Abstract

It is widely recognized that business models can serve as important strategic tools in innovation and market formation processes. Consequently, business models should have a prominent position in the marketing literature. However, marketing scholars have, so far, paid little attention to the business model concept, perhaps because it lacks an established definition and clear theoretical foundation. This article offers a definition for the business model concept that, using a fractal approach, connects business models to technological and market innovation. Furthermore, the article questions several cornerstone strategic concepts by reconceptualizing business model development from a firm-centric activity that promotes owning key resources and altering sets of decision variables to one that highlights the facilitation of broad institutional change processes. As such, it takes the potentially controversial position of advocating a service-strategy-based understanding of business models for all of marketing strategy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Despite increased scholarly attention and consensus regarding the importance of business models, the literature has yet to arrive at a clear conceptualization of what business models are (Chesbrough and Rosenbloom 2002; Zott et al. 2011) and, perhaps more importantly, what business models do (Doganova and Eyquem-Renault 2009). Somewhat surprisingly, marketing researchers, with some notable exceptions, have not participated in developing the theoretical foundation needed to advance an understanding of business models. We believe that this participation is important though, since, as we show, understanding business models has important implications for marketing strategy.

Our emphasis on service strategy is partially motivated by the appearance of a service revolution. Clearly, there is a reorientation toward service in individual companies, economies, and research; however, there are two ways of understanding this reorientation. The first is based on a traditional perspective, which categorizes “services” by contradistinction to goods—i.e., “what goods are not” (Vargo and Lusch 2004b). Most classifications of economic activity reflect this divide, in which processes directly involved in the production of goods (e.g., manufacturing) are seen as primary, and all other processes are categorized as service(s). From this perspective, the marketing strategy for services is usually based on adjusting a marketing strategy for goods. That is, such service marketing strategies are often grounded on some variation of the IHIP characteristics (intangibility, heterogeneity, inseparability of production and consumption, and perishability; Zeithaml et al. 1985)—generally, problems associated with services in comparison to goods. However, these IHIP characteristics have been called into question by numerous scholars (see Lovelock and Gummesson 2004; Vargo and Lusch 2004b).

The second way of seeing the service revolution is more of a service revelation, based on a perspective that service—seen as the use of one’s knowledge and skill to benefit (i.e., to serve) other actors (Vargo and Lusch 2004a; Vargo and Lusch 2008; Vargo and Lusch 2016)—is the basis of all exchange. This service can be provided directly or indirectly—e.g., through a good. Service strategy, then, involves actors developing an understanding of how they can best serve themselves through service to others. The representation and performance of this understanding is captured in the concept of a business model.

Specifically, we explore business models using a service dominant (S-D) logic lens and show that it is beneficial to view business model formation, in line with all marketing activities, in terms of service-for-service exchange among systemic actors. This primacy of service—the application of knowledge and skills for the benefit of others—allows us to break free from the notion of value-creating producers and value-destroying consumers employed by much of the business model literature. An S-D logic lens also emphasizes the importance of interactive and dynamic network and systems orientations (Vargo and Lusch 2011, 2016), which highlight the foundational role of customers and other stakeholders in service-for-service exchange and the creation and evaluation of value (Prahalad and Ramaswamy 2004; Vargo and Lusch 2004a).

This service perspective has several advantages compared to the one based on the goods–service divide. Perhaps most important is that service becomes a transcending concept, and, thus, a service strategy becomes a strategy applicable to all of marketing, rather than just a subset (i.e., non-goods) of it. Using S-D logic’s service ecosystems perspective to provide an interactive and dynamic systems orientation (Vargo and Lusch 2016), we make four primary contributions to the business model and service marketing strategy literatures.

First, we highlight the importance of institutions (i.e., rules, norms, meanings, symbols, and similar aides to collaboration) in the formation of business models by showing that the value-creation and resource-integration practices of systemic actors in service ecosystems are guided by institutional arrangements (i.e., interdependent assemblages of institutions). The service ecosystems perspective highlights the broad involvement of systemic actors in business model development and overcomes the overly firm-centric conceptualizations that dominate much of the business model literature. Based on this perspective, we define business models as dynamic assemblages of institutions that, through the performative practices (i.e., actions, constructions) of actors, reciprocally link and influence technological and market innovation and contribute to the viability of these actors and the viability of the service ecosystems of which they are a part.

Second, we show how, as reflected in this definition, a service ecosystems perspective not only highlights the institutional foundation of business models but also points to a similar institutional foundation of markets and technologies. This is important since the business model literature frequently connects these three elements without providing a robust theoretical foundation that explains their interplay. A service ecosystems perspective, on the other hand, offers a common theoretical foundation that elucidates the performative nature of markets, technologies, and business models. This performative nature emphasizes that the theories and social structures of actors influence the enactment and interplay of these three elements (Callon 1998a; MacKenzie 2003). That is, given its metatheoretical perspective (Vargo and Lusch 2017), S-D logic also allows reconciliation with other midrange theoretical frameworks, such as those used to examine technological and market innovation, which can then all be understood through a common narrative with common constructs. Thus, S-D logic supports and informs the fractal orientation we adopt in this paper and informs both the business model literature and emerging work on market performativity (i.e., market [re]formation—see, for example, Azimont and Araujo 2007; Kjellberg and Helgesson 2006) and, consequently, firmly anchors research on business models in the heart of the marketing discipline.

Third, our research suggests that idealized conceptions of economic rationality and calculations common in the business model literature need to be questioned. As Simon (1996) reveals, the rationality of individual actors’ decision making is bounded by their cognitive abilities, limited information, and finite time. Similarly, in the context of business model development, Doganova and Eyquem-Renault (2009) argue for the importance of collective action, such as replication and the formation of shared understandings and sensemaking. We demonstrate that the proposed service ecosystems perspective expands on this prior work to aid the literature in overcoming unbounded views of rationality in business model development.

Fourth, a service ecosystems perspective on business models offers rich normative implications for marketing strategy. Specifically, this perspective suggests that service marketing strategy should be less concerned with traditional marketing mix decisions and instead focus on fostering ongoing relationships, collaboration, and narrative formation among broad sets of actors. Consequently, we caution marketing researchers not to leave the theorizing of business models to colleagues in management and entrepreneurship, but to actively explore the rich strategic implications that an understanding of business models can provide. In short, we believe that the service-oriented approach we embrace is unifying and elaborative, rather than divisive and exclusive.

The remainder of this paper is structured as follows. First, we review the business model literature and argue that this literature is moving toward embracing a systemic and institutional perspective that can be aided and extended by contemporary marketing literature. Second, we discuss the study of systems and institutions in marketing and related fields to highlight how work on a service ecosystems perspective can inform the business model literature. Third, using this perspective, we review the three highlighted elements—markets, technologies, and business models—and their performative interplay. Finally, we discuss the theoretical and practical implications of this research.

Toward a systemic and institutional view of business models

The business model concept

The business model literature is in its infancy. Only since the proliferation of Internet-based businesses in the late 1990s has the business model concept received substantial attention (Zott et al. 2011). Many researchers (e.g., Coombes and Nicholson 2013; Doganova and Eyquem-Renault 2009; Morris et al. 2005; Zott et al. 2011) have noted misalignments and opacity regarding the definition, conceptualization and composition of the business model. For example, business models have been referred to as statements, descriptions, representations, architectures, conceptual tools or models, structural templates, methods, frameworks, patterns, and sets of decision variables, among other descriptions (Zott et al. 2011). Despite this disparity, some of which can be attributed to differences in terminology rather than conceptualizations, a review of the literature reveals a trend that highlights the need to explore business model development through a holistic and systemic lens (see Table 1).

Much of the early work positions business models as sets of decision variables that allow firms to use and coordinate their resources to create and deliver value to customers for appropriate monetary compensation (see Table 1, Emphasis on decision variables for dyadic relationships). Such work is, implicitly or explicitly, often grounded in resource-based (e.g., Barney 1991; Wernerfelt 1984), competence-based (e.g., Prahalad and Hamel 1990) and capabilities-based (e.g., Day 1994; Teece et al. 1997) views of firms. Such views suggest the success of firms can be attributed to their abilities to (a) secure valuable, rare, inimitable, non-substitutable resources (e.g., resource-based), (b) unite technological and other skills into competencies that allow them to respond more adeptly to opportunities (e.g., competence-based) and to develop market-sensing and customer-linking capabilities (e.g., capabilities-based), or (c) “integrate, build, and reconfigure internal and external competencies to address rapidly changing environments” (e.g., dynamic capabilities-based) (Teece et al. 1997, p. 516).

Consider, as an example, Uber and its impressive growth. Since launching its ridesharing service in 2011, Uber has expanded rapidly in the U.S. and overseas, contributing to the transformation of personal transportation markets in many cities. Many scholars and practitioners would probably argue that Uber’s ability to develop and sustain a robust and innovative business model is responsible for this growth. Viewed through a traditional business model lens, Uber’s success can be described as the outcome of a producer-driven value proposition that drastically departs from and improves traditional transportation solutions such as taxis, busses, and personal cars. As seen from this perspective, Uber has, with the help of partners (e.g., venture capitalists, mobile platform providers), used its resources (e.g., programing expertise, customer knowledge) to create an attractive value proposition that persuades customers to purchase transportation services from independent contractors. Stated differently, Uber can be perceived as creating value for customers by providing a business model that is, according to Uber, “better, faster, and cheaper” than those of traditional taxi companies.

However, consistent with broader business literature trends, research on business models has begun to adopt more networked perspectives (see Table 1, Emphasis on decision variables but in a broader context of networked actors) that underscore the interplay among decision variables and broad sets of actors interacting directly and indirectly. Viewed from a network perspective, Uber’s success is, to a large degree, built on broad complementary institutionalization and adoption processes such as shared understandings that transportation services are compensated by distance traveled (e.g., taxis and trains), sharing can be more beneficial than owning (e.g., Airbnb and Zipcar), and online rating systems can be trusted (e.g., eBay and Amazon). Institutionalization, in this context, can be conceptualized as the formation of “rules, norms, meanings, symbols, practices, and similar aides to collaboration” (Vargo and Lusch 2016, p. 6). Also, the political and legal debate over whether ridesharing creates unfair disadvantages for taxi companies and violates existing regulations has influenced both the development and acceptance of business models incorporating ridesharing practices. Some cities and countries, for example, have legally banned ridesharing practices altogether. Thus, whether a firm and its business model succeed or fail is always dependent on broad sets of actors and their practices.

In line with this broader view, Timmers (1998, p. 2) defines a business model as “an architecture of product and information flows, including a description of the various business actors and their roles.” Similarly, Zott and Amit (2010, p. 6) conceptualize a firm’s business model as “a system of interdependent activities that transcends the focal firm and spans its boundaries.” While these boundary-spanning and more systemic approaches often maintain traditional views on business models as sets of elements (i.e., decision variables) developed and altered to maximize firm objectives, they begin to align with the contemporary marketing literature and its focus on interactivity and relationships (e.g., Gummesson 2006) and its move away from one-way flow models in which one entity acts on another (Ballantyne and Varey 2006; Ulaga and Eggert 2006).

These more systemic approaches also begin to question unbounded views of rationality in managerial decision-making and calculation processes. Chesbrough and Rosenbloom (2002), for example, articulate that, in the context of business model development, rational calculations have been overstated. Based on Prahalad and Bettis’s (1986) work on dominant logics, Chesbrough and Rosenbloom (2002, p. 531) claim that the decision-making processes of human actors are mediated by “cognitive biases,” “previous experiences,” and “path-dependencies.” Similarly, Doganova and Eyquem-Renault (2009) argue for the importance of collective action, such as replication and the formation of shared understandings (i.e., “institutional work”; Lawrence and Suddaby 2006), in the development and legitimization of business models. Thus, recent developments in business model thought acknowledge that all economic activities are embedded in broader social contexts and that individual actors, due to limits on their cognitive abilities, rely on value assumptions, cognitive frames, rules, and routines (i.e., institutions) to function in complex environments (Simon 1996).

Doganova and Eyquem-Renault’s (2009) conceptualization of business models, for example, goes further than most networked perspectives (see Table 1, Emphasis on systems and institutions). Drawing on economic sociology and science and technology studies, these authors articulate the systemic and institutional nature of business models by arguing that business models enable collective actors to form shared understandings. Specifically, Doganova and Eyquem-Renault define business models as narrative and calculative devices that enable the encounters of systemic market actors. Thus, this work not only points to the need to acknowledge broader actor participation in business model development but also questions perceptions of overly rational calculations and unbounded rationality.

This systemic conceptualization, which we subsequently address in greater detail, aligns with Zott et al.’s (2011) observation that research is beginning to, and needs to, look at business models using holistic and systemic approaches. While marketing scholars, with some notable exceptions (e.g., Araujo and Easton 2012; Gummesson et al. 2010; Storbacka et al. 2013), have thus far contributed relatively little to the scholarly inquiry into the business model concept, the intersection of contemporary marketing and business model research can, arguably, as we detail below, inform the business model and marketing strategy literature by providing a robust systemic and institutional foundation. Such a foundation not only overcomes firm-centric views, but also advances the marketing literature by providing insights into the role of business models in performative, market-formation processes. To assist the reader, the Appendix provides the definitions of the key concepts used as building blocks to arrive at this systemic and institutional foundation.

Systemic and institutional thought in marketing and other disciplines

The study of systems and institutions has a long tradition in marketing (e.g., Alderson 1957; Duddy and Revzan 1953; Hunt 1981). Alderson’s (1957) functionalism, for example, and early work on the “institutional school” (Weld 1916) describe the need for holistic approaches to marketing systems which consider the roles, functions, and interactions of marketing actors. Likewise, Revzan (1968) and Arndt (1981) argue that an institutional approach is a mandatory requirement for deeper analyses of relational mechanisms of marketing systems. However, despite this early recognition, the study of systems and institutions in marketing has not yet reached a high degree of prevalence.

Recent work, however, is revitalizing the recognition that systemic and institutional thought needs to be foundational to the discipline and therefore, arguably, also to the study of business models. As we will elaborate, research on markets, for example, has begun to overcome the shortcomings of early neoclassical-based market conceptualizations by describing their formation as institutional (e.g., Humphreys 2010), systemic (e.g., Giesler 2008), and discursive processes (Rosa et al. 1999), or as performative practices (Kjellberg and Helgesson 2006, 2007). Similarly, Vargo and Lusch (2016) argue that only an institutional and systemic perspective can capture the holistic and dynamic nature of value creation and provide a more comprehensive view of the involved actors.

Much of this recent work on institutions and social systems is informed by, and draws from, research from the economic, organizational, and sociological literatures. The new institutional economics movement, for example, aims to address the question of how and why institutions emerge. Based on the seminal work of Coase (1937), both Williamson (1981, 1988) and North (1990) argue for the importance of customs, traditions, and norms in the formation of markets and firms. The sociology and organizational literatures, on the other hand, have been instrumental in addressing the tension between agency (i.e., conscious choice) and structure (i.e., normative forces that constrain the actions of individuals in social systems).

Sociological work on practice theory, for example, such as Giddens (1984) structuration theory and Bourdieu’s (1977) habitus, has helped overcome both overly static and rational views of institutions by recognizing their enabling and constraining properties. Specifically, such work begins to explain how institutions influence and are influenced by the behavior of actors, or how actors engage in translations (i.e., the travel of an idea or practice), interpretations, and modifications of institutional arrangements (Lawrence and Suddaby 2006). Furthermore, both the organizational and the sociological literatures describe institutional views on markets. Fligstein (1996), for example, argues that a more political model of markets is necessary to account for the social construction of the institutions that are foundational to their formation. Likewise, Scott (1987) and Zucker (1987) highlight that market formation processes are institutional in nature, and Callon (1998a), in his work on actor-network theory, points to the performative nature of markets in which the theories and social structures of actors influence the enactment of markets.

Thus, while mainstream marketing has, arguably, been slower to adopt a systemic and institutional view on value creation and market formation than other disciplines, the need for such a view is commonly articulated. Hunt and Morgan’s (1996) resource-advantage theory, for example, calls for exploration of sets of actors, institutions, and dynamic change. Layton’s (2007) work on marketing systems in the macromarketing literature and a systems approach promoted by stakeholder marketing to capture broader participation in value creation processes and exchange relationships (Hillebrand et al. 2015; Hult et al. 2011) also both echo the importance of broader, more systemic, perspectives. Furthermore, Webster and Lusch (2013, p. 389) encourage the marketing discipline to go “beyond individual customer satisfaction and short-term financial performance to encompass the total value creation system.” Such perspectives suggest that a firm’s success is not solely attributable to its ability to acquire resources, develop competencies or capabilities, or reconfigure competencies in changing environments but rather to the formation of broader value cocreation practices that connect systemic actors and their resources and that provide the context for the integration of such resources.

A service ecosystems perspective for the study of business models

Recent marketing literature highlights not only the importance of systemic and institutional perspectives but also their convergence. The concept of the service ecosystem, for example, which Vargo and Lusch (2016, p. 10-11) define as “a relatively self-contained, self-adjusting system of resource-integrating actors connected by shared institutional arrangements and mutual value creation through service exchange,” demonstrates the systemic and institutional nature of value cocreation and resource integration. That is, by highlighting the primacy of service-for-service exchange in all marketing activities, an S-D logic–informed, service ecosystems view shifts the focus from the (firm-centric) production of outputs to activities and processes in which “all economic and social actors are resource integrators” who participate in service exchange. Stated differently, actors are active participants in value-creation processes since they integrate physical activities, mental effort, and socio-psychological experiences (Xie et al. 2008). In this view, value is cocreated “through holistic, meaning-laden experiences in nested and overlapping service ecosystems, governed and evaluated through their institutional arrangements” (Vargo and Lusch 2016, p. 6; see Fig. 1).

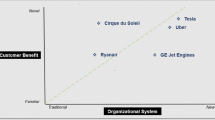

The performative nature of markets, technologies and business models: a fractal, service ecosystems perspective (adapted from Vargo and Lusch 2016)

In the context of dynamic marketing systems, Gummesson (2011) argues for replacing labels such as buyers and sellers and, instead, refers solely to actors interacting with other actors (A2A). Similarly, adopting this A2A view, the S-D logic literature points to the fact that all social and economic actors (e.g., firms, customers) engaged in exchange are fundamentally doing the same thing. That is, they integrate resources from various sources, reciprocally exchange service to cocreate value, and participate in the dynamic cocreation of the institutions that enable and constrain these value creation practices. While many networked views on business models recognize the importance of resource integration (e.g., key resources, processes, knowledge of innovation partners) and exchange (e.g., customer relationships, customer segments, cost structures, and revenue streams), these views often overemphasize the role of the focal firm and overlook the systemic participation of actors in the dynamic cocreation of institutions that enable and constrain value creation practices.

Below, we show that a service ecosystems (i.e., institutional, systemic, and A2A) perspective can provide a strong theoretical foundation for the study of business models that both supports the emerging themes in the business model literature (see Table 1) and converges with broader trends in business research (see Table 2).

To develop a systemic and institutional theoretical foundation of the business model concept, we first briefly review three elements—business models, markets, and technologies—that the literature frequently connects. Business models have been described as mechanisms that connect technologies and customers (i.e., markets), or as mechanisms that convert technologies into market outcomes (Zott et al. 2011). The emergence of the digital economy, for example, often highlights the interplay of these three elements as technology managers need to “find the right business model, or the right ‘architecture of the revenue’ “to turn their technological innovations into successful new markets” (Chesbrough and Rosenbloom 2002: 530). Similarly, Abernathy and Clark (1985) argue that innovation processes in general possess both a technological and a market component. Likewise, Vargo et al. (2015) argue that, by using an institutional perspective, these technological and market components can be linked. Thus, we first provide a service ecosystems perspective of these three elements before we explicate their interplay and performative nature through an institutional narrative.

An institutional and systemic foundation for business models, markets, and technologies

Business models

Amit and Zott (2001, p. 511) articulate that business models can be conceptualized as “the content, structure, and governance of transactions designed so as to create value.” Similarly, Storbacka and Nenonen (2011) highlight that business models guide the interaction of actors with other actors and resources. More broadly, Doganova and Eyquem-Renault (2009) argue that business models enable collective actors to form shared understandings, while Chesbrough and Rosenbloom (2002) argue that heuristic rules, norms, and beliefs (i.e., institutions) guide the actions of actors and, therefore, the development of business models. Thus, recent work on business models supports the need for an institutional perspective, such as that of the service ecosystem, that highlights how human actors are guided by value assumptions, cognitive frames, rules and routines and the ways that “the rational individual is, and must be, an organized and institutionalized individual” (Simon 1945/1997: 111).

As stated, Vargo and Lusch (2011) posit that, in the process of cocreating value, all social and economic actors fundamentally do the same thing: they integrate resources and engage in service exchange. That is, viewed from a service ecosystems perspective, all actors, whether they are individuals, firms or other stakeholders, engage in the process of benefiting their own existence and the existence of other actors through service-for-service exchange. This process is not a unidirectional process limited to “producer” and “consumer” dyads. Instead, this process comprises the value-cocreation practices that are continually enacted through the activities of broader sets of social and economic actors.

Similarly, the use of business models cannot be unique to “producers” as all economic and social actors continually use business models in their enactment of resource integration and market practices. This is because, as stated, business models are institutional arrangements that “define the resources that an individual market actor possesses and the ways that the market actor can interact with other actors—and their resources” (Storbacka and Nenonen 2011, p. 247). The fact that all actors continually use business models in their enactment of resource integration practices is often overlooked. This may, at least partially, be because the business models of firms and entrepreneurs are often more salient due to the fact that they are commonly documented, communicated, and scrutinized. Entrepreneurs, for example, regularly communicate their business models to other actors (e.g., potential investors) who scrutinize their viability.

To return to the illustrative example explored earlier, Uber has a clearly documented business model (e.g., payment terms, rules of conduct, and conflict resolution policies) that describes how the involved actors (e.g., drivers, riders, Uber) interact with each other and how their resources (e.g., driving skills, cars, payments, programing and operations expertise) are exchanged and integrated. Nevertheless, Uber riders are also guided by business models. As Scott (2008) explains, institutions span a broad spectrum of awareness, codification, and enforceability. This spectrum comprises enforceable rules, as well as norms, and cultural frames, since they all belong into the institutional realm as they enable and constrain practices by defining legal, moral, and cultural boundaries (Scott 2008). Thus, the fact that most Uber users do not have documented business models does not mean that they lack these models.

Decision heuristics of Uber users, for example, fall as much into the institutional realm as do documented rules. The business models of Uber users also define the resources that other market actors possess (e.g., perceptions of cars and driving skills of Uber drivers, busses and trains and the skills of their professional personnel) and the ways that the market actor can interact with these actors (e.g., using an app to call a ride or go to a bus station at a scheduled time). Hence, the legitimacy, desirability, and change of Uber’s ridesharing solution is not only influenced by the resource offerings from Uber, but also by the institutional arrangements of Uber riders, their resource integration practices, and their contexts. As stated, business models are actor-centric, rather than firm-centric, since all actors possess bounded rationalities and, therefore, rely on institutional arrangements to interpret resources and guide integrative practices. Based on this actor-centric and institutional perspective, we define business models as dynamic assemblages of institutions that, through the performative practices (i.e., actions, constructions) of actors, reciprocally link and influence technological and market innovation and contribute to the viability of these actors and the viability of the service ecosystems of which they are a part. For the actor typically identified as the “firm,” these contributions are usually captured in terms of profit, co-production, positive word of mouth, etc. However, we state this definition in more general terms because, as we have shown, all economic actors, including those usually referred to as “customers,” rely on business models.

As captured by this definition, a service ecosystems perspective highlights that business models are the assemblages of institutions that shape an actor’s perceptions of problems and solutions and their linkages since business models provide a collaborative framework for the interaction and evaluation of resources among systemic actors (i.e., solutions) as well as perceptions of what problems need to be solved. Furthermore, defining business models in the context of innovation points to ongoing alignment processes through which institutional arrangements across actors are reconciled. This reconciliation occurs because problem perceptions result from nested institutional inconsistencies and contradictions (i.e., inconsistencies and contradictions across individual, organizational, and societal institutional levels); these are inconsistencies and contradictions that are part of even mature and seemingly homogenous service ecosystems (Greenwood and Suddaby 2006). These inconsistencies and contradictions “are areas of opportunity that can be exploited by individuals and organizations in identifying and solving problems and garnering support through new combinations of existing symbols and practices” (see also Siltaloppi et al. 2016; Thornton et al. 2012, p. 62).

The increasing availability of online and application-based service provisions, for example, has shaped the perceptions of many actors and has made whistling or waving at taxis seem outdated. Furthermore, an always-connected communication network (i.e., the Internet) has changed actors’ perceptions of appropriate response times for services such as those for taxis. Indeed, just a few years ago, many perceived it to be more than appropriate to make a phone call to a taxi company and wait twenty or more minutes for an ordered ride, a wait time that many modern-day actors would deem unacceptable. While many institutions, by definition, become broadly shared, it is important to point out that business models are generally unique to each actor. Actors can apply their institutions across a wide range of circumstances and contexts, preventing institutions and institutional contradictions from ever becoming completely homogeneous (Sewell 1992).

Markets

As a whole, the marketing discipline has devoted little attention not just to investigating business models but also to exploring one of its most fundamental concepts—markets (Mele et al. 2014; Vargo et al. 2015; Venkatesh et al. 2006). As Johanson and Vahlne (2011, p. 484) assert, “in marketing, market conceptualizations are almost absent,” and neo-classical economic thought on markets still dominates the field. However, recent work is beginning to pay more attention to markets and to highlight their dynamic and systemic natures. Such work argues that markets are, contrary to neoclassical economic thought, neither pre-existing nor static, a priori realities (Mele et al. 2014). Rather, markets are continually “performed” through the action and interaction (i.e., practices) of systemic actors mediated by institutions (e.g. Kjellberg and Helgesson 2007; cf. Latour 1987; Vargo and Lusch 2016).

Recognizing the variety and variability of markets, “be they physical or virtual, embryonic, or developed” (Mele et al. 2014, p. 114), this emerging literature has begun to describe the formation of markets as social (Giesler 2012; Humphreys 2010; Martin and Schouten 2014), socio-material (Nenonen et al. 2014), political (Fligstein 1996), and discursive processes (Rosa et al. 1999). Humphreys (2010) and Kates’ (2004) work, for example, explicates the role of legitimization in institutional change on market creation. Rosa et al. (1999, p. 68), on the other hand, suggest that markets are created and stabilized by means of market stories, which “are critical sensemaking tools among participants in social systems.” Similarly, Venkatesh et al. (2006) describe markets as sign systems. Hence, the contemporary marketing literature, while using various theoretical foundations, is beginning to address the foundational role of institutions and institutional change in the (re)formation of markets.

Somewhat more explicitly, Kjellberg and Helgesson (2006, 2007) view markets as being continually “performed” through the enactment of interlinked sets of exchange, normalizing and representational practices of systemic actors. Thus, the literature is beginning to converge on an institutional view in which markets can be described as “institutional solutions” of service-for-service exchanging actors (Lusch and Vargo 2014). This institutional view of markets implies not only that markets are continually (re)formed through the activities of social and economic actors, but also that multiple versions of markets may co-exist and that these co-existing markets, at least partly, need to be reconciled (Azimont and Araujo 2007). Our ridesharing example makes this social construction of markets and their co-existing perceptions salient. Uber, as stated, has expanded quickly and has now enabled more than 1 billion rides. However, many actors still view the ridesharing market as illegitimate, unregulated, unsafe, and unprofessional.

Technologies

The business model literature broadly acknowledges the role of technology in the formation of business models and markets. The term “technology,” however, as Pinch (2008) points out, is elusive and problematic since it has taken on various disparate and often limiting meanings (e.g., in regards to material constraints). Therefore, unpacking this commonly used term further and providing a clear conceptualization are critical.

Highlighting the importance of practices (i.e., routinized activities) in technological developments, Arthur (2009, p. 28) describes technological advancement as the (re)combination of useful knowledge and defines “technology as an assemblage of practices and components that are means to fulfill human purposes.” Traditionally, technology has often been viewed as physical devices, but Arthur’s definition shows that devices and processes do not have to be classified as disparate categories, but, instead, that the term “technology” is applicable to a wide class of phenomena which spans both “software” (i.e., processes or methods) and “hardware” (i.e., physical devices). Arthur, for example, classifies contracts and legal systems as technologies. The ridesharing example supports and corroborates this broad classification. Downloadable phone applications, by definition, need both software and hardware to function. Software, in this context, includes rating procedures, driving skills and rules, and payment processes in addition to computer programs and algorithms. The hardware side of car sharing technology, on the other hand, includes smart phones, a cellular data infrastructure, and cars.

Other definitions of technology avoid the distinction between physical components and processes altogether. Hughes (1989, p. 6), for example, defines technology as “the effort to organize the world for problem solving so that goods and services can be invented, developed, produced and used,” and Mokyr (2004), even more broadly, describes technology as “useful knowledge.” These definitions point to the similarities in concepts such as knowledge, competences and capabilities which, according to Hunt (2000, p. 188), “may be equated and defined as socially complex, interconnected combinations of tangible resources” and “intangible basic resources…that fit together in a synergistic manner.” Thus, while the business model literature uses various terminologies and conceptualizations of resources, technologies, and capabilities, many of these terms are similar or even interchangeable.

Furthermore, Hunt’s (2000) work points to the socially complex nature of technologies and resources. Work on the social construction of technology (SCOT), for example, highlights that social groups play an important role not only in the construction of technology (Pinch and Bijker 1984) but also, more broadly, in the construction of value perceptions. In other words, this view rejects the notion that technologies possess inherent functional and economic advantages and points to the importance of institutional arrangements that enable actors to make sense of technologies (Hargadon and Douglas 2001; Munir and Phillips 2005). Akaka and Vargo (2013), for example, provide a framework that shows how technology, in service ecosystems, both influences and is influenced by various institutions. These institutional thoughts on technologies are compatible with a concept that has become known as “interpretive flexibility” (Pinch and Bijker 1984), which describes how different actors, based on their existing rules, norms and beliefs, can construct radically different meanings of technologies. This “interpretive flexibility” highlights the role of institutions in the interpretation, evaluation and use (i.e., integration) of technologies (Nelson and Nelson 2002; Pinch 2008; Vargo et al. 2015).

That is, contrary to Chesbrough and Rosenbloom’s (2002) claim, technologies do not possess “latent value” that can be unlocked through the use of business models. Rather, value perceptions of technologies are shaped through institutional processes and the integration practices with other resources. These institutional processes are ongoing processes that enable and constrain the emergence, stabilization and destruction of predominant meanings and uses (Pinch and Bijker 1984). Thus, consistent with the highlighted importance of institutions in market (re)formation, technological developments always need to be viewed through an institutional lens. In the case of Uber, for example, a rating system was implemented that enables riders to see and rate specific drivers in their mobile application. The ease with which this rating system was implemented was enabled by the previous institutionalization of similar rating systems in other online solutions, such as the rating of sellers on eBay. However, while this rating system has alleviated the safety concerns of many Uber riders, other actors still, consistent with the imperfectly aligned nature of institutions, question its effectiveness and the safety of ridesharing altogether.

The performative interplay of markets, technologies, and business models

We argue that business models, markets, and technologies all share an institutional foundation (see Appendix for definitions). While this shared institutional foundation provides a robust theoretical foundation to explain the interplay among these three concepts, at the same time, it can lead to some fuzziness in their distinctions. For example, we describe both the formation of business models and markets as ongoing institutionalization processes shaping perceptions of problems and solutions. What distinguishes the two concepts is the degree of their objectification. Objectification describes the generalized acceptance of a solution (Tolbert and Zucker 1996). In contrast to a business model, for example, a market requires broader institutional alignments in which solutions become increasingly independent of specific actors. Many markets in the sharing economy, for example, share institutions across solutions and sets of actors (e.g., Uber, Lyft, Airbnb, CouchSurfing, and others). A single actor, on the other hand, can propose a business model. To sharpen the distinctions among technologies, business models, and markets, we highlight their differences in Table 3.

Arguably, institutional change is the central issue for the study of technologies, business models, and markets because it explicates not only “how institutions influence actors’ behavior but also how these actors might, in turn, influence, and possibly change institutions” (Battilana et al. 2009, p. 66). Specifically, a service ecosystems perspective points to the performative nature of markets, technologies, and business models. Doganova and Eyquem-Renault (2009), for example, claim that actors always define business models with reference to existing ones. That is, existing business models form institutional repertoires upon which actors draw. Similarly, Kjellberg and Helgesson’s (2007) work emphasizes that markets do not emerge and evolve purely based on calculated and conscious choices of human actors but instead are influenced by translation processes from existing market practices and, thus, possess traces of path dependencies. Lastly, Arthur (2009) articulates how changes in technology occur through “combinatorial evolution”: “New elements (technologies) are constructed from ones that already exist, and these offer themselves as possible building-block elements for the construction of still further elements” (Arthur 2009, p. 167). Using the example of a jet engine, Arthur explains that such an engine could not have been brought into being without previous knowledge of compressors, gas turbines, precision machine tools and the refining of fuels. That is, all technologies, in a performative manner, are birthed from combinations of previous technologies.

However, performativity is not limited to translations within these concepts—business models, markets, and technologies—but also includes translations between and among them. Doganova and Eyquem-Renault (2009, p. 1568), for example, point to the performative nature of business models since business models “support a shared understanding among various participants” by providing scale models that aim “at demonstrating [their] feasibility and worth to the partners whose enrolment is needed.” If a business model “succeeds in enrolling allies [i.e., achieves legitimacy], it begins to perform the world it narrates with every successful iteration” (Araujo and Easton 2012, p. 316). That is, business models can have a performative effect on markets as exemplified by the widespread adoption and taken-for-grantedness of rating systems across various context and markets (e.g., online commerce). Similarly, technologies such as online payment methods, encryption protocols, and credit card fraud protection programs, for example, have enabled not only the ridesharing business model but also, in turn, the shared acceptance of this business model or, stated differently, the institutionalization of the ridesharing market. Markets, likewise, also have performative effects on business models and technologies. The highly institutionalized taxi market, for example, continues to shape the perceptions of many actors that ridesharing is an unprofessional and unsafe practice.

As others have argued (e.g., Chandler and Vargo 2011; Mele et al. 2014), these institutional and performative change processes can only be understood by employing a perspective in which institutions are viewed from multiple levels of aggregation, such as relative perspectives of micro-level institutions of individuals, groups, and organizations; meso-level institutions such as those associated with professions or industries; and macro-level societal institutions (Thornton et al. 2012; Lawrence and Suddaby 2006). Indeed, as Vargo and Lusch (2016, p. 18) and others have articulated, “value creation can only be fully understood in terms of integrated resources applied for another actor’s benefit (service) within a context (e.g., Akaka and Vargo 2013; Chandler and Vargo 2011; Edvardsson et al. 2011).”

Institutional inconsistencies and contradictions propel the ongoing emergence of new business models. It is important to reiterate, however, consistent with their nested and overlapping nature, that business models are always imperfectly aligned. Thus, many proposed business models are rejected—or, stated in institutional terms, fail to find institutional alignment. That is, the prescribed actions of these business models are not perceived to be “desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs, and definitions” (Suchman 1995, p. 574). New markets do not form (i.e., market innovation does not occur) when actors (e.g., firms) or groups of actors (e.g., innovation networks) introduce new technologies or new business models but, instead, when new practices (i.e., solutions) become institutionalized (Vargo et al. 2015).

Thus, the occurrence of new markets (i.e., the formation and institutionalization of novel market practices) needs to be conceptualized as a systemic process in which multiple actors, all guided by business models, engage in “ongoing negotiations, experimentation, competition, and learning” (Zietsma and McKnight 2009, p. 145) until these actors arrive at shared but always imperfectly aligned conceptions of problems and solutions. These conceptions of problems and solutions, as discussed, comprise perceptions of useful knowledge (i.e., technologies), business models, and interrelated and overlapping market practices.

While the traditional business model literature often focuses on the managerial creation and replication of best practices of firms, a systemic and institutional approach shifts the study of business models to the investigation of how institutions are (re)formed. That is, a service ecosystems approach shifts the focus to how institutional change occurs since, as described, institutional processes are foundational to technologies, markets, and business models (see Fig. 1). Specifically, it is through an iterative and dynamic process involving a broad range of actors (i.e., firms, customers, other stakeholders, etc.) that institutionalization—the maintenance, disruption and change of rules, norms, meanings, symbols—enables and constrains resource integration and value cocreation practices.

This view of institutional development, termed institutional work, expands the analysis beyond the creation of new institutions (Lawrence et al. 2009) by highlighting the influence of a broad range of actors on both maintaining and disrupting existing institutions. Lawrence and Suddaby (2006) emphasize that institutional work is concerned not only with transformative action, but also with repairing and concealing tensions and conflicts within and across institutions. Callon (1998b), for example, argues that human actors need a degree of institutional stability (i.e., institutional maintenance) to function, highlighting the importance of path dependence and lock-in in institutional change processes. Similarly, the creative destruction of existing solutions (i.e., institutional disruption) is a necessary part of institutional change processes and business model developments (cf. Schumpeter 1942).

Zietsma and McKnight (2009) propose a framework in which systemic actors engage in the three activities of institutional work at the same time and over substantial time periods. An Uber driver, for example, not only participates in institutional change by engaging in emerging ridesharing practices but also, at the same time, maintains institutions such as determining monetary compensation by distance traveled. Simultaneously, the Uber driver might, by providing a cleaner and more comfortable car, disrupt the practice of using taxis for personal transportation. Thus, in line with an S-D logic view, Zietsma and McKnight conceptualize institutional work as cocreated, a recursive process in which multiple actors cocreate institutions iteratively, by competing and collaborating, until shared meanings and uses of technologies, business models and market practices form. Therefore, this view overcomes conceptions that firms singlehandedly create business models and highlights systemic processes, which resolve over time into shared, but always imperfect, conceptions of problems and solutions.

Further discussion and implications

As noted, the term “business model” has become somewhat of a buzzword, and the literature is beginning to converge on a more holistic conceptualization of the concept. We have shown that a systemic, institutional, actor-to-actor perspective, such as the service ecosystems perspective, can inform and facilitate this convergence. This perspective explicates what business models are and what they do. Furthermore, it points to an A2A view that overcomes narrow, firm-centric views in which business model development is described as a firm-driven process that concludes with the creation of appealing value propositions. Many normative recommendations on business model development, however, have yet to embrace a systemic view. Chesbrough and Rosenbloom (2002, p. 534), for example, articulate still commonly perscribed business model development steps, stating that business model development processes “begin with articulating a value proposition in the new technology. This requires a preliminary definition of what the product offering will be and in what form the customer may use it. The business model must then specify a group of customers or a market segment to whom the proposition will be appealing and from whom resources will be received.”

The broader innovation literature, on the other hand, has made significant progress in prescribing more systemic ways to engage in change processes in complex and dynamic ecosystems and markets. Freeman (1991), for example, argues for broadening the scope of innovation beyond internal firm activities by recognizing the importance of “external sources of scientific and technical information and advice” from which firms need to draw. Similarly, von Hippel (2005) argues that innovation research needs to broaden its unit of analysis to explicitly incorporate broader actor categories, while Geels (2004, p. 915) claims that only an institutional perspective on innovation can provide “a dynamic sociological conceptualization” for the use of technologies. Thus, the innovation literature further aids the convergence on more systemic business model thought by emphasizing the need to not only rethink the normative tools that are used for business model development, but also many other traditional marketing management decisions. As we subsequently discuss, the introduction of Tesla cars can provide an exemplar for the strategic implications that a service ecosystems approach can provide.

Tesla Motors was not the first company to introduce electric vehicles. In fact, actors were building electric cars for human transportation as early as the 1880s. Since the first electric cars were introduced such a long time ago, why is it that a meaningful electric car market has only recently formed? A firm-centric view on business models would probably suggest that early electric car companies did not meet the needs of enough customers. A deeper look into Tesla’s success to date, however, reveals that this success was not based on meeting explicit or latent customer needs but rather on systemic institutional alignment processes.

The energy crises in the 1970s and 1980s, for example, fostered increased interest in electric and alternative energy automobiles. However, neither the technologies nor the institutional arrangements were in place to support meaningful electric car business models. Nevertheless, these crises resulted in institutional frictions in the practices of using fossil fuel–powered cars and trucks and highlighted the need for energy independence, lower energy costs, and more environmentally friendly personal transportation options. These frictions, arguably, provided the impetus for the development of mass-produced hybrid vehicles that can be seen as an important stepping-stone in the institutionalization of electric automobiles. These hybrid vehicles maintained most of the institutions pertaining to fossil fuel powered vehicles, such as using gasoline as the principal source of energy and perceptions of acceptable driving ranges. The introduction of these vehicles helped to institutionalize favorable perceptions of electric drive trains, energy management systems, and battery technologies. That is, viewed through an institutional lens, hybrid cars were an important upstream innovation for the electric car business model in general and for Tesla cars in particular.

Thus, while Tesla cars may be masterfully designed and produced, the development of Tesla Motors’ business model, and electric car business models more generally, has been based on much broader cocreated and systemic processes. The first Tesla, for example, was built on a chassis of the Lotus Elise and not only maintained many of the aesthetic as well as functional designs of the already institutionalized sports car market, but it also relied on co-innovation in the broader service ecosystem and its actors (i.e., Lotus, hybrid car and battery manufacturers, suppliers of electric drive trains). In other words, the first Tesla, in a performative manner, was birthed through the combination of previous technologies. Furthermore, the Tesla business model also maintained broader institutional developments that had established cars as status symbols that highlight the social and economic standing of their drivers.

Institutional arrangements also influenced what driving ranges (or battery capacities) were deemed acceptable. Based on these (and other) existing institutional arrangements (e.g., business models of drivers that guide the integration of cars and fuel), Tesla Motors recognized the need to build not only cars but also a supercharger ecosystem that closely resembled the already institutionalized network of gas stations. In other words, frictions within the institutional arrangements between traditional and electric car business models aided the development of complementary innovations.

These institutional developments were not limited to Tesla and its customers but were influenced by the broader involvement of public and private actors, such as shopping malls, businesses, universities, and regulatory bodies. These actors have helped build a charging infrastructure that is much broader than Tesla’s own network and have provided incentives to adopt electric cars. The government of Norway, for example, has provided the drivers of electric vehicles with lucrative tax benefits, free battery-charging facilities and free parking. These drivers can also use bus and taxi lanes and are exempt from paying for the use of toll roads. Consequently, as of 2016, the small country of Norway is Tesla’s largest European market.

This broad involvement of actors has, by reducing the costs and increasing the convenience for Tesla drivers, played an important role in the institutionalization of the electric car as a solution. Similarly, at least partially attributable to institutions pertaining to carbon footprints and perceptions of desirable fuel costs, many Tesla owners have broadened the charging infrastructure by integrating the use of photovoltaic panels into their business models. In doing so, these Tesla owners have also participated in the institutionalization of novel solutions to generate sustainable energy and, likewise, the producers of sustainable energy generation equipment have participated in the institutionalization of Tesla cars. Furthermore, by making its patents public and working closely with firms that are often viewed as competitors (e.g., Daimler and Toyota), Tesla has been able to facilitate the institutionalization of the electric car as a viable solution for human transportation, showing performative chains among technologies, business models, and markets. Consequently, many other actors have contributed resources and co-developed an infrastructure that has strengthened, if not sustained, Tesla’s business model to date and formed a number of nested and overlapping service ecosystems.

Implications for business model design processes

Traditionally, business model design and communication has focused on decision variables that can be influenced and controlled by a focal firm as exemplified by the quote from Chesbrough and Rosenbloom (2002) at the beginning of this section. This quote highlights how many traditional business model development processes begin with a new product or service (i.e., a new value proposition) and end with finding “customers or a market segment to whom the proposition will be appealing.” Similarly, Osterwalder and Pigneur’s (2010) popular business model canvas promotes the use of building blocks that are arranged in a manner that clearly highlights a unidirectional value flow from firm to customers and narrowly assigns development activities to focal firms and their partners.

However, the Tesla example shows that business models, technologies, and markets are developed and continually shaped through performative processes in which the institutional arrangements of a broad range of actors influence the enactment of resource integration practices. This performative view refocuses prescriptions for market development from war metaphors in which market actors fight to win market share to more collaborative views in which actors generate and negotiate nested and overlapping service ecosystems. Furthermore, a service ecosystems view underscores the importance of gaining access to resources, such as capabilities and competencies, rather than owning them. That is, since views on resources and their integration practices can change very dynamically, firms gain a comparative resource advantage when they can improve access and coordination of resources (Hunt and Morgan 1995; Madhavaram and Hunt 2008). This improved access and coordination of resources often requires cooperating with other resource-integrating actors and accessing these actors’ resources. What has distinguished Tesla from many other firms is not that the company possesses novel capabilities or competencies such as technical expertise, but rather that it has actively supported an open source service ecosystems movement that has facilitated electric vehicle adoption and continual market reformation processes.

The Tesla example accentuates the need for practitioners to gain deeper understanding of the various participants and their roles, including non-users and other stakeholders, and the underlying and iterative processes from which technologies, business models, and markets emerge. This understanding has to include the need for complementary innovations and downstream adoption processes (Adner 2006) that emerge over extended periods of time. Arguably, without the formation of the broader service ecosystem, the introduction of Tesla cars could have easily failed. The participation of many actors in building a charging infrastructure greatly reduced the amount of behavioral change necessary as this infrastructure helped to maintain institutions consistent with buying gas via a network of gas stations. Similarly, the institutionalization of renewable energy sources, in combination with broadly shared concerns about carbon footprints, has positively influenced perceptions of the usefulness of Tesla cars.

Given their nested and overlapping nature, business models are always imperfectly aligned and broader integrative practices in service ecosystems are continually changing. Many of these changes result in discontinuous departures from established practices, which only become salient when practitioners zoom out to broader systems perspectives and adopt longitudinal views on business model development. Viewed from this perspective, all technology adoption processes evolve in a continual manner since they are based on recombinations of knowledge and shared institutional arrangements among various participants that develop over time. Thus, the institutionalization process of the Tesla business model neither began with the launch of the first Tesla car, nor will it end with the last Tesla car that is designed and produced. Tesla engineers did not just develop a product and find a customer segment to which this product was appealing, but they, among many other actors, collectively formed a service ecosystem that supported the institutionalization of battery powered personalized transportation.

Arguably, used as a foundation for normative tools, a service ecosystems perspective can help practitioners to participate in broader disruption, change, and stabilization processes of markets. This perspective provides managers and policymakers a practical perspective that informs the understanding of both continuous and discontinuous innovation and market change (Vargo and Lusch 2016). Discontinuous innovation processes, by definition, point to dynamically evolving practices in which the past is not a reliable predictor of the future. Consequently, achieving long-haul success can be viewed as an entrepreneurial process in which actors “seize contingent opportunities and exploits any and all means at hand to fulfill a plurality of current and future aspirations, many of which are shaped and created through the very process of economic decision making and are not given a priori” (Sarasvathy 2001, p. 262).

While marketing and entrepreneurship have conventionally been treated as somewhat distinct disciplines, and many marketing tools have been based on a logic of foresight and predictability (Read et al. 2009), the conceptualization of business models proposed in this article should, arguably, lead to a stronger convergence of these two fields in which marketing can be viewed as a special case of entrepreneurship (Vargo and Lusch 2014). To aid practitioners in developing a service ecosystems perspective of business models, we summarize some implications and managerial considerations in Table 4.

Implications for academic research

Framing business model development in the context of continual institutionalization processes also has important implications for academic research. While recent marketing literature has begun to discuss the institutional, systemic and socio-technical nature of market formation processes (e.g., Humphreys 2010; Kjellberg and Helgesson 2006; Mele et al. 2014; Vargo et al. 2015), additional work is needed to advance understanding of institutionalization processes in the context of markets. As Webster and Lusch (2013, p. 389) point out, the marketing discipline needs to adopt broader and more systemic perspectives and, in this process, rethink “its fundamental purpose, premises, and implicit models” in order to stay relevant. Thus, researchers need to fully embrace and explore the complexity of socio-technical market systems and the required institutional alignment processes among systemic actors and their business models.

Research priorities 1

What role do business models play in the institutionalization and deinstitutionalization of solutions? What role does institutional complexity play in the formation of business models, technologies, and markets? How can systemic boundaries be delineated situationally and contextually to simplify the analysis?

We do not believe that adopting a service-oriented conceptualization of business models implies that all of what is understood from more goods-centered orientations needs to be abandoned. On the contrary, a service orientation provides goods-based strategic research an explicit purpose which, through metatheoretical reconciliation, can make the latter more robust. Therefore, we want to encourage marketing researchers to reconcile existing midrange theoretical business model frameworks with a service ecosystems perspective (Vargo and Lusch 2017).

With few exceptions, marketing researchers have ignored the importance of business models in market (re)formation and have left much of the theorizing in this area to colleagues in management and entrepreneurship. This exploration, due to the continual and systemic nature of business model development, must break with the overreliance on cross-sectional and experimental data that is prevalent in much of the marketing literature and, instead, focus on longitudinal research to capture systemic developments over time. Similarly, this exploration needs to draw from various disciplines, such as sociology, social psychology, organizational studies, and communication, in which human collaboration and sensemaking are the units of analysis, and include institutional, practice-based, socio-cognitive, and discursive perspectives.

Research priorities 2

What are the metrics for evaluating and classifying business models and their effects on sensemaking, performativity, and institutional alignment in the (re)formation of markets? What is the appropriate time horizon to evaluate business model developments? How can the role that complementary innovation and downstream adoption processes play in longitudinal institutional change processes be accounted for?

The exploration of discursive perspectives, in particular, seems to offer great promise in understanding the institutional and performative processes that are foundational to business model development and market formation. As highlighted, Doganova and Eyquem-Renault (2009) and Araujo and Easton (2012) describe business models as narrative devices that enable the interactions of systemic market actors. Similarly, Rosa et al. (1999) posit that stories create and stabilize markets. That is, narratives have a constitutive role in the creation of agency by enabling market actors to envision where they are heading (Emirbayer and Mische 1998).

While the marketing literature is beginning to recognize the sensemaking and enabling properties of stories and narratives, this literature often views the firm as the main storyteller. Ballantyne and Varey (2006), for example, claim that “monological” or “one-way message-making systems” are the most dominant conceptualization of communication in the marketing literature. While, as Akrich et al. (2002) articulate, successful market change needs a “good speaker” and firms undoubtedly play an important role in the formation of narratives, market narratives are always cocreated by systemic actors. These actors build on, adapt, or contrast earlier stories, and these stories can come into alignment to form narrative infrastructures. Doganova and Eyquem-Renault (2009), for example, articulate how the storytelling dimension of business models is always cocreated as these stories are shaped through encounters with other actors whose enrolments are sought. Arguably, much may be learned about business models by reconciling the cocreated nature of narratives with a service ecosystems perspective. Foundationally, narratives and institutions both “deal with the evolutionary process through which actors form, reform, and are influenced by the endogenously generated structures that support their joint survival” (Vargo and Lusch 2016, p. 20).

Research priorities 3

What role do narratives play in the formation and development of technologies, business models, and markets? How do cocreated narrative infrastructures enable and constrain agency and shape institutionalization processes?

Conceptualizing business models as actor-centric requires a move away from pre-designated roles of “producers”/“consumers,” “firms”/“customers,” and “business model developers”/“business model adopters.” That is, all actors, viewed through a service ecosystems lens, participate in the shaping of value cocreation practices and business models, in a fundamentally similar way—by creating, maintaining, and disrupting the institutions that enable and constrain resource integration and value cocreation practices. This opens up questions about how contextual differences mediate the perceptions of roles, such as service provider and beneficiary. Furthermore, this role assignment may impact which institutions are applied and, thus, the developments and interplays of business models.

Research priorities 4

How are actor roles determined and negotiated? Do perceived roles of actors influence the transposability of institutions? Do perceived roles of actors impact business model developments and interplays?

In summary, we encourage marketing scholars to explore the business model concept and the related concepts of markets and technologies, using a discursive systemic, institutional, and service perspective. The research priorities introduced above are intended to initiate such efforts.

Conclusion

We have drawn from service ecosystems, institutional, and practice theory literatures to provide a unifying framework that can facilitate the investigation of business models using a system-level, holistic perspective. This perspective and its focus on service-for-service exchange among systemic actors reveals that any attempt to understand business models and the roles they play in facilitating value creation must account for dynamic relationships among systemic actors, technologies (i.e., useful knowledge), and overlapping market practices (i.e., markets) within service ecosystems. On the basis of this perspective, business models shape perceptions of resources (e.g., knowledge, skills and abilities), integration processes of these resources, relationships among actors, and perceptions of what problems need to be solved.

Using an A2A conceptualization, we show that business models are not unique to “producers” (e.g., firms). Rather, all economic and social actors rely on business models since all actors rely on perceptions of resources and views on the ways “market actors can interact with other actors– and their resources” (Storbacka and Nenonen 2011, p. 247). This view overcomes traditional views in which firms singlehandedly or within narrowly defined innovation networks create business models. Instead, a service ecosystems perspective points to systemic, non-linear, dynamic processes in which multiple actors cocreate institutions by competing and collaborating until common but always imperfect institutional arrangements form.

This perspective highlights the performative nature of markets, technologies, and business models and reconceptualizes the business model concept from one that describes interrelated sets of decision variables used to define value propositions and venture strategies to one that highlights the broad participation of systemic actors in market (re)formation processes. That is, a systemic and performative perspective places business models and their development processes at the heart of the marketing discipline.

The performative nature of business models also explains why, despite unsatisfactory definitions and normative prescriptions in the extant literature, many practitioners have adopted the concept with ease. When an actor’s business model frames exchange as a dyadic transfer of value for money, this actor is likely to view and enact exchange practices in terms of a particular product or service category with rather static or latent customer needs. However, when an actor’s business model frames the actions of firms, customers, and other market actors in a collaborative manner, this actor is likely to actively negotiate the rules, norms, meanings, as well as roles of market actors, with a broad range of stakeholders. That is, a performative view of business models accounts for continuous and discontinuous innovation and market change. Consequently, we encourage both practitioners and academics to further explore business models and business model development in the context of systemic and dynamic market formation processes.

References

Abernathy, W. J., & Clark, K. B. (1985). Innovation: Mapping the winds of creative destruction. Research Policy, 14(1), 3–22.

Adner, R. (2006). Match your innovation strategy to your innovation ecosystem. Harvard Business Review, 84(4), 98.

Akaka, M. A., & Vargo, S. L. (2013). Technology as an Operant resource in service (eco) systems. Information Systems and e-Business Management, 12, 1–18.

Akrich, M., Callon, M., Latour, B., & Monaghan, A. (2002). The key to success in innovation part II: The art of choosing good spokespersons. International Journal of Innovation Management, 6(02), 207–225.

Alderson, W. (1957). Marketing behavior and executive action: A functionalist approach to marketing theory. Homewood, IL: Richard D. Irwin.

Amit, R., & Zott, C. (2001). Value creation in e-business. Strategic Management Journal, 22(6–7), 493–520.

Araujo, L., & Easton, G. (2012). Temporality in business networks: The role of narratives and management technologies. Industrial Marketing Management, 41, 312.

Arndt, J. (1979). Toward a concept of domesticated markets. The Journal of Marketing, 43, 69–75.

Arndt, J. (1981). The political economy of marketing systems: Reviving the institutional approach. Journal of Macroeconomics, 1(2), 36–47.

Arthur, W. B. (2009). The nature of technology: What it is and how it evolves. New York: Free Press.

Azimont, F., & Araujo, L. (2007). Category reviews as market-shaping events. Industrial Marketing Management, 36(7), 849–860.

Ballantyne, D., & Varey, R. J. (2006). Creating value-in-use through marketing interaction: The exchange logic of relating, communicating and knowing. Marketing Theory, 6(3), 335–348.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Battilana, J., Leca, B., & Boxenbaum, E. (2009). How actors change institutions: Towards a theory of institutional entrepreneurship. The Academy of Management Annals, 3(1), 65–107.

Bourdieu, P. (1977). Outline of a theory of Pracitce. Cambridge: The Press Syndicate of the University of Cambridge.

Callon, M. (1998a). An essay on framing and overflowing: Economic externalities revisited by sociology. The Sociological Review, 46(S1), 244–269.

Callon, M. (Ed.). (1998b). The laws of the markets. Oxford: Blackwell.

Chandler, J. D., & Vargo, S. L. (2011). Contextualization: Network intersections, value-in-context, and the co-creation of markets. Marketing Theory, 11, 35.

Chesbrough, H., & Rosenbloom, R. S. (2002). The role of the business model in capturing value from innovation: Evidence from Xerox Corporation's technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555.

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Constantin, J., & Lusch, R. F. (1994). Understanding resource management. Oxford: Paper presented at the The Planning Forum.

Coombes, P. H., & Nicholson, J. D. (2013). Business models and their Relationship with marketing: A systematic literature review. Industrial Marketing Management, 42(5), 656–664.

Day, G. S. (1994). The capabilities of market-driven organizations. Journal of Marketing, 58(4), 37–52.

Deuten, J. J., & Rip, A. (2000). Narrative infrastructure in product creation processes. Organization, 7(1), 69-93

Doganova, L., & Eyquem-Renault, M. (2009). What do business Dodels do?: Innovation devices in technology entrepreneurship. Research Policy, 38(10), 1559–1570.

Duddy, E. A., & Revzan, D. A. (1953). Marketing: An institutional approach. New York: McGraw-Hill.