Abstract

In any business transaction the constant unit price assumption is not true. The tendency in inflationary environment is to buy more in order to reduce the total system cost, which may be true in certain situations but it is not true when consumption rate of items is dependent on initial stock level since buying more quantity under inflationary environment leads to more consumption resulting in higher total system cost. The model developed in this paper helps to determine optimum ordering quantity for stock dependent consumption rate items under inflationary environment with infinite replenishment rate without permitting shortages. The effect of the inflation rate, deterioration rate, Initial-stock-dependent consumption rate and delay in payment are discussed. This study develops an inventory model for constant demand rate and time dependent deterioration rate with delay in payment is discussed. In this study mathematical model are also derived under two different cases. Case-I: The credit period is less then cycle time T; and Case-II: Credit period is greater than cycle time T. This study will proposes an inventory model under a situation in which the supplier provides the purchaser a permissible delay of payments if the purchaser orders a large quantity. Numerical example is given to support the purposed model. Mathematica 7.0 is used for numerical solutions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the traditional inventory models, it is usually assumed that retailer must pay to the supplier for the ordered items as soon as the items are received. In practice, however, the supplier is willing to offer the retailer a certain credit period with-out interest to promote market competition. In this connection we may mention a three parameter distribution for describing deterioration depending on time. Deterioration cannot be avoided in business scenarios. Rau et al. [20] presented an integrated model to determine economic ordering policies of deteriorating items in a supply chain management system.

The problem of deteriorating inventory has received considerable attention in recent years. Deterioration is defined as change, damage, decay, spoilage, obsolescence and loss of utility or loss of marginal value of a commodity that results in decreasing usefulness from the original one. Products such as vegetables, medicine, blood, gasoline and radioactive chemicals have finite shelf life, and start to deteriorate once they are produced. Most researches in deteriorating inventory assumed constant rate of deteriorating inventory assumed constant rate of deteriorating. However, the Weibull distribution is used to represent the product in stock deteriorates with time.

Besides, the assumption of constant demand is not always applicable to real situations. For instance, it is usually observed in the supermarket that display of the consumer goods in large quantities attracts more customers and generates higher demand. In the last several years, many researchers have given considerable attention to the situation where the demand rate is dependent on the level of the on-hand inventory. Gupta and Vrat [9] were first to develop models for stock-dependent consumption rate. Later, Baker and Urban [2] also established an economic order quantity model for a power-form inventory-level-dependent demand pattern. Mandal and Phaujdar [14] then developed an economic production quantity model for deteriorating items with constant production rate and linearly stock-dependent demand. Other researches related to this area such as Pal et al. [16], Padmanabhan and Vrat [15], Giri et al. [8], Ray and Chaudhuri [21], Datta et al. [5], Ray et al. [22] and so on.

Furthermore, when the shortages occur, some customers are willing to wait for backorder and others would turn to buy from other sellers. Many researchers such as Park [19], Hollier and Mak [10] and Wee [36] considered the constant partial backlogging rates during the shortage period in their inventory models. In some inventory systems, such as fashionable commodities, the length of the waiting time for the next replenishment would determine whether the backlogging will be accepted or not. Therefore, the backlogging rate is variable and dependent on the waiting time for the next replenishment. Chang and Dye [3] investigated an EOQ model allowing shortage and partial backlogging. It assumed that the backlogging rate is variable and dependent on the length of the waiting time for the next replenishment. Recently, many researchers have modified inventory policies by considering the “time-proportional partial backlogging rate” such as Abad [1], Papachristos and Skouri [17], Chang et al. [4], Papachristos and Skouri [18], etc.

Recently, Ghiami and Williams [6] established a production inventory model in which a Manufacture in delivering a deteriorating products to retailers. Taleizadeh and Nematollahi [27] investigated the effects of time value of money and inflation on the optimal ordering policy in an inventory control systems. Sicilia et al. [25] studied deterministic inventory systems for items with a constant deteriorating rate. Taleizadeh et al. [26] developed a vendor managed inventory model for a two level supply chains comprised of one vendor and several non-competing retailers in which both the raw materials and the finished products have different deteriorations rates. Wee et al. [37] established a VMI strategy for green electronic products. Lee and Kim [13] have established the optimal policy considering both deteriorating and defective items is an integrated productions distributions model for a single-vendor single-buyer supply chains. Wu et al. [38] have built and EOQ model for the retailer to obtain its optimal credit period and cycle time in a supplier-retailer buyer supply chains in which (i) the retailer receives an up-stream trade credits to the buyer (ii) deteriorating items not only deteriorate continuously but also have their expiration dates and (iii) downstream credit period increases not only demand but also opportunity cost and default risk. Wang et al. [35] proposed an economic order quantity model for seller by incorporating the following relevant facts: (i) deteriorating products not only deteriorate continuously but also have their maximum lifetime and (ii) credit period increases not only demand but also default risk. Some related citations in this direction are by Khanra et al. [12], Sarkar et al. [24], RoyChowdhury et al. [23] and Ghosh et al. [7].

For fitting in with realistic circumstances, the problem of determining the optimal replenishment policy for non-instantaneous Weibull deteriorating items with constant demand is considered in this study. In the model, shortages are allowed; the backlogging rate is variable and dependent on the waiting time for the next replenishment. The necessary and sufficient conditions of the existence and uniqueness of the optimal solution are shown. As the special cases, the results for the models with instantaneous or non-instantaneous deterioration rate and with or without shortages are derived. Further, we analytically identify the best circumstance among these special cases based on the minimum total relevant cost per unit time. Sensitivity analysis of the optimal solution with respect to major parameters is carried out. Finally, four numerical examples are presented to demonstrate the developed model and the solution procedure.

In the past most recent studies in the inventory model have considered the influence of inventory model. In this paper we considered the weibull distribution deterioration instead of constant deterioration. Some of the related articles under inflation are Taleizadeh and Nematollahi [27] developed an inventory control problem for deteriorating items with back-ordering and financial considerations. Hou [11] studies an inventory model for deteriorating items with stock-dependent consumption rate and shortages under inflation and time discounting. Tyan Lo et al. [34] developed integrated production-inventory model with imperfect production processes and Weibull distribution deterioration under inflation. Yang [39] discussed two-warehouse inventory models for deteriorating items with shortages under inflation. Gilding (2014) discussed Inflation and the optimal inventory replenishment schedule within a finite planning horizon. Other related articles in this direction are Taleizadeh et al. [28,29,30], Taleizadeh [31], Taleizadeh [32], Tal et al. [33] etc. This was due to belief that inflation have considered the would not influence the inventory police to any significant degree. This belief is unrealistic since the resource of an enterprise in highly correlated to the return on investment. The concept of the inflation should be considered especially for long-term investment and forecasting.

Notation and Assumption

- q(t):

-

: Inventory level at time t

- Q :

-

: Stock level at the beginning of each cycle after fulfilling backorders

- \(Q^{*}\) :

-

: Optimal order quantity

- H :

-

: length of planning horizon

- K :

-

: Constant rate of inflation ($/$/unit time)

- C(t):

-

: Unit purchase cost for an item bought at time t, i.e. \(C(t) = C_{0} e^{K t}\) where \(C_{0}\) is the unit purchase cost at time zero

- h :

-

: Holding cost ($/unit/year) excluding interest charges

- \(C_{0}\) :

-

: Unit purchase Cost

- \(C_{2}\) :

-

: Shortage cost ($/unit/time)

- \(C_{3}\) :

-

: The ordering cost/cycle

- \(i_{e}\) :

-

: Interest earned ($/time)

- \(i_{p}\) :

-

: Interest charged ($/time)

- M :

-

: Permissible delay in settling the accounts

- T :

-

: Length of a cycle

- \(T_{1}^{*}\) :

-

: Optimal Cycle length for Case-I

- \(T^{*}_{2}\) :

-

: Optimal Cycle length for Case-II

- TCU :

-

: The average total inventory cost per unit time

- \(TCU_{1}\) :

-

: The average total inventory cost per unit time for T \(\ge \) M (Case-I)

- \( TCU_{1}^{*}\) :

-

: The optimal inventory cost per unit time for T \(\ge \) M (Case-I)

- \( TCU_{2}\) :

-

: The average total inventory cost per unit time for T \(\le \) M (Case-II)

- \( TCU_{2}^{*}\) :

-

: The optimal inventory cost per unit time for T \(\ge \) M (Case-II)

In additions the following assumptions are made

-

(i)

The inventory system involves only one item.

-

(ii)

The rate of replenishment in instantaneous.

-

(iii)

The deterioration rate is a two parameter Weibull distribution: \(\theta (t)=\alpha \beta t^{\beta -1}, \quad \alpha , \beta >0, \, t\ge 0\). Where \(\upalpha \) is the shape parameter, \(\upbeta \) is the scale parameter and \(\theta (t)\) is a non-negative real number and \(\upbeta \ne 1\).

-

(iv)

The demand rate is D which is constant.

The Mathematical Model

During the time [0,T] the instantaneous inventory level at time t will satisfy the following equations

with the boundary condition

On solving equation (1) and using boundary condition in (2):

Now we find optimal order quantity, using equation (3):

Case (I) (M < T)

The total cost is sum of at ordering, holding, deterioration cost with interest payable minus the interest earned. We evaluate all the cost separately and grouped together.

The total holding cost HC during [0, T] is

We assume that the length of planning horizon \(H = n T\), where n is an integer for the number of replenishments to be made during period H, and T is an interval of time between replenishment.

The interest earned \(\hbox {IE}_{1}\) during time [0,T] is

The interest payable \(\hbox {IP}_{1}\) per cycle for the inventory not being sold during due date M:

The number of deteriorated items during [0, T] is

The total variable cost, \(TVC_{1}\), is define as

From Eq. (2)–(7), we obtain \(TVC_{1}\) as

The total variable cost per unit time \(\hbox {TCU}_{1}\), during the cycle time [0,T] is

Case (II) (M > T)

Now as per results the ordering cost \(\hbox {C}_{3}\), the deterioration cost DC, the holding cost during the cycle period (0,T) are the same as in case I. So now interest earned per cycle is

The total variable cost, \(\hbox {TCV}_{2}\) is defined as

The total variable cost per unit time \(\hbox {TCU}_{2}\) (0, T) is

Now

Optimal Slution

For optimal solution we differentiate Eqs. (10) and (13) with respect to T.

The necessary condition for finding optimal (minimum) solution of total inventory cost is

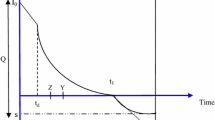

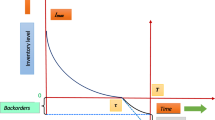

It is difficult to find second order derivative for sufficient condition of optimality. We can show it by the graph. The graph of two cases (I & II) is given below:

Case-I (M \({\varvec{<}}\) T)

Case-II (M \({\varvec{>}}\) T)

Above Figs. 1 and 2 for case-I and II are convex, which proves that the optimal total cost with respect to time is minimum. That is, second derivative of \(\frac{d^{2}TCU_1 }{dT^{2}}\;and\;\frac{d^{2}TCU_2 }{dT^{2}}\) are positive.

Numerical Examples

In this paper we discussed the ordering polices in deferent conditions for which we define two cases Case (I) (M < T) (Payment before depletion) and Case (II) (M > T) (Payment after depletion).

Numerical Example-1 on Case-I (M < T)

Let’s take the parameter values \(D=10,000, \alpha = 0.5, \beta = 1.5, M = 0.1, {C}_{0}= 0.5, i_{e} = 0.01, i_{p}= 0.30, K = 0.3, H = 5, h = 10.00, C_{3}= 5.0, C_{2} = 0.8\), in their appropriate units. Substituting these parameter values in the first equation of (18) we get \(T=T_{1}^{*}{} \mathbf{= 0.122438}\,\mathbf{year,}\) the corresponding value of optimal order quantity \({{\varvec{Q}}}_{{{\varvec{1}}}}= {{\varvec{Q}}}_{{{\varvec{1}}}}^{*}\mathbf{= 1234.87}\,\mathbf{units}\,\mathbf{and }\,{{\varvec{TCU}}}_{{{\varvec{1}}}}=\mathbf{TCU}_{{{\varvec{1}}}}^{*} = \$\,\mathbf{51784.3}.\)

Numerical Example-2 on Case-II (M > T)

The following inventory parametric values are used for Case-II, \(D = 1000, \alpha = 0.8, \beta = 1.2, {{\varvec{M}}}{} \mathbf{= 0.7}, C_{0}= 0.5, i_{e}=0.16, i_{p} =0.30, K = 0.3, H = 4, h= 10.00, C_{3}= 5.0, C_{2}=0.8\), in their appropriate units. Substituting these parameter values in the second equation of (18) we get \({{\varvec{T}}}_{{{\varvec{2}}}}={{\varvec{T}}}_{{{\varvec{2}}}}^{*}=\mathbf{0.581251}\,\mathbf{year,}\) the corresponding value of optimal order quantity \({{\varvec{Q}}}_{{{\varvec{2}}}}={{\varvec{Q}}}_{{{\varvec{2}}}}^{*}=\mathbf{691.473}\, \mathbf{units}\) and \({{\varvec{TCU}}}_{{{\varvec{2}}}}={{\varvec{TCU}}}_{{{\varvec{2}}}}^{*}=\mathbf{7282.95.}\)

Sensitivity Analysis

Any business transactions uncertainty may occur. Sensitivity analysis may play important role for decision makers. In this section we study the variation of order quantity, total inventory cost with the variation of several key parameters.

-

(i)

Case-1

Variation of D keeping all parameters same as numerical example (1)

D | T | Q | \(TCU_{1}\) |

|---|---|---|---|

10100 | 0.122436 | 1247.2 | 52294.6 |

10200 | 0.122433 | 1259.52 | 52801.3 |

10300 | 0.122431 | 1271.84 | 53311.4 |

10400 | 0.122429 | 1284.17 | 53821.3 |

10500 | 0.122427 | 1296.50 | 54331.1 |

Variation of \(C_{0}\) (keeping all parameters same as numerical example (1)

\(C_{0}\) | T | Q | \(TCU_{1}\) |

|---|---|---|---|

0.55 | 0.122485 | 1235.37 | 51948.1 |

0.60 | 0.122524 | 1235.75 | 52083.9 |

0.65 | 0.122557 | 1236.09 | 52198.7 |

0.70 | 0.122585 | 1236.37 | 52296.0 |

0.75 | 0.122610 | 1236.63 | 52382.9 |

Variation of \(\alpha \) (keeping all parameters same as numerical example (1)

\(\alpha \) | T | Q | \(TCU_{1}\) |

|---|---|---|---|

0.505 | 0.120926 | 1219.53 | 41587.2 |

0.510 | 0.119487 | 1204.94 | 31175.7 |

0.515 | 0.118116 | 1191.04 | 20551.9 |

0.520 | 0.116807 | 1177.77 | 9711.48 |

0.525 | 0.115555 | 1165.08 | \(-\)1348.37 |

Variation of \(\beta \) (keeping all parameters same as numerical example (1)

\(\beta \) | T | Q | \(TCU_{1}\) |

|---|---|---|---|

1.0 | 0.708136 | 7865.33 | 168941 |

1.1 | 0.540321 | 5791.26 | 174199 |

1.2 | 0.398229 | 4157.82 | 188018 |

1.3 | 0.280667 | 2923.64 | 196089 |

1.4 | 0.184170 | 1877.62 | 166393 |

Variation of K (keeping all parameters same as numerical example (1)

K | T | Q | \(TCU_{1}\) |

|---|---|---|---|

0.4 | 0.133285 | 1345.82 | 115994 |

0.5 | 0.145984 | 1476.13 | 216504 |

0.6 | 0.159987 | 1620.35 | 368626 |

0.7 | 0.174611 | 1771.59 | 595503 |

0.8 | 0.189352 | 1924.72 | 933457 |

-

(ii)

Case-II

Variation of D keeping all parameters same as numerical example (2)

D | T | Q | \(TCU_{2}\) |

|---|---|---|---|

1100 | 0.581235 | 760.595 | 8042.54 |

1200 | 0.581222 | 760.575 | 8772.7 |

1300 | 0.58121 | 898.839 | 9502.95 |

1400 | 0.5812 | 967.961 | 10233.2 |

1500 | 0.581192 | 1037.98 | 10963.5 |

Variation of \(C_{0}\) (keeping all parameters same as numerical example (2)

\(C_{0}\) | T | Q | \(TCU_{2}\) |

|---|---|---|---|

0.35 | 0.581896 | 692.387 | 8502.18 |

0.40 | 0.582381 | 693.075 | 9692.15 |

0.45 | 0.582758 | 693.609 | 10882.1 |

0.50 | 0.583061 | 694.039 | 12072.0 |

0.55 | 0.583308 | 694.39 | 12074.4 |

Variation of \(\alpha \) (keeping all parameters same as numerical example (2)

\(\alpha \) | T | Q | \(TCU_{2}\) |

|---|---|---|---|

0.7 | 0.638117 | 756.545 | 7184.1 |

0.9 | 0.535673 | 639.282 | 7430.54 |

1.0 | 0.498185 | 596.323 | 7541.84 |

1.5 | 0.378252 | 458.565 | 8036.27 |

2.0 | 0.312089 | 382.238 | 8475.04 |

Variation of \(\beta \) (keeping all parameters same as numerical example (2)

\(\beta \) | T | Q | \(TCU_{2}\) |

|---|---|---|---|

1.3 | 0.591145 | 694.96 | 7343.59 |

1.4 | 0.60113 | 699.396 | 7371.26 |

1.5 | 0.611054 | 704.454 | 7395.72 |

1.6 | 0.620819 | 709.908 | 7417.40 |

1.7 | 0.630361 | 715.596 | 7436.66 |

Variation of K (keeping all parameters same as numerical example (2)

K | T | Q | \(TCU_{2}\) |

|---|---|---|---|

0.4 | 0.588615 | 659.454 | 9030.34 |

0.6 | 0.603498 | 679.277 | 14294.4 |

1.2 | 0.651265 | 744.348 | 70164.7 |

1.5 | 0.678551 | 782.543 | 168536.0 |

1.9 | 0.721293 | 843.932 | 569736.0 |

From the above table the following inferences can be made:

-

Increase in demand rate D results the values of cycle time T decreases, the value of order quantity Q increases but the total inventory cost TCU increases in both cases.

-

Increase purchase cost \(C_{0}\), results the values of cycle time T decreases, the value of Order quantity Q increases and total inventory cost TCU increases in both cases.

-

Increase of parameter \(\upalpha \), results the values of cycle time T decreases, the value of order quantity Q decreases and total inventory cost TCU decreases in cases-I.

-

Increase of parameter \(\upalpha \) results the values of cycle time T decreases, the value of order quantity Q decreases and total inventory cost TCU increases in cases-II.

-

Increase of parameter \(\upbeta \) results the values of cycle time T decreases, the value of order quantity Q decreases and total inventory cost TCU decreases both cases.

-

Increase in inflation rate K, results the values of cycle time T increases, the value of Order quantity Q increases and total inventory cost TCU increases in both cases.

Conclusion

Any type of business depends on future planning and future planning in uncertain. Probability is a measure of uncertainty. It is beneficial for both vendor and buyer. Deterioration plays an important role for fresh products like bread, green vegetable etc. In this paper we have discussed inventory models for Weibull distribution detracting items under constant demand rate by considering two different cases. Second order approximation has been used for closed form numerical results. From the managerial point of view the following results are obtained:

-

Total cost increases if the demand rate increases in both cases

-

Total cost increases if the purchase cost increases in both cases

-

Total cost decreases if the parameter \(\upbeta \) increases in both cases

-

Total cost increases if the inflation rate increases in both cases

The research work presented in this study generalized in different manners. We may generalize our research work by considering demand rate as stock level. We could also extend the model by adding advertisement cost and freight cost and others.

References

Abad, P.L.: Optimal lot size for a perishable good under conditions of finite production and partial backordering and lost sale. Comput. Ind. Eng. 38, 457–465 (2000)

Baker, R.C., Urban, L.T.: A deterministic inventory system with an inventory-level-dependent demand rate. J. Op. Res. Soc. 39, 823–831 (1988)

Chang, H.J., Dye, C.Y.: An EOQ model for deteriorating items with time-varying demand and partial backlogging. J. Op. Res. Soc. 50, 1176–1182 (1999)

Chung, K.J., Hung, C.H., Dye, C.Y.: An inventory model for deteriorating items with linear trend demand under the condition of permissible delay in payments. Prod. Plan. Control 12, 274–282 (2001)

Datta, T.K., Paul, K., Pal, A.K.: Demand promotion by up gradation under stock-dependent demand situation–a model. Int. J. Prod. Econ. 55, 31–38 (1998)

Ghiami, Y., Williams, T.: A two-echelon production-inventory model for deteriorating items with multiple buyers. Int. J. Prod. Econ. 159, 233–240 (2015)

Ghosh, S.K., Chaudhuri, K.S.: An order-level inventory model for a deteriorating item with Weibull distribution deterioration, time-quadratic demand and shortages. Int. J. Adv. Model. Optim. 6(1), 21–35 (2004)

Giri, B.C., Pal, S., Goswami, A., Chaudhari, K.S.: An inventory model for deteriorating items with stock-dependent demand rate. Euro. J. Op. Res. 95, 604–610 (1996)

Gupta, R., Vrat, P.: Inventory model with multi-items under constraints systems for stock dependent consumption rate. Op. res. 24, 41–42 (1986)

Hollier, R.H., Mak, K.L.: Inventory replenishment policies for deteriorating items in a declining market. Int. J. Prod. Res. 21, 813–826 (1983)

Hou, K.L.: An inventory model for deteriorating items with stock-dependent Consumption rate and shortages under inflation and time discounting. Eur. J. Oper. Res. 168(2), 463–474 (2006)

Khanra, S., Ghosh, S.K., Chaudhuri, K.S.: An EOQ model for a deteriorating item with time dependent quadratic demand under permissible delay in payment. Appl. Math. Comput. 218(1), 1–9 (2011)

Lee, S., Kim, D.: An optimal policy for a single-vendor single-buyer integrated production-distribution model with both deteriorating and defective items. Int. J. Prod. Econ. 147, 161–170 (2014)

Mandal, B.N., Phaujdar, S.: An inventory model for deteriorating items and stock dependent consumption rate. J. Op. Res. Soc. 40, 483–488 (1989)

Padmanabhan, G., Vrat, P.: EOQ models for perishable items under stock dependent selling rate. Euro. J. Op. Res. Soc. 86, 281–292 (1995)

Pal, S., Goswami, A., Chaudhari, K.S.: A deterministic inventory model for deteriorating items with stock-dependent demand rate. Int. J. Prod. Econ. 32, 291–299 (1993)

Papachristos, S., Skouri, S.: An optimal replenishment policy for deteriorating items with time-varying demand and partial–exponential type–backlogging. Oper. Res. Lett. 24(4), 175–184 (2000)

Papachristos, S., Skouri, K.: An inventory model with deteriorating items, quantity discount, pricing and time-dependent partial backlogging. Int. J. Prod. Econ. 83, 247–256 (2003)

Park, K.S.: Inventory models with partial backorders. Int. J. Syst. Sci. 13, 1313–1317 (1982)

Rau, H.L., Wu, M.Y., Wee, H.M.: Deteriorating item inventory model with shortage due to supplier in an integrated supply chain. Int. J. Syst. Sci. 35(5), 293–303 (2004)

Ray, J., Chaudhuri, K.S.: An EOQ model with stock-dependent demand shortage, inflation and time discounting. Int. J. Prod. Econ. 53, 171–180 (1997)

Ray, J., Goswami, A., Chaudhuri, K.S.: On an inventory model with two levels of storage and stock-dependent demand rate. Int. J. Syst. Sci. 29, 249–254 (1998)

RoyChowdhury, R., Ghosh, S.K., Chaudhuri, K.S.: The effect of imperfect production in an economic production lot size model. Int. J. Manag. Sci. Eng. Manag. 10(4), 288–296 (2014). doi:10.1080/17509653.2013.867097

Sarkar, T., Ghosh, S.K., Chaudhuri, K.S.: An economic production quantity model for items with time proportional deterioration under permissible delay in payments. Int. J. Math. Op. Res. 5(3), 301–316.5 (2013)

Sicilia, J., Rosa, M.G.: De-la, Acosta, J.F., Pablo, L.D.: An inventory model for deteriorating items with shortages and time-varying demand. Int. J. Prod. Econ. 155, 155–162 (2014)

Taleizadeh, A.A., Daryan, M.N., Barron, L.E.C.: Joint optimization of price, replenishment frequency, replenishment cycle and production rate in vendor managed inventory system with deteriorating items. Int. J. Prod. Econ. 159, 285–299 (2015)

Taleizadeh, A.A., Nematollahi, M.: An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl. Math. Model. 38, 93–109 (2014)

Taleizadeh, A.A., Pentico, D.W., Jabalameli, M.S., Aryanezhad, M.: An EOQ problem under partial delayed payment and partial backordering. Omega 4(2), 354–368 (2013a)

Taleizadeh, A.A., Pentico, D.W., Jabalameli, M.S., Aryanezhad, M.: An economic order quantity model with multiple partial prepayments and partial backordering. Math. Comput. Model. 57(3–4), 311–323 (2013b)

Taleizadeh, A.A., Wee, H.M., Jolai, F.: Revisiting fuzzy rough economic order quantity model for deteriorating items considering quantity discount and prepayment. Math. Comput. Model. 57(5–6), 1466–1479 (2013c)

Taleizadeh, A.A.: An economic order quantity model with consecutive payments for deteriorating items. Appl. Math. Model. 38, 5357–5366 (2014)

Taleizadeh, A.A.: An economic order quantity model with partial backordering and advance payments for an evaporating item. Int. J. Prod. Econ. 155, 185–193 (2014)

Tal, R., Taleizadeh, A.A., Esmaeili, M.: Developing EOQ model with non-instantaneous deteriorating items in vendor-managed inventory (VMI) system. Int. J. Syst. Sci. 46(7), 1257–1268 (2015)

Tyan Lo, S., Wee, H.M., Huang, W.C.: An integrated production-inventory model with imperfect production processes and Weibull distribution deterioration under inflation. Int. J. Prod. Econ. 106(1), 248–260 (2007)

Wang, W.C., Teng, J.T., Lou, K.R.: Seller’s optimal credit period and cycle time in a supply chain for deteriorating items with maximum lifetime. Euro. J. Op. Res. 232, 315–321 (2014)

Wee, H.M.: A deterministic lot-size inventory model for deteriorating items with shortages and a declining market. Comput. Op. Res. 22, 345–356 (1995)

Wee, H.M., Lee, M.C., Yu, J.C.P., Wang, C.E.: Optimal replenishment policy for a deteriorating green product: life cycle costing analysis. Int. J. Prod. Econ. 133, 603–611 (2011)

Wu, J., Ouyang, L.Y., Barron, L.E.C., Goyal, S.K.: Optimal credit period and lot size for deteriorating items with expiration dates under two-level trade credit financing. Euro. J. Op. Res. 237, 898–908 (2014)

Yang, H.L.: Two-warehouse inventory models for deteriorating items with shortages under inflation. Eur. J. Oper. Res. 157(2), 344–356 (2004)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tripathi, R.P., Chaudhary, S.K. Inflationary Induced EOQ Model for Weibull Distribution Deterioration and Trade Credits. Int. J. Appl. Comput. Math 3, 3341–3353 (2017). https://doi.org/10.1007/s40819-016-0298-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40819-016-0298-9