Abstract

This paper adopts the robust cross-correlation function methodology developed by Hong (J Econom 103:183–224, 2001) in order to test for volatility and mean spillovers between Greek long-term government bond yields and the banking sector stock returns of four Southern European countries, namely Greece, Portugal, Italy, and Spain. Its primary focus is on investigating the potential impacts of the recent European sovereign debt crisis. While most previous studies have focused on within-country causalities, we rather assess cross-country transmission effects. The presented results provide evidence of bidirectional volatility spillovers between Greek long-term interest rates and the banking sector equities of Portugal, Italy, and Spain that emerged during the European sovereign debt crisis. We also find significant unidirectional causality-in-mean from bank stock returns in Greece to Greek long-term bond yields during the crisis period as well as significant causality at the mean level from the bank equity returns in Portugal, Italy, and Spain to Greek bond yields.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the onset of the recent Greek sovereign debt crisis, bank managers and monetary authorities not only in Greece but also in neighboring countries such as Portugal, Italy, and Spain have become more cautious about the relationships between their bank stock returns and changes in Greek government bond yields. Their imminent concerns seem to stem from the fact that these neighboring countries hold considerable amounts of Greek sovereign bonds. In fact, according to the results of the stress test conducted by the European Banking Authority in July 2011, the exposure of banks in Greece, Portugal, Italy, and Spain to Greek sovereign debt amounts to 54.4, 1.4, 1.4, and 0.4 billion euro, respectively. This degree of exposure implies that even a moderate level of haircuts on these debts might cause significant losses in the banking sectors of those countries. This conclusion suggests that it is worthwhile investigating the potential causality between Greek government bond yields and the bank stock returns of these four Mediterranean countries.

Previous studies have shown that the causal linkage between bank stock returns and bond yields can display different directions and signs. Present value models imply that stock prices fall when long-term interest rates increase. Nonetheless, as Shiller and Beltratti (1992) contend, a positive relationship between stock prices and long-term interest rates can also exist when changes in interest rates carry information about the outlook for future dividends. Moreover, we can also consider the opposite causality, namely from stock returns to long-term interest rates. As Alaganar and Bhar (2003) argue, because stock markets have a forward-looking nature, current stock prices, especially those of the banking sectors whose profit levels can be closely related to interest rates, may reflect expectations about future interest rates.

Another stream of research has empirically analyzed the relationships between bank stock returns and interest rates. Earlier studies that typically employed a two-index model (i.e., interest rates and market factors) under the assumption of constant variance yielded mixed results in terms of the causality between them. Further, several studies have also contended that interest rates do not significantly affect the stock returns of financial institutions (e.g., Lloyd and Shick 1977; Chance and Lane 1980). By contrast, Flannery and James (1984) and Bae (1990) provide evidence of the negative impact of interest rates on returns on banking sector stocks. As Bae (1990) points out, a varied construction of the interest rate series may be one reason for such mixed results.

Moreover, recent studies of the relationship between interest rates and bank stock returns have assumed time-varying conditional variance. Based on this assumption, they have adopted different classes of the autoregressive conditional heteroskedastic (ARCH) models developed by Engle (1982) or the generalized autoregressive conditional heteroskedastic (GARCH) models proposed by Bollerslev (1986). Song (1994) was among the first to use an ARCH-type model in order to demonstrate that the time-varying risk measures of interest rates are incorporated in the pricing of U.S. banking sector stocks, while Elyasiani and Mansur (1998) employed a GARCH-in-mean (GARCH-M) model to identify the negative effects of long-term interest rates and their volatilities on both the means and the variances of U.S. bank stock returns. Tai (2000), using three different approaches including a multivariate GARCH-M model, confirms the significant impacts of interest rates, the world market, and exchange rate risks on U.S. bank stock returns. Using a multivariate GARCH model, Elyasiani and Mansur (2004) also find evidence of the significant influence of short-term and long-term interest rates and their volatilities on U.S. bank stock returns. Verma and Jackson (2008) extend that study by employing a multivariate exponential generalized autoregressive conditional heteroskedasticity (EGARCH) model in order to demonstrate the asymmetric influence of positive and negative interest rate changes on U.S. bank stock returns, indicating that bank equity returns are more sensitive to negative than positive changes in interest rates.

Another approach in the literature employs cross-correlation function (CCF) methodologies primarily to investigate short-term dynamics in the relationship between interest rates and bank stock returns. Alaganar and Bhar (2003) find support for a two-way information flow between the interest rates and financial sector returns of G7 countries by using the causality-in-mean and causality-in-variance tests suggested by Cheung and Ng (1996). One of the key advantages of this approach is that it can detect not only the direction of causality but also the leads and lags structure of causality at the variance as well as at the mean levels. It is important to analyze causality-in-variance because volatility contains useful data on information flows, as Ross (1989) points out. In addition, Engle et al. (1990) attribute the volatility movement of asset price changes to the time necessary for investors to process new information.

The present paper uses daily data from January 2007 to June 2011 in order to examine the causality-in-variance and causality-in-mean between long-term government bond yields in Greece and the banking sector stock returns of four Southern European countries, namely Greece, Portugal, Italy, and Spain. We thus extend the existing literature on the relationship between interest rates and bank stock returns in the following two directions. First, ours is one of the few studies that assess the two-way cross-border spillover of information flows between bond yields and bank stock returns. Most previous studies of this topic have investigated only within-country transmission effects. Indeed, we are among the first to study how the recent Greek sovereign debt crisis might affect the relationship between Greek long-term government bonds and the banking sector stocks in neighboring countries. Second, we use the CCF approach recently developed by Hong (2001). This methodology improves on Cheung and Ng’s (1996) model, which is constrained by weighting each lag uniformly, making no distinction between recent and distant cross-correlations. The results of our study are relevant not only for policymakers who intend to monitor and prevent cross-country spillover effects between sovereign bond yields and bank stock returns, but also for the bank managers and investors who manage the portfolios of banking sector stocks in the affected countries.

The remainder of the paper is organized as follows. The next section presents the empirical framework used in this study, followed by an explanation of our dataset in Section 3. Section 4 reports our findings from the causality tests, while Section 5 concludes.

2 Empirical framework

This paper employs the two-step CCF methodology proposed by Hong (2001). In the first step, we fit a univariate model to each data series, allowing for a time-varying conditional mean and variance. Compared with the research designs of Elyasiani and Mansur (1998) and Alaganar and Bhar (2003), who apply GARCH(1,1) models, we select the best of the AR(k)-EGARCH(p,q) models, shown as followsFootnote 1:

where \( {{z}_t} = {{\varepsilon}_t}/{{\sigma}_t} \) has a normal distribution with zero mean and unit variance and ∆r t represents the first differences of the natural logarithm of each time series. We select k (= 1, 2, …, 10), p(= 1, 2), and q(= 1, 2) on the basis of the Schwarz Bayesian information criterion and use residual diagnostics to avoid autocorrelation.

Using the EGARCH model for this purpose is appropriate for the following two reasons. First, because the logarithmic form of the model ensures the nonnegativity of the conditional variance, we are not constrained by the signs of the coefficients, unlike the GARCH framework. Second, and more importantly, the coefficients of the ARCH terms in the EGARCH model can capture the asymmetric effects caused by positive and negative shocks. This may provide a good fit to test the proposed relationships in this paper, because in the actual banking sector stock (or government bond) markets, the shocks to volatilities differ depending on whether stock price returns (or bond yields) increase or decrease.

In the second step, we conduct the causality-in-variance and causality-in-mean tests using weighted CCF values.Footnote 2 Previously, a typical approach to investigate volatility spillovers was to apply a GARCH model, simultaneously modeling more than two time series. One drawback of using a multivariate GARCH framework is that because many parameters must be estimated, it generates a degree of computational complexity. Moreover, uncertainty can be created in terms of first- and second-moment dynamics, as the time series are likely to interact. By contrast, the CCF approach put forward by Cheung and Ng (1996) avoids these issues by employing a two-step procedure, where each time series is fitted to a univariate model and then the null hypothesis of no causality-in-variance is tested using the CCF values of the squared standardized residuals. This test makes no distributional assumptions on innovation processes, and this it tends to display greater power compared with traditional Granger causality tests.

Let X t and Y t be two stationary time series and denote two information sets,

We can conclude that Y t causes X t in variance if

where μ X,t represents the mean of X t conditioned on I t .

In order to test for the null hypothesis of no causality-in-variance during the first M lags, Cheung and Ng (1996) developed an S-statistic, which is asymptotically robust to distribution assumptions as follows:

where

Here, c uu (0) and c vv (0) represent the sample variances of disturbances u t and v t . Further, h i,t represents a conditional variance of a GARCH(p, q) model and T is the sample size.

A key shortcoming of this S-statistic is that it places a uniform weight on each lag, with no differentiation between recent cross-correlations and distant ones. Therefore, the S-statistic is not consistent with the intuition that more recent information should be weighted to a heavier degree. In order to avoid this issue, Hong (2001) modified and extended the CCF methodology by developing the following Q-statistic in order to test for one-sided causalityFootnote 3:

where

Hong (2001) shows that

If the Q-statistic is larger than the upper-tailed N(0,1) critical values, we reject the null hypothesis of no causality-in-variance during the first M lags. Further, because this test does not rely on distributional assumptions, the specification of the innovation process is more flexible. A similar process could be employed for causality-in-mean tests using the CCF values of standardized residuals instead of squared standardized residuals, as is carried out in subsequent analyses in this paper.

3 Data

We obtain daily data on 10-year Maastricht convergence bond yields from Eurostat, which are widely used for comparative studies of long-term sovereign bonds in eurozone countries.Footnote 4 With regard to banking sector equities in the four investigated countries, we extract daily values on the DataStream stock market indices in the banking sector of each country from Thomson Financial DataStream. We focus on the banking sector partly because banks and financial institutions are considered to have been badly affected by the Greek sovereign debt crisis on account of their direct holding of Greek government bonds. Moreover, comparable datasets of all the countries studied over the tested period are available only for the banking sector and not for other sub-sectors such as insurance and real estate.

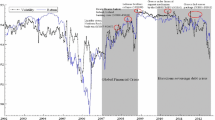

The sample covers the period from January 2, 2007, to June 30, 2011. We divide the period into two sub-periods: the pre-crisis period (from January 2, 2007, to November 4, 2009) and the crisis period (from November 5, 2009, to June 30, 2011). We choose November 5, 2009, as the beginning of the debt crisis period because on that day the Greek government disclosed that its fiscal deficit was twice as much as it had announced previously.Footnote 5 This disclosure led market participants to realize that the nation faced a serious solvency issue.

We use daily data in our study primarily for two reasons. First, we try to avoid the issue of aggregation effects, which using less frequent data may trigger. Second, daily datasets contain a sufficient number of samples for analyzing the impacts of relatively recent events such as the Greek sovereign debt crisis.

Table 1 summarizes the descriptive statistics of the data on Greek long-term sovereign bond yields and Southern European banking sector stock indices. The mean of Greek bond yield returns increased (i.e., the interest rates soared) during the course of the crisis, but the mean of the stock index returns decreased, except in Italy. With regard to the movement in volatilities, the standard deviation of Greek bond yields, Greek stock indices, and Portuguese stock indices increased, whereas that of the stock indices of other countries decreased. Further, the Jarque–Bera tests rejected normality for all cases regardless of the sub-sample periods.

By employing an augmented Dickey–Fuller test, we identified the unit root processes for level data but not for the first log-differenced data of government bond yields and banking sector stocks at the 1 % significance level, as shown in Table 2. Hence, we express the data as percentage changes over the previous period, as is common in the previous literature.

4 Empirical results

Table 3 summarizes the parameter estimates for each of the selected AR(k)-EGARCH(p,q) models. The lag lengths in the return equations differ across each time series in each sub-sample period; however, we select the EGARCH(1,1) model for all the time series in the variance equations. It is noticeable that all the coefficients of the ARCH (α i ), GARCH (β i ), and asymmetric (γ i ) terms are statistically significant at the 5 % significance level, except for the ARCH term with regard to Greek banking sector stock indices during the crisis period. Q(20) and Q 2(20) represent the Ljung–Box statistics that are used to test for the null hypothesis of no autocorrelation up to order 20 for the standard residuals and standard residuals squared, respectively. As indicated in Table 3, both the statistics are well above 0.05 for all cases. Hence, the null hypothesis of no autocorrelation up to order 20 for the standardized residuals and standardized residuals squared is accepted at the 5 % significance level. These results empirically support our specification of the presented AR-EGARCH models.Footnote 6

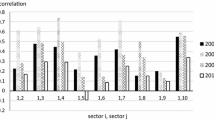

Tables 4, 5, 6 and 7 report Hong’s (2001) Q-statistics that are used to test for the null hypothesis of no causality up to lag M (= 5, 10, 15), measured in days, for each combination of Greek long-term bond yields and the banking sector stock indices of the four investigated countries before and during the Greek sovereign debt crisis. Figure 1 graphically indicates the detected causality-in-mean and causality-in-variance. From these results, we extract three interesting findings.

First, we find support for the significant causality-in-mean effects seen from bank stock returns in Greece to Greek long-term bond yields—but only during the sovereign debt crisis period. By contrast, the reverse causality (i.e., the negative impact of interest rate changes on the country’s bank stock returns) is not significant. One possible reason for the detected causality from bank stock returns to bond yield changes is that in the short run the crisis may have strengthened the forward-looking nature of stock returns in troubled banking sectors. As Alaganar and Bhar (2003) contend, banking sector stock prices can incorporate the expectations of market participants about the state of the economy as well as future interest rates.

Second, we find evidence of significant causality at the mean level from bank stock returns in Portugal, Italy, and Spain to Greek sovereign bond yields. This causality is transient up to lag 5 and prevalent both before and during the crisis period in Portugal and Italy; in Italy, the significant causality is detected only during the crisis period. One reason behind this causality is that market participants believe that Greece’s solvency depends on its chances of being bailed out by its neighboring nations and thus any slump in the bank stock returns in those countries may affect Greek bond yields. This finding implies that the short-term relationship between Greek bond yields and Southern European bank stock returns is more intricate compared with the one-way causality from interest rates to stock prices, which most previous studies have tended to assume when examining these relations over longer horizons.

Third, we detect bidirectional causality-in-variance from and to Greek long-term bond yields, which emerged after the crisis, in banking sector stocks in Portugal, Italy, and Spain. Such an interesting finding of a two-way causal linkage is consistent with the findings of Alaganar and Bhar (2003). The emerging volatility spillovers from Greek bond yields to banking sector equity returns may indicate that the banking sectors of Portugal, Italy, and Spain were vulnerable to the solvency risks of the Greek sovereign bonds they held. As the onset of the debt crisis made market participants fully realize such risks, the volatilities may have begun to reflect such information flows significantly, even though they were not captured in the causality at the mean level. Nonetheless, we should also mention that the sovereign debt crisis may have affected all the studied countries at the same time and that a common factor may have driven this apparent bidirectional causality during the crisis period. If this were the case, the detected causality would be considered to be spurious. Investigating the existence of such a common factor would thus call for different methodologies, because Hong’s (2001) approach focuses on testing the short-term dynamics between only two variables.

5 Conclusion

This paper investigated the causality-in-variance and causality-in-mean between Greek long-term bond yields and the banking sector equity returns of four Southern European countries based on daily data from January 2007 to June 2011. It focused on assessing the potential impacts of the recent European sovereign debt crisis. To conduct the causality tests, we used the robust CCF approach developed by Hong (2001), which does not rely on simultaneous inter-series modeling and thereby allows for flexible specifications of innovation processes.

The main findings from our analysis are threefold. First, the significant unidirectional causality-in-mean from bank stock returns in Greece to Greek long-term bond yields arises only during the sovereign debt crisis period. Second, we also detect significant causality-in-mean from the bank equity returns in Portugal, Italy, and Spain to Greek sovereign bond yields. Third, interestingly, we find significant evidence of bidirectional causality-in-variance between Greek long-term bond yields and the banking sector stocks in Portugal, Italy, and Spain during the debt crisis. The presented empirical results are thus relevant for the regulators of the banking sectors in the investigated countries as well as the bank managers and investors who manage equity portfolios in the affected countries.

The present paper also considered the possibility that Greek bond yields influence the banking stock returns in neighboring nations by affecting the bond markets in these countries. Although the focus of this paper was on examining the relationship between the Greek bond market, the origin of the crisis, and Southern European bank equity markets, future studies should consider analyzing the causalities among sovereign bond yields in different markets.

Notes

See Nelson (1991) for details of the EGARCH model.

Hong’s (2001) approach is typically used in a bivariate framework, because it allows for dealing with only two variables at once. Some previous studies have conducted Granger causality tests with multiple variables as a system. For instance, Lee (1992), using a VAR system, investigates the relationships among stock returns, interest rates, inflation rates, and growth in industrial production. Our study focuses specifically on the bivariate relationship between bank stock returns and bond yields.

In terms of the weighting function k(z) above, we selected the truncated kernel, which provides compact support. By performing Monte Carlo experiments, Hong (2001) contends that for a smaller M (i.e., M = 10), the truncated kernel gives approximately similar power to non-uniform kernels such as the Bartlett, Daniell, and QS kernels. For the application of the Hong test, refer to, for example, Xu and Hamori (2012) and Tamakoshi and Hamori (2013).

One possible choice for the Greek government bond data is to use the risk premium on bond prices, because we use stock price-level data to represent the banking sector. Nevertheless, we employ bond yields data to ensure that the results of our analysis are comparable with those of similar studies such as Alaganar and Bhar (2003).

We selected this date based on the key event that signified the onset of the crisis, as is common in the related literature. Nonetheless, we also need to mention that the break date in the time series could be earlier or later than this announcement by the Greek government. Indeed, some methodologies detect structural breakpoints endogenously, although these statistical procedures do have their own limitations. For instance, Bai and Perron (1998, 2003) describe how to estimate the location of multiple endogenous structural breaks in mean and variance parameters.

However, it must be noted that even though the variance equation in the pre-crisis period displays a very good fit to the EGARCH specification, the fit of the equation in the crisis period is relatively poor. An alternative approach that may be useful for considering the effect of the crisis in the EGARCH framework, although not used in this paper, is to include a dummy variable in the conditional variance equation.

References

Alaganar V, Bhar R (2003) An international study of causality-in-variance: interest rate and financial sector returns. J Econ Financ 27:39–54

Bae SC (1990) Interest rate changes and common stock returns of financial institutions: revisited. J Financial Res 13:71–79

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J of Appl Econom 18:1–22

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 52:5–59

Chance DM, Lane WR (1980) A re-examination of interest rate sensitivity in the common stocks of financial institutions. J Financial Res 3:49–55

Cheung Y, Ng L (1996) A causality-in-variance test and its applications to financial market prices. J Econom 72:33–48

Elyasiani E, Mansur I (1998) Sensitivity of the bank distribution to changes in the level and volatility of interest rate: a GARCH-M model. J Bank Financ 22:535–563

Elyasiani E, Mansur I (2004) Bank stock return sensitivities to the long-term and short-term interest rates: a multivariate GARCH approach. Manage Financ 30(9):32–55

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1007

Engle RF, Ito T, Lin KL (1990) Meteor showers or heat waves? Heteroskedastic intra-daily volatility in the foreign exchange market. Econometrica 58:525–542

Flannery MJ, James CM (1984) The effect of interest rate changes on the common stock returns of financial institutions. J Finance 39:1141–1153

Hong Y (2001) A test for volatility spillover with application to exchange rates. J Econom 103:183–224

Lee BS (1992) Causal relations among stock returns, interest rates, real activity, and inflation. J Finance 47(4):1591–1603

Lloyd WP, Shick RA (1977) A test of Stone’s two-index model of returns. J Financial Quantitative Anal 12:363–376

Nelson D (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

Ross SA (1989) Information and volatility: no-arbitrage Martingale approach to timing and resolution irrelevancy. J Financ 44:1–17

Shiller RJ, Beltratti AE (1992) Can their co-movements be explained in terms of present value models? J Monetary Econ 30:25–46

Song F (1994) A two-factor ARCH model for deposit-institution stock returns. J Money, Credit, Bank 26:323–340

Tai CS (2000) Time-varying market, interest rate, and exchange rate risk premia in the US commercial bank stock returns. J Multinatl Financ Manag 10:397–420

Tamakoshi G, Hamori S (2013) Volatility and mean spillovers between sovereign and banking sector CDS markets: a note on the European sovereign debt crisis. Appl Econ Lett 20:262–266

Verma P, Jackson OD (2008) Interest rate and bank stock returns asymmetry: evidence from U.S. banks. J Econ Financ 32:105–118

Xu H, Hamori S (2012) Dynamic linkages of stock prices between the BRICs and the United States: effects of the 2008–09 financial crisis. J Asian Econ 23:344–352

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tamakoshi, G., Hamori, S. Causality-in-variance and causality-in-mean between the Greek sovereign bond yields and Southern European banking sector equity returns. J Econ Finan 38, 627–642 (2014). https://doi.org/10.1007/s12197-012-9242-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-012-9242-y

Keywords

- Bank Stock Returns

- Bond Yields

- Causality-In-Variance Test

- International Volatility Spillover

- Greek Sovereign Debt Crisis