Abstract

In this paper we consider a supply chain where the purchasing behavior of final users of the product influences the decisions that are made. We particularly examine the effects of customers’ competition for the offered service level on the facility location decisions. We consider two types of decision makers, the producer who tries to provide at facilities the best level of service at minimum cost and the customers who make their choices in order to minimize their perceived costs. We consider first the case where customers are assigned for service to the facilities by the producer. In such a case the producer could be considered as monopolist who dominates and tries, through the facility location decisions, to ensure the best, at his opinion, service level at minimum cost. Then we suppose that the customers are involved in a Nash type game in their effort to ensure the best level of services for themselves, i.e. we assume that they are involved in an oligopsony. In order to take into consideration the effects of this competition to the facilities location decisions we formulated the problem as a bilevel programming model. Next, we suppose that there are two producers operating in the network, who constitute a duopoly. The producers compete with each other with respect to the service level they offer in order to attract customers. We propose a bilevel model with two leaders in order to take into account both the competition between producers and the competition among customers.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The location of facilities, i.e., the determination of the best places for production facilities warehouse or intermediate distribution centers, is a key issue of the strategic management covering the core of the supply chain planning.

Facilities Location Problem and capacity allocation to them in order to be able to serve customer demand is one of the most traditional areas of optimization. The basic task of all variants of facility location problems is the following: a company wants to open up a number of facilities to serve their customers. Both the opening of a facility at a specific location and the service of a particular customer through a facility incurs some cost. The goal is to minimize the overall cost associated with a specific way of opening up facilities and serving customers [7, 8].

Therefore, when creating a new facility, factors including the selection of appropriate capacity and area of the facility deserves separate attention and should be taken carefully.

The location of facilities affects not only the distance that users will travel to them, but also, in connection with decisions about capacity, the time customers spend on-site prior to their service. The conditions under which customers make their choice of service facility are complicated, but it is generally reasonable to assume that every customer will choose the facilities that minimize their total transportation and waiting cost.

Mathematical models dealing with such situation (for example [12–14]) use direct choice to assign customers to facilities, that is the assignment is done by the system and each customer and his demand is directed to the closest facility. The congestion in facilities is controlled by incorporating constraints in order to ensure a desired level of waiting time or a specific number of customers. Such constraints tend to equalize the level of congestion at different facilities, whether it is measured by the number of users waiting or by waiting time. But empirical studies [9, 10] have shown that when customers are traveling, they select the facility that minimizes the travel time and waiting time. It is therefore likely that a user may choose not to travel to the nearest facility, but in another which although it is further away it is less congested.

In this work, we examine a supply chain network where the producer wants to determine the number of facilities and the total production capacity in order to ensure a certain level of satisfaction to his customers while taking into account the waiting time of customers in the system.

In the mathematical models presented initially a central coordinator, we assume that the producer, has the ability to direct customers to distribution centers that would be located. Particularly, we assume that we are dealing with a centralized supply chain management. Considering the supply network as a single market, the manufacturer can be regarded as a monopolist who dominates the market and tries, through the location and capacity choices to ensure a certain level of service to customers.

Next, the mathematical models are extended to include the case where customers are able by themselves to determine the distribution center from which to seek satisfaction of their demand. The customer’s choice is affected by the total personal costs incurred during the transaction process with the producer. Besides the price, the total cost includes the transportation cost required to be paid by the customer to ensure the product and the costs generated by the delay observed during the serving process. Therefore, the selection of distribution center is made competitively aiming at minimizing their personal cost. It is proven that the choices of the customers are different from the assignments of the central coordinator when they are competing each other for the received service levels. That is, the customers form an oligopsony. Consequently, this competitive behavior should be taken into consideration by the producer during his decision-making process. Assuming that customers observe the location decisions of the producer and that he is fully informed about the events at each distribution center, we formulate the facility location problem as bilevel programming model.

We examine two types of decision makers who have different objectives and they are in different levels of hierarchy. The first level, the producer (the leader), offers at the distribution centers the best at his opinion service level, including location, at minimum cost. The second level, the customers (the followers) make their choices competitively (a Nash type game) aiming at minimizing their personal expenses These two levels of hierarchy are involved in a Stackelberg game. First the leader, determining the service level that minimise his cost. The followers react, being fully informed about the leader’s decision. The leader knows it and takes it into account before he announces his strategy.

The results obtained by the numerical analysis of the proposed models demonstrate that the oligopsonistic behavior of the customers, regarding the service level, improves the quality of the provided service at the distribution centers by imposing adjustments to the market needs. It improves therefore market’s flexibility. This finding opens a new research area in the study of classical oligopsonistic market structure, which in recent decades has received a lot of criticism [15].

In the last part of this work, we assume that the distribution centers are owned by two producers. Specifically, we assume that the producers form a duopoly which compete for customers through the provided service levels involved in a Nash game.

Unlike the existing models in the literature dealing with competition of suppliers in the supply chain (e.g., [18]), we formulate the problem of the competition between suppliers for service level they offer as a bilevel problem with two competing leaders. Due to the competitive nature of duopoly, the bilevel formulation of the problems is more complicated compared to those with one leader. We also demonstrate that due to the behavior and choices of competing producers the bilevel game is significantly different from those of monopoly. The bilevel oligopoly game formulation of the competitive location and capacity allocation is to our knowelge proposed for the first time in the bibliography.

The rest of the paper is organized as follows: Section 2 gives a short overview of the bilevel programming problem. We present in Sect. 3 the models dealing with the centralized supply chain management. Particularly, the model of Sect. 3.1 is concerned with the case where the the producer makes the related decisions by ignoring the competitive behavior of customers, while in the location resulting from the model of Sect. 3.2 this behavior is taken into account directly. The comparison of these two different models is illustrated in Sect. 3.3. In Sect. 4 we examine the case where more than one producers are competing for the offered service level.

2 Bilevel Programming

Bilevel programming problems describe a hierarchical system involving two decision levels with different, often conflicting, objectives [1, 17]. In the first level, the leader controls the decision variable x. In the second level, the follower controls the decision variable y. The corresponding loss functions ϕL(x,y) and ϕF(x,y) describe the interaction between these two decisions variables. These two levels of hierarchy are usually involved in a Stackelberg game. The basic idea of this game can be described as follows:

The leader chooses the strategy x which minimizes his loss function ϕL(x,y) and the follower, fully informed about the leader’s decision, reacts by choosing the strategy which minimizes his own loss function ϕF(x,y). Thus, follower’s choices depend on the leader’s choices, i.e., y = y(x). The leader, on the other hand, is aware of the follower’ s choices and he takes this reaction into account before announcing his strategy. The bilevel problem could be written in the following general form:

where y(x) solves

where \(\mathbf{x} \in \mathcal{X} \subset {R}^{},\mathbf{y} \in \mathcal{Y}\subset {R}^{}\) and \(\mathcal{X},\mathcal{Y}\) are closed subsets and \({\varphi }_{\mathrm{L}} : \mathcal{X}\times \mathcal{Y}\rightarrow {R}^{p},\ {\varphi }_{\mathrm{F}} : \mathcal{X}\times \mathcal{Y}\rightarrow {R}^{q}\).

The upper level of the problem (1)–(2) is the leader’s problem, whereas the lower level (3)–(4) corresponds to the follower’s problem The set \(\mathcal{S} =\{ (\mathbf{x},\mathbf{y}) : \mathbf{x} \in \mathcal{X},\mathbf{y} \in \mathcal{Y},{\phi }_{\mathrm{L}}(\mathbf{x},\mathbf{y}) \leq 0,\ {\phi }_{\mathrm{F}}(\mathbf{x},\mathbf{y}) \leq 0\}\) is called constraint set. The set \(\mathcal{Y}(\mathbf{x}) =\{ \mathbf{y} \in \mathcal{Y} : {\phi }_{\mathrm{F}}(\mathbf{x},\mathbf{y}) \leq 0\}\) is the feasible set of the follower for every given \(\mathbf{x} \in \mathcal{X}\). The set of all orthological reactions of the follower is the \(\mathcal{R}(\mathbf{x}) =\{ \mathbf{y} \in \mathcal{Y} : \mathbf{y} {\in \arg \ \min }_{\mathbf{z}\in \mathcal{Y}(\mathbf{x})}{\phi }_{\mathrm{F}}(\mathbf{z},\mathbf{y})\}\), while the set \(\mathcal{F} =\{ \mathbf{x},\mathbf{y} : (\mathbf{x},\mathbf{y}) \in \mathcal{S},\mathbf{y} \in \mathcal{R}(\mathbf{x})\}\) is the set of the feasible solution of the [BP]. A feasible point \(({\mathbf{x}}^{\star },{\mathbf{y}}^{\star }) \in \mathcal{F}\) is a Stackelberg equilibrium if \({\phi }_{\mathrm{L}}({\mathbf{x}}^{\star },{\mathbf{y}}^{\star }) \leq {\phi }_{\mathrm{L}}(\mathbf{x},\mathbf{y})\ \forall \ (\mathbf{x},\mathbf{y}) \in \mathcal{F}\). This equilibrium point describes the optimal leader’s strategy.

Originally formulated as a mathematical model by Bracken and McGill [2, 3], the [BP] has been studied extensively in the last decades due to its numerous applications [1, 11, 16, 17].

A bilevel model can be linear, nonlinear, quadratic, etc., depending on the problem it formulates. Consequently, various methodological approaches and algorithms have been developed for its solution. Some recent application of the bilevel programming can be found at [11, 16].

3 Optimal Facilities Location and Capacity Assignment Under Customer Competition

In this section we assume that the producer addresses the supply chain as a single market and therefore he may be considered as a monopolist who dominates the market. Consequently, given the total demand of the chain, he can determine the optimal location of distribution centers and their total capacity by applying a combination of both the principles of the monopolistic market and the facilities location models (see, e.g., [15] and [8], respectively).

As soon as the distribution centers are located and capacity is assigned to them, the procurement of the customers is limited due to these decisions, since the sales of the products to the customers is actually a capacity assignment process to these distribution centers.

Therefore, the main problem of the supply chain management system under consideration is to find an appropriate decision-making mechanism based on which the location of the distribution centers will be, at individual level, advantageous for all members of the network.

3.1 Optimal System Location

We assume that the producer tries to provide to the n customers the best, at his opinion, service level at minimum cost. The evaluation of the offered service is based on the delay faced by the customers at each distribution center i.

If x ij is the amount that the customer j buys from the distribution center i, then the performance function d i (x i ) measures the level of service offered by the distribution center i, where \({x}_{i} = \sum\nolimits_{j=1}^{n}{x}_{ij}\).

Suppose that m is the set of potential sites for the location of the distribution centers. We assume that the establishment of a distribution center to the candidate site i implies a fixed location cost F i . Furthermore, suppose further r j is the demand of the customer \(j\ (j = 1,\ldots,n)\) for the product, p i is the unit price paid by customers at every distribution center and q i the capacity of the distribution center \(i\ (i = 1,\ldots,m)\).

The producer (the central coordinator) should choose the location of the distribution center such that the optimal benefit of the system is achieved. The aim is to find the location of the facilities and to assign the customers to them so as to minimize the total system cost. The mathematical model can be formulated as:

The objective function of problem (5) minimizes the total cost consisting of the cost of the delay, plus the transportation and purchasing costs plus the cost involved in setting up a distribution center. The constraints (6) ensure that the quantities purchased by the customer j at all distribution centers meet his overall demand. The constraints (7) impose that the total amount of the product available at each distribution center i does not exceed its capacity. In addition, it enables that the assignment of the customers’ demand only in sited distribution. The relations (8) are the defining constraints of the model, ensuring the maintenance of flow in the network.

Another important decision the producer should make is the determination of the capacity of the distribution center. If the capacity is set at a level higher than the demand faced by a distribution center, then the producer will bear the cost of the capital committed to the production of this excess capacity. On the other hand, a low level of capacity leads to an increasing service time and consequently to lost sales since customers will be forced to seek service from other distribution center.

In the model discussed above, the capacity of a potential distribution center is given in advance. However, the case where the capacity is not given but it must be decided during the configuration of the system can be examined. In such a case the performance function will depend not only on the total amount of the product x i that the distribution center i sells but also on the decision made by the producer concerning the level of the capacity q i i.e d(x i , q i ). Essentially, this means that the capacity assignment to a distribution center implies the location of this center, since zero capacity implies a non-located distribution center.

Hence, the producer should solve the following problem:

The relations (15) impose the total amount of money spent in capacity investment to m distribution center must not exceed the available budget B, while the constraints (16) ensure that the capacity of the distribution center will not exceed U unit.

It is possible to add to the objective function a cost function similar to that of (5) instead of the constraint (15), i.e., ∑ i = 1 m F i (q i ) where F i ( ⋅) are continuous function, to depict the economies of scale produced by the different capacity assignment levels.

3.2 Bilevel Problem Formulation Under Customer Competition

The producer must take into account the reactions of customers in every decision he takes and determine the final location of the distribution centers based on these reactions. In other words, the producer should understand that he cannot control the choices of the customers. Consequently he should use the Nash game, in which the customers are involved, as an oracle in order to be able to predict their reaction. That is, he should compute the total cost of the system based on the reactions of the customer to every decision he makes and select the most satisfactory.

The problem can be formulated as bilevel programming model:

where \([\bar{{x}}_{i}]\) and \([\bar{{x}}_{ij}]\) solve

According to this model, the leader (producer) decides the location of distribution centers solving the problem (18)–(19), but he does not control the variables x i and x ij since they describe the choices of his customers. The values of the variables \([\bar{{x}}_{i}]\) and \([\bar{{x}}_{ij}]\) are derived from the model (20)–(24) corresponding to an oracle. In other words, the leader uses (20)–(24) as an oracle to discover trends / reactions of the customers in each potential location and tries to minimize the total cost of the system based on these discoveries.

The bilevel capacity assignment problem can be formulated analogously:

where \([\bar{{x}}_{i}]\) and \([\bar{{x}}_{ij}]\) solve

According to this model, the producer determines the capacity of the distribution centers by solving the problem (25)–(27). The customers fully informed about the decisions of the producer, choose the distribution center which ensures them the optimal level of service by solving the problem (28)–(32). The leader knows that the selection of the customers is based on this criterion, and due to this reason he uses the problem (20)–(24) as a tool to predict the trends / reactions of customers in each potential location.

3.3 Numerical Comparison of the Models

The aim of this section is to clarify the differences in the decision-making process that are proposed by the models (5)–(10) and (18)–(24). Furthermore, the purpose of this section is to determine the negative results of the incorrect choice of location. For this reason we will employ a randomly generated numerical example.

We consider the case where the producer has 3 potential sites for the establishment of distribution centers that should satisfy the demand of 5 customers. These sites differ with each other not only in the available capacity but also in the fixed location cost.

The performance function is given by the equation:

and the total unit cost is calculated using the formula:

Table 1 presents all the necessary parameters.

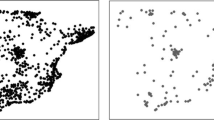

The Problems (SO-FL) and (BSO-FL) were modeled using the mathematical programming language AMPL and solved, after implementing a branch-and-bound scheme, by the MINOS 5.5 solver. Figure 1 depicts the flow of customers to distribution centers arising after the solution of the problem.

As it is shown in Fig. 1a, when the producer is interested in minimizing the “average” cost faced by the customers plus the location cost (i.e., when the (SO-FL) is solved), a single distribution center is located and all customers fullfil their demands there.

The basic question is then: Does this assignment satisfy all the customers? If we look at the unit cost of the solution in Table 2 we observe that the assignment, for example, of the C2 to the distribution of center F1 results to a unit cost of 30.60, which is not the minimum that could be faced by this particular customer, since the unit cost at the distribution center F 3 is lower (30 vs. 30.6).

Figure 1b shows the optimal location when the producer solves the problems (20)–(24) i.e., when the producer tries to identify the reaction/trends of the customers to his location options. The optimal location of this scenario indicates that a second distribution center must be opened and customer C2 will choose to satisfy the maximum amount of his demand from this distribution center.

It is obvious that in terms of location cost, the solution proposed by the second model is more expensive. So, naturally arises the question “why should the producer take into account the behavior of the customers instead of accepting the solution of the first model?”

By comparing the two figures we can conclude that the customer 2 has “escape” trends in the sense that if a new distribution center will be opened (either by the producer himself or even worse by a competitor selling the same product) then the the larger part of the customer’s demand will be lost. In the next section, we will examine in more detail the location decision under competition among producers.

4 Duopoly

In a supply chain network where there are more than one producers, none of them has the power (monopolistic power) to direct customers to distribution centers. Thus, as a result, the offered service level and the customer satisfaction are the basic differentiation and discrimination components among economic units of the same sector.

In this section we examine the impact of the producers’ competition for the customers attraction, first to the location decisions and second of setting capacity assignment to distribution centers. We examine a duopolistic supply chain network. We assume that producers compete by taking part in Nash game. They try to attack the customers’ demand by providing the optimal service level, that is the one which minimizes the costs arising from the customers reaction to their decision.

Definition 1.

A Nash equilibrium for this duopolistic game corresponds to a set of location and capacity choices (strategies), which ensure that none of the players are better of by unilaterally changing his strategy.

We assume further that the customers participate in a second Nash game in order to ensure the optimal service level for themselves.

We formulate the problem as a bilevel model, where the two producers determine the optimal location and capacity of the distribution centers, by taking into account the choices and the requirements set by the customers for the offered service level.

The competition among the members of the supply chain has been studied extensively in the literature [4–6, 18, 19]. The vast majority of this scientific work has be carried out in the framework of the classical economic theory of duopoly. The competition takes place either by fixing the price level or by determining production levels that maximize the profit of the producer. In addition, in all these models the decision-making process takes place in a single level.

The competition models that will be developed in the next section refer to the competition between two producers but can easily be extended in the case where more than two producers participate.

4.1 Competitive Facility Location when Customers Participate in Their Competitive Game

Let’s assume that the potential location of distribution centers \(i = 1,\ldots,m\) are dispersed between the two producers who in turn are involved in a competition for customer attraction through the provided service level. Let M 1 and M 2 \((m = \vert {M}_{1}\vert + \vert {M}_{2}\vert )\) be the nodes of the two producers, respectively. Then, under the assumption that both producers “announce their strategies simultaneously,” we obtain a Nash game with two players who are dealing (for K = 1, 2) with the following problems:

- The facility location problem of the producer 1::

-

$$\begin{array}{rcl} \mathbf{(CF{L}_{1})}\ \min & & \sum\limits_{i\in {M}_{1}}{F}_{i}{y}_{i} \\ & +& \sum\limits_{i\in {M}_{1}}{d}_{i}(\bar{{x}}_{i})\bar{{x}}_{i} + \sum\limits_{i\in {M}_{1}}{p}_{i}\bar{{x}}_{i} + \sum\limits_{i\in {M}_{1}} \sum\limits_{j=1}^{n}{t}_{ ij}\bar{{x}}_{ij} \end{array}$$(35)$$\begin{array}{rcl} \ \ \ \mbox{ s.t }& & {y}_{i} \in \{ 0,1\},\forall i \in {M}_{1} \end{array}$$(36)

- The facility location problem of the producer 2::

-

$$\begin{array}{rcl} \mathbf{(CF{L}_{2})}\ \min & & \sum\limits_{i\in {M}_{2}}{F}_{i}{y}_{i} \\ & +& \sum\limits_{i\in {M}_{2}}{d}_{i}(\bar{{x}}_{i})\bar{{x}}_{i} + \sum\limits_{i\in {M}_{2}}{p}_{i}\bar{{x}}_{i} + \sum\limits_{i\in {M}_{2}} \sum\limits_{j=1}^{n}{t}_{ ij}\bar{{x}}_{ij} \end{array}$$(37)$$\begin{array}{rcl} \mbox{ s.t}& & {y}_{i} \in \{ 0,1\},\forall i \in {M}_{2} \end{array}$$(38)

where \([\bar{{x}}_{i}]\) and \([\bar{{x}}_{ij}]\) solve (20)–(24)

Let Y = { y i | y i ∈ { 0, 1}, ∀i ∈ M k } be the feasible sets of the players for k = 1, 2, \({\mathbf{y}}_{k} = {[{y}_{i}]}_{i\in {M}_{k}}\) and \(\mathbf{y} = \left[\begin{array}{cc} {\mathbf{y}}_{1} \\ {\mathbf{y}}_{2} \end{array} \right].\) We have already mentioned the existence of optimal solutions \(\bar{{x}}_{i}\) and \(\bar{{x}}_{ij}\) for given capacity \([\bar{{q}}_{i}]\). Thus, there is a function from ℝm to ℝm, such that for a given \(\bar{\mathbf{y}}\) it returns the unique equilibrium point \([\bar{{x}}_{i}]\) from (20)–(24) and a corresponding mapping from ℝm to ℝm ⋅n such that for a given \(\bar{\mathbf{y}}\) it returns an optimal transportation plan \([\bar{{x}}_{ij}]\), which correspond to the equilibrium point \([\bar{{x}}_{i}]\), thus it holds that \(\bar{{x}}_{i} = {x}_{i}(\bar{\mathbf{y}})\) and \(\bar{{x}}_{ij} = {x}_{ij}(\bar{\mathbf{y}})\), respectively.

Hence problems (CFL k ) could be formulated as a single-level problems:

Each problem, (SCFL k ) corresponds to player k who is involved into the Nash game.

Similarly, we can formulate the competitive capacity assignment of these two producers.

- The problem of the first producer::

-

$$\begin{array}{rcl}{ \mathbf{({P}_{1})}\ }\mathop{\min}\limits_{[{q}_{i}]}& & \sum\limits_{i\in {M}_{1}}{d}_{i}(\bar{{x}}_{i},{q}_{i})\bar{{x}}_{i} \sum\limits_{i\in {M}_{1}}{p}_{i}\bar{{x}}_{i} + \sum\limits_{i\in {M}_{1}} \sum\limits_{j=1}^{n}{t}_{ ij}\bar{{x}}_{ij} \end{array}$$(41)$$\begin{array}{rcl} \mbox{ s.t}& & \sum\limits_{i\in {M}_{1}}{\alpha }_{i}{q}_{i} \leq B, \end{array}$$(42)$$\begin{array}{rcl} & & 0 \leq {q}_{i} \leq {U}_{i},\ \forall i \in {M}_{1} \end{array}$$(43)

- The problem of the second producer::

-

$$\begin{array}{rcl} \mathrm{{({P}_{2})}\ }\mathop{\min}\limits_{[{q}_{i}]}& & \sum\limits_{i\in {M}_{2}}{d}_{i}(\bar{{x}}_{i},{q}_{i})\bar{{x}}_{i} \sum\limits_{i\in {M}_{2}}{p}_{i}\bar{{x}}_{i} + \sum\limits_{i\in {M}_{2}} \sum\limits_{j=1}^{n}{t}_{ ij}\bar{{x}}_{ij} \end{array}$$(44)$$\begin{array}{rcl} \ \ \ \mbox{ s.t}& & \sum\limits_{i\in {M}_{2}}{\alpha }_{i}{q}_{i} \leq B, \end{array}$$(45)$$\begin{array}{rcl} & & 0 \leq {q}_{i} \leq {U}_{i},\ \forall i \in {M}_{2} \end{array}$$(46)

where \([\bar{{x}}_{i}]\) and \([\bar{{x}}_{ij}]\) solve (28)–(32)

Let \({Q}_{k} =\{ {q}_{i} \in \mathbb{R}\vert \sum\limits_{i\in {M}_{k}}{a}_{i}{q}_{i} \leq B,\ 0 \leq {q}_{i} \leq {U}_{i},\ \forall i \in {M}_{k}\}\) for = 1, 2, the feasible sets of the player, \({\mathbf{q}}_{k} = {[{q}_{i}]}_{i\in {M}_{k}}\) and \(\mathbf{q} = \left[\begin{array}{cc} {\mathbf{q}}_{1} \\ {\mathbf{q}}_{2} \end{array} \right].\) We have already mentioned the existence of optimal solution \(\bar{{x}}_{i}\) and \(\bar{{x}}_{ij}\) for given capacity \([\bar{{q}}_{i}]\). Thus, there is a function from ℝm to ℝm, such that for given \(\bar{\mathbf{q}}\) it returns the unique equilibrium point \([\bar{{x}}_{i}]\) from (28)–(32). There is also a respective mapping for ℝm to ℝm ⋅n such that for a given \(\bar{\mathbf{q}}\) it returns an optimal transportation plan \([\bar{{x}}_{ij}]\) which corresponds to \([\bar{{x}}_{i}]\). We can then write that \(\bar{{x}}_{i} = {x}_{i}(\bar{\mathbf{q}})\) and \(\bar{{x}}_{ij} = {x}_{ij}(\bar{\mathbf{q}})\). Therefore the problem (P k ) could be stated as single-level problems. For k = 1, 2 we will have:

where the problem (SLP k ) is faced by the player k of the Nash game.

4.2 The Impact of the Duopoly in the Service Level

In this part we extend the analysis of Sect. 3.3 in order to make inferences on the impact of the competition of producers with respect to the service level offered. We assume that both producers have the opportunity to locate distribution centers in the same area, where they face exactly the same fixed location cost.

The corresponding problems were specified using the parameters listed in Table 1 and were modeled using the mathematical programming language AMPL and solved by the MINOS 5.5 solver.

In order to be able to find the Nash equilibrium points of the game, it is useful to transfer it into its normal bimatrix form.

It should be mentioned that a bimatrix game in strategic or normal form formulates a non-repeatable situation where rational players choose their strategies independently and simultaneously, having full information about the game details. Specifically, each player knows (a) the number of the players, (b) the pure strategies available to each player, and (c) all the possible outcomes of the game. This knowledge is common i.e., each player knows that all other players are rational and all players know that all players know this and so on. Since players decide simultaneously, none of them knows the choice of others when deciding. In other words, when a player chooses his strategy he does not know in advance and with certainty the choices of his competitors but he can assume that his opponents, being rational, are reasong along the same lines.

In our case the available strategies for the players are the choices for the location or not of a distribution center in the candidate region \(i,\ \ i = 1,2,\ldots,8\). Assuming that the regions are listed in numerical order, Table 3 presents all the strategies for each player where 1 means that the player k opens the corresponding distribution center while 0 that the corresponding center do not open and so player does not pay the fixed costs.

Tables 4 and 5 contain the solution results of the CFL k (for k = 1, 2) for all pairs of strategies, that is, they are the loss matrices of players 1 and 2, respectively. Thus, they present the cost paid by each producer for every possible outcome of the game. Tables 4 and 5 suggest that there are 4 Nash equilibria:

-

1.

The pair of strategies (S 11, S 22) according to which only player 2 opens a distribution center in region 1.

-

2.

The pair of strategies (S 12, S 21) according to which only player 1 opens a distribution center in region 1.

-

3.

The pair of strategies (S 13, S 24) which suggests that producer 1 opens a distribution center in region 2 and producer 2 in the region 3.

-

4.

The pair of strategies (S 14, S 23) which suggests that producer 1 opens a distribution center in region 3 and producer 2 in the region 2.

The Nash equilibria appear symmetrical, which is a natural result of players’ symmetry not only in strategies but also in costs functions.

Figure 2 shows all possible outcomes of the game in a Cartesian space. These points are represented by the EV and EP. Points EP correspond to the four Nash equilibrium points. It is evident from the Fig. 2 that no equilibrium point is dominated by another. The indeterminacy phenomenon, often inherent to Nash games, does not allow us to conclude directly about the actual outcome of the game. In fact an disequilibrium is possible, if, for example, the first player persists in the strategy S 12, while the second player persist in the equilibrium S 24. The pair of strategies (S 12, S 24) does not correspond to an equilibrium.

Nevertheless, we can assume that in a real situation, players will focus on some of the equilibrium point and they will ignore others. The equilibrium points in which the players will focus their attention are referred to as focal equilibrium points.

In our case it is easy to report that points (S 11, S 22) and (S 12, S 21), where only one player should install a single distribution center may not be focal equilibrium point. One reason is the mere fact that a player examines where and how distribution centers will open makes the decision of his opponent to open somewhere some center to be almost taken. In other words, by putting himself in his opponent’s position he will reject the possibility to allow the opening of the distribution center only by his competitor. Indeed, by making a complete analysis of the game he will realize that having a single distribution center does not satisfy all customers. Additionally, he understands that there will be tendency to escape by some of them, as we have already seen in Sect. 3.3 and is demonstrated in Fig. 1 and consequently his competitor will take advantage of this escape. Therefore the focal equilibrium point of the game are points (S 13, S 24) and (S 14, S 23).

According to this analysis, the first two pairs of strategies although they are equilibrium points they will never be followed by the player. Players participate in the game, having already decided to enter in the network. Thus the choice of either strategy S 11 of the producer 1 or the S 21 of the producer 2 is not compatible with such a decision. Consequently, under real circumstances, only the equilibrium points (S 13, S 24) and (S 14, S 23) are possible outcomes of the game.

Observe that producers, taking into account the competition of customers with respect to the service, will choose to operate their distribution centers in different locations trying to attract non satisfied customers of their competitor. It should be noted that, the equilibrium points guarantee the fulfillment of customer demand at the minimum cost while satisfying their preferences about the service level they receive. Table 6 confirms this finding.

The comparison of Tables 2, 4 and 5 certifies that the competitive location of the distribution centers is, in terms of total cost, more beneficial for each producer. No matter which of these two equilibria will be chosen the cost that each producer is going to deal with is smaller in comparison with the total cost of the system optimum and the cost of the monopolistic solution which takes into consideration the competition of the customers.

However, the indeterminacy among the focal equilibrium points cannot easily be eliminated. These two focal equilibrium are symmetric in terms of total cost (36,806, 52071.46) and (52071.46, 36,806), respectively. As illustrated in Fig. 3 both structures of the network distribute symmetrically the customers’ demand. Table 6 demonstrates that this distribution is a robust equilibrium for the customers’ game, since none of them wants to deviate from it. Therefore, the existence of those loyal customer for any of the focal outcome should satisfy the competing producers.

It should be mentioned that we do not consider equilibrium in mixed strategies although we could examine their existence using the free and open source software Gambit [20]. The reason we ignore mixed strategies is that they may propose expected cost for the competing producers which generally do not correspond to an equilibrium of the customers. For the same reason we can ignore the Nash arbitration solution. A simple analysis which takes into consideration points MP1 and MP2 in Fig. 2 can convince us. First, the point MP1 is pareto dominated by MP2, therefore it cannot be a Nash arbitration point. On the other hand, point MP2 which represents the pair of total cost (33,315, 34,315) does not correspond to costs (35) and (37) which are calculated for an equilibrium of customers. Such a decision of the competitors would lead to a situation where customers would tend to escape. The nearest point to (34,315, 34,315), which has been estimated based on an equilibrium of customers, is the point (33,828, 34428.75) corresponding the pair (S 12, S 22) open a center, the first one. However, in a competitive environment, the competitors should not have opportunities for such agreements.

5 Conclusion

The aim of this work was to formulate problems of facility location and capacity assignment resulting from the competitive behavior of economic unit operating in a supply chain network. Within this context we examined two different types of models. In the beginning we considered the case where the producer controls the overall supply network and tries to choose the facility location and capacity allocation plan that minimizes the total system cost. Next, we expand the formulation in order to take into account the purchasing behavior of customers. In this case the problem is formulated as bilevel programming problem.

In addition we proposed a bilevel problem with two leaders. This model describes the competition between the two producers in order to attract customers through the quality of the service they provide. The results of the analysis of a random example indicate that the competitive location decisions proposed by the model are the most effective since it minimizes the cost of the system as perceived by producers while they handle of customer behavior.

In conclusion, we could say that the competition of the producers in terms of the service level they provide competition increases the benefit of the purchasers since it ensures:

-

1.

High service level

-

2.

Low cost with declining trends.

-

3.

Improvement of the producer flexibility and their adaptation to the market needs.

References

Bard, F.J.: Practical Bilevel Optimization, Algorithms and Applications. Kluwer, Dordrecht (1998)

Bracken, J., McGill, J.M.: Mathematical programs with optimization problems in the constraints. Oper. Res. 21, 37–44 (1973)

Bracken, J., McGill, J.M.: A method for solving mathematical problems with nonlinear programs in the constrains. Oper. Res. 22, 1097–1101 (1973)

Cachon, G.P.: Supply chain with contracts. In: Graves, S., de Kok, T. (eds.) Handbooks in Operations Research and Management Science: Supply Chain Management, pp. 229–340. North-Holland, Amsterdam (2003)

Cachon, G.P., Lariviere, M.: Capacity choice and allocation: strategic behavior and supply chain performance. Manag. Sci. 45, 1091–1108 (1999)

Chinchuluun, A., Karakitsiou, A., Mavrommati, A.: Game theory models and their application in inventory management and supply chain. In: Migdalas, A., Pardalos, P.M., Pitsoulis, L. (eds.) Pareto Optimality, Game Theory and Equilibria, Springer, NY, pp. 833–865 (2008)

Daskin, M.S.: Network and Discrete Location: Models Algorithms and Applications. Wiley, New York (1995)

Drezner, Z., Hamacher H.W.: Facility Location: Applications and Theory. Springer, Berlin (2003)

Grossman, T.A., Jr., Brandeau M.L.: Optimal pricing for service facilities with self-optimizing customers. Eur. J. Oper. Res. 141, 39–57 (2002)

Heinhold, M.: An operational research approach to allocation of clients to a certain class of service institutions. J. Oper. Res. Soc. 29, 273–276 (1978)

Karakitsiou, A., Prokopye, O.A.: Special issue in multilevel optimization: algorithms and applications. J. Global Optim. 38(4), 507–666 (2007)

Marianov, V., Rios, M.: A probabilistic quality of service constraint for a location model of switches in ATM communications networks. Ann. Oper. Res. 96, 237–243 (2000)

Marianov, V., Serra D.: Probabilistic maximal covering location-allocation for congested systems. J. Regional Sci. 38, 401–424 (1998)

Marianov, V., Serra, D.: Hierarchical location-allocation models for congested systems. Eur. J. Oper. Res. 135, 196–209 (2001)

Mas-Colell, A., Whinston, M.D., Green, J.R.: Microeconomic Theory. Oxford University Press, New York (1995)

Migdalas A., Pardalos, P.M.: Special issue in global optimization and hierarchical decision making. J. Global Optim. 8(3), pp. 209–215 (1996)

Migdalas, A., Pardalos, P.M., Värbrand, P.: Multilevel Optimization - Algorithms and Applications. Kluwer Academic (1997)

Nagurney, A., Dong J., Zhang, D.: A supply chain network equilibrium model. Transport. Res. E 38, 281–303 (2002)

Van Mieghem, J., Dada, M.: Price versus production postponement: capacity and competition. Manag. Sci. 45, 1631–1649 (1999)

http://econweb.tamu.edu/gambit, LAST VISITED 25/6/2010

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Science+Business Media New York

About this paper

Cite this paper

Karakitsiou, A. (2013). Competitive Multilevel Capacity Allocation. In: Migdalas, A., Sifaleras, A., Georgiadis, C., Papathanasiou, J., Stiakakis, E. (eds) Optimization Theory, Decision Making, and Operations Research Applications. Springer Proceedings in Mathematics & Statistics, vol 31. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-5134-1_5

Download citation

DOI: https://doi.org/10.1007/978-1-4614-5134-1_5

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-5133-4

Online ISBN: 978-1-4614-5134-1

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)