Abstract

Forest management for carbon sequestration is a low-cost, low-technology, relatively easy way to help mitigate global climate change that can be adopted now while additional long-term solutions are developed. Carbon-oriented management of forests also offers forest owners an opportunity to obtain a new source of income, and commonly has environmental co-benefits. The USA is developing climate change policy that recognizes forestry as a source of offsets in carbon markets, and the emissions trading programs and standards that have developed to date offer opportunities for afforestation, reforestation, reduced emissions from deforestation and forest degradation, and improved forest management projects. Private forest owners are key players in carbon markets because they own over half of the forest land in the USA and carbon offsetting from public forest land is rare. However, a number of environmental, economic, and social constraints currently limit carbon market participation by forest owners. Key issues include: the low price of carbon and high cost of market entry; whether small landowners can gain market access; how to meet requirements such as management plans and certification; and whether managing for carbon is consistent with other forest management goals. This paper provides an overview of current and emerging opportunities for family forest owners to contribute to climate change mitigation in the USA, and explores ways of overcoming some of the challenges so that they can take advantage of these opportunities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Countries around the world are seeking ways to reduce greenhouse gas concentrations in the atmosphere to avoid significant and potentially catastrophic environmental change. Forest management for carbon sequestration and storage is one of many options available for doing so, and represents a low-cost, low-technology, relatively easy way to help mitigate climate change now while additional long-term solutions are developed. Carbon-oriented management of forests also offers landowners an opportunity to obtain a new source of income, and commonly has environmental co-benefits such as enhancing wildlife habitat, improving soil quality, increasing water storage and filtration, and conserving biodiversity.

The potential to simultaneously improve environmental conditions and obtain financial benefits has generated substantial interest in emerging carbon markets from landowners and others. In the USA, forests and farmlands together sequester a volume of carbon every year equivalent to 10–12% of all national annual greenhouse gas emissions (Murray et al. 2005; Woodbury et al. 2007). At a price of $15/metric tonne of carbon dioxide equivalent (tCO2e), improved forest management and afforestation together could account for as much as 430 million tCO2e in offsets per year from 2010 to 2020, the annual equivalent of approximately 6% of 2007 US greenhouse gas emissions (Daigneault and Fawcett 2009; USEPA 2009). Consequently, many of the policies being developed in the USA to reduce emissions over the next century include opportunities for forest owners to be compensated for managing their land in ways that sequester and store carbon.

This article provides an overview of current and emerging opportunities for small-scale forestry to contribute to climate change mitigation in the USA through land use, land use change, and forestry, and examines ways of encouraging forest owners to take advantage of these opportunities. About 56% of the forest land in the USA is privately owned, and 35% (264 M ac) is under family forest ownership (Butler 2008). The focus here is on family forest owners because finding ways to engage them in carbon-oriented management is likely to be more challenging than it is for industrial and corporate owners, who typically have much larger forest holdings (an advantage) and less diverse management objectives. To date, public land in the USA has rarely been used for carbon offsetting, and it is unclear whether it will be eligible in a future federal scheme. This paper focuses on carbon markets because there are currently few non-market mechanisms that reward landowners for carbon-oriented management in the USA. Although many of the conservation programs authorized under the US Farm Bill encourage activities that may indirectly lead to carbon sequestration, the Healthy Forests Reserve Program managed by the Natural Resources Conservation Service (NRCS) is the only one that explicitly identifies carbon sequestration as a program goal. This program provides funding to assist landowners in restoring and protecting forest land to enhance carbon sequestration, among other environmental objectives. Conservation Innovation Grants from the NRCS have also been used to support development of carbon projects on private forest lands.

First, an overview is provided of the current status of climate change policy and carbon markets in the USA to establish context. A brief summary is then given of the forest management practices that qualify as a source of carbon offsets in existing US markets. A number of challenges to forest owner participation in carbon markets are then addressed, and finally policy implications are drawn. The article is based largely on data gathered from existing sources and a review of the literature. The policy and market context for forestry offsets in the USA is shifting rapidly; the information presented here is current as of July 2010.

Greenhouse Gas Emissions Policies

In 1992, the USA ratified the United Nations Framework Convention on Climate Change (UNFCCC). The UNFCCC served as the framework for negotiating international agreements to reduce greenhouse gas emissions and led to the development of the Kyoto Protocol. Since the ratification of the UNFCCC, the USA has not entered into any international agreements that require emissions reductions over time.

As of this writing, there is no comprehensive federal mandate for reducing greenhouse gas emissions in the USA. More than 10 cap-and-trade bills had been proposed by members of Congress as of July 2010. Many of these bills explicitly mention a role for forest-based offsets. Only one of these bills has passed through the US House of Representatives (the American Clean Energy and Security Act, H.R. 2454, passed in June 2009) and none have yet passed the Senate. The House bill lists afforestation, reforestation, forest management, and reduced emissions from deforestation and degradation as offset project types to be considered. In the US Senate, the development of comprehensive climate legislation including a cap-and-trade component has proceeded in fits and starts. The most recent legislation (the American Power Act), developed by Senators Kerry and Lieberman, is currently stalled. Several iterations of this legislation have included a role for both domestic and international forestry offsets. The fate of climate legislation in the Senate remains uncertain, and this uncertainty has fueled speculation in the voluntary carbon market in the USA (Hamilton et al. 2010b).

In the absence of federal mandates, most greenhouse gas regulation in the USA has been pursued through the actions of individual States and through the formation of regional agreements between States. Many States have implemented renewable energy standards and passed resolutions establishing emissions targets to be met in the future, but few have passed binding legislation regulating the emissions of greenhouse gases. Exceptions are Oregon and Washington, which regulate carbon dioxide (CO2) emissions from power plants, and California, the first State to pass legislation (in 2008) supporting the implementation of a market-based strategy covering emissions of the six greenhouse gases from major industries regulated under the international climate treaty of the Kyoto Protocol. Ten north eastern States launched the Regional Greenhouse Gas Initiative (RGGI) in 2008 to regulate emissions of CO2, the only greenhouse gas included in this program, from major power plants using a cap-and-trade system.

Elsewhere in the USA, regulations are still under development. The governors of seven mid-western States signed the Midwestern Greenhouse Gas Reduction Accord in November 2007, which calls for the establishment of a regional emissions trading program to reduce greenhouse gas emissions in 2010. The Western Climate Initiative is a regional agreement that was signed by the governors of seven western States and the premiers of four Canadian Provinces in 2007. The Initiative includes a cap-and-trade program planned for launch in 2012. The use of offsets will be included in these programs, though the eligible activities have not yet been disclosed. They will likely include private forest owners as offset providers.

Carbon Markets and Forestry Offsets

The only compliance market that operates currently in the USA is the cap-and-trade system associated with the RGGI. Only landowners who reside in the 10 eastern States that are party to the RGGI are eligible to participate in this market. Elsewhere, many companies and individuals are pursuing voluntary greenhouse gas emissions reductions by participating in voluntary carbon markets. There are two kinds of voluntary carbon markets in the USA: the Chicago Climate Exchange (CCX) and over-the-counter (OTC) transactions. The CCX has been open since 2003. It is a legally binding cap-and-trade program composed of member companies and organizations that enter into the program voluntarily and trade emissions allowances and credits from offsetters according to an emissions cap set individually for each participant by the CCX. Forestry projects accounted for 14% of the offset credits registered on the CCX between 2004 and mid-2009, generating 11.5 million tCO2e in forest carbon offsets, all of which came from afforestation and improved forest management projects (Hamilton et al. 2010a). Twenty-seven percent of these credits came from forestry projects in the USA.

Over-the-counter transactions involve the sale of offsets to companies or individuals through private contracts between an offset provider and an offset buyer. The diversity of buyers and their interests in OTC transactions have made this voluntary market a potentially valuable niche market for offset providers. Because OTC transactions are based on private contracts, the contract terms—such as types of offset activities allowed, verification and documentation requirements, and price of offsets—are negotiable. The exchange of voluntary offsets through OTC transactions are not currently coordinated or regulated by any centralized market exchange or institution. Between the 1990s and mid-2009, an estimated 15.3 million tCO2e in forestry offsets were transacted in OTC markets worldwide, 38 percent of which came from projects in North America (Hamilton et al. 2010a). Of the estimated 1.68 million tCO2e in forestry offsets transacted in OTC markets in the USA in 2008, 72% came from afforestation and reforestation projects, 2% were from avoided deforestation projects, and 26% were from improved forest management projects (Hamilton et al. 2009). There are no readily available data indicating what proportion of these offsets came from family forest lands.

Several entities have developed carbon offset standards for forestry in the USA to ensure that a forest management activity truly increases carbon sequestration and provides real, measurable offsets over time. Each standard commonly includes protocols that describe the permissible types of activities and the specific accounting procedures used to calculate the amount of carbon sequestration. Forest owners who wish to participate in a carbon market must decide whether to develop a project under an existing market program (i.e., the CCX or the RGGI), or whether they want to pursue the sale of offsets through OTC transactions which may involve choosing to comply with a voluntary offset standard. In general, compliance markets and the CCX have set standards, whereas credits traded in OTC markets may comply with a range of standards or none at all. Potential buyers of offset credits may prefer a particular standard, so landowners should determine whether they have or can obtain the financial resources needed to comply with that standard before they commit to using it. The CCX and the American Carbon Registry are the only standards that currently have protocols for aggregating small land owners, meaning it may not be cost-effective for small landowners to comply with the other standards as currently designed. In April 2010 the Climate Action Reserve proposed a protocol for aggregating landowners that is currently going through a public comment and revision process.

Registries—databases that keep track of emissions inventories, carbon credits, allowances, and transactions between market participants—are another important component of the market, as they provide transparency and reliably track the sale and use of emissions allowances and carbon credits. Landowners wishing to participate in compliance markets and the CCX must register their credits; those participating in OTC transactions are not obliged to use a registry, although doing so may increase the visibility of their credits to potential buyers. For a more comprehensive overview of how carbon markets work and the steps forest landowners in the USA will generally be expected to follow in order to participate, see Diaz et al. (2009).

Table 1 indicates the leading emissions trading programs and voluntary offset standards relevant for forest landowners in the USA, and the types of forestry projects that they currently accept offset credits from. Afforestation and reforestation projects are allowed by all of them. Improved forest management is allowed by most; reduced emissions from degradation and deforestation (REDD or avoided deforestation) is allowed by the majority. The RGGI, the only compliance market, accepts forestry offsets from afforestation and reforestation projects only.

Forest Management Practices and Carbon Sequestration

Most forestry offset standards in the USA are outcome-based, relying on carbon inventories to measure changes in forest carbon over time. Consequently, landowners have the leeway to choose the forest management practices that are best suited to their circumstances. As noted above, offsets from three general categories of forest management—afforestation and reforestation, avoided deforestation, and improved forest management—are eligible in US carbon markets.

Afforestation and Reforestation

Afforestation is the term used for the establishment of forests on land that has not previously been forested (e.g. agricultural land). In many cases, afforestation can lead to rapid and dramatic accumulation of carbon in tree biomass. Carbon accumulation in litter and soil organic carbon may also increase with afforestation—depending on the status of the soil—although these gains will likely be smaller and accumulate more slowly than carbon in tree biomass (Post and Kwon 2000; Guo and Gifford 2002). Reforestation involves reestablishing forests on land where forests were recently removed or destroyed (e.g. land severely affected by forest fire). Many offset standards distinguish between afforestation and reforestation on the basis of how much time the land has been under a land use other than forestry. Offset standards may also stipulate how long a land area must have lacked forest cover to be considered as a source of carbon offsets.

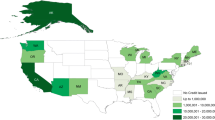

Planting new forests is a relatively straightforward way to sequester carbon and is the simplest carbon sequestration activity to account for in forest carbon offset programs. The South-central and Midwestern corn belt regions of the USA have the greatest potential for afforestation projects because of the large area of private land, marginal agricultural land, and other land where trees could be planted (Murray et al. 2005). About 20% of family forest owners have planted trees on their lands (Butler 2008), and owners have responded to government-sponsored tree planting programs in the past, suggesting they may do so in the future given the right economic incentives (Alig 2003).

Avoided Deforestation

The conversion of forested landscapes to other land uses (e.g. agriculture, residential and commercial development) typically involves a dramatic release of carbon to the atmosphere, even if wood products are produced in the process (Solomon et al. 2007). Deforestation and forest conversion lead to large losses of carbon from live and dead biomass, and often from soil organic matter. Although forest clearing and land conversion represent a straightforward loss of carbon, the methods used to estimate carbon losses that could be avoided by preventing them are complicated and can be contentious.Footnote 1 A major barrier to accepting avoided deforestation offset projects in the USA has been the difficulty of estimating reliably the real threat of future forest conversion in specific places. Another barrier is the risk of leakage. When forests are controlled by one landowner, leakage of carbon benefits in one stand by increased harvesting in another is not particularly difficult to control, and is often addressed through monitoring or verification requirements associated with offset standards. Leakage to forests outside of a landowner’s ownership and control is much more difficult to measure and mitigate. The challenges presented by quantifying and verifying offsets from avoided deforestation account in large part for its limited use as a source of offsets to date.

Improved Forest Management

There are several forest management practices that can increase carbon stocks in forests, as summarized in Table 2. While the carbon benefits of some of these practices are clear, those of others are not as straightforward, or are debated in the scientific literature (see Diaz et al. 2009). Improved forest management is the approach to sequestering carbon that is most likely to be used in the USA outside of the Rocky Mountains and South-central regions (Murray et al. 2005). Some of these practices, such as extended harvest rotation intervals, are consistent with the existing practices of many family forest owners (Bliss and Kelly 2008). Others, such as reducing dead biomass removal or avoiding wildfire mitigation activities, may conflict with existing management preferences and priorities.

Challenges for Small-Scale Forestry in Carbon Market Participation

To date, forestry has played a minor role in global carbon markets. The biggest opportunities for carbon offsetting through forestry currently lie in voluntary markets, which in 2008 accounted for only 2.9% of the total volume of carbon credits transacted worldwide, and 0.6% of the monetary value (Hamilton et al. 2009). In recent years, the role of forestry in voluntary carbon markets has declined, reaching 10% of the transaction volume of carbon credits in 2008. In 2009, for the first time since data began to be collected, forestry’s market share in global voluntary markets increased to 24%, as many other project types suffered from the economic recession (Hamilton et al. 2010a, 2010b). Between the early 1990s and mid-2009, 22 percent of the forest offset credits transacted worldwide came from projects on private lands owned by individuals, foundations, and nongovernmental organizations (NGOs). To date, few family forest owners in the USA have engaged in carbon offset projects and carbon markets; most private-lands forestry offset projects in the USA have been undertaken by NGOs.Footnote 2 A number of environmental, economic, and social constraints limit their participation.

Environmental Constraints to Carbon Market Participation

Several environmental variables affect whether a forest owner is a candidate for carbon market participation. Forest types and productivity vary, influencing the sequestration potential of different places. For example, the Douglas Fir and Western Hemlock-Sitka Spruce forests on the west side of the Cascade Range in the Pacific Northwest have two to four times the carbon storage potential of the Loblolly Short Leaf Pine and Maple-Beech-Birch forests in the eastern United States, depending on forest age (Smith et al. 2006). Some trading programs and aggregators set a threshold amount of emissions reductions per year for forestry projects, meaning that landowners who cannot meet this requirement on their parcels (because of their size, forest type, or forest conditions) may not qualify.

Another concern in forestry offset projects is permanence. Harvesting and natural disturbances such as blowdowns, wildfire, and insect and disease outbreaks can cause carbon sequestered in trees, litter, and soil to be released back to the atmosphere. Thus, offset standards and programs may require a strategy for mitigating the risk of future carbon loss. Fear that natural disasters could jeopardize a forest owner’s investment in carbon management and result in financial loss has been a barrier to participation in some cases (Beddoe and Danks 2009).

Global climate change is also causing forests to change. For example, in the western USA increased temperatures and earlier snowmelt correspond to a more frequent occurrence of wildfire (Westerling et al. 2006). Regional tree die-backs and bark beetle outbreaks have been attributed to “global-climate-change-type drought” (Breshears et al. 2005). Impacts like these, as well as other plant and animal responses to climate change, may affect landowners’ abilities to manage for carbon in ways that are difficult to predict.

Economic Constraints and Uncertainty in Carbon Market Participation

The fundamental economic constraint on carbon market participation by family forest owners is currently the low price of carbon and the high cost of participating. Table 3 reports recent carbon prices for emissions trading programs and voluntary offset standards in the USA, and by way of comparison, for the European Union Emissions Trading Scheme and Kyoto’s Clean Development Mechanism and Joint Implementation (compliance markets). The highest prices in the USA are commonly obtained from OTC transactions where credits meet rigorous standards. Even so, the data show that prices in OTC markets are not as strong as in international compliance markets. Carbon prices also fluctuate frequently; what looks to be profitable at the start of a project can change by the time the project is ready to sell its credits. For example, in early 2010 the price of carbon on the CCX was $0.15/tCO2e offset. Forest owners can wait to sell until more favorable conditions prevail, but may face financial pressures to sell early.

The potential development of a federal emissions trading scheme in the USA includes the possibility that credits from some existing standards will be allowed into a federal compliance market. For example, legislative language from the House climate change bill (H.R. 2454, Sec. 740) declares that federal “early offset credits” may be issued to projects receiving credits from programs “established by State or tribal law or regulation” prior to 2009. This raises the prospect that credits from the RGGI and the Climate Action Reserve may be grandfathered into a federal scheme. The House bill also leaves room for other voluntary standards, provided they be demonstrated to have “criteria and methodologies of at least equal stringency” to those created by State and tribal law. This more subjective determination by a federal administrator leaves an open question of how other US-based voluntary offset standards such as the American Carbon Registry, the Voluntary Carbon Standard, and CCX will be treated under any future federal scheme. Since the value of these offset credits is closely tied to the demand for them from offset buyers, the exclusion of any of these programs from a federal emissions trading scheme may greatly reduce the demand and therefore value of these credits. The most recent data on voluntary markets suggest that as many as half of the purchases in the marketplace correspond to so-called “pre-compliance” speculation (Hamilton et al. 2010b). Landowners thus face a complex landscape when choosing a standard, as the longer-term outlook for these standards remains uncertain.

The requirements for market participation, and the costs, vary depending on the standard or trading program the forest owner chooses and its associated protocols. More rigorous standards have greater requirements. These requirements can include developing a forest management plan and an offset project plan, forest certification to ensure sustainable forest management, a conservation easement to address concerns over permanence, a carbon inventory to establish a baseline and estimate sequestration over time, subsequent inventories to monitor change in forest carbon storage, verification of offset activities by a third party, registering credits before selling them, and paying a project developer who is responsible for preparing the documentation needed to submit and run the offset project. Although some of these costs are back-end costs that can be deducted at the time the credits are sold (e.g. registration, project developer), others are up-front costs that the landowner or project developer must meet. The cost of verification alone—one of the largest single expenses of the project—can range anywhere from $2,000 to $40,000, depending on the standard, the amount of land to be verified, and the type of project (Merger 2008). There may also be opportunity costs associated with shifting to carbon-oriented management, such as the loss of timber revenue in the short term as a result of lengthening harvest rotations; or, the loss of revenue from agricultural production when pasture and croplands are forested. And, there are significant start-up costs associated with afforestation and reforestation projects (e.g. site preparation, tree planting).

Efficiencies in market participation can be attained by people who already meet some of these requirements, such as management plans or certification. Because credits verified to a rigorous and well-known third party standard generally transact at higher prices, it may be cost-effective for landowners to comply and undergo the process of verification and registration. The adoption of offset standards by forest projects has been increasing over time; by mid-2009 more than 90% of forest carbon projects were applying some form of third-party or internal offset standard (Hamilton et al. 2009). Compliance with a more rigorous standard does not guarantee that the price for the resulting offset credits will be higher, however.

Whether participation in a carbon market is financially feasible for a forest owner will also depend on the productivity of the land and the size of the landholding. There are economies of scale for market participation. Owners with small landholdings can reduce the cost of market participation by going through an aggregator—someone who works with multiple landowners or project developers to combine their carbon management activities so they can access the market as if it were one bigger project. Nevertheless, aggregators may limit who can participate in order to keep costs down. For example, the Michigan Forest Offset and Trading Program—an aggregation scheme with 122 landowner participants as of June 2009—included nonindustrial private forest owners who had already had their land certified and who owned at least 100–200 ac (Grossman 2009). Not all aggregation programs have minimum parcel size requirements for participants; however, participation may not be viable at current market prices for landowners having under 100 ac of forest. About 95% of the family forest owners in the USA own less than 100 ac of forestland (Butler 2008).

Social Constraints to Carbon Market Participation

Economic considerations are an important influence on carbon market participation by family forest owners (Fletcher et al. 2009), but they are not the only influence. Willingness to engage in carbon-oriented forest management may also be influenced by perceptions of climate change; forest management goals and objectives; the social acceptability of project requirements; and access to the infrastructure needed for market engagement.

Little has been published on how family forest owners in the USA perceive the risk of climate change and its potential effects on them, and how risk perception will affect their motivation to manage for carbon. One study found that some people who were skeptical about climate change were willing to get involved in offset projects because doing so allowed them to be recognized and rewarded for contributing to conservation (Beddoe and Danks 2009). Insight may be gained from existing research on how family forest owners perceive and respond to fire risk. This research finds that they are more likely to take mitigation actions if they are aware of the risk, believe their lands are vulnerable, have direct experience with fire, live on their properties, and proactively manage their forests (Winter and Fried 2000; McCaffrey 2004; Jarrett et al. 2009). But even if owners do perceive a risk, there is no guarantee this will motivate them to act. Some homeowners who perceive and understand the risk posed to their property by fire may forego taking actions to reduce it because of the benefits they gain by behaving otherwise, such as the ability to manage for other landscape values (Cortner 2008). These findings suggest that forest owners’ land management goals and values are another important consideration in whether they will adopt carbon-oriented management practices.

Managing for carbon is more likely to occur it if is complementary to a landowner’s forest management goals. Family forest owners in the USA own forest land for a host of reasons, the most important of which are because it is part of their home, farm or ranch; for its beauty and scenic value; to pass on to heirs; for privacy; for nature protection; as an investment; and for recreational activities (Butler 2008). Owning forest land for commercial timber production is an important ownership objective for only 10% of owners, and only 27% of family forest owners have harvested trees commercially (Butler 2008). This finding suggests that most owners do not view their land as a source of income, or manage it with this primary goal in mind, which could limit their interest in carbon markets and other economic incentives to manage for carbon. Nevertheless, many owners have a utilitarian view of their forests and take the opportunity for profit into account when making land management decisions (Beach et al. 2005; Fischer and Bliss 2008). Family forest owners having larger parcels (>100 ac) may be more likely to respond to economic incentives because the larger the parcel size, the more likely an owner is to harvest timber commercially (Butler 2008). Alternatively, owners for whom commercial harvesting is not a priority may be more open to carbon-oriented management because it is not likely to conflict with practices that prioritize timber production.

Management goals may also play a role in the choice of forestry offset project types and standards. For example, research indicates that family forest owners manage their land to promote diversity, including species diversity (both native and commercial species), habitat diversity (forest and non-forest habitat types), and stand diversity (Fischer and Bliss 2006, 2008). Some standards have requirements for native species, species diversity and stand diversity. The Climate Action Reserve requires landowners to maintain diverse forest age classes, and has minimum requirements for native species planting and diversity. Such requirements may or may not fit with forest owners’ species and stand preferences. Family forest owners also commonly maintain part of their land in nonforest cover (Stanfield et al. 2002). If they value open areas for aesthetic or other reasons, they may not want to plant trees there, limiting the appeal of afforestation projects.

Offset project requirements can be a barrier not only from an economic standpoint, but from a social one as well. Requirements vary, depending on the standard and trading program used. Program complexity alone is a barrier for some landowners (Wright et al. 2009). Most standards and trading programs require forest management plans. Only 4% of the family forest owners in the USA have written forest management plans (Butler 2008), perhaps because timber production is not a priority for most. The larger the ownership the more likely there will be a management plan.

To address concerns over permanence, the Climate Action Reserve requires conservation easements for avoided deforestation projects. The use of easements in the Climate Action Reserve and in other standards may also help a project receive a lower risk rating, reducing the percentage of credits that must be held in a buffer pool. Only 2% of family forest owners currently have easements of some kind, including conservation easements (Butler 2008). Family forest owners may be concerned about the loss of property rights and autonomy associated with conservation easements, though interaction with professional foresters and peers can encourage owners to sell easements (Rickenbach 2002, Leahy et al. 2008). Some landowners cannot obtain easements, however. For example, American Indian reservation land is federal trust land and cannot have permanent easements. Also owners who have conservation easements obtained prior to a specific date may not be able to pursue carbon offsetting depending upon the additionality requirements from each standard.

Many standards require that a family forest owner’s land be certified as a sustainably-managed forest either by the Forest Stewardship Council, the Sustainable Forestry Initiative, or the American Tree Farm System. Only 1% of all family forest owners in the USA have sustainable forest certification at present (totaling 4% of the family forest land) (Butler 2008). Certification originated to address concerns over unsustainable forestry practices that reduce the ability of a forest to provide desired economic and ecological functions into the future, and to serve as a market incentive for promoting environmentally sustainable forestry. Barriers to certification include the associated costs, and an emphasis on forest management for eventual harvest, which is inconsistent with the goals of many owners (Rickenbach 2002; Leahy et al. 2008).

Most standards also require landowners to sign a contract and commit to long-term project monitoring and verification to ensure that sequestered carbon is maintained. The duration of third-party monitoring and verification commitments for domestic standards currently range from as little as 15 years (the CCX) to as long as 100 years (the Climate Action Reserve). While landowners may be willing to sign shorter-term contracts, it is doubtful whether many will commit to a 100-year contract, though 100-year contracts may be preferable to easements.

Finally, the infrastructure needed for participating in carbon markets must be accessible to family forest owners. Intermediaries play an important role in this regard, including aggregators, organizations that facilitate OTC transactions (i.e. project developers, consultants, and financiers), and professional foresters. These individuals and organizations often conduct outreach and education activities, and serve as project developers who work with landowners to provide the technical assistance needed to manage for carbon and to access markets. The limited research available indicates that family forest owners who have entered carbon markets may often be those who had personal relationships with a professional forester or an aggregator in advance who encouraged them to participate (Beddoe and Danks 2009; Snyder 2009). In some cases, a shortage of foresters having credentials that meet the requirements of a given standard, and a lack of pre-existing relationships between intermediaries and landowners, have been barriers to market entry (Beddoe and Danks 2009; Gray 2009).

Little research with family forest owners who have participated in carbon markets in the USA has been published. Preliminary findings for family forest owners participating in the CCX indicate that some have done little to change business as usual (Snyder 2009). They already had management plans and were managing their forests sustainably, engaging in practices that were consistent with program requirements. They did not view relatively short-term contracts as a barrier. Instead, carbon markets represented an opportunity to be rewarded for forest management practices they were already undertaking (Snyder 2009). This finding raises questions about how likely family forest owners will be to participate in trading programs having more rigorous standards that require greater behavioural change. It also points to the importance of having offset standards that are not overly restrictive.

Conclusions and Policy Implications

Family forest owners in the USA can help mitigate global climate change and be important players in America’s carbon markets because they control the majority of the private forest land in the country. Carbon-oriented management of forests also offers family forest owners an opportunity to obtain a new source of income, and commonly has environmental co-benefits. The USA has consistently argued for the inclusion of forest carbon offset activities in policies associated with the UNFCCC. Although federal climate change cap-and-trade legislation has yet to materialize, virtually every major proposal to date mentions forestry as a potential source of offsets, as does every regional proposal. The emissions trading programs and standards that have developed to date include diverse opportunities for forestry offset projects. Despite these opportunities, a number of challenges exist to engaging family forest owners in carbon-oriented management and climate change mitigation. Key issues include: the low price of carbon and high cost of market entry; whether small landowners can gain market access; how to meet requirements such as management plans and certification; and whether managing for carbon is consistent with the other forest management goals of forest owners.

Regarding pricing, many observers believe that if and when federal climate change legislation passes and a mandatory cap-and trade-system is established in the USA, the price of carbon will rise due to increased demand for offsets. It is reasonable to assume that offsets from forestry will be included in a national compliance market, based on the proposed legislation that is currently in Congress. Until then, family forest owners may be able to obtain higher prices from carbon offsets traded over the counter that meet higher standards, but they must be able to meet those standards. Economic studies suggest that financial incentive programs such as taxes, carbon payments, or other subsidies can encourage family forest owners to manage in ways that increase carbon sequestration (Stainback and Alavalapati 2002; Alig 2003). However, the effectiveness of financial incentives will also depend on a number of social variables.

An important question is whether efforts to engage family forest owners in carbon sequestration and markets should focus on the minority that own large parcels, for whom market participation is more financially viable. Nationwide, the average parcel size in the USA is 25 ac (Butler 2008). However, 53% of the family forest land is owned by people having 100 ac or more, though this land is held by only 5% of the owners. These are the owners that are most likely to already have forest management plans, sustainable forest certification, and to be open to property encumbrances such as conservation easements (Butler 2008). From a carbon perspective, it makes sense to target these landowners for technical assistance and outreach because they are the ones who can participate in existing markets in a manner that is most efficient and cost-effective. Engaging them would also capture roughly half of America’s family forest land in climate change mitigation activities.

From a social equity perspective, it is also important to create carbon sequestration opportunities on the other half of America’s family forests. Some creative market and non-market strategies are being developed to address the problem of small ownership. Examples of market strategies include aggregation schemes, group certification, revolving loan programs to assist with startup costs, and the ‘stacking’ of payments for ecosystem services in which landowners bundle goods such as carbon, clean water and habitat conservation from their land and find ways of being compensated for all of them. Non-market strategies could include tax breaks, landowner assistance programs and incentive programs. A bill introduced in the US Senate in August 2009 (the Forest Carbon Incentive Programs Act of 2009) would create a carbon incentives program within the Department of Agriculture that would give private forest owners financial incentive payments to undertake carbon sequestration practices by entering into a climate mitigation contract. The program would target small forest owners excluded from carbon markets. These kinds of strategies and policy options will likely continue to be experimented with in order to find ways of overcoming barriers to market entry.

Regarding the compatibility of forest management objectives, family forest owners have diverse reasons for owning forest land. Maintaining opportunities for forestry offsets from a broad spectrum of project types (afforestation, reforestation, REDD, and improved forest management) to be traded in markets will enable forest owners to have flexibility in choosing the carbon sequestration activities that are most compatible with environmental conditions on their lands and with their forest management goals.

There is cause for optimism that viable approaches for engaging small-scale forestry in the USA to help mitigate global climate change will evolve in the coming years. A gap that could be filled to help speed the way is research among family forest owners to understand better: their perceptions of climate change and its potential effects on them; their level of interest in carbon-oriented management; how open they are to adopting forest management practices that sequester carbon, and the compatibility of these practices with existing management goals and activities; what kinds of technical and financial assistance programs are needed to support their participation; and what would help them overcome existing barriers to managing for carbon and gaining access to market or non-market opportunities to be compensated for doing so. Little information is available on these topics at present. Given that policies, programs, standards and protocols are rapidly evolving, such information could make a substantial contribution to shaping systems that work to maximize both the social and environmental benefits of engaging family forest owners in climate change mitigation.

Notes

The REDD debate has occurred primarily in the context of tropical forests. One prominent example is the debate over the Noel Kempff project in Bolivia (For example, see Greenpeace 2009).

See http://www.forestcarbonportal.com for a detailed inventory of forest carbon projects in the USA and around the world.

References

Alig RJ (2003) US landowner behavior, land use and land cover changes, and climate change mitigation. Silva Fennica 37(4):511–527

Beach RH, Pattanayak SK, Yang JC, Murray BC, Abt RC (2005) Econometric studies of non-industrial private forest management: a review and synthesis. For Policy Econ 7(3):261–281. doi:10.1016/S1389-9341(03)00065-0

Beddoe R, Danks C (2009) Carbon trading: a joint effort between the Delta Institute, Illinois, and Michigan. Case study, Rubenstein School of Environment and Natural Resources, University of Vermont (http://www.uvm.edu/~cfcm/?Page=interim_products.html)

Bliss JC, Kelly EC (2008) Comparative advantages of small-scale forestry among emerging forest tenures. J Small-scale For 7(1):95–104. doi:10.1007/s11842-008-9043-5

Breshears DB, Cobb NS, Rich PM, et al. (2005) Regional vegetation die-off in response to global-change-type drought. Proc Natl Acad Sci 102(42):15144–15148. doi:10.1073/pnas.0505734102

Butler BJ (2008) Family forest owners of the United States, 2006. USDA Forest Service Northern Research Station GTR-NRS-27, Newtown Square

Capoor K, Ambrosi P (2009) State and trends of the carbon market 2009. The World Bank, Washington, DC

Chen W, Chen JM, Price DT, Cihlar J, Liu J (2000) Carbon offset potentials of four alternative forest management strategies in Canada: a simulation study. Mitig Adapt Strateg Glob Chang 5(2):143–169. doi:10.1023/A:1009671422344

Cortner HJ (2008) Introduction. In: Martin WE, Raish C, Kent B (eds) Wildfire risk: human perceptions and management implications. Resources for the Future Press, Washington, DC, pp 1–6

Daigneault F, Fawcett A (2009) Memorandum on updated forestry and agriculture marginal abatement cost curves, March 31, 2009. U.S. Environmental Protection Agency, Office of Atmospheric Programs, Climate Change Division, Washington, DC

Diaz D, Charnley S, Gosnell H (2009) Engaging western landowners in climate change mitigation: A guide to carbon-oriented forest and range management and carbon market opportunities. General technical report PNW-GTR-801. United States Department of Agriculture, Forest Service, Pacific Northwest Research Station, Portland, OR

Dixon RK, Krankina ON (1993) Forest fires in Russia: carbon dioxide emissions to the atmosphere. Can J For Res 23(4):700–705. doi:10.1139/x93-091

Fischer AP, Bliss JC (2006) Mental and biophysical terrains of biodiversity: conservation of oak woodland on family forests. Soc Nat Resour 19(7):635–643. doi:10.1080/08941920600742393

Fischer AP, Bliss JC (2008) Behavioral assumptions of conservation policy: conserving oak habitat on family-forest land in the Willamette Valley, Oregon. Conserv Biol 22(2):275–283. doi:10.1111/j.1523-1739.2007.00873.x

Fletcher LS, Kittredge D, Stevens T (2009) Forest landowners’ willingness to sell carbon credits: a pilot study. North J Appl For 26(1):35–37

Gray G (2009) Personal communication. Vice president of forest policy, American Forests, Washington DC

Greenpeace (2009) CARBON SCAM: new Greenpeace report exposes how coal and oil companies are trying to use forest offset projects to cheat the climate. http://www.greenpeace.org/usa/news/carbon-scam

Grossman G (2009) Accessing the US carbon market through sustainable forest management. In: Proceedings of the annual payments for ecosystem services meeting, Northwest Environmental Business Council, Portland, Oregon, USA

Guo LB, Gifford RM (2002) Soil carbon stocks and land use change: a meta analysis. Glob Chang Biol 8(4):345–360. doi:10.1046/j.1354-1013.2002.00486.x

Hamilton K, Sjardin M, Shapiro A, Marcello T (2009) Fortifying the foundation: state of the voluntary carbon markets 2009. Ecosystem Marketplace, New Carbon Finance, Washington, DC

Hamilton K, Chokkalingam U, Bendana M (2010a) State of the forest carbon markets 2009: taking root and branching out. Ecosystem Marketplace, New Carbon Finance, Washington, DC

Hamilton K, Peters-Stanley M, Marcello T (2010b) Building bridges: state of the voluntary carbon markets 2010. Ecosystem Marketplace, Bloomberg New Energy Finance, Washington, DC

Harmon ME, Marks B (2002) Effects of silvicultural practices on carbon stores in Douglas-fir-western hemlock forests in the Pacific Northwest, USA: results from a simulation model. Can J For Res 32(5):863–877. doi:10.1139/x01-216

Harmon ME, Garman SL, Ferrell WK (1996) Modeling historical patterns of tree utilization in the Pacific Northwest: carbon sequestration implications. Ecol Appl 6(2):641–652. doi:10.2307/2269398

Harmon M, Moreno A, Domingo J (2009) Effects of partial harvest on the carbon stores in Douglas-fir/western hemlock forests: a simulation study. Ecosystem 12(5):777–791. doi:10.1007/s10021-009-9256-2

Hurteau M, North M (2009) Fuel treatment effects on tree-based forest carbon storage and emissions under modeled wildfire scenarios. Front Ecol Environ 7(8):409–414. doi:10.1890/080049

Janisch JE, Harmon ME (2002) Successional changes in live and dead wood carbon stores: implications for net ecosystem productivity. Tree Physiol 22(2–3):77–89. doi:10.1093/treephys/22.2-3.77

Jarrett A, Gan J, Johnson C, Munn IA (2009) Landowner awareness and adoption of wildfire programs in the southern United States. J For 107(3):113–118

Kollmus A, Zink H, Polycarp C (2008) Making sense of the voluntary carbon market: a comparison of carbon offset standards. World Wildlife Fund, Frankfurt

Leahy JE, Kilgore MA, Hibbard CM, Donnay JS (2008) Family forest landowners’ interest in and perceptions of forest certification: focus group findings from Minnesota. North J Appl For 25(2):73–81

Malmsheimer RW, Heffernan P, Brink S et al (2008) Preventing GHG emissions through biomass substitution. J For 106(3):136–140

McCaffrey S (2004) Thinking of wildfire as a natural hazard. Soc Nat Resour 17(6):509–516. doi:10.l080/08941920490452445

Merger E (2008) Forestry carbon standards 2008: a comparison of the leading standards in the voluntary carbon market. In: Carbon positive. Carbon Positive Net. Available via DIALOG. http://www.carbonpositive.net/viewFile.aspx?FileID=133. Accessed 20 Aug 2009

Murray BC, Sohngen B, Sommer AJ et al (2005) Greenhouse gas mitigation potential in U.S. forestry and agriculture, EPA 430-R-05–006. US Environmental Protection Agency Office of Atmospheric Programs, Washington, DC

Nabuurs GJ, Masera O, Andrasko K et al (2007) Forestry. In: Metz ORDB, Bosch PR, Dave R, Meyer LA (eds) Climate change 2007: mitigation of climate change. Cambridge University Press, New York, pp 541–585

Pierce E (2009) States release results of third auction for RGGI CO2 allowances. In: RGGI, Inc. News Releases. Regional Greenhouse Gas Initiative. http://www.rggi.org/docs/Auction_3_News_Release_MM_Report.pdf. Accessed 29 Oct 2009

Post WM, Kwon KC (2000) Soil carbon sequestration and land-use change: processes and potential. Glob Chang Biol 6(3):317–327. doi:10.1046/j.1365-2486.2000.00308.x

Pregitzer KS, Burton AJ, Zak DR, Talhelm AF (2008) Simulated chronic nitrogen deposition increases carbon storage in Northern Temperate forests. Glob Chang Biol 14(1):142–153. doi:10.1111/j.1365-2486.2007.01465.x

Rickenbach MG (2002) Forest certification of small ownerships: some practical challenges. J For 100(6):43–47

Smith JE, Heath LS, Skog KE, Birdsey RA (2006) Methods for calculating forest ecosystem and harvested carbon with standard estimates for forest types of the United States. USDA Forest Service Northern Research Station, Newton Square, PA

Snyder S (2009) Personal communication. Operations research analyst, US Department of Agriculture, Forest Service. Northern Research Station, St. Paul

Solomon S, Qin D, Manning M, Chen Z, Marquis M, Averyt KB, Tignor M, Miller HL (2007) Climate change 2007: the physical science basis. Contribution of working group 1 to the fourth assessment report of the intergovernmental panel on climate change. Cambridge University Press, New York

Stainback GA, Alavalapati JR (2002) Economic analysis of slash pine forest carbon sequestration in the southern US. J For Econ 8(2):105–117

Stanfield BJ, Bliss JC, Spies TA (2002) Land ownership and landscape structure: a spatial analysis of sixty-six Oregon (USA) coast range watersheds. Landsc Ecol 17(8):685–697. doi:10.1023/A:1022977614403

US Environmental Protection Agency (USEPA) (2009) Inventory of U.S. greenhouse gas emissions and sinks: 1990–2007, EPA 430-R-09–004. Environmental Protection Agency, Washington, DC

Westerling AL, Hidalgo HG, Cayan DR, Swetnam TW (2006) Warming and earlier spring increase Western U.S. forest wildfire activity. Science 313(5789):940–943. doi:10.1126/science.1128834

Winter G, Fried J (2000) Homeowner perspectives on fire hazard, responsibility, and management strategies at the wildland-urban interface. Soc and Nat Resour 13(1):33–49. doi:10.1080/089419200279225

Woodbury PB, Smith JE, Heath LS (2007) Carbon sequestration in the US forest sector from 1990 to 2010. For Ecol Manag 241(1–3):14–27. doi:10.1016/j.foreco.2006.12.008

Wright JL, Beddoe R, Danks C (2009) Oregon’s forest resource trust forest establishment program. Case Study, Rubenstein School of Environment and Natural Resources, University of Vermont (http://www.uvm.edu/~cfcm/?Page=interim_products.html)

Acknowledgments

The funding for this research was provided by the United States Department of Agriculture, Forest Service. We are extremely grateful to Paige Fischer for her helpful suggestions on this manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

The U.S. Government’s right to retain a non-exclusive, royalty-free license in and to any copyright is acknowledged.

Rights and permissions

About this article

Cite this article

Charnley, S., Diaz, D. & Gosnell, H. Mitigating Climate Change Through Small-Scale Forestry in the USA: Opportunities and Challenges. Small-scale Forestry 9, 445–462 (2010). https://doi.org/10.1007/s11842-010-9135-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11842-010-9135-x