Abstract

Emerging economies have become new destinations for knowledge sourcing, forcing Multinational Enterprises (MNEs) to reconfigure their global innovation strategies and structure. While foreign subsidiaries located in emerging economies were conventionally viewed as having market or efficiency seeking roles, they have started to evolve towards knowledge-seeking roles. We argue that the conventional wisdom shall be reassessed considering this recent shift. We empirically investigate 129 manufacturing MNE subsidiaries of Fortune 500 companies in China, in terms of their roles and sources of technology. Our results indicate that market and knowledge seeking subsidiaries located in China tend to have a positive impact on the generation of new knowledge, either through locally established MNE R&D laboratories or through collaborations with local firms and scientific institutions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent innovating activities of MNE subsidiaries in emerging economies have been noted to increasingly consist of knowledge exploration rather than focus on exploitation (Hsu et al. 2013; Van Egeraat and Breathnach 2012). The World Investment Report (2005), was among the first publications to provide significant evidence of MNEs’ significant increase in innovation-related investment into emerging economies such as China, India, and Brazil (D’Agostino 2015; Castelli and Castellani 2013). This is arguably associated with two interrelated causes: the development of national innovation systems (NIS) and the general strategic need of MNEs for maximum worldwide learning in order to enhance their global competitive advantage (Castellani and Zanfei 2006; von Zedtwitz 2006; Sun et al. 2007; Castellani et al. 2015; von Zedtwitz and Gassmann 2016).

The rapid development of emerging economies such as China in recent years has called for MNEs to reconsider their global innovation strategies. Whilst advanced economies remain the locus of their strategic activities, such as R&D, due to rising R&D costs and a shortage of R&D personnel at home a strategic shift has become necessary in the generation of new knowledge. Furthermore, the substantially improved market and institutional conditions of emerging economies including growth in R&D personnel and government support (Liu et al. 2011) are increasingly attracting MNE R&D (Haakonsson and Ujjual 2015). Consequently, in recent years MNE global R&D networks have extended to encompass some of the emerging economies, with China being one of the most popular new destinations (Liu and Chen 2012). Although this emerging trend is gaining a growing level of attention, research on MNE R&D in emerging economies such as China remains limited (e.g. Figueiredo 2011; Collinson and Wang 2012; Castellani et al. 2013; D’Agostino 2015 for a recent review of the relevant literature). Hence, as Zhang (2009) attests: “China has gone through several important stages of its globalization process since it officially opened its door to foreign investors in 1978 under Deng Xiaoping’s Open door policy and its gradually turning into an international trading magnet by allowing a large-scale inflow of foreign investments and a further open-up to the world, both being provoked by the respected old man’s ‘Southern Tour’ in 1992. From the experiment of the first Special Economic Zones in the coastal cities Shen Zhen, Zhu Hai, Xia Men and Shan Tou to the improvement of China’s communication with the rest of the world stimulated by China’s entering the World Trade Organisation (WTO) in 2001, China has enjoyed the benefit brought about by the significant increases in foreign investment” (p. 13).

In this paper we adopt a familiar categorisation of MNE subsidiary motivations (Behrman 1984; Dunning 1993, 2000; Dunning and Lundan 2008; Manea and Pearce 2004, 2006; Buckley 2009). The first two of these motivations, Market seeking (MS) and Efficiency seeking (ES), reflect very different ways in which MNEs seek to maximise the immediate returns they are able to secure from the global application of their mature sources of competitiveness as embodied in a range of standardised and successful products. The third motivation then addresses the complementary overarching strategic need of MNEs to build the capability to move forward from the effective use of current capabilities to the generation of the new sources of competitiveness that will secure survival and diversification. This motivation has been designated as Strategic-asset seeking (Dunning 2000; Dunning and Lundan 2008) or as Knowledge seeking (KS) (Papanastassiou and Pearce 1999, 2009; Manea and Pearce 2004, 2006; (Li and Kozhikode 2009; Sartor and Beamish 2014).Footnote 1

Recent research by Govindarajan and Ramamurti (2011), Zhang and Pearce (2010) and von Zedtwitz et al. (2015) shows that emerging economies have the ability to generate the most distinctive new scientific and technological potentials and the most original sources of innovatory capacities and capabilities. This then provides the increasingly internationalised context in which MNEs pursue competitive revitalisation and renewal. Such firms now see that these countries have the capacity to provide strong and distinctive new technological inputs into building up the knowledge bases for significant new innovations.Footnote 2

In this paper, we implement Zhang and Pearce (2010) and von Zedtwitz et al.’s (2015) approach to knowledge development and we thus, depart from the view that roles of subsidiaries are designated by headquarters and are consequently defined by sources of technology internal to MNE. In contrast, we argue that all the three different types of roles (MS, ES, and KS) interact with different sources of technology (from both internal and external knowledge networks) and we assert that subsidiary roles determine the technology sourcing and the innovative capacity of both the MNE as well as that of the local economy (Gupta and Govindarajan 1991, 1994). To operationalise, we empirically investigate 129 manufacturing MNE subsidiaries of Fortune 500 companies in China, in terms of their roles and sources of technology (Zhang and Pearce 2010, 2012). Our results confirm that subsidiary roles are a key influence in technology sourcing with both MS and KS subsidiaries having a great impact on the development of new internal and external technological trajectories.

The rest of the paper is organised as follows: in the next section we provide a literature review and conceptual development, followed by hypotheses. In the methodology section we describe the data and present the econometric model applied. We then present and discuss the findings and finally we conclude.

2 Literature review and conceptual development

Interdependent network has been an important term to describe the internal differentiation of the ‘evolved’ MNEs. Many MNEs, which were structured either in the form of federation (mainly represented by US and European firms) or in the way of centralisation (mainly represented by Japanese firms), underwent a series of structural developments to this current form of network structure (Bartlett and Ghoshal 2002). Some of the causes behind this evolution of MNE structure are shifts in the global environment, such as advancement in information technology and transportation, reduction in trade barriers, opening up of new economies, growing customer demand, and increasing global competition (Yu 2011). Hence, it became imperative that MNEs were able to achieve global integration, local responsiveness, and worldwide learning simultaneously (Bartlett and Ghoshal 2002). This led to the structural shift towards one which could encompass their multiple needs. The new structure was then known as the interdependent network whereby subsidiaries take on specialised and differentiated motivations and roles (Bartlett and Ghoshal 2002; Pearce and Papanastassiou 1999).

Here, we take the view of technological dynamism to analyse the internal strategic diversity of this structure. Specifically, we adopt MS, ES and KS subsidiary motivations. Dunning and Lundan (2008) state that MS investments are undertaken by MNEs “that invest in a particular country or region to supply goods or services to markets in these or adjacent countries…[and are] undertaken to sustain or protect existing markets, or to exploit or promote new markets” (pp. 69–70). The second strategic imperative that interdependent network MNEs pursue through their production subsidiaries is that of efficiency seeking (ES). This involves operations in particular locations focusing on specific production responsibilities within an MNE’s geographically dispersed, but usually carefully integrated, network of supply facilities.Footnote 3 An important feature of this was that ES subsidiaries allowed the rest of the internal network to realise economies of scale.

Lastly, in contrast to commonly found MS and ES subsidiaries in developing countries (Buckley 2009), most MNEs have found developed countries to have the most ideal environment and innovation capacity to provide strong and distinctive new technological inputs into building up the firm knowledge base and innovation (Cantwell and Mudambi 2005; Pearce 1999; Ronstadt 1978). The ability to tap into this internationally-dispersed differentiated learning and creative opportunities defines the third of the strategic motivations of MNEs, that of knowledge seeking (KS) (Bartlett and Ghoshal 1986, 1990) or strategic-asset seeking (Dunning 2000; Dunning and Lundan 2008; Bhaumik et al. 2016). According to Manea and Pearce (2004) this role represents “the pursuit by MNEs of new technological capabilities, scientific capacity (research facilities) and creative expertise (e.g. dimensions of tacit knowledge) from particular host countries, in order to extend the overall competences (product range and core technology) of the group” (p. 4).Footnote 4

Hedlund and Rolander (1990) noted the presence in MNEs of “many centres, of different kinds” within the network so that there is increasing geographical dispersion of traditional HQ functions and “no dimension (product, country, function) uniformly super ordinate” (pp. 25–26). Crucially this provides “a strategic role for foreign subsidiaries” where these operate “for the corporation as a whole [so that] corporate level strategy has to be formulated and implemented in a geographically scattered network”. In contrast, thus, to the early view of subsidiary role as prior designations, a stream of later research questioned the assumption of immutableness of subsidiary role (Bartlett and Ghoshal 2002; Birkinshaw and Hood 1998; Pearce 1999; Collinson and Wang 2012). In particular, several of the studies that applied the scope-typology approach to MNE subsidiaries in Europe (including Taggart 1996, 1997; Papanastassiou and Pearce 1999; Pearce and Tavares 2002; Figueiredo 2011; Collinson and Wang 2012) revealed evolution of strategic positioning.Footnote 5 This process of evolution was carefully conceptualised in Birkinshaw and Hood (1997, 1998) and Birkinshaw et al. (1998). They noted that the cause of transition was because subsidiaries simultaneously responded to headquarters, subsidiary-level, and host-country driven forces leading to multiple sources of knowledge accumulation.

Furthermore, these studies have identified a key trend which is expanding the range of roles played by subsidiaries, with the scope eventually extending to encompass positions of strategic influence. Subsidiary embeddedness has been noted to provide explanations. Specifically, previous studies argued subsidiary dual (i.e. internal and external) embeddedness to have provided the context for subsidiary evolution towards increasing importance within the MNE (Frenz and Ietto-Gillies 2009; Meyer et al. 2011; Yamin and Andersson 2011). Subsidiaries are increasingly seen as a potential source of distinctive capabilities (Cantwell and Mudambi 2005) on the basis of their host-location access to knowledge sources which are unavailable inside the MNE (Santangelo et al. 2016; Scott-Kennel and Michailova 2016). These sources can have important complementing benefits to the MNE internal knowledge pool. Consequently, these subsidiaries can be viewed as sources of local variation within MNE networks (Collinson and Wang 2012).

Moreover, a general recognition found in international business research regarding MNE competitive advantages, is the ability to combine knowledge resources across heterogeneous national environments. For example, Cantwell (2009) focused on the context-specific activities of learning. This places a new emphasis on understanding how capability development within MNE is closely associated with learning across different local networks in distinct markets (Collinson and Wang 2012). National economic development is seen as innately dynamic and therefore is likely to manifest in distinctive forms of differentiation (Pearce 1999). This then feeds back into the potential of MNE subsidiaries to become embedded components in national development processes in ways that can also define their own status in the evolution of the MNE (Birkinshaw et al. 1998). The MNE’s ability to assert such an effectively differentiated status will derive from accessing, and operationalising in competitive ways, attributes that define the current strengths of its host economy (D’Agostino et al. 2013). Whilst these changes in a host-economy’s sources of competitiveness are likely to undermine a subsidiary’s current role they will provide it with a dynamic impetus to accede to an upgraded future responsibility (Gkypali et al. 2012).

Hence, these studies provide a context for two important analytical themes in understanding subsidiary roles. First is the differentiation of subsidiary role. There are a range of different roles (MS, ES, and KS) a subsidiary could play at a given point in time. Second is the dynamism as reflected in the propensity for that role to change over time. Thus, in an MNE that is fully responsive to the potentials of a global economy, a specific subsidiary will take on a role that contributes in some distinctive and individualised way to the group’s overall competitiveness. Its ability to assert such an effectively differentiated status can derive from successful local access and operations. These are attributes that can define current strengths of the host location (D’Agostino et al. 2013). However, as national economies develop these defining attributes are likely to change in ways that would normally be expected to provide higher-value-added potentials (Van Egeraat and Breathnach 2012; Figueiredo 2011). Hence such economic changes can provide subsidiaries with a dynamic impetus to accede to an upgraded new or future role. Ultimately, therefore, we can characterise the process of subsidiary evolution as one in which they reposition in the global profile of the MNE through an interactive response to changes in the host-economy conditions (Holl and Rama 2014; Garcia Sánchez et al. 2016).

This analysis leads us to the identification of two gaps. First, previous research on interdependent network structure, and subsidiary role and evolution have had limited discussions and findings relating to the context of non-advanced economies (Holmes et al. 2016). Second and more importantly, previous research in the area of subsidiary role and evolution seems to imply a two-way influence, i.e., the former stream of literature implies subsidiary roles are designated by headquarters where technology sourcing is a determining factor for this pre-assigned role. The latter stream of the literature implies a more interactive relationship between technology sourcing and subsidiary roles (Awate et al. 2015; Frost et al. 2002; Phene and Almeida 2008). In this paper we focus on the latter interactive dimension, i.e., how technology sourcing is determined by subsidiary roles and how subsidiaries adopt a pro-active role in knowledge creation both internally to the MNE as well as externally to the host-country environment.

For both national economies and international business drawing in new technological opportunities has been an essential component of their pursuit of sustainable development and competitive progress. At the level of national economic policy, it has become clear for an increasing range of countries, that new and more competitive and productive ways of using resources have become more important than any possible quantitative growth in their availability (Pearce and Zhang 2010). This led to extensive commitments to the creation of strong scientific research capacities and of National Innovation Systems (NIS). The most successful of these efforts have been those that have generated the most distinctive new scientific and technological potentials and the most original sources of innovatory capacities and capabilities. Thus, at the core of technological change has been a growing technological heterogeneity, with different countries possessing increasingly different new knowledge scopes and creative potentials. The vital foundation texts that pioneered documentation of NIS (Freeman 1987, 1991; Dosi et al. 1988; Edquist 1997; Nelson 1993; Lundvall 1992) and more recent interpretative overviews (Edquist 2005; Lundvall 2007) focused mainly on developed economies.

By contrast the now quite extensive investigation of a Chinese NIS and of Chinese innovative capacity (e.g. Liu and White 2001; Lu and Lazonick 2001; Gu and Lundvall 2006; Lazonick 2004; Hu and Mathews 2008; Li 2009; Yang et al. 2012; Franco and Leoncini 2013) implies a much less intuitive and more systemically proactive attempt to establish the relevant institutions and to inculcate the creative mindsets of an innovation-driven development. Earlier work by Rugman and Verbeke (1998), Brouthers (2002), Dunning and Lundan (2008) and Kumaraswamy et al. (2012) highlighted the importance of the MNE as an input to local institutional transformation in R&D related interactions (Cantwell et al. 2010). In a recent paper Zhao et al. (2018) investigate the R&D activities of Astra Zeneca in China since its establishment in the country in 1993. Within the context of a detailed single-case study they show how predetermined subsidiary R&D activities co-evolved into more independent technological trajectories feeding into the innovative capacity of China through the development of own R&D facilities and collaborations with local research and scientific institutions engaging in high-value added technological activities such as product development, basic and applied research. Similarly, Papanastassiou and Pearce (2009) provided three different scenarios, i.e., how MS, ES and KS subsidiaries can respectively embed in the local NIS and how each role can influence the innovative capacity of the host country.

As reported in Zhang (2009), since the launch of the The Key Technologies Research and Development ProgramFootnote 6 (China.org.cn 1999) in 1982, China began its quest for innovation programmes for Science and Technology that suit the country’s basic conditions at different stages of development. Prior to 1980s, the Chinese system was characterised by the complete separation of science and technology activities in public research institutions from manufacturing in state-owned enterprises. The reform was then to focus on connecting the two. To do so, the government had pushed research institutions to adapt to the market environment and to conduct research that had industrial implications. As a result of a series of programmes, such as the Spark programmeFootnote 7 and 863 ProgrammeFootnote 8 in 1986, Torch ProgrammeFootnote 9 in 1988 and 973 programmeFootnote 10 in 1998, were launched and China has welcomed the boost in science and technology research and development. In summarising, the government took three specific steps between the 1980s and 1990s: (1) advocating the merger of some research and development institutions with companies in the 1980s; (2) offering financial incentives to commercialise research results through various programmes in the 1980s; and (3) reforming the established research centres into institutions with economic functions such as production and consultancy organisations from the 1990s (Fan 2006; Heilmann et al. 2013).

In June 1998 China’s own NIS known as the National Programmes for Science and Technology (S&T), started to form. The core of the system was a network of large-firm groups, high-tech companies, scientific institutions and higher education institutes. The aim was to build up a NIS that suits a socialist market economy and supports the sustainable development of the economy and at the same time helped to successfully establish a collection of world class national S&T base stations by the year 2010 that would have enabled China to gain significant scientific breakthroughs that would increase the country’s overall competitiveness.

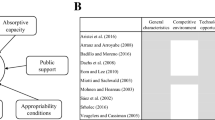

Outcomes of China’s S&T development in the last two decades, attracted dramatically increasing numbers of MNE R&D operations to China and turning the country into a new source of technological competitiveness for MNEs. As a result, MNEs have become involved in the NIS whereby more of their R&D has been conducted in China (Asakawa and Som 2008; Holmes et al. 2016). Articulating and investigating these perspectives in China we address a context that is currently sui generis but also plausibly indicative of major emerging situations; a large, very fast-growing economy that is increasingly taking responsibility for the technology-driven roots of its future development. Figure 1 summarises the focus of the paper and our approach to addressing the gaps identified.

3 Hypotheses development

Our paper takes the fundamental view that subsidiary roles vary within the MNE, hence, we build on the literature to suggest three types of subsidiary roles (i.e. MS, ES, and KS), which can determine both internal and external technology sourcing, in the context of an emerging economy.

3.1 Subsidiary market-seeking role vs. sources of technology

In the case of emerging economies such as China where market potential is significant, securing a responsive presence may be a defining priority for MNE expansion, particularly at the early stage of market entry. Previous research by Holmes et al. (2016) and Wang et al. (2014) confirms that one of the core motivations for foreign MNEs to establish an overseas R&D operation in China is driven by the need to adapt and/or develop products for the large Chinese market. Yang and Hayakawa (2015) showed that the degree of production localisation of Taiwanese subsidiaries in China seems to define the extent of local technology use. Similarly, Motohashi (2010) stresses the importance of market-driven factors as a motivation for local technology sourcing. Hu et al. (2005) found that market technology transfer in China was not linked with knowledge creation relating to “asset exploiting” rather than “asset-seeking” activities (Dunning and Narula 1995; Narula and Zanfei 2005). Reflecting this, we build on Dunning and Lundan (2008) and argue that MS subsidiaries are concerned with the adaptation of established group technologies “to local tastes or needs, to cultural mores and to indigenous resources and capabilities” (p. 70). Hence, for the MS role, we develop the following hypothesis:

H1: The more important MS is as a subsidiary role, the stronger the impact assigned by the subsidiary will be on existing MNE technology and established local technology.

3.2 Subsidiary efficiency-seeking role vs. sources of technology

Efficiency-seeking has been a well acknowledged motive for MNEs (Dunning 1998; Buckley et al. 2007; Dunning and Lundan 2008). The idiosyncratic nature of the Chinese context opens up distinctive possibilities. First, the sheer size of the market in terms of population and growing income levels indicate the potential to achieve local economies of scale. Second, the vast geographical area implies a diversity of input supply conditions which are of great production potential. Hence, MNE’s knowledge in production can be matched with the high level of input availability, making locating production in China for supply to the local market a strategically sound decision. This knowledge can be categorised into two sources: (1) existing MNE technology as it is embodied in established products and processes (2) new technology from the MNE group R&D activities. The significant market potential and growing customer sophistication and disposable income mean that both of these types of knowledge are necessary for local production. Furthermore, prior studies have also referred to China as a location choice for not only local but group-wide production for global supply due to MNE level efficiency seeking (Kim et al. 2016; Zhang and Pearce 2012) linking MNE technology transfer to productivity improvement in China (Liu and Wang 2003; Liu 2002. Thus, for ES subsidiaries we formulate the following hypothesis:

H2: The more important ES is as a subsidiary role, the stronger the impact assigned by the subsidiary will be on existing MNE technology sourcing.

3.3 Subsidiary knowledge-seeking role vs. sources of technology

Global reach of new technological opportunities has been an essential component of MNEs’ pursuit of sustainable development and competitiveness. Evidence from recent investment figures (UNCTAD 2005) show such a phenomenon to deepen in terms of scale and scope. Pearce and Zhang (2010) have argued that such a trend towards greater globalisation of knowledge sourcing has much to do with the recent evolving national innovation development encouraged by the introduction of economic policies across a number of emerging economies. For instance, China presents extensive government commitments to the creation of strong scientific research capacities and of national systems of innovation (von Zedtwitz et al. 2007). These national efforts have been seen to have led to generation of certain highly distinctive new scientific and technological potentials and the most original sources of innovatory capacities and capabilities. The access to the KS role by subsidiaries in China is potentially predictable as a result of the basis of the enhanced national innovation capability (Hu and Mathews 2008; Li 2009; Yang et al. 2012; Franco and Leoncini 2013). Previous research by Cantwell and Janne (1999) supports that overseas R&D operations by MNE subsidiaries can augment and compliment the technological trajectory of the MNE group. Similarly, Song and Shin (2008) confirmed the positive effect of overseas R&D activity on enhancing the MNE HQ knowledge base particularly when the host-country is technologically more advanced than the home-country of the MNE. In the context of an emerging or developing country this has been called as “reverse innovation” (von Zedtwitz et al. 2015; Govindarajan and Ramamurti 2011). For example, the ‘upgraded’ host environment is likely to allow new capability development inside the subsidiary. The increased availability of new local knowledge from Chinese firms or research institutions are also likely to be important sources. The main sourcing of new technologies is thus expected to be well diversified and come primarily from the subsidiary, from inside the MNE group as well as from subsidiary collaborations with local firms and research institutions reflecting “strategic-asset seeking” and “asset-augmenting” motivations (Frost 2001; Branstetter 2006; Dunning and Lundan 2008). The improved innovation environment is likely to lead to MNE decisions to allocate this ‘renewed’ subsidiary role in the country which was much less evident in the past and was viewed as a strategically ‘less important’ destination for KS (von Zedtwitz 2004; Kim et al. 2016). Hence, our third hypothesis is formulated as follows:

H3: The more important KS is as a subsidiary role, the stronger the impact assigned by the subsidiary will be on subsidiary-own R&D, other group R&D results, local-firm, or local research-institution- generated technology.

4 Methodology

4.1 Data description

The empirical evidence this paper provides was originally collected through a questionnaire survey. In terms of sample selection, we focused on manufacturing MNEs from the Fortune 500 List. Then, all manufacturing subsidiaries of these MNEs in China were identified using the Lexus Nexus Corporate Affiliate Directory. This provided a total population of 812 subsidiaries in China. The data collection was then carried out on three field trips to China between late 2006 and early 2007. As the empirical research was supported by the National Bureau of Statistics of China and from the Ministry of Commerce of the People’s Republic of China, we were able to obtain relevant statistics and direct contacts to the sample companies.

From this, a total of 129 subsidiaries provided completed and useable responses providing an overall response rate of 15.9%. By industry the largest sub-sample was in electronics with 61 responding subsidiaries. Others were from automobiles (20), IT (14), personal care products (12), pharmaceuticals and chemicals (18), and food and drink with (6). 45 subsidiaries originated from the USA and 50 from Europe, including UK, Germany, Italy, Finland, France, Sweden and Switzerland. From elsewhere in Asia, 26 originated from Japan and 8 from South Korea. Though the majority of the subsidiaries were established between 1991 and 2005, 19 had been set up prior to 1990 (see Zhang and Pearce 2012, Table 1.5, p. 15 for a detailed analysis).

4.2 Econometric analysis

We estimate the following model for the determinants of technological sources for the sample of 129 subsidiary firms operating in China.

where the sub-index i refers to subsidiary, TS denotes the sources of technology, \({\rm X}\) is a vector of subsidiaries’ roles taken from questionnaire’s question 11 (See Appendix A, Fig. 2 for definitions of roles of subsidiaries). Originally in the questionnaire survey six subsidiary roles were identified, i.e., two variants of the MS role (MS1 and MS2), two variants of the ES role (ES1 and ES2) and two variants of the KS role (KS1 and KS2). Respondents were asked to rank each role in terms of its relative importance. Specifically, respondents were requested to order each role as follows: (4) our only role, (3) a major role, (2) a secondary role, (1) not a part of our role.

Due to high degree of correlation in the raw variables collected from question 11 of the survey we used principal component analysis (PCA) to group answers to these questions into the three main categories of subsidiary roles (MS, ES and KS). PCA uses orthogonal transformation of highly correlated variables leading to eigenvectors from the uncorrelated linear combinations of those variables. The transformed eigenvalues are continuous, mainly describing the underlying variation of the original data (Table 4 in Appendix B displays the correlation matrix of the original six roles and Table 5 shows the correlation matrix of principal componentsFootnote 11).

Concerning the remaining variables used in (1), age is the number of years that firm i operates in China (Birkinshaw and Hood 1998; Van Egeraat and Breathnach 2012), and entry indicates the entry mode of firm i in the new market. Both were extracted from the questionnaire survey. Regarding entry, we consider three dummies, the first one takes the value 1 if i entered the market through an acquisition and zero otherwise; the second one is a dummy that takes the value 1 if i entered the market as a greenfield investment and zero otherwise and the third one takes the value 1 if i entered the market using a joint venture and zero otherwise. Parameters \(\alpha\) and \(\beta\) are to be estimated and u is an error term.

For the key dependent variable, sources of technology (TS), respondents were asked to grade each source of technology as (4) their only source, (3) a major source, (2) a secondary source, (1) not a source (see Appendix A, Fig. 3, for definitions of sources of technology as extracted from question 14 in the questionnaire survey).

As TS is a categorical variable taking values from 1 to 4 indicating the importance of the technological source of interest, we estimate (1) using an ordered logit (OLOGIT) regression. Table 1 provides summary statistics of all variables appeared in (1).

Finally, a key concern with estimating Eq. (1) is that regressors in \({\rm X}\) might not be exogenous treatments to technological sources. For instance, whether firm i develops a MS strategy in China depends on technologically unobserved factors that might be correlated to the error term in (1). This raises an endogeneity issue between elements of \({\rm X}\) and TS. To address this issue, we use a two stage (2S) Instrumental Variable (IV) approach following Terza et al. (2008). We proceed with the IV estimation into two stages: (1) we regress all elements of X using OLOGIT on exogenous instruments plus, age and entry and (2) at the second stage, we use the fitted values of \(\hat{\rm X}\) from the first stage to run a OLOGIT regression of TS on \(\hat{\rm X}\) and other regressors as specified in Eq. (1). The fact that we are using the fitted values of \({\rm X}\) at the second stage guarantees that we obtain consistent standard errors and unbiased estimates for \(\alpha\).

Turning to the instruments used in the first stage we consider dummies related to the size of Chinese cities where firms are located (León-Ledesma and Christopoulos 2016). More precisely, we use the following dummies: a dummy for small-sized cities with value 1 if the population is up to 10 million and zero otherwise, a dummy for medium-sized cities with value 1 if the population is between 10 and 30 million and zero otherwise and a dummy for large-sized cities with value 1 if the population is above 30 million and zero otherwise. Information on the city location of subsidiaries was extracted from the questionnaire survey whilst population was extracted from China’s Statistical Yearbook (2016). The second instrument is a set of dummies with the country of origin of firm i. They take value 1 if firm i has its headquarters in a particular country (or groups of countries) and zero otherwise. We consider three groups, firms with headquarters in USA, Europe and Japan–Korea (home-country information was extracted from the questionnaire survey). The size of the cities where firms are located as well as the origin of the parental firm can be easily regarded as strictly exogenous instruments thus uncorrelated to the technological sources and the error term in Eq. (1).

5 Results and discussion

In addressing the three hypotheses, we have produced the following findings presented in Tables 2 and 3 with the latter reporting results after controlling for endogeneity.Footnote 12 We find partial support for H1 as the MS type of subsidiaries supports (positively) a range of technology sources, including TS2 (in line with H1) but is negatively related to existing MNE technology (statistically negative sign for TS1). An explanation for this result can be the outcome of the fact that the MS role incorporates a strong element of adaptation. Thus, from this perspective the results reflect the idiosyncratic nature of the Chinese market, i.e., large market with strong demand conditions, which push MNE subsidiaries to adapt their products in order to meet the local consumer needs. Thus, the interaction of an MS subsidiary with local sources of technology, i.e., TS4 and TS5 (according to our findings in Table 2) shows that in order to meet the specific demands of the Chinese markets local sourcing of technology is a necessary prerequisite.

The positive and statistically significant result for TS2 reflects the fact that the MNE has the know-how to “revive” local Chinese technology into more sophisticated variants. The idiosyncratic host-country characteristics have been found to be an important determinant of technology sourcing. The work of Ito and Wagasugi (2007) on Japanese affiliates’ overseas R&D determinants showed that even supporting overseas R&D laboratories require local sophisticated technological inputs contrary to findings by Cantwell and Santangelo (2000) and Athreye and Cantwell (2007) and Athreye et al. (2016). This outcome also agrees with the findings of Ivarsson and Alvstam (2017) who notice a progressive commitment of Swedish subsidiaries in sourcing innovative inputs in emerging economies, such as China, in the context of co-location of production and R&D.

With regard to H2 our results are statistically insignificant. Similar results were provided by Yang and Hayakawa (2015) for the operations of Taiwanese subsidiaries in China. Their findings suggest that the ES type of subsidiaries do not have any impact on local technological sourcing. They assumed however that knowledge transfer from the parent would compensate for the lack of local R&D linkages. The negative statistically significant result for ES on TS1 (once endogeneity is accounted, see Table 3) is not in support of our second hypothesis and is also contrary to Yang and Hayakawa’s assumption. Thus, subsidiaries with an ES role would not rely on established MNE technology, which was a finding confirmed, though, by Nieto and Rodriguez (2011). In broad terms, we can suggest that such incoherent technology sourcing may reflect the perception of an innate vulnerability of an ES role which, in scope typology terms, will have a limited (and dependent) product scope and a functional scope that may be constrained to routine production. The inconclusive results obtained here agree with some recent research by Driffield et al. (2016) who found that in the context of affiliate-parent knowledge flows, these exist strongly in horizontal affiliates, i.e., affiliates that are involved in reverse-knowledge transfer, whilst in upstream affiliates (which are comparable to our ES subsidiaries) they found no sign of knowledge transfer.

With regard to our third hypothesis, the positive and statistically significant results for KS on TS3 and TS4, (as seen in both Tables 2 and 3), and TS5 and TS6 (as seen in Tables 2 and 3, respectively) provide, thus, strong support for H3 (Asakawa and Som 2008). On the other hand, Motohashi (2010) found no technology-driven motivations for foreign MNEs in China. However, he sees a great variation of motivations among regions. For example, his results show that in Beijing, foreign MNEs tend to source technology locally through collaborations with local scientific institutions. Ultimately these results suggest that, though a KS subsidiary is mandated to generate and apply knowledge that reflects the distinctive capacities of its host NIS it may do this most effectively, and in ways that most benefit its group, when its operations are also defined interactively through an understanding of the technological trajectory of the parent-MNE network (Li and Wang 2014). In their work Zhao et al. (2018) linked the initial technological inertia of Astra Zeneca in China with institutional avoidance and no local innovation activities were carried being out. However, as the MNE became more embedded in the local economy and as China was progressing technologically, interaction with local sources of innovation, for adaptive and consequently developmental R&D, were embodied by the MNE’s dynamic technological trajectory. Thus, a KS subsidiary in China eventually becomes embedded in the host-country NIS (Li and Wang 2014; Guimón et al. 2017; Santangelo et al. 2016).

Finally, the moderators are shown to have some impact as well. Specifically, age of the subsidiary is shown to be most significantly moderating TS4, TS5, and TS6, which are all locally available sources of technology. As in previous studies age serves as an indicator of experience of the MNE of the local economy (Oladottir et al. 2012: Hsu et al. 2015). The statistically positive results for locally embedded sources of technology suggest that familiarity with the local market leads to deeper commitment to local resources (Pant and Ramachandran 2017; Mudambi et al. 2014). With regard to entry mode, the statistically significant and positive result for greenfield on TS4 may reflect Zhang’s et al. (2007) argument on local market hazard avoidance as we see that this type of subsidiary tends to rely on the innovative capacity of their group rather on local sources of technology that would require some form of collaboration. This result complements Mudambi et al.’s (2014) argument on greenfield subsidiaries’ low level of local embeddedness which leads them to more intra-group reliance. The negative and statistically significant results for acquisition on TS1 and TS6 provides further evidence on the challenging nature of such governance structures on determining knowledge sourcing strategies (Bresman et al. 1999; Nair et al. 2015; Brueller et al. 2015).

6 Conclusion

This paper aims to investigate the link between technology sourcing in the host country and subsidiary role in an emerging economy, i.e., China. There are a number of studies in the literature that look how subsidiaries interact with their host country environment in terms of technology sourcing (Manolopoulos et al. 2005, 2007). Although the majority of this work focuses on developed countries, more recent work analyses the process in the context of emerging economies (Pearce and Zhang 2010; Zhang and Pearce 2010; von Zedtwitz et al. 2015). Not all emerging economies have managed to attract the R&D activities of foreign MNEs and not all subsidiaries located in these economies are positioned strategically within their MNE group. In this paper we try to capture the qualitative dimension of how various sources of technology can be determined by the subsidiary mandate in an emerging economy by using survey data, collected in 2007 on 129 foreign subsidiaries of Fortune 500 companies operating in China. Compared to other subsidiary-level analysis we have extracted information on the subsidiary role and a range of technology sources available to the subsidiary, allowing us to link these two uniquely collected qualitative features of foreign subsidiaries in China.

As previous research has shown, the immediate preoccupation of a subsidiary in the host-country would be to utilise a subset of the current competitive capabilities of its parent group in ways that take advantage of current opportunities presented by its host economy. As we have seen these host-economy potentials may derive from the local market (MS) or production conditions (ES). Though there is some sense of short-run optimising involved in these strategic approaches, both can be seen to possess the capacity to become compatible with the dynamics of the economy’s development, which will within its essential nature involve changes to its original conditions (Motohashi 2010; Buckley et al. 2006).

However, for these ‘pure’ formulations of MS and ES to be dynamically effective depends on the persistent detection of serendipitous overlaps between two essentially independent developmental processes; those of the host economy and of the subsidiary’s wider MNE group. For a developing host economy, it constrains the benefits it can secure from MNE participation to inherently dependent transfer of existing knowledge scopes generated externally in other contexts. For MNEs it restricts their understanding of a host’s potentials to its already defined market and input conditions and is thus myopic with regard to any emerging creative potentials and learning scopes. The implicit virtue of the KS role is that it is positioned to address these limitations by becoming, in effect, part of the innovation processes that aim to drive the competitive progress of both its host economy and parent MNE group.

The first significant impression from this is of a very considerable inculcation of ‘impurities’ into the traditional model of MS, with a very prompt and systematic commitment to adapting already successful MNE goods towards the distinctive tastes of the Chinese customer base.

The logical outcome of this adaptive progression is the move through evolution to the KS status of developing unique new goods for the Chinese market, and then a potential widening of ambition to innovation of goods for MNEs’ global markets. But even where the host market has the potential to provide a vital impetus to KS innovation operations, we suggest, this is not, and should not be, exercised in an autarchic way. Thus, the second important finding underlines that, whilst in-house TS3-R&D (OWNLAB) clearly provides an organising centre to MNEs’ KS in China, the supportive participation of an access to other R&D sources in the parent company TS4 (GROUPLAB) may also be vital.

The subtext implicit in this narrative of national-level evolution applies to the international context in terms of evolving patterns of knowledge sourcing and transfers. The traditional roots of pre- KS behaviour reside in centralised creation of competitive knowledge capacities by MNEs, with these applied in dispersed contexts (for MS or ES reasons) through processes of ‘outward’ technology transfer (Vernon 1966). Applied to an emerging economy context, such as China here, this becomes North–South knowledge flows (Cantwell 1995; Govindarajan and Ramamurti 2011). But, we have argued, enhancing their competitiveness within such an economy will involve MNEs in drawing in external local knowledge sources (Castellani and Pieri 2013). This will eventually drive subsidiary evolution (D’Agostino and Santangelo 2012). In line with the work of Buckley (2009) and Mudambi et al. (2014), after this, the subsidiary will have derived, from a range of group-level and local sources, unique forms of subsidiary-level competitiveness. These individualise its position both in the parent-company networks and the Chinese host economy (Figueiredo 2011). These new sources of competitiveness may then be applicable to other developing economies or wider MNE group markets. The former of these implies a knowledge source for South–South transfer and the latter one that may lead to South–North transfers (Zhao et al. 2017; von Zedtwitz et al. 2015).

Future research should then focus on how subsidiary roles and technology sourcing interact within emerging economies within a co-evolutionary framework and how co-location of production and R&D relates to subsidiary roles in order to better understand the positioning of emerging economies in the global innovation map (von Zedtwitz and Gassmann 2016).

Notes

All three papers embrace the impact of “reverse innovation” i.e., innovation that takes place in emerging economies and then is “trickled up” to developed countries. However, Govindarajan and Ramamurti (2011) focus on where innovation is firstly adopted whilst Zhang and Pearce (2010) and von Zedtwitz et al. (2015) focus on where innovation is firstly developed, assigning a more dynamic role to both MNE subsidiaries and the host economy.

This can involve production (or assembly) of a part of a group’s range of final products: supply of components for assembly elsewhere in the network; or the performance of one stage in a vertically-integrated process.

For Dunning and Lundan (2008) strategic-asset seeking FDI involves “acquiring the assets of foreign corporations, to promote their long-term strategic objectives- especially that of sustaining or advancing their global competitiveness” (p. 72). Our KS focuses more explicitly on inputs into creative activity and thus extends the relevant learning processes into investigation (R&D, market research, etc.) of potentials that have not yet been fully formulated as strategic assets.

This was originally generated through study of the roles of MNE subsidiaries in Canada (White and Poynter 1984; D’Cruz 1986) and later applied, in varied formulations, to the European context (e.g. Hood and Young 1988; Hood et al. 1994; Taggart 1996, 1997; Papanastassiou and Pearce 1999; Pearce and Tavares 2002).

The programme oriented towards national economic construction and aimed to solve problems that affect country’s development.

Program aimed to assist the development in rural areas in the name of improving the living quality of the rural population.

National Hi-tech Research and Development Program. Aimed at creation of new technology that is immediately applicable in production.

The Program mainly aimed at developing new technology, such as new materials, biotechnology, electronic information, integrated mechanical–electrical technology, and advanced and energy-saving technology.

The program encouraged outstanding scientists to carry out key research in cutting-edge science.

The degree of correlation between ES1 and ES2, MS1 and MS2, KS1 and KS2 is very high (in the order of 0.7 and above) and thus justifies the use of PCA.

Overall the results remain consistent after accounting for endogeneity.

References

Asakawa, K., & Som, A. (2008). Internationalization of R&D in China and India: Conventional wisdom versus reality. Asia Pacific Journal of Management, 25(3), 375–394.

Athreye, S., Batsakis, G., & Singh, S. (2016). Local, global, and internal knowledge sourcing: The trilemma of foreign-based R&D subsidiaries. Journal of Business Research, 69(12), 5694–5702.

Athreye, S., & Cantwell, J. (2007). Creating competition? Globalisation and the emergence of new technology producers. Research Policy, 36(2), 209–226.

Awate, S., Larsen, M., & Mudambi, R. (2015). Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1), 63–86.

Bartlett, C. A., & Ghoshal, S. (1986). Tap your subsidiary for global reach. Harvard Business Review, 64, 87–94.

Bartlett, C. A., & Ghoshal, S. (1990). Managing innovation in the transnational corporation. In C. A. Bartlett, Y. Doz, & G. Hedlund (Eds.), Managing the global firm. London: Routledge.

Bartlett, C. A., & Ghoshal, S. (2002). Managing across borders: The transnational solution. Cambridge, MA: Harvard Business Press.

Behrman, J. N. (1984). Industrial policies: International restructuring and transnationals. Lexington, MA: Lexington Books.

Bhaumik, S. K., Driffield, N., & Zhou, Y. (2016). Country specific advantage, firm specific advantage and multinationality–Sources of competitive advantage in emerging markets: Evidence from the electronics industry in China. International Business Review, 25(1), 165–176.

Birkinshaw, J. M. (1994). Approaching heterarchy: A review of the literature on multinational strategy and structure. Advances in International Comparative Management, 9, 111–144.

Birkinshaw, J. M., & Hood, N. (1997). An empirical study of development processes in foreign-owned subsidiaries in Canada and Scotland. Management International Review, 37, 339–364.

Birkinshaw, J. M., & Hood, N. (1998). Multinational subsidiary evolution: capability and charter change in foreign-owned subsidiary companies. Academy of Management Review, 23, 773–795.

Birkinshaw, J. M., Hood, N., & Jonsson, S. (1998). Building firm-specific advantages in multinational corporations: The role of subsidiary initiative. Strategic Management Journal, 19, 221–241.

Branstetter, L. (2006). Is foreign direct investment a channel of knowledge spillovers? Evidence form Japan’s FDI in the United States. Journal of International Economics, 68, 325–344.

Bresman, H., Birkinshaw, J., & Nobel, R. (1999). Knowledge transfer in international acquisitions. Journal of Ιnternational Βusiness Studies, 30(3), 439–462.

Brouthers, K. D. (2002). Institutional, cultural and transaction cost influences on entry mode choice and performance. Journal of International Business Studies, 33(2), 203–221.

Brueller, N. N., Ellis, S., Segev, E., & Carmeli, A. (2015). Knowing when to acquire: The case of multinational technology firms. International Business Review, 24(1), 1–10.

Buckley, P. J. (2009). The impact of the global factory on economic development. Journal of World Business, 44(2), 131–143.

Buckley, P., Clegg, J., Cross, A., Liu, X., Voss, H., & Zheng, P. (2007). The determinants of Chinese outward FDI. Journal of International Business Studies, 38, 499–518.

Buckley, P. J., Clegg, J., & Wang, C. (2006). Inward FDI and host country productivity: Evidence from China’s electronics industry. Transnational Corporations, 15(1), 13–37.

Cantwell, J. (1995). The globalisation of technology: What remains of the product cycle model? Cambridge Journal of Economics, 19, 155.

Cantwell, J. (2009). Location and the multinational enterprise. Journal of International Business Studies, 40(1), 35–41.

Cantwell, J., Dunning, J. H., & Lundan, S. M. (2010). An evolutionary approach to understanding international business activity: The co-evolution of MNEs and the institutional environment. Journal of International Business Studies, 41(4), 567–586.

Cantwell, J., & Janne, O. (1999). Technological globalisation and innovative centres: The role of corporate technological leadership and locational hierarchy. Research Policy, 28(2), 119–144.

Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12), 1109–1128.

Cantwell, J., & Santangelo, G. (2000). Capitalism, profits and innovation in the new techno-economic paradigm. Journal of Evolutionary Economics, 10(1–2), 131–157.

Castellani, D., Jimenez, A., & Zanfei, A. (2013). How remote are R&D labs? Distance factors and international innovative activities. Journal of International Business Studies, 44(7), 649–675.

Castellani, D., Mancusi, M.-L., Santangelo, G., & Zanfei, A. (2015). Exploring the links between offshoring and innovation. Economia e Politica Industriale, 42(1), 1–7.

Castellani, D., & Pieri, F. (2013). R&D offshoring and the productivity growth of European regions. Research Policy, 42(9), 1581–1594.

Castellani, D., & Zanfei, A. (2006). Multinational firms, innovation and productivity. Cheltenham, UK: Edward Elgar Publishing.

Castelli, C., & Castellani, D. (2013). The internationalisation of R&D: Sectoral and geographic patterns of cross-border investments. Economia e Politica Industriale, 40(1), 127–143.

China Statistical Yearbook. (2016). National Bureau of statistics of China. Beijing: Beijing Info Press.

Collinson, S. C., & Wang, R. (2012). The evolution of innovation capability in multinational enterprise subsidiaries: Dual network embeddedness and the divergence of subsidiary specialisation in Taiwan. Research Policy, 41(9), 1501–1518.

D’Agostino, L. M. (2015). The neglected effects of R&D captive off-shoring in emerging countries on the creation of knowledge at home. Economia e Politica Industriale, 42(1), 61–91.

D’Agostino, L. M., Laursen, K., & Santangelo, G. (2013). The impact of R&D offshoring on the home knowledge production of OECD investing regions. Journal of Economic Geography, 13(1), 145–175.

D’Agostino, L. M., & Santangelo, G. D. (2012). Do overseas R&D laboratories in emerging markets contribute to home knowledge creation? Management International Review, 52(2), 251–273.

D’Cruz, J. (1986). Strategic management of subsidiaries. In H. Etemad & L. Seguin Dulude (Eds.), Managing the multinational subsidiary (pp. 75–89). London: Croom Helm.

Dimitratos, P., Liouka, I., & Young, S. (2009). Regional location of multinational corporation subsidiaries and economic development contribution: Evidence from the UK. Journal of World Business, 44(2), 180–191.

Dosi, G., Freeman, C., Nelson, R. R., Silverberg, G., & Soete, L. (Eds.). (1988). Technology and economic theory. London: Pinter.

Driffield, N., Love, J. H., & Yang, Y. (2016). Reverse international knowledge transfer in the MNE: (Where) does affiliate performance boost parent performance? Research Policy, 45(2), 491–506.

Dunning, J. H. (1993). Multinational enterprises and the global economy. Wokingham: Addison-Wesley.

Dunning, J. H. (1998). Location and the multinational enterprise: A neglected factor?. Journal of International Business Studies, 29, 45–66.

Dunning, J. H. (2000). The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review, 9, 163–190.

Dunning, J. H., & Lundan, S. (2008). Multinational enterprises and the global economy (2nd ed.). Cheltenham, UK: Edward Elgar.

Dunning, J. H., & Narula, R. (1995). The R&D activities of foreign firms in the US. International Studies in Management & Organisation, 25(1–2), 39–73.

Edquist, C. (1997). Systems of innovation: Technologies, institutions and organisations. London: Pinter.

Edquist, C. (2005). Systems of innovation: Perspectives and challenges. In D. Faberberg, D. Mowery, & R. R. Nelson (Eds.), The Oxford handbook of innovation. Oxford: Oxford University Press.

Fan, P. (2006). Promoting indigenous capability: The Chinese government and the catching-up of domestic telecom-equipment firms. China Review, 6(1), 9–35.

Figueiredo, P. N. (2011). The role of dual embeddedness in the innovative performance of MNE subsidiaries: Evidence from Brazil. Journal of Management Studies, 48(2), 417–440.

Franco, C., & Leoncini, R. (2013). Measuring China’s innovative capacity: A stochastic frontier exercise. Economics of Innovation and New Technology, 22, 199–217.

Freeman, C. (1987). Technology policy and economic performance. London: Pinter.

Freeman, C. (1991). Networks of innovation: A synthesis of research issues. Research Policy, 20, 499–514.

Frenz, M., & Ietto-Gillies, G. (2009). The impact on innovation performance of different sources of knowledge. Evidence from the UK Community Innovation Survey. Research Policy, 38(7), 1125–1135.

Frost, T. S. (2001). The geographic sources of foreign subsidiaries’ innovation. Strategic Management Journal, 22, 101–123.

Frost, T. S., Birkinshaw, J. M., & Ensign, P. C. (2002). Centers of excellence in multinational corporations. Strategic Management Journal, 23(11), 997–1018.

Garcia Sánchez, A., Molero, J., & Rama, R. (2016). Local cooperation for innovation: food and beverage multinationals in a peripheral European country. International Journal of Multinational Corporation Strategy, 1(2), 107–132.

Gkypali, A., Tsekouras, K., & von Tunzelmann, N. (2012). Endogeneity between internationalization and knowledge creation of global R&D leader firms: an econometric approach using Scoreboard data. Industrial and Corporate Change, 21(3), 731–762.

Govindarajan, V., & Ramamurti, R. (2011). Reverse innovation, emerging markets, and global strategy. Global Strategy Journal, 1(3–4), 191–205.

Gu, S., & Lundvall, B.-A. (2006). China’s innovation system and the move towards a more harmonious growth and endogenous innovation. Innovation, Management, Policy and Practice, 8, 1–26.

Guimón, J., Chaminade, C., Maggi, C., & Salazar-Elena, J. C. (2017). Policies to attract R&D related FDI in small emerging countries: Aligning incentives with local linkages and absorptive capacities in Chile. Journal of International Management, 24(2), 165–178.

Gupta, A. K., & Govindarajan, V. (1991). Knowledge flows and the structure of control within multinational corporations. Academy of Management Review, 16, 768–792.

Gupta, A. K., & Govindarajan, V. (1994). Organising for knowledge flows within MNCs. International Business Review, 3, 443–458.

Haakonsson, S. J., & Ujjual, V. (2015). Internationalisation of R&D: New insights into multinational enterprises R&D strategies in emerging markets. Management Revue, 26(2), 101–122.

Hedlund, G., & Rolander, D. (1990). Action in heterarchies: New approaches to managing the MNCs. In C. A. Bartlett, Y. Doz, & G. Hedlund (Eds.), Managing the Global Firm. London: Routledge.

Heilmann, S., Shih, L., & Hofem, A. (2013). National planning and local technology zones: Experimental governance in China’s Torch Programme. The China Quarterly, 216, 896–919.

Holl, A., & Rama, R. (2014). Foreign subsidiaries and technology sourcing in Spain. Industry and Innovation, 21(1), 43–64.

Holmes, R. M., Li, H., Hitt, M. A., DeGhetto, K., & Sutton, T. (2016). The effects of location and MNC attributes on MNCs’ establishment of foreign R&D centers: Evidence from China. Long Range Planning, 49(5), 594–613.

Hood, N., & Young, S. (1988). Inward Investment and the EC: UK evidence on corporate integration strategies. In J. H. Dunning, P. Robson (Eds.), Multinationals and the European Community (pp. 91–104). Oxford: Blackwell.

Hood, N., Young, S., & Lal, D. (1994). Strategic evolution within Japanese manufacturing plants in Europe: UK evidence. International Business Review, 3(2), 97–122.

Hsu, C. W., Lien, Y. C., & Chen, H. (2013). International ambidexterity and firm performance in small emerging economies. Journal of World Business, 48(1), 58–67.

Hsu, C. W., Lien, Y. C., & Chen, H. (2015). R&D internationalization and innovation performance. International Business Review, 24(2), 187–195.

Hu, A. G., Jefferson, G. H., & Jinchang, Q. (2005). R&D and technology transfer: Firm-level evidence from Chinese industry. Review of Economics and Statistics, 87(4), 780–786.

Hu, M. C., & Mathews, J. A. (2008). China’s national innovative capacity. Research Policy, 37, 1465–1479.

Ito, B., & Wakasugi, R. (2007). What factors determine the mode of overseas R&D by multinationals? Empirical evidence. Research Policy, 36(8), 1275–1287.

Ivarsson, I., & Alvstam, C. G. (2017). New technology development by Swedish MNEs in emerging markets: The role of co-location of R&D and production. Asian Business & Management, 16(1–2), 92–116.

Kim, J. Y., Driffield, N., & Temouri, Y. (2016). The changing nature of South Korean FDI to China. International Journal of Multinational Corporation Strategy, 1(3–4), 269–287.

Kumaraswamy, A., Mudambi, R., Saranga, H., & Tripathy, A. (2012). Catch-up strategies in the Indian auto components industry: Domestic firms’ responses to market liberalization. Journal of International Business Studies, 43(4), 368–395.

Lazonick, W. (2004). Indigenous innovation and economic development: Lessons from China’s leap into the information age. Industry and Innovation, 11, 273–297.

León-Ledesma, M. A., & Christopoulos, D. (2016). Misallocation, access to finance, and public credit: firm-level evidence. Asian Development Review, 33(2), 119–143.

Li, X. (2009). China’s regional innovation capacity in transition: An empirical approach. Research Policy, 38, 338–357.

Li, J., & Kozhikode, R. K. (2009). Developing new innovation models: Shifts in the innovation landscapes in emerging economies and implications for global R&D management. Journal of International Management, 15(3), 328–339.

Li, Y. & Wang, Y. (2014). The dual role of local R&D collaboration partners for firms’ technological innovation in China, Academy of Management Proceedings, 1, (supplement 11013).

Liu, Z. (2002). Foreign direct investment and technology spillover: Evidence from China. Journal of Comparative Economics, 30(3), 579–602.

Liu, M., & Chen, S. (2012). MNCs’ offshore R&D networks in host country’s regional innovation system: The case of Taiwan-based firms in China. Research Policy, 41(6), 1107–1120.

Liu, F. C., Simon, D. F., Sun, Y. T., & Cao, C. (2011). China’s innovation policies: Evolution, institutional structure, and trajectory. Research Policy, 40(7), 917–931.

Liu, X., & Wang, C. (2003). Does foreign direct investment facilitate technological progress? Evidence from Chinese industries. Research Policy, 32(6), 945–953.

Liu, X., & White, S. (2001). Comparing innovation systems: A framework and application to China’s transitional context. Research Policy, 30, 1091–1114.

Lu, Q., & Lazonick, W. (2001). The organisation of innovation in a transitional economy: Business and government in Chinese electronic publishing. Research Policy, 30, 55–77.

Lundvall, B.-A. (1992). National systems of innovation: Towards a theory of innovation and interactive learning. London: Pinter.

Lundvall, B.-A. (2007). National innovation systems: an analytical concept and developmental tool. Industry and Innovation, 14, 95–119.

Manea, J., & Pearce, R. (2004). Multinationals and transition: Business strategies, technology and transformation in central and eastern Europe. London: Palgrave.

Manea, J., & Pearce, R. (2006). MNEs’ strategies in Central and Eastern Europe: Key elements of subsidiary behavior. Transnational Corporations, 46, 235–255.

Manolopoulos, D., Papanastassiou, M., & Pearce, R. (2005). Technology sourcing in multinational enterprises and the roles of subsidiaries: An empirical investigation. International Business Review, 14(3), 249–267.

Manolopoulos, D., Papanastassiou, M., & Pearce, R. (2007). Knowledge-related competitiveness and the roles of multinationals’ R&D in a peripheral European economy: Survey analysis of Greece. Management International Review, 47(5), 661–682.

Meyer, K. E., Mudambi, R., & Narula, R. (2011). Multinational enterprises and local contexts: The opportunities and challenges of multiple embeddedness. Journal of Management Studies, 48(2), 235–252.

Motohashi, K. (2010). R&D activities of manufacturing multinationals in China: Structure, motivations and regional differences. China and World Economy, 18(6), 56–72.

Mudambi, R., Piscitello, L., & Rabbiosi, L. (2014). Reverse knowledge transfer in MNEs: Subsidiary innovativeness and entry modes. Long Range Planning, 47(1), 49–63.

Nair, S. R., Demirbag, M., & Mellahi, K. (2015). Reverse knowledge transfer from overseas acquisitions: A survey of Indian MNEs. Management International Review, 55(2), 277–301.

Narula, R., & Zanfei, A. (2005). Globalization of innovation: the role of multinational enterprises, chap 12. In J. Fagerberg, D. Mowery, R. Nelson (Eds.), The Oxford Handbook of Innovation. Oxford: Oxford University Press.

Nelson, R. R. (Ed.). (1993). National systems of innovation: A comparative study. Oxford: Oxford University Press.

Nieto, M. J., & Rodriguez, A. (2011). Offshoring of R&D: Looking abroad to improve innovation performance. Journal of International Business Studies, 42(3), 345–361.

Oladottir, A. D., Hobdari, B., Papanastassiou, M., Pearce, R., & Sinani, E. (2012). Strategic complexity and global expansion: An empirical study of newcomer Multinational Corporations from small economies. Journal of World Business, 47(4), 686–695.

Pant, A., & Ramachandran, J. (2017). Navigating identity duality in multinational subsidiaries: A paradox lens on identity claims at Hindustan Unilever 1959–2015. Journal of International Business Studies, 48(6), 664–692.

Papanastassiou, M., & Pearce, R. (1999). Multinationals, technology and national competitiveness. Cheltenham: Edward Elgar.

Papanastassiou, M., & Pearce, R. (2009). The strategic development of multinationals. London: Palgrave.

Pearce, R. D. (1999). Decentralised R&D and strategic competitiveness: Globalised approaches to generation and use of technology in multinational enterprises (MNEs). Research Policy, 28(2), 157–178.

Pearce, R., & Papanastassiou, M. (1999). Overseas R&D and the strategic evolution of MNEs: Evidence from laboratories in the UK. Research Policy, 28(1), 23–41.

Pearce, R., & Tavares, A.-T. (2002). On the dynamics and coexistence of multiple subsidiary roles: An investigation of multinational operations in the UK. In S. M. Lundan (Ed.), Network knowledge in international business (pp. 73–90). Cheltenham: Edward Elgar.

Pearce, R., & Zhang, S. (2010). Multinationals’ strategies for global competitiveness and the sustainability of development in national economies. Asian Business and Management, 9(4), 481–498.

Phene, A., & Almeida, P. (2008). Innovation in multinational subsidiaries: The role of knowledge assimilation and subsidiary capabilities. Journal of International Business Studies, 39, 901–919.

Ronstadt, R. C. (1978). International R&D: The establishment and evolution of research and development abroad by seven US multinationals. Journal of International Business Studies, 9(1), 7–24.

Rugman, A. M., & Verbeke, A. (1998). Corporate strategies and environmental regulations: An organizing framework. Strategic Management Journal, 19(4), 363–375.

Santangelo, G. D., Meyer, K. E., & Jindra, B. (2016). MNE subsidiaries’ outsourcing and insourcing of R&D: The role of local institutions. Global Strategy Journal, 6(4), 247–268.

Sartor, M. A., & Beamish, P. W. (2014). Offshoring innovation to emerging markets: Organizational control and informal institutional distance. Journal of International Business Studies, 45(9), 1072–1095.

Scott-Kennel, J., & Michailova, S. (2016). Subsidiary internal and external embeddedness: Trade-up and trade-off. International Journal of Multinational Corporation Strategy, 1(2), 133–154.

Song, J., & Shin, J. (2008). The paradox of technological capabilities: A study of knowledge sourcing from host countries of overseas R&D operations. Journal of International Business Studies, 39(2), 291–303.

Sun, Y., Von Zedtwitz, M., & Simon, D. F. (2007). Globalization of R&D and China: An introduction. Asia Pacific Business Review, 13(3), 311–319.

Taggart, J. H. (1996). Multinational manufacturing subsidiaries in Scotland: Strategic role and economic impact. International Business Review, 5, 447–468.

Taggart, J. H. (1997). US MNC affiliates in the UK: A special relationship? In P. J. Buckley, M. Chapman, J. Clegg, A. R. Cross (Eds.) The Organisation of International Business: Proceedings of the 1997 Annual Conference, Academy of International Business (pp. 31–64). Leeds.

Terza, J. V., Bradford, W. D., & Dismuke, C. E. (2008). The use of linear instrumental variables methods in health services research and health economics: a cautionary note. Health Services Research, 43(3), 1102–1120.

UNCTAD. (2005). World investment report 2005. Geneva: UNCTAD.

Van Egeraat, C., & Breathnach, P. (2012). The drivers of transnational subsidiary evolution: The upgrading of process R&D in the Irish pharmaceutical industry. Regional Studies, 46(9), 1153–1167.

Vernon, R. (1966). International investment and international trade in the product cycle. The Quarterly Journal of Economics, 80(2), 190–207.

von Zedtwitz, M. (2004). Managing foreign R&D laboratories in China. R&D Management, 34(4), 439–452.

von Zedtwitz, M. (2006). International R&D strategies of TNCs from developing countries: The case of China. In UNCTAD: Globalisation of R&D and Developing Countries: Proceedings of the Expert Meeting (pp. 117–140). Geneva: UNCTAD.

Von Zedtwitz, M., Corsi, S., Søberg, P. V., & Frega, R. (2015). A typology of reverse innovation. Journal of Product Innovation Management, 32(1), 12–28.

von Zedtwitz, M. & Gassmann, O. (2016) Global Corporate R&D to and from emerging economies. In The Global Innovation Index 2016. Cornell University, INSEAD, and the World Intellectual Property Organization (pp. 125–131). Printed and bound in Geneva, Switzerland.

Von Zedtwitz, M., Ikeda, T., Gong, L., Carpenter, R., & Hämäläinen, S. (2007). Managing foreign R&D in China. Research-Technology Management, 50(3), 19–27.

Wang, J., Liang, Z., & Xue, L. (2014). Multinational R&D in China: Differentiation and integration of global R&D networks. International Journal of Technology Management, 65(1–4), 96–124.

White, R. E., & Poynter, T. A. (1984). Strategies for foreign-owned subsidiaries in Canada. Business Quarterly, 48, 59–69.

Yamin, M., & Andersson, U. (2011). Subsidiary importance in the MNC: What role does internal embeddedness play? International Business Review, 20(2), 151–162.

Yang, C. H., & Hayakawa, K. (2015). Localization and overseas R&D activity: The case of Taiwanese multinational enterprises in China. R&D Management, 45(2), 181–195.

Yang, C.-H., Lee, C.-M., & Lin, C.-H. (2012). Why does regional innovative capability vary so substantially in China? The role of regional innovation systems. Asian Journal of Technology Innovation, 20, 239–255.

Yu, S. (2011). Information technology in multinational corporations: The managerial role of enterprise resource planning system in headquarters-subsidiary power tussle and local performance. Germany: LAP Lambert.

Zhang, S., (2009). Multinational subsidiaries and china’s industrialisation: a process of shared competitive development. PhD thesis: University of Reading.

Zhang, Y., Li, H., Hitt, M. A., & Cui, G. (2007). R&D intensity and international joint venture performance in an emerging market: moderating effects of market focus and ownership structure. Journal of International Business Studies, 38(6), 944–960.

Zhang, S., & Pearce, R. (2010). Sources of technology and the strategic role of MNE subsidiaries in China. Multinational Business Review, 18(3), 49–72.

Zhang, S., & Pearce, R. (2012). Multinationals in China: Business strategy, technology and economic development. London: Palgrave.

Zhao, S., Papanastassiou, M., Pearce, R. D & Iguchie, C. (2017). The internationalization of R&D in Asia (mimeo).

Zhao, S., Tan, H., Papanastassiou, M. & Harzing, A-W. (2018). The internationalization of innovation towards the South: A historical case study of a global pharmaceutical corporation in China (1993–2017) (UKAIB 2018_ proceedings).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhang, S., Zhao, S., Bournakis, I. et al. Subsidiary roles as determinants of subsidiary technology sourcing: empirical evidence from China. Econ Polit 35, 623–648 (2018). https://doi.org/10.1007/s40888-018-0120-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-018-0120-8