Abstract

This is paper considers the role of economic sentiment and economic uncertainty in explaining economic adjustment in the Euro area during the Financial Crisis and Great Recession. The analysis is based on VAR models of economic activity, sentiment and uncertainty in four sectors—industry, retail, services and construction. Evidence is found that sentiment and uncertainty have non-negligible effects on economic activity. Finally also some additional evidence is provided by studying the two largest Euro area countries: Germany and France.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Policy makers and economists still have a hard time in fully understanding the forces that caused the recent Financial Crisis and Great Recession that affected (to various degrees) developed, and developing countries during 2008–2013. Factors that have been cited relate to the bursting of bubbles in financial markets—notably in housing markets-, balance-sheet recession and credit crunch in a debt-loaded aftermath of the crisis, pro-cyclical fiscal austerity policies, monetary policy impotence in a zero lower-bound environment, high commodity prices, general lack of demand and adverse supply conditions, notably a lack of innovation and investment.

While all these conventional factors and explanations have certainly played an important role, we focus on an additional factor that has not received a lot of attention and has not often been related to the Financial Crisis and Great Recession directly. We take as starting point the idea that macroeconomic sentiment (or confidence) and macroeconomic uncertainty are two factors that actually may have played a major role in the Great Recession. In particular, is it possible that negative consumer and producer sentiment and a general perception of increased uncertainty, have contributed significantly to the deep and prolonged recession in many countries? The recent financial crisis and recession, in this interpretation, is marked by a large negative shock to sentiment and a substantive increase in uncertainty. In a similar fashion it could be asked if positive sentiment and low uncertainty may have played a positive role during the Great Moderation period of 2001–2007.Footnote 1

That sentiment and uncertainty did not receive a lot of attention, relates for a great deal to their subjective nature: it is hard to define, measure or build conceptual models with these subjective variables. In standard macroeconomic theory, models and empirical research one will therefore not find such psychological variables.

In this paper we analyse the effects of both sentiment and uncertainty shocks on Euro area output using VAR models. We provide some empirical evidence for the sentiment and uncertainty hypothesis for the case of the Euro area. In particular, we consider the effects of sentiment and uncertainty per sector (industry, retail/consumption, services, construction) as there are possible differences in how these sectors are affected by shocks in sentiment and uncertainty. We also provide some cross-country evidence by looking at the cases of Germany and France, as there are always possible cross-country heterogeneities in the effects of sentiment and uncertainty. Innovative aspects of this paper are therefore the joint inclusion of sentiment and uncertainty fluctuations in the analysis of real activity, the possible variation across sector of activity and the considering of possible cross-country heterogeneity in the Euro area.

Our analysis is structured as follows: Sect. 2 provides a detailed analysis of the concepts of sentiment and uncertainty in the academic literature, Sect. 3 studies sentiment and uncertainty in the Euro area during the period of the Great Moderation and the Great Recession and constructs a set of VAR models on economic activity, sentiment and uncertainty. Section 4 provides the evidence that is obtained from the VAR models on the effects of sentiment and uncertainty on Euro area economic activity. Section 5 considers evidence on the role of sentiment and uncertainty in case of two individual Euro area countries: Germany and France. The conclusions summarizes the main findings.

2 Economic Sentiment and Uncertainty: Concepts and Theory

In this section we look at the concepts of economic sentiment and economic uncertainty. We try to summarize the main insights in the academic literature on the role of sentiment and uncertainty in macro-economic fluctuations. This literature is not very extensive: while Keynes (1936) himself attached crucial importance to both sentiment and uncertainty, these variables did not enter into the mainstream macro-economic analysis that has been developed since then.Footnote 2

2.1 Economic Sentiment

Sentiments (and behavioural theories more in general) do not feature in modern mainstream macroeconomics as they imply departing from a number of crucial paradigms of Neo-Classical economics. The Rational Expectations Hypothesis is crucial to understand why the concept of sentiment did not enter into mainstream macroeconomics: if expectations are rational, there is no room for animal spirits to exert an independent influence on economic activity. In other words, considering the possibility that sentiments (and other forms of behavioural economics) do matter in macroeconomics, implies also departing from the Chicago Rational Expectations Hypothesis/inter-temporally optimizing representative agent assumption/Efficient Markets Hypothesis/Walrasian General Equilibrium models.

In empirical business cycle research, however, the use of sentiment indicators is more common than in modern economic theory: sentiment indicators feature quite prominently among statistical indicators (found/assumed to be) capable in providing early detection and prediction of business cycle turning points. Survey data are therefore regularly used for economic surveillance and forecasting. The sentiment indicators can be used as a descriptive device about the current condition of the economy as well as of its future prospects. They provide early statements about variables which have quantitative counterparts (e.g. recent production trends) as well as information about variables which, although not directly observed (such as expectations), are widely used for assessing the current situation of the industrial sector. They are unique sources of information about the “moods” of businesses and consumers, in other words.

The idea that perceptions and expectations of households, entrepreneurs and investors play a role in macroeconomic outcomes—apart from a wide set of other potential factors, of course-, was one of the central lines of thought of Keynes. The term “Animal spirits” was used by Keynes (1936) in his The General Theory of Employment Interest and Money to capture the idea that aggregate economic activity might be driven in part by waves of optimism or pessimism of consumers and entrepreneurs. Some circularity is present: optimism stimulates spending, investment, employment and production and the resulting income growth on its turn reinforces that optimism. Similarly, a lack of optimism depresses the economy which on its turn stimulate further pessimism. Keynes’ animal spirits are influenced by Keynes notion of “long-run expectations”, i.e. how economic agents perceive economic conditions to evolve in the long-run.Footnote 3

In financial markets, market sentiment is often referred to as the “mood” or “gut feelings” in the financial markets reflecting the general attitude of investors as to anticipated price developments. This attitude is related to a variety of fundamental and technical factors, including price history, trading activity, economic reports and news about national and world events. Swings in market sentiment can create waves of pessimism or optimism and thereby generate excess volatility and bubbles in financial markets. In a well-known book, Shiller (1989) analyses how the market sentiment in financial markets feeds bubbles and excess volatility as markets are subject to “fashions and fads”. Such market sentiments imply that market outcomes will deviate from predictions from the Efficient Market Hypothesis and the Rational Expectations Hypothesis.

Dequech (1999) assumes that there are three fundamental determinants of expectations: knowledge, creativity and spontaneous optimism, i.e. the optimistic disposition towards the future. Spontaneous optimism implies optimism not based on information/knowledge. High animal spirits leads to positive expectations and high confidence, low animal spirits give raise to spontaneous pessimism and low confidence.

Akerlof and Shiller (2009) provide a recent, comprehensive account of animal spirits which they define as the psychological forces that explain why agents behaviour may deviate from the rational, representative agents in the mainstream macroeconomic models, and why the economy does not behave in the manner predicted by these models. Five aspects of animal spirits are highlighted: (1) the role of confidence, (2) the desire for fairness, (3) the presence of corruption and bad faith, (4) the effects of money illusion, (5) the role of stories in affecting behaviour. It is analysed how animal spirits shapes business cycle fluctuations in the economy and elicit a strong case for policy activism in particular in the conditions of a financial crisis and recession.

A few recent contributions do consider a possible role for sentiment in amplifying business cycles fluctuations. De Grauwe (2011) and Jang and Sacht (2016) relate sentiment to economic agents switching between an optimistic forecast rule and a pessimistic one, generating endogenous business cycles as agents become more or less optimistic about next period output. Rather than assuming rational expectations, agents are assumed to use simple forecast rules reflecting the cognitive limitations of agents. In contrast to the rational expectations hypothesis, it is, in other words, assumed that individuals are rather constricted in understanding and processing information leading them to use simple rules (“heuristics”) to guide their behavior. This behavioral model produces correlations in beliefs which in turn generate waves of optimism and pessimism (or “animal spirits”) that produce endogenous cycles. Also Milani (2014) relates sentiment to expectational shocks: exogenous changes in the private sector’s degree of optimism or pessimism and analyses the role of sentiment as a source of aggregate economic fluctuations in a New Keynesian model with sentiment fluctuations that is calibrated/estimated for US data. Sentiment shocks are found to explain roughly 40% of U.S. output fluctuations at business cycle horizons. In a similar spirit, Bofinger et al. (2013) build animal spirits in housing markets to see the effects of these on output fluctuations in a New Keynesian model. Agents are hovering between an optimistic and a pessimistic rule to forecast future real house prices.

A substantial literature in macroeconomics—see e.g. Benhabib and Farmer (1999)—highlights the importance of self-fulfilling fluctuations driven by sunspots. Sunspots—in the sense of entirely unforeseen events- and “black swans” (or extreme outlier events Taleb (2007)), which could relate to sentiment shocks (see Angeletos and La’O 2013), induce fluctuations in economic activity and possible shifts between multiple equilibria in the economy. In Caballero et al. (2016)’s analysis of “speculative growth” episodes, a growth-funding feedback occurs by which the future supply of effective funding increases as a result of the current conditions created by a speculative expansion. This lowers the cost of capital, lowering the price of new capital relative to consumption goods, initiating a speculative growth episode. The “speculative growth” represents the emergence of a (rational) bubble that eventually pops.

A final relevant literature concerns the effects of news shocks on economic activity, -the news driven business cycle hypothesis- launched by Beaudry and Portier (2006). News shocks relate to the arrival of new information on future technology changes that could contribute to an upbeat—in case of positive “news” shocks- economic mood today.Footnote 4 Crucial insight is that agents may thus identify changes in technological opportunities well in advance of their effect on productivity. This anticipated future increase in TFP leads to a boom in both current consumption and investment, generating and expectations driven business cycle in other words. Such “news shocks”—while attached to one specific variable namely TFP-, share with the sentiment shocks the notion that expected future economic conditions can depress or uplift current spending.

2.2 Economic Uncertainty

Not only negative sentiment but also high economic uncertainty has marked the macroeconomic situation since the start of the crisis in 2008. In the real economy, uncertainty increased as it was unclear how strong and how long the effects from the global financial crisis would impact on the real economy. In the financial system, uncertainty was elevated because of perceived systemic risk, i.e. uncertainty because of the (perceived) possibility that the financial sector would implode. During the Financial Crisis and Great Recession not only economic and financial uncertainty peaked, also levels of political uncertainty increased substantially and may have contributed on its turn to the depth and length of the recession. Uncertainty increased in particular over the European Sovereign Debt Crisis. The high political uncertainty was evidenced by the widespread speculations about the possibility of defaults on government debt by a number of peripheral Euro area countries and possible bailouts and measures by the ECB to counteract Europe’s Sovereign Debt Crisis. All this seemingly in contrast to the period preceding the crisis which has been referred to as the Great Moderation, because of the very low level of uncertainty perceived by economic subjects.

It is important to note that economic theory distinguishes between risk and uncertainty.Footnote 5 In case of risk, the numerical probabilities in a decision problem are given objectively and agents are able to use stochastic calculus to determine optimal actions given their risk aversion profile. In case of uncertainty no objective information about probability distributions is known and agents instead will have to form subjective probabilities about uncertain events. Ambiguity, in the sense of Ellsberg (1961), would lie in between risk and uncertainty. Ambiguity could be defined as uncertainty about probability, created by missing information which is relevant but could be known in principle: ambiguity arises as economic agents experience cognitive limitations to the absorption of information. This ambiguity in the sense of uncertainty about probability distributions is larger, the more information is missing. As new information emerges, probability estimates are updated and degree of ambiguity reduces.

Keynes’ analysis of economic uncertainty and its effects centers around the notion of fundamental uncertainty and its effects on economic agents. Dequech (2011) defines Keynes’ fundamental uncertainty as “situations in which at least some essential information about future events cannot be known at the moment of decision because this information does not exist and can not be inferred from any existing data set”. Dequech links fundamental uncertainty also to liquidity preference: the higher are an individual’s uncertainty perception and uncertainty aversion the stronger is her inclination not to act, in economic terms this not acting corresponds to liquidity preference. Keynes’ fundamental uncertainty is directly related to “Knight’s (1921) and Minsky’s (1982)” etc. “Knightian uncertainty” and Alchian’s (1950) “radical uncertainty” and “sheer ignorance”.Footnote 6 All these concepts share the general absence of quantified probabilities and fundamental ignorance about the future and the outcomes of economic mechanisms and structures.

Whereas Neoclassical economics studies cases where people know what they do not know, i.e. risk and its implications, in these alternative approaches, cases are studied where people do not know what they do not know. Decision making under Knightian uncertainty implies an environment where there are unmeasurable and unknown probabilities. In Alchian’s approach uncertainty arises in addition from the human inability to solve complex problems containing a host of variables even when an optimum is definable in principle. This approach stresses the importance of model uncertainty: economic agents are confronted with a plethora of economic models and find it simply impossible to determine what is the “true” model. Confronted with this uncertainty, Alchian argues that economic agents in particularly rely on imitation of observed successes, producing herding behaviour e.g.Footnote 7

A high level of economic uncertainty can dampen economic activity via its impact on investment, consumption and employment. When uncertainty is perceived to be high, households and businesses may take a wait-and-see approach, i.e. to postpone action until uncertainty is resolved. Uncertainty can also dampen activity via impact of higher risk premia on cost of finance, and via managerial risk aversion. In the model of Faigelbaum et al. (2014), higher uncertainty discourages investment and uncertainty shocks cause real instability. The real and financial instability causes increased liquidity preference and reduced expenditure plans during the crisis. Uncertainty is endogenous as agents learn from the actions of others: as a consequence the economy features uncertainty traps: self-reinforcing episodes of high uncertainty, low economic activity and persistent recession.

In financial markets, fundamental uncertainty takes the form of systemic risk, the risk of collapse of an entire financial system or entire market, (as opposed to risk associated with any one individual entity or component of a system). It represents financial system instability, potentially catastrophic, caused or exacerbated by idiosyncratic events or conditions in financial intermediaries. It results from the inter-linkages and interdependencies in the financial system, where the failure of a single entity or cluster of entities can cause a cascading failure, which could potentially bankrupt or bring down the entire system or market. Engle et al. (2015) consider systemic risk in Europe. Interestingly, it is found that their systemic risk measure Granger-causes industrial production in most European countries, providing in other words an early warning signal of distress in the real economy. It is also found that the main driver of systemic risk in most countries is the 3-month interbank rate which strongly affects both asset and liability sides of bank balances.

A final form of economic uncertainty that may matter is economic policy uncertainty the future path of government policy is typically uncertain. Policy uncertainty may relate to uncertainty about monetary or fiscal policy, taxation and other regulatory policies and electoral or other forms of political uncertainty.Footnote 8 If policy uncertainty increases, risk premia on government debt may increase as financial markets may be uncertain about future policy actions. Business and consumers may delay investment and spending until this uncertainty is resolved.

In case of empirical analysis of economic uncertainty and its effects, an obvious question is: how to find an empirical approximation of the amount of uncertainty in the economy? Alternative empirical measures can been used to proxy uncertainty (ECB 2013): (1) observed volatility in stock markets, (2) the dispersion of expert or business survey expectations, (3) the frequency of press references to terms relating to economic policy uncertainty, (4) the common variation of forecasting errors in econometric models.

A substantial recent literature on the effects of macroeconomic uncertainty has followed from Bloom (2009), who develops a theoretical framework to analyse the impact of uncertainty shocks. Macroeconomic uncertainty shocks produce a rapid drop and subsequent rebound in aggregate output and employment. This occurs because higher uncertainty causes firms to temporarily pause their investment and hiring. In the medium term a “volatility overshoot” is produced as the increased volatility from the shock induces an overshoot in output, employment, and productivity. Thus, uncertainty shocks generate short, sharp recessions and recoveries once uncertainty is resolved. In the empirical application for the US, stock market volatility is used as an indicator of uncertainty in a VAR model of stock prices, stock market volatility, Federal Funds Rate, average hourly earnings, consumer prices, hours, employment and industrial production. It is found that volatility shocks generate a short-run drop in industrial production, lasting about 6 months and a longer-run overshoot.

Choi and Loungani (2015) explore the role of uncertainty shocks in explaining US unemployment dynamics, disentangling macro-economic from sectoral uncertainty. Bachmann et al. (2013) uses survey expectations data to construct empirical proxies for time-varying business-level uncertainty and analyse the impact of business uncertainty on the economy using bivariate VAR models for German and the U.S. economy. Bansal and Yaron (2004) and Bansal et al. (2010) developed the Long Run Risk (LRR) model which emphasizes the role of long run risks, that is, low-frequency movements in consumption growth rates and volatility, in accounting for a wide range of asset pricing puzzles. The presence of long-run risk is modelled as persistent stationary labour productivity shocks, shocks to firms fixed costs and shocks in investment technology. Such non-stationary shocks are shown to be important to explain the short run dynamics in the growth rate of consumption and GDP.

3 Economic Sentiment and Economic Uncertainty in the Euro Area

In this section, we analyse the adjustment of activity, sentiment and macroeconomic uncertainty in the Euro area using monthly data during the period 2000:1–2015:8. This period can be divided in two sub-periods: period 1 of pre-crisis Great Moderation, 2000:1–2007:12, and period 2 of the Great Recession and European Debt Crisis and its aftermath, 2008:1–2015:8.

3.1 Economic Sentiment in the Euro Area

The European Commission provides for each country in the EU a set of sentiment indicators that are calculated using information from business and consumer surveys, the Joint Harmonised EU Programme of Business and Consumer Surveys. Surveys are conducted on a monthly basis in the following five areas: industry, construction, consumers, retail trade and services. A sixth survey from the financial sector, has not yet been fully incorporated into the regular survey programme. About 125.000 firms and almost 40.000 consumers are surveyed every month across the EU.

The main questions of the industry survey refer to an assessment of recent trends in production, of the current levels of order books and stocks, as well as expectations about production, selling prices and employment. Construction surveys are an important source of information concerning short-term developments in building activity. In the retail trade survey managers are asked about their assessment of recent developments in their business situation, of the current level of stocks, and their expectations about a number of economic variables (production, new orders and employment). The consumer survey gathers information on households spending and savings intentions and their perception of the factors influencing these decisions. The questions are organised around four topics: households financial situation, general economic situation, savings and intentions with regard to major purchases. Finally, the services survey provides information about managers assessment of their recent business situation, and of the past and future changes in their companys turnover and employment.

All the monthly surveys have a similar answer scheme: answers are given according to a three-option ordinal scale: “increase” (+), “remain unchanged” (=), “decrease” (−); or “more than sufficient” (+), “sufficient” (=), “not sufficient” (−); or “too large” (+), “adequate” (=), “too small” (−). Also the possibility to answer “don’t know” is given. Answers obtained from the surveys are aggregated in the form of “balances”. Balances are constructed as the difference between the percentages of respondents giving positive and negative replies.Footnote 9 The Commission calculates EU and euro-area aggregates on the basis of the national results and seasonally adjusts the balance series.

The balance series are used to build composite indicators. First, for each surveyed sector, the Commission calculates confidence indicators as arithmetic means of answers (seasonally adjusted balances) to a selection of questions closely related to the reference variable they are supposed to track. These indicators thus provide information on economic developments in the different sectors. Second, the results for the five surveyed sectors are aggregated into the Economic Sentiment Indicator (ESI), whose purpose is to track GDP growth at Member State, EU and euro-area level.Footnote 10

3.2 Economic Uncertainty in the Euro Area

Measuring uncertainty is not obvious as noted earlier. A natural approach seems to explore the consumer and producer surveys: the heterogeneity of economic sentiment surveys reflects the dispersion of expectations and can be interpreted as a gauge of macroeconomic uncertainty. If heterogeneity in survey responses is high this would reflect high uncertainty, if heterogeneity is low, uncertainty is low. An indication of consumer-, producer- and financial market uncertainty can therefore be obtained from exploring the heterogeneity of economic sentiment indicators of households, business and financial investors.

This reasoning is related to the approach by Haddow and Hare (2013) who define macroeconomic confidence shocks and macroeconomic uncertainty shocks as shifts in the mean, respectively variance of the probability density function of GDP growth expectations (assuming of course that such a probability density function can be properly defined/identified at each moment). In that interpretation a joint adverse shock to confidence and uncertainty would imply a leftward and downward shift in this probability density. Both the lower confidence and higher uncertainty are then likely to exert a negative effect on future actual GDP growth through channels indicated earlier.

To measure uncertainty of consumers and producers we use the following dispersion measure in the responses to forward-looking questions in the survey results of the European Business and Consumer Surveys:

where frac(+) is the fraction of “increase” responses to a survey question at time t and frac(−) is the fraction of “decrease” responses. Uncertainty ranges from 0 (no uncertainty) to 100 (maximum uncertainty) when frac(+) = frac(−) = 0.5. For our purposes, the dispersion approach towards forward-looking questions in consumer- and producer confidence indicators seems the most direct way to proxy the amount of fundamental uncertainty in the economy.Footnote 11

3.3 Dataset

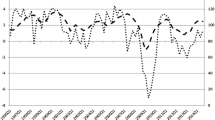

Data were collected from Eurostat and the EU Commission Business and Consumer Surveys. All details on the variables included in the dataset includes are provided in the Appendix. Figure 1 graphs Euro area output, sentiment and uncertainty in (a) industry, (b) consumption, (c) services and (d) construction.

Industrial production was increasing steadily during the period 2002–2007. The financial crisis resulted in a sharp negative shock to production of 20% in 2009. From this negative shock, the Euro area economy is recovering only slowly, also a second downturn is witnessed during 2012. Industry sentiment displays broadly the same pattern as industrial production, possibly with a small lead.Footnote 12 Uncertainty was low and stable before the crisis of 2008–2009, but then spiked at the onset of crisis, it is broadly following an opposite pattern from industrial production. Since then uncertainty in industry has remained higher than the pre-crisis levels. Taken together, the Financial Crisis and Great Recession are marked by a substantial negative sentiment and a positive uncertainty shock in Euro area industry.

Panel (b) of Fig. 1 graphs consumption (proxied by retail sales), consumer sentiment and consumer uncertainty. Consumer sentiment dropped markedly and consumer uncertainty increased as a result of the Financial Crisis. Consumers gradually adjusted consumption: consumption has been dropping slowly until early 2015.

Services sector activity, services sector sentiment and services sector uncertainty are displayed in panel (c). The services sector was also affected by the Financial Crisis and Great Recession but to a lesser extent than industry, retail and construction. Nevertheless, it is clearly seen that sentiment dropped and uncertainty increased to some extent.

Finally, panel (d) graphs construction sector activity, construction sector sentiment and construction sector uncertainty. The construction sector has been hardest hit by the Financial Crisis and economic slowdown according to Fig. 1. Output is some 30% lower than pre-crisis and without sign of a recovery. This is also mirrored in the large negative sentiment in the sector since 2008 and also a higher level of uncertainty.

3.4 A VAR Model of Output, Output Volatility, Sentiment and Uncertainty in the Euro Area

The main aim of this paper is to analyse the impact of sentiment and uncertainty shocks on real activity in the Euro area. This can help in particular to answer the question which hypothesis about the role of sentiment and uncertainty is the more relevant one when we consider the Great Moderation and Financial Crisis periods in the Euro area. Is it the Keynesian hypothesis that sentiment and uncertainty are crucial to understand macroeconomic adjustment—here proxied by output adjustment—or is that case overstated and can we safely rely on the Neo-Classical/RE model in which such subjective aspects like sentiment and uncertainty do not influence decision making and economic outcomes?

A convenient approach for our purposes is the the vector auto-regression (VAR) model. It is commonly used for analysing the dynamic impact of random disturbances on the system of variables and for forecasting systems of interrelated time series. The VAR approach sidesteps the need for structural modelling by treating every endogenous variable in the system as a function of the lagged values of all of the endogenous variables in the system. The mathematical representation of a VAR is:

where \(y_t\) is a vector of endogenous variables, \(x_t\) is a vector of exogenous variables, A and B are matrices of coefficients to be estimated, and \(\epsilon _t\) is a vector of innovations that may be contemporaneously correlated but are uncorrelated with their own lagged values and uncorrelated with all of the right-hand side variables. Since only lagged values of the endogenous variables appear on the right-hand side of the equations, simultaneity is not an issue: OLS yields consistent and efficient estimates.

We constructed four VAR models: for each sector of the Euro area economy outlined in the previous section: industry (INDU), consumers/retail trade (RETA), services (SERV) and construction (BUIL), a VAR model of output, economic sentiment and uncertainty is build:.

The estimation samples for the four VAR models are 2000:5–2015:7, 2000:3–2015:7, 2005:3–2015:6, 2000:4–2015:7, respectively. Prior to estimation it was verified that the data series are stationary when entering the model and the appropriate lag length was selected (in all cases the appropriate lag length is either 3 or 4 months). All data characteristics, stationarity and lag-length tests, and estimation results of the VAR models are found in a separate annex available for the reader upon request. A Great Moderation/Great Recession dummy variable was also included in all models to try to capture some independent effect from the European Financial Crisis. The variable takes a value of 0 before August 2008 and a value of 1 afterwards. In all estimations, the dummy is found to be significantly negative in case of output and sentiment, and significantly positive in case of uncertainty, an strong indication of the importance of the Crisis in the data.

The VAR models were identified with recursive identifying restrictions: a lower triangular Choleski identification ordering the uncertainty index first, sentiment second and output third, implying that on impact shocks to the uncertainty index affect the both other variables, sentiment shocks on impact affect output. It was verified that changing the ordering does not greatly change our results.

The identification of uncertainty shocks is recent in the empirical literature and most of the studies also identify them using the recursive Choleski decomposition, see Bachmann et al. (2013) among others. Under this ordering, uncertainty does not contemporaneously respond to other shocks while an innovation to it can have an immediate effect on the variables ordered after. This assumption is broadly in line with how uncertainty is treated in theoretical models (Fig. 2).

4 Effects of Sentiment and Uncertainty on Economic Activity in the Euro Area

The previous section outlined the VAR model that is constructed to analyse the joint impact of sentiment and uncertainty shocks on Euro area economic activity. After estimation and identification we can apply a set of tools to analyse the estimated relations between sentiment, uncertainty and economic activity. We focus on four types of evidence that follow from or analysis: (1) the impulse-response functions, (2) Granger causality tests, (3) error variance decompositions and (4) forecasting performance relative to a no-change forecast.Footnote 13

Figure 5 summarises the results that are obtained from the four VAR models concerning the effects of sentiment and uncertainty shocks on activity: effects of a one standard deviation shock in sentiment and uncertainty on output are displayed. The blue solid lines are median responses of output to a positive one unit innovation to sentiment and uncertainty, the dotted red lines delineate 95% confidence intervals. Shocks occur at time 0 and the transmission of this initial shock until period 24 (2 years therefore) are given.

In case of industrial production, retail sales, services and construction the impulse response functions suggest quite consistently that positive sentiment shocks have a positive effect on real activity and positive uncertainty shocks have a negative effect on real activity. In some cases, the effects would not be significant for all periods at the strict 95% confidence levels, but still we see that the effects are in the direction of a positive effect in case of sentiment and a negative effect in case of uncertainty. This, therefore, credits to a certain extent the Keynesian hypothesis that sentiment and uncertainty may matter for economic activity and should not be disregarded a priori.

The analysis of the Impulse Response Functions of the VAR models of real activity, sentiment and uncertainty provides evidence of a possible effect of sentiment shocks and of uncertainty shocks on economic activity in the Euro area. A next question that naturally arises then is, whether sentiment and uncertainty can be used to forecast economic activity: if sentiment and uncertainty do matter in explaining real activity fluctuations, one would expect sentiment and uncertainty shocks to contribute in forecasting real activity. Using sentiment and uncertainty in a forecast experiment should then increase forecasting performance for real activity in subsequent periods. In other words, it is not only important if sentiment or uncertainty would have a statistically significant impact on current activity but also if their influence is economically meaningful/substantial in the sense of being helpful in predicting future output.

Aim of this section is therefore to determine how tightly linked sentiment and uncertainty fluctuations are to future real activity fluctuations. To do so, three types of evidence are collected: (1) Granger-causality tests between activity and sentiment and uncertainty, (2) a variance error decomposition of the estimated VAR models, (3) an in-sample forecast exercise in which the forecasting performance of the estimated VAR models is compared with a naive forecasting rule. A similar strategy is used e.g. in Gayer (2006) who concentrates on the use of survey data in forecasting real output movements.

First evidence is provided by carrying out Granger causality tests between lagged sentiment and current output and between lagged uncertainty and current output. Table 1 provides the Granger causality tests whether sentiment and uncertainty Granger-cause their respective macroeconomic tendencies with a lagging time of 6 months.

The null-hypothesis that sentiment/uncertainty Granger do not cause real activity is rejected in most cases. In case of services, however, the tests find no evidence for Granger causality between sentiment and activity in the services sector and between uncertainty and output in the services sector for the 6 months lagging period.

The second type of evidence about the value of sentiment and uncertainty in explaining activity in the Euro area comes from the variance error decompositions of the VAR models estimated in the previous section. Variance decomposition examine the relative importance of each individual indicator in explaining the variability of the reference series—here economic activity-, as a function of the forecast horizon. Table 2 provides the results from this exercise:

The effects of sentiment and uncertainty are strongest in case of industry where these factors can explain up to 50% of total output variation. In the other cases the explained variation is between 10 an 20%. Sentiment shocks have more explanatory power than uncertainty shocks in all cases.

The final approach to assess the forecasting power of sentiment and uncertainty wrt economic activity takes the form of a in-sample forecast comparison between two models: (1) the VAR models estimated in the previous section and (2) a naive forecasting model that assumes that economic activity will simply take the same value as in the previous period.Footnote 14 To determine forecasting performance, we calculate the Root Mean Squared Error (RMSE), the Mean Average Percentage Error (MAPE), and Theil’s Inequality coefficient (THEIL). In all cases a lower value of these indicators implies higher forecast accuracy. We calculate the indicators for (1) a 3 months, (2) a 12 months and (3) a 24 months ahead forecasting horizon. The Diebold-Mariano (DM) test-statistic is used to test the null-hypothesis of equal forecasting accuracy of the VAR model and the naive forecasting model.Footnote 15 Table 3 displays all results.

Starting date of all forecasts is August 2008, the month that in retrospect could be seen as the starting point of the Global Financial Crisis and Great Recession. The forecasting periods therefore concern: (1) August 2008–October 2008, (2) August 2008–July 2009, (3) August 2008–July 2010. The use of short and longer horizons is useful to determine forecasting ability in the short and longer term. The exercise is therefore also an ex-post evaluation of the ability of the models to forecast the effects of the Global Financial Crisis and Great Recession.

Except for two 3 months forecasting horizons (in case of retail sales and Services), the VAR models with sentiment and uncertainty outperform—typically with a comfortable margin-the naive output forecast models. In particular with a long-run forecast horizon, the sentiment and uncertainty models would provide substantially more forecasting accuracy during this sample of the first 2 years of the Global Financial Crisis and Great Recession. The DM test-statistics confirm that—with the exception of the 3 months horizon-the VAR models with sentiment and uncertainty have a statistically significant higher forecasting accuracy than the naive ’no-change’ output prediction model.

5 Sentiment and Uncertainty in Individual Countries

A limitation of the analysis of the aggregate Euro area economy of the previous section is that it masks the possibility that at the disaggregated country level there may be quite a lot of heterogeneity in the aspect that is studied. Here in particular it may be the case that the relations between activity, sentiment and uncertainty are quite heterogeneous across countries. In that case, it would be more useful to look individual countries rather than a aggregate like the Euro area before more definite answers on the relation between these variables can be made.

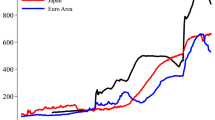

In this section we therefore consider the relations between activity, sentiment and uncertainty in two individual Euro area countries: Germany and France.Footnote 16 Germany, has withstood the Financial and European Debt crises remarkably well. France on the other hand has had more difficulties in absorbing and recovering the same crises. We collect the production, sentiment and uncertainty data for both countries and then estimate the VAR models. We can then compare the effects of sentiment and uncertainty shocks between the countries and also with the aggregate Euro area model in Sect. 4. Also we calculate again the forecasting powers of the sentiment and uncertainty variables.

5.1 Germany

The German economy displayed a relatively swift recovery from the global financial crisis and recession. The data on German industrial production, consumption, services, construction, sentiment and uncertainty—collected in Fig. 3—also suggest this recovery. Sentiment clearly rebounded from the lows in 2009 and uncertainty has been reduced steadily. The IRFs of the estimated VAR models with output, sentiment and uncertainty—found in Fig. 4—indicates positive links between sentiment and output in all cases. A negative link between uncertainty and output is most clear in case of retail/consumption in the German case.

The forecasting exercise in Table 5 shows that also in the case of Germany, higher forecasting accuracy (with the exception of 3 months forecasting in industry and services) of the VAR models with sentiment and uncertainty is obtained compared to the naive ‘no-change’ forecasting model. This result is therefore similar to the Euro area case in Table 4.

5.2 France

The French case is marked by a mixed picture: output and sentiment declined much more in industry and construction, whereas consumption and services have recovered as Fig. 5 shows. The IRFs of the estimated VAR models displayed in Fig. 6, indicate positive links between sentiment and output in case of industrial production, services and construction and negative links between uncertainty and output in case of services in particular. While broadly consistent with the German case, these results on France differ in other words somewhat from the German case (which on its turn also differed somewhat from the Euro area case) (Table 5).

6 Conclusion

Conventional economics seems to struggle with a full account of the recent Global Financial Crisis and Great Recession and its dramatic effects. One possibility to explain this could be that mainstream economic theory and empirical analysis does not give much attention to psychological factors like sentiment and uncertainty when explaining business cycles. This while it is clear that the Global Financial Crisis and its aftermath has also been characterised by a large drop in economic sentiment and an upswing in macroeconomic uncertainty.

This paper tried to address the question whether sentiment and uncertainty could have been factors that have been overlooked in the analysis of the Global Financial Crisis and Great Recession. To do so, we constructed VAR models of economic activity, sentiment and uncertainty for the Euro area during the period 2000–2015. We showed that sentiment tends to have a positive impact on economic activity while uncertainty tends to depress uncertainty in the four main sectors of the economy. In a next step, we evaluated the contribution of sentiment and uncertainty in forecasting future real activity. We compared the forecasting accuracy of the VAR models of economic activity, sentiment and uncertainty with a naive forecasting model. For the crisis period, our VAR models clearly outperform the naive model, which supports the idea that sentiment and uncertainty do have relevance for explaining economic activity during this event.

To gain additional evidence on these results that were based on the aggregate Euro area, we considered the case of two individual countries: Germany that absorbed the Crisis successfully while France’s adjustment was significantly slower. Carrying out the same analysis for these countries, we find similar but not completely identical results between these countries and in comparison with the aggregate Euro area case: some cross-country heterogeneity in the effects of sentiment and uncertainty fluctuations on economic activity is likely to be present in the Euro area.

Our study could not address—because of data issues in particular-the role of two main aspects of sentiment and uncertainty that also seem highly relevant in the context of the Global Financial Crisis and Great Recession: sentiment and uncertainty in financial markets and political stability and political uncertainty. It is left for potential future research to investigate the effects of financial market sentiment and uncertainty and political uncertainty during the Crisis.

Notes

This possibility of intermittent periods of crisis and stability was also stressed by Minsky (1982): Minsky’s Financial Instability Hypothesis argues that stability breeds instability by encouraging an unreasonable increase in confidence in expectations. From a Minskian perspective, financial instability is the norm rather than the exception and the incidence of crisis cannot be prevented, because of the nature of financial markets. Given fundamental uncertainty, there are no true prices to act as benchmarks, to which financial markets can return after a crisis.

Other concepts of the Keynesian paradigm, e.g. the multiplier idea, the liquidity trap, the idea of limited price and wage flexibility and the importance of macro-economic stabilization policies, obviously did enter into mainstream macro.

Bonciani and van Roye (2015) add uncertainty to such news about future TFP shocks, showing that this has additional complications for economic adjustment and monetary policy making. Barsky and Sims (2011) find that surprise changes in consumer confidence are associated with long-lasting movements in macroeconomic aggregates. This relationship between confidence and the economy obtains because empirical measures of confidence are found to reflect changes in future economic fundamentals, in particular productivity.

In practice, however, uncertainty and risk are often mixed. In empirical studies, -such as Serven (1998)-, the volatility of innovations to key macroeconomic variables (inflation, growth, the terms of trade, the real exchange rate and the price of capital goods) are used as proxies for macroeconomic uncertainty. These proxies are used to examine their association with aggregate private investment. Including this proxy in a panel data analysis of investment dynamics, Serven (1998) finds that the proxies have a significant negative effect on investment in a panel of 94 developing countries during the period 1970–1995. Stasavage (2002) uses the same dataset and includes also proxies of political institutions and political instability to estimate also the impact of these variables on private investment.

In management science, the term deep uncertainty is used which according to Lempert et al. (2006) implies a “condition in which analysts do not know or the parties to a decision cannot agree upon (1) the appropriate models to describe interactions among the variables in the system, (2) the probability distributions to represent uncertainty about key parameters in the models, or (3) how to value the desirability of alternative outcomes”.

For a recent overview on the workings of herding behaviour in financial markets, see Chang (2014).

The analysis of Villaverde et al. (2015) e.g. focuses on the effects of fiscal uncertainty: it is asked how fiscal volatility shocks (which proxy fiscal uncertainty) affect economic activity using an estimated DSGE model of the US economy. Baker et al. (2016) develop an index of economic policy uncertainty based on newspaper coverage frequency for the United States and some European countries and find evidence of a negative impact of economic policy uncertainty on output.

Balance values therefore range from − 100, when all respondents choose the negative option to +100, when all respondents choose the positive option. When the balance is 0, the number of positive respondents matches the number of negative respondents.

The aggregate Economic Sentiment Indicator is made up of the five sectoral confidence indicators using the following weights: Industry 40%, Services 30%, Consumers 20%, Construction 5%, Retail trade 5%, reflecting the relative shares in the economy. Soric et al. (2016) shows that this set of weights to calculate the aggregate ESI, however, is not necessarily optimal in terms of predictive accuracy. The results of the industry survey, are used by the EU Commission to produce a factor-model-based Business Climate Indicator designed to assess cyclical developments in the Euro area.

Given the setup of the empirical analysis we therefore do not explore the possibility to include the other uncertainty proxies used in the literature, the stock market volatility based proxies and the proxies based on the economic policy uncertainty indices.

Thomakos and Papailias (2014) use the Economic Sentiment Indicator to analyse economic sentiment cycle synchronization for Germany, France and the UK and the group of Southern European countries Italy, Spain, Portugal and Greece. ESI movements were mostly synchronous before 2008 but they exhibit a breakdown after 2008, with this feature being more prominent in Greece. It is also found that, since 2012 a cycle of re-synchronization is on the way.

This no-change alternative would therefore resonate the random-walk/unit-root hypothesis that the Efficient Market Hypothesis would maintain and according to which sentiment and uncertainty would not yield any useful information in predicting output.

Golinelli and Parigi (2004) assess the forecasting performance of consumer sentiment by comparing a VAR model with consumer sentiment and GDP growth, inflation, interest rate, unemployment and stock prices. Forecasting accuracy is assessed by comparing performance of restricted VAR models with consumer sentiment and unrestricted VAR models without consumer sentiment. It is found that the models with consumer sentiment outperforms in most cases the models without consumer sentiment. Disadvantage of their approach is that outcomes depend on comparing forecast of two similar but nevertheless not identical estimated models.

The Diebold-Mariano test (Diebold and Mariano 1995) has the null hypothesis of equal forecast accuracy between two models, i.e. it tests whether two sets of forecast errors have equal mean value. To assess the forecast error a loss function is—mainly squared forecast error and absolute forecast error—is used. The DM test-statistic has an asymptotic standard normal distribution.

We have also investigated two other countries: Greece and the UK to see if similar results apply to these countries as well. Greece is chosen because it was by far the hardest hit country during Europe’s Debt Crisis. The UK was considered as a natural non-Euro area, benchmark country. We find that overall also the outcomes in case of Greece and the UK confirm the results we obtained for the Euro area aggregate, Germany and France. For those interested the results for the case of Greece and the UK will be provided upon request.

References

Akerlof, R., & Shiller, R. (2009). Animal spirits. Princeton: Princeton University Press.

Alchian, A. (1950). Uncertainty, evolution and economic theory. Journal of Political Economy, 58, 211–221.

Angeletos, G., & La’O, J. (2013). Sentiments. Econometrica, 81(2), 739–779.

Bachmann, R., Elstner, S., & Sims, E. (2013). Uncertainty and economic activity: Evidence from business survey data. American Economic Journal Macroeconomics, 5(2), 217–249.

Baker, S., Bloom, N., & Davis, S. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636.

Bansal, R., Kiku, D., & Yaron, A. (2010). Long Run risks, the macroeconomy, and asset prices. American Economic Review Papers and Proceedings, 100, 542–546.

Bansal, R., & Yaron, A. (2004). Risks for the long run: A potential resolution of asset pricing puzzles. Journal of Finance, 59(4), 1481–509.

Beaudry, P., & Portier, F. (2006). Stock prices, news, and economic fluctuations, stock prices, news, and economic fluctuations. American Economic Review, 96(4), 1293–1307.

Benhabib, R., & Farmer, R. (1999). Indeterminacy and sunspots in macroeconomics. Handbook of Macroeconomics, 1(1), 387–448.

Blanchard, O. (1993). Consumption and the Recession of 1990–1991. American Economic Review, 83(2), 270–274.

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623–685.

Bofinger, P., Debes, S., Gareis, J., & Mayer, E. (2013). Monetary policy transmission in a model with animal spirits and house price booms and busts. Journal of Economic Dynamics and Control, 37(12), 2862–2881.

Bonciani, D., & van Roye, B. (2015). Uncertainty shocks, banking frictions and economic activity. ECB Working Paper Series, no. 1825.

Barsky, R., & Sims, E. (2011). News shocks and business cycles. Journal of Monetary Economics, 58(3), 273–289

Caballero, R., Farhi, E., & Hammour, M. (2016). Speculative growth: Hints from the U.S. economy. American Economic Review, 96(4), 1159–1192.

Chang, S. (2014). Herd behavior, bubbles and social interactions in financial markets. Studies in Nonlinear Dynamics and Econometrics, 18(1), 89–101.

Choi, S., & Loungani, P. (2015). Uncertainty and unemployment: The effects of aggregate and sectoral channels. Journal of Macroeconomics, 46, 344–358.

De Grauwe, P. (2011). Animal spirits and monetary policy. Economic Theory, 47, 423–457.

Dees, S., & Soares Brinca, P. (2013). Consumer confidence as a predictor of consumption spending: Evidence for the United States and the Euroarea. International Economics, 134, 1–14.

Dequech, D. (1999). Expectations and Confidence under uncertainty. Journal of Postkeynesian Economics, 21(3), 415–430.

Dequech, D. (2011). Uncertainty: A typology and refinements of existing concepts. Journal of Economic Issues, 45(3), 621–640.

Diebold, F., & Mariano, R. (1995). Comparing predictive accuracy. Journal of Business and Economic Statistics, 13, 253–263.

Ellsberg, D. (1961). Risk, ambiguity, and the savage axioms. Quarterly Journal of Economics, 75(4), 643–669.

Engle, R., Jondeau, E., & Rockinger, M. (2015). Systemic risk in Europe. Review of Finance, 19, 145–190.

European Central Bank (2013). How has macroeconomic uncertainty in the Euro area evolved recently? Monthly Bulletin, 2013, 44–48.

Faigelbaum, P., Schaal, E., & Taschereau-Dumouchel, M. (2014). Uncertainty traps. NBER Working Paper No. 19973. URL:http://www.nber.org/papers/w19973.

Fuhrer, J. (1993). What role does consumer sentiment play in the US economy? New England Economic Review, 1993, 32–44.

Gayer, C. (2006). Forecast evaluation of European Commission survey indicators. Journal of Business Cycle Measurement and Analysis, 2005(2), 157–183.

Golinelli, R., & Parigi, G. (2004). Consumer sentiment and economic activity: A cross country comparison. Journal of Business Cycle Measurement and Analysis, 2004(2), 147–170.

Haddow, A., & Hare, C. (2013). Macroeconomic uncertainty: What is it, how can we measure it and why does it matter? Bank of England Quarterly Bulletin, 2013(Q2), 100–109.

Jang, T., & Sacht, S. (2016). Animal Spirits and the business cycle: Empirical evidence from moment matching. Metroeconomica, 67(1), 76–113.

Keynes, J. (1936). The general theory of employment, interest and money. London: MacMillan and Co.

Knight, F. (1921). Risk, uncertainty, and profit. Boston, MA: Schaffner and Marx, Houghton Mifflin Company.

Lempert, R., Groves, D., Popper, S., & Bankes, S. (2006). A general analytic method for generating robust strategies and narrative scenarios. Management Science, 52(4), 514–528.

Ludvigson, S. (2004). Consumer confidence and consumer spending. Journal of Economic Perspectives, 18(2), 29–50.

Milani, F. (2014). Sentiment and the U.S. business cycle. Working Papers 141504. University of California-Irvine, Department of Economics.

Minsky, H. (1982). Can it happen again? Essays on instability and finance. Armonk, NY: ME Sharpe.

Serven, L. (1998). macroeconomic uncertainty and private investment in developing countries an empirical investigation. Worldbank Policy Research Working Paper No. 2035.

Shiller, R. (1989). Market volatility. Cambridge: The MIT Press.

Soric, P., Lolic, I., & Cizmesija, M. (2016). European economic sentiment indicator: An empirical reappraisal. Quality and Quantity, 50(5), 2025–2054.

Stasavage, D. (2002). Private investment and political institutions. Economics and Politics, 14(1), 41–63.

Taleb, N. (2007). The black swan: The impact of the highly improbable. London: Penguin.

Thomakos, D., & Papailias, F. (2014). Out of sync: The breakdown of economic sentiment cycles in the EU. Review of International Economics, 22(1), 131–150.

Villaverde, J., Guerrn-Quintana, P., Kuester, K., & Rubio-Ramrez, J. (2015). Fiscal volatility shocks and economic activity. American Economic Review, 105(11), 3352–3384.

Acknowledgements

We are grateful to two anonymous referees for their pertinent suggestions on several issues. Seminar participants at the 2016 Research on Money in the Economy (ROME) conference, Duesseldorf University, the 2017 EEFS Workshop Financial Econometrics at Bochum University and the 2017 ERMEES Macroeconomics Workshop at the University of Strasbourg also provided valuable feedback.

Author information

Authors and Affiliations

Corresponding author

Appendix: Data Definitions and Sources

Appendix: Data Definitions and Sources

The dataset includes the following variables:

1.1 Eurostat

INDU Mining and quarrying; manufacturing; electricity, gas, steam and air conditioning supply, Volume index of production (2010 = 100), Seasonally adjusted and adjusted data by working days.

RETA Retail trade, except of motor vehicles and motorcycles Index of deflated turnover (2010 = 100) , Seasonally adjusted and adjusted data by working days.

SERV Total Services required by STS regulation (except retail trade and repair), Index of turnover (2010 = 100), Seasonally adjusted and adjusted data by working days.

BUIL Construction, Volume index of production (2010 = 100), Seasonally adjusted and adjusted data by working days.

1.2 EU Commission Business and Consumer Surveys

ESI.INDU Industrial Confidence Indicator, (balanced = 0, + = optimistic, − = pessimistic), Seasonally adjusted.

ESI.CONS Consumer Confidence Indicator, (balanced=0, + = optimistic, − = pessimistic), Seasonally adjusted.

ESI.SERV Services Confidence Indicator, (balanced=0, + = optimistic, − = pessimistic), Seasonally adjusted.

ESI.BUIL Construction Confidence Indicator, (balanced=0, + = optimistic, − = pessimistic), Seasonally adjusted.

UNC.INDU Industrial Uncertainty Indicator, Dispersion measure (1) based on Q5: “How do you expect your production to develop over the next 3 months? It will...+ increase, = remain unchanged, − decrease”.

UNC.CONS Consumer Uncertainty Indicator, Dispersion measure (1) based on Q2: “How do you expect the financial position of your household to change over the next 12 months? It will...++ get a lot better, + get a little better, = stay the same, − get a little worse, \({-}{-}\) get a lot worse, N don’t know”.

UNC.SERV Services Confidence Indicator, Dispersion measure (1) based on Q3: “How do you expect the demand (turnover) for your company’s services to change over the next 3 months? It will... + increase, = remain unchanged, − decrease”.

UNC.BUIL Construction Sector Uncertainty Indicator, Dispersion measure (1) based on Q4: “How do you expect your firm’s total employment to change over the next 3 months? It will... + increase, = remain unchanged, − decrease”.

Rights and permissions

About this article

Cite this article

van Aarle, B., Moons, C. Sentiment and Uncertainty Fluctuations and Their Effects on the Euro Area Business Cycle. J Bus Cycle Res 13, 225–251 (2017). https://doi.org/10.1007/s41549-017-0020-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-017-0020-y