Abstract

The current sovereign debt crisis in the Euro-Zone is a cause of major concern for European insurers. Especially the fears about increased sovereign credit risk in Italy—leading to higher risk premia—may result in major difficulties because many insurance companies have invested in Italian government bonds. Therefore, this paper examines the relationship between German and Italian government bond yields using techniques of cointegration analysis. Furthermore, implications for insurance companies and regulators (focussing on Solvency II) are discussed.

Zusammenfassung

Die aktuelle Staatsschuldenkrise in der Euro-Zone löst große Bedenken in der europäischen Versicherungswirtschaft aus. Vor allem die Sorgen bezüglich eines größeren Kreditrisikos des Staates Italien – welche zu erhöhten Risikoprämien führen – können Probleme bei Versicherern auslösen, da viele Unternehmen italienische Staatsanleihen gekauft haben. Folglich betrachtet diese Studie den Zusammenhang zwischen den Renditen deutscher und italienischer Papiere. Dabei werden Techniken der Kointegrationsanalyse genutzt. Zudem erfolgt die Diskussion der Implikationen der Ergebnisse für die Versicherungswirtschaft und für den Regulator (unter besonderer Berücksichtigung von Solvency II).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The introduction of the Euro has led to a process of interest rate convergence among government bond yields in EMU member states (see, for example, Laopodis 2008 and Jenkins and Madzharova 2008). The current sovereign debt crisis in the Euro area quite clearly has affected the relationship among government bond yields in the different countries. While at first there were only worries about sovereign credit risk in some smaller EMU member states (namely Greece, Portugal and Ireland) now the sovereign debt crisis also has started to affect the market for Italian government bonds. Given that many European insurers have invested in these bonds it is important for the insurance industry to have a better understanding of how financial markets price sovereign credit risk. Moreover, regulators should also be interested because at the moment it is not clear whether Solvency II will handle sovereign credit risk in an appropriate way. Insights into this issue will be gained by examining whether there has been structural change in the relationship between German and Italian government bond yields.

The paper is structured as follows: Sect. 2 gives a short review of the relevant literature. The 3rd section tries to clarify the research question, discusses methodological issues and introduces the data examined. The empirical evidence is presented in Sect. 4. Section 5 contains some thoughts about implications for insurance companies and regulators focussing on Solvency II. Then the 6th section concludes.

2 Literature review

There are numerous empirical studies examining the linkages among various interest rates in the European fixed income market. Therefore, it would be an impossible task to adequately summarize all relevant papers. Many observers (as will be discussed later on) have argued that the introduction of the Euro has eliminated the relevance of exchange rate risk for investors interested in buying government bonds issued by EMU member countries other than their home country. Consequently, the new currency regime established in 1999 has obviously increased the integration of government bond markets within the Euro-Zone. Thus, it is hardly a surprise that there are many empirical research efforts trying to test the hypothesis that the new currency regime in Europe has strengthened the convergence among interest rates in the EMU countries. Employing techniques of cointegration analysis to be discussed in more detail in the Sects. 3 and 4 has become very popular trying to test this hypothesis.

Pigott (1994) has provided an excellent overview of issues related to international interest convergence and has also discussed the earlier empirical evidence documented in numerous papers. Therefore, we will focus on more recent research efforts. However, a few “older” studies simply have to be mentioned. Most importantly, Lund (1999) has noted that the introduction of the Euro affected interest rates well before 1999 arguing that a binding time table for the introduction of the common currency was agreed upon already in December 1991. In this study he has tried to calculate “EMU probabilities” for various European countries examining yield spreads to Germany. The paper has documented an almost 100 % probability of EMU membership for France and the Benelux countries since 1995 while the EMU probabilities for Italy, Spain, and Portugal seem to have been quite low until the second half of 1996. Some observers seem to believe that the Exchange Rate Mechanism (ERM) of the European Monetary System (EMS)—an exchange rate regime which could be interpreted as a de facto fixed exchange rate system for many European currencies with the German mark as an anchor—already should have led to an increased convergence of interest rates by reducing exchange rate risk. According to this theory (which is often called German Dominance Hypothesis) German government bond yields already should have massively influenced the development of interest rates in the other ERM countries before the advent of the European single currency.

The ERM was introduced in 1979. Testing the German Dominance Hypothesis has resulted in no clear picture. Hassapis et al. (1999), for example, have found almost no evidence indicating that the implementation of the ERM created a stronger link between interest rates in Germany and the other member countries. The Netherlands seem to be an exception; this is no surprise because there was a de facto fixed exchange rate among the Dutch guilder and the German mark in this period that somehow should have led to an even stronger linkage between these two currencies than between the German mark and the other ERM currencies. There are numerous similar studies. Kanas (1997), for example, also has shown that a special relationship between interest rates in Germany and the Netherlands seems to exist.

Other studies have reported less unfavorable results testing the German Dominance Hypothesis. Siklos and Wohar (1997), for example, have found at least some empirical evidence for interest rate convergence among ERM countries during certain periods of time. Moreover, Fountas and Wu (1998) have noted that structural change might be of relevance searching for interest rate convergence. The presence of structural breaks could bias cointegration tests in favor of accepting the hypothesis of no cointegration between the bond yields in Germany and other ERM members. They have reported evidence indicating that interest rate convergence in the period 1979 to 1995 has been a phenomenon of economic relevance finding cointegration with a structural break.

A very important study by Laopodis (2008) documenting an increase in the correlation of the returns on Euro government bonds after the introduction of the common currency has recently received quite a lot of attention. The author has examined the period December 1994 to July 2006 analyzing the MSCI total return 10 year government bond indices from a number of EMU countries. The study also has reported the existence of weak convergence using cointegration analysis identifying two groups of EMU countries. More specifically, besides of a core group of members (e.g., Germany and France) there also are some countries forming the periphery (for example Italy and Ireland). The bond markets of the EMU countries belonging to the periphery do not seem to be part of the whole systems long-term equilibrium. The study also documents that the US and European bond markets over time have become more strongly integrated. In fact, EMU interest rates seem to be uni-directionally Granger caused by US government bond yields. Jenkins and Madzharova (2008) have focused on data from Europe and have found cointegration among nominal interest rates in the Eurozone after the introduction of the Euro. Interestingly, cointegration does not seem to be a relevant phenomenon among real interest rates in the EMU.

Following Pigott (1994) it may also be helpful to take a more macroeconomic perspective. Most importantly, according to Fisher (1907) a direct link between interest rates and inflation expectations should exist. With regard to the so-called Fisher effect there is an excellent literature survey by Cooray (2003). Thus, we simply want to note that while the Fisher effect probably is no perfect description of the reality there is a lot of empirical evidence showing that a positive relationship between nominal interest rates and inflation rates seems to exist in many countries. In fact, inflation rates can be seen as major driver of changes to interest rates. Consequently, inflation convergence and nominal interest rate convergence certainly ought to be related phenomena.

Camarero et al. (2000), for example, have noted that the inflation rates in France have shown stronger convergence tendencies to German inflation rates than in Italy or Spain. However, there are catching-up processes in these two countries. Busetti et al. (2007) have argued that there is empirical evidence supporting the convergence hypothesis examining the period 1980 to 1997. The ERM may have strengthened this process. Interestingly, their study seems to indicate that inflation differentials among EMU countries have increased again after the introduction of the Euro. Moreover, Holmes (1998) has argued that the convergence of inflation in the ERM countries could be a part of a world-wide rather than a purely European phenomenon. Basse (2006), for example, has noted that the German move to introduce flexible exchange rates in 1973 has not completely isolated the macroeconomic price level in Germany from shocks originating in the US. Additionally, Siklos and Wohar (1997) have argued that there are indubitable signs for inflation convergence on a global level examining data from a number of countries (e.g., Canada, France, Germany and the US).

3 Research question, methodology and data

The introduction of the Euro clearly has affected the relationship between German and Italian government bond yields (see Fig. 1). The research question addressed here requires a method to measure convergence among interest rates. Becker and Hall (2007) have argued convincingly that cointegration is a useful operating definition of convergence for non-stationary time series. Given that interest rates are generally assumed to be variables with a grade of integration of one, government bond yields in two countries should accordingly follow common stochastic trends when convergence is a relevant economic phenomenon. Camarero et al. (2002) have noted that there are two different types of convergence of interest rates—namely catching-up and long-run convergence. Long-run convergence describes a very close relationship between the variables examined and implies the absence of a time trend in the deterministic process. Given that there may be some catching-up processes at play in the time period examined here we allow for deterministic trends in the cointegration tests.

This paper will follow the approach suggested by Basse et al. (2011) trying to detect regime changes among interest rates in different countries. More specifically, after having estimated the vector error correction model (VECM) this study will test for structural change in the cointegration relationship among government bond yields in Germany and Italy to identify regime shifts that could be a signal for market participants assigning a higher credit risk to Italian government bonds by demanding an increased risk premium. We examine 10 year bond yields from both countries. In order to avoid problems with structural breaks due to the introduction of the Euro the sample analyzed is 1999/1–2011/12. The data (monthly data, end of period) is taken from Bloomberg. Unit root tests (see the result of the PP tests documented in Table 1) do indicate that the two time series are non-stationary variables integrated of order one. This finding is not a surprise because many studies have documented similar results examining long-term interest rates (see, for example, Siklos and Wohar 1997 and Jenkins and Madzharova 2008).

In order to test for interest rate convergence cointegration analysis is employed. The concept of cointegration describes a close long-run equilibrium among variables. Becker and Hall (2007)—as already noted—have argued that cointegration is a useful operational definition of convergence for non-stationary time series. Testing for cointegration we employ the approach suggested by Johansen (1991). This test is based on the econometric technique of vector autoregressions (VAR). More specifically, the popular trace test is employed. Summing up, we follow Basse et al. (2011) and—first of all—are interested in analyzing whether there is cointegration among German and Italian government bond yields. When cointegration is found to exist, we plan to search for structural breaks in the cointegration relationship. This would be a sign for changes to risk premia. While we do not use the “classical” event study methodology we will also plan to consider timing issues. More specifically—if structural breaks should be detected—we want to identify when structural change has occurred. In fact, the approach of comparing the exact timing of structural change (if existing) can offer an interesting perspective on interest rate convergence (see Basse et al. 2011).

4 Empirical evidence

As already discussed, the concept of cointegration—implying the existence of a long-term equilibrium relationship among the variables examined—is of central importance for this study because cointegration is commonly seen to be a useful operational definition of convergence for non-stationary time series (see Becker and Hall 2007 and Basse et al. 2011). Cointegration tests are known to have some problems with structural breaks (e.g., Gregory and Hansen 1996 and Zietz 2000). In fact, Fountas and Wu (1998) have argued that the presence of structural breaks may bias cointegration tests in favor of accepting the hypothesis of no cointegration between government bond yields in Europe. Given that the EMU sovereign debt crisis most probably should have caused structural change affecting EMU government bond markets due to an increased default risk of the southern member states, the results of the Johansen cointegration test reported in Table 2 could be interpreted as a surprise because this test seems to indicate quite clearly that there is evidence for the existence of a cointegration relationship between 10 year government bonds yields in the two countries.

The presence of a deterministic trend is assumed. The critical values of Doornik (1998) are used and the lag length of 3 is selected using the Hannan-Quinn information criterion. Finding cointegration among the two variables does not necessarily imply that there was no structural change. Consequently, the VECM has to be estimated. Then, tests for structural breaks in the cointegration relationship have to be employed. In order to preserve space no details on the testing procedure for structural change in VECMs are discussed here (see, for example, Hansen and Johansen 1999 and Lütkepohl 2004). We have used a significance level of 5 % for the Tau stability test.

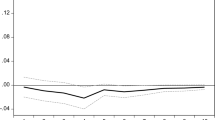

The Tau stability test reported in Fig. 2 identifies two clear structural breaks. At this point, timing issues are of central importance. The first structural break coincides with the US sub-prime crisis and the resulting financial sector rescue programmes in Europe. These national rescue measures in response to the crisis already seem to have caused some thoughts about sovereign credit risk in the Euro area. The second break date identified by the test probably is a little earlier than most observers may have expected reading the financial press; this break point clearly is associated with the European sovereign debt crisis. It is not only a consequence of higher Italian sovereign credit risk in 2009 but can also be attributed to German interest rates falling due to the financial crisis (“flight to quality”—see Basse et al. 2011). In any case, the bond market seems to have anticipated at least some problems with Italy’s government budget at an early stage. This interesting result could be seen to be supportive for the efficient market hypothesis because German and Italian government bond yields have reflected new information about sovereign credit risk in a very timely manner according to the data examined here.

5 Consequences for European insurers

European insurance companies have invested strongly in government bonds issued by EMU member states. Given that the European insurance sector is at the moment facing a paradigm change in risk governance and solvency regulation that also is going to affect how risk mangers in the insurance industry have to treat government bonds it is of some importance to understand how German and Italian government bond yields are related. Phrased somewhat differently, Solvency II is to be introduced in 2013 (or even later) and will dramatically alter the industry’s risk management processes (see Arneth and Sauka 2008 and Basse and Friedrich 2008).

With regard to life insurers the key question which has to be answered is whether German long-term government bonds—because of lower credit risk—are better suited to neutralize interest rate risks inherent in the liabilities of European life insurers than Italian long-term government bonds. Answering this question with yes would challenge the current design of Solvency II because the new regulatory framework plans to treat all Euro governments bonds the same way in terms of solvency capital requirement calculations. More precisely, no EMU government bond is planned to be subject to a spread risk solvency capital provision. Given the current market environment there should be some doubts about a risk management approach that ignores sovereign credit risk.

Data are commonly seen to be a foundation of risk management (see Vishnu 2010 and Basse et al. 2011). Therefore, it is clearly helpful for risk managers to know whether there is any empirical evidence for structural changes affecting the EMU government bond market that could signal an increase of sovereign credit risk in some countries. Stated differently, given that bond markets (according to the empirical evidence documented above) seem to have been at least somewhat efficient detecting sovereign credit risk it could be asked, whether regulators and risk managers should not focus more strongly on the information provided by yield spreads among government bonds issued by different countries. Thus, it could be argued that regulators ought to rethink their approach of handling sovereign credit risk under Solvency II. Changing the perspective, the currently suggested new regulation could also be seen to give some room for regulatory capital arbitrage—which might be welcome in turbulent times (though, of course, internal risk management processes still would create some difficulties for insurance companies that plan to dramatically increase their exposure to Italy by buying government bonds).

6 Conclusion

There is clear evidence for the existence of structural breaks affecting the relationship among German and Italian government bond yields. The timing issues discussed above seem to suggest that this structural change is somehow linked to sovereign credit risk. While Solvency II turns a blind eye on intra EU sovereign credit risk, it apparently has become of some importance for the EMU government bond market. This is a noteworthy finding for regulators as well as for risk and asset managers in the European insurance industry. There are numerous consequences of the empirical evidence reported above. Solvency II as envisioned today could, for example, leave some room for regulatory capital arbitrage by investing in higher yielding Italian long-term bonds instead of German ones when trying to neutralize the interest rate risk inherent to the liabilities of life insurance companies in the Europe.

References

Arneth, S., Sauka, C.: Solvency II – Konsequenzen für das Kapitalanlagegeschäft der Versicherungen. Z. Gesamte Kreditwes. 61, 796–799 (2008)

Basse, T.: Floating exchange rates and inflation in Germany: are external shocks really irrelevant? Econ. Lett. 93, 393–397 (2006)

Basse, T., Friedrich, M.: Solvency II, asset liability management, and the European bond market—theory and empirical evidence. ZVersWiss 97, 155–171 (2008)

Basse, T., Friedrich, M., v.d. Schulenburg, J.-M.: The Greek debt crisis, structural change and sovereign credit risk: empirical evidence from cointegration analysis. Unpublished working paper (2011)

Becker, B., Hall, S.G.: Measuring convergence of the new member countries’ exchange rates to the Euro. J. Financ. Transform. 19, 20–25 (2007)

Busetti, F., Forni, L., Harvey, A., Venditti, F.: Inflation convergence and divergence within the European monetary union. Int. J. Cent. Bank. 3, 95–121 (2007)

Camarero, M., Esteve, V., Tamarit, C.: Price convergence of peripheral European countries on the way to the EMU: a time series approach. Empir. Econ. 25, 149–168 (2000)

Camarero, M., Ordónez, J., Tamarit, C.: Tests for interest rate convergence and structural breaks in the EMS: further analysis. Appl. Financ. Econ. 12, 447–456 (2002)

Cooray, A.: The Fisher effect: a survey. Singap. Econ. Rev. 48, 135–150 (2003)

Doornik, J.A.: Approximations to the asymptotic distributions of cointegration tests. J. Econ. Surv. 12, 573–593 (1998)

Fisher, I.: The Rate of Interest. Macmillan, New York (1907)

Fountas, S., Wu, J.-L.: Tests for interest rate convergence and structural breaks in the EMS. Appl. Financ. Econ. 8, 127–132 (1998)

Gregory, A.W., Hansen, B.E.: Residual-based tests for cointegration in models with regime shifts. J. Econom. 70, 99–126 (1996)

Hansen, H., Johansen, S.: Some tests for parameter constancy in cointegrated VAR-models. Econom. J. 2, 306–333 (1999)

Hassapis, C., Pittis, N., Prodromidis, K.: Unit roots and Granger causality in the EMS interest rates: the German dominance hypothesis revisited. J. Int. Money Financ. 18, 47–73 (1999)

Holmes, M.J.: Inflation convergence in the ERM: evidence for manufacturing and services. Int. Econ. J. 12, 1–16 (1998)

Jenkins, M.A., Madzharova, P.: Real interest rate convergence under the euro. Appl. Econ. Lett. 15, 473–476 (2008)

Johansen, S.: Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59, 1551–1580 (1991)

Kanas, A.: The monetary exchange rate model within the ERM: cointegration tests and implications concerning the German dominance hypothesis. Appl. Financ. Econ. 7, 587–598 (1997)

Laopodis, N.T.: “Government bond market integration within European Union“. Int. Res. J. Finance Econ. 19, 56–76 (2008)

Lund, J.: A model for studying the effect of EMU on European yield curves. Eur. Finance Rev. 2, 321–363 (1999)

Lütkepohl, H.: Vector autoregressive and vector error correction models. In: Lütkepohl, H., Krätzig, M. (eds.) Applied Time Series Economics, pp. 86–156. Cambridge University Press, Cambridge (2004)

Pigott, C.A.: International interest rate convergence: a survey of the issues and evidence. Q. Rev. - Fed. Reserve Bank New York 18, 24–37 (1994)

Siklos, P.L., Wohar, M.E.: Convergence in interest rates and inflation rates across countries and over time. Rev. Int. Econ. 5, 129–141 (1997)

Vishnu, S.: Enterprise friction—the mandate for risk management. J. Financ. Transform. 28, 14–18 (2010)

Zietz, J.: Cointegration versus traditional econometric techniques in applied economics. East. Econ. J. 26, 469–482 (2000)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Basse, T., Friedrich, M. & Kleffner, A. Italian government debt and sovereign credit risk: an empirical exploration and some thoughts about consequences for European insurers. ZVersWiss 101, 571–579 (2012). https://doi.org/10.1007/s12297-012-0208-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12297-012-0208-0