Abstract

Contrary to the popular view that the U.S. welfare system has been in a contractionary phase after the expansions of the welfare state in the 1960s, welfare spending resumed steady growth after a pause in the 1970s. However, although aggregate spending is higher than ever, there have been redistributions away from non-elderly and nondisabled families to families with older adults and to families with recipients of disability programs; from non-elderly, nondisabled single-parent families to married-parent families; and from the poorest families to those with higher incomes. These redistributions likely reflect long-standing, and perhaps increasing, conceptualizations by U.S. society of which poor are deserving and which are not.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The nature of the U.S. welfare system has been a subject of long-standing research interest among those who study low-income and disadvantaged families and children. The country’s system of welfare programs has a strong relationship to the family. Historically, for example, the primary recipient group has been single-mother families—a group that has been the focus of much research given their high rates of poverty and the implications of that poverty for children. The role of absent fathers and their relationship to children, as well as the role of the child support system, have been another focus of research relating the welfare system to the family. The U.S. welfare system also provides support that is quite different depending on whether individuals are single or in a union, whether children are present in the family, whether a male and female partner are married or cohabiting, and whether the adults are biologically related to the children. In all these classic areas of research on the family, the welfare system plays a role.

This article will address two broad questions about the evolution of the U.S. welfare system and how that evolution has resulted in changing patterns of support for families of different types. The first question is simply whether the welfare system, taken as a whole, has become more or less generous. I will argue that the common view among researchers and many (although perhaps not all) members of the public is that the system had its greatest expansion in the 1960s and early 1970s, partly stemming from the War on Poverty campaign. However, that expansion was later halted, if not reversed, and the United States has been in a contractionary period for two or three decades. I will note the scholarly research that supports this view and will examine the evidence to determine whether it is correct.

The second question is whether, given whatever has happened to the generosity of the system in aggregate, the distribution of support across different family types and across families at different points in the income distribution has changed. Here I examine whether trends in support have been different for single mothers and their children, married couples with children, and childless families, for example. I also examine whether support has evolved differently for the poorest of the poor, as well as for those with still modest incomes but with incomes just below or just above the official U.S. government poverty line, the most commonly used index of economic status of the disadvantaged population. I also examine whether support has evolved differently for families with older adults and those with disabled family members relative to the rest of the population.

My results show that the aggregate generosity of the system has continually trended upward, albeit with some pauses and slowdowns, and that the rate of spending growth has in fact been greater in some recent periods than it was in the 1960s and early 1970s. However, financial support has evolved very differently for different demographic and economic groups, with the disabled and the aged experiencing much greater increases in support than the rest of the population and with much slower rates of increase, if not decreases, for single mothers and their children. In addition, support for families with the lowest incomes has decreased, but support for those with higher incomes has increased. I interpret these changes in the distribution of benefits as reflecting centuries-old notions of which of the poor are “deserving” and which are not (Katz 1989).

One well-known topic to which I devote minimal attention is whether the U.S. welfare system has encouraged nonmarital childbearing and the formation of single-parent families, and whether it has discouraged work. These issues are important in and of themselves but also because if family and work behaviors have been influenced by the welfare system, this could bias trends in support by family type and by level of earnings—for example, an increase in the number of poor single-mother families could be the result of work reductions induced by the welfare system. At the end of the article, I briefly review the existing research literature and argue that although some incentive effects of this type are probably present, they are small in magnitude and would not affect the large trends I document earlier in the article.

A Short Chronology of the Development of U.S. System of Transfers

The modern welfare state in the United States was begun in the depths of the Great Depression when Congress passed, and President Roosevelt signed, the Social Security Act of 1935. That act created three programs: the old-age retirement program that is often simply called “Social Security,” the Unemployment Insurance (UI) system, and the Aid to Dependent Children (ADC) program (its name was changed to Aid to Families with Dependent Children (AFDC) in 1962 and to Temporary Assistance for Needy Families (TANF) in 1996).

The first two are “social insurance” programs that base eligibility on having worked a sufficient amount and having had a sufficient level of earnings to quality. For example, currently an individual establishes eligibility for Social Security retirement benefits only if he or she has worked at least 10 years in so-called covered jobs and has earned at least $1,200 per quarter. Likewise, eligibility for UI payments is based on whether an involuntarily unemployed individual has had a certain amount of work and earnings in the past year or so, depending on the state of residence. The important feature of social insurance programs is that they do not base eligibility primarily on current income or poverty status; and, in fact, to the extent that poor individuals tend to have spotty employment histories and low earnings, they are less likely to be eligible for these programs in the first place. However, despite the fact that these two social insurance programs are not specifically directed to the poor, their enormous size means that they do provide large transfers to poor elderly families and to poor unemployed families at the same time that they are providing payments to middle-class families. In 2007, for example, expenditures in the Social Security retirement program were $485 billion, and expenditures in the UI program were $30 billion (and this was a low unemployment year). By comparison, expenditures were only $12 billion in the cash portion of the TANF program.

The third program—the original Aid to Dependent Children (ADC)—was explicitly directed to poor families by providing benefits to families with children and with one biological parent absent from the home. Rather than reflecting a sympathetic view of the poor in general, however, the ADC program was instead intended to support widows with children and women whose husbands had become disabled. In some sense, it was not unlike a social insurance program because it presumed that the husband had provided income to the mother and the children—income that they had lost involuntarily. Because it was assumed that mothers would not work but would instead stay home with their children, it seemed natural that the children should be helped and that the mother should be helped in the process.

Interestingly, although mothers whose husbands had become disabled were supported by the 1935 Social Security Act through the creation of the ADC program, the act had no provision for support for the disabled in general. Intense debate in Congress starting in 1936 centered on whether a program for the disabled should be included along with the other three programs created by the Social Security Act (Berkowitz 2000). There was strong opposition to its inclusion because Congress believed that such a program would serve too many men who were not really disabled and who could obtain a job. Debate over whether to have a program for individuals with disabilities continued for the next 20 years, until 1956, when Congress finally added a program for those individuals: the Social Security Disability Insurance (SSDI) program. However, this program covers only the severely disabled in order to reduce the probability that recipients would be capable of employment. The severity of the eligibility condition in the SSDI program distinguishes the United States from many countries in Western Europe, where less-stringent definitions are often used, and the moderately disabled are often covered. The SSDI program is yet another social insurance program: only those who have worked and earned enough in the past are eligible. However, the program is large—distributing $99 billion in 2007—and covers many individuals who are in poverty.

After the creation of the three programs in the Social Security Act as well as the SSDI program, little development in the transfer system occurred until the 1960s. The 1960s and early 1970s are widely recognized a period of major expansion of government social welfare programs. Beginning with the publication of Michael Harrington’s book The Other America (Harrington 1962), which awakened Americans to the existence of widespread poverty in the midst of the country’s general prosperity, and continuing with President Kennedy’s plan to address the poverty problem and then on to President Johnson’s heralded War on Poverty announced in 1964, the need for government intervention to help the neediest families became evident and gained widespread public support.

Interestingly, President Johnson intended the War on Poverty to be focused on education, training, and health programs for the poor, and not welfare programs—or, in the words of those at the time, a “hand up” and not a “hand out.” The Head Start program, which provides early education assistance to children from low-income families, is one program of this type. Nevertheless, whether intended by Johnson or not, and whether officially part of the War on Poverty, the 1960s and early 1970s were a period in which just about all major welfare programs for the poor that are still with us today were created, formalized, or expanded (see Table 1). These include the Supplemental Nutrition Assistance Program (SNAP), Medicare, Medicaid, the National School Lunch Program, the School Breakfast Program, Supplemental Security Income, the Women’s, Infants, and Children program, and the Earned Income Tax Credit (EITC).

For example, the Food Stamp Act of 1964 (now referred to as SNAP), provides food coupons for low-income families and individuals. It began as a small voluntary program but was eventually made mandatory for all counties in the 1970s and began its evolution toward the major program it is currently.

Medicare and Medicaid were created in 1965. Medicare is a health program for older individuals; it is a social insurance program, not a welfare program, but Congress has made all individuals 65 or older eligible even if they have not worked for 10 years in the Social Security system. Medicaid is the medical care program explicitly providing health care to those with low income and assets and hence is directly aimed at helping poor families. It has grown dramatically since 1965, as will be shown later.

In 1966, the National School Lunch Program (NSLP) and the School Breakfast Program were formalized, providing subsidized lunch and breakfast to low-income children. Housing programs were expanded in the early 1970s, for the first time giving low-income families a voucher that they could take to a private landlord and have to pay only a portion of the rent on the housing unit. The Supplemental Security Income (SSI) program, which provides cash payments to the aged, blind, and disabled individuals if they have sufficiently low income or assets, was created in 1972. Up to that time, there was no national program under which poor, aged, or disabled were eligible for cash assistance if they did not qualify for Social Security, although there were state programs. The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which provides food and nutrition assistance to pregnant women and to infants, was created in 1975. Finally, Congress passed the Earned Income Tax Credit (EITC) in 1975, giving working families a tax credit on their federal income taxes in proportion to their amount of earnings. Economists call this an “earnings subsidy” program because it helps those who work more by supplementing their earned income. Although the public does not ordinarily see the EITC as a welfare program, it does, in fact, fit the definition: it gives credits to only those families whose earnings are below an upper level cutoff and is intended to help only those in the population who have low or modest levels of earned income.

As I asserted in the Introduction, the dominant view of researchers is that this era of expansion of the welfare state and programs to help the poor was followed by a long period of retraction and retrenchment, or at least stabilization and failure to further expand. Many observers believe that this began as early as 1971, when President Nixon submitted to Congress, and later resubmitted, a bill to create a program called the Family Assistance Plan which provided a guaranteed annual income to poor families, a program called a “negative income tax” by most policy analysts (Table 1). It failed in Congress after both submissions. Later in the 1970s, President Carter formulated a vastly expanded program for the poor with higher benefits, with more universal eligibility, and calling for the creation of millions of public service jobs for the disadvantaged. It never made it to the floor of the House. In 1980, Ronald Reagan was elected president, having campaigned on a promise to curtail the welfare state, and he continued to enjoy enormous popularity during his two terms in office. In 1984, Charles Murray published the influential volume called Losing Ground (Murray 1984), which argued that the expansion of the welfare state had not only failed to reduce poverty but actually made the problem worse by discouraging the poor from working and giving them incentives to not marry. In 1988, President George H. W. Bush, a moderate Republican, proposed to Congress a bill to add mandatory work programs to the AFDC program. The bill passed, but the implementation of the program never made work mandatory and was widely considered to be a failure. When William (Bill) Clinton (Democrat) was elected as president, he presided over and signed in 1996 the most retractionary bill in the modern history of welfare reform, imposing into the AFDC program work requirements backed up by credible and enforced monetary sanctions for noncompliance, and legislating maximum time limits of receipt into the program, which was renamed the Temporary Assistance for Needy Families (TANF) program. The legislation reduced the number of poor families served by the program by 63 % within 10 years, effectively removing it as an important program in the nation’s safety net for the poor. Since 1996, welfare reform has been mostly off the political agenda, whether under President George W. Bush or President Obama, with no further major reforms discussed. Jencks, writing in 1992 (even before the 1996 reform), provided one of the best and most cogent summaries of the post-expansionary era: “After 1976 . . . the idea that government action could solve—or even ameliorate—social problems became unfashionable, and federal spending was increasingly seen as waste” (Jencks 1992:70).

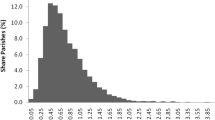

Answering the First Question: Whether the Transfer System Has Grown Less Generous

With this fairly extended background, let me address the first question of whether the U.S. system of transfers has grown less generous overall during the last two or three decades. To take the most comprehensive approach, I include social insurance as well as welfare (or means-tested) programs first, and then take the largest 16 of those programs.Footnote 1 Government statistics on expenditure—including state and local spending as well as federal—are available back to 1970. Figure 1 shows the pattern of growth of total real per capita spending (to control for natural population growth) from 1970 to 2007, the last year before the Great Recession (which will be considered separately later). As expected, spending rose rapidly from 1970 to 1975, to pick an end year roughly coinciding with the end of the expansionary period noted earlier, by 60 % over the short five years; this amount would have been larger if pre-1970 data were available. Also as expected, per capita spending rose at a much slower pace, by 25 %, from 1975 to 1986. However, the end date 1986 is selected in Fig. 1 despite the contractionary events after 1986 noted in Table 1, because spending picked up again after that year. From 1986 to the end of the period in 2007, spending rose significantly, by 72 %—larger than in the first period of the early 1970s. Although this third period was obviously longer in total years than the initial five-year period, there is no sign of a slowdown in spending growth in that recent 20-year period.Footnote 2 , Footnote 3

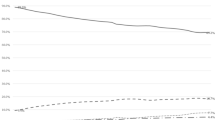

One issue with these figures is that they include major social insurance programs, and it is well-known that the Social Security retirement program (as only one example) was liberalized repeatedly by Congress over the 1960s and 1970s. In addition, toward the latter period, the size of the older population has been growing. The upper line in Fig. 2 shows a data series compiled by the Congressional Research Service (Spar 2006) for per capita real spending on 84 of the largest means-tested programs in the country, thereby excluding those for social insurance; however, the series was not collected after 2004 and was only sparsely collected before 1975. The rates of growth of real per capita means-tested spending, in fact, rose faster than total spending, by 90 %, 18 %, and 93 % in the same three periods. Thus, social insurance programs are not responsible for the continued growth of spending in the last period.

Real expenditure per capita in means-tested programs, 1970–2007. Sources: Top 84 programs from Spar (2006), and 10 largest programs from author’s calculations from individual program statistics. Expenditures are sum of federal, state, and local total expenditures on the programs. Top 84 figures prior to 1975 are interpolations between 1968, 1972, and 1975. All values are in 2009 CPI-U-RS dollars

Another issue is that the large rate of growth in the third period may be partly a result of the growth of spending in the Medicaid program, which is by far the largest means-tested program in the country in terms of expenditure and which has been growing more rapidly than spending in other programs in recent decades. From 1986 to 2007, for example, real per capita Medicaid spending rose by 210 %.Footnote 4 The lower line in Fig. 2 returns to the large programs shown in Fig. 1 but excludes the five social insurance programs as well as Medicaid. Although the rate of growth of spending in the third period is now less than that of the upper line in Fig. 2, it is still 69 %, representing a major increase in spending. In sum, this evidence provides no indication of a more conservative era of retraction and retrenchment that the popular view assumes.

The explanation for the difference in the popular view and the actual experience is in large part that the 1996 welfare reform referred to in Table 1, which dramatically reduced the size and spending in one important program (AFDC-TANF), was the exception rather than the rule. This is demonstrated in Fig. 3, which shows growth in per capital real spending from 1970 to 2007 for that program but also for several other important ones. As the line for the AFDC-TANF program in the figure shows, spending in the program took a dramatic dive in the 1990s. By 2007, spending was only about one-quarter of what it was in 1995. In fact, it was lower in 2007 than it was in 1970. Comparatively, spending in the SSI program, for example, which pays cash to poor aged, blind, and disabled individuals, rose by 80 % in the five years between 1990 and 1995. This extra spending was a result of changes in eligibility rules that allowed more children to be defined as eligible by disability criteria (Daly and Burkhauser 2003). Additionally, the EITC, which provides a tax credit to low-income families with earnings, was greatly expanded by both Presidents George H. W. Bush and Clinton in the late 1980s and early 1990s, resulting in expenditure growth of 274 % from 1988 to 1998 and taking it from a minor program in the country’s welfare system to one of the leading ones (and the largest one among those shown in Fig. 3). Another tax credit, the Child Tax Credit (CTC), was passed by Congress and signed by President Clinton in 1997 and started in 1998. The CTC gives low-income families with children a significant tax break and, as Fig. 3 shows, is now a major program in the country’s safety net. The Medicaid program—not shown in the figure because the magnitude of the numbers is so much higher than for other programs—also rose dramatically beginning in the mid-1980s.

The SNAP program, as shown in the figure, grew through the 1980s, fell as the economy improved in the later 1980s, but then rose again to a new peak in the early 1990s as a result of changes in the program that liberalized various rules. The most interesting aspect of the spending growth in the Food Stamp program is that after falling in the late 1990s as a result of the improvement in the economy, it resumed growth through the middle and latter part of the 2000s despite a falling unemployment rate over the period, growing by 20 % from 2003 to 2007. The reason for the increase was that the U.S. Department of Agriculture reformed the program to reduce barriers to participation and to reduce paperwork, and encouraged families who were eligible but hadn’t applied to apply for benefits—a conscious and deliberate expansion of the program.Footnote 5

Answering the Second Question: Whether There Has Been a Redistribution of Benefits

Although aggregate spending continued to rise after the mid-1980s, and even accelerated for many programs, whether the distribution of that spending differed across families of different demographic and economic types is a separate question. Indeed, Fig. 3 suggests that the distributional impact of the rise in aggregate spending may not have been neutral: most of the programs that grew served different types of recipients than the program that fell (AFDC-TANF). An obvious example is the SSI program, which serves only the aged, blind, and disabled, not the poor population in general or even single-mother families, one of the major groups served by AFDC-TANF. Further, by its structure, the EITC does not serve any family with no workers because it is an earnings subsidy. Indeed, the largest tax credits in the EITC program go to families whose earnings are roughly between $10,000 and $20,000 per year, which means that it does not primarily serve those who are the most disadvantaged. The CTC, as will be noted shortly, shares this characteristic with the EITC. The Food Stamp program is the only program that serves all family types equally (that is, if they have low income and assets) and also serves those who have no other income, including no earnings. However, that program also provides benefits only for food purchases, and these benefits are far less than those provided by, for example, AFDC-TANF or the SSI program, both of which are intended to assist in all the living needs of the family or individual.

Returning to social insurance programs, the evidence also shows that the programs that have expanded the most are Medicare, Social Security retirement, and the SSDI program for the disabled. Many of the recipients of those programs (as noted before) are poor, but nevertheless those programs benefit only older individuals and the disabled. Poor families in these groups are in need of assistance from the government, but once again, this merely demonstrates how many of the programs that have grown in size serve specific groups in need.

Nevertheless, a close examination of distributional changes requires data on individual families and the benefits they receive. For this purpose, I draw on recent work by Ben-Shalom et al. (2012), which used the Survey of Income and Program Participation (SIPP) to examine the question of whether benefits received by different types of families have changed over time. The SIPP is perhaps the best data set for this type of examination because it is a representative household survey of the U.S. noninstitutional population conducted by the U.S. Census Bureau, which has as one of its main goals the collection of information on receipt by families of benefits from all major transfer programs, both social insurance and welfare. The survey asks specific questions about each program, and underreporting of benefits is much lower than in other surveys, such as the Current Population Survey (CPS) (Meyer et al. 2009). However, the SIPP was begun only in 1983, and the last survey before the Great Recession was conducted in 2004, making 1983–2004 the only period that can be examined with these data. Nevertheless, because this period covers both the contraction of the AFDC-TANF program and the expansion of many of the other programs discussed earlier, it should bear directly on the question of interest.

Ben-Shalom et al. (2012) calculated the total amount that each family received from all major social insurance and means-tested programs in the month prior to interview, except for Medicaid and Medicare. (Medicaid and Medicare have to be excluded because families answering a household survey do not know how much the government has spent on their health care under those programs, and that is the relevant figure for these calculations.) Ben-Shalom et al. examined how that total varied across different types of families and how it changed between 1983 and 2004 for those different family types.Footnote 6

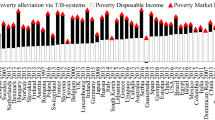

Figures 4 and 5 illustrate some of the results of their study.Footnote 7 Figure 4 shows the average monthly benefits received from all transfer programs in 1983 and 2004 for families with an older head of household (62 years or age or older), families with an adult receiving SSI or SSDI,Footnote 8 and the residual category that I term “non-elderly nondisabled families.” The figure shows mean total transfers over all families of each type and indicates whether families receive benefits (or not) from each of the programs; hence, the figure shows an average of benefits received among recipients of each program weighted by the fraction of the group receiving benefits from each program. Figure 4 clearly shows that families with older adults and families with disabled members receive much more in transfers than other families, which is a result of the high rate of receipt of Social Security retirement benefits by older individuals and of the relatively high benefit amounts in the retirement program and in SSI and SSDI: that is, they are intended to cover all expenses, not just food or medical care, and are much higher than AFDC-TANF benefit amounts. More relevant to the issue here is the change over time. Figure 4 shows that although all three types of families experienced increases in benefits, the families with older individuals and with disabled members received greater increases than non-elderly nondisabled families in absolute magnitude ($208, $74, and $20, respectively), although in percentage terms, the third group had a somewhat large increase because of its small base (percentage increases for the three are 19 %, 6 %, and 13 %, respectively). Thus, the share of transfer benefits received by older adult families necessarily rose between 1983 and 2004, and the benefits for the disabled also rose significantly, which represents one type of redistribution of total benefits.

Figure 5 shows similar figures for non-elderly, nondisabled single-parent families, married-parent families, and childless individuals and families.Footnote 9 Here again, the size of transfers differs markedly across groups, with single-parent families receiving more than married-parent families and with childless individuals and families receiving very little from the U.S. transfer system. However, changes in benefits over time for the three groups are dramatically different, with transfers to the average single-parent family falling by 20 % and those to the average married-parent family rising by 68 %. The decline for single-parent families reflects the contraction of the AFDC-TANF program combined with increases in transfers from other programs, which were smaller in magnitude because those other programs largely served different family types. Transfers to childless individuals and families were essentially unchanged, rising by a mere 7 %. These results imply a redistribution of benefits away from single-parent families toward married-parent families.

These figures suffer from the obvious problem that income is not being controlled for, and transfers should ordinarily be expected to flow disproportionately to those with low income. It is possible that the redistributional movements shown in Figs. 4 and 5 could be the result of differential changes in income across the different groups, which would give them a rather different interpretation. To address this issue, I must condition on private income for each family. To this end, I define private income for a family as the sum of its earned income and its private unearned income. For most families eligible for welfare programs, private unearned income is very small relative to earned income; most families have very little capital income and only miscellaneous income from other sources (e.g., child support). After calculating each family’s income, I will classify their degree of disadvantage by the relation of their income to the official U.S. government poverty threshold for their family size, putting families into one of four groups: private income less than 50 % of the poverty threshold (referred to as “deep” poverty); private income greater than 50 % but less than 100 % of the threshold (the “shallow” poor); private income greater than the poverty threshold but less than 150 % of it (the “near-poor”); and greater than 150 % but less than 200 % of the threshold (the “nonpoor”).

Figures 6, 7, and 8 show the results when the three groups in Fig. 5 are broken out by the level of their private income relative to the poverty threshold. Figure 6, for example, shows the results for single-mother families. If their overall decline observed in Fig. 5 had been solely a result of a change in the private incomes of those families, the average benefit levels for the four separate private income groups would have been stable over time, but the fractions in each group would have changed. Instead, what is shown is a sharp decline in the transfers made to the poorest single-mother families—those in pretransfer deep poverty—by a remarkable 35 %. At the same time, the transfers made to single-mother families in shallow poverty rose (by 73 %) as did those in the near-poor and nonpoor groups (75 % and 80 %, respectively).Footnote 10 These patterns are explained by the changes in the AFDC-TANF, Food Stamp, EITC, and CTC programs. On the one hand, the drastic decline in the AFDC-TANF program meant that although 57 % of single-mother families in private income deep poverty received support from the program in 1983, only 20 % did by 2004. Real benefits of recipients also fell. In addition, the percentage of families in deep poverty receiving Food Stamps declined from 73 % to 54 % over the same period, probably because AFDC recipients were automatically eligible for Food Stamps, whereas non–AFDC recipients have to make an independent application to the program. On the other hand, the major expansion of the EITC program in the late 1980s and early 1990s provided significant additional support to working single-mother families above about $10,000 of annual earnings. And the introduction of the CTC, which is a nonrefundable tax credit—meaning that only families with positive tax liability are eligible, and therefore the size of the credit grows as earnings grow, up to a point—led to additional government support for working single-mother families but little or no support to those with low levels of private income. The net result was another redistribution of benefits, in this case from the poorest single-mother families to those with higher incomes.

Figure 7 shows the same pattern for married-parent families, with declines in support among those in pretransfer deep poverty (31 % decline) and large increases for those with higher incomes (ranging from 75 % to 138 % increases).Footnote 11 Part of the decline among the poorest families of this type was also from the decline of the AFDC-TANF program because although the participation rate of married couples in 1983 was less than one-half of what it was for single-mother families, it was still substantial. The AFDC program did allow two-parent families to participate in the program; in addition, stepparent families have always been treated by the program as single-parent families because both biological parents are not present (Moffitt et al. 2015). Married-parent families in deep poverty also experienced declines in Food Stamp receipt and in UI receipt. At the same time, married-parent families with higher incomes received even greater EITC payments than working single-mother families because the former had both higher earnings levels and more children, both of which raise EITC benefits in the relevant ranges.

Figure 8 shows a similar pattern for childless families and individuals, but the amounts are very small, with a difference of only a few dollars in the two years’ benefit levels. The major benefits received by the low-income childless are Food Stamp and UI benefits, although working families could receive a small tax credit from the EITC as well.Footnote 12

Transfers to families with older individuals, individuals receiving disability benefits, and the residual non-elderly nondisabled group can also be separated by private income category. Figures for their trends in benefits are not shown, for brevity. However, almost all families in the first two groups are not working, so a comparison with the few families who work is not particularly important. Nevertheless, the results show that average benefits for both these two groups rose from 1983 to 2004, even for those with private incomes less than 50 % of the poverty threshold. Once again, the sizable increases in benefits from the Social Security retirement program, the SSDI program, and SSI are responsible for this result.

The results in this section of this article allow me to answer the second question that I posed at the beginning: namely, whether there has been a change in the distribution of transfer benefits to low-income families within the overall growing total size of total transfers. The results show three major redistributions: (1) a redistribution away from non-elderly and nondisabled families to families with older adults and to families with recipients of disability programs; (2) a redistribution away from non-elderly, nondisabled single-parent families to married-parent families; and (3) within single-parent and married-parent families, a redistribution of transfers away from the poorest families to those with higher incomes—those with incomes just below and just above the official government poverty threshold. These developments constitute a new type of “diverging destinies” (McLanahan 2004), although in this case not between those from low-income and middle-income families, but between different types of families within the low-income population.Footnote 13

Caveats and Concerns

Three caveats and concerns are worth addressing: the importance of the Medicaid program, the impact of the Great Recession, and the relevance of incentives to work and to change family structure. All these issues could, in principle, affect the results on trends in redistribution found in the previous section.

The Medicaid program is omitted from the benefit calculations because government spending on each individual family cannot be obtained in a household survey. Yet, those eligible for Medicaid can receive it even if not working, and hence it is an important benefit for the poorest families. In addition, there were significant expansions of eligibility over the 1983–2004 period: although most who were eligible in 1983 were single mothers on AFDC, eligibility was extended in the late 1980s and early 1990s to poor pregnant women in general and later to most children in poor families. Later, many states also extended eligibility to many parents in low-income families in general. In addition, looking to the future, Medicaid eligibility expansions under the Affordable Care Act (ACA) are likely to make even more low-income families eligible.

On the other hand, some researchers have obtained data from different sources that have information on medical spending under Medicaid for individual families (Burkhauser et al. 2013; Burtless and Svaton 2010). Those studies have noted that if Medicaid is included as a transfer, logic requires that the value of employer-provided health insurance also be included. When both Medicaid and employer-provided health insurance are both valued and added to individual incomes, the result is a remarkably distribution-free change in inequality, with the additions to middle-income families about the same, or sometimes greater, than those going to low-income families. A similar issue going forward will arise with the ACA because that legislation also introduced new subsidies for private health insurance for those families with incomes between 133 % and 400 % of the poverty line, which means a further increase in implicit government transfers to the higher-income portion of the disadvantaged population. Even one of the Medicaid provisions in the ACA—which encourages states to raise their upper income-eligibility levels from where they often are now (often below the poverty line) at least up to the poverty line—will benefit the shallow poor, not the poorest families. Consequently, it is unclear at the present time how much adding Medicaid would change the conclusions reached in the last section, although this is certainly an important topic for subsequent research.

Much attention has also been focused recently on the performance of the safety net during the Great Recession, roughly between 2007–2008 and 2012. The federal government expanded many of the major transfer programs significantly during the Great Recession. Benefit levels for the Food Stamp program were raised, and eligibility requirements were relaxed; EITC amounts were increased for large families; additional funds were provided for the TANF program; amounts for the CTC were increased; income and payroll tax rates were temporarily reduced; and one-time extra benefits were given to Social Security retirement and SSI recipients. An additional major legislative change involved the UI program, for which the potential duration of benefits was increased, benefit levels were raised, and states were encouraged to broaden the bases for eligibility. For present purposes, the relevant question is whether these additional benefits were provided in equal or unequal measures to different family types and to those of different income levels, and whether therefore the redistributional trends noted in the last section were continued or countered. Interestingly, the evidence on this question indicates that, contrary to the long-term trend, the additional benefits provided went to both single-parent and married-parent families, and to childless individuals and families as well as those with children, and were about equally spread among those in deep poverty and those with higher income levels (Moffitt 2013). The poorest families received major increases from the Food Stamp and UI programs, while millions of families who lost their jobs but still had significant earnings (e.g., more than $10,000 per year) received additional EITC benefits.

Nevertheless, at this writing, most of these temporary expansions have phased out. Some of the EITC and CTC changes have been extended a bit further, and some of the UI eligibility changes are likely to stay. Aside from these, however, the safety net will return to its pre–Great Recession structure. Consequently, for the safety net as a whole, there is no indication that the long-run trend of reduction in support for single mothers and for the poorest families and increases in support for married-parent families and better-off working families will be reversed.

Finally, a traditional issue with examining how safety net programs affect low-income families is whether those programs discourage work and hence increase the proportion of families with very low or zero earnings, and whether those programs encourage the formation of single-parent families. The research evidence to date suggests that these issues are of little or no importance for the purposes of this article for two reasons. First, the evidence shows that neither work disincentives nor family structure incentives are large in magnitude, especially in the aggregate. Ben-Shalom et al. (2012) reviewed the evidence on work disincentives for all major transfer programs and found that although some of them appear to induce nontrivial reductions in work effort among the recipients of some programs, the aggregate effect on earnings in the low-income population is almost zero because too few families participate in programs where those reductions occur. As for family structure incentives, a large body of research on this question for the AFDC program failed to show any major effects on the fraction of single-mother families, although the evidence has suggested perhaps a small effect (Moffitt 1998). Research on the effects of the 1996 reform of the program on family structure also has shown very mixed results and no evidence of any major effect (Grogger and Karoly 2005).

Second, however, the calculations in the previous section were of average benefits conditional on level of earnings and conditional on family structure, and hence any effect of the program on changing the proportions of families at different earnings levels or in different demographic groups should not, at least at the simplest level, affect the level of transfers conditional on belonging to one of those earnings or family-type groups. Further, with regard to the trends noted earlier, if anything, the work disincentives of the nation’s transfer programs should have declined from 1984 to 2004 as benefits for nonworkers declined and benefits for workers increased. If anything, work incentives should have increased. The decline in benefits for single-mother families and the increase in benefits for married-parent families likewise should have provided even fewer incentives for single motherhood and greater incentives for marriage over time.

The Deserving Poor

Although I am not a professional political scientist or even a sociologist, I nevertheless suggest that one explanation for the changing distribution of transfer benefits that I have uncovered can be traced to long-standing concepts of what is called the “deserving poor.” I am far from the first to note that the U.S. society has, for most of its history starting in the eighteenth century, distinguished which poor families are deserving and which are not, just as some of our forebears in England did with the English Poor Laws (Iceland 2013; Jencks 1992; Katz 1989; Patterson 1994). In the eyes of the American voter, those who are deserving are those who work, who are married or at least widowed, and who have children. Those who are undeserving are those who do not work, who are single parents, and who do not have children. In colonial America, the elderly and children were also seen as more deserving than prime-age adults (Iceland 2013:13). Interestingly, the research literature just referred to also reveals that historically, simply receiving government assistance has been taken itself as a sign of undeservingness—a signal that the individual has not been exerting enough effort on his or her own. This notion dates to the England and the English Poor Law Amendment Act of 1834, where “pauperism” referred to those who were receiving relief and were less deserving than the more honest individuals who were desperately poor but not receiving government help. A similar conceptualization appeared in the popular debate over the 1996 welfare reform law and its subsequent discussion, in which welfare “dependency”—meaning simply receiving benefits—was taken as an object to be reduced for its own sake and independent of whether such reductions lowered the incomes of the poor. Another interesting parallel to current economic developments is that in certain historical periods, like the early nineteenth century, many prime-aged unemployed men were unable to find jobs because of rapid technological change, such as the mechanization of agriculture (Iceland 2013:13). Today, the emergence of skill-biased technological change, with its increasing demand for workers with high skill levels and decreasing demand for workers with low levels of skills and education, is a leading explanation for the decline in earnings among the most disadvantaged and the rise in their unemployment levels. As occurred in colonial times, when unemployed men were treated as lacking effort, low-skilled men without jobs today are often regarded as being at fault for their lack of employment.

Although these distinctions have long been made, they have grown sharper over the last 20 or 30 years in the United States. The emphasis on work in welfare programs has grown: work requirements have been added to various programs, and some of the major expansions in welfare programs have been directed to help only those with earnings. For women, it is often argued—for example, by Garfinkel and McLanahan (1986) in their landmark volume on single mothers—that this change in attitudes has its source in the rise in employment among middle-class and higher-educated women, leading to a greater expectation that all women today should work, even if they have young children and even if their job opportunities and skill levels are low (Garfinkel and McLanahan 1986). The growing negative attitudes toward the AFDC program that contributed to the 1996 reform were partly a reflection of the changing nature of its caseload, from one composed primarily of widows to one composed primarily of never-married mothers. In 1942, 59 % of AFDC adult recipients were widows or widowers or were married to spouses with disabilities; but by 1992, 58 % of the caseload consisted of the much less popular group of unmarried mothers.

As for families with older adults, the impact of government transfer programs, especially the Social Security retirement program, is well known (for a recent contribution, see McGarry 2013). Also, the PAA Presidential Address by Preston (1984) noted the increase in government support of the elderly relative to that of children. Preston offered a number of explanations for this trend rooted in the political process. I would only add to his account that the disabled, both children and adults, have been similarly favored. (Christopher Jencks also adds the disabled to the elderly as a favored group.) I would probably add to Preston’s account that those without children are even less favored than those with children.

To economists, the distinction between more- and less-deserving families is at odds with their classic models of how welfare should be delivered, as formulated by Milton Friedman (1962) in his proposal for welfare reform in the United States. Friedman argued forcefully that families should be given assistance entirely and solely on the basis of their level of income, and possibly family size; no family or personal characteristics should be used for eligibility or benefit levels, and families with the same level of income should be treated identically. He decried government programs in the United States in the 1950s that singled out particular groups for government support (farmers, for example). Friedman thought that making distinctions on the basis of characteristics other than income would lead to support reflecting political lobbying and would harm the economy.

New Directions for Safety Net Policy and Research

Addressing the trends noted in this article with new policies should not be pursued by reducing support for families with older adults, those with disabilities, or those with significant levels of earnings in the low-income population. Families in these groups deserve support and, particularly for the last group, the long-term trend in providing additional assistance for disadvantaged individuals to work more through additional child care, additional education and training, and earnings subsidies like the EITC is a welcome development. Nor is the solution to the problem a return to a welfare system with completely open-ended transfers available to those who do not work with no questions asked, although the United States has never really had such a system. However, the decline in support for the poorest families and for single-mother families is not likely to increase the prospects for their improvement and is, if anything, likely to achieve the opposite. Families in the poorest and most disadvantaged sections of the population face many barriers to work, including low levels of education and literacy, learning disabilities, physical and mental health issues, domestic violence, substance abuse, and criminal histories (Loprest 2011). The best direction for public policy should be one that searches for a way to support the non-aged, nondisabled families at the bottom of the earnings distribution in ways are that consistent with long-standing American values, such as taking responsibility for one’s own actions. The decline of support to families with nonemployed members and to single parents is presumably rooted in the presumption that they have not taken personal responsibility for their own situation. Along with Jencks (1992), Garfinkel and McLanahan (1986), and many others, we should not dispute the societal norm in favor of work and marriage, which gives that norm such primacy. This norm is part of the American heritage and has had enormous positive effects on our society. However, more needs to be done for those facing the largest obstacles to work, whether it be training programs, more discriminating work requirements, better child care for working mothers, or other forms of employment assistance. Most importantly, even if their employment and earnings cannot rise to the levels that we and they would desire, new ways to assist those families who are making an effort but are not succeeding should be developed for assistance in the short-term and even in the medium-term.

As for research, there are several areas where more investigation would be worthwhile. The crude demographic categories used in the classifications here miss the important developments in the American family requiring distinctions between never-married and divorced and widowed mothers and children, cohabiting unions, stepparent families, and blended families with children from multiple partners as well as absent fathers. How those more-detailed family types have fared under trends in the safety net would be of interest. On a related topic, the calculations here do not account for the variability and instability of government support in response to instability of family types themselves, which requires a more dynamic examination of changes in family structure and corresponding changes (or lack of changes) in government support. Yet another research topic is how families with decreasing government support “make ends meet,” in the words of Edin and Lein (1997)—what strategems they follow to provide for the adults and children in their families. The consequences of decreasing government support for children in the poorest families would also be of research interest, and would tie in with the large and growing literature on the determinants of child development and the consequences for intergenerational mobility and intergenerational transmission of poverty. These and other research topics would contribute to the knowledge base that we need for the public policy discussion of these issues.

Notes

The 16 are the Old-Age Survivors Insurance program (i.e., Social Security retirement), Medicare, UI, Workers Compensation, SSDI, Medicaid, the Children’s Health Insurance Program (CHIP), the Supplemental Security Income (SSI) program, AFDC-TANF, the EITC, the CTC, Food Stamps, subsidized housing programs, school food programs, WIC, and Head Start. The one important set of programs that is left out for lack of good data are child care programs.

The annualized rates of growth in the three periods are 10 %, 2 %, and 2.6 %, respectively.

Spending in the third period also rose relative to gross domestic product (GDP), from 9 % of GDP in 1985 to 12 % in 2007, a significant and nontrivial increase.

Part of this growth is a result of increases in medical care prices, which were rising faster than general inflation over this period. These figures deflate spending by a general price index and hence overstate the growth of real medical care utilization.

Some of the decline in spending after 1996 has been attributed to the decline of the AFDC-TANF program as well given that many recipients of that program prior to 1996 had been automatically eligible for Food Stamps.

The programs include Social Security retirement, SSDI, Workers Compensation, UI, AFDC-TANF, Food Stamps, SSI, subsidized housing, veterans benefits, WIC, General Assistance, Other Welfare, the EITC, and the CTC.

Because I modified the price index and a few of the details of their calculations, these figures will not exactly match those in their published study.

It would be preferable to define a disabled population independent of benefit receipt, but the questions on disability in the SIPP data are not adequate to do so.

The data on cohabitation in the 1983 SIPP are inadequate, so marriage is used to define the first two groups. Families with children are those with children under age 18 in the household.

The percentage of single mothers in the income groups did change somewhat over the period. In 1983, the percentage of families in the four groups (of those with private income less than 200 % of the poverty threshold) from lowest to highest were 53 %, 16 %, 16 %, and 14 %, and they had changed to 41 %, 22 %, 21 %, and 16 % by 2004.

There are many fewer married-parent families in deep poverty: 20 % in 1983 and 17 % in 2004.

Separate tabulations for childless individuals and married childless families show similar, small changes.

Some other past research on related topics provides complementary evidence. A literature on “disconnected” families shows a rising fraction of low-income families who have little or no earnings as well as little or no cash welfare (Blank and Kovak 2009; Loprest 2011). Shaefer and Edin (2013) showed an increase in the number of families with incomes less than $2 per day, which is partly a result of these declines in government assistance for the poorest families.

References

Ben-Shalom, Y., Moffitt, R., & Scholz, J. K. (2012). An assessment of the effectiveness of antipoverty programs in the United States. In P. Jefferson (Ed.), The Oxford handbook of the economics of poverty (pp. 709–749). New York, NY: Oxford University Press.

Berkowitz, E. (2000). Disability policy and history. Statement before the subcommittee on social security of the committee on ways and means.

Blank, R. M., & Kovak, B. K. (2009). The growing problem of disconnected single mothers. In C. J. Heinrich & J. K. Scholz (Eds.), Making the work-based safety net work better (pp. 227–258). New York, NY: Russell Sage Foundation.

Burkhauser, R. V., Larrimore, J., & Simon, K. (2013). Measuring the impact of valuing health insurance on levels and trends in inequality and how the Affordable Care Act of 2010 could affect them. Contemporary Economic Policy, 31, 779–794.

Burtless, G., & Svaton, P. (2010). Health care, health insurance, and the distribution of American incomes. Forum for Health Economics & Policy, 13(1), 1–39.

Daly, M. C., & Burkhauser, R. V. (2003). The supplemental security income program. In R. Moffitt (Ed.), Means-tested transfers in the United States (pp. 79–139). Chicago, IL: University of Chicago Press.

Edin, K., & Lein, L. (1997). Making ends meet: How single mothers survive welfare and low-wage work. New York, NY: Russell Sage Foundation.

Friedman, M. (1962). Capitalism and freedom. Chicago, IL: University of Chicago Press.

Garfinkel, I., & McLanahan, S. S. (1986). Single mothers and their children: A new American dilemma. Washington, DC: Urban Institute Press.

Grogger, J., & Karoly, L. A. (2005). Welfare reform: Effects of a decade of change. Cambridge, MA: Harvard University Press.

Harrington, M. (1962). The other America: Poverty in the United States. Baltimore, MD: Penguin.

Iceland, J. (2013). Poverty in America: A handbook (3rd ed.). Berkeley: University of California Press.

Jencks, C. (1992). Rethinking social policy: Race, poverty, and the underclass. Cambridge, MA: Harvard University Press.

Katz, M. B. (1989). The undeserving poor: From the war on poverty to the war on welfare. New York, NY: Pantheon.

Loprest, P. J. (2011). Disconnected families and TANF (Brief No. 2). Washington, DC: Urban Institute.

McGarry, K. (2013). The safety net for the elderly. In M. J. Bailey & S. Danziger (Eds.), Legacies of the war on poverty (pp. 179–205). New York, NY: Russell Sage Foundation.

McLanahan, S. (2004). Diverging destinies: How children are faring under the second demographic transition. Demography, 41, 607–627.

Meyer, B. D., Mok, W. K. C., & Sullivan, J. X. (2009). The under-reporting of transfers in household surveys: Its nature and consequences (NBER Working Paper No. 15181). Cambridge, MA: National Bureau of Economic Research.

Moffitt, R. A. (1998). The effect of welfare on marriage and fertility. In R. A. Moffitt (Ed.), Welfare, the family, and reproductive behavior (pp. 50–97). Washington, DC: National Research Council.

Moffitt, R. A. (2013). The great recession and the social safety net. Annals of the American Academy of Political and Social Science, 650, 143–166.

Moffitt, R. A., Phelan, B., & Winkler, A. (2015). Welfare rules, incentives, and family structure (Working paper). Baltimore, MD: Johns Hopkins University.

Murray, C. (1984). Losing ground: American social policy, 1950–1980. New York, NY: Basic.

Patterson, J. T. (1994). America’s struggle against poverty, 1900–1994. Cambridge, MA: Harvard University Press.

Preston, S. H. (1984). Children and the elderly: Divergent paths for America’s dependents. Demography, 21, 435–457.

Shaefer, H. L., & Edin, K. (2013). Rising extreme poverty in the United States and the response of means-tested transfer programs. Social Service Review, 87, 250–268.

Spar, K. (2006). Cash and noncash benefits for persons with limited income: Eligibility rules, recipient, and expenditure data, FY2002–2004. Washington, DC: Congressional Research Service.

Acknowledgments

This article is a revised version of Presidential Address to the Population Association of America, Boston, May 2, 2014. I thank Andrew Cherlin, Kathryn Edin, and other participants of a seminar at the Hopkins Population Center, as well as Sandra Hofferth, Michael Rendall, and other participants of a seminar at the Maryland Population Research Center for comments. Nadia Diamond-Smith and Gwyn Pauley provided excellent research assistance. Financial support from the Russell Sage Foundation is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Moffitt, R.A. The Deserving Poor, the Family, and the U.S. Welfare System. Demography 52, 729–749 (2015). https://doi.org/10.1007/s13524-015-0395-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-015-0395-0