Abstract

This article studies the impact of internal migration and remittance flows on wealth accumulation and distribution in 51 rural villages in Nang Rong, Thailand. Using data from 5,449 households, the study constructs indices of household productive and consumer assets with principal component analysis. The changes in these indices from 1994 to 2000 are modeled as a function of households’ prior migration and remittance behavior with ordinary least squares, matching, and instrumental variable methods. The findings show that rich households lose productive assets with migration, potentially because of a reduction in the labor force available to maintain local economic activities, while poor households gain productive assets. Regardless of wealth status, households do not gain or lose consumer assets with migration or remittances. These results suggest an equalizing effect of migration and remittances on wealth distribution in rural Thailand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

To evaluate the economic impact of migration flows, researchers study the amount and distribution of remittances, funds and goods sent by migrants to their origin families and communities. Remittances from international migrants amount to US$325 billion annually, far exceeding the volume of official aid and approaching the level of foreign direct investment flows to developing countries in 2010 (Ratha et al. 2011). These flows are critical for understanding the economic trends in the developing world; thus, several studies have evaluated their impact on the receiving economies (Acosta 2008; Adams and Page 2005; Koechlin and Leon 2007). However, most of these studies have relied on macro-level data and focused only on remittances from international migrants.

This study builds on the recent body of work that has used micro-level survey data to investigate the impact of migration and remittance flows in origin communities (Garip 2012; McKenzie and Rapoport 2007) but takes a mixed-methods approach in an internal migration setting. The study first uses qualitative data obtained from focus group discussions with migrants, migrant-sending household members, and village leaders in eight rural villages in Nang Rong, a relatively poor district and a major supplier of migrants to urban regions in Thailand. These data suggest that migration and remittance choices may have differential effects, depending on households’ initial economic positions.

To test these hypotheses systematically, I exploit longitudinal survey data from 51 rural villages, which record the migration and remittance choices of 5,449 households prior to 1994 as well as households’ asset holdings in 1984, 1994, and 2000. To measure households’ economic positions over time, I use Filmer and Pritchett’s (2001) method, creating an index of household wealth in 1994 and 2000 based on principal component analysis of 14 asset indicators in the pooled data. I compute separate indices for productive and consumer assets, which differentially shape long-term economic trajectories (Brown and Alhburg 1999; Durand et al. 1996b; Massey and Parrado 1998; Papademetriou and Martin 1991).

I use regression analysis to link the changes in households’ productive and consumer assets from 1994 to 2000 to prior migration and remittance behavior. I estimate separate models for poor, medium-wealth, and rich households, as well as for changes in productive and consumer assets. Because households do not choose migration and remittance strategies randomly, I consider two alternative models (matching and instrumental variables) to ordinary least squares to correct for potential sample selection bias.

The results confirm the hypotheses suggested by qualitative data: poor households with a migrant between 1984 and 1994 (or a remitter between 1993 and 1994) gain productive assets from 1994 to 2000, while rich households with a migrant lose productive assets. Regardless of initial wealth status, households with a migrant (or a remitter) do not experience a change in consumer assets. Qualitative data suggest potential mechanisms for these patterns. Poor households seem to benefit from migration because of reduced consumption needs as well as potential remittances, while rich households often suffer because of reduced labor force for local economic activities.

Background

Remittances from internal or international migrants comprise a critical component of economic outcomes in the developing world, reaching 20 % of the GDP in many countries (Ratha et al. 2011). The key debates in the literature have revolved around the impact of remittance flows on poverty and inequality.

Many studies have shown that remittances reduce poverty (Adams 2006; Adams and Cuecuecha 2010; Adams and Page 2005; Taylor et al. 2008) and initiate a development dynamic by lessening the production and investment constraints in the economy (Goldring 1990; Rozelle et al. 1999; Stark 1991; Stark and Lucas 1988; Stark et al. 1988; Taylor 1999; Taylor et al. 1996), by providing income growth opportunities (Durand et al. 1996a; Massey and Parrado 1998), or by creating a vessel for risk diversification (Lauby and Stark 1988). Ample evidence from different settings has established how remittances help migrants establish small businesses in origin communities (Funkhouser 1992; Woodruff and Zenteno 2007), afford better education for their children (Edwards and Ureta 2003; Yang 2008), and accumulate wealth (Garip 2012; Greenwood 1985; Taylor 1992; Taylor and Wyatt 1996).

Research has also suggested that remittances may produce a cycle of dependency and stunted development in the origin (Papademetriou and Martin 1991; Reichart 1981; Wiest 1984), especially if the funds are spent on consumption rather than income- or employment-generating productive activities, hence contributing to a way of life that cannot be sustained in the long run or through local means (Brown and Alhburg 1999; Grasmuck and Pessar 1991; Massey and Basem 1992; Mills 1999; Mines and De Janvry 1982; Rempel and Lobdell 1978; Russell 1992). However, recent work showed that remittances—even those used for consumption—generate strong multiplier effects in the receiving economy (Durand et al. 1996a; Taylor et al. 1996).

A related debate in the literature considered the impact of migration and remittances on economic disparities in receiving countries. Several studies have found that remittance flows decreased income or wealth inequalities (Adams 1992; Taylor 1992; Taylor et al. 2008), while others observed the opposite pattern (Mora 2005). Recent work has attempted to reconcile these patterns by showing how the impact of remittances on inequality depends on the cost (Ebeke and Le Goff 2011) or level of migration (Garip 2012; Koechlin and Leon 2007; McKenzie and Rapoport 2007).

This study contributes to both debates with an analysis of internal migration in Thailand. Remittances from internal migrants—although smaller in magnitude compared with those from international migrants—are a vital component of rural livelihoods in many developing countries (Reardon 1997; Rempel and Lobdell 1978). Studies in the Thai setting have obtained mixed results on the economic impact of internal migration and remittances. Ford et al. (2009), for example, found that remittances have no effect on asset accumulation in Kanchanaburi province, whereas Entwisle and Tong (2005) observed strong positive effects in Nang Rong.

This study seeks to move beyond prior work by not only evaluating the economic effects of migration and remittance flows but also suggesting the reasons for those effects using a mixed-methods approach. I first rely on qualitative data from focus group interviews to develop hypotheses about the economic impact of migration and remittance choices. I then test these hypotheses through a rigorous statistical analysis of longitudinal survey data. Finally, I return to qualitative data to understand the potential mechanisms underlying the observed statistical regularities.

Analytical Strategy

The Thai Setting

The study uses qualitative and survey data from Nang Rong, a district in the historically poor northeastern region of Thailand and an important source of migrants to urban areas. Migration flows from this region gained steam from mid-1980s to mid-1990s, when Thailand led the world in economic growth (Jansen 1997). This growth, fuelled mostly by production in export manufacturing, led to an increased demand for labor in urban destinations (Bello et al. 1998) and attracted rural migrants (mostly from the northeastern region) to factory, construction, and service jobs at unprecedented rates (Mills 1999). The period of expansive growth slowed down in the mid-1990s. In 1996, the export growth slumped from more than 20 % to zero, partly because of increasing competition from China and India. In 1997, the Asian financial crisis hit Thailand, leading to a devaluation of the Thai currency (baht) and precipitating a brief recession. Unemployment rates increased, and migration flows from rural to urban regions slowed. The survey data capture this roller coaster period of economic boom and bust in the country, leading to dramatic changes in migration and remittance flows between rural and urban regions.

Generating Hypotheses From Qualitative Data

In this study, I first use qualitative data from focus group interviews conducted in eight rural villages in Nang Rong in 2005 to generate hypotheses about the effect of migration and remittances on wealth accumulation. In each village, the headman helped us identify between six and eight participants (typically, as equal number of men and women) for each of the three focus groups: (1) village leaders (village headman, village committee members, mothers’ group members), (2) migrant-sending household members, and (3) return migrants. I trained and supervised three graduate students from Mahidol University. One student, who spoke the northeastern dialect, ran the focus group discussions, which lasted from one to two hours, and asked open-ended questions about the reasons for and consequences of migration and remittance decisions. The remaining two students took notes, recorded, and simultaneously translated the discussion. The fieldwork lasted four weeks and recruited 158 respondents. Three bilingual research assistants transcribed the data and translated them to English.

The fieldwork observations suggested that migration and remittances often positively contribute to household economies in Nang Rong. A headman told us that in his village, “Some migrant households have improved so much from remittances that they are now richer than [initially] rich households.” A village committee member similarly commented: “Migrant households receive remittances and become rich. In our village, the richest person is not the Kamnan (the town chief) but one of the migrant villagers.”

Many parents talked about the contributions of their migrant children. A mother of migrants, for example, stated: “We were poor and had nothing to live on. There was nothing to do here, no farmland for us. . . . If [my children] had stayed, we would have to feed them. They went with our blessing because we understood they wanted to help support the family.” When asked about remittances, the mother replied: “That is the reason why I sent my children away.” Another mother echoed: “When my kids went, I was happy. I was eagerly waiting for them to remit some money home every month so that we would have money to spend.” Return migrants also recognized the benefits of their absence to the household economy: “There are more expenses if the children stay home. If we go away to work, there are less people home, and it is less expensive to feed the family.” Thus, in poor households, migrants helped the household economy not only by sending back remittances but also by relieving the household’s burden of supporting them.

The experiences of households that owned land, however, were different. A father whose three sons migrated told us about the devastating effect of that move on the household economy: “Before, three men helped work in the rice field, so things were easier. Now I don’t have any help.” Similarly, a return migrant acknowledged the negative effect of his migration decision on the household: “It might have been better for me to stay in the village because we had land. When I migrated for work, no one took care of the land, so we had to rent it out.”

In rich households, then, migration implied a loss in the labor force available for local economic activities. Some migrants, realizing the effect of their departure, sent remittances to make up for their absence, as one migrant told us: “The money [I send] is mainly for hiring help with the farm.” In most cases, though, migrants from wealthier households chose not to send remittances home. A village headman explained this pattern: “They think that their father is already well off . . . not in any difficulty, so they don’t send money. [Migrants] are still teenagers, so they go out and spend all their money.” In fact, in some cases, migrants from wealthy households asked for money. The father of the three migrant sons, for example, told us: “No one sends me money. Whenever they come, I give them money.”

These observations suggest that households’ initial economic status determines the labor needs in the origin and thus the potential impact of migration on the household economy. In poor households, the departure of young adults seems beneficial because it relieves the consumption burden and potentially brings remittances. Conversely, in rich households, the opportunity cost of losing young adults is higher because of the household’s local economic activities. Accordingly, migration may be detrimental, especially if the migrants do not send remittances in lieu of their domestic labor.

Based on these observations, I hypothesize that the impact of having a migrant or a remitter will vary by households’ wealth status. All else equal, poor households with a migrant will gain more assets than those without a migrant. Poor households with a remitting migrant will gain more assets than those with a nonremitting migrant. Rich households with a migrant, by contrast, will lose more assets than those without a migrant, but rich households with a remitting migrant will gain more assets than those with a nonremitting migrant.

These hypotheses qualify some of the mixed findings on the impact of migration on household wealth. Many studies have found that migration increases household investments through remittances (Dustmann and Kirchkamp 2001; Lucas 1987; Woodruff and Zenteno 2007; Yang 2008), but others have argued that migration diminishes household investments by reducing the labor endowment (Miluka et al. 2010; Rozelle et al. 1999) or efficiency (Itzigsohn 1995). My hypotheses connect these two sets of findings and suggest that the impact of migration on household wealth depends on the household’s initial wealth status.

Prior research has distinguished between migrants’ investments in productive and consumer assets, suggesting that the former leads to greater economic growth in the long run (Durand et al. 1996a; Massey and Parrado 1998). Qualitative data have provided mixed evidence on how households used remittance funds in the Nang Rong villages. Asked about how remittances have contributed to her household’s welfare, for example, the mother of a migrant responded: “My life is much better than before. I now own a home and farmland.” Referring to a successful migrant, a headman described: “[With remittance money] he bought cattle worth of 200,000 baht. He also bought land for his wife worth 200,000 to 300,000 baht [about $4000 to $6000 US].” A return migrant similarly explained that he “opened a grocery store for [his] wife with remittance income.”

Although such examples of productive use of remittances were numerous, a considerable share of respondents spent remittances to buy consumer goods. Some respondents actually received household appliances from migrants instead of money. The mother of a migrant daughter told us: “Sometimes they [migrants] do send back some small commodities like clothes or small electronic devices. It is quite rare to get microwaves, fridges, and other big stuff, but two or three of us do get those things.” Similarly, a return migrant explained: “Those whose children remit have a TV and a fridge.” A return migrant remarked on the gender differences: “Men usually spend money on new cars, new motorcycles. . . . They’re less likely to open a business compared to women.”

These mixed observations do not suggest a clear direction on whether migrant households invest in productive or consumer assets. Thus, I pose this as an empirical question for the survey data.

Survey Data

To test the hypotheses, I use the Nang Rong survey data collected in three waves in 1984, 1994, and 2000. The 1984 wave was a census of 51 villages in Nang Rong (including the eight villages selected for fieldwork) that collected information on individual demographics, household assets, and village characteristics. The 1994 and 2000 waves replicated the 1984 census, following all 1984 respondents who were still living in the original 51 villages and adding any new residents. The 1994 and 2000 household rosters recorded whether a household member from the previous wave moved out of the village two months or more prior to the survey, and whether those who had moved out sent money or goods to the household in the past 12 months. The rosters also collected detailed records of household assets. I use these data to compute the key indicators for analysis.

The 1997 Asian financial crisis falls roughly in the middle of the study period. These data cannot capture the immediate response to the crisis, but migration and remittance behaviors show remarkable consistency over time. More than 90 % (78) of households that had migrants (remitters) according to the 1994 survey also had migrants (remitters) in the 2000 survey. Therefore, I expect the 1994 measures to provide a good proxy for the migration and remittance patterns after the 1997 crisis.

Measuring Wealth Change

I seek to evaluate how having a migrant or a remitter in the household prior to 1994 affects subsequent changes in assets from 1994 to 2000. Migrants are defined as individuals who were members of their households in 1984 but who moved out of the village two months or more prior to the 1994 survey. Remitters are defined as migrants who sent money or goods (food, clothing, household items, electrical appliances, or vehicles) to their households in the 12 months preceding the survey (as reported by the household members in origin communities).

To measure the change in household assets from 1994 to 2000, I create an aggregate index from 14 asset categories measured in both years. Following Filmer and Pritchett (2001), I apply principal components analysis (PCA) but retain the ordinal measures by using polychoric rather than Pearson’s correlation (Kolenikov and Angeles 2009). The polychoricpca routine in Stata generates weights for the 14 asset indicators in the pooled data from 1994 and 2000. These indicators include counts (number of cows, buffalo, or pigs; number of TVs, VCRs, refrigerators, cars, motorcycles, itans (small tractors), tractors, and sewing machines) as well as categorical variables (house has windows, household uses gas or electricity for cooking, whether water is piped into household).Footnote 1 To avoid arbitrary weighting in PCA resulting from differences in scale, I use three categories for the count measures. For the livestock indicators, the categories included a group of zero values (the majority of cases) and two groups for low and high levels of ownership based on the median of nonzero values. The counts of assets were top-coded at 2; the higher values contain less than 1 % of the sample.

A separate PCA generates weights for the assets in the 1984 survey, which included a different set of indicators. I do not include the 1984 data in the global PCA because it would force me to drop several indicators measured in 1994 and 2000. The 1984 asset index is not a central measure for this analysis and serves only as a control for baseline wealth.

Table 1 displays the scoring coefficients of the first principal component given by the polychoric PCA of the pooled data from 1994 and 2000. The left panel reports the coefficients for productive assets: (1) farming tools (itans and tractors) and (2) livestock (cows, buffalo, and pigs). The right panel reports the coefficients for consumer assets: (1) housing quality (windows, type of cooking fuel, water piped in) and (2) durables (TVs, VCRs, refrigerators, cars, motorcycles, and sewing machines).Footnote 2 Household indices for productive and consumer assets are computed by summing the value of each indicator weighted by the corresponding PCA coefficient. For ease of interpretation, the asset indices are scaled to range between 0 and 10. The change in household assets is measured by subtracting the 1994 (productive or consumer) index from its 2000 value.

Modeling Households’ Migration and Remittance Choices

The analysis begins with two logit models of (1) whether a household has any migrants recorded in the 1994 survey (who may have moved any time from 1984 to 1994) and (2) whether any migrant sent remittances in the year preceding the survey. These models help demonstrate the selectivity in migration and remittance choices, which the subsequent models for change in wealth correct for. For the first model, let π i = Pr(mig i = 1) denote the probability that household i has a migrant. The log odds of migrating relative to not migrating, denoted η i , is a linear function of relevant characteristics x i ,

where β represents the vector of coefficients. The second model is identical but considers the probability that household i receives remittances given that it has a migrant.

The surveys did not collect information on the exact timing of migration, which may have occurred any time from right after the 1984 (1994) survey to two months prior to the 1994 (2000) survey. All indicators in the migration model are kept at 1984 values to ensure that they capture the conditions prior to migration. Number of seniors (aged 65 or older) and children (aged 14 or younger) indicate the dependents in the household; the age of the household head, number of sons and daughters (aged 15 or older), and mean years of education capture the potential for mobility in the household. Indices of household productive and consumer assets in 1984 measure household’s baseline wealth. Indicators for whether household had any prior migrants and the percentage of ever-migrants in the village (both aggregated from the 1984 household survey)Footnote 3 proxy the prevalence of migration behavior. The indicators for electrification, number of rice mills, and presence of a primary or secondary school capture the village development level. Months of water shortage in the village measure risks to farming income. Time to district proxies distance to urban centers, and hence, the cost of migrating.

The remittance model includes four additional indicators that measure migrant characteristics as recorded in the 1994 survey.Footnote 4 The indicators for the number of male and female migrants are intended to capture the gendered remittance patterns. The average years of education among migrants indicates the earning potentials in destination. Finally, the percentage of remitters among households in the village (aggregated from the 1994 household survey) measures the collective remittance behavior.

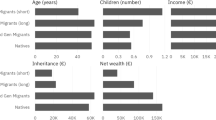

Table 2 summarizes the sample characteristics by households’ migration and remittance status as reported in the 1994 survey. Households with migrants have a higher number of seniors and children as well as older sons and daughters, and higher average education; but they are poorer in productive assets than nonmigrant households. Among households with migrants, those receiving remittances have a higher number of sons and daughters and a higher number of male and female migrants. Migrants are more likely to come from households with prior migrants and villages with a higher percentage of migrants, and remitters from villages with a higher percentage of remitters (p < .05, two-tailed, for all mentioned differences). This descriptive analysis suggests the explanatory power of the selected variables for migration and remittance outcomes.

Modeling Wealth Change

The main analysis tests the effect of migration and remittance decisions (binary indicators introduced in two separate models) on the change in households’ productive and consumer asset indices from 1994 to 2000. The hypotheses suggest that the effect might vary across wealth groups; thus, the analysis is run separately for poor, medium-wealth, and rich households. The wealth categories are based on the tertiles of the productive asset index, but the robustness of the results to alternative categorizations is established in Table 6 of Appendix A. The wealth change models include all the controls in the migration and remittance models.

To set a baseline, I start with an ordinary least squares (OLS) estimation. The model expresses the change in household i’s assets from 1994 to 2000 (Δa i = a i,00 − a i,94) as a function of the household’s migration decisions prior to 1994 (mig i,84 → 94) and other relevant characteristics x i (measured in 1984),

where λ and α are the corresponding coefficients, and ε i is the error term. A second model estimates the effect of remittance behavior prior to 1994 (rem i,93 → 94) on asset change among households with migrants. Based on the definitions in the questionnaires, migration could have occurred anytime from 1984 to two months prior to the 1994 survey (indicated as 84→94 in the variable subscript). Remittances could be sent anytime during the 12 months preceding the 1994 survey (indicated as 93→94 in the variable subscript).Footnote 5

I focus on the change in assets in order to control for unobserved time-invariant factors that might affect a household’s assets in both 1994 and 2000. By comparing the change in households with a migrant (or a remitter) to that in households without a migrant (or a remitter), I also account for unobserved time-varying factors to the extent that those factors affect both types of households similarly. This difference-in-differences method assumes that in the absence of migration or remittances, all households would have experienced similar changes in wealth from 1994 to 2000 (controlling for the observed characteristics). A descriptive analysis suggested by Gertler et al. (2011), and available upon request, suggested no threat to this “equal trends” assumption.

OLS regression also assumes treatment effects to be constant in the population, but in reality, households may assign themselves to treatment (having a migrant or a remitter) based on expectations about the outcome (change in assets). This endogenous selection leads to heterogeneity in the treatment effects; put differently, because households do not randomly send migrants or receive remittances, a simple comparison of the change in assets across households’ migration-remittance choices confounds the effect of those choices with the selection process into those choices. Matching methods account for this heterogeneity by balancing the covariates between the treatment and control groups, and thus by undoing the selection into treatment, given that the selection is based on observable characteristics.Footnote 6

Prior research on wealth accumulation in Thailand relied on matching methods to correct for heterogeneous treatment effects (Ford et al. 2009). These methods use a distance measure to group similar observations from the treated and control cases (e.g., households with and without migrants) into matched categories. A popular distance measure is the Mahalanobis distance, which is based on the Euclidean distance between the covariate vectors of each pair of observations weighted by the sample covariance matrix. Using this measure, I perform one-to-one nearest-neighbor matching using the same covariates, x, included in the OLS with psmatch2 routine in Stata. I remove the treated units that are outside the common support of the control units as well as those that are more distant to the controls than a selected caliper (the cutoff for the maximum distance allowed). I use a caliper of 2 to match migrants to nonmigrants and a caliper of 5 to match remitters to nonremitters (among migrants).Footnote 7 I repeat the matching for each subsample (poor, medium-wealth, and rich households) and compute the standard errors for the estimates with the bootstrap.Footnote 8

Table 3 compares covariate and propensity score (the predicted probability of treatment given the covariates) means in the overall and the restricted matched sample for two treatments of interest (having a migrant or a remitter) across three wealth groups. For each covariate, the table reports the standardized difference of means, that is,

to quantify the bias between treatment and control samples (Rosenbaum and Rubin 1985), where \( {\overline{x}}_T \)and s T represent the mean and standard deviation of the covariate in the treatment sample, and \( {\overline{x}}_C \)and s C denote the same statistics in the control sample.

Panel A shows the standardized mean differences in all covariates for a subsample of poor households. In the unmatched sample, the differences between the treatment and control groups are considerable. The bias for the age of the household, for example, is about 90 % (suggesting that the difference in means for the treatment and control groups is 90 % as large as the standard deviation). The bias drops to 11 % in the matched sample (an 88 % reduction). Other covariates display similar rates of reduction in bias, suggesting dramatic improvements in balance.

Panels A through F also show the standardized differences in propensity scores for different subsamples (poor, medium-wealth, and rich households) and treatments (having a migrant or a remitter). In all six cases, the standardized difference in the matched sample is much smaller than 50 %, the upper bound suggested by Rubin (2001) for the regression adjustment to be reliable. Each panel also shows the ratio of the variances of the propensity score in the treatment and control groups in the matched sample. In all cases, the ratio is close to 1 (and invariably between 0.5 and 2.0), thus indicating acceptable balance according to Rubin’s (2001) rule of thumb. Finally, Table 7 in Appendix B shows the robustness of the final results to caliper size. It also demonstrates the direct relationship between the size of the caliper and the size of the matched sample (both of which are inversely related to the degree of covariate balance).

Matching methods are not robust to potential bias arising from unobserved variables that affect both assignment to treatment (migrating and remitting) and the outcome (change in assets). Instrumental variable (IV) estimation provides an alternative method for identifying treatment effects in such cases (implemented in the treatreg routine in Stata for binary treatments). The method relies on the availability of an instrument, a variable that affects the probability of treatment but not the outcome (nor any unobserved variables affecting the outcome).

Prior work has relied on an indicator of migration prevalence in the community as an instrument for selecting into migration (Hoddinott 1994; Mora 2005; Taylor et al. 2003). Similar to this work, I use the percentage of migrants in the village prior to 1984 as an instrument for migration. Additionally, I compute the percentage of migrants in household’s sibling network in 1984. The sibling network includes the households in which the members of the respondent’s household include at least one sibling (often as a result of that sibling marrying into the alter household) in 1994. Similarly, for remittance behavior, I use two instruments: the percentage of remitters in the community and the percentage of remitters in the household’s sibling network in 1984.Footnote 9

This estimation strategy relies on the assumption that the instruments affect changes in household wealth only indirectly through their effect on migration (or remittances). This exogeneity assumption is essentially untestable, but one can consider potential threats to its validity. One potential threat is that village characteristics may have determined prior migration or remittance rates as well as current opportunities for wealth gain. To consider this possibility, I include controls for the availability of infrastructure (electrification, schools, rice mills) and village distance to district measured in 1984—the same year as the migration (and remittance) prevalence indicators. I also include indicators of household size and education, which may affect both past migration and remittance decisions in the sibling network and recent trends in household wealth.

A second potential threat is that the members of the sibling network may have remitted to the individual’s household, contributing to that household’s asset gain directly. To discard this possibility, I exclude from the sample 388 households with ties to households in which the members reported remitting to other households than their own. Despite the introduction of the household- and village-level controls and the sample restrictions, the instruments remain strong predictors of migration and remittance decisions in 1994, with F statistics (displayed in upcoming Table 5) typically higher than or close to the lower bound of 10 suggested by Staiger and Stock (1997) to reject the hypothesis of weak instruments.

A lingering threat to validity involves the possibility that past migration and remittance rates are associated with the unobserved determinants of wealth change. In that case, one would expect those rates to be correlated with other measures, such as household’s local labor force, that are highly predictive of wealth change. I examine the partial correlations between the instruments and number of individuals involved in local economic activities in 1994. The regression results (available from the author) show that both instruments have statistically insignificant associations with household economic activities for all wealth categories. These analyses suggest that the proposed instruments are valid sources of identification.

Results

Modeling Households’ Migration and Remittance Choices

Table 4 presents the odds ratios from two logit models of households’ migration and remittance choices, which allow me to demonstrate the selectivity in these choices—and to suggest potential underlying behavioral mechanisms—in the Thai setting. The estimates in the first column show that the odds of having a migrant increase with the age of the household head and the number of children in the household, but decrease with the number of seniors in the household. The odds of remitting also increase with the number of children, suggesting a potential contractual agreement between the household and the migrant to exchange child care for remittances (Banerjee 1984; Itzigsohn 1995); this finding counters that of other research in the same setting (Osaki 2003).

The odds of migrating increase with the number of sons and daughters (older than 15) in the household. This pattern may reflect a competition for future inheritances, such that sons or daughters opt to show their worth by migrating and remitting, or a simple crowding-out effect in which young adults leave large households for better opportunities. Given that the odds of remitting also increase with the number of daughters (who are more likely to be heirs in the Thai context), the inheritance-seeking hypothesis seems more viable and is supported by prior evidence from Thailand (Chamratrithirong et al. 1988; Curran et al. 2005; VanWey 2004). The slightly higher effect sizes for daughters and female migrants than for sons and male migrants support the gendered remittance patterns identified by VanWey (2004).

The odds of migration increase with the mean years of education in the household, possibly because of the higher returns to education in urban destinations than in the rural origin. The odds of migration decrease with household’s productive and consumer assets in 1984, suggesting that individuals from poor households—those who have the least to lose and the most to gain by migrating—are at the greatest risk to do so. This pattern, also identified in Osaki’s (2003) work and facilitated by the low financial costs of migrating in Thailand, could reflect either an individual strategy to maximize income in line with the neoclassical theory of migration (Todaro 1969) or a household strategy to overcome credit constraints as argued by the new economics of labor migration (NELM) (Stark and Taylor 1989). The latter implies that migrants from poor households should be more likely to send remittances to reach household economic objectives. The data support this pattern; the odds of receiving remittances are higher in poor households (measured by consumer assets).

Migration is more likely in communities with a higher percentage of migrants, and remittances in communities with a higher percentage of remitters. Both patterns suggest that individuals or households may respond to social influences or resources from prior migrants or remitters as argued by the cumulative causation theory of migration (Massey 1990). An alternative explanation, which considers the lingering economic pressures that lead past behavior to be correlated with current decisions, has been discarded with longitudinal data from Nang Rong in other work (Garip 2008; Garip and Curran 2010).

Modeling Wealth Change

Panel A of Table 5 shows results from OLS, matching, and IV models of the change in households’ productive assets from 1994 to 2000 estimated separately for poor, medium-wealth, and rich households. Wealth categories are based on the tertiles of the productive asset index in 1994. The dependent variable is standardized to a mean of 0 and a standard deviation of 1. The primary variables of interest—whether a household had any migrants in the 1994 survey and whether those migrants sent remittances—are introduced separately in the left and right columns.

The three estimation strategies, with a different set of assumptions, yield remarkably similar results. For poor households, having a migrant is associated with a 0.38 standard deviation increase in productive assets according to OLS. This effect is slightly lower (0.33) in the matching model and highest (0.42) in the IV model. For medium-wealth households, having a migrant is related to a 0.20 standard deviation decrease in productive assets, an effect closely mirrored in the matching model but insignificant in the IV model. For rich households, having a migrant leads to a devastating 0.36-standard deviation decrease in productive assets, an effect replicated in the matching (–0.39) and IV (–0.35) estimates.

The three models also yield consistent estimates of the effect of remittances on household assets (among those with migrants). For poor households, having a remitter is associated with a 0.45 standard deviation gain in productive assets according to OLS, an effect that is slightly larger in the matching model (0.56) and the largest in the IV model (0.72). For medium-wealth households, having a remitter has no effect on productive assets in any of the models. For rich households, having a remitter is related to a 0.32 standard deviation loss in productive assets, an effect that is larger in the matching model (–0.38) but insignificant in the IV model. The negative effect in the first two models is likely due to unobserved factors that are correlated with both having a remitter and wealth change. (For example, rich households may receive remittances only if they are already losing wealth as the result of unobserved economic difficulties.) Because the IV estimate takes account of such unobserved characteristics, it is given the highest weight here.

Panel B of Table 6 repeats the same analysis for consumer assets. In all wealth groups and across the three estimation strategies, having a migrant or a remitter has no effect on the changes in consumer assets, with one exception: the effect of having a migrant is negative for poor households in the OLS model. However, this result is not supported by the alternative models, so it is not given any weight here.

Discussion

The results generally support the hypotheses generated from qualitative data. Poor households with a migrant gain more assets than those without a migrant, and those with a remitting migrant gain more assets than those with a nonremitting migrant. By contrast, rich households with a migrant lose more assets than those without a migrant. In contrast to my hypothesis, rich households with a remitting migrant experience similar, not higher, wealth gain compared with those with a nonremitting migrant. One explanation for this pattern—namely, that rich households do not receive sufficiently large remittances to instigate wealth gain—could be tested with more refined data on remittance amounts in future work. Finally, the results contribute to the empirical debate on migrant investments by showing that having a migrant or a remitter is associated with the changes in households’ productive, but not consumer, assets.

The qualitative data suggest the differential labor needs at origin as a potential mechanism for the observed differences in wealth change in poor and rich households, and the survey data provide some supporting evidence. In 1984, prior to migration, poor and medium-wealth households engaged in an average of 3.7 and 3.8 (respectively) economic activities (land cultivation, animal raising, cloth weaving, silkworm raising, food preservation, bamboo and basket weaving, and vegetable gardening). Rich households, by contrast, participated in 4.3 activities on average—a significantly higher number (p < .001). Similarly, poor and medium-wealth households both had around 1.6 members per economic activity, while rich households had the significantly lower number of 1.5 (p < .001). These patterns confirm that rich households may face higher opportunity costs to sending migrants.

Given these costs, then, why do rich households still send migrants? A potential explanation is an intergenerational maximization model, where parents invest in migration to transfer low-return resources in rural areas (e.g., land) to higher-return resources in urban destinations (e.g., education for the migrant). This model implies that rich households may benefit from migration in the next generation. The data cover a limited period of six years, prohibiting a test of such long-term trajectories.Footnote 10 An alternative explanation builds on the within-household conflict suggested in focus group discussions. A village headman told us: “If parents have enough money, they don’t want their children to go [migrate].” However, children sometimes ignore their parents’ wishes, as a return migrant explained: “I went to find work. [My parents] didn’t really want me to go, but I was stubborn.” A father of three migrant sons similarly told us: “[My sons] ran away. Maybe they were bored of working in the rice fields. . . . The oldest son went first, and told the two younger brothers to follow.” These examples challenge the household-level accounts, such as the NELM theory, which presume joint decision-making between the migrant and other household members (Stark 1991; Stark and Taylor 1991). Prior work showed how gender hierarchies in the household produce conflict about women’s migration (Goss and Lindquist 1995; Grasmuck and Pessar 1991; Hondagneu-Sotelo 2001). These findings contribute to that work but suggest alternative, potentially intergenerational sources of conflict, and similarly render the treatment of household as a unified decision-making unit questionable (Mahler and Pessar 2005).

Conclusion

This study evaluates the impact of internal migration and remittance flows on wealth accumulation and distribution in 51 rural villages in the Nang Rong district of Thailand. Migration literature remains bifurcated on these questions. Many studies have found that remittances from migrants lead to productive asset accumulation and therefore support economic growth at origin; other studies have shown that these funds are spent exclusively on consumption and merely contribute to higher living standards that are unsustainable in the long run. Similarly, several studies have claimed that remittances decrease economic disparities by closing the gap between the rich and the poor, while others have connected these funds to increasing economic inequalities in origin communities.

To contribute to these debates, this study first uses qualitative data from focus group interviews to generate hypotheses about the impact of migration and remittances on wealth accumulation in the internal migration setting of Thailand. The study then tests the hypotheses with survey data from 51 rural villages in Nang Rong and returns to qualitative data to suggest potential mechanisms for the observed regularities.

This mixed-methods approach yields several insights. First, households’ migration and remittance choices have a significant effect on the level and nature of their subsequent investments. The direction of the effect, however, depends on households’ initial wealth status. Among the poorest one-third (based on the distribution of productive assets), households with a migrant gained more productive assets than those without a migrant, and households with a remitting migrant gained more than those with a nonremitting migrant. Many studies observed the latter pattern, but not the former, which the focus group participants attributed to reduced consumption needs in households with a migrant.

In stark contrast, among the richest one-third, households with a migrant lost more productive assets compared with those without a migrant. One explanation for this pattern—supported by descriptive analysis—is provided by the respondents, who emphasize the existing investments of rich households in the origin, which require labor to maintain and thus impose high opportunity costs to migration. Theoretically, migrants can compensate for their departure by sending remittances. In the Thai data, however, households with a remitting migrant did not experience an additional asset gain compared with those with a nonremitting migrant, suggesting that remittances may not be sufficiently large in magnitude, which could be tested in future work.

Finally, the results establish that while migration and remittances significantly affected the changes in households’ productive assets, these decisions had no impact on households’ consumer asset investments. These results show that migration and remittance flows lead to productive asset acquisitions among poor households and thus carry potential for long-term economic growth. The same flows lead to losses among the rich and thus are likely to have an equalizing effect on the wealth distribution in rural Thai villages.

A shortcoming of this analysis is the lack of data to assess the impact of the 1997 Asian financial crisis on the changes in household assets. My focus here, though, is on the differences in wealth gain (or loss) between households with and without migrants; therefore, this omission is not problematic as long as the crisis can be assumed to have affected all households similarly, regardless of their migration choices. This assumption can be verified (or refuted) in future work if longitudinal data capturing household wealth immediately before and after the crisis become available to researchers.

Overall, the findings suggest two fruitful research directions. The first is to consider households’ initial wealth as an important qualifier for the effect of migration on future investments. Prior work has observed that migration may affect household investments through three channels: (1) by reducing the consumption needs, (2) by changing the labor supply, and (3) by generating remittances (Davis et al. 2010). Future work might question how households’ initial wealth interferes with each channel. A second direction is to develop more complex behavioral models of migration. Prevailing models depict migration as an individual strategy to maximize income (Todaro 1969) or a household strategy to diversify risks (Stark and Taylor 1989). The findings here—for example, migration out of rich households despite subsequent economic loss—call these classic models into question. New models that take into account intergenerational dynamics (e.g., households maximizing income across multiple generations) or conflicts (e.g., sons and daughters migrating despite parents’ objections) may help us better understand these outlier cases.

Notes

Household land is measured inconsistently across survey waves and is also excluded from the asset index computation. Although the 1984 and 1994 surveys captured both the total amount of land owned and land used, the 2000 survey asked about only the latter. The exclusion of land does not affect the main results. Alternative models of productive asset change (where the asset index includes land owned in 1994 and land used in 2000) produce qualitatively similar results (available upon request) to those presented here.

Some of the consumer assets can be considered productive. For example, household members may use a car or motorcycle for work, or a sewing machine to produce clothing to be sold. This alternative classification does not change any of the results.

Migrants are defined as “temporarily absent” household members, whose reason for moving is reportedly related to education or work.

Because migration, by definition, precedes remittance behavior, simultaneity bias is not a concern.

I restrict the analysis to migration decisions reported in the 1994 survey to ensure that the decisions are strictly prior to the changes in wealth from 1994 to 2000. I exclude from the sample 835 households that reported no migrants in the 1994 survey but had a migrant in the 2000 survey (final N = 4,614). Thus, I compare households with a migrant in the 1994 survey with those without a migrant in both the 1994 and 2000 surveys. Similarly, in testing the effect of remittances on wealth change, I take out 531 households that reported no remitters in 1994 but had a remitter in 2000 (final N = 2,687).

Endogenous selection is especially problematic for remittance receipts because households with a migrant can exercise the option of asking for remittances under economic duress. However, the matching method used here, along with the descriptive analysis testing the equal trends assumption, reduces its viability to households that do not show any visible signs of wealth change prior to 1994 but still expect one between 1994 and 2000 and receive remittances as a result. The IV method applied later further reduces the potential sources of endogeneity to time-variant unobservables that affect both wealth change and the selected instruments (that is, the percentage of remitters among sibling and village ties).

A common concern with the one-to-one nearest-neighbor matching is that it can discard a large number of observations that are not selected as matches (Stuart 2010). An alternative method—kernel matching—includes all observations, matching treated units with a weighted average of all controls. The weights are inversely proportional to the distance between the treated and control pairs. The estimates from this method (available upon request) are very similar to those from one-to-one nearest-neighbor matching.

Abadie and Imbens (2008) questioned the use of the bootstrap for calculating standard errors and provided an alternative estimator (Abadie and Imbens 2006, 2011). The results obtained with this estimator (available upon request) are very similar to those estimated with the bootstrap standard errors.

The sibling network was measured in 1994, but I compute the aggregate migration or remittance behavior in that network in 1984. Some of the network ties in 1994 may be absent in 1984. To consider this possibility, I exclude the ties to siblings who were younger than 35 in 1984 because those siblings may still be living in the individual’s household then. The results, however, are robust to their inclusion.

I thank an anonymous reviewer for suggesting this explanation.

References

Abadie, A., & Imbens, G. W. (2006). Large sample properties of matching estimators for average treatment effects. Econometrica, 74, 235–267.

Abadie, A., & Imbens, G. W. (2008). On the failure of the bootstrap for matching estimators. Econometrica, 76, 1537–1557.

Abadie, A., & Imbens, G. W. (2011). Bias-corrected matching estimators for average treatment effects. Journal of Business & Economic Statistics, 29, 1–11.

Acosta, P. (2008). What is the impact of international remittances on poverty and inequality in Latin America? World Development, 36, 89–144.

Adams, R. (1992). The effects of migration and remittances on inequality in rural Pakistan. Pakistan Development Review, 31, 189–203.

Adams, R. (2006). International remittances and the household: Analysis and review of global evidence. Journal of African Economies, 15(AERC Suppl. 2), 396–425.

Adams, R., & Cuecuecha, A. (2010). Remittances, household expenditure and investment in Guatemala. World Development, 38, 1626–1641.

Adams, R., & Page, J. (2005). Do international migration and remittances reduce poverty in developing countries? World Development, 33, 1645–1669.

Banerjee, B. (1984). The probability, size and uses of remittances from urban to rural areas in India. Journal of Development Economics, 16, 293–311.

Bello, W., Cunningham, S., & Li, K. P. (1998). A Siamese tragedy: Development and disintegration in modern Thailand. Oakland, CA: Food First Books.

Brown, R. P., & Alhburg, D. (1999). Remittances in the South Pacific. International Journal of Social Economics, 26, 325–344.

Chamratrithirong, A., Morgan, P., & Rindfuss, R. (1988). Living arrangements and family formation. Social Forces, 66, 926–950.

Curran, S. R., Garip, F., & Chung, C. Y. (2005). Advancing theory and evidence about migration and cumulative causation: Destination and gender in Thailand (CMD Working Paper No. 05-04). Princeton, NJ: Center for Migration and Development, Princeton University.

Davis, B., Carletto, G., & Winters, P. (2010). Migration, transfers and economic decision making among agricultural households: An introduction. Journal of Development Studies, 46, 1–13.

Durand, J., Kandel, W., Parrado, E. A., & Massey, D. S. (1996a). International migration and development in Mexican communities. Demography, 33, 249–264.

Durand, J., Parrado, E. A., & Massey, D. S. (1996b). Migradollars and development: A reconsideration of the Mexican case. International Migration Review, 30, 423–444.

Dustmann, C., & Kirchkamp, O. (2001). The optimal migration duration and activity choice after re-migration (IZA Discussion Paper No. 266). Bonn, Germany: Institute for the Study of Labor.

Ebeke, C., & Le Goff, M. (2011). Why migrants’ remittances reduce income inequality in some countries and not in others? (Working paper). Retrieved from http://halshs.archives-ouvertes.fr/halshs-00554277/en/

Edwards, A. C., & Ureta, M. (2003). International migration, remittances, and schooling: Evidence from El Salvador. Journal of Development Economics, 72, 429–461.

Entwisle, B., & Tong, Y. (2005, April). The impact of remittances on rural households in Nang Rong, Thailand. Paper presented at the annual meetings of the Population Association of America, Philadelphia, PA.

Filmer, D., & Pritchett, L. H. (2001). Estimating wealth effects without expenditure data—or tears: An application to educational enrollments in states of India. Demography, 38, 115–132.

Ford, K., Jampaklay, A., & Chamratrithirong, A. (2009). Longitudinal analysis of remittance and household wealth in Kanchanaburi, Thailand. Asian and Pacific Migration Journal, 18, 283–301.

Funkhouser, E. (1992). Mass emigration, remittances and economic adjustment: The case of El Salvador in the 1980s. In G. J. Borjas & R. B. Freeman (Eds.), Immigration and the work force: Economic consequences for the United States and source areas (pp. 135–177). Chicago, IL: The University of Chicago Press.

Garip, F. (2008). Social capital and migration: How do similar resources lead to divergent outcomes? Demography, 45, 591–617.

Garip, F. (2012). Repeat migration and remittances as mechanisms for wealth inequality in 119 communities from the Mexican Migration Project Data. Demography, 49, 1335–1360.

Garip, F., & Curran, S. (2010). Increasing migration, diverging communities: Changing character of migrant streams in rural Thailand. Population Research and Policy Review, 29, 659–685.

Gertler, P., Martinez, S., Premand, P., Rawlings, L. B., & Vermeersch, C. M. J. (2011). Impact evaluation in practice. Washington, DC: World Bank.

Goldring, L. (1990). Development and migration: A comparative analysis of two Mexican migrant circuits. Washington, DC: Commission for the Study of International Migration and Cooperative Economic Development.

Goss, J., & Lindquist, B. (1995). Conceptualizing international labor migration: A structuration perspective. International Migration Review, 29, 317–351.

Grasmuck, S., & Pessar, P. R. (1991). Between two islands: Dominican international migration. Berkeley: University of California Press.

Greenwood, M. (1985). Human migration: Theory, models, and empirical studies. Journal of Regional Science, 25, 521–544.

Hoddinott, J. (1994). A model of migration and remittances applied to western Kenya. Oxford Economic Papers, 46, 459–476.

Hondagneu-Sotelo, P. (2001). Domestica: Immigrant workers cleaning and caring in the shadows of afluence. Berkeley: University of California Press.

Itzigsohn, J. (1995). Migrant remittances, labor markets, and household strategies: A comparative analysis of low-income household stategies in the Caribbean basin. Social Forces, 74, 633–655.

Jansen, K. (1997). External finance in Thailand’s development: An interpretation of Thailand’s growth boom. New York: St. Martin’s Press.

Koechlin, V., & Leon, G. (2007). International remittances and income inequality: An empirical investigation. Journal of Economic Policy Reform, 8, 205–226.

Kolenikov, S., & Angeles, G. (2009). Socioeconomic status measurement with discrete proxy variables: Is principal components a reliable answer? The Review of Income and Wealth, 55, 128–165.

Lauby, J., & Stark, O. (1988). Individual migration as a family strategy: Young women in the Philippines. Population Studies, 42, 473–486.

Lucas, R. E. (1987). Emigration to South Africa’s mines. American Economic Review, 77, 313–330.

Mahler, S. J., & Pessar, P. R. (2005). Gender matters: Ethnographers bring gender from the periphery toward the core of migration studies. International Migration Review, 40, 27–63.

Massey, D. S. (1990). The social and economic origins of migration. Annals of the American Academy of Political and Social Science, 510, 60–72.

Massey, D. S., & Basem, L. C. (1992). Determinants of savings, remittances, and spending patterns among U.S. migrants in four Mexican communities. Sociological Inquiry, 62, 185–207.

Massey, D. S., & Parrado, E. A. (1998). International migration and business formation in Mexico. Social Science Quarterly, 79, 1–20.

McKenzie, D., & Rapoport, H. (2007). Network effects and the dynamics of migration and inequality: Theory and evidence from Mexico. Journal of Development Economics, 84, 1–24.

Mills, M. B. (1999). Thai women in the global labor force: Consuming desires, contested selves. New Brunswick, NJ: Rutgers University Press.

Miluka, J., Carletto, G., Davis, B., & Zezza, A. (2010). The vanishing farms? The impact of international migration on Albanian family farming. Journal of Development Studies, 46, 140–161.

Mines, R., & De Janvry, A. (1982). Migration to the United States and Mexican rural development: A case study. American Journal of Agricultural Economics, 64, 444–454.

Mora, J. (2005). The impact of migration and remittances on distribution and sources of income (U.N. Population Division Working Paper). New York: United Nations.

Osaki, K. (2003). Migrant remittances in Thailand: Economic necessity or social norm? Journal of Population Research, 20, 203–222.

Papademetriou, D. G., & Martin, P. L. (1991). In D. G. Papademetriou & P. L. Martin (Eds.), The unsettled relationship: Labor migration and economic development (pp. 3–26). New York: Greenwood Press.

Ratha, D., Mohapatra, S., & Silwal, A. (2011). Migration and remittances factbook 2011. Washington DC: World Bank Publications.

Reardon, T. (1997). Using evidence of household income diversification to inform study of the rural nonfarm labor market in Africa. World Development, 25, 735–747.

Reichart, J. S. (1981). The migrant syndrome: Seasonal U.S. wage labor and rural development in central Mexico. Human Organization, 40, 56–66.

Rempel, H., & Lobdell, R. A. (1978). The role of urban-to-rural remittances in rural development. Journal of Development Studies, 14, 324–341.

Rosenbaum, P. R., & Rubin, D. B. (1985). Constructing a control group using multivariate matched sampling methods that incorporate the propensity score. The American Statistician, 39, 33–38.

Rozelle, S., Taylor, J. E., & DeBrauw, A. (1999). Migration, remittances, and agricultural productivity in China. American Economic Review, 89, 287–291.

Rubin, D. B. (2001). Using propensity scores to help design observational studies: Application to the tobacco litigation. Health Services and Outcomes Research Methodology, 2, 169–188.

Russell, S. S. (1992). Migrants’ remittances and development. International Migration, 30, 267–287.

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65, 557–586.

Stark, O. (1991). Migration in LDCs: Risk, remittances, and the family. Finance and Development, 28(4), 39–41.

Stark, O., & Lucas, R. E. (1988). Migration, remittances, and the family. Economic Development and Cultural Change, 36, 465–481.

Stark, O., & Taylor, J. E. (1989). Relative deprivation and international migration. Demography, 26, 1–14.

Stark, O., & Taylor, J. E. (1991). Migration incentives, migration types: The role of relative deprivation. The Economic Journal, 101, 1163–1178.

Stark, O., Taylor, E. J., & Yitzhaki, S. (1988). Migration, remittances and inequality: A sensitivity analysis using the extended Gini index. Journal of Development Economics, 28, 309–322.

Stuart, E. (2010). Matching methods for causal inference: A review and a look forward. Statistical Science, 25, 1–21.

Taylor, J. E. (1992). Remittances and inequality reconsidered: Direct, indirect, and intertemporal effects. Journal of Policy Modeling, 14, 187–208.

Taylor, J. E. (1999). The new economics of labour migration and the role of remittances in the migration process. International Migration, 37, 63–88.

Taylor, J. E., Mora, J., Adams, R., & López-Feldman, A. (2008). Remittances, Inequality and Poverty: Evidence from Rural Mexico. In J. DeWind & J. Holdaway (Eds.), Migration and development within and across borders: Research and policy perspectives on internal and international migration (pp. 103–130). Geneva, Switzerland, and New York: International Organization for Migration and The Social Science Research Council.

Taylor, J. E., Arango, J., Hugo, G., Kouaouci, A., Massey, D. S., & Pellegrino, A. (1996). International migration and national development. Population Index, 62, 181–212.

Taylor, J. E., Rozelle, S., & DeBrauw, A. (2003). Migration and incomes in source communities: A new economics of migration perspective from China. Economic Development and Cultural Change, 52, 75–101.

Taylor, J. E., & Wyatt, T. J. (1996). The shadow value of migrant remittances, income and inequality in a household-farm economy. Journal of Development Studies, 32, 899–912.

Todaro, M. P. (1969). A model of labor migration and urban unemployment in less developed countries. The American Economic Review, 59, 138–148.

VanWey, L. K. (2004). Altruistic and contractual remittances between male and female migrants and households in rural Thailand. Demography, 41, 739–756.

Wiest, R. E. (1984). External dependency and the perpetuation of temporary migration to the United States. In R. C. Jones (Ed.), Patterns of undocumented migration: Mexico and the United States (pp. 110–135). Totowa, NJ: Rowman and Allanheld.

Woodruff, C., & Zenteno, R. (2007). Migration networks and microenterprises in Mexico. Journal of Development Economics, 82, 509–528.

Yang, D. (2008). International migration, remittances and household investment: Evidence from Phillipine migrants. The Economic Journal, 118, 591–630.

Acknowledgements

This research was funded by grants from the Clark Fund, Milton Fund, Weatherhead Center for International Affairs (Synergy Semester Grant), and the Center for Population and Development Studies at Harvard University. I thank Sara Curran, Paul DiMaggio, Douglas Massey, Michael White, Viviana Zelizer, and the participants at the Conference on Immigration and Poverty at UC Davis for helpful suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A. Robustness of the Results to Alternative Wealth Categories

Table 6 checks the robustness of the results to alternative wealth categorizations. The first row of Panel A reproduces the matching estimates presented in Table 5, where the wealth categories are based on the tertiles of the household productive index in 1994. The second row uses an alternative categorization, where the poorest one-fourth in productive assets is compared with the richest one-fourth and the remaining middle half. The third row employs the tertiles of household land owned in 1994 to determine wealth categories. The fourth row uses a simple sum of assets, where binary indicators for having land greater than 10 rai (4 acres), a tractor, an itan, and a car are added and top-coded at 2 to create three categories (0, 1, and 2) that correspond to poor, medium-wealth, and rich households, respectively.

The effect of having a migrant on productive assets is positive and significant for poor households in the first two categorizations based on the tertiles and quantiles of the productive asset index. The effect is negative and significant for medium-wealth households in the first categorization only. The effect is negative and significant for rich households in three of the four categorizations. The effect of having a remitter (among households with migrants) on productive assets is positive for poor households in the first two categorizations and negative for rich households across all categorizations except for the one based on land alone. Models in Panel B replicate the analysis for consumer assets. Regardless of the categorization, having a migrant or a remitter has no effect on the changes in consumer assets for all wealth groups. These results show certain consistency across alternative categorizations, establishing the robustness of the conclusions to various definitions of wealth.

Appendix B. Sensitivity of the Matching Estimates to Caliper Size

Rights and permissions

About this article

Cite this article

Garip, F. The Impact of Migration and Remittances on Wealth Accumulation and Distribution in Rural Thailand. Demography 51, 673–698 (2014). https://doi.org/10.1007/s13524-013-0260-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-013-0260-y