Abstract

Increasing energy efficiency and savings will play a key role in the achievement of the climate and energy targets in the European Union (EU). To meet the EU’s objectives for greenhouse gas emission reductions, renewable energy use and energy efficiency improvements, its member states have implemented and will design and implement various energy policies. This paper reviews a range of scientific articles on the topic of policy instruments for energy efficiency and savings and evaluates the strengths and weaknesses of different measures. The review demonstrates the variety of possible instruments and points to the complex policy environment, in which not a single instrument can meet the respective energy efficiency targets, but which requires a combination of multiple instruments. Therefore, the paper in particular focuses on assessing potential interactions between combinations of energy efficiency policies, i.e. the extent to which the different instruments counteract or support one another. So far, the literature on energy efficiency policy has paid only limited attention to the effect of interacting policies. This paper reviews and analyses interaction effects thus far identified with respect to factors that determine the interaction. Drawing on this review, we identify cases for interaction effects between energy efficiency policies to assess their potential existence systematically and to show future research needs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy efficiency policy will play a key role in meeting the EU’s energy targets, addressing environmental, energy security and economic challenges. Policy makers can choose from a range of policy instruments to foster future energy efficiency and savingsFootnote 1 and indeed, they have chosen to implement multiple policy instruments on various policy levels all targeting efficiency and savings. Given the policy crowded environment, policy interactions are inevitable (Oikonomou et al. 2010; Rosenow et al. 2016). As the number of implemented instruments increases, so does the incidence of interactions between them. These interactions may be complementary and mutually reinforcing; however, there may as well be a risk for overlapping policies and mitigating effects between them (Boonekamp 2006; Braathen 2007, Oikonomou et al. 2010; Rosenow et al. 2016).

In November 2016, the European Commission proposed a binding energy efficiency target for the EU of 30% energy savings until 2030 compared to business as usual scenario (European Commission 2016). This target will likely become even more stringent in view of the European Energy Roadmap 2050, in which the European Commission highlights that the focus in transforming the future energy system should remain on energy efficiency and savings. They propose that a sustainable transformation requires further improvement with respect to energy efficiency of new and existing buildings, efficiency investments by households and companies, and incentives for behavioural change (European Commission 2011). Considering that the need for a well-functioning instrument mix will likely increase, it is crucial for policy makers to achieve a better understanding of the effectiveness of different instruments and especially instrument combinations.

This paper provides an overview and evaluation of major energy efficiency policies that aim at increasing efficiency and savings on a household, and small and medium-scale industry level. Furthermore, it investigates the potential interaction effects between different combinations of these policies.Footnote 2 Interaction effects between energy efficiency policies are to date underrepresented in the literature (e.g. Markandya et al. 2015; Rosenow et al. 2016). This paper shall reduce the gap of knowledge by gathering and analysing interaction effects, which the limited research on this topic has identified so far. Drawing on this analysis, we define relevant influencing factors and exemplify specific interaction cases.

The structure of the paper is as follows. In section 2, we review a number of policies for energy efficiency and savings and assess these policies with respect to effectiveness, efficiency and feasibility criteria. In section 3, we focus on interaction effects between combinations of policy instruments, applying an assessment of interaction effects between energy efficiency policies. Section 4 summarises the results and discusses the need for future research and section 5 concludes the paper.

Review of policy instruments for energy efficiency and savings

One major rational for implementing energy efficiency policy is to reduce negative externalities associated with the production and consumption of energy, i.e. primarily greenhouse gas emissions. Following traditional economic theory and assuming that negative externalities are the major market failure to address in order to reduce final energy consumption, a single instrument could cost-effectively lead to a pareto-optimal outcome (Stiglitz and Rosengaard 2015). In that case, the internalisation of external costs, e.g. through energy taxation, and the associated increase in energy prices would incentivise the reduction of (fossil) energy use by absolute savings or energy efficiency investment (Lecuyer and Bibas 2012). Applying market-based instruments as a first best solution requires fully competitive market conditions besides the externality, e.g. rationality of individuals, perfect information and lack of transaction costs. Yet, researchers in this field commonly argue that in the markets for energy efficiency and savings market failures and barriers beyond the negative externality problem exist. These market failures and barriers cause a suboptimal level of energy efficiency, i.e. from an economic point of view, energy end-users have not realised all cost-effective efficiency potential, and explain the existence of the ‘energy efficiency gap’ (Jaffe and Stavins 1994). The failures and barriers include, e.g. imperfect and asymmetric information, principal agent problems, behavioural failures, including bounded rationality, and limited access to capital.Footnote 3 Thus, the portfolio of energy efficiency policies also includes instruments addressing these failures and barriers: financial incentives, regulatory and non-regulatory measures, and information and feedback.

A large number of instruments and an equally extensive amount of literature on policies aiming at energy efficiency improvements and absolute energy savings exist. The review gives an overview of instruments promoting energy efficiency and savings at the end-use level. Thus, the considered instruments create a framework or requirement for industries or households to invest in energy efficient technology and products or provide an incentive to save energy through behavioural change. As the specific implementation of a policy instrument is context dependent, the aim is to point at generally relevant policy characteristics in the following assessment.

Comparative assessment

Table 1 shows the assessment of energy efficiency policies, defining policy categories and applying effectiveness, efficiency and feasibility criteria. A major criterion to evaluate policies aiming at energy efficiency and savings is the extent to which they are effective in fostering energy efficiency improvements and increasing energy savings. Static efficiency (i.e. cost-effectiveness) assesses the ability of an instrument to achieve its target at least cost. This efficiency criterion requires the policy design to realise the relatively cheapest savings first. Dynamic efficiency, which will partly be included in the assessment, defines the ability of an instrument to give a long-term incentive for technological progress. The feasibility criteria refer to institutional demands, i.e. organisational capacity or knowledge that is required for the implementation of a policy, and governmental concerns, i.e. distributional impacts, administrative costs and other positive or negative effects that may be of concern for a governmental regulator. In the following, a number of theoretical and empirical studies highlight different aspects of the table.

Market-based instruments

A too low energy price that does not internalise the external costs caused by energy production and consumption discourages the adoption of energy efficiency and saving measures. Market-based instruments challenge this problem by adding external costs to the energy price and thereby incentivising energy efficiency and savings based on market mechanisms (e.g. Stiglitz and Rosengaard 2015).

An energy tax on consumption increases the price of energy, giving a direct incentive to reduce final energy use. However, if end-users do not respond to a change in energy prices, the effectiveness of a tax may be very small. Studies assessing energy price elasticities found inelastic energy demand in the short run, while long-run elasticities are larger (Ferrer-i-Carbonell et al. 2002; Gillingham et al. 2009). Empirical evidence on the impact of energy price changes on the adoption of energy efficient technology and innovation supports the finding of larger long-run elasticities (e.g. Ley et al. 2016; Popp 2002).

Tradable emission permits and emission taxes primarily target emission reductions and we therefore define them as an indirect energy efficiency policy. Yet, energy efficiency improvements and savings are one major way to reduce emissions. The sectors that are covered by a trading scheme or are exposed to emission taxation may pass on their abatement costs and affect final energy prices. Due to this effect, sectors not directly exposed to a price on emissions, typically households and non-energy-intensive industries, also have an incentive to reduce their energy consumption. This indirect impact on energy savings depends on the actual increase in energy prices and the relevant price elasticities (European Parliament 2013; Schleich et al. 2009).

Energy efficiency obligation (EEO) schemes exist in various ways; thus, there is no consistent definition of the incentive mechanism of this instrument. In general, EEOs set a quantitative energy savings target for energy companies (e.g. suppliers or distributors), who have to achieve the targeted reduction in end-use energy consumption in a given period. Within a tradable scheme, the obligated parties receive a certificate for energy saving achievements and can trade these certificates among one another. This instrument design is known as tradable white certificate (TWC) scheme.Footnote 4 The TWC scheme uses market mechanisms to achieve cost-effective energy savings, while an EEO scheme is based on a regulatory framework, which, however, leaves it to the obligated parties how to deliver energy savings. To reach the targeted savings, energy companies typically provide financial incentives for energy efficiency investment and/or give information on potential energy efficiency improvement. Thus, on the end-user level, where final energy savings are realised, EEO/TWC schemes translate into financial support or tailored information provision and have the potential to challenge multiple market failures and barriers to energy efficiency (Giraudet and Finon 2014). First, the instrument addresses negative externalities through investments (or purchases of certificates) to fulfil the obligation and thereby the internalisation of additional costs. Second, EEO/TWC schemes address financial barriers and information failures when providing financial incentives for energy efficiency investments and information respectively.

Furthermore, auction mechanisms for energy efficiency investments, e.g. in terms of tendering schemes and capacity market participation, use market-based bidding processes to foster energy efficiency and savings at lowest costs. E.g. in Europe, Germany has launched a tendering program for the support of industrial energy saving investments and the United Kingdom are testing, whether energy efficiency measures could compete in capacity markets (OECD/IEA 2017). However, these mechanisms are to date less established and in a pilot stage.

Financial incentives

Financial incentives address the issue of high investment costs, which constitute a potential barrier for energy efficiency improvements, motivating energy efficiency investments through subsidies (direct payments, tax rebates, grants and loans). Policy makers typically choose to apply these instruments to incentivise specific product purchases (Galarraga et al. 2016) and to support certain technologies (Bertoldi et al. 2013). Empirical findings show that financial incentives increase energy efficiency investment (Datta and Filippini 2016; Datta and Gulati 2014; Markandya et al. 2009); however, they are also associated with two main drawbacks: the free-rider problem and the rebound effect.Footnote 5 Researchers in the field have investigated that households and industries are likely to free ride on financial support provided (e.g. Grösche and Vance 2009) and further that subsidies on a product level may increase the number demanded of that product and increase final energy consumption (e.g. Galarraga et al. 2013).

Regulatory measures

Within energy efficiency policy, regulatory measures translate into codes and standards, e.g. building codes or energy performance standards. Thus, they typically enforce producers to supply energy efficient options and impose consumers to reduce their energy consumption by installing or purchasing a particular product. Having this impact on decision-making, regulatory measures tackle information failures, bounded rationality and principal agent problems (Linares and Labandeira 2010). As a number of case studies have analysed, appliance standards have a significant energy saving potential (e.g. Augustus de Melo and de Martino Jannuzzi 2010; Lu 2006; Rosenquist et al. 2006; Schiellerup 2002). Further, Kjærbye et al. (2010) show that the tightening of the Danish building codes has been effective with respect to energy consumption per m2. However, building codes give no incentives to achieve efficiency and savings beyond the compliance threshold (e.g. Jacobsen, 2016).

Information and feedback

Suboptimal investment in energy efficiency may occur to a significant extent due to information and behavioural failuresFootnote 6 (e.g. Ramos et al. 2015). Information campaigns, certificates, labels and audits, or feedback measures can address these failures. Certificates and labels give information on the energy efficiency performance of certain products, e.g. buildings and residential appliances. Energy audits provide tailored information on cost-effective energy efficiency and saving potential, mainly on a household or firm level, whereas feedback measures reveal consumers’ energy use, e.g. through smart meters, which provide detailed and frequent information on energy consumption, or bills with comparative data (Ramos et al. 2015). Ramos et al. (2015) provide a comprehensive overview of empirical results, which investigate the effect of certificates and labels on the consumers’ decision-making process. Looking at sales prices or rents of different energy products, these results show that consumers positively value both measures. Barbetta et al. (2015) provide a case study, in which the provision of information does not have a significant effect on the implementation of energy efficiency investments. They conclude that within public non-residential buildings in Italy, information is not sufficient to promote investments. Further studies have found similar results with respect to the energy saving potential of information provision (e.g. Kjærbye 2008; Larsen and Jensen 1999). Gleerup et al. (2010) study the impact of immediate feedback via text messages or email on household electricity consumption and find energy savings of about 3% due to the feedback measure. Yet, Buchanan et al. (2015) indicate potential problems associated with feedback measures and question their effectiveness, particularly focusing on the necessity of user engagement. In general, the impact of information and feedback measures is unclear.

Non-regulatory measures

Rezessy and Bertoldi (2011) define voluntary agreements as, ‘tailor-made negotiated covenants between the public authorities and individual firms or groups of firms which include targets and timetables for action aimed at improving energy efficiency or reducing GHG emissions and define rewards and penalties’ (Rezessy and Bertoldi 2011: 7121). As this definition indicates, voluntary agreements primarily target the industry sector; thus, various agreement schemes between governments and industries exist. Johannsen (2002) evaluates the Danish agreement scheme on energy efficiency between the national energy agency and energy-intensive industries. He concludes that the agreement has an impact on the firms’ investment behaviour; however, administrative costs are high for both, government and firms. Rietbergen et al. (2002) analyse the long-term agreements on industrial energy efficiency improvement in the Netherlands targeting the energy-intensive manufacturing industry. They conclude that the agreements are effective given ambitious targets, supporting measures (e.g. energy audits, financial incentives and support schemes for innovation) and credible monitoring.

Energy efficiency and the policy mix

The preceding assessment shows the variety of instruments policy makers can choose from when targeting energy efficiency improvements and a reduction in energy consumption. Indeed, an evaluation of the European Energy Efficiency Directive shows that the member states of the EU have implemented or will implement 479 policy measures in total to comply with the European energy efficiency target. The number of policies per country ranges from one to 112 (European Parliament 2012). On a national level, governments commonly implement these policies in a policy mix, i.e. a combination of instruments all aiming at the same primary target of efficiency improvements and savings. Different rationales, of which some are characteristic for energy efficiency policy, explain the use of policy combinations.

As the previous section indicated, market failures and barriers, which lead to a lower energy efficiency level than would be optimal, are a major justification for implementing multiple policies in order to address all existing failures and barriers (Gillingham et al. 2009; Linares and Labandeira 2010; Markandya et al. 2015). According to Tinbergen (1952), who the policy mix literature frequently refers to (e.g. Braathen 2007; Oikonomou et al. 2010; Rosenow et al. 2016), there should be one instrument per market failure to overcome the failure and reach a more efficient outcome. Braathen (2007) discusses this approach and makes the justified case for applying more instruments than market failures when one instrument alone cannot overcome all aspects of a particular failure. Nevertheless, the existence of multiple market failures in the markets for energy efficiency justifies the use of policy combinations. This rationale not only applies with respect to energy efficiency policy, but also constitutes a basic economic rationale that reducing market failure increases social welfare (e.g. Stiglitz and Rosengaard 2015).

Furthermore, the imperfection or failure of a policy instrument itself due to political feasibility or acceptance may lead to the implementation of multiple policy instruments. In the case of energy efficiency, exemptions from regulation for some selected target groups are common practice and lead to distortive incentives for energy efficiency and savings. Additional instruments may repair these distortions of among others energy tax exemptions in particular due to competitiveness reasons (Council Directive 2003/96/EC). In that case one instrument compensates for the weakness of the other instrument and thereby increases the robustness of achieving given policy targets. Thus, policy making, which certainly cannot be exogenous of the wider political process, may require various policy approaches and therefore the implementation of instrument combinations.

The specific characteristic of energy efficiency policy that it can target different groups of end-users, and also products and technologies, represents another rationale for the combination of multiple instruments. The potential to realise reductions in final energy consumption is diverse. E.g., energy savings are achievable on an industry and on a household level, moreover, through technological efficiency improvements and behavioural change. Considering this complexity, it is reasonable that not a single instrument can achieve energy efficiency improvements and savings, but a combination of instruments, which address the various target groups and aim at different behavioural factors. The following section 3 will investigate the potential interactions between instruments in a policy mix.

Interaction effects of energy efficiency policies

The implementation of multiple instruments all targeting a reduction in energy consumption inevitably promotes interactions between these instruments. While a number of studies looks at the interactions between energy and climate policies (Spyridaki and Flamos 2014), especially between the EU emissions trading scheme and policies for renewable energy use (e.g. Del Rio 2010; 2007; Fischer and Preonas 2010; Gawel et al. 2014; OECD 2011; Sorrell et al. 2003), only a limited number of research has addressed interactions between policies directly aiming at energy efficiency and savings. The following section first clarifies the specific definition of interaction effects. Second, in order to get an overview of how researchers have assessed interactions between energy efficiency policies so far, section 3.2 provides a literature review of relevant studies. Third, section 3.3 further assesses the results and conclusions that these studies have drawn. The assessment aims at investigating specific factors that influence the interaction effect between instrument combinations and highlighting certain patterns looking at interaction cases, and thereby at contributing to the research on interaction effects between energy efficiency policies.

How interaction is defined

Boonekamp (2006) introduced a definition of interactions between energy efficiency policies and this definition became dominant in the literature. It states that a policy interaction means the influence of one measure on the energy saving effect of another measure and this influence can be mitigating, neutral or reinforcing. An instrument combination is mitigating or overlapping when the combined saving effect is less than the sum of the saving effects these instruments would achieve stand-alone. When the combined effect is larger, the combination is reinforcing or complementary (Oikonomou et al. 2010; Rosenow et al. 2016). Thus, for a neutral combination, the combined saving effect is equal to the sum of the individual saving effects.

This dominating definition for interactions between energy efficiency policies focuses on, first, direct interactions on the instrument level, which ‘may occur when the targets or design characteristics of a policy instrument may affect the functioning or result of another policy instrument’ (Spyridaki and Flamos 2014: 1091); second, on the impact of interactions on energy savings, i.e. the effectiveness of instrument combinations. Thus, the assessment of interaction effects between combinations of energy efficiency policies largely leaves out of consideration other policy evaluation criteria, e.g. cost-effectiveness or feasibility concerns, as e.g. applied in the comparative assessment of individual energy efficiency policies in this paper (see Table 1). We will further discuss this limitation in section 4.

Literature review

The majority of research on interactions between energy efficiency policies applies qualitative, theory-based approaches, which may reflect the complex policy setting described in section ‘Energy efficiency and the policy mix’. These approaches commonly focus on policy design characteristics as a main source of interactions and assess their specific cause and effect during the implementation and operation of policy instrument combinations. The following review presents the limited literature that addresses interactions between instruments for energy efficiency and savings and shows its particular research focus.

Boonekamp (2006) conducts an ex-post analysis of interactions between household energy efficiency policies in the Netherlands from 1990 to 2003, e.g. building codes, information measures and financial incentives. He applies a qualitative approach using a matrix of policy combinations to assess pairwise interaction effects. As a basic element of the assessment, Boonekamp defines four different conditions for a successful implementation of saving options: availability, sufficient knowledge, no restrictions, and motivation. Considering overlaps or synergies in the conditions, which different policies address, he assesses the strength and type of interactions between policy combinations. Within his quantitative approach, which is an exception in the predominantly qualitative research on energy efficiency policy interactions, he quantifies the interaction effects between three major measures (energy tax, investment subsidy and regulation of gas use for space heating) using a bottom-up energy simulation model. Simulating the combined saving effect of these measures, Boonekamp’s results show mitigating effects between them. As a concluding remark, he claims that a higher efficiency requirement and intensity of measures may increase mitigating interaction effects and further challenge the effectiveness of policy combinations. To benefit from reinforcing interactions a better tuning and timing of combinations is necessary.

Braathen (2007) conducts a case study analysis and assesses interactions between various environmental policies, among those, instrument mixes for residential energy efficiency in the United Kingdom. He identifies possible positive interactions between instruments, e.g. considering the effect of information provision, and negative interactions, e.g. looking at flexibility restrictions and redundancy issues. The article emphasises that interaction effects are case specific; thus, policy makers need to evaluate both possible interaction outcomes within their specific social, political and economic context in order to apply effective and efficient instrument mixes. Braathen’s study builds on a project at Organisation for Economic Co-operation and Development (OECD): ‘Instrument mixes for Environmental Policy’ (OECD 2007).

Child et al. (2008) analyse interactions between TWCs and other instruments that aim at a more sustainable use of energy in Europe, i.e. tradable green certificates, the EU emissions trading scheme and energy efficiency policies (namely building energy certificates; energy taxes; subsidies; soft loans; performance standards and appliance labelling; voluntary/negotiated agreements; and information, education and audits). In their research framework, they compare and assess the design and implementation process of TWCs and energy efficiency policies, e.g. with respect to policy objectives and obligated parties, and thereby identify potential complementarities or overlaps when they operate simultaneously. Child et al. primarily consider TWCs as an instrument that provides financial support and therefore emphasise its reinforcing saving effect due to a larger amount of affordable energy savings in combination with all other energy efficiency policies.

Oikonomou et al. (2010) make use of the energy and climate policy interactions (ECPI) model developed by University of Groningen and National Technical University of Athens. The ECPI model is a decision support tool for policy makers, incorporating their individual preferences, and uses a qualitative multi-criteria framework for the (ex-ante) analysis of policy interactions. Taking into account environmental, socio-political, financial, macroeconomic and technological criteria, the tool measures, if interacting combinations of instruments provide an added value (see also Oikonomou et al. 2014; Oikonomou et al. 2012; Oikonomou and Jepma 2008). Oikonomou et al. (2010) use the ECPI model to assess different instrument combinations that address energy end-users: energy and carbon tax, subsidies for energy efficiency, labelling in buildings and white certificates. They find that only subsidies show a reinforcing interaction effect in combination with the other instruments. However, as the results highly depend on the policy makers’ preferences, the use of the model aims at emphasising that the analysis of interaction effects should consider multiple criteria and does not provide a generally applicable rating of interaction effects.

Rosenow et al. (2016) conduct an analysis of policy instrument combinations within building energy efficiency in 14 EU countries. They analyse the results of both a theory-based evaluation of policy combinations and a survey among experts within the field of energy efficiency policy to identify the effectiveness of different combinations and illustrate common combinations in the building sector (e.g. voluntary agreements with purchase subsidies and information measures with regulation). The analysis shows that policy makers have implemented many reinforcing policy combinations in the building sector. However, a major finding is also that purchase subsidies and access to capital measures, which governments commonly apply, tend to overlap and reduce the energy saving effect in combination. Rosenow et al. conclude that these results are important to elaborate on, but emphasise that the simplified approach of the theoretical assessment, which focuses on the effectiveness of policy combinations and does not take into account further policy goals, limits the validity. Thus, future research should conduct more contextual analysis. The study partly builds on results from the EU-funded project ‘Energy Saving Policies and Energy Efficiency Obligation Schemes’ (Rosenow et al. 2015).

The international initiative bigEE—‘bridging the information gap on Energy Efficiency in buildings’—studies how to combine policies and measures for energy efficiency in buildings and appliances to achieve potential but still untapped energy efficiency improvements.Footnote 7 The initiative, which a number of research institutes for technical and policy advice on energy and climate challenges initiated, focuses on how policies can potentially reinforce one another and finally recommends specific policy packages for building and appliance energy efficiency. Within both domains, a general recommendation is to combine minimum performance standards with information measures and financial incentives to first encourage the market penetration of energy efficient products and subsequently be able to strengthen the performance standard to achieve higher future efficiency levels.

Interaction assessment

To what extent policy instruments interact depends to a certain degree on their context, i.e. specific design characteristics and framework conditions. However, other factors determine interaction effects context-independent. The following assessment identifies those influencing factors and discusses specific interaction cases with respect to their interaction outcome.

Influencing factors

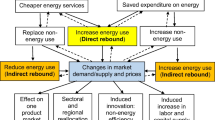

What factors determine, if there is a risk for mitigating or potential for reinforcing effects between instrument combinations? By reference to the relevant literature, we identify influencing factors and divide them in three broad categories: steering mechanism, scope and timing (Fig. 1).

The category steering mechanism comprises the type of incentive that a policy provides, i.e. how it shall steer the behaviour of the relevant target group. Rosenow et al. (2015, 2016) and Boonekamp (2006) consider the steering mechanism in their interaction assessment by reflecting on the class, type and function of two or more policies in combination. Rosenow et al. (2016) point out that combinations within the same policy class are typically mitigating and define six different policy classes: taxation, purchase subsidy, access to capital, minimum standards, underpinning measurement standards, and information and feedback. Similarly, Boonekamp (2006) concludes that instruments of the same type, which he divides into legislation, taxes, information and agreements, tend to interact. Furthermore, Boonekamp defines four different conditions for a successful implementation of saving options and applies these conditions to assess interaction effects between policy combinations qualitatively. The conditions for a successful implementation of saving options include availability of saving options, sufficient knowledge, the removal of restrictions, and motivation. Boonekamp follows the logic that two or more instruments addressing the same condition, e.g. ensuring sufficient knowledge, have a mitigating, combined saving effect. Correspondingly, Rosenow et al. (2015) argue that policies fulfilling the same function, e.g. increasing the energy price, reducing the price for energy efficiency options or enabling individuals to take account of energy in their purchase decision, are likely to cause a mitigating interaction. By definition, the steering mechanism of a policy has a direct impact on the behaviour of the targeted energy end-users. Thus, from the end-users’ perspective, the policy class, type or function determines their behavioural response, which in turn is an important factor that defines the final saving effect of (combinations of) instruments. End-users respond to instruments when the underlying mechanism drives them to change behaviour. Using the conditions for a successful implementation of Boonekamp (2006), this change is obtainable when instruments provide the potential to save energy, knowledge about the potential and finally a motivation to benefit from the potential. Policy instruments encourage these drivers by minimising existing barriers, which discourage end-users to invest in energy efficiency and savings, as mentioned before. E.g., information and feedback make the energy saving potential more visible to the end-users and enable them to be more aware of energy in their consumption behaviour of energy services. Rogge and Reichardt (2016) and Rosenow et al. (2017) discuss this point using the concept of comprehensiveness of a policy mix, which ‘captures how extensive and exhaustive its elements are’ (Rogge and Reichardt, 2016: 1627) and furthermore, which ‘can be assessed according to the degree to which it considers relevant failures and barriers’ (Rosenow et al. 2017: 97).Footnote 8 Drawing on that discussion, in the context of interaction effects, two instruments are reinforcing if they contribute to the comprehensiveness of a policy mix and are mitigating if they do not, thus if they use the same steering mechanism. In other words, considering combinations of energy efficiency policies, the degree to which their policy function encourages the same behavioural response determines potential interaction effects, which are mitigating when two instruments steer the same behavioural driver of energy efficiency improvement and reinforcing otherwise.

The instrument scope indicates the sector, the technology or the specific energy end-user that an instrument addresses, thus the overall target to which a certain policy pertains. Energy efficiency policy can target different groups of end-users, also products and technologies. Thus, interactions between policy combinations exist only between policies with the same scope (Boonekamp 2006; Rosenow et al. 2016; Rosenow et al. 2015; Simoes et al. 2015). Therefore, both Boonekamp (2006) and Rosenow et al. (2016) focus their analysis on instruments targeting building energy efficiency.

The timing factor indicates that two or more instruments can only directly interact when they act simultaneously (Boonekamp 2006; Rosenow et al. 2016). Furthermore, policies may interact when their implementation follows in sequence (Boonekamp 2006; Sorrell et al., 2003), e.g. expected changes in regulation may both reinforce or mitigate present regulation. However, the existing research on interactions of energy efficiency policies focuses on interactions at one point in time (Kern et al. 2017).Footnote 9

The general intuition behind the categorisation of influencing factors is that the relevance in interactions of two or more instruments increases to the extent that they apply the same steering mechanism, have the same scope and act at the same time. Instruments tend to be reinforcing when they are different in at least one of the three categories. I.e., when two or more instruments target the same sector at the same time, the interaction between them is most likely mitigating when they also use the same steering mechanism, but reinforcing when they are different with respect to this factor. This categorisation is very straightforward and simple; however, considering the accumulated amount of energy efficiency policies in force, researchers may use this framework as a starting point for a more profound assessment of policy interaction effects.

Interaction cases

Table 2 presents interaction cases, which the literature on interactions between energy efficiency policies (section ‘Literature review’) has analysed and discussed. Referring back to the influencing factors, the instrument combinations in Table 2 target the same scope at the same time; thus, the steering mechanism determines the interaction outcome. The combined saving effect of instrument combinations can be mitigating or reinforcing, as Boonekamp (2006) introduced. The aim is to highlight those determinants that are relevant from a general perspective and not only apply in the specific context of the studies.

-

(1)

Boonekamp (2006) and Braathen (2007) classify the combination of a performance standard with an energy tax as mitigating. Boonekamp (2006) argues that the target group of a standard, which sets a high and legally binding requirement, has to fulfil this standard, while a tax would not lead to the implementation of additional measures to increase energy efficiency. Thus, he points at the prescriptive policy mechanism of performance standards, which force the energy end-user to save energy, thus no further motivation is needed, and defines this mechanism as the reason for the mitigating interaction. Braathen (2007) takes this combination as an example for mitigating interaction effects, which hinder the effective and efficient functioning of both instruments and cause redundancies and unnecessary administrative costs.

-

(2)

Furthermore, Boonekamp (2006) assesses that the combination of an energy tax with financial incentives, i.e. different subsidy schemes, can be mitigating or reinforcing depending on the specific application of the subsidy. On the one side, Boonekamp (2006) discusses that both instruments target the motivation of energy end-users to invest in energy saving options and together they provide too much motivation, i.e. only one instrument would have led to the same investment decision. On the other side, he argues that a subsidy, which specifically motivates saving options that are not yet established and still expensive, can have a reinforcing interaction with an energy tax. In that case, consumers would not have chosen to implement these saving options only motivated by a tax. Thus, the target of a subsidy scheme, i.e. proven or not yet established saving options, determines the interaction outcome.

-

(3)

Rosenow et al. (2016) highlight that a tax on energy has a reinforcing interaction with all other instruments they include in their analysis. They argue that the direct price effect of a tax generally increases the incentive and motivation of end-users to invest in energy efficient technology and reduce energy consumption, i.e. to use financial incentives, implement regulation or join voluntary agreements. Thus, the price mechanism of a tax strengthens the functionality of other instruments. Furthermore, Child et al. (2008) classify the combination of an energy tax with a TWC scheme as reinforcing and reason that with a tax as the single instrument, end-users may choose to pay the tax when it is expensive to reduce consumption. The combination with a white certificate scheme, which implies the provision of financial incentives, increases the amount of affordable energy saving options and the final energy saving effect.

-

(4)

Assessing the combination of EEOs with financial incentives, Rosenow et al. (2016) point out that the obligation scheme implies a capped saving level, which entails that financial incentives on top of the scheme would not achieve additional savings, and classify this combination as mitigating. Thus, similar to the policy mechanism of performance standards in (1), the predefined energy saving target of EEOs limits the effectiveness of additional financial incentives. On the contrary, Child et al. (2008) conclude that the combination of TWCs with financial incentives is reinforcing, because the increase in total compensation for energy efficiency investment (increase in financial support available) accelerates technology diffusion of energy efficient equipment. However, they also consider that this combination may be an unnecessary use of resources once a technology becomes standard in the market.

-

(5)

Rosenow et al. (2015) classify the combination of voluntary agreements with EEOs as mitigating and argue that the obligation scheme sets a certain energy saving target, so that a voluntary agreement, which targets the same sector and aims at a similar saving level, would not generate additional savings. Child et al. (2008), when assessing the combination of TWCs and voluntary agreements, highlight the challenge of the measurement and verification of savings, which the voluntary agreement scheme achieves, as being eligible to count as a saving certificate.

-

(6)

On one side, the combination of performance standards with financial incentives is mitigating, when the financial support finances investments that are required by the performance standard, as Rosenow et al. (2015) evaluate. In that case, the legally binding target of the standard entails that additional financial incentives do not increase effectiveness, but the number of free-riders, here defined as agents that make use of a subsidy, although they have to do a certain investment to fulfil the standard. On the other side, the bigEE project argues that financial incentives in combination with performance standards are important to trigger energy efficiency investments, especially in the presence of high financing barriers. Thus, this combination of policies ensures a broad market introduction of energy efficient products and finally enables policy makers to tighten the standard and achieve higher future efficiency levels.

-

(7)

Furthermore, Rosenow et al. (2016) discuss that two instruments, which both provide a financial incentive for energy efficiency investments, cause a mitigating interaction, when the recipient had made the same investments in the presence of only one of the two instruments. In that case, the benefit recipient is overpaid.

-

(8)

All studies categorise the provision of information, especially via labelling schemes, as mutually reinforcing. Thus, providing information supports the effectiveness of all other instruments and vice versa. E.g. Braathen (2007) illustrates that a label increases the awareness of consumers and therefore their responsiveness to energy prices. This effect finally increases the effectiveness of a price-increasing tax on energy. Moreover, consumers may be more attentive to a label due to a tax. Thus, the policy mechanism of information provision to increase the awareness of end-users towards their energy consumption determines the mutually reinforcing interaction with other instruments. Yet, Braathen (2007) also mentions the exceptional case that the provision of too much information, e.g. due to the implementation of various different labelling schemes, may cause confusion and a mitigating combined effect. Considering the combination of information provision (in particular building certificates) with financial incentives, Child et al. (2008) furthermore point out that information provision may increase the free-rider problem. I.e., the increase in awareness entails that more consumers would increase their energy efficiency investments without financial incentives, but are still able to receive them.

These interaction cases show a systematic pattern. First, a combination of instruments that enforce a certain target of energy efficiency or savings, e.g. performance standards and EEOs, is more likely mitigating. Due to the fixed and legally binding target of one instrument, the second instrument does not achieve additional savings beyond the target. Considering the steering mechanism as the influencing factor, we can conclude that an enforcing mechanism causes more likely a redundancy and therefore a mitigating interaction because the enforcement ensures that a certain saving potential is achieved and the targeted energy end-users do not need additional knowledge or motivation to be incentivised to invest in energy efficiency and increase energy savings. Second, a combination of instruments that are flexible regarding how the target group responds to this instrument, e.g. energy taxes and information measures, is more likely reinforcing. The flexibility entails that within this combination one instrument does not hamper, but strengthen the functionality of the other instrument. Therefore, their effectiveness is higher in combination. In that case the functioning of one steering mechanism, e.g. energy price increase, does not make information provision redundant, but both mechanisms together have the potential to complement one another, in this example by providing motivation and knowledge, and maximise the final energy saving effect. Braathen (2007) draws a similar conclusion.

Discussion

The interaction assessment highlights critical influencing factors, which policy makers should take as a starting point when investigating potential mitigating or reinforcing effects between combinations of energy efficiency policy. Furthermore, it assesses cases of instrument combinations and the interaction effects between them. The identification of these interaction effects will become even more important, when energy efficiency and saving targets increase in stringency and policy mixes need to become more effective. The direct and straightforward way to increase the energy saving effect of a policy mix would be to maximise reinforcing effects and minimise mitigating interactions. This argumentation draws on the predominant research focus on effectiveness as the main goal to achieve, however, does not take into account further criteria, which influence policy making.

In contrast, Rosenow et al. (2015) remark that ‘it may be legitimate to combine policy instrument types even if the overall effect on energy savings is diminishing’ (Rosenow et al. 2015: 18). Drawing on a discussion on double regulation from Sorrell et al. (2003), they argue that the avoidance of mitigating interactions should not be the only objective, but that it needs a broader assessment of circumstances, in which these interactions might be acceptable or unacceptable. The combination of financial incentives and energy performance standards can illustrate the argument. Rosenow et al. (2015) evaluate that this combination is mitigating, when the financial support finances investments that are required by the performance standard. However, the financial support might only make it affordable for e.g. low-income households to be able to comply with the standard. In that case, the perceived mitigating interaction addresses social equity concerns. Thus, including governmental concerns beyond the energy saving target in the assessment of this policy combination could change the evaluation of the interaction effect.

Furthermore, researchers have paid only limited attention on the impact of interactions on the efficiency or cost-effectiveness of instrument combinations. Boonekamp (2006) and Rosenow et al. (2016) do not consider cost-effectiveness in their assessments and Rosenow et al. argue that this is due to a lack of evidence on the cost side. In the OECD project report (OECD 2007) efficiency considerations are limited to the theoretical discussion that policy makers should add additional instruments to an existing instrument mix at the lowest marginal costs possible and only if marginal benefits are larger than marginal costs. Braathen (2007) mentions the case that overlapping instruments cause redundancies and thus unnecessary administrative costs. Administrative costs are also part of the multi-criteria approach of the ECPI model, besides compliance and transaction costs (Oikonomou et al. 2014, 2012, 2010). However, the existing research has not thoroughly assessed the impact of interactions on efficiency or administration and compliance costs of instrument combinations.

Future work on interaction effects of energy efficiency policies should extend the predominant research focus and include assessment criteria beyond effectiveness, such as efficiency and feasibility. Furthermore, the research on interactions between energy efficiency policies is largely limited to qualitative and theory-based approaches. Thus, the quantification of interaction effects between policy combinations is an area, where a gap of knowledge exists. Future research should investigate case studies of instrument combinations, where relevant data on the (cost-)effectiveness of specific instruments, stand-alone and in combination, is available. Considering the challenges to empirically derive the impact of energy efficiency policies in real world applications, there may be a need for controlled experiments, which could test and evaluate different combinations of instruments. Various studies have already used this approach to investigate the effect of single instruments (e.g. Allcott and Rogers 2014; Gleerup et al. 2010). A careful combination of qualitative and quantitative results of (multi-criteria) interaction assessments could sharpen the analysis of interactions between energy efficiency policies. In particular, the combination could enable to make concrete statements on the magnitude and importance of interaction effects. I.e., the results could clarify, if mitigating interactions are a major problem that should make us reduce the number of applied instruments or how reinforcing effects could optimise the implementation of a policy mix for energy efficiency and savings. The existing research has not drawn conclusions on the magnitude and importance of interactions, although information on this issue may be most important for policy making.

Conclusion

Policy makers can choose to implement various policy instruments to foster future energy efficiency and savings. These instruments all have their individual strengths and weaknesses, which policy makers should balance in the process of finding the appropriate instrument(s) for a specific policy context. In many cases, they choose to implement not only one instrument, but a combination of instruments, which all target energy efficiency improvements and savings. In that case, interactions between these instruments are inevitable. By definition, interactions can be reinforcing, neutral or mitigating depending on the combined saving effect of instrument combinations. The interaction assessment of this paper shows that the steering mechanism, the scope and the timing of two or more instruments influence the interaction outcome. Furthermore, the assessment identifies that a combination of instruments that enforce a certain target of energy efficiency and savings is more likely mitigating, while a combination of instruments that are flexible regarding how the target group responds to this instrument is more likely reinforcing. However, the existing research on interaction effects of energy efficiency policies is restricted to mainly qualitative results focusing on the energy saving effect of instrument combinations as the main evaluation criterion. Thus, the magnitude and importance of interaction effects is yet unclear.

Change history

06 July 2018

In the original publication, 8 paragraphs under subsection Interaction cases were incorrectly set as footnotes of Table 2.

06 July 2018

In the original publication, 8 paragraphs under subsection Interaction cases were incorrectly set as footnotes of Table 2.

06 July 2018

In the original publication, 8 paragraphs under subsection Interaction cases were incorrectly set as footnotes of Table 2.

06 July 2018

In the original publication, 8 paragraphs under subsection Interaction cases were incorrectly set as footnotes of Table 2.

Notes

We use the classical definitions of energy efficiency and savings: Energy efficiency relates to the ratio between energy consumption and the amount of energy service or production obtainable, whereas energy savings concern the absolute reduction in final energy consumed, which the end-user can achieve through investment in technical energy efficiency improvement or behavioural change. In this paper, both concepts represent the same policy target of a reduction in final energy consumption.

Future research could make a similar assessment shifting the scope to further sectors, e.g. public, commercial and large-scale industries, where different policies and policy interactions would be relevant to investigate.

Market barriers include any disincentives to invest in energy efficiency or reduce energy consumption. Not all barriers can be defined as a market failure in a welfare economic perspective, e.g. uncertainty, irreversibility of energy efficiency investment and bounded rationality. For a detailed discussion on market failures and barriers to energy efficiency see for example Gillingham et al. (2009); Jaffe and Stavins (1994), Linares and Labandeira (2010).

See Bertoldi and Rezessy (2008) for a comprehensive overview of fundamental concepts behind tradable white certificate schemes.

Free-riders are agents who make use of an incentive program, although they would have invested in energy efficiency improvements without any financial support. The free-riding problem therefore challenges the additionality of energy savings achieved through financial incentives. The rebound effect causes an increase in final energy consumption and may occur due to an effective price reduction once energy efficiency improves (Greening et al. 2000). Alternatively, an increase in the total number and the size of certain energy consuming products in use may increase final energy consumption, when e.g. a subsidy reduces initial investment costs (Galarraga et al. 2013; Markandya et al. 2015).

Information problems include imperfect, asymmetric information and split incentives, and behavioural failures refer to any departure from perfect rationality.

http://www.bigee.net/media/filer_public/2013/11/28/bigee_txt_0006_pg_how_policies_need_to_interact_2.pdf (Accessed 18 January 2018)

Kern et al. (2017) analyse the development of policy mixes for energy efficiency over time. Yet, the assessment of sequencing interactions between energy efficiency policies is a field for future research.

References

Abrahamse, W., Steg, L., Vlek, C., & Rothengatter, T. (2007). The effect of tailored information, goal setting, and tailored feedback on household energy use, energy-related behaviors, and behavioral antecedents. Journal of Environmental Psychology, 27(4), 265–276. https://doi.org/10.1016/j.jenvp.2007.08.002.

Allcott, H., & Rogers, T. (2014). The short-run and long-run effects of behavioral interventions: experimental evidence from energy conservation. The American Economic Review, 104(10), 3003–3037. https://doi.org/10.1257/aer.104.10.3003.

Amecke, H. (2012). The impact of energy performance certificates: a survey of German home owners. Energy Policy, 46, 4–14. https://doi.org/10.1016/j.enpol.2012.01.064.

Annunziata, E., Rizzi, F., & Frey, M. (2014). Enhancing energy efficiency in public buildings: the role of local energy audit programmes. Energy Policy, 69, 364–373. https://doi.org/10.1016/j.enpol.2014.02.027.

Augustus de Melo, C., & de Martino Jannuzzi, G. (2010). Energy efficiency standards for refrigerators in Brazil: a methodology for impact evaluation. Energy Policy, 38(11), 6545–6550. https://doi.org/10.1016/j.enpol.2010.07.032.

Barbetta, G. P., Canino, P., & Cima, S. (2015). The impact of energy audits on energy efficiency investment of public owners. Evidence from Italy. Energy, 93, 1199–1209. https://doi.org/10.1016/j.energy.2015.09.117.

Berkhout, P. H. G., Ferrer-i-Carbonell, A., & Muskens, J. C. (2004). The ex post impact of an energy tax on household energy demand. Energy Economics, 26(3), 297–317. https://doi.org/10.1016/j.eneco.2004.04.002.

Bertoldi, P., & Rezessy, S. (2008). Tradable white certificate schemes: fundamental concepts. Energy Efficiency, 1(4), 237–255. https://doi.org/10.1007/s12053-008-9021-y.

Bertoldi, P., Rezessy, S., and Bürer, M.J. (2005). Will emission trading promote end-use energy efficiency and renewable energy projects. Proceedings of the 2005 Summer Study on Energy Efficiency in Industry of the American Council for Energy Efficient Economy. http://aceee.org/files/proceedings/2005/data/papers/SS05_Panel04_Paper01.pdf. Accessed 05 April 2017.

Bertoldi, P., Rezessy, S., Lees, E., Baudry, P., Jeandel, A., & Labanca, N. (2010). Energy supplier obligations and white certificate schemes: comparative analysis of experiences in the European Union. Energy Policy, 38(3), 1455–1469. https://doi.org/10.1016/j.enpol.2009.11.027.

Bertoldi, P., Rezessy, S., & Oikonomou, V. (2013). Rewarding energy savings rather than energy efficiency: exploring the concept of a feed-in tariff for energy savings. Energy Policy, 56, 526–535. https://doi.org/10.1016/j.enpol.2013.01.019.

Boonekamp, P. G. M. (2006). Actual interaction effects between policy measures for energy efficiency—a qualitative matrix method and quantitative simulation results for households. Energy, 31(14), 2512–2537. https://doi.org/10.1016/j.energy.2006.01.004.

Braathen, N. A. (2007). Instrument mixes for environmental policy: how many stones should be used to kill a bird? International Review of Environmental and Resource Economics, 1(2): 185–235. doi: https://doi.org/10.1561/101.00000005

Buchanan, K., Russo, R., & Anderson, B. (2015). The question of energy reduction: the problem(s) with feedback. Energy Policy, 77, 89–96. https://doi.org/10.1016/j.enpol.2014.12.008.

Child, R., Langniss, O., Klink, J., & Gaudioso, D. (2008). Interactions of white certificates with other policy instruments in Europe. Energy Efficiency, 1(4), 283–295. https://doi.org/10.1007/s12053-008-9025-7.

Council Directive 2003/96/EC of 27 October 2003 on Restructuring the Community framework for the taxation of energy products and electricity. http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2003:283:0051:0070:EN:PDF. Accessed 04 September 2017.

Datta, S., & Filippini, M. (2016). Analysing the impact of ENERGY STAR rebate policies in the US. Energy Efficiency, 9(3), 677–698. https://doi.org/10.1007/s12053-015-9386-7.

Datta, S., & Gulati, S. (2014). Utility rebates for ENERGY STAR appliances: are they effective? Journal of Environmental Economics and Management, 68(3), 480–506. https://doi.org/10.1016/j.jeem.2014.09.003.

Del Río, P. (2010). Analysing the interactions between renewable energy promotion and energy efficiency support schemes: the impact of different instruments and design elements. Energy Policy, 38(9), 4978–4989. https://doi.org/10.1016/j.enpol.2010.04.003.

Del Río González, P. (2007). The interaction between emissions trading and renewable electricity support schemes. An overview of the literature. Mitigation and Adaptation Strategies for Global Change, 12(8), 1363–1390. https://doi.org/10.1007/s11027-006-9069-y.

Dubois, M., & Allacker, K. (2015). Energy savings from housing: ineffective renovation subsidies vs efficient demolition and reconstruction incentives. Energy Policy, 86, 697–704. https://doi.org/10.1016/j.enpol.2015.07.029.

bigEE, Bridging the information gap on Energy Efficiency in buildings. How policies need to interact in packages: bigEE recommendations on which measures to combine for effective policy. Wuppertal Institute for Climate, Environment and Energy. http://www.bigee.net/media/filer_public/2013/11/28/bigee_txt_0006_pg_how_policies_need_to_interact_2.pdf. Accessed 18 Januar 2018.

Ek, K., & Söderholm Patrik, P. (2010). The devil is in the details: household electricity saving behavior and the role of information. Energy Policy, 38(3), 1578–1587. https://doi.org/10.1016/j.enpol.2009.11.041.

European Commission (2011). 'Energy roadmap 2050. COM(2011) 885. http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52011DC0885&from=EN. Accessed 04 April 2017.

European Commission (2016). Clean energy for all Europeans. COM(2016) 860. http://eur-lex.europa.eu/resource.html?uri=cellar:fa6ea15b-b7b0-11e6-9e3c-01aa75ed71a1.0001.02/DOC_1&format=PDF. Accessed 05 April 2017.

European Parliament (2012). Implementation of the energy efficiency directive (2012/27/EU): energy efficiency obligation schemes. European Implementation Assessment. European Parlamentary Research Service. http://www.europarl.europa.eu/RegData/etudes/STUD/2016/579327/EPRS_STU(2016)579327_EN.pdf. Accessed 10 April 2017.

European Parliament (2013). Energy efficiency and the ETS. Directorate General for Internal Policies, Policy Department A: Economic and Scientific Policy. http://www.europarl.europa.eu/RegData/etudes/etudes/join/2013/492468/IPOL-ITRE_ET(2013)492468_EN.pdf. Accessed 05 April 2017.

Ferrer-i-Carbonell, A., Muskens, A. C., & van Leeuwen, M. J. (2002). Behavioural responses to energy-related taxes: a survey. International Journal of Global Energy Issues, 18(2–4), 202–217. https://doi.org/10.1504/IJGEI.2002.000960.

Fischer, C. (2008). Feedback on household electricity consumption: a tool for saving energy? Energy Efficiency, 1(1), 79–104. https://doi.org/10.1007/s12053-008-9009-7.

Fischer, C., and Preonas, L. (2010). Combining policies for renewable energy: is the whole less than the sum of its parts? International Review of Environmental and Resource Economics, 4(1): 51–92. doi: https://doi.org/10.1561/101.00000030

Galarraga, I., Abadie, L. M., & Ansuategi, A. (2013). Efficiency, effectiveness and implementation feasibility of energy efficiency rebates: the “Renove” plan in Spain. Energy Economics, 40, 98–107. https://doi.org/10.1016/j.eneco.2013.09.012.

Galarraga, I., Abadie, L. M., & Kallbekken, S. (2016). Designing incentive schemes for promoting energy-efficient appliances: a new methodology and a case study for Spain. Energy Policy, 90, 24–36. https://doi.org/10.1016/j.enpol.2015.12.010.

Gawel, E., Strunz, S., & Lehmann, P. (2014). A public choice view on the climate and energy policy mix in the EU—how do the emissions trading scheme and support for renewable energies interact? Energy Policy, 64, 175–182. https://doi.org/10.1016/j.enpol.2013.09.008.

Gillingham, K., Newell, R. G., Sweeney, J., Brennan, T., Auffhammer, M., Howarth, R., & Cullenward, D. (2009). Energy efficiency economics and policy. Annual Review of Resource Economics, 1(1), 597–620. https://doi.org/10.1146/annurev.resource.102308.124234.

Giraudet, L.-G., and Finon, D. (2014). European experiences with white certificate obligations: a critical review of existing evaluations. Economics of Energy & Environmental Policy, 4(1): 113–130. doi: https://doi.org/10.5547/2160-5890.4.1.lgir

Giraudet, L.-G., Bodineau, L., and Finon, D. (2011). The costs and benefits of white certificates schemes CIRED Working Papers Series, No. 29-2011.

Gleerup, M., Larsen, A., Leth-Petersen, S., & Togeby, M. (2010). The effect of feedback by text message (SMS) and email on household electricity consumption: experimental evidence. The Energy Journal, 31(3), 113–132.

Greening, L. A., Greene, D. L., & Difiglio, C. (2000). Energy efficiency and consumption—the rebound effect—a survey. Energy Policy, 28(6–7), 389–401. https://doi.org/10.1016/S0301-4215(00)00021-5.

Grösche, P., & Vance, C. (2009). Willingness to pay for energy conservation and free-ridership on subsidization: evidence from Germany. The Energy Journal, 30(2), 135–153.

Hargreaves, T., Nye, M., & Burgess, J. (2013). Keeping energy visible? exploring how householders interact with feedback from smart energy monitors in the longer term. Energy Policy, 52, 126–134. https://doi.org/10.1016/j.enpol.2012.03.027.

Henriksson, E., & Söderholm, P. (2009). The cost-effectiveness of voluntary energy efficiency programs. Energy for Sustainable Development, 13(4), 235–243. https://doi.org/10.1016/j.esd.2009.08.005.

Hou, J., Liu, Y., Wu, Y., Zhou, N., & Feng, W. (2016). Comparative study of commercial building energy-efficiency retrofit policies in four pilot cities in China. Energy Policy, 88, 204–215. https://doi.org/10.1016/j.enpol.2015.10.016.

Jacobsen, G. D. (2016). Improving energy codes. Energy Journal, 37(1), 25–40. https://doi.org/10.5547/01956574.37.1.gjac.

Jaffe, A. B., & Stavins, R. N. (1994). The energy-efficiency gap: what does it mean? Energy Policy, 22(10), 804–810. https://doi.org/10.1016/0301-4215(94)90138-4.

Johannsen, K. S. (2002). Combining voluntary agreements and taxes—an evaluation of the Danish agreement scheme on energy efficiency in industry. Journal of Cleaner Production, 10(2), 129–141. https://doi.org/10.1016/S0959-6526(01)00031-2.

Kern, F., Kivimaa, P., & Martiskainen, M. (2017). Policy packaging or policy patching? The development of complex energy efficiency policy mixes. Energy Research and Social Science, 23, 11–25. https://doi.org/10.1016/j.erss.2016.11.002.

Kjærbye, V. H. (2008). Does energy labelling on residential housing cause energy savings? AKF Workingpaper. https://www.kora.dk/media/272155/udgivelser_2008_pdf_energy_labelling.pdf. Accessed 05 April 2017.

Kjærbye, V. H., Larsen, A., & Togeby, M. (2010). The effect of building regulations on energy consumption in single-family houses in Denmark. Copenhagen: Ea Energy Analyses http://www.ea-energianalyse.dk/reports/the_effect_of_building_regulations_on_energy_consumption_in_single_family_houses_in_Denmark.pdf. Accessed 05 April 2017.

Krarup, S., & Ramesohl, S. (2002). Voluntary agreements on energy efficiency in industry—not a golden key, but another contribution to improve climate policy mixes. Journal of Cleaner Production, 10(2), 109–120. https://doi.org/10.1016/S0959-6526(01)00032-4.

Laing, T., Sato, M., Grubb, M., & Comberti, C. (2014). Assessing the effectiveness of the EU emissions trading system. Wiley Interdisciplinary Reviews: Climate Change, 5(4), 509–519.

Larsen, A., & Jensen, M. (1999). Evaluations of energy audits and the regulator. Energy Policy, 27(9), 557–564. https://doi.org/10.1016/S0301-4215(99)00033-6.

Lecuyer, O. and Bibas, R. (2012). Combining climate and energy policies: synergies or antagonism? Modeling interactions with energy efficiency instruments. CIRED Working Papers Series, No. 37–2012.

Leiva, J., Palacios, A., & Aguado, J. A. (2016). Smart metering trends, implications and necessities: a policy review. Renewable and Sustainable Energy Reviews, 55, 227–233. https://doi.org/10.1016/j.rser.2015.11.002.

Ley, M., Stucki, T., & Woerter, M. (2016). The impact of energy prices on green innovation. Energy Journal, 37(1), 41–75. https://doi.org/10.5547/01956574.37.1.mley.

Linares, P., & Labandeira, X. (2010). Energy efficiency: economics and policy. Journal of Economic Surveys, 24(3), 573–592. https://doi.org/10.1111/j.1467-6419.2009.00609.x.

Lu, W. (2006). Potential energy savings and environmental impact by implementing energy efficiency standard for household refrigerators in China. Energy Policy, 34(13), 1583–1589. https://doi.org/10.1016/j.enpol.2004.12.012.

Markandya, A., Ortiz, R. A., Mudgal, S., & Tinetti, B. (2009). Analysis of tax incentives for energy-efficient durables in the EU. Energy Policy, 37(12), 5662–5674. https://doi.org/10.1016/j.enpol.2009.08.031.

Markandya, A., Labandeira, X., and Ramos, A. (2015). Policy instruments to foster energy efficiency. In Green Energy and Efficiency, Springer International Publishing: 93–110. doi: https://doi.org/10.1007/978-3-319-03632-8

Mundaca, L. (2008). Markets for energy efficiency: exploring the implications of an EU-wide “tradable white certificate” scheme. Energy Economics, 30(6), 3016–3043. https://doi.org/10.1016/j.eneco.2008.03.004.

Mundaca, L., & Neij, L. (2009). A multi-criteria evaluation framework for tradable white certificate schemes. Energy Policy, 37(11), 4557–4573. https://doi.org/10.1016/j.enpol.2009.06.01.

Nadel, S. (2002). Appliance and equipment efficiency standards. Annual Review of Energy and the Environment, 27(1), 159–192. https://doi.org/10.1146/annurev.energy.27.122001.083452.

Nauleau, M.-L., Giraudet, L.-G., & Quirion, P. (2015). Energy efficiency subsidies with price-quality discrimination. Energy Economics, 52, S53–S62. https://doi.org/10.1016/j.eneco.2015.08.024.

OECD. (2007). Instrument mixes for environmental policy. Paris: OECD Publishing. https://doi.org/10.1787/9789264018419-en.

OECD (2011). Interactions between emission trading systems and other overlapping policy instruments. General Distribution Document, Environment Directorate, OECD, Paris. http://www.oecd.org/env/tools-evaluation/Interactions%20between%20Emission%20Trading%20Systems%20and%20Other%20Overlapping%20Policy%20Instruments.pdf. Accessed 05 April 2017.

OECD. (2013). Taxing energy use: a graphical analysis. Paris: OECD Publishing. https://doi.org/10.1787/9789264183933-en.

OECD/IEA. (2017). Market-based instruments for energy efficiency: policy choice and design. Paris: IEA Publications https://www.iea.org/publications/insights/insightpublications/MarketBased_Instruments_for_Energy_Efficiency.pdf. Accessed 01 September 2017.

Oikonomou, V., & Jepma, C. J. (2008). A framework on interactions of climate and energy policy instruments. Mitigation and Adaptation Strategies for Global Change, 13(2), 131–156. https://doi.org/10.1007/s11027-007-9082-9.

Oikonomou, V., Flamos, A., & Grafakos, S. (2010). Is blending of energy and climate policy instruments always desirable? Energy Policy, 38(8), 4186–4195. https://doi.org/10.1016/j.enpol.2010.03.046.

Oikonomou, V., Flamos, A., Zeugolis, D., and Grafakos, S. (2012). A qualitative assessment of EU energy policy interactions. Energy Sources, Part B: Economics, Planning, and Policy, 7(2): 177–187. doi: https://doi.org/10.1080/15567240902788996

Oikonomou, V., Flamos, A., and Grafakos, S. (2014). Combination of energy policy instruments: creation of added value or overlapping? Energy Sources, Part B: Economics, Planning, and Policy, 9(1): 46–56. Doi https://doi.org/10.1080/15567241003716696.

Popp, D. (2002). Induced innovation and energy prices. American Economic Review, 92(1), 160–180.

Price, L. (2005). Voluntary agreements for energy efficiency or GHG emissions reduction in industry: an assessment of programs around the world. Proceedings of the 2005 Summer Study on Energy Efficiency in Industry of the American Council for Energy Efficient Economy. http://aceee.org/files/proceedings/2005/data/papers/SS05_Panel05_Paper12.pdf. Accessed 05 April 2017.

Ramos, A., Gago, A., Labandeira, X., & Linares, P. (2015). The role of information for energy efficiency in the residential sector. Energy Economics, 52, S17–S29. https://doi.org/10.1016/j.eneco.2015.08.022.

Rezessy, S., & Bertoldi, P. (2011). Voluntary agreements in the field of energy efficiency and emission reduction: review and analysis of experiences in the European Union. Energy Policy, 39(11), 7121–7129. https://doi.org/10.1016/j.enpol.2011.08.030.

Rietbergen, M. G., Farla, J. C. M., & Blok, K. (2002). Do agreements enhance energy efficiency improvement? Analysing the actual outcome of long-term agreements on industrial energy efficiency improvement in the Netherlands. Journal of Cleaner Production, 10(2), 153–163. https://doi.org/10.1016/S0959-6526(01)00035-X.

Rogge, K. S., & Reichardt, K. (2016). Policy mixes for sustainability transitions: an extended concept andframework for analysis. Research Policy, 45(8), 1620–1635. https://doi.org/10.1016/j.respol.2016.04.004.

Rosenow, J. (2012). Energy savings obligations in the UK-A history of change. Energy Policy, 49, 373–382. https://doi.org/10.1016/j.enpol.2012.06.052.

Rosenow, J., Fawcett, T., Eyre, N., and Oikonomou, V. (2015). Energy saving policies and energy efficiency obligation schemes. D5.1 Combining of Energy Efficiency Obligations and alternative policies. http://enspol.eu/sites/default/files/results/D5.1Combining%20of%20Energy%20Efficiency%20Obligations%20and%20alternative%20policies.pdf. Accessed 05 April 2017.

Rosenow, J., Fawcett, T., Eyre, N., and Oikonomou, V. (2016). Energy efficiency and the policy mix. Building Research & Information, 4(5–6): 562–574. doi: https://doi.org/10.1080/09613218.2016.1138803

Rosenow, J., Kern, F., & Rogge, K. (2017). The need for comprehensive and well targeted instrument mixes to stimulate energy transitions: the case of energy efficiency policy. Energy Research & Social Science, 33, 95–104. https://doi.org/10.1016/j.erss.2017.09.013.

Rosenquist, G., McNeil, M., Iyer, M., Meyers, S., & McMahon, J. (2006). Energy efficiency standards for equipment: additional opportunities in the residential and commercial sectors. Energy Policy, 34(17), 3257–3267. https://doi.org/10.1016/j.enpol.2005.06.026.

Schiellerup, P. (2002). An examination of the effectiveness of the EU minimum standard on cold appliances: the British case. Energy Policy, 30(4), 327–332. https://doi.org/10.1016/S0301-4215(01)00099-4.

Schleich, J., Rogge, K., & Betz, R. (2009). Incentives for energy efficiency in the EU emissions trading scheme. Energy Efficiency, 2(1), 37–67. https://doi.org/10.1007/s12053-008-9029-3.

Sijm, J. (2005). The interaction between the EU emissions trading scheme and national energy policies. Climate Policy, 5(1), 79–96. https://doi.org/10.1080/14693062.2005.9685542.

Simoes, S., Huppes, G., & Seixas, J. (2015). A tangled web: assessing overlaps between energy and environmental policy instruments along the electricity supply chain. Environmental Policy and Governance, 25(6), 439–458. https://doi.org/10.1002/eet.1691.

Sorrell, S., Smith, A., Betz, R., Waltz, R., Boemare, C., Quirion, P., Sijm, J., Mavrakis, D., Konidari, P., Vassos, S., Haralampopoulos, D., Pilinis, C. (2003). Interaction in EU climate policy. INTERACT project. Final Report. http://sro.sussex.ac.uk/53992/1/INTERACT_Final_Report.pdf. Accessed 05 April 2017.

Spyridaki, N. A., & Flamos, A. (2014). A paper trail of evaluation approaches to energy and climate policy interactions. Renewable and Sustainable Energy Reviews, 40, 1090–1107. https://doi.org/10.1016/j.rser.2014.08.001.

Steg, L. (2008). Promoting household energy conservation. Energy Policy, 36(12), 4449–4453. https://doi.org/10.1016/j.enpol.2008.09.027.

Stenqvist, C., & Nilsson, L. J. (2012). Energy efficiency in energy-intensive industries-an evaluation of the Swedish voluntary agreement PFE. Energy Efficiency, 5(2), 225–241. https://doi.org/10.1007/s12053-011-9131-9.

Stiglitz, J. E., & Rosengaard, J. K. (2015). Economics of The Public Sector (4th ed.). New York / London: W.W. Norton & Company.

Tinbergen, J. (1952). On the theory of economic policy. Amsterdam: North Holland.

Togeby, M., Dyhr-Mikkelsen, K., & James-Smith, E. (2007). Design of white certificates. Comparing UK, Italy, France and Denmark. Copenhagen: Ea Energy Analyses http://www.ea-energianalyse.dk/reports/710_White_certificates_report_19_Nov_07.pdf. Accessed 05 April 2017.

Zvingilaite, E., & Togeby, M. (2015). Impact of feedback about energy consumption. Copenhagen: Ea Energy Analyses http://www.ea-energianalyse.dk/reports/1517_impact_of_feedback_about_energy_consumption.pdf. Accessed 05 April 2017.

Acknowledgments

The research has been financed by the Innovation Fund Denmark under the research project SAVE-E, grant no. 4106-00009B.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

In the original publication, 8 paragraphs under subsection Interaction cases were incorrectly set as footnotes of table 2.

Rights and permissions

About this article

Cite this article

Wiese, C., Larsen, A. & Pade, LL. Interaction effects of energy efficiency policies: a review. Energy Efficiency 11, 2137–2156 (2018). https://doi.org/10.1007/s12053-018-9659-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-018-9659-z