Abstract

This paper investigates retailers’ competition and cooperation in a closed-loop green supply chain consisting of one common manufacturer and two competing retailers under governmental intervention and cap-and-trade policy. Considering a consistent pricing strategy of the manufacturer, this study develops one centralized policy and three manufacturer-led decentralized policies viz. Collusion, Cournot (Nash), and Stackelberg depending on different competitive behaviors of the retailers. Optimal decisions are compared analytically through a special case where the retailers face the same basic market, and numerically where they face both the same basic market and different basic markets. A transfer payment mechanism is developed so that all the channel members achieve Pareto improvement. Numerical results indicate that (1) among the three decentralized scenarios, Nash behavior is profitable to the manufacturer, customers, and the whole supply chain, but Collusion behavior is profitable to the retailers only when the difference of their basic markets is small, (2) when the retailers face the same basic market and play Stackelberg game, it is beneficial for the retailers to be follower rather than leader, and (3) occurrence of both the government subsidy and cap-and-trade policy is profitable to all the channel members.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In today’s competitive business environment, the competitive behavior of manufacturers and retailers has become more responsive and an important factor of every economy in the world. Most of the companies are focused on fulfilling value to their customers. Every company wants to provide better products and services than its competitors. That’s why, more and more manufacturers distinguish product varieties by differentiating one or more product specifications like technology, appearance, color, etc. For instance, many manufacturers like IBM, Xerox, HP, Dell, and Adidas are using unconventional production methods (product greening) to distinguish their businesses from competitors. Similar to manufacturers, retailers like Wal-Mart and Tesco have unmatched supply chains which focus on reducing selling prices of the products, while the other retailers try to reduce prices of the products so as to compete with big retailers. For an online business, one can use social media to increase competitive behavior. Supply chain management (SCM) is very important for the retail market as it provides its services directly to customers. Retail businesses can enhance service and boost supply chain speed by improving upstream and downstream processes. Therefore, an effective supply chain provides a competitive advantage to all the retailers.

Cap-and-trade policy (CTP) can play a major role to protect our atmosphere by shortening carbon emission. Under CTP, the government allocates some emission credit (either free or through auction), which is called ‘cap’, to the manufacturers when starting the business, and they can ‘trade’ (buy or sell) the emission credit with each other in the carbon trading market or ‘bank’ them for future use. That means, a company that reduces its emission is economically and environmentally rewarded. Greenhouse gas (GHG) is the main target of this cap. The European Union’s Emission Trading System (EU ETS) lowered the cap by 15% in 2015 than that in the program starting time in 2005. The Government of India has also taken a few steps on CTP. In 2008, National Action Plan on Climate Change (NAPCC) policy is instated for improving energy efficiency, solar technology, the Himalayan ecosystem, “Green India”, etc.

Government subsidy can also play an important role in green manufacturing. The government wants companies to promote and develop green products in order to protect the environment. Sometimes they subsidize to encourage customers to buy green products, and customers’ demand forces the manufacturers to produce green products. The Government of Germany provided a subsidy to consumers who exchange their old vehicles with new ones (Li et al. 2018). Again, the government can also give subsidies to manufacturers to produce more green products. Some enterprises like IBM, Xerox, HP, Dell, and Adidas are busy in greening their products. Government subsidy to these enterprises not only improves the environment, but also increases the manufacturers’ competitive advantage (Pujari 2006). To encourage green vehicle consumption, the Japan Government provided 100,00 Yen subsidy towards tax reduction and exemption (Li et al. 2018). For providing these types of subsidy, governments may impose different types of taxes like GST, VAT, etc. on the consumers. India committed to the voluntary Copenhagen Accord to reduce emissions intensity by 20–25% of 2005 by 2020 and adopted several measures including increased use of renewable energy, nuclear energy, afforestation, and solar energy for sustainable development.Footnote 1

Cooperative or non-cooperative behavior among vertical and/or horizontal players of a supply chain can play an important role in optimal decision making. In a market, multiple retailers under governmental intervention may cooperate or compete or play the Stackelberg game while making decisions. Most of the previous literature considered either retailers’ competitive behavior, or government subsidy or cap-and-trade policy for green innovation. No attempt has been made to consider all these issues together in a closed-loop supply chain (CLSC). While considering all these issues, the following questions may arise:

-

What would be the optimal pricing strategy and greening level of the CLSC system under consideration?

-

Which behavior of the retailers is the best from the point of view of the manufacturer, the retailers, and the consumers?

-

What are the impacts of government policies on the green supply chain under retailers’ different behaviors?

-

What are the effects of retailers’ different behaviors on the wholesale price and the profit of the manufacturer?

-

Does the leader always get higher profit in the case of the Stackelberg game between the retailers?

-

Are the government policies beneficial to all the players in the supply chain?

In order to find answers to the above questions, this article constructs a manufacturer–retailer Stackelberg game in which the manufacturer is the Stackelberg leader and two competing retailers are the Stackelberg followers. The manufacturer produces the green product and sells it to the retailers with consistent wholesale price depending on the reactions of the retailers. The market demand is assumed to vary with retail prices and greening level of the product, and its deterministic archetype is known to the manufacturer and the retailers. Besides manufacturing a new product from fresh raw materials, the manufacturer also remanufactures the returned products. To reduce the GHG emissions and encourage the manufacturer in green production, the government gives some emission cap and subsidy. At the time of selling products to the customers, the retailers can behave differently. Depending on the retailers’ behavior, we consider different scenarios viz. Collusion (C), Nash (N), and Retailer-led Stackelberg (R) scenarios along with the centralized scenario. To the best of our knowledge, we are the first to consider CTP and governmental intervention with two competing retailers in a closed-loop green supply chain.

The remainder of the paper is organized as follows: In the following section, the related literature is reviewed. Section 3 deals with notations and assumptions, model formulation, and analysis. Numerical results are presented in Sect. 4. In Sect. 5, the sensitivity of some key-parameters is examined. Some managerial insights are presented in Sect. 6. Section 7 concludes the paper with future research directions.

2 Literature review

In this section, we review the relevant literature across four research domains—pricing policies in green supply chain (GSC), operational decisions under CTP, operational decisions under governmental intervention, and channel leadership.

2.1 Pricing policies in green supply chain (GSC)

In recent years, due to drastic changes in nature, a large number of customers desire to buy green products even paying more penny. So, GSC becomes an interesting area of research. This subsection deals with pricing policies of green products in GSC. Zhu et al. (2005) suggested different aspects of green practices such as sale of excess inventory, sale of scrap and used material, environmental auditing program, cleaner production, patent, internal service quality, green design, green purchasing, and green innovation. To identify the policies which promote environmental sustainability, Krishnan and Lacourbe (2011) modeled and analyzed a problem with the dual goal of profit maximization and improvement of environmental quality of the products. They showed that firms are capable of achieving these goals in some terms. Zhang et al. (2014) investigated the pricing and greening strategies of a single-period green supply chain in which the manufacturer produces both green and non-green products, and they substitute each other. They showed that, through Rubinstein bargaining, the cooperating members can increase 33.3% profit from that in noncooperative strategy. Yi et al. (2016) constructed a retailer oriented dual recycling CLSC in the construction machinery industry. They explored how the collection efforts should be appropriately allocated to retailers and third parties, and found that it depends on the relationship of the reverse logistics cost coefficients. Introducing the green product in the dual-channel supply chain, Li et al. (2016) discussed the pricing and the greening strategies of the supply chain members using consistent pricing strategies in both centralized and decentralized scenarios, and investigated the existence of the dual-channel by comparing the profits of the channel members. They further extended it by introducing an inconsistent pricing strategy. Using the game-theoretic approach, Jamali and Rasti-Barzoki (2018) investigated the economic and environmental aspects of sustainability by introducing a substitutable green product of a non-green product in a dual-channel supply chain which includes a retail channel and an online channel. Giri et al. (2018) analyzed the selling price, warranty period, and greening level of a product in a CLSC consisting of one manufacturer and one retailer. They showed that the channel members can improve the greening level, warranty period, and profits through revenue sharing contract. Recently, Mondal and Giri (2020) investigated the pricing policies, marketing effort, and greening level of a product in a two-period CLSC under consideration of three different collection options of used products. However, the present work is focused on the retailers’ different behaviors under governmental intervention and cap-and-trade policy in GSC.

2.2 Operational decisions under CTP

Dobos (2005) studied the effect of emission trading on production and inventories under CTP, and found that optimal production quantities are reduced after applying emission trading policy. Song and Leng (2012) investigated a newsvendor problem under different carbon emission policies including the mandatory carbon emission capacity, the carbon emission tax and the cap-and-trade system, and derived a specific condition under which the expected profit of the system is increased and carbon emission is reduced after implementation of CTP. Du et al. (2013) considered an emission-dependent supply chain consisting of one emission-dependent manufacturer and one emission-dependent supplier under CTP. They proved that with an emission cap, the manufacturer’s profit increases but the supplier’s profit decreases, and the supply chain can be coordinated to get more profit under certain conditions. Xu et al. (2016) analyzed pricing, sustainability and coordination issues (revenue sharing and two-part tariff contract) in a two-echelon make-to-order (MTO) sustainable supply chain under cap-and-trade regulation. They showed that an increase in centralized profit is at most 1/3 of that in decentralized policy, and a two-part tariff contract can achieve perfect coordination. In order to provide policy-making information to the government, and production and emission reduction insights to the manufacturer, Cao et al. (2017) analyzed the impacts of CTP and low carbon subsidy (LCS) policies on optimal production and emission reduction level. Their results showed that cap does not always have positive effect and carbon trading price does not always produce a negative effect on the profit of the manufacturer, and CTP and LCS are beneficial to the society under some conditions. Considering a two-echelon MTO supply chain with one supplier and two retailers, Qi et al. (2017) studied the pricing decision process under a carbon cap regulation through a game theoretical approach. They showed that the consistent wholesale price of the manufacturer and the inconsistent selling prices of the retailers under a transfer payment mechanism can help the channel members in achieving Pareto improvement. They also provided the appropriate range of carbon cap which can reduce carbon emission. Pang et al. (2018) investigated the impacts of carbon trading price and consumer’s environmental awareness on carbon emissions in supply chain under CTP, and showed a relation between different manufacturers’ (green, non-green) optimal per-unit carbon emissions and carbon trading prices. Besides considering CTP, the present study considers government subsidy to the manufacturer to investigate retailers’ different competitive behaviors.

2.3 Operational decisions under governmental intervention

Governmental intervention can encourage the members of the supply chain to deal with environment-friendly products and improve the environment. Mitra and Webster (2008) investigated the competition between new and remanufactured products and the effects of government subsidies for promoting remanufacturing activity. They showed that the implementation of subsidies increases remanufacturing activity. Zhang (2014) considered the reference-dependence newsvendor model with both consumer trade-offs and government subsidies to evaluate the influences on the optimal electric vehicle (EV) production decisions. They found that factors like performance of both EVs, subsidies, loss aversion, etc. influence the expected utilities of EV production and the optimal production quantity. Luo and Fan (2015) constructed a three-stage game model to investigate the influence of different types of subsidy on the carbon reduction technology investment decision in supply chain. They showed that besides increasing profits of supply chain members, the governmental intervention can promote social welfare. Guo et al. (2016) analyzed supply chain under different subsidy policies of the government, and showed that a government’s selection of subsidy policy depends on the consumer’s price sensitivity. Madani and Rasti-Barzoki (2017) discussed pricing policies, greening strategies, and government tariffs determining strategies in a competitive model with the government as the leader and two competitive green and non-green supply chains as followers. They suggested that the effect of subsidy rate is notably higher than the tax rate and it helps to produce more eco-friendly product and increase the profits of the government and the whole supply chain. Li et al. (2018) studied the impacts of the government’s consumption subsidy and replacement subsidy towards environment-friendly products in a dual-channel supply chain. They observed that the replacement subsidy is more efficient at protecting the environment, but the consumption subsidy is more efficient at improving social welfare. He et al. (2019) investigated different channel structures for the manufacturer in a four-stage dual-channel CLSC consisting of the government, a manufacturer, a retailer for trading new product and a third party firm or platform for trading remanufactured product under government subsidy to customers to encourage in purchasing remanufactured products. They found that the higher subsidy level encourages customers and enhances channel performance but it can hurt the sales of new products. Unlike previous works on governmental intervention, this study considers retailers’ different competitive behaviors in GSC.

2.4 Channel leadership

Considering duopolistic retailers’ different competitive behaviors viz. Collusion, Cournot, and Stackelberg, Yang and Zhou (2006) investigated the pricing and quantity decisions in a two-echelon supply chain consisting of a manufacturer and two competing retailers. They showed that duopolistic retailers charge higher selling price under Collusion behavior and the lowest selling price under Cournot behavior, and while facing the dissimilar market, if the degree of dissimilarity is large enough then total profit of the duopolistic retailers exceeds the profit of the manufacturer. Xiao and Qi (2008) studied pricing and coordination issues in a supply chain with two competing retailers. They investigated different contracts and found that the supply chain can be coordinated (fully or partially) under some conditions. Wu et al. (2012) explored the pricing decision in a two-echelon supply chain with one common supplier and two retailers through six different power structures characterizing the horizontal competition of the retailers and vertical competition of the supplier and the retailers. They showed that when retail substitutability is low, vertical competition has more impact than the horizontal competition, and competition between the retailers is not profitable to them. Zhao et al. (2012) analyzed the pricing decision for a substitutable product in a duopoly supply chain with one common manufacturer and two competing retailers under fuzzy environment. Considering one centralized and three decentralized policies depending on power structures, they showed that the maximal expected profit of the whole supply chain does not depend on power structures. Ghosh and Shah (2012) investigated an apparel serial supply chain in which players launch product “greening”, and showed how greening levels, prices, and profits are affected by channel structure. They used a two-part tariff contract to coordinate the green supply chain and showed that coordination can improve the greening level. Choi et al. (2013) investigated a CLSC with a retailer, a collector and a manufacturer, and analyzed the performance of CLSC under different channel leaderships, and found that the retailer-led game provides the most effective policy while the collector-led game provides the worst policy for collecting used-products. Liu and Xu (2014) studied the pricing problem in a supply chain consisting of a manufacturer and two competing retailers in fuzzy environment using the Stackelberg game model. Huang et al. (2016) analyzed the effect of pricing strategies and power structures on the performance of a two-echelon supply chain with one common manufacturer and duopoly retailers through building six decentralized power structures. They showed that regardless of power structures, Collusion behavior increases the selling price, and the benefit of the retailers under Collusion behavior depends on power structures, retail substitutability and different non-price parameters. Modak et al. (2016) developed both cooperative and non-cooperative models for a CLSC consisting of a manufacturer and duopolistic retailers with a recycling facility. They showed that besides making a positive impact on the environment, recycling activities enhance the interaction between the retailer and consumers. Jafari et al. (2016) investigated the pricing and ordering decisions on a dual-channel supply chain with the monopolistic manufacturer and duopolistic retailers under different behaviors of retailers viz. Bertrand, Collusion, and Stackelberg. They found that retailers’ different behaviors have no effect on the manufacturer’s decision; Collusion gives the highest profit to the retailer and the lowest profit to the manufacturer. Yang and Xiao (2017) developed three game models of a green supply chain with governmental interventions (subsidy or penalty) under fuzzy uncertainties to find the optimal pricing and greening level decisions. They observed that under strong governmental intervention, the manufacturer-led Stackelberg scenario is subservient and retailer-led Stackelberg scenario is supercilious to the other scenarios considered in the supply chain; government subsidy is not always beneficial to the supply chain; a relatively high green level floor for providing subsidy is harmful to the manufacturer. They also illustrated the coordination issues of parallel and serial CLSC. In order to investigate the optimal pricing and return product collection strategies, Giri et al. (2017) considered both dual forward and reverse logistics (collection through a third party and e-tail channel) under the centralized, manufacturer-led decentralized, retailer-led decentralized, third party-led decentralized policies and Nash game. Mondal et al. (2020) extended the work of Giri et al. (2017) by considering used products collection through the retail channel and e-tail channel. This paper assumes that the manufacturer is the Stackelberg leader and two competing retailers are the followers who follow different competitive behaviors. Table 1 shows the difference between our study and previous studies.

From the above literature review, it is observed that several works have been done on CTP, governmental intervention, channel leadership, CLSC, and GSC. However, no attempt has been made to consider duopoly retailers’ different behaviors under CTP and governmental intervention in CLSC. In this paper, a two-echelon CLSC model consisting of one single manufacturer and two competing retailers with manufacturer’s consistent pricing strategy and retailers’ different behaviors under CTP and governmental intervention is developed to study the optimal pricing, greening level and profitability of channel members.

3 Model formulation and analysis

In this section, we develop the proposed models and derive the optimal results for each model analytically.

3.1 Notations and assumptions

The following notations are used for developing the proposed models:

\(w_i\) | Unit wholesale price of the manufacturer to the retailer i (\(i=1,2\)) |

\(p_i\) | Unit selling price of the retailer i (\(i=1,2\)) |

\(\theta\) | Level of green innovation |

\(D_i\) | Demand function of the retailer i (\(i=1,2\)) |

D | Total demand |

\(D_R\) | Return quantity |

\(c_m\) | Unit manufacturing cost of the end product from the raw materials |

\(c_r (< c_m)\) | Unit manufacturing cost of the end product from the used products |

\(c_e\) | Unit carbon trading cost |

e | Carbon emission for unit product |

\(E_m\) | Carbon emission of the manufacturer |

E | Carbon cap given by the government to the manufacturer |

\(a_i\) | Basic market demand to the retailer i (\(i=1,2\)) |

\(\tau\) | Fraction of demand which is returned, \(0 \le \tau \le 1\) |

\(\lambda\) | Green investment cost coefficient |

\(A_0\) | Price paid by the manufacturer to the customer to collect the used product |

\(\Pi _m\) | Profit of the manufacturer |

\(\Pi _{ri}\) | Profit of the retailer i (\(i=1,2\)) |

\(\Pi\) | Profit of the whole supply chain |

The following assumptions are made to establish the proposed models:

A1. The market demand faced by the retailers is deterministic and linearly dependent on the greening level and the selling prices of the green product. The demand functions of the two retailers are assumed as \(D_i = a_i - \alpha p_i + \beta p_j + \gamma \theta ,\) \(i = 1,2; j = 3 - i\). So, the total demand is \(D = (a_1 + a_2) - (\alpha - \beta ) (p_1 + p_2) + 2 \gamma \theta\). The parameters \(\alpha\) and \(\beta\) represent the self-price sensitivity and the cross-price sensitivity, respectively. We assume \(\alpha > \beta\), which indicates that the self-price effect is greater than the cross-price effect i.e. if there is any change in the selling price of retailer i, it has more effect on its own demand than the rival’s demand (Hanssens et al. 2003; Kurata et al. 2007). \(\gamma\) is the sensitivity of greening level.

A2. The return quantity \(D_R\) is assumed as \(D_R = \tau D.\) The manufacturer pays \(A_0\) per unit to customers for returning the used items and he remanufactures these return items at a cost of \(c_r\) per unit.

A3. Similar to Zhu and Dou (2011) and Yang and Xiao (2017), here we consider that the government offers a subsidy \(s = k \theta _0 (\theta - \theta _0)\) to the manufacturer for producing each unit of green product, where \(\theta _0\) is the greening level floor given by the government. If \(\theta \ge \theta _0\), the subsidy is \(k \theta _0 (\theta - \theta _0)\); otherwise, the punishment is \(-k \theta _0 (\theta - \theta _0)\).

A4. All the remanufactured products have the same quality as that of the new ones (Savaskan et al. 2004). So, remanufactured products are sold with the new products in the same market. As we assume \(c_m > c_r\), so remanufacturing a used product is more profitable than manufacturing a new product.

A5. In order to ensure that all players of the supply chain are profitable in the business, we assume that \(p_1> w_1> 0, p_2> w_2> 0; c_m - c_r> A_0 > 0\). To avoid complexity in calculation, we assume \(C_0 = c_m - c_r - A_0 > 0\).

A6. Carbon emission for a unit product depends on the greening level and is given by \(e = e_0 - \psi \theta\), where \(e_0\) is the basic emission and \(\psi\) is the adjustment factor. Since both the new and the remanufactured products are sold in the same market, in order to avoid complexity in calculation, we assume that carbon emission due to manufacturing is the same as that of remanufacturing. So, the total emission is \(E_m = (D - D_R) e\) (due to new production) + \(D_R e\) (due to product remanufacturing) i.e. \(E_m = D e\). If \(E_m \ge E\), then the manufacturer has to buy the shortage of emission permit at the cost of \(c_e\) per unit to produce more. The opposite situation occurs when \(E_m < E\) i.e. the manufacturer can sell the emission permit in the same emission trading market at the same trading price and get some profit. This produces an additional income (Xu et al. 2016).

We consider a two-echelon closed-loop green supply chain consisting of a single manufacturer (remanufacturer) and two competing retailers. The manufacturer produces (at a cost of \(c_m\) per unit) and sells the green product with greening level \(\theta\) to the retailer i at a price \(w_i, i = 1, 2\) per unit. Qi et al. (2017) showed that the consistent pricing strategy of the manufacturer gives the best possible optimal result. Here we consider the consistent pricing strategy of the manufacturer i.e. \(w_1 = w_2 = w\). The retailers sell the product to potential customers through the traditional retail channel at selling prices \(p_1\) per unit and \(p_2\) per unit, respectively. In the reverse channel, the manufacturer collects the used products, which is a fraction of total demand, at a cost \(A_0\) per unit and remanufactures these returned products at a cost \(c_r\) per unit. So, the total cost due to remanufacturing is \((A_0 + c_r)\) per unit. The manufacturer has to invest some extra money to achieve green innovation. We assume an increasing and convex cost component \(\lambda \theta ^2\), (\(\lambda > 0\)) (Ghosh and Shah 2012) to characterize the diminishing investment with respect to \(\theta\). The profit function for the manufacturer is given by

Here, the first term indicates the revenue obtained from selling the product to the retailers and the second term denotes government subsidy. Production costs (including recycling cost of the returned products) of the new and the remanufactured products are given in the third and the fourth terms, respectively. Carbon trading cost is represented by the fifth term. The last term denotes the extra cost for producing a green product.

The profit function for the retailer i is given by

We develop the models under centralized and decentralized scenarios. As we are interested in competition and cooperation of the retailers, in the decentralized scenario, we mainly study retailers’ different behaviors with the manufacturer as the Stackelberg leader and the retailers as the followers. The duopolistic retailers can implement the following three scenarios:

-

Collusion scenario (C)—both the retailers act jointly to maximize the total profit of the downstream market (Fig. 1b).

-

Nash scenario (N)—both the retailers work independently by setting their selling prices and giving service to the customers assuming the rival’s decision variable as a parameter (Fig. 1c).

-

Retailer-led Stackelberg (R)—one retailer (say, retailer 1) acts as the Stackelberg leader and another one (say, retailer 2) as the follower, assuming the rival’s decision variable as a parameter and vice-versa (Fig. 1d).

The case of the manufacturer-led Stackelberg game is explained in Fig. 2 for better understanding the sequence of decision making. During calculation, we use a backward induction method in which the downstream members first decide their decisions for the given decisions of the upstream member, and then the upstream member decides its decisions.

3.2 Centralized policy (J)

In this policy, the manufacturer and the competing retailers work jointly to optimize their decisions viz. greening level and retail prices, through optimizing the joint profit of the manufacturer and the retailers. Due to joint optimization, the internal transfer price w does not play any role (Fig. 1a). The profit function for the centralized policy is given by

Using the first order conditions for optimality of \(\Pi (p_1,p_2,\theta )\), the equilibrium solution for the centralized policy can be obtained as given in the following proposition:

Proposition 1

If \(\lambda > \max \{2 \gamma \Psi _1, \frac{\Psi _3^2}{2 (\alpha - \beta )}\}\), the centralized policy has the following unique solution

where \(\Psi_1 = k \theta_0 + c_e \psi ,~\Psi_2 = c_m + k \theta_0^2 - C_0 \tau + c_e e_0,~ \Psi_3 = \gamma + (\alpha - \beta ) \Psi_1,~ X_1 = 4 \alpha \lambda - \Psi_3 [\gamma + (3 \alpha + \beta )\Psi_1],~ X_2 = 4 \beta \lambda + \Psi_3 [\gamma - (\alpha + 3 \beta )\Psi_1],~ X_3 = \Psi_2 [\lambda (\alpha - \beta ) - \gamma \Psi_3]\).

Proof

Proofs of Proposition 1 and subsequent propositions are given in “Appendix”. \(\square\)

3.3 Manufacturer-led-decentralized policy

There are industries like GM, Toyota (automobile markets), Canon, Xerox, HP (for printing), where the manufacturers are larger than the retailers. So, in such cases, the manufacturer acts as the Stackelberg leader and the retailers as the followers. The retailers first give their best responses to the manufacturer and then the manufacturer sets his optimal decisions to maximize the profit. With a common manufacturer, the retailers may cooperate or compete or play Stackelberg game for their pricing strategies. In the following subsection, we discuss about the pricing policies and profits of the retailers with different pricing strategies under manufacturer-led structure.

3.3.1 Collusion policy

In this subsection, we assume that the duopoly retailers agree to act jointly to maximize the total profit in the downstream market. For example, Beijing-based Guotong Electrical Appliance Company and Asia Financial Service Company, GOME with its foreign counterpart Best Buy Inc. (Wang et al. 2011), Europe’s largest clothing retailer Inditex and its flagship store Zara, H & M and Alexander Wang (apparel retailer), Samsung Group and Tesco in South Korea as Tesco Home plus, etc. act cooperatively. So, the total profit of the two retailers is given by

Now, the problem is reduced to a two-player Stackelberg game. So, the Collusion policy is formulated as follows:

We first calculate the decisions of the retailers from their joint profit. For any given wholesale price w and greening level \(\theta\), the optimal decisions of the retailers can be obtained from the first order necessary conditions for optimality, which are given as follows:

Substituting (3) in the manufacturer’s profit function and solving the first order necessary conditions for optimality, we can obtain optimal decisions of the manufacturer as follows:

Proposition 2

If \(\lambda > \max \{\gamma \Psi _1,\frac{\Psi _3^2}{4 (\alpha - \beta )}\}\), in Collusion policy, the optimal decisions of the manufacturer are given by

and optimal decisions of the retailers are

where \(Y_1 = 2 \lambda (5 \alpha + \beta ) - \Psi _3 [\gamma + (3 \alpha + \beta )\Psi _1],~ Y_2 = 2 \lambda (\alpha + 5 \beta ) + \Psi _3 [\gamma - (\alpha + 3 \beta )\Psi _1],~ Y_3 = 4 (\alpha + \beta )[\lambda (\alpha - \beta ) - \gamma \Psi _3]\Psi _2\) and \(\Sigma _1 = 4 \lambda (\alpha - \beta ) - \Psi _3^2.\)

3.3.2 Nash policy

In the proposed two-echelon CLSC, suppose that the manufacturer sets the same wholesale price for the retailers. The retailers decide to act independently to maximize their own profits by choosing their respective selling prices. In the real world, GOME and Suning (home appliances), Wal-Mart and Tesco, Shoppers Stop and Big Bazar (family store in India), Amazon and eBay (online retailer), Carrefour and Auchan, H & M and Zara, Walgreens and CVS (drug store in US), Kroger and Publix, Macy’s and BelkFootnote 2 are few examples where the retailers work independently. The Nash model can be represented as

As mentioned before, we use backward induction method to obtain optimal decisions. Thus retailer-1 (retailer-2) maximizes its profit \(\Pi _{r1}(\Pi _{r2})\) with respect to \(p_1(p_2)\) treating \(p_2(p_1)\) as parameter. As \(\frac{\partial ^2\Pi _{ri}}{\partial p^2_i} = - 2 \alpha < 0\), for any given wholesale price w and greening level \(\theta\), the optimal solution is obtained by solving the equations \(\frac{\partial \Pi _{r1}}{\partial p_1}=0\) and \(\frac{\partial \Pi _{r2}}{\partial p_2}=0\), simultaneously. The optimal solution is given by

Substituting (4) into the manufacturer’s profit function (1) and solving the first order conditions for optimality, we obtain optimal decisions of the manufacturer as follows:

Proposition 3

If \(\lambda > \max \{\frac{2 \alpha \gamma \Psi _1}{2 \alpha -\beta },\frac{\alpha \Psi _3^2}{2 (\alpha - \beta )(2 \alpha - \beta )}\}\), in Nash policy, the optimal decisions of the manufacturer are given by

and optimal decisions of the retailers are

where \(Z_1 = \lambda (2 \alpha ^2 - 5 \alpha \beta - 4 \beta ^2) + \alpha \gamma (\gamma - 3 \beta \Psi _1) - \alpha (\alpha - \beta )(\alpha + 2 \beta )\Psi _1^2,~ Z_2 = \lambda (10 \alpha - 7 \beta ) - (\gamma +3 \alpha \Psi _1) \Psi _3, Z_3 = 2 \alpha (2 \alpha + \beta )[\lambda (\alpha - \beta ) - \gamma \Psi _2 \Psi _3],\) and \(\Sigma _2 = 2 \lambda (\alpha - \beta )(2 \alpha - \beta ) - \alpha \Psi _3^2.\)

3.3.3 Retailer-led Stackelberg policy

We now assume that one of the retailers (say, retailer-1) is the Stackelberg leader and other retailer (say, retailer-2) is the Stackelberg follower. This type of situation can be noticed in the business of large retailers, for instance, Tesco launches Jack’s, Wal-Mart operates Sam’s club, etc. In this case, our problem is

In the following, we obtain the best response of the retailer-2 for given values of \(w,\theta ,p_1\) by equating \(\frac{\partial \Pi _{r2}}{\partial p_2}\) to zero as

Substituting (5) in the profit function of retailer-1 and solving the first order optimality condition for \(p_1\), we can obtain the best response of retailer-1 as

Again, substituting (5) and (6) into the manufacturer’s profit function and solving the first order conditions for optimality, we can obtain the best response of the manufacturer which is given in the following proposition.

Proposition 4

If \(\lambda > \max \{\frac{\gamma \Psi _1 \Psi _4}{4 \alpha (2 \alpha ^2 - \beta ^2)},\frac{\Psi _3^2 \Psi _4}{16 \alpha (\alpha - \beta )(2 \alpha ^2 - \beta ^2)}\}\), in Retailer-led Stackelberg policy, the optimal decisions of the manufacturer are given by

and optimal decisions of the retailers are

where \(\Psi _4 = 4 \alpha ^3 + 2 \alpha ^2 \beta - \alpha \beta ^2 - \beta ^3,~ \Psi _5 = 2 \Psi _4 - \beta ^2 (\alpha - \beta )\) and \(\Sigma _3 = 16 \alpha \lambda (\alpha - \beta )(2 \alpha ^2 - \beta ^2) - \Psi _3^2 \Psi _5.\)

3.4 A comparison of optimal results

3.4.1 Special case

As it is difficult to compare the optimal results of the proposed models derived above, in this subsection, we consider a special case in which both the retailers face the same basic market i.e. \(a_1 = a_2 = a\). Using the solution procedure shown in the previous subsection, we present optimal solutions of the proposed models for the special case in Table 2.

Proposition 5

When the duopolistic retailers face the same basic market they charge the same selling price to the customers and get the same profit while playing Nash and Collusion games. But in the case of Stackelberg game, they charge different selling prices and so get different profits.

Proposition 6

In the special case, the greening level of the product follows the pattern \(\theta ^J> \theta ^N> \theta ^R > \theta ^C\).

Proposition 6 shows that the greening level of the product produced by the manufacturer depends on the duopolistic retailers’ different competitive behaviors. As usual, the centralized policy suggests a higher green product. Among the duopolistic retailers’ three different behaviors, the Nash behavior helps the manufacturer to produce a higher green product while Collusion behavior forces the manufacturer to produce a lower green product. The reason behind this outcome is described as follows: In a manufacturer-led Stackelberg game, the manufacturer optimizes its decisions after knowing the decisions of the retailers. When the retailers work independently (in Nash situation), in order to get more market demand they tend to sell their products with lower selling prices. This induces the manufacturer to set a lower wholesale price for the retailers. But according to our assumption, the manufacturing cost is constant. So, naturally, a lower wholesale price results in a revenue loss to the manufacturer. In order to get more government subsidy and reduce GHG emissions, the manufacturer has no option without increasing the greening level of the product. The opposite situation holds when the retailers work jointly.

Proposition 7

In the special case, the selling prices and wholesale price follow the following pattern \(p_i^C> p_i^R> p_i^N > p_i^J\) and if \((\alpha - \beta ) \Psi _1 > \gamma\), then \(w^C> w^R > w^N, i = 1,2\).

Proposition 7 shows that duopolistic retailers’ different behaviors affect the wholesale price of the manufacturer which is contrary to the result of Yang and Zhou (2006) and Huang et al. (2016) who showed that duopolistic retailers’ different behaviors have no effect on the optimal pricing policy of the manufacturer. The reason behind this type of different outcome probably lies in the consideration of green products, government subsidy and CTP. In our model, if the condition given in Proposition 7 holds then the wholesale price becomes higher in Collusion policy and lower in Nash policy. As the manufacturer produces the lower green product in Collusion, it gets lower government subsidy. So, in order to maintain profitability, the manufacturer sets higher wholesale price in the case of Collusion behavior. The opposite result can be seen in the case of Nash behavior.

The selling prices of the retailers follow the pattern similar to the wholesale price of the manufacturer. The reason behind this type of outcome is that a higher wholesale price of the manufacturer forces the retailers to set their selling prices higher. In the case of centralized policy, since there is no double marginalization effect, the centralized decision-maker can set a lower selling price to get more profit from the market.

Proposition 8

In the special case, the profits of the manufacturer follow the pattern \(\Pi _m^N> \Pi _m^R > \Pi _m^C\).

Proposition 8 shows that the duopolistic retailers under Nash behavior help the manufacturer to get higher profit while the manufacturer’s profit becomes lower when the duopolistic retailers play Collusion behavior. This is due to the fact that in case of Nash behavior of the retailers, the manufacturer produces the higher green product and sells it to the retailers with the lower wholesale price. The retailers also sell these products with lower selling prices to the potential customers. Higher greening level and lower selling prices of the product help to increase the market demand which in turn increases the profit of the manufacturer.

Due to algebraic complexity, we are unable to compare the profits of the retailers under different competitive behaviors. But one can easily calculate the difference between the profits of the retailers in the Stackelberg game, which is given in the following:

This means that when the duopolistic retailers face the same basic market and play Stackelberg game, the follower gets higher profit in comparison to the leader. So, it is beneficial to be a follower rather than a leader. This is a contradiction to the intuitive expectation but this result is consistent with the result of Yang and Zhou (2006). Actually, the leader gets a higher profit only when its basic market is higher than the follower. In the case of a similar basic market, in order to get higher market demand, the follower sells the product with lower selling price. The higher market demand produces a higher profit to the follower. That’s why, in this particular situation, the follower gets higher profit than the leader although the leader is more powerful.

Now, one question may arise whether all the results given in the propositions for the special case hold for the general case. Due to algebraic complexity, it is difficult to answer this question. However, we discuss this matter taking numerical examples in the next section.

3.5 Transfer payment through bargaining

To achieve the Pareto improvement for the players of the supply chain, in this subsection, we coordinate through transfer payment mechanism. Suppose that the three players of the supply chain are denoted by 1, 2 and 3 and their profits in two policies (say, (model I) and (model II)) are (\(\Pi ^I_1\), \(\Pi ^I_2\), \(\Pi ^I_3\)) and (\(\Pi ^{II}_1\), \(\Pi ^{II}_2\), \(\Pi ^{II}_3\)), respectively. We assume the profit of any one of the three players (say, player 1) in model II is higher than that in model I and profits of the remaining two players in model II are lower than those in model I. So, the profit gain by player 1 is \(\triangle \Pi _1 = \Pi ^{II}_1 - \Pi ^I_1\) and the profit loss by other two players are \(\triangle \Pi _2 = \Pi ^I_2 - \Pi ^{II}_2\) and \(\triangle \Pi _3 = \Pi ^I_3 - \Pi ^{II}_3\), respectively. If the increment of profit of player 1 is greater than the decrement of the total profit of the other two players, then player 1 can design a transfer payment mechanism to coordinate the channel members. Transfer payment (\(T_1\)) to player 2 lies between \(\triangle \Pi _2\) and \(\triangle \Pi _1 - \triangle \Pi _3\) i.e. \(T_1 \in (\triangle \Pi _2, (\triangle \Pi _1 - \triangle \Pi _3))\) and transfer payment (\(T_2\)) to player 3 lies between \(\triangle \Pi _3\) and \(\triangle \Pi _1 - \triangle \Pi _2\) i.e. \(T_2 \in (\triangle \Pi _3, (\triangle \Pi _1 - \triangle \Pi _2))\) such that \(T_1 + T_2 < \triangle \Pi _1\). Players’ profit shares depend on their bargaining powers. More bargaining power implies more profit share to the channel members. In the following, we discuss the bargaining model (Maiti and Giri 2017) following Aust and Buscher (2012) to share the extra profit \(\triangle \Pi\):

where \(\mu _m\), \(\mu _{r1}\) and \(\mu _{r2}\) are positive parameters such that \(\mu _m + \mu _{r1} + \mu _{r2} = 1\), and are called the bargaining powers of the manufacturer and the retailers, respectively; \(\triangle \Pi _i\)’s \((i = m, r1, r2)\) are profit shares to the manufacturer and the retailers, and \(U_i\)’s \((i = m, r1, r2)\) are the utility functions which can be taken as (Seyed Esfahani et al. 2011)

Now, the optimization problem becomes,

The optimal solution of this problem is

4 Numerical analysis

In this section, we perform a numerical study for the developed models to explore the answers of the following questions: How do the retailers’ different pricing strategies affect the equilibrium results and profitability of the channel members? Is there any economic inspiration for the retailers to choose Collusion rather than Nash strategy? Do the government subsidy and CTP help the manufacturer in decision making? We consider the following data sets which are closely related to Xu et al. (2016) and Yang and Xiao (2017) with some adjustments:

Set 1: \(a_1 = 500; a_2 = 300; \alpha = 0.6; \beta = 0.15; \gamma = 0.8; \tau = 0.35; k = 0.5; \theta _0 = 1.5; e_0 = 1; \psi = 0.2; c_m = 150; c_r = 70; c_e = 12; A_0 = 50; \lambda = 300; E = 300.\)

Set 2: \(a_1 = 500; a_2 = 450; \alpha = 0.6; \beta = 0.15; \gamma = 0.8; \tau = 0.35; k = 0.5; \theta _0 = 1.5; e_0 = 1; \psi = 0.2; c_m = 150; c_r = 70; c_e = 12; A_0 = 50; \lambda = 300; E = 300.\)

Set 3: \(a_1 = 500; a_2 = 500; \alpha = 0.6; \beta = 0.15; \gamma = 0.8; \tau = 0.35; k = 0.5; \theta _0 = 1.5; e_0 = 1; \psi = 0.2; c_m = 150; c_r = 70; c_e = 12; A_0 = 50; \lambda = 300; E = 300.\)

Set 4: \(a_1 = 500; a_2 = 550; \alpha = 0.6; \beta = 0.15; \gamma = 0.8; \tau = 0.35; k = 0.5; \theta _0 = 1.5; e_0 = 1; \psi = 0.2; c_m = 150; c_r = 70; c_e = 12; A_0 = 50; \lambda = 300; E = 300.\)

Set 5: \(a_1 = 500; a_2 = 700; \alpha = 0.6; \beta = 0.15; \gamma = 0.8; \tau = 0.35; k = 0.5; \theta _0 = 1.5; e_0 = 1; \psi = 0.2; c_m = 150; c_r = 70; c_e = 12; A_0 = 50; \lambda = 300; E = 300.\)

Here, Set 1 and Set 2 represent the situation where retailer 1 has greater basic market than retailer 2, and the basic market for retailer 2 in Set 2 is higher than that in Set 1. Set 3 distinguishes from other Sets by making the same basic market for the two retailers. Set 4 and Set 5 are taken by considering that the retailer 2 has greater basic market than retailer 1, and the basic market for retailer 2 in Set 5 is higher than that in Set 4. We have checked all the conditions which are necessary for the existence and uniqueness of the optimal solution. For example, for the centralized policy with the numerical data of Set 2, the principle minors are \(|M_1| = - 2 \alpha = - 1.2 < 0,~ |M_2| = 4 (\alpha ^2 - \beta ^2) = 1.35 > 0\) and \(|H| = - 795.248 < 0\). It clearly shows that the Hessian matrix is negative definite for the chosen data set. The condition \(\lambda = 300 > \max \{6.384, 7.48513\}\) also holds. We use Mathematica 9.0 software for derivation of the optimal results following the sequence of events given in Fig. 2. Optimal results of the proposed models for each numerical example are presented in Table 3.

From Table 3, we note that the centralized policy gives better performance than other policies as usual. Since this policy is free from double-marginalization effect, the customers get higher green product in comparatively lower prices. Higher greening level and lower selling prices increase the market demand. As a result, the total profit of the whole supply chain increases. While considering the decentralized policies, we note that the Nash behavior of the retailers is profitable for the manufacturer and the whole supply chain, but the behavior which is beneficial to the retailers depends on the basic market of the retailers. The reason behind this type of outcome is that, when the retailers work independently (i.e. in Nash behavior), they sell the higher green product with lower selling prices to get competitive advantage of the market. The higher green product helps the manufacturer to get a higher government subsidy. But when they work jointly (i.e. in Collusion behavior), there is no competition between them. So, they decide to sell a lower green product with a higher selling price, which decreases the market demand and government subsidy to the manufacturer. Through higher selling prices, the retailers may or may not manage to get higher profit, but it definitely hurts the manufacturer. Again, when they play the Stackelberg game between them, they sell the comparatively higher green product at a lower selling price than that in case of Collusion behavior. It gives a slightly higher profit to the manufacturer than that in case of Collusion behavior, but it may hurt one of the retailers. It is interesting to note that the retailer with a higher basic market charges higher selling price without any hesitation. When they face the same basic market, they sell their products at the same price in case of Nash and Collusion but when they play the Stackelberg game between them, the rival sells the product with a lower selling price. That’s why profit becomes higher. Hence‚ it is better to be a follower than a leader for the retailers when they face the same basic market. Thus, from Table 3, we have the following insights on wholesale price, selling prices, greening level, and profitability of the manufacturer and the retailers: (1) The wholesale price of the product does not follow the pattern similar to the special case. In case of different basic markets, the variation of the wholesale price depends on the basic market parameter. Generally, the manufacturer sets a higher wholesale price when the retailers make their decisions jointly but sometimes the Stackelberg game between them forces the manufacturer to set a higher wholesale price. (2) Similar to the special case, for the general case, the duopolistic retailers set higher selling prices in case of Collusion behavior while, in case of Nash behavior, they demand lower selling prices. (3) The greening level of the product does not depend on the market size; it is always higher in case of Nash behavior and lower in case of Collusion behavior. A higher market size influences the manufacturer to produce a higher green product. (4) Similar to the special case, the duopolistic retailers’ Nash behavior always promotes the manufacturer and the whole supply chain through improving the profits. The profit of the manufacturer is more than twice the total profit of the retailers. So, being a Stackelberg leader, the manufacturer should try to find out a way that will induce the retailers to work in Nash behavior. (5) Although Nash behavior is profitable to the manufacturer and the whole supply chain, it is not beneficial for the retailers. Moreover, Collusion behavior of the retailers always does not make higher profit to both the retailers. It is not favorable to the retailer with lower value of \(a_i/\alpha\), as it produces a lower profit to that retailer. The retailer with a higher basic market gets higher profit. This insight will help the retailers to decide proper selling prices before agreeing to work jointly. (6) When the duopolistic retailers play the Stackelberg game, the leader gains higher profit only when the basic market to the leader is higher than the rival. Due to this reason, the leader gets a lower profit than the rival when they play the Stackelberg game and face the same basic market.

Table 4 represents the optimal results for data Set 2 when the government does not offer any subsidy, and both the government subsidy and carbon cap do not play any role in the supply chain. For the first case, the manufacturer is forced to set a higher wholesale price for the product with a lower greening level in order to maintain profitability. Although the wholesale price increases, due to lower green product, the customers refuse to buy the product with higher selling price. So, retailers have to reduce the selling prices. In the centralized policy, due to joint decisions, they manage to sell the lower green product with a slightly higher selling price. In the decentralized policies, as the greening level decreases, the market demand also decreases. So, the profits of the manufacturer, retailers, and the whole supply chain decrease in all policies. Due to no government subsidy and no cap on emission for the second case, the manufacturer can produce lower green product and sell it at a lower wholesale price. As a result, the retailers also set lower selling prices to hold their markets. When CTP occurs, the manufacturer can emit less and earn some revenue through emission trading. In that case, the profit of the manufacturer is higher than that in the case where CTP does not occur. In the second case, the rate of decrement of the wholesale price is slightly higher than those of selling prices. So, the profits of the retailers are higher in this case than those in the first case. Therefore, a government subsidy to the manufacturer and CTP play important role in sustainable development.

From Tables 3 and 4, it can be noted that the centralized policy outperforms the other policies. Retailers’ Nash behavior among the decentralized policies gives better result from the viewpoint of the whole supply chain. For the manufacturer, the retailers, the customers, and the whole supply chain, the model with both the governmental intervention and carbon cap are beneficial.

From all the aforementioned results, it can be seen that the duopolistic retailers’ Collusion behavior is only helpful to the retailers under certain conditions but their Nash behavior is beneficial to both the manufacturer and the whole supply chain. As the manufacturer produces higher green product in Nash behavior, s/he can get higher subsidy and profit in this policy. So, from the environmental viewpoint, it is necessary for the manufacturer to design a transfer payment mechanism to achieve Pareto improvement of all members in the supply chain. It is necessary for this mechanism that, the increment in profit of the manufacturer must be greater than the decrement in total profit of the retailer 1 and retailer 2. Comparing Nash and Collusion behaviors for Set 2, we note that the profit of the manufacturer is increased by 13,362.7 (from 96,162.30 to 109,525.0), whereas the profit of the retailer 1 is decreased by 630.2 (from 28,117.7 to 27,487.5) and that of retailer 2 is decreased by 207.7 (from 19,005.4 to 18,797.7). So, the increment in profit of the manufacturer is greater than the decrement in total profit of the retailer 1 and retailer 2. Thus, the transfer payment \(T_1\) to the retailer 1 is such that \(T_1 \in (630.2, 13{,}155.0)\) and the transfer payment \(T_2\) to the retailer 2 is such that \(T_2 \in (207.7, 12{,}732.5)\). It is necessary that \(T_1 + T_2 < 13{,}362.7\). Supply chain members’ profit shares depend on their bargaining powers and risk attitudes. As the manufacturer is the leader, we consider the bargaining power (\(\mu _m\)) of the manufacturer as \(\mu _m = 0.5\) and bargaining powers of the retailers as \(\mu _{r1} = \mu _{r2} = 0.25\). Also, as the decrement in profit of the retailer 2 is higher, risk attitudes of the manufacturer and the retailers are taken as \(\lambda _m = 1.1,~ \lambda _{r1} = 1.8\) and \(\lambda _{r2} = 2.0\). Then profit shares to the manufacturer and the retailers are obtained as 4592.79, 3757.74 (\(\in T_1\)), and 4175.27 (\(\in T_2\)), respectively.

5 Sensitivity analysis

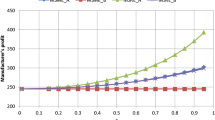

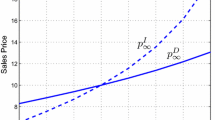

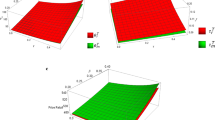

In this section, we discuss the sensitivity of some key model-parameters to investigate the effect of those parameters on the optimal results. We change the value of one parameter at a time and keep other parameter-values unchanged. Here, we consider the parameter-values given in data Set 2. Tables 5 and 6 represent the effect of green investment cost coefficient \(\lambda\) and that of the adjustment factor k, respectively on the optimal decisions in all policies, and Figs. 3 and 4 represent the sensitivity of the parameters \(\lambda\) and k, respectively on the profitability of the channel members. Figure 5 represents the joint effect of green level floor \(\theta _0\) and emission cap E on the total profit of the supply chain.

It is obvious that a higher value of \(\lambda\) has negative effect on the greening level of the product i.e. if \(\lambda\) increases, the greening level of the product decreases. The reason behind this result is that when \(\lambda\) increases, the green innovation related cost also increases. In order to maintain profit intact, the manufacturer has no option without reducing the greening level of the product. Therefore, for higher value of \(\lambda\), the greening level of the product will be lower. Table 5 shows that for lower values of \(\lambda\), the greening level decreases rapidly. As a higher value of \(\lambda\) lowers the greening level of the product, the manufacturer gets lower government subsidy, which may affect its profitability and this forces the manufacturer to increase the wholesale price of the product.

In the centralized policy, since there is a single decision-maker, the selling price of the product increases. However, in other policies, the customers refuse to buy the lower green product at a higher price. So, the retailers decrease the selling prices to increase the demand and keep the profit intact. For a lower value of \(\lambda\), as the greening level changes drastically, the selling prices also decrease faster. When the value of \(\lambda\) increases, the rate of decrease becomes slower. As the manufacturer charges a higher wholesale price for a lower green product, and a lower green product causes lower government subsidy, the profit of the manufacturer decreases. Although the selling prices are lower, due to lower green product, the demand at the retailers’ end decreases. As a result, the profit of each retailer decreases. Hence, the overall profit of the supply chain decreases (Fig. 3).

From Table 6 we note that the adjustment factor has a positive impact on the greening level and it can improve the greening level rapidly. A higher value of the greening level helps the manufacturer to get more government subsidy and so s/he can decrease the wholesale price. The rate of decrement of the wholesale price is slightly higher in Nash case. In the centralized policy, the higher greening level of the product helps the decision-maker to obtain higher government subsidy. So, the selling prices of the product decrease as k increases. Due to the improved greening level of the product, the retailers can increase the selling prices up to a certain level of k. After that, although the greening level increases with k, the selling prices of the product decrease. This result is similar to that of Yang and Xiao (2017). The reason behind this result is that higher selling prices of the product may decrease the market demand and this may harm the profit of the retailers. So, the retailers cannot increase the selling prices infinitely with the greening level; they have to decrease the selling prices of the product after a certain level. Therefore, under strong governmental intervention, the conflict between the selling prices and the greening level of the product tends to reduce. This shows that increasing the adjustment factor is beneficial to both customers and the environment. An improved greening level and lower selling prices of the product increase the market demand, which increases the profits of the manufacturer, the retailers, and the whole supply chain. The rate of increment of the retailers’ profit is higher than those of the manufacturer and the whole supply chain (Fig. 4). From this outcome, one can easily comment that even if government subsidy is given to the manufacturer, with the issue of higher greening level with higher adjustment factor, the retailers actually get more profit.

Among the four decentralized policies, as the total profit of the supply chain is higher in Nash policy and lower in Collusion policy, we consider the joint effect of green level floor \(\theta _0\) and carbon cap E on the total profit of these two policies and the centralized policy in Fig. 5. As the green level floor increases, the greening level of the product also increases. As a result, the market demand increases. The total profit of the supply chain increases as the green level floor increases up to a certain value. After that, although the green level floor increases, the total profit of the supply chain begins to decrease. The reason behind this result is that up to a certain level of the green level floor, the increased profits as a result of increasing customer demand outweigh the green investment costs. After that, an increase in retail price due to higher green product reduces the market demand. Again, the manufacturer has to invest more money to produce the higher greening product. This reduces the profit of the manufacturer, retailers, and the whole supply chain. A carbon cap also has a positive impact on the total profit of the supply chain. As the carbon cap increases, the manufacturer gets the license to emit more and produce more products. Due to higher production, the selling prices of the product become lower, which increase the market demand. A higher market demand improves the profits of the manufacturer, the retailers, and the whole supply chain. But due to environmental issues, the manufacturer should produce higher green product, and to do so, the government should lower carbon cap.

6 Managerial implications

In this section, we present some significant managerial implications for the supply chain under consideration. From the discussions of the numerical results given above, we have the following important observations:

-

1.

Green innovation investment cost has a negative impact on the greening level and profits of the supply chain members and the whole supply chain.

-

2.

A higher value of adjustment factor not only increases the greening level of the product, but also decreases the selling prices of the product. This can reduce the channel conflict between the greening level and the selling price. A higher value of the adjustment factor becomes beneficial to the manufacturer, the retailers, and the customers too. This outcome is similar to the result of Yang and Xiao (2017).

-

3.

The government should set a higher value of green level floor to promote green product development as it has a positive impact on the greening level of the product.

-

4.

Profits of the manufacturer and the whole supply chain become higher when the retailers work independently than those of the case when they work cooperatively or they play the Stackelberg game between them. But retailers can get higher profits only when they agree to work cooperatively, and the difference between their basic markets is sufficiently low. The retailer with a larger basic market can get higher profit.

-

5.

In the case of the same basic market, if the retailers play the Stackelberg game, the follower gets higher profit. So, for the retailers, it is beneficial to become a follower than leader when the basic market remains the same.

-

6.

When the retailers work in Collusion scenario, they charge higher selling prices than other scenarios. When they work in Nash scenario, the opposite situation occurs. This result is similar to the result of Yang and Zhou (2006).

Firstly, the retailers get higher profit when they work cooperatively, and the difference between their basic markets is sufficiently low but their conflicting (Nash) situation is beneficial to the manufacturer, the customers, and the whole supply chain. If a mechanism (here transfer payment mechanism) is developed in which the retailers always agree to work independently, it will be beneficial. Secondly, although a higher value of the green level floor increases the greening level of the product, it affects the profit of the manufacturer. So, a green investment cost sharing contract can encourage the manufacturer to undertake green manufacturing. Thirdly, the nonoccurrence of governmental intervention and CTP decrease the greening level and increase the selling prices of the product. The government sector should discuss about the awareness of environmental issues (GHG emissions, global warming) so that the manufacturer and retailers can agree to obey the governmental intervention and CTP. Lastly, in order to address the environmental issue, a comparatively high adjustment factor and green level floor should be set by the government to motivate the green innovation without worrying about the profit of the supply chain. A higher level of information sharing also helps to increase the overall profit.

7 Conclusions and future research directions

In today’s competitive business environment, many manufacturing companies consider the greening level of the product as an important factor due to the growing environmental awareness of consumers, and there are many retailers for selling these products. Due to the presence of multiple retailers in the market, there is competition among them. Keeping this in mind, this paper presents a two-echelon CLSC model consisting of one manufacturer and two competing retailers. The centralized and manufacturer-led decentralized policies are developed. Further, the manufacturer-led decentralized policy is studied under retailers’ different strategies such as Collusion, Nash and Stackelberg game policies under governmental intervention and CTP to find the optimal selling prices and greening level of the product. For analytical comparison of the optimal results, a special case is considered in which the retailers face the same basic market. A transfer payment mechanism is developed so that the channel members can achieve Pareto improvement. From the analytical comparison and numerical study, we have the following observations which are also the answers with regard to the questions prescribed in the introduction section: (1) Among the three different behaviors of the retailers, the Nash behavior is beneficial to the customers, the manufacturer, and the whole supply chain but Collusion behavior is beneficial to the retailers only when the difference between their basic markets is small enough. (2) When both the government subsidy and carbon cap are considered, the policy becomes profitable to all the channel members. (3) In case of the retailer-led Stackelberg game, the leader cannot always get higher profit; they can get a higher profit only when the basic market is higher. If the basic market remains the same, it is beneficial to be follower rather than leader.

Although this work is well-sustained by the literature and it integrates governmental subsidy and carbon cap, similar to other works, there are some limitations due to some assumptions which can be relaxed in future research. In this paper, we have assumed deterministic demand. One can extend this work by assuming stochastic demand. We have assumed only manufacturer-led decentralized policy. Consideration of other decentralized policy can be an appropriate extension of this work. One can also use different types of contract for supply chain coordination. We have considered a single manufacturer and two competing retailers. So, consideration of multiple manufacturers, multiple retailers, or multi-period scenarios would be useful for future study.

Notes

Emission Trading Scheme: A Brief Overview and Indian Perspective. On February 7, 2015, By Hariharan.

References

Aust G, Buscher U (2012) Vertical cooperative advertising and pricing decisions in a manufacturer-retailer supply chain: a game-theoretic approach. Eur J Oper Res 223(2):473–482

Cao K, Xu X, Wu Q, Zhang Q (2017) Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J Clean Prod 167:505–513

Choi TM, Li Y, Xu L (2013) Channel leadership, performance and coordination in closed loop supply chains. Int J Prod Econ 146(1):371–380

Dobos I (2005) The effects of emission trading on production and inventories in the Arrowe–Karlin model. Int J Prod Econ 93:301–308

Du S, Zhu L, Liang L, Ma F (2013) Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy 57:61–67

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135(2):568–583

Giri BC, Chakraborty A, Maiti T (2017) Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J Manuf Syst 42:104–123

Giri BC, Mondal C, Maiti T (2018) Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J Clean Prod 190:822–837

Guo D, He Y, Wu Y, Xu Q (2016) Analysis of supply chain under different subsidy policies of the government. Sustainability 8:1290. https://doi.org/10.3390/su8121290

He P, He Y, Xu H (2019) Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. Int J Prod Econ 213:108–123

Hanssens DM, Parsons LJ, Schultz RL (2003) Market response models: econometric and time series analysis, vol 12. Springer, Berlin

Huang H, Ke H, Wang L (2016) Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly retailers. Int J Prod Econ 178:12–21

Jafari H, Hejazi SR, Rasti-Barzoki M (2016) Pricing decisions in dual-channel supply chain including monopolistic manufacturer and duopolistic retailers: a game-theoretic approach. J Ind Compet Trade 16:323–343

Jamali MB, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043

Krishnan V, Lacourbe P (2011) Designing product lines with higher aggregate environmental quality. Available at SSRN 1744301

Kurata H, Yao DQ, Liu JJ (2007) Pricing policies under direct vs indirect channel competition and national vs. store brand competition. Eur J Oper Res 180:262–281

Li B, Zhu M, Jiang Y, Li Z (2016) Pricing policies of a competitive dual-channel green supply chain. J Clean Prod 112:2029–2042

Li B, Chen W, Xu C, Hou P (2018) Impacts of government subsidies for environmental-friendly products in a dual-channel supply chain. J Clean Prod 171:1558–1576

Liu S, Xu Z (2014) Stackelberg game models between two competitive retailers in fuzzy decision environment. Fuzzy Optim Decis Mak 13:33–48

Luo R, Fan T (2015) Influence of government subsidies on carbon reduction technology investment decisions in the supply chain. IEEE. https://doi.org/10.1109/ICSSSM.2015.7170143

Madani SR, Rasti-Barzoki M (2017) Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: a game theoretic approach. Comput Ind Eng 105:287–298

Maiti T, Giri BC (2017) Two-way product recovery in a closed-loop supply chain with variable markup under price and quality dependent demand. Int J Prod Econ 183:259–272

Mitra S, Webster S (2008) Competition in remanufacturing and the effects of government subsidies. Int J Prod Econ 111:287–298

Modak NM, Panda S, Sana SS (2016) Two-echelon supply chain coordination among manufacturer and duopolies retailers with recycling facility. Int J Adv Manuf Technol 87:1531–1546

Mondal C, Giri BC (2020) Pricing and used product collection strategies in a two-period closed-loop supply chain under greening level and effort dependent demand. J Clean Prod 265:121335. https://doi.org/10.1016/j.jclepro.2020.121335

Mondal C, Giri BC, Maiti T (2020) Pricing and greening strategies for a dual-channel closed-loop green supply chain. Flex Serv Manuf J 32(3):724-761

Pang Q, Li M, Yang T, Shen Y (2018) Supply chain coordination with carbon trading price and consumers’ environmental awareness dependent demand. Hindawi Math Prob Eng Article ID 8749251. https://doi.org/10.1155/2018/8749251

Pujari D (2006) Eco-innovation and new product development: understanding the influences on market performance. Technovation 26(1):76–85

Qi Q, Wang J, Bai Q (2017) Pricing decision of a two-echelon supply chain with one supplier and two retailers under a carbon cap regulation. J Clean Prod 151:286–302

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manag Sci 50(2):239–252

Seyed Esfahani MM, Biazaran M, Gharakhani M (2011) A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer-retailer supply chains. Eur J Oper Res 211(2):263–273

Song JP, Leng MM (2012) Analysis of the single-period problem under carbon emission policies. Int Oper Res Manag Sci 176(2):297–312

Wang SD, Zhou YW, Min J, Zhong YG (2011) Coordination of cooperative advertising models in a one-manufacturer two-retailer supply chain system. Comput Ind Eng 61:1053–1071

Wu CH, Chen CW, Hsieh CC (2012) Competitive pricing decisions in a two-echelon supply chain with horizontal and vertical competition. Int J Prod Econ 135:265–274

Xiao T, Qi X (2008) Price competition, cost and demand disruptions and coordination of a supply chain with one manufacturer and two competing retailers. Omega 36:741–753

Xu J, Chen Y, Bai Q (2016) A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J Clean Prod 135:42–56

Yang D, Xiao T (2017) Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J Clean Prod 149:1174–1187

Yang SL, Zhou YW (2006) Two-echelon supply chain models: considering duopolistic retailers’ different competitive behaviors. Int J Prod Econ 103:104–116

Yi P, Huang M, Guo L, Shi T (2016) Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. J Clean Prod 137:1393–1405

Zhang X (2014) Reference-dependent electric vehicle production strategy considering subsidies and consumer trade-offs. Energy Policy 67:422–430

Zhang CT, Wang HX, Ren ML (2014) Research on pricing and coordination strategy of green supply chain under hybrid production mode. Comput Ind Eng 72:24–31

Zhao J, Tang W, Wei J (2012) Pricing decision for substitutable products with retail competition in a fuzzy environment. Int J Prod Econ 135:144–153

Zhu Q, Dou Y (2011) A game model for GSC management based on government subsidies. J Manag Sci China 14(6):86–95

Zhu Q, Sarkis J, Geng Y (2005) Green supply chain management in China: pressures, practices and performance. Int J Oper Prod Manag 25(5):449–468

Acknowledgements

The authors are sincerely thankful to the Editor, the Associate Editor and anonymous reviewers for their helpful comments and suggestions on the earlier version of the manuscript. The funding was provided by University Grants Commission (F.No. 16-9(June 2017)/2018(NET/CSIR)) and Council of Scientific and Industrial Research (Grant Number 25(0282)/18/EMR-II).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

The profit function for the manufacturer is given by

The profit function for the retailer i is given by

So, the profit function of the centralized policy is given by

Now,

The corresponding Hessian matrix is given by

Now, the leading principle minors are \(M_1 = - 2 \alpha < 0\), \(M_2 = 4 (\alpha ^2 - \beta ^2) > 0\) and \(|H| = 4 (\alpha + \beta ) [\Psi _3^2 - 2 \lambda (\alpha - \beta )]< 0\) if \(\lambda > \frac{\Psi _3^2}{2 (\alpha - \beta )}\). Thus‚ the Hessian matrix is negative definite if

\(\lambda > \max \{2 \gamma \Psi _1, \frac{\Psi _3^2}{2 (\alpha - \beta )}\}\). Using the first order conditions for optimality i.e. \(\frac{\partial \Pi ^{J}}{\partial p_1}=0, \frac{\partial \Pi ^{J}}{\partial p_2}=0\) and \(\frac{\partial \Pi ^{J}}{\partial \theta }=0\), the optimal values of the decision variables can be obtained as given in Proposition 1.

1.2 Proof of Proposition 2

Solving the equations \(\frac{\partial \Pi _{r}}{\partial p_1}=0\) and \(\frac{\partial \Pi _{r}}{\partial p_2}=0\) simultaneously, we get the optimal solution as

Substituting these values in the manufacturer’s profit function (1), we get the profit function of the manufacturer as follows:

Now,

The corresponding Hessian matrix of the manufacturer’s profit function is given by

Now, \(\frac{\partial ^2\Pi _m^{C}}{\partial \theta ^2}\) will be negative if \(\lambda > \gamma \Psi _1\) and \(|H| = 4 \lambda (\alpha - \beta ) - \Psi _3^2 > 0\) if \(\lambda > \frac{\Psi _3^2}{4 (\alpha - \beta )}\).

Therefore, the Hessian matrix corresponding to the manufacturer’s profit function will be jointly concave w.r.t w and \(\theta\) if \(\lambda > \max \{\gamma \Psi _1, \frac{\Psi _3^2}{4 (\alpha - \beta )}\}\).

Using the first order conditions for optimality i.e. \(\frac{\partial \Pi _m^{C}}{\partial w}=0\) and \(\frac{\partial \Pi _m^{C}}{\partial \theta }=0\), the optimal decisions of the manufacturer can be obtained and putting these decisions in retailers’ profit functions the optimal decisions of the retailers can also be obtained, which are given in Proposition 2.

1.3 Proof of Proposition 6

1.4 Proof of Proposition 7

Rights and permissions

About this article

Cite this article

Mondal, C., Giri, B.C. Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper Res Int J 22, 859–894 (2022). https://doi.org/10.1007/s12351-020-00596-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-020-00596-0