Abstract

The market for the leading German equity index DAX comprises electronically traded futures contracts, fully replicated and swap-based exchange-traded funds (ETFs), and certificates. This paper reveals that DAX futures contracts contribute an economically and statistically significant proportion to contemporaneous price quotes of ETFs and certificates. This finding is surprising because the prospectus of ETFs and certificates claim to follow the stock index solely, but not the index futures contract. Exploring further the short-run dynamics, our results suggest that fully replicated ETFs cope better with adjusting their prices to the DAX index than swap-based ETFs and certificates.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While an actively managed portfolio aims to outperform a benchmark index, a passively managed portfolio seeks to exactly replicate the underlying benchmark. In recent years, products offering passive investment strategies have experienced a significant growth. Particularly in the U.S., Exchange Traded Funds (ETFs) introduced in 1993 via Standard and Poor’s Depository Receipts (SPDRs) gained tremendous popularity among investors. Also in the German market, passive index products have been highly successful in terms of trading volume over the last years. The natural question which this empirical paper seeks to address is the extent to which a passive strategy’s primary goal of replicating an underlying benchmark is fulfilled in the German equity index market. We analyze the short run price dynamics of all the five existing ETFs and three selected index certificates replicating the leading German equity index “Deutscher Aktienindex” (DAX) for the months of September and October 2008. The DAX is a value-weighted total return index, i.e., dividends are reinvested, consisting of the 30 largest German companies.

The German market environment offers the unique possibility to compare the related products ETFs and index certificates, while index funds which cannot be traded during the day have basically disappeared in this market. DAX ETFs are constructed either by recreating the index physically which is denoted as “full replication method” or by using swap contracts in order to exchange the return of an arbitrary portfolio for the return of the index. In contrast to fully replicated or cash-based ETFs, swap-based ETFs are synthetically structured, i.e., the ETF itself does not physically hold the DAX’s component shares, but tracks it through derivatives. The fund holds a basket of securities which may be not related to the DAX. It enters into a swap arrangement with a counterparty where the latter agrees to deliver the performance of the DAX to the fund. In exchange, the fund will deliver the returns on its basket of securities. Being held as separate assets, ETFs do not bear any default risk of the issuer. Although DAX certificates have the same objective as DAX ETFs, which is tracking the performance of the underlying index, the redemption of an index certificate depends on the solvency of the issuer since it is constructed as a bearer note. We choose DAX certificates with unlimited duration and no capital guarantee to make ETFs and certificates comparable. Both product types can be bought and sold during the whole trading day. For further information on the differences between ETFs and index certificates in the German market consult Klein and Kundisch (2008), and Lobe (2009).

The paper’s key results may be summarized as follows. Preexisting studies find that ETFs “lead” the floor-traded index futures contract. The present study finds that DAX futures contracts contribute an economically and statistically significant proportion to contemporaneous price quotes of ETFs and certificates. This finding is surprising because the prospectus of ETFs and certificates claim to follow the stock index, but not the index futures contract. Hedging concerns of the market makers or the issuing banks could serve as one possible explanation. Also, “arbitrage activities which are easier to implement using the future rather than a portfolio of 30 stocks” could be considered as an explanation.Footnote 1 We further find that fully replicated ETFs cope better with adjusting their prices to the DAX index than swap-based ETFs and certificates.

The remainder of this paper is organized as follows. Section 2 reviews the literature related to the paper’s principal economic themes and gives a brief overview of prior studies examining ETFs and index certificates. Section 3 discusses the data used in our study and provides a motivating example. Section 4 presents the methodology and the results of our empirical analysis. Section 5 concludes the paper.

2 Literature review

A considerable body of academic research on index ETFs has examined arbitrage opportunities and pricing efficiencies regarding passive index products, stock indexes and index futures. Switzer et al. (2000) find that positive mispricing of the Standard and Poor’s 500 Index Futures Market was reduced when SPDRs were introduced. Kurov and Lasser (2002) examine the impact of the Nasdaq100 Index Tracking Stock (ETF) on the underlying futures. The effect of decimalization of ETFs is studied by Chou and Chung (2006). Their results suggest that ETFs start to lead index futures in the price discovery process indicating a close relationship between passively managed index products and index futures. This paper reveals that the prices of ETFs and index certificates additionally commove with index futures in the short run. To our knowledge, this is the first paper examining the intraday pricing of DAX ETFs and certificates in comparison to the DAX futures. In the following, we present a brief survey of the existing literature regarding passive index products.

Apart from questioning price efficiency, prior literature on passively managed index products also discusses topics like performance, tracking quality, risk, tax effects and trading quality. Using intraday trades, Klein and Kundisch (2009a) analyze the price-setting fairness of DAX index certificates from the perspective of an individual investor. Klein and Kundisch (2008) compare ETFs and index certificates with respect to performance, risk, and tax effects based on a decision theoretic model. Elton et al. (2002) discover that the underperformance of SPDRs compared to the Standard and Poor’s 500 Index is due to management fees and the missing dividend reinvestment. Poterba and Shoven (2002) investigate tax implications of ETFs in general and the specific performance of the SPDR. Examining 30 American ETFs, Rompotis (2006) finds that the gap between the return of ETFs and their respective index calculated as tracking error is close to zero. Johnson (2008) compares 20 ETFs based on country-specific indexes with the SPDR in order to explain differences in the tracking error. Klein and Kundisch (2009b) find a considerably decreasing tracking error during the years 2001–2006 examining the ETF DAX EX and ten DAX index certificates.

Rompotis (2008) investigates the performance of ETFs and index funds. Agapova (2009) shows that conventional index funds and ETFs are not perfect substitutes. Boney et al. (2006) examine the effect of SPDRs on the cash inflows of Standard and Poor’s index mutual funds. They find that the SPDR has a significant negative effect on the flows to mutual index funds due to benefits of ETFs like intraday trading. However, Huang and Guedj (2008) develop an equilibrium model and argue that ETFs do not dominate index mutual funds. Despite an arguably increased market efficiency, Richie et al. (2008) show that due to ETFs arbitrage opportunities between Standard and Poor’s 500 Index Futures and SPDRs still exist.

Boehmer and Boehmer (2003) document that entry of ETFs to the NYSE leads to a dramatic improvement in liquidity due to the elimination of market maker rents. Confirming this result, Peterson (2003) notes that market makers have earned significant returns prior to the NYSE entry. Svetina and Wahal (2008) find that enhanced competition between ETFs and index mutual funds leads to dissipating rents comparing 584 different ETFs. Using data from the French stock market, De Winne et al. (2009) establish that the first ETF replicating the French index CAC40 leads to tightening spreads associated with best-limit quotes. In contrast to the market efficiency hypothesis, Cherry (2004) shows that ETF prices consistently move away from their net asset value (NAV). Jares and Lavin (2004) identify trading strategies to profit from such price deviations. Engle and Sarkar (2006) investigate the magnitude and properties of premiums and discounts of ETF prices in relation to their fair value.

3 A first look at the data

The sample period considered here is September 01, 2008 through October 31, 2008. From the resulting 45 trading days we exclude the five trading days which exhibit an extreme DAX return volatility. We do this (described in more detail in Sect. 3.2) because we aim to focus on the behavior of average trading days. This paper examines all five DAX ETFs and three selected DAX index certificates in the German market. The specific index certificates are chosen from different German banks being member of the reference market makers. We purposely abstain from disclosing the issuers’ names. All products stem from different issuers. However, the issuers of ETF A (B) and certificate F (G) belong to the same parent company.

3.1 Description of the instruments

We first analyze the pricing relative to the DAX index and the electronically traded DAX futures. Data of the index certificates are from the EUWAX Börse-Stuttgart. The data for the DAX index, the DAX futures contracts and the quotes of the ETFs are from the Deutsche Börse AG. Estimations are carried out at a 1-min level of resolution to be computationally acceptable leading to over 1,40,000 observations.Footnote 2 The data is time stamped. Therefore, it is possible to exactly match the prices of the DAX and the DAX futures contract, and price quotes of the ETFs and certificates at a 1-min level of resolution. We restrict the time frame of the sample according to the availability of DAX data reaching from 9:00 to 17:30. To account for differences of index products’ bid and ask prices midquotes are calculated. Table 1 reports the absolute and relative number of 1-min intervals. Since ETF D was lately introduced in September 2008, and was not available during the first five days of our analysis, its number of 1-min intervals is naturally the lowest. Additionally, we report the construction method. Besides traditional cash-based ETFs like ETF A and C which physically replicate the underlying benchmark, swap-based ETFs mimic the performance of the DAX index exchanging returns of an alternative portfolio against the returns of the DAX index.

The bid-ask quotes of index certificates represent a fraction of 1/100 of the DAX index. In contrast to index certificates, ETFs do not exactly replicate this fraction. Depending on the inception date, the Net Asset Value (NAV) of ETFs differs from the DAX index because of daily discounted management fees. To correct for these differences, we calculate a factor for each ETF which relates to the DAX index and the preceding day. The actual daily NAV cannot be known at the beginning of this day. To obtain the fair value of the bid-ask quotes, the fraction 1/366 (due to the leap year in 2008) of the annual total expense ratio is added to the factor.Footnote 3 We would like to stress again that we use the product’s quotes, and not the product’s prices. Thus, the data is the result of the managers’ replication strategy and not the investors’ trading decisions.

For the DAX futures, the FDAX t nearby-contract with expiration date on September 19, 2008 is selected for the time span from September 01, 2008 to September 18, 2008. In order to avoid distortions due to price fluctuations of the futures contract on the expiration day, the nearby-contract with expiration date on December 19, 2008 is chosen for the time span from September 19, 2008 to October 31, 2008. Since the settlement is carried out on September 22, 2008 and December 22, 2008 respectively, intraday values of the DAX futures are discounted for the time span θ between the analyzed day and the corresponding settlement day (method: act/360 according to the convention of the EURIBOR published by the “Deutsche Bundesbank”) to obtain fair values with respect to the cost-of-carry approach. We use the θ-adjusted EURIBOR as a discount rate. Because the DAX is a total return index, dividend payments do not have to be considered in the following equation for the time-adjusted DAX futures:

3.2 A motivating example

Figure 1 illustrates the contemporaneous difference between the DAX index and the discounted value of the DAX futures contract (upper line) and the difference between the DAX index and certificate G (lower line) on an average trading day. The smoothed lines are 10-min moving averages which are plotted for illustration purposes only. The difference between the DAX and the discounted value of the DAX futures contract is mostly in the range of ten to fifteen index points during October 14, 2008.Footnote 4 Overall, the difference between the DAX and the discounted value of the DAX futures contract is higher compared to the difference between the DAX and certificate G. The moving averages indicate that the price difference between the DAX and the discounted DAX futures and the DAX and certificate G seems to move together.

Development of the difference of the DAX index and the time-adjusted DAX futures, and the difference of the DAX index and certificate G on October 14, 2008. Index certificates represent a fraction of 1/100 of the DAX, therefore, the value of certificate G is scaled. For illustration purposes only, 10-min moving averages are employed

In the following, we analyze the pricing of all ETFs and the selected index certificates at 1-min intervals. For all index products, we observe a qualitatively identical pricing behavior compared to certificate G. Again, all products are passively managed and seek only to track the development of the DAX index as portrayed in their respective product information. However, our results reveal that the DAX futures contract contributes economically and statistically significant to the contemporaneous pricing of ETFs and index certificates.

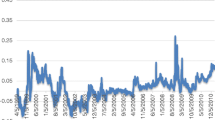

For inspection of the DAX return volatility during September 2008 and October 2008, we estimate the daily volatility for each of the 45 trading days. Figure 2 illustrates the development of the average (mean) daily DAX return volatility at a 1-min level of resolution exhibiting remarkable spikes during October 2008 with the highest measured at October 28, 2008. On this day, the heavy price jump of the Volkswagen shares leads to a major contribution (27% in the maximum) to the capitalization-weighted DAX index.Footnote 5 Because we aim to focus on days with average volatility, we exclude the five trading days with the highest volatility spike (indicated by cells in Fig. 2).Footnote 6 Hence, our final sample comprises 40 trading days excluding October 08, October 10, October 24, October 27, and finally October 28, 2008.

4 Empirical analysis: methodology and results

This section presents the methodology and reports the results. First, we analyze the influence of the stock index futures on the pricing of the index products. Then, we compare the pricing efficiency of the single products.

4.1 Index product pricing and the stock index futures

We investigate our central hypothesis whether ETFs and index certificates tracking the DAX index are influenced by DAX futures applying a suitable regression model. As dependent variable, we define the relative price difference of product i at 1-min intervals t:

Adjusted midquotes are compared to a fraction of 1/100 of the DAX. For a fair comparison between ETFs and certificates we employ quotes before costs.

The individual adjustment factor AdjF i,d of ETF i (i = A,…,E) at day d is calculated as the relation of 1/100 of the previous day’s closing DAX index value (DAXd−1) and the previous day’s ETF-specific net asset value (NAVi,d−1). We also add the fraction of 1/366 of the total expense ratio (TER) for product i. To adjust for interruptions between two following trading days, i.e., for weekends, each fraction is multiplied by the number of days nd d;d−1 lying in between. Certificates (i = F,…,H) do not need to be further adjusted.

As independent variable, the relative price difference of the DAX and the time-adjusted DAX futures contract (cost-of-carry approach) according to formula (1) is calculated as follows:

Our following OLS regression model explains the relative price difference of the DAX index and the adjusted midquotes of the products (ΔPrice), estimating the fixed impact of the relative price difference of the DAX index and the time-adjusted DAX futures, and the variable impact of the relative price difference of the DAX index and the time-adjusted DAX futures depending on the specific product i controlling for hourly and calendar-day specific trading time effects. We specifically control for weekly and intradaily patterns because Harris (1986) and recently Heston et al. (2010) empirically establish their influence for traded stocks.

where B′ is the I × 1 vector of coefficients for ETFs and index certificates, ΔDAX_FDAX t × D_Product i represents an interaction term of the relative DAX-Futures difference multiplied by a dummy variable for the specific product i, C′ is the (J − 1) × 1 vector of coefficients, and D_Timeh,d denotes the (J − 1) × 1 vector of time dummies for trading hour h on trading day d. Including 40 trading days and 9 trading hours per day, this model specification leads to an estimation of J = 360 coefficients. To correct for heteroscedasticity and autocorrelations which can be observed in the sample’s residuals, the method of Newey and West (1987) is applied. To diagnose autoregressive disturbances in the time series, the Breusch (1978) and Godfrey (1978) serial correlation LM-test is employed. A sufficient number of AR-terms are used because these effects are present.

We further hypothesize that the gap between the relative price difference of the DAX index and the time-adjusted DAX futures is conditional on the expected DAX volatility. Controlling for a possible variable influence of the DAX return volatility on the relative DAX-Futures difference, we extend the OLS regression model (5) as follows:

where ΔDAX_FDAX t × DAXV t represents an additional interaction term between the expected short-term DAX return volatility and the relative difference of the DAX index and the time-adjusted DAX futures ΔDAX_FDAX. The expected short-term volatility is estimated at the 1-min interval using a rolling window of the previous 30 min during the trading day.Footnote 7

Table 2 shows that in Model 1 the relative price difference of the DAX index and the time-adjusted DAX futures has a highly significant positive influence on the relative price difference of the DAX and passively managed index products (measured as ΔPrice). The estimated coefficient of ΔDAX_FDAX has a value of 33.4% which means that an increase in the relative price difference of the DAX and the time-adjusted DAX futures of 100 basis points leads to an increase in the relative price difference of the DAX and the index products of about 33 basis points. This result confirms our hypothesis that the DAX futures contract contributes significantly to the price quotes of DAX ETFs and DAX index certificates. The interaction terms of the specific index products trying to capture variable components of ΔDAX_FDAX do not contribute to explain the pricing differences of the index products in general. Interestingly, synthetic products (swap-based ETFs and certificates) cannot be found to correlate better with futures than fully replicated ETFs.

Model 2 additionally captures the variable influence of the expected DAX return volatility on the relative DAX-Futures difference.Footnote 8 Note that the number of observations is reduced in comparison to model 1 because we apply a rolling volatility estimation window of 30 min for each day. Therefore, all observations between 9:00 and 9:30 do not enter the regression. Due to the different sample size, the adjusted R 2 between models 1 and 2 cannot be easily compared. However, the results show that this variable component which scales the influence of the relative DAX-Futures difference conditional on the expected volatility picks up a sizeable part in comparison to the fixed effect. However, diminished, the fixed effect ΔDAX_FDAX still remains significantly positive.

To encounter the objection that the rest of our October data with its strikingly high volatility (see Fig. 2) contaminates our results we run an additional robustness test. In this, we estimate the coefficients of the regression specifications of Model 1 and Model 2 for September 2008 since the monthly DAX return volatility of September 2008 roughly represents the average volatility of the DAX index. The results (not reported) of Model 1 and Model 2 remain qualitatively unchanged. We are therefore safe to conclude that the used data during the October period do not change our results in a material way.

4.2 Pricing efficiency of ETFs versus index certificates

Having unraveled the major influence of the DAX futures contract on the price quotes of ETFs and the three selected index certificates, the question regarding the pricing efficiency is still unanswered. Pricing efficiency is measured comparing the returns of passive index products and the DAX index. Using the Sharpe (1963, 1964) market model, we estimate alphas and betas of the DAX returns at 1-min intervals as independent variables for each product in an individual regression.

Theoretically, one would expect no significant Jensen alphas α, and betas β clustering more or less around one. Thus, we apply a Wald-test for H 0: β = 1, and spanning tests to discover differences in a product’s ability to replicate the development of the DAX index. According to Huberman and Kandel (1987), we test the joint hypothesis H 0: α = 0 and β = 1. If the null hypothesis is rejected, the passive index product fails to deliver a satisfactory replication of the DAX index. Table 3 reports the results, again excluding the returns of the five extreme event days. To correct for heteroscedasticity in the market model which can be observed in the sample’s residuals, the method of Newey and West (1987) is applied. Autoregressive disturbances are again controlled for by a sufficient number of AR-terms.

The results are as follows. First, ETFs and the selected index certificates do not outperform the DAX index exhibiting overall insignificant Jensen alphas. This result is to be expected. In an appendix, we show that this result is also robust to an estimation method similar to that in Sect. 4.1 controlling specifically for the influence of the DAX futures contract.

Second, regarding the results of H 0: β = 1 using a Wald-test, only fully replicated ETFs deliver a satisfactory replication in the short-term. For all other products, the null hypothesis is rejected. Our finding establishes that in the short-run only cash-based ETFs deliver an acceptable replication of the DAX index while the swap-based ETFs and certificates fail to do so. It seems that in the short-run a physical replication is superior to a synthetical replication in practice.

Third, our spanning tests unequivocally confirm both results.

As a robustness test, we additionally estimate the coefficients of the regression specification illustrated in Table 3 for September 2008 since the monthly DAX return volatility of September 2008 roughly represents the average volatility of the DAX index. Again, the results (not reported) remain qualitatively unchanged.

5 Conclusions

The market for the leading German equity index DAX comprises electronically traded futures contracts, exchange-traded funds (ETFs), and certificates. We conduct a pricing analysis at 1-min intervals between September 01, 2008 and October 31, 2008 totaling 40 trading days with average volatility. In this paper, we discover that DAX futures contracts contribute economically and statistically significant to the contemporaneous pricing of ETFs and certificates. A higher DAX volatility strengthens this futures contract effect by further decreasing the overall pricing efficiency of index products. This finding is surprising because the prospectus of ETFs and certificates claim to follow the stock index, but not the index futures contract. Evaluating individual differences in the pricing efficiency, fully replicated ETFs perform quite well in the short-term. However, swap-based ETFs and certificates do not replicate the DAX sufficiently. There are still unanswered questions which certainly deserve further attention. Which story drives the effect of futures contracts on the pricing of index products: arbitrage and/or hedging? In particular, we also have not dwelled on the interesting question, on how robust pricing characteristics are under extreme circumstances like inflated index volatility. We hope our paper instigates future research based on our key findings.

Notes

The second reviewer graciously offered this explanation.

However, the total expense ratio does not include all fees like, e.g., swap costs. Our data did not permit to use these cost elements.

Such a difference is representative. For our total sample between September and October 2008, the mean of the difference is 12.92 index points.

This landmark event has led the Deutsche Börse AG to reconsider its own index rules. Since then, the Deutsche Börse AG responsible for calculating the index has decided to immediately cap the weighting of a specific stock in the DAX index if a predetermined threshold is reached.

We obtain qualitatively similar results when using a forward looking measure of the DAX volatility like the index VDAX-NEW developed by Deutsche Börse and Goldman Sachs. VDAX-NEW measures the implicit volatility as percentage of the DAX value expected by the futures-market for the forthcoming 30 days. Daily historical values of VDAX-NEW are provided by Deutsche Börse. Based on historical data from January 2, 1992 to December 17, 2009 (mean: 23.42), we can conclude that the month of September 2008 with a mean of 27.87 can be regarded as a month roughly representing the average volatility of the DAX index. In contrast, for October 2008 the volatility mean of 60.37 is considerably higher than the total average due to volatility spikes. Hence, we exclude the five trading days exhibiting abnormal high volatility which represent 10% of the total sample period comprising 45 trading days.

Our data do not permit us to use the VDAX-NEW instead because it is available only at a daily resolution.

Our results (not reported) remain nearly unchanged if we additionally include the expected volatility DAXV in regression specification (6). Also, DAXV alone does not exhibit a significant explanatory power.

References

Agapova A (2009) Conventional mutual index funds versus exchange traded funds. J Financ Mark, Forthcoming. Available via DIALOG: http://ssrn.com/abstract=1346644. Accessed 18 Mar 2010

Boehmer B, Boehmer E (2003) Trading your neighbor’s ETF: Competition or fragmentation? J Bank Finance 27:1667–1703

Breusch T (1978) Testing for autocorrelation in dynamic linear models. Aust Econ Pap 17:334–355

Cherry J (2004) The limits of arbitrage: evidence from exchange traded funds. Available via DIALOG: http://ssrn.com/abstract=628061. Accessed 18 Mar 2010

Chou R, Chung H (2006) Decimalization, trading costs, and information transmission between ETFs and index-futures. J Futures Mark 26:131–151

De Winne R, Gresse C, Platten I (2009) How does the introduction of an ETF with a hybrid market impact the liquidity of the underlying stocks? Available via DIALOG: http://www.carolegresse.com/medias/recherches/papiers-en-cours/abstract_etf_may2008.pdf?PHPSESSID=8e8be461e7adba03d715953da7478f2d. Accessed 18 Mar 2010

Doran J, Boney V, Peterson D (2006) The effect of the Spider exchange traded fund on the cash flow of funds of S&P index mutual funds. Available via DIALOG: http://ssrn.com/abstract=879777. Accessed 18 Mar 2010

Elton E, Gruber M, Comer G, Li K (2002) Spiders: where are the bugs? J Business 75:453–472

Engle R, Sarkar D (2006) Premiums-discounts and exchange traded funds. J Derivatives 13:27–45

Godfrey L (1978) Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica 46:1293–1301

Harris L (1986) A transaction data study of weekly and intradaily patterns in stock returns. J Financ Econ 16:99–117

Heston SL, Korajczyk RA, Sadka R (2010) Intraday patterns in the cross-section of stock returns. J Finance 65:1369–1407

Huang J, Guedj I (2008) Are ETFs replacing index mutual funds?. AFA 2009 San Francisco Meetings Paper. Available via DIALOG: http://ssrn.com/abstract=1108728. Accessed 18 Mar 2010

Huberman G, Kandel S (1987) Mean-variance spanning. J Finance 42:873–888

Jares T, Lavin A (2004) Japan and Hong Kong exchange-traded funds (ETFs): discounts, returns and tracking strategies. J Financ Serv Res 25:57–69

Johnson WF (2008) Tracking errors of exchange traded funds. J Asset Manage 10:253–262

Klein C, Kundisch D (2008) Indexzertifikat oder ETF? Eine entscheidungstheoretische Analyse. Zeitschrift für Planung & Unternehmenssteuerung 19:353–370

Klein C, Kundisch D (2009a) Zur Preissetzung verschiedener Emittenten bei Indexzertifikaten auf den DAX. Zeitschrift für Bankrecht und Bankwirtschaft (ZBB) 21:212–224

Klein C, Kundisch D (2009b) Der Tracking Error von indexnachbildenden Instrumenten auf den DAX-eine empirische Analyse des DAX EX sowie zehn Indexzertifikaten. Der Betrieb 62:1141–1145

Kurov A, Lasser D (2002) The effect of the introduction of cubes on the NASDAQ-100 index spot-futures relationship. J Futures Mark 22:197–218

Lobe S (2009) Zum Einfluss der Abgeltungsteuer auf die Vorteilhaftigkeit von Renten, Aktien und Aktienindexanlagen. Zeitschrift für Bankrecht und Bankwirtschaft (ZBB) 21:434–441

Newey W, West K (1987) A simple, positive semi-definite, heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Peterson M (2003) Discussion of “Trading your neighbor’s ETFs: Competition or fragmentation?” by Boehmer and Boehmer. Journal of Banking & Finance 27:1705–1709

Poterba J, Shoven J (2002) Exchange traded funds: a new investment option for taxable investors. Am Econ Rev 92:422–427

Richie N, Daigler R, Gleason K (2008) The limits to stock index arbitrage: examining S&P 500 futures and SPDRS. J Futures Mark 28:1182–1205

Rompotis G (2006) An empirical look on exchange traded funds. Available via DIALOG: http://ssrn.com/abstract=905770. Accessed 18 Mar 2010

Rompotis G (2008) An empirical comparing investigation on exchange traded funds and index funds performance. Eur J Econ Finance Adm Sci 13:7–17

Sharpe W (1963) A simplified model for portfolio analysis. Manage Sci 9:277–293

Sharpe W (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J Finance 19:425–442

Svetina M, Wahal S (2008) Exchange traded funds: performance and competition. Available via DIALOG: http://ssrn.com/abstract=1303643. Accessed 18 Mar 2010

Switzer L, Varson P, Zghidi S (2000) Standard and poor’s depository receipts and the performance of S&P 500 index futures market. J Futures Mark 20:705–716

Acknowledgments

We would like to thank Erdal Atukeren, Philippe Masset, Petra Halling, and seminar participants of the Campus for Finance Research Conference (Otto Beisheim School of Management), the 13th Conference of the Swiss Society for Financial Market Research (Zurich), and the Financial Management Association European Conference (Hamburg) for their suggestions. We are also grateful to Wolfgang Kürsten (the editor), and two referees (anonymous) for numerous helpful insights. We also would like to thank Sarah Jane Kelley-Lobe, Kilian Schubert and Matthias Kapfhammer for their research assistance, as well as DZ BANK AG and Deutsche Börse AG for supporting this project. All errors are our own responsibility.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Is the Jensen alpha of the index products robust?

The following OLS regression again explains ΔPrice (the relative price difference of the DAX and the adjusted midquotes of the products) as dependent variable. To control for the influence of the DAX futures, the impact of the relative price difference of the DAX index and the time-adjusted DAX futures contract is estimated. Again, the five extreme event days during the sample period are removed. To discriminate between the pricing efficiency of ETFs and index certificates, individual product dummies are now employed.

where in addition to the explanation of regression (5), D′ is the I × 1 vector of coefficients. Note that the constant in this specification is captured by a product dummy variable for the sake of a more convenient interpretation.

The estimated coefficient of ΔDAX_FDAX remains stable compared to model 1 in Sect. 4.1 with a significant positive value of 38.6%. The signs do not show that any product except certificate H influences the pricing difference in any way confirming largely the market model results (Table 4).

Rights and permissions

About this article

Cite this article

Schmidhammer, C., Lobe, S. & Röder, K. Intraday pricing of ETFs and certificates replicating the German DAX index. Rev Manag Sci 5, 337–351 (2011). https://doi.org/10.1007/s11846-010-0049-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-010-0049-y