Abstract

Different fundamental methodological spatial econometric issues are discussed not yet addressed by the existent empirical literature on FDI and third country effects that explains why it has failed to find results consistent with formal theory. This is demonstrated by taking the baseline spatial econometric model developed by Blonigen et al. (Eur Econ Rev 51:1303–1325, 2007) as point of departure and using US data on outbound FDI into 20 European countries observed over the 1999–2008 period. By refining the spatial econometric approach, we find significant empirical evidence in favor of competition among European countries in attracting US companies, and results that are consistent with export-platform and pure vertical FDI motives.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The boom in foreign direct investment (FDI) by multinational enterprises (MNEs) since the 1980s has led to a substantial interest in the determinants of FDI behavior in the economics literature. Most models and empirical examinations on the determinants of FDI have used a two–country framework [see (Blonigen 2005) for an overview]. This framework assumes that the decision of an MNE to invest in a particular host country is independent of the decision whether or not to invest in any other country. However, if an MNE invests in a particular host country not only to substitute for export flows but also to use it as a platform to serve nearby countries, or if an MNE off-shores parts of its production chain over various host countries in order to benefit from factor cost differences among these countries, countries cannot be treated as independent entities.

A number of recent papers recognize that FDI decisions are multilateral in nature and, therefore, take third-country effects into account: Baltagi et al. (2007), Blonigen et al. (2007), Poelhekke and Van der Ploeg (2009), and Uttama and Peridy (2009) for US outward FDI, Garretsen and Peeters (2009) for Dutch outward FDI, Ledyaeva (2009) for Russian inward FDI, and Chou et al. (2011) for Chines outward FDI. These studies find that potential host countries nearby a particular target country affect FDI to that country. Nevertheless, many of these studies struggle with empirical results that are inconsistent with formal theory on horizontal, vertical, export-platform or complex vertical FDI. Section 2 provides a detailed explanation. Following Blonigen et al. (2007) and subsequent studies, we start from a linear regression model in which the spatial arrangement of the countries in the sample and thus third-country effects enter our empirical analysis in two ways. The linear regression model is extended to include an endogenous spatial lag on FDI, measured by FDI into markets nearby the host country, and the set of explanatory variables is extended with an exogenous market potential variable, measured by the size of markets nearby the FDI host country in terms of gross domestic product (GDP). The question whether the empirical results are compatible with horizontal, vertical, export-platform or complex vertical FDI then depends on the signs and the significance levels of the coefficients of these two variables. However, Blonigen et al. (2007), Garretsen and Peeters (2009), Poelhekke and Van der Ploeg (2009), and Chou et al. (2011) all find results that are incompatible with any of these motives.

The main purpose of this paper is to discuss different fundamental methodological spatial econometric issues not yet addressed by the existent empirical literature that explains why the aforementioned studies failed to find results consistent with formal theory. These issues are spelled out in Sect. 2 and partly 3. To illustrate that these inconsistencies can be fixed, we use US data on outbound FDI into 20 European countries observed over the 1999–2008 period. The data are described in Sect. 3, the main results of previous studies are summarized in Sect. 4, and the results of this study are reported and discussed in Sect. 5. Section 6 concludes.

2 Potential shortcomings of the baseline spatial econometric model on FDI

The baseline spatial econometric model in the applied literature on FDI reads as

where ln(FDI \(_{t})\) denotes an \(N\times \)1 vector consisting of one observation on the dependent variable (Foreign Direct Investment) for every host country in the sample (\(i\) = 1,...,\(N)\) at time \(t\) (\(t\) = 1...,\(T)\). The variable \(W\)ln(FDI \(_{t})\) denotes the interaction effect of the dependent variable FDI \(_{it}\) in country \(i\) with the dependent variables FDI \(_{jt}\) in neighboring countries \(j\) at time \(t\), where \(W\) is a pre-specified nonnegative \(N\times N\) spatial weights matrix describing the arrangement of the countries in the sample. In the FDI literature \(W\) is commonly specified as an inverse distance matrix; its elements are defined as \(w_{ij} = 1/d_{ij}\) for \(i\ne j\), where \(d_{ij}\) represents the (great circle) distance between countries \(i\) and \(j\). The diagonal elements of \(W\) are set to zero by assumption, since no country can be viewed as its own neighbor. Finally, the matrix \(W\) is row-normalized. Ln(GDP \(_{t})\) is one of the explanatory variables of foreign direct investment in addition to the control variables that are assumed to be part of the \(N\) by \(K\) matrix \(X\). This variable is taken apart since it also affects foreign direct investments in neighboring countries through the term ln(\(W\)*GDP \(_{t})\). Since \(W\) is defined as an inverse distance matrix, this variable reflects (the log of) the market potential of a country, i.e. the sum of GDP in surrounding countries divided by the distance to these countries. The scalars \(\rho ,\,\gamma ,\,\theta \) and the \(K\times 1\) vector \(\beta \) represent unknown parameters to be estimated and measure the impact of the corresponding explanatory variables. \(\varepsilon _t =(\varepsilon _{1t} ,\ldots ,\varepsilon _{Nt} )^T\) is a vector of disturbance terms, where \(\varepsilon _{it}\) are independently and identically distributed error terms for all \(i\) and \(t\) with zero mean and variance \(\sigma ^{2}\). \(\mu _{i}\) denotes a country-specific effect and \(\lambda _{t}\) a time-period specific effect, and are optional.

The popularity of the so-called spatial lag model in (1) is that it can easily be used to test which motive predominantly drives FDI (Blonigen et al. 2007; Garretsen and Peeters 2009; Ledyaeva 2009; Chou et al. 2011). The outcome \(\rho =\theta =0\) reflects horizontal FDI where the decision of a parent country to invest in a host country is governed by a trade-off between the possibility to avoid trade costs and the costs of setting up an extra plant. The outcome \(\rho <0\) and \(\theta =0\) points to vertical FDI to get access to cheaper factor inputs (e.g., labor) and is likely to occur when trade costs are low. The parameter combination \(\rho <0\) and \(\theta >0\) is consistent with export-platform FDI, which occurs when an MNE invests in a host country with the purpose of using this country as a base to export final products to markets other than the home country. The parameter combination \(\rho >0\) and \(\theta \ge 0\) can be interpreted as empirical evidence in favor of complex vertical FDI, which is defined as an investment whereby a firm off-shores parts of its production chain over various host countries with the purpose to benefit from factor cost differences among these countries. Finally, the outcome \(\theta <0\) is inconsistent with any formal theory.

The commonly used normalization procedure of the spatial weights matrix has two purposes. First, it restricts the interval on which the spatial autoregressive parameter \(\rho \) of the spatial lag \(W\ln (FDI_t)\) is defined to (1/\(\omega _{min}\),1), where \(\omega _{min}\) represents the smallest eigenvalue of the spatial weights matrix \(W\). Second, it facilitates the interpretation of the magnitude of spatial dependence since the impact on each country by all other countries is equalized. Unfortunately, when an inverse distance matrix is row normalized its economic interpretation in terms of distance decay is no longer valid [(Anselin 1998), pp. 23–24; (Elhorst 2001)]. There are (at least) two reasons for this. First of all, because of row-normalization the inverse distance matrix may become asymmetric, as a result of which the impact of country \(i\) on country \(j\) is no longer the same as that of country \(j\) on country \(i\). Second, as a consequence of row normalization, information about the mutual proportions between the elements in the different rows of the inverse distance matrix gets lost. For example, remote and central countries may end up having the same impact, i.e. independent of their relative location. One example may illustrate this. Consider a centrally located country and a remote country that both have two neighbors sharing a common border, e.g., the Netherlands and its neighbors Germany and Belgium, and Spain and its neighbors France and Portugal. The distance of the Netherlands to its neighbors is \(d\) (suppose also that there are no other neighbors and that the distance to the two neighbors is the same), while the distance of the Spain to its neighbors is a multiple of \(d\). Despite this difference in distance, the entries in the inverse distance matrix describing the spatial arrangement of the Netherlands and Spain to its neighbors will be 1/2 and sum to 1 in both cases, provided that the spatial weights matrix is row-normalized. Further note that exactly for this reason the inverse distance matrix is generally not row-normalized when calculating the market potential variable (Blonigen et al. 2007, footnote 16; Poelhekke and Van der Ploeg 2009, footnote 14; Ledyaeva 2009, p. 655).

Kelejian and Prucha (2010a) point out that the normalization of the elements of a spatial weights matrix by a different factor for each row as opposed to a single factor is likely to lead to a misspecification problem. For this reason Elhorst (2001) and Kelejian and Prucha (2010a) propose a normalization procedure where each element of \(W\) is divided by its largest eigenvalue \(\tilde{w}_{ij} =w_{ij} /\omega _{max} \). As a direct consequence of this, the eigenvalues of \(W\) are also divided by \(\omega _{max}\). The largest eigenvalue of the matrix \(\tilde{W}\) equals one as for the case of a row normalized matrix, but, in this case, the proportions between the elements of the spatial weights matrix remain unchanged.

Many empirical studies use point estimates of one or more spatial regression model specifications to test the hypothesis as to whether or not spatial spillovers exist. One of the key contributions of LeSage and Pace’s book (2009, p. 74) is the observation that this may lead to erroneous conclusions, and that a partial derivative interpretation of the impact from changes to the variables of different model specifications represents a more valid basis for testing this hypothesis. Blonigen et al. (2007), Garretsen and Peeters (2009), and Chou et al. (2011) use the point estimates \(\gamma \) of the variable ln(GDP\(_{t})\) and \(\theta \) of the market potential variable ln(\(W\)*GDP \(_{t})\) to test the hypothesis as to whether host GDP and GDP in neighboring countries have identical effects. This comparison, however, is invalid. By rewriting the spatial lag model in (1) as

where \(R\) is a rest term containing the intercept, the country and time specific effects, and the error terms, the matrix of partial derivatives of the expected value of \(\ln (FDI_t )\) with respect to \(\ln (GDP_t )\) in unit 1 up to unit \(N\) at a particular point in time can be seen to be

where \(s_{ij}\) measures the share of each neighboring country \(j\) in the surrounding market potential of a host country \(i\): \(s_{ij} =w_{ij} GDP_j /(w_{i1} GDP_1 +\cdots +w_{iN} GDP_N )\). LeSage and Pace (2009) define the direct effect as the average of the diagonal elements of the matrix on the right-hand side of (3), and the indirect effect as the average of either the row sums or the column sums of the off-diagonal elements of these matrices. Because \(s_{ij} \) measures GDP of one country relative to that of all other countries and the diagonal elements of \(W\) are set to zero by construction, the off-diagonal elements in each row of \(S\) always sum to unity. Consequently, the share matrix \(S\) suffers from the same problems as the row-normalized inverse distance matrix; just as the latter matrix causes misspecification problems since information gets lost about mutual distances between countries due to normalizing each row by a different factor, so does the share matrix since information gets lots about mutual distances and levels of GDP between countries in the formula that is used to test the hypothesis as to whether a change in GDP in one country affects FDI in other countries.

Except for a partial derivative interpretation, LeSage and Pace (2009) also advocate models that include both a spatially lagged dependent variable and spatially lagged explanatory variables

This model is known as the spatial Durbin model. Instead of taking the logarithm of the weighted average of GDP in neighboring countries, this model takes the weighted average of the logarithm of GDP in neighboring countries. Consequently, the matrix of partial derivatives of the expected value of \(\ln (FDI_t )\) with respect to \(\ln (GDP_t )\) in unit 1 up to unit \(N\) at a particular point in time changes into

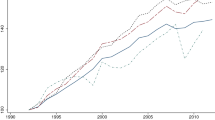

Figure 1 graphs the relationship between the market potential variable, \(\ln (W*GDP_t )\), and the spatial lagged value of the GDP variable, \(W*\ln ( {GDP_t })\) for the 20 countries in our sample over the period 1999–2008 (see next section). This figure shows that there is hardly any difference between these two variables both across space and time; the mutual correlation coefficient amounts to 0.96 and within each country one can easily observe a steady growth rate of GDP over time. Nevertheless, even though the matrix of partial derivatives in Eqs. (3) and (5) have the same form, their degree of flexibility differs. The difference is that the row sums of the off-diagonal elements taken from \(W\) in Eq. (5) rather than \(S\) in Eq. (3) do not sum to one, may be different from one to another, and do depend on the relative location of a particular country, provided that \(W\) is normalized by its largest eigenvalue rather than row-normalized. For this reason, the spatial Durbin specification in GDP is expected to produce more reasonable results than the spatial lag model extended to include the natural logarithm of the market potential variable.

3 Data and implementation

To test for third-country effects and the motivation behind MNEs to invest in a particular host country, we use a balanced panel of annual data on US outbound FDI into 20 European countriesFootnote 1 observed over the 1999–2008 period. We focus on the US since it is the largest foreign investor in the world. In contrast to previous studies, the 20 countries are chosen such they form a set of adjacent countries in an unbroken study area. If the countries would have been sampled more arbitrarily, for example, if a set of countries would be selected without the country or countries located in between, such as in Blonigen et al. (2007),Footnote 2 important information about spatial interaction effects with other countries may get lost, as a result of which especially the coefficient of the spatial lag might be biased. One potential limitation that remains is that neighboring countries just located outside the study area are still not accounted for. This is a problem that requires much more attention in the spatial econometrics literature than it did up too now [see, for example (Kelejian and Prucha 2010b)], but by considering a study area without white spots one can at least reduce this problem.

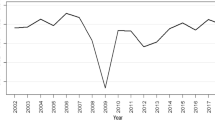

Following Beugelsdijk et al. (2010), foreign direct investments are measured by total sales to third countries of US MNE affiliates in our sample of European host countries,Footnote 3 and converted to millions of real US dollars using a chain type price index for gross domestic investments. Over the period 1999–2002 US affiliate sales to our 20 countries was quite stable, approximately 1.2 trillion US dollars, but over the period 2002–2009 it more than doubled, representing the overall upward trend in FDI.

The control variables have been selected on the basis of previous studies, especially Blonigen et al. (2007), and consist of host country gravity-model variables (GDP, population, trade costs, distance and institutional quality) complemented by a variable that measures the skill level of the host country. The variable \(GDP_{it} \) measures the size of the host market in country \(i\) at time \(t\). From a theoretical viewpoint, we expect this variable to be positively related to FDI. The spatial spillover effect of GDP is either expected to be positive or, if the FDI motivation is pure horizontal or pure vertical, to be zero. Data on GDP are taken from the Penn World Tables. According to Blonigen et al. (2007), FDI has the tendency to move between wealthier markets. For this reason, they also control for the size of the population in country \(i\) at time \(t\) (\(POPULATION_{it} )\), whose effect they expect to be negative. However, a more straightforward measure in this respect would be GDP per capita; wealthier countries do have higher levels of GDP per capita. If this has a positive effect on FDI, in addition to the size of the market, the coefficient of this variable is expected to be positive. Since \(\gamma \ln ( {GDP})+\beta \ln (GDP/Population)=( {\gamma +\beta })\ln ( {GDP})-\beta \ln (Population)\), the coefficient of the Population variable will indeed be negative if both \(\gamma \) and \(\beta \) are positive. More recent studies also use GDP per capita (Poelhekke and Van der Ploeg 2009; Chou et al. 2011).

The host trade costs variable (\(TRADECOSTS_{it} )\) is a proxy of national protectionism and captures the barriers that might hamper trade between the home and host country (Carr et al. 2001). Just as in Blonigen et al. (2007), its measurement is equal to predetermined values of exports plus imports divided by GDP. Brainard (1997) argues that higher levels of trade costs are associated with an influx of horizontal FDI, as exports will be replaced by affiliate sales. Since other forms of FDI will decrease if trade costs are high, the effect of trade costs thus depends on which form of FDI dominates.

The distance between the U.S. and the host country \(({DISTANCE\ FROM\ US_{it}})\), as well as the mutual distances between the host countries needed to construct the inverse distance matrix, is measured as the great circle distance between capital cities (in kilometers).

Following Carr et al. (2001), FDI is also taken to depend on the amount of skilled workers relative to the total workforce in the host country \(({SKILLS_{it}}).\) The relationship is expected to be positive. Only when an MNE invests in a country to benefit from low skilled labor abundance, the effect will be negative, which is the case when vertical motives dominate the investment decision. Skill levels are measured by the average years of schooling of people aged over 25 and taken from Barro and Lee (2010).

To account for the impact of investment risks on FDI inflows, we follow Garretsen and Peeters (2009) and measure the risk of investing in a particular country by the quality of government \(({QOG_{it}})\).Footnote 4 This variable is based on data by Quality of Government InstituteFootnote 5 and calculated as the mean value of the variables corruption, law and order, and bureaucratic quality. It ranges between 0 and 1, and increases if the quality of government increases. Generally, its effect is expected to be positive since lower risks reflect lower costs. Chou et al. (2011), however, point out that if higher risk host countries also offer higher returns, then FDI may still flow to them (see also the four references in this study).

Parent characteristics are left aside. Since the parent country is always the US, these characteristics have no effect on its outbound FDI into different countries. In principle, this property no longer holds if we also have data over time, but it is easily seen that time-period fixed effects may be used to control for these changes over time (Zhang et al. 2011). In contrast, a linear or quadratic time trend specification, as in Blonigen et al. (2007), Garretsen and Peeters (2009), and Poelhekke and Van der Ploeg (2009), may be insufficient to capture these kinds of changes.

4 Results of previous studies

Starting from the model in (1) with time-period fixed effects only and using panel data on US outbound FDI into 35 countries located all over the world during the period 1983-1998, Blonigen et al. (2007) find the coefficient on the spatially lagged value of FDI to be positive and significant and the coefficient of the market potential to be negative and significant. This unexpected result does not correspond to any of the FDI motives, and in their own words rather puzzles them. Another important finding of Blonigen et al. (2007) is that the inclusion of country fixed effects substantially eliminates the statistical and economic significance of the two spatial explanatory variables. This would mean that the impact of these variables is primarily cross-sectional and that third-country effects can be effectively eliminated from the model by controlling for country fixed effects. Qualitatively similar results are found by Poelhekke and Van der Ploeg (2009, Table 2) and Chou et al. (2011, Table 5), who successively investigate US outbound FDI into 68 countries over the period 1984–1998 and Chinese outbound FDI into 61 countries from 1993 to 2008.

Garretsen and Peeters (2009) focus on Dutch outbound FDI into 18 OECD countries over the period 1984–2004. They reject models that do not control for country fixed effects and, just as Blonigen et al. (2007), find that the coefficient of the spatial lag on FDI decreases substantially when controlling for them. They find the coefficients of both the spatially lagged value of FDI and the market potential to be positive and significant, which points to complex vertical FDI. However, when the study area is limited to European countries only, the coefficient of the spatially lagged value of FDI becomes negative and significant, which together with the positive and significant coefficient of the market potential variable points to export-platform FDI. Ledyaeva (2009) finds evidence in favor of vertical FDI when investigating FDI into 64 contiguous regions of Russia in the periods 1999–2002 and 2003–2005. The empirical evidence, however, is rather weak since the negative coefficient of the spatial lag on FDI is only significant at ten percent, while the coefficient on the market potential variable has a wrong sign for the period 2003–2005.

5 Results of this study

Column (1) of Table 1 reports the results of the baseline spatial econometric model in (1) with time-period fixed effects of this study. In contrast to Blonigen et al. (2007), we find the coefficient on the spatially lagged value of FDI to be negative and significant instead of positive, and the coefficient of the market potential to be positive (though insignificant) instead of negative. There are two explanations for this result. First, due to choosing an unbroken study area without white spots, third-country effects can better manifest themselves. Second, we only focus on European countries. When Garretsen and Peeters (2009) limit their study area to European countries only or when Ledyaeva (2009) focuses on contiguous regions in Russia only, they also find a negative and significant sign for the spatial lag on FDI. In addition, Blonigen et al. (2007) argue that export-platform motivations for FDI are more likely when considering a set of comparable European OECD countries. This argument is consistent with Ekholm et al. (2007), who point out that export-platform FDI is most likely to occur among countries of free trade agreements.

In Sect. 2 it has been argued that a row-normalized inverse distance matrix may be misspecified since it loses its economic interpretation of distance decay. Column (2) of Table 2 reports the results when considering an inverse distance matrix normalized by its largest eigenvalue. In contrast to the row-normalized model, the coefficient of the spatially lagged value of FDI is not only negative and significant again; both results are also stronger in magnitude. Furthermore, the positive coefficient of the market potential now also becomes significant. On the basis of these results, one might conclude that export-platform motivations drive FDI in Europe, just as Blonigen et al. (2007) and Ekholm et al. (2007) expected.

Column (3) of Table 1 adds controls for country fixed effects as an introduction to the next piece of the puzzle. This model has been estimated by maximum likelihood (Lee and Yu 2010) using Matlab routines Elhorst (2014) provides at his website www.regroningen.nl/elhorst. Just as in Blonigen et al. (2007) and partly Garretsen and Peeters (2009), the inclusion of country fixed effects eliminates the statistical significance of the spatial lag and the market potential variable. Furthermore, the coefficient estimates of these two spatial variables change sign. As pointed out in Sect. 2, however, this instability might be due to adopting an inflexible expression for the indirect effect with respect to GDP. Table 2 reports the results when the spatial lag model extended to include the market potential variable is replaced by its spatial Durbin counterpart; the first column when controlling for time-period fixed effects and the second column when controlling for both country and time-period fixed effects. If we compare the results in column (2) with those in column (1), we see that the point estimates of the spatially lagged value of FDI and of the market potential variable (W * Ln GDP) no longer change sign and that both coefficients remain significant. In other words, whereas previous studies suffer from changes in sign and significance levels of the spatial variables when country fixed effects are controlled for, the spatial Durbin specification appears to be robust. In sum, the export-platform explanation as the main driver of FDI in Europe holds up.

It should be stressed that the results also point to a second motive. Rather than the point estimate of the market potential variable, one may also consider the indirect effect of GDP to test the hypothesis as to whether a change of GDP in a particular country causes spatial spillover effects on FDI in neighboring countries.Footnote 6 Although the indirect effects of the variables GDP and GDP per capita are positive, just as the point estimate of the spatially lagged value of GDP, neither of them is significant [see column 2(c) of Table 2]. This indicates that if indirect effects rather than point estimates are used to test the hypothesis as to whether a change in GDP in one country affects FDI in other countries, pure vertical motives result. This observation is strengthened by the finding that the coefficients of the variables GDP per capita, Skills and Government Quality in both Tables 1 and 2 change sign when country fixed effects are also controlled for. Apparently, MNEs are guided by cost conditions too. Lower values of GDP per capita, a less well-educated workforce and lower levels of government quality are synonymous with less wealthy countries and low skilled labor abundance; it might be another motive of MNEs to invest in a particular host country in addition to the third-country effects. The results reported in column (2c) of Table 2 finally show that the Tradecosts variable is the only variable with a significant indirect effect. Its negative sign indicates that FDI to neighboring countries decreases if trade costs to the own country fall. As pointed out in Sect. 2, this additional competition effect is in line with both the export-platform and pure vertical motive of FDI.

6 Conclusion

Due to sub-optimal use of spatial econometric techniques, a number of recent papers that recognize that FDI decisions are multilateral in nature have not been able to find empirical results that are consistent with formal theory on horizontal, vertical, export-platform or complex vertical FDI. Rather than arbitrarily sampling a set of countries, an unbroken study area without white spots should be chosen, otherwise third-country effects cannot manifest themselves. Rather than row-normalizing the inverse distance matrix, it should be normalized by its largest eigenvalue, otherwise its interpretation of economic distance decay gets lost. Rather than point estimates, direct and indirect effects estimates of the explanatory variables should be considered, otherwise one might draw invalid conclusions about their impact, especially with respect to GDP. Rather than the market potential, FDI may also be taken to depend on \(W\times \ln (GDP)\) to avoid that the indirect effect of GDP loses the flexibility that is needed to test whether a change of GDP in one country affects FDI in other countries. By adopting these refinements, we find significant empirical evidence in favor of competition among European countries in attracting US companies, and results that are consistent with export-platform and pure vertical FDI motives.

One potential limitation of spatial econometric models in general and this study in particular requiring further research is the exclusion of countries just located outside the study area. Another potential limitation is that aggregate FDI consists of different sectors, each of which might have different cost functions and different motives. A sector-specific approach is therefore an important topic for further research.

Notes

Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

Blonigen et al. (2007) include many countries without considering their neighbors, such as Egypt.

Source: Bureau of Economic Analysis, US direct investment abroad: Operations of US parent companies and their foreign affiliates Retrieved from http://www.bea.gov/international/index.htm#omc on 05-02-2011.

Blonigen et al. (2007) use a composite index based on measures of political, financial and economic risk indicators, but data to construct this index are not publically available.

References

Anselin, L.: Spatial Econometrics: Methods and Models. Kluwer Academic Publishers, Dordrecht (1998)

Barro, R.J., Lee, J.W.: International data on educational attainment: updates and implications. Harvard University, Center for International Development (2010)

Beugelsdijk, S., Hennart, J.M.A., Slangen, A.H.L., Smeets, R.: Why and how FDI stocks are a biased measure of MNE affiliate activity. J. Int. Bus. Stud. 41, 1444–1459 (2010)

Blonigen, B.A.: A review of the empirical literature on FDI determinants. Atl. Econ. J. 33, 383–403 (2005)

Blonigen, B.A., Davies, R.B., Waddel, G.R., Naughton, H.T.: FDI in space: spatial autoregressive relationships in foreign direct investment. Eur. Econ. Rev. 51, 1303–1325 (2007)

Brainard, S.L.: An empirical assessment of the proximity-concentration trade-off between multinational sales and trade. Am. Econ. Rev. 87, 520–544 (1997)

Baltagi, B.H., Egger, P., Pfaffermayr, M.: Estimating models of complex FDI: are there third-country effects? J. Econ. 140, 260–281 (2007)

Carr, D.L., Markusen, J.R., Maskus, K.E.: Estimating the knowledge-capital model of the multinational firm. Am. Econ. Rev. 91, 693–708 (2001)

Chou, K.-H., Chen, C.-H., Mai, C.-C.: The impact of third-country effects and economic integration on China’s outward FDI. Econ. Model. 28, 2154–2163 (2011)

Ekholm, K., Forslid, R., Markusen, J.R.: Export-platform foreign direct investment. J. Eur. Econ. Assoc. 5, 776–795 (2007)

Elhorst, J.P.: Dynamic models in space and time. Geogr. Anal. 33, 119–140 (2001)

Elhorst, J.P.: Spatial Econometrics: From Cross-sectional Data to Spatial Panels. Springer, Heidelberg, New York, Dordrecht, London (2014)

Garretsen, H., Peeters, J.: FDI and the relevance of spatial linkages: do third-country effects matter for Dutch FDI. Rev. World Econ. 145, 319–338 (2009)

Kelejian, H.H., Prucha, I.R.: Specification and estimation of spatial autoregressive models with autoregressive and heteroskedastic disturbances. J. Econ. 157, 53–67 (2010a)

Kelejian, H.H., Prucha, I.R.: Spatial models with spatially lagged dependent variables and incomplete data. J. Geogr. Syst. 12, 241–257 (2010b)

Ledyaeva, S.: Spatial econometric analysis of foreign direct investments determinants in Russian regions. World Econ. 32, 543–666 (2009)

Lee, L.F., Yu, J.: Estimation of spatial autoregressive panel data models with fixed effects. J. Econ. 154, 165–185 (2010)

LeSage, J.P., Pace, R.K.: Introduction to Spatial Econometrics. CRC Press Taylor & Francis Group, Boca Raton (2009)

Poelhekke, S., Van der Ploeg, F.: Foreign direct investment and urban concentrations: unbundling spatial lags. J. Reg. Sci. 49, 749–775 (2009)

Uttama, N.P., Peridy, N.: The impact of regional integration and third-country effects of FDI; evidence from ASEAN. ASEAN Econ. Bull. 26, 239–252 (2009)

Zhang, J., van Witteloostuijn, A., Elhorst, J.P.: China’s politics and bilateral trade linkages. Asian J. Polit. Sci. 19, 25–47 (2011)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors thank two anonymous reviewers for their helpful comments on a previous version of this paper.

Rights and permissions

About this article

Cite this article

Regelink, M., Paul Elhorst, J. The spatial econometrics of FDI and third country effects. Lett Spat Resour Sci 8, 1–13 (2015). https://doi.org/10.1007/s12076-014-0125-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-014-0125-z