we could have access to a single forecast provided by a third party. In this case, we cannot use the any of the methods discussed so far. Since a single forecast does not include any information about uncertainty, we have to use other sources. If we have access to historical forecasts and actual observed values, we can use a scenario-generation method from [30], which is a multi-stage extension to a method from [5]. The method works by creating a scenario tree for prediction errors and combining it with the forecast to get the scenario values. Internally, the method treats errors of forecasts of different lengths as separate random variables, which allows modelling of inter-temporal dependencies between errors. A similar approach is used in Vespucci et al. [56], where a scenario tree for the day-ahead wind production is obtained by combining a single wind power production forecast with a scenario tree of historical prediction errors.

5.3 Further considerations on scenario generation methods

For multi-market bidding, multi-stage scenario trees are needed to describe how prices and commitments in sequential markets are revealed over time. However, which markets, i.e. prices, to include as uncertain variables in the tree is still mostly an unanswered question. Modelling all markets in detail will likely lead to models that are too large. One way of reducing the model size might be using the multi-horizon modelling approach from Kaut et al. [32], with markets beyond the DAM modelled in the inner layer of the scenario tree. This, however, is beyond the scope of the paper. Another approach is to model only a subset of the markets, which require some assessments of which markets are most important for producers. This subject is further discussed in Sect. 6.

Since the scenario tree introduces an additional approximation step in the modelling process, it is important to ensure that it does not deteriorate the quality of the solutions too much. However, the solution obtained by using the true, full distribution of the uncertain variables is generally not obtainable, either because the true distribution is unknown, or because the resulting optimization problem would be too large. Without the true solution as a benchmark, the approximation error of using scenario trees is, in general, difficult to estimate; we refer interested readers to Bayraksan and Morton [6] and Bayraksan et al. [7].

Instead, we focus on the easier issue of stability, as defined in Kaut and Wallace [31]. Simply said, stability is the requirement is that if we repeat the scenario generation and optimization steps using the same input, we should get (approximately) the same results. Stability may thus also be called reproducibility. In more detail, if we solve the same problem with N scenario trees, the variation of the obtained optimal objective values should be within some specified limit—the exact value is case-dependent.

Since the approximation to the true distribution should improve with increasing number of scenarios S, the task is often to find the smallest number of scenarios S that produces acceptable results. Note that if we use a scenario-generation tool that produces randomized output (such as sampling), we can use N trees of size S. If, on the other hand, the tool always produces the same tree for a given size, we can generate trees with \(s \in \{S - N/2,\dots ,S + N/2\}\) scenarios instead. In [31], this is called an in-sample stability test, since it uses objective values from the trees it was obtained on. In contrast, an out-of-sample stability test would compare the solutions on an additional scenario tree, preferably with as many scenarios as possible. This is usually only applicable to two-stage models, see the discussion in [31].

To summarize, stability is the minimal requirement for a scenario generation method: if the model produces different results at each run, it is of no use. The allowed calculation time of stochastic programming models will be limited in operational settings, and large trees lead to long run times and potentially also trouble with memory. In our context, bids must be submitted before certain closing times for the various markets, and producers must divide their limited time between updating forecasts, scenario generation and optimization. It is therefore important to find a minimal size of the scenario tree that still produces stable results for the optimization model it is used with.

6 The value of coordinated multi-market bidding

Formulating an optimization model that includes the decisions to be taken and uncertain variables for all markets (DAM, IDM and BM) might quickly grow prohibitively complex, and it would be difficult to define a scenario tree structure that adequately represent the information structure; such models are not pursued very often in the literature. Rather, we find bid optimization models that cover one or two of the markets. Even such problems possess challenges in terms of consistency and dependency in forecasts for prices, and the size of the resulting scenario trees, which again leads to long run times. The question then arises, what are the gains of modelling bids in all markets as a joint problem?

Both Klæboe and Fosso [35] and Boomsma et al. [9], define the term coordinated bidding as taking subsequent energy markets into account when determining bids to the day-ahead market, while separate bidding is defined as making bids to the day-ahead market without considering the opportunities in the IDM and BMs until after the closure of the DAM. [9] develop bounds on the gain from coordinated bidding in the day-ahead and balancing market, and find that the gain averaged at 2%, with a difference between lower and upper bound of 7%. In general, the value of stochastic planning becomes smaller when moving from single-market bidding to multi-market bidding. This is because the additional markets represent an opportunity to adapt and ‘make up for’ bad decisions taken at earlier time steps.

Klæboe and Fosso [35] discuss modelling challenges for multi-market bidding in more general terms, and come to the conclusion that consistency of assumptions across markets should be kept in mind. We hold that this consistency should also include assumptions made in forecasting and scenario generation, which must be seen as integrated and equally important tasks when developing the model framework.

With the gains from coordinated bidding reported to be small and the models needed to calculate such strategies increasingly complex, some alternative modelling choices arises: (a) use simplified descriptions for the IDM and/or BM; (b) include only one of the additional markets; or (c) consider the markets as separate bidding problems. Approach (b) is used in most of the papers reviewed in Sect. 3. This method involves a choice of which market to include, and further on what basis this choice is to be made. Should we include the market with the highest profit potential? Or the market that gives the producer largest flexibility to change production close to the operating hour? This depends on the objectives of the producer, and may even change with seasons or conditions in the water courses. If hydropower production resources are constrained due to wet/dry conditions, flexibility might be the most important concern, while profit-maximization might be the goal in more ‘normal situations’. Even if profit potential is used as the decision criterion, evaluating this potential for different markets require forecasts of expected prices and their variation in the long term. Using approach (a) and simplifying the descriptions of latter markets, involves challenges of consistency. Does the simplified formulation still represent enough detail to adequately describe the opportunities in the intraday and balancing markets? Is the information structure in the scenarios intact? If we simplify by using smaller scenario trees (or even deterministic modelling), will the statistical properties and dependencies of prices still be maintained? Lastly, what is lost if using approach (c) in terms of profit or flexibility?

Characterizing and bounding the gains of coordinated bidding in all short-term energy markets similar to what is done in [9] for the day-ahead and balancing market would be a guide to choose which markets to include/exclude from the multi-market hydropower bidding problem. Here, the term ‘gain’ is used in a broader sense than just profits, and includes for example increased flexibility when managing the production system and watercourses. Using state-of-the-art methods and striving for consistency in all steps of the modelling process will help reduce any estimation errors of such bounds. Simulating and comparing the use of models based on different modelling choices will also guide in deciding which markets or assumptions are important.

7 Conclusions

In this paper, we review optimization models that describe the multi-market bidding problem for hydropower producers, together with methods for multi-market price forecasting and scenario tree generation. These tasks may be seen as interconnected steps in the modelling process.

The multi-market setting offer both opportunities and challenges for power producers; opportunities in the form of possibilities to trade their way to profitable and flexible production schedules, and challenges in the form of managing uncertainty in several markets. Our opinion is that managing uncertainty and the interconnections and dependencies between different markets will be a competitive advantage for producers in the near future.

In order to develop decision-support tools that can aid producers in an increasingly complex market environment, we need to take an integrated view of all steps of the modelling process. Understanding the characteristics and variability of prices in different markets and their interaction, and describing this variability and how its is revealed to the producer through stages in the scenario tree, are the foundation on which stochastic-programming models can be build. To properly account for stochasticity in a multi-market setting, forecasting, scenario generation and optimization are all equally important. A successful stochastic model for decision-making heavily relies on the right selection of methods to manage the uncertainty of the variables involved.

When it comes to bidding in a multi-market setting, there are only a few sources available, and all of them show little or no gain from coordinated bidding. Our opinion is that multi-market participation, although reportedly having a limited profit potential, can provide gains in flexibility and system stability for hydro producers. With the current shift towards renewable sources (which, aside from hydropower, are intermittent), the need for being able to change production closer to real-time will increase. This gives opportunities for hydropower producers, which are flexible in the sense that energy can be stored until needed and production can be started or changed quickly. Power producers, and hydro power producers in particular, are expected to increasingly participate in more than one market, and we believe there is a lack of literature and models that address the topic in a more comprehensive manner.

Notes

Arguably, the term ‘bidding problem’ could be more properly defined as ‘offer problem’, as the producer needs to decide what volumes to offer to the market; the term bids traditionally being used for buyers, i.e. the demand side. However, the term ‘bidding problem’ is widely incorporated in the literature, at least in the European setting. Some of the references cited use ‘offer problem’.

References

Aasgård, E.K., Andersen, G.S., Fleten, S.-E., Haugstvedt, D.: Evaluating a stochastic-programming-based bidding model for a multireservoir system. IEEE Trans. Power Syst. 29(4), 1748–1757 (2014)

Aasgård, E.K., Naversen, C.Ø., Fodstad, M., Skjelbred, H.I.: Optimizing day-ahead bid curves in hydropower production. Energy Systems, pp. 1–19 (2017)

Anbazhagan, S., Kumarappan, N.: Day-ahead deregulated electricity market price forecasting using recurrent neural network. IEEE Syst. J. 7(4), 866–872 (2013)

Anderson, E.J., Philpott, A.B.: Using supply functions for offering generation into an electricity market. Oper Res 50(3), 477–489 (2002)

Andersen, J., Kaut, M., Tomasgard, A.: Stochastic model for short-term balancing of supply and consumption of electricity. In: Modelling and Optimisation of Renewable Energy Systems, pp. 37–66. School of Business and Social Sciences, Aarhus University, Aarhus (2015). ISBN 9788793195189, http://pure.au.dk/portal/en/publications-research/modelling-and-optimisation-of-renewable-energy-systems%2880b927a9-a945-4d22-9e8e-3210714bea9c%29.html

Bayraksan, G., Morton, D.P.: Assessing solution quality in stochastic programs. Math Program 108(2–3), 495–514 (2006)

Bayraksan, G., Morton, D.P., Partani, A.: Simulation-based optimality tests for stochastic programs. In: Infanger, G. (ed.) Stochastic Programming: The State of the Art In Honor of George B. Dantzig, International Series in Operations Research & Management Science, pp. 37–55. Springer, Berlin (2011). https://doi.org/10.1007/978-1-4419-1642-6

Berrada, A., Loudiyi, K., Zorkani, I.: Valuation of energy storage in energy and regulation markets. Energy 115(Part 1), 1109–1118 (2016). https://doi.org/10.1016/j.energy.2016.09.093

Boomsma, T.K., Juul, N., Fleten, S.-E.: Bidding in sequential electricity markets: the Nordic case. Eur. J. Oper. Res. 238(3), 797–809 (2014)

Brolin, M.O., Söder, L.: Modeling Swedish real-time balancing power prices using nonlinear time series models. In: 2010 IEEE 11th International Conference on Probabilistic Methods Applied to Power Systems (PMAPS), pp. 358–363. IEEE (2010)

Chan, K.F., Gray, P., Van Campen, B.: A new approach to characterizing and forecasting electricity price volatility. Int. J. Forecast. 24(4), 728–743 (2008)

Chopra, V., Ziemba, W.: The effects of errors in means, variances, and covariances on optimal portfolio choice. J. Portfolio Manag. 19(2), 6–11 (1993)

Conejo, A.J., Contreras, J., Espínola, R., Plazas, M.A.: Forecasting electricity prices for a day-ahead pool-based electric energy market. Int. J. Forecast. 21(3), 435–462 (2005)

De Ladurantaye, D., Gendreau, M., Potvin, J.-Y.: Strategic bidding for price-taker hydroelectricity producers. IEEE Trans. Power Syst. 22(4), 2187–2203 (2007). https://doi.org/10.1109/TPWRS.2007.907457

De Ladurantaye, D., Gendreau, M., Potvin, J.-Y.: Optimizing profits from hydroelectricity production. Comput. Oper. Res. 36(2), 499–529 (2009). https://doi.org/10.1016/j.cor.2007.10.012

Dupačová, J., Consigli, G., Wallace, S.W.: Scenarios for multistage stochastic programs. Ann. Oper. Res. 100, 25–53 (2000)

Faria, E., Fleten, S.-E.: Day-ahead market bidding for a nordic hydropower producer: taking the elbas market into account. Comput. Manag. Sci. 8(1), 75–101 (2011)

Fleten, S.-E., Kristoffersen, T.K.: Stochastic programming for optimizing bidding strategies of a nordic hydropower producer. Eur. J. Oper. Res. 181(2), 916–928 (2007). https://doi.org/10.1016/j.ejor.2006.08.023

Fleten, S.-E., Haugstvedt, D., Steinsbø, J.A., Belsnes, M.M., Fleischmann, F.: Bidding hydropower generation: integrating short- and long-term scheduling. In: Proceedings of 17th Power Systems Computations Conference PSCC 2011, pp. 352–358 (2011)

Garcia, R.C., Contreras, J., Van Akkeren, M., Garcia, J.B.C.: A garch forecasting model to predict day-ahead electricity prices. IEEE Trans. Power Syst. 20(2), 867–874 (2005)

Gjelsvik, A., Mo, B., Haugstad, A.: Long- and medium-term operations planning and stochastic modelling in hydro-dominated power systems based on stochastic dual dynamic programming. In: Pardalos, P.M., Rebennack, S., Pereira, M.V.F., Iliadis, N.A. (eds.) Handbook of Power Systems I, pp. 33–55. Springer, Berlin (2010)

Guo, J.-J., Luh, P.B.: Improving market clearing price prediction by using a committee machine of neural networks. IEEE Trans. Power Syst. 19(4), 1867–1876 (2004)

Haldrup, N., Nielsen, M.Ø.: A regime switching long memory model for electricity prices. J. Econom. 135(1), 349–376 (2006)

Heitsch, H., Römisch, W., Strugarek, C.: Stability of multistage stochastic programs. SIAM J. Optim. 17(2), 511–525 (2006). https://doi.org/10.1137/050632865

Heitsch, H., Römisch, W.: Scenario tree modelling for multistage stochastic programs. Math. Program. 118(2), 371–406 (2009). https://doi.org/10.1007/s10107-007-0197-2

Heitsch, H., Römisch, W.: Scenario tree generation for multi-stage stochastic programs. In: Bertocchi, M., Consigli, G., Dempster, M.A.H. (eds.) Stochastic Optimization Methods in Finance and Energy, International Series in Operations Research and Management Science, vol. 163, chapter 14, pp. 313–341. Springer, Berlin (2011). https://doi.org/10.1007/978-1-4419-9586-5_14

Høyland, K., Kaut, M., Wallace, S.W.: A heuristic for moment-matching scenario generation. Comput. Optim. Appl. 24(2–3), 169–185 (2003)

Jónsson, T., Pinson, P., Nielsen, H.A., Madsen, H., Nielsen, T.S.: Forecasting electricity spot prices accounting for wind power predictions. IEEE Trans. Sustain. Energy 4(1), 210–218 (2013)

Kaut, M.: A copula-based heuristic for scenario generation. Comput. Manag. Sci. 11(4), 503–516 (2014). https://doi.org/10.1007/s10287-013-0184-4

Kaut, M.: Forecast-based scenario-tree generation method. Optimization Online, e-print ID 2017-03-5898 (2017). http://www.optimization-online.org/DB_HTML/2017/03/5898.html

Kaut, M., Wallace, S.W.: Evaluation of scenario generation methods for stochastic programming. Pac. J. Optim. 3, 257–271 (2007)

Kaut, M., Midthun, K.T., Werner, A.S., Tomasgard, A., Hellemo, L., Fodstad, M.: Multi-horizon stochastic programming. Comput. Manag. Sci. 11(1–2), 179–193 (2014). https://doi.org/10.1007/s10287-013-0182-6. Special Issue: Computational Techniques in Management Science

Kiesel, R., Paraschiv, F.: Econometric analysis of 15-minute intraday electricity prices. Energy Econ. 64, 77–90 (2017)

King, A.J., Wallace, S.W.: Modeling with Stochastic Programming. Springer Series in Operations Research and Financial Engineering. Springer, Berlin (2012). https://doi.org/10.1007/978-0-387-87817-1

Klæboe, G., Fosso, O.B.: Optimal bidding in sequential physical markets—a literature review and framework discussion. PowerTech (POWERTECH), 2013 IEEE Grenoble, pp. 1–6 (2013)

Klæboe, G., Eriksrud, A.L., Fleten, S.-E.: Benchmarking time series based forecasting models for electricity balancing market prices. Energy Syst. 6(1), 43–61 (2015)

Kosater, P., Mosler, K.: Can Markov regime-switching models improve power-price forecasts? Evidence from German daily power prices. Appl. Energy 83(9), 943–958 (2006)

Kristiansen, T.: Forecasting Nord Pool day-ahead prices with an autoregressive model. Energy Policy 49, 328–332 (2012)

Li, G., Shi, J., Qu, X.: Modeling methods for genco bidding strategy optimization in the liberalized electricity spot market—a state-of-the-art review. Energy 36(8), 4686–4700 (2011). https://doi.org/10.1016/j.energy.2011.06.015

Lindqvist, J.: Operation of a hydrothermal electric system: a multistage decision processr. AIEE Trans. Power Appar. Syst. 81, 1–7 (1962)

Löhndorf, N., Wozabal, D., Minner, S.: Optimizing trading decisions for hydro storage systems using approximate dual dynamic programming. Oper. Res. 61(4), 810–823 (2013)

Lu, N., Chow, J.H., Desrochers, A.A.: Pumped-storage hydro-turbine bidding strategies in a competitive electricity market. IEEE Trans. Power Syst. 19(2), 834–841 (2004)

Olsson, M.: On optimal hydropower bidding in systems with wind power: modeling the impact of wind power on power markets. PhD thesis, KTH, Stockholm (2009)

Olsson, M., Söder, L.: Modeling real-time balancing power market prices using combined SARIMA and Markov processes. IEEE Trans. Power Syst. 23(2), 443–450 (2008)

Paraschiv, F., Fleten, S.-E., Schürle, M.: A spot-forward model for electricity prices with regime shifts. Energy Econ. 47, 142–153 (2015). https://doi.org/10.1016/j.eneco.2014.11.003. ISSN 0140-9883

Pereira, M.V., Pinto, L.M.: Multi-stage stochastic optimization applied to energy planning. Math. Program. 52(1–3), 359–375 (1991)

Pflug, G.C.: Version-independence and nested distributions in multistage stochastic optimization. SIAM J. Optim. 20(3), 1406–1420 (2010). https://doi.org/10.1137/080718401. ISSN 1095-7189

Pflug, G.C., Pichler, A.: Dynamic generation of scenario trees. Comput. Optim. Appl. 62(3), 641–668 (2015). https://doi.org/10.1007/s10589-015-9758-0. ISSN 1573-2894

Pflug, G.C., Pichler, A.: From empirical observations to tree models for stochastic optimization: convergence properties. SIAM J. Optim. 26(3), 1715–1740 (2016). https://doi.org/10.1137/15M1043376

Philpott, A., Guan, Z., Khazaei, J., Zakeri, G.: Production inefficiency of electricity markets with hydro generation. Utilities Policy 18(4), 174–185 (2010). ISSN 0957-1787. https://doi.org/10.1016/j.jup.2010.09.001. URL http://www.sciencedirect.com/science/article/pii/S0957178710000585. Designing Electricity Auctions

Pritchard, G., Philpott, A.B., Neame, P.J.: Hydroelectric reservoir optimization in a pool market. Math. Program. 103(3), 445–461 (2005)

Séguin, S., Fleten, S.-E., Côté, P., Pichler, A., Audet, C.: Stochastic short-term hydropower planning with inflow scenario trees. Eur. J. Oper. Res. 259(3), 1156–1168 (2017)

Stage, S., Larsson, Y.: Incremental cost of water power. Power apparatus and systems, part III. Trans. Am. Inst. Electr. Eng. 80(3), 361–364 (1961)

Steeger, G., Barroso, L.A., Rebennack, S.: Optimal bidding strategies for hydro-electric producers: a literature survey. IEEE Trans. Power Syst. 29(4), 1758–1766 (2014)

Triki, C., Beraldi, P., Gross, G.: Optimal capacity allocation in multi-auction electricity markets under uncertainty. Comput. Oper. Res. 32(2), 201–217 (2005). https://doi.org/10.1016/S0305-0548(03)00211-9

Vespucci, M.T., Bertocchi, M., Tomasgard, A., Innorta, M.: Integration of Wind Power Production in a Conventional Power Production System: Stochastic Models and Performance Measures, pp. 129–152. Springer, Berlin (2013). ISBN 978-3-642-41080-2. https://doi.org/10.1007/978-3-642-41080-2_5

Wang, P., Zareipour, H., Rosehart, W.D.: Descriptive models for reserve and regulation prices in competitive electricity markets. IEEE Trans. Smart Grid 5(1), 471–479 (2014)

Weron, R.: Electricity price forecasting: a review of the state-of-the-art with a look into the future. Int. J. Forecast. 30, 1030–1081 (2014)

Wolfgang, O., Haugstad, A., Mo, B., Gjelsvik, A., Wangensteen, I., Doorman, G.: Hydro reservoir handling in Norway before and after deregulation. Energy 34(10), 1642–1651 (2009)

Yakowitz, S.: Dynamic programming applications in water resources. Water Resour. Res. 18(4), 673–696 (1982)

Acknowledgements

This work was supported by the Research Council of Norway under Project Number 255100/E20 MultiSharm.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Aasgård, E.K., Fleten, SE., Kaut, M. et al. Hydropower bidding in a multi-market setting. Energy Syst 10, 543–565 (2019). https://doi.org/10.1007/s12667-018-0291-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-018-0291-y