Abstract

This paper looks at the causes of environmental degradation by regarding the asymmetric effect of financial development and energy consumption in the presence of urbanization and economic growth for South Asia. Using a yearly dataset from 1974 to 2014, this study employs the non-linear autoregressive distributive lag (NARDL) approach to investigate the asymmetry that emerges from positive or negative shocks of financial development and energy consumption. The results of NARDL model assert that the shocks in energy consumption, both positive and negative, significantly contribute to rise the environmental degradation in the long run and also cut down the density of \({\mathrm{CO}}_{2}\) emissions in the short run. In contrast, only a negative shock in financial development has an adverse and significant impact on \({\mathrm{CO}}_{2}\) emissions in the long run. Besides, the results of the ARDL model indicate that financial development declines environmental degradation, while energy consumption evolves the \({\mathrm{CO}}_{2}\) emissions in the long run. This paper suggests that policymakers may strive to attain high economic success using environmental favorable energy consumption and financial development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environment helpful economic progress have increased in place of only focusing on growth since the commencement of the industrial era (Teodorescu 2012; Muhyidin et al. 2015; Manzoor et al. 2018). The concept of sustainable development receives more attention from both developed and developing countries due to environmental degradation such as global warming and climate change. However, Uchiyama (2016) emphasized that there is a symphony among scholars that different economic approaches tempt environmental damages. Consequently, an ultimate discussion is about how to mitigate the effect of \({\mathrm{CO}}_{2}\) emissions without disturbing the economic activities. Collins and Zheng (2015) argued that to detect a quick solution for \({\mathrm{CO}}_{2}\) emissions is a difficult task. In the recent Paris agreement (12 December 2015), all countries stand into a universal motive to fight global warming and climate change. The prime aim of this agreement is to retain the global temperature increase of 2 °C till 2100.

Additionally, the objective is to enhance the capability of all nations to confront the effect of environmental degradations. Therefore, 20 nations including the United States, the United Kingdom, China, Australia, and India, were agreed to improve global assistance to overcome the threat of \({\mathrm{CO}}_{2}\) emissions. But a question emerges that how the developing economies make this hypothesis of agreement true. While most of the economy has achieved remarkable economic growth during the last decade, \({\mathrm{CO}}_{2}\) emissions also increase through multiple effects. Therefore, it is crucial to perceive how to reduce \({\mathrm{CO}}_{2}\) emissions by continuing the growth trend. Frankel and Romer (1999) described that we cannot avoid financial development, while the study deals with increasing \({\mathrm{CO}}_{2}\) emissions, since it enhances a country’s national income that ultimately raises \({\mathrm{CO}}_{2}\) emissions. Moreover, Sadorsky (2010) revealed that augmentative and proficient financial institutions appear with compatible consumer lending approaches, increasing the purchasing power of consumers such as houses, refrigerators, automobiles, etc. which produces more \({\mathrm{CO}}_{2}\) emissions. To clarify this solution for South Asia, this current study examines the asymmetric impact of financial development and energy consumption on \({\mathrm{CO}}_{2}\) emissions during 1974–2014 in the presence of economic growth and urbanization.

In recent years, several theoretical and empirical studies for different countries have expressed the conjunction between financial development and \({\mathrm{CO}}_{2}\) emissions. Academic scholars predominantly focus on this connection during the international financial crisis of 2007–2008. For instance: Ayeche et al. (2016) for European Countries; Tamazian and Rao (2010) for transitional economies; Hao et al. (2016) for China; Ozturk and Acaravci (2013) for Turkey; Yuxiang and Chen (2011) for China; Lee, Chen, and Cho (2015) for OECD economies; Mugableh (2015) for Jordan; Farhani and Ozturk (2015) for Tunisia; Tamazian et al. (2009) for BRIC economies; Shahbaz et al. (2013) for Malaysian economy; Boutabba (2014) for Indian economy; Charfeddine and Khediri (2016) for UAE; Dar and Asif (2018) for Turkey; Jalil and Feridun (2011) for China; Sehrawat et al. (2015) for India; Zhang (2011) for China; Dar and Asif (2017) for India; Siddique (2017) for Pakistan; Al-Muali et al. (2015) for 129 economies; Abbasi and Riaz (2016) for emerging countries; Dogan and Seker (2016) for top renewable energy economies; Godli et al. (2020) for Pakistan; Ahmad et al. (2018) for China; and Godli et al. (2020) for Turkey. In the theoretical work, Yuxiang and Chen (2011) explained that financial development has four different effects on environmental performance such as capitalization effect, technology effect, income effect, and finally, the regulation effect. Numerous empirical studies reveal the mixed impact of financial development on \({\mathrm{CO}}_{2}\) emissions. Addressing the positive impact of financial development, Ma and Stern (2008), Cole, Elliott, and Shimamoto (2005), Lundgren (2003), and Yuxiang and Chen (2011) concluded that not only financial development accelerates the economic condition ameliorating excellent manufacturing tools but also reduces environmental damages by declining pollution and loss in production.

Moreover, as mentioned by Lundgren (2003), financial development accounts as an investment effect for the economy by which it produces modern production equipment and update technology to alleviate environmental degradation. Also, financial development imposes several restrictions on product strategy and manages attractive funds for the company to be benefitted economically plus alleviating environmental degradation in production (Cole et al. 2005). In addition, Ma and Stern (2008) identify financial development as a technological benefit for both the economy and environment.Footnote 1 Conversely, several scholars find an inconsistent relationship between financial development and the environment. In general, financial development degrades environmental quality through producing more \({\mathrm{CO}}_{2}\) emissions (Ayeche et al. 2016; Tamaziana and Rao 2010; Ozturk and Acaravci 2013; Lee et al. 2015; Mugableh 2015; Farhani and Ozturk 2015; Basarir and Cakir 2015). As noted by Cole et al. (2005), financial development arises questionable signals for sustainable development by introducing new heavy industries. Additionally, Ozturk and Acaravci (2013) stated that there is no long-term significant impact of financial development on \({\mathrm{CO}}_{2}\) emissions for Turkey. Therefore, the relationship between financial development and \({\mathrm{CO}}_{2}\) emissions is ambiguous.

To the best of our know-how, the asymmetric combined association between financial development, energy consumption, and \({\mathrm{CO}}_{2}\) emissions is not explored for South Asia. Our paper contributes to the relevant body of work in the field by estimating a non-linear autoregressive distributed lag (NARDL) model to examine the impacts of the shocks, positive and negative, in financial development and energy consumption with the existence of urbanization and economic growth. Moreover, this study analyses the linear ARDL approach to explore the symmetric scenario among the variables and to compare with the non-linear model.

The rest of the paper is arranged as follows: “Literature review and hypothesis” reports the literature review and hypothesis. “Data and methodology” discusses the data and methodology of the study. The results and discussion are in “Methodology”, while Sect. 5 concludes the paper.

Literature review and hypothesis

In general, previous researches use several control variables to examine the relationship between financial development and environmental quality. Table 1 reports the causality between financial development–\({\mathrm{CO}}_{2}\) emissions.

On the contrary, there are several findings on the relationship between energy consumption and environmental quality. For instance: Siwar et al. (2009) for Malaysia; Akbostanci et al. (2009) for Turkey; Akin (2014) for 85 countries; Sharif et al. (2020a, b) for Turkey; Zafar et al. (2020) for OECD countries; and Sharif et al. (2020a, b) for top-10 polluted countries. Munir and Riaz (2019) showed that there is an asymmetric association between electricity and coal consumption and \({\mathrm{CO}}_{2}\) emissions in the long run for South Asian economies. Following the previous studies, for instance: Ahmad et al. (2018), Lahiani (2019), Dar and Asif (2017), Mohiuddin et al. (2016), Rayhan et al. (2018), Islam et al. (2017), Sarkodie (2018), Munir and Riaz (2019), Sarkodie and Strezov (2019), Destek and Sarkodie (2019) and Bekun et al. (2019a, b), we see that economic growth and urbanization also affect the environmental performance besides financial development and energy consumption.

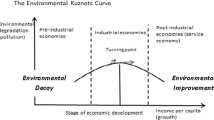

Numerous studies have investigated the relationship between economic growth and environmental performance. Apart from ambiguous findings, a great number of studies have explored an inverted U-shaped connection between economic growth and environmental degradation. This hypothesis of the U-shaped relationship is known as ‘Environmental Kuznets Curve (EKC)’ which is first theoretically introduced by Grossman and Krueger (1991) and empirically heralded by Shafik and Bandyopadhyay (1992) and Shafik (1994). Thereafter, several scholars of different countries and regions investigate the presence of EKC. For instance: Moomaw and Unruh (1997), Friedl and Getzner (2003), Martinez-Zarzoso and Bengochea-Morancho (2004), Dinda (2004), Dinda and Coondoo (2006), Galeotti et al. (2006), Kanjilal and Ghosh (2013), Managi and Jena (2008), Akbostanci et al. (2009), He and Wang (2012), Ozturk et al. (2016) and Dogan and Turkekul (2016).

Since the asymmetric relationships between financial development, energy consumption, and \({\mathrm{CO}}_{2}\) emissions are not investigated in the context of South Asia. This current study fulfills this research gap by empirically analyzing the association between considered variables whether it is symmetric or asymmetric. Therefore, the proposed hypothesis is as follows:

-

Null \(({H}_{0})\): There is a symmetric association between financial development, energy consumption, and CO2 emissions.

-

Alternative \(({H}_{A})\): There is an asymmetric association between financial development, energy consumption, and CO2 emissions.

Data and methodology

Data

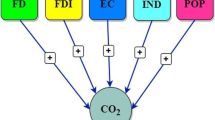

Since the primary sign of climate change and global warming is \({\mathrm{CO}}_{2}\) emissions, this study uses Carbon dioxide emissions (metric tons per capita) as a proxy of the environmental indicator. Besides, the study uses domestic credit to the private sector (% of GDP) for financial development, GDP per capita (constant 2010 US$) for economic growth, the urban population for urbanization, and energy consumption is taken in kg of oil equivalent per capita. All data, over 1974–2014, are collected from the World Development Indicator (WDI).

Methodology

The existing literature investigated symmetric analysis employing Autoregressive Distributive Lag (ARDL) model associated with the error correction model and granger causality test through which it solely presents the existence of sort run and long run relationships. That is why an asymmetric relationship among variables is not possible for the previous studies. The NARDL modeling technique is employed, because it generates an asymmetric and non-linear cointegration among the variables and also captures short run and long run effects. Moreover, the NARDL approach relaxes the integration order restrictions where the order should be the same for the error correction model. This facility is supported by Hoang et al. (2016).

The NARDL model has some other benefits for ascertaining the cointegration association in a small sample (Romilly et al. 2001). Also, it can be applied regardless of whether the regressors are integrated of order one, zero, or both (Pesaran et al. 2001), thus avoiding the prior problems connected with conventional cointegration techniques such as the Engle and Granger (1987) and Johansen and Juselius (1990). Besides, it discovers not only to assess the short run and long run asymmetries but also to unroll concealed cointegration (Shin et al. 2014). Finally, any endogeneity and multicollinearity problems are eschewed with the appropriate interchange of lag lengths in the model (Pesaran et al. 2001; Shin et al. 2014), which makes the approach more flexible than the other techniques.

Shin et al. (2014) developed new modeling called NARDL model, followed by asymmetric error correction model:

Similarly,

Following Eqs. (1) and (2), \(\Delta\) reports the first difference term; \(\theta \mathrm{ and }{\theta }^{^\circ }\) are the drift term; p to v is optimum lag orders selected by the Akaike information criterion (AIC); \(\Psi ,\phi ,\xi ,\lambda , \mu ,{\Psi }^{^\circ },{\phi }^{^\circ },{\xi ,}^{^\circ }{\lambda }^{^\circ },\mathrm{ and }{\mu }^{^\circ }\) show the short run effects, while \({\partial }_{i}\mathrm{ and }{{ \partial }_{i}}^{^\circ }\) denote the long-term effects, and \({\varepsilon }_{t}\mathrm{ and }{{\varepsilon }_{t}}^{^\circ }\) are the white noise error term. A long run estimation contains the speed of adjustment and response time towards an equilibrium point, while short term estimation provides the quick reaction of the exogenous variables. To examine the long run asymmetry (\(\partial ={\partial }^{+}={\partial }^{-}\)) and short run asymmetry (\(\lambda ={\lambda }^{+}={\lambda }^{-}\)), this study uses the Wald test.

However, \({\mathrm{FD}}^{+}\) and \({\mathrm{FD}}^{-}\) are attained by a decomposition of financial development into partial sum of positive and negative changes \(({\mathrm{FD}}_{t}= {\mathrm{FD}}_{0}+ {\mathrm{FD}}_{t}^{+}+{\mathrm{FD}}_{t}^{-})\) as follows:

Likewise, energy consumption follows the same decomposition of partial positive and negative changes. Shin et al. (2014) proposed a bounds test procedure to explore an asymmetric long-term cointegrating relationship among the variables. From two procedures of the bound test, this study uses F test of Pesaran et al. (2001).

A long run relationship presents among the variables if the null hypothesis is rejected. The estimation of long run asymmetric effect is based on \({L}_{{mi}^{+}}={\partial }_{4}/{\partial }_{0}\mathrm{ and }{L}_{{mi}^{-}}= {\partial }_{5}/{\partial }_{0}\). This study also examines the asymmetric granger causality test (1969) among financial development, energy consumption, and CO2 emissions.

There are some scholars who employed the NARDL modeling approach to exhibit an asymmetric relationship. For instance: Aftab et al. (2017) for emerging financial markets; Bahmani-Oskooee and Aftab (2017); Aftab et al. (2019) for Asian emerging economies; Ahmad et al. (2018) for Pakistan; Godil et al. (2020a, b) for Turkey; and Zafar et al. (2020) for OECD countries.

Results and discussion

Prior to check cointegration analysis for ensuring long run and short run relationships among variables, it is necessary to examine the stationary properties for every single variable. As mentioned by Gujarati and Porter (1999), non-stationary of time series generates spurious outcomes. The ARDL bound test can be carried out if every single time series variable is stationary at \(I(0)\) or \(I(1)\). Additionally, F-statistics (bound test) of Pesaran et al. (2001) becomes ineffective if the integrated order of any single variable is two or more (Ouattara 2004). This study employs the Augmented Dicky–Fuller (ADF) test and Phillips–Perron (PP) test.

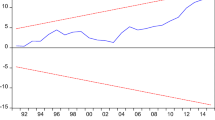

Table 2 reports the results of the unit root test. The findings clearly show that \({\mathrm{CO}}_{2}\) emissions, financial development, energy consumption, urbanization, and economic growth are integrated at \(I(1)\) for both ADF and PP test except economic growth is stationary at the level for PP test. Thereby, bound tests may continue. Tables 3 and 4 reports the results of Shin et al. (2014) non-linear ARDL approach for Eqs. (1) and (2). The table contains four segments. Part A and B indicate long run and short run coefficient estimates, while part C and D exhibit ARDL bounds test and Wald test. However, Table 5 reports the findings of the diagnostic test. However, Fig. 1 discloses the positive and negative trend of financial development and energy consumption. Following the results of Table 4, the calculated F-statistic value is 7.614 which lies over the lower and upper bound critical value at a 1% significance level. Therefore, the NARDL bound test explicitly reject the hypothesis of no cointegration relationship among the variables, connoting long run connection among them.

The short run results of model (1) reveal that partial positive sum of financial development has significant and negative impact on \({\mathrm{CO}}_{2}\) emissions, while in the long run, it has no significant effect on South Asian economies. Contrariwise, there is a positive and highly significant effect of the partial negative sum of financial development on \({\mathrm{CO}}_{2}\) emissions but a negative and significant impact in the long run. Accordingly, 1% increase in partial positive changes of financial development leads to decrease \({\mathrm{CO}}_{2}\) emissions by 0.79 or 0.92 percent in the short run and 1% decrease in partial negative changes of financial development proves to raise environmental degradation by 1.71% uplifting \({\mathrm{CO}}_{2}\) emissions in the short run, while reduces environmental erosion by 1.77% in the long run for South Asian economy.

However, urbanization only has a negative and significant effect on \({\mathrm{CO}}_{2}\) emissions in the short run, while economic growth has both short and long run impacts. In the short run estimation, economic growth has a significant and negative relationship with \({\mathrm{CO}}_{2}\) emissions where has a positive association with \({\mathrm{CO}}_{2}\) emissions in the long run. The error correction term measures the speed of adjustment that explains how shortly variables respond to the long run equilibrium. Accordingly, the coefficient of \({\mathrm{ECM}}_{\mathrm{t}-1}\) is negative and significant at 1% confidence level which also means that there exists a static long-term relationship (Banerjee et al. 1998). The adjusted \({R}^{2}\) value (0.6895) exhibits the goodness of fit of the models.

However, the results of the Wald test reject the null hypothesis in the long run that financial development asserts a symmetric impact on \({\mathrm{CO}}_{2}\) emissions long run, explaining that positive and negative variation of financial development has a different significant effect on \({\mathrm{CO}}_{2}\) emissions in the long run. Besides, the diagnostic test results of Table 6 validate that the model is free from heteroscedasticity. Also, Skewness and kurtosis sign ensure that the residuals of the model practice normal distribution.

Now, according to the estimated results of Table 4, a partial positive sum of energy consumption has a significant and negative effect on \({\mathrm{CO}}_{2}\) emissions in the short period regarding different lag orders, but contrariwise, it has a positive and significant relationship with \({\mathrm{CO}}_{2}\) emissions in the long period for South Asia. Also, partial negative changes in energy consumption has a negative significant impact on \({\mathrm{CO}}_{2}\) emissions in the short run considering various lag order, while as per expectation, it positively affects the \({\mathrm{CO}}_{2}\) emissions in the long run. Accordingly, 1% increase in the partial positive sum of energy consumption minimizes environmental degradation by 0.44% in the short period taking lag order two and over against produces environmental deterioration by 0.37% in the long period for South Asia. However, as expected, 1% decrease in partial negative changes in energy consumption declines environmental wasting by 5.4% in the short run regarding lag order three, while it pollutes the environmental quality by 3.94% in the long run.

Besides, urbanization worsens the environment of South Asia by 1.99% in the long period. Also, economic growth has a significant and negative impact on \({\mathrm{CO}}_{2}\) emissions in the short run and it has no significant effect in the long run. The speed of adjustment (\({\mathrm{ECM}}_{t-1}\)) shows that Eq. (2) is stable as it is negative and highly significant at 1% level of significance. The value of F-statistic is 6.345 which lies over the lower and upper bound critical value at 1% significance level. Thus, the NARDL bound test clearly reject the hypothesis of no cointegration relationship among the variables, indicating long-term association among them.

However, the outcomes of the Wald test reject the null hypothesis mean that energy consumption validates symmetric impact on \({\mathrm{CO}}_{2}\) emissions in the short run and long run, interpreting that positive and negative changes of energy consumption have a different significant impact on \({\mathrm{CO}}_{2}\) emissions (long run: 10.83; short run: 5.43). The adjusted \({\mathrm{R}}^{2}\) value (0.8661) describes the goodness of fit of the models. Additionally, the estimated results of the diagnostic test in Table 5 proves that the model is free from heteroscedasticity. Also, Skewness and kurtosis sign prove that the residuals of the model practice normal distribution.

Now, moving to Table 6, the ARDL model is calculated to match with NARDL model. Following the estimations of the model (1), the long run elasticities of \({\mathrm{CO}}_{2}\) emissions are positive and highly significant for urbanization and economic growth, while negative for financial development. The outcome suggests that 1% increase in financial development reduces \({\mathrm{CO}}_{2}\) emissions by 0.8%. In contrast, relative to economic growth and urbanization, the short run elasticities are negative and significant for the model (1). Turning to the model (2), energy consumption and urbanization badly affect the environment increasing \({\mathrm{CO}}_{2}\) emissions in the long run and economic growth has a negative association. This result explains that 1% rise in energy consumption enhances \({\mathrm{CO}}_{2}\) emissions by 0.49%. The short run results exert that energy consumption has an adverse relationship with \({\mathrm{CO}}_{2}\) emissions, while economic growth positively affects the \({\mathrm{CO}}_{2}\) emissions.

The error correction term (\({\mathrm{ECT}}_{t-1}\)) is statistically significant and negative for models (1) and (2), thus confirming the presence of long-run dynamics in these models. According to the findings, the ARDL bound test rejects the null hypothesis of no cointegration relationship for both models as the F-statistic values lie over the lower and upper bound critical value at 1% significance level. Both models are well defined due to the characteristics of constant variance and homoscedasticity.

Table 7 reports the asymmetric granger causality test. The results exhibit that there is a unidirectional causal relationship from partial positive sum of financial development to \({\mathrm{CO}}_{2}\) emissions, while \({\mathrm{CO}}_{2}\) emissions also have a unidirectional causal connection with partial negative sum of financial development. On the other hand, partial negative sum of energy consumption generates unidirectional causal relationship with \({\mathrm{CO}}_{2}\) emissions, while there is also a unidirectional causality from \({\mathrm{CO}}_{2}\) emissions to partial positive sum of energy consumption.

Conclusions and remarks

Based on the yearly data from 1972 to 2014, this study explores the relationships among \({\mathrm{CO}}_{2}\) emissions, financial development, energy consumption, economic growth, and urbanization for South Asia. With the help of non-linear ARDL model, the empirical results validate the asymmetric connection between energy consumption, financial development and environment as the \({\mathrm{CO}}_{2}\) emissions are highly affected by both positive and negative shocks in energy consumption and financial development. The outcomes of the ARDL approach express that energy consumption has a positive impact on \({\mathrm{CO}}_{2}\) emissions in the long run, while financial development has an adverse effect. Comparing the analysis of the ARDL and NARDL model, this study confirms that energy consumption vastly contributes to rise the \({\mathrm{CO}}_{2}\) emissions in South Asia than financial development. To prevent the environmental wasting of South Asia, these factors can be used as important techniques for policy makers and governments.

This paper offers some policy recommendation which is consistent with the results. First, the positive connection between \({\mathrm{CO}}_{2}\) emissions and financial development propounds that the policymakers of South Asia should concentrate on financial development while making policy to decline the greenhouse gases. They should adopt different policies for the different order of economic development. For example: when the economic development is at an early period, the ratio of financial development should be exhorted. Contrariwise, when the economy thrives enough, the adverse effects of financial development on the atmosphere should be cautiously governed. To minimize the deleterious effects of financial development on the environment, the banking sector of South Asia should aware of the misallocation of financial funds. The bank authority should be provided useful financial resources to the proficient and productive industry in place of issuing cheap loans to inefficient and consumptive enterprises. Then, there will be environment friendly technology with high production. Second, the positive relationship between \({\mathrm{CO}}_{2}\) emissions and energy consumption in the findings proposes that the government can enhance the environment quality by imposing restrictions on inefficient energy consumption machines and the use of fossil fuels and should grant subsidies on low carbon use technologies such as renewable energy.

This paper suggests further study using other determinants of environmental degradation such as globalization, trade balance, global value chain, and total employment. Moreover, similar econometric tools can be employed considering both renewable and non-renewable energy consumption.

Data availability

The data can be made available upon reasonable request.

Material availability

The authors will follow the journal policy.

Notes

As mentioned by Brännlund et al. (2007), the effects of technology are suspicious for the environment, because it can thrive the production of the companies which ultimately increases the waste and pollution in the environment.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Aftab M, Ahmad R, Ismail I (2018) Examining the uncovered equity parity in the emerging financial markets. Res Int Bus Finance 45:233–242

Aftab M, Ahmad R, Ismail I, Phylaktis K (2019) Economic integration and the currency and equity markets nexus. Available at SSRN 3434379

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manage 9(6):631–644

Akbostancı E, Türüt-Aşık S, Tunç Gİ (2009) The relationship between income and environment in Turkey: is there an environmental Kuznets curve? Energy Policy 37(3):861–867

Akin CS (2014) The impact of foreign trade, energy consumption and income on CO2 emissions. Int J Energy Econ Policy 4(3):465

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Ayeche MB, Barhoumi M, Hammas MA (2016) Causal linkage between economic growth, financial development, trade openness and CO2 emissions in European countries. Am J Environ Eng 6(4):110–122

Bahmani-Oskooee M, Aftab M (2017) Malaysia-Japan commodity trade and asymmetric effects of exchange rate changes. MPRA paper No. 81213

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19(3):267–283

Basarir C, Cakir YN (2015) Causal interactions between CO2 emissions, financial development, energy and tourism. Asian Econ Fin Rev 5(11):1227–1238

Bekun FV, Alola AA, Sarkodie SA (2019a) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bekun FV, Emir F, Sarkodie SA (2019b) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 65(5):759–765

Bello AK, Abimbola OM (2010) Does the level of economic growth influence environmental quality in Nigeria: a test of environmental Kuznets Curve (EKC) Hypothesis? Pakistan J Soc Sci 7(4):325–329

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Brännlund R, Ghalwash T, Nordström J (2007) Increased energy efficiency and the rebound effect: effects on consumption and emissions. Energy Econ 29(1):1–17

Charfeddine L, Khediri KB (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sustain Energy Rev 55:1322–1335

Cole MA, Elliott RJ, Shimamoto K (2005) Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manage 50(1):121–143

Collins D, Zheng C (2015) Managing the poverty–CO2 reductions paradox: the case of China and the EU. Organiz Environ 28(4):355–373

Dar JA, Asif M (2017) Is financial development good for carbon mitigation in India? A regime shift-based cointegration analysis. Carbon Manage 8(5–6):435–443

Dar JA, Asif M (2018) Does financial development improve environmental quality in Turkey? An application of endogenous structural breaks based cointegration approach. Manage Environ Quality 29(2):368–384

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dinda S, Coondoo D (2006) Income and emission: a panel data-based cointegration analysis. Ecol Econ 57(2):167–181

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sustain Energy Rev 60:1074–1085

Dogan E, Turkekul B (2016) CO 2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: J Econ Soc 55(2):251–276

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Frankel JA, Romer DH (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Friedl B, Getzner M (2003) Determinant of CO2 emissions in a small open economy. Ecol Econ 45(1):133–148

Galeotti M, Lanza A, Pauli F (2006) Reassessing the environmental Kuznets curve for CO2 emissions: a robustness exercise. Ecol Econ 57(1):152–163

Godil DI, Sharif A, Rafique S, Jermsittiparsert K (2020a) The asymmetric effect of tourism, financial development, and globalization on ecological footprint in Turkey. Environ Sci Pollut Res 27(32):40109–40120

Godil DI, Sharif A, Agha H, Jermsittiparsert K (2020b) The dynamic nonlinear influence of ICT, financial development, and institutional quality on CO2 emission in Pakistan: new insights from QARDL approach. Environ Sci Pollut Res 27(19):24190–24200

Gokmenoglu K, Ozatac N, Eren BM (2015) Relationship between industrial production, financial development and carbon emissions: the case of Turkey. Procedia Econ Fin 25(May):463–470

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424–438

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of economic research Working Paper 3914 NBER, Cambridge, MA

Gujarati DN, Porter DC (1999) Essentials of econometrics. Irwin/McGraw-Hill 2, Singapore

Hao Y, Zhang ZY, Liao H, Wei YM, Wang S (2016) Is CO2 emission a side effect of financial development? An empirical analysis for China. Environ Sci Pollut Res 23(20):21041–21057

He J, Wang H (2012) Economic structure, development policy and environmental quality: an empirical analysis of environmental Kuznets curves with Chinese municipal data. Ecol Econ 76:49–59

Hoang TH, Lahiani A, Heller D (2016) Is gold a hedge against inflation? New evidence from a nonlinear ARDL approach. Econ Model 54:54–66

Islam MZ, Ahmed Z, Saifullah MK, Huda SN, Al-Islam SM (2017) CO2 emission, energy consumption and economic development: a case of Bangladesh. J Asian Fin Econ Bus 4(4):61–66

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with appucations to the demand for money. Oxford Bull Econ Stat 52(2):169–210

Kanjilal K, Ghosh S (2013) Environmental Kuznet’s curve for India: Evidence from tests for cointegration with unknown structural breaks. Energy Policy 56:509–515

Komal R, Abbas F (2015) Linking financial development, economic growth and energy consumption in Pakistan. Renew Sustain Energy Rev 44:211–220

Lahiani A (2020) Is financial development good for the environment? An asymmetric analysis with CO2 emissions in China. Environ Sci Pollut Res 27(8):7901–7909

Lee JM, Chen KH, Cho CH (2015) The relationship between CO2 emissions and financial development: evidence from OECD countries. Singapore Econ Rev 60(05):1550117

Lundgren T (2003) A real options approach to abatement investments and green goodwill. Environ Resour Econ 25(1):17–31

Ma C, Stern DI (2008) China’s changing energy intensity trend: a decomposition analysis. Energy Econ 30(3):1037–1053

Managi S, Jena PR (2008) Environmental productivity and Kuznets curve in India. Ecol Econ 65(2):432–440

Martı́nez-Zarzoso I, Bengochea-Morancho A (2004) Pooled mean group estimation of an environmental Kuznets curve for CO2. Econ Lett 82(1):121–126

Mohiuddin O, Asumadu-Sarkodie S, Obaidullah M (2016) The relationship between carbon dioxide emissions, energy consumption, and GDP: a recent evidence from Pakistan. Cogent Eng 3(1):1210491

Moomaw WR, Unruh GC (1997) Are environmental Kuznets curves misleading us? The case of CO2 emissions. Environ Dev Econ 2(4):451–463

Mugableh MI (2015) Economic growth, CO2 emissions, and financial development in Jordan: equilibrium and dynamic causality analysis. Int J Econ Fin 7(7):98–105

Muhyidin H, Saifullah MK, Fei YS (2014) CO2 emission, energy consumption and economic development in Malaysia. Int J Manag Excell 6(1):1648–2292

Munir K, Riaz N (2019) Energy consumption and environmental quality in South Asia: evidence from panel non-linear ARDL. Environ Sci Pollut Res 26(28):29307–29315

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Rayhan I, Akter K, Islam MS, Hossain MA (2018) Impact of urbanization and energy consumption on CO2 emissions in Bangladesh: an ARDL bounds test approach. Int J Sci Eng Res 9(6):838–843

Romilly P, Song H, Liu X (2001) Car ownership and use in Britain: a comparison of the empirical results of alternative cointegration estimation methods and forecasts. Appl Econ 33(14):1803–1818

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Sarkodie SA (2018) The invisible hand and EKC hypothesis: What are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25(22):21993–22022

Sarkodie SA, Strezov V (2019) A review on environmental Kuznets curve hypothesis using bibliometric and meta-analysis. Sci Total Environ 649:128–145

Sehrawat M, Giri A, Mohapatra G (2015) The impact of financial development, economic growth and energy consumption on environmental degradation: evidence from India. Manage Environ Quality 26(5):666–682

Shafik N (1994) Economic development and environmental quality: an econometric analysis. Oxford Econ Papers 46:757–773

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time-series and cross-country evidence. The World Bank, Washington, DC

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Mod 35:145–152

Sharif A, Afshan S, Qureshi MA (2019) Idolization and ramification between globalization and ecological footprints: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 26(11):11191–11211

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020a) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from quantile ARDL approach. Sustain Cities Soc 57:102138

Sharif A, Mishra S, Sinha A, Jiao Z, Shahbaz M, Afshan S (2020b) The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. Renew Energy 150:670–690

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickles RC, Horrace WC (eds) Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Siddique HMA (2017) Impact of financial development and energy consumption on CO2 emissions: evidence from Pakistan. Bull Bus Econ (BBE) 6(2):68–73

Siwar C, Huda N, Hamid A (2009) Trade, economic development and environment: Malaysian experience. Bangladesh Deve Stud 32(3):19–39

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional. Econ Energy Econ 32(1):137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries? Energy Policy 37(1):246–253

Teodorescu AM (2012) Links between the Pillars of sustainable development. Ann Univ Craiova-Econ Sci Ser 1(40):168–173

Uchiyama K (2016) Environmental Kuznets curve hypothesis. In Environmental Kuznets curve hypothesis and carbon dioxide emissions. Springer Briefs in Economics: Springer, Tokyo

Yuxiang K, Chen Z (2011) Resource abundance and financial development: evidence from China. Resour Policy 36(1):72–79

Zafar MW, Shahbaz M, Sinha A, Sengupta T, Qin Q (2020) How renewable energy consumption contribute to environmental quality? The role of education in OECD countries. J Clean Prod 268:122149

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Author information

Authors and Affiliations

Contributions

The authors have equal contribution.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Rights and permissions

About this article

Cite this article

Kibria, M.G., Jahan, I. & Mawa, J. Asymmetric effect of financial development and energy consumption on environmental degradation in South Asia? New evidence from non-linear ARDL analysis. SN Bus Econ 1, 56 (2021). https://doi.org/10.1007/s43546-021-00064-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-021-00064-7