Abstract

Recent empirical research questions the validity of using Malthusian theory in preindustrial England. Using real wage and vital rate data for the years 1650–1881, I provide empirical estimates for a different region: Northern Italy. The empirical methodology is theoretically underpinned by a simple Malthusian model, in which population, real wages, and vital rates are determined endogenously. My findings strongly support the existence of a Malthusian economy wherein population growth decreased living standards, which in turn influenced vital rates. However, these results also demonstrate how the system is best characterized as one of weak homeostasis. Furthermore, there is no evidence of Boserupian effects given that increases in population failed to spur any sustained technological progress.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Preindustrial economic stagnation is typically explained through the use of a Malthusian-style model. This model demonstrates how living standards are trapped by a self-equilibrating system of population and vital rates. However, recent empirical assessments have questioned the model’s validity in preindustrial England (see Crafts and Mills 2009; Kelly and Ó Gráda 2010; Møller and Sharp 2008; Nicolini 2007). The negative relationship between living standards and death rates—the positive check—may have vanished before the Industrial Revolution. Meanwhile, the positive correlation between the birth rates and living standards—the preventive check—persisted longer, although it too may have disappeared before the Industrial Revolution. Deviations in economic conditions ceased to be a matter of life and death in England before the transition to modern economic growth.

This article is motivated by the need to explore the validity of a Malthusian-style model, using a modern statistical methodology as suggested in contemporary research, beyond the confines of the much-studied case of England. Considering data constraints, the focus of previous research on England is understandable. However, reliable annual demographic and economic statistics have also been computed for preindustrial (1650–1881) Northern Italy. These data highlight some substantial differences between the two regions. Between 1650 and 1881, the English economy—and, consequently, English living standards—rose dramatically. This was not the case in Northern Italy, which like the majority of Europe, suffered from economic stagnation. England, and to a lesser extent the Netherlands, were exceptions in premodern Europe. Thus, I argue that my empirical estimates for Northern Italy provide a more accurate representation of the Malthusian relationship in early modern Europe.

The population of Northern Italy grew rapidly during this period, while subsistence crises and epidemic disease caused vital rates to fluctuate accordingly. Considering the aforementioned economic stagnation, along with the demographic variables, strongly suggests a role for Malthusian theory in preindustrial Northern Italy. To investigate this relationship formally, I use a methodological approach that complements the theory alongside the idiosyncrasies of time-series statistical analysis. First, I estimate a textbook vector autoregression (VAR) model to test for the presence of the equilibrating mechanisms, or checks. Using the impulse response functions, I find that a real wage rise causes death rates to fall and birth rates to rise. Additionally, I find that the impact occurred within two years, suggesting that living standards were very much at a subsistence level. To understand how these relationships changed over time, I apply the VAR methodology recursively, using 70-year subsamples. The results of this analysis show that the magnitude of these relationships could deviate somewhat over time. However, I find no indication that the influence of living standards on vital rates had been eradicated by the end of the nineteenth century.

The VAR methodology does not empirically test the relationship between population and living standards. To examine this, I specify a structural state space model estimated using a combination of maximum likelihood and Kalman filter techniques, as in Crafts and Mills (2009) and Lee and Anderson (2002). The structural model results are consistent with the VAR estimates and also yield additional information, such as the speed at which the model converges toward equilibrium as well as the movement of unobservable elements, which can be modeled as time-varying Markov chain processes. First, I find slow convergence, which indicates that the system is best characterized by weak homeostasis. This result suggests that although the main elements of the Malthusian model were indeed present, this model was working somewhat lightly in the background of the Northern Italian demographic landscape. That the strength of both the positive and the preventive checks could fluctuate over time is clearly consistent with this. I confirm the presence of diminishing returns, as population growth had a negative impact on real wages. Theory defines technological growth as real wage growth after population is held constant. Using this definition, I find that no evidence of sustained technological growth during this period. Diminishing returns in the face of population growth suggest the absence of Boserupian feedback effects. Necessity was not the mother of invention in early modern Northern Italy.

This article is motivated by recent developments in the theory of very long–run growth. The emergence of unified growth theory presents us with a blueprint explaining how the Western world transformed from centuries of economic stagnation to modern economic growth via the European fertility transition (Galor and Weil 2000). The Galor and Weil model occurs in three phases. The first phase assumes the existence of a Malthusian steady-state equilibrium. This article tests whether this assumption holds in early modern Italy. These results hold contemporary relevance. Understanding how the transition between economic stagnation and modern growth occurred is relevant to policy makers concerned about the developing world. If demographic change is a cause of economic growth, policies that encourage demographic adjustment could be powerful tools in the long-run development of least-developed countries.

The rest of the article is structured as follows. The following two sections present a simple Malthusian model and a review of the relevant literature. Following that, I offer a discussion of the available data sources and their historical context. Then I show the specification and results from a VAR model, followed by my estimation of a structural model that permits unobserved time-varying influences to enter the model. The empirical results from both models are remarkably consistent and strongly suggest that the population and economic dynamics in Northern Italy are captured by the Malthusian model described in the second section.

A Simple Malthusian Model

The following equations demonstrate a simple economic model that captures the main elements of Malthusian theory. Consider a one-sector, one-period, non-overlapping generations model wherein one homogeneous good is produced using two factors of production: land and labor. Production is captured by the following Cobb-Douglas function with constant returns to scale:

where Y t , N t , and X t denote levels of output, population (labor), and land; while A t measures productivity—all at time t. Diminishing returns are exhibited when the elasticity of output with respect to population (labor) is less than 1. The real wage is equivalent to per capita output and can be expressed as

where W t is the real wage and land is assumed as a normalized constant factor of production. Taking logs produces the following wage equation:

where w

t

, a

t

, and p

t

are the natural logarithms of real wages, the level of productivity, and population, respectively. The parameter  measures the elasticity of real wages with respect to population, and s

t

is introduced as a white noise error term to model unsystematic shocks. The negative relationship between population and living standards is implied by

measures the elasticity of real wages with respect to population, and s

t

is introduced as a white noise error term to model unsystematic shocks. The negative relationship between population and living standards is implied by  . The level of technology or labor demand, a

t

, evolves according to the value of two variables, the lagged stock of technology and this period’s growth rate:

. The level of technology or labor demand, a

t

, evolves according to the value of two variables, the lagged stock of technology and this period’s growth rate:

where g t measures technological growth. The rate of technological progress is modeled as a random walk since this unit root process captures the transition from Malthusian stagnation (where g t has no trend) to modern economic growth (where g t trends upward). Therefore, the rate of technological growth is

where ψ t is the usual independent and identically distributed (IID) error term.

The Malthusian checks provide the population correction mechanisms and can be modeled like linear demand and supply functions:

where b t and d t measure the birth and death rates over time,Footnote 1 while r t and u t represent unsystematic variation, such as war, climatic change, and disease epidemics. Equations (6) and (7) provide an algebraic form of the positive (δ < 0) and preventive (μ > 0) checks.

Steady-state solutions exist when there are no unsystematic shocks (s t = r t = u t = ψ t = 0). Consequently, technological growth collapses to a constant value (a t = ā), and the steady-state solutions are

where p

*, b

*, and d

* denote the steady state values. The results of the following comparative statics— and

and  —demonstrate how technological progress affects the level of population—but not the level of subsistence—in the long run.

—demonstrate how technological progress affects the level of population—but not the level of subsistence—in the long run.

Figure 1 is a schematic illustration of the system. The left graph shows the equilibrating relationship between the real wage (w *) and crude birth and death rates (V *). At point A, birth and death rates are equal, with no population growth. The right side demonstrates the real wage–population relationship. The downward sloping LD 0 schedule is the labor demand curve. Point B illustrates the level of population or labor demand, p 0 corresponding to the equilibrium real wage, w *, given a fixed level of technology, ā. Imagine a technological shock that causes an exogenous outward labor demand shift (LD 0 shifts to LD 1). Initially, the population level (labor supply) is fixed at p 0, and demand shift results in the real wage rising from w * to w 1, such that point C is reached. The effect of this shock on vital rates is displayed on the left side of Fig. 1. At a real wage of w 1, the vital rates will be out of equilibrium because the extra resources lead to lower rates of mortality and higher fertility: the Malthusian checks. The excess of births over deaths—namely, the gap between points D and E—results in population growth. However, these rates cannot remain out of equilibrium in the long run because the resulting increases in population induces a movement along the LD 1 curve until point F, the new equilibrium, is reached. Hence, technological shocks improve economic welfare only in the short run. An inelastic labor supply always responds to technological innovations, such that the long-run real wage is constant. This is the equilibrating mechanism, or Malthusian trap.

Demography and the History of Economic Development

Empirical research assessing the utility of Malthusian theory in historical demography tests at least one of the following three hypotheses:

-

1.

Real wages are inversely related to population (Eq. (3)).

-

2.

Mortality increases as real wages decline (Eq. (6)).

-

3.

Fertility increases as real wages rise (Eq. (7)).

However, obtaining consistent statistical parameter estimates for the preceding relations is not a trivial task. To begin with, the system is endogenous. Population determines the real wage, which in turn affects population growth (births minus deaths). The circularity of this argument introduces a potential problem of simultaneous equation bias. For example, an ordinary least squares (OLS) estimate of Eq. (6) will potentially overestimate μ because Cov{w t ,r t } > 0. Furthermore, because technological progress, a t , is a random walk with drift, it is probable that the demographic and real-wage series evolve as unit root processes. This problem is exacerbated when allowing for the possibility of time-varying intercepts in the check equations.Footnote 2 If these series contain unit roots, the standard statistical tools are likely to become redundant because the estimated parameters could have nondegenerate limiting distributions.

Essentially, two waves of empirical research in this area have sought to overcome these identification issues. Earlier research, largely conducted in the 1980s, provided estimates of the system from a number of regions throughout Europe. Overall, the findings from these studies are largely consistent. The emergence of unified growth theory, alongside other notable scholarly works (e.g., Clark (2007a)), has generated a renewed interest in understanding the interaction between living standards and demography in the preindustrial world. This renewed interest has generated a second wave of research, the findings of which have varied considerably. As of yet, a general consensus on the validity of Malthusian models has yet to be reached. Herein, I present the requisite literature and trace its evolution, with due attention given to contrasting samples, methodologies, and results.

Earlier work, aided by the collection and digitization of a number of historical data in demography and economics, typically estimated the impact of wheat prices on vital rates. Decomposing all these series as deviations from a moving average representation provided a credible identification strategy, which argued that short-term variation in food prices served as an accurate proxy for exogenous real income shocks. Studies by both Lee (1981) and Galloway (1988) represented two seminal contributions that employ this methodology. Lee’s analysis used the now well-known demographic series of Wrigley and Schofield (1989) to study the interaction between vital rates and living standards in England. The results of this study suggested the positive check was eradicated in England before the Industrial Revolution, while the preventive check continued to prevail. Galloway (1988) employed a similar methodology in his comprehensive pan-European study. Using a sample from 1756–1870, Galloway (like Lee) found no relationship between wheat prices and death rates in England. However, Galloway also found that both checks had a strong presence elsewhere in Europe. Interestingly, the strength of the positive check was strongly correlated with national income. This finding suggested that the expansion of national income was an important factor that determined the disappearance of the positive check. This argument was reiterated and expanded in Galloway (1994b), who also found a strong relationship between vital rates and climatic variation.

The results of contemporary estimates of the Malthusian model have been ambiguous. The main reason for these contrasting results can be primarily attributed to differing methodologies. One such approach is vector autoregression (VAR), which after being originally proposed by Eckstein et al. (1984), was used, albeit in different forms, by Crafts and Mills (2009), Nicolini (2007), and Rathke and Sarferaz (2010). The advantage of using VAR is that it requires fewer theoretical assumptions because the interaction between variables can be measured according to the so-called impulse response functions. Using this analysis on English demographic and real wage data, Nicolini did not find any evidence in support of either check after the seventeenth century. These results are echoed by Crafts and Mills (2009), who used VAR but argued that their use of the Clark (2007b) real wage series represented a more accurate measure of living standards. Møller and Sharp (2008) included marriages in their model and argued that the system exhibits persistence (contains a unit root) and therefore can be modeled as a system of cointegrated equations, estimated via the vector error correction model. Their results were broadly in line with Nicolini and Crafts and Mills: the preventive check prevails, operating through marriages.

In addition to the methodologies discussed earlier herein, a structural model identifying the system has also been proposed. This model was originally estimated by Lee and Anderson (2002), who argued that the Malthusian economy can be specified as a dynamic linear-state space system. This approach has two main advantages. First, because the system contains population, real wages, and vital rates, one can conduct a test of all three Malthusian hypotheses. Second, estimation is performed using the Kalman filter, which is a recursive estimation technique that permits time-varying parameters. By specifying all equation intercepts as unobserved Markov chains, Lee and Anderson (2002) simultaneously addressed the issue of nonstationarity and also obtained the trajectories of the intercepts, or random walks. The evolution of these time-varying intercepts yields additional information, such as the rate of technological progress. This method was also employed by Crafts and Mills (2009), who, like Lee and Anderson (2002), used English data. The results of both studies are broadly similar. Population is negatively correlated with real wages, there is a preventive check on fertility, and the relationship between mortality and real wages is absent. Furthermore, the authors obtained parameter estimates of all three Malthusian relations and measured the degree of homeostasis, or how quickly the system adjusts to equilibrium following a shock. Once again, both studies are consistent in their finding of weak homeostasis.

That early-modern England ceased to be a positive check society has been challenged by the even more recent work of Kelly and Ó Gráda (2010) and Rathke and Sarferaz (2010). Using a multilevel model, the former showed that the strength of the positive check varied considerably over time but was still eminent in the eighteenth century. In contrast to Galloway (1988), Kelly and Ó Gráda (2010) argued that economic conditions could not have been a decisive factor in the check’s eradication because the check first disappeared at a time when real wages were falling. Rathke and Sarferaz (2010) used a time-varying VAR that employed a Bayesian approach. However, unlike the structural models, Rathke and Sarferaz (2010) specified all the parameters as time-varying random variables and measured the relationship between real wages and vital rates using impulse response functions. Their results were striking; the authors demonstrated how the positive check actually increased in strength during the Industrial Revolution until the mid-nineteenth century.

It is worth discussing a number of studies that have attempted to test the validity of Malthusian theory in preindustrial Italy and also elsewhere outside England. Galloway (1988) used vital rate and wheat price statistics from Tuscany (1817–1870) and found strong evidence in favor of both checks. Chiarini (2010) provided a recent contribution by using decennial data (1320–1870) on real wage and population levels and tested the diminishing returns hypothesis. Both series are cointegrated, and Chiarini deemed a vector error correction model appropriate. The results are broadly in line with Malthusian theory: Chiarini found a negative relationship between population and real wages both in the long-run cointegration vector and short-run impulse response functions. Furthermore, Chiarini also concluded that the preventive check was absent in preindustrial Italy. However, this conclusion appears hard to justify given that birth rates were not included in the Chiarini model. This present study incorporates birth rates, and therefore provides a direct, and more accurate, measure of the preventive check.

A recent analysis by Pfister and Fertig (2010) used a sample from preindustrial Germany and found that the positive check disappeared in the nineteenth century; death rates became exogenous. The concurrent rise in living standards led the authors to conclude that Germany ceased to be a Malthusian economy prior to industrialization. These results contrast somewhat with Murphy (2010), who found a strong positive check existing in early-modern France. Finally, Ashraf and Galor (2010) used a panel of countries during the time period 1–1500 CE and empirically tested the diminishing returns mechanism. The author’s findings strongly supported the existence of a Malthusian world, in the sense that cross-country technological superiority led only to population growth and not an improvement in the standard of living.Footnote 3

The Data and Context

The demographic series used in this article is directly taken from Galloway's reconstruction of the Northern Italian population.Footnote 4 Like with all historical time series, the need to assess its accuracy is paramount. The area chosen by Galloway (1994a), and throughout the article referred to as Northern Italy, consists of the five provinces, as shown in Fig. 2: Piedmont, Lombardy, Emilia, Veneto, and Tuscany. The northern regions of Liguria and Trento were excluded from the analysis because of their lack of historical data. All five regions selected contain a rich amount of published sources detailing parish registers of burials (deaths), baptisms (births), and marriages. In total, these data include 11 city parishes and 222 rural parishes. The annual population series is inferred from the population growth rate given an initial population level, a method known as inverse projection.

These demographic data are reliant on several assumptions and caveats, which in turn need to be considered. Previous demographic reconstructions, such as in France and Spain, have been undermined by registration issues, typically involving infant and child mortality. However, this problem appears to have been much less severe, if not entirely absent, in these Northern Italy data. After the conclusion of the Council of Trent (1563), parish registration of all vital rates was compulsory and came under the strict control of the Catholic Church, the Rituale Romanum (Del Panta and Rettaroli 1994). The absence of underregistration issues has been highlighted in previous research articles, such as Del Panta and Livi Bacci (1980:103).

Another crucial assumption of the inverse projection method concerns migration. Migration flows exist for the 1861–1881 period, and the data have been adjusted to account for this. Zero net migration is assumed in for all pre-1861 data. The findings of a recent study by Breschi et al. (2011) provide empirical support for this assumption. Given language and cultural barriers, migration within Europe was likely to have been small. The same barriers also existed within Italy: there is no substantial evidence of significant migration flows between Italian states. The failure of the 1656–1657 plague to spread from Southern to Northern Italy is clearly consistent with this idea. Furthermore, real wage differences between Southern and Northern Italy fail to show any significant economic incentives that would cause substantial migration (Malanima 2006). Migration to the new world was similarly insignificant before the age of mass migration at the end of the nineteenth century. Indeed, the U.S. Census Bureau (1975:106) recorded only 13,793 emigrants from all of Italy during the period 1820–1860, a total that amounted to approximately 0.1 % of the 1861 Northern Italian population.

Living conditions in preindustrial urban Europe were notoriously bad, and urban centers in Northern Italy were no exception. Overcrowding, poor sanitation, and the absence of adequate public heath provisions distorted demographic statistics. The difference between urban and rural demography was striking. Galloway (1994a) found that life expectancy in the cities was only 26 years, compared with the rural figure of 36 years. Meanwhile, urban infant mortality was some 40 % higher than rural. The heterogeneity characterizing the urban and rural demographic regimes is evident. These differences would be problematic for my analysis if there were any substantial change in the relative urban–rural population proportions. However, the available urbanization statistics do not lend support to this objection. Defining urbanization as the proportion of individuals living in a city with a population greater than 5,000, Malanima (2003) found that this figure was static, growing only by only 1 percentage point, from 15.2 % to 16.2 %, for the large majority of the period in question (1650–1861).

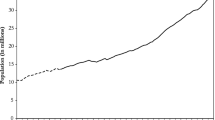

Panels A–C in Fig. 3 present the relevant demographic series. It is worth examining how well these figures correspond to the existing Northern Italian historiography. To understand the trends in Fig. 3, it is necessary to predate 1650. In 1629–1630, a plague swept across Northern Italy. Although the last occurrence in the region, the death toll was massive. Estimates suggest that 27 % of the region’s population perished in the epidemic (Cipolla 1997:318). In this context, the rapid population growth from 1650 to 1730 is unsurprising. Following Malthusian logic, the plague of 1629–1630, spread by French and Spanish troops fighting in the War of the Mantuan Succession (1628–1631), can be seen as an independent, or exogenous, shift in the labor demand schedule, causing the population to fall below its long-run steady-state level. The first portion of the series can be classified as a recovery phase, wherein excess births over deaths spurred population growth.

Population, vital rates, and real wages: Northern Italy, 1650–1881. Panels A–D present time-series plots of population (000,000), crude birth rate, crude death rate, and real wage, respectively. Both vital rate series are expressed per thousand of population, and the real wage series is in logs. Sources: The series in panels A–C are from Galloway (1994a); the data in panel D was collected by Paolo Malinima and is available online (http://www.paolomalanima.it/default_file/Italian%20Economy/Wages_Italy_1290_1990.pdf)

The population trajectory in Fig. 3 illustrates two other periods of population growth: a slow-down in the 1730 s, followed by a rapid acceleration in the 1820 s. However, to interpret how these demographic series evolved, it is necessary to introduce the other key component of Malthusian theory: namely, living standards. Panel D in Fig. 3 displays the real wage series deployed for this analysis. It is worth exploring the ability of these data to represent Northern Italian living standards and also their resemblance to economic welfare in other European regions. Various sources contain both quantitative and qualitative accounts of preindustrial living standards in both Europe and Northern Italy. Overall, the picture is quite unambiguous: between 1650 and 1881, the standard of living for the average Northern Italian failed to improve. Panel A of Fig. 4 displays some comparisons, taken from Malanima (2009:289), of per capita gross domestic product (GDP) in pre–twentieth century Europe. It is clear that England was an exception in terms of economic growth, although the English population accounted for only a small fraction of Europe’s overall population. The series for Italy support the notion that Italian economic conditions were more comparable with those in other European regions.Footnote 5 In 1600, Italian GDP per capita was marginally higher than in England. In 1700, the ratio of English to Italian GDP per capita fell to 0.76; and by 1870, it had diminished to 0.43.

Population density figures provide a rough estimate of available resources. In a purely neoclassical world, increases in population density will cause greater strain on resources, given all other factors are held constant. However, it is certainly arguable that a higher population density has more representative higher productivity, such as the improvement of agricultural techniques. Disentangling the causality between population and living standards is dealt with elsewhere in this article. Nevertheless, a comparison of population densities across Europe, taken from Malanima (2009:16), and the cross-country GDP per capita figures can reveal much about the productive capacities of economies. These figures are displayed in panel B of Fig. 4. Italy had both a high population density and level of national income in 1500. This finding indicates that by the end of the Renaissance, Italy had some form of productivity advantage compared with most other European regions. However, the courses of population density and GDP per capita throughout this period suggest that by 1800, this productivity advantage had been wiped out as GDP per capita declined in the face of a rising population density. By contrast, England saw a simultaneous explosion in population density and national income, an observation that strongly suggests high productivity growth. Patterns in the other regions—France, Spain, and Germany—show a closer resemblance to Italy than England.

Other measures of living standards exist alongside the aforementioned GDP per capita data. Nearly all the previous empirical research used real wages. Accordingly, I turn to the various real wage sources. These series contain information on either rural or urban workers. The difference between urban and rural environments in preindustrial Italy has been noted earlier herein, and hence it is worth considering a series that acknowledges the difference between the two. Federico and Malanima (2004) cautioned against the use of urban wages as unrepresentative, and provided an alternative real wage index that combines both urban and rural wage data but adjusts for the relative population proportions.Footnote 6

The indexed series used in Federico and Malanima (2004) presents the most accurate measure of living standards in the region. Other sources of economic welfare are consistent with this. By the seventeenth century, the collapse of the Mediterranean region as a maritime commercial center caused a substantial decrease in urban economic output. Cipolla (1956) provided a vivid account of how the “industrial structure had almost collapsed” in the seventeenth century. The decline of the Florentine woolen cloth industry provides a useful illustration. Between the end of the sixteenth and first quarter of the seventeenth centuries, the number of firms and output nearly halved.Footnote 7 Nevertheless, the deterioration of urban industry and its effect on living standards was not matched in the more populous rural regions, where a certain degree of innovation and technological progress could be found. The emergence of mulberry tree cultivation in the eighteenth century spawned a network of industrial activity in silk production outside urban areas. Furthermore, the diffusion of maize as a staple crop in the seventeenth century doubled calorie yields per acre, and its adoption also improved soil fertility.Footnote 8 The argument supporting technological advancement was also forwarded in recent research by Alfani (2010). However, this technological improvement failed to improve the standard of living, which is the definition of technological progress in this research.

The indexed series is also consistent with the GDP per capita series displayed in panel A of Fig. 4. A comparison of real wages in Italy and England in 1700, as in Malanima (2009:272), reveals only a minor difference between the two regions. Using the urban series overstates the economic decline during the period. The decline in Malanima’s compromise series is less severe and is consistent with the alternative evidence sources. I proceed on the basis that the compromised annual indexed real wage series is the most accurate measure of economic welfare. The anthropometric evidence tallies well with the measures of economic development discussed earlier herein. A’Hearn (2003) found a sizable decrease in the heights of Lombard army recruits for the period 1730–1860. It is noteworthy that the urban–rural divide is once again evident: on average, urban recruits were smaller.

VAR Modeling

To look at how real wages influenced vital rates, I estimate an unrestricted VAR model. A similar strategy was originally pursued by Eckstein et al. (1984) and later by Nicolini (2007). However, panels B–D of Fig. 3 raise suspicions that these series are nonstationary. To test for stationarity, I employ the following unit root tests: augmented Dickey-Fuller, Phillips-Perron, and KPSS.Footnote 9 The results of these tests are unanimous. Birth rates are clearly nonstationary, real wages are trend-stationary, and death rates are stationary. The results of these tests caution against the use of the data in levels. Furthermore, these series have differing degrees of integration, which also creates difficulties when implementing the cointegration approach pursued by Møller and Sharp (2008). Nevertheless, when marriage rates are included, they are cointegrated with birth rates; therefore, a portion of the preventive check can be attributed to the delay or postponement of marital unions. Because these data are not compatible with either the levels or they cointegrated VAR approach, I posit that a VAR in differences is the most appropriate methodology with which to proceed. The unrestricted VAR model is defined as

where \( {{\mathbf{y}}_{t}}={{\left( {\Delta {{b}_{t}},\Delta {{d}_{t}},\Delta {{w}_{t}}} \right)}^{\prime }} \) is a vector of birth rates, death rates, and real wages; D t contains year dummy variable vectors; and ε t is a vector of white noise error terms—all at time t. The matrix A i and vector Φ contain the estimated coefficients.

Table 1 reports the VAR model coefficients, their associated standard errors, and the results of diagnostic tests, for a model with year dummy variables for 1693 and 1855 and a lag length of 3.Footnote 10 All rates are first differences of natural logarithms and can be read as elasticities. Initially, I estimate the VAR model without year dummy variables. However, the post-estimation residual diagnostic tests reject normality. An inspection of the residuals reveals two outliers in the mortality series: 1693 and 1855. The unusually high mortality recorded in both years was the result of infectious disease outbreaks. Arguably, these years can be seen as exogenous shocks in the system. Therefore, I include dummy variables to control for these “shocks”; however, their inclusion does not have a substantial impact on the results.Footnote 11 The inclusion of these dummy variables improves the post-estimation diagnostics considerably.

It is evident that real wage variation strongly influences vital rates. The positive check elasticity is −0.18 in the following year and effectively zero thereafter. The preventive check elasticity is stronger and also more dispersed over time: 0.2 and 0.11 in the following two years. However, these results may be biased because of simultaneity. To correct for this potential bias, I perform an analysis of the orthogonalized impulse response functions. Identification requires restrictions such that the variables follow a causal chain. Biology dictates that birth rates be the first variable because fertility will not (or is very highly unlikely to) respond to either a shock in the level of subsistence or the death rate in the same calendar year. The next step is to establish the correct order between death rates and real wages. I argue that death rates do not respond in the same calendar year to real wage innovations because the effects of reduced living standards affect mortality with a lag. Hence, the order of variables in the VAR runs from the crude birth rate to the crude death rate to the real wage rate.Footnote 12

Figure 5 plots the cumulative impulse responses of both the birth and death rates to a 1 % increase in real wages, alongside 95 % bootstrapped confidence intervals. Again, these can be viewed as elasticities. To capture both the immediate and long-run impact of a real wage innovation, these cumulative responses are traced over 10 periods. Essentially, the x-axis here represents the counterfactual—that is, what would have happened to either vital rate if there were no change in the real wage.

It is clear that real wages affect both vital rates as previously shown in Table 1; however, the elasticities are smaller in magnitude. The short-run impact is immediate and severe in both cases. However, there appears to be a slight rebound effect after 2 to 3 years, in which the cumulative responses fall. The long-run (after 10 periods) elasticities for both vital rates are quantitatively similar. The preventive check is 0.13, and the positive check is −0.1, indicating that a 10 % increase in the real wage causes a 1.3 % rise in births and a 1 % fall in the death rate. The preventive check is roughly comparable with the figure produced by Galloway (1988) for Tuscany during the period 1817–1870. The magnitude of the positive check is much smaller than Galloway’s comparable estimate. However, this elasticity is more in line with the estimates for other European regions produced by Galloway. The so-called feedback effect, in which death rates influence the real wage, is minute. Calculating the impulse response for this relationship, like in the previous examples, reveals an elasticity of −0.06. This effect remains stable when traced out over 10 periods, and the 95 % confidence bands always overlap with the x-axis. The absence of the feedback effect is not inconsistent with the Malthusian model, however. The second section of this article demonstrates that real wages are determined by stocks of technology and population, and therefore the effect of mortality on the real wage must percolate through the stock of population. Hence, there is a dichotomy between the long-run and short-run covariance structures of the system because of the distinction between stocks and flows. The VAR methodology captures only the effects of the short-run covariances—that is, between the flows.

To further investigate how the relationship between real wages and vital rate changed over time, I estimate the VAR model of Eq. (11) iteratively, using overlapping 70-year subsamples. For example, the first subsample is drawn from 1651–1721, the second from 1652–1722, and so forth. A similar method was performed in Galloway (1994b). To measure the effect of real wage variation on birth and death rates, I again employ the impulse responses and define the strength of each check as the cumulative impact of a 1 % increase in real wages after 10 years. Figure 6 demonstrates the evolution of both checks from the overlapping subsamples. Note that a reduction in the sample size decreases the precision of both estimates. Nevertheless, Fig. 6 reveals a number of interesting trends. First, the magnitude of the preventive check halves over time, falling from around 0.2 to 0.1. This decline occurred in the mid-eighteenth century. The trajectory of the positive effect is more ambiguous. In multiple periods, relationship appears to be absent. The beginning of the eighteenth century marks the first such period, after which the check reemerges and declines again before eventually reemerging in the nineteenth century. Both checks are in operation in the last period, as nineteenth century–Northern Italy remained consigned to the Malthusian world. When considered alongside the preventive check’s almost continuous decline, the positive check’s breakdown in various periods—but not permanent eradication—indicates that this system is characterized by weak homeostasis: that is, the Malthusian model of the second section of this article adjusted slowly to changes. Measuring the degree of homeostasis requires the wage-population parameter, which captures diminishing returns (β). Accordingly, I estimate this parameter in the following section.

The evolution of the checks. Panels A and B display the 10-year cumulative percentage effect of a 1 % increase in the real wage on birth rates and death rates, respectively, after taking subsamples from 70-year overlapping periods. The shaded area indicates the 95 % confidence intervals obtained via bootstrap with 500 repetitions

Structural Modeling

I have shown that real wage variation caused movements in vital rates as predicted by a simple Malthusian style model. However, this analysis imposes a number of restrictions that I now seek to rectify. In this section, I present a state-space model that links real wages, fertility, and mortality via population as originally proposed by Lee and Anderson (2002). This methodology includes all three wage and check equations, which are estimated simultaneously. The model is estimated within a state-space system, using the Kalman filter. Given the question at hand, this approach has one key advantage. The three equations of interest—Eqs. (3), (6), and (7)—are all expressed as dynamic linear models. In other words, the intercept term in each equation is not a constant but is rather a time-varying random walk variable, otherwise known as a “Markov chain.” These random walks capture the presence of unit roots and thus permit all the variables of interest to be included in untransformed levels form. Furthermore, the evolution of these Markov chains—the states—can be used as a proxy for secular change, such as technological progress. In the second section, I introduced the time-varying intercepts for the wage equation, a t and g t , which measure technological stock and the growth rate in technology, respectively. The intercepts in the check equations evolve according to the following random walks: m t = m t – 1 + ς t , and n t = n t – 1 + υ t . Both ς t and υ t are IID terms representing random variation.

The variables that capture unsystematic shocks (s t , r t , and u t ), such as climatic variation and disease prevalence, are potentially correlated from year to year. For example, large subsistence crises, like the one of 1693–1694, often entail consecutive years of high mortality. These years of extreme mortality are expected to be only partially explained by the model, thus introducing autocorrelation in the residuals. To account for this, I amend Eqs. (3), (6), and (7) so that the errors are the following stationary second-order autoregressive processes:

where τ t , ς t , and η t are all assumed to be white noise. The following two equations represent the state-space model:

where Eqs. (15) and (16) are known as the measurement and transition equations, respectively. The y t term is a 3 × 1 output vector containing real wage, birth rates, and death rates. The state vector θ t contains the unobserved state elements (both the time-varying and static coefficients at time t), while the F matrix contains the regressors of interest. The dynamic elements are simply a linear combination of their previous value and random noise, as specified in the transition equation (Eq. (16)). Both l t and v t are error vectors representing random variation, which is assumed to have a Gaussian distribution. After the state-space form is specified, estimation is performed via the Kalman filter within a maximum likelihood algorithm. The maximum likelihood estimates, together with their standard errors, are displayed in Table 2. The estimated version of the preventive check includes an extra lag. The coefficient values of any other extra lags are statistically insignificant; thus, for reasons of parsimony, they are excluded.

The estimated wage-population elasticity is −0.41. I find that population growth depressed living standards because the presence of diminishing returns is confirmed. This result tallies well with the constant returns to scale assumption, β∈ϵ(−1,0). The roots of autoregressive error term coefficients, γ1 and γ2, exceed unity in absolute value (the modulus of roots is 1.84), demonstrating how the estimated wage equation is a stationary process after specifying the intercept term to be a random walk with drift. The direction and magnitude of both positive and preventive checks is consistent with the evidence provided in the VAR analysis. Dividing by means yields the relevant elasticities. A positive check of −0.24 and a preventive check of 0.24 (over two years) clearly demonstrate the constraints that living standards placed on vital rates. The state-space model uses the contemporary correlation between real wages and vital rates; consequently, the elasticities are slightly larger than those reported as the 10-year cumulative elasticities in Fig. 5. However, the state-space check elasticities bear a remarkable resemblance to the cumulative elasticities after two years in Fig. 5, the VAR model coefficients in Table 1, and also the elasticities obtained from using static linear models. The consistency of these results across specifications is comforting: the estimates do not appear to be strongly biased by endogeneity or adversely affected by the differencing transformation.

These short-run elasticities, which are much larger than those found in Lee and Anderson (2002) for England, are congruent with evidence of comparative living standards in the two regions at the time, as illustrated by Fig. 4. The greater sensitivity of vital rates to real wage variation is unsurprising given the observed divergence in living standards across the two regions. Quite simply, the lower purchasing power of the Northern Italian population put a greater proportion of their population at the edge of biological survival. The relative importance of lagged real wages in England in comparison with Northern Italy also warrants closer inspection. Recent research by Kelly and Ó Gráda (2010) demonstrated the existence of a number of additional safeguards that served to protect the poorest in English society: in particular, introduction of state-funded poor relief, the Poor Law system. Additionally, a substantial wage premium existed for those who wished to move from rural to urban centers in early modern England, most likely as compensation for the increased chance of morbidity. The relative importance of lagged real wages in England is likely to stem from combination of these observations. In effect, the Poor Laws had the ability to sustain those on the biological edge of survival, while the urban wage premium created incentives for the poorest to migrate into England’s burgeoning urban areas, thus spreading infectious diseases. The absence of these factors in Northern Italy offers a plausible explanation for why the effect of real wages on vital rates was both instantaneous and severe.

Figure 7 shows the evolution of the two wage equation states: the natural log of labor demand a t ; and the rate at which labor demand increases, or technological progress, g t . The failure of either series to show any sustained increase agrees with all other evidence of economic stagnation in Northern Italy during this period. Effectively, these series suggest that the population growth that occurred during this period entailed a heavy cost. Real wages were forced down, through diminishing returns, as the Northern Italian economy failed to absorb a rising population. There is no evidence to suggest that population growth causes technological progress in the manner proposed by scholars such as Boserup (1965) and Kremer (1993). The trajectory of the birth rate intercept, n t , is almost identical to that of the underlying series, indicating that real wages played a relatively little part in the evolution of this vital rate. Death rates are stationary; as a result, it is unsurprising that the mortality intercept did not exhibit any time variation. The variance term for the mortality random walk is essentially zero, although removing this parameter leaves the results unchanged.

Lee and Anderson (2002) proposed a simple methodology with which to examine the strength of homeostasis in the system. The product of the lag sum of fertility minus mortality (0.015159) and the (negative) population elasticity (0.041) determines the rate of convergence toward equilibrium in this system. Here, it is at an exponential rate of 0.0062 per year. The half-life of a shock can be found by solving 0.5 = e –0.0062T for T. Here, I find that the half-life of a shock is 112 years. This figure is quite high, indicating that this system is best characterized as one of weak homeostasis or slow convergence. This finding demonstrates that although the features of a Malthusian system were present, the regime was one that could move away from the equilibrium depicted in Fig. 1 for sustained periods of time. The finding of weak homeostasis helps to rectify patterns displayed in Fig. 6. While Northern Italy remained trapped in the Malthusian world, the system could stray from equilibrium for extended periods of time. However, this is not a decisive objection, as demonstrated by the fact that both checks are evident in the last subsample of Fig. 6.

Unified growth theory stresses the role of fertility transitions as a key causal factor in the departure from Malthusian stagnation to modern economic growth. Again, the results of this article are consistent with both this idea and previous literature on Italian demographic and economic history. For example, Livi Bacci (1967) found that there was no fertility transition before the last decade of the nineteenth century in Italy. The period 1650–1881 appeared to be punctuated by high marital fertility rates, low investment in children, and consequent poorer outcomes. The Italian transition to a modern growth regime developed in unison with major changes in the demographic landscape, and only after the age of mass migration provided a new mechanism by which population pressure could be corrected.

Conclusion

Whether a stylized Malthusian model captures the relationship between living standards and population in preindustrial England is debatable. The estimates that I provide here are less ambiguous and strongly suggest a role for Malthusian theory in preindustrial Northern Italy. My findings have relevance to the current research agenda on the empirical validity of unified growth theory. The results of this exercise roughly concur with the theory. Between 1650 and 1881, economic growth in the region stalled. However, this was not at a Malthusian steady state. I find slow convergence, and therefore exogenous forces could move the economy away from any so-called steady state for prolonged periods. Nevertheless, the presence of the population control mechanisms, or checks, is apparent during the entire 1650–1881 series. Additionally, diminishing returns meant that any technological improvement was eroded by population growth as Northern Italy appeared to be Malthusian both before and after the life of Malthus.

Notes

These rates are calculated as number of births or deaths divided by the population, unless stated otherwise.

For example, the death rate equation intercept may vary according to public health innovations and birth rates as the costs (including opportunity costs) of rearing children rises.

Additionally, Galloway (1994a) conducted a comprehensive review of empirical Malthusian model estimates from a large number of regions, some of which, for reasons of parsimony, are not discussed earlier herein.

Available online (http://www.patrickrgalloway.com/galloway_1994_north_italy.tif).

The growth trajectory for Northern Italy is the same.

Available online (http://www.paolomalanima.it/).

Other examples, such as Como, Genoa, Monza, and Pavia, abound.

However, the impact of this diffusion on living standards is somewhat ambiguously defined because maize prices were only one-half those of wheat, and its adoption also resulted in well-known nutritional defects (Livi Bacci 1986).

Test statistics are available on request.

The lag length was chosen in accordance with the relevant information criterion.

The cumulative impulse response elasticity (after 10 years) increases slightly from −0.15 to −0.1. The preventive check is unchanged.

The results shown here change little either when the order between death rates and real wages is changed or when the order invariant generalized impulse responses are used.

References

A’Hearn, B. (2003). Anthropometric evidence on living standards in Northern Italy, 1730–1860. The Journal of Economic History, 63, 351–381.

Alfani, G. (2010). Climate, population and famine in Northern Italy: General tendencies and Malthusian crisis, ca. 1450–1800. Milan, Italy: Carlo F. Dondena Centre for Research on Social Dynamics (DONDENA), Università Commerciale Luigi Bocconi.

Ashraf, Q., & Galor, O. (2010). Dynamics and stagnation in the Malthusian epoch (Department of Economics Working Papers 2010–01). Williamstown, MA: Williams College.

Boserup, E. (1965). The Conditions of Agricultural Growth: The Economics of Agrarian Change under Population Pressure. London, UK: Allen & Unwin.

Breschi, M., Manfredini, M., & Fornasin, A. (2011). Demographic responses to short-term stress in a 19th century Tuscan population: The case of household outmigration. Demographic Research, 25(article 15), 491–512. doi:10.4054/DemRes.2011.25.15

Chiarini, B. (2010). Was Malthus right? The relationship between population and real wages in Italian history, 1320 to 1870. Explorations in Economic History, 47, 460–475.

Cipolla, C. M. (1956). The decline of Italy: The case of a fully matured economy. The Economic History Review, 5, 178–187.

Cipolla, C. M. (1997). Storia Economica dell'Europa pre-industiale [The economic history of pre-industrial Europe]. Bologna, Italy: Il Mulino.

Clark, G. (2007a). A Farewell to Alms: A Brief Economic History of the World. Princeton, NJ: Princeton University Press.

Clark, G. (2007b). The long march of history: Farm wages, population, and economic growth, England 1209–1869. The Economic History Review, 60, 97–135.

Crafts, N., & Mills, T. C. (2009). From Malthus to Solow: How did the Malthusian economy really evolve? Journal of Macroeconomics, 31, 68–93.

Del Panta, L., & Livi Bacci, M. (1980). Le componenti naturali dell'evoluzione demografica nell'Italia del settecento [Natural factors of demographic development in 18th century Italy]. In S.I.D.E.S (Ed.), La popolazione Italiana nel Settecento (pp. 71–139). Bologna, Italy: CLUEB.

Del Panta, L., & Rettaroli, R. (1994). Introduzione alla demografica storica [Introduction to historical demography]. Roma-Bari, Italy: Laterza.

Eckstein, Z., Schultz, T. P., & Wolpin, K. I. (1984). Short-run fluctuations in fertility and mortality in pre-industrial Sweden. European Economic Review, 26, 295–317.

Federico, G., & Malanima, P. (2004). Progress, decline, growth: Product and productivity in Italian agriculture, 1000–2000. The Economic History Review, 57, 437–464.

Galloway, P. R. (1988). Basic patterns in annual variations in fertility, nuptiality, mortality, and prices in pre-industrial Europe. Population Studies, 42, 275–303.

Galloway, P. R. (1994a). A reconstruction of the population of North Italy 1650 to 1881 using annual inverse projection with comparisons to England, France, and Sweden. European Journal of Population, 10, 223–274.

Galloway, P. R. (1994b). Secular changes in the short-term preventive, positive, and temperature checks to population growth in Europe, 1460–1909. Climatic Change, 26, 3–63.

Galor, O., & Weil, D. N. (2000). Population, technology, and growth: From Malthusian stagnation to the demographic transition and beyond. The American Economic Review, 90, 806–828.

Kelly, M., & Ó Gráda, C. (2010). Living standards and mortality since the middle ages (School of Economics Working Papers 201026). Belfield, Dublin: University College Dublin.

Kremer, M. (1993). Population growth and technological change: One million B.C. to 1990. Quarterly Journal of Economics, 108, 681–716.

Lee, R. D. (1981). Short-term variation: Vital rates, prices and weather. In E. A. Wrigley & R. S. Schofield (Eds.), The Population History of England, 1541–1871. A Reconstruction (pp. 356–401). London, UK: Edward Arnold.

Lee, R. D., & Anderson, M. (2002). Malthus in state space: Macro economic-demographic relations in English history, 1540 to 1870. Journal of Population Economics, 15, 195–220.

Livi Bacci, M. (1967). Modernization and tradition in the recent history of Italian fertility. Demography, 4, 657–672.

Livi Bacci, M. (1986). Fertility, nutrition, and pellagra: Italy during the vital revolution. Journal of Interdisciplinary History, 16, 431–454.

Malanima, P. (2003). Measuring the Italian economy 1300–1861. Rivista di Storia Economica, 19, 265–295.

Malanima, P. (2006). An age of decline. Product and income in eighteenth-nineteenth century Italy. Rivista di Storia Economica, 21, 91–133.

Malanima, P. (2009). Pre-modern European economy: One thousand years (10th–19th centuries). Leiden-Boston: Brill.

Møller, N. F., & Sharp, P. (2008). Malthus in cointegration space: A new look at living standards and population in pre-industrial England (Department of Economics Discussion Papers 08–16). Copenhagen, Denmark: University of Copenhagen.

Murphy, T. E. (2010). Persistence of Malthus or persistence in Malthus? Mortality, income, and marriage in the French fertility decline of the long nineteenth century (Working Papers 363, IGIER). Milan, Italy: Innocenzo Gasparini Institute for Economic Research, Bocconi University.

Nicolini, E. A. (2007). Was Malthus right? A VAR analysis of economic and demographic interactions in pre-industrial England. European Review of Economic History, 11, 99–121.

Pfister, U., & Fertig, G. (2010). The population history of Germany: research strategy and preliminary results (MPIDR Working Papers WP-2010-035). Rostock, Germany: Max Planck Institute for Demographic Research.

Rathke, A., & Sarferaz, S. (2010). Malthus was right: New evidence from a time-varying VAR (IEW Working Papers iewwp477). Zurich, Switzerland: Institute for Empirical Research in Economics.

U.S. Census Bureau. (1975). Historical Statistics of the United States, Colonial Times to 1970 (Bicentennial ed., Part 2). Washington, DC: U.S. Census Bureau.

Wrigley, E. A., & Schofield. (1989). The population history of England 1541–1871: A reconstruction. Cambridge, UK: Cambridge University Press.

Acknowledgments

Fernihough is a graduate student at the UCD School of Economics. He acknowledges financial support from the Irish Research Council for the Humanities and Social Sciences, and helpful comments from Cormac Ó Gráda, Morgan Kelly, Michael J. Harrison, Mark McGovern, Terence C. Mills, Paulo Malanima, Patrick R. Galloway, and three anonymous referees.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fernihough, A. Malthusian Dynamics in a Diverging Europe: Northern Italy, 1650–1881. Demography 50, 311–332 (2013). https://doi.org/10.1007/s13524-012-0141-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-012-0141-9