Abstract

European iron and steel producers are working towards increased energy efficiency to meet requirements set by European policies such as the Energy Efficiency Directive. In this study, we show that the specific energy consumption (SEC), representing the iron and steel sector in the Odyssee energy efficiency index (ODEX)—the tool for policy evaluation recommended by the European Commission—is insufficient for capturing energy efficiency trends of European iron and steel production. European producers focus on niche markets, diversifying and specialising their set of products well beyond crude steel, which is the benchmark product for deriving the SEC. We compare the SEC with the more comprehensive Malmquist productivity index (MPI) methodology, which is calculated using data envelopment analysis (DEA) techniques. An evaluation of energy efficiency trends during 2000–2010 showed that the SEC overestimated energy efficiency improvements for European steel industries, while underestimating the improvements achieved by Swedish steel industries. A comparison between the SEC, the MPI/DEA approach, and energy intensity based on value added in the Swedish case provides further insight to the methodological differences between the approaches. We conclude that the approaches highlight different aspects of energy efficiency analyses and that the SEC is not sufficient for capturing the energy efficiency of steel industries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Iron and steel production, together with chemical and petrochemical production, comprise the most energy intensive segments of European industries, corresponding to 18 and 19 % of the final industrial energy use, respectively (European Commission (EC) 2012). Iron and steel production is intrinsically carbon intensive due to the coal required for the iron ore reduction in prevailing industrial processes. In 2010, iron and steel production was responsible for 4.7 % of the overall greenhouse gas emissions in the EU-27, equivalent to approximately 181 million tonnes of CO2 (UNFCCC 2012).

In the EU, significant efforts have been made to improve the energy efficiency of the economy as well as reduce the environmental impact of human activities. For instance, the Energy Services Directive (ESD), which will be repealed mid-2014, and the recently adopted Energy Efficiency Directive (EED) set targets for energy efficiency, which are also needed to reach the targets for mitigating environmental impacts and climate change. The directives are translated into policies at regional or national levels, thus affecting the context in which European industries are operating (EC 2006, 2012). The EU Emission Trading System (EU ETS) introduces a carbon price to be paid by industries. Iron and steel production facilities are included in the EU ETS, and their profitability is directly affected by the carbon cost (EC 2013).

In Sweden, a voluntary agreement was introduced in mid-2004, granting energy intensive industries an electricity tax exemption in exchange for participation in an energy efficiency programme. As part of the requirements of the programme, the industries had to perform an energy audit, adopt an energy management system, and implement measures for increasing electrical efficiency (Swedish Energy Agency 2011a). In addition, the iron and steel industries received public funding for several projects aimed at increasing knowledge about energy efficiency, including education of engineers and practitioners in the mining and steel industries. These efforts resulted in education of approximately 7,000 persons, development of an online energy handbook, and establishment of an energy network for industries in the targeted sectors (Lindblad and Axelsson 2009; Nordqvist and Axelsson 2011).

The effectiveness of regional (EU) as well as national initiatives towards increasing energy efficiency needs to be evaluated post-implementation. For the EU Member States, there is a recommendation in the ESD as well as in the EED to use the Odyssee energy efficiency index (ODEX) for evaluating the effectiveness of the policies emanating from the directives (EC 2006, 2012). ODEX aggregates energy intensity trends from all sectors of the economy (industry, transportation, and households) into one single index and is developed and maintained within the EU project Odyssee Mure (Enerdata 2010). However, the methodology has been criticized for several reasons.

At the aggregated level, ODEX is largely influenced by fluctuations in the data and less robust than other established methods for estimating efficiency development (Cahill et al. 2010). ODEX is based on a number of sectoral unit consumption indicators (or specific energy consumption—SEC) to represent the energy intensity of the production of steel, cement as well as pulp and paper (Enerdata 2010). SEC for steel production has been criticized for being misleading. SEC compares the total energy use of the sector with an intermediary product of the production process, crude steel. In other words, it allocates larger amounts of energy use to a product than what is actually required for its production (Swedish Energy Agency 2011b; Tanaka 2008).

The use of physical indicators for the energy efficiency evaluation of a whole industry sector has been discussed for some time. Worrell et al. (1997) and Schenk and Moll (2007) ponder that, although the SEC allows international comparisons, it fails to capture energy efficiency in a sector with a diversified set of products. This discussion is particularly relevant in the European context, since some European iron and steel producers have operated within niche markets for high-value products to withstand increased global competition (Okereke and McDaniels 2012). These high-value products are far from the intermediary product crude steel used as reference, both when it comes to value as well as the process of production. This leads us to the question: Does SEC capture actual energy efficiency improvements in European iron and steel production?

In this empirical study, we analyse energy efficiency trends of European iron and steel production and compare the results with the SEC. To analyse the trends, the more comprehensive Malmquist productivity index (MPI) methodology was used based on data envelopment analysis (DEA) techniques and following the example of Wei et al. (2007). The novelty of the study lies in applying a well-established and comprehensive method for evaluating energy efficiency, MPI/DEA, on European iron and steel production, highlighting catching-up effects and innovation effects among the Member States. A non-oriented and non-radial slacks-based DEA model was applied in this study rather than the radial and input-based model previously used by Wei et al. (2007), alleviating some of the drawbacks identified in the latter. This will be further explained below.

Following this introduction, we present the use of MPI and DEA in the analysis. The results of the analysis discuss general trends in energy efficiency of European production as well as the development of the individual Member States. We then compare the results of the analysis with the SEC and highlight the implications of method choice for policy evaluation in the case of Swedish iron and steel production. Finally, we close with the major conclusions and give direction for next steps in research on this topic.

Methodology

Liu and Ang (2007) have reviewed the literature analysing industrial energy use since the oil crisis in the 1970s, covering industrialized, emerging, and developing economies in different time frames. The methods used have all aimed to decompose energy use trends to identify the impact of structural changes as well as understand the linkage between energy use and development. More recent studies decompose trends in energy efficiency and CO2 emission reductions in Swedish manufacturing industries (Pardo Martínez and Silveira 2012a) and analyse factors influencing energy efficiency and CO2 emission reductions in Swedish service industries (Pardo Martínez and Silveira 2012b). Furthermore, Mulder and de Groot (2012) decompose trends in energy intensity development in both manufacturing and service industries for 18 OECD countries.

However, if the aggregation level of the study is too high, the sectoral detail may be lost. For example, iron and steel production is grouped together with other metal production in a category called “basic metals” in the two-digit level of aggregation, which is used in many studies (Mulder and de Groot 2012; Pardo Martínez and Silveira 2012a). Eichhammer and Mannsbart (1997) warn of the potential problem of intra-sectoral structural changes being accounted as energy efficiency improvements if the level of aggregation is too high. Obviously, depending on the aim of the study (e.g. for analysing the overall national trends), a high level of aggregation may be sufficient and also preferable (from a data intensity point of view). Meanwhile, a lower aggregation level is required for in-depth sectoral analysis. In addition, several industry sectors require a global perspective to account for global markets (Liu and Ang 2007; Pardo Martínez and Silveira 2012a).

At the European level, the ODEX indicator has been developed to aggregate the energy efficiency development of the various sectors of the economy. For each sector, a sectoral indicator is calculated, which is then aggregated into the economy-wide index through a weighted average using the share in final energy use as the weighting factor for each sector. In the case of steel production, the sectoral indicator is the SEC, which is defined as final energy use in the iron and steel sector divided by the quantity (in terms of mass) of crude steel produced (Enerdata 2010). However, this method does not replicate the sectoral activities due to the fact that energy use, given in the numerator, includes a larger number of activities than needed to produce the intermediary product given in the denominator, that is, the crude steel (Swedish Energy Agency 2011b; Tanaka 2008). The result of this assumption is especially important in Europe, where focus is given to quality products with values that are higher than that of crude steel. To a large extent, Okereke and McDaniels (2012) see the niche markets created for European steel products as an explanation to how European producers withstand global competition.

There are also upstream activities that are only partially captured or not captured at all by the indicator. For example, a country’s crude steel production might shift some of its intermediary inputs (e.g. pig iron) from domestic production to imports. In that case, the energy use would decrease due to the decrease in domestic production, but the benchmark product (in this case crude steel) would remain at a stable level as its demand for pig iron is satisfied through imports rather than domestic production (Eichhammer and Mannsbart 1997). This suggests that pig iron should be considered a separate product category in energy efficiency analyses.

Some studies have attempted to disaggregate intra-sectoral trends in iron and steel production for the different process routes to analyse the factors influencing the SEC. In an international comparison, Worrell et al. (1997) and Farla and Blok (2001) used the global best-practice energy intensity as a weighting factor for disaggregating the SEC when it comes to process. However, the results of this approach are uncertain since the global best-practice energy intensity is different from the situation in the countries analysed. A more robust analysis could have been achieved by assigning statistical weights dependent on country-specific energy intensities. Oda et al. (2012) used a series of methods to define disaggregated indicators for each process route, using a number of assumptions for the macro-data and a large number of sources for the micro-data, thus increasing the risk of mixing system boundaries. Siitonen et al. (2010) used plant-specific energy data to disaggregate the SEC, showing the importance of clear system boundary definitions when using SEC.

Moving beyond the SEC for crude steel, Eichhammer and Mannsbart (1997) differentiate between two processes for producing crude steel, adding hot rolled steel to their analysis of the inter-sectoral structural changes between industrial sectors. However, this approach requires data on both two-digit and four-digit levels of aggregation. Also, Arens et al. (2012) attempt to increase the sectoral detail in a study of the German iron and steel production, constructing the SEC for five product categories independently, all at different levels of quality. These approaches are more robust in comparison with those only focusing on crude steel. However, the analyses require detailed data on energy use as well as production quantities, which is in many cases not available at national level (Oda et al. 2012).

Alternatively, energy efficiency improvements in an industry with multiple inputs and multiple outputs can be analysed non-parametrically. Wei et al. (2007) performed such an analysis of Chinese iron and steel production using DEA calculation techniques together with MPI methodology, capturing the energy efficiency improvements of the sector as well as the individual development of the Chinese regions.

DEA is a calculation technique for estimating the relative efficiency of a decision-making unit (DMU) compared to the other DMUs in a given sample set. The benefit of using DEA lies in the possibility to evaluate efficiency without explicitly introducing a mathematical relationship between the inputs and outputs of the DMUs. Multiple inputs and multiple outputs are evaluated relative to the frontier line constructed by the DMUs with highest productivity, that is either (i) utilizing a minimum amount of inputs for producing a fixed amount of outputs or (ii) utilizing a fixed amount of inputs and maximizing the amount of outputs (Cooper et al. 2007).

DEA is a technique for evaluating productivity under static conditions, meaning that the analysis is limited to one point in time. For the purpose of evaluating trends in productivity, DEA needs to be extended with other methods. One such method is window analysis, but it suffers from being computationally demanding and not providing a result consisting of a single index (Cooper et al. 2007). MPI is an established methodology for evaluating productivity over time that produces such an index. MPI was first introduced by Malmquist (1953) for analysing consumption patterns through analysis of the development of price indices. Since then, the MPI has been further enhanced by Färe et al. (1994), among others. MPI is now used for measuring total factor productivity, which is generally a measure of the economic efficiency of the DMUs. It is also used in several other applications, integrating evaluation of economic efficiency, energy efficiency, and environmental impacts.

The MPI methodology produces an index, total factor productivity, describing the productivity change over time. One benefit of the method is that this index is composed of two sub-indices, technical efficiency and technical efficiency change. The sub-indices indicate two trend effects, the catching-up effect and the innovation effect, respectively, which were first defined by Färe et al. (1994). To illustrate this, consider the following example. We analyse the productivity of one DMU using one input and producing one output compared to a sample of DMUs for two time periods. Two productivity frontiers have been constructed based on the productivity of the whole sample. The catching-up effect is then defined as the efficiency of the DMU in the second time period compared with the frontier of the second time period divided by the efficiency of the DMU in the first time period compared with the frontier of the first time period. If this is shown graphically, one could say that the distance from the DMU to the frontier is compared between the first and second time periods; hence, a DMU that increased its productivity will be catching up with the best-practice frontier (Fig. 1). The innovation effect is demonstrated as an efficiency shift from the lower-efficiency frontier of t 1 (dashed grey line in Fig. 1) to the higher-efficiency frontier of t 2 (blue line in Fig. 1). The catching-up effect is illustrated in the figure as the decreasing distance when DMU1(t 1) compared with the frontier of t 1 moves to DMU1(t 2) compared with the frontier of t 2. The shift of the frontier is defined as the innovation effect since it describes the progress of the best-practice frontier in the vicinity of the investigated DMU (Färe et al. 1994). Some studies also refer to this effect as the frontier shift effect (e.g. Wei et al. 2007).

Innovation effect and catching-up effect of the Malmquist productivity index, inspired by illustrations in Cooper et al. (2007)

MPI is constructed based on four distance functions, which are estimated using DEA. Since the MPI aims to show the changes between two time periods, the score of each DMU is needed for four cases. The first two are the scores when the DMU is analysed in the first time period in relation to the frontier of the first time period, and then the second time period. The second two are the scores when the DMU is analysed in the second time period in relation to the two frontiers.

However, DEA is not the only technique used for these calculations. Stochastic production frontier (SPF) techniques were used by Chou et al. (2012) for investigating the productivity of the IT industries in 19 OECD countries. SPF is preferred for its possibilities to account for errors and other stochastic influences on the data. Because of this, the method is seen as especially useful in international comparisons at macro level since errors of this kind are common in the statistics and would otherwise be included as part of the inefficiency of the DMUs. However, SPF is not appropriate when handling multiple-output production systems, as it would require a mathematical function for the production within the DMU. In DEA, this functional formula is not needed, which makes the DEA method more versatile.

There are a large number of DEA models available. Since they have different characteristics, the model choice will largely influence the results of the analysis. Thus, the character of the DEA model has to be carefully assessed before the choice is made and the results understood. First, the radial character of the model refers to the proportional behaviour of the inputs and outputs in the model. A radial model assumes that the inputs and outputs of the model change proportionally. Mathematically, this means that the inputs, x 1 and x 2, will be interlinked through the constant, α, when the model is run, thus only allowing solutions that satisfy (αx 1 , αx 2). This means that the slacks produced by a DMU (the input excess and/or output shortfalls that the proportionality of the radial model results in) are ignored. In other words, in a radial model, a DMU may be considered as efficient compared to the efficiency frontier even though it has slacks. Tone (2001) alleviates this by introducing the non-radial slacks-based model (SBM). The SBM is based on the product of the input and output inefficiencies, and the author proves that a DMU is CCR-efficient (denoting the traditional radial model, designed by Charnes, Cooper and Rhodes (CCR) 1978) only if it is also SBM-efficient. The author shows that there are DMUs that would have been considered efficient using a radial model but are in fact inefficient when taking the slacks into account. However, the SBM is not translation invariant, which means that all inputs and outputs have to be positive.

Second, there are three choices in the orientation of the DEA model. Traditionally, DEA models are either input-oriented or output-oriented, meaning that the linear programme for solving the model either evaluates the DMUs from the perspective of minimizing the input for producing the given output or maximizing the output based on the given input. The SBM proposed by Tone (2001) is based on the inefficiencies of both the input and output and, hence, is non-oriented. The choice of input or output orientation has implications for the results as, in reality, measures to improve efficiency can be taken on the input side as well as the output side. Using an oriented model assumes that efficiency measures are only possible to implement on one of the two sides. Hence, non-oriented models are preferred as they are more general and flexible than oriented ones (Silva Portela et al. 2003).

Third, one of the drawbacks of using DEA compared to SPF is that the type of returns to scale has to be chosen prior to the analysis. DEA was first developed to handle constant returns to scale (CRS), but has since then been extended to handle other environments. CRS assumes that outputs will change proportionally to change of inputs, which is not always the case in this type of analysis. The SBM can handle both CRS and variable returns to scale (VRS) (Cooper et al. 2007).

The resulting score from DEA shows the efficiency of the DMUs in an index form, where the efficient DMUs are given the status 100 % and the inefficient ones are given a value reflecting how they compare to the frontier built up by the efficient DMUs. However, one might also be interested in knowing the differentiation between the efficient DMUs. Tone (2002) developed the concept of super-efficiency and the Super-SBM model, which assigns an index value larger than 100 % to DMUs considered efficient compared to the efficiency frontier.

DEA and MPI are versatile tools that can be used at all levels of aggregation. The DMUs analysed can be companies, industry sectors, regions, or even nations. However, it is important that all analysed DMUs have similar inputs and outputs to ensure meaningful results. Morita et al. (2005) used Super-SBM to analyse the managerial productivity of different sales branches within a Japanese power company. Liu and Wang (2008) analysed the economic productivity of 15 Taiwanese companies working with semiconductor testing and packaging to capture the productivity within each company. This was also done by Mohammadi and Ranaei (2011) for 22 cement-producing companies in Iran. Ng (2011) analysed the productivity of hospitals in one of the provinces in China, using MPI decomposition to show the factors influencing the inefficiencies in the evaluated hospitals. Pires and Fernandes (2012) showed the impact of the terrorist attack in the USA in 2001 on 42 airlines by comparing the economic productivity of the airlines between 2001 and 2002. Li et al. (2005) showed the development of economic productivity in the Chinese construction industry considering four major Chinese regions as DMUs in the analysis. Chou et al. (2012) compared economic productivity of the information technology sector between 19 OECD countries.

DEA and MPI are widely used for evaluating trends in energy efficiency and greenhouse gas emissions. Azadeh et al. (2007) used DEA to analyse the energy efficiency of the petroleum refinement sector in a number of countries. In this case, principal component analysis and numerical taxonomy were integrated with DEA to provide additional verification of the analysis. Pardo Martínez and Silveira (2012b) evaluated energy efficiency improvements and greenhouse gas emission reductions in the Swedish service sector under static conditions (using only DEA), evaluating each segment of the sector as a DMU. Statistical tests applied within the study confirmed that results from DEA are consistent with the development of the traditional indicators. Blomberg et al. (2012) analysed electricity and oil use of Swedish pulp and paper industries in relation to labour requirements and physical output using DEA at the company level. The study highlights the effects of a Swedish energy efficiency programme on the electrical efficiency of the companies. Honma and Hu (2009) constructed a total-factor energy productivity index, an extension of the MPI, and showed how the development of consumption of different energy carriers contributed to the GDP development in Japanese provinces. Rao et al. (2012) showed the energy efficiency of Chinese provinces and identified provinces with potential for improvement. SBM in static conditions was used taking economic and energy inputs into account as well as economic outputs and undesired outputs (i.e. chemical oxygen demand and sulphur dioxide emissions). Zou et al. (2013) compared the results of Super-SBM with SPF and used MPI to show the energy efficiency disparity of Chinese provinces, suggesting policy changes to reduce the technology level imbalance in the provinces. Wu et al. (2012) showed that energy efficiency increased in Chinese industries mainly due to technological improvements and that there is further potential for improvements. This study considered the Chinese provinces as DMUs. The authors’ conclusions were based on results from both static and dynamic models. Ramanathan (2006) analysed the linkage between CO2 emissions, energy use, and GDP development using a version of DEA. However, the approach used by Ramanathan (2006) did not use MPI to analyse the development over time, but rather the static conditions of DEA considering each year between 1980 and 2001 as a separate DMU. The DEA model was then used to forecast the requirements for preserving the world GDP level until 2025.

The energy efficiency of iron and steel production has also been specifically analysed by Wei et al. (2007), who showed a 60 % energy efficiency improvement in the Chinese iron and steel sector, considering the Chinese provinces as DMUs and using static as well as dynamic models. Furthermore, Ma et al. (2002) used MPI to evaluate the economic productivity as well as energy efficiency of Chinese iron and steel producers, considering 88 companies as the DMUs in the analysis. The results were used to suggest a number of policy changes to promote economic productivity and energy efficiency in Chinese iron and steel production. He et al. (2013) used a similar approach, focusing on economic and energy efficiency based on data from 50 iron and steel companies in China, but extended the scope by also analysing undesirable outputs (i.e. sulphur dioxide, nitrogen dioxide, and smoke) within the MPI/DEA framework. The authors analysed the implications of including undesirable outputs in the total productivity of the companies and concluded that total productivity growth was underestimated when not taking undesirable outputs into account. It should, however, be noted that this study did not consider carbon dioxide as undesirable output, which was also acknowledged as a limitation by the authors.

Applying MPI and DEA models in iron and steel production

Based on the literature survey presented above, we opted for MPI combined with DEA calculation techniques in this study. The static DEA and the dynamic MPI were calculated using the software DEA-Solver-Pro, version 9. The models called “SBM-V”, “Super-SBM-V”, and “Malmquist-V” were applied, as defined by Cooper et al. (2007). In contrast with the study by Wei et al. (2007), which used a radial and input-based model in the CRS environment, we applied the following DEA models: the non-radial and non-oriented SBM and Super-SBM, both assuming the VRS environment. The DEA scores in static conditions were calculated using the models defined by Tone (2001, 2002).

Following Färe et al. (1994) the sub-indices and the MPI for energy efficiency were calculated using the following equations:

where the technical efficiency change index (EI), the technical change index (TI), and the change in energy efficiency index (EEI) were shown from year i to year i + 1. The four distance functions needed to construct the MPI (as shown in Eqs. (1–3)) were i to year i + 1. The four distance functions needed to construct the MPI (as shown in Eqs. (1–3)) were δ 1((x o, y o)1), δ 2((x o, y o)2), δ 1((x o, y o)2), and δ 2((x o, y o)2) where \( {\delta}^{t_1} \) was the score of DMU \( {\left({x}_{\mathrm{o}},{y}_{\mathrm{o}}\right)}^{t_2} \) with t 1 denoting the time period of the frontier and t 2 the time period of the DMU. The distance functions were calculated based on the static SBM and Super-SBM models, as defined by Cooper et al. (2007). Super-SBM was used when SBM returned infeasible results, since Super-SBM is always feasible in the VRS environment. Further details on the calculation steps and the linear programmes can be found in Cooper et al. (2007).

Cumulative indices were calculated, using year i = 0 as the baseline year (index equal to unity):

where n is the number of years included in the cumulative index. For comparison, the SEC and the energy intensity per value added (EIVa) were provided in index form by applying

where SECref is the SEC of the base year and EIVaref is the EIVa of the base year. Siitonen et al. (2010) previously used this method for converting the SEC into an energy efficiency index.

Data sources and limitations

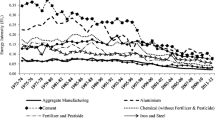

Although we based our approach on the study by Wei et al. (2007), some of the inputs to the model were shifted to better reflect the conditions of the industry. Wei et al. (2007) chose to group fuel oils, gas, and electricity in one input category and coal and coke in two separate categories. In this study, we grouped the inputs as follows: solid fuels (coal and coke), electricity, and others (gas plus other energy carriers) (Fig. 2). Since there is a clear division between primary production, which is based on coal and coke as energy input mainly, and secondary production, which is based on electricity as energy input mainly, this grouping of the energy inputs to the model provided an energy efficiency frontier better representing the structural division within the sector.

The products chosen to represent the output from the sector were pig iron, crude steel, and finished steel (hot rolled steel), which is consistent with the methodology used in the study by Wei et al. (2007). The products chosen are indeed intermediary products, but also sold independently by the steel manufacturers of the Member States. The three products represent three major steps in steel making, also in terms of energy requirements. Pig iron is the most energy intensive step. Crude steel production can be done through primary or secondary production. While primary production uses pig iron or hot metal as feedstock, secondary production is based on scrap (Arens et al. 2012). An analysis that considers crude steel as the only product of the sector completely overlooks the composition of the product and the variations of energy inputs required along the process.

The three products considered contribute to value creation for the steel producers in different ways. Since European producers are in the high-end segment of the market for steel products (Okereke and McDaniels 2012), the value creation by pig iron and crude steel is not representative for the European industry. The high-end segment is diverse, but to capture one additional degree of value creation, the hot rolled steels were considered in the analysis. Hot rolled steel products can be sold as is, but may be refined further (e.g. through cold rolling, annealing, etc.) into products designed for niche markets, thus incurring higher prices and creating higher value for the producers.

The analysis was limited to energy use within the gates of iron and steel industries (groups 24.1–24.3 and 24.51–24.52, in NACE (Nomenclature statistique des activités économiques dans la Communauté européenne) Rev. 2.0 statistical classification) located inside the borders of the 27 Member States of the EU, which is consistent with the system boundaries used for territorial energy statistics provided by Eurostat (EC (Eurostat) 2013). Cyprus, Estonia, Lithuania, and Malta were excluded from the analysis since they do not produce iron and steel. Denmark and Ireland were also excluded since their production was comparatively small and discontinued during the analysed time period. The total European production and energy use was included as one independent DMU for the possibility of analysing the overall European trends. As determined by Wei et al. (2007), the efficiency of the total European production can be neither best nor worst compared with the other Member States and therefore will not interfere with the overall results of the analysis.

Several authors have indicated difficulties in finding reliable and available data for performing DEA (Oda et al. 2012; Tanaka 2008; Wei et al. 2007). This is especially an issue when using DEA on multi-national sectoral level since the analysis depends on large amounts of data from several statistics offices, where data may not have been collected using uniform methods (Farla and Blok 2001). For increasing reliability, only Eurostat was used for sourcing data on final energy use (EC (Eurostat) 2013) and World Steel Association for data on production quantitiesFootnote 1 (International Iron and Steel Institute 2000; World Steel Association 2012, 2010). Energy data was extracted in terajoules (TJ) and production data in kilotonnes (kt). We chose to use final energy data rather than primary energy data since the focus of this study is on energy efficiency in iron and steel. Primary energy data would have introduced structural differences between the Member States in the electricity generation sector especially.

The data used were limited to the time period 1992–2010. The starting year was chosen due to the territorial changes within Europe in the years before. Data are otherwise available from 1990, but establishing the DMUs for the first years would have been difficult. Data for the EIVa for Swedish steel production were limited to the time period 2004–2010. The data on value added were supplied in current prices and adjusted for inflation using the net price index (SCB 2013).

Results

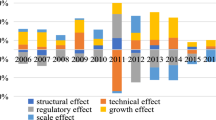

The overall trends in energy efficiency in the European iron and steel production show an increasing TI, which indicates progress in the innovation effect, and slightly decreasing EI, which indicates that European production (i.e. the DMU representing total European production) is falling behind in comparison with the best-practice frontier. The aggregated trends and some highlights of the development of individual Member States are presented below (details are available in Online Resource 1).

When evaluating the cumulative energy efficiency of European iron and steel production, four phases were identified in the period analysed (see Fig. 3). In the first phase between 1992 and 1995, rapid progress was achieved in terms of energy efficiency improvements. The second phase, from 1996 to 2000, showed slow energy efficiency progress. Energy efficiency gained speed again during the third phase, which started in 2000 and lasted until 2007. The last phase was between 2007 and 2010, when the sector’s energy efficiency actually regressed drastically to again pick up speed in 2010.

The decomposition of the energy efficiency index showed a decreasing catching-up effect from 2005 onwards (see EI in Fig. 3). However, the innovation effect showed a steady progress (despite some fluctuations) throughout the whole time period except in 1993, 1996, and 2009 (see TI in Fig. 3). The innovation effect indicates a pushing forward of the best-practice frontier in the vicinity of the DMU. This decomposition indicates that the best practice of European steel production was pushed forward during the period analysed, thus implying increased energy efficiency. In this case, the DMU is the total production of all the Member States analysed. Hence, the best-practice frontier has been pushed forward by the efficient Member States increasing energy efficiency also for the average. Using a similar reasoning, the regression observed in the catching-up effect is interpreted as an increase in the gap between efficient Member States and inefficient ones.

The fourth phase shows quite different development than the other phases in the period. The EEI estimated in the period between 1992 and 2007 showed 16 % energy efficiency progress in European iron and steel production, which results from the best practice being pushed forward. However, in 2008, a large number of countries regressed to such a high degree that the energy efficiency improvements achieved in the previous 16 years were cancelled out at the European scale. The EEI estimated between 1992 and 2010 showed energy efficiency regression of 2 %, as several countries fell behind the best-practice frontier. All in all, TI still progressed by 10 % over the whole period.

The trends of the individual Member States, as indicated in the static analysis (see details in Online Resource 1), show that most of the EU-15Footnote 2 countries were on the efficiency frontier during most of the analysed period. There were some exceptions; some countries are inefficient for single years. The more long-lasting inefficiencies within EU-15 were found in Finland and the UK, which were not on the frontier during the late 1990s. Sweden was also inefficient from 2002 until 2009. Other than the EU-15, Hungary and Latvia were on the production frontier for practically the whole time period.

Slovenia had the lowest score (0.18) in the year 1996. However, Slovenia was also the country with the strongest increase in energy efficiency. From 1995 to 2009, Slovenia increased its EEI as much as 3.5 times. Actually, Slovenia had the largest improvement among the analysed countries over that period. This was mainly due to catching-up effects, implying that Slovenia was closing in on European best practice in steel production.

Romania, on the other hand, had low scores during the whole studied period ranging from 0.38 to 0.54. Although Romania increased energy efficiency during the analysed period, it did not manage to catch up with the best-practice frontier. The efficiency score of some Member States (i.e. Bulgaria, Czech Republic, Poland, and Romania) was especially low, indicating gaps between the best-practice frontier and production practices in these countries. These countries improved during the period (except Czech Republic, which actually regressed by 29 % over the whole period), but still did not surpass the threshold of the best-practice frontier in any of the years.

The dynamic analysis showed that all Member States but three progressed in energy efficiency between 1992 and 2010 and several quite strongly (e.g. Bulgaria, Hungary, and Spain—see details in Online Resource 1). The exceptions were Czech Republic, Slovakia, and Slovenia. Interestingly, Portugal was regressing in energy efficiency until 1997, but then progressed significantly during the years of the recession. This may be due to the fact that Portugal shifted production to the more efficient electric arc furnaces (EAF) in the early 2000s and, in addition, it was not affected by the production decreases experienced by the rest of Europe during the fourth phase.

During the period of the global economic recession, the energy efficiency of European steel production was negatively affected (see phase IV in Fig. 3). The effect was primarily seen as a sharp regression in the innovation effect, though also the catching-up effect regressed during 2008–2009. Only four Member States (i.e. Hungary, Latvia, Portugal, and Slovenia) progressed during 2008–2009, and another four Member States (i.e. Belgium, Poland, Spain, and the UK) kept their efficiency score from the previous year (see details in Online Resource 1). Common for the progressing Member States during this period was that their production was low in comparison with other Member States.

Effects on energy efficiency due to the economic recession

The reduced energy efficiency during the recession may be linked to decreasing demand. In fact, production fell approximately 30 % in all segments of European iron and steel industry in 2009 compared to 2008 (32.7 % for pig iron, 29.7 % for crude steel, and 27.3 % for hot rolled steel). In absolute numbers, the major reductions in production were observed in Germany and Italy, which were also among the top producers in 2008. Germany followed the European average reduction shares for the three products, whereas Italy reduced production to a higher degree than the European average. As Italy was one of the most efficient producers in 2008, one could speculate that production shifted towards less efficient Member States, explaining the reduction of energy efficiency. However, it was found that the Member States considered inefficient in 2008 actually reduced production to a higher degree than Member States considered efficient. The Member States considered inefficient in 2008 were Bulgaria, Czech Republic, Poland, Romania, Slovakia, Slovenia and Sweden, based on the efficiency scores of the static DEA.

Disaggregation of the reduction observed in energy use showed that coal was the energy carrier most reduced from 2008 to 2009, whereas electricity was the least affected; the reductions were 37 and 23 %, respectively. A shift from the more energy intensive blast furnace/basic oxygen furnace (BF/BOF) production route (using iron ore as feedstock and coal/coke as main energy source) to EAF steel production (to a large degree using scrap as feedstock and electricity as energy source) was also seen, which is consistent with the shift in energy carriers. The shift towards the EAF process was evident in both Germany and Italy during the recession. However, since EAF steel production is more energy efficient than BF/BOF steel production (Worrell et al. 2007), the shift in production routes should have resulted in increasing energy efficiency rather than the opposite.

Hence, factors other than geographical production distribution and character of the production processes must have influenced the change in energy efficiency of iron and steel production during the economic recession. Since demand dropped swiftly during the economic recession, the capacity utilization factor may have decreased too in European iron and steel production facilities. Since energy use in manufacturing industries usually benefit from scale effects (higher energy efficiency due to increased production volumes), energy efficiency benefits may have been lost when the capacity of the plants was not being fully utilized. Siitonen et al. (2010) concluded that production levels had an effect on energy efficiency of steel production from iron ore when analysing the influence of production levels (in terms of mass) on the SEC of a case steel mill. The effect was also seen in the Canadian manufacturing sector during the global recession, especially in iron and steel production (Natural Resources Canada 2011). This is also indicated as one of the reasons for the energy efficiency decrease in European industry during the 2009 recession in a presentation by Lapillonne and Pollier (2012).

Jenne and Cattell (1983) showed that the two recessions in 1975 and 1980 affected the UK manufacturing sector in similar ways. Energy efficiency decreased significantly during 1975, but then recovered and increased in 1980. Thus, the plants reduced their production volumes in 1975 but stayed in business, resulting in decreased energy efficiency. The increase in energy efficiency in 1980 was the result of inefficient plants not coping with another recession and closing down.

To further understand the energy efficiency dynamics during the time of the 2009 recession, a more detailed analysis would be required. Such an analysis should be extended to take an economic perspective into account, also capturing changes in the value added of products. This is especially important due to the heterogeneity of European iron and steel production. As mentioned by industry stakeholders, the market focus of East European producers is different from that of West European producers (EC 2010). Hence, the product segment in each Member State may have implications for its resilience to fluctuations in the global market. This may be a reason why inefficient East European Member States were more severely affected by the economic recession and, hence, had to reduce production to a higher degree than West European producers.

Energy efficiency policy evaluation—EEI and SEC

The economy-wide energy efficiency index called ODEX is based on a number of sectoral unit consumption indicators (or SEC). In the case of steel production, this is calculated by dividing energy use for iron and steel production by the total crude steel production. In this section, we compare the trends observed using the MPI/DEA approach with the SEC and, for the case of Sweden, the EIVa. This serves to verify the ability of the SEC to capture energy efficiency developments. To be able to compare the indicators, the SEC and the EIVa were converted into indices, EEISEC and EEIEIVa (see mathematical description in the “Methodology” section).

The EEISEC shows 16 % average increase in energy efficiency in Europe during the period 2000–2010. In contrast, the MPI/DEA approach shows that energy efficiency actually regressed by 8 % during the same time period (see Fig. 4). A closer look reveals that EEISEC followed the EEI closely until 2005. The two indices then diverge, showing the lower influence of the 2009 economic recession on the EEISEC than on the EEI.

The reason behind this may be the difference in construction of the MPI/DEA approach compared to the SEC. The MPI/DEA approach was based on the trend in production quantities of three different products that were all significantly affected by the economic recession. Since SEC is only based on the production quantity of one of these products, the effect on the indicator would logically be considerably lower. The same reasoning can be applied for the energy used in the production.

Furthermore, the structural change from coal-based steel production to electricity-based steel production affects the MPI/DEA approach to a less extent than it affects the SEC. The reasoning behind this is that the structural split of the industry into coal-based and electricity-based production is reflected in the inputs as well as the outputs of the MPI/DEA approach. Pig iron is directly related to the amount of coal-based steel production and the use of solid fuels, and electricity is directly related to the structural split on the input side. A structural shift from coal-based to electricity-based production was observed during the economic recession and may account for the higher energy efficiency level seen in the EEISEC.

Although the impact of the economic crisis on EEISEC may have been reduced due to structural shifts, it is still visible in both approaches. However, in the case of the MPI/DEA approach, the impact of the economic crisis seems to have been captured to a higher degree by the technical change index rather than the technical efficiency change index. This means that the economic crisis had a larger impact on shifting the efficiency frontier than on how individual Member States are catching up with the frontier. This is logical since the economic crisis is likely to have affected all Member States similarly. Nevertheless, it could be argued that these approaches emphasize the impact of production levels on energy efficiency rather than actual energy efficiency improvements, this being a result of the top-down methodologies. Steel production processes have a high base load energy demand, which is not affected by lower production levels and reduced capacity utilization, as shown by, e.g. Siitonen et al. (2010). Since these approaches do not take capacity utilization into consideration, benefits from technological improvements may be hidden in the energy efficiency deterioration exhibited in aggregated statistics at times of low production levels. This can be seen as a weakness of the indicators if the energy efficiency analyses are aimed at providing support for promoting technological improvements.

Effects of different approaches—the case of Sweden

A case study was carried out to further highlight the differences between the MPI/DEA approach, the SEC and the EIVa. Sweden is especially interesting since considerable efforts have been made to improve energy efficiency in the past years. In the manufacturing sector, a decrease of 46 % was achieved in energy intensity (based on the economic value of production) between 1993 and 2008 (Pardo Martínez and Silveira 2012a). Specific energy efficiency initiatives targeting the iron and steel sector started in the mid-2000s as part of a national energy efficiency programme designed for energy intensive industries, and training efforts focused on the mining and steel industries.

The energy efficiency programme PFE (Programmet för energieffektivisering i energiintensiv industri), a medium-term voluntary agreement, was implemented in Sweden between 2004 and 2012. Energy intensive companies were granted an electricity tax relief if they performed an energy audit, invested in measures for increasing electricity efficiency, and implemented an energy management system. Routines for assuring energy efficiency in new equipment being procured were also introduced. Four companies in the iron and steel sector participated in the first period of the PFE programme between 2004 and 2009 (definition as done in Eurostat, 24.1–24.3 and 24.51–24.52 in NACE Rev. 2.0 statistical classification). The first period of PFE resulted in annual gross electricity savings of 5.2 PJ, of which 182 TJ was attributed to the iron and steel companies. The electricity savings corresponded to 1 % when compared with the electricity consumption of the Swedish iron and steel industry in 2004 (Swedish Energy Agency 2011a). However, the success of the programme is disputed. The Swedish National Audit Office (2013) means that the goal set for the PFE was unclear, resulting in difficulties in estimating the savings attributed to the programme. Furthermore, the estimation of the savings may be biased since it was based on the companies’ own estimations.

Swedish steel industries also received support for engaging in energy efficiency activities through funds for educational and networking activities provided by the Swedish Energy Agency. During the period 2005–2008, approximately 7,000 people were trained in energy efficiency practices in the mining and steel industries, and an on-line energy handbook was developed and launched. In addition, an energy network for practitioners (ENET-Steel) was established during the initial years of the educational activities and further developed during 2009–2011, also with support from the Swedish Energy Agency (Lindblad and Axelsson 2009; Nordqvist and Axelsson 2011).

Additional energy efficiency improvements may also have been achieved through multiplier effects. Stenqvist and Nilsson (2011) identified the multiplier effect in terms of achieving savings on energy carriers other than electricity through the implementation of the energy management system. Since only approximately one quarter of the consumed energy for steel production comes from electricity in Sweden (EC 2012), the multiplier effect may have had an impact on the total energy efficiency of the sector. Stenqvist and Nilsson (2011) estimate that the additional energy savings due to the multiplier effect may be as high as 65 % for the whole PFE, though the authors warn for potential double counting the effect of measures that are promoted through other policy initiatives (such as the educational activities mentioned above).

Our analysis showed that, analogous with EEISEC for the European aggregated steel production, the differences between the EEISEC and the EEI became more pronounced after 2004–2005 also in the Swedish iron and steel production (see Fig. 5). While the EEI showed energy efficiency progress for all years after 2005, except a slight decrease in 2008 and a significant decrease in 2009, the EEISEC indicates a stable but low level of energy efficiency. The EEISEC remained below unity for all years except 2001 and 2010, meaning that the SEC was higher than the SEC of year 2000 for all years except 2001 and 2010.

World Steel Association statistics shows a minor decrease in EAF production from 37 % in the 1990s to 33 % in the early 2000s, but the share of EAF production remained stable for the remainder of the decade. The share of continuous casting remained stable at approximately 88 % during the whole period 1992–2010. Hence, these two structural changes cannot have affected energy efficiency trends in the period 2000–2010, standing in contrast with the results obtained in both approaches applied in this study.

To examine the differences more closely, a comparison between the SEC, the MPI/DEA approach, and the EIVa was made. Due to lack of data, the base year was changed to 2004 for this comparison (see Fig. 6). The EEISEC seems to capture the energy efficiency minima as good as the EEI, while the EEIEIVa is less affected by energy efficiency deterioration. However, during periods of higher energy efficiency, the differences between the approaches become more significant. For the year 2007, the EEI shows energy efficiency progress of 18 %, while the EEISEC shows progress of only 2 % compared to the level of 2004. The EEIEIVa, on the other hand, shows progress of as much as 37 % compared to the level of 2004. The results for EEI in 2010 indicated a recovery to levels of energy efficiency seen before the start of the economic recession. The recovery is more pronounced in the EEI than both EEIEIVa and EEISEC.

The attention given to energy efficiency in Swedish manufacturing industries from the mid-2000s and onwards is expected to have had an impact on the energy efficiency of the sector and may explain the development of the EEI (Fig. 5). However, this reasoning cannot support the choice of one indicator over the other, although it may be considered explaining the development shown by the EEI.

To discuss the benefits and drawbacks of these indicators, we need to examine the methodological differences. While the SEC and the EIVa provide the ratio of two quantities (i.e. energy use and production in physical or economic terms), the MPI/DEA approach finds the optimal combination of a set of inputs for producing a set of outputs. Hence, the approaches are intrinsically different, and it is only logical to expect them to give different results. The question is which phenomena are being highlighted by each approach and whether these phenomena agree with the goal of the energy efficiency analyses at hand.

On the energy use side, total energy use was observed to steadily decrease until 2009 for the Swedish iron and steel industries (see Fig. 7). The solid fuels followed the trend of total energy use, while gas and other fuels remained stable and electricity use actually increased between 2005 and 2008. In the MPI/DEA approach, these dynamics are taken into account and compared to the dynamics seen for the other DMUs considered (the European Member States). The SEC and EIVa, on the other hand, are only based on the trends of the total energy use.

On the production side, crude steel production (the benchmark product for the SEC) was steadily decreasing until 2009, which is in line with the trend seen for total energy use. In contrast, economic production (indicated by the value added) increased until 2007 to then decrease until 2009 (see Fig. 8). Hence, the observed difference between the SEC and the EIVa may be explained by the simultaneous effect of decreasing energy use and increasing value added for the EIVa compared to decreasing energy use and decreasing crude steel production in the SEC (see Fig. 6). The production of pig iron and crude steel seems to follow similar downward trends, while the trend of hot rolled steels is showing an increase during the years of high value added (see Fig. 8). When it comes to the MPI/DEA approach, the method takes the dynamics of the three products (i.e. pig iron, crude steel, and hot rolled steels) into account and compares these dynamics with that of the other Member States.

It is evident from the observation of the Swedish case that the three approaches highlight different aspects of energy efficiency in the iron and steel sector. The SEC compares energy use of the whole sector with one intermediary product. From the trends seen in crude steel production and value added, it is clear that crude steel is not the main contributor to value creation since value creation actually increased in parallel with a decrease in crude steel production (see Fig. 8). Hence, the SEC does not capture value creation in the Swedish case, which is actually a result of the focus on high-end niche markets and required refinements done to the product after the point of crude steel production (Sandberg et al. 2001). Thus, there are significant implications of using different system boundaries for the numerator and the denominator of the SEC, a concern previously expressed by the Swedish Energy Agency (2011b), among others.

The Swedish Energy Agency (2011b) argues that the EIVa, which compares energy use with value added, is suitable for monitoring energy efficiency of industrial activities. In this case, the problem of not capturing the value created beyond the point of crude steel production is alleviated. On the other hand, there is a risk of the EIVa capturing market dynamics rather than the actual energy efficiency development (Patterson 1996; Schenk and Moll 2007; Swedish Energy Agency 2011b; Worrell et al. 1997).

The MPI/DEA approach captures product differentiation to a larger extent than the SEC and is based on physical production, thus being more robust against market dynamics and trends. In fact, the hot rolled steels follow production trends of the value added more closely than crude steel, thus capturing value creation to a higher degree than the SEC. However, it should be noted that the MPI/DEA is relative to the whole population of DMUs (in this study, the Member States of the EU) and, therefore, not an absolute measure of energy efficiency.

Concluding discussion

The MPI/DEA analysis showed that energy efficiency improved by 16 % between 1992 and 2007 in European iron and steel production (the 22 Member States where significant iron and steel production takes place). However, the economic recession in 2008–2009 had severe effects on the energy efficiency of the sector, resulting in a regression of 2 % when considering the whole period between 1992 and 2010. An analysis of what caused this development showed that progress in energy efficiency was due to the innovation effect, which can be interpreted as the pushing forward of the best-practice frontier, rather than the catching-up effect, which can be interpreted as inefficient Member States catching up with the frontier. In fact, the results show that the gap between inefficient Member States and the European best practice increased during the period. We see this as an indication that improvements could be made in inefficient Member States, perhaps through technology transfer from Member States already on the best-practice frontier.

A number of structural effects were investigated to identify the cause of the rapid fall in energy efficiency during the economic recession. However, it was found that factors other than geographical production distribution and character of the production processes must have influenced the change in energy efficiency during this period, confirming that the MPI/DEA approach is robust against intra-sectoral structural changes. However, the capacity utilization factor could have been lower during these years due to the fall in demand for steel, and this could have been the cause of lower energy efficiency in the steel industry.

When comparing the MPI/DEA approach with the SEC, large differences were revealed. At the European level, the SEC may have overestimated the energy efficiency development. Between 2000 and 2010, the SEC showed an energy efficiency increase of 16 %, while the MPI/DEA approach showed a decrease of 8 %. The curves for the two approaches followed each other until 2005 and then sequentially diverged as the economic recession approached. The MPI/DEA approach showed a much more pronounced effect of the economic recession on energy efficiency performance of the sector.

The reasons behind the differences between the two approaches were scrutinized in the case of the Swedish iron and steel sector and compared with an economic indicator for energy efficiency, the EIVa. While the SEC highlights the energy use compared to crude steel production, the EIVa compares energy use with value creation. The comparison of the results for the EIVa showed that the SEC is not equipped to capture value creation in the Swedish case. However, there is a risk of capturing market dynamics rather than actual energy efficiency improvements, despite the EIVa being adjusted for inflation. The MPI/DEA approach can be seen as a compromise. It is based on physical quantities, thus alleviating the drawbacks of the EIVa. It covers a wider range of products as opposed to only one product (crude steel) as benchmark for the SEC. On the other hand, the MPI/DEA approach, as used in this study, provides a relative energy efficiency index. When analysing a single Member State, the results should therefore be seen as relative to the whole population of DMUs.

We conclude that the SEC is not sufficient for estimating energy efficiency in European iron and steel production. This is especially the case in countries and regions that focus on a more diversified set of products than only crude steel. To provide a more refined measure of energy efficiency, both economic and physical production statistics should be used in the analysis. Such a study, combined with more in-depth analysis of the factors influencing energy efficiency in iron and steel production, may help formulate more robust energy efficiency indicators. These shall be essential in a context of higher energy efficiency targets and greenhouse gas emissions reductions in the EU.

Notes

In the category “Hot Rolled Steel”, ten data points were missing for various countries. In these instances, the crude steel to hot rolled steel ratio of the previous year was used to estimate the hot rolled steel produced using the crude steel data. The data points concerned were Slovenia, Slovakia, Romania, and Latvia for year 2001; Slovenia, Slovakia, and Latvia for year 2002; and Sweden, Slovenia, and Slovakia for year 2010.

EU-15 consists of the following Member States: Austria, Belgium, Cyprus, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, and the UK. However, Cyprus and Denmark are not part of the analysis.

References

Arens, M., Worrell, E., & Schleich, J. (2012). Energy intensity development of the German iron and steel industry between 1991 and 2007. Energy, 45(1), 786–797.

Azadeh, A., Amalnick, M. S., Ghaderi, S. F., & Asadzadeh, S. M. (2007). An integrated DEA PCA numerical taxonomy approach for energy efficiency assessment and consumption optimization in energy intensive manufacturing sectors. Energy Policy, 35(7), 3792–3806.

Blomberg, J., Henriksson, E., & Lundmark, R. (2012). Energy efficiency and policy in Swedish pulp and paper mills: a data envelopment analysis approach. Energy Policy, 42, 569–579.

Cahill, C. J., Bazilian, M., Gallachóir, Ó., & Brian, P. (2010). Comparing ODEX with LMDI to measure energy efficiency trends. Energy Efficiency, 3(4), 317–329.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(4), 429–444.

Chou, Y.-C., Shao, B. B. M., & Lin, W. T. (2012). Performance evaluation of production of IT capital goods across OECD countries: a stochastic frontier approach to Malmquist index. Decision Support Systems, 54(1), 173–184.

Cooper, W. W., Seiford, L. M., & Tone, K. (2007). Data envelopment analysis—a comprehensive text with models, applications, references and DEA-Solver software. New York: Springer.

Eichhammer, W., & Mannsbart, W. (1997). Industrial energy efficiency. Energy Policy, 25(7–9), 759–772.

Enerdata (2010). Definition of ODEX indicators in ODYSSEE data base. Internet Resource. http://www.odyssee-indicators.org/registred/definition_odex.pdf. Accessed 25 Feb 2013.

European Commission (2006). Directive 2006/32/EC of the European Parliament and of the Council on energy end-use efficiency and energy services and repealing Council Directive 93/76/EEC. Official Journal of the European Union, 114, 64–85.

European Commission (2010). Final report of the SET-Plan workshop on technology innovations for energy efficiency and greenhouse gas (GHG) emissions reduction in the iron and steel industries in the EU27 up to 2030. Internet Resource. http://setis.ec.europa.eu/newsroom-items-folder/report-of-set-plan-workshop-on-iron-and-steel-1. Accessed 23 Nov 2012.

European Commission (2012). Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on energy efficiency, amending Directives 2009/125/EC and 2010/30/EU and repealing Directives 2004/8/EC and 2006/32/EC. Official Journal of the European Union, 315, 1–56.

European Commission (2013). Emissions trading system (EU ETS). Internet Resource. http://ec.europa.eu/clima/policies/ets. Accessed 22 Feb 2013.

European Commission (Eurostat) (2013). Statistics database. Internet Resource. http://ec.europa.eu/eurostat/. Accessed 23 Apr 2013.

Färe, R., Grosskopf, S., Norris, M., & Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in industrialized countries. American Economic Review, 84(1), 66–83.

Farla, J. C., & Blok, K. (2001). The quality of energy intensity indicators for international comparison in the iron and steel industry. Energy Policy, 29(7), 523–543.

He, F., Zhang, Q., Lei, J., et al. (2013). Energy efficiency and productivity change of China’s iron and steel industry: accounting for undesirable outputs. Energy Policy, 54, 204–213.

Honma, S., & Hu, J.-L. (2009). Total-factor energy productivity growth of regions in Japan. Energy Policy, 37(10), 3941–3950.

Jenne, C. A., & Cattell, R. K. (1983). Structural change and energy efficiency in industry. Energy Economics, 5(2), 114–123.

Lapillonne, B., & Pollier, K. (2012). Is industry energy efficiency back to pre-crisis trends in the EU. Fourth meeting of the project "Monitoring of EU and national energy efficiency targets" (ODYSSEE-MURE 2010), May 31 - June 1 2012, Copenhagen, Denmark.

Li, X., Shen, Q., & Xue, X. (2005). Application of DEA-Based Malmquist productivity index measure to the construction industry in China. Construction Research Congress 2005, San Diego, California, United States, April 5–7, 2005.

Lindblad, B., & Axelsson, H. (2009). Energikompetens inom gruv- och stålindustri (Energy competence in mining and steel industries) final report JK D-824 (73203). Stockholm, Sweden: Jernkontoret.

Liu, N., & Ang, B. W. (2007). Factors shaping aggregate energy intensity trend for industry: energy intensity versus product mix. Energy Economics, 29(4), 609–635.

Liu, F.-H. F., & Wang, P. (2008). DEA Malmquist productivity measure: Taiwanese semiconductor companies. International Journal of Production Economics, 112(1), 367–379.

Ma, J., Evans, D. G., Fuller, R. J., & Stewart, D. F. (2002). Technical efficiency and productivity change of China’s iron and steel industry. International Journal of Production Economics, 76(3), 293–312.

Malmquist, S. (1953). Index numbers and indifference surfaces. Trabajos de Estadística, 4(2), 209–242.

Mohammadi, A., & Ranaei, H. (2011). The application of DEA based Malmquist productivity index in organizational performance analysis. International Research Journal of Finance and Economics, 62, 68–76.

Morita, H., Hirokawa, K., & Zhu, J. (2005). A slack-based measure of efficiency in context-dependent data envelopment analysis. Omega, 33(4), 357–362.

Mulder, P., & de Groot, H. L. F. (2012). Structural change and convergence of energy intensity across OECD countries, 1970–2005. Energy Economics, 34(6), 1910–1921.

Natural Resources Canada (2011). Industrial consumption of energy (ICE) survey: summary report of energy use in the Canadian manufacturing sector, 1995–2009. Ottawa, Canada: Natural Resources Canada.

Ng, Y. C. (2011). The productive efficiency of Chinese hospitals. China Economic Review, 22(3), 428–439.

Nordqvist, A., & Axelsson, H. (2011). Energinätverk inom gruv- och stålindustrin (Energy network in the mining and steel industries)—final report JK D-837. Stockholm, Sweden: Jernkontoret.

Oda, J., Akimoto, K., Tomoda, T., et al. (2012). International comparisons of energy efficiency in power, steel, and cement industries. Energy Policy, 44, 118–129.

Okereke, C., & McDaniels, D. (2012). To what extent are EU steel companies susceptible to competitive loss due to climate policy? Energy Policy, 46, 203–215.

Pardo Martínez, C. I., & Silveira, S. (2012a). Energy efficiency and CO2 emissions in Swedish manufacturing industries. Energy Efficiency, 6(1), 117–133.

Pardo Martínez, C. I., & Silveira, S. (2012b). Analysis of energy use and CO2 emission in service industries: evidence from Sweden. Renewable and Sustainable Energy Reviews, 16(7), 5285–5294.

Patterson, M. (1996). What is energy efficiency? Energy Policy, 24(5), 377–390.

Pires, H. M., & Fernandes, E. (2012). Malmquist financial efficiency analysis for airlines. Transportation Research Part E Logistics and Transportation Review, 48(5), 1049–1055.

Ramanathan, R. (2006). A multi-factor efficiency perspective to the relationships among world GDP, energy consumption and carbon dioxide emissions. Technological Forecasting and Social Change, 73(5), 483–494.

Rao, X., Wu, J., Zhang, Z., & Liu, B. (2012). Energy efficiency and energy saving potential in China: an analysis based on slacks-based measure model. Computers and Industrial Engineering, 63(3), 578–584.

Sandberg, H., Lagneborg, R., Lindblad, B., et al. (2001). CO2 emissions of the Swedish steel industry. Scandinavian Journal of Metallurgy, 30(6), 420–425.

SCB (2013). Public statistics on value added for the Swedish iron and steel sector (24.1-24.3 and 24.51-24.52 in NACE 2.0 classification). Retrieved from the unpublished statistical database in June 2013. SCB - Statistics Sweden.

Schenk, N. J., & Moll, H. C. (2007). The use of physical indicators for industrial energy demand scenarios. Ecological Economics, 63(2–3), 521–535.

Siitonen, S., Tuomaala, M., & Ahtila, P. (2010). Variables affecting energy efficiency and CO2 emissions in the steel industry. Energy Policy, 38(5), 2477–2485.

Silva Portela, M. C. A., Castro Borges, P., & Thanassoulis, E. (2003). Finding closest targets in non-oriented DEA models: the case of convex and non-convex technologies. Journal of Productivity Analysis, 19(2–3), 251–269.

International Iron and Steel Institute (2000). Steel statistical yearbook 2000. Brussels, Belgium: International Iron and Steel Institute.

Stenqvist, C., & Nilsson, L. J. (2011). Energy efficiency in energy-intensive industries—an evaluation of the Swedish voluntary agreement PFE. Energy Efficiency, 5(2), 225–241.

Swedish Energy Agency (2011a). Programmet för energieffektivisering - Erfarenheter och resultat efter fem år med PFE (The programme for energy efficiency—experiences and results after five years with PFE). Internet Resource. http://www.energimyndigheten.se/sv/Foretag/Energieffektivisering-i-foretag/PFE/Om-PFE/. Accessed 28 Feb 2011.

Swedish Energy Agency (2011b). Indikatorer och beräkningsmetoder för uppföljning av politik för energieffektivisering (Indicators and methods for follow-up of policies for energy efficiency). Internet Resource. http://energimyndigheten.se/sv/Press/Nyheter/Ny-rapport-Indikatorer-for-energieffektivisering/. Accessed 3 Feb 2012.

Swedish National Audit Office (2013). Energieffektivisering inom industrin – effekter av statens insatser (Energy efficiency in industry—the effects of state measures) RIR 2013:8. Eskilstuna, Sweden: Swedish National Audit Office.

Tanaka, K. (2008). Assessment of energy efficiency performance measures in industry and their application for policy☆. Energy Policy, 36(8), 2887–2902.

Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research, 130(3), 498–509.

Tone, K. (2002). A slacks-based measure of super-efficiency in data envelopment analysis. European Journal of Operational Research, 143(1), 32–41.

UNFCCC (2012). GHG data. Internet Resource. UNFCCC. http://www.unfccc.int. Accessed 27 Jun 2012.

Wei, Y.-M., Liao, H., & Fan, Y. (2007). An empirical analysis of energy efficiency in China’s iron and steel sector. Energy, 32(12), 2262–2270.

World Steel Association (2010). Steel statistical yearbook. Brussels, Belgium: World Steel Association.

World Steel Association (2012). Steel statistical yearbook. Brussels, Belgium: World Steel Association.

Worrell, E., Price, L., Martin, N., et al. (1997). Energy intensity in the iron and steel industry: a comparison of physical and economic indicators. Energy Policy, 25(7–9), 727–744.

Worrell, E., Neelis, M., Price, L., et al. (2007). World best practice energy intensity values for selected industrial sectors LBNL-62806 Rev. 1. Berkeley, United States: Lawrence Berkeley National Laboratory.

Wu, F., Fan, L. W., Zhou, P., & Zhou, D. Q. (2012). Industrial energy efficiency with CO2 emissions in China: a nonparametric analysis. Energy Policy, 49, 164–172.

Zou, G., Chen, L., Liu, W., et al. (2013). Measurement and evaluation of Chinese regional energy efficiency based on provincial panel data. Mathematical and Computer Modelling, 58(5–6), 1000–1009.

Acknowledgments

The authors would like to acknowledge the generous funding provided by the Swedish Energy Agency. The authors would like to thank the two anonymous reviewers for valuable comments that lead to significant improvements of the paper. The authors would also like to thank the conference participants of the 11th International Conference on Data Envelopment Analysis, 27-30 June 2013 in Samsun, Turkey, for their comments on a first version of the paper.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

ESM 1

(PDF 118 kb)

Rights and permissions

About this article

Cite this article

Morfeldt, J., Silveira, S. Capturing energy efficiency in European iron and steel production—comparing specific energy consumption and Malmquist productivity index. Energy Efficiency 7, 955–972 (2014). https://doi.org/10.1007/s12053-014-9264-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-014-9264-8