Abstract

Demand for several variety of commodity depends on its nature like; price, corrosion and time. In most inventory models demand is considered constant or time-dependent. In this study, we set up a deterministic EOQ for weakening stuffs when demand is quadratic time linked. Shortages are permitted and totally backlogged. Mathematical representation is derived and then some constructive outcomes is framed to demonstrate most favorable answers. Numerical illustrations are incorporated to demonstrate the optimal clarification. Sensitivity analysis with effects of system constraints is provided to scrutinize the nature of representation. Mathematica 7.1 software is employed to get arithmetical results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In past few years, several investigations is available on inventory problems for failing goods. Majority of substances in nature suffer decay or spoilage over time. Green vegetables, fruits, radioactive substances, blood, alcohol etc. bear from exhausted by spoilage during storage. The foremost difficulty of any production association is how to manage and uphold the inventories of failing products. Demand for a particular item made by producer depends on price, quality and season etc.

Ghare and Schrader [1] were originally planned an EOQ model with exponentially decaying foodstuffs. Covert and Philip [2] analyzed a model with two-parameters Weibull distribution weakening. Philip [3] widespread and extended the model of Covert and Philip taking into description with three parameters Weibull distribution deterioration. Whitin [4] recognized the corrosion of fashion merchandise at the last part of agreed cargo space time. Shah and Jaiswal [5] addressed an arrange level EOQ model in favor of weakening objects. Aggarwal [6] and Dave and Patel [7] explored inventory models for item fading at a steady rate. Shah et al. [8] measured an inventory structure by means of failing commodity where demand rate is associated to advertising and selling charge. Goyal and Giri [9] addressed a comprehensive evaluation of deteriorating inventory. Some research effort linked to deteriorating objects has been done by Goyal [10], Raafat et al. [11], Wee [12], Mishra [13], Deb and Chaudhuri [14], Chung and Ting [15], Fujiwara [16], Chakraborti and Chaudhuri [17], Jalan and Chaudhuri [18], Wu [19], Dye et al. [20], Panda et al. [21], Widyadana et al. [22], Tripathi and Kumar [23], Tripathi and Pandey [24], Singh et al. [25] and Tripathi [26].

In traditional economic order quantity models demand rate is unspecified to be stable. However, demand rate for most of the products may not be always constant, it may be stock, time, selling price and advertising sensitive demand rate. Roy [27] published an EOQ model where decline rate is time comparative and demand associated by means of selling price. Tripathi [28] presented an inventory model for item whose demand is a decreasing function of selling price. Yang [29] established an EOQ model for stock-dependent demand and holding cost. Jaggi et al. [30] proposed a model under two stages of traffic credit strategy by guessing demand is linked with credit epoch presented by vendor to buyer via DCF approach.

Teng et al. [31] introduced an EOQ model under trade credit financing through escalating demand under tolerable delay in expenses. Hsieh et al. [32] widespread the demand for an EOQ model by means of fluctuating trade credits to an rising function of time. Skouri et al. [33] pointed out EOQ model for incline type demand in the midst of Weibull corrosion rate. Khanra et al. [34] established a model for a failing objects containing time-linked demand in which holdup in expenses are tolerable. Several researchers worked in this direction like Donaldson [35], Silver [36], Ritchie [37], Mitra et al. [38], Min et al. [39], Patra [40], Sahoo et al. [41] and others.

In real life, demands for medicines, foodstuffs, vegetables etc. are generally lost throughout the storage phase, it means that items produced may have fraction of defective. Ghiami et al. [42] explored a two-level supply succession model in favor of fading inventory where vendor’s storehouse has inadequate capability. Jaggi et al. [43] offered an EOQ model in support of defective quality item to settle on best possible ordering strategies of a seller with allowed delay in expenditure for acceptable shortages. Ouyang and Chang [44] established a mathematical model to learn the most advantageous fabrication procedure for an economic production quantity (EPQ) scheme in the midst of unsatisfactory construction process under permitted delay in payment and complete backlogging. Wee et al. [45] projected an EPQ model for unfinished backorders. Bhunia et al. [46] presented an inventory model for single weakening commodity through two part warehouses containing dissimilar conserving services under shortages. Sana [47] recognized best possible selling price by means of time changeable weakening and fractional backlogging.

In this paper an EOQ model is presented for an item with quadratic time sensitive demand rate (i.e. D(t)= a + bt + ct2) with deterioration. If c = 0 then demand rate is linear, and if, b = c = 0, demand rate is invariable. Shortages are acceptable and linearly time dependent. The foremost purpose of the model is to settle on minimum total average cost.

The remaining component of manuscript is prepared as followed. In the next allotment 2, we afford assumption and notations used all over the study. In “Mathematical Formulation” section, mathematical formulation is obtained for deciding minimum total cost/unit time. The optimal solutions are provided in subdivision 4. In “Some Results” section, some significant results are provided based on optimal solution. Numerical illustrations are conversed in “Numerical Examples” section. The sensitivity investigation is provided in “Sensitivity Analysis and Managerial Implication” section. We establish conclusion and future research directives in “Conclusion and Future Investigation” section.

Assumptions and Notations

The following assumptions are made to build up the model:

-

Replenishment rate in instantaneous.

-

Demand rate D(t) is a quadratic time dependent during [0, t1] and time dependent between [t1, T].

-

Shortages are tolerable and fully backlogged. Backlog rate is time induced.

-

Time horizon is endless.

-

Deterioration rate θ is invariable.

Notations are as follows:

- q(t):

-

inventory level at instant ‘t’

- A :

-

cost of placing order

- h :

-

holding cost/unit time

- θ :

-

worsening rate 0≤ θ <1

- p :

-

unit cost of an item

- s :

-

shortage cost/unit time

- t 1 :

-

time for inventory depletion due to corrosion and demand, at time t1, shortages occurring just after t1

- T :

-

length of cycle time

- SC, HC and DC:

-

shortage, holding and deterioration costs

- Z(T, t1):

-

total cost/unit time

- Z(T*, t1*):

-

optimal Z(T, t1)

- t1* and T*:

-

optimal t1 and T

- Q 1 :

-

positive order quantity

- Q 2 :

-

negative order quantity

- Q :

-

order quantity

- Q*:

-

optimal Q

- D1(t)= a + bt + ct2:

-

demand rate in [0, t1] and a > b > c >0, b ≠ 0, c ≠ 0

- D2(t)= a + bt:

-

backlogged rate in [t1, T] and a > b >0, b ≠ 0.

Mathematical Formulation

Inventory level q(t) at time ‘t’ during the time interval [0, T] is given by the following differential equations:

with the condition

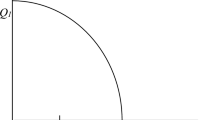

Solution of (1) and (2) with (3) are specified in “Appendix A” (Fig. 1)

Thus, maximum inventory level and shortage quantity during [0, T] are:

and

Order quantity

Number of deteriorated item during [0, t1] is:

Cost of deterioration during [0, t1] is

Total cost/unit time is

It is complicated to grip Eq. (10) in the present form. Truncated Taylor’s series estimate is used for exponential term to obtain closed form solution. From Eq. (10), we have

Determination of Optimal Solution

Differentiating (11) partially w.r.t. T and t1 twice, we obtain

Our aim is to acquire least total cost/unit time. On putting \( \frac{\partial Z}{\partial T} = 0\,{\text{and}}\,\frac{\partial Z}{{\partial t_{1} }} = 0; \) solving simultaneously, we get at t1* and T*, which minimizes Z, provided \( \frac{{\partial^{2} Z}}{{\partial T^{2} }} > 0, \, \frac{{\partial^{2} Z}}{{\partial t_{1}^{2} }} > 0; \) and \( \left( {\frac{{\partial^{2} Z}}{{\partial T^{2} }}} \right)\left( {\frac{{\partial^{2} Z}}{{\partial t_{1}^{2} }}} \right) - \left( {\frac{{\partial^{2} Z}}{{\partial T\partial t_{1} }}} \right)^{2} > 0 \) (See “Appendix C” section), at t1* and T*. Putting \( \frac{\partial Z}{\partial T} = 0 \, \) and \( \frac{\partial Z}{{\partial t_{1} }} = 0 \), we get

and

Solving Eqs. (17) and (18) concurrently, we get T* and t1*.

From the above conversation, we find following fallouts.

Some Results

Result 1

T* is growing function of t1*.

Proof

Differentiating (17) and (18) w.r.t. t1, we get

and

From (19) and (20) we see that \( \frac{dT}{{dt_{1} }} > 0 \). Therefore, optimal T is rising function of t1.□

Result 2

Z*(T*, t1*) is convex function of T* and t1*.

Proof

From Eqs. (14)–(16), it obvious that \( \, \left( {\frac{{\partial^{2} Z}}{{\partial T^{2} }}} \right)\left( {\frac{{\partial^{2} Z}}{{\partial t_{1}^{2} }}} \right) - \left( {\frac{{\partial^{2} Z}}{{\partial T\partial t_{1} }}} \right)^{2} > 0 \, \), and \( \frac{{\partial^{2} Z}}{{\partial T^{2} }} > 0 \, ,\frac{{\partial^{2} Z}}{{\partial t_{1}^{2} }} > 0 \). Thus, optimal total cost/unit time Z*(T*, t1*) is convex function of T* and t1*.□

Numerical Examples

Numerical examples are making available to exhibit the outcomes of model developed in this study with the following data:

Numerical Example 1

Consider the value of a = 1500 units/year, b = 150 units/year, c = 15 units/year, A = $200/order, h = $2.0/year, s = $5/year, p = $20/unit and θ = 0.01. Putting theses in Eqs. (17) and (18) and solving, we have t1* = 0.405452 year and T* = 0.518376 year and corresponding Q* = 799.002 units and Z(T*, t1*) = $886.005.

Numerical Example 2

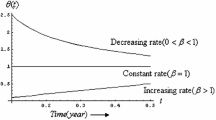

Let us consider numerical value of a = 2000, b = 200, c = 20, A = $200, h = $2.0, s = $5, p = $20 t and θ = 0.01 in appropriate units. On substitution these values in (17) and (18) and solve simultaneously, we get t1* = 0.323048 year and T*= 0.423219 year, corresponding Q* = 865.428 units and Z(T*, t1*) = $1039.09 (Figs. 2, 3).

Sensitivity Analysis and Managerial Implication

In this section we discuss, the outcome of distinction of constraints a, b, c, θ, s, A, and h, on Q* and total cost Z* (T, t1*). Sensitivity investigation will be very supportive in pronouncement making to scrutinize effect in modify of these differences. Using the identical data as in numerical Example 1, sensitivity investigation of unlike parameters has been completed. We learn outcome of discrepancies in a single factor maintaining additional scheme parameters equal on optimal solutions.

From the above Table 1 following results are made:

-

(i)

Rise of ‘a’, results diminish of t1 and T and enlarge in Q* and Z*.

-

(ii)

Raise in ‘c’ leads increase in t1*, T*, Q* and decrease in Z*).

-

(iii)

Augment in b, θ, p and h will lead decrease in t1*, T*, Q* and augment in optimal total cost.

-

(iv)

Amplify in s and A leads enlarge in t1*, T*, Q* and Z*(t1*, T*).

(Please see “Appendix B” section).

Managerial Implication

The quadratic demand is rare in nature. This type of demand is often happens during earth quake, storm etc. In case of any trade deal, if initial demand increases order quantity and total cost increases. It means that initial demand, order quantity and total cost move in the same direction. In addition shortages cost, cost of placing order, order quantity and total cost shift in the same mode.

Conclusion and Future Investigation

In this paper, a deterministic EOQ model is established for fading objects by means of quadratic time induced demand. In case of seasonal foodstuffs demand rises suddenly to utmost in the middle season and then go down to a least abruptly as season ends. Quadratic time linked demand [i.e. D(t)= a + bt + ct2, a > 0, b ≠ 0, c ≠ 0] is a best demonstration of these different types of demand. If b > 0, c > 0, the demand rate is the growing function of time. This is said to be accelerated expansion in demand, i.e. \( \frac{{d^{2} D}}{{dt^{2} }} = 2c > 0 \).If b > 0, c < 0, demand rate is said to be slow down growth in demand. If, b < 0, c < 0, demand rate is retarded decline for every time. The functional form of demand pattern D(t)= a + bt + ct2, depending on the sign of b and c. Shortages are acceptable and linearly time dependent. Due to uncertainties, stock out is inescapable for many business connections. Mathematical model has been developed to formulate most advantageous answer. Next, numerical illustrations are given to authenticate the consequences. Sensitivity study with the dissimilarity of dissimilar scheme parameters on optimal solution has been also deliberated. We have obtained numerous administrative phenomena. For instance (i) a advanced value of ‘a’ and ‘A’ caused a higher order quantity and total cost, (ii) a superior value of θ, s, p and h caused lesser order quantity and higher total cost, (iii) a elevated value of ‘c’ caused lower order quantity and total cost and (iv) advanced value of ‘b’ caused elevated values of total cost and slightly decrease in order quantity.

At hand model provides quite a lot of probable extensions. For illustration, we may extend model for stochastic demand as well as Weibull deterioration rate. Another possible extension would be to regard as holding cost to be time or price sensitive

References

Ghare, P.M., Schrader, G.H.: A model for exponentially decaying inventory system. J. Ind. Eng. 14, 238–243 (1963)

Covert, R.P., Philip, G.C.: An EOQ model for items with Weibull distribution deterioration. AIIE Trans. 5, 323–326 (1973)

Philip, G.C.: A generalized EOQ model for items with Weibull distribution. AIIE Trans. 6, 159–162 (1974)

Whitin, T.M.: Theory of Inventory Management. Princeton University Press, Princeton (1957)

Shah, Y.K., Jaiswal, M.C.: An order-level inventory model for a system with constant rate of deterioration. Opsearch 14, 174–184 (1977)

Aggarwal, S.P.: A note on an order-level inventory model for a system with constant rate of deterioration. Opsearch 15, 184–187 (1978)

Dave, U., Patel, L.K.: (T, S) policy inventory model for deteriorating items with time proportional demand. J. Oper. Res. Soc. 32, 137–142 (1981)

Shah, N.H., Soni, H.N., Patel, K.A.: Optimizing inventory and marketing policy for non-instantaneous deteriorating items with generalized type deterioration and holding cost rates. Omega 41(2), 421–430 (2013)

Goyal, S.K., Giri, B.C.: Recent trends in inventory for deteriorating inventory. Euro. J. Oper. Res. 134, 1–16 (2001)

Goyal, S.K.: Economic ordering policy for deteriorating items over an infinite time horizon. Eur. J. Oper. Res. 28, 298–301 (1987)

Raafat, F., Wolfe, P.M., Eldin, H.K.: Inventory model for deteriorating items. Comput. Ind. Eng. 20, 89–104 (1991)

Wee, H.M.: Economic production lot size model for deteriorating items with partial back-ordering. Comput. Ind. Eng. 24, 449–458 (1993)

Mishra, R.B.: Optimum production lot-size model for a system with deteriorating inventory. Int. J. Prod. Econ. 3, 495–505 (1975)

Deb, M., Chaudhuri, K.S.: An EOQ model for items with finite rate of production and variable rate of deterioration. Opsearch 23, 175–181 (1986)

Chung, K., Ting, P.: A heuristic for replenishment of deteriorating items with a linear trend in demand. J. Oper. Res. Soc. 44, 1235–1241 (1993)

Fujiwara, O.: EOQ models for continuously deteriorating products using linear and exponential penalty costs. Eur. J. Oper. Res. 70, 104–114 (1993)

Chakraborti, T., Chaudhuri, K.S.: An EOQ model for deteriorating items with a linear trend in demand and shortages in all cycles. Int. J. Prod. Econ. 49, 205–213 (1997)

Jalan, A.K., Chaudhuri, K.S.: Structural properties of an inventory system with deterioration and trended demand. Int. J. Syst. Sci. 30, 627–633 (1999)

Wu, K.S.: An EOQ inventory model for items with Weibull distribution deterioration, ramp type demand rate and partial backlogging. Prod. Plan. Con. 12, 787–798 (2001)

Dye, C.Y., Chang, H.J., Teng, J.T.: A deteriorating inventory model with time varying demand and shortage-dependent partial backlogging. Eur. J. Oper. Res. 172, 417–429 (2006)

Panda, S., Senapati, S., Basu, M.: Optimal replenishment policy for perishable seasonal products in seasons with ramp type, time-dependent demand. Comput. Ind. Eng. 54, 301–314 (2008)

Widyadana, G.A., Cardenas-Barron, L.E., Wee, H.M.: Economic order quantity model for deteriorating items with planned backorder level. Math. Comput. Model. 54, 1569–1575 (2011)

Tripathi, R.P., Kumar, M.: A new model for deteriorating items with inflation under permissible delay in payments. Int. J. Ind. Eng. Comput. 5, 365–374 (2014)

Tripathi, R.P., Pandey, H.S.: An EOQ model for deteriorating items with Weibull time-dependent demand rate under trade credits. Int. J. Inf. Manag. Sci. 24, 329–347 (2013)

Singh, D., Tripathi, R.P., Mishra, T.: Inventory model with deteriorating item and time dependent holding cost. Glob. J. Math. Sci. Theory Pract. 4, 213–220 (2013)

Tripathi, R.P.: Inventory model with different demand rate and different holding cost. Int. J. Ind. Eng. Comput. 4, 437–446 (2013)

Roy, A.: An inventory model for deteriorating item with price dependent demand and time-varying holding cost. Adv. Mod. Opt. 10(1), 25–37 (2008)

Tripathi, R.P.: Economic order quantity models for price dependent demand and different holding cost functions. Jord. J. Math. Stat. 12(1), 15–33 (2019)

Yang, C.T.: An inventory model with both stock-dependent demand rate and stock-dependent holding cost rate. Int. J. Prod. Econ. 155, 214–221 (2014)

Jaggi, C.K., Aggarwal, K.K., Goel, S.K.: Retailer’s optimal ordering policy under two stage trade credit financing. Adv. Mod. Opt. 9(1), 67–80 (2007)

Teng, J.T., Min, J., Pan, Q.: Economic order quantity model with trade credit financing for non-decreasing demand. Omega 40, 328–335 (2012)

Hsieh, T.P., Chang, H.J., Dye, C.Y., Weng, M.W.: Optimal lot size under trade credit financing when demand and deterioration are fluctuating with time. Int. J. Inf. Manag. Sci. 20, 191–204 (2009)

Skouri, K., Konstantaras, I., Papachristos, S., Ganas, I.: Inventory models with ramp type demand rate, partial backlogging and Weibull deterioration rate. Eur. J. Oper. Res. 192, 79–92 (2009)

Khanra, S., Ghosh, S.K., Chaudhuri, K.S.: An EOQ model for a deteriorating item with time dependent quadratic demand under permissible delay in payment. Appl. Math. Comput. 218, 1–9 (2011)

Donaldson, E.A.: Inventory replenishment policy for a linear trend in demand an analytical solution. Oper. Res. Q. 28, 663–665 (1977)

Silver, E.A.: A simple inventory replenishment decision rule for a linear trend in demand. J. Oper. Res. Soc. 30, 71–75 (1979)

Ritchie, E.: Practical Inventory replenishment policies for a linear trend in demand followed by a period of steady demand. J. Oper. Res. Soc. 31, 605–613 (1980)

Mitra, A., Fox, J.F., Jessejr, R.R.: A note on determining order quantities with a linear trend in demand. J. Oper. Res. Soc. 35, 141–144 (1984)

Min, J., Zhou, Y.W., Zhao, J.: An inventory model for deteriorating items under stock-dependent demand and two level trade credit. Appl. Math. Model. 34, 3273–3328 (2010)

Patra, K.: A production inventory model with imperfect production and risk. Int. J. Appl. Comput. Math. 4, 91 (2018). https://doi.org/10.1007/s40819-018-0524-8

Sahoo, A.K., Indrajitsingha, S.K., Samanta, P.N., Mishra, U.K.: Selling price dependent demand with allowable shortages model under partially backlogged—deteriorating items. Int. J. Appl. Comput. Math. 5, 104 (2019). https://doi.org/10.1007/s40819-019-0670-7

Ghiami, Y., Williams, T., Wu, Y.: A two-echelon inventory model for a deteriorating item with stock-dependent demand, partial backlogging and capacity constraints. Eur. J. Oper. Res. 231, 587–597 (2013)

Jaggi, C.K., Goel, S.K., Mittal, M.: Credit financing in economic ordering policies for defective item with allowable shortages. Appl. Math. Comput. 219, 5268–5282 (2013)

Ouyang, L.Y., Chang, C.T.: Optimal production lot size with imperfect production process under permissible delay in payments and complete backlogging. Int. J. Prod. Econ. 144, 616–617 (2013)

Wee, H.M., Huang, Y.D., Wang, W.T., Cheng, Y.L.: An EPQ model with partial backorders considering two backordering cost. Appl. Math. Comput. 232, 898–907 (2014)

Bhunia, A.K., Jaggi, C.K., Sharma, A., Sharma, R.: A two-warehouse inventory model for deteriorating item under permissible delay in payment with partial backlogging. Appl. Math. Comput. 232, 1125–1137 (2014)

Sana, S.: Optimal selling price and lot size with time varying deterioration and partial backlogging. Appl. Math. Comput. 217, 185–194 (2010)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

The holding cost HC during [0, T1] is

The shortage cost during [t1, T] is given by

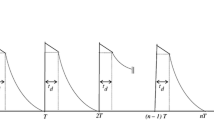

Appendix B

See Fig. 4.

Appendix C

Let

Then

Consider

Similarly, we can show that, \( 2\alpha \left( {AA_{1} + \beta t_{1}^{2} A_{2} - A_{3} A_{4} } \right)\,{\text{and}}\,\alpha^{2} \left( {2\beta t_{1}^{2} A_{1} - A_{3}^{2} } \right) \) are positive.

Hence

Rights and permissions

About this article

Cite this article

Tripathi, R.P. Innovation of Economic Order Quantity (EOQ) Model for Deteriorating Items with Time-Linked Quadratic Demand Under Non-decreasing Shortages. Int. J. Appl. Comput. Math 5, 123 (2019). https://doi.org/10.1007/s40819-019-0708-x

Published:

DOI: https://doi.org/10.1007/s40819-019-0708-x