Abstract

Using data from the Panel Study of Income Dynamics (PSID) from 1968 to 2005, we estimate the cumulative probability that young adults in the United States will receive food stamps during adulthood, and examine how that probability varies with an individual’s income and education at age 25 as well as by race and gender. We find that the probability of first food stamp receipt as an adult declines sharply with age, indicating that most adult recipients do so by age 40. Also, those receiving food stamps in early adulthood are likely to receive them again. For these reasons, and because food stamp receipt is a repeatable event, life table analyses that include individuals who are not observed until after they become exposed to the risk of food stamp receipt (whom we label “late entrants”) are likely to overstate cumulative participation during adulthood. For example, one often-cited study included individuals who enter their sample after age 20 (late entrants) and report that 50.8% of 20-year-olds are recipients by age 65. In contrast, when we exclude late entrants, we find that 39.2% of 20-year-olds and 29.7% of 25-year-olds receive benefits during adulthood.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In this article, we analyze data from the 1968–2005 waves of the Panel Study of Income Dynamics (PSID). We estimate the cumulative probability that an adult will ever receive food stamps between ages 25 and 62 and examine how this probability varies with an individual’s characteristics at the onset of adulthood (age 25).

Rank and Hirschl (2005) used traditional life table techniques to estimate the probability of food stamp receipt during adulthood. We show that their method overstates receipt because it includes respondents who were not observed until after they were initially exposed to risk: thus, after they may have received food stamps. We label these respondents as “late entrants.” We use similar life table techniques but exclude late entrants. Thus, our sample includes only those respondents observed from the time they are first exposed to risk: that is, from age 25. These individuals contribute person-years for every year from the year they turn age 25 until the year when they receive food stamps, are right-censored, or attrite from the sample. As a result, we report unbiased estimates of the proportion of 25-year-olds who receive food stamps by age 62.

Background

Supplemental Nutrition Assistance Program (SNAP): The U.S. Federal “Food Stamp Program”

The U.S. federal government first provided food assistance to qualifying individuals via food stamps following the Great Depression, from 1939 to 1943. After a hiatus, food stamp pilot programs were reinitiated in 1961, and the Federal Food Stamp Act of 1964 made the program permanent, although the program was unavailable in some localities. By 1971, national eligibility standards were adopted; in 1974, the program was nationalized. Program eligibility is determined by a means test that considers household assets and income. Eligibility rules vary slightly by locality. Typically, a household is eligible if assets, excluding the value of a primary home and vehicle, fall below a modest amount ($2,000 in 2006, $3,000 if the household includes an elderly person), if gross household income is below 130% of the federal poverty line, and if net income is below 100% of the poverty line. As of October 1, 2008, the U.S. Federal Food Stamp Program was renamed the Supplemental Nutrition Assistance Program (SNAP). We use the former name because 2006 is the end of our analysis period.

The food stamp recipient caseload increased from 14 million people in July 1974 to almost 39 million in December 2009 (USDA 2010). Participation rates are highest among the least educated, the disabled, nonwhites, and previous food stamp recipients (Russo and Faux 2003; U.S. Census Bureau 1999).

Knowing the percentage of adults who received food stamps in any year tells us little about how many adults ever received food stamps during adulthood. At one extreme, all individuals in a given year face the same probability of receipt, independent of receipt in the prior year. Under this scenario, food stamp receipt at some point during adulthood would be a common experience. At the other extreme, the same x% of adults receive food stamps in every year, and nonrecipients never receive them. Assuming a stable population, only x% would ever receive benefits, but the same x% of adults would be on the rolls for all their adult years.

To calculate the cumulative proportion of adults who ever use food stamps, a researcher needs information about receipt across the entire period of interest. This is not always practical, especially for very long periods of time, such as all of adulthood. However, panel data sets that provide information on a portion of the lives of sample members can yield informative estimates when used with appropriate statistical methods.

Rank and Hirschl (2005) estimated that 50.8% of 20-year-olds receive food stamps at least once by the time they reach age 65. Although they analyzed only 30 years of panel data, they estimated food stamp receipt over a 45-year period by including late entrants—in this case, respondents first observed after age 20. As we document later in the article, when cumulative failure probabilities (i.e., Kaplan-Meier survival estimates) are calculated for repeatable events like food stamp receipt, inclusion of late entrants leads to upwardly biased estimates.

Analyzing Incomplete Event Histories

Calculating the proportion of adults who ever experience a repeatable event is complex. One method is to select a representative group of 25-year-olds (or any initial age of interest) and, upon the conclusion of their lifetimes (or when they reach some predetermined age of interest), calculate the proportion who ever experienced the event. This method, while computationally simple, is generally unfeasible because it requires data collection on a cohort over a very long time frame.

Another way to calculate the proportion of adults who ever experience a repeatable event is to ask all individuals of a certain age (say, 65) if they ever experienced the event and then calculate the proportion who reported affirmatively. Respondents may suffer from recall error if the event occurred long ago, and estimates may be subject to selection bias if, for example, differential mortality causes selective attrition from the sample. For either method, the estimates would be representative of one age cohort only. This would be problematic if young adults today differ in food stamp receipt from older cohorts. For example, eligible young adults from earlier birth cohorts may be less likely to participate because of the relative newness of the program. Also, members of earlier birth cohorts would not have benefitted from more recent outreach efforts targeted at young adults to increase participation.

Demographers address these data problems by using a synthetic cohort. Rather than following one birth cohort of individuals over many years, the researcher groups a sample of respondents of different ages to form one hypothetical age cohort. The age-specific probability of experiencing an event is calculated, and by using a life table approach, the cumulative proportion can be estimated. This cumulative proportion represents the proportion of synthetic cohort members who experience an event by age x, where x is the latest age represented in the cohort. Implicit in this methodology is the assumption that the cumulative probabilities are valid for an actual age cohort only if age-specific probabilities for that cohort mirror those of the synthetic cohort (i.e., that 30-year-old synthetic cohort members will have the same age-specific probability when they are age 60 as present-day 60-year-olds). This method can be used with cross-sectional data or with longitudinal data comprising respondents with incomplete event histories, as in the case of survival analysis. These analytic approaches allow researchers to use information from respondents whose exposure to risk had not ended by the time of their last interview.

Because we are interested in calculating the proportion of adults who ever receive food stamps, we use the first instance of food stamp receipt to calculate the age-specific probability of first receipt. However, because we are using a synthetic cohort, and because the survey does not inquire about the age of first receipt, we do not know whether respondents previously received food stamps. Thus, we must determine whether an observed food stamp spell is the first or not for the respondent after she is initially exposed to risk.

Methodological challenges are associated with calculating age-specific probabilities of experiencing a repeatable event. Unlike mortality, where a researcher is certain that an observed mortality “spell” is the first (and only) one that a subject will ever experience, with repeatable events, knowing whether a spell is the first is uncertain unless a subject has been continuously observed from initial exposure to risk until the start of the observed spell.Footnote 1

For example, consider a 35-year-old individual whose first food stamp spell was at age 25 but is unobserved because she was first interviewed at age 35. Assume that she reported that she was receiving food stamps at age 35. Including her in a life table analysis leads to an upward bias in the age-specific probability of first food stamp receipt at age 35. Because individuals who receive food stamps are likely to receive them again (Russo and Faux 2003; U.S. Census Bureau 1999) and because, as we show later, the probability of first food stamp receipt declines sharply with age, including late entrants is problematic because many of their observed spells are not first spells. As a result, inclusion of late entrants results in an upward bias in the cumulative proportion ever receiving food stamps that escalates with age. To correct for this bias, researchers must exclude late entrants or make untestable identifying assumptions about the proportion of late entrants who previously received food stamps at each age.

Table 1 demonstrates how including late entrants causes upward bias when calculating the cumulative proportion who ever receive benefits. The table includes three different representations of the same data set for 30 fictitious individuals. The leftmost panel contains the actual event histories for each respondent between ages 25 and 29. A 0 represents a year when the respondent did not experience the event; a 1 represents a year when the respondent did experience the event. The data have been constructed so that the age-specific probability of experiencing the event declines monotonically with age, as is the case for food stamp receipt. Using a standard life table approach, or simply by counting how many individuals out of 30 who experience the event, yields the proportion of 25-year-olds who experienced the event by age 29. This cumulative proportion in the actual data is 50% (last row of table).

In an ideal world, we would have access to the full event histories, as we do in the leftmost panel. In reality, however, we must create synthetic cohorts when respondents enter the sample at different ages. The shaded cells in the table represent the first age at which each respondent was actually observed in our fictitious panel. For example, Respondent 24 experienced the repeatable event at ages 26, 27, and 29 but entered the panel at age 28. Thus, the researcher observes her experiencing the event only at age 29.

The center panel of Table 1 indicates how the observed data would be used to calculate age-specific and cumulative failure/survival probabilities if late entrants were included. Any respondent whose first observed spell occurs after her actual first spell will contribute to the age-specific probability at an age older than her actual age. For example, Respondent 24 is assumed to have a first spell at age 29, leading to an upward bias in the age-specific probability of first food stamp receipt. In the center panel, for example, the age-specific probability of first receipt declines with age but is higher than the actual probability at every age, leading to an overstatement of cumulative failure that escalates with age. If late entrants are included, 73.9% of 25-year-olds are estimated to have experienced the event by age 29—23.9 percentage points higher than the actual probability.

The rightmost panel of Table 1 documents how the observed data would be used if late entrants were excluded. Excluding late entrants allows us to determine with certainty whether any observed spell of food stamp receipt in the panel study is the first or not. Using data only from respondents who were observed from their initial exposure to risk (age 25) leads to an estimate equal to the proportion in the actual data: 50%. Excluding late entrants reduces the sample size and, as a result, increases estimated standard errors. For example, when late entrants are excluded, the number of respondents who contribute person-years to the analysis is reduced from 30 in the center panel (one shaded cell for each respondent, regardless of the age when they enter the panel) to only 6 in the rightmost panel (the shaded cells for those observed at age 25). However, this loss in efficiency ensures that our estimates are consistent.

Inclusion of right-censored respondents is not problematic in an analysis of repeatable events if censorship is uncorrelated with the outcome. In our food stamp analysis, the typical reason for right-censoring is that respondents have aged up to the most recent survey wave: they are in the midst of their exposure to risk. This type of right-censoring is not a problem because age is exogenous to attrition (Box-Steffensmeier and Jones 2004; Cox 1972; Cox and Oakes 1984). Sample attrition owing to nonresponse is potentially more important, but Fitzgerald et al. (1998) found that PSID attrition is also largely exogenous.

Rank and Hirschl (2005) used 30 years of panel data to estimate food stamp receipt over a 45-year period by including late entrants and by assuming that late entrants did not receive food stamps before they were first observed. As explained earlier, inclusion of late entrants overstates cumulative program participation.Footnote 2

Data and Methods

Measuring Food Stamp Receipt

The PSID is a nationally representative panel study that collects detailed information on sample members and their families.Footnote 3 It consists of the self-weighting Survey Research Center (SRC) sample and the Survey of Economic Opportunity (SEO) oversample of low-income and African American respondents, which together form the core sample. We employ 34 waves of the core sample—the years 1968–2005—and required sample weights.

Information on food stamp receipt was collected in every year between 1968 and 1997, except 1973, and in every other year beginning in 1999. Respondents were asked whether they received (or purchased, under the old program rules) food stamps during the previous year and about the dollar amount of these benefits. We determine whether a person received food stamps in a given year by examining the dollar value of food stamps received by the family in which they reside. If a person lives in a family that reports positive benefits for the year, that person is considered to have participated in the program.Footnote 4

During interview years when food stamp receipt is not reported in the PSID (1973, 1999, 2001, and 2003), we assume that a respondent’s receipt is identical to that of the previous year. This allows us to maintain a larger sample of person-years, especially those from older individuals. The disadvantage of this assumption is that a food stamp spell may be unobserved. As a specification check, we conducted analyses that use data for only those years after 1973; that right-censor observations in 1973; and that right-censor observations in 1973, 1999, 2001, and 2003. Our results were nearly identical to when we assume that food stamp receipt was the same as the previous year (results not shown; available from the first author on request).Footnote 5

Analytic Approach

We calculate Kaplan-Meier survival estimates of the probability an individual receives food stamps for the first time as a function of age between the ages of 25 and 62. We begin our analysis at age 25 because we expect that most individuals by this age will have begun their adult attachment to the labor force and completed their schooling. At each age, we compute the failure rate, which is 1 minus the survival rate. The failure estimate at age 62 can be interpreted as the cumulative proportion of 25-year-olds who ever receive food stamps by age 62.Footnote 6

We use one observation for each individual for every consecutive survey wave from age 25 until they attrite from the sample, become right-censored, or end their exposure to risk by receiving food stamps. For those who were age 25 in 1968, we observe their histories from ages 25 to 62. For those who turn age 25 in later years, we observe their early adulthood experiences, but their food stamp histories are right-censored before they reach 62. Thus, individuals contribute between 2 and 38 person-years of information.Footnote 7

Age-specific probabilities of first food stamp receipt are required for calculating Kaplan-Meier survival estimates, and we obtain these by using stacked logistic regressions with the person-year as the unit of analysis. We include a dummy variable for age, which leaves age dependence unspecified. This allows us to model the hazard of receiving food stamps without specifying the shape of the underlying hazard function and with flexible duration dependence (Allison 1982).

Next, we estimate the hazard of ever receiving food stamps as a function of covariates measured at the onset of adulthood (age 25). Key covariates include income-to-needs and education at age 25, gender, and race. To calculate income-to-needs, we divide total family money income as reported in the PSID by the U.S. Census Bureau’s poverty threshold for a family of the appropriate size using the method described in Grieger et al. (2009).Footnote 8 We also include the time-varying national unemployment rate and the year when the respondent turned age 25 as period and cohort controls, respectively.

From these regression results, we obtain age-specific probabilities of first food stamp receipt for individuals based on their characteristics. Then we calculate that group’s cumulative probability of ever receiving food stamps by age 62.

Results

To document that our weighted PSID sample of 25-year-olds is comparable with the population of 25-year-olds over the years between 1967 and 2004 (corresponding to PSID interview years 1968–2005), we compare characteristics from our sample to Current Population Survey (CPS) data. Table 2 shows that the pooled sample of 25-year-olds from the PSID has characteristics very similar to those in the CPS, although the PSID sample is slightly better educated on average. Fewer 25-year-olds are in poverty in the PSID than in the CPS, but this lower PSID poverty rate is due to differences in how income data are collected in the two data sets (Grieger et al. 2009).

Figure 1 shows the unconditional cumulative proportion of adults who receive food stamps by age 62 and compares our estimates with those from Rank and Hirschl (2005). The survival curve flattens with age, indicating that the age-specific probability of first-time food stamp receipt declines sharply with age. We find that 29.7% of 25-year-olds receive food stamps by the age of 62, and that most recipients do so by age 40. First-time recipients after age 40 account for only 15% of all recipients.

Because Rank and Hirschl began their analysis at age 20, we present comparable estimates in Fig. 1. We find that 39.2% of 20-year-olds received food stamps by the end of adulthood—11.6 percentage points lower than the Rank and Hirschl estimate of 50.8%.Footnote 9 Note that our estimates and theirs are quite similar at age 40. After that age, our survival curve flattens, but theirs continues to increase, presumably because of their inclusion of late entrants.

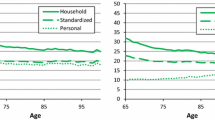

In Fig. 2, we use our data to document how the age-specific probability of first food stamp receipt varies when we include and then exclude late entrants. The age-specific probabilities of first-time receipt are consistently higher when late entrants are included. Among older respondents, the age-specific probability of first food stamp receipt is extremely low: less than 1% per year after age 40. This is why the Rank and Hirschl estimate of cumulative receipt during adulthood is upwardly biased.

We next estimate the unconditional survival curve separately by demographic group and find large differences between whites and blacks, males and females, and the more and less affluent (as measured at the beginning of adulthood). Figure 3 shows the cumulative probability of receiving food stamps for black and white respondents. Nearly three times as many black 25-year-olds (67.4%) receive food stamps by age 62 as whites (23.6%). Figure 4 shows that more 25-year-old females (33.8%) receive food stamps by age 62 than males (24.2%). Figure 5 shows cumulative probabilities by income-to-needs at the beginning of adulthood: 79% of respondents who begin adulthood below the poverty line receive food stamps by age 62, compared with 15.9% of those who begin adulthood with incomes greater than 2.5 times the poverty line.

These descriptive findings reveal substantial heterogeneity in the likelihood of ever receiving food stamps during adulthood. However, the sharp decline in age-specific probabilities of receipt, shown in Fig. 2 for all respondents, is also apparent for every demographic group. By age 40, most individuals who will ever receive food stamps have already done so.

Next, we examine heterogeneity in the probability of ever receiving food stamps. Table 3 shows results from a hazard regression that confirm the widely documented group differences: on average, blacks have twice the odds of ever receiving food stamps as whites, and those with a high school diploma or college degree have one-half and one-fifth the odds of high school dropouts, respectively, net of other observed characteristics.

The regression includes an interaction between gender and income-to-needs at age 25, and between gender and the square of income-to-needs. Figure 6 compares the predicted proportion of females and males who receive food stamps during adulthood for different values of income-to-needs at age 25, net of other characteristics. For both men and women, lifetime receipt falls sharply as income-to-needs at age 25 increases. Females residing in households with income at the poverty line at age 25 are more likely to receive food stamps during adulthood (73.2%) than similar males (62.8%). Conversely, females who lived in affluent households (five times the poverty line) when they were 25 were less likely than similar males to ever use food stamps in adulthood (15.2% vs. 10.3%).

Summary and Discussion

We find that about 29% of U.S. adults receive food stamps at least once between the ages of 25 and 62—about 20 percentage points lower than the estimate of Rank and Hirschl (2005). Although part of this difference is due to the differing ages at which the analyses begin (age 25 vs. 20), about one-half of the difference is due to our exclusion of late entrants. Late entrants are appropriately excluded because the age-specific probability of first food stamp receipt declines sharply with age and because many respondents who receive food stamps in early adulthood do so again. A similar bias may be present when examining related outcomes that are repeatable, such as poverty status (Sandoval et al. 2009).

The unconditional probability of receiving food stamps masks significant heterogeneity. African Americans and the less educated are far more likely to receive food stamps than their white and more-educated counterparts. We also find that food stamp receipt is much higher among those with low incomes at age 25 than among those who are affluent at that age.

The rapidly declining age-specific probability of receiving food stamps deserves further examination. Our regression models are descriptive, so unobserved heterogeneity likely accounts for some of the decline. Other research has found that an individual’s level of food security improves with age, which may explain the declining age-specific probabilities of first-time food stamp receipt (Nord and Hopwood 2008). It also may be the case that as people age, they become less likely to accept public assistance if they have never done so before, or that more recent cohorts are more willing to accept government benefits.

Notes

It is possible to discern whether an observed spell is the first if the events are likely to be easily recalled, as is the case with repeatable events like marriage and divorce, or if the timing can be deduced from information collected during the course of the interview (such as using children’s reported ages to deduce timing of childbirths).

Rank and Hirschl acknowledged that including late entrants (what they call “left censorship”) could bias estimates of the cumulative proportion receiving food stamps. To address this, they employed a “correction” in which they compared the shape of their survival curve with the shape of the survival curve when they excluded late entrants; they reported finding little difference between the two estimates. Because they had access to fewer waves of data than are now available, they were unable to examine the degree of bias at older ages. This is problematic because the cumulative probability of food stamp receipt has an upward bias that escalates with age. In another study, Rank and Hirschl (2009) estimated the proportion of children who receive food stamps by age 20 and omitted late entrants, as we do here. They also published analyses of the proportion of adults who experience poverty. Some of these studies included late entrants (Rank and Hirschl 1999, 2001b), but others excluded them (Rank and Hirschl 2001a; Sandoval et al. 2009).

Until the 1990s, when an immigrant subsample was added, the PSID was representative only of the nonimmigrant population. We do not include subsample members for whom data are available for only a few years. PSID documentation is available online at http://www.psidonline.psc.isr.umich.edu.

Ratner and Danziger (2008) found that this method of determining Food Stamp Program participation yields rates comparable with those based on Current Population Survey data.

Our assumption that food stamp receipt during a year in which the PSID did not collect information about receipt is the same as that of the previous year affects only those who did not previously receive food stamps. Respondents who did receive food stamps in the previous year would already be removed from the risk set. Because receipt in one year is positively associated with receipt in a subsequent year (Russo and Faux 2003; U.S. Census Bureau 1999), a respondent who experiences a food stamp spell during a one-year observational gap is likely to have experienced another spell shortly before or after the gap. Thus, our assumption would lead to a bias in the age-specific probability of first-time food stamp receipt, but the effect on cumulative failure/survival probabilities should be relatively small because the time between the unobserved and observed spell is small (as short as one year). More problematic are late entrants: those respondents whose food stamp experiences are not observed until many years after they are first exposed to risk.

We also show results that begin at age 20 because that is the starting age in Rank and Hirschl (2005).

Unfortunately, small sample sizes require us to exclude nonblack/nonwhite respondents.

This differs from the income-to-needs variable included with the PSID data file. Grieger et al. (2009) showed that the method produces annual poverty rates that are very similar to those published by the U.S. Census Bureau.

Starting the analysis at age 20 and excluding late entrants allows us to calculate cumulative probabilities only up to age 57, preventing an exact comparison to Rank and Hirschl. Because of declining age-specific probabilities of first food stamp receipt, very few individuals beyond age 57 (but before reaching retirement age) receive benefits for the first time.

References

Allison, P. (1982). Discrete-time methods for the analysis of event histories. Sociological Methodology, 13, 61–98.

Box-Steffensmeier, J., & Jones, B. (2004). Event history modeling: A guide for social scientists. Cambridge, UK: Cambridge University Press.

Cox, D. R. (1972). Regression models and life tables. Journal of the Royal Statistical Society Series B, 34, 187–220.

Cox, D. R., & Oakes, D. (1984). Analysis of survival data. London, UK: Chapman and Hall.

Fitzgerald, J., Gottschalk, P., & Moffitt, R. (1998). An analysis of sample attrition in panel data: The Michigan Panel of Income Dynamics. Journal of Human Resources, 33, 251–299.

Grieger, L. D., Danziger, S. H., & Schoeni, R. F. (2009). Accurately measuring the trend in poverty in the United States using the Panel Study of Income Dynamics. Journal of Economic and Social Measurement, 34, 105–117.

Nord, M., & Hopwood, H. (2008). A comparison of household food security in Canada and the United States (Economic Research Report No. ERR-67). Washington, DC: U.S. Department of Agriculture.

Rank, M. R., & Hirschl, T. A. (1999). The likelihood of poverty across the American adult life span. Social Work, 44, 201–216.

Rank, M. R., & Hirschl, T. A. (2001a). The occurrence of poverty across the life cycle: Evidence from the PSID. Journal of Policy Analysis and Management, 20, 737–755.

Rank, M. R., & Hirschl, T. A. (2001b). Rags or riches? Estimating the probabilities of poverty and affluence across the adult life span. Social Science Quarterly, 82, 651–669.

Rank, M. R., & Hirschl, T. A. (2005). Likelihood of using food stamps during the adult years. Journal of Nutrition Education and Behavior, 37, 137–146.

Rank, M. R., & Hirschl, T. A. (2009). Estimating the risk of food stamp use and impoverishment during childhood. Archives of Pediatrics and Adolescent Medicine, 163, 994–999.

Ratner, D., & Danziger, S. H. (2008). Investigating food stamp participation in the PSID. Unpublished manuscript, National Poverty Center, Gerald R. Ford School of Public Policy, University of Michigan.

Russo, R., & Faux, M. (2003). Characteristics of food stamp households: Fiscal year 2002 (Report No. FSP-03-CHAR02). Washington, DC: US Department of Agriculture.

Sandoval, D. A., Rank, M. R., & Hirschl, T. A. (2009). The increasing risk of poverty across the American life course. Demography, 46, 717–737.

U.S. Census Bureau. (1999). Dynamics of economic well-being: Program participation, who gets assistance? (Current Population Reports P70-69). Washington, DC: U.S. Census Bureau.

U.S. Department of Agriculture. (2010). Supplemental Nutrition Assistance Program. Washington, DC: Author. Retrieved from www.fns.usda.gov/pd/34snapmonthly.htm

Acknowledgments

This research was supported by Grant Agreement #43-3AEM-5-80056 from the Economic Research Service and the U.S. Department of Agriculture, and by funds provided to the National Poverty Center by the Office of the Assistant Secretary for Planning and Evaluation at the U.S. Department of Health and Human Services (5U01 AE000002-03). Mary Corcoran, Peter Gottschalk, Robert Schoeni, Yu Xie, and two anonymous reviewers provided helpful comments on a previous version. Any opinions expressed are solely those of the authors and not those of any sponsoring agency or organization.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Grieger, L.D., Danziger, S.H. Who Receives Food Stamps During Adulthood? Analyzing Repeatable Events With Incomplete Event Histories. Demography 48, 1601–1614 (2011). https://doi.org/10.1007/s13524-011-0056-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-011-0056-x