Abstract

This paper investigates empirically whether inward greenfield foreign direct investment (FDI) is related to greater sectoral innovative activity in the host narrow territorial units (provinces). We combine several sources of data on Italy to estimate panel count models, regressing the annual number of patents in each province and industry against a series of lagged FDI variables. Our results show that a positive relationship between FDI and local patenting emerges only for services. In particular, we find that larger inward FDI in services positively influences local patenting activity in knowledge-intensive business services. These results are robust to endogeneity and the inclusion of province controls and fixed effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The views expressed in this paper are those of the authors and do not necessarily reflect those of their home institutes. We would like to thank for their helpful comments and useful suggestions: Davide Castellani, Maria Luisa Mancusi Lucia Piscitello, two anonymous referees and the participants at the conferences of Bank of Italy, University of Bari and Bocconi University. We are very grateful to Francesca Lotti and Giovanni Marin for providing us with firm-level data on patent applications. The usual disclaimer apply.

The effect of inward foreign direct investment (FDI) on host countries has been the subject of a longstanding empirical investigation in the economics literature. The theory suggests two main effects of the entry of foreign firms on the host economy. First, FDI are considered an important channel of technology transfer because multinational enterprises (MNEs) are more productive, more innovative and invest more in research and development (R&D) than domestic enterprises. The entry of MNEs is supposed to benefit incumbent firms thanks to knowledge transmission fostered by vertical or horizontal linkages or knowledge spillovers (Blomström and Kokko 1998). However, technology transfer cannot be taken for granted. Rather, it will depend on the capacity of the incumbent firms to assimilate and apply new technologies and, more generally, on the economic environment to allow knowledge transmission among foreign and domestic firms.

The economic theory suggests also that inward FDI might have a pro-competitive effect on the host economy. The entry of foreign firms boosts competition in the local market, pushing incumbent firms to search for productivity improvements, and promoting the reallocation of resources toward more productive units (Kiriyama 2012; Keller 2009). However, if the resources released from domestic firms pushed out of the market are not quickly re-employed in more efficient firms, in the short term FDI might also have negative effects.

In many countries, in order to take advantage of the supposed gains from hosting MNEs, governments offer tax relief, financial assistance and other types of benefits to attract foreign firms. Since these policies imply large costs for public finance, they are justified only if the positive externalities on the host economy stemming from FDI are substantial. However, empirically, the effect of FDI on host economies remains an open question.

While the impact of inward FDI on productivity has been investigated extensively in the empirical literature, including at regional level (see e.g. Castellani and Pieri 2011; Greenstone et al. 2010; Haskel et al. 2007; Peri and Urban 2006), the effect on domestic innovation capabilities has received much less attention and, to our knowledge, there are no investigations of this effect at the local level.Footnote 2 The present paper fills this gap. We study the impact of inward greenfield FDI (IGFDI) on the inventive capability of narrow Italian territorial areas (the provinces-NUTS 3), measured by their patenting activity. Theoretically, host country innovativeness can be affected by the entry of foreign firms through the mechanisms described above, namely, technology transfers and pro-competitive effects.

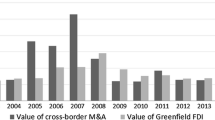

There are two modes of entry of a FDI in a region: cross-border mergers and acquisitions (M&A) and greenfield FDI. By M&A a foreign company takes over, or merges with, an existing domestic firm, whereas greenfield FDI is defined as a new entry or an expansion in the host country of a foreign firm or plant. Thus, unlike cross-border M&A which involve existing domestic assets, greenfield FDI are investment projects that entail the establishment of new assets and activities in the host country (e.g. see UNCTAD 2009; chapter III). Since greenfield FDI have an additional effect on the host-economy, it is more likely that they cause pro-competitive effects and technological spillovers within the host-country than cross-border M&A. For instance, by opening new productive plants (or research centres) in the domestic countries, or by expanding existing ones, a foreign enterprise will compete more strongly with domestic firms and might give a boost to their productivity improvements. For these reasons, we focus only on IGFDI because in our view they are more able to trigger these effects than cross-border M&A (here not considered). At the same time, our data take account of the size of the FDI in terms of capital flows or employment created, which is useful for empirical analysis to evaluate the impact of FDI based on the intensity of investment flows.Footnote 3 As regards innovative capability, we use a hard measure of innovation given by the number of patent applications from incumbent firms to the European Patent Office (EPO).

To study the impact of FDI at the local level over the Italian territory is important for several reasons. First, technological transfer might have a local dimension. Knowledge transmission can be fostered by geographical proximity between MNEs and domestic firms (Jaffe et al. 1993) based, for example, on informal contacts, collaboration among firms, workers’ mobility, and supply and demand linkages. All these channels are likely to be more effective among firms in the same location. Furthermore, it is likely also that pro-competitive effects on incumbent firms will be stronger if the foreign firms compete in the same local domestic market. Notice that, unlike most previous papers that examine the effects of FDI (on domestic productivity) from a regional perspective, we use a narrower geographic unit, the provinces, which correspond to the NUTS-3 Eurostat classification, more suitable to capture agglomeration economies and local spillovers.

Second, innovation is considered a key driver of economic growth, but Italy lags behind most advanced countries in terms of innovation performance (European Commission 2013). In addition, among the main European Union countries, Italy is the most affected by geographical economic disparities. Therefore, understanding whether the entry of foreign enterprises improves innovation production in domestic firms is particularly important to achieve a better appreciation of these regional disparities and, potentially, for its policy implications.

Using panel count data models and controlling for province, industry-specific fixed effects, and endogeneity with instrumental variable (IV) estimates, we find that IGFDI in service sector increases the numbers of local patents related to service activities, namely those produced by knowledge intensive business service (KIBS) firms. This result holds if IGFDI is measured through a simple dummy variable and also if we account for the intensity of IGFDI in terms of jobs created or capital investments. However, we do not find a significant relationship between innovation and IGFDI in the manufacturing activities.

The remainder of the paper is organized as follows. Section 2 presents an overview of the related literature; Sect. 3 describes the empirical model, the econometric strategy and the data employed. Section 4 discusses our baseline empirical results and Sect. 5 presents some robustness checks. Section 6 draws the main conclusions of our investigation.

2 Background literature

Our paper bridges the gap between two streams of literature (Table 1 summarizes the most recent papers). There is a strand of work on whether inward FDI boosts the productivity of the incumbent firms in the same territorial area.Footnote 4 These papers are grounded on theories of agglomeration economies, which argue that positive knowledge spillovers from FDI are more likely if the domestic and foreign firms are located in the same area since geographical proximity encourages the diffusion of ideas and technology, owing to personal contacts and/or transfer of workers across firms (Greenstone et al. 2010). In these papers the main empirical issue is related to the potential reverse causation between FDI and productivity: MNEs might invest more in the most productive regions because they are likely to provide the highest profits. In these circumstances, spurious correlations between inward FDI and host-region productivity could arise.

The paper by Peri and Urban (2006) analyses the impact of inward FDI on domestic firms’ productivity in Italian and German regions. They show that the average level of productivity among the foreign-owned firms affects the productivity of incumbents located in the same region. In their view, what matters is the productivity gap between foreign and domestic firms, and their results demonstrate the scope for productive catch-up by domestic firms. They tackle the issue of endogeneity using lagged explanatory variables as instruments, according to standard dynamic panel estimation methods.

Haskel et al. (2007) test the impact of inward FDI (measured as share of foreign-owned plant employment in total employment by sector or region) on the productivity growth of domestic firms in the UK regions. They find that FDI spurs the productivity of incumbent firms in the same industry as the investment, but do not find a significant correlation between FDI and productivity growth among firms in the same region as the investment. They address the endogeneity issue using lagged measures for FDI, or the FDI directed to the US.Footnote 5 In a more recent study, Greenstone et al. (2010) analyse the impact of large foreign plant entry in US counties on the productivity of incumbent firms. They show that positive spillovers due to agglomeration economies occur among firms that share the same workers or the same technology. However, their findings do not support the hypothesis that input–output linkages encourage productivity spillovers. Greenstone and colleagues estimate the model for recipient counties that host foreign plants and those that did not receive the foreign plants because were barely dismissed as hosting county by the foreign enterprise. Since the latter are very similar to the former in terms of observable and, probably, unobservable variables, it is assumed that the estimates are not affected by endogeneity bias.Footnote 6

The second strand of works investigates the impact of inward FDI on incumbent firms’ innovation capabilities. Most of these papers focus on the mechanism of increased competition due to the entry of MNEs into the domestic market. Stronger competition can encourage incumbent firms to improve their competitiveness by increased innovation, and spur the reallocation of resources toward more competitive and more innovative firms. In the case of German firms Bertschek (1995) and Blind and Jungmittag (2004) show that inward FDI has a positive impact on product and process innovations in manufacturing and service firms, respectively. Aghion et al. (2009) find a positive effect of MNE entry on the number of UK domestic firms’ patents in technologically advanced, but not traditional sectors. Aghion and colleagues apply an instrumental variables approach using a series of policy reforms to instrument the entry of foreign firms. The results provided in Brambilla et al. (2009) mostly support their findings. They find that the probability of domestic Chinese firms introducing a product innovation increases with the presence of foreign firms in the same industry; moreover, since this overall effect is driven by less sophisticated firms (i.e. non-exporters, small employers, and small investors in R&D) they conclude that FDI mainly encourages imitation. Finally, Vahter (2011) examines the effect of FDI on innovation among domestic manufacturing firms in Estonia and finds that an increase in the share of FDI in one sector increases the probability that domestic firms in the same sector will introduce product or process innovations. Like Haskel et al. (2007), Vahter instruments inward FDI with FDI in the same industries in other Central and Eastern European economies.

Although several studies investigate the effect of foreign investment on the innovation propensity of domestic firms, ours is the only paper that studies this effect at the local level. These effects are interesting for a number of reasons. First, theoretical work on agglomeration economies highlights how geographic proximity can encourage the transmission of ideas owing, for example, to informal contacts or transfer of workers across firms. These informational spillovers are best captured by studying domestic and foreign firms that share a local market. In the present paper, our territorial unit is the province (corresponding to the NUTS 3 level of European classification of territorial units), a smaller geographic unit than those generally utilized in the empirical literature (i.e. NUTS 2 regions). In our view, a province level study is better suited for capturing local spillovers. Second, the entry of a foreign firm can trigger pro-competitive effects on incumbent firms which are better studied using a narrow local lens, since the local market in the area targeted by FDI is likely to be the most affected by the entry of foreign enterprises. Finally, to the extent that the (hopefully positive) effects of entry of foreign firms are local in scope, inward FDI could be important for understanding the innovation gap affecting many Italian regions and could also constitute a potential regional policy channel to reduce territorial disparities.

3 Empirical model and data

3.1 Empirical model

The empirical model corresponds to an equation that can be considered an extension of the knowledge production function (Griliches 1979), where provincial innovation is regressed on a series of innovation inputs including FDI. The model has the following implicit form:

where Y SPT is a measure of the innovation performance of industry S located in province P at time T; FDI is the IGFDI in province P at time T − 1,Footnote 7 and X is a vector of the additional time-lagged covariates.

Our measure of innovation is the number of patent applications submitted to the EPO. There are advantages and disadvantages to measuring innovation by patents. On the one hand, it is well known that not all innovations are patented and there are informal mechanisms, such as secrecy or lead time advantages, that firms may use to appropriate returns from their inventions. Also, the propensity to patent might differ across sectors and time. On the other hand, the patent is a hard measure of innovation. Compared to proxies based on survey data, such as number of new products and processes introduced by the firms, patent applications suggest a higher quality of the innovation, because firms know that for being granted a patent requires accurate examination of the invention by experts who judge its novelty. Moreover, they are less prone to, even though not completely free from, personal or subjective considerations.Footnote 8 In conclusion, we believe patent propensity to be a sound and powerful measure of innovation output suitable to evaluate the impact of FDI on host-country innovation capability, which has been also extensively used by the empirical literature on FDI and innovation (see e.g. Aghion et al. 2009).

Our empirical analysis uses several greenfield FDI variables. The first is a dummy (DFDI) that equals 1 when at least one FDI project is registered in a province P and year T − 1, and 0 otherwise. The second is a continuous variable measuring the number of jobs created by foreign project investments in province P and year T − 1 (JOBS_FDI). The third is a continuous variable measuring total capital investment in the province P and the year T − 1 (KINV_FDI p,t−1 ). This provides information on the localization of FDI and also its intensity. We split these last two variables according to the industry of the FDI investment: we distinguish between jobs created by FDI in the manufacturing industry of province P (JOB_FDI_MAN) and jobs created by FDI in the service industry of province P (JOB_FDI_SER). In addition, we distinguish between capital investment in manufacturing (KINV_FDI_MAN) and capital investment in services in province P (KINV_FDI_SER).Footnote 9

In addition to FDI, we include a large set of controls in our estimation of Eq. 1. We include some determinants of innovation inputs such as the T − 1 expenditure on R&D in province P and industry S (R&D) and (log) level of employment in province P, and sector S (EMPL) at time T − 1. The latter variable is used as scaling factor to capture the existence of scale economies in the knowledge production function. Following the literature on the spatial determinants of innovation (Beaudry and Schiffauerova 2009; Carlino et al. 2007; Feldman and Audretsch 1999; Knudsen et al. 2008 for reviews) we include variables capturing urbanization and specialization economies. The former are proxied by the provincial population density (DEN) and a dummy that is equal to 1 for provinces that include large metropolitan areas or large urban zones (LUZ). The latter are measured by an index of provincial manufacturing specialization (SPEC_MAN), given by the (log) share of manufacturing value-added in province P over total provincial value-added. Finally, we include a set of NUTS-1 regional dummies, industry dummies [low tech (LT), medium–low tech (MLT), medium–high tech (MHT), high-tech (HT) and KIBS according to the OECD classification—see Appendix 1], and year dummies to capture region-specific, industry-specific and macroeconomic fixed effects.

3.1.1 The econometric strategy

Since we measure local innovation performance as \( y_{spT} \), that is the number of patent applications from firms in sector S and province P in year T, we estimate a panel data count model. Following Baltagi (2005), the Poisson panel regression model is specified as follows:

where \( y_{spT} \) (s = 1, 2,…, N; p = 1, 2,…, 103, T = 2003,…, 2008) denotes the number of occurrences of the event and \( \lambda \) is the mean and the variance of the distribution. Since we assume that y is the number of patent applications, parameter \( \lambda \) will depend on a set of covariates that affect innovation propensity at the provincial industry level. We specify \( \lambda \) as a log-linear model such as \( \ln \, \lambda_{\text{spT}} = \mu_{sp} + x_{spT}^{'} \beta \), where \( \mu_{sp} \) denotes unobservable individual specific effects.

The Poisson specification assumes equality between the mean and variance of the distribution, or the equidispersion property. If this hypothesis is rejected—the case generally defined as “overdispersion”—the Poisson specification is not appropriate and a negative binomial model specification is preferred. The panel data version was developed by Hausman et al. (1984). The negative binomial distribution has mean \( \lambda \) and variance \( \lambda + \alpha \lambda^{2 - k} \). If \( \alpha = 0 \), a Poisson specification can be estimated. Therefore, we estimate a random-effect negative binomial model if \( \alpha \) is significantly different from 0.Footnote 10

3.2 Dataset and variables

The data for the empirical analysis come from several sources. The first source is Lotti and Marin (2013) who matched Italian patent applicants and Italian firms included in the AIDA database collected by Bureau van Dijk. Original patent data come from the EPO Worldwide Patent Statistical database (PATSTAT) constructed by the EPO on behalf of the OECD Taskforce on Patent Statistics. This database provides information on the patent applications of over 80 countries, including title and abstract, priority, patent family and PCT links, citation links and technology class of the patent. Our data come from the April 2011 release for all patent applications to the EPO in the years 2002–2008. Specifically, we extracted the number of firms’ patent applications from Lotti and Marin (2013) that provide numbers of patent applications filed between 1977 and 2011 by Italian firms registered in the AIDA dataset sourced by Bureau van Dijk. They apply a very accurate matching procedure to PATSTAT and AIDA datasets, enabling matching of more than 80 % of the patent applications submitted by Italian companies to the EPO, during the observation period.Footnote 11

We assign our patents to specific sectors and provinces (NUTS-3 regions) according to the firm sector and headquarters’ location available from AIDA. We use the patent application date as the patent reference year. For robustness purposes we also estimated the model using the patent priority date obtaining very similar results (they are not shown but available under request). In order to reduce as many zero observations as possible, we aggregate our two-digit industries according to the OECD classification of sectors, i.e. into LT, MLT, MHT and HT (see Appendix 1, Table 12 for details). In addition, we consider KIBS, which correspond to computer and related activities, R&D, and other business services including engineering, architectural, legal and management consulting activities (Miles et al. 1995). Our final variable is the annual number of patent (PAT) applications from firms located in each of the 103 Italian provinces, belonging to the four OECD sectors and the KIBS industry.

Data on R&D are extracted from the OECD Analytical Business Enterprise Research and Development database (ANBERD), which provides annual information on business R&D expenditure broken down into 60 manufacturing and service sectors. We consider data for Italy and for the time period 2002–2008. ANBERD data are at the two-digit industry level. In order to make them compatible with our patent data, we converted them to province (NUTS 3 region) and OECD sector levels (see Appendix 2). The final R&D variable (R&D) is log-transformed.Footnote 12

Data on FDI come from the fDi Markets database, which tracks cross-border greenfield investments for all sectors and all countries worldwide. Greenfield FDI are defined as entry or expansion in the host country of a foreign firm or a plant belonging to a foreign enterprise, which does not take account of inward FDI from mergers between domestic and foreign firms, or acquisition of domestic firms from foreign enterprises.

The data extracted on Italian IGFDI include detailed information on type and motivation of investment projects, business function, project localization, cluster, sector, capital investment and job creation,Footnote 13 on a yearly basis over the period 2003–2008 (for more details see http://www.fdimarkets.com). The FDI variable is aggregated at the NUTS 3 regional level, for each year T. Table 2 presents some descriptive statistics for our PAT, R&D and FDI variables.

Table 3 reports the distribution of IGFDI projects by year, function (i.e. by type of activity located in Italy according to the fDi Markets classification) and top five FDI destination cities.

For the remaining independent variables, information on province-level population density, province-industry employment are based on census data provided by the Italian Statistical Institute (ISTAT). Annual employment and value added are from the ASIA database (i.e. Archivio Statistico delle Imprese Attive).

Finally, to identify large metropolitan regions, we use the concept of LUZ. Classification of Italian cities into larger urban zones is based on Eurostat-Urban Audit III data. LUZ are approximated to the functional urban region extending beyond the city core. In Italy, the 32 selected LUZ refer to the national capital (Rome), the regional capitals, and large (min. 250,000 inhabitants) and medium-sized (50,000–250,000 inhabitants) local labour systems.

Table 4 summarizes all the variables utilized in the econometric analysis, while Table 5 shows the correlation matrix.

4 Results

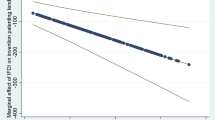

Tables 6, 7 and 8 present the results of our baseline random effects panel negative binomial model,Footnote 14 while a series robustness checks are presented in Tables 9, 10 and 11. In order to make the size of the effects comparable across the variables, in the tables are reported the marginal effects.

Table 6, Column 1, shows that for the whole economy the number of patents is positively related to lagged province and sectoral level R&D intensity, province-industry employment, local population density, the LUZ status and manufacturing specialization of the province, but not to the IGFDI dummy. In Columns 2 and 3 the sample is split according to the patenting sector i.e. manufacturing and KIBS. In Column 2, the coefficient of DFDI remains not statistically significant, while in Column 3 it is significant at 5 % level. Patenting in manufacturing is related more to past R&D and agglomeration forces, whereas patenting in KIBS is related to the size of the NUTS 3 region and to the arrival of foreign capital.Footnote 15

Table 7 excludes the FDI dummy and includes IGFDI intensity measured in terms of (actual or predicted) jobs created.

The results in Column 1 show that patents are not related to the intensity of IGFDI, while Columns 2 and 3 show that a positive relationship emerges only for the case of patents in the KIBS industry. In particular, a unit increase in JOBS_FDI is related to a 5 % increase in KIBS patenting. Columns 4 and 5 show that only job creation related to FDI in services is significantly related to patenting in the KIBS sector. Thus, the positive link between FDI and innovation occurs only within services.

The results are similar when looking at the financial intensity of FDI. According to our estimates in Table 8, the larger the amount of service IGFDI, the higher is the related number of patents in the province’s KIBS industry. The results of our estimations confirm that patenting in manufacturing remains related to urbanization economies, while patenting in KIBS is related more to external knowledge transfer through IGFDI.Footnote 16

This result can be explained in part by the distribution of IGFDI in Italy. fDi Markets data show that almost 80 % of investment projects registered in 2003–2009 are in service activitiesFootnote 17 and only 15 % are in manufacturing. The main activities in the former group are retail, sales and marketing, customer care, logistics, and design and R&D. Therefore, we would argue that the positive relationship between IGFDI and regional patenting capability is probably driven by foreign MNEs’ demand for customized knowledge intensive services (i.e. software development, new business solutions, design, forecasting).

5 Robustness checks

The estimates in the previous section provide evidence of a positive relationship between inward FDI and the patenting activity in advanced business service firms. In this section, we test for the robustness of our findings in different ways.

First, we estimate the baseline equations using different econometric approaches. Table 9 shows the results for the main specification estimated through a ‘fixed effects’ panel Poisson model which controls for province-industry fixed-effects and time fixed-effects.

The estimates suggest that our previous results on the impact of FDI are robust to the inclusion of province-industry fixed effects.Footnote 18 Only IGFDI in services are positively related to higher patenting in KIBS, with a marginal effect between 0.05 and 0.06.

Second, we normalize our dependent variable, subtracting from the number of patent applications in province P, sector S, year T, the national mean (or the national median) by sector and year. Using this ‘new’ dependent variable, we can estimate linear panel models. The results of these estimates (not reported here for reasons of space, but available upon request) confirm the existence of a positive relationship between inward FDI and the patenting activity KIBS firms in the host region.Footnote 19

Third, we try to control for spatial effects in the FDI-patenting (in KIBS) relationship by including in the baseline specifications of Table 7 a new set of variables: (1) 20 NUTS-2 region dummies instead of the four NUTS-1 dummies in order to control for finer spatial effects; (2) a new LUZ variable—LUZ2—constructed excluding the provinces of Rome and Milan; (3) a dummy variable for regional border effect which takes the value 1 if two provinces belonging to different NUTS 2 regions share common border, and 0 otherwise.

In order to capture unobserved heterogeneity related to the characteristics of the local/territorial system, we also include in our specifications: (a) a variable for the level of labour productivity in manufacturing (PROD_IND) in province P; and (b) two variables capturing, respectively, the average level of social capital (SOCIAL_CAPITAL) (see e.g. Albanese and de Blasio 2014) and capital market/financial development (CAPITAL_MKT) in the province.

Table 10 reports the results of these estimates. Again, we find no significant change with respect to the previous specifications.

Finally, we test for the potential endogeneity of FDI. Provinces with higher levels of innovative activity may attract more foreign investments, thus generating a problem of reverse causality.Footnote 20 To address this issue, we adopt an instrumental variable approach using measures of criminal activity as instruments. As suggested by recent studies (see, e.g. Al-Sadig 2009; Daniele and Marani 2010) there is a clear negative relationship between criminality and inward FDI since these activities tend to discourage foreign investment at the local level by increasing the risks and costs of doing business. Danakol et al. (2013), p. 13 also underline that ‘the argument for corruption rests in the view that domestic players are better acclimatized to the institutional arrangements of the host economy than outsiders, and that perhaps the most significant indicator of institutional quality and the business environment from the perspective of foreign investors is the extent of local corruption’. This argument is supported by the US Department of State (2012) which suggests that “political violence is not a threat to foreign investments in Italy, but corruption, especially associated with organized crime can be a major hindrance, particularly in the South”.

At the same time we believe that criminality, even though not totally uncorrelated with innovation, can affect innovative activity not directly but mainly indirectly, by hampering economic activity. Therefore, if we control for the main factors affecting the economic activity included in the model, such as geographical and sectoral fixed effects, together with the other control variables that measure the level of economic activity of the province (e.g. R&D expenditure and employment), we can eventually consider criminality as an exogenous variable with respect to the innovation performance.

We test different measures of criminality, including some indicators of the presence of criminal organizations such as Mafia and Camorra. According to our analysis, the best instrument is a variable MAFIA which measures the population share of those municipalities where city councils were dissolved because of infiltration of Mafia over the total population of the province in which the municipality is located. This indicator is correlated with inward FDI, but not patents. Table 11 reports estimates of an exponential mean model in which the lagged FDI province variables are instrumented by the lagged measure of MAFIA in the province. In the first stage regression, the estimated coefficient of the instrument is negative and statistically significant. This supports the theoretical validity of our instrumentation strategy. However, the first-stage R2 and the related F statistics (which ranges between 3.11 and 10.96) reveal that the selected instrument may be to some extent weak.

Table 11 shows that sign and statistical significance of the coefficients of the instrumented inward FDI variables are consistent with previous estimates, confirming the robustness of our main results. However, this exercise should be considered just as a first attempt to mitigate the problem of endogeneity of our main explanatory variable, in absence of more exogenous instruments or the possibility to apply counter-factual analysis based on randomization.

6 Conclusions

This paper provides an empirical investigation of whether IGFDI are related to higher sectoral innovation activity in the host province. Combining different data sources, we estimated panel count models, where the yearly number of patents in province P and (OECD) sector S is regressed against a series of lagged FDI variables measuring both the presence and intensity of FDI.

Our results show a positive relationship between FDI and local patenting capability only for the service industry. In particular, we find that larger inward FDI in service activities positively influences local patenting activity in KIBS, whereas we do not find a significant relationship between innovation and IGFDI in the manufacturing activities. The results are robust to the inclusion of spatial controls, fixed effects and, to some extent, to endogeneity.

The scenario that emerges seems to be one of foreign multinationals locating new and large investment projects in service-related activities (such as stores, retail or showroom offices, and business-related activities), which stimulates innovative activity in advanced business-service industries (such as computer-related firms, software industries, legal and management consulting industries and engineering services), likely related to the provision of new and customized knowledge-intensive services.

These results have two policy implications. First, we provide robust evidence that attracting FDI helps to promote local innovation capability. The introduction of new activities from abroad seems to generate the creation of new ideas in the territory, which suggests that policy targeted at promoting FDI inflows could actually improve the competitiveness of local territories. Second, we found that the FDI-innovation relationship is not universal, but depends on the sectors receiving the FDI. In the case of Italy, foreign investments are mainly concentrated in services, and these activities seem to stimulate patenting activity of knowledge-intensive firms. Policies aimed at attracting services FDI can be expected to promote innovation in related, knowledge-intensive industries. However, we found no evidence that patenting in manufacturing is affected by the presence of foreign multinationals. Moreover, innovation in manufacturing seems to depend on urbanization economies, confirming the findings of previous studies (e.g. Carlino et al. 2007). Therefore, innovation policies should not be the same for all sectors of the economy, rather they should be tailored depending on the type of targeted activity.

Our analysis has also some limitations. First, although panel data and the use of external instruments reduce the problem of endogeneity, more work should be done in order to fully control for the endogeneity issue, e.g. by using more exogenous instruments or other identification strategies, such as counterfactual analysis. Second, in this paper we do not explicitly address spatial correlation between local patenting and FDI location. Future research could assess the potential spatial decay of knowledge spillovers using spatial statistics and suitable econometric techniques. Despite these limitations, we believe our study provides a useful set of empirical and policy insights, and constitutes an interesting first attempt to study the economic impact of FDI location at the sub-national level.

Notes

Aghion et al. (2009) use a similar measure of FDI, namely the employment related to the annual greenfield foreign firm entry. With respect to Aghion et al. (2009) our measure includes also the expansions of existing foreign firms or plants, not only the entry of new foreign firms. In our view this is not a limitation of our data since also an expansion of existing foreign firms might cause pro-competitive effects on incumbent enterprises as well as technological spillovers.

This is a branch of a wider and older literature on the impact of inward FDI on host firm productivity or economic growth that includes among others: Aitken and Harrison (1999), Haddad and Harrison (1993), who found a negative effect of FDI on domestic productivity Bitzer and Görg (2009), Javorcik (2004), Keller and Yeaple (2009), who show a positive impact of FDI on host country productivity. Cipollina et al. (2012) find a positive effect on the growth of recipient sectors. See also Blomström and Kokko (1998) for a review.

Similarly, for Venezuela, Aitken and Harrison (1999) found no evidence of productivity spillovers from FDI on domestic firms located in the same region as the MNEs.

We use 1-year lagged explanatory variables to mitigate (potential) simultaneity bias between patenting and FDI at the local level.

E.g., the Community Innovation Survey (CIS), the main European survey of firm innovation, which is administered by Eurostat, considers firms to be innovative if they have produced a good that is new to the firm, but not necessarily to the market. Using patents as a measure ensures that we are capturing both firm level and market level innovation.

Since we observe many zero-values for FDI at province-sector level, we aggregate FDI for the whole manufacturing and service sectors (either jobs created or capital investment) at province level.

Note that we do not estimate a fixed-effects negative binomial model: as Guimaraes (2008) points out, this specification is able to control for ‘true’ fixed effects only under a very specific set of assumptions. However, in the robustness section we present the results of a Poisson model estimated with province-industry fixed effects.

For more details see Lotti and Marin (2013).

This computation of the R&D variable has some limitations. First, it does not reproduce the actual geographical distribution of R&D expenditure. Second, it assumes that the industry composition in each province mirrors the industry composition in the region. The present study uses this variable only as a control.

Since fDI Markets includes both actual and predicted investment projects, the number of jobs created each year may refer to the actual or the expected number of jobs. Data on FDI are updated annually by a team of experts and analysts matching media and press news, balance of payments statistics and company-level information.

The choice between a negative binomial (NB) and a zero-inflated negative binomial (ZINB) specification is made on the base of a Vuong test. The test statistics is standard normally distributed, with positive values favouring the ZINB model, and negative values favouring the NB model. In our case the value of the test statistics is −2.90 (and statistically significant), indicating that the NB specification is better suited for our data.

We also split the DFDI variable into two dummies—for manufacturing and services IGFDI. These two dummies are never statistically significant in the estimates. For reasons of space, we do not report these estimates here.

The magnitude of the effect is also very similar to that of jobs created by IGFDI: a one-unit increase in KINV_FDI in services is related to a 6 % increase in the number of patents in KIBS sectors.

It is useful to remember that KIBS represent only a small share of total service activities.

In this case, while using the Poisson specification, we impose the equidispersion property.

In other unreported estimates, we also extended the time lag of our IGFDI variables to 2 and 3 years, but they were never statistically significant.

We test this hypotheses by using a test of endogeneity which confirms the presence of this problem (see Table 11).

References

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effect of entry on incumbent innovation and productivity. Review of Economics and Statistics, 91(1), 20–32.

Aitken, B., & Harrison, A. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605–618.

Albanese, G., & de Blasio, G. (2014). Who trusts others more? A cross-european study. Empirica (forthcoming).

Al-Sadig, A. (2009). The effects of corruption on FDI inflows. Cato Journal, 29(2), 267–294.

Baltagi, B. H. (2005). Econometric analysis of panel data (4th ed.). Chichester: Wiley.

Beaudry, C., & Schiffauerova, A. (2009). Who’s right, Marshall or Jacobs? The localization versus urbanization debate. Research Policy, 38(2), 318–337.

Bertschek, I. (1995). Product and process innovation as a response to increasing imports and foreign direct investment. Journal of Industrial Economics, 43(4), 341–357.

Bitzer, J., & Görg, H. (2009). Foreign direct investment, competition and industry performance. The World Economy, 32(2), 221–233.

Blind, K., & Jungmittag, A. (2004). Foreign direct investment, imports and innovations in the service industry. Review of Industrial Organization, 25, 205–227.

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys, 12(3), 247–277.

Bode, E., & Nunnenkamp, P. (2011). Does foreign direct investment promote regional development in developed countries? A Markov chain approach for US states. Review of World Economics, 147, 351–383.

Brambilla, I., Hale, G., & Long, C. (2009). Foreign direct investment and the incentives to innovate and imitate. Scandinavian Journal of Economics, 111(4), 835–861.

Branstetter, L. (2006). Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. Journal of International Economics, 68(2), 325–344.

Carlino, G. A., Chatterjee, S., & Hunt, R. M. (2007). Urban density and the rate of invention. Journal of Economics, 61, 389–419.

Castellani, D., & Pieri, F. (2011). Foreign investment and productivity: evidence from European regions. Quaderni del Dipartimento di Economia, Finanza e Statistica, Quaderno No. 43, Università di Perugia, Perugia.

Cipollina, M., Giovannetti, G., Pietrovito, F., & Pozzolo, A. F. (2012). FDI and growth: what cross-country data say. The World Economy, 35(11), 1599–1629.

Danakol, S.H., Estrin, S., Reynolds, P., Weitzel, U. (2013). Foreign direct investment and domestic entrepreneurship: blessing or curse? IZA Discussion Paper No. 7796, IZA.

Daniele, V., & Marani, U. (2010). Organized crime and foreign direct investment: the Italian case. CESifo Working Paper No. 2416, Munich.

Driffield, N. (2004). Regional policy and spillovers from FDI in the UK. Annals of Regional Science, 38, 579–594.

European Commission (2013). Innovation union scoreboard. European Union.

Feldman, M. P., & Audretsch, D. B. (1999). Innovation in cities: science-based diversity, specialization and localized competition. European Economic Review, 43, 409–429.

Girma, S., & Wakelin, K. (2007). Local productivity spillovers from foreign direct investment in the UK electronics industry. Regional Science and Urban Economics, 37, 399–412.

Greenstone, M., Hornbeck, R., & Moretti, E. (2010). Identifying agglomeration spillovers: evidence from winners and losers from large plants openings. Journal of Political Economy, 118(3), 536–598.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell Journal of Economics, 10(1), 92–116.

Guimaraes, P. (2008). The fixed effects negative binomial model revisited. Economics Letters, 99, 63–66.

Haddad, M., & Harrison, A. (1993). Are there positive spillovers from direct foreign investment? Journal of Development Economics, 42, 51–74.

Haskel, J., Pereira, S., & Slaughter, M. (2007). Does inward foreign direct investment boost the productivity of domestic firms? Review of Economics and Statistics, 89(3), 482–496.

Hausman, J. A., Hall, B. H., & Griliches, Z. (1984). Econometric models for count data with an application to the patent-R&D relationship. Econometrica, 59, 731–753.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics, 108(3), 577–598.

Javorcik, B. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605–627.

Kiriyama, N. (2012). Trade and innovation. OECD Trade Policy Working Papers, No. 135.

Keller, W. (2009). International trade, foreign direct investment, and technology spillovers. NBER Working Paper No. 15442.

Keller, W., & Yeaple, S. (2009). Multinational enterprises, international trade, and productivity growth: firm level evidence from United States. Review of Economics and Statistics, 91(4), 821–831.

Knudsen, B., Florida, R., Stolarick, K., & Gates, G. (2008). Density and creativity in US regions. Annals of the Association of American Geographers, 98(2), 461–478.

Lotti, F., & Marin, G. (2013). Matching of PATSTAT applications to AIDA firms: discussion of the methodology and results. Bank of Italy, Occasional Papers, No. 166.

Miles, I., Kastrinos, N., Flanagan, K., Bilderbeek, R., den Hertog, P., Huntink, W., Bouman, M. (1995). Knowledge intensive business services: their roles as users, carriers and sources of innovation. Manchester: PREST Report to DG13 SPRINT-EIMS.

Peri, G., & Urban, D. (2006). Catching-up to foreign technology? Evidence on the Veblen–Gerschenkron effect of foreign investment. Regional Science and Urban Economics, 36, 72–98.

UNCTAD (2009). Training manual on statistics for FDI and the operations of TNCs. Volume 1, Geneva.

US Department of State (2012). Investment climate statement—Italy. Bureau of Economic and Business Affairs. http://www.state.gov/e/eb/rls/othr/ics/2012/191170.htm.

Vahter, P. (2011). Does FDI spur knowledge sourcing and innovation by incumbent firms? Evidence from manufacturing industry in Estonia. The World Economy 1308–1326.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

See Table 12.

Appendix 2. Constructing the yearly R&D variable at the province-sector level

Here, we describe the computation of the R&D variable used in the econometric estimates. Original industry R&D expenditure comes from the ANBERD database provided by the OECD and is available at the two-digit industry level of aggregation. In order to transform the data to the province-(OECD) industry level, we adopted the following strategy.

First, we used census data on regional firm demographics from the ASIA archive which provides yearly information on number of firms in each province and in each two-digit industry. Using the criteria in Appendix 1, we first pooled the two-digit industries into the four OECD sectors plus KIBS and then calculated a series of weights equal to the share of firms located in province P, OECD sector S and year T, in the total number of Italian firms in sector S and year T.

Following the same rule, we extracted R&D data (at the 2-digit level) from the ANBERD database and aggregated them at the level of the four OECD sectors plus KIBS, for each year. We then multiplied these yearly R&D data, initially available at NUTS 2 regional level, by the province-sector-year weight previously calculated. This provides us with a yearly R&D expenditure series for province P and (OECD) sector S across the period 2002–2009.

Finally, in order to test the representativeness of our new R&D data, we aggregated yearly province-sector values at the NUTS 2 region level, to obtain, year by year, regional industry R&D expenditure. These values were then compared with the values in the OECD STructural ANalysis (STAN) database of business enterprise R&D expenditure (in $ million PPP) in Italy. For each of the years across 2002–2009, we found an average 0.9 correlation between our NUTS 2 region-level R&D variable and the value provided by OECD-STAN. We can conclude that our province-level disaggregation is a good representation of regional industry R&D expenditure in Italy.

Rights and permissions

About this article

Cite this article

Antonietti, R., Bronzini, R. & Cainelli, G. Inward greenfield FDI and innovation. Econ Polit Ind 42, 93–116 (2015). https://doi.org/10.1007/s40812-014-0007-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-014-0007-9