Abstract

The research aimed to assess the influence of multiple dimensions of innovation on performance. The research is motivated from the possible impact of the internal organizational factors on the firm performance. We investigate the effect of dynamic capabilities such as product innovation, process innovation, and innovation culture on the firm performance. We collect a sample of 115 respondents and unique primary data from the executives of Indian firms. Established scales were used to design the survey instrument. A measurement model was developed in AMOS to conduct the confirmatory factor analysis and validate the scale again. A path model was developed to test the hypotheses. We find support for process innovation but not for product innovation and innovation culture. We extend the analysis further to understand whether the size of the firms has differences in the results. We find further support for innovation culture in large-size firms. We discuss the results in the Indian context to substantiate our hypotheses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The speed with which the competitive landscape has transformed in the last decade is significantly more than the past few decades. Eisenhardt and Bourgeois (1988) described the periods of businesses earlier than 1988 as high-velocity environment. Selsky et al. (2007) titled the recent economies as a hyperenvironment for competition. Likewise, the competition that the organizations will foresee in the coming few years is expected to be significantly more than the past decade. A series of scholars have been emphasizing the rapidly changing competitive landscape of manufacturing industries (Brennan et al. 2015) and important industrial sectors such as energy (Bagheri and Di Minin 2015), automobile (Breitschwerdt et al. 2016), and telecommunication (Yaseen et al. 2016). The key reasons for the organization’s competitive thirst are many. The emerging economies of South Asia such as China, India and Vietnam have attracted the flow of funds from international investors (Bhaumik and Beena 2003; Pradhan 2017). The investors look for labor and supplies arbitrage (Kim et al. 2018) in these countries, which enables improved profit margins. Many manufacturing industrial sectors such as automobile, heavy engineering and telecom have opened their operations in India and adapted to the local needs (Ojha 2014). Many IT services (Noronha and D’Cruz 2016), consulting, knowledge and business processing operations (Fernandez-Stark et al. 2011; Berry et al. 2016; Hoyler et al. 2018) have offshored to India.

The advent of computers with cheaper memory and high computation power has enabled organizations to access data quickly. In a recent review, Bhadani and Jothimani (2016) compared the different platforms of storing the big data in the context of IoT, Web 2.0, and cloud in various industrial sectors including health care, telecommunication, financial sector, retail, law enforcement, marketing, new product development, energy utilities, insurance, education, and other sectors. The organizations have learned to store every datum for competitive advantage. The data are so important that organizations like to keep their data on the cloud and with backup at multiple locations. A large number of social media platforms like Facebook, LinkedIn, etc. have emerged in the last decade. The social media networks have made the consumers more aware and attentive of their benefits (Ashley and Tuten 2015; Awad Alhaddad 2015; Barreda et al. 2015; Liu and Lopez 2016).

Plenty of handful examples are available to understand that the organizations have been constantly working toward innovation. Organizations can churn big data and create meaningful information for businesses to stay innovative (El-Kassar and Singh 2019). Organizations collect consumer preferences from social media networks. The faster and accurate information availability has become vital to in-house external stakeholders to conduct a comprehensive analysis and informed decision making (Kaur et al. 2019). The predictive analytics algorithms help organizations to stay ahead of the competition. The mode of business, which is earlier used to be customer approaching companies, is now reverse. The companies have started approaching the customers. The phenomenon has now reached where companies are reaching a customer’s home as home delivery markets. The methods of payments have now been transformed to develop ease to the customer. Even, the return percentage of FMCG goods in e-commerce is about 30%, which enables the customers to touch and feel the products. The new concepts such as religious connects have now been used by the companies to attract the consumers (Sardana et al. 2018).

While organizations survive and grow on the basis of their constant innovation, it is also evident that a large number of start-up organizations die within 2–3 years. It is interesting to investigate the probable reasons for a successful and sustainable organization. We hypothesize that the organizations engage in constant innovation in their processes and innovate in their products using their consumer knowledge to perform in stiff competition.

The human resource practices and management culture have been argued as drivers of competitive advantage (El-Kassar and Singh 2019; Singh et al. 2019). In a recent empirical study by Singh (2019), the effect of a lack of knowledge sharing and dissemination culture in organizations was examined. It was observed that that knowledge hiding culture may be an obstacle to the collaborative behavior, task performance, and therefore the firm performance. The study also argues that human resource practices should be documented to develop a culture of inter-dependence, which may lead to creative culture. The innovation culture may have a direct or a moderating role in improving firm performance.

The primary aim of the research is to investigate the effect of different types of innovation on the performance of organizations. The study includes manufacturing and services organizations all over India. The different dimensions of the innovation considered under investigation are namely product innovation (PDI), process innovation (PRI), and innovation culture (IC). Innovation is one of the dynamic capabilities which creates a competitive edge for organizations to survive competitive markets (Gupta and Gupta 2019). Innovation has been defined by several scholars and also by the organizations such as OECD (the Organization for Economic Co-operation and Development). The (OECD 2005) definition of product innovation is “a good or service that is new or significantly improved. This includes significant improvements in technical specifications, components and materials, software in the product, user-friendliness or other functional characteristics,” and process innovation is “a new or significantly improved production or delivery method. This includes significant changes in techniques, equipment and/or software,” and organization innovation is “a new organizational method in business practices, workplace organization or external relations.” The organization culture is a reasonable synonym to an innovation culture. Tuan et al. (2016) described that there is a dire need of studying the internal and external factors of organizations affecting the innovation impact.

The study addresses important research questions as follows:

-

To what extent the different dimensions of the innovation such as process innovation, product innovation, and innovation culture influence the firm performance

-

To what extent the size of firms moderates the influence of types of innovation on the firm performance.

A sample size of 115 was used to conduct the analysis and address the research questions. The research was operationalized in India. We collected perception responses from the middle to top management executives of manufacturing as well as services organizations in India. There are scholarly articles on innovation in organizations, and we differentiate the innovation in two dimensions and uniquely investigate the influence of the firm size on the direct effects.

The remaining paper is organized as follows. Section 2 reviews relevant literature and build a theoretical perspective to the research. We present the research methodology adopted to test our hypotheses in Sect. 3. Section 4 describes academic and practice contributions. The limitations and scope of further research are articulated in Sect. 5. The paper ends with a list of references.

Theoretical Background

Dynamic Capability View

Wernerfelt (1984) in a seminal work on resource-based view, also known as RBV (Resource base View) theory, described that organizations build resources to gain competitive advantages. A series of scholars studied the RBV in various organizational resources contexts and firm performance. The roots of dynamic capability theory are in RBV theory. Later, Teece et al. (1997) argued that merely accumulating the resources by the organizations is not sufficient to achieve competitive advantage. The organizations need to convert these resources in dynamic capabilities to respond to the rapidly changing customer needs. The dynamic capability theory fetched the attention of the scholars to study in the context of innovation to achieve improved customer satisfaction.

The innovation has been widely studied by scholars over the last three decades. On advent of resource-based theory (Wernerfelt 1984; Barney 2001), initially scholars studied innovation in association with resource-based view (Bates and Flynn 1995; Irwin et al. 1998; Verona 1999; Tarafdar and Gordon 2007; Abu Bakar and Ahmad 2010; Terziovski 2010). The dynamic capability theory (Teece et al. 1997) was substantiated by scholar’s views on multiple supply chain concepts. The innovation was claimed as one of the dynamic capabilities of the organizations, which helps improve sense and responding capability. The innovation was later studied by scholars in view of dynamic capability (Lawson and Samson 2001; Zahra and George 2002). Bag and Gupta (2017) studied innovation sustainability in supply chain networks in steel and engineering firms of South Africa. Innovation and flexibility have been claimed as two strategic intents for the vitality of organizations in competitive environments (Bishwas 2015). The detailed investigations of the innovation later delved into product innovation and process innovation. The product innovation (Verona and Ravasi 2003; Dinesh and Sushil 2019) and process innovation (Kohlbacher 2013) were later investigated by scholars in dynamic capability contexts.

Teece and Pisano (1994) described innovation as one of the dynamic capabilities in the context of organizational performance which offers competitive advantage (Beske et al. 2014). A good number of reported studies are available in the public domain on innovation as a single construct. The innovation was further studied in greater detail with product innovation (Singh and Sushil 2004; Tuan et al. 2016)- and process innovation (Tuan et al. 2016)-specific dimensions. The novelty of this research lies in the fact that we consider innovation culture also along with the key innovation dimensions. Literature has argued that the key functional competencies and dynamic capabilities make significant difference in the presence of the behavioral competencies such as organizational innovation (Malaviya and Wadhwa 2005; Gunday et al. 2011; Rajapathirana and Hui 2018), top management support (Kanwal et al. 2017), organization culture (Tuan et al. 2016) and adequate training (Michaelis and Markham 2017). In view of the literature, we anticipated that innovation culture of an organization may be an appropriate construct to study and investigate firm performance.

Piansoongnern (2016) studied innovative work behavior and Chinese leadership in a Chinese–Thai automotive company. Dubey et al. (2017) studied the performance management systems (PMS) of organizations in view of institutional perspective, where the organization culture was used as a moderator. It was presented that the organization culture can strengthen the institutional pressures to engage in performance management system in the context of sustainability benchmarking. In another study, the organization culture was again studied as a moderator, where it was argued by Dubey et al. (2019b) that the big data analytical capability positively influences the swift trust and collaborative performance. The effect of information processing capability on trust and performance is strengthened further by a positive culture of civil and military organizations in the context of disaster relief operations. Dubey et al. (2019a) in an empirical study described the role of big data culture in building organizational capability to influence operational performance. They studied the big data culture in view of institutional theory and RBV.

Process innovation is usually a dominating force in manufacturing- and production-focused organizations in emerging markets. The design innovation in companies like automobiles, electronics, etc., leads to higher performance. Product innovation is usually a common phenomenon in services markets. In a recent study, a group of scholars studied the innovation process in the Brazilian business sector, an emerging business environment like South Asia (dos Santos e Silva et al. 2019). They classified the innovation process of Brazilian businesses in various sectorial dimensions.

The Indian subcontinent is presently going through a transformational situation, where the recent Indian government promotes the Make in India campaignFootnote 1 and develops the policiesFootnote 2 accordingly. However, the economies’ faster growth inducted by the offshoring and outsourcing (Fernandez-Stark et al. 2011) from the developed countries accelerates the services industries more than manufacturing. Under these conflicting market developments, it is difficult to argue the dominant force of the firms’ performance as process innovation or product innovation.

Product Innovation and Firm Performance

A series of scholars have established that innovation is positively associated with firm performance (Rajapathirana and Hui 2018). Researchers have used multiple endogenous variables such as new product success, financial performance, non-financial performance to measure the impact of any new change in the organization be it technological, strategical, social, etc. Tuan et al. (2016) in a study in developing economy Vietnam found support for product innovation. In an automotive study, Zaefarian et al. (2017) established that product innovation success has a positive association with the firm performance.

Effect of product innovation on business performance is measured using new product success by Najafi-Tavani et al. (2018) and financial firm performance by Zaefarian et al. (2017), both found to be positive and significant. Mitrega et al. (2017) found that in the presence of product innovation, not only firm performance was improved but also the networking capability of the firm improved. Han and Nielsen (2018) used financial performance to measure the product innovation effect. They found that exploratory and exploitative product innovations improve firm’s financial performance. Out of the last four research studies, the sampling frame for the first three were Iranian manufacturing firms while fourth was Chinese enterprises.

To analyze the impact of product innovation on firm performance, Jajja et al. (2017) studied 296 Indian and Pakistanis companies. They found that product innovation not only influences the firm but also inculcates innovation focus in supplier and further enhances the buyer–supplier relationship. Haleem et al. (2018) indicated that the management of product innovation can lead to attract new customers and therefore the competitive advantage to firms. Impact of product innovation on firm though is reasonably researched, and results are more or less consistent but the impact on Indian firms still requires more attention. We propose our hypothesis based on this existing relation as follows:

H1

The product innovation has a positive influence on firm performance.

Process Innovation and Firm Performance

Several scholars have studied the relationship of process innovation on firm performance in a different functional and geographical context. In a recent study, process innovation was found to have positive and significant effect on new product success when conducted on the Iranian manufacturing industries (Najafi-Tavani et al. 2018). Piening and Salge (2015) from Germany established that process innovation has a positive association with firm performance. They also established that both technological turbulence and market turbulence positively influence the relationship between a firm’s process innovation and its financial performance. Similarly, Tuan et al. (2016) argued a similar direction for this relationship in Vietnam. Baer and Frese (2003) argued that the success of process innovation in organizations depends on appropriate climate to implement such innovations. They stated that the managers who adopt this initiative need psychological safety to drive such change. Process innovation is also considered as a moderating variable for establishing a relation between business systems and operating performance (Hsin Chang et al. 2019) and was found significant. In view of the existing established relations and underdeveloped knowledge area of process innovation in businesses in emerging economies, we phrase the following hypothesis:

H2

The process innovation has a positive influence on firm performance

Innovation Culture and Firm Performance

Innovation culture is alternatively defined as organizational innovative performance, which is argued impacting positively on the organization performance (Tuan et al. 2016). The variables of innovation culture in this research were primarily emphasized on the top management support. In an emerging market, the firms compete on the products, margins, and survival is the quest. The large firms may probably be more supportive from the top management point of view, so we also explore later that how the firm size moderates innovation culture impact on firm performance. Research on innovation culture showed a positive and significant effect on new product performance when tested on the combination of 24 eastern and western region counties (Jin et al. 2018; Michaelis et al. 2018). A similar study performed on software companies also showed a similar effect (Lee et al. 2017). Recent research in oil and gas industries in UAE published a comprehensive framework advocating the role of organizational innovation in the innovation culture and in turn performance of the organization (Busaibe et al. 2017). A study involving 253 Croatian SMEs for measuring the effect of innovation culture on business performance also found the positive effect on performance (Dabić et al. 2018) and also observed significant moderating effect of firm size. In a recent empirical study in UAE, scholars observed that the four key knowledge dimensions of knowledge processes have a positive influence on innovation performance (Al Ahbabi et al. 2019). The knowledge processes are a key component of innovation culture. On the basis of our single group, we hypothesize the following:

H3

The organization’s innovation culture has a positive influence on firm performance.

Moderating Effect of Firm Size (Employee Strength)

Scholars in the published literature have studied the firm size as the moderating variable in the context of innovation (Leal-Rodríguez et al. 2015; Jugend et al. 2018), and argued that it can influence the impact of innovation on firm performance. Firm employee strength, total asset, etc., have been used by scholars as an indicator for firm size. Firm size is extensively used as a moderating variable in the research for establishing different theories. It has been believed that large-size firms may have different impacts of innovation on firm performance as opposed to small-size firms. The reflection of using firm size was to show the organization’s economies of scale (Lee and Xia 2006) or firm’s overall resource constraints (Baum and Oliver 1991; Hannan et al. 2003), where a larger firm has higher external and internal resources.

Literature has observed that larger firms have structured systems and sufficient resources and capacity to invest in R&D and innovation as compared to SMEs (Schumpeter 1934) and size is stated as an important driver of innovation (Ahuja et al. 2008).

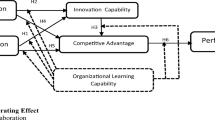

While analyzing the impact of firm size on establishing the relationship between innovation and firm performance, it was found that firm size negatively affects the impact of innovation outcome on overall firm performance (Leal-Rodríguez et al. 2015). There was another study where firm size effect on establishing a relation between innovation culture and innovation outcome (Jin et al. 2018) or business performance (Dabić et al. 2018) was found to be significant and positive. Under these conflicting views, we established our hypotheses to investigate the effect of firm size on the impact of innovation types on performance (Fig. 1). We used firm size (employee strength less than 500 as small-size firms and rest as large-size firms) as the moderator.

H1A

The product innovation has a positive influence on performance in small firms.

H2A

The process innovation has a positive influence on performance in small firms

H3A

The organization’s innovation culture has a positive influence on performance in small firms

H1B

The product innovation has a positive influence on performance in large firms

H2B

The process innovation has a positive influence on performance in large firms

H2C

The organization’s innovation culture has a positive influence on performance in large firms

Research Methodology

Survey method of research has been selected to analyze the impact of innovation on firm performance. A survey instrument was designed to collect the measures of innovation, and a unique set of data was collected from the National Capital Region in India. The manufacturing and production organization representation in the sample was 32.2% as opposed to the services as 68.8%. Similarly, the firms with less than and equal to 500 employee strength (designated as small firms) were 40.9% while the firms with employee strength more than 500 were 59.1%. The construct’s measures (Appendix) were adapted from the literature from validated and established scales.

The measures of the constructs were adapted from Tuan et al. (2016). The scale was validated in Vietnam which is another fast-growing emerging economy in South Asia. The firm performance has been used as the dependent variable. It is well established in the literature that firm performance should be measured considering financial and nonfinancial measures (Jusoh et al. 2008; Leachman et al. 2005). The market share, profitability, sales revenue, ROI, inventory turnover ratio, and productivity have been considered as the items of firm performance. A five-point Likert scale was used for capturing the perception responses. The “5” stands for strongly agree, while ‘”1” stands for strongly disagree.

Common Method Bias/Variance (CMB/V)

CMB is the variance, related to the method of data collection or measurement. This can greatly influence the significance, magnitude, and direction of a correlation/regression coefficient and hence spurious support for the tested theories (Campbell and Fiske 1959). CMV is a major potential validity threat in social sciences research (Doty and Glick 1998; Podsakoff et al. 2003). Two methods are proposed in the literature: procedural and statistical, for the possible reduction of CMB/V (Podsakoff et al. 2003). To address CMV by procedural method, we followed some required measures (Podsakoff and Organ 1986; Podsakoff et al. 2003), during the design and administering of the survey instrument to address the CMV. The item statements were clear and concise. The positioning of dependent variables and independent variables was staggered in the instrument. Also, the instrument was administered using multiple methods such as hard print, online, and e-mails.

Second, for the statistical method, we tested CMV using Harman’s single-factor test in AMOS-20 using CFA and in SPSS using exploratory factor analysis (EFA). Total variance for the single factor using EFA should be less than 50% for the absence of CMB in the survey data (Podsakoff et al. 2003). EFA for single factor returned a total variance of 36.5%. Similarly, method biases are assumed to be substantial if the hypothesized model fits the data (Mossholder et al. 1998). Model fit indices estimated using CFA in AMOS-20 are as follows: Cmin/Df = 5.2, GFI = 0.6, AGFI = 0.55, CFI = 0.7, RFI = 0.6, NFI = 0.65, RMSEA = 0.13 and PCLOSE = 0.

Both the tests on single factor (EFA and CFA) represented that survey data are free from CMB/V. That rejected the presence of CMB/V.

AMOS Measurement Model for CFA

We used structural equation modeling using SPSS 24.0 for developing our measurement model. The results of confirmatory factor analysis (CFA) as an outcome of the measurement model are described in Table 1. We found a close model fit with model indices as (χ2 = 158.96, df = 145, χ2/df = 1.10, CFI = .99, NFI = .86, GFI = .88; RMSEA = .029), while the recommended model fit indices are (1 < χ2/df < 3, CFI > .90, NFI > .85, GFI > .85, RMSEA < .1). The measures were tested for discriminant validity. The mean shared variance (MSV) of each construct was smaller than the average variance explained (AVE) of the respective constructs (Table 1). The convergent validity was ensured by the AVE, construct reliability and reliability coefficient Cronbach’s alpha. The factor loading cutoff for each item was .50 in line with recommended threshold (Hair et al. 2010) for a sample size of 100 (Fig. 2). The descriptive and bi-variate correlation beween the constructs are presented in Table 2.

Empirical Analysis

In this section, we analyze testing our set of hypotheses.

SEM Analysis

We developed a SEM path model to test the hypotheses by tweaking measurement model. We developed a path model and then ran multivariate regression with three independent variables (product innovation, process innovation, and innovation culture) and one dependent variable (firm performance). The model explained a total of 49.70% variance. We hypothesized H1, H2, and H3 as product innovation, process innovation, and innovation culture are positively associated with firm performance, respectively. We found the effect of process innovation (β = .44, p < .001) on firm performance as positive, and therefore we found support for hypothesis H2. We found the effect of product innovation (β = .13, p > .19) and innovation culture (β = .19, p > .11) statistically not significant, and therefore we did not find support for H1 and H3. We extended this analysis to multi-group analysis considering the firm size as the moderator to investigate whether the hypothesis findings are consistent (Table 3; Fig. 3).

Small-Size Firms

The small-size firms were defined as firms with employee strength less than equal to 500. We developed a SEM regression model and conducted the model fit analysis. The model explained a total of 19.50% variance. We found the effect of process innovation (β = .50, p < .01) on firm performance as positive, and therefore we found support for hypothesis H2A. We found the effect of product innovation (β = .18, p > .22) and innovation culture (β = − .10, p > .55) statistically not significant, and therefore we did not find support for H1A and H3A (Fig. 4).

Large-Size Firms

We conducted the analysis using the large-size firms with the criterion of employee strength above 500. The model fit indices were found close to good fit. The model explained a total variance of 59.70%. We found the effect of process innovation (β = .48, p < .01) and innovation culture (β = .32, p < .05) on firm performance was positive, and therefore we found support for hypotheses H2B and H3B. We found the effect of product innovation (β = − .00, p > .98) statistically not significant, and therefore we did not find support for H1B (Fig. 5).

Discussion and Conclusion

In this research, we hypothesized that the different dimensions of the innovation such as product innovation, process innovation, and innovation culture have impact on firm performance (Bates and Flynn 1995; Irwin et al. 1998; Verona 1999; Tarafdar and Gordon 2007; Abu Bakar and Ahmad 2010; Terziovski 2010). In our SEM analysis, we found that only process innovation has shown a significant impact on firm performance in Indian enterprises context (Piening and Salge 2015; Najafi-Tavani et al. 2018); however, the product innovation and innovation culture did not show a positive influence. Our findings are consistent with the published literature for emerging economies. We attribute these findings to the fact that India has now moved to the service economy (54.40%) more than mere manufacturing.Footnote 3 The maturity level of services industries in India is at a nascent stage, and the scope of improvements and business opportunities is plenty. There is immense published literature which advocates toward process development in manufacturing which effectively leads to improved communication among the internal stakeholders and departments. The services businesses primarily operate on quality service to the customers (Izogo and Ogba 2015). The organizations have learned to constantly work to improve the ease of operations with customers. In every aspect of the business including the service design or service delivery, we see the constant innovation (Yang and Sung 2016).

The organizations have also sensed that mere product innovation in services markets will not suffice to sustain profitability. In view of dynamic capability theory (Teece et al. 1997), this confirms our findings that process innovation has taken a front seat as opposed to product innovation (Lawson and Samson 2001; Zahra and George 2002) in growing markets such as Indian businesses. The organization’s innovation culture has shown a weak influence on firm performance. The culture of an organization has been argued to influence its practices. In our study also, we cannot reject the probable positive influence of the innovation culture on performance. We observed a weak influence in our research settings. We notice that the influence of process innovation has a strong positive influence on performance, and therefore the effect of an innovation culture is suppressed in our empirical analysis. This effect became apparent in our multi-group analysis.

The levels of innovation and in turn their influence on performance in organizations may significantly vary on the basis of firm sizes (Ahuja et al. 2008). We then extended the analysis to test the influence of firm size on the impact of the innovation dimensions on firm performance. We observed process innovation influence on performance was positive and significant in small as well as large firm size sample groups. Similarly, the product innovation influence on performance was not significant in both groups.

Interestingly, innovation culture was observed to be significant in larger firms contrasting with small-size firms (Gunday et al. 2011; Rajapathirana and Hui 2018). The large firms in their growth stage need to constantly innovate to stay competitive in the market. The past studies in Indian manufacturing context have shown that the organizations do efforts in building market responsiveness by aligning their operations with its strategic priorities (Sardana et al. 2016). To achieve constant innovation, the organizations invest in research and development (Schumpeter 1934) process orientation, employee training, and rewards to innovate. This builds an innovation culture in the organizations. The larger firms in their maturity stages strive to maintain their presence in the market and like to keep the concepts of their product offerings and services fresh in the minds of consumers. This requires constant innovation across an organization. The organizations allocate budgets to develop an innovation culture.

Since the effect of innovation culture was clearly positive and significant (Jin et al. 2018; Michaelis et al. 2018) in larger firms but not in smaller firms, we could conclude that firm size moderates this relationship and similarly product innovation showed statistically no significance on the performance for both the groups; therefore, no further statistical investigation was conducted further in the scope of this study.

However, process innovation showed a significant and positive impact on firm performance in both the groups and we further tested the effects in the two groups and conducted a two-independent-sample t test. We report the results as follows. We find that at 10% significance (t = 1.89, p < 0.1) the two effects were found different and therefore we concluded that the moderating effect of firm size on the effect of process innovation on performance was significant. In totality, we can conclude that firm size is a moderator for the effect of process innovation and innovation culture on firm performance (Dabić et al. 2018). Process innovation appears to have a predominant effect on firm performance as opposed to product innovation and innovation culture in Indian businesses context.

Implications for Theory

Our research was operationalized in India, which is one of the fast-growing economies in the world. The findings of the research are as much consistent with the other emerging economies, as also they are unique for this setting. The key theoretical contributions of this research are many.

First, the organizations in emerging economies should emphasize process innovation, because in emerging economies the manufacturing and services grow in parallel. The services sector usually takes over manufacturing, because even the manufacturing processes involve a large part as services. The involvement of people in services requires constant process mapping and process innovation. The product innovation receives attention more in the manufacturing sector in emerging economies which are in their initial stages of emergence. Most organizations engage only in attracting customers by innovating on products.

Second, the innovation culture of the organizations was shown to be positive and significant at p < 0.11, though we rejected the hypothesis in our limits of significance levels considered for this study, and at the same time we investigated this further with firm size as the moderator. We observed that the innovation culture was not significant in small firms, while it was influencing firm performance in larger firms. We argue that the large firms are getting benefitted from innovation culture. Such organizations should enhance their pie of spending on developing this culture not only within the organization but also for the associated small organizations such as suppliers and distribution network players. This can help the small firms in also receiving the benefits of innovation culture. These benefits of smaller firms will, in turn, benefit the larger firms and make their spending worthwhile.

Third, innovation and its dimensions are key dynamic capabilities. Our research would help to activate the scholarly debate in this discipline, especially when we present our study in a context where the businesses are growing exceptionally fast and the competitive landscape is ever changing.

Implications for Practice

The study reemphasized the importance of innovation culture in organizations to achieve sustained firm performance. Our research indicates important managerial insights.

First, the organizations in emerging economies such as India, where the markets have moved in service in parallel with the manufacturing, need to maintain their focus on the innovation culture, which in turn should lead to process innovation. A lack of process innovation leads to systems inefficiencies, which influences customer satisfaction and firm performance.

Second, smaller firms should allocate required budgets for developing an innovation culture. Our research indicated that the innovation culture in larger firms has a positive influence on performance. It is just that the smaller firms usually remain in firefighting modes in emerging markets and are not able to leverage the innovative practices which may benefit firms in their sustained development.

Third, the larger firms have clearly demonstrated the impact of innovation culture on performance. The top management of such firms needed to improve their spending on building a culture of constant innovation and continuous improvements. The employees should be rewarded for innovations of every size. The knowledge of suppliers should be leveraged by the organizations to build an innovation culture in their inbound supply chain. The knowledge acquired from customers should be transferred to the internal stakeholders and also to the suppliers so that all stakeholders can work in a coherent supply chain and support the innovation culture. In this process, the larger firms help small firms build an innovation culture and get benefited in turn.

Limitations and Future Score

No studies are free of limitations and so is this study. The limitation of this research is that the study focused on Indian businesses, and therefore the findings may be valid only for emerging economies and not worldwide. This study used only a few important dimensions of the innovation. The innovation has several functional dimensions, which can also be used to elaborate on this research and investigate their effects.

There are few important directions where the research has further extensions:

-

1.

To extend our same work to the majority of the developing countries to create a robust model which finds acceptance in the region as a whole.

-

2.

The types of innovation can be further explored beyond the lines discussed in this research. The other dimensions could be marketing innovation, organizational innovation, etc., and aligning them with the different theoretical perspectives also.

-

3.

The study can be extended for a dedicated group of manufacturing and services to understand the individual effects.

-

4.

The scholars may also extend the research by testing the moderating effects of investments and budgets, internationalization, types of firms, etc.

References

Abu Bakar, L. J., & Ahmad, H. (2010). Assessing the relationship between firm resources and product innovation performance: A resource-based view. Business Process Management Journal. https://doi.org/10.1108/14637151011049430.

Ahuja, G., Lampert, C. M., & Tandon, V. (2008). 1 Moving beyond Schumpeter: Management research on the determinants of technological innovation. Academy of Management Annals. https://doi.org/10.5465/19416520802211446.

Al Ahbabi, S. A., Singh, S. K., Balasubramanian, S., & Gaur, S. S. (2019). Employee perception of impact of knowledge management processes on public sector performance. Journal of Knowledge Management. https://doi.org/10.1108/JKM-08-2017-0348.

Ashley, C., & Tuten, T. (2015). Consumer perceptions of online shopping environments. Psychology & Marketing. https://doi.org/10.1002/mar.20323.

Awad Alhaddad, A. (2015). The effect of advertising awareness on brand equity in social media. International Journal of E-Education, e-Business, e-Management and e-Learning. https://doi.org/10.17706/ijeeee.2015.5.2.73-84.

Baer, M., & Frese, M. (2003). Innovation is not enough: Climates for initiative and psychological safety, process innovations, and firm performance. Journal of Organizational Behavior. https://doi.org/10.1002/job.179.

Bag, S., & Gupta, S. (2017). Antecedents of sustainable innovation in supplier networks: A South African experience. Global Journal of Flexible Systems Management. https://doi.org/10.1007/s40171-017-0158-4.

Bagheri, S. K., & Di Minin, A. (2015). The changing competitive landscape of the global upstream petroleum industry. Journal of World Energy Law and Business. https://doi.org/10.1093/jwelb/jwu036.

Barney, J. B. (2001). Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. Journal of Management. https://doi.org/10.1016/S0149-2063(01)00115-5.

Barreda, A. A., Bilgihan, A., Nusair, K., & Okumus, F. (2015). Generating brand awareness in online social networks. Computers in Human Behavior. https://doi.org/10.1016/j.chb.2015.03.023.

Bates, K. A., & Flynn, E. J. (1995). Innovation history and competitive advantage: A resource-based view analysis of manufacturing technology innovations. Academy of Management Proceedings. https://doi.org/10.5465/ambpp.1995.17536502.

Baum, J. A. C., & Oliver, C. (1991). Institutional linkages and organizational mortality. Administrative Science Quarterly. https://doi.org/10.2307/2393353.

Berry, A., Bohn, T., & Mulder, N. (2016). The changing landscape of global trade in business services and value chains: Are emerging economies taking over? Research Handbooks on the WTO Series. https://doi.org/10.4337/9781783478064.

Beske, P., Land, A., & Seuring, S. (2014). Sustainable supply chain management practices and dynamic capabilities in the food industry: A critical analysis of the literature. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2013.12.026.

Bhadani, A. K., & Jothimani, D. (2016). Big data: Challenges, opportunities, and realities. Effective Big Data Management and Opportunities for Implementation. https://doi.org/10.4018/978-1-5225-0182-4.ch001.

Bhaumik, S., & Beena, P. (2003). Survey of FDI in India. Centre for New and Emerging Markets.

Bishwas, S. K. (2015). Achieving organization vitality through innovation and flexibility: An empirical study. Global Journal of Flexible Systems Management. https://doi.org/10.1007/s40171-014-0089-2.

Breitschwerdt, D., Conet, A., Michor, L., Müller, N., & Salmon, L. (2016). Performance and disruption—A perspective on the automotive supplier landscape and major technology trends. Hg. v. McKinsey & Company, zuletzt geprüft am, 7, 2018.

Brennan, L., Ferdows, K., Godsell, J., Golini, R., Keegan, R., Kinkel, S., et al. (2015). Manufacturing in the world: Where next? International Journal of Operations and Production Management. https://doi.org/10.1108/IJOPM-03-2015-0135.

Busaibe, L., Singh, S. K., Ahmad, S. Z., & Gaur, S. S. (2017). Determinants of organizational innovation: A framework. Gender in Management. https://doi.org/10.1108/GM-01-2017-0007.

Campbell, D. T., & Fiske, D. W. (1959). Convergent and discriminant validation by the multitrait-multimethod matrix. Psychological Bulletin. https://doi.org/10.1037/h0046016.

Dabić, M., Lažnjak, J., Smallbone, D., & Švarc, J. (2018). Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. Journal of Small Business and Enterprise Development. https://doi.org/10.1108/JSBED-04-2018-0117.

Dinesh, K., & Sushil (2019). Strategic innovation factors in startups: Results of a cross-case analysis of Indian startups. Journal of Global Business Advancement, 12(3), 449–470.

dos Santos e Silva, D. F., Bomtempo, J. V., & Alves, F. C. (2019). Innovation opportunities in the Brazilian sugar-energy sector. Journal of Cleaner Production, 999, 999. https://doi.org/10.1016/j.jclepro.2019.02.062.

Doty, D. H., & Glick, W. H. (1998). Common methods bias: Does common methods variance really bias results? Organizational Research Methods. https://doi.org/10.1177/109442819814002.

Dubey, R., Gunasekaran, A., Childe, S. J., Blome, C., & Papadopoulos, T. (2019a). Big data and predictive analytics and manufacturing performance: Integrating institutional theory, resource-based view and big data culture. British Journal of Management. https://doi.org/10.1111/1467-8551.12355.

Dubey, R., Gunasekaran, A., Childe, S. J., Papadopoulos, T., Hazen, B., Giannakis, M., et al. (2017). Examining the effect of external pressures and organizational culture on shaping performance measurement systems (PMS) for sustainability benchmarking: Some empirical findings. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2017.06.029.

Dubey, R., Gunasekaran, A., Childe, S. J., Roubaud, D., Fosso Wamba, S., Giannakis, M., et al. (2019b). Big data analytics and organizational culture as complements to swift trust and collaborative performance in the humanitarian supply chain. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2019.01.023.

Eisenhardt, K. M., & Bourgeois, L. J. (1988). Politics of strategic decision making in high-velocity environments: Toward a midrange theory. Academy of Management Journal. https://doi.org/10.5465/256337.

El-Kassar, A. N., & Singh, S. K. (2019). Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2017.12.016.

Fernandez-Stark, K., Bamber, P., & Gereffi, G. (2011). The offshore services value chain: Upgrading trajectories in developing countries. International Journal of Technological Learning, Innovation and Development. https://doi.org/10.1504/IJTLID.2011.041905.

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2011.05.014.

Gupta, A. K., & Gupta, N. (2019). A dynamic capability view of adaptability on new product success launch. Journal of Supply Chain Management Systems, 8(1), 38–44.

Hair, J. F., Anderson, R. E., Tatham, R. L., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7th ed.). Upper Saddle River: Pearson Prentice Hall. https://doi.org/10.1016/j.ijpharm.2011.02.019.

Haleem, A., Kumar, S., & Luthra, S. (2018). Flexible system approach for understanding requisites of product innovation management. Global Journal of Flexible Systems Management. https://doi.org/10.1007/s40171-017-0171-7.

Han, C., & Nielsen, B. (2018). Management innovation and firm performance: Toward ambidextrous product innovation. Academy of Management Proceedings. https://doi.org/10.5465/ambpp.2018.16709abstract.

Hannan, M. T., Carroll, G. R., & Pólos, L. (2003). The organizational niche. Sociological Theory. https://doi.org/10.1046/j.1467-9558.2003.00192.x.

Hoyler, M., Parnreiter, C., Watson, A., Lambregts, B., Kleibert, J., & Beerepoot, N. (2018). The making of Mumbai as a global city: Investigating the role of the offshore services sector. Global City Makers. https://doi.org/10.4337/9781785368950.00014.

Hsin Chang, H., Hong Wong, K., & Sheng Chiu, W. (2019). The effects of business systems leveraging on supply chain performance: Process innovation and uncertainty as moderators. Information & Management. https://doi.org/10.1016/j.im.2019.01.002.

Irwin, J. G., Hoffman, J. J., & Lamont, B. T. (1998). The effect of the acquisition of technological innovations on organizational performance: A resource-based view. Journal of Engineering and Technology Management. https://doi.org/10.1016/S0923-4748(97)00028-3.

Izogo, E. E., & Ogba, I. E. (2015). Service quality, customer satisfaction and loyalty in automobile repair services sector. International Journal of Quality and Reliability Management. https://doi.org/10.1108/IJQRM-05-2013-0075.

Jajja, M. S. S., Kannan, V. R., Brah, S. A., & Hassan, S. Z. (2017). Linkages between firm innovation strategy, suppliers, product innovation, and business performance: Insights from resource dependence theory. International Journal of Operations and Production Management. https://doi.org/10.1108/IJOPM-09-2014-0424.

Jin, Z., Navare, J., & Lynch, R. (2018). The relationship between innovation culture and innovation outcomes: Exploring the effects of sustainability orientation and firm size. R&D Management. https://doi.org/10.1111/radm.12351.

Jugend, D., Jabbour, C. J. C., Alves Scaliza, J. A., Rocha, R. S., Junior, J. A. G., Latan, H., et al. (2018). Relationships among open innovation, innovative performance, government support and firm size: Comparing Brazilian firms embracing different levels of radicalism in innovation. Technovation. https://doi.org/10.1016/j.technovation.2018.02.004.

Jusoh, R., Ibrahim, D. N., & Zainuddin, Y. (2008). The performance consequence of multiple performance measures usage: Evidence from the Malaysian manufacturers. International Journal of Productivity and Performance Management. https://doi.org/10.1108/17410400810847393.

Kanwal, N., Zafar, M. S., & Bashir, S. (2017). The combined effects of managerial control, resource commitment, and top management support on the successful delivery of information systems projects. International Journal of Project Management. https://doi.org/10.1016/j.ijproman.2017.08.007.

Kaur, S., Gupta, S., Singh, S. K., & Perano, M. (2019). Organizational ambidexterity through global strategic partnerships: A cognitive computing perspective. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2019.04.027.

Kim, B., Park, K. S., Jung, S. Y., & Park, S. H. (2018). Offshoring and outsourcing in a global supply chain: Impact of the arm’s length regulation on transfer pricing. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2017.09.004.

Kohlbacher, M. (2013). The impact of dynamic capabilities through continuous improvement on innovation: The role of business process orientation. Knowledge and Process Management. https://doi.org/10.1002/kpm.1405.

Lawson, B., & Samson, D. (2001). Developing innovation capability in organisations: A dynamic capabilities approach. International Journal of Innovation Management. https://doi.org/10.1142/s1363919601000427.

Leachman, C., Pegels, C. C., & Shin, S. K. (2005). Manufacturing performance: Evaluation and determinants. International Journal of Operations and Production Management. https://doi.org/10.1108/01443570510613938.

Leal-Rodríguez, A. L., Eldridge, S., Roldán, J. L., Leal-Millán, A. G., & Ortega-Gutiérrez, J. (2015). Organizational unlearning, innovation outcomes, and performance: The moderating effect of firm size. Journal of Business Research. https://doi.org/10.1016/j.jbusres.2014.11.032.

Lee, K., Woo, H. G., & Joshi, K. (2017). Pro-innovation culture, ambidexterity and new product development performance: Polynomial regression and response surface analysis. European Management Journal. https://doi.org/10.1016/j.emj.2016.05.002.

Lee, G., & Xia, W. (2006). Organizational size and IT innovation adoption: A meta-analysis. Information & Management. https://doi.org/10.1016/j.im.2006.09.003.

Liu, Y., & Lopez, R. A. (2016). The impact of social media conversations on consumer brand choices. Marketing Letters. https://doi.org/10.1007/s11002-014-9321-2.

Malaviya, P., & Wadhwa, S. (2005). Innovation management in organizational context: an empirical study. Global Journal of Flexible Systems Management, 6(2), 1–14.

Michaelis, T. L., Aladin, R., & Pollack, J. M. (2018). Innovation culture and the performance of new product launches: A global study. Journal of Business Venturing Insights. https://doi.org/10.1016/j.jbvi.2018.04.001.

Michaelis, T. L., & Markham, S. K. (2017). Innovation training: Making innovation a core competency. Research Technology Management. https://doi.org/10.1080/08956308.2017.1276387.

Mitrega, M., Forkmann, S., Zaefarian, G., & Henneberg, S. C. (2017). Networking capability in supplier relationships and its impact on product innovation and firm performance. International Journal of Operations and Production Management. https://doi.org/10.1108/IJOPM-11-2014-0517.

Mossholder, K. W., Bennett, N., Kemery, E. R., & Wesolowski, M. A. (1998). Relationships between bases of power and work reactions: The mediational role of procedural justice. Journal of Management. https://doi.org/10.1177/014920639802400404.

Najafi-Tavani, S., Najafi-Tavani, Z., Naudé, P., Oghazi, P., & Zeynaloo, E. (2018). How collaborative innovation networks affect new product performance: Product innovation capability, process innovation capability, and absorptive capacity. Industrial Marketing Management. https://doi.org/10.1016/j.indmarman.2018.02.009.

Noronha, E., & D’Cruz, P. (2016). Creating space: The role of the state in the Indian IT-related offshoring sector. Space, Place and Global Digital Work. https://doi.org/10.1057/978-1-137-48087-3_8.

OECD. (2005). Oslo manual Guidelines for collecting and interpreting innovation. In F. Gault (Ed.), Handbook of innovation indicators and measurement. Cheltenham: Edward Elgar Publishing. https://doi.org/10.4337/9780857933652.00010.

Ojha, A. K. (2014). MNCs in India: Focus on frugal innovation. Journal of Indian Business Research. https://doi.org/10.1108/JIBR-12-2012-0123.

Piansoongnern, O. (2016). Chinese leadership and its impacts on innovative Work behavior of the Thai employees. Global Journal of Flexible Systems Management. https://doi.org/10.1007/s40171-015-0110-4.

Piening, E. P., & Salge, T. O. (2015). Understanding the antecedents, contingencies, and performance implications of process innovation: A dynamic capabilities perspective. Journal of Product Innovation Management. https://doi.org/10.1111/jpim.12225.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. The Journal of Applied Psychology. https://doi.org/10.1037/0021-9010.88.5.879.

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: Problems and prospects. Journal of Management. https://doi.org/10.1177/014920638601200408.

Pradhan, J. P. (2017). Emerging multinationals: A comparison of Chinese and Indian outward foreign direct investment. Institutions and Economies, 3, 113–148.

Rajapathirana, R. P. J., & Hui, Y. (2018). Relationship between innovation capability, innovation type, and firm performance. Journal of Innovation & Knowledge. https://doi.org/10.1016/j.jik.2017.06.002.

Sardana, D., Gupta, N., & Sharma, P. (2018). Spirituality and religiosity at the junction of consumerism: Exploring consumer preference for spiritual brands. International Journal of Consumer Studies. https://doi.org/10.1111/ijcs.12467.

Sardana, D., Terziovski, M., & Gupta, N. (2016). The impact of strategic alignment and responsiveness to market on manufacturing firm’s performance. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2016.04.018.

Schumpeter, J. (1934). The theory of economic development—An inquiry into profits, capital, credit, interest, and the business cycle. Regional Studies., 51, 1–2.

Selsky, J. W., Goes, J., & Babüroǧlu, O. N. (2007). Contrasting perspectives of strategy making: Applications in “hyper” environments. Organization Studies. https://doi.org/10.1177/0170840607067681.

Singh, S. K. (2019). Territoriality, task performance, and workplace deviance: Empirical evidence on role of knowledge hiding. Journal of Business Research. https://doi.org/10.1016/j.jbusres.2018.12.034.

Singh, S. K., Chen, J., Del Giudice, M., & El-Kassar, A. N. (2019). Environmental ethics, environmental performance, and competitive advantage: Role of environmental training. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2019.05.032.

Singh, N., & Sushil (2004). Flexibility in product development for success in dynamic market environment. Global Journal of Flexible Systems Management, 5(1), 1–12.

Tarafdar, M., & Gordon, S. R. (2007). Understanding the influence of information systems competencies on process innovation: A resource-based view. Journal of Strategic Information Systems. https://doi.org/10.1016/j.jsis.2007.09.001.

Teece, D., & Pisano, G. (1994). The dynamic capabilities of firms: An introduction. Industrial and Corporate Change. https://doi.org/10.1093/icc/3.3.537-a.

Teece, D. J., Pisano, G., & Shuen, A. M. Y. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18, 509–533.

Terziovski, M. (2010). Innovation practice and its performance implications in small and medium enterprises (SMEs) in the manufacturing sector: A resource-based view. Strategic Management Journal, 31(8), 892–902.

Tuan, N., Nhan, N., Giang, P., & Ngoc, N. (2016). The effects of innovation on firm performance of supporting industries in Hanoi, Vietnam. Journal of Industrial Engineering and Management. https://doi.org/10.3926/jiem.1564.

Verona, G. (1999). A resource-based view of product development. Academy of Management Review. https://doi.org/10.5465/AMR.1999.1580445.

Verona, G., & Ravasi, D. (2003). Unbundling dynamic capabilities: An exploratory study of continuous product innovation. Industrial and Corporate Change, 12(3), 577–606.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal. https://doi.org/10.1002/smj.4250050207.

Yang, C. F., & Sung, T. J. (2016). Service design for social innovation through participatory action research. International Journal of Design, 10, 21–36.

Yaseen, S. G., Dajani, D., & Hasan, Y. (2016). The impact of intellectual capital on the competitive advantage: Applied study in Jordanian telecommunication companies. Computers in Human Behavior. https://doi.org/10.1016/j.chb.2016.03.075.

Zaefarian, G., Forkmann, S., Mitręga, M., & Henneberg, S. C. (2017). A capability perspective on relationship ending and its impact on product innovation success and firm performance. Long Range Planning. https://doi.org/10.1016/j.lrp.2015.12.023.

Zahra, S. A., & George, G. (2002). The net-enabled business innovation cycle and the evolution of dynamic capabilities. Information Systems Research. https://doi.org/10.1287/isre.13.2.147.90.

Acknowledgements

This revision has helped us to improve our research articulation, our understanding of our research areas, and it was an opportunity for an immense amount of learning. We like to thank the editor in chief and the esteemed reviewers for their valuable comments, which had helped us to bring this manuscript to the stage where it is now.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Items of the questionnaire

Appendix: Items of the questionnaire

Constructs | Manifest | Code |

|---|---|---|

Product innovation | New product and service introduction, company is often first-to-market | PDI1 |

Products and services are often perceived as very novel by customers | PDI2 | |

Products and services often take you up against competitors | PDI3 | |

Company has introduced more innovative products and services during past 5 years. | PDI4 | |

Constantly emphasizes development of particular and patent products | PDI5 | |

Manages to cope with market demands and develop new products quickly | PDI6 | |

Continuously modifies design of your products and rapidly enters new emerging markets | PDI7 | |

Firm manages to deliver special products flexibly according to customers’ order | PDI8 | |

Firm continuously improves old products and raises quality of new products | PDI9 | |

Process innovation | Development of new channels for products and services offered by your organization is an ongoing process | PRI1 |

Firm deals with customers’ suggestions or complaints urgently and with utmost care | PRI2 | |

Organization does R&D process improvements where they are required | PRI3 | |

In comparison with competitors, your company has introduced more innovative products and services during past 5 years | PRI4 | |

Entering new markets, new pricing methods, new distribution methods, etc., company is better than competitors | PRI5 | |

Organization does R&D process improvements where they are needed | PRI6 | |

Innovative culture | Innovation proposals are welcomed by management | IC1 |

Management actively seeks innovative ideas | IC2 | |

Your management perceives innovation as too risky and is resisted | IC3 | |

People are not penalized for new ideas that do not work | IC4 | |

Program/project managers promote and support innovative ideas, experimentation and creative processes | IC5 | |

Innovation is very much reflected in organization’s vision statement | IC6 | |

Firm performance | Market share | FP1 |

Sales revenue of new products | FP2 | |

Profitability | FP3 | |

Productivity | FP4 | |

ROI | FP5 | |

Inventory turnover | FP6 |

Rights and permissions

About this article

Cite this article

Gupta, A.K., Gupta, N. Innovation and Culture as a Dynamic Capability for Firm Performance: A Study from Emerging Markets. Glob J Flex Syst Manag 20, 323–336 (2019). https://doi.org/10.1007/s40171-019-00218-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40171-019-00218-5