Abstract

Smart grids present major potential benefits in terms of economic, environmental, and social considerations. The deployment of smart grids however requires not only technological advancement but also the ability to overcome many regulatory barriers. This chapter brings regulator perspectives—an area that is under-explored—into the field of smart grid studies. We examine why regulators should be concerned about smart grid developments, the nature of the regulatory challenges they may face, and what they can do to address these challenges. We have two major findings. Firstly, we demonstrate that smart grids present new challenges to regulators. Regulators are faced with three major challenges: utility disincentives, pricing inefficiencies, and cybersecurity and privacy. Market liberalisation, decoupling, dynamic pricing, and protocols and standards on cybersecurity are the major mechanisms that regulators can deploy to address these issues. Secondly, our international case studies of countries and cities provide an overview of a variety of actual regulatory initiatives in place. This overview shows how economies have pioneered a variety of regulatory approaches that tend to be more participatory to better respond to the more dynamic stakeholder landscape that is emerging.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Smart grids are a key to both demand-side (e.g. energy saving and energy efficiency) and supply-side (e.g. renewable energy) management of energy systems. Many countries have elevated smart grid deployment to the status of major national economic and energy strategies. The Obama administration has positioned smart grid as a key component of the new energy model for America and announced a national policy framework for smart grids in 2011 [4, 31]. South Korea regards smart grid as a new growth engine for the country [69]. In China, smart grids represent a major component of the current national energy plan [75].

The potential benefits of smart grids could be substantial. For example, it has been estimated that an investment of US$338 billion to US$476 billion for a fully functional smart grid could result in benefits up to US$2 trillion in the USA [28]. Another study has estimated that €67 billion for building and running peak infrastructure could be avoided in the EU if dynamic pricing can be adopted [33]. The nation-wide smart grid demonstration project, Smart Grid, Smart City, in Australia is estimated to generate AU$3.4 billion of direct financial savings, and a total of AU$5 billion with reliability and environmental savings included [21].

However, to fully utilise the potential benefits that smart grids may offer, many technological, operational, economical, institutional, and policy challenges have to be overcome [108]. Among them, regulatory challenges are particularly significant because the design and operation of smart grids are fundamentally different from traditional power grids. Traditional systems are predominantly centralised, fossil fuel based with the presence of monopoly market conditions. Important features of smart grids—including the existence of a more decentralised power system, the emergence of new market actors (such as independent power producers), more dynamic two-way utility–consumer relationships and the use of massive amounts of energy usage data [20, 82, 97]—present to regulators new challenges that may include utility disincentives, monopoly power, information asymmetry, consumer inertia, and breach of personal privacy.

To cope with these challenges, new regulatory initiatives in relation to smart grid technologies are increasingly being developed and implemented in many economies. Mandatory hourly pricing for large customers in New York [87], electricity price control regulation and efficiency grants in the UK [5, 56], mandatory smart meter roll-out and time-of-use pricing in Italy [66], and the smart metering privacy rules in the Netherlands and California [8, 9, 18] are some examples.

This chapter aims to identify and examine the key issues that may confront regulators in relation to smart grid deployment, and how these challenges can be addressed. We attempt to answer these specific questions: Why do regulators have to be concerned about smart grid deployment? What are the gaps between existing regulatory practices and the new regulatory requirements for smart grid deployment? How and to what extent can regulators address these gaps? What approaches can regulators deploy? Are there any examples of good practice that we can discern from international experience?

Our analysis is based on a review of published work from academic sources, government documents, and reports. This chapter is organised into five sections. Following the introduction, we examine why regulators should be concerned about smart grid deployment. We then identify and discuss three major regulatory issues that confront regulators and the approaches that can be deployed to address these issues. This is followed by an overview of international cases of countries and cities that have pioneered a broad range of regulatory measures to overcome these challenges. Three specific cases are highlighted to illustrate the features, outcomes, and keys to success of these initiatives. We conclude by highlighting the policy implications.

2 Why Should Regulators Be Concerned About Smart Grid Deployment?

Electricity markets need regulators to oversee the effective functioning of the electricity sector through rule-setting, monitoring, and enforcement [10, 11, 22, 106]. Specifically, regulators have important roles to play in two main areas: market structure and conduct. In terms of market structure, regulators can determine ownership, access to the market (who can enter and who should be restricted from entering), and contractual relationships, market planning as well as the mechanisms of allocation [1]. In terms of conduct, regulators are concerned about the production of electricity. Regulation may influence the fuel mix, production technologies, the environmental impacts of electricity generation, the security of supply, and tariffs [1]. Examples of electricity market regulators include the Office of Gas and Electricity Markets (Ofgem) in the UK, the Federal Energy Regulatory Commission (FERC) in the USA, and the State Electricity Regulatory Commission (SERC) in China [84].

In recent decades, two trends have reshaped the roles of regulators in the electricity sector. The first is the global trend towards electricity market liberalisation. Driven by the aspiration for efficiency, many developed and developing economies have since the mid-1980s introduced electricity market liberation in various forms. These measures include privatisation, the establishment of sector regulators, the introduction of competition into generation, and the unbundling of generation, transmission, distribution, and retail activities [56]. Regulatory functions since then have progressively evolved beyond economic efficiency considerations to encompass the development of market codes and standards, monitoring market behaviour related to the abuse of market power and information asymmetries, and the facilitation of dispute resolution [11, 27, 56].

Another trend is related to the context of rising public awareness on climate change impacts. This trend is noticeable particularly since the early 2000s. Regulations seem to be increasingly required to correct market failures in the energy sector, most notably externalities of emissions [2, 100]. Regulators are therefore expected to place more emphasis on the environmental performance of the regulated utilities as well as their economic performance.

It is in these evolving contexts that smart grid deployment presents new challenges by introducing two major additional changes in electricity systems: changes in hardware and software of power grids, and changes in the stakeholder landscape. In terms of hardware changes, centralised grid systems need to be upgraded to accommodate the integration of more decentralised electricity generation systems with intermittent renewables. Devices such as smart meters, which are capital intensive with high investment uncertainty, are necessary to support the data exchange between suppliers and end users [51]. In the USA, for example, about US$338 to US$476 billion of investment is required for full smart grid implementation over the next 20 years [28]. Smart grid investment in Europe, China, and South Korea is expected to reach €56.5 billion, €71billion, and €16.8 billion, respectively, in the next decades [58]. Regulators therefore have an important role to play in providing adequate incentives for smart grid investment and ensuring the benefits of smart grid are adequately accounted for in economic terms [30, 98].

Apart from hardware, smart grids require new software—which include dynamic pricing systems to incentivise consumers’ participation, more open markets to allow new market players and competition, and a new, efficient and reliable data management system that can manage the massive sets of energy usage data [50, 70, 97]. All these changes require regulators to set up new market rules and protocols to ensure resilience, fairness, security, and effectiveness of modernised grids [23].

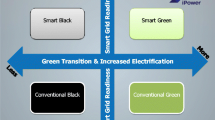

Another major change that can be brought about by smart grid deployment is a change in the stakeholder landscape. Unlike the conventional top-down linear systems in which established utilities possess dominating roles and consumers are passive, smart grids provide opportunities to electricity consumers, new market players (such as independent power producers) as well as established utilities to take up new roles in energy management systems.

Smart grids allow electricity consumers to take a proactive role in managing their electricity use. Consumers can be better informed and price responsive, and can contribute to energy saving, energy efficiency, and peak load shifts through responding to real-time electricity information linked with dynamic pricing systems [68]. Consumers can also assume the role of “prosumers”: consumers can produce electricity and sell it to utilities through decentralised generation technologies such as roof-top solar panels [44, 86]. Furthermore, consumers can become proactive in choosing their electricity suppliers or which kind of electricity products (such as green electricity) they wish to consume because suppliers and utilities are under pressure to develop a larger variety of products and services. For example, the electricity market reforms in Texas since 2002 allow residential consumers to choose from about 200 retail offers provided by about 40 suppliers, and as a result about 40 % of the consumers have switched away from their original providers [62].

Apart from consumers, new players can enter the market not only in traditional fields such as power generation (e.g. as independent power producers), but also in new energy service and product areas such as energy audit and green power marketing [70]. Existing power utilities may also take up new roles in smart grids. Because of the perceived increase in market competition, these established utilities are under greater pressure to diversify their business by expanding services in such areas as renewable energy and energy efficiency.

Smart grid deployment therefore gives rise to new two-way utility–consumer relationships, the co-existence of existing players and new market entrants, and a redistribution of benefits and costs among these diverse stakeholders in more decentralised energy systems. Such changes need to be accompanied by regulatory oversight in areas that range from consumer protection to grid access and to market transparency. Because of the dynamic and complex nature of the new stakeholder landscape, smart grids also require a more participatory approach to energy decision-making in which new market players and consumers can assume a more proactive role.

These changes give rise to a number of important questions: What are the gaps between existing regulatory practices and the new regulatory requirements for smart grid deployment? What should regulators be concerned about? What can be done by regulators to address these issues? In the next section, we will discuss three major issues confronting regulators and the possible regulatory approaches that can be deployed to overcome these challenges. These issues are utility disincentives, pricing inefficiencies, and cybersecurity and privacy.

3 Major Regulatory Issues on Smart Grids: Utility Disincentives, Pricing Inefficiencies, and Cybersecurity and Privacy

3.1 Regulatory Issue 1: Utility Disincentives

Many current regulatory regimes do not adequately address the issues of lock-in situations, inertia, cost increases, and new risks that deter utilities from investing in smart grid technologies [3, 53, 72]. Many require a link between a utility’s revenue and the sales of electricity or capital investments, and have tended to reinforce the lock-in effects of established energy technologies. Sunk investments tend to make rapid diffusion of smart grids difficult to achieve [3, 46]. These mechanisms have therefore created an incentive structure that encourages utilities to supply fossil fuel-based power, but discourage them from investing in distributed generation such as renewable energy and demand-side management projects [46].

Regulators can introduce changes in regulatory regimes to address these disincentives. Such regime changes can be made either through introducing radical electricity market reforms that overhaul the electricity sector or through more moderate approaches such as introducing some programme-based changes, for example decoupling mechanisms.

The important role that electricity market reforms or liberalisation can play to facilitate technology innovations including smart grids and renewable energy has been extensively documented (see, for example [48, 51, 62, 70]). Traditionally, generation, transmission, and distribution of electricity have been carried out by vertically integrated monopolies [12]. Market reforms can foster energy innovation through introducing structural changes that are associated with accessibility, market rules, and incentive systems [62]. Liberalised markets tend to improve market accessibility through lowering the barriers for new entrants [62]. Accessibility is conducive to market competition to a large extent because competition can drive innovation, and the consumer’s right to choose between suppliers can pressure utility companies to develop new products and services. Accessibility can therefore reduce lock-in effects. Liberalised markets also tend to provide fair market rules and thus a level playing field for both existing and new market players [62]. This is another way to induce competition-driven innovation [62]. In addition, new incentive mechanisms, most notably decoupling, can be established to ensure the extra costs incurred from smart grid deployment can be covered. This can stimulate risk-adverse utilities to invest in asset innovation for smart grids rather than expanding existing assets [62, 72, 73].

It is important to note that electricity market reforms have been introduced in different forms that vary in scope and depth across countries [27]. Some countries such as the UK and some states in the USA have introduced competition into all the generation, transmission, distribution, and retail sectors of the power industry that was once vertically integrated and nationalised (HK EAC, 2003). On the other hand, countries such as China, Japan, and South Korea have introduced partial liberalisation in which competition has been introduced but this has mainly limited to the generation sector, and some state monopolies and distorted pricing systems have remained [69, 71, 107].

As noted earlier, moderate regime changes rather than a complete overhaul of electricity market structures can be considered as a pragmatic approach to facilitating smart grid deployment, and it is particularly so in economies where electricity market reforms are partially implemented. Decoupling mechanisms are one of the most widely discussed approaches that regulators can deploy as a first step in major regime changes.

Decoupling is a regulatory approach that breaks or decouples the linkages between electricity sales from revenues [46]. A regulator can introduce two major forms of decoupling: cost-based and incentive-based. Cost-based decoupling mechanisms such as direct-cost recovery and fixed-cost recovery are regulator-approved mechanisms for recovering costs that usually include administrative costs and transmission costs. These mechanisms can take the form of rate cases, tariff surcharges, revenue caps, and price caps.

Incentive-based mechanisms such as performance incentive programmes, on the other hand, provide financial rewards for utility companies according to their achievements in energy efficiency programmes. For example, utility companies may receive a percentage of the achieved savings, an adjusted rate of return for achieving savings targets, or a penalty for failing to meet energy saving goals [54]. Table 1 highlights the features of the major types of decoupling mechanisms. Table 2 provides some details of an example of performance incentive programme in California.

In consideration of the potential benefits that decoupling mechanisms can offer, it is important to note that these mechanisms have not been widely implemented worldwide. About 70 % of IEA member countries have not implemented any decoupling regulations for energy utilities [52]. Some pioneer measures were implemented by some countries such as the USA, the UK, and Germany. As of July 2012, 46 out of 52 states in the USA have introduced direct-cost recovery systems, 27 states with fixed-cost recovery, and 23 states offering performance incentives, in which all measures were found to be contributing to decoupling [54].

3.2 Regulatory Issue 2: Pricing Inefficiencies

Electricity consumers and demand-side energy management are core elements of smart grid deployment. A major challenge for regulators is therefore to create a favourable environment that can incentivise consumer participation. Another major regulatory issues associated with smart grid deployment is electricity pricing. This has direct impacts on electricity consumption patterns of individuals, including the total amount of consumption, when they consume, and what they consume [102].

In general, two aspects of inefficient pricing have created barriers to energy innovations including smart grids, and these need to be more effectively regulated. The first is that external costs of emissions are often not fully reflected in electricity prices. A European study has estimated that if the environmental costs of fossil fuels are accounted for, the external cost of fossil fuel-based electricity generation could be nearly 27 times higher than that of renewables, with 5.8 c€/kWh for brown coal, 1.5 c€/kWh for natural gas, 0.09–0.12 c€/kWh for wind, and 0.21–0.41 c€/kWh for solar PV [25].

Secondly, inefficiency in tariff systems may undervalue the benefits of demand management practices and renewable energy in many ways. For instance, flat rates generally assume consumers are highly price inelastic and provide no incentives to peak-shaving consumption behaviour [36, 102]. Regressive rate systems tend to discourage customers from saving energy because the more energy they consume, the lower the energy rate per unit is [32]. Another example is that except in places where net-metering is in place [26], households have no economic incentives to produce renewable electricity and sell it to their suppliers even though such a community-based option is technologically available.

Regulators can deploy a range of measures to overcome these pricing issues. These include pricing emissions (e.g. congestion charges and carbon taxes), reducing subsidies for fossil fuels, and net-metering with feed-in tariffs [64, 100]. In particular, regulators can introduce changes in tariff systems, most notably through dynamic pricing, as an effective means to incentivise consumer engagement in the areas of peak shaving, energy saving, and energy efficiency.

In contrast to flat rate systems, dynamic pricing is the charging of different electricity rates at different times of the day and year to reflect the time-dependent cost of supplying electricity [35]. Dynamic pricing differentiates energy prices between peak and non-peak hours and therefore provides financial incentives for customers to shift their consumption pattern and to conserve energy [10, 69]. Dynamic pricing can also facilitate a better match between marginal costs and marginal demand and hence improve the efficiency of electricity systems [102].

There are a wide range of dynamic pricing modes and they include, ranging from the least to most varying, block rates, seasonal rates, time-of-use rates, super peak time-of-use rates, critical-peak pricing, variable peak pricing, and real-time pricing [34]. The most widely discussed and adopted schemes are time-of-use rate (TOU), real-time pricing (RTP), and critical-peak pricing (CPP) [49, 89].

Time-of-use rate can be established at least a day before and at even longer time interval, charging higher rates for peak-hour use. In contrast, with real-time pricing, consumers are provided with simultaneous pricing which is established based on the demand and supply balance at that moment, similar in some respects to those pricing systems in stock markets. A more sophisticated variation of real-time pricing is two-part real-time pricing, in which real-time pricing only applies to usage that deviates from a baseline level and therefore provides consumer protection against price volatility. Critical-peak pricing is a combination of time-of-use rates and real-time pricing in which a base rate is applied unless certain load circumstance occurs to trigger peak load pricing. Peak time rebate (PTR) is a variation of critical-peak pricing that compensates peak-shaving consumers rather than penalising peak-riding consumers [34].

In practice, dynamic pricing systems have recorded mixed results. While some dynamic pricing pilots produced minimal responses [69], some have positive outcomes. A study based on 18 dynamic pricing pilot programmes has found that time-of-use and critical-peak pricing could lead to 5 and 20–30 % peak load reductions, respectively [37]. A number of studies also show that the potential energy savings from consumer feedback triggered by dynamic pricing or other demand response measures ranges from 5 to 15 % [19, 38, 83]. Another study has found that the dynamic pricing pilot programme in Ontario led to 11–25 % peak reduction, 6 % consumption reduction, and CAN$4.17 savings in monthly electricity bills on average [47].

However, introducing dynamic pricing for smart grid deployment is often politically sensitive as consumers are themselves highly sensitive to tariff changes [68, 69]. In the USA, for example, although dynamic pricing has been contemplated for decades, there are only a few established systems. In many cases, regulators have opted for voluntary programmes initiated by specific target groups who are more receptive to such changes. One example of such a voluntary programme on dynamic pricing is in Tennessee. In 2011, the Tennessee Valley Authority approved a tariff structure to include options of time-of-use rate for customers to encourage energy efficiency and peak demand reductions [26]. Other states such as California have been making progress on enforcing dynamic pricing. The California Public Utilities Commission (CPUC) requires Pacific Gas and Electric Company (PG&E) to replace flat rate with mandatory peak day pricing for large consumers by May 2010 and mandatory time-of-use tariff for small and medium business and agricultural consumers by March 2012 [13, 17]. CPUC also approved optional TOU and CPP for residential consumers and mandatory TOU and default CPP for small commercial consumers by 2013 and 2014 for San Diego Gas & Electric [16].

3.3 Regulatory Issue 3: Cybersecurity and Privacy

A defining feature of smart grids is the extensive use of information and communication technology in modernising power systems. In smart grid systems, massive sets of energy consumption data are generated, collected, aggregated, and utilised for various purposes including billing, measuring power quality, updating instant electricity prices as well as providing real-time feedback on household energy consumption to incentivise energy efficient behaviour [40, 83]. These data are provided by smart meters and control devices [83].

The transformation to automatic connection and control systems exposes the grid to three types of risks: grid operation failures, data breaches, and cybercrimes. Disruption of grid services can be caused by intrusions to the two-way communication system of smart grids, which may lead to temporary power outages or blackouts. Consumer privacy is another risk because massive sets of personal information and energy usage data are exchanged through smart meters and networks. These data may expose personal details of consumer’s activities and occupancy patterns [97]. Unauthorized disclosure of this information resulting from for example cyberattacks may give rise to home security issues [19, 83, 97]. In addition, automatic metering provides a new gateway for cybercrimes. Hackers could intrude into smart meter systems and alter metering data to reduce energy use resulting in electricity theft [99]. There are also concerns about loss of control over national grids under terrorist attack [29, 39, 83]. All these issues can impose profound impacts on national security, public safety, privacy protection, and cybersecurity.

It is important to note that cybersecurity and privacy is particularly a challenging issue to regulators because data management systems involve various parties including electricity producers, distributors, smart technology developers, and energy efficiency service providers and consumers. It is difficult for regulators to ensure sufficient investment in security be incentivised where many actors have a collective stake but diffused and unclearly defined responsibility in grid reliability [83, 99].

Most of the existing safety standards have a narrow focus on the physical component of the grids [15]. Regulators are therefore required to enhance standards in the digital aspects of the grids. Regulators need to strengthen the regulatory framework in relation to the ownership and sale of information [10]. Specifically, regulators need to ensure the integrity of the data management system, preventing cyberattacks, incentivise investment in cybersecurity as well as to enhance consumers protection [83].

There are three measures that a regulator can deploy. These are privacy regulation, facilitating public–private collaboration, and providing financial incentives for cybersecurity innovation. Privacy regulations could be enforced by clearly defining the roles and responsibilities of each party involved in data processing and management [97]. Privacy regulations could prevent misuse of data. More importantly, they can increase consumers’ confidence and acceptance of smart grid deployment and this is especially important in a context in which public distrust of governments and utilities is not uncommon in many countries and cities [68, 69]. For instance, California enforces energy data privacy rules as state legislation, and is the pioneer in energy data privacy regulations and has inspired other states to join the path [15].

Public–private collaboration can also help to ensure that policy measures evolve along with the changing risks as well as the needs of diverse stakeholders. Workshops and working group meetings are crucial to address new challenges and solutions. For example, since 2006, the USA Department of Energy has been working with different energy sector stakeholders on developing grid cybersecurity and has implemented 65 initiatives to develop cybersecurity solutions [79]. The private–public collaboration taskforce, the Energy Sector Control Systems Working Group, collected inputs from various stakeholders such as government leaders, asset owners and operators, chief information officers (CIOs), research and technical experts, security specialists, and vendors and generated two roadmaps to address these issues [29]. Another example of stakeholder collaboration is the Cyber Security Working Group (CSWG) under the USA National Institute of Standards and Technology (NIST). The group consists of more than 650 stakeholders worldwide including utilities, vendors, academia, regulators, and government [77]. This group aims to develop overall cybersecurity strategies for smart grids, and sub-groups have been set up to focus on different topics such as advanced metering infrastructure, privacy, and design principles [77].

Financial incentives for cybersecurity investment are crucial to motivate both the utility companies and technology developers to move into this new area. For instance, the USA Recovery Act delegated US$3.4 billion to 99 projects under the Smart Grid Investment Grant Programme (SGIG), in which awardees are required to prepare and implement cybersecurity plans specific to their projects [29]. The programme also fosters a peer sharing of experience in implementing cybersecurity plans, persistent security risks, and information gaps through a two-day workshop [24].

To sum up, utility disincentives, pricing inefficiencies, and cybersecurity and privacy are the three major regulatory issues that regulators need to effectively address to facilitate smart grid deployment. The lock-in effect and the coupling between electricity sales and utility revenue have created utility disincentives to smart grid investment. Regulators may introduce market liberalisation and decoupling mechanisms to facilitate smart grid deployment through market accessibility, fair market rules, and incentive systems. To overcome the issues associated with pricing inefficiency, regulators may introduce tariff reforms, most notably through different forms of dynamic pricing with a phase-in approach moving from voluntary to mandatory. Regulators may address cybersecurity and privacy issues through introducing regulations on privacy, enabling public–private collaboration as well as providing financial incentives for cybersecurity investment. Table 3 below provides an overview of the major regulatory issues, approaches and examples of specific regulatory measures.

4 Smart Grid Regulatory Approaches: An Overview of International Experience

We now provide an overview of the diversity of regulatory approaches that have been deployed in various places, examine the achievements of these approaches, and then highlight the unresolved issues that confront regulators.

4.1 A Variety of Regulatory Approaches and the Achievements

Our case examples summarised in Table 4 show that the USA and a number of European countries, including the UK, Germany, Italy, France, and the Netherlands, have introduced a wide range of approaches to address the three major regulatory issues. Decoupling, dynamic pricing, and cybersecurity and privacy protocols and standards are the commonly adopted approaches.

Two observations can be drawn from these case examples. Firstly, countries and cities have adopted a diversity of regulatory measures within each approach. The case examples show that the UK, California, and Germany have adopted different forms of decoupling mechanisms (e.g. price caps and revenue caps). Similarly, our case examples that deployed dynamic pricing measures differed in the forms of pricing systems (e.g. time-of-use and critical-peak pricing) as well as the level of obligation (i.e. voluntary or mandatory basis). In relation to cybersecurity and privacy issues, privacy regulations in these case examples also differ with some focusing on data disclosure and some on data aggregation.

Secondly, the implementation of these regulatory measures involved various stakeholders. Regulators worked closely with utilities and consulted other stakeholders on decoupling to develop effective incentive mechanisms through rate case review, energy savings goal evaluation, and project grants assessment. Dynamic pricing measures also involved consumer engagement through outreach and education about new energy pricing systems and to ensure public acceptance. Similarly, some cybersecurity measures were based on private–public or stakeholder collaboration to develop strategies and plans.

Although a comprehensive analysis of these regulatory approaches is yet to be available, these initiatives have recorded some achievements of facilitating smart grid development. Decoupling, for instance, as a major regulatory measure to address the issue of utility disincentives provides new incentives for some utilities to divert investment into new areas. One of the achievements of decoupling is a reduction in network and electricity costs through efficiency gains. The electricity price cap (RPI-X) in the UK, for instance, has effectively promoted efficiency and led to a 7.7 % decrease in operational costs for distribution network operators as well as 50 and 41 % reduction in electricity distribution and transmission charges for consumers, respectively, over a period of 11 years [5]. Decoupling measures also effectively altered utilities’ investment strategies on energy efficiency. One example is that the gas conservation programme by Pacific Gas & Electric reduced US$46 million of revenue from natural gas sales, which would not have been implemented without a mandatory decoupling measure [91].

Dynamic pricing, on the other hand, as a key regulatory approach to engaging consumers through the use of pricing signals, has recorded some successes in terms of peak load shifts and consumption reductions. A review on dynamic pricing pilot programmes found that time-of-use and critical-peak pricing with automated responding technology installed could possibly reduce peak loads by 5 and 30 %, respectively [76]. The pilot programme in Ontario also demonstrated 6 % reduction in energy consumption and CAN$4.17 savings in monthly electricity cost [47].

Cybersecurity rules have been regarded as an important component of smart grid deployment plans in many economics including the USA, EU, South Korea, and China. However, the assessment of what privacy rules have accomplished is not readily available due to the mostly preventative nature of the regulations [57].

Table 4 below provides an overview of international experience of implementing the three regulatory approaches, followed by three case studies of each approach to elaborate the key features, outcomes, and lessons learned (Boxes 1–3).

Box 1 Case—Decoupling Electricity in California

What happened

Triggered by the first energy crisis, decoupling mechanism was adopted in California from 1982 to late 1990s, with high tail block rates, revenue adjustment, and performance-based incentives [105]. After 1996, the regulatory strategy was shifted to relying on market force and competition for energy efficiency by restructuring the market [105]. During the 2001 energy crisis, the state re-introduced revenue decoupling mechanism, with an explicit political priority on energy efficiency and energy saving goals specific to each utility [14, 94].

Outcomes

Decoupling measures facilitated intensive development of energy efficiency programmes, which led to about US$1.5 billion net benefits from pre-1998 energy savings [105]. The energy saving goals also appeared to succeed in promoting energy efficiency—all three utilities exceeded their saving goals in electricity use by 27–30 % and demand by 21–31 % [14].

Lessons learned

California’s experience shows that decoupling requires a mix of decoupling mechanisms and compliance regulation, such as revenue adjustment and energy saving goals, to provide incentives for energy efficiency on both demand and supply side. Clear political commitment and priorities, explicit targets as well as tailor-made energy saving goals specific to each utility, are the keys to succeed of these decoupling mechanisms.

Box 2 Case—Dynamic Pricing Pilot in Ontario

What happened

The Ontario Energy Board Smart Price Pilot (OSPP) started in August 2006 with 373 Hydro Ottawa consumers for one and a half years, aiming to explore implications of province-wide smart meter roll-out and mandatory time-of-use tariff [47]. This pilot programme tested three types of pricing—the time-of-use, time-of-use with critical-peak price, and time-of-use with critical-peak rebate, in which the two critical-peak time-of-use rates charge 3¢ more for on-peak use with an addition of CAD 30¢/kWh charge for peak-hour or rebate for avoided peak-hour use on critical-peak days [47].

Outcomes

Time-of-use with critical-peak price appears to have the most robust impacts on peak shaving—about 11 % demand reduction on average and 25 % during critical-peak hours [47]. All three pricing types led to lower total energy use (6 % on average) [47]. Taking both load shifting and conservation effects into account, over 93 % of OSPP participants paid CAD$4.17 less on their electricity bills per month—35 % savings from load shifting and 65 % from conservation [47]. Most of the participants (78 %) were satisfied with the TOU pricing [47].

Lessons learned

OSPP provides insights into effectiveness of different time-of-use pricing options and programme implementation approach. A comprehensive set of consumer engagement tools, such as automated peak notification, and education package and flyers, is essential to the responsive consumer behaviour to dynamic pricing. Dynamic pricing with penalty on on-peak use appears to be more effective in peak shaving and conservation [36, 76].

Box 3 Case—Cybersecurity and Data Privacy in California

What happened

Several legislative bills, namely SB 17, SB 1476, and SB 674, contribute to the cybersecurity regulation in California. Utilities are required by California Public Utility Commission to address cybersecurity in their smart grid deployment plans (SGDPs) and are prohibited to disclose energy data without prior consent from customers [7–9].

Outcomes

These regulations facilitate over US$19 million utility investment in cybersecurity [85, 93, 96]. Measures are implemented in the following approaches [55, 85, 92, 95]:

-

Network upgrade: threat-detective and threat-adaptive control systems, pilot projects

-

Private–public collaboration: professional societies and working groups

-

Standard and policy: network standards (NIST, NERC), internal security governance policy

-

Privacy frameworks: privacy protocols (i.e. fair information practice principles and privacy by design), privacy impact assessments

-

Risk management: cyberincident response team and plan

-

Internal measures: awareness training, Chief Customer Privacy Officer and team

Lessons learned

California establishes a pioneer case of how regulatory changes can facilitate security and privacy protection measures by utilities via compliance-based reporting and privacy rules. The annual updates of SGDPs provide insights into regulatory improvement and can better respond to the evolving nature of cyber-risks. Defining roles and authorisation limitation of utilities in data disclosure enhance consumers’ privacy protection. However, there is a lack of local information sharing, cyberincident reporting, and independent auditing of implemented measures.

4.2 Unresolved Issues

Although these regulatory approaches have recorded some achievements, there are still a number of unresolved issues remaining. The major challenge of decoupling is to optimise the regulatory regime with the least cost [91]. It is a particular area of concern because financial incentives such as grants that are required for implementing decoupling often involve a large amount of public expenditure. For instance, California has received US$314.5 million from the American Recovery and Reinvestment Act (ARRA) for efficiency grants, state energy programmes on training and financing, and energy assurance planning [6]. Sufficient funding is essential to decouple with financing incentives, and the challenge is therefore to ensure active involvement of the government or the development of viable business models for financing. Another unresolved issue of decoupling is concerned with the trade-offs between the implementation of unbundling to guarantee fair access conditions and the additional burden put on small new entrants in terms of costs and complexity of system integration [12].

In relation to dynamic pricing, the effectiveness of this regulatory measure is closely tied to the demand responses of consumers. However, if prices are excessively volatile or manipulated by utilities through exerting market power, residential consumers may become particularly vulnerable [10]. How to ensure consumers will benefit from dynamic pricing would be an area of major concern to regulators. Furthermore, the political and economic feasibility of introducing dynamic pricing may be highly uncertain and vary across different regulatory regimes as showed in some studies [69]. Consumer response to price signals is often deterred by the lack of awareness, knowledge, and ability to respond. For instance, in the case of New York, minimal differences between market prices and dynamic prices do not pay for customer’s cost of responding to price signals, such as time spent on monitoring hourly prices and changes in consumption behaviour. Underutilisation of real-time pricing software and lack of knowledge of load reduction strategies also contribute to the insignificant peak-shaving effort of the programmes [59–61, 78, 80, 90].

In addressing the issues of cybersecurity and privacy, regulators are concerned with the evolving nature of cyber-risks, and the trade-off between acceptable risk and costs [15]. What complicates the matter is that utility companies are often not motivated to invest in cybersecurity, especially in relation to data privacy. One of the reasons is that even if cybersecurity is associated with high impacts, it has a low probability of occurrence but high implementation cost [15]. The limited market for smart grid security technology also leads to the lack of incentives for technology developers to provide responsive technical support and innovation while smart security technology is still in its early development stage.

5 Conclusions

To fully capitalise on the potential benefits of smart grid deployment, it requires not only technological advancement but also a good understanding of the regulatory barriers. This chapter has contributed to the literature on smart grid by bringing the regulator perspectives—an area that is under-explored [102]—into the field of smart grid studies. We examine why regulators should be concerned about smart grid developments, the nature of the regulatory challenges, and what they can do to address these challenges.

We have two major findings. Firstly, we demonstrate that smart grids present new challenges to regulators. We found that regulators have important roles to play in establishing rules and mechanisms to address these regulatory challenges and facilitate smart grid deployment. Specifically, regulators can regulate investment incentives, consumer incentives, and the use of data through introducing market liberalisation, dynamic pricing, and protocols and standards on cybersecurity and privacy issues.

Secondly, our international case studies of countries and cities provide an overview of a variety of actual regulatory initiatives in place. This overview showed how these economies pioneered a variety of regulatory approaches that include different forms of decoupling, dynamic pricing and ways to address cybersecurity and data privacy issues. It is important to note that while these regulatory initiatives have secured some achievements, the unresolved issues are substantial. The trade-offs between the potential benefits of market liberalisation and the new burden put on both existing and new market players, the difficulties in predicting consumer responses to dynamic pricing, and the evolving nature of cyber-risks are some examples of the major issues confronting regulators when attempting to regulate smart grid deployment.

Our findings have some important policy implications. Firstly, rather than relying on a single solution, in practice regulators need to use a combination of regulatory measures to enhance regulatory effectiveness. For instance, various means of decoupling measures including direct-cost recovery, fixed-cost recovery, and performance incentives programmes may reduce the financial barriers for utility companies to invest in energy efficiency efforts. But these incentives may still not be adequate. Mandatory requirements for energy efficiency such as energy efficiency resource standards (EERS)—which are energy efficiency targets for utility companies—could be the ultimate driver to enhance the utilities’ willingness to promote energy efficiency [88, 94]. The combination of legal requirements and incentive mechanisms may enhance regulatory effectiveness.

Secondly, regulators need to adopt a more engaging approach to effectively involve stakeholders when formulating regulatory solutions. Smart grid deployment presents challenge to the traditional technocratic way of energy decision-making. For instance, in relation to cybersecurity, the nature of potential risks, forms of attacks, and potential consequences are evolving [15]. A static set of rules will not be able to respond to such challenges. Regulators therefore need to engage more widely to formulate more proactive and adaptive measures. Furthermore, as shown in the case study of Ontario’s dynamic pricing scheme (Box 2), consumer engagement through effective automated peak notification and education tools is essential to the smooth implementation of dynamic pricing.

Thirdly, regulating smart grid deployment requires an intelligent match of the choices of regulatory approaches and regulatory capacities. Worldwide, countries and cities adopt different regulatory approaches, a reflection of differing institutional endowments and regulatory capacities [42, 56]. It is a challenge to a regulator to learn how to make use of possible regulatory tools to effectively respond to the local context, and the opportunities and constraints for introducing regulatory changes.

Our analysis has however some limitations. Our overview of regulatory approaches in practice (Table 4) does not constitute a representative sample of the regulatory initiatives in this field. It is at best a brief analysis. Future research may generate fruitful findings through a thorough assessment of the extent to which regulatory measures have been implemented in the countries of reference. Furthermore, regulatory alignment between the regulatory tools and a regulator’s abilities is a major research area that is under-explored [42]. A comparative study from this perspective may generate useful findings that can contribute to the literature on regulatory governance.

References

Arentsen M, Künneke R (1996) Economic organization and liberalization of the electricity industry. Energy Policy 24(6):541–552

Ashford N, Ayers C, Stone R (1985) Using regulation to change the market for innovation. Havard Environ Law Rev 9(2):419–466

Belyaev LS (2011) Electricity market reforms: economics and policy challenges. Springer, New York

Blarke MB, Jenkins BM (2013) SuperGrid or SmartGrid: competing strategies for large-scale integration of intermittent renewables? Energy Policy 58:381–390. doi:10.1016/j.enpol.2013.03.039

Buchanan A (2008) Is RPI-X still fit for purpose after 20 years? Office of Gas & Electricity Markets, London. http://www.ofgem.gov.uk/Networks/rpix20/Factsheets/Documents1/AB%20Oct%20speech.pdf. Accessed 13 May 2013

California Energy Commission (2010) ARRA Funded Energy Programs: investing in California’s Energy Future. California Energy Commission, Sacramento. http://www.energy.ca.gov/2010publications/CEC-180-2010-003/CEC-180-2010-003.PDF. Accessed May 15, 2013

California State Legislature (2009) Electricity: smart grid systems. SB 17 (2009–2010 edn, vol SB 17). California State Legislature, USA

California State Legislature (2010) Public utilities: customer privacy: advanced metering infrastructure. SB 1476 (2009–2010 edn, vol SB 1476). California State Legislature, USA

California State Legislature (2011) Telecommunications: master-metering: data security. SB 674 (2011–2012 edn). California State Legislature, USA

Clastres C (2011) Smart grids: another step towards competition, energy security and climate change objectives. Energy Policy 39(9):5399–5408

Córdova-Novion C, Hanlon D (2003) Regulatory governance: improving the institutional basis for sectoral regulators. OECD J Budgeting 2(3):16. doi:10.1787/budget-v2-art16-en

Cossent R, Gómez T, Frías P (2009) Towards a future with large penetration of distributed generation: is the current regulation of electricity distribution ready? Regulatory recommendations under a European perspective. Energy Policy 37(3):1145–1155. doi:10.1016/j.enpol.2008.11.011

CPUC (2011) Decision granting in part and denying in part petitions for modification of decision 10-02-032. Decision 11-11-008. California Public Utilities Commission, San Francisco

CPUC (2012) 2010–2011 energy efficiency annual progress evaluation report. In: C. P. U. Commission (ed) California Public Utilities Commission, San Francisco

CPUC (2012) Cybersecurity and the evolving role of state regulation: how it impacts the California Public Utilities Commission. California Public Utilities Commission, San Francisco. http://www.cpuc.ca.gov/NR/rdonlyres/D77BA276-E88A-4C82-AFD2-FC3D3C76A9FC/0/TheEvolvingRoleofStateRegulationinCybersecurity9252012FINAL.pdf. Accessed 4 July 2013

CPUC (2012) Decision adopting a dynamic pricing structure for residential and small commercial customers and denying the motion for approval of a settlement agreement. Decision 12-12-004. California Public Utilities Commission, San Francisco

CPUC (2012) Decision denying petition for modification of decision 10-02-032 and decision 11-11-008. Decision 12-08-005.California Public Utilities Commission, San Francisco

Cuijpers C, Koops B-J (2013) Smart metering and privacy in Europe: lessons from the Dutch case. In: Gutwirth S, Leenes R, de Hert P, Poullet Y (eds) European data protection: coming of age. Springer, Netherlands, pp 269–293

Darby S (2006) The effectiveness of feedback on energy consumption: a review for DEFRA of the literature on metering, billing and direct displays. Environmental Change Institute, University of Oxford, Oxford. http://www.eci.ox.ac.uk/research/energy/downloads/smart-metering-report.pdf. Accessed 13 June 2013

Devine-Wright P (2007) Energy citizenship: psychological aspects of evolution in sustainable energy technologies. In: Murphy J (ed) Governing technology for sustainability. Earthscan, London, pp 63–89

DEWHA, Australia (2009) Smart grid, smart city: a new direction for a new energy era. Department of the Environment, Water, Heritage and the Arts, Australia

Dixit S, Dubash N, Nakhooda S, Owen G (2008) Clean energy, good governance and regulation. In forum on clean energy, good governance and regulation, Singapore, March 16–18 2008: World Resources Institute, Prayas Energy Group, Renewable Energy & Energy Efficiency Partnership, Centre on Asia and Globalisation

DOE (2008) What the smart grid means to Americans. Department of Energy, Washington DC. http://energy.gov/sites/prod/files/oeprod/DocumentsandMedia/ConsumerAdvocates.pdf. Accessed 4 July 2013

DOE (2012) Smart Grid Investment Grant Program–Progress Report July 2011. In U. S. Department of Energy (Ed). Department of Energy, Washington, DC

Dones R, Heck T, Bauer C, Hirschberg S, Bickel P, Preiss P, et al (2005) Externalities of energy: extension of accounting framework and policy applications (ExterE-Pol). European Commission, France. http://www.externe.info/externe_2006/expolwp6.pdf. Accessed 5 June 2013

EIA (2011) Smart grid legislative and regulatory policies and case studies. U.S. Department of Energy, Washington, DC. http://www.eia.gov/analysis/studies/electricity/pdf/smartggrid.pdf. Accessed 4 July 2013

Energy Advisory Committee (2003) Electricity market review: role of regulator. Energy Advisory Committee, Hong Kong. http://www.enb.gov.hk/en/resources_publications/policy_consultation/files/Reference11.pdf. Accessed 28 May 2013

EPRI (2011) Estimating the costs and benefits of the smart grid: a preliminary estimate of the investment requirements and the resultant benefits of a fully functioning smart grid. Electric Power Research Institute, Palo Alto. http://www.epri.com/abstracts/Pages/ProductAbstract.aspx?ProductId=000000000001022519. Accessed 2 July 2013

ESCSWG (2011) Roadmap to achieve energy delivery systems cybersecurity. Energy Sector Control Systems Working Group. http://energy.gov/sites/prod/files/Energy%20Delivery%20Systems%20Cybersecurity%20Roadmap_finalweb.pdf. Accessed 7 June 2013

Eurelectric (2011) Regulation for smart grids. Eurelectric, Brussels. http://www.eurelectric.org/media/25920/eurelectric_report__on_reg_for_sg_final-2011-030-0131-01-e.pdf. Accessed 2 July 2013

Office Executive (2011) A policy framework for the 21st century grid: enabling our secure energy future. Executive Office of the President of the United State, Washington DC

Faruqui A (2012) The ethics of dynamic pricing. In: Fereidoon PS (ed) Smart grid. Academic Press, Boston, pp 61–83 Chapter 3

Faruqui A, Harris D, Hledik R (2010) Unlocking the 53 billion Euro savings from smart meters in the EU: how increasing the adoption of dynamic tariffs could make or break the EU’s smart grid investment. Energy Policy 38:6222–6231

Faruqui A, Harris D, Hledik R (2010) Unlocking the €53 billion savings from smart meters in the EU: how increasing the adoption of dynamic tariffs could make or break the EU’s smart grid investment. Energy Policy 38(10):6222–6231. doi:10.1016/j.enpol.2010.06.010

Faruqui A, Palmer J (2011) Dynamic pricing and its discontents. Regul Fall 34:16–22

Faruqui A, Palmer J (2012) The discovery of price responsiveness—A survey of experiments involving dynamic pricing of electricity. The Brattle Group, San Francisco. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2020587. Accessed 23 May 2013

Faruqui A, Sergici S, Palmer J (2010) The impact of dynamic pricing on low income customers. Institute for Electric Efficiency, Washington DC

Fischer C (2008) Feedback on household electricity consumption: a tool for saving energy? Energ Effi 1(1):79–104. doi:10.1007/s12053-008-9009-7

GAO (2012) Cybersecurity: challenges in securing the electricity grid. U.S. Government Accountability Office, Washington DC. http://www.gao.gov/assets/600/592508.pdf. Accessed 8 July 2013

Giordano V, Fulli G (2012) A business case for smart grid technologies: a systemic perspective. Energy Policy 40:252–259. doi:10.1016/j.enpol.2011.09.066

Giraud D (2004) The tempo tariff. In: EFFLOCOM workshop. EDF, Trondheim, 10 June 2004

Glachant J-M, Khalfallah H, Perez Y, Rious V, Saguan M (2012) Implementing incentive regulation and regulatory alignment with resource bounded regulators. European University Institute, Italy. http://cadmus.eui.eu/bitstream/handle/1814/22734/RSCAS%20_2012_31.pdf?sequence=1. Accessed 4 July 2013

Grattieri W, Maggiore S (2012) Impact of a mandatory Time-of-Use tariff on the residential customers in Italy. In: Current issues in Demand Side Management, Espoo, Finland, 2012: RSE (Ricerca sul Sistema Eneretico S.p.A.)

Grijalva S, Tariq MU (2011). Prosumer-based smart grid architecture enables a flat, sustainable electricity industry. In: Innovative Smart Grid Technologies (ISGT), 2011 IEEE PES, 17–19 Jan 2011, 2011, pp 1–6. doi: 10.1109/isgt.2011.5759167

Hadre S (2009) Impact of the German regulatory framework on investment incentives. In: The 20th international conference and exhibition on Electricity Distribution—Part 2, 2009 (CIRED 2009), 8–11 June 2009, 2009, pp 1–9

Heins S, Sandersen J (2007) Decoupling: divorcing electricity sales from revenues creates win-win for utilities and customers. In: 2007 ACEEE summer study on energy efficiency in industry: “improving industrial competitiveness: adapting to volatile energy markets, globalization, and environmental constraints”. Orion Energy Systems, White Plains, NY, 24 July 2007

IBM (2007) Ontario Energy board smart price pilot—final report. IBM Global Business Services and eMeter Strategic Consulting, Ontario. http://www.ontarioenergyboard.ca/documents/cases/EB-2004-0205/smartpricepilot/OSPP%20Final%20Report%20-%20Final070726.pdf. Accessed 21 May 2013

IEA (2001) Towards a sustainable energy future. OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264193581-en. Accessed 4 July 2013

IEA (2011) Empowering customer choice in electricity markets. International Energy Agency, Paris. http://www.iea.org/publications/freepublications/publication/Empower.pdf

IEA (2011) Smart grid-smart customer policy needs. International Energy Agency, Paris. https://www.iea.org/publications/freepublications/publication/sg_cust_pol.pdf. Accessed 4 July 2013

IEA (2011) Technology roadmap: smart grids. International Energy Agency, Paris. http://www.iea.org/papers/2011/smartgrids_roadmap.pdf

IEA (2012) Progress implementing the IEA 25 energy efficiency policy recommendations—2011 evaluation. International Energy Agency, Paris. http://www.iea.org/publications/insights/progress_implementing_25_ee_recommendations.pdf. Accessed June 13 2013

IEA/OECD (2003) The power to choose: demand response in liberalised electricity markets. OECD/IEA, Paris

Institute for Electric Efficiency (2012) State electric efficiency regulatory frameworks. Institute for Electric Efficiency, Washington DC. http://www1.eere.energy.gov/buildings/betterbuildings/neighborhoods/pdfs/iee_state_reg_frame.pdf. Accessed 4 July 2013

IPC (2012) Applying privacy by design best practices to SDG&E’s smart pricing program. Information and Privacy Commissioner, San Diego Gas & Electric Co., Ontario http://www.sdge.com/sites/default/files/documents/pbd-sdge_0.pdf. Accessed 4 July 2013

Jamasb T, Pollitt M (2007) Incentive regulation of electricity distribution networks: lessons of experience from Britain. Energy Policy 35(12):6163–6187. doi:10.1016/j.enpol.2007.06.022

John JS (2013) Report: US smart grid cybersecurity spending to reach $7.25B by 2020. Greentech Media. http://www.greentechmedia.com/articles/read/report-u.s.-smart-grid-cybersecurity-spending-to-reach-7.25b-by-2020. Accessed 4 July 2013

JRC (2011) Smart Grid projects in Europe: lessons learned and current developments. European Commission Joint Research Centre and Institute for Energy, Netherlands. http://ses.jrc.ec.europa.eu/sites/ses/files/documents/smart_grid_projects_in_europe_lessons_learned_and_current_developments.pdf. Accessed 4 June 2013

KEMA (2009) Mandatory hourly pricing report of consolidated edison company of New York, Inc. KEMA, Inc., Connecticut. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 2 July 2013

KEMA (2009) Orange and rockland utilities, Inc. Submits its mandatory hourly pricing report. KEMA, Inc., New York http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 2 July 2013

KEMA (2009) Two year evaluation report of Niagara Mohawk Power Corp d/b/a National Grid. KEMA, Inc., Connecticut. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 2 July 2013

KEMA (2011) KEMA white paper: innovation in competitive electricity markets. KEMA, Inc., Massachusetts. http://www.competecoalition.com/files/KEMA%20Innovation%20in%20Electricity%20Markets%20White%20Paper.pdf. Accessed 2 July 2013

KEMA (2012) Mandatory hourly pricing program evaluation (prepared for Consolidated Edison Company of New York, Inc.). KEMA, Inc., Connecticut. https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&ved=0CDMQFjAA&url=http%3A%2F%2Fdocuments.dps.ny.gov%2Fpublic%2FCommon%2FViewDoc.aspx%3FDocRefId%3D%257B1BB38D64-2382-4AF4-8A1D-46622C0A5585%257D&ei=zmFvUYW5F-SWiQeCloCQCA&usg=AFQjCNHHv06uLgQCZpq4MReL9Ub-2wsnwg&sig2=QB78lf0Zr73iiPPXLN03rg. Accessed 2 July 2013

King C, Strapp J (2012) Software infrastructure and the smart grid. In: Fereidoon PS (ed) Smart grid. Academic Press, Boston, pp 259–288 Chapter 11

LBST, HINICIO, Barquín J (2012) Effect of smart metering on electricity prices. Policy Department Economic and Scientific Policy, European Parliament, Brussels. http://www.europarl.europa.eu/document/activities/cont/201202/20120223ATT39186/20120223ATT39186EN.pdf. Accessed May 2 2013

Lo Schiavo L, Delfanti M, Fumagalli E, Olivieri V (2013) Changing the regulation for regulating the change: Innovation-driven regulatory developments for smart grids, smart metering and e-mobility in Italy. Energy Policy 57:506–517. doi:10.1016/j.enpol.2013.02.022

Maeding S (2009) Investment incentives in the context of revenue cap regulation. In: 20th international conference and exhibition on electricity distribution—part 1, 2009 (CIRED 2009), 8–11 June 2009, pp 1–4

Mah DNY, van der Vleuten JM, Hills P, Tao J (2012) Consumer perceptions of smart grid development: results of a Hong Kong survey and policy implications. Energy Policy 49:204–216. doi:10.1016/j.enpol.2012.05.055

Mah DN-Y, van der Vleuten JM, Ip JC-M, Hills PR (2012) Governing the transition of socio-technical systems: a case study of the development of smart grids in Korea. Energy Policy 45:133–141

Markard J, Truffer B (2006) Innovation processes in large technical systems: market liberalization as a driver for radical change? Res Policy 35(5):609–625. doi:10.1016/j.respol.2006.02.008

Mathews JA, Tan H (2013) The transformation of the electric power sector in China. Energy Policy 52:170–180. doi:10.1016/j.enpol.2012.10.010

Meeus L, Saguan M (2010) Smart regulations for smart grids. European University Institute, Italy. http://cadmus.eui.eu/handle/1814/14043. Accessed 4 July 2013

Müller C (2011) New regulatory approaches towards investments: a revision of international experiences (IRIN working paper for working package: advancing incentive regulation with respect to smart grids). WIK GmbH, Bad Honnef. http://www.bremer-energie-institut.de/download/IRIN/pub/discussion/WIK-Diskus_353.pdf. Accessed 4 July 2013

NAPEE (2007) Aligning utility incentives with investment in energy efficiency. National Action Plan for Energy Efficiency. http://www.epa.gov/cleanenergy/documents/suca/incentives.pdf. Accessed 4 July 2013

NEA (2011) 12th five-year plan for energy technology (2011–2015). In: CNEA (ed) China National Energy Administration, Beijing

Newsham GR, Bowker BG (2010) The effect of utility time-varying pricing and load control strategies on residential summer peak electricity use: a review. Energy Policy 38(7):3289–3296. doi:10.1016/j.enpol.2010.01.027

NIST (2011) SmartGrid Interoperability Panel (SGIP)—Cyber Security Working Group (CSWG). National Institute of Standards and Technology, Washington DC

NMPC (2009) Niagara Mohawk Power Corporation d/b/a national grid: two-year evaluation report on mandatory hourly pricing. Niagara Mohawk Power Corporation, New York. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 2 July, 2013

NSTC, Executive Office of the President (2011) A Policy framework for the 21st century grid: enabling our secure energy future. In: NSTC (ed) National Science and Technology Council, Washington DC

NYSEG (2009) New York State Electric and Gas Corp. Mandatory hourly pricing program report. New York State Electric & Gas Corporation, New York. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 17 Apr 2013

Ontario Energy Board (2008) Staff discussion paper: regulated price plan—Time-of-Use prices: design and price setting issues. In O. E. Board (ed) Ontario Energy Board, Ontario

Parag Y, Darby S (2009) Consumer-supplier-government triangular relations: rethinking the UK policy path for carbon emissions reduction from the UK residential sector. Energy Policy 37(10):3984–3992

Pearson I (2011) Smart grid cyber security for Europe. Energy Policy 39(9):5211–5218. doi:10.1016/j.enpol.2011.05.043

Pearson M (2005) The business of governing business in China: institutions and norms of the emerging regulatory state. World Polit 57(2):296–322

PG&E (2011) Smart grid deployment plan: 2011–2020. Pacific Gas & Electric Co., San Francisco. http://www.pge.com/includes/docs/pdfs/shared/edusafety/electric/SmartGridDeploymentPlan2011_06-30-11.pdf. Accessed 4 July 2013

Potter CW, Archambault A, Westrick K (2009) Building a smarter smart grid through better renewable energy information. In: Power systems conference and exposition, 2009. PSCE’09. IEEE/PES, 15–18 Mar 2009, pp 1–5. doi: 10.1109/psce.2009.4840110

PSC (2006) Proceeding on motion of the commission regarding expedited implementation of mandatory hourly pricing for commodity service, order denying petitions for rehearing and clarification in part and adopting mandatory hourly pricing requirements. In: PSC (ed) Case 03-E-0641 (vol Case 03-E-0641). Public Service Commission, New York

RAP (2011) Electricity regulation in the US: a guide. The Regulatory Assistance Project, Vermont. www.raponline.org/document/download/id/645. Accessed 4 Jul 2013

RAP (2012) Time-varying and dynamic rate design. Regulatory Assistance project. http://www.hks.harvard.edu/hepg/Papers/2012/RAP_FaruquiHledikPalmer_TimeVaryingDynamicRateDesign_2012_JUL_23.pdf. Accessed 5 Jun 2013

RG&E (2009) Rochester Gas and Electric Corp. Two year mandatory hourly pricing summary report. Rochester Gas and Electric Corporation, New York. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=03-E-0641. Accessed 17 Apr 2013

Risser R (2006) Decoupling in California: more than two decades of broad support and success. In: Aligning regulatory incentives with demand-side resources. Pacific Gas and Electric Company, San Francisco, 2 Aug 2006

SCE (2011) Smart grid deployment plan. Rosemead: Southern California Edison Company. http://www.smartgrid.com/wp-content/uploads/2011/09/SG-Plan-SCE.pdf. Accessed 4 Jul 2013

SCE (2012) Annual update—smart grid. Rosemead: Southern California Edison Co. http://www.cpuc.ca.gov/NR/rdonlyres/E11D9761-733C-4BD1-BC1B-4B52E1AF9FB1/0/R0812009SCESmartGridAnnualDeploymentPlanUpdate2012.pdf. Accessed 4 Jul 2013

Sciortino M, Nowak S, Witte P, York D, Kushler M (2011) Energy efficiency resource standards: a progress report on state experience. American Council for an Energy-Efficiency Economy, Washington, DC. http://aceee.org/research-report/u112. Accessed 13 May 2013

SDG&E (2011) Smart grid deployment plan: 2011–2020. San Diego Gas & Electric Co., San Diego. http://www.sdge.com/sites/default/files/documents/smartgriddeploymentplan.pdf. Accessed 4 July 2013

SDG&E (2012) Smart grid deployment plan—2012 annual report. San Diego Gas & Electric Co., San Diego. http://www.sdge.com/sites/default/files/documents/1138900767/SDGE_Annual_Report_Smart_Grid_Deployment.pdf. Accessed 4 July 2013

SEE Action (2012) A regulator’s privacy guide to third-party data access for energy efficiency. State and Local Energy Efficiency Action Network, Washington, DC. http://www1.eere.energy.gov/seeaction/pdfs/cib_regulator_privacy_guide.pdf. Accessed 2 May 2013

Sioshansi FP (2012) Smart grid: integrating renewable, distributed & efficient energy. Elsevier/Academic Press, Amsterdam

Sorebo GN, Echols MC (2011) Smart grid security: an end-to-end view of security in the new electrical grid. Taylor & Francis, Florida

Stern N (2006) Stern review: the economics of climate change. HM Treasury, London. http://www.hm-treasury.gov.uk/independent_reviews/stern_review_economics_climate_change/sternreview_index.cfm. Accessed 4 July 2013

Stronzik M (2011) Incentive Regulation and the Return on Equity. WIK GmbH, Bad Honnef. http://www.wik.org/index.php?id=diskussionsbeitraegedetails&L=1&tx_ttnews%5Btt_news%5D=1335&tx_ttnews%5BbackPid%5D=93&cHash=ff0a74079c96bbde7e899a665c723f30. Accessed 5 July 2013

Tabors R, Parker G, Caramanis M (2010) Development of the smart grid: missing elements in the policy process. In: IEEE 43rd Hawaii international conference on system sciences, Honolulu, Hawaii, 5–8 Jan 2010

Torriti J (2012) Price-based demand side management: assessing the impacts of time-of-use tariffs on residential electricity demand and peak shifting in Northern Italy. Energy 44(1):576–583. doi:10.1016/j.energy.2012.05.043

Vasconcelos J (2008) Survey of regulatory and technological developments concerning smart metering in the european union electricity market. European University Institute, Florence. http://cadmus.eui.eu/bitstream/handle/1814/9267/RSCAS_PP_08_01.pdf?sequence=2. Accessed 28 May 2013

Weber T, Besa A, Miller B (2006) Decoupling mechanisms: energy efficiency policy impacts and regulatory implementation in less is more: En route to zero energy buildings. American Council for an Energy-Efficient Economy, Pacific Grove, CA, 13–18 Aug 2006

Wolak FA (2005) Lessons from international experience with electricity market monitoring. The World Bank, California. http://elibrary.worldbank.org/docserver/download/3692.pdf?expires=1369795827&id=id&accname=guest&checksum=D0B61F56AD1E619E2216DDDDFBDC8642. Accessed 29 May 2013

Zhao X, Wang F, Wang M (2012) Large-scale utilization of wind power in China: obstacles of conflict between market and planning. Energy Policy 48:222–232

Zio E, Aven T (2011) Uncertainties in smart grids behavior and modeling: what are the risks and vulnerabilities? How to analyze them? Energy Policy 39(10):6308–6320. doi:10.1016/j.enpol.2011.07.030

Acknowledgments

We gratefully acknowledge the funding of our research by the Hong Kong Baptist University (through the Faculty Research Grants from the Faculty of Social Sciences, FRG2/12-13/057 and FRG1/13-14/051) and the University of Hong Kong (through the Initiative on Clean Energy and Environment).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag London

About this chapter

Cite this chapter

Mah, D., Leung, K.Py., Hills, P. (2014). Smart Grids: The Regulatory Challenges. In: Mah, D., Hills, P., Li, V., Balme, R. (eds) Smart Grid Applications and Developments. Green Energy and Technology. Springer, London. https://doi.org/10.1007/978-1-4471-6281-0_7

Download citation

DOI: https://doi.org/10.1007/978-1-4471-6281-0_7

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-6280-3

Online ISBN: 978-1-4471-6281-0

eBook Packages: EnergyEnergy (R0)