Abstract

This study seeks to expose environmental implication of Turkey’s urbanization towards its sustainable development. Turkey is considered a commercial cum industrial hub where economic activities are increasingly taking place. Specifically, the economic and manufacturing activities are centered in big cities and this has drawn many people to the urban centers of the country which has potential threats to the environmental performance and sustainable development of the country. We applied 1970–2018 Turkey’s data for this assessment. Structural break, dynamic autoregressive distributed lag (ARDL)-bound and Granger causality estimates were applied in this research. From dynamic ARDL-bound test, we found long run cointegration among the selected variables. From the ARDL short run and long run, we find economic growth (GDP per capita) and FDI having a negative relationship with carbon emission. Also, fossil fuels, industry and urban population showed positive relationship with the carbon emission (CO2). Similar result (except for that of economic growth that is positively related to carbon emission and urban population that is significant) was established in the long run with varying degrees through their various coefficients. We found nexus among the variables of interest in Granger causality estimate. Hence, a two-way Granger causal relationship exist between CO2 and GDP, CO2 and fossil fuels, GDP and fossil fuels while one-way causal relationship exist from urban population to CO2, from FDI and urban population to GDP, from urban population to fossil fuels, from urban population to FDI. Similar pattern Granger result is confirmed in both short run and long run. With these findings, policy is expected to be framed towards mitigation of carbon emissions and increase the chance of achieving sustainable development through controls on urbanization and industrialization negative impacts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Urbanization process comes with both positive and negative impacts when considered economic cum environmental performance of any given country. The positive effects are mostly on the economic development, while environmental impact through carbon emission and quality degeneration remains one of the biggest problems it has created worldwide. The climate change through greenhouse gas emissions problem has become a sensitive problem to both developed and developing countries which calls for urgent handling to avert the imminent danger it poses to mankind. Part of the influencers of climate change is the rapid rise of the world population after the Second World War and the increasing industrialization which generate pollutant emissions through excessive use of energy source (Kaya and Taylan Susan 2020). The issue of carbon emission, which was first discussed after the 1st World Climate Conference in Geneva in 1979, was put on the world agenda as a result of the "United Nations Framework Convention on Climate Change" (UNFCCC). The agreement was signed in order to keep the carbon emission, climate change and environmental pollution at a level that can be prevented. Following UNFCCC is Kyoto Protocol agreement which was signed in 1997 and entered into force in 2005 (Sancar and Bostancı 2020; UN 1998). Nevertheless, the carbon emissions have not declined due to the carbon intensive activities in energy sector, the use of fossil fuels and the increasing industrialization which have kept the emission rates at record breaking (Udemba 2020a,b, c, 2021).

Turkey has experienced an intense and one-way process of migration from rural to urban areas following the investments made in the industrial sector and economic breakthroughs (Sağlam 2006). While the population living in urban was around 15% in the early 1950s, this rate increased to 31.5% in 1960, 38.2% in 1970, 43.8% in 1980, and 64.7% in 2000. According to the data, 75.6% of the country's population lives in urban nowadays (World Bank-TEPAV 2015). However, the country, which has undergone an unplanned urbanization process due to the lack of state controls, is going through a painful period regarding environmental pollution, even though it shows economic growth. As stated in the 9th Development Plan (PSB 2006) covering the years 2007–2013, the rapid and unplanned urbanization movements caused an abnormal increase in the population in big cities and an increase in the ownership of motor vehicles in these cities. The population increase and the increasing nature of acquiring vehicles in these cities coupled with the fossil fuel consumption of large industries, increasing energy needs and excessive fuel consumption in urban transportation cause serious environmental pollution.

1.1 Carbon emissions in Turkey

Turkey is faced with the problem of carbon emissions as well as in the whole world. There is a direct relationship between the methods used in electricity generation and carbon emissions (Bajpai et al. 2012). The fuel used in the energy sector in Turkey is formed by a vast majority of coal, crude oil and natural gas (Çetintaş et al. 2017; Kumbur et al. 2005); thus, it causes a considerable increase of the country's carbon emissions. Turkey has not yet made a grand breaking shift to renewables like use of nuclear energy and this has contributed in increase in its fossil fuel consumption. This has made Turkey to be among the countries that contribute the most to global carbon emissions. The per capita carbon emission level, which was 0.6 metric tons in 1960, exceeded the level of 5 metric tons by 2020. On the other hand, the carbon emission (by kiloton) realized in the country during the same period increased 24 times. The gravity of the situation is striking when compared to the data from EU and OECD countries in order to show what danger the country poses to carbon emissions. For OECD countries, carbon emissions per capita were 7.1 metric tons in 1960 and 10 metric tons in 2020. When we consider all OECD countries, the total carbon emission (kt) almost doubled. In the European Union, the per capita carbon emission level, which increased from 4.6 metric tons to 7 metric tons, has increased by approximately 75% in total. On the other hand, electricity use per capita (kW) has increased 30 times between 1960 and 2019 while the share of carbon emissions that occur as a result of electricity usage and heating has increased from 20 to 50%. Looking at these data, it attests to the implication of carbon emission to Turkish environmental performance compared to both the European Union and OECD countries. As of 2019, Turkey is the fourteenth country with the highest total carbon emissions among all countries in the world, surpassing countries such as the UK, Italy, France, India and Spain. Considering the data of the last decade, it is expected that the country will be in the top ten in the list if similar rates of increase occur and if the country does not focus on renewable energy (Say and Yücel 2006).

Turkey is considered a commercial cum industrial hub where economic activities are increasingly taking place. Specifically, the economic and manufacturing activities are centered in big cities as remarked earlier and this has drawn many people to the urban centers of the country which has potentials threats to the environmental quality. On this note, we seek to investigate the environmental implication of the Turkish urbanization towards its sustainable development. In addition to this, we expand our study to accommodate other vital indexes such as industry, fossil fuels and FDI in measuring both the environment and economic performance of Turkey. It is proven that urbanization due to increase in industrial and manufacturing activities in cities can pose essential threat to the environmental development (Musah et al. 2020) of any country if not handled well. To ascertain the effect of urbanization, authors incorporate industrialization and FDI which have positive correlations to the urbanization. Scholars (McGee and York 2018) have tried to investigate the impact of urbanization to the environmental performance of many countries but only few (Liu and Bae 2018)) have tried to incorporate industrialization and FDI in their studies to see if there is a link between the three variables. To contribute to the literature, we attempt to answer the following questions: is there a link between urbanization and Turkish environmental degradation through carbon emission? Is the economic growth via FDI and industrial operations affecting the country’s environmental performance, and in what way? Is there a nexus among the adopted variables (economic growth, urban population, industry, FDI and fossil fuels) in this study pointing towards Turkey’s environmental degradation? For effective and efficient research into unfolding the answers to the raised questions, we apply different methods such structural break, autoregressive distributed lag (ARDL)-bound tests with vector error correction Granger causality estimate.

The remaining section of this study are literature review, data and methodology, empirical results and discussion and conclusion.

2 Literature review

In the literature, there are several studies investigating the relationship between urbanization and its effects on carbon emission. In a study of determinants of carbon emissions for Turkey, Rjoub et al. (2021a, b) find that economic growth and financial development degrade Turkish environment. In their study on Turkish sustainability, find that financial regulations is essential in achieving sustainable green economy in Turkey. Ankwar et al. (2020) examine the major determinants of carbon emissions in Far East countries between 1980 and 2017 by adopting panel data-fixed effect model and find a positive and significant relationship between urbanization, economic growth and carbon emission levels. Wang et al. (2013) use STIRPAT model and show carbon emission could be increased by specific factors such as population growth and density, urbanization, industrialization level and service level. Musah et al. (2020) work on West Africa by using several econometric analyses and conclude that urbanization has significantly cause an increase in carbon emission. In their study on South Africa carbon emission, Joshua et al. (2020) find coal consumption impacting negatively on environment because of excessive emissions from using the source. Umar et al. (2021) in their research on USA environmental performance observed that biomass and, fossil fuels energy consumption and real GDP cause the increase of carbon emission from transport sector. Also, in a study on EU countries, Adedoyin et al. (2021) find trade and income inducing carbon emissions which is applicable to the environmental performance in some developing countries. Alola et al. (2021) in their study on EU member countries with respect to sustainability observe that consumption of domestic materials and real income contributes to greenhouse gas emissions in Czech, Lithuania and Malta. This is also the similar case in some developing countries like Turkey where the excessive utilization of domestic fossil fuels (coal) contributes to emissions. Barido and Marshall (2014) investigate how carbon emissions are affected by urbanization and environmental policy by using panel data on annual carbon emissions from eighty countries between 1983 and 2005 and find that for countries with stronger environmental policy, urbanization has less negative impact on emissions, and vice versa. Liu and Bae (2018) show that 1% increase on energy usage intensity, real GDP, industrialization and urbanization increase carbon emissions by 1.1, 0.6, 0.3, and 1.0%, respectively. Ghosh and Kanjilal (2014) examine the negative effects of urbanization on environmental degradation in India and state that to prepare and implement long-term energy and emission scenario planning, policy makers should pay attention to urbanization. Liu (2009) shows the positive relationship between rapid urbanization, increase in energy consumption and increase in carbon emission in China using ARDL over the period 1978–2008. McGee and York (2018) show that not only the urbanization directly affects the increase in carbon emissions, also the reverse process called deurbanization may help to reduce carbon emissions. Sharma (2011) also shows the significant effects of GDP per capita growth and urbanization level on carbon emission levels in 69 countries and states that these two can be considered as main determinants of carbon emissions. Salim et al. (2019) state that the urbanization tends to increase carbon emission as Shahbaz et al. (2014) showing the positive relationship between carbon emission and urbanization in United Arab Emirates. Chang (2010) also finds an interesting result showing the significant relationship between the Chinese growth and its effects on energy consumption resulting increase in carbon emission. Zhang and Lin (2012) analyze the impact of urbanization on carbon emission caused by energy consumption between 1995 and 2010 using STRIPAT model and find that urbanization increases energy consumption and carbon emissions in China. However, there are other studies showing that once urbanization reaches a certain level, its effect on carbon emission begins to fall (Martínez-Zarzoso and Maruotti 2011). Dodman (2009) also suggests that in most cases, per capita carbon emissions in cities are lower than non-urbanized cases. Saidi and Mbarek (2017) worked on 19 emerging economies including Brazil, Russia, Turkey, Poland, etc. and found that planned and controlled urbanization can decrease carbon emission. Azam and Khan (2016) found the significant relationship between carbon emission and urbanization for Sri Lanka while the relationship is insignificant for Pakistan. Rafiq et al. (2016) showed that while urbanization significantly increases the intensity of energy consumption, its effect on carbon emission is insignificant.

Due to the lack of studies on urbanization its effects on carbon emission for Turkey, we have decided to focus on this subject in order to investigate and show whether the urbanization process in Turkey since 1960 have an effect on high carbon emission rates.

3 Methodology, data and modeling

3.1 Analytical framework

According Connor (2015), achieving sustainable development goals means achieving both viable economic and environmental performance which will ascertain peace and prosperity for people and the planet, now and into the future. For this course, 17 sustainable development goals (SDGs) which is an urgent call for action by all nations (both developed and developing) to partner in achieving economic and climate goals have been initiated by United Nation. The economic aspects of SDGs includes improved health and education, reduce inequality and boost economic growth while the climate cum environment aspects includes tackling climate change through moderation of environment quality and working to preserve oceans and forests. Sustainable development is not fully achieved if any of the economic and environmental expectation is missing from the outcome of development. Many nations are yet to come up with reality of pursing both economic and environmental progress, instead, they end up achieving economic goals at the expense of environmental performance. In an attempt to measure the success level of achieving sustainability development, scholars have used different instruments and indicators to proxy and measure both environment and economic growth cum development. In some literature, economic development has been proxy and measured by gross domestic product (GDP) per capita, while indicators such as carbon dioxide (CO2) emissions, ecological footprint, greenhouse gas emissions and others have been utilized in some other literature to measure environment development. Asides from GDP and environment indicators, other economic and environment instruments (such as energy use, industry, urbanization, FDI, natural resources, international trade, political stability etc.) have been adopted to test the success of achieving both economic and environment development by different scholars. The impact of the listed instruments could be positive or negative on either economic or environment development through the mechanism of emitting or controlling pollutant emissions. We adopt some of the listed instruments that are unique to Turkey’s economy to test the sustainable development of the country.

3.2 Model specification

The model specification of our study is based on STIRPAT model as proposed by Dietz and Rosa (1997). Also, ARDL-bound testing by Pesaran et al. (2001) is equally incorporated as among the model specifications of this study. While, we adopt STIRPAT model for linear and statistical testing of our analysis, ARDL-bound testing is adopted for cointegration analysis. As remarked from the theoretical background, STIRPAT is an extension of Ehrlich and Ehrlich (1997) IPAT model to accommodate the stochastic impact of human activities on the environmental performance through population, affluence and technology. Also, STIRPAT model allows the expansion and addition of other variables in determining and describing the human impact on environment. This is considered helpful in statistical testing conditions. The STIRPAT model is specified as follows:

where \(\alpha\) represents the constant, b, c and d represent the exponents of instruments population (P), wealth (A) and technology (T) to be estimated and \(\varepsilon\) represents the error term. Equation (1) can be written in logarithmic form as

where a, b, c and d have been defined, they are the coefficients that determines the rate of change that occurred in the exogenous (dependent) variable because of a percentage change in the explanatory variables (population as proxy by Urban population, wealth as proxy by GDP per capita and Technology as proxy by FDI). Sometimes, it may look confusing and difficulty on how to measure the technology, but some other literature (Hubler and Keller 2010; Javorcik and Spatareanu 2008; Keller 2004) have adopted foreign direct investment (FDI) to measure the technological impact on environmental performance because of its (FDI) externalities and spillover effects in any economy. The externalities and spillover effect of FDI could be seen from the introduction of technologies and skills into the economy of their interest through importation advance equipment and machineries from their countries and engagements of foreign expatriates for the effective and efficient handling of the newly imported equipment. Transference of skills and technological knowhow from the foreign owned investments and companies to the domestics companies are made possible from the platform of FDI. In fact, technological impact is multi-dimensional in both economic and environmental operations. According to Dietz and Rosa (1997), effects of other variables on the environment could be captured with STIRPAT through technological impact. Following this, STIRPAT model has been expanded by other literature (Zhang et al. 2019; Yang et al. 2018; Gao et al. 2019) to accommodate other variables in determination of the environment performance. Based on this, our study expands STIRPAT model to accommodate other variables such as FDI to measure technology, industry and total energy use proxy by fossil fuels. Hence, the extended STIRPAT model according to the variables adopted in our work is as follows:

where

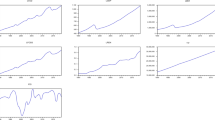

\({\mathrm{logCO}}_{2}\), \(\mathrm{log}U.P\), \(\mathrm{logGDP}\), \(\mathrm{FDI}\), \(\mathrm{logFOSS}\) and \(\mathrm{IND}\) represent Carbon dioxide emission (CO2), population proxy by urban population, economic growth proxy by GDP per capita (constant, 2010 US$), foreign direct investment (%GDP), energy use proxy by fossil fuels, and industry (%GDP), respectively. ε represents the error term. All the variables are in logarithmic form except FDI and industry which are already expressed in percentage. It is important to state here that fossil fuels as a variable was gotten through the summation of three dominant fossil fuels (crude oil, Natural gas and coal all measured in million tones oil equivalent) in the Turkey and was sourced from 2019 British Petroleum world energy statistics. Most times, different indicators are used by different scholars to measure environment depends on the objective of the study. Following the objective of our study which is exposing the environmental implication of urbanization with reference to excessive economic activities due to urbanization and industrialization, we consider carbon dioxide emission (\({\mathrm{CO}}_{2}\)) appropriate for this study. More carbon dioxide emission tends to be emitted in the course of economic and productive activities in cities than any other type of gas. Considering the classification by Intergovernmental Panel on Climate Change (IPCC 2014), \({\mathrm{CO}}_{2}\) tends to have the greater percentage of the gasses the greenhouse gas with about 76% of the gasses. Our study covers the period from 1970 to 2018. The summary and definition of the variables and the data sources are shown in the Table 1. Also, the movement and trends of the variables are displayed in Fig. 1.

3.3 Methods

Going further, we modelled the cointegration analysis in line with autoregressive distributed lag (ARDL) bound test. ARDL according to Pesaran et al. (2001) is a preferred approach of estimating cointegration and long run relationship among the series. This is attributed to its unconditional [irrespective of the order of integration except I(2)] suitability for estimating cointegration unlike other approaches of cointegration. Also, its ability to accommodate the sample size irrespective of whether it is small or large size distinguishes the ARDL from other approaches. Irrespective of the ability of the ARDL approach to accommodate lesser sample period, our study covers a commendable sample period of 1970–2018, that is 48 years which contributes to the current literature by extending the time to 2018. The empirical model specification of ARDL–bound comprising both long run and short run dynamics with error correction model (ECM) is as follows:

Equation (4) presents the variables (\({\mathrm{logCO}}_{2}\), \(\mathrm{logU}.\mathrm{P}\), \(\mathrm{logGDP}\), \(\mathrm{FDI}\), \(\mathrm{logFOSS}\) and \(\mathrm{IND}\)) as earlier explained from the Eq. (3). Further, properties of Eq. (4) that need explanation are \({\alpha }_{i}\), \({\rho }_{i}\) (i = 1,2…, etc.), \(\sum , \Delta \mathrm{and }{\mathrm{ECM}}_{t-i}\). Hence, they are coefficients of long run (\({\alpha }_{i}\)) and short run (\({\rho }_{i}\)) variables, the signs of short run and differenced form of the variables (\(\sum , \Delta\)), and the error correction model (ECM) which shows the speed of correcting the short run disequilibrium in the long run and establish equilibrium and the possibility of long run relationship between the selected variables. The specification of ARDL-bound test model yields the values of F and T statistics which form the basis of testing cointegration through a hypothetical statements (null hypothesis with assertion of no cointegration, and alternative hypothesis with assertion of presence of cointegration). Hence, null hypothesis (H0:\({\alpha }_{i}\)=0) and alternative hypothesis (H1:\({\alpha }_{0}\ne 0\)). According to Pesaran et al. (2001), when the values of F and T tests are more than the critical values of upper bounds at 1, 5 and even 10%, it is concluded that cointegration exists and vice versa. However, if the values of F and T test are in between the two bounds, it is inconclusive.

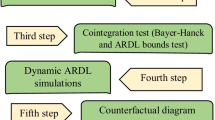

The scientific approaches adopted in this work include descriptive statistics, stationarity tests with both the traditional and structural break test, autoregressive distributed lag (ARDL)-bound test and vector error correction model (VECM) Granger causality. Descriptive statistics is applied in this study to explain the properties of the data and variable utilized in this study. The stability and distribution of the data is determined through descriptive statistics with Jarque–Bera and Kurtosis. Stationarity test as part of the analysis is performed to ascertain the stationarity and order of integration among the series. Both the traditional (ADF 1979; PP 1990; KPSS 1992) and structural break (Zivot and Andrews 1992) methods. Structural break test is equally adopted in this study to uncover the areas that could not be uncovered with the traditional method of testing unit root due to shocks that may be occur in the economy either because of policy, natural phenomenon or macroeconomic problem (Sharif et al. 2020). Cointegration analysis with short-run and long-run dynamics were estimated with dynamics and ARDL-bound tests. VECM Granger causality estimates is adopted in this research for a validation check, forecasting power and inferential analysis among the selected variables. Diagnostic estimates are also adopted in this study to test for the statistical problems such as serial and autocorrelation, heteroscedasticity. Also, stability of the model is ascertained with cumulative sum and cumulative sum squared (CUSUM and CUSUM2).

4 Empirical results and discussion

4.1 Descriptive statistics

The properties of the data with respect to the normal distribution were explained with descriptive statistics through Jarque–Bera and Kurtosis. The output of the descriptive statistics is shown in Table 2. The output displays the values of Jarque Bera and kurtosis confirming the normal distribution of the data. Normal distribution of the data is confirmed with the p value of the majority of the variables except FDI and GDP showing nonstationary in Jarque–Bera estimate, while the values of the variables in the case of kurtosis confirmed normal distribution of the data with all the values below 3 except for the case of FDI with a value greater than 3.

4.2 Unit root test

Stationarity of the variables and order of integration among the series are estimated with both traditional and structural break methods and the outputs are displayed in the Tables 3 and 4. Application of different unit root tests methods (ADF 1979; PP 1990; KPSS 1992) confirmed a mixed order of integration and stationarity at both I(0) and I(1). Also, structural break tests was incorporated in unit root analysis to identify if there is any event capable of causing unexpected change over a time and leaving a permanent shock on the economic performance which will eventually affect the operation of the variables adopted in this study. This may lead to a huge forecasting errors and unreliability of the model in general and policy recommendations can be misleading or worse (Hansen 2001). We found the evidence of structural change in our structural break test. The structural change are exposed in 2001–2004 for CO2, GDP and FOSS, 2005–2009 for FDI and U.POP, 1990–1999 for IND and U.POP. The structural change took place within the periods of 1990–2009 which is well bounded in the period of this study (1970–2018). This shows that it is essential we account for these structural breaks to avoid any misleading information in our study. Among the events that cause this structural change in the history of Turkish economic operation is the external factor. This is rooted in the macroeconomic expansionary policies of both USA and Germany which were targeted to create avenue for the external penetration of their domestic products through currency devaluation and reduction of their domestic and world interest rate. This adversely affect the economic development of some developing countries including Turkey who peg their exchange regime to that of USA and Germany through the appreciation of their currencies which will make the price of their domestic products expensive to the external world. Also, the global financial meltdown of 2008/9 which negatively affected many economies of the world including Turkey was equally accounted in this study for the case of FDI and urban population. This is depicted from the graphical illustration of the trend of the data in Sect. 3. Having found mixed order of integration of the series, we proceed with the cointegration analysis. We applied ARDL-bound testing for the cointegration estimation considering its suitability in the case of different order of stationarity and integration without any condition to fulfill before adopting the method (Pesaran et al. 2001).

4.2.1 Linear and cointegration

The long run relationship and cointegration was estimated with ARDL-bound method and the output is shown in Table 5. Among other results shown in Table 5 are the short-run and long-run interactions and effects of the explanatory variables on the dependent variable, cointegration results with the outputs of the diagnostic (serial and autocorrelation, heteroscedasticity) tests and CUSUM and CUSUM2 estimates. The goodness of fit of the model is confirmed with the values of R2 and Adj.R2 as 0.999613 and 0.999533 which shows the rate at which the endogenous variable (CO2) is explained by the exogenous variables (GDP, fossil fuels, FDI, urban population, industry). The remaining part of the dependent variable that could not be explained by the exogenous variables is explained by the error term (residual) in the model. The estimated value of error correction model (ECM) displayed a negative a negative coefficient at 1% significant level. This confirms the ability of the model to be corrected to long run equilibrium after short run disequilibrium at 88% (− 0.8869). Serial and autocorrelation problems were dismissed with both the Durbin Watson (DW) and Breusch–Godfrey serial correlation LM tests at 1.99 and 1.125 [0.3356], respectively. Also, problem of heteroscedasticity is equally dismissed with Heteroskedasticity test: Breusch–Pagan–Godfrey at 1.575 [0.164]. This shows that the data and the model of this study are free from any error and are without spurious outcomes. Testing further for the stability of the model apart from the structural break estimate, we adopted CUSUM and CUSUM2 estimates which confirms the consistency of the model with the blue lines fitted inside the red lines and are presented in Figs. 2 and 3 immediately after ARDL linear and cointegration Table. The optimal lag choice was performed with Akaike ınformation criterion (AIC) and the optimal lag chosen from the test is 2. This will be made available upon a request. Test of cointegration was done with ARDL-bound test and the result confirmed the existence of cointegration and long run relationship between the variables with F-stat and upper bound test at 5.467 and 4.98, respectively, at 1% significant level. This output is shown in Table 5 as well with other estimates.

For better insight into this study, we proceed with the inferences from both the short run and long run estimates of this study. From the ARDL dynamic test we found the outputs of the short run and long run as follows: from short run perspective, we find economic growth (GDP per capita) and FDI having a negative relationship with carbon emission at 5% significant level, respectively. This points to the positive effect of the variable towards to Turkish environmental performance. It means that positive shock or increase in both economic growth and FDI will mitigate the carbon emission of the country thereby reflecting positively on the country’s environment quality. This is a good trend for the country in achieving a sustainable development which is in line with the United Nation’s sustainable development goal (SDG 12 and 15). Statistically, a percent change in economic growth and FDI will improve Turkish environment by reducing the emission by 0.003 (− 0.002808) percent and 1.29 (− 1.288953) percent point, respectively. Studies (Ozturk and Acaravci 2013; Gökmenoğlu and Taspinar 2016; Kizilkaya 2017 found EKC but FDI is not significant) have been performed for the case of Turkey in this regards and similar results were discovered. The above-cited studies found EKC for case of Turkey but with mixed findings as regards to the effect of FDI. This could happen where statistical approaches, sample years of observation and the modelling of the indicators and instruments are different. There is a tendency that economic growth will impact favorably on environment of any economy at some point of economic growth which is not far from this finding even though, we did not adopt EKC theory in this study.

Also, fossil fuels, industry and urban population showed positive relationship with the carbon emission (CO2) at 1 and 5% significant level, respectively. This means that the above-mentioned variables (fossil fuels, industry and urban population) are negatively impacting the Turkish environment through increase in emission level. Turkey is known a commercial hub (Udemba et al. 2020a; b, for Turkey) due to its industrial breakthroughs and this in many occasions have been pointed as among the driving factors of rural urban migration. The increase in urban population due to availability of jobs and good livelihood in the city will amount to excessive utilization of energy and its sources for both household and industrial purposes. Turkish economic activities (industrial cum rural urban migration due to commercial activities) are still done with old and outdated technologies which are framed to run with fossil fuels and other non-renewable energy sources. This is capable of degrading the environment through carbon emission due to the excessive utilization of the fossil fuels. The current Turkish economic and productive culture suggests over dependence on fossil fuels for energy need as most of the technologies are framed towards utilization of the non-renewable energy sources. Hence, a percent change in fossil fuels, industry and urban population suggest a decrease in Turkish quality due increase in carbon emission by 3.13, 0.34 and 0.00000038 (3.83E−07), respectively. Though, the impact of urban population is very minute and insignificant, it still displays a positive relationship with carbon emission showing the tendency of impacting negatively on Turkish environment. These findings supports the findings by Rjoub et al. (2021a), Sharif et al. (2020), Eyuboglu and Uzar (2019). However, similar result (except for that of economic growth that is positively related to carbon emission and urban population that is significant) was established for the case of Turkey in the long run with varying degrees through their various coefficients. Statistically, a percent increase in economic growth (GDP), fossil fuels (FOSS), industry and urban population will, respectively, cause 0.000616, 2.646819, 0.384946, 4.32E−07 degradation to the environment due to increase in carbon emission. The relationship between FDI and environment is constant in both periods with varying impact from the coefficients which is progressive in nature showing that the positive impact is trending upward thereby confirming pollution halo hypothesis (PHH). This is a good and success story for the case of Turkey. This contradicts the finding by Udemba (2020a, b), Seker et al. (2015) for Turkey, Kaya et al. (2017) for Turkey, Solarin et al. (2017), Gökmenoğlu and Taspinar (2016) for Turkey, Udemba (2019) for China; but consistency with finding from Udemba et al. (2019) for Indonesia. This development is not far from the different environmental indicators (ecological footprint and carbon emission) used in these studies policy implementation with time varying factor which is capable of upturning ugly trend to positive trend.

4.3 Diagnostic tests

4.3.1 (CUSUM and CUSUM2)

4.4 Granger causality tests

Among the approaches adopted in this study is Granger causality estimate and analysis. Specifically, we adopted vector error correction model (VECM) because of the order of integration (mixed) found in the stationarity test. This method enables us to estimate Granger causality in both short run and long run. Granger causality analysis helps in exposing the predicting power of the selected variables and equally expose the originator of the relationship that existed in the linear and cointegration analysis, whether the interaction is a one-way or two-ways transmission. The result from VECM Granger causality estimation is shown in Table 6. Hence, the findings are as follows: from long run estimate of causal analysis, two-way Granger causal relationship exist between CO2 and GDP, CO2 and fossil fuels, GDP and fossil fuels while one-way causal relationship exist from urban population to CO2, from FDI and urban population to GDP, from urban population to fossil fuels, from urban population to FDI. Again, from short run estimate of the causal analysis, two-way causal relationship exist between CO2 and FDI, between fossil fuels and FDI, between GDP and FDI while unilateral (one-way) transmission exist from urban population to CO2, from CO2 to GDP, from fossil fuels to FDI and urban population to GDP, from urban population to fossil fuels.

5 Concluding remark and policy framing

Our study investigates the impact of the selected variable (urbanization, FDI, fossil fuels and industrialization) on Turkish environmental performance towards its sustainable development. Specifically, we consider inference from urbanization on environment as the key subject of this study. Also, we compliment urbanization with other important variables (such as industry, FDI, fossil fuels and GDP) capable of inducing pollutant emission in any economy through economic operation in this study. The triggering force behind this study is the trend of rural urban migration due to the industrial booming in the urban areas. As remarked in the discussion section, the increase in urban population due to availability of jobs and good livelihood in the city will amount to excessive utilization of energy and its sources for both household and industrial purposes. The current Turkish economic and productive culture suggests over dependence on fossil fuels for energy need as most of the technologies are framed towards utilization of the non-renewable energy sources. We found interesting and insightful results (that explain the objective of this study and dully advise on the policy constructing) with ARDL-bound tests and VECM Granger causality approaches. Inferences from the short run and long run of ARDL give credence to the objectives of our study. Hence, economic growth (GDP per capita) and FDI impact the Turkish environmental performance positively, while on the contrary, fossil fuels, industry and urban population showed negative impact on Turkish environment quality through increasing emissions. From VECM Granger causality, our findings support the findings from ARDL approach through the established nexus among the variables of interest.

Findings from the two approaches, point to the sensitivity of the selected variables to the economic and environment performance towards sustainable development of Turkey. Turkey as a country has adopted some policies such as increasing of the country’s renewable energy sector with the target of sources like wind and geothermal power, submission of its Nationally Determined Contribution (NDC) with boosting of its solar capacity to 10GW and 16GW by 2030. From our estimates urban population is confirmed a very important factor in determining the environment performance in Turkey. With the position of urbanization in Turkey’s sustainable development, its Policy formulation should be people oriented. Sensitization and awareness creation towards getting people to know the environmental implication of some of their activities and importance of maintaining clean environment should be first in priority. Provision of public transport system in support of the existing metropolitan buses and train will help to reduce emission from private vehicles in cities. Also, industry and fossil fuels are found promoting emission, therefore, policy towards curtailing the excessive utilization of fossil fuels and carbon intensive production should be promulgated either through carbon tax on the side of the industries or through a shift to renewable energy source on the side of private and public authorities. Policies to moderate FDI and consolidate economic growth with less use of fossil fuels should be considered. Findings and policy framing of this study has implication to the neighboring countries that has the same history of economic and environment performance of Turkey.

Conclusively, this study is open for more research especially utilizing other variables such as institutional quality and renewable energy sources.

Availability of data and material

Data will be made available only on request.

References

(Intro)

Bajpai V, Kulkarni G, Han SS, Ramachandra TV (2012) Carbon emissions due to electricity consumption in the residential sector. In: National conference on conservation and management of wetland ecosystems, Kottayam, Kerala

Çetintaş H, Bicil M, Turkoz K (2017) Turkiye'de Enerji Uretiminde Fosil Yakit Kullanimi ve CO2 Emisyonu Iliskisi: Bir Senaryo Analizi. EconWorld Working Papers 17002, WERI-World Economic Research Institute, revised Mar 2017

DPT (2006) Dokuzuncu Kalkınma Planı 2007–2013. T.C. Başbakanlık Devlet Planlama Teşkilatı, Ankara

Kaya H, Taylan Susan A (2020) Sürdürülebilir Bir Kentleşme Yaklaşımı Olarak. Ekolojik Planlama Ve Eko-Kentler İdealkent 11(30):909–937. https://doi.org/10.31198/idealkent.533730

Kumbur H, Özer Z, Özsoy HD, Avcı ED (2005) Türkiye’de Geleneksel ve Yenilenebilir Enerji Kaynaklarının Potansiyeli ve Çevresel Etkilerinin Karşılaştırılması, III. Yenilenebilir Enerji Kaynakları Sempozyumu ve Sergisi, pp 32–38

Sağlam S (2006) 1923–1950 yılları arasında Türkiye’de kent ve kentleşme olgusu, Sosyoloji Konferansları Dergisi, vol S. 53, pp s.257–s.274

Sancar O, Bostancı SH (2020) COVID-19 Pandemi Sürecinde Karbon Emisyonu Üzerine Bir Tartışma

Say NP, Yücel M (2006) Energy consumption and CO2 emissions in Turkey: empirical analysis and future projection based on an economic growth. Energy Policy 34(18):3870–3876

Udemba EN (2020a) Mediation of foreign direct investment and agriculture towards ecological footprint: a shift from single perspective to a more inclusive perspective for India. Environ Sci Pollut Res 27:26817–26834

Udemba EN (2021) Nexus of ecological footprint and foreign direct investment pattern in carbon neutrality: new insight for United Arab Emirates (UAE). Environ Sci Pollut Res 1–19

United Nations (1998) Kyoto protocol to the United Nations framework convention on climate change; adopted at COP3 in Kyoto, Japan

World Bank-TEPAV (2015) The rise of Anatolian Tigers: Turkey urbanization review. Report No 87180-TR. TEPAV Working Paper. Ankara, Turkey

References (Lit rev)

Adedoyin FF, Alola AA, Bekun FV (2021) The alternative energy utilization and common regional trade outlook in EU-27: evidence from common correlated effects. Renew Sustain Energy Rev 145:111092

Alola AA, Akadiri SS, Usman O (2021) Domestic material consumption and greenhouse gas emissions in the EU-28 countries: implications for environmental sustainability targets. Sustain Dev 29(2):388–397

Anwar A, Younis M, Ullah I (2020) Impact of urbanization and economic growth on CO2 emission: a case of Far East Asian countries. Int J Environ Res Public Health 17(7):2531. https://doi.org/10.3390/ijerph17072531

Azam M, Khan AQ (2016) Urbanization and environmental degradation: evidence from four SAARC countries—Bangladesh, India, Pakistan, and Sri Lanka. Environ Prog Sustain Energy 35:823–832. https://doi.org/10.1002/ep.12282

Barido D, Marshall J (2014) Relationship between urbanization and CO2 emissions depends on income level and policy. Environ Sci Technol. https://doi.org/10.1021/es405117n

Chang CC (2010) A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Appl Energy 87(11):3533–3537. https://doi.org/10.1016/j.apenergy.2010.05.004

Connor R (2015) The United Nations world water development report 2015: water for a sustainable world (vol 1). UNESCO publishing

Dodman D (2009) Blaming cities for climate change? An analysis of urban greenhouse gas emissions inventories. Environ Urban 21(1):185–201. https://doi.org/10.1177/0956247809103016

Ehrlich PR, Ehrlich AH (1997) The population explosion: why we should care and what we should do about it. Environ Law 27:1187

Ghosh S, Kanjilal K (2014) Long-term equilibrium relationship between urbanization, energy consumption and economic activity: empirical evidence from India. Energy 66:324–331. https://doi.org/10.1016/j.energy.2013.12.052

Joshua U, Bekun FV, Sarkodie SA (2020). New insight into the causal linkage between economic expansion, FDI, coal consumption, pollutant emissions and urbanization in South Africa (No. WP/20/011). AGDI Working Paper

Liu Y (2009) Exploring the relationship between urbanization and energy consumption in China using ARDL (autoregressive distributed lag) and FDM (factor decomposition model). Energy 34:1846–1854. https://doi.org/10.1016/j.energy.2009.07.029

Liu X, Bae J (2018) Urbanization and industrialization impact of CO2 emissions in China. J Clean Prod 172:178–186. https://doi.org/10.1016/j.jclepro.2017.10.156

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70(7):1344–1353. https://doi.org/10.1016/j.ecolecon.2011.02.009

McGee JA, York R (2018) Asymmetric relationship of urbanization and CO2 emissions in less developed countries. PLoS ONE 13(12):e0208388. https://doi.org/10.1371/journal.pone.0208388

Musah M, Kong Y, Mensah IA, Antwi SK, Donkor M (2020) The connection between urbanization and carbon emissions: a panel evidence from West Africa. Environ Dev Sustain. https://doi.org/10.1007/s10668-020-01124-y

Rafiq S, Salim R, Nielsen I (2016) Urbanization, openness, emissions, and energy intensity: a study of increasingly urbanized emerging economies. Energy Econ 56:20–28. https://doi.org/10.1016/j.eneco.2016.02.007

Rjoub H, Odugbesan JA, Adebayo TS, Wong WK (2021a) Sustainability of the moderating role of financial development in the determinants of environmental degradation: evidence from Turkey. Sustainability 13(4):1844

Saidi K, Mbarek M (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24:12748–12757. https://doi.org/10.1007/s11356-016-6303-3

Salim R, Rafiq S, Shafiei S, Yao Y (2019) Does urbanization increase pollutant emission and energy intensity? Evidence from some Asian developing economies. Appl Econ 51:1–17. https://doi.org/10.1080/00036846.2019.1588947

Shahbaz M, Sbia R, Hamdi H, Ozturk I (2014) Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecol Ind 45:622–631. https://doi.org/10.1016/j.ecolind.2014.05.022

Sharma SS (2011) Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl Energy 88(1):376–382. https://doi.org/10.1016/j.apenergy.2010.07.022

Umar M, Ji X, Kirikkaleli D, Alola AA (2021) The imperativeness of environmental quality in the United States transportation sector amidst biomass-fossil energy consumption and growth. J Clean Prod 285:124863

Wang P, Wu W, Zhu B, Wei Y (2013) Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl Energy 106:65–71. https://doi.org/10.1016/j.apenergy.2013.01.036

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO2 emissions: a regional analysis in China. Energy Policy 49:488–498. https://doi.org/10.1016/j.enpol.2012.06.048

References (body)

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci USA 94:175–179

Eyuboglu K, Uzar U (2019) The impact of tourism on CO2 emission in Turkey. Curr Issue Tour 23(13):1631–1645. https://doi.org/10.1080/13683500.2019.1636006

Gao Y, Zhang H, Jiao Y, Lu W, Liu Y, Han H, Dong C et al (2019) Strategy for activating room-temperature phosphorescence of carbon dots in aqueous environments. Chem Mater 31(19):7979–7986

Gökmenoğlu K, Taspinar N (2016) The relationship between CO2 emissions, energy consumption, economic growth and FDI: the case of Turkey. J Int Trade Econ Dev 25(5):706–723. https://doi.org/10.1080/09638199.2015.1119876

Hansen BE (2001) The new econometrics of structural change: dating breaks in US labor productivity. J Econ perspect 15(4):117–128

Hübler M, Keller A (2010) Energy savings via FDI? Empirical evidence from developing countries. Environ Dev Econ 15(1):59–80

IPCC (2014) Climate change 2014: synthesis report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, p 151

Javorcik BS, Spatareanu M (2008) To share or not to share: does local participation matter for spillovers from foreign direct investment? J Dev Econ 85(1–2):194–217

Kaya G, Kayalica MÖ, Kumaş M, Ulengin B (2017) The role of foreign direct investment and trade on carbon emissions in Turkey. Environ Econ 8(1):8–17

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782

Kızılkaya O (2017) The impact of economic growth and foreign direct investment on CO2 emissions: the case of turkey. Turk Econ Rev KSP J 4(1):106–118

MacKinnon JG (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econometrics 11(6):601–618

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econometr 16:289–326

Rjoub H, Odugbesan JA, Adebayo TS, Wong WK (2021b) Sustainability of the moderating role of financial development in the determinants of environmental degradation: evidence from Turkey. Sustain MDPI Open Access J 13(4):1–18

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sustain Energy Rev 52:347–356

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on turkey’s ecological footprint: evidence from quantile ARDL approach. Sustain Cities Soc 57:102138. https://doi.org/10.1016/j.scs.2020.102138

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Udemba EN (2019) Triangular nexus between foreign direct investment, international tourism, and energy consumption in the Chinese economy: accounting for environmental quality. Environ Sci Pollut Res 26(24):24819–24830

Udemba EN (2020b) Ecological implication of offshored economic activities in Turkey: foreign direct investment perspective. Environ Sci Pollut Res 27(30):38015–38028

Udemba EN (2020c) Mediation of foreign direct investment and agriculture towards ecological footprint: a shift from single perspective to a more inclusive perspective for India. Environ Sci Pollut Res 27(21):26817–26834

Udemba EN, Güngör H, Bekun FV (2019) Environmental implication of offshore economic activities in Indonesia: a dual analyses of cointegration and causality. Environ Sci Pollut Res 26(31):32460–32475

Yang L, Xia H, Zhang X, Yuan S (2018) What matters for carbon emissions in regional sectors? A China study of extended STIRPAT model. J Clean Prod 180:595–602

Zhang X, Zhao Y, Wang C, Wang F, Qiu F (2019) Decoupling effect and sectoral attribution analysis of industrial energy-related carbon emissions in Xinjiang, China. Ecol Ind 97:1–9

Zivot E, Andrews D (1992) Further evidence on the great grash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270

Funding

The author wishes to inform the Editor/Journal that no funding was received for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author wishes to inform the Editor/Journal that there are no conflicts of interest of any sort in this research.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Udemba, E.N., Keleş, N.İ. Interactions among urbanization, industrialization and foreign direct investment (FDI) in determining the environment and sustainable development: new insight from Turkey. Asia-Pac J Reg Sci 6, 191–212 (2022). https://doi.org/10.1007/s41685-021-00214-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-021-00214-7