Abstract

Many studies have shown that women pay a wage penalty for motherhood, whereas men earn a wage premium for fatherhood. A few recent studies have used quantile regression to explore differences in the penalties across the wage distribution. The current study builds on this research and explores trends in the parenthood penalties and premiums from 1980 to 2014 for those at the bottom, middle, and top of the wage distribution. Analyses of data from the Current Population Survey show that the motherhood wage penalty decreased, whereas the fatherhood wage premium increased. Unconditional quantile regression models reveal that low-, middle-, and high-earning women paid similar motherhood wage penalties in the 1980s. The motherhood wage penalty began to decrease in the 1990s, but more so for high-earning women than for low-earning women. By the early 2010s, the motherhood wage penalty for high-earning women was eliminated, whereas low-earning women continued to pay a penalty. The fatherhood wage premium began to increase in the late 1990s, although again, more so for high-earning men than for low-earning men. By the early 2010s, high-earning men received a much larger fatherhood wage premium than low- or middle-earning men.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Women pay a wage penalty for motherhood, whereas men earn a wage premium for fatherhood (e.g., Anderson et al. 2003; Avellar and Smock 2003; Budig and England 2001; Hodges and Budig 2010; Killewald and Gough 2013; Waldfogel 1997; Yu and Kuo 2017). In recent years, research has focused on two questions: do those at the top or bottom of the earnings distribution pay a more substantial motherhood wage penalty (Budig and Hodges 2010; Cooke 2014; England et al. 2016; Killewald and Bearak 2014)? And has the motherhood wage penalty declined over the past few decades in the United States (Pal and Waldfogel 2016; Weeden et al. 2016)? To the best of my knowledge, no study has looked at these two issues simultaneously. This is a significant omission for at least two reasons.

First, the decline in gender inequality over the last half-century has fundamentally altered women’s and men’s lives. This change, which has been called a “grand gender convergence” (Goldin 2014) or a “gender revolution” (England 2010) centers on the influx of women into the labor force, the decline in the gender wage gap, and the rise in cultural support for working mothers. The statistics are common knowledge, but they bear repeating. In 1975, 47 % of mothers worked for pay, but by 2015, 70 % of mothers worked for pay (U.S. Bureau of Labor Statistics 2016). In 1970, women earned 62 % of what men earned. The gender wage ratio increased to 72 % by 1990. The convergence slowed in the 1990s, but by 2010, the wage ratio was still up to 83 % (Bailey and DiPrete 2016; Blau and Kahn 2016). By 2009, women were 47 % of the total workforce, and for the first time, the majority of workers in managerial and professional occupations (Buchmann and McDaniel 2016).

Second, as income and wage inequality between women and men decreased, income and wage inequality among women and among men increased (Autor et al. 2008; Blau 1998; Card and DiNardo 2002; Western and Rosenfeld 2011). As McCall and Percheski (2010) noted, the level of income inequality today is higher than at any point in the past 40 years. Occupations have become more polarized, and those at the top of the distribution have more resources, more flexibility, and more job security (Kalleberg 2011, 2012). These structural changes are pervasive and have touched nearly every facet of women’s and men’s lives. It is reasonable to assume that they have affected high- and low-earning parents differently, yet few—if any—studies have explored trends in the family wage gap across the earnings distribution. Three studies (Buchmann and McDaniel 2016; Pal and Waldfogel 2016; Weeden et al. 2016), all published in a recent edition of the Russell Sage Foundation Journal of the Social Sciences, come close. These studies analyzed data from the Current Population Study (CPS) to explore trends in the family wage gaps, but they did not analyze differences across the wage distribution. Building on these, I use the 1980–2014 CPS and an unconditional quantile regression approach to explore changes in the parenthood penalties and premiums for those at the bottom, middle, and top of the wage distribution. This study focuses explicitly on trends and provides a jumping-off point for future research to consider the causal mechanisms that underlie such trends. Before turning to the analyses, I review recent research on the family wage gaps.

The Motherhood Wage Penalty and the Fatherhood Wage Premium

The motherhood wage penalty has a few interrelated causes. Motherhood leads to a more traditional division of household labor (Sanchez and Thomson 1997), and women shoulder more responsibility for childcare. This may leave them with less time and energy for paid work. Kmec (2011) found no difference between mothers’ and childless women’s work effort, work intensity, motivation to work because of family, and other pro-work behaviors. But a more recent study by Azmat and Ferrer (2017) found that young children reduce women’s job performance, which in turn reduces their likelihood of promotion.

Another explanation for the motherhood wage penalty, which has received considerable empirical support, proposes that employers consciously or subconsciously discriminate against mothers. A number of recent studies show that mothers are viewed as less competent, capable, and committed than women without children (Benard and Correll 2010; Correll 2004; Correll et al. 2007). These perceptions may seep into hiring, promotion, and compensation decisions.

Finally, many women take time off for childbearing and childrearing, and this reduces their seniority, job-related skills, and experience (Aisenbrey et al. 2009; Staff and Mortimer 2012). Budig and England (2001) found that the decline in women’s human capital explains about one-third of the total motherhood wage penalty.

Similar mechanisms account for the fatherhood wage premium. Parenthood tends to increase household specialization: men spend more time and energy on paid work, and women devote more time and energy to their families. Killewald and García-Manglano (2016) found that motherhood is associated with a decrease in paid work time, an increase in housework, and a wage penalty. Partnered fatherhood, in contrast, is associated with a modest increase in housework, no change in paid work hours, and a wage premium. Findings from other studies echo these results (e.g., Glauber 2008; Killewald 2013). Only a few studies, however, have explored differences in the parenthood penalties and premiums across the earnings distribution.

Parenthood Penalties and Premiums Across the Earnings Distribution

A large portion of the gender wage gap can be attributed to the differential effects of parenthood on the gender division of labor. It is important to understand variation in the parenthood penalties and premiums at various points on the earnings distribution because they affect gender wage inequality in general. Quantile regression models, both unconditional and conditional, help us understand the effect of a covariate (in this case, parenthood) on the entire distribution of the outcome (in this case, wage). As such, quantile regression improves on ordinary least squares (OLS) regression, which tells us only about the effect of a covariate on the conditional mean outcome.

Budig and Hodges (2010) were the first to explore variation in the motherhood wage penalty across the wage distribution. They analyzed data from the National Longitudinal Survey of Youth (NLSY79) and estimated conditional quantile regression models with person-specific fixed effects. The authors found that the motherhood wage penalty is larger for women at the bottom of the wage distribution. Killewald and Bearak (2014) published a brief reanalysis, which Budig and Hodges (2014) accepted, and noted that the original study should have used unconditional quantile regression (UQR) models. As Killewald and Bearak (2014:350) noted, UQR is “an analytic method that can be used to estimate varying associations between predictors and outcomes at different points of the outcome distribution.” Using the NLSY79 and UQR with fixed effects, Killewald and Bearak (2014) found that the motherhood wage penalty is largest for those in the middle of the wage distribution. Most recently, England et al. (2016) used the NLSY79 and UQR models with fixed effects and found that the motherhood wage penalty is largest for highly paid, highly skilled women.

In contrast to these studies, Cooke (2014) did not use the NLSY79 and instead used cross-sectional data from the Luxembourg Income Study (LIS) to analyze cross-national differences in the parenthood penalties and premiums across the wage distribution. The author used UQR models (but without person-specific fixed effects) and found that in the United States in 2004, the motherhood wage penalty was largest for women at the bottom of the wage distribution and smallest for those at the top. In contrast, the fatherhood wage premium was largest for men at the top of the wage distribution. This study did not explore temporal trends.

Penalties and Premiums Over Time

Most studies on the family wage gap have analyzed data from the NLSY79, a cohort of women and men who became parents during the 1980s and early 1990s (e.g., Budig and Hodges 2010; England et al. 2016; Hodges and Budig 2010; Killewald and Bearak 2014). The NLSY79 provides a broad array of variables, and it follows the same people over time, which helps researchers isolate causal effects. The main limitation of the NLSY79 is that it cannot be used to understand more contemporary trends.

A few studies have explored recent trends in the parenthood penalties and premiums using the CPS. Pal and Waldfogel (2016), for example, found that the motherhood wage penalty has decreased since the early 1980s. Weeden et al. (2016) also analyzed data from the CPS and found that since the mid-1980s, the motherhood wage penalty has decreased whereas the fatherhood wage premium has increased. Buchmann and McDaniel (2016) found that from 1980 to 2010, the motherhood wage penalty decreased for highly educated professionals. In fact, by 2010, mothers in very elite occupations, including those in medicine and law, earned a wage premium. These studies shed light on trends over time, but they do not help us understand differences across the wage distribution.

Women and men at the top of the wage distribution have fared well over the past couple of decades (e.g., Autor et al. 2008; Lemieux 2008; Piketty and Saez 2003). Many have gained financial resources, which may improve, or at least protect, their productivity following the transition to parenthood. Parents at the upper end of the earnings distribution may be able to purchase high-quality, stable childcare, for example, which could provide greater peace of mind and fewer work-related absences. They may also have more flexibility, autonomy, seniority, and labor market experience than others. It is reasonable to expect that rising inequality since the 1980s had differential effects on mothers and fathers at the bottom, middle, and top of the earnings distribution, and it is this expectation that I test in the current study.

Method

Sample

The March CPS, a monthly survey of about 57,000 U.S. households, was obtained from the Integrated Public Use Microdata Series (King et al. 2010). Following previous research that has used the CPS to estimate parenthood penalties and premiums (Buchmann and McDaniel 2016; Pal and Waldfogel 2016), I restrict the sample to individuals aged 25 to 44. I analyze change from 1980 to 2014 by estimating separate regressions for five-year periods (for example, from 1980 to 1984, 1985 to 1989, and so on). Avellar and Smock’s (2003) study showed little change in the motherhood wage penalty prior to the 1980s. Given these results and a need to simplify the current presentation, I show results beginning with the 1980s.

Measures

The primary dependent variable is the log hourly wage adjusted for inflation to 2014 dollars using the consumer price index (CPI). Hourly wage is constructed by dividing annual pretax earnings by the number of weeks worked and the number of hours usually worked per week. Following conventional practice (Lemieux 2006; Mouw and Kalleberg 2010), I multiply all CPS top-coded earnings by 1.4 before calculating hourly wages. I exclude workers making less than $1 per hour and those making more than $300 per hour.

The primary independent variable is a dichotomous measure indicating that a child under the age of 18 resides in the household. I also present results for two alternative specifications. One includes categorical measures for one, two, and three or more children under the age of 18 residing in the household; the other includes a continuous measure of the number of children under the age of 18 residing in the household. All the regression models include controls for age and a quadratic in age, marital status, education, race/ethnicity, geographical region, part-time work hours (fewer than 35 hours per week), industry, and occupation. The online appendix Table A1 shows descriptive statistics for these variables.

Analytic Strategy

Following England et al. (2016), Killewald and Bearak (2014), and Cooke (2014), I use UQR models to analyze differences in the parenthood penalties and premiums across the wage distribution. Whereas OLS regression allows us to estimate the effect of a given variable at the mean, UQR, which was first proposed by Firpo et al. (2009), allows us to estimate the effect of a variable on a person’s position in the wage distribution. The regression consists of transforming the dependent variable into a recentered influence function (RIF) of the unconditional quantile and then estimating a regression of the transformed dependent variables on covariates. The transformations are calculated separately for men and women. The RIF is calculated from the following equation, where Y is the outcome variable, wage; qτ is the value of wage at the given quantile, τ; FY is the unconditional distribution of wage; 1 {Y ≤ qτ} is an indicator that is equal to 1 if the value of wage for a specific woman or man is less than the qτ; and fY(qτ) is the density function at qτ that is estimated using the Gaussian kernel density estimator.

The unconditional quantile regression consists of estimating the following regression on the transformed dependent variable:

Most analyses of the parenthood penalties and premiums use fixed-effects models to control for the selection of women and men into parenthood. Although I cannot control for unobserved heterogeneity using the CPS, previous research suggests that it accounts for just 15 % to 30 % of the motherhood wage penalty (e.g., Anderson et al. 2003; Budig and England 2001).

Results

Descriptive Statistics

Table 1 presents descriptive statistics for some of the variables used in the analyses. An online appendix (Table A1) provides descriptive statistics for all of the variables. For simplicity, Table 1 shows only the earliest and latest periods. Men in the bottom quintile earned a similar wage in the early 1980s as they did in the early 2010s: $9.76 (in 2014 dollars) compared with $9.23. Men in the top quintile, however, saw their average wage increase from $43.28 to $57.06. Put another way, in the early 1980s, high-earning men made 4.4 times more than low-earning men. But by the early 2010s, high-earning men earned 6.2 times more than low-earning men. The same holds true for women. In the beginning of the 1980s, high-earning women made 4.3 times more than low-earning women. But by the early 2010s, high-earning women made almost 6 times more than low-earning women. These results are consistent with the story of rising inequality driven by an increase at the top of the distribution (e.g., Hacker and Pierson 2010).

A Decrease in the Motherhood Penalty for High Earners

From the early 1980s to the early 2010s, the motherhood wage penalty decreased, whereas the fatherhood wage premium increased, although only marginally so. Table 2 presents OLS estimates that reflect changes in the parenthood penalties and premiums at the mean. The motherhood wage penalty was 7 % in the early 1980s, 5 % at the beginning of the 1990s, 2 % at the start of the 2000s, and negligible by the early 2010s. These results are very similar to those reported by Pal and Waldfogel (2016). They found that women paid an 8 % motherhood wage penalty between 1981 and 1983 and a 9 % wage penalty between 1984 and 1986. They also found that the motherhood wage penalty decreased to 3 % by 2001 to 2004 and to 1 % by 2011 to 2013. Similarly, Weeden et al. (2016) found that the motherhood wage penalty decreased by about 4 percentage points between 1984 and 2014. The results presented in Table 2 also show that fathers earned a 5 % to 6 % wage premium in the 1980s and 1990s and a 7 % to 8 % premium in the 2000s and early 2010s. These results are similar to those reported by Weeden et al. (2016).

The results are robust to various specifications and types of regression models. In both the OLS and UQR models (shown in Tables 3 and 4), the estimates are presented separately for various periods. In previous analyses, I included interactions between parenthood and the periods, and the trends remained the same. Further, all of the regression models include controls for age, education, marital status, race/ethnicity, part-time work hours, region, occupation, and industry. In other analyses that are not shown, I included spouse’s earnings (for those who were married) and the interactions between age and education. These variables did not alter the results, so they are omitted from the current regression models. Table 3 presents UQR models for women and men in the bottom, middle, and top quintiles. The online appendix presents results for more quantiles. To address uncertainty in the RIF, I calculate standard errors using 1,000 bootstraps. The differences between coefficients in the quantiles are significantly different if their 95 % confidence intervals do not overlap, which is a conservative test. The confidence intervals are presented in the online appendix.

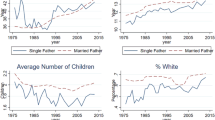

As Table 3 and Fig. 1 show, the motherhood wage penalty began to decrease in the 1990s, but the decrease was most substantial for high earners and was smallest for low earners. By the early 1990s, the motherhood wage penalty for high earners declined to 4 %. By the late 1990s, it fell to 1 %, and by the 2000s, the motherhood wage penalty for high earners was eliminated. High-earning women began to pull away from other women beginning in the mid-1990s. The motherhood wage penalty did not start to decline substantially for low earners until the early 2000s. By the beginning of the 2010s, high-earning women did not pay a motherhood wage penalty, middle-earning women paid a 1 % wage penalty, and low-earning women paid a 4 % wage penalty. These are all statistically significant differences. In short, although the motherhood wage penalty declined for low-, middle-, and high-earning women, the timing and magnitude of the decline differed.

An Increase in the Fatherhood Wage Premium for High Earners

As Table 3 and Fig. 2 show, low-, middle-, and high-earning fathers earned a similar wage premium throughout the 1980s and early 1990s. But by the late 1990s, the fatherhood wage premium had increased for men in the top quintile and had decreased for men in the bottom quintile. Between 1995 and 1999, high-earning men earned a 7 % premium, whereas low-earning men received a 3 % premium. The premium for low-earning men began to increase during the early 2000s only to decline again during the early 2010s. Thus, by the early 2010s, high-earning men earned a 10 % wage premium for fatherhood, middle-earning men earned a 6 % wage premium for fatherhood, and low-earning men earned a 5 % wage premium for fatherhood. In the early 2010s, the difference between high-earning men and middle- and low-earning men was statistically significant, whereas the difference between middle-earning and low-earning men was not. Put another way, from the early 1980s to the early 2010s, the fatherhood wage premium for high-earning men doubled from 5 % to 10 %. In contrast, the premium for both low- and middle-earning men remained the same in the early 2010s as it had in the early 1980s. The online appendix (Table A6) shows similar trends across a more extensive set of quantiles. Thus, to summarize, the fatherhood wage premium increased but only for high-earning men, whereas the motherhood wage premium decreased but, again, more so for high-earning women than for low- and middle-earning women.

Sensitivity Analyses With Alternative Measures of Parenthood

The trends for women and men are remarkably similar regardless of the way parenthood is measured. Table 4 presents estimates of the parenthood penalties and premiums from UQR models using alternative measures of parenthood. The first three columns show the penalties and premiums using a continuous measure of the number of children. Apart from the expected differences in magnitude, the results are similar to those presented in Table 3. During the early 1980s, high- and low-earning women paid a similar 3 % wage penalty per child, whereas middle-earning women paid a slightly larger 4 % penalty per child. By the early 1990s, the wage penalty per child for high earners declined to 2 %. By the late 1990s, it fell to 1 %, and by the early 2010s, the motherhood wage penalty for high earners was eliminated. Similar to the results shown in Table 3, the penalty per child decreased for low- and middle-earning women. But compared with high-earning women, the decrease came later and was smaller.

For men, the trends presented in Table 4 are similar to those shown in Table 3. Namely, low-, middle-, and high-earning men earned a similar 1 % premium per child in the early 1980s. As with the results shown in Table 3, the fatherhood wage premium did not increase for low- or middle-earning men. But for high-earning men, from the early 1980s to the early 2010s, the fatherhood wage premium tripled, from 1 % per child to 3 % per child.

The trends are also similar in UQR regression models that include categorical variables for one, two, and three or more children. These estimates are also presented in Table 4. Throughout the 1980s, low-, middle-, and high-earning women paid a similar wage penalty for one child that hovered between 2 % and 3 %. The penalty for one child decreased precipitously for high-earning women and was eliminated by the 1990s. Likewise, in the early 1980s, the motherhood wage penalty for two children was relatively similar for low, middle, and high earners: 6 %, 9 %, and 8 %, respectively. The penalty for two children started to decline for high-earning women in the 1990s. Finally, trends in the wage penalty for three or more children are similar, although—as expected—the penalty is larger. In the early 1980s, low-earning women paid a 10 % wage penalty for three or more children. Middle-earning women paid a 12 % wage penalty for three or more children, and high-earning women paid a 10 % penalty for three or more children. As Table 4 shows, the penalty for three or more children started to decline in the 1990s but, again, more so for high-earning women than for low-earning women. By the early 2010s, low-earning women paid an 8 % wage penalty for three or more children. Middle-earning women paid a 5 % wage penalty for three or more children, and high-earning women did not pay a penalty for three or more children.

The fatherhood wage premium follows similar patterns. In the early 1980s, low-, middle-, and high-earning men earned a similar wage premium for one child that ranged from 3 % to 4 %. Among low-earning men, the premium for one child decreased during the 1990s, increased during the 2000s, and then decreased back down to 4 % by the early 2010s. In contrast, for middle- and high-earning men, the premium for one child reached its highest point by the early 2010s. The wage premium for two children follows a pattern that is remarkably consistent with the results presented in Table 3. Namely, low-, middle-, and high-earning men earned a similar wage premium throughout the 1980s. The wage premium for two children increased most substantially for high-earning men. By the early 2010s, the wage premium for two children was 6 % for low-earning men, 8 % for middle-earning men, and 12 % for high-earning men. In other words, from the early 1980s to the early 2010s, the two-child wage premium for high-earning men nearly doubled from 7 % to 12 %. The same holds true for high-earning men with three or more children. In the early 1980s, high-earning men earned a 5 % premium for three or more children. By the early 2010s, these men earned a 12 % premium for three or more children. Thus, the results for both women and men are consistent across alternative measures of parenthood.

Sensitivity Analyses With Alternative Regression Methods

I also conducted sensitivity analyses using Heckman selection models and coarsened exact matching (CEM) models (Iacus et al. 2009). I present these models in the online appendix. Matching improves the estimation of causal effects by balancing treatment and control groups and reducing selection bias. Essentially, I try to match a parent to a childless individual when they are very similar in other respects (they are of the same age, they have the same education, and so on). With exact matching, individuals in the treatment and control groups are matched only when they have equal values on all pre-treatment characteristics. This produces a highly balanced sample, but it is often impractical and data demanding. Propensity score matching (PSM) matches individuals who come close to each other in pretreatment characteristics (but are not exactly matched). Propensity score matching poses problems because it requires the researcher to, a priori, set the size of the match (the degree of closeness they are willing to accept) and check for balance after the match. Numerous iterations may be necessary to achieve balance. In contrast, CEM stakes a middle ground between exact matching and PSM. It coarsens (or groups) variables and then exactly matches on the coarsened groups. A recent study found that CEM produces estimates of causal effects that are less biased than propensity score matching (King et al. 2011).

Coarsened exact matching works in three steps. In the first step, a group of variables were divided into distinct categories (they were “coarsened”). In the current study, I included age, marital status, education, race/ethnicity, occupation, industry, and period. In the second step, parents and childless individuals were exactly matched by sorting the sample into strata that had identical values on all the coarsened variables. In the third step, respondents were dropped from the sample if they had no close matches. Individuals were also assigned a CEM weight that was specific to their strata and accounted for the different sizes of the strata. Following CEM, I estimated OLS models on the sample of matched women and matched men using their CEM weight. The OLS models also included control variables to reduce remaining imbalances between parents and childless individuals. Online appendix Table A4 presents results from CEM models, and the trends are similar to those shown in Table 2. Namely, the motherhood wage penalty decreased, and the fatherhood wage premium increased, although only marginally.

The online appendix Table A4 also includes estimates from Heckman selection models. Sample selection poses a problem if parents who work for pay—and report wages—systematically differ from parents who do not work for pay. Following previous research on the motherhood wage penalty (e.g., Korenman and Neumark 1992), I used a Heckman (1979) two-step model to correct for this type of sample selection bias. In the first stage, I estimated a probit model of the likelihood of working from parenthood, age and a quadratic in age, marital status, education, race/ethnicity, period, and the natural log of nonlabor income. Following previous research (e.g., Budig et al. 2012), I included nonlabor income in the selection equation, but I excluded it from the wage equation. The estimates from Heckman selection models are again similar to the OLS estimates presented in Table 2.

Discussion and Conclusion

This research explores trends in the parenthood penalties and premiums from 1980 to 2014 for those at the bottom, middle, and top of the wage distribution. The results from OLS models presented in this study show that on average, the motherhood wage penalty decreased. These findings are consistent with other studies that have also used the CPS to analyze trends in the parenthood penalties and premiums (Buchmann and McDaniel 2016; Pal and Waldfogel 2016; Weeden et al. 2016). Results from the current study also show that the motherhood penalty has declined more substantially for high earners than for low earners. This decreasing wage penalty for mothers at the top of the earnings distribution is complemented by a rising wage premium for fathers at the top of the distribution. From the early 1980s to the early 2010s, the fatherhood wage premium for high-earning men doubled, from 5 % to 10 %. In contrast, low- and middle-earning men received the same 5 % to 6 % premium in the early 2010s as they did in the early 1980s.

These results extend our understanding of fathers’ labor market outcomes. Several studies have shown that some fathers receive a more substantial wage premium than others. Hodges and Budig (2010), for example, found that the fatherhood premium was larger for married men, white men, college graduates, those in professional or managerial occupations, and those in households with a more traditional gender division of labor. Killewald (2013) found that married, residential, and biological fathers earned a larger wage premium than unmarried fathers, nonresidential fathers, or stepfathers. Killewald and Gough (2013) also found that marriage increased the fatherhood wage premium. Most of these studies used the NLSY79, which has prevented an understanding of contemporary fathers and temporal changes to the fatherhood wage premium.

A recent study by Cooke (2014) used relatively recent data and UQR models to explore parenthood penalties and premiums across the wage distribution for those living in Australia, the United Kingdom, and the United States. The study found that in the United States, higher-earning fathers earned a larger wage premium than lower-earning fathers. In fact, men in the 10th and 25th percentiles paid a wage penalty. Men in the 75th and 90th percentiles earned, respectively, a 2 % and 5 % fatherhood premium. The current study extends Cooke’s (2014) analysis by exploring temporal change.

The results from the current study raise important questions for future research to consider. Namely, why has the fatherhood wage premium increased for high-earning men? And why has the motherhood wage penalty decreased so precipitously for high-earning women? These changes among high earners fit with the story of rising inequality that has been driven by gains at the top (e.g., Hacker and Pierson 2010). It is possible that those at the top of the earnings distribution have secured financial and job-related resources (such as flexibility and autonomy) that protect their productivity and allow them to devote more effort to their paid jobs.

The decrease in the motherhood wage penalty may also be due to an increase in women’s labor supply and, by extension, their labor market experience, job seniority, and accrual of job-specific skills. Anderson et al. (2002) found that women’s diminished labor market experience explained about one-quarter to one-third of the total motherhood wage penalty. Gangl and Ziefle (2009) found that labor market experience accounted for more than one-half of the wage penalty. Budig and England (2001) found that the loss of human capital explained about one-third of the total motherhood wage penalty. Staff and Mortimer (2012) showed that for young mothers, cumulative time out of school and work accounted for the entire motherhood wage penalty. Finally, England et al. (2016) found that labor market experience accounted for the larger motherhood wage penalty incurred by highly paid, highly skilled women.

The labor force participation rate of mothers rose from 47 % in 1975 to 70 % by 2015 (U.S. Bureau of Labor Statistics 2016). Motherhood reduced women’s employment by 21.8 percentage points in 1979 but by only 12.7 percentage points in 2005 (Boushey 2008). The decrease in the motherhood wage penalty at the top of the distribution may be due to an increase in women’s labor supply and labor market experience. The CPS provides large, nationally representative samples that allow for an understanding of contemporary trends in the family wage gaps, but it does not include specific measures that can help explain these patterns.

As noted at the beginning of this article, two changes have fundamentally altered women’s and men’s lives over the past half-century. Gender labor market inequality has decreased, while income inequality among women and among men has increased. The results reported in this study reflect both of these trends and are reminiscent of England’s (2010) conclusion of the “uneven” gender revolution. High-earning men earn a substantial bonus for fatherhood, but high-earning women no longer pay a wage penalty for motherhood. Full gender equality is far from realized, but high-earning contemporary mothers may fare better today than they did in the 1980s and 1990s. Low-earning women, however, pay a similar motherhood wage penalty today as they did in the early 1980s. Future research should not only explain the trends that are presented in this study but also situate our understanding within the broader context of growing economic inequality.

References

Aisenbrey, S., Evertsson, M., & Grunow, D. (2009). Is there a career penalty for mothers’ time out? A comparison of Germany, Sweden and the United States. Social Forces, 88, 573–605.

Anderson, D. J., Binder, M., & Krause, K. (2002). The motherhood wage penalty: Which mothers pay it and why? American Economic Review: Papers & Proceedings, 92, 354–358.

Anderson, D. J., Binder, M., & Krause, K. (2003). The motherhood wage penalty revisited: Experience, heterogeneity, work effort, and work-schedule flexibility. Industrial and Labor Relations Review, 56, 273–294.

Autor, D. H., Katz, L. F., & Kearney, M. S. (2008). Trends in U.S. wage inequality: Revisioning the revisionists. Review of Economics and Statistics, 90, 300–323.

Avellar, S., & Smock, P. J. (2003). Has the price of motherhood declined over time? A cross-cohort comparison of the motherhood wage penalty. Journal of Marriage and Family, 65, 597–607.

Azmat, G., & Ferrer, R. (2017). Gender gaps in performance: Evidence from young lawyers. Journal of Political Economy, 125, 1306–1355.

Bailey, M. J., & DiPrete, T. A. (2016). Five decades of remarkable but slowing change in U.S. women’s economic and social status and political participation. Russell Sage Foundation Journal of the Social Sciences, 2(4), 1–32.

Benard, S., & Correll, S. J. (2010). Normative discrimination and the motherhood wage penalty. Gender & Society, 24, 616–646.

Blau, F. D. (1998). Trends in the well-being of American women, 1970–1995. Journal of Economic Literature, 36, 112–165.

Blau, F. D., & Kahn, L. M. (2016). The gender wage gap: Extent, trends, and explanations (NBER Working Paper No. 21913). Cambridge, MA: National Bureau of Economic Research.

Boushey, H. (2008). “Opting out?” The effect of children on women's employment in the United States. Feminist Economics, 14(1), 1–36.

Buchmann, C., & McDaniel, A. (2016). Motherhood and the wages of women in professional occupations. Russell Sage Foundation Journal of the Social Sciences, 2(4), 128–150.

Budig, M. J., & England, P. (2001). The wage penalty for motherhood. American Sociological Review, 66, 204–225.

Budig, M. J., & Hodges, M. J. (2010). Differences in disadvantage: Variation in the motherhood wage penalty across white women’s earnings distribution. American Sociological Review, 75, 705–728.

Budig, M. J., & Hodges, M. J. (2014). Statistical models and empirical evidence for differences in the motherhood penalty across the earnings distribution. American Sociological Review, 79, 358–364.

Budig, M. J., Misra, J., & Boeckmann, I. (2012). The motherhood penalty in cross-national perspective: The importance of work–family policies and cultural attitudes. Social Politics: International Studies in Gender, State and Society, 19, 163–193.

Card, D., & DiNardo, J. E. (2002). Skill-biased technological change and rising wage inequality: Some problems and puzzles. Journal of Labor Economics, 20, 733–783.

Coltrane, S. (2004). Elite careers and family commitment: It’s (still) about gender. Annals of the American Academy of Political and Social Science, 596, 214–220.

Cooke, L. P. (2014). Gendered parenthood penalties and premiums across the earnings distribution in Australia, the United Kingdom, and the United States. European Sociological Review, 30, 360–372.

Correll, S. J. (2004). Constraints into preferences: Gender, status, and emerging career aspirations. American Sociological Review, 69, 93–113.

Correll, S. J., Benard, S., & Paik, I. (2007). Getting a job: Is there a motherhood penalty? American Journal of Sociology, 112, 1297–1338.

England, P. (2010). The gender revolution: Uneven and stalled. Gender & Society, 24, 149–166.

England, P., Bearak, J., Budig, M. J., & Hodges, M. J. (2016). Do highly paid, highly skilled women experience the largest motherhood penalty? American Sociological Review, 81, 1161–1189.

Firpo, S., Fortin, N. M., & Lemieux, T. (2009). Unconditional quantile regressions. Econometrica, 77, 953–973.

Gangl, M., & Ziefle, A. (2009). Motherhood, labor force behavior, and women’s careers: An empirical assessment of the wage penalty for motherhood in Britain, Germany, and the United States. Demography, 46, 341–369.

Glauber, R. (2008). Race and gender in families and at work: The fatherhood wage premium. Gender & Society, 22, 8–30.

Goldin, C. (2014). A grand gender convergence: Its last chapter. American Economic Review, 104, 1091–1119.

Hacker, J. S., & Pierson, P. (2010). Winner-take-all politics: Public policy, political organization, and the precipitous rise of top incomes in the United States. Politics and Society, 38, 152–204.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Hodges, M. J., & Budig, M. J. (2010). Who gets the daddy bonus? Organizational hegemonic masculinity and the impact of fatherhood on earnings. Gender & Society, 24, 717–745.

Iacus, S. M., King, G., & Porro, G. (2009). CEM: Software for coarsened exact matching. Journal of Statistical Software, 30. Retrieved from http://j.mp/2oSW6ty

Kalleberg, A. L. (2011). Good jobs, bad jobs: The rise of polarized and precarious employment systems in the United States, 1970s–2000s. New York, NY: Russell Sage Foundation.

Kalleberg, A. L. (2012). Job quality and precarious work: Controversies, clarifications, and challenges. Work and Occupations, 39, 427–448.

Killewald, A. (2013). A reconsideration of the fatherhood premium: Marriage, coresidence, biology, and fathers’ wages. American Sociological Review, 78, 96–116.

Killewald, A., & Bearak, J. (2014). Is the motherhood penalty larger for low-wage women? A comment on quantile regression. American Sociological Review, 79, 350–357.

Killewald, A., & García-Manglano, J. (2016). Tethered lives: A couple-based perspective on the consequences of parenthood for time use, occupation, and wages. Social Science Research, 60, 266–282.

Killewald, A., & Gough, M. (2013). Does specialization explain marriage penalties and premiums? American Sociological Review, 78, 477–502.

King, G., Nielsen, R., Coberley, C., Pope, J. E., & Wells, A. (2011). Comparative effectiveness of matching methods for causal inference. Unpublished manuscript, Institute for Quantitative Social Science, Harvard University, Cambridge, MA.

King, M., Ruggles, S., Alexander, J. T., Flood, S., Genadek, K., Schroeder, M. B., . . . Vick, R. (2010). Integrated Public Use Microdata Series, Current Population Survey: Version 3.0. [Machine-readable database]. Minneapolis: University of Minnesota.

Kmec, J. (2011). Are motherhood penalties and fatherhood bonuses warranted? Comparing pro-work behaviors and conditions of mothers, fathers, and non-parents. Social Science Research, 40, 444–459.

Korenman, S., & Neumark, D. (1992). Marriage, motherhood, and wages. Journal of Human Resources, 27, 233–255.

Lemieux, T. (2006). Increasing residual wage inequality: Composition effects, noisy data, or rising demand for skill? American Economic Review, 96, 461–498.

Lemieux, T. (2008). The changing nature of wage inequality. Journal of Population Economics, 21, 21–48.

McCall, L., & Percheski, C. (2010). Income inequality: New trends and research directions. Annual Review of Sociology, 36, 329–347.

Mouw, T., & Kalleberg, A. L. (2010). Occupations and the structure of wage inequality in the United States, 1980s to 2000s. American Sociological Review, 75, 402–431.

Pal, I., & Waldfogel, J. (2016). The family gap in pay: New evidence for 1967 to 2013. Russell Sage Foundation Journal of the Social Sciences, 2(4), 104–127.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. Quarterly Journal of Economics, 118, 1–39.

Sanchez, L., & Thomson, E. (1997). Becoming mothers and fathers: Parenthood, gender, and the division of labor. Gender & Society, 11, 747–772.

Staff, J., & Mortimer, J. T. (2012). Explaining the motherhood wage penalty during the early occupational career. Demography, 49, 1–21.

U.S. Bureau of Labor Statistics (BLS). (2016). Working mothers issue brief (Women’s Bureau issue brief). Washington, DC: U.S. Department of Labor.

Waldfogel, J. (1997). The effect of children on women’s wages. American Sociological Review, 62, 209–217.

Weeden, K. A., Cha, Y., & Bucca, M. (2016). Long work hours, part-time work, and trends in the gender gap in pay, the motherhood wage penalty, and the fatherhood wage premium. Russell Sage Foundation Journal of the Social Sciences, 2(4), 71–102.

Western, B., & Rosenfeld, J. (2011). Unions, norms, and the rise in U.S. wage inequality. American Sociological Review, 76, 513–537.

Yu, W., & Kuo, J. C. (2017). The motherhood wage penalty by work conditions: How do occupational characteristics hinder or empower mothers? American Sociological Review, 82, 744–769.

Acknowledgments

I am grateful to several anonymous reviewers for helpful comments and suggestions. A version of this article was presented at the 2013 annual meeting of the Population Association of America, San Diego, CA.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 299 kb)

Rights and permissions

About this article

Cite this article

Glauber, R. Trends in the Motherhood Wage Penalty and Fatherhood Wage Premium for Low, Middle, and High Earners. Demography 55, 1663–1680 (2018). https://doi.org/10.1007/s13524-018-0712-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-018-0712-5