Abstract

This account of turnpike theorems concentrates on the discrete time model, descended from the early von Neumann growth model and the Dosso model. It portrays the current state of the theory under the following five headings: (i) a turnpike in the von Neumann model, (ii) a turnpike in the Ramsey model, (iii) Ramsey models with discounting, (iv) turnpike theorems for competitive equilibria, and (v) further generalizations. It emphasizes von Neumann facets and neighborhood convergence as the author’s principal contribution to the theory. Under (v), it discusses models that allow for habit formation so that current preferences are affected by past consumption, and for non-convex technologies that have an initial phase of increasing returns followed by a terminal phase of decreasing returns. The theorems that have been reviewed are all concerned with the convergence of optimal paths to stationary optimal paths. However, the method of the proofs is to show that optimal paths converge to one another. The considerable literature on continuous time models related to the literature on the investment of the firm and to the engineering literature on optimal control, as well as applications of the asymptotic results of optimal growth theory to the theory of finance, have not been reviewed.

Access provided by CONRICYT-eBooks. Download reference work entry PDF

Similar content being viewed by others

Keywords

- von Neumann growth model

- Ramsey model

- Asymptotic convergence

- Neighborhood turnpike theorem

- Competitive equilibrium

- Intertemporal resource allocation

JEL Classifications

The classical economists discussed the eventual convergence of the economy to a stationary state as a consequence of the growth of population and the accumulation of capital, in the absence of continual technical progress or continual expansion of natural resources (Mill 1848, Book IV, ch. V). In their theories they proposed a natural level of real wages equal to subsistence wages and a natural rate of profit just sufficient to prevent decumulation of capital. With a given amount of land and given methods of production, wages and profits would tend to these levels. Both the classical and the neoclassical economists also described a progressive state of the economy where capital accumulates faster than population grows and where technical improvements occur. Cassel (1918, ch. 1, section 6) explicitly considers a ‘uniformly progressing state’ in which resources and population grow at the same constant rate. However, there is no suggestion that competitive equilibrium converges to such a state.

Ramsey (1928) introduced another type of convergence result in which population, natural resources, and technology are constant but capital is accumulated in an optimal way, that is, in a way to maximize in some sense the sum of utility from consumption over the future. In an aggregative model with one good he describes an optimal path for the capital stock that converges over time to the stock providing the maximum sustainable utility.

A second development in capital theory occurred a few years later and provided the second component of the eventual asymptotic theory for optimal paths. A disaggregated model of capital accumulation was described by von Neumann (1937). In this model there were many alternative production processes with many capital goods as inputs and as outputs. However, labour inputs and consumption did not appear explicitly. In effect, labour was treated as an intermediate product produced by given consumption processes, which were integrated into the processes presented in the model. These processes had stocks of goods as their only inputs and outputs, so all flows of services and intermediate products were suppressed through integration with other processes. Also there were no scarce non-producible goods (natural resources). In this model with a finite number of goods and processes von Neumann proved that there exists a kind of competitive equilibrium in which the maximal rate of uniform expansion of capital stocks is achieved. He proved that this equilibrium is supported by prices in the sense that activities in use earn zero profits and other activities earn zero or negative profits. Also the interest rate implicit in the price system is equal to the maximum rate of expansion.

A Turnpike in the von Neumann Model

The von Neumann model may be defined by an input matrix A = [aij] and an output matrix B = [bij]. The term aij ≥ 0 represents the input of the ith good needed at a unit level of the jth activity, and bij ≥ 0 represents the output of the ith good achieved at a unit level of the jth activity. There are n goods and m activities so A and B are n × m. Inputs occur at the start of a production period, which is uniform for all activities, and outputs appear at the end of the period. Goods at different levels of depreciation are treated as different goods but the number of goods may be as large as needed to achieve an adequate approximation to reality.

An equilibrium of the von Neumann model is defined by a price vector p ≥ 0, a vector of activity levels x ≥ 0, and a rate of expansion a > 0 which satisfy the relations (1) Bx ≥ αAx, (2) pB ≤ αpA, and (3) pBx > 0. Relation (1) provides that output is adequate to supply next period’s input requirements. Relation (2) implies that no activity is profitable. Relation (3) implies that some good that is produced has a positive price. Since the relations are homogeneous in x and p, x and p may be chosen to satisfy \( {\sum}_1^m{x}_j=1 \) and \( {\sum}_1^n{p}_t=1. \) If (1) is multiplied on the left by p and (2) on the right by x, we find that pBx = αpAx > 0. Therefore, some activities are used and they earn zero profits.

Assume the conditions (1) aij > 0 for some i and any j, (2) bij > 0 for some j for any i and (3) if α′ is the maximum value of a such that Bx ≥ Ax holds for some x ≥ 0, then Bx > 0 (irreducibility). With these conditions (essentially) von Neumann proved that the model has a unique equilibrium, after normalizing x and p, and that the equilibrium value of α is the maximal rate of proportional expansion.

The turnpike name was applied to an asymptotic result for the von Neumann model by Dorfman et al. (Dosso) (1958). They consider paths of accumulation starting from given initial stocks which maximize the size of terminal stocks at the end of the period of accumulation where the proportions of goods in the terminal stocks is specified in advance. They show that for sufficiently long paths which are maximal in this sense the configuration of stocks will be within an arbitrary neighbourhood of the von Neumann equilibrium for all but an arbitrary fraction of the time. This theorem gives the von Neumann equilibrium, which is called ‘the turnpike’, a general significance for efficient accumulation. An efficient path may be supported by prices just as the equilibrium path is. The turnpike theorem was conjectured by Samuelson (1966) in an unpublished Rand research memorandum as early as 1949. The Dosso theorem is a local result which was proved (not quite completely) for a two sector model. It was extended in a rigorous way to an n sector model by McKenzie (1963).

A global turnpike theorem was proved for a von Neumann model with many capital goods by Radner (1961), who also introduced the ‘value loss’ method of proof. This method of proof has been very productive of other turnpike results in subsequent years. Radner’s model also allows an infinity of processes and joint production. The equilibrium theorem was extended to this context by Gale (1956). We will consider Radner’s theorem in the model with a finite list of processes. Make a further assumption, (4) if (x, p, α) is a von Neumann equilibrium and x1 0 is any other vector of activity levels, p(B − αA)x1 < 0. With this assumption Radner proved a ‘value loss’ lemma which may be stated in this way, for any ε > 0 there is δ < 1 such that pBx1 ≤ (αpAx1), if x1 is any vector of activity levels, and |x1/|x1| − x/|x|| > ε. With this lemma it is easy to prove a turnpike theorem.

Let a sequence of captial stock vectors, (y0, y1, …, yT) be a path if there is a corresponding sequence of activity vectors (x1, x2, …, xT) such that yt = Axt+1 for t = 0, …, T − 1, and yt ≥ Bxt for t = 1, …, T. Assume that the vector y0 of initial stocks satisfies y0 > 0. Then by disposal y < y0 may be chosen so that y = Ax and (x, p, α) is a von Neumann equilibrium. Then (y, αy, …, αTy) is a feasible path (the comparison path). Suppose (y0, y1, …, yT) is a maximal path. Then the value loss lemma implies that for any ε > 0 there is δ < 1 such that δαpyt≥ pyt+1when |xt/|xt| − x/|x|| > ε. But the equilibrium conditions imply αpyt≥ pyt+1. Thus if xt/|xt| is outside the ε-neighbourhood of x/|x| for τ periods then for T > τ it will be true that

Let the desired configuration of terminal stocks be given by the vector y. Define a utility function on terminal stocks by \( \rho (z)=\min \kern0.5em z(i)/\overline{y}(i) \) over i = 1, …, n. Then (y0, …, yT) maximal implies

Since y > 0, ρ(y) > 0. Now choose the length of the equilibrium price vector p so that \( p(i)\ge 1/\overline{y}(i) \) for some i with p(i) > 0. This implies that

Combining (1), (2), and (3), gives the sequence of inequalities

The first and last terms of (4) imply that δτ cannot exceed ρ(y)/py0 which is a well defined positive number. Thus (4) implies that an integer \( \overline{\tau} \) exists such that xt/|xt| cannot lie outside the ε-neighbourhood of x/|x| for more than \( \overline{\tau} \) periods regardless of the length T of the accumulation path. Since y and yt are linear transforms of x and xt+1, an analogous statement holds for y and yt. This is a stronger form of the conclusion of the original Dosso theorem.

A Turnpike in the Ramsey Model

Ramsey’s aggregative model of capital accumulation was extended to a model with a growing population by Koopmans (1965). Koopmans defines optimality as the maximization of a sum of per capita utilities. When utility is not discounted, he proves that the optimal path converges monotonically to the stock that provides maximum sustainable per capita utility. However, he is also able to treat the case of discounted utility, a case which was not analysed in a satisfactory way by Ramsey. The optimal path of stocks in the discounted case is shown to converge monotonically to the stock for which the marginal product of capital is equal to the sum of the rate of population growth and the rate of discount on utility. The generalization of this result to the many goods case proved very difficult and was only achieved much later by Scheinkman (1976) and Cass and Shell (1976). Also Cass (1966) proved a turnpike theorem for this discounted model with a per capita objective in the sense of Dosso where the accumulation period is finite and a terminal stock is specified. This was proved in an aggregative model.

The spirit of the original turnpike theorem is not well preserved in the aggregative model since the emphasis in the original theorem lies on the relative composition of the capital stock. Samuelson and Solow (1956) generalized the original Ramsey analysis to many goods in a model based on a strictly concave social production function. However, the first rigorous proof of a turnpike result in a Ramsey setting with growing population and more than one capital good was given by Atsumi (1965) in a neoclassical model with two goods, the Dosso model with a Ramsey style objective stated in terms of utility sums. On analogy with the theorem of von Neumann, Atsumi established the existence of a unique maximal balanced growth path along which capital stocks expand at the rate of population growth. The path is maximal in the sense that per capita consumption is maximized over the set of balanced growth paths expanding at the rate of population growth. However, the path is also the only such balanced growth path that is efficient. It is price supported like the von Neumann path, except that consumption goods are now treated as net output rather than as intermediate product. The rate of interest is equal to the growth rate as in von Neumann’s case. If the growth rate of population is zero the balanced growth path represents capital saturation, or Ramsey’s bliss.

In order to prove the turnpike theorem Atsumi proved a value loss lemma analogous to Radner’s lemma for the von Neumann model. He also gave a new definition of an optimal path, that a path is optimal if its utility sums over sufficiently longer initial periods exceed the utility sums of any given alternative path over the same periods. This criterion, in variant forms, is called the overtaking criterion. It was proposed in the same journal issue in a slightly different form, allowing ‘eventually equalling’ as well as ‘exceeding’, by Weiszäcker (1965), who used it to discuss the existence of optimal paths. Atsumi proves that infinite optimal paths converge to the maximal balanced growth path. He also proves a theorem for finite optimal paths with assigned terminal stocks analogous to the Dosso theorem.

Turnpike theorems for the general multisector model with a Ramsey objective and a von Neumann technology were first proved by Gale (1967) and McKenzie (1968). Their order of proof does not differ from that of Atsumi, which is, in turn, parallel to the proof used by Radner in the model with maximal growth as an objective. It is simplest to stay close to to the von Neumann model. Let Y represent a reduced model for the activity of one period where (u, y, −x) is a typical element of Y. In the typical element, u is a real number giving a per capita utility level for the period, y ≤ 0 is a vector of terminal stocks, and x ≥ 0 is a vector of initial stocks. There are n goods. Since Y is independent of time and of past activities, this model does not allow depletable natural resources or technical progress. Assume

- I.

Y is a closed convex subset of 2n + 1 dimensional Euclidean space. Also (u, y, −x) ∈ Y implies that (u′, y′, −x′) ∈ Y when u′ ≤ u, 0 ≤ y′ < y, and x′ ≤ x, that is, there is free disposal.

- II.

There is \( \overline{x} \) such that (u, y − \( \overline{x} \)) ∈ Y and y > \( \overline{x} \), that is, \( \overline{x} \) is expansible.

- III.

(a) For any ξ there is η such that |x| < ξ and (u, y, −x) ∈ Y implies u < η and |y| < η. (The output from bounded input is bounded.) (b) There is ζ and γ < 1 such that (u, y, −x) ∈ Y and |x| ≥ ζ implies |y| < γ|x|. (All paths are bounded.)

- IV.

If (u*, k*, −k*) ∈ Y and u* ≥ u for any (u, y, −x) ∈ Y, then k* is expansible.

A path in this model is a sequence (ut, kt, −kt−1) ∈ Y for t = 1, …, T, with T finite or infinite and (ut, kt, −kt−1) ∈ Y for each t. The existence of k* which defines a path of maximal utility at balanced growth is guaranteed by assumptions I, II, and III. It may be proved that a price vector p* ≥ 0 exists which satisfies the support property.

Define the von Neumann facet F of the technology set Y as all (u, y, −x) ∈ Y such that u + p*(y − x) = u*. This means there will be no value loss when the path of accumulation lies on F. However, when the path is off F, a value loss lemma due to Atsumi (1965) applies and for any ε > 0 there is δ > 0 such that if (u, y, −x) lies outside the ∈-neighbourhood of F it follows that

As before a comparison path is found, but no longer simply by disposal to an equilibrium. a lemma due to Gale (1967) implies that a path exists from any expansible stock to any other expansible stock. Thus k0 expansible and k* expansible (Assumption IV) implies that a path exists from k0 to ks = k* for some integer s. Then kt = k* may be maintained indefinitely for t > s.

With this preparation the proof of the turnpike theorem as given by McKenzie (1968) is straightforward. Let u1 be the utility sum along the approach to k* from k0 along the comparison path and let (ut, kt, −kt−1t = 1, 2, … be an optimal path by the overtaking criterion. Suppose the optimal path lies outside the ε-neighbourhood of F for τ periods. Let u1 be the period in which the optimal path overtakes the comparison path and let \( T>\overline{t} \) be chosen arbitrarily. Consider the inequalities

The first inequality is justified by T > \( \overline{t} \) and optimality. The second inequality follows from (5) and (6). However, (7) implies that τ ≤ (su* − u1)/p*(kt − k0), which is a constant. Since ∈ is arbitrary, it is clear that an optimal path converges to F. Indeed, as one might suspect from (7), paths that are any good converge to F, since paths that do not converge become indefinitely worse than the comparison path. Also there is no difficulty in proving the analogue of the Dosso type of theorem for finite paths when terminal stocks are specified.

In order to prove that optimal paths converge to a maximal balanced path or, in per capita terms, a maximal stationary path, the assumptions must be strengthened. The most general assumption is that the von Neumann facet F is stable, in the sense that all paths that remain on the facet forever converge uniformly to a maximal stationary path. The assumption in this general form was proposed by Inada (1964) for the von Neumann model. Then it may be proved that a path which converges to a stable facet must also converge to the stable point on the facet (see McKenzie 1968). The simplest case arises when F = {(u*, k*, −k*)}. This is analogous to the case analysed by Radner for the von Neumann model. It is implied if it is assumed that the technology set Y is strictly convex. However, it should be noted that strict convexity of Y is not consistent with neoclassical models of production when goods are produced by independent industries, even though consumer utilities are strictly concave functions of consumption. Indeed, as Bewley (1982) has pointed out, it is not consistent with the use of machines in production since an input of m machines leads to an output of m older machines at the end of the period. The behaviour of paths on F may be studied by means of difference equations which are defined in terms of points (uj, yj, −xj) ∈ F that span F. In the analogous problem for the von Neumann case this was done explicitly for the generalized Leontief model by McKenzie (1963). However, the time that can be spent outside an ∈-neighbourhood of the turnpike by an optimal path is no longer a given number of periods but a given fraction of the total time of accumulation. Even though the facet is not stable, it was proved by Brock (1970) that if the maximal stationary path is unique the average capital stock of an optimal path over time converges to the capital stock of the maximal stationary path.

Ramsey Models with Discounting

Turnpike theorems for Ramsey models with von Neumann technologies and positive discounting of utility are much harder to prove. The difficulty is that discounting utility implies discounting value losses, so value loss is bounded and need not exceed the loss from going over to a comparison path. The first theorems were due to Scheinkman (1976) and Cass and Shell (1976). These were global results proved for models defined by differentiable functions. Also the theorems are proved for discount factors sufficiently close to 1. Scheinkman showed for discount factors close to 1 and with Y strictly convex that the optimal path would visit a small neighbourhood of the maximal stationary path at least once. Then he showed that if this neighbourhood were small enough the path would not leave it but would in fact converge to the maximal stationary path.

The reduced model that is frequently used for the multisector Ramsey case with discounting expresses per capita utility over a period by a function u(x, y) where x is the vector of initial stocks per capita and y is the vector of terminal stocks per capita. The function expresses the maximum utility achievable during the period given these and conditions. It is assumed that utility in one period is independent of events that occur in other periods except as they influence the initial or terminal stocks of that period. The technology set Y described for the model without discounting corresponds to the epigraph of the function u. The function u is defined on a convex set D contained in the positive orthant of a Euclidean space of dimension 2n, the Cartesian product of the space of initial stocks and the space of terminal stocks. Let the discount factor be ρ < 1. The assumptions are

- I′.

The utility function u(x, y) is concave and upper semi-continuous. If (x, y) ∈ D, then (z, w) ∈ D for all z ≥ x and all w such that 0 ≤w ≤ y. Also u(z, w) ≤ u(x, y) holds (free disposal).

- II′.

There is \( \overline{x} \) such that (\( \overline{x}y\in D \)) and \( \rho y>\overline{x} \), that is \( \overline{x} \) is ρ-expansible.

- III′.

For any ξ there is η such that |x| ≤ ξ and (x, y) ∈ D implies |y| < η. (b) There is ζ and γ < 1, such that (x, y) ∈ D and |x| ≥ ξ implies |y| < γ|x|.

These assumptions are closely parallel to the assumptions of the undiscounted Ramsey model except that the expansibility assumption is strengthened. It is easily seen that any neoclassical model with utility defined on consumption and labour services and a production function that converts inputs of labour services, initial stocks of capital, and natural resource flows into outputs of capital goods and consumption goods corresponds uniquely to a reduced model. The utility function of the reduced model is derived by maximizing the utility of consumption and labour services given the initial and terminal stocks of capital goods. Upper semi-continuity of utility carries over from the neoclassical model to the reduced model.

A path is a sequence {kt}, t = 1,2,…, such that (kt−1;kt) ∈ D for all t.

A path {kt} is optimal if \( {\sum}_1^{\infty }{\rho}^tu\left({k}_{t-1},{k}_t\right)\ge {\sum}_1^{\infty }{\rho}^tu\left({k}_{t-1}^{\prime },{k}_t^{\prime}\right) \) holds for every path {k′t}. On Assumptions I′, II′, and III′ it may be proved that a stationary path with kt = k, all t, exists which is price supported in the sense that there exists a vector q ≥ 0 such that

We may use the relation (8) to prove that kt = k defines an optimal path from k. Let k′t be any path from k with k′0 = k. Then summing the relations (8) over the path gives for any T ≥ 1,

where δt ≥ 0. Since k′t is non-negative and bounded, and ρT → 0 as T → ∞, in the limit the right-hand side of (9) is less than or equal to 0 which establishes the optimality of {kt}.

In the discounted model it is also useful to have prices to support any optimal path. Let V(x) = sup \( {\sum}_1^{\infty }{\rho}^tu\left({k}_{t-1},{k}_t\right) \) over all paths {kt}, t = 0, 1, …, with k0 = x. Put V(x) = −∞ if no path from x exists. Define a sufficient stock as a stock from which there exists a path that reaches an expansible stock in finite time. It has been proved by McKenzie (1974), extending a result of Weitzman (1973), that a price sequence {q1} exists for any optimal path {kt} that starts from a sufficient stocks k0. This price sequence satisfies

and

where τ is independent of ρ.

Using the prices q1 as well as the prices q(ρ) that support a stationary optimal path k(ρ) allows the definition of a symmetric value loss function L(t) = [qt(ρ) − q(ρ) (kt(ρ) − k(ρ)] which can play a crucial role in proving turnpike theorems for this model. It should be kept in mind that L(t) depends on ρ and on the particular k(ρ) as well.

If one writes (10) with (x, y) = [k(ρ), k(ρ)] and then writes (10) again with the roles of kt and k(ρ) reversed, with the support prices of k(ρ), that is, [q(ρ), q(ρ)] in place of (qt, qt+1), subtracting the second version of (10) from the first gives the result

Doing the same operation with (11) gives

Then using L(t) in a similar manner to the asymmetric value loss for the undiscounted model a turnpike result may be proved for paths which start from a sufficient stock.

Define a von Neumann facet F[k(ρ)] for this model as the set of all (x, y) ∈ D such that u(x, y) + q(ρ)y − ρ−1q(ρ)x = u[k(ρ), k(ρ)] + (1 − ρ−1)q(ρ)k(ρ). This is the projection of a flat in the graph of the function u(x, y) on the commodity space. There is a von Neumann facet for every non-trivial stationary optimal path, that is, for every stationary optimal path k(ρ) which satisfies the condition that u[k(ρ), k(ρ)] is maximal over the set of (x, y) such that ρy − x ≥ (ρ − 1)k.

If ρ = 1, this set is the same as that over which u(k, k) is maximal.

Say that a point (x, y) ∈ D is supported by the prices (p, q) if u(x, y) + qy − ρ−1px ≥ u(z, w) + qw − ρ−1pz for any (z, w) ∈ D.

Two additional assumptions are made. Let \( \overline{\rho} \) be a value of ρ for which D satisfies assumption II′. Assume

- IV′.

If (p, q) are support prices for some point of the von Neumann facet F[k(ρ)] where \( \overline{\rho} \) ≤ ρ ≤ 1, then (p, q) = [q(ρ), q(ρ)].

In other words, the von Neumann facet has a unique support. Assumption IV′ implies that L(t) is zero F[k(ρ)] and that L(t) is close to zero in a small neighbourhood of F[k(ρ)]. This assumption is needed since kt(ρ)] is need not be near k(ρ) even though [kt(ρ), kt+1] is near F[k(ρ)].

The second assumption is needed to obtain a uniform value loss condition which is analogous to (6) in the undiscounted model for all F(k(ρ)), \( \overline{\rho} \)≤ρ < 1. Let δ(k(ρ), (x, y)) be the deficiency of the right-hand side of (10) when kt = kt+1 = k(ρ) and qt = qt+1 = q(ρ). Assume

- V′.

For any ε > 0 there is δ > 0 such that |x| < ξ and (x, y) outside the ∈-neighbourhood of F[k(ρ)] implies that δ[k(ρ), (x, y)] > δ for any ρ with \( \overline{\rho} \)≤ ρ < 1 and any choice of k(ρ).

Rewrite (12) in the form

As a consequence of V′ the value loss δ may be chosen uniformly over ρ and k(ρ). Then ρ may be chosen so that (ρ−1 − 1)L(0) ≥ −δ/2, uniformly. Moreover, this condition continues to hold for t ≥ 0 which implies that L(t) grows by an indefinite amount unless the path enters the ε-neighbourhood of F(k(ρ)). This it must do or violate (13). Then using Assumption IV′ the existence may be established of an ε′-neighbourhood to which the path is subsequently confined. Also the ε′-neighbourhood can be made arbitrarily small by the choice of ε. For the details of this argument see McKenzie (1983). It is not implied that the k(ρ) are unique or that cyclic paths, or even chaotic paths, are absent. However, these paths must eventually lie in the ε′-neighbourhood. The larger is the neighbourhood chosen, the smaller the discount factor that may be allowed. It is implied that all k(ρ) for a given ρ lie in the ε′-neighbourhood of any one of the F(k(ρ)). An example using the discounted utility function ρtu(x, y) = ρtxβ(1 − y)1−β, 0 < ρ ≤ 1, 0 < β < 1 is described in McKenzie (1983).

As in the undiscounted model it is possible to go beyond facet stability on further assumptions. Most simply if strict concavity of u(x, y) is assumed the von Neumann facets are trivial since F[k(ρ)] = {{k(ρ)}}. Then a neighbourhood theorem is implied for the nontrivial optimal stationary paths, each of which must lie within e of any other. Indeed, it may be shown for differentiable u(x, y) that the optimal stationary path is unique for ρ near enough to 1 (Brock 1973). Indeed, Boldrin and Montrucchio (1986b) have a simple condition on ρ in terms of the concavity of u which implies uniqueness. Even without strict concavity convergence to a neighbourhood of k(ρ) may be proved if it is assumed that k(1) = k* is unique (in any case the set of maximal stationary paths is convex) and that the von Neumann facet F(k*) = F is stable in the sense that all paths in F converge uniformly to (k*, k*).

Suppose u(x, y) is strictly concave and twice continuously differentiable. Also assume that the Hessian matrix of u is negative definite at (k*, k*). Then ρ may be chosen close enough to 1 so that the matrix

evaluated at (k(ρ), k(ρ)) is negative definite. Here uxy = ∂2u(x, y)/∂x∂y, and analogously for the other blocks for Q(ρ). If k0 is sufficient, the neighbourhood turnpike theorem implies that the path is eventually confined to a neighbourhood where Q(ρ) is negative definite when ρ is chosen sufficiently near 1. If this neighbourhood is small enough it may be shown that L(t + 1) − L(t) is positive and L(t) ≤ 0 will be violated unless k(t) converges to k* (McKenzie 1985). The condition Q(ρ) negative definite assumed over the interior of D was proposed by Brock and Scheinkman (1978) and used to prove a global turnpike theorem.

An asymptotic result is also available when the von Neumann facets have positive dimension. The conditions needed are Q(ρ) negative definite at (k*, k*) in directions leading immediately off the facet F, the absence of cyclic paths on F, and the condition that the stable manifold at (k*, k*) have a tangent plane whose projection on the input space covers a neighbourhood of k*. The implications of these conditions for the neoclassical model without joint production have been studied by Takahashi (1985).

The turnpike theorems for the multisector Ramsey model thus far described depend on discount factors near 1. There are some theorems, however, which are free of this condition. Suppose u(x, y) is twice continuously differentiable in the interior of D and strictly concave. Under Assumptions I′–V′ a necessary and sufficient condition for the optimality of a path {kt which is bounded away from the boundary of D is

for t = 1, 2, …, Araujo and Scheinkman (1977) consider the Jacobian of the infinite sequence of equations given by (15). They define a notion of dominant diagonal blocks for the Jacobian and show that this, together with local asymptotic stability, implies that kt converges to k(ρ). However, the assumption of local stability has been shown to be unnecessary (McKenzie 1977). The dominant diagonal block condition is independent of ρ.

An interesting special case arises where u12[k(ρ), k(ρ)] is nonsingular and symmetric and the linearization of (15) at kt−1 = kt = kt+1 = k(ρ) does not have roots of unit modulus. Then the dominant diagonal block condition for the optimal stationary path kt = k(ρ) is necessary and sufficient for local stability (Dasgupta and McKenzie 1985). However, the dominant diagonal block condition is sufficient for global stability, so in this case it is necessary and sufficient for global stability.

Another approach of turnpike theory which is independent of ρ has been found by Boldrin and Montrucchio (1986a). Assume that u(x, y) is concave and strictly concave in y. Define the binary relation P by yPx if and only if u(x, x) + ρV(x) < u(x, y) + ρV(y), where V is the value function. Let the projection of D on the space of initial stocks be a compact set X. P is said to be acyclic if there is no sequence (x1, …, xn) such that xi+1Pxi for i = 1, …, n, when xn+1 is set equal to x1. Define the policy function f(x) equal to the maximizer of u(x, y) + ρV(y) over y. Then f(x)Px holds whenever f(x) ≠ x. Any optimal path is generated by repeated applications of f. Suppose the optimal stationary path kt = k(ρ) is unique. Then if P is acyclic, all optimal paths converge to k(ρ). But it may be seen that P is acyclic if and only if \( {\sum}_1^nu\left({x}_t,{x}_t\right)\ge {\sum}_1^nu\left({x}_t,{x}_{t+1}\right) \), for every path (x1, …, xn) and xn+1 = x1. This condition holds, for example, if u(x, y) = φ(x) + ψ(y − x), which has been referred to as the separable case. This case occurs in some models of investment by the firm in which u is a profit function (see Treadway 1971).

Turnpike Theorems for Competitive Equilibria

In recent years the circle has been completed and turnpike theorems have led to asymptotic results for the theory of competitive equilibrium. These results bear some analogy to the convergence to a stationary state described by the classical economists. However, the modern results are based on capital accumulation in the absence of a population dynamics. There is also an analogy to the Dosso theorems on efficient capital accumulation in the von Neumann model, but now it is utility maximization rather than efficient capital accumulation that defines the path.

The equilibrium model with many households was described briefly by Ramsey but the first serious analysis of the model was given by Becker (1980), who verified Ramsey’s conjecture that the long-run equilibrium would place all capital in the hands of the most thrifty households. Subsequently Bewley (1982) applied the turnpike results of optimal growth theory to prove that the competitive equilibrium path with infinitely lived households, who hold identical discounts on future utility from consumption, will converge to a stationary equilibrium. He made use of the duality of competitive equilibrium and a social optimum which was described by Negishi (1960).

Bewley presents an equilibrium model in which production over the infinite horizon is decentralized to a finite number of firms that possess in each period strictly concave production functions which are twice continuously differentiable. Similarly the consumers, who are finite in number, have strictly monotone, strictly concave, and twice continuously differentiable utility functions in each period. Zero production is possible and primary inputs are necessary for production. Each firm maximizes its profit over the future at present prices. Each consumer maximizes his discounted utility sums from consumption over the future subject to a budget constraint derived from the value of his endowment of primary goods (assumed the same in each period) and his share of firms’ profits, all calculated at present prices. To guarantee income each consumer is assumed to have a positive endowment of some primary good which is also a consumption good. It is feasible to produce a positive amount of all goods in all periods. Finally it is assumed that in any stationary equilibrium (with transfer payments) every firm has positive initial stocks of all produced goods. Transfer payments must be allowed in the stationary equilibrium since the consumer’s budget is balanced only over the infinite horizon, so that asymptotically he may be (in effect) a debtor or a creditor and (in effect) pay or receive interest.

An equilibrium is a feasible allocation {xh(t), yf(t)}, t = 1, 2, …, where h indexes consumers and f indexes firms, together with a price vector p(t) such that \( {\sum}_0^{\infty }p(t)<\infty, \) and where each consumer maximizes utility and each firm maximizes profit. In a stationary equilibrium the budget constraint for consumers is written px(t) ≤ pxh(t) to take account of the transfer payments which may occur. It is proved that if all consumers have the same discount factor and this discount factor is sufficiently close to 1, then the allocation of the competitive equilibrium converges exponentially to the allocation of a stationary equilibrium with transfers \( \left({\overline{x}}_h(t),{\overline{y}}_f(t),\overline{p}(t)\right). \)

The proof that the equilibrium converges to a stationary state is given by identifying the competitive equilibrium with the maximization of a weighted sum of consumers’ utilities which is given by V(K) = sup \( {\sum}_{t=0}^{\infty }{\rho}^t{\sum}_h{\varLambda}_h^{-1}{U}_h\left({x}_h(t)\right). \) The weights \( {\varLambda}_h^{-1} \) are the inverses of the marginal utilities of expenditure, and ρ is the discount factor on future utility, K is the vector of initial stocks of capital (produced goods), V is a maximum of the weighted utility sum over all consumption streams consistent with the initial stocks K, the endowments, and the production functions of the firms. Bewley shows that V(K(t)) may be used as a Lyapounov function to establish that K(t) converges to \( \overline{K} \) which is the vector of stocks of a stationary optimal path for the optimal growth problem and of a stationary competitive equilibrium with transfers that corresponds to it. The proof depends on the consumers’ utility functions being concave, not just quasi-concave. Bewley’s theorem differs from the other asymptotic theorems we have considered in that the stationary state depends on the initial stocks since they affect the weights \( {\varLambda}_h^{-1} \), that is, the relative wealth of consumers.

Other theorems analogous to Bewley’s have been proved by Yano (1984a, 1985). Yano describes a model with a production sector given by a cone with a cross-section which is strictly convex in the neighbourhood of the path achieving maximum sustainable utility. This is analogous to the model used by Radner for the Dosso problem. As a consequence the production sector does not have a multiplicity of firms with distinct technologies since this would lead to flats in the production cone. However, his consumers are allowed to have different tastes and endowments. He dispenses with differentiability and proves a neighbourhood turnpike theorem similar to McKenzie’s but applying to a competitive equilibrium path. The turnpike depends on consumer endowments and initial stocks as in Bewley’s analysis.

Yano also shows (1984b) that the turnpikes in the discounted model can be brought within an ε-neighbourhood of a stationary competitive equilibrium without discounting for arbitrary ε > 0 for an appropriate choice of ρ and a given initial distribution of capital. In this sense the equilibrium turnpike has an invariance to initial stocks typical of the turnpikes of optimal growth theory. The explanation is that as ρ converges to 1, the importance of initial stocks compared with future endowments becomes negligible in determining the wealth of the consumer. The stationary competitive equilibrium without discounting is based upon the capital stocks that achieve capital saturation, as at Ramsey’s bliss point. Thus there is no interest income and by homogeneity of production there is no profit. In other words, consumer wealth is independent of ownership shares in profits (which are zero) or in capital stocks (which have zero rental income). However, the distribution of endowments remains important, both of personal skills and of natural resources.

Some progress has been made toward handling the case of consumers whose discounts on future utility differ without leading to an asymptotic state in which all capital is in the hands of a few patient consumers. To avoid this outcome it is assumed that the discount on future utility depends on the level of utility achieved, either by the consumption of the current period or by the entire future consumption stream. Lucas and Stokey (1984) consider a model with one consumption good and many capital goods. They use a device of Koopmans (1960) to write the utility of a consumption stream 1C = (C1, C2, …) in terms of the first period consumption and the utility of the stream 2C = (C2, C3, …), that is, U(1C) = W(C1, U(2C)). In the case of additively separable utility the formula appears as U(1C) = U(C1) + ρU(2C), where ρ ≤ 1 is the discount factor. This suggests that the subjective discount factor implied by W be defined by W2, the derivative of W with respect to its second argument. Consider constant paths 2C = (C, C, …). Lucas and Stokey assume, unlike Fisher (1930), that along constant paths the discount factor W2, is a decreasing function of C. They prove in their model that the stationary state of the perfect foresight economy is unique on this assumption. They also prove a turnpike theorem for the competitive equilibrium of a two consumer model without production.

More recently Epstein (1987), using a continuous time version of the Lucas and Stokey model has succeeded in proving a turnpike theorem for a model with many consumers whose utility functions and implied discount factors may differ. He defines the implicit rate of time preference as equal to minus the proportional rate of change of marginal utility along a locally constant path. The corresponding periodwise discount factor would be approximately ρ = 1 − r. Then r is a function of current consumption and the utility of future consumption. However, he assumes r to be independent of current consumption but increasing in the utility of future consumption. He is able to prove with this assumption that all Pareto optimal paths of accumulation converge to a unique stationary path. Thus by the first welfare theorem all competitive equilibria converge to a unique stationary equilibrium. However, these results depend on implicit rates of time preference sufficiently close to 0, or else own rates of return in production sufficiently close to 0. Unlike the stationary equilibria of Bewley and Yano, this equilibrium is independent of initial stocks and their distribution of ownership. All that matters finally for the wealth of consumers are their endowments, repeated each period, and their rates of time preference. Such a result is compatible with classical ideas. The methods used by Epstein in his proof are derived from the work of Brock and Scheinkman (1976) in a differentiable multi-sector Ramsey model.

It should be pointed out that the assumptions made by these writers on the function W or U imply a weak form of separability between present and future consumption. Loosely speaking the ranking of future consumption bundles is not affected by current consumption, nor a fortiori by past consumption. Thus intuitively what is done by their formulation is to make the rate of time preference, or the implicit discount factor, depend on present consumption and the utility of the future consumption stream.

Further Generalizations

Turnpike theorems have also been generalized to allow habit formation so that current preferences are affected by past consumption (for example, Samuelson 1971; Heal and Ryder 1973). It has been shown by Epstein (1986) that the turnpike theorems hold in these circumstances if and only if a form of asymptotic independence holds or that the effect of earlier consumption on current preferences fades out over time.

The theorems on the correspondence of turnpike theorems for optimal paths and for equilibrium paths have been extended in two ways. Coles (1985) proved asymptotic convergence to the von Neumann facet in a model like that of Yano where separable additive utility is assumed and the discount factors of consumers may differ. This extension allows the use of capital equipment in production without introducing interdependence between industries.

On the other hand, the Bewley theorems were extended by Marimon (1984) to a stochastic model. The preferences and technology, as well as the discount factors and endowments, are made to depend on a stationary and transitive stochastic process. The equilibrium is that of a complete Arrow-Debreu market in which consumers own given shares of the firms and all trading occurs at the initial date. Marimon proves that the equilibrium allocation converges almost surely to the allocation of a stationary equilibrium with transfer payments. This result holds when the discount factors are sufficiently close to 1, almost surely. From the viewpoint of optimal growth his results generalize those of Brock and Mirman (1972) for the one sector model, those of Evstigneev (1974) for the undiscounted multisector model, and those of Brock and Majumdar (1978) for the discounted multisector model.

Conditions have been found to guarantee the presence of cycles in models of economic growth and by the same token in models of competitive equilibrium.

These results are relevant to the study, of endogenous cycles in competitive economies, a study which has been pursued in overlapping generations models by Grandmont (1985). In the context of optimal growth models Benhabib and Nishimura (1985) have given sufficient conditions for robust periodic optimal paths in Ramsey models with additively separable utility and neoclassical technology. The utility function is strictly concave and there is one capital good. If u(x, y) is the reduced form utility function the basic condition for oscillations on interior optimal paths in the discrete time model is that u12(x, y) < 0 hold throughout the interior of D, the domain of definition of u. This says that larger initial stocks (an increase in wealth) cause the marginal utility of terminal stocks to be smaller (saving is discouraged). However, added conditions are needed to ensure sustained oscillations which are robust to small perturbations of the model. In particular, it is assumed there is a ρ such that u22 + ρu11 > (1 + ρ)u12 where the derivatives are evaluated at a nontrivial stationary optimal path.

This line of research has been further advanced by Boldrin and Montrucchio (1985). Consider a multisector Ramsey model defined by a reduced utility function u(x, y). Assume that u(x, y) is defined over a compact set \( D\subset XxX\subset {R}_{+}^n\times {R}_{+}^n \) where X is the projection of D on the first factor. Let u(x, y) be continuous and concave, strictly concave in y, strictly increasing in x and strictly decreasing in y. Define the optimal policy function f(x) = y where y is the unique vector of terminal stocks for the first period of an optimal path, when x is the vector of initial stocks. Let θ map X into X and assume that it may be extended to be twice continuously differentiable on x. Then there exists ρ*0 such that, given any ρ with 0 < ρ ≤ ρ*, θ is the policy function for some Ramsey problem satisfying the usual assumptions. Since the policy function can be chosen freely, it follows that no complex behaviour of optimal paths can be excluded, in particular chaotic paths are possible. Boldrin and Montrucchio also provide a way of calculating a possible value for ρ* in terms of the diameter of X and bounds on the derivatives of θ.

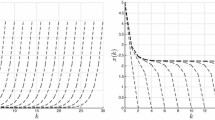

Another direction of generalization is to models with non-convex technologies. The principal turnpike results that have been proved with non-convexity are concerned with one good Ramsey models of optimal growth in which the production function has an initial phase of increasing returns followed by a terminal phase of decreasing returns (for example, Skiba 1978; Majumdar and Mitra 1982; Dechert and Nishimura 1983). Optimal paths in differentiable models with discrete time and discounted utility converge to steady states, that is, stationary paths, among which the origin is included. Nontrivial steady states are solutions of f′(x) = ρ−1 where f(x) is a differentiable production function. There cannot be more than two nontrivial steady states, k* in the concave region and k* in the convex region, and there may be none. Every optimal path converges to a steady state. If the discount factor ρ is near 1, optimal paths converge to k*. If ρ is small enough, they converge to 0. For intermediate values of ρ the turnpike depends on the initial capital stock. There is a critical value kc such that k0 < kc implies that optimal paths converge to the origin and k0 < kc implies that optimal paths converge to k*. If kc = k*, then kt = k*, t = 0, 1, …, is the unique optimal path from k0 = kc.

The theorems that have been reviewed are all concerned with the convergence of optimal paths to stationary optimal paths. However, the method of the proofs is to show that optimal paths converge to one another. Thus it is not really necessary that the reduced utility function be constant over time. Loosely speaking, constancy may be replaced by variation within bounds. The variation of the reduced utility function may reflect a varying production function and a varying utility function over consumption bundles. Examples of this approach are found in Keeler (1972), McKenzie (1974, 1976, 1977), Mitra (1979) and Brock and Magill (1979).

The account of turnpike theorems has concentrated on the discrete time model, which is descended from the early von Neumann growth model and the Dosso model. There is a considerable literature on the continuous time model which is related to the literature on investment in the firm and to the engineering literature on optimal control. With a continuous time model some results become available from the theory of differential equations which permit further theorems to be proved on the asymptotic behaviour of optimal paths. Many of these results are found in Brock and Scheinkman (1977). Particularly complete results for the local problem were found by Magill (1977). Also the asymptotic results of optimal growth theory have been applied in areas which have not been reviewed, for example, in the theory of finance (see Brock 1982).

This article was first published in The New Palgrave Dictionary of Economics, First Edition, 1987 and was updated with an abstract, keywords and JEL codes by Professor M. Ali Khan in June 2012.

Bibliography

Atsumi, H. 1965. Neoclassical growth and the efficient program of capital accumulation. Review of Economic Studies 32: 127–136.

Becker, R.A. 1980. On the long-run steady state in a simple dynamic model of equilibrium with heterogeneous households. Quarterly Journal of Economics 94: 375–382.

Benhabib, J., and K. Nishimura. 1985. Competitive equilibrium cycles. Journal of Economic Theory 35: 284–306.

Bewley, T.F. 1982. An integration of equilibrium theory and turnpike theory. Journal of Mathematical Economics 10: 233–268.

Boldrin, M., and L. Montrucchio. 1986a. On the indeterminacy of capital accumulation paths. Journal of Economic Theory 40: 26–39.

Boldrin, M., and L. Montrucchio 1986b. Acyclicity and stability for intertemporal optimization models, Working Paper. Rochester: University of Rochester, March.

Boldrin, M. and Montrucchio, L. 1986c. Private communication.

Brock, W.A. 1970. On existence of weakly maximal programmes in a multi-sector economy. Review of Economic Studies 37: 275–280.

Brock, W.A. 1973. Some results on the uniqueness of steady states in multisector models of optimum growth when future utilities are discounted. International Economic Review 14: 535–559.

Brock, W.A. 1982. Asset prices in a production economy. In The economics of information and uncertainty, ed. J.J. McCall. Chicago: University of Chicago Press.

Brock, W.A., and M. Magill. 1979. Dynamics under uncertainty. Econometrica 47: 843–868.

Brock, W.A., and M. Majumdar. 1978. Global asymptotic stability results for multisector models of optimal growth with uncertainty when future utilities are discounted. Journal of Economic Theory 18: 225–243.

Brock, W.A., and L. Mirman. 1972. Optimal economic growth and uncertainty the discounted case. Journal of Economic Theory 4: 479–513.

Brock, W.A., and J. Scheinkman. 1976. The global asymptotic stability of optimal control systems with applications to the theory of economic growth. Journal of Economic Theory 12: 164–190.

Brock, W.A., and J. Scheinkman. 1977. The global asymptotic stability of optimal control with applications to dynamic economic theory. In Applications of control theory to economic analysis, ed. J.D. Pitchford and Jose A. Scheinkman. Amsterdam: North-Holland.

Brock, W.A., and J. Scheinkman. 1978. On the long-run behavior of a competitive firm. In Equilibrium and disequilibrium in economic theory, ed. G. Schwödiauer. Dordrecht: D. Reidel.

Cass, D. 1966. Optimum growth in an aggregative model of capital accumulation: a turnpike theorem. Econometrica 34: 833–850.

Cass, D., and K. Shell. 1976. The structure and stability of competitive dynamical systems. Journal of Economic Theory 12: 31–70.

Cassel, G. 1918. Theoretische Sozialökonomie. Trans. from the 5th German edn. as Theory of Social Economy. New York: Harcourt, Brace, 1932.

Coles, J.L. 1985. Equilibrium turnpike theory with constant returns to scale and possibly heterogeneous discount factors. International Economic Review 26: 671–680.

Dasgupta, S., and L.W. McKenzie. 1985. A note on comparative statics and dynamics of stationary states. Economic Letters 18: 333–338.

de Araujo, A.P., and J.A. Scheinkman. 1977. Smoothness, comparative dynamics, and the turnpike property. Econometrica 45: 601–620.

Dechert, W.D., and K. Nishimura. 1983. A complete characterization of optimal growth paths in an aggregated model with a non-concave production function. Journal of Economic Theory 31: 332–354.

Dorfman, R., P. Samuelson, and R. Solow. 1958. Linear programming and economic analysis. New York: McGraw-Hill.

Epstein, L.G. 1986. Implicitly additive utility and the robustness of turnpike theorems. Journal of Mathematical Economics 15: 111–128.

Epstein, L.G. 1987. The global stability of efficient intertemporal allocations. Econometrica 55: 329–356.

Evstigneev, I.V. 1974. Optimal stochastic programs and their stimulating prices. In Mathematical models in economics, ed. J. Loś and M. Loś. Amsterdam: North-Holland.

Fisher, I. 1930. The theory of interest. New York: Macmillan.

Gale, D. 1956. The closed linear model of production. In Linear inequalities and related systems, ed. H.W. Kuhn and A.W. Tucker. Princeton: Princeton University Press.

Gale, D. 1967. On optimal development in a multi-sector economy. Review of Economic Studies 34: 1–18.

Grandmont, J.M. 1985. On endogenous business cycles. Econometrica 53: 995–1046.

Heal, G., and H. Ryder. 1973. An optimum growth model with intertemporally dependent preferences. Review of Economic Studies 40: 1–33.

Inada, K. 1964. Some structural characteristics of turnpike theorems. Review of Economic Studies 31: 43–58.

Keeler, E.B. 1972. A twisted turnpike. International Economic Review 13: 160–166.

Koopmans, T.C. 1960. Stationary ordinal utility and time perspective. Econometrica 28: 287–309.

Koopmans, T.C. 1965. The concept of optimal economic growth. In The econometric approach to development planning, Pontificae Academiae Scientiarum Scripta Varia No. 28. Amsterdam: North-Holland.

Lucas, R., and N. Stokey. 1984. Optimal growth with many consumers. Journal of Economic Theory 32: 139–171.

Magill, M.J.P. 1977. Some new results on the local stability of the process of capital accumulation. Journal of Economic Theory 15: 174–210.

Majumdar, M., and T. Mitra. 1982. Intertemporal allocation with a non convex technology: The aggregative framework. Journal of Economic Theory 27: 101–136.

Marimon, R. 1984. General equilibrium and growth under uncertainty: The turnpike property, Discussion paper No. 624. Evanston: North-western University, August, 1984.

McKenzie, L.W. 1963. Turnpike theorems for a generalized Leontief model. Econometrica 31: 165–180.

McKenzie, L.W. 1968. Accumulation programs of maximum utility and the von Neumann facet. In Value, capital, and growth, ed. J.N. Wolfe. Edinburgh: Edinburgh University Press.

McKenzie, L.W. 1974. Turnpike theorems with technology and welfare function variable. In Mathematical models in economics, ed. J. Loś and M.W. Loś. New York: American Elsevier.

McKenzie, L.W. 1976. Turnpike theory. Econometrica 44: 841–865.

McKenzie, L.W. 1977. A new route to the turnpike. In Mathematical economics and game theory, ed. R. Henn and O. Moeschlin. New York: Springer-Verlag.

McKenzie, L.W. 1983. Turnpike theory, discounted utility, and the von Neumann facet. Journal of Economic Theory 30: 330–352.

Mill, J.S. 1848. Principles of political economy. London: Parker. New edn, London: Longmans, Green, 1909.

Mitra, T. 1979. On optimal growth with variable discount rates: Existence and stability results. International Economic Review 20: 133–146.

Negishi, T. 1960. Welfare economics and existence of an equilibrium for a competitive economy. Metroeconomica 12: 92–97.

Radner, R. 1961. Paths of economic growth that are optimal with regard only to final states. Review of Economic Studies 28: 98–104.

Ramsey, F. 1928. A mathematical theory of savings. Economic Journal 38: 543–559.

Samuelson, P.A. 1966. Market mechanisms and maximization. In The Collected scientific papers of Paul Samuelson, ed. J. Stiglitz, vol. 1, 425–492. Cambridge, MA: M.I.T. Press.

Samuelson, P.A. 1971. Turnpike theorems even though tastes are intertemporally interdependent. Western Economic Journal 9: 21–26.

Samuelson, P.A., and R.W. Solow. 1956. A complete capital model involving heterogeneous capital goods. Quarterly Journal of Economics 70: 537–562.

Scheinkman, J. 1976. On optimal steady states of n-sector growth models when utility is discounted. Journal of Economic Theory 12: 11–20.

Skiba, A.K. 1978. Optimal growth with a convex-concave production function. Econometrica 46: 527–540.

Takahashi, H. 1985. Characterizations of optimal programs in infinite horizon economies. PhD thesis, University of Rochester.

Treadway, A.B.. 1971. The rational multivariate flexible accelerator. Econometrica 39: 845–855.

von Neumann, J. 1937. Über ein Okonomisches Gleichungssystem und eine Verallgemeinerung des Brouwerschen Fixpunktsätzes. Ergebnisse Eines Mathematischen Kolloquiums 8: 73–83. Translated in Review of Economic Studies 13, (1945): 1–9.

von Weiszäcker, C.C. 1965. Existence of optimal programs of accumulation for an infinite time horizon. Review of Economic Studies 32: 85–104.

Weitzman, W.L. 1973. Duality theory for infinite horizon convex models. Management Science 19: 783–789.

Yano, M. 1984a. Competitive equilibria on turnpikes in a McKenzie economy, I: A neighborhood turnpike theorem. International Economic Review 25: 695–718.

Yano, M. 1984b. The turnpike of dynamic general equilibrium paths and its insensitivity to initial conditions. Journal of Mathematical Economics 13: 235–254.

Yano, M. 1985. Competitive equilibria on turnpikes in a McKenzie economy, II: An asymptotic turnpike theorem. International Economic Review 26: 661–670.

Author information

Authors and Affiliations

Editor information

Copyright information

© 2018 Macmillan Publishers Ltd.

About this entry

Cite this entry

McKenzie, L.W. (2018). Turnpike Theory. In: The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95189-5_1628

Download citation

DOI: https://doi.org/10.1057/978-1-349-95189-5_1628

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-349-95188-8

Online ISBN: 978-1-349-95189-5

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences