Abstract

Mining, mineral processing and metal extraction are undergoing a profound transformation as a result of two revolutions in the making—one, advances in digital technologies and the other, availability of electricity from renewable energy sources at affordable prices. The demand for new metals and materials has also arisen concurrently. This necessitates discovery of new ore deposits, mining and mineral processing of newly discovered ore deposits, and extraction of metals for meeting the projected requirements of the industry and the society. Some of the innovations that impacted the industry, for example, electric and autonomous equipment for drilling, haulage and processing of ores, drones for monitoring and control of operations, space/deep-sea/urban mining and molten salt electrolysis for metal extraction are discussed here. The transformative potential of integrated digital platforms such as TCS PREMAP and TCS PEACOCK is illustrated with examples where the platforms have been gainfully deployed in operating plants and creating values for the industry.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Metallurgical products are manufactured by a series of engineering operations, starting with exploration to mining, mineral processing, metal extraction and finally manufacturing of finished products. Recycling of waste streams is also an important step at each stage of operations. The cradle-to-cradle cycle or the complete process value chain for metals is illustrated in Fig. 1. We shall, however, limit our discussion here to a few selected areas of current research and innovation that are of significance for the mining, minerals and metal industries.

We are living in exciting times. The digital revolution is rapidly transforming the very nature of industrial enterprise today. Many disruptive transformations are on the horizon because of the advent of cloud computing and Internet of things (IoT) and due to major advances and breakthroughs being made in several research areas such as artificial intelligence (AI) including machine learning (ML) and big data analytics, robotics, autonomy, drones, 3D printing, sensor technologies and generation of electricity based on renewable energy. It is inevitable that our industry will leverage these advances and breakthroughs and will develop innovative solutions to address the challenging problems confronting the industry.

Another revolution in the making is the exciting possibility of fossil fuel-free generation of electricity in the coming decade. The availability of electricity based on renewable sources such as sun, wind and biomass will cause a major disruption since fossil fuels (coal, oil or natural gas) are used in our industry both as sources of heat and reductants in many cases currently. Use of fossil fuels creates deleterious environmental consequences which need urgent attention.

While our industry will have to reckon with these two revolutions in the making, they have also created new technology frontiers for the minerals and metals industry. Both digital hardware and generation of electricity from renewables (including the technological challenges associated with energy storage) require a host of new metals and materials for which the new value chains (also the novel supply chains) will have to be established. Innovative processes for extraction of minerals and metals as well as recycling, which are more energy efficient and environment-friendly, will have to be developed to produce these critical elements. The recycling of battery electrodes and electronic waste, for example, has been an area of contemporary research interest.

According to the World Bank report “The Growing Role of Minerals and Metals for a Low Carbon Future,” published in 2017, there will be a substantial increase in demand for several key minerals and metals to manufacture industrial products necessary to usher in low-carbon future and clean energy technologies [1]. The much-anticipated energy transition will therefore require innovations in mining, mineral processing and extractive metallurgy [2,3,4,5,6,7,8,9]. For example, production of solar photovoltaic cells requires copper, indium, silicon, selenium, molybdenum, cadmium, tellurium, titanium, gallium, germanium, arsenic, boron and tin besides aluminum. Each wind turbine requires tons of rare earths (neodymium, samarium, praseodymium and dysprosium), copper, nickel, molybdenum and manganese besides steel, aluminum and concrete. Batteries for large-scale energy storage and for electric vehicles (electric mobility in general) require lithium, cobalt, indium, copper, manganese, graphite, vanadium, zinc and lead besides steel and aluminum. The relative proportion of these metals will, however, vary depending on the technological breakthroughs in the domain of energy storage. The unprecedented demand for the top five metals critical for energy transition, according to one estimate, is summarized in Table 1 [10].

It is also well acknowledged that some of these metals will be produced as by-products during the processing of ores containing the base metals (copper, lead and zinc). Some of them occur in nature only in ppm concentrations (g/ton), and hence, novel techniques will have to be invented for mining, mineral processing and extraction of these metals at affordable costs of production and with minimum environmental impact.

One of the related challenges is to prepare human resources with high level of domain expertise and appropriate engineering skill needed to deal with the problems of scalability (several million tons of metals to be produced per year), uncertainty, reliability, systems engineering, ability to deal with variability of ore grades and yet manufacture products of uniform and reproducible quality, issues related to personnel health, safety and environmental impact, energy efficiency and optimization of the throughput, productivity and quality during commercial operations, etc. [11,12,13].

We present, in this paper, a brief overview of the innovations being commercialized by several research and innovation groups globally, including the recent work carried out by our group at the interface of information technology and the minerals, metals and materials engineering domain. Some of these innovations have already attracted massive investments and inspired talented human minds to take up the challenge and have made a visible impact on a commercial scale.

2 New Technology Frontiers

2.1 Electrification Based on Renewable Energy and Autonomy of Mining Operations

Mining operations are tailor-made for electrification and autonomy. The mines are often located in remote areas, and the operations are often hazardous. This requires high level of investments in the health and safety of those working in the mines, mineral processing plants or smelters. It is in this context we must examine the advances being made in the introduction of all electric, battery-operated, autonomous equipment, controlled remotely through digital platforms in mining operations. It is anticipated that with the maturing of digital technologies, smart micro-grids, affordable energy storage solutions and autonomous vehicle technologies, the mining operations will be run remotely with little or no manual/human intervention on-site. A few examples of successful initiatives on this front are presented here to illustrate the advantages of electrification and autonomy in mining operations, already being derived by several mining companies around the world [14,15,16,17,18,19,20].

2.2 Electrification

As illustrated by a few examples summarized in Table 2, electrification of mining, powered by renewable energy sources, is increasingly being adopted by all major mining companies.

According to a recent Fitch report, Chile is currently the global leader with respect to installed power based on renewables in the mines. Nine different companies in Chile have installed either wind or solar capacity including copper-mining giants like Codelco, Collahuasi and Antofagasta Minerals [26, 27]. According to this report, the mining companies will enhance their investments in renewable energy with battery storage in addition to investments in improving energy efficiency of the operations and to adopt carbon capture and storage (CCS) technologies, wherever possible, so as to improve their social license to operate in the coming years.

2.3 Autonomy

Rio Tinto launched its “Mine of the Future” project back in 2008, and today it boasts of a large fleet of autonomous vehicles. Ten years after it began the trial, Rio Tinto achieved a major milestone in 2018. It has moved more than one billion tons of material through a fleet of driverless trucks supplied by Komatsu, in Australia’s Pilbara region. More than 20% of its existing fleet of 400 haul trucks is autonomous. A supervisory control system using a predefined GPS has replaced the driver. These driverless trucks are 15% cheaper to run. Rio Tinto has signed contracts with both Komatsu and Caterpillar to retrofit 48 trucks with autonomous haulage system (AHS) technology [28].

Furthermore, Rio Tinto is also successfully running the world’s largest driverless and automated heavy-haul, long-distance rail network called Auto Haul. It operates 200 locomotives on more than 1700 km track in the Pilbara region, transporting ore from 16 different mines to four-port terminals [29]. These driverless trains have already travelled more than 4.5 million kilometers. Rio Tinto is also using autonomous production drills in order to enhance safety and productivity in its iron ore operations in Western Australia.

Rio Tinto with help from FLSmidth will be commissioning an “intelligent iron ore mine” in 2019 at a cost of US$ 2.2 billion incorporating all advanced technologies such as robotics, 3D design, driverless trains and trucks on its Koodaideri mine site in the Pilbara region [30, 31]. This mine will have a capacity of 40 million tons per year (as compared to Rio Tinto’s total iron ore mining capacity of 300 million tons of ore per year).

Adani Mining, owner of the US$ 16.5 billion Carmichael coal mine in Australia, has awarded a contract to Komatsu to supply 55 super-large dump trucks—at least 45 of them will be autonomous to start and become fully autonomous later. The mine is expected to produce 60 million tons of coal per year [32].

BHP Billiton, the world’s largest mining company, is also deploying driverless trucks and drills in its iron ore mines in Australia. Other major mining companies that have opted for autonomous haulage trucks include Vale in Brazil, Suncor, Canada’s largest oil company in its oil sands in Alberta, Barrick Gold in its Cortez mine in Nevada, USA, and Fortescue Metals Group in Australia [33,34,35].

Komatsu America Corp. has achieved an unprecedented milestone of moving more than 2 billion tons of mined material autonomously through its Front Runner autonomous haulage system (AHS) [36].

Besides Komatsu and Caterpillar, other suppliers of autonomous and/or electric, battery operated trucks include Hitachi, Volvo, Atlas Copco, Liebherr, BelAZ, Cummins and BEML, India [20, 37].

In addition to trucks and trains, cargo ships can also be made autonomous. The US DARPA has demonstrated the technology in 2016 through its unmanned warship called Sea Hunter. BHP is exploring opportunities to adopt automated self-navigating cargo ships for its operations since it transports more than 250 million tons of ore on 1500 voyages every year. Recently, Norway-based fertilizer company YARA has commissioned an autonomous and electric container vessel with the help of VARD, a ship builder and Kongsberg, a technology company that supplies sensors and related software. The ship is expected to achieve full autonomy by 2022 [38].

On a trip between Parainen and Nauvo in Finland, Rolls Royce in partnership with Intel has demonstrated its “fully autonomous ferry,” loaded with several sensors and AI software to identify and avoid objects in its immediate vicinity. Rolls Royce has plans to commercialize the technology of self-guided cargo ships by 2025 [39].

2.4 Digital Connected Mining Solutions

2.4.1 Blockchain Technologies for the Mining Industry

The global mining and metal market estimated to be around US$ 1.8 trillion relies on the conventional supply chains consisting of manual paper-based processes which lack traceability and transparency between supply chain participants. Automaker Ford, in partnership with IBM, South Korean battery maker LG Chem and China’s largest cobalt producer Huayou Cobalt, will be testing the first blockchain project for mining [40]. It will enable tracing supplies of the metal from Democratic Republic of Congo (DRC) to the customers. Earlier, De Beers in collaboration with Alrosa, Russia, had developed and deployed blockchain technology through its Tracr platform [41]. The platform is used to trace gemstones throughout the entire value chain and the supply chain—from the mine to the buyer, particularly to provide enhanced assurance to its clients about the authenticity of its gemstones.

Goldcorp, ING Bank, Kutcho Copper Corp., Ocean Partners USA and Wheaton Precious Metals Corp. are working with a mining technology company, MineHub to build a new mining supply chain solution on top of the IBM Blockchain Platform. The technology demonstration will consist of a digital platform installed at the Goldcorp’s Penasquito mine in Mexico and enabling full traceability from the mine to the market [40].

By successfully digitizing the supply chain through the integrated blockchain platforms like MineHub and Tracr, one can increase the level of automation and reduce reliance on intermediaries, thereby increasing the speed of delivery as well as the reliability and the authenticity of goods to the customers.

2.4.2 Data Analytics and Predictive Maintenance Solutions

Several IT service providers are working with major global mining companies for opportunities in the area of the digital transformation of the mining operations. While a detailed discussion on the digital solutions for the mining industry is beyond the scope of this review, it is important to emphasize that the mining industry has benefitted immensely by digital intervention and these success stories are multiplying at a rapid pace. OSIsoft has implemented several condition-based monitoring and predictive maintenance solutions based on its OSIsoft PI platform for the mining industry to help customers reduce downtime of equipment [42]. CISCO’s connected mining solutions [43] provided to the mining industry include (a) connected predictive maintenance (b) digital tailings monitoring (c) secure mining operations (d) asset visibility and monitoring (e) connected plant—basically to connect end-to-end operations across different geographies. IBM in collaboration with service providers like Garmin, Guardhat, Smartcone and Mitsufuji in the domain of wearable technologies has leveraged its IBM Maximo Worker Insights Platform to provide enhanced safety to mine workers [44]. A few more illustrative examples are listed in Table 3 [45,46,47,48,49,50].

2.5 Drones for Mining Applications

Unmanned aerial vehicles (UAVs), also known as drones, are routinely being used to collect data from locations which are either hazardous to access and/or difficult to approach. For example, the inspection of wind farms and solar panels is being done by drones at much lower cost. The applications of drones in the mining industry are extremely cost-effective, and they address the safety and productivity concerns as well. Tailings monitoring and management is being done by drones at several locations [51,52,53]. Drones have been successfully deployed, for example, in Barrick Gold’s Pueblo Viejo mine in Dominican Republic, to collect survey data from pre-marked ground control points using GPS technology which helps the engineers track the stability, construction and volume of materials available within tailings storage facilities in the mine [54].

Tata Steel’s Noamundi iron ore mine is the first mine in India to introduce drones for monitoring the mining areas, including surveillance, dump profiling and tracking vegetation in the reclaimed mine areas [55]. At the Rio Tinto’s Bingham Canyon Open Pit Mine, Kennecott has 30 FAA-certified drone pilots running four to five flights every day. Drones collect high-quality data even from otherwise inaccessible locations in the mine, for exploration, surveying and real-time 3D mapping and inspection of equipment and stockpiles. It has helped the company to achieve highest levels of safety and productivity [56, 57]. Spain’s OHL is providing maintenance services to Codelco’s underground copper mine in El Teniente, Chile. The services include observation, monitoring, inspection of the tailings canal using drones, efficient and timely maintenance, operational support and inspection of the equipment in the wastewater, thickening and recirculation units, tailings disposal operations, hydrometallurgical plant and overall maintenance support [58].

2.6 Space Mining–Mining on the Asteroids and on the Moon

In their quest for richer sources of critical minerals and metals, several companies are investing in the technologies to explore and eventually mine in places other than Earth, for example, asteroids, Moon and Mars. Geologists believe that the asteroids are rich in several metals of interest to us on earth, for example, some of the asteroids are rich in iron, nickel, cobalt and platinum group metals.

Luxembourg is one of the first countries to launch its Space Agency (LSA) in 2016 and promote exploration and commercial mining on near earth objects [59]. The government of Luxembourg reached an agreement with the US-based company Deep Space Industries to conduct prospecting missions for minerals in outer space. It also invested in another US company called Planetary Resources to help launch its first commercial asteroid prospecting mission by 2020. Russian government has also shown interest in joining Luxembourg in its efforts to explore opportunities in space mining.

Earlier this year in 2019, Japanese Aerospace Exploration Agency confirmed that its Hayabusa2 spacecraft landed on the asteroid Ryugu. It successfully deployed two MINERVA-II rovers on the surface of the asteroid, created a crater, using a tantalum bullet. The objective was to collect the rock samples available on Ryugu and bring them back to earth for further analysis, and the mission has been successful. NASA also has its own spacecraft OSIRIS-Rex which landed at the asteroid Bennu in December 2018. It will also be bringing back some of the rock samples from Bennu. Both Bennu and Ryugu belong to the most common family of C-type asteroids, rich in carbon and possibly water locked up in hydrated minerals. The S-type asteroids are believed to be rich in iron and nickel along with their corresponding silicate minerals. The M-type asteroids are rich in metallic iron and nickel, gold and other precious metals—possibly more valuable than the other two types of asteroids from the point of view of mining. The M-type asteroid 16 Psyche will be the target of the next mission of NASA, called NASA Psyche mission, scheduled to be launched in 2023 and land on the surface of Psyche in 2030 [60, 61].

The Moon is also thought to contain rich concentrations of iron, water, rare-earth elements, precious metals, nitrogen, hydrogen and helium-3. Helium-3 is particularly precious since it can be used for space-based fuel in fusion reactors without generating nuclear waste. Moon Express is a company started by a billionaire Naveen Jain, a space technology expert, Dr Barney Pell and futurist Dr. Bob Richards. Canadian-based Deltion Innovations will help Moon Express collect, process, store and use materials found on the surface of the Moon—that is, “in situ utilization.” Deltion has been working with NASA as well as Canadian Space Agency (CSA) since 1999 and has assisted in the development of space mining equipment for drilling/excavation, mobility, remote operations and subsurface exploration [62, 63].

NASA has announced that nine US companies, namely Lockheed Martin, Astrobotic Technology, Deep Space Systems, Draper, Firefly Aerospace, Intuitive Machines, Masten Space Systems, Moon Express and Orbit Beyond, will compete to land on the Moon and deliver payloads sponsored by NASA. Other companies that can also be roped in later include Blue Origin, Boeing and Space X.

Other successful expeditions include the one undertaken by Chinese, landing a rover on the Moon’s far side. Indian Space Agency, ISRO, has successfully launched its Chandrayaan-2 rover in July 2019 to explore near the Moon’s south pole [64]. A joint effort of Israel Aerospace Industries and SpaceIL to land its Beresheet spacecraft crash-landed on moon earlier this year in 2019. European Space Agency is also exploring opportunities to join the expeditions. Australian Centre for Space Engineering Research (ACSER) has announced its Wilde mission to extract water from the shaded craters on the Moon surface [65]. The expectation from all these efforts is that, one may be able to exploit asteroids, the most valuable being the 511 Davida containing minerals worth trillions of dollars.

2.7 Deep-Sea Mining

A lot of work has been carried out by researchers around the world, including those in India, on the processing of Manganese nodules found on the sea floor. A vast repository of critical minerals like cobalt, zinc, manganese and rare earths is present in the sea in three forms: (a) polymetallic manganese nodules lying on the sea floor (b) cobalt-rich ferromanganese crusts that cover the seamounts and (c) massive polymetallic sulfide deposits around hydrothermal vents. Typically, an ore from the seabed deposit is seven times enriched with minerals than that mined on the land. At least 20 countries have been carrying out exploration activities since 2000. According to the National Institute of Ocean Technology (NIOT), India, the manganese nodules present in the 150,000 sq. km of the Indian Ocean floor (licensed to India) amount to about 380 million tons. NIOT is developing technologies to exploit this deposit for the recovery of critical minerals like cobalt, nickel, copper and manganese [66, 67].

UN’s International Seabed Authority (ISA) grants prospecting, exploration and exploitation licenses for all mining activities in the seabed of the international waters, which are beyond the limits of individual national jurisdiction. ISA has granted so far 29 licenses for mineral exploration in the deep sea. Sixteen of them are for the Clarion–Clipperton Zone (CCZ)—one of the world’s largest and the richest deposits of high-value ores. According to a 2010 estimate, approximately 21 billion tons of nodules found in this zone are estimated to hold six billion tons of manganese, 270 million tons of nickel, 234 million tons of copper and 46 million tons of cobalt in the form of oxides and hydroxides [66]. Deep Green Resources (DPGs), in partnership with Maersk Launcher, a shipping company, have recently completed a campaign to estimate the potential of deep-ocean mining in the CCZ area. Deep Green and Nauru Ocean Resources (NORI), a subsidiary of Maersk, have embarked on developing state-of-the-art technologies to collect the manganese nodules from the ocean floor and process them.

A few years ago, Japanese researchers reported the discovery of huge rare-earths-rich deposits in the seabed around Minami-Torishima island in the Pacific Ocean. The deposits are rich in critical rare earths such as dysprosium and terbium [68].

A team of British scientists has earlier reported their discovery of tellurium-rich deposits in the Atlantic Ocean, about 500 km off the Canary Islands. Scientists are also exploring the potential of another deposit, the Rio Grande Rise, located 1500 km off Brazil’s southern coast in international waters [69].

Canada’s Nautilus Minerals, one of the world’s first seafloor miners, are also going to start mining operations at Solwara I for gold, copper and silver, off the coast of Papua Guinea later in 2019. It is also developing a similar project off the coast of Mexico [70]. Typically, an ore from seabed deposit is seven times more enriched with minerals than that mined on land. Debmarine (a joint venture between De Beers and the government of Namibia) operates five diamond mining vessels. The process involves dredging on the ocean floor using advanced drill technology supported by tracking, positioning and surveying equipment. The dredged gravel is processed in the treatment plants onboard the ships. The residue is returned to the ocean, and the recovered diamonds are brought to the shore by helicopters [70].

Along with the efforts to start mining operations in the deep sea, scientists are also investigating concurrently the adverse environmental impact of such mining operations, if any, on the flora and fauna at the sea floor. Later this year, Global Sea Mineral Resources (GSR), a mining subsidiary of a dredging company, DEME will begin harvesting these sea floor deposits using a prototype machine called Patania II. Concurrently, scientists on the German research vessel, RV Sonne, will deploy deep-sea cameras and sensors to monitor how the dredging will churn the soft, sedimentary part of the sea floor that surrounds the nodules [71, 72].

Considering the demand for critical minerals going up in the coming decade, it is expected that deep-sea mining will become a commercial activity soon. ISA is deliberating on the issue of granting licenses for exploitation, not merely for exploration, as has been the case so far [73].

2.8 Urban Mining

It is not so well known or recognized that the unprecedented successes of the digital era are based on smart chips and digital hardware which create enormous quantities of electronic waste, requiring innovative means of smart recycling or safe disposal. More than 40 million metric tons of e-waste, from TV sets to computers, mobile phones, smart devices, medical diagnostic instrumentation to fast moving consumer goods like microwave ovens, refrigerators, washing machines and lighting devices, are being generated worldwide every year. It is projected to grow to 50 million tons by 2020 [74]. There are also huge stockpiles of this waste in the form of landfills, accumulated over the past few decades in different parts of the world.

Electronic waste contains almost all the elements in the periodic table, and since we have not yet graduated to designing all industrial products for easy recycle, the recycling of e-waste continues to be a major technological challenge for the metallurgical engineers. It is obvious that it is a source of many precious metals critical for our continued prosperity and that is why the name “urban mining” has been coined to emphasize the need to consider waste also as a resource.

In an interesting investigation carried out in Switzerland recently, the investigators found that the concentrations of some of the precious metals like gold in the municipal wastewater sludge were comparable to what is found in the primary ores being mined [75]. Not surprisingly, researchers have demonstrated that it is cheaper to recover some of the metals like copper and gold from electronic waste (urban mining) rather than from primary ores. Taking into account the real cost data from e-waste processors in China and after due diligence, the authors have reported that the costs of copper and gold (two metals which were investigated in detail) in per ton of metal are comparable to those incurred by the mining companies extracting metals from ores currently being mined in China [76]

One of the most important technological breakthroughs, in which the industry is waiting for, is in the field of recycling of lithium-ion batteries and rare-earths-based permanent magnets. Both comprise of precious metals like lithium, nickel, cobalt and rare earths, and the global supply chains for all these metals are extremely uncertain and unreliable.

Urban mining is an exciting field by itself and requires many engineering innovations, before it becomes a commercial success. This interesting topic, however, is beyond the scope of this paper. The readers are referred to some of the recent literature in the field, articulating the materials engineering challenges associated with the recycling of electronic waste [77, 78].

3 Metal Extraction Using Electricity Generated from Renewable Energy Sources

It is now generally accepted by experts in the field that for energy transition from fossil fuels to renewables (solar, wind and biomass) to succeed, one needs to find commercially attractive solutions to two basic technological challenges—namely the energy storage to take care of intermittent nature of electricity generated from renewable sources and the improvement in the grid infrastructure (establishing smart grids and/or micro-grids). The grids should be able to accommodate a larger share of renewables as an energy source and the distributed generation of power, having multiple touch points.

Lithium-ion batteries, even though currently being deployed for large-scale energy storage, are not the solution we are looking for. Liquid metal–flow batteries are perhaps a better option [79]. Large-scale energy storage thus remains an unsolved problem, waiting for smart and innovative solutions.

Smart grids deal with the demand-side management (managing instant pricing of electricity available to the consumers) of electricity in case availability of the intermittent renewable electricity reaches very high levels. Recent advances in sensor technologies, control algorithms, artificial intelligence (AI), machine learning and data analytics should help achieve the balance between electricity supply and demand. Novel algorithms must take into consideration the parameters like local weather, grid status, available electricity generation, historical demand profiles and other such factors. Investments are being made in what is known as distributed energy resource management and intelligent systems for demand management. The solutions address the problem of the distribution grid with distributed assets, whether they be batteries, charging electric vehicles, flexible heating and cooling loads or solar/wind power with storage [80]. The Department of Energy and ARPA-E (Advanced Research Projects Agency-Energy) have initiated a research program called NODES (Network Optimized Distributed Energy Systems) on how distributed resources can help with frequency regulation on the grid and provide control of the total load on the grid through smart online modulation of flexible demand side loads [80].

It is anticipated that commercially viable solutions will soon alter the energy scenario. We will have access to affordable fossil fuel-free power, and it will mean that metal extraction technology should be based on this clean power. We must replace fossil fuels with electricity as the source of heat and in the reduction of oxides into metals. Currently, aluminum is the only metal that is produced in Hall–Heroult cells, by what is known as molten salt electrolysis of alumina into aluminum metal in a cryolite bath. It is interesting to note that Hall–Heroult cells, though use electricity for smelting, also use carbon anodes which results in emission of greenhouse gases like CO2. For example, by 2020, with the production of 70 million tons of aluminum, more than 100 million tons of CO2 will be emitted per year. In 2018, the top global aluminum producers Rio Tinto, ALCOA and Apple (large consumer of aluminum as well) came together to invest in a joint venture company called Elysis, besides investments from the Canadian and Quebec governments. Elysis will be scaling up the process to produce carbon-free aluminum. Oxygen will be produced instead of carbon dioxide since the conventional graphite anodes will be replaced with novel carbon-free ceramic anodes. In fact, Elysis will also help establish the supply chain for the proprietary anodes and cathodes for this novel process of carbon-free smelting to produce aluminum [81, 82].

Extraction of metals including the production of iron and steel contributes significantly to the emission of greenhouse gases. Once the electricity from renewable energy sources is available at affordable prices and micro-grids/smart grids take care of intermittency and distributed power generation, the molten salt electrolysis will become a preferred route to reduction in oxide and sulfide minerals to their corresponding metals. In anticipation of these possibilities, several research groups globally have been working on metal extraction through the molten salt or the fused salt electrolysis route. Although a detailed discussion on this topic is beyond the scope of this review, the readers are referred to some of the recent literature for more details. Sadoway and co-workers at MIT [83] have, for example, demonstrated that iron oxide can be reduced to iron through this process. If successful, this process can potentially compete with the conventional blast furnace route. The obvious advantages of a fossil fuel-free process of reduction in iron oxide to iron make this process extremely attractive. The well-known FFC process of titanium production through a molten salt electrolysis route is also being pursued by several research groups globally [84, 85]. Furthermore, Allanore and co-workers [86, 87] have also demonstrated the feasibility and the utility of electrolytic extraction of metals like copper, molybdenum and rhenium from a molten sulfide electrolyte.

An interesting paper on the clean metals production by a process called solid oxide membrane (SOM) process is worth citing in this context [88]. The authors have argued that electrochemical reduction using an oxygen ion-conducting membrane typically made of yttria-stabilized zirconia (YSZ) as an anode has obvious advantages over the traditional carbothermic, metallothermic or halide reduction in oxides. Oxygen is the by-product of SOM process instead of carbon dioxide produced in the conventional molten salt electrolysis with graphite anodes. The process is ideally suited to produce metals like magnesium, aluminum, silicon, germanium, titanium, rare earths (neodymium and dysprosium) and tantalum from their corresponding oxides.

For a country like India which needs all the above-mentioned metals in large quantities, the molten salt electrolysis route of metal extraction with inert anodes needs urgent attention. Recent work on the production of magnesium and titanium through this route by Nagesh and co-workers from India is therefore extremely important [89, 90].

4 Digital Platforms for the Integrated Design and Optimization of Mineral Processing and Metal Extraction Plants

Recent advances in information technology (IT) and knowledge engineering, in combination with the relevant domain expertise, that is, our enhanced understanding of the underlying science of mining, mineral processing and metal extraction unit operations and the availability of a variety of extremely powerful modeling, simulation and data analytics tools, make it possible to address the challenging problems facing the mining, mineral processing and metal extraction industry in an integrated manner.

IT-enabled platforms are the key to provide an integrated view of the industrial enterprise. Attempts to integrate all functions in an enterprise such as mine-to-port, mine-to-mill, mine-to-product or mine-to-market initiatives, wherever and to whatever extent implemented, have provided significant benefits to the industry [91]. Achieving operational excellence across the enterprise, for example, calls for integration of all business units as well as supply chains located in several locations into a centralized database having visibility and traceability of a data point in an automated manner to all the stakeholders. It is possible now with the currently available state-of-the-art digital tools and technologies.

For example, if we wish to optimize the energy consumption during size reduction across the operations all the way from the mine to the mill, one will have to optimize the blasting design concurrently with the grinding of the run of the mine ore in the grinding mill (part of the milling operations). Such integrated constrained optimization strategies are currently available and have been deployed to accomplish significant savings in energy consumption in the mining industry [92].

Integration across different units in a large enterprise also fosters a culture of strong collaboration among the associates and sharing not just the data but also the business intelligence and the learning which takes place across the enterprise daily. It creates an eco-system which will not be possible without the implementation of digital technologies and integrated platforms.

Since the literature is vast on this topic, it is beyond the scope of the current article to review the various software platforms available commercially. Instead, the transformative potential of IT-enabled integration platforms in this context is illustrated in this communication with the help of case studies from our recent work in this field—using our own two distinct platforms, namely TCS PREMAP and TCS PEACOCK.

4.1 TCS PREMAP

TCS PREMAP (Platform for the Realization of Materials and Products) is a knowledge-assisted, simulation-driven engineering decision-making platform which leverages modeling and simulation and artificial intelligence into the engineering design process with contextual delivery of curated knowledge. The key differentiator of the platform is its underlying model-driven architecture which allows for formal specification of various entities—product, material, manufacturing process, design process, assembly, simulation tool, knowledge model, etc.—supported by appropriate meta-models and thereby providing semantic language for the expression of knowledge, data and achieving seamless integration between different entities and underlying engineering design and decision processes. These meta-models have features to describe materials and systems at different scales and degrees of complexity in a hierarchical fashion [93, 94]

It further allows for the setting up of engineering design and analysis processes in the form of workflows for integrated design and analysis of engineering products including their geometric design, performance analysis, material design and selection as well as the design of manufacturing and testing processes using the semantic representation defined in the platform. It allows for leveraging design methods, analytical models, simulation tools, decision algorithms, external databases and knowledge services and makes it easy for an end designer with limited knowledge of simulation tools or other design processes to carry out engineering design of components, materials and manufacturing processes. Our platform facilitates easier decision making by leveraging systems engineering components such as design of experiments, multi-disciplinary optimization, decision support algorithms and knowledge engineering components such as rule engines, data mining and machine learning algorithms.

A knowledge engineering framework provides ways for capturing knowledge systematically along with the intent and context using the semantic language of entities [95]. A knowledge engine provides contextual assistance during creation of engineering decision workflows as well as the execution of the same by retrieving appropriate knowledge elements curated in the platform. The methods and knowledge generated during the design processes, such as the failure mode and effect analysis (FMEA), can also be easily extended for root cause analysis or diagnostics during the operations of the system under consideration. It can also act as the repository of the enterprise-wide intelligence and learning gathered over years of hard work and inputs from experts.

A machine learning engine provides means to generate knowledge from past executions and store them for later use. The layered modeling architecture of the platform makes it highly extensible across domains by allowing the user to create domain-specific models derived from standardized meta-models.

Our generic platform thus enables digitally driven design workflows with strong capabilities to retain and reuse knowledge, to enhance design processes for integrated engineering across multiple steps, to reduce product development time and to design better products and processes. A brief description of the platform is given in Fig. 2.

TCS PREMAP is already being used for various downstream processes and products in the metallurgical and manufacturing industry such as design and optimization of a manufacturing process for new grades of steels in a given plant, including steel making, casting and solidification, heat treatment, sheet production and product design [96, 97]. It is also being applied to the process industry for root cause analysis using FMEA-based methods combining heuristic knowledge and modeling and simulation. We are working with several industrial partners globally, including a major steel producer in India to customize TCS PREMAP for their specific requirements.

We are also customizing our generic platform for the design and optimization of mineral processing plants in an integrated manner (Fig. 3). With the advent of automated mineralogy tools (which makes it possible to represent the feed to a mineral processing plants digitally), the recent breakthroughs in our ability to design and screen flotation reagents based on an automated molecular modeling framework [98,99,100] and the availability of mathematical modeling and simulation tools for all mineral separation unit operations—it is now possible to establish design workflows for a mineral processing plant—for a given ore mineralogy, liberation characteristics and a set of unit operations to achieve the required recovery-grade performance in the operating plant [101, 102]. The whole process of designing flowsheets is thus amenable to automation and this is what we have attempted with the help of our platform. Once the expert sets up these workflows and the requisite knowledge associated with those workflows is made available, the design and optimization process will be automated to a large extent. More importantly, the past work on the development of flowsheets can also be leveraged in a user-friendly manner with the help of the platform.

4.2 TCS PEACOCK

It is well known that even though we collect a lot of data in the operating mineral processing and metal extraction plants, we are not able to leverage it for enhancing plant performance, either due to lack of data analytic tools or due to adequate expertise available on-site. There is also a strong need to utilize digital platforms for online optimization and control through what are now referred to as ‘digital twins’ for enhancing the performance of not only the individual unit operations and equipment but also the complete plant or manufacturing operations. We have therefore concurrently worked on the development of another platform, TCS PEACOCK (Process and Equipment Analytics for Optimization and Control), that can enable automation of data analytics in operating plants and help in the development and deployment of digital twins [103].

TCS PEACOCK has been applied for carrying out data mining and analytics off-line as well as for creation of digital twins of various processes and equipments that are deployed in the plant for process and equipment monitoring, analysis, optimization and control. The important components of this platform are the Data Quality Verification, Data Pre-processing, Data Fusion/Integration, Descriptive Analytics, Diagnostic Analytics, Predictive Analytics and Prescriptive Analytics. The platform is useful for carrying out end-to-end analytics, starting from raw data from sensors in a manufacturing or process plant, and going all the way to prescriptive analytics for coming up with recommendations for improving the operations in terms of the key performance indicators (KPIs) either for a process or for an equipment. The steps involved in carrying out data analytics are shown in detail in Fig. 4.

The TCS PEACOCK framework has been successfully applied for sintering and pelletization of iron ores [104,105,106,107], prediction of silicon content in hot metal from a blast furnace, regime identification of the operation of a coke oven, production of sponge iron in a rotary kiln [108,109,110], optimization of mineral processing circuits [111] and the performance of important operations in thermal power plants.

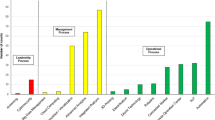

More recently, we have also leveraged our platform for enhancing the performance of an operating mineral processing plant consisting of crushing–grinding–flotation circuits [111]. TCS PEACOCK has been found to be useful in quantifying (and leveraging the knowledge thus gained) the extent of liberation achieved under a given set of operating conditions and relating it to the overall plant performance. (Liberation is the single most important parameter in determining the separation efficiency of various unit operations.) Since it is possible now to collect the liberation data through automated devices, one can model liberation through appropriate machine learning algorithms (since rigorous physics-based models are not available), correlate it with several operating conditions, particularly the operation of the crushing and grinding circuit and thus optimize the plant performance based on the data collected in the plant. The data thus are converted into standard recovery-grade plots for different operating conditions (Fig. 5).

5 Indian Scenario

While it will not be possible to cover in detail the current status and the future prospect of the mining, mineral processing and metal extraction industry in India as part of this review, we shall attempt to briefly discuss the immediate challenges faced by us in India, in the light of the global status of our industry. India is fortunately well endowed with natural resources, and therefore, it is extremely important that we devise an appropriate strategy to utilize our resources judiciously.

Steel and cement are the foundational materials for the modern civilization, and we do have adequate resources of iron ore and limestone in the country. Major Indian companies are associated with the production of these two materials. The current annual global production is 1.8 billion tons of steel and 4.1 billion tons of cement and is increasing year after year. As expected, India is the second largest producer of both steel (131.6 million tons last year) and cement (290 million tons last year) in the world after China. (It produces 2.38 billion tons of cement and 928 million tons of steel per year). Steel and cement industries also contribute (each contributing 7–9% of the total) significantly to the global greenhouse gas emissions. Both these industries are extremely mature, thanks to the continuous process engineering improvements made by the engineering fraternity over the years. Since there are no materials on the horizon today to replace cement and steel, we in India must innovate and find alternate technological options to make a significant reduction in the energy consumption and the environmental impact for both steel and cement.

We would also like to emphasize that cement and steel industries are interdependent. All load-bearing civil structures use steel bars as the reinforcement. A significant portion of steel is used in building and construction industry. Also, the granulated blast-furnace slag (produced in the integrated steel plants), when ground to cement fineness, does possess enough lime reactivity that one can replace part of cement with granulated BF slag in the concrete mix. Depending on the quality of the granulated BF slag, one can grind upto 70% by weight slag along with the Portland cement clinker, to produce what are known as Portland Blast-Furnace Slag Cements. Almost all the blast-furnace slag produced in India is granulated and converted into cements—contributing significantly to the reduction in greenhouse gas emissions.

We also have rich resources of bauxite and copper–lead–zinc ores in the country. The land, water and the energy—the most important inputs for the growth of these industries, are, however, in short supply. Additionally, we need to address the challenge of minimizing the greenhouse gas emissions (primarily CO2) as per the commitments of the Paris Accord.

With a population comparable to China, currently, our per capita cement and metal consumption is relatively small. We will therefore have to increase our production several-fold in order to meet the basic needs of our people in India. For example, National Steel Policy 2017 aims to increase our steel production threefold to 300 million tons by 2030–2031. While our industry is globally competitive currently, we will have to develop our own strategy and find innovative solutions to deal with the constraints of land, water and energy while increasing metal production in India.

As an illustration, in Table 4, we summarize the results of the life-cycle analysis carried out by Norgate et al. [112, 113] for selected metals, considering the various technological options available today. These numbers may not be the same for the kind of natural ores being processed in India, and therefore, the projected values for greenhouse gas emissions per unit of metal should be considered as indicative only. It is clear, however, that the carbon footprint (GWP) and the energy requirement to produce these metals differ significantly. Furthermore, one must select the appropriate technology route to produce metals depending on the natural ore feed used for the metal production. As illustrated earlier in the previous section, an integrated approach must be employed to reduce the overall production cost as well as the environmental impact and the availability of digital platforms make it relatively easier. Digital platforms such as TCS PREMAP can also help us make the proper selection of metals and materials to be used in specific industrial applications (steel vs. aluminum, for example), while considering all the constraints as well as the performance specifications.

As discussed in the earlier sections, several Indian mining companies and metal producers have adopted the digital solutions to optimize their operations. With the advent of renewable energy sources such as solar and wind power, Indian companies are also exploring leveraging renewable energy options in their operations.

The urgent need to assess alternate technological routes for metal production in our country is illustrated with the help of the data taken from the literature on steel production by alternate processes [114, 115].

As illustrated in Table 5, the conventional blast furnace reduction of iron oxide to iron, followed by basic oxygen furnace (LD Converter) to produce steel, known as the BF-BOF route leads to the GHG emission level of 2.3 tons of CO2 per ton of steel. A significant proportion of steel in the world is currently produced using the electric arc furnace (EAF) starting with the directly reduced iron (DRI) and/or the steel scrap as the feed to the furnace. It is obviously a much greener route to make steel, but there is not enough scrap currently available in India, and hence, we have to resort to production of DRI (sponge iron). India also happens to be the largest producer of sponge iron in the world. The most interesting option is the last one in Table 5—electrolytic reduction of iron oxide to iron followed by steel making in the electric arc furnace. It is assumed here that the electricity used in the process is based on renewable (fossil fuel free) energy sources. There is no commercial plant operating currently, but we in India must explore this option seriously for obvious reasons. Several technological challenges will have to be addressed to commercialize the process, but it is worthwhile investing funds, time and effort in developing such an alternate route. Hydrogen replacing coke during the reduction of iron oxide (thus reducing the greenhouse gas emissions partially during steel production), is also being investigated as a possible greener option by a consortium of Swedish companies [116]. The major challenge, however, is to be able to produce hydrogen without fossil fuels in India.

As discussed in Sect. 3, we in India must master the electrolytic route to reduce sulfide or oxide ores to their respective metals, using electricity based on renewable energy sources (solar, wind or biomass) available in India. Considering our immediate requirements of other metals besides steel, for example, titanium, magnesium and rare-earth metals (dysprosium, neodymium, etc.), we must embark on developing this technology as an urgent priority. The scientific principles of the reduction process are known, but there are formidable engineering challenges in designing and developing the appropriate cathodes, anodes and the electrolytes as well as scaling up the process to commercial scale.

Recovery of values from waste—for example, mine tailings, smelter slags, scrap, demolition waste, red mud, spent pot lining, LD slag, electronic waste, spent batteries, etc. (known as secondary sources), and/or safe disposal of waste remains a technological challenge for us in India.

One of the most important challenges faced by process metallurgists in India is the paucity of trained human resources in process engineering who can lead this technological transformation of our industry. In the words of Professor Peter Hayes [11], “However, if we examine the structure and content of metallurgical engineering programs, we find, particularly in the United States and Europe, that the majority have morphed over time into materials science and engineering (MSE) programs—a matrix of disciplines that are related to the common elements of structure, composition, properties, performance, and product synthesis… a marked decline in teaching, and in research and development capabilities in core aspects of metallurgical process engineering… it has become a minor component of most of these programs”…The metallurgical industry also needs engineers with specialist knowledge and advanced skills in mineral (physical) processing, hydro/electrometallurgy, and pyrometallurgy. A graduate engineer must have an understanding of the whole value chain.

Even though Professor Hays refers to the crisis of minerals and metallurgical engineering education in USA and Europe, it is very much true of Indian education system as well. Our undergraduate education curricula do not adequately prepare our minerals, metals and materials engineers in the kind of skill sets needed to transform the industry, to be effective as professional leaders. The principles of engineering scale up and the production, optimization and control on an industrial scale are not adequately covered in our course curricula.

A critical review of the current scenario and our personal experience suggests the following strategy, going forward. Develop mineral processing and extractive metallurgy as one new discipline. (There is no way one can break it into two separate disciplines since both are extremely intertwined.) Furthermore, the engineers trained in this new mineral engineering and process metallurgy discipline, in addition to conventional metallurgy, must have depth in electrochemistry, surface and colloid chemistry as well as in chemical engineering (subjects like transport phenomena, reactor design and engineering, instrumentation and control, modeling and simulation of unit operations, different modeling paradigms including data analytics, CFD, FEM, etc., engineering scale up, systems engineering, robust design methodology under uncertainty, life-cycle analysis and recycling) and adequate exposure to software engineering tools available for integrated design, optimization and control. One possibility is to have this discipline developed with one major (mineral processing and process metallurgy) and two minors in computer science and chemical engineering. Research programs will also need to be designed accordingly so that we have competent graduate and post-graduate engineers available to face the challenges in India in the new era of digital technologies and renewable energy-based electricity. There are immense possibilities, and only the best-trained minds can seize the opportunities and make an impact. These engineers will also be able to deal with the challenges faced by us in the renewable energy solutions domain, particularly with respect to developing appropriate solutions for large-scale energy storage (batteries other than lithium-ion batteries) and its integration with the grids. In our view, it is important to teach both integrated steel production (from raw material to the final products and recycling) and integrated cement production (from raw materials to the final concrete structures) to the undergraduate materials engineers since both these industries are the product of application of rich engineering expertise and one can best convey the materials engineering principles with the story of steel and cement. Digital platforms like the ones discussed in this review must be part of the undergraduate education so that our engineers are familiar with the integrated computational engineering approach to materials design, development, manufacture and deployment for a variety of industrial applications [117].

6 Concluding Remarks

Digital technology revolution coupled with the energy transition to electricity from renewable energy sources at affordable prices will have major repercussion so far as the mining, minerals and metal extraction industry is concerned. While they are critically dependent on the availability of certain minerals and metals on one hand, both these revolutions will also impact how we mine, process and extract metals from primary ore deposits and more importantly from secondary resources like electronic waste. It is almost certain that by the end of the coming decade, autonomy and electrification of mining, mineral processing and metal extraction industries will become a norm rather than an exception. It will be possible not only to design and develop the processes but also optimize and control the operations remotely using state-of-the-art digital platforms in an integrated manner. Battery operated, autonomous equipment will become the norm in the industry, and they will be maintained using automated asset management solutions. The materials handling operations involving haulage trucks, trains and ships will be both electric and autonomous. All these developments will make our industry more environment-friendly, capable of creating safer environments for the operators, wherever needed as well as enable continuous improvement in the productivity of operations and the quality of our products.

It is now possible to design (off-line) extremely flexible and robust mineral processing and metal extraction plants using IT platforms (for example, TCS PREMAP) which are capable of handling ores and concentrates from different sources. Similarly, one can achieve higher levels of efficiency in the operating plants using data analytics platforms like TCS PEACOCK and utilizing the data being collected in the plant for continuous improvement of its performance.

IT platforms like TCS PREMAP also have knowledge engineering capabilities that can be used in the plants, not only to act as a repository of accumulated knowledge and expertise but also to leverage stored use cases to search for preferred operating regimes for a given ore (or for a given input to the plant) and for a given objective function through advanced machine learning techniques in an automated manner. The engineers need not be experts in the usage of various tools and technologies that are integrated through the platform at the backend and leveraged in an automated manner by the user to solve the specific problem under consideration. Digital platforms are also the best means of teaching engineering principles in an integrated manner.

We have been able to provide only a glimpse of what is already possible and/or has become commercially attractive, but there are several other tools and technologies which are in the pipeline based on innovations occurring at the interface of IT and the domain expertise. The future of our industry is extremely bright, and it calls for trained engineers who possess the required skill sets to work in this exciting environment. It calls for continuous learning and an interdisciplinary approach to industrial problem solving on the part of all the professionals who are associated with this industry.

References

Arrobas, D P, Hund K L, Mccormick, M S, Ningthoujam J, Drexhage J R, The Growing Role of Minerals and Metals for a Low Carbon Future (English). Washington, D.C.: World Bank Group (2017), p 112. http://documents.worldbank.org/curated/en/207371500386458722/The-Growing-Role-of-Minerals-and-Metals-for-a-Low-Carbon-Future.

Mamula N, Bridges A, Ground Breaking – America’s New Quest for Mineral Independence, Terradynamics Corporation (2018), p 277.

Klinger J M, in Rare Earth Frontiers, Cornell University Press, Ithaca and London (2017). 325.

Abraham D S, The Elements of Power, Yale University Press, Yale (2015), p 319.

Usher B, Renewable Energy, Columbia University Press, New York (2019), p 209.

Veronese K, RARE – The High Stakes Race to Satisfy Our Need for the Scarcest Metals on Earth, Prometheus Books, New York (2015), p 270.

Kalantzakos S, China and the Geopolitics of Rare Earths, Oxford University Press, Oxford (2018), p 236.

Fortier S M, Hammarstrom J H, Ryker S J, Day, W C, and Seal R R, USGS Critical Minerals Review, Mining Engineering (2019), p 35.

Hayes Peter C, JOM, 71 (2019) 463. https://doi.org/10.1007/s11837-018-03316-4.

Cilliers J, Drinkwater D, and Heiskanen K, in Minerals Industry – Education and Training, IMPC Council (2012), p 160.

https://creativeseed.co.za/clients/IMPC/FINAL_IMPC_Book.pdf and http://impc-council.com/wp-content/uploads/2018/02/Section-1-Chapter-1.pdf (2018).

Fox J, Greth A, and Kocsis K, Min Eng 70 (2018) 16.

Gleason W, Min Eng 71 (2019) 26.

Chadwick J, KOMATSU – Underground Load and Haul- Autonomous Mining, Spotlight Feature Article, International Mining (2017), p 9.

Chottani A, Hastings G, Murnane J, Neuhaus, F, Distraction or Disruption? Autonomous Trucks Gain Ground in US Logistics, McKinsey Report (2018), p 13.

Chu F, Gailus S, Liu L, and Liumin N, The Future of Automated Ports, McKinsey Report (2018), p 10.

Special Issue on Digital Technologies in Mining, May 2019, p 9.

Moore P, Mining Trucks – Electrification and Autonomy, Spotlight Feature Article, International Mining (2019), p 7. https://gmggroup.org/guidelines/guideline-for-the-implementation-of-autonomous-systems-in-mining/.

http://www.mining.com/antofagasta-announces-first-mine-use-100-renewable-energy/.

https://im-mining.com/2017/10/19/edumper-mining-truck-wins-european-emove360-award/.

http://ieefa.org/energy-intensive-mining-companies-look-to-renewables-for-cost-savings/.

https://www.miningglobal.com/machinery/adani-mining-inks-deal-komatsu-carmichael-coal-project.

http://www.mining.com/canadian-oil-sands-giant-testing-autonomous-haul-trucks/.

http://www.mining.com/worlds-first-autonomous-electric-container-vessel-launch-early-2020/.

http://www.mining.com/worlds-two-top-diamond-miners-join-forces-test-blockchain-pilot/.

Steyn J, Bascur O, and Gorain B, Min Eng (2018), p 18.

https://www.cisco.com/c/en/us/solutions/industries/materials-mining/goldcorp.html.

http://www.mining.com/ibm-steps-efforts-help-miners-improve-health-safety-records/.

Sahu R, Min Eng 70 (2018) 33.

Schug B, Anderson C, Naeri S, Cristoffanini C, Min Eng 71 (2019) 20.

Moore P, Int Min (2016) 11.

Richards G, Mater World (2015) 48.

Zhou C, Damiano N, Whisner B and Reyes M, Min Eng 69 (2017) 50.

https://im-mining.com/2019/04/30/ericsson-ambra-expands-5g-partnership-mine-automation/.

Morin R, E&MJ (2016) 54.

Castendyk D, Straight B, Filiatreault P, Thibeault S, and Cameron L, Min Eng 69 (2017) 20.

http://insideunmannedsystems.com/monitoring-mapping-measuring-drones-changing-mining-industry/.

http://www.miningmagazine.com/technology/data-management/noamundi-conducts-drone-pilot-launch/.

https://im-mining.com/2017/12/27/major-el-teniente-tailings-project-spains-ohl/.

http://www.mining.com/luxembourgs-space-agency-ready-lift-off/.

https://futurism.com/humanitys-future-in-space-depends-on-asteroid-mining/.

https://cen.acs.org/physical-chemistry/astrochemistry/tale-2-asteroid-sample-return/96/i39.

Peacock D A, Min Eng 69 (2017) 23.

https://theconversation.com/australia-well-placed-to-join-the-moon-mining-race-or-is-it-111746.

Misra A, Das S, Sharma D, Sangomla A, Sharma R, Gottschalk K, Gaffney C, Narlikar J V, Space Race 2.0, Down to Earth, 1-15 May (2019), p 26.

http://www.mining.com/canadian-space-mining-developer-inks-deal-us-based-moon-express/.

http://www.downtoearth.org.in/coverage/mining-at-deep-sea-46049.

Sharma R (ed) Deep Sea Mining – Resource Potential, Technical and Environmental Considerations, Springer, Berlin (2017), p 535.

Takaya Y, Yasukawa K, Kawasaki T, Fujinaga K, Ohta J, Usui Y, Nakamura K, Kimura J, Chang Q, Hamada M, Dodbiba G, Nozaki T, Iijima K, Morisawa T, Kuwahara T, Ishida Y, Ichimura T, Kitzume M, Fujita T and Kato Y, Sci Rep 8 (2018) 1. https://doi.org/10.1038/s41598-018-23948-5.

http://www.mining.com/british-scientists-find-sub-sea-minerals-treasure-trove/.

http://www.mining.com/worlds-first-seabed-mine-to-begin-production-in-2019/ and https://www.mining.com/de-beers-namibia-spend-468m-worlds-first-custom-built-diamond-searching-ship/.

Dunn D C, Van Dover C L, Etter R J, Smith C R, Levin LA, Morato T, Colaco A, Dale A C, Gebruk, A V, Gjerde, K M, Halpin, P N, Howell, K L, Johnson, D, Perez J A, Ribeiro M C, Stuckas H, Sci Adv 4 (2018) 1.

Anon., Report on Critical Raw Materials and the Circular Economy, European Commission (2018), p 68.

Vriens B, Voegelin A, Hug S J, Kaegi R, Winkel LHA, Buser A M, and Berg M, Environ Sci Technol 51 (2017) 10943.

Zeng X, Mathews J A, and Li J, Environ Sci Technol, 52 (2018) 4835.

Mihai, F-C (ed) in E Waste in Transition – From Pollution to Resources, In Tech Publishers, Croatia (2016), p 178.

Honda S, Khertiwal D S, and Kuehr R, Regional E-Waste monitor – East and South-east Asia, United Nations University Report (2016), p 213.

Kim H, Boysen D A, Newhouse J M, Spatocco B L, Chung B, Burke P J, Bradwell D J, Jiang K, Tomaszowska AA, Wang K, Wei, W, Ortize L A, Barriga S A, Poizeau S M, and Sadoway D R, Chem Rev, 113 (2013) 2075.

https://in.yahoo.com/finance/news/forcing-breakthrough-energy-storage-interview-190000173.html.

Fray D J, Chen G Z, and Farthing T W, Nature 407 (2000) 361.

Hu D, Dolganov A, Ma M, Bhattacharya B, Bishop M T, and Chen G Z, JOM 70 (2018) 129.

Sokhanvaran, S, Lee, S, Lambotte, G, and Allanore A, J Electrochem Soc 163 (2016) D115.

Sahu S K, Chmielowiec B, and Allanore A, Electrochim Acta 243 (2017) 382.

Guan X, Pal U B, Yihong J, and Su S, J Sustain Metall 2 (2016) 152.

Nagesh, Ch R V S, Prasad M R S, and Prasad V V S, IIM Metal News 21 (2018) 9.

Rajulu G G, Kumar M G, Rao K S, Baby B H, and Nagesh C R V S, Mater Trans 58 (2017) 914.

Seshan A, and Gorain B K in Innovative Process Development in Metallurgical Industry – Concept to Commission, (eds) Lakshmanan V I, Roy R, and Ramachandran V, Springer, Berlin (2016), p 203.

Gautham B P, Singh A K, Ghaisas S S, Reddy S S, and Mistree F, ICoRD’13, Lecture Notes in Mechanical Engineering, (eds) Chakrabarti A, and Prakash R V, Springer, New Delhi (2013), p 1301.

Gautham B P, Reddy S, Das P, Malhotra C, in Proceedings of the 4th World Congress on Integrated Computational Materials Engineering (ICME 2017). https://doi.org/10.1007/978-3-319-57864-4_9.

Yeddula R R, Vale S, Reddy S, Malhotra C P, Gautham B P, Zagade P, Proceedings of the 28th International Conference on Software Engineering and Knowledge Engineering, (SEKE 2016) (2016).

John D M, Farivar H, Rothenbucher G, Kumar R, Zagade P, Khan D, Babu A, Gautham B P, Berhardt R, Phanikumar G, and Prahl U, in Proceedings of the 4th World Congress on Integrated Computational Materials Engineering (ICME 2017) (2017). https://doi.org/10.1007/978-3-319-57864-4_1.

Khan D, Suhane A, Srimannarayana P, Bhattacharjee A, Tennyson G, Zagade P, and Gautham BP, in Proceedings of the 4th World Congress on Integrated Computational Materials Engineering (ICME 2017) https://doi.org/10.1007/978-3-319-57864-4_2.

Pradip, and Rai B, Int J Miner Process 72 (2003) 95.

Rai B, and Pradip, in Molecular Modelling for the Design of Novel Performance Chemicals and Materials, (eds) Rai B, CRC Press, Boca Raton, p 27.

Fuerstenau D W, and Pradip, Min Metall Explor 36 (2019) 3.

Sabne M P, Pradip, Vora S B, and Kapur P C, in Mineral Processing: Recent Advances and Future Trends, (eds) Mehrotra S P, and Shekhar R, Allied Publishers, New Delhi (1995), p 749.

Pradip, Kapur P C, and Raha S in Computer Applications in Mineral Industry, (eds) Bandyopadhyay C, and Sheorey P R, Oxford and IBH Publishing Co, New Delhi (2001), p 79.

Runkana V, Pandya R, Kumar R, Panda A, Nistala S, Rathore P, Jayasree B, Method and system for data-based optimization of performance indicators in process and manufacturing industries, Indian Patent Application Number: 201721009012 (2017).

Majumder S, Natekar P V, and Runkana V, Comput Chem Eng 33 (2009) 1141.

Mitra, K, Majumder S, Runkana V, Mater Manuf Process 24 (2009) 331.

Runkana V, and Majumder S, On-line Optimization of Induration of Wet Iron Ore Pellets on a Moving Grate, US Patent No. 12/960,122 (2013).

Runkana V, KONA Powder Part J (2015) 115.

Runkana V, Natekar P V, Bandla V, Pothal G, Chatterjee A, Steel Technol 5 (2010) 9.

Runkana V, Natekar P V, Bandla V, Pothal G, Chatterjee A, Steel Express (2010) 56.

Baikadi A, Runkana V, and Subramanian S, IFAC-Papers On Line, 49-1, 468–473 (2016).

Masampally VS, Pareek A, Nadimpalli, NKV, Runkana V, Proceedings, International Mineral Processing Congress (IMPC-2018), Moscow (Russia), 15–21 September (2018).

Norgate T E, Jahanshahi S, Rankin W J, J Clean Prod 15 (2007) 838.

Norgate T E, and Haque N, J Clean Prod, 18 (2010) 266.

Anon, Energy Transitions Commission Consultation Paper on Reaching Zero Carbon Emissions from Steel (2018). http://energy-transitions.org/sites/default/files/ETC_Consultation_Paper_-_Steel.pdf.

Lisienko V G, Lapteva A V, Chesnokov Y N, and Lugovkin V V, Steel Transl 45 (2015) 623.

Olsson O, Low Emission Steel Production, SEI Perspective Paper, HYBRIT (2018), p 4. https://www.sei.org/perspectives/low-emission-steel-production-hybrit/.

Horstemeyer M F, Integrated Computational Materials Engineering (ICME) for Metals – Concepts and Case Studies, Wiley, New York (2018), p 650.

Acknowledgements

The authors thank Mr. K. Ananth Krishnan, Chief Technology Officer, Tata Consultancy Services for his guidance and sustained support. We also gratefully acknowledge the contributions of our colleagues at Tata Research Development and Design Centre, Pune, in the design, development and deployment of IT platforms discussed in this communication.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Pradip, Gautham, B.P., Reddy, S. et al. Future of Mining, Mineral Processing and Metal Extraction Industry. Trans Indian Inst Met 72, 2159–2177 (2019). https://doi.org/10.1007/s12666-019-01790-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12666-019-01790-1