Abstract

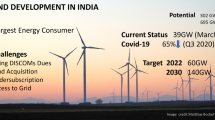

Being among the most populated country with one of the fastest growing economies in the world, the country is met with ever-increasing fossil fuel consumption. The use of fossil fuels for energy is threatening India with emission pollutants, the import burden of crude oil and natural gas, and coal resource extinction. Clean energies have long been thought to reduce or eliminate a country’s dependence on fossil fuels for electricity generation. In the past decade, India has made major additions to its renewable energy capacity, especially with respect to solar and wind, which represent a major proportion of renewable generation in the country. This paper analyzes the government policies, programs, and incentives to enhance and develop the solar–wind sector in India, alongside potential limitations and solutions. It also reviews the development of “offshore wind,” which is slated to be added to the energy mix of the country over the coming decade.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

India is home to 1.3 billion people and is expected to surpass the Chinese population by 2025 to become the most populated country in the world [1]. The growing population will be met with increasing energy demand. The total primary energy consumption of India has more than doubled from 326.77 million tons of oil equivalent (Mtoe) in 2002 to 753.3 Mtoe in 2017 [2]. The same period has witnessed an increase in the installed energy capacity, from 102.32 to 319.46 GW. India’s current energy mix is composed of both conventional (coal, oil, gas) and renewable (solar, wind, hydro, etc.) energy resources, but traditionally it has always been more inclined toward coal, oil, and gas for power (Figs. 1, 2) [3].

Installed energy capacity in India as of March 31, 2018 [3]

The growth of installed energy capacity in India [3]

At present, 64.80% of the installed capacity is conventional (coal, oil, gas), 13.20% is large hydro, 2% is nuclear, and 20.10% is renewable energy of the total 344 GW capacity [4]. This bifurcation of installed capacity, however, does not present the entire picture. Due to the intermittent nature of renewable energy like solar and wind, the capacity utilization factor (CUF) is much lower as compared to coal-based plants, resulting in a low contribution to the cumulative generation year round. The contribution of solar and wind combined for fiscal year (FY) 2017–2018 amounts to only 6.01% of the total electricity generation. This leads to a substantial amount of the electricity generation (80%) being conducted by thermal power plants (Fig. 3) [5].

Electricity generation by source [5]

The continuous dependence on coal, oil, and gas is a serious concern due to many issues:

- 1.

Total CO2 emissions have increased from 935.56 million tonne (MtCO2) in 2002 to 2400 (MtCO2) in 2017, making India the fourth largest emitter of CO2 in the world [6, 7].

- 2.

Crude oil production has remained static, while imports have risen to about 2.5 times their amounts from 2002 to 2015 [2]. An estimated 219.15 million tonne (Mt) were imported in FY 2017–2018 for 87.725 billion USD, which means that India relies on imports for more than 80% of its oil needs. Trends show that the dependence on crude oil imports is expected to rise in the future. Liquefied natural gas imports have also seen a serious rise from 10.93 billion cubic meters (BCM) in FY 2007–2008 to 26.33 BCM in FY 2017–2018 [8]. The coal imports have risen from 49.79 Mt in 2007–2008 to 190.95 Mt in 2016–2017. The total coal imported in 2017–2018 was 188.51 Mt [9].

- 3.

The emissions and the pollution caused by coal-based power plants also seem to have serious health implications. In FY 2010–2011, approximately 503 Mt of coal was burnt which produced 580 Ktons of Particulate matter (PM2.5). The exposure to PM2.5 and other hazardous gases like sulfur dioxides, nitrogen oxides, carbon dioxide, and volatile matter produced during the combustion of coal is estimated to have caused deaths of up to 115,000 people and 20 million asthma cases, costing up to USD 4.6 billion to the public and government. [10]

These issues suggest that the cost of powering India (given its increasing economy and population) with fossil fuels may be huge in terms of carbon emissions, health, and resource limitations. There is a need to look toward cleaner, more cost-effective, and sustainable forms of energy to propel further economic growth, which will come from sources like solar, wind, and nuclear energy. In fact, in recent years, we have witnessed a more serious shift in government preference from encouraging fossil fuel-based energy toward solar and wind through its various policies, programs, and incentives. During the 2015 United Nations Climate Change Conference in Paris, India made a bold pledge to reduce its carbon emissions by 33–35% from 2005 levels by 2030 and achieve 40% of its cumulative electric power (of around 350 GW installed capacity) from clean energy resources. The country also set a goal of achieving 175 GW in renewable installed capacity with 100 GW from solar, 60 GW from wind, 10 GW from bioenergy, and 2 GW from small hydro plants by 2022 [11].

Wind Energy

Overview

The idea of wind power dates back to 1952 when Council of Scientific and Industrial Research (CSIR) reviewed data for surface winds and their duration for identifying potential sites. From 1960s to 1980s, National Aerospace Laboratories and CSIR conducted surveys to improve wind energy estimates. Consequently, the first demonstration wind farms were set up in 1986 in the states of Maharashtra (Ratnagiri), Gujarat (Okha), and Tamil Nadu (Tirunelveli) with 55 KW Vestas wind turbines. However, with all these efforts, the installed capacity remained at 220 MW until the year 2000 [12].

The wind installations increased rapidly after 2002 from just 1.6 to 34.29 GW by June 2018, contributing 4% to the total electricity generation in FY 2017–2018. The country currently has the fourth highest installed wind capacity in the world, only following China, the USA, and Germany. Historically, wind has held a major proportion (more than 50%) of total renewable installation capacity of the country. The growth of the cumulative installed wind capacity after 2002 is shown in Fig. 4 [13]. During 2016–2017, a record 5502 MW of installed wind capacity was added—the highest amount to be ever added in India.

The growth of wind installations [13]

The resource-rich states include Tamil Nadu, Gujarat, Maharashtra, Karnataka, Rajasthan, Andhra Pradesh, and Madhya Pradesh. With an installed capacity of over 8 GW, Tamil Nadu is the leader in wind power. Its Muppandal wind farm has a total capacity of 1500 MW, making it the largest wind power plant in India. The CUF of wind plants approaches 15–16%, and the state has a separate agency (Tamil Nadu Energy Development Agency) to deal with matters of renewable energy [14]. The installations by state along with the generation amount for FY 2017 are given in Table 1 [15].

Wind energy is intermittent and highly site specific; hence, the government and Ministry of New and Renewable Energy (MNRE) have always focused on wind assessment programs. About 800 wind-monitoring stations are installed across the country. A recent assessment by the National Institute of Wind Energy suggested that the country had 302 GW of exploitable potential at 100-m height, which was mostly concentrated in the top seven wind-rich states [16].

This shows that, despite all the improvements in the sector, a vast amount of potential remains unexploited, and the sector will continue aggressive expansion given India’s increasing energy needs and its efforts to reduce fossil fuel consumption.

Amendments in Tariff Policy

The concept of Renewable Purchase Obligation (RPO) came with the Electricity Act of 2003. The amended tariff policy in 2016 obligated uniform RPOs for all states and union territories. The policy also provided for Ministry of Power plans for the long-term growth of RPOs in consultation with the MNRE. The RPO for non-solar resources has been on the rise from 8.75 to 10.25% in 2018–2019, with targets set to reach 10.50% of non-solar renewable energy by 2021 [17]. The MNRE has recently also created a compliance cell to deal with the sluggish implementation of RPOs by many states. The compliance cell will coordinate with Central Electricity Regulatory Commission (CERC) and State Electricity Regulatory Commission (SERC) to generate monthly reports on the achievement of targets and to resolve issues with appropriate authorities [18].

Wind energy is concentrated in seven to eight windy states. In order to facilitate the non-windy states meeting their non-solar obligations and encourage project developments in resource-rich areas, the Ministry of Power has ordered to refrain from imposing interstate transmission charges and losses on solar–wind projects commissioned until March 2022. The duration of the waiver would be equal to the duration of Power Purchase Agreements (PPAs), i.e., 25 years for projects obtained through a competitive bidding process [19].

Given the promise of interstate transmission systems for evacuation from wind-rich states coupled with the introduction of reverse auctions (See footnote 1) in place of feed-in tariffs (FITs), the year 2017 witnessed a fall in wind tariffs to 3.46 Rs/kWh in a February auction conducted by Solar Energy Corporation of India (SECI) and to a further low of 2.43 Rs/kWh in an auction conducted by Gujarat Urja Vikas Nigam Limited in December 2017. By comparison, regulator-determined FITs in various states have always been above 4 Rs/kWh. The policy changes, however, led to the addition of less than 2 GW in FY 2017–2018, which could be attributed to many factors, like delays in auction guidelines (especially at the state level), concerns about state utilities back-tracking on previous PPAs during the FIT method, confusion over generation-based incentives (GBIs), and an overall reduction in auctions [20].

The wind tariffs have conventionally been very flat over the previous decade in contrast to solar tariffs (Fig. 5), which have seen a steep decline over the years mainly attributable to the falling photovoltaic (PV) panel prices in the international market, while no such decline has been seen with the cost of wind turbines. India is also a global manufacturing hub for wind turbines. The domestic manufacturing capacity isFootnote 1 over 10 GW annually, meeting most of the country’s requirements. Under these conditions, a further fall in tariffs could be financially unviable and hit the local manufacturing industry; consequently, the tariffs may be seen to stabilize or increase in the near future.

Offshore Wind Energy

With the maturity of many European markets like the United Kingdom, Germany, and Denmark in the offshore wind sector, there has been an effort to add this new source into India’s renewable capacity. Offshore wind offers various advantages over land-based turbines which include large area availability which is specially important in Indian context since land is scarce, much higher wind speeds, less turbulence in air which may lead to lower fatigue of turbine components and enhanced efficiency, lower transmission losses since the power is utilized in nearby cities and load centers. The MNRE ratified the National Offshore Wind Policy in October 2015 to realize the offshore wind power both at the southern tip of the Indian peninsula and along the west coast. Initial studies suggest that the maximum potential can be found along the coasts of Tamil Nadu, Gujarat, and Maharashtra. MNRE targets include 5 GW offshore by 2022 and 30 GW by 2030. In April 2018, it also sought Expression of Interest for 1 GW of offshore wind along the Gulf of Khambhat off the coast of Gujarat, later releasing leasing rules for offshore wind and setting up a LIDAR station for the assessment of wind resources.

The development of offshore wind in India is facilitated by a European Union–funded project by the name of Facilitating Offshore Wind in India (FOWIND). The project focuses on two states (Tamil Nadu and Gujarat) with the prime objective of providing techno-economic analysis and resource assessments. It also provides suggestions regarding policy regulation, industry, human resource development, research, and development activities and acts as a platform for knowledge sharing between Indian and European stakeholders [21].

The FOWIND pre-feasibility report (2015) identified eight zones in Gujarat that are most suitable for commercial offshore development, taking into consideration key technical and environmental constraints (Fig. 6). Zone A among them is identified as the most promising for demonstration projects. The wind speeds in these zones vary from 6.8 to 7 m/s (at 120 m above ground level (AGL)) and depths in the range of 15–43 m below Lowest Astronomical Tide (LAT) [22]. A similar report for Tamil Nadu also identifies eight zones (Fig. 7), with Zone A being the most promising. The wind speed in the select zones varies from 7.1 to 8.2 m/s (at 120 m AGL), and the water depth is in the range of 10–50 m below LAT [23].

The established markets in Europe identified five key challenges for offshore wind in India: (1) Complex development processes: the project is a long-term capital investment that requires interaction with diverse stakeholders and skilled management over a period of 7–9 years. (2) Levelized cost of electricity: since onshore wind and solar PV are already cost-competitive with thermal power, support mechanisms are necessary to encourage local markets until they reach maturity. (3) Finance: access to low-cost financial and insurance instruments is yet another challenge; as initial projects will need help from public funds, currency hedging may also be utilized for same. (4) Supply chain, ports, and grid development: one key bottleneck in the United Kingdom was a lack of dedicated specialized vessels, as the use of oil–gas sector vessels was inappropriate for offshore wind farms, and they were subjected to restrictions in availability. Schedules need to be optimized considering the restrictions, distances, vessel capabilities, and assembly scenarios spanning the length of the installation periods. FOWINDS report on supply chain, port infrastructure, and logistics (2016) compiles an illustrative procurement list to help with the same. Transmission infra poses yet another challenge. Grid integration study (2017) by FOWIND has proposed regulatory models of delivery and ownership of offshore transmission assets that best suite Indian power system conditions. (5) Environmental constraints: preplanning has to be done to avoid conflict with third parties like fishing communities and shipping routes.

Suggestions to neutralize these challenges include: (1) a clear roadmap that includes a long-term plan for offshore-related infrastructure and a transmission system aligned with the national five-year plan; (2) consent and permission from various stakeholders; (3) grid development that takes into account special needs like space constraints, long cables, and boundaries for suitable grids; (4) mitigating risks for developers by various financial support mechanisms like accelerated depreciation, GBIs, generic Levelized tariffs (i.e., FITs), offshore RPOs, income tax holidays, equipment duty exemption, and exemption from payment of sales tax until the sector matures and prices become competitive; (5) Developing skills: Interaction with international suppliers, developers, consultants, and utilities can play a crucial role in developing local knowledge to deal with this new and complex sector [24].

Given the government interest and some serious work by FOWIND, the offshore sector can be expected to take off in the near future with demonstration projects in Gujarat and Tamil Nadu. The sector will be a good boost to the country’s renewable aspirations; however, given the complex nature of the offshore sector and uncertainties related to policies/plans and the costs of new and existing technologies, it is difficult to anticipate the growth of this sector in the country.

Other Important Developments

-

1.

Repowering: In 2016, MNRE released a repowering policy to replace old turbines with capacities less than 1 MW with new turbines of greater capacity. Since the wind installations date back to the 1990s, as much as 5 GW will be eligible for replacement. The target states will include Maharashtra, Karnataka, Gujarat, Tamil Nadu, and Rajasthan. The current policy is a start to a major overhaul, which needs more clarity in terms of guidelines, PPAs (which are state subjects), land requirements and ownership, etc. [25].

-

2.

Hybrid Systems: There are Indian states like Gujarat, Tamil Nadu, Maharashtra, Karnataka, and Andhra Pradesh, which are rich in both solar and wind. These states might benefit from solar–wind hybrid systems which would lead to better utilization of transmission infrastructure, improved CUF of the combined system in comparison to standalone solar–wind and better grid stability. In May 2018, M.N.R.E announced the new solar–wind hybrid policy which provides a broad overview for expansion of this new concept alongside encouraging technological solutions for bottlenecks in combined operation of solar–wind. [26]. India’s first big auction of a solar–wind hybrid system was conducted by Solar Energy Corporation of India (SECI) in December 2018 giving 840 MW contract to Adani Power and S.B Energy with a low tariff of 2.67 Rs/kWh.

Barriers and Solutions

(1) Inadequate Infrastructure lack of evacuation and transmission links is one common barrier to solar–wind power. There is need of proper infrastructure like substations, transformers, communication network, road, and water to allow smooth grid connection and site development. Some high potential sites in Gujarat, Rajasthan, and Tamil Nadu could not be adequately exploited for the mentioned reasons. (2) Lack of precise resource assessment The National Institute of Wind Energy (N.I.W.E), Chennai, has some resource assessment programs, but data are not organized and reliable as in Tamil Nadu the actual wind generation is already past the estimation. [27]. The lack of precise resource assessment could also risk the developers who are forced to bid at competitive margins due to introduction of reverse auctions. The use of modern technologies like Sonic Detection and Ranging (SODAR) (SODAR) and Light Detection and Ranging (LiDAR) in conjunction to Meteorological towers could be utilized for accurate resource assessment. (3) Land Land acquisition is a complicated process and obtaining clearances from authorities for utilizing agricultural/protected land is difficult. Forest land acquisition should be eased by reducing official formalities and exemptions could be given from wildlife zones, mitigatory bird routes constraints, air flight path restrictions, etc. (4) R.P.O compliance Despite the formation of compliance cell by M.N.R.E, most states have failed to meet even 60% of the R.P.O. Many of the state DISCOMS are negligent because of lack of penalties. There have even been halts in renewable energy certificates (R.E.Cs) trading due to disputes regarding changes in price by C.E.R.C. Binding of RPO compliance may result in much relief to a number of independent power producers (IPPs) and may lead to more investment. As India is a country of small agricultural land holdings, these small lands and households can be encouraged to mount micro wind turbines (less than 10 kw), R&D is required for efficient designs.Net metering policies, real time monitoring, and subsidies inline with solar rooftop can help develop this area, helping the states meet their RPOs. (5) Fluctuation in policies There has been variation in policies, especially at the state level on open access, cross-subsidies, banking and wheeling, group captive, F.I.Ts, etc. These changes hamper the existing projects making them unviable and also affect future investment. The policies should be clear and fixed for a specific duration of time and changes (if any) should be forecasted. Encouragement with Accelerated depreciation and adequate GBIs should be continued as well.

Solar Energy

Overview

Solar PV systems convert sunlight directly into electricity; the conversion is explained by the “photoelectric effect,” which was observed by Becquerel in 1839 [28, 29]. Solar P–V panels provide some important advantages: they can be manufactured in bulk providing for economics of scale, are emission free with simple operation and maintenance, the technology is quite flexible with respect to applications which range from small scale like calculators, rooftop P–V, etc., to large-scale utility P–V plants [30]. Solar thermal technologies concentrate direct sunlight with mirrors creating high energy densities to be absorbed by some material surface. The energy is then used to drive conventional cycles like steam, gas turbine, or sterling engine for electricity generation [31]. The solar installation in India is dominated by photovoltaic systems due to the various problems surrounding solar thermal plants, like the absence of proper direct normal irradiation (DNI) data, very high installation and operating costs, and the requirement of water, like in coal-based thermal plants [32].

Radiation Potential of India

Owing to its high DNI, India has huge potential for solar energy—about 5000 trillion kWh per year [33]. The solar radiation incident over India is equal to 4–7 kWh per square meter per day [34] and 1200–2300 kWh per square meter annually [35]. The country has up to 300 sunny days [34] and up to 3200 h of sunshine per year [36]. Solar radiation levels differ across the country, as shown in Fig. 8 [37]. The top states receiving the highest amounts of annual global radiation are Rajasthan, northern Gujarat, and parts of the Ladakh region. However, portions of Andhra Pradesh, Maharashtra, and Madhya Pradesh also receive a good amount of radiation in comparison to Japan, the USA, and Europe, which have utilized their solar potential to a much better extent [37]. The potential for harvesting solar energy in India can be understood by a report published by MNRE, which states that the wastelands alone, like the Thar Desert in Rajasthan, parts of Jammu and Kashmir, and Ladakh, can harness as much as 750 GW capacity, which is more than twice the current total installed capacity (thermal and renewable) of 344 GW [38].

Solar insolation in India [37]

Solar Thermal Power (S.T.P)

S.T.P is in nascent stage in India. The two most mature S.T.P technologies are Parabolic Trough Collector (P.T.C) and Central Receiver system (C.R.S). In PTC temperature of the Heat Transfer Fluid (HTF) can go as much as 500 °C when using pressurized water and 550 °C in case of molten salt. In CRS, the temperature of HTF can go as high as 1000 °C in pressurized gas/air. Other HTFs used in CRS are water/steam and liquid sodium. The pressurized air/gas at high temperature can even be used as working fluid in turbines of Natural gas-based power plant to achieve overall higher efficiencies. The concept is called integrated solar combined cycle power plants (ISCCPP). In India, there is a 50 MW Godavari power plant at Rajasthan based on PTC and a 2.5 MW C.R.S plant at Bikaner district in Rajasthan built by ACME solar.

The economic potential for STP in India is estimated by various studies (which includes an exclusion for higher wind speeds for wind energy and land availability analysis) to be about 571 GW at D.N.I 2000 kWh/m2 at wind speed ≥ 150 m/s and 756 GW for D.N.I ≥ 1800 kWh/m2 [39, 40]. S.T.Ps also have two major advantages compared to P–V, which may favor the technology. (1) its ability to be stored in the form of heat in thermal storage tanks with nitrate salts of sodium, lithium, etc., and be released later for running the thermodynamic cycle, this will enhance the dispatchability of the resource, the current research is focused on improving the CUF of the STP plants by enhancing thermal storage so as to bring the levelized cost of electricity which is currently near 12 Rs/kWh in India. Madaeni et al. has shown such improvements can be made by enhancing thermal energy storage [41]. (2) It can be used in conjunction to clean sources like Natural Gas-based plants in a combined cycle for higher thermal efficiencies. Elmohlawy et al. [42], Boretti et al. [43], Bonforte et al. [44], Rashid et al. [45], Mehropooya et al. [46], Alqahtami et al. [47] have shown that the concept can be utilized for improving economics and fuel utilization. The main reasons for negligible utilization of the STP in India are high costs and complexities involved with erecting a S.T.P plant; solar P–V plants easily solve both of which. There is a need of precise D.N.I data, material and technological improvements, cost-effective storage mediums, local manufacturing of various components to meet economics of scale, and policy support at initial stages to bring the sector in forefront.

Evolution of Solar Energy in India

The oil crises of 1973–1977 forced the policy makers in India to think of more reliable forms of energy. This led to the National Fuel Policy in 1973 and the Working Group on Energy Policy in 1979, which recognized the need for renewable energy. The Department of Non-conventional Energy Resources (DNES) was formed in 1982, and was renamed as the MNRE with the liberalization of the power sector in the 1990s. The Electricity Regulatory Commissions Act in 1998 was formed for the purpose of distancing the government from tariff determination and enhancing private participation [48]. The CERC and SERC were set up to determine tariffs and formulate regulations for the power sector [49]. It was with the introduction of the Electricity Act in 2003, however, that renewable energy became mandatory, with an RPO-renewable purchase obligation that mandates each state procure at least 5% of its power in renewables by 2010, an increase of 1% per year for the next 10 years (15% share by 2020) [50]. All of the reforms since 1990s led to a steep rise in wind energy installations of more than 10 GW by 2008, but solar installations remained dismal at nearly 10 MW in 2008 [48].

In January 2010, the Jawaharlal Nehru National Solar Mission (JNNSM) was launched, which triggered a solar revolution in India. The mission was to be implemented in three phases to achieve a target of 20 GW (utility and rooftop) of solar capacity by the end of 2022 (Table 2) [51]. With the JNNSM, a massive rise in the installed solar capacity was seen, which was just 10 MW in 2008 compared to 10 GW of wind installations (Fig. 9).

An exponential rise in the solar capacity additions can be seen after 2014. India added 4131 MW between FY 2014–2016 and 9362 MW in the year 2017–2018—the highest addition in the country. India’s current installed solar power capacity as of March 2018 is 21.65 GW. Since the country was way ahead of its previous target of 20 GW by 2022, the JNNSM was revised in July 2015 to set a target of 100 GW by 2022. The revised targets are given in Table 3 [53]. The relative slowdown in the wind sector and the increase in solar capacity after 2014 has led to a significant portion of solar capacity in India’s current renewable energy mix (as of March 2018; Table 4, Fig. 10) [54].

Bifurcation of renewable installed capacity [54]

Solar Tariffs’ Steep Fall in India

Solar power capacity has seen a serious rise recently, from 3 GW in FY 2015 to 12 W in FY 2017. Today, the solar power tariffs are competitive with variable coal power. The minimum tariffs fell from 12.16 Rs/kWh in 2010 to 2.44 Rs/kWh in 2017, which is around a 73% drop over the time frame (Fig. 11) [55]. The falling trend reached a landmark in a bid for a 500 MW plant in Bhadla, Rajasthan, reaching a tariff of INR 2.44 per unit in May 2017—the lowest solar tariff ever. For the reverse auctions conducted in April 2017, the average bid was around 3.15 Rs/kWh. In comparison, NTPC’s coal tariff was near 3.20 Rs/kWh for the same period showing that the P–V electricity had been around 18% cheaper in comparison to coal. The falling prices have been attributed to many factors like the use of low-cost P–V panels from china, lower borrowing cost, introduction of solar parks, competitive auctions and the entrance of large power companies [55].

Falling solar tariffs (minimum) [55]

The trend of lowering solar tariffs has also been seen around the world (see Table 5) [56].

According to an estimate by KPMG in India’s analysis for FY 2022, about 108 GW of coal power capacity will have a variable tariff of less than INR 3 per unit, suggesting that it is economically feasible to replace large amounts of coal-based generation with solar power [57].

Manufacturing Challenge

The PV module costs have seen a continuous fall in the past few decades. The prices have fallen by a massive 99% from 1976 to 2015 and continue to fall further; the same period witnessed a nearly 280-fold increase in global annual PV installations. The decreasing global cost of solar panels has made grid parity possible in India.

According to the MNRE, in order to meet its target of 100 GW of solar power by 2022, there is a need for PV panels on the order of 20 GW annually; it would be desirable to handle a lot of the manufacturing capacity domestically in order to achieve more stable and lower values of solar tariffs and promote the industry. However, according to Bridge to India, the total module manufacturing capacity as of 2016 was estimated at 5.2 GW, but most of it was obsolete, sub-scale, and non-competitive [58]. The domestic production in 2016 was just about 1.3 GW; consequently, India has had to import more than 88% of its solar PV modules from other countries, mostly China (Fig. 12) [59].

Breakdown of solar PV imports [59]

The dismal performance of solar P–V manufacturing in India can be attributed to a number of factors, like inferior technology and improper ground policy implementation. Most of the raw materials and technology are imported and not generated within the country, which leads to much higher prices for Indian PV modules in comparison to those from China (Fig. 13) [60].

Discrepancy in prices of Chinese and Indian solar modules [60]

Due to the decreasing PV module prices from China, the solar tariff in India is on a continuous decline, leading to cost-effective expansion of solar power but increased dependence on imports year after year could seriously damage the local manufacturers who are unable to compete with Chinese quality and price. The Indian government needs to frame adequate policies to determine the proper balance between the desire to expand its installed capacity and the need to protect its local manufacturers by imposing proper safeguards and anti-dumping regulations.

Expansion Challenges

The inability to store intermittent solar energy in an economic manner represents the greatest challenge for any country wishing to expand its renewable capacity. The CUF of solar power plants is low (15–22%), which means that it will always need some other power source to provide its base load capacity; also, renewable energy is transferred to the grid on a “priority basis,” meaning that the “fossil fuel plants need to shut down” when adequate power is produced from renewable sources like solar. This will lead to lower plant load factors (PLFs) from fossil fuel plants and losses especially to merchant plants selling power on the open market, as they do not have power purchasing agreements with state governments. The PLF of coal-based plants in the year 2009–2010 was 77.5% and fell to just 59.88% by 2016–2017 [61]. Given the target of 175 GW by 2022 and the continued expansion of fossil fuel plants, the problem needs serious attention. There is a need to enhance the transmission system so that excess power from renewables to fossil fuel plants can be transferred to power-deficit regions, avoiding any forced curtailment of power.

The industry is also concerned about the adequacy of the transmission infrastructure to absorb the huge influx of renewables. Many completed large-scale projects were unable to be commissioned during the fourth quarter of 2017 due to delays in grid infrastructure and evacuation issues [62].

To handle the addition of a huge amount of renewable energy capacity, India launched the Green Energy Corridor in 2013, a 380 billion USD intra/interstate transmission network to connect renewable energy–rich states to those in deficit. These centers will also be responsible for forecasting and scheduling renewable energy generation at state and regional levels and coordinating with state load dispatch centers. The stipulated target under GEC is 8500 circuit (ckt)-kms of installed transmission lines by March 2020. According to the standing committee report, the budget allocated for 2018–2019 is 6 billion USD for the installation of 1900 ckt-kms. This will still lead to 5500 ckt-kms of installations pending for the year 2019–2020 [63]. This lack of funding should be dealt with, as it can cause serious damage to future developers who may go into debt or avoid bidding because of the absence of proper transmission capabilities.

As solar energy fluctuates, grid stability is another issue, as several states like Uttar Pradesh, Punjab, Maharashtra, Haryana, Andhra Pradesh, Gujarat, and Tamil Nadu have imposed deviation charges to maintain the stability of the grid [62].

Land acquisition is also problematic, as a requirement for the solar utility scale is huge 1 MW installations that require up to four acres of land. In 2016, the government of India approved 34 solar parks in 21 states with an aggregate capacity of 20 GW. Solar parks are large-scale utility stations with a capacity of more than 500 MW. These are lands specially developed by the government to provide easy access to land, clearances, and evacuation infrastructure to the developers. It may also offer other advantages like guaranteed off-take. The problems associated with developing solar parks include land acquisition conflicts like the one in the Anantapur district in Andhra Pradesh and delays in evacuation infrastructure [64].

The limitations associated with large-scale utility plants, like the availability of land, difficult geographical terrain, transmission and distribution losses (T&D; ~ 23%), extension of the power grid, and aggregate technical and commercial losses (AT&C; ~ 25%), also make off-grid/decentralized solar power a very attractive option [65]. In Germany, where renewable energy penetration is among the highest in the world, almost 70% of the installed capacity is in the form of solar rooftop installations [66]. However, despite government support, like direct capital subsidy, e-governance initiatives, and net metering policies, the presence of rooftop/decentralized solar installations is very dismal in India. As of September 2017, the installed capacity is just 1.8 GW, while the target for rooftop installations under JNNSM is 40 GW by 2022. The slow development of off-grid/decentralized power has been attributed to various factors, like lack of education among end users regarding government subsidies and policies, lack of funding from banks because of the unproven nature of renewable energy, and poor technical/commercial skills [67].

Conclusion

With the introduction of reverse auctions, among other factors, the solar–wind tariffs in India are now comparable and even lower in comparison to coal tariffs. Hence, we can infer that the aggressive expansion of both these sectors is going to continue. There is a need to add new dimensions to them, such as offshore wind. In order to further enhance the sectors, some areas warrant attention, like the manufacturing capabilities of India’s PV panels, which continuously fall short in quality in comparison to their Chinese counterparts, the need to enhance spending on transmission capabilities, especially interstate transmissions that will allow states to meet their RPOs and avoid curtailment of power. More clarity and public awareness is required to increase rooftop installations, which still lag behind the targeted goals at just ~ 2 GW. Finally, there is a need to increase the installations of other sustainable resources like nuclear energy to provide backing power to solar–wind other than coal. A mix of solar–wind and nuclear could be a good potential combination to phase out coal-based power generation in India.

Notes

In an ordinary auction (also known as a 'forward auction'), buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

References

http://www.worldometers.info/world-population/india-population/

https://web.archive.org/web/20180503151432/http://mnre.gov.in/physical-progress-achievements

https://mercomindia.com/solar-2-percent-total-power-generation/

https://www.iea.org/statistics/statisticssearch/report/?country=INDIA&product=indicators&year=2015

https://www.carbonbrief.org/guest-post-why-indias-co2-emissions-grew-strongly-in-2017

https://coal.nic.in/content/production-supplies, https://ujwalbharat.gov.in/

S.K. Guttikunda, P. Jawahar, Atmospheric emissions and pollution from the coal-fired thermal power plants in India. Atmos. Environ. 92, 449–460 (2014)

http://www.wri.org/ {world resource institute}

A. Mani, Wind Energy Resource Survey in India—I (Allied Publishers Limited, New Delhi, 1995), p. 185. ISBN 81-7023-297-X

All India installed capacity of power stations (PDF). March 2018. Retrieved 16 April 2018

SRLDC monthly report, March 2015 (PDF). Retrieved 8 May 2015

https://mnre.gov.in/file-manager/akshay-urja/october-2017/Images/20-25.pdf

https://mnre.gov.in/sites/default/files/webform/notices/RPO%20Compliance%20cell%20order.pdf

https://mercomindia.com/no-ists-charges-wind-solar-projects-commissioned-2022/

http://www.fowind.in/uploads/default/files/report/stuff/bbf012b136f5b4618c619af3a18d960b.pdf

http://niwe.res.in/assets/Docu/FOWIND/FOWIND_2017_Final_Outlook_2032.pdf

http://www.fowind.in/uploads/default/files/report/stuff/f8cedae4da92519cd77be91a6eac2cea.pdf

https://mnre.gov.in/sites/default/files/schemes/Repowering-Policy-of-the-Wind-Power-Projects.pdf

https://mnre.gov.in/sites/default/files/webform/notices/National-Wind-Solar-Hybrid-Policy.pdf

A Research and Development on Renewable Energies: A Global Report on Photovoltaic and Wind Energy, ISPRE (2009)

B. Parida, S. Iniyan, R. Goic, A review of solar photovoltaic technologies. Renew. Sustain. Energy Rev. 15, 1625–1636 (2011)

T.M. Razykov, C.S. Ferekides, D. Morel, E. Stefanakos, H.S. Ullal, H.M. Upadhyaya, Solar photovoltaic electricity: current status and future prospects. Sol. Energy 85, 1580–1608 (2011)

S.M. Moosavian, N.A. Rahim, J. Selvaraj, K.H. Solangi, Energy policy to promote photovoltaic generation. Renew. Sustain. Energy Rev. 25, 44–58 (2013)

C. Philibert, The Present and Future Use of Solar Thermal Energy as a Primary Source of Energy. Solar Thermal Energy. Technical Report. Paris: International Energy Agency (2005). http://www.iea.org/publications/freenewDesc.asp?PUBSID=1574. Accessed 21 Sept 2010

A. Kumara, O. Prakashc, A. Dubec, A review on progress of concentrated solar power in India

S. Pandey, V.S. Singh, Determinants of success for promoting solar energy in India. Renew. Sustain. Energy Rev. 16, 3593–3598 (2012)

A. Kumar, K. Kumar, Renewable energy in India: current status & future potentials. Renew. Sustain. Energy Rev. 14, 2434–2442 (2010)

MNRE. Annual Report, NewDelhi; 2006

N.K. Sharma, P.K. Tiwari, Solar Energy in India: strategies, policies, perspectives & future potential. Renew. Sustain. Energy Rev. 16, 933–941 (2011)

Garud, S, Purohit, I. Making solar thermal power generation in India a reality—overview of technologies, opportunities and challenges, The Energy and Resources Institute (TERI), Darbari Seth Block, IHC Complex, Lodhi Road, New Delhi 110003, India

India’s Solar Power Potential Estimated at 750 GW. http://cleantechnica.com/2014/11/29/indias-solar-power-potential-estimated-750-gw/ Accessed 7 Jan 2015

I. Purohit, P. Purohut, Technical and economic potential of concentrating solar thermal power, generation in India. Renew. Sustain. Energy Rev. 78, 648–667 (2017)

C. Sharma et al., Assessment of solar thermal power generation potential in India. Renew. Sustain. Energy Rev. 42, 902–912 (2015)

S.H. Madaeni, R. Sioshansi, P. Denholm, How thermal energy storage enhances the economic viability of concentrating solar power. Proc. IEEE 100(2), 335–347 (2012)

A.E. Elmohlawy et al., Study and analysis the performance of two integrated solar combined cycle. Energy Procedia 156, 79–84 (2019)

A. Boretti et al., A case study on combined cycle power plant integrated with solar energy in Trinidad and Tobago. Sustain. Energy Technol. Assess. 32, 100–110 (2019)

G. Bonforte et al., Exergo-economic and exergo-environmental analysis of an integrated solar gas turbine/combined cycle power plant. Energy 156, 352–359 (2018)

K. Rashid et al., Techno-economic evaluation of different hybridization schemes for a solar thermal/gas power plant. Energy 181, 91–106 (2019)

M. Mehropooya et al., Investigation of a combined cycle power plant coupled with a parabolic trough solar field and high temperature energy storage system. Energy Convers. Manag. 171, 1662–1674 (2018)

B.J. Alqahtami et al., Integrated solar combined cycle power plants: paving the way for thermal solar. Appl. Energy 169, 927–936 (2016)

K. Yanneti, The grid connected solar energy in India: structures and challenges. Energy Strategy Rev. 11–12, 41–51 (2016)

S. Mukherjee et al., Status of Electricity Act, 2003: A systematic review of literature. Energy Policy

An overview of Indian energy trends, low carbon growth and development challenges, prays energy group, Pune, India (2009)

http://indianpowersector.com/electricity-regulation/national-solar-mission/

“Installed capacity of wind power projects in India”. Retrieved 7 April 2018

T. Kapoor, Scaling up of Grid Connected Solar Power Projects”(PDF). Ministry of New and Renewable Energy. 2015. Archived from the original (PDF) on February 26 (2017)

Share renewables of India: all India installed capacity of utility power stations (pdf). Retrieved 5 April 2018

https://mercomindia.com/mercom-exclusive-solar-tariffs-india-fallen-73-percent-since-2010/

https://assets.kpmg/content/dam/kpmg/in/pdf/2017/09/Solar-beats-coal-cost.pdf

https://www.ft.com/content/a6599b78-f9cc-11e7-9b32-d7d59aace167

https://powermin.nic.in/en/content/power-sector-glance-all-india

https://mercomindia.com/grid-infrastructure-india-solar-wind-tenders/

Mercom Exclusive: Incomplete Solar Park Infrastructure Affecting Large-Scale Project Development in India

T. Muneer, M. Asif, S. Munawwar, Sustainable production of solar electricity with particular reference to the Indian economy. Renew. Sustain. Energy Rev. 9, 444–473 (2005)

Ministry of New and Renewable Energy Sources. Available from: 593 http://mnre.gov.in/file-manager/UserFiles/workshop-gcrt-0870616/german.pdf

P.K.S. Rathore, D.S. Chauhan, R.P. Singh, Decentralized solar rooftop photovoltaic in India: on the path of sustainable energy security. Renew. Energy 131, 297–307 (2019)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Singh, A.K., Idrisi, A.H. Evolution of Renewable Energy in India: Wind and Solar. J. Inst. Eng. India Ser. C 101, 415–427 (2020). https://doi.org/10.1007/s40032-019-00545-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40032-019-00545-7