Abstract

Due to the increased population growth in South Africa, particularly in urban areas, the generation of municipal solid waste has increased and so is the demand of energy. Municipal solid waste can be considered a good candidate for electricity generation in South Africa. This approach does not only have the benefit of recovering electricity from municipal waste, but also contributes to the integrated waste management system. This study aimed to investigate the economic feasibility of hybrid of anaerobic digestion and gasification of municipal waste for electricity generation in South Africa. The research developed a techno-economic model to evaluate the financial profitability of waste-to-energy of gasification, anaerobic digestion and a hybrid system of both waste-to-energy technologies. A spreadsheet was developed to evaluate the financial profitability of waste-to-energy of gasification, anaerobic digestion and hybrid system of both waste-to-energy technologies. The techno-economic model provides cost estimates for the implementation of waste-to-energy technologies in South Africa. This is carried out through a set of financial indicators, namely payback period (PBT), net present value (NPV), profit index (PI), internal rate of return (IRR), levelised cost of electricity (LCOE) and levelised cost of waste (LCOW). Hybrid of gasification and anaerobic digestion manifested positive results across all the financial indicators. The study concluded that a hybrid of anaerobic digestion and gasification waste-to-energy is economically viable. In addition, the hybrid system also provides optimal solution for energy recovery and waste disposal, based on the IRR, LCOE and LCOW values. Sensitivity analysis showed that, energy price and capital expenditure are the major variables affecting the hybrid plant’s investment decision.

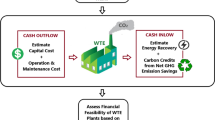

Graphic Abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Statement of Novelty

There have not been any reports of a hybrid (gasification and AD) WTE system for paper, plastics and organic wastes. Paper, plastics and organic wastes such as food wastes are key fractions of any MSW. The combination of gasification and anaerobic digestion technologies can improve the energy efficiency of the WTE plant and its economic viability. This study developed an economic model for hybrid WTE system of gasification and anaerobic digestion for municipal solid waste (MSW) in South Africa.

Introduction

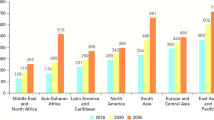

Energy is essential in the development of the world economy and South Africa is no exception. A country’s economic advancement can be measured in terms of the amount of energy it consumes per person [1]. For many years, non-renewable energy sources, such as fossil fuels, have been exploited globally to produce electricity and other forms of energy generation. The combustion of fossil fuel yields greenhouse gas (GHG) emission, predominantly carbon dioxide, which causes global climate change [1, 2]. Lately, there is a concerted effort by governments throughout the world to transit from non-renewable to renewable energy sources that are considered cleaner and environmentally friendly, amongst other benefits [3].

State-owed enterprise, Eskom, dominates electricity generation and distribution in South Africa. According to Pegels, Eskom produces ~ 95% of electricity in South Africa [4]

Coal is the major source of electricity production in South Africa, contributing ~ 86%. The remainder is produced from nuclear energy (5%) and various other sources. Private companies produce only about 2% of the South African electricity [4].

Since 2007, Eskom has been experiencing a lack of capacity in the generation of electricity. In addition, in the first quarter of 2008, as a result of lack of generation of electricity, power shortage and blackouts became common in South Africa. Also, during 2018 to 2019 South Africans experienced load shedding due to urgent maintenance needed in different power stations operated by Eskom. This has contributed negatively towards the South African economy, as the economic growth fell drastically to 1.57% in 2008 from 5.4% in 2007 [5, 6]

Renewable energy sources include solar, hydropower, wind, geothermal, ocean and biomass. Most renewable energy supplies suffer from several drawbacks. These drawbacks include the inability to supply the optimum amount of energy as compared to the traditional fossil fuel electricity generation, the reliability of energy supply since renewable energy often relies on the weather for its power source Hydro-energy needs sufficient rainfall for supply of water to fill up the dams for excusive flow of water, wind power needs sufficient wind for blowing the wind turbine and solar energy needs clear skies. Renewable energies also suffer from the drawback of cost implications and inefficiencies and can be unsustainable. These factors tend to limit their exploitation [6, 7]. Exploitation of energy sources, such as the municipal solid waste (MSW), not only has the benefit of recovering electricity from municipal waste, but also contributes to the integrated waste management system (including the cleaning of the environment) in municipalities [8].

Global MSW is expected to reach 2.2 billion tons by the year 2025 from 1.3 billion tons in 2012 [9]. This increment is attributed to urbanisation, population growth and economic development. Similarly, to [10] reported that South Africa produces a total of 108 million tons of MSW per year, with 59 million tons being general waste and 1 million ton representing hazardous waste, while the remainder is unclassified. From 59 million tons of general MSW, 10% is recyclable, of which 53.1 million tons are sent to landfill. Without the implementation of an appropriate waste management system, MSW will continue to accumulate in cities due to the increment of population growth and economic development, thereby posing serious health and environmental risks. MSW contributes to water and air pollutions, which can lead to global climate change [11, 12]. The authors noted that the negative trend can be reversed only if sustainable methods of managing municipal wastes are implemented. Sustainable waste management involves waste prevention, waste recycling and the conversion of waste to generate energy, called Waste-to-Energy (WTE) [7].

Without a doubt, WTE strategies need to be implemented in South Africa. WTE technology is the process that converts waste, into electricity and heat. This technology can supply an alternative and more environmentally friendly source of energy and will also reduce waste dumped into landfill [13, 14].

WTE is a unique opportunity for South Africa to address waste management challenges and to reduce the quantity of coal used in generating electricity reduction of coal utilisation to produce electricity [10]. Some well-known technologies for WTE which this study focuses on are gasification and anaerobic digestion [11,12,13,14].

Gasification is an environmentally friendly thermochemical process in which carbon-based materials are exposed to limited amounts of oxygen to produce syngas. The syngas produced can be used to generate electricity through a gas turbine [2, 15, 16] On the other hand, anaerobic digestion (AD) is a biological process that involves the decomposition of organic materials, such as MSW, in the absence of oxygen to produce biogas. Biogas is categorised as a mixture of gases, such as hydrogen sulphide, carbon dioxide, methane and other trace components. The main product in biogas is methane, which can also be used to generate energy [17,18,19].

A hybrid system was developed to combine AD and gasification for energy recovery by using MSW as substrates [2]. AD has several advantages to the waste management system; however, biogas digesters are unable to handle solid wastes containing polymeric material, paper, and plastic. Hence, there is still a lot to be done on the post-treatment of residues of the substrate that is used, simply because AD is not efficient enough in minimising waste when compared to thermal treatment process, such as gasification. Residues from AD may contain pathogenic microorganisms and other harmful heavy metals that are not suitable for the environment [2]. Gasification can be added as post-treatment of residual of the AD, as proposed by [2]. They reported that a hybrid system of gasification and AD increases the efficiency of organic waste and woody biomass. However, there have not been any reports of a hybrid (gasification and AD) WTE system for paper, plastics and organic wastes. Paper, plastics and organic wastes such as food wastes are key fractions of any MSW [2]. This study aims to evaluate the economic feasibility of WTE technology by using MSW in South Africa.

The rate of municipal solid waste generation is increasing and there is a low rate of implantation of waste-to-energy plants in South Africa and globally. This may be due to the low economic viability of the traditional waste energy plants, such as gasification plants or anaerobic plants [20, 21]. The combination of gasification and anaerobic digestion technologies can improve the energy efficiency of the WTE plant and its economic viability. This study aims to develop an economic model for hybrid WTE system of gasification and anaerobic digestion for municipal solid waste (MSW) in South Africa.

The objective of this study is to develop an economic model for hybrid WTE system of gasification and anaerobic digestion by using MSW in South Africa. A techno-economic analysis will be carried out by using the following financial indicators: Payback period (PBP), Net present value (NPV), Profit index (IP), internal rate of return (IRR), Levelized cost of electricity (LCOE) and Levelized cost of waste (LCOW). The techno-economic viability will be done by investigating the energy efficiency of hybrid WTE system of gasification and anaerobic digestion and comparison of the energy efficiency of gasification and anaerobic digestion WTE for different MSW compositions will be established. Lastly, the evaluation of the sensitivity analysis will be carried out in order to determine the key factors that can affect the economic viability of WTE.

Methodology

The study focuses on desk work by collecting relevant data from reports and studies of different individuals, government entities, international published researches and independent agencies. Excel spreadsheets were compiled to design the WTE model technologies. The following financial set of indicators was employed in the model to calculate the economic viability: payback period (PBP), net present value (NPV), internal rate of return (IRR), profitable index (PI), levelised cost of electricity (LCOE) and levelised cost of waste (LCOW). The techno-economic evaluation of the hybrid system of anaerobic digestion and gasification was based on the data and information available on MSW in South Africa.

Municipal Solid Waste in South Africa

South Africa produces a total of ~ 108 million tons of MSW per year, with 59 million tons being general waste and 1 million tons representing hazardous waste, while the remainder is unclassified. Of the 59 million tons of general MSW generated, 10% is recyclable, while ~ 53.1 million tons are sent to landfill [22]. Table 1 illustrates the average percentage composition of South African MSW.

Non-recyclable municipal waste contributes 35% (by weight) of the overall general waste, they include biomass from the sugar mills, sawmills, pulp and paper industry, followed by organic waste (16%), and mainline recyclables (including paper, plastics, glass and metal scrap (19%) etc. [22].

Techno-economics Analysis

Six main capital budgeting techniques were used to critically analyse the economic viability for an AD WTE plant, gasification WTE plant and a hybrid of AD and gasification WTE plant in South Africa. The financial set of PBP, NPV, IP, IRR, LCOE and LCOW are used in this study.

Definition of Equations

Data analysis was done by compiling a Microsoft Excel model to assist in calculating the set of financial indicators listed above. To calculate the financial indicators, the following definitions are in use:

- \({I}_{0}\):

-

The total investment cost at year 0.

- \({OPEX}_{t}\):

-

The fixed and variable operation and maintenance expenditure in year t.

- \({L}_{t}\):

-

The cost of landfilling the residual generated waste in year t.

- Et:

-

The quantity of electricity generated in year t (MWh).

- n:

-

The project economic life.

- \(r\):

-

The weight average cost of capital (WACC) or the discount rate.

- \({W}_{t}\):

-

The amounted of waste treated in year t (ton).

- \(C\):

-

The net cash flow i.e. cash inflow – cash outflow, at time t.

The Net Present Value

NPV is the difference between the present value of cash inflows and outflows, discounted at a rate that is consistent with the project’s risk over a period [5, 23].

To determine whether a project is a satisfactory investment, the NPV criteria of the present values of the cash flows are used Eq. 1.

The NPV is expressed as

Internal Rate of Return

IRR is known as the marginal efficiency of capital on the investment. It is the value that makes the NPV equal to zero [11, 24].

Profitability Index

PI is the ratio of the present value to the future expected cash flows, after the initial investment, divided by the amount of the initial investment [11].

The profitability decision rule is to invest when the PI is more than 1.0 and to abstain from investing when the PI is less than 1.0, as exemplified in Eq. 2

Payback Period

PBP is the amount of time it takes for a given project’s net cash inflows to recover the initial investment or the needed number of years to recover the initial investment [5, 11].

Levelised Cost of Electricity

LCOE is the most common methodology to enable the comparison of the cost of electricity generated from different conversion technologies. The method of LCOE allows for different WTE conversion technologies with different power capacity to be compared against one another, based on the unit cost of electricity (kWh), during the operational life of the facility [5, 25, 26] This is calculated by using Eq. 3.

Levelised Cost of Waste

The method of LCOW allows for different WTE conversion technologies with different facility waste capacity to be compared against one another, based on the unit cost of waste (ton) during the operational life of the facility [26, 27]. This is calculated by using Eq. 4.

General Assumption

Most of the financial data that were used in the financial model for gasification, AD and hybrid of gasification and AD were taken from the literature [28, 29].

-

The operating days for gasification, AD and a hybrid of both gasification and AD are assumed to be 365 days per year. Hence, the total operating hours are 7446 h per year, while the remaining hours will be for unforeseen shutdown and maintenance, which will not be part of the calculation for economic analysis of each technology.

-

CAPEX (capital expenditure) breakdown, based on gasification, AD and a hybrid of gasification and AD WTE: The CAPEX assumptions in this instance include fluidised bed gasifier conversion systems, civil cost, prime mower, consultancy design, mechanical handling systems and plant electricity utilisation.

-

The economic life of the technologies that include gasification and AD technologies of WTE is between 20 and 25 years [29]. However, this paper assumes 23 years of economic life, starting from 2017.

-

The procurement and construction of this plant are assumed to take 3 years. Therefore, all WTE plants will start to become operational in the year 2020.

-

The depreciation method for this paper assumes a Double-Declining Depreciation Method, starting from operation with zero salvage value.

Depreciation for a period = 2 × (straight − line depreciation percent) × (book value at beginning of period).

-

The transportation costs of MSW to be delivered to the feedstock waste facilities is considered only on an average distance of 25 km. The external cost associated with transportation of MSW to landfill is assumed to be R24.22 per ton MSW will be inflated at a rate of 4% annually [30]

-

Electricity price of this work assumes that the electricity produced by the WTE plant is sold at a rate of R1.30 per kWh, although the tariffs are regulated by NERSA. This price represents the price that Eskom will pay the municipality for the generated electricity and it is also regulated by NERSA.

-

Weight Average Cost of Capital (WACC): a 12% WACC is assumed.

-

The annual inflation rate: It is assumed that the selling price of the generated electricity will be inflated at a rate of 5% [29].

-

The inflation rate of cost of landfilling the residual waste and selling price of the generated recycled waste is inflated at a rate of 5%; the fixed and variable operation expenditure (OPEX) is inflation at a rate of 8% annually.

-

The assumptions of this study assumed that the mechanical treatment process will be done manually. In order to minimise the cost of sorting MSW, according to this study, MSW is separated into different coloured containers at the source site (household and commercial industries) according to the type of the waste. The process advances the recycling and minimise the MSW management cost. The manual cost of recycling is R72000 per person with inflation rate of 7% annually. The sorting will require about 40 people.

The Amount of MSW Processed and Energy Produced in Gasification Plant

The average CAPEX for gasification technology system that will use a fluidised bed is 1949.910 USD/kw. This amount is R27310.8/kwFootnote 1 when converted to South African Currency [11].

The capacity factor for this gasification plant is assumed to be 80%. This is the ratio of the processed waste and waste that can be processed if the plant is working at maximum capacity [11].

If 1,000,000 tons of unsorted MSW will be delivered to the gasification plant annually, only 800,000 tons of unsorted MSW can be delivered for mechanical handling to be converted into RDF. RDF is the amount of material that is fed inside the gasifier for energy generation. During mechanical handling, all recyclable and unwanted waste is removed from unsorted waste to increase the efficiency of the plant.

According to Purser, a ton of unsorted waste produces 0.3 ton of sorted RDF. Therefore, 800,000 tons of unsorted wastes are equivalent to 240,000 tons of RDF. Furthermore, one ton of RDF has energy content of 23,000 MJ and 1 MJ is equivalent to 0.0003 MWh of energy rate. Therefore, 240,000 tons of RDF are equal to 5,520,000,000 MJ, which is equivalent to 1,656,000 MWh [20].

An electrical efficiency ranges between 31–35%; for this research, 34% energy efficiency rate is assumed and 34% of 1,656,000 MWh is 563,040 MWh [11].

24% of MSW in South Africa is recyclable, this value is the total of all the recyclable waste listed in Table 1. Therefore, out of the 800,000 tons of the unsorted MSW, 192,000 almost tons have recycling potential [22].

Furthermore, 8% of South African MSW consists of metals; that is, 80 kg per ton. Assuming a selling price of R0.47/kg of metal, R37.60 per ton is therefore generated from selling recycled metals. Glass accounts for 3% of recyclables, which is 30 kg per ton. Assuming a selling price of R0.27/kg, R8.10 is generated from the selling of glass [22, 29]. The total waste recycling revenue is R74.60 per ton from selling recycled glass and metal that is delivered as unsorted waste to the gasification feedstock. Therefore, a total of R36 560 000 is generated annually for recycling glass and metal.

The portion of MSW that is sent to landfill accounts for 52% of MSW received at the gasification plant after all the recycling activities have been completed, amounting to 520,000 tons. The price of R303.88 per ton is assumed for landfilling the residual [22, 29].

Operation and maintenance refer to the fixed and variable costs related to the operation of gasification plants. Fixed costs can be expressed as a percentage of capital costs. For gasification plants, these costs normally range between 3–6% of the initial CAPEX per year and for the purpose of this study, 4% is assumed. Fixed costs consist of labour, scheduled maintenance, routine equipment replacement (for boilers, gasifiers, feedstock handling equipment, and insurance). The variable costs depend on the output of the system and are usually expressed as a value per unit of output (R/kWh). They include fuels costs, ash disposal, unexpected maintenance and equipment replacement. The variable cost for gasification technology plant is USD4/MWh and this amounts to about R53.59/MWh in South African currency [11].

A schematic diagram (Fig. 1) of gasification WTE plant shows the difference of weight of MSW for energy product.

The Amount of MSW Processed and Energy Produced in Anaerobic Digestion (AD) Plant

The average CAPEX for AD technology system that will use organic waste is USD2912.7/kW which amounts to about R40795.81/kw when converted to the South African currency [11].

The capacity factor is also 80%. If 1,000,000 tons of unsorted waste will be delivered to the AD plant annually, 800,000 tons of unsorted waste can be delivered only for mechanical handling to be converted into RDF. The RDF is fed into the gasifier for energy generation. During the mechanical handling, all recyclable and unwanted waste is removed from unsorted waste to increase the efficiency of the plant. According to [11, 28], a ton of unsorted waste process yields 0.3 ton of sorted RDF. Therefore, 800,000 tons of unsorted wastes are equivalent to 240,000 tons of RDF.

A ton of RDF has energy content of about 992 kWh. Therefore, 240,000 tons of RDF have the potential to produce energy of 238,080 MWh [11]. Electrical efficiency ranges between 31 and 35%. For the purpose of this research, an energy efficiency rate of 34% is used. Therefore, 34% of 238,080 MWh is 857,088 MWh of energy.

This study assumed that the AD has the potential to recycle metal, paper, plastic and glass since AD plants are unable to handle solid wastes containing polymeric material, paper, plastic, to name a few. The costs of metal and glass have already been stated in the general assumption of gasification plant and it is added to the revenue of paper and plastic. Plastic accounts for 5% of recyclables or 50 kg per ton of unsorted waste. The cost of plastic is R1.20/kg, which makes a total of R60. Paper accounts for 8% or 80 kg per ton of unsorted waste. The cost of paper is R0.27/kg and R21.60 cost of revenue is generated [11, 28]. A total of R 127.3 per ton can be achieved by selling glass, metal, paper and plastic. Therefore, a total of R 101,840,000 can be generated from 800,000 tons of the MSW received in the AD plant.

The price of R303.88 per ton is assumed for landfilling the residual. For this paper, it is assumed that the residual waste remaining after the AD conversion process and mechanical handling is sent to landfill. Only ~ 15% of the MSW received at the AD station is sent for landfilling.

Operation and maintenance refer to the fixed and variable costs related to the operation of plants. Fixed costs can be expressed as a percentage of capital costs. For AD plants, fixed costs normally range from 2.1% to 7% of the initial CAPEX per year. For this study, 5% is assumed [11].

Like gasification, plant fixed costs consist of labour, scheduled maintenance, and routine equipment replacement (for boilers, feedstock handling equipment, and insurance). The variable costs depend on the output of the system and they are usually expressed as a value per unit of output (USD/kWh). These costs include fuels costs, ash disposal, unexpected maintenance and equipment replacement. The variable cost for gasification technology plant is ~ USD4.4/MWh, which is about R59.89/KWh [11].

Table 2 shows a summary of all the assumptions used in this paper. It also shows the energy recovery of each AD WTE plant. Figure 2 below is the schematic diagram of an AD WTE plant, showing the difference in weight of the MSW and the energy recovered.

The amount of MSW processed and energy produced in a hybrid of gasification and anaerobic digestion plant

The hybrid system was developed to combine AD and gasification for energy recovery by using MSW as substrate. The first stage is AD; most of the assumptions will be the same as in the AD plant, as demonstrated in this study.

The average CAPEX as stated for a hybrid system utilising AD and gasification process technology system that will do simultaneous energy conversion is about R1 035,152,242. This cost is derived from the CAPEX/Kw of AD and gasification waste to energy. In addition, the capacity of gasification in the post-treatment is less. In the post-treatment, only 99,744 tons of waste from AD process are treated [11].

If 1,000,000 tons of the unsorted are delivered to the hybrid of gasification and AD plant annually, when capacity factor is included, only 800,000 tons of unsorted are received at the plant for mechanical handling. After the mechanical handling process, RDF is produced. RDF is the fuel produced from various types of MSW, which will be fed into the first stage of the process, that is, AD for energy generation.

Typically, ~ 0.3 ton of RDF can be produced from 1 ton of unsorted wastes after the entire mechanical handling process. Therefore, 800,000 tons of unsorted waste are equivalent to 240,000 tons of RDF and they feed into the first stage of AD.

According to Hadidi and Omer, 1 ton of RDF has the potential to generate 992 kWh. Therefore, 240,000 tons of RDF have a potential to produce an energy content of about 238,080 MWh [11].

Recycling revenue: Like the assumption of a gasification plant, 8% of South African MSW consists of metals; that is, 80 kg per ton. Assuming a selling price of R0.47/kg of metal, R37.60 per ton is therefore generated from selling recycled metals. Glass accounts for 3% of recyclables, which is 30 kg per ton. Assuming a selling price of R0.27/kg, R8.10 is generated from the selling of glass [11]. The total waste recycling revenue is R45.7 per ton from selling recycled glass and metal that is delivered as unsorted waste to the gasification feedstock. Therefore, a total of R36560 000 is generated annually for recycling glass and metal.

Hadidi and Omer [28] stated that only 15% of the MSW received at the AD station is sent to landfill. The total percentage of plastic and paper is 14%, which is ~ 112,000 tons [28]. It therefore constitutes the total of 232,000 tons when added to the total of 15% of waste that was supposed to be sent for landfill.

The total percentage of the waste rejected after the mechanical treatment of the waste received from the first stage of the hybrid WTE plant is 16.88%. Therefore, 83.12% of the waste will be sent to the post-treatment stage of hybrid WTE plant [28, 31].

The following Eq. 5 is for the energy produced (kWh) in the hybrid WTE system [23]:

-

0.28 is used to convert kWh to MJ and conversion rate of 1 MJ is equivalent to 0.28 kWh.

-

\(Rf\) is the percentage of the rejected MSW after mechanical operation has taken place. The total percentage of the waste rejected after the mechanical treatment of the waste received from the first stage of hybrid WTE plant is 16.88%; therefore, 83.12% of the waste will be gasified.

-

\({LHV}_{RF}\) is the lower heating value of the reject (MJ/t). The value in use is 10,000 MJ/t.

-

\({n}_{g}\) is the efficiency of the gasification which is 0.23. The value is used since the power out from the hybrid system is less as compare to gasification waste to energy.

-

\(G\) is the amount of tons of MSW treated annually from the first treatment stage of the hybrid WTE plant (t/yr).

Ash disposal for this process is 4% of the received waste after the mechanical treatment of the first stage of the process of hybrid WTE plant. For this study, R303.88 per ton is assumed for landfilling the residual which, in this case, will be ash. However, Bottom ash and char, which are the by-products generated from gasification process, can be developed into commercial products such as construction material, fertiliser and catalysts.

Figure 3 presents the schematic diagram of mass balance of the hybrid of gasification and AD WTE plant.

Results and Discussion

In this study, the Excel spreadsheet was used to model different financial indicators. The set of financial indicators were employed to calculate the economic viability of a hybrid WTE system of gasification and AD for MSW. The assumption used to design a model was used to describe and measure the performance of gasification, AD and a hybrid of gasification and the AD WTE plant. The assumptions made were also used to investigate a set of financial indicators, namely NPV, IRR, PI, PBP, PB, LCOE and LCOW.

Results

Table 2 shows the results of the financial model developed for the three WTE plants, namely AD, gasification and a hybrid of gasification and AD WTE plants for 20 years’ evaluation time.

Discussion

According to the assumptions made, the respective results of financial data set, namely IRR, NPV, PI, LCOE and LCOW, were achieved.

The financial model was developed to assess the techno-economic viability of gasification, AD and hybrid of gasification and AD WTE plants in South Africa. This model employs the different cash inflows and outflows and can determine set of financial indicators. The same is used to evaluate the sensitivity analysis to determine the key factors that affect the economic viability.

The results obtained in the financial model are discussed in detail, according to each set of financial indicators as used in this study, as follows:

Gasification WTE

The assumption for a 75.6 MW gasification plant was discussed and this WTE plant has the capacity to process 240,000 tons of RDF. Financial data sets, namely IRR, NPV, PI, LCOE and LCOW were achieved over 20 years life cycle of the gasification WTE plant. The values are shown in Tables 2.

The techno-economic analyses of gasification revealed positive returns across the main key financial set of indicators and the results are discussed as follows.

The acceptable payback is set according to the financial investment contract agreement. The profitable case scenario is when the payback point is less than the financial investor’s minimum payback. However, for this study, financial investor contract agreement is neglected. As shown in Tables 2, gasification WTE technology has manifested a payback period of less than 10 years. Some literature also manifested a PBP of less than 10 years [11]. In addition, the study gives a confidence of good results and confidence in terms of reliability and viability. The economic viability criteria as referenced by Goosen [17], affirmed that a payback period of seven or less years accomplished regard the project to be economically feasible. Although the payback period attained is close and higher to marginal value of viability criteria, the project will not be regarded as being uneconomical. A comprehensive look will be taken the results of other financial sets of indicators.

As previously discussed in this report, the NPV of the project is equal to the sum of its cash flow and outflow, discounted at a rate that is dependable with the project risk. The criteria for determining the techno-economic viability of the WTE plant state that if the NPV is greater than zero, the plant or technology is economically viable. As shown in Tables 2, the NPV of R656 388 489.68 for a 20-year period. This indicates that the gasification WTE technology will be financially viable. Moreover, gasification plants manifested higher NPV for investment, due to that it has higher capacity of waste handling and energy generation.

As defined earlier, the profitability decision rule is to invest when the PI is greater > 1.0 and to abstain from investing when the PI is < 1.0.

The profit index for the 20-year periods are both profitable, simply because they are both greater than 1. This also indicates the fact that the gasification WTE plant technology operating under the same assumptions made in this study will, therefore, result in a financial gain for the investors.

IRR is the value that makes the NPV equal to zero and it should always be higher than the discounted payback (WACC).

The assumed value of WACC is 12% and the actual values of IRR are 15.13% for 20 years, respectively. This is expected since the capital investment for this technology is higher, since it has the capability of high-energy efficiency yield when compared to the AD and the hybrid of gasification and AD WTE. From the results of IRR, it is obvious that high-energy generation and high CAPEX value with considerable OPEX yield of the required IRR will make the technology economically viable and be able to positively influence an investment decision.

LCOE is a measure of energy source which compares the different methods of energy generation. It is regarded as the average minimum cost of energy at which different energies produced must be sold to make the WTE plant to be financially viable. LCOE focuses on only the amount of energy produced and how much must be sold. It does not comprise the other source of income, such as recycling. As shown in Tables 2, LCOE is lower than the actual energy price that was considered in this report. The LCOE is R 0.19 and the electricity retail price assumed is R1.3 per KWh, which is the current tariff rate in South Africa for domestic operation. From the finding, it is obvious that LCOE of the WTE plant is considerably lower than the current electricity price rate, which, however, indicates that even if these WTE plants are without recycling revenue from the selling of recyclable waste, they will still be economically viable.

This is the method that allows for the different WTE conversion technologies with different waste capacities to be compared against one another based on the unit cost of waste (ton), during the operational life of the facility. A R459,30/ton of waste processed with the LCOW technology is relatively high when compared to the other WTE technologies.

AD WTE

The assumption of 11.5 MW AD plant was discussed and this WTE plant has the capacity to process 240,000 tons of organic waste from wet fraction after the mechanical process has taken place. Financial data set, namely IRR, NPV, PI, LCOE and LCOW was achieved over a 20-year. The values are shown Tables 2.

The techno-economic analysis of AD plant has also revealed the positive return across the main key financial set of indicators and its results are discussed as follows.

As shown in Tables 2, AD WTE technology has scored a PBP less than 10 years. The investors will not wait for more than 10 years to recover the return on their investment. Purser [20] and Goosen [17] reported similar results. Goosen [17] reported that a PBP of seven or less years must be accomplished for the project to be economically feasible [17]. The PBP attained is close and higher than the marginal value of viability criteria; however, the project will not be regarded to be uneconomical, hence a faster PBP is manifested. The recycling revenue plays a vital role in influencing a faster PBP. In AD WTE all recyclable components are recycled hence higher revenue is manifested.

As shown in Tables 2, the NPV of R 298 998 029.15 for the 20-year period. This indicates that the AD WTE technology, by using the assumption employed in this report, the technology will result in a financial gain for the investors for the 20-year periods of operation.

The profit index for the 20-year periods are profitable, simply because they are > 1. The AD WTE exhibited a higher profit index when compared to other WTE technologies. This also indicates the fact that the AD WTE plant technology, operating under the same assumptions of AD WTE presented in this report will result in a financial gain for the investors because it is considered economically viable.

The assumed value of WACC is 12% and the actual values of IRR is about 17.03% for 20 years. The IRR is also higher than the gasification and the hybrid of AD and gasification. This is probably the outcome of low CAPEX costs, together with considerable low energy recovery. Apart from these observations, these figures are higher than the WACC and confirm the fact that the WTE technology is a viable option for investment.

As revealed in Table 2, LCOE is lower than the actual energy price used in this report. The LCOE is R0.69 and the electricity retail price assumed is R1.3 per kWh, which is the current domestic tariff rate in South Africa. From the finding, it clear that the LCOE of the WTE plant is considerably lower than the current electricity price rate, which indicates that even if this technology was without recycling revenue from selling recyclable waste, it will not be economically viable, since recyclable waste plays a vital role in making AD technologies to become profitable. AD has manifested an LCOE (R0.69 per kWh) because of its low capacity to produce energy. Nevertheless, its investment cost is also lower than other WTEs, and it might be the best alternative from an environmental point of view due to its cleaner energy production.

This is the method that allows for different WTE conversion technologies with the different waste capacities to be compared against one another, based on the unit cost of waste (ton) during the operational life of the facility. R62.7/ton of waste processed is lower than the LCOW of gasification, but higher than the LCOW of hybrid technology system of gasification and AD WTE technologies. According to Purser, the value of LCOW is less than the cost landfill, which concludes this technology to be economically viable [20].

The assumption for 25.37 MW hybrid of AD and gasification plant was discussed and this WTE plant has the capacity to process 240 000 tons of RDF and runs a post-process of the residuals from the digester of the AD. Financial data set, namely IRR, NPV, PI, LCOE and LCOW were achieved over the 20 years. The values are shown in of Tables 2.

The techno-economic analyses of the AD plant have also revealed a positive return across the main key financial set of indicators and its results are discussed as follows.

As revealed in Tables 2, a hybrid of AD and gasification WTE exhibited a PBP less than 10 years. This technology is the one that has recorded a high PBP when compared to other WTE technologies. This is expected since it produces less energy recovery and high capital investment when compared to other WTE technologies. The recycling revenue plays a vital role in influencing a high PBP since, in hybrid technology, only glass and metals are sold. Therefore, recycling revenue is not high as in AD technology. However, this confirms the fact that the hybrid of AD and gasification technology, operating under the same assumptions used in this report, can be economically viable since the payback is lower than the 10-year period.

As revealed in Tables 2, the NPV of R 335 313 324.30 for over a period of 20 years. This indicates the fact that the hybrid of AD and gasification WTE technology by using the assumption employed presented earlier will result in a financial gain for the investors for 20-year periods of operation. The NPV for a hybrid of AD and gasification over 20-year periods is lower than the NPV of gasification and AD WTE technologies. This is expected since gasification WTE has high energy recovery and high revenue is expected, hence having higher NPV than other WTE technologies presented in this report. The AD WTE has high recycling revenue that results in high NPV. The hybrid of gasification and AD WTE technology in this study manifested a positive NPV and it is therefore considered to be financially viable.

The PI for the 20-year periods are profitable simply because they are both more than 1. AD WTE has scored a higher profit index as compared to other WTE technologies. This also indicates that the AD WTE plant technology operating under the same assumptions made in this paper will, therefore, result in a financial gain for investors because they are economically viable.

The assumed value of WACC is 12% and the estimated values of IRR are 19.68% for 20 years. The IRR is also higher than the gasification method and lower than the AD WTE, at 19.68%. This is the outcome of the CAPEX costs, together with considerably low energy recovery. Apart from these observations, these figures are higher than the WACC and this confirms the fact that the WTE technology can be considered as a viable option for investment.

As revealed in both Tables 2, LCOE is less than the actual energy price used in this report. The LCOE is R 0.69 and the retail price assumed is R1.3 per KWh, which is the current domestic tariff rate in South Africa. From this finding, LCOE of the WTE plant is significantly lower than the current electricity price rate. This, however, indicates that even if this technology were without recycling revenue the technology will still be economically viable, since recyclable waste plays a vital role in making AD technologies to become profitable. LCOE of hybrid technology is higher than the LCOE of gasification technology and lower than the LCOE of AD technology.

As stated earlier, LCOW is the method that allows different WTE conversion technologies with the different waste capacities to be compared against one another based on the unit cost of waste (ton) during the operational life of the facility. R69.88/ton of waste processed is lower than LCOW of gasification and AD WTE technology.

Sensitivity Analysis on the NPV Criteria for Gasification WTE

Sensitivity analysis is a method of evaluating uncertainty in the output of a model by varying the input parameters. In this study, sensitivity analysis will focus on the NPV criteria of AD, gasification and a hybrid of both WTE technologies because NPV is the highest investment criterion affected by input parameters. To compute the sensitivity analysis model, input parameters will allow the subject to have positive and negative changes to the NPV criteria. The positive and negative changes to the NPV criteria will be discussed in detail. The parameters selected for the analysis are a capacity factor, WACC, OPEX (fixed and variable), CAPEX, total energy produced, electricity generation, generated electricity revenue, recycling revenue and RDF of the waste received. Each of these parameters is designated to vary from (-25 to 25%) and NPV is calculated according to the change of each variable input data. The sensitivity will be outlined according to the following:

-

High sensitivity means the difference between the NPV at zero percent and the NPV at − 25 and 25 percent is maximal.

-

Low sensitivity means the difference between the NPV at zero percent and the NPV at − 25 and 25 percent is minimal.

According to Fig. 4, NPV of the gasification WTE plant has a positive change with a change in the capacity factor, the energy produced, recycling revenue, energy price with the inflation rate and RDF (MSW input fuel). Negative change is also indicated in WACC (discount payback or Weight Average Cost of Capital), fixed OPEX, variable OPEX and CAPEX. The dependent variables that have high sensitivity are WACC, energy price and CAPEX and input variable that are less sensitive are fixed OPEX, variable OPEX, capacity factor and recycling revenue indicated in Fig. 4.

The refuse derived fuel (RDF), this variable is related to all input variables and has the capability in determining the amount of energy that is generated during the gasification WTE. The amount of RDF used for this study is 240,000 tons. This value is subjected under sensitivity analysis where is designated to vary from − 25 to 25%, it indicates that the project is less attractive to investors when the WTE facility processes less waste material.

The amount of waste processed follows the same trend as the amount of energy produced as indicated in Fig. 4.

The base scenario in terms of energy price, R1.30/KWh was used for this study. This value is also subjected under sensitivity analysis where is designated to vary from -25 to 25%.

The − 25 to 25% criteria values varied from -R 431 348 280.91 to R 1 744 125 260.27 respectively. A lower NPV were the result of the lowest price scenario and a higher NPV result were the results of highest price scenario as revealed in Table 3 and Fig. 4. The energy price has significance effect in influencing the financial performance of the WTE plant than the amount of waste processed (RDF) as indicated in both Table 3 and Fig. 4. According to NERSA as referenced by Goosen [5], the price of energy will always go up in the future. Therefore, the gasification WTE financial performance will improve while keeping the amount of waste processed constant.

The recycle revenue has a minimal change in the NPV criteria as illustrated in Table 3. The—25 to 25% criteria manifested R 602 057 527.6 to R 710 719 451.73 respectively. This indicate, gasification WTE is financially viable without the recyclable revenue being generated.

CAPEX and WACC manifested a similar trend. 25% increase in CAPEX manifested NPV of about − R64 772 047.04. A 25% decrease in CAPEX increases the NPV to about R1 377 549 026.40. The return on an investment would be difficult to be covered if the amount of CAPEX is increased by 25% and it also resulted in the financial loss in term of the economic viability.

Table 3 illustrates the results of the gasification of WTE. The sensitivity analysis results show that the NPV is highly sensitive to changes in CAPEX, WACC, electricity prices, RDF and energy produced. The sensitivity analysis also shows that the NPV is less sensitive to changes in the energy produced, RDF, fixed OPEX, Capacity factor variable OPEX and Recyclable revenue.

Sensitivity Analysis on the NPV Criteria for AD WTE

A similar sensitivity analysis is also calculated on the AD plant using different input variables for the NPV (in R) criteria. NPV of the AD WTE plant has a positive relationship with change in capacity factor, the energy produced, fixed OPEX, variable OPEX, CAPEX and the RDF as highlighted in Table 4. A negative change is also indicated in relation to the discount capacity factor, recycling revenue and energy price. The financial indicators that have high sensitivity are WACC, energy price, recycling revenue and CAPEX investments. The variables with low sensitivity are the fixed OPEX, capacity factor, variable OPEX, energy produced and RDF.

Amount of waste processed or refuse derived fuel (RDF): This variable is related to all cost variables and is supposed to have significant effect on the amount of electricity produced in the anaerobic digestion WTE as indicated by Table 4. The value of 240,000 tons per annum was used. Like in gasification WTE, this value waste treated is also subjected to sensitivity analysis where is designated to vary from − 25 to 25%. 25% decrease of the amount of waste processed decrease the NPV slightly. The effect of waste processed is less in AD than in the gasification WTE. Furthermore, similar trend is manifested between RDF and the amount of energy produced.

AD stores waste for longer time in the digestor and the dependant factor is the decomposition rate of the waste, hence − 25 to 25% sensitivity criteria has no effect in influencing the financial performance. The consideration that must be considered that if AD is an option for decision makers, then larger facilities than the base case would still yield NPV of within the same range.

One of the reasons for starting this study was to implement a renewable WTE that could operate within Eskom (South African energy supply entity) grits and enforce independence on fossil fuel electricity generation. The price of electricity is therefore main key in decision making criteria of the investors. The electricity price used for this study is R1.30 per kw. The sensitivity analysis of the price of electricity for anaerobic digestion WTE showed very similar trends as gasification WTE. The highest scenario results of NPV is about R 476 876 160.00. This shows that the increase in energy price expands financial performance of the AD technology. However, the effect of the price increase in AD is less than in gasification WTE.

The price of electricity has a greater effect on the financial performance than the amount of waste processed (RDF). For decision making criteria on the financial performance, one must be aware that a slight increase on the energy price would impact the financial viability positively.

The sensitivity analysis between CAPEX and WACC have similar trend, however, WACC trend is non-linear and intersects the trend of CAPEX on the x-axis. This is expected since the electricity produced is resultant from RDF waste processed in the AD process and the value of WACC is always dependent on CAPEX. The energy produced in the AD WTE technology is directly proportional to NPV. This was expected; the higher the energy produced, the higher the NPV manifested. Lastly, the sensitivity analysis results show that the NPV is highly sensitive to changes in the CAPEX, WACC, generated electricity prices and energy produced. The study also shows that NPV is less sensitive to fixed OPEX, variable OPEX, capacity factor, recycling revenue and RDF. Furthermore, the sensitivity analysis shows that an increase in WACC and CAPEX is inversely proportional to NPV. An increase in the electricity tariff price rate is directly proportional to the NPV. The financial indicators, including CAPEX, WACC and energy price, highly influence the NPV of AD WTE plant when they are subjected to changes.

Table 4 shows the AD technology WTE plant sensitivity analysis result and the variables that highly affect the sensitivity. Energy produced variables, OPEX and RDF are omitted in the plot since their sensitivity analyses are minimal.

Figure 5 shows the AD technology WTE plant sensitivity analysis and the variable that highly affects the sensitivity. Energy produced, variables, OPEX and RDF are omitted in the plot since their effects are minimal.

Sensitivity Analysis on the NPV Criteria for Hybrid of Gasification and AD WTE

A similar sensitivity analysis was also designed for the hybrid of gasification and AD plant by using input variables with the financial indicators NPV (in R). From Fig. 6 and Table 5, it is indicated that NPV of hybrid of gasification and AD WTE plant has a positive change with an increase in capacity factor, energy price and recycling revenue.

A negative change is also manifested with a decrease in CAPEX, variable OPEX, energy price with the inflation rate, energy produced, RDF, capacity factor and CAPEX. The financial indicators that have high sensitivity are WACC, fixed OPEX, CAPEX and energy price. The financial indicators that have low sensitivity change are the fixed OPEX, capacity factor, energy being produced, recycling revenue and RDF.

The values of NPV with changes in WACC and CAPEX parameters have a similar trend. This is expected since the electricity produced is the resultant of the RDF waste processed in both the gasifier and the AD digester and the value of WACC is always dependent on CAPEX similarly to gasification and AD WTE.

The amount of energy produced in the hybrid of gasification WTE technology is inversely proportional to NPV. When the amount of energy is increased, the CAPEX increases as well. If the CAPEX increases, the NPV of the WTE plant is affected. Furthermore, the sensitivity analysis shows that an increase in WACC and CAPEX is also inversely proportional to NPV. An increase in the electricity tariff price rate is directly proportional to the NPV. The financial indicators, including CAPEX, WACC and energy price highly influence the NPV of hybrid of gasification and AD WTE plant whenever they are subjected to change. Table 5 shows the hybrid of gasification and AD technology WTE plant sensitivity analysis result.

All three WTE technologies have manifested favourable NPV, PI and PBP. They are therefore regarded to be economically viable. However, there is a great difference between the investment and the size of each WTE technology and it is difficult to choose which one performs better in terms of viability. The researcher therefore opted to rely on only the LCOW, LCOE and IRR. Hybrid of gasification and AD WTE is a better performer with the lowest LCOW and lower IRR and LCOE higher than gasification WTE. Gasification WTE performs moderately well with lowest IRR and LCOE. Gasification WTE has manifested a higher LCOW. Lastly, the AD WTE manifested a higher LCOE and IRR with the second highest in LCOW.

The non-thermal technologies (AD) have its own disadvantages in terms capability of large number of energy supply. However, it performed moderately well and better than gasification in terms IRR and LCOW but weaker when it comes to LCOE. It has the highest LCOE, which renders its energy price to be expensive when differentiated to other WTE technologies presented in this study. Furthermore, AD has manifested the highest LCOE and the LCOW is a lot lower than gasification WTE. The AD is insensitive to the RDF or the capacity of waste treated, as illustrated by the sensitivity analysis of LCOW and LCOE. Therefore, it is very difficult for AD WTE to accumulate an LCOE less than gasification WTE technology. Unless the otherwise CAPEX investment is reduced, it will be able to reduce LCOW and LCOE. However, if the CAPEX investment is reduced, the size of the technologies must be reduced as well.

The hybrid of both gasification performs moderately well, with the lowest number of LCOW and the second lowest LCOE. Furthermore, gasification WTE manifested the highest LCOW and the value is higher than the landfill cost presented in this study. The aim and purpose of the study was to establish a combination of two technologies that will be effective when integrated into a waste management system. Therefore, the study recommends the hybrid to be implemented as it has manifested all favourable results according to its financial tools.

Conclusion

This study investigated the economic feasibility of using a hybrid of gasification technology and anaerobic digestion technology to recover energy from MSW such as metal, paper, plastics and organic wastes in South Africa. Financial analysis tools such as payback period (PBP), net present value (NPV), profit index (IP), internal rate of return (IRR), levelised cost of electricity (LCOE) and levelised cost of waste (LCOW) were used to evaluate the economic viability.

Gasification WTE revealed a higher NPV than AD and hybrid of gasification and AD WTE. Hybrid had the lowest NPV since recycling revenue is less when compared to the AD. AD is higher than hybrid technology with energy recovery and less than the gasification WTE technology. WTE has inequalities between the capital investment and the size; hence, the NPV difference between these technologies is immense. The hybrid of gasification and AD is the better performer, since it has manifested the higher IRR and lower LCOE and LCOW. The hybrid of gasification and AD revealed positive results on the whole set of financial indicators presented in this study. This indicate that combination of two technologies (Gasification + AD WTE) will increase the financial and technical feasibility of both Gasification + AD WTE technologies. Hence be integrated into a solid waste management system.

Sensitivity analysis revealed that the energy price and capital expenditure are the major variables that can affect the feasibility of the hybrid WTE system (Gasification + AD WTE). The hybrid system is less sensitive to operating cost (both fixed and variable), capacity factor, weighted cost of capital (WACC) and recycling revenue.

Notes

USD to ZAR = 1: 14.00.

References

Sukhatme, S.(2012) Can India's future needs of electricity be met by renewable energy sources? A revised assessment. Current Science 1153–1161.

Yao, Z., et al.: Anaerobic digestion and gasification hybrid system for potential energy recovery from yard waste and woody biomass. Energy 124, 133–145 (2017)

Maya, D.M.Y., et al.: Gasification of municipal solid waste for power generation in Brazil, a review of available technologies and their environmental benefits. J. Chem. Chem. Eng. 10, 249–255 (2016)

Pegels, A.: Renewable energy in South Africa: potentials, barriers and options for support. Energy policy 38(9), 4945–4954 (2010)

Goosen, C., Assessing the economic viability of biogas plants at abattoirs in South Africa. 2013.

Inglesi, R., Pouris, A.: Forecasting electricity demand in South Africa: A critique of Eskom's projections. S. Afr. J. Sci. 106(1–2), 50–53 (2010)

Demirbas, A.: Waste management, waste resource facilities and waste conversion processes. Energy Convers. Manage. 52(2), 1280–1287 (2011)

Singh, R., et al.: An overview for exploring the possibilities of energy generation from municipal solid waste (MSW) in Indian scenario. Renew. Sustain. Energy Rev. 15(9), 4797–4808 (2011)

Hoornweg, D. and P. Bhada-Tata, What a waste: a global review of solid waste management. 2012.

Amsterdam, H., Thopil, G.A.: Enablers towards establishing and growing South Africa’s waste to electricity industry. Waste Manage. 68, 774–785 (2017)

Hadidi, L.A., Omer, M.M.: A financial feasibility model of gasification and anaerobic digestion waste-to-energy (WTE) plants in Saudi Arabia. Waste Manage. 59, 90–101 (2017)

Scarlat, N., et al.: Evaluation of energy potential of municipal solid waste from African urban areas. Renew. Sustain. Energy Rev. 50, 1269–1286 (2015)

Xu, S., H. He, and L. Luo, Status and prospects of municipal solid waste to energy technologies in China, in Recycling of solid waste for Biofuels and bio-chemicals. 2016, Springer. p. 31–54.

Tozlu, A., Özahi, E., Abuşoğlu, A.: Waste to energy technologies for municipal solid waste management in Gaziantep. Renew. Sustain. Energy Rev. 54, 809–815 (2016)

Bosmans, A., et al.: The crucial role of Waste-to-Energy technologies in enhanced landfill mining: a technology review. J. Cleaner Prod. 55, 10–23 (2013)

Lan, W., et al.: Progress in techniques of biomass conversion into syngas. J. Energy Inst. 88(2), 151–156 (2015)

Al Seadi, T., Ruiz, D., Prassl, H., Kottner, M., Finsterwaldes, T., Volke, S., Janssers, R., Biogas handbook., : Esbjerg, Denmark: University of Southern Denmark: Esbjerg. University of Southern Denmark, Denmark (2008)

Rao, P.V., et al.: Biogas generation potential by anaerobic digestion for sustainable energy development in India. Renew. Sustain. Energy Rev. 14(7), 2086–2094 (2010)

Khalid, A., et al.: The anaerobic digestion of solid organic waste. Waste Manage. 31(8), 1737–1744 (2011)

Girotto, F., Alibardi, L., Cossu, R.: Food waste generation and industrial uses: a review. Waste Manage. 45, 32–41 (2015)

Abbasi, T. and S. Abbasi, Renewable energy sources: Their impact on global warming and pollution. 2011: PHI Learning Pvt. Ltd.

Affairs., D.o.E., South Africa state of waste report. A report on environmental state. 2018: Department of Environmental Affairs.

Shrieves, R.E., Wachowicz Jr., J.M.: Free Cash Flow (FCF), Economic Value Added (EVA™), and Net Present Value (NPV): a reconciliation of variations of discounted-Cash-Flow (DCF) valuation. Eng. Econ. 46(1), 33–52 (2001)

Magni, C.A.: Average internal rate of return and investment decisions: a new perspective. Eng. Econ. 55(2), 150–180 (2010)

Leme, M.M.V., et al.: Techno-economic analysis and environmental impact assessment of energy recovery from Municipal Solid Waste (MSW) in Brazil. Resour. Conserv. Recycl. 87, 8–20 (2014)

Ueckerdt, F., et al.: System LCOE: what are the costs of variable renewables? Energy 63, 61–75 (2013)

King, J.E., J. Hannifan, and R. Nelson, An assessment of the feasibility of electric power derived from biomass and waste feedstocks. Report No. KRD-9513. Kansas Electric Utilities Research Program and Kansas Corporation Commission, Topeka, KS, 1998.

Purser, R., A financial feasibility study of waste to energy generation in the City of Cape Town. 2011, University of Cape Town.

Statistics, R.C., International Renewable Energy Agency (IRENA). 2016, ed.

Nahman, A.: Pricing landfill externalities: Emissions and disamenity costs in Cape Town. South Africa. Waste Management 31(9–10), 2046–2056 (2011)

Fernández-Gonzalez, J.-M., et al.: Economic and environmental review of Waste-to-Energy systems for municipal solid waste management in medium and small municipalities. Waste Manage. 67, 360–374 (2017)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mabalane, P.N., Oboirien, B.O., Sadiku, E.R. et al. A Techno-economic Analysis of Anaerobic Digestion and Gasification Hybrid System: Energy Recovery from Municipal Solid Waste in South Africa. Waste Biomass Valor 12, 1167–1184 (2021). https://doi.org/10.1007/s12649-020-01043-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12649-020-01043-z