Abstract

We find that correlations between international markets continue to increase over time compared to previous research, with only Asian markets providing lower correlations relative to American and European markets. Consistent with previous studies, the benefits from international diversification are asymmetric, with reduced diversification benefits during bear markets. We extend previous results by examining the characteristics and causes of the returns affecting these asymmetric correlations, relating these results to the herding behavior of investors across markets rather than to fundamental economic reasons. Specifically, we determine that the increase in correlations among markets is most closely associated with the larger correlations from the largest positive return time intervals in bear markets rather than the negative returns. Use of stock index futures avoids issues inherent in the use of international cash indexes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Numerous studies on international stock diversification support investing globally to reduce the risk of a stock portfolio. However, more recent studies reveal increasing correlations (decreasing diversification benefits) between markets over time, especially during more volatile periods, bear markets, business downturns, and financial crises (for example, see Erb et al. 1994; Longin and Solnik 1995; Shawky et al. 1997; Longin and Solnik 2001; and Schwebach et al. 2002). This increase in correlations over time, as well as the associated asymmetric correlations during different types of markets, raises the question of what statistical characteristics of the underlying return distributions are associated with these asymmetric diversification results and whether behavior rather than economic fundamentals are related to these results.

The main purpose of this study is to examine the high and asymmetric correlations during periods of major market movements in a different way, namely by investigating how the characteristics of the market returns are associated with the correlation patterns. We achieve this by employing the most actively traded international stock index futures (SIF) contracts from the recent major bull (late 1990’s) and bear markets (early 2000’s). We find that the resultant asymmetric correlations for the bull market relative to the bear market are (logically) strongly associated with the larger returns of the SIFs distributions. Most surprising, and contrary to previous literature, it is the largest positive returns during bear markets, not the largest negative returns, that have the greater influence on the higher asymmetric correlations that occur during declining markets. This is consistent with a herding instinct of investors as the key factor affecting the higher correlation between international markets, since the alternative of fundamental news of widespread economic recovery is inconsistent with a continuing bear market. Moreover, these results show that knowledge of the characteristics of the underlying returns across markets helps us understand the asymmetric correlation patterns between the bull and bear markets. Consequently, these results should motivate additional research to determine the interrelations of the statistical characteristics of return behavior that are associated with the results found in this paper. Finally, our results show that the level of correlations across countries continues to increase over time, with only the Asian markets now having significantly lower correlations with other markets. Our use of SIF avoids common problems inherent in the practice of employing cash stock indexes to examine diversification, as discussed in the data section of this paper. Consequently, the results should be more consistent and contain fewer biases, at least concerning stale prices and liquidity, compared to previous studies.

2 The literature

In this section we briefly discuss two issues concerning diversification and then examine the statistical aspects of correlation. First, we examine the increasing level of correlation over time between international markets, including the effect of developed vs. developing countries on the degree of diversification. Second, we discuss asymmetric correlations for different types of market periods including bear markets, business downturns, and market crises. Third, we briefly examine how the conditioning variable affects correlation.

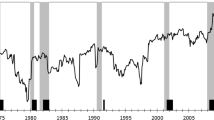

Academic studies have documented an increase in correlations between international markets over time.Footnote 1 Bertoneche (1979) finds that correlations between international markets were below 0.20 in the 1970’s. By the 1980’s Odier and Solnik (1993) find many correlations to be around 0.50, a substantial increase. Similarly, Shawky et al. (1997) determine correlations to be above 0.50 in most pairwise combinations for data from the early 1990’s. Solnik et al. (1996) substantiate the increase in correlations over time interval of 1982–1995, especially during more volatile time periods. A common practice among these and similar studies is to concentrate on U.S. and European markets (later we include Asian markets). The higher correlations in the 1980’s and 1990’s imply a greater integration of these economies and markets, as well as show that the diversification of risk is less successful when investments are restricted to only the more developed U.S. and European economies. This conclusion is supported by Goetzmann et al. (2005), who find that correlations between markets over the past 150 years were strongly influenced by the globalization of markets and that diversification is enhanced by using newer markets.

Several studies examine the asymmetric nature of correlations during declining vs. increasing markets. Erb et al. (1994) show that the correlations among the Group 7 countries are higher during recessions than during economic growth periods. Shawky et al. (1997) find that during the economic recession of the early 1990’s the correlations between U.S. and European markets were higher than when the economies recovered in the years following the recession. Longin and Solnik (1995); Solnik et al. (1996) and others associate the higher correlations with greater volatility in declining markets rather than to the economic periods per se. Karolyi and Stulz (1996) and Ramchand and Susmel (1998) show that the correlations between U.S. and other markets are higher when markets are more volatile. De Santis and Gerard (1997) examine the correlations between the G-7 countries in the seven bull and bear markets over the 1970–1994 period, finding that the largest three correlations are associated with the most severe market declines. Longin and Solnik (2001) find that correlations increase substantially in bear markets and that negative returns have higher correlations than positive returns. They also show that correlation is not related to market volatility per se, but rather to the market trend. Since our emphasis in on the characteristics of returns during major bull and bear markets and the associated market trend rather than volatility, we do not employ volatility as a variable in this study.

Specific crises periods provide similar correlation results to business downturns and bear markets. Schwebach et al. (2002) examine World Equity Benchmark Shares (WEBS) before and after the 1997 Asian crisis.Footnote 2 The WEBS had correlations mostly in the range of 0.180–0.274 in the first period, rising to 0.451–0.531 in the second period. Studying the same Asian crisis, but from the perspective of a New Zealand investor in relation to mostly other Asian and South Pacific countries, Meyer and Rose (2003) find an increase in correlations from 0.133–0.216. Tuluca and Zwick (2001) also find an increase in correlations due to the Asian crisis using daily observations.

Recently, more complicated methodology is employed to examine the issue of asymmetric correlations. One key issue is the difference between conditional and unconditional correlations for the same distributions. As noted by Longin and Solnik (2001), correlations conditioned on large absolute returns are higher than unconditioned correlations from the same distribution. Ang and Chen (2002) devise tests for these asymmetric correlations that adjust for the bias in conditional correlations and Hong et al. (2007) provide a model-free approach to assess the degree of asymmetry in equity portfolios that possess different characteristics.Footnote 3 However, these more recent tests simply attempt to fit the asymmetry into a given distribution or model; they do not examine the source of the asymmetry. Moreover, our study employs separate distributions for the bull and bear markets rather than the assumption of these studies that both types of markets can be obtained from the same distribution. Hence, our study examines the asymmetry in correlation from a different perspective relative to the above literature.

Although most of these studies involving correlations confirm the statistical increase in correlations for declining market periods relative to increasing market periods, none of them examine the relation of these larger correlations with the characteristics of the underlying returns. Here we attempt to remedy this deficiency.

3 Data and methodology

We obtain weekly prices for the most active sixteen international SIF contracts, as listed in Table 1, using the Commodity Research Bureau (CRB) database.Footnote 4 We also generate an overall weekly aggregate “world index” by equally weighting the individual SIF contracts.Footnote 5 The use of weekly returns is more realistic for studying correlations relative to the monthly periods often employed in diversification studies, especially given the short institutional risk horizons and the importance of larger sample sizes for correlation studies.

We split the data into two time periods in order to determine how the level of correlations have changed over more recent time periods and to analyze the asymmetric conditional correlations for major bull versus bear markets. The first (major bull market) period starts in January 1997 and ends in March 2000; the second (major bear market) period begins in March 2000 and ends in December 2002. Our choice of these recent market periods is made to examine the effects of extreme market conditions on diversification and correlation.

A second part of the analysis compares bull and bear market correlations conditional on the size of the returns. The S&P 500 is employed as the criteria for ranking returns as it represents the largest capitalization in the world and given our perspective of examining international diversification for institutional investors in the United States. The sorted returns are divided into six equally-sized groups for each market period, namely three positive return groups (high, medium, and low) and three negative return groups (high, medium, and low), with the S&P 500 employed to determine which weeks for all of the markets are assigned to which groups. Groups 1 to 3 represent the positive returns for each market period (group 1 employs the largest positive returns), while groups 4 to 6 represent the negative returns for each period (group 6 employs the largest negative returns). Therefore, groups 1 to 6 are ranked from the largest positive return group to the most negative return group. This segregation into groups allows us to examine the relations between correlations for bull vs bear markets and for different size returns. Since the weekly returns are based on a Friday to Friday close, the effect of timing differences across markets with different time zones is minimized.Footnote 6

The advantages of using stock index futures instead of cash stock indexes are: (1) futures avoid stale price problems, particularly in smaller markets, since stock index futures react to new information more quickly than do the individual stocks in an index; (2) cash stock prices can be significantly affected by the bid-ask bounce at the close, while any bid-ask effects for futures are typically limited to one tick; (3) futures do not have the liquidity risk issues that can exist when buying a large block of stocks, especially outside the U.S.; (4) using futures contracts when generating a portfolio of country assets avoids the large cash investment needed for diversification, since futures are zero dollar investment vehicles (exclusive of margin); and, (5) the transactions costs for cash investments can be significant (see Rowland 1999).Footnote 7 Hence, a portfolio manager could diversify internationally by purchasing U.S. stocks and then purchasing stock index futures from other countries. Here the S&P 500 futures acts as a substitute for a cash U.S. portfolio, with the futures benefiting from the characteristics listed above.

4 Empirical results

4.1 Basic statistics

Table 1 provides the statistics for the four moments of the returns for each of the international SIF contracts and for the equally-weighted world index. The “average” values provide the arithmetic averages of the individual SIFs. Table 1 shows that the average weekly return is a positive 0.32% during the bull market and a negative 0.31% in the bear market. Meanwhile, the volatility increased from the bull to bear market periods by an average of 22%. When the naively constructed world portfolio is compared to the average performances of the SIFs, the world portfolio generates better risk-return results in both the bull and bear markets. While both the world portfolio and the average of the SIFs have the same return, the world portfolio possesses a substantial smaller risk due to diversification (29% less risk than the average SIF in period 1 and 23% in period 2). Moreover, the diversified world portfolio is less risky than all but two individual SIFs during the bull market and four SIFs in the bear market. Thus, regardless of the higher correlations between (developed) markets in recent studies, a well diversified portfolio of international markets still provides a better risk-return tradeoff than investing in individual markets, a conclusion often ignored by typical correlation studies.

Figures 1 and 2 show the graphical relations for return and risk (as measured by the standard deviation) for each SIF, identified by continent. During the bull market the U.S. SIFs typically possess lower risk and return, while the Asian SIFs have the opposite risk-return characteristics; most of the European SIFs are a mixture of these two extremes. During the bear market the Asian SIFs performed the worst in terms of both return and risk, while U.S. SIFs generally performed better than the other two groups. Figures 1 and 2 also show that the world portfolio achieved better results than the majority of the individual SIFs for both periods. These results provide a different perspective than only employing correlations.

4.2 Levels and changes in correlation

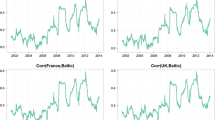

In order to determine the importance of the level of correlations across continents, Table 2 provides equally-weighted correlations using all of the pair-wise correlations for each continent. This table shows that high correlations exist between the U.S. and European SIFs, with the latter correlations being 0.69 and 0.79 during the bull and bear market periods, respectively. Only correlations between the Asian markets and the other two continents are below 0.53, which implies the Asian markets and economies are less integrated with the West. The correlations from above the diagonal (bull market) to below the diagonal (bear market) increase, although the increase is typically small. These results are consistent with previous studies, such as Erb et al. (1994); Longin and Solnik (1995); Solnik et al. (1996); and Shawky et al. (1997), who show that correlations between markets increase during market declines and recessions.

Table 3 shows the pair-wise correlations between each SIF for each period. The cross-correlations in developed countries for each period are highly correlated, while the correlations with Asian markets are lower. This reinforces our findings from Table 2. These results also support the usefulness of adding markets in Asia to diversify a portfolio. Our conclusion also is consistent with previous findings by Levy and Sarnat (1970); Bekaert and Harvey (1995), and Odier et al. (1995) who show that including emerging markets provides more diversification than investing solely in developed markets.

In Table 3 all of the average correlations between the U.S. and European SIFs for both periods are above 0.50 (with one exception). These values are a substantial increase from the findings by Odier and Solnik (1993). Thus, these results show that markets are becoming even more interrelated over time compared to past results. Moreover, almost all of the pair-wise correlations increase from the bull to bear market periods, with the averages of all the country correlations increasing from 0.476 in the bull market to 0.559 in the bear market. The average of the correlations between the world index and the individual countries also increases, from 0.708–0.763. As discussed previously, these results are consistent with the research findings in the literature of increasing correlations during declining markets.

The increase in correlations from the bull to the bear market is confirmed by the z-values in Table 4. In fact, 106 out of 136 pairs increase their correlations between periods 1 and 2, with the increase being statistically significant for 36 of the 106 cases at the 5% level of significance (shown in bold).Footnote 8 Only 30 of 106 correlations declined from the bull to the bear market and only one of these changes is statistically significant.Footnote 9 These results show that the correlation pattern is consistent across markets and not just restricted to a few markets, such as the U.S. vs European markets typically emphasized in this type of research.

4.3 Effect of the size of returns on the correlation asymmetry

This subsection examines the associations between the increases in the pairwise correlations from the bull to bear markets to the sign and size of the underlying market returns. In fact, the larger correlations in the bear market relative to the bull market are associated mostly with the larger correlations for the largest positive and negative return groups rather than the correlations for the smaller return groups. To examine this association we separate the returns for each market period into six ranked groups, as described in the data section. Group 1 in each period includes the largest positive returns for each type of market and Group 6 has the largest negative returns for each market period. We then calculate the pairwise correlations between the SIFs for each of the ranked return groups.Footnote 10 Finally, we test the direction and significance of the differences in correlations for the equivalent group for the two types of markets. The z-statistics for the correlation differences for Group 1 are presented in Table 5 and the summary of the z-values for all groups are given in Tables 6 and 7.

Table 5 shows that the differences in correlations for the largest positive return group (Group 1) has 61 of its 103 z-values being significant at the 5% level. This supports the contention that the largest positive returns have an important effect on the asymmetric correlations between bull and bear markets. The 61 significant values are a substantial increase from the 36 significant values in Table 4, where the z-values are shown for the entire set of data.

Table 6 reports the average z-values for the differences in correlations between each SIF for each return group, where the comparisons are between the same group numbers. The size of the z-values for the correlation differences between the two periods generally decreases from Group 1 (the largest positive returns) to Group 2 (medium positive returns), and from Group 2 to Group 3 (low positive returns). The z-values for the correlation differences in Group 4 (low negative returns) and Group 5 (medium negative returns) are mostly negative, which implies that the correlations actually decrease from the bull to the bear market when only the low and medium negative returns are employed in the calculations. The z-values generally increase again for Group 6 (the largest negative returns). Table 7 summarizes the number of positive and negative z-values as well as the number of significant z-values for each group of returns. From Table 7 it is apparent that Group 1 has more positive z-values, as well as more significant positive z-values, than any other comparison between equivalent group numbers. Hence, the largest positive return group has the largest number of differences in correlations between the bull and bear markets. More importantly, these correlations actually increase from the bull to the bear market, even though they are positive returns rather than the expected negative return group. This result contradicts the results of Longin and Solnik (2001), who show that the correlation of large negative returns is much larger than the correlation of large positive returns.

The results in Tables 4 through 7, especially for the comparisons for the extreme positive and negative return groups, show a greater herding of traders across different markets during bear market major moves than during bull market major moves, with bear market rallies possessing the greatest degree of herding. Moreover, the negative return comparisons for Groups 4 and 5 possess more negative z-values and more significant negative z-values than positive ones, showing that the moderate and smaller negative returns in bear markets are not associated with larger correlations relative to bull markets.

Therefore, we conclude that the differences in correlations for the Group 1 comparison is consistent with investor’s fear of missing out on the start of a new bull market, since the positive rallies during the bear market period possess the greatest degree of herding by traders across markets relative to the bull market results, even though such optimism on the part of investors is not justified (the bear market continues). On the other hand, these results do provide new insights into investor behavior during bear markets. Consequently, this result provides strong evidence that investors across international markets will herd during major (bear) market moves, which also supports the study by DeBondt (1993) that investors are trend followers. This greater herding among investors in different countries also is consistent with world stock markets becoming more integrated. Hirschey and Nofsinger (2008, p 227) explain this behavior by invoking behavior finance: “investors often look to the actions of others to validate what they are doing.” Herding behavior is consistent with this need for validation in trading decisions. Moreover, herding magnifies price movements, since investors base their decisions on market behavior rather than independent fundamental analysis. In fact, the irrational bubble in technology stocks in the late 1990’s is typically associated with herding behavior.

5 Summary and conclusions

Previous studies on international diversification show that correlations among international markets increase during bear markets and that correlations have increased over time due to globalization. Here we examine the characteristics of the individual market returns to determine the relation between the returns and the asymmetric increase in correlations during bull and bear markets. This approach differs from previous empirical research and methods that examine biases in conditional correlation when bull and bear markets are assumed to be from the same distribution. Further, our use of international stock index futures contracts avoids various data problems inherent with cash stock indexes, including price staleness due to non-trading.

The correlations in our more recent dataset are higher than the correlations in earlier studies, especially for U.S.-European pairings, showing a continued decrease in diversification benefits over time. We also find that the correlations do increase from the bull market of the late 1990’s to the bear market of the early 2000’s, with this asymmetric pattern of correlations being statistically significant. In order to examine the effect of the return characteristics on the increased correlations from the bull to the bear market we rank the returns into six different groups based on the size and sign of the weekly returns (three positive, three negative), for the bull and bear markets, respectively. We find that the increase in the pairwise correlations from the bull to bear markets is mostly related to the largest positive return and then the largest negative return groups, which is consistent with herding of investors across markets during major market moves. Our unique finding is that the largest positive returns during bear markets are the returns most associated with the higher correlations during declining markets.

The results presented here provide a different way to think about the asymmetric correlations between stock markets over bull and bear markets. In particular, investors are prone to herd across markets during a bear market rally, showing that optimism overshadows either economic reality or strong economic ties between countries during these situations. Hence, one way to examine the statistical characteristics of correlation over different types of markets would be to look more closely into the behavior of the underlying returns.

Notes

Here we concentrate on benchmark studies. Shawky et al. (1997) provide a more comprehensive review of past literature. Initial studies on the benefits of international diversification started in the late 1960’s. Grubel (1968) was among the first to show that lower correlations among international markets lead to international portfolios with improved portfolio return/risk characteristics. Levy and Sarnat (1970) demonstrate how the correlation between developed and developing countries provides a significant risk-reduction benefit. Solnik (1974) shows that combining U.S. securities and foreign stocks can substantially reduce portfolio risk and that diversification across countries provides greater risk reduction than diversification across industries.

Schweback, et al. also employ closed-end mutual funds (CEFs). However, CEFs have an inconsistent pattern of premiums and discounts from their net asset value, creating unpredictable returns not related to country stock performance. They also possess high costs that discourage institutions from buying them. CEFs tend to have much lower correlations due to these factors.

The empirical results of these articles are not discussed here since they focus on different issues and different markets.

We chose the futures instruments based on a consistent volume of at least 2,000 contracts per day for futures that trade for the entire time period. The Dow Jones and KOSPI futures did not trade in much of the first time period (the two stock index futures started in 1998) and the Toronto 35, Kuala Lumper and Mexico ICP futures did not trade in most of the second period (the Toronto 35 contract ended in 1999, and the Kuala Lumper and Mexican ICP data are unavailable after October 2001). Hence, these contracts are eliminated from this study.

A number of different weighting schemes are possible. We chose an equal weighting because of our emphasis on the individual correlations for diversification purposes.

Rollovers of contracts are accommodated by selling the expiring contract near expiration (when the volume of the nearby consistently declines below the deferred) and buying the next expiration. Returns are always calculated between the same futures expiration. Hence, this procedure explicitly considers the “roll return” as part of the determination of the weekly return series.

The weekly returns employed in this study are calculated using (Pt /P t–1). We follow the common practice to consider futures as zero dollar investment vehicles and hence employ returns based on the notional value of the contract. Moreover, the focus of this research relates to institutional investing rather than the speculators who desire leverage. Institutional investors could place part or all of the notional value of the contracts into a risk-free investment vehicle to minimize the futures leverage effect.

The z-statistic is measured as follows: z = (z2 – z1)/√(N2 + N1) where zi = ln √(1 + ρi)/ (1-ρi) and Ni = 1/(ni -3), ρi = the correlation in period i, and ni is the number of observations in period i.

The importance of the increase in correlation is ascertained by squaring the correlations in Table 3 to obtain R-squares. The higher correlations represent an increase in the explanatory variance from 22.7–31.2% for the pairwise correlations and from 50.1–58.2% for the world index. This 8–9% increase does support the conclusions that the correlations are significantly higher during bear markets.

For example, analyzing the correlation differences between the bull and bear returns for each SIF in the positive Group 1’s provides a measure of the importance of the size of the returns in these two market periods on the level of the correlations.

References

Ang A, Chen J (2002) Asymmetric correlation of equity portfolio. J Financ Econ 63:443–494. doi:10.1016/S0304-405X(02)00068-5

Bekaert G, Harvey C (1995) Time-varying world market integration. J Finance 50:403–444. doi:10.2307/2329414

Bertoneche ML (1979) Spectral analysis of stock market prices. J Bank Finance 3:201–208. doi:10.1016/0378-4266(79)90015-3

DeBondt WFM (1993) Betting on trends: intuitive forecasts of financial risk, return. Int J Forecast 9:355–371. doi:10.1016/0169-2070(93)90030-Q

De Santis G, Gerard B (1997) International asset pricing and portfolio diversification with time-varying risk. J Finance 52:1881–1912. doi:10.2307/2329468

Erb CB, Harvey CR, Viskanta TE (1994) Forecasting international equity correlations. Financ Anal J 50:32–45. doi:10.2469/faj.v50.n6.32

Goetzmann WN, Li L, Rouwenhorst KG (2005) Long-term global market correlations. J Bus 78:1–38. doi:10.1086/426518

Grubel HG (1968) Internationally diversified portfolios: welfare gains, capital flows. Am Econ Rev 58:1299–1314

Hong Y, Tu J, Zhou G (2007) Asymmetries in stock returns: statistical tests, economics evaluation. Rev Financ Stud 20:1547–1581. doi:10.1093/rfs/hhl037

Hirschey M, Nofsinger J (2008) Investments: analysis, behavior. New York, McGraw Hill Irwin

Karolyi GA, Stulz RM (1996) Why do markets move together? An investigation of U.S.-Japan stock return comovements. J Finance 51:951–986. doi:10.2307/2329228

Levy H, Sarnat M (1970) International diversification of investment portfolios. Am Econ Rev 60:668–675

Longin F, Solnik B (1995) Is the correlation in international equity returns constant: 1960–1990? J Int Money Finance 14:3–26. doi:10.1016/0261-5606(94)00001-H

Longin F, Solnik B (2001) Extreme correlation of international equity markets. J Finance 56:649–676. doi:10.1111/0022-1082.00340

Meyer TO, Rose LC (2003) The persistence of international diversification benefits before, during the Asian crisis. Glob Finance J 14:217–242. doi:10.1016/S1044-0283(03)00013-9

Odier P, Solnik B (1993) Lessons for international asset allocation. Financ Anal J 49:63–77. doi:10.2469/faj.v49.n2.63

Odier P, Solnik B, Zucchinetti S (1995) Global optimization for Swiss pension funds. Financ Mark Portfolio Manage 9:210–231

Ramchand L, Susmel R (1998) Volatility and cross correlation across major stock markets. J Empir Finance 5:397–416. doi:10.1016/S0927-5398(98)00003-6

Rowland PF (1999) Transaction costs, international portfolio diversification. J Int Econ 49:145–170. doi:10.1016/S0022-1996(98)00059-2

Schwebach RG, Olienyk JP, Zumwalt JK (2002) The impact of financial crises on international diversification. Glob Finance J 13:147–161. doi:10.1016/S1044-0283(02)00050-9

Shawky HA, Kuenzel R, Mikhail AD (1997) International portfolio diversification: a synthesis and an update. J Int Financ Mark Inst Money 7:303–327. doi:10.1016/S1042-4431(97)00025-5

Solnik B (1974) Why not diversify internationally rather than domestically? Financ Anal J 30:48–54. doi:10.2469/faj.v30.n4.48

Solnik B, Boucrelle C, Le Fur Y (1996) International market correlation, volatility. Financ Anal J 52:17–34. doi:10.2469/faj.v52.n5.2021

Tuluca SA, Zwick B (2001) The effects of the Asian crisis on global equity markets. Financ Rev 36:125–141. doi:10.1111/j.1540-6288.2001.tb00007.x

Author information

Authors and Affiliations

Corresponding author

Additional information

We wish to thank the reviewer, who helped us focus the relevance of the issues in this paper.

Rights and permissions

About this article

Cite this article

You, L., Daigler, R.T. The strength and source of asymmetric international diversification. J Econ Finan 34, 349–364 (2010). https://doi.org/10.1007/s12197-009-9081-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-009-9081-7