Abstract

This paper addresses the question of how an established firm can successfully defend its market against current and future competitors. Previous studies on this issue are surprisingly scarce and typically concentrate on only a single generic defense strategy. Thus, little is known about the degree and the manner in which different generic defense strategies, such as a deterrence strategy (pursued before competitor market entry) and a shakeout strategy (pursued after competitor market entry), differ in effectiveness and efficiency and about the corresponding role of product and market conditions. As these strategies tend to be costly, an established firm must decide which of these strategies to focus its scarce resources on. Drawing on evolutionary game theory and an empirical calibration and validation study, this paper seeks to fill these research gaps. While both strategies turn out to be viable options for market defense, the authors find that in general, a shakeout strategy tends to be superior to a deterrence strategy. However, the authors also identify product and market conditions under which an established firm is better off focusing on a deterrence strategy. In methodological respects, the paper contributes to the marketing discipline by introducing evolutionary game theory, which has not been used previously for analyzing marketing issues, as well as an evolutionary approach to research on market defense.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

In today’s competitive environment, managers of established firms frequently face challenges by companies trying to enter their market. As new entrants may strongly depress incumbents’ profits, choosing the most appropriate defense strategy is of high relevance (Shankar 1999) and today is “more important than ever” (Hauser and Shugan 2008, p. 85). On a generic level, managers must decide whether to focus their resources on defensive action in the pre-entry phase (i.e., before competitors have entered their market) or in the post-entry phase (i.e., after competitors have entered their market). In other words, they must choose between focusing on a deterrence strategy against potential competitors and relying on fighting against competitors after market entry has materialized, for example, by means of a shakeout strategy (Gruca and Sudharshan 1995; Kuester et al. 1999; Porter 1985).Footnote 1

However, despite the high relevance of choosing the most appropriate defense strategy, the literature remains surprisingly silent on this issue in particular and incumbents’ defense strategies in general (Varadarajan and Jayachandran 1999). In support of this view, Roberts (2005, p. 150) states that compared to “research on marketing as an offensive tactic, there has been remarkable little [research] on how … incumbents can use marketing [as a defense tactic] to respond to new or anticipated threats.”

In addition, the relatively small number of existing studies typically focus on only a single generic defense strategy. Specifically, previous game-theoretic work (e.g., Bain 1956; Eliashberg and Jeuland 1986) mostly focuses on competitor deterrence (for a review, see Gruca and Sudharshan 1995), whereas previous empirical work (e.g., Bowman and Gatignon 1995; Steenkamp et al. 2005) typically concentrates on competitor shakeout (for a review, see Kuester et al. 1999). Thus, little is known about the degree and the manner in which generic defense strategies differ in terms of effectiveness and efficiency. In this context, prior research has also failed to examine the conditions (e.g., product and market characteristics) under which an established firm should focus on a particular generic defense strategy (e.g., a deterrence strategy) at the expense of another generic defense strategy (e.g., a shakeout strategy).

To fill these research gaps, thereby contributing to the marketing literature in general and academic understanding of defense strategies in particular, we seek to answer the following research questions: (1) How and to what extent do different generic defense strategies—a deterrence strategy (pursued before competitor market entry) and a shakeout strategy (pursued after competitor market entry)—differ in terms of effectiveness and efficiency, both in general and depending on specific conditions? (2) For market defense purposes, under what conditions should an established firm focus on a deterrence strategy, and when should it focus on a shakeout strategy?

Therefore, unlike previous studies, we do not limit our analysis to a single generic defense strategy, but we examine and compare multiple generic defense strategies a firm can pursue in different phases of the competitor market entry process (pre-entry vs. post-entry phase). This approach takes into account established firms’ option of choosing between different generic defense strategies and addresses a corresponding claim by Cubbin and Domberger (1988). Besides examining and comparing a deterrence strategy and a shakeout strategy in terms of effectiveness, efficiency, and superiority, we also analyze the corresponding role of important contingency factors, such as the length of the product lifecycle.

To examine these issues, we draw on a discrete time susceptible-infected-recovered (SIR) epidemic model from theoretical biology that uses techniques of evolutionary game theory (van Boven and Weissing 2004). This approach is supported by studies confirming the economic validity of the assumptions of evolutionary game theory (e.g., Friedman 1991), answers calls for a more frequent application of the evolutionary concept in marketing (e.g., Palmer 2000), and is in line with an increasing acceptance of this concept in marketing (e.g., Holak and Tang 1990). Moreover, using this approach offers several benefits important to the investigation of defense strategies.

First, the SIR epidemic model from theoretical biology properly fits the issue of incumbents’ defense strategies. Specifically, according to this model, a subject can adopt three different states: First, it can be susceptible to infections. Second, it may be infected by pathogens. Third, after being infected, the subject can either recover completely or try to continue living with the infection (thereby risking succumbing to the infection in the long run) (van Boven and Weissing 2004). Similar logic can be applied to the scenario of an established firm trying to defend its market against competitors. The first state in the SIR epidemic model represents a situation in which the firm is potentially jeopardized by competitor market entry. The second state reflects a situation in which the incumbent fails to deter competitors from entering the market. The third state represents a situation in which the incumbent may either achieve a successful competitor shakeout or try to coexist with the entrants through competitor influencing.

Second, evolutionary game theory “brings game theory closer to economics” (Samuelson 2002, p. 48) and explicitly incorporates dynamic considerations by focusing on “the robustness of [a] strategy … with respect to evolutionary forces in games played repeatedly” (Weibull 1998, p. 641) in a large population (Sugden 2001). Hence, unlike traditional game theory that allows only a single or specific number of contests to identify the optimal defense reaction against a limited set of clearly defined competitors, evolutionary game theory permits numerous contests in the presence of both current and future competitors. Consistent with an incumbent’s ultimate goal of long-term survival (e.g., Hannan and Freeman 1977), this benefit ensures that our study is able to identify the optimal defense reaction for maximizing the probability of surviving invasion attempts by both current and future competitors, and thus of maintaining “long-term existence of the firm under competition” (Parayre and Hurry 2001, p. 284).

Third, in contrast with traditional game theory that rests on the unrealistic assumption of perfectly rational and thus fully informed decision makers (e.g., Tirole 1988), evolutionary game theory assumes actors to be only partially knowledgeable, making it more appropriate for modeling individual decision making (e.g., Parayre and Hurry 2001; Samuelson 2002). Accordingly, models of incumbents’ defense strategies that are based on evolutionary game theory require a significantly smaller amount of information about specific current and future competitors, such as the number of competitors and the extent of barriers to their entry or exit (e.g., Han et al. 2001; Karakaya and Stahl 1992). This benefit accounts for the scarcity of such information in business practice (e.g., Montgomery et al. 2005) and the corresponding incomplete information for individual decision makers when assessing their firm’s competitive situation and choosing the most appropriate defense strategy (Gruca and Sudharshan 1995).

This paper proceeds as follows: We begin by introducing the content and structure of our model. On the basis of an empirical calibration and validation study, we then present applications of our model. We conclude with a discussion of how our study contributes to the marketing literature and of how it provides guidance for managers on effectively protecting their firm’s markets against competitors.

Overview of model content and structure

Introduction of generic defense strategies

According to Porter’s (1985) theory of defense strategies, managers of established firms may take action in either the pre-entry phase (“deterrence”) or the post-entry phase (“response”). In contrast to “deterrence, or preventing a challenger from initiating a move in the first place, response is one in which the firm reacts to challenges as they occur. Response seeks to lower the challenger’s objectives for a move once begun [i.e., influencing] or lead the challenger to rescind it altogether [i.e., shakeout]” (Porter 1985, p. 504). In our study, we have labeled these three generic defense strategies according to their primary goal—that is, competitor deterrence, influencing, and shakeout, respectively.

In the pre-entry phase (i.e., before competitors have entered their market), firm managers can apply a deterrence strategy. This strategy refers to the firm’s activities of erecting barriers to prevent potential competitors from market entry (Gruca and Sudharshan 1995; Porter 1985). These activities discourage potential competitors by reducing anticipated benefits or increasing expected costs of market entry, for example through limit pricing, preannouncements of innovations, raising customer switching costs, or blocking access to suppliers and sales channels (Burnham et al. 2003; Lam et al. 2004; Robinson and Fornell 1985). We denote the probability that the firm fails to prevent competitor market entry as η. Consequently, (1 – η) refers to the probability of successful competitor deterrence.

In the post-entry phase (i.e., after competitors have entered their market), firm managers can, for instance, pursue a shakeout strategy. This strategy refers to the firm’s retaliatory activities aimed at squeezing actual competitors out of the market (Kuester et al. 1999; Porter 1985). These activities discourage competitors by reducing their benefits or raising their costs of staying in the market. They include, for example, comparative advertising, predatory pricing, or enticing customers away from competitors (Guiltinan and Gundlach 1996; Hauser and Shugan 1983; Wang et al. 2009). We denote the probability of a successful competitor shakeout resulting in a regained monopoly as ρ, which is, for example, negatively related to the number of competitors.

In the post-entry phase, firm managers can also apply an influencing strategy. This strategy refers to the firm’s activities aimed at coexisting more or less peacefully with actual competitors by causing them to pursue less threatening goals that do not endanger the incumbent’s long-term survival in the market (Porter 1985; Robinson 1988; Scherer and Ross 1992). Through activities such as advertising or litigation (Cubbin and Domberger 1988; Hauser and Wernerfelt 1989; Olazábal et al. 2006), actual competitors can be influenced, for example, to focus solely on market segments or niches that are of merely minor interest to the incumbent. This strategy is consistent with the approach of “strategic resource diversion” aimed to “divert competitors’ resource allocations … without precipitating a destructive all-out war” (McGrath et al. 1998, p. 724). We denote the probability of a successful influencing strategy as σ. In the case of an unsuccessful influencing strategy, where the incumbent faces dominant competitors that cannot be influenced to pursue goals that do not endanger its long-term survival in the market, the firm is likely to exit the market in the long run.Footnote 2

Our study considers all three generic defense strategies. Specifically, we analyze and compare a deterrence strategy with a shakeout strategy based on effectiveness, efficiency, and superiority, and we examine how the effectiveness, efficiency, and superiority of these two strategies are contingent on the probability of a successful influencing strategy (as well as the length of the product lifecycle). In the following, we present the model required for these analyses.

Short-term basic structure of the model

In the previous section, we introduced the probabilities of successful use of deterrence (1 – η), shakeout (ρ), and influencing (σ) strategies. Several studies stress the importance of considering the lifespan (and thus the attractiveness) of a product market in strategic decision making (Bordley 2003; Krider and Weinberg 1998). As this criterion also plays an important role in deciding the most appropriate defense strategy, our model incorporates the length of the product lifecycle (PLC), which refers to the expected duration of time the product (at the category level) will exist in the market. The definition of the PLC at the category level allows us to account for extensions of the lifecycle caused by incremental innovations or slight shifts in customer needs. Accordingly, we assume the lifecycle ends only in the case of radical innovations or fundamental shifts in customer needs. In our model, the expected length of the PLC is derived by 1/(1 – P), where the parameter P represents the probability that the lifecycle of the product (at the category level) continues from one period to the next. Thus, the complementary probability (1 – P) denotes the probability that the lifecycle of the product (at the category level) ends, and as a consequence, the product market drops out of the industry.Footnote 3

Drawing on these parameters and starting from an arbitrary initial situation (at time t) in which the incumbent operates in N markets, we now examine how the firm’s market structure \( {n^t} = \left( {n_M^t,n_O^t,n_{{RM}}^t} \right) \), characterized by the number of the incumbent’s monopoly \( \left( {n_M^t} \right) \), oligopoly \( \left( {n_O^t} \right) \),Footnote 4 and regained monopoly \( \left( {n_{{RM}}^t} \right) \) markets, evolves over time. We arrive at this by means of the following equation:

where \( {n^{{t + 1}}} = (n_M^{{t + 1}},n_O^{{t + 1}},n_{{RM}}^{{t + 1}}) \) represents the number of the incumbent’s monopoly\( (n_M^{{t + 1}}) \), oligopoly\( (n_O^{{t + 1}}) \), and regained monopoly\( (n_{{RM}}^{{t + 1}}) \) markets at time t+1, which depends on n t and on the following matrix:

Matrix A encompasses the proportion of markets in which the incumbent manages to protect its monopoly (i.e., successfully deters competitors from entry) with the probability (1 – η), loses its monopoly (i.e., fails to deter competitors from entry) with the probability η, and regains its monopoly (i.e., successfully squeezes competitors out of the market) with the probability ρ. Footnote 5 Matrix A also includes the proportion of oligopoly markets in which the firm fails to squeeze competitors out of the market with the probability (1 – ρ) but successfully influences competitors with the probability σ. By including P, we consider a reduction of the firm’s total number of markets caused by the end of the PLC. On the other hand, by reinvesting its generated short-term profits—for example, in R&D—the incumbent may develop new product markets, thus increasing its total number of markets. To account for this issue, we introduce F M , F O , and F RM , which describe the growth of the incumbent’s number of new markets generated by short-term profits from monopoly, oligopoly, and regained monopoly markets, respectively (from t to the subsequent period t+1). Finally, ζ denotes a normalization factor (see Appendix A).

Long-term basic structure of the model

Thus far, we have analyzed how, in the short term, the incumbent’s market structure changes from t to t+1. However, consistent with resource dependence theory (Pfeffer and Salancik 1978) and the theory of organizational ecology (Hannan and Freeman 1977), our study concentrates on the incumbent’s long-term survival. Accordingly, we now examine how the market structure evolves in the long run. Consequently, Eq. 1 converges to:

The parameter λ reflects the long-term growth rate of the incumbent’s total number of markets and accounts for the long-term impact of the success probabilities of different defense strategies, the length of the PLC, and the possibility of developing new product markets. Moreover, the parameter \( u = ({u_M},{u_O},{u_{{RM}}}) \) denotes the proportion of the incumbent’s monopoly (u M ), oligopoly (u O ), and regained monopoly (u RM ) markets in the long run (for details, see Appendix A and Caswell 2001).

In correspondence with its multi-phase and long-term perspective, our model also accounts for inter-temporal effects between the pre-entry and post-entry phase. Specifically, a firm’s successful competitor shakeout in the post-entry phase is likely to enhance its reputation for retaliation and thus discourages potential competitors in the pre-entry phase from stepping into one of its markets in the future. This effect is supported by work in marketing (Clark and Montgomery 1998; Prabhu and Stewart 2001), economics (Kreps and Wilson 1982; Milgrom and Roberts 1982), and strategic management (Basdeo et al. 2006; Porter 1985). For example, Porter (1985, p. 497) notes that “a firm affects its image for retaliation … through its behavior in response to threatening challengers …. A very vigorous response to one challenger sends a [discouraging] message to others.” Clark and Montgomery (1998, p. 81–82) similarly find that “an incumbent’s reputation for aggressiveness … makes a market less attractive and more risky to a potential entrant … [and thus] can deter market entry.”

For potential entrants, the proportion of an incumbent’s oligopoly markets is a good indicator of whether the firm is willing and able to fight for its markets. While a small proportion increases potential entrants’ perceived threat of retaliation (and thereby reduces the probability of competitor market entry), a high proportion is likely to be interpreted as a sign of the incumbent’s reluctance or weakness with respect to market defense (thus increasing the probability of competitor market entry). Accordingly, in our model, the proportion of oligopoly markets (u O ) is negatively associated with the firm’s reputation for retaliation and thus positively associated with the probability η of competitor market entry. Hence, the probability η of competitor market entry can be decomposed into the proportion of oligopoly markets (u O ) and the residual probability g of competitor market entry:

Positive and negative consequences of defense investments

So far, the probabilities of successful defense strategies have been considered as fixed. Henceforth, consistent with Gatignon et al. (1997), who find evidence for a positive impact of marketing expenditures on defense success, we suppose these probabilities depend on the amount of defense investment x.

Specifically, deterrence investments are likely to reduce the residual probability g of competitor market entry (i.e., of failed competitor deterrence). For example, investments in brand image and loyalty raise customer costs of switching to brands offered by later market entrants (Burnham et al. 2003; Homburg and Fürst 2005). This reduces potential competitors’ anticipated benefits (as they would win fewer customers) and increases their expected costs (as they would also have to invest heavily in brand equity), thus averting their market entry. Also, investments in exclusivity contracts (Dutta et al. 1994), brand-specific assets (Stump and Heide 1996), and spatial pre-emption of retailer shelf space (Robinson and Fornell 1985) serve to control access to critical suppliers and sales channels. In turn, lack of access seriously handicaps potential competitors if they decide to step into the market, reducing their probability of market entry.

Moreover, shakeout investments are likely to enhance the probability ρ of successful competitor shakeout. For example, an incumbent’s investment in advertising reduces entrants’ benefits (as they will lose customers or have to lower prices) and raises their costs of staying in the market (as they will also have to invest heavily in advertising) (Aaker 1988; Calantone and di Benedetto 1990). Reduced benefits and increased costs in turn encourage entrants to, sooner or later, exit the market. Investing in predatory pricing through significant price cuts can also considerably weaken competitors and eventually force them to withdraw from the market (Guiltinan and Gundlach 1996; Karakaya 2000).

However, beyond these positive consequences, an established firm must also take into account that defense investments are costly and thus associated with a decrease in short-term profits from its monopoly, oligopoly, and regained monopoly markets. As these short-term profits provide the resources needed for new market development activities, such as R&D or the establishment of a distribution network (Chandy and Tellis 2000; Karakaya and Stahl 1989), defense investments indirectly reduce F M , F O , and F RM (i.e., the growth rate of the firm’s number of new markets generated by short-term profits from monopoly, oligopoly, and regained monopoly markets, respectively).

Hence, in making defense investments, a firm has to balance the trade-off between the positive consequences (i.e., the increase in the probability of successful market defense and thus of long-term survival) and the negative consequences (i.e., the reduction of short-term profits and thus of resources available for new market development, leading to a decreased probability of long-term survival). In support of this, Porter (1985, p. 487) notes that “defense tactics are costly and reduce short-term profitability in order to raise the longer-term sustainability of a firm’s position.”

Optimal amount of defense investment

In our model, λ (i.e., the long-term growth rate of the total number of markets) accounts for both the impact of the probability of successful market defense (which is increased by defense investments x) and the possibility of developing new markets (which is reduced by defense investments x). Thus, λ can be used to resolve the trade-off between positive and negative consequences of defense investments and thus to identify the firm’s optimal amount of defense investment x*.

Evolutionary game theory’s concept of evolutionary stable strategies (ESS) represents the theoretical basis for these analyses. It provides “a population-level analytical construct that offers a meaningful rubric for firm-level optimization” (Parayre and Hurry 2001, p. 281) and focuses on a large population in which repeated (pairwise) contests occur in the presence of evolutionary forces. Its objective function serves to identify the optimal amount of defense investment in the case of numerous contests, rather than for one specific contest, thus maximizing the probability of long-term survival (i.e., of successfully withstanding attacks from all current and future competitors) (Samuelson 2002). For this purpose, we repeatedly compare pairs of different alternative amounts of investment by means of the parameter λ. Footnote 6 The optimal amount of investment x* is characterized by the fact that no alternative amount of investment y leads to a higher λ when competing with x*. Following this idea, we derive the condition for x* (for details, see Appendix B):

The parameter \( v = ({v_M},{v_O},{v_{{RM}}}) \) denotes the left eigenvector (see Eq. B.4 in Appendix B). The notations indicate that all components are evaluated at the optimal amount of investment x*. The equation represents the trade-off between the positive consequences of defense investments (i.e., an increased probability of competitor deterrence, shakeout, and influencing; see left-hand side) and the negative consequences of defense investments (i.e., reduced number of newly developed markets; see right-hand side). The optimal amount of investment x* satisfies this equation (i.e., balances both sides of the equation) and thus solves the corresponding trade-off.

Data generation for model calibration and validation

We conducted an empirical study for two purposes. First, we aimed to validate whether the theoretical model provides useful practical recommendations. Second, we strived to calibrate the model parameters to derive realistic values, which is in line with other marketing studies using game-theoretic models (Ailawadi et al. 2005; Bohlmann et al. 2002) and with Day and Montgomery (1999, p. 11), who “propose that academic marketing give increasing attention to issues of calibration.”

With respect to model calibration, there is an important tradition in marketing of incorporating managerially estimated parameter values into models of strategic decision making (Leeflang and Wittink 2000). The validity of such parameter values, as well as the efficacy of judgment-based models for improving managerial decision making, are supported by a large number of studies (e.g., Blattberg and Hoch 1990; Gupta 1994). Following this tradition, we obtained the estimates of model parameters by drawing on decision calculus (Little 1970, 2004), an approach that is well established and frequently used for this purpose (Blattberg and Deighton 1996; Dong et al. 2007; Shang et al. 2009). “In the absence of objective information on probabilities” (O'Shaughnessy 1992, p. 94), such as in our study, this approach captures “useful information from managers’ rich knowledge of the marketing environment” (Little and Lodish 1981, p. 28) and thus allows the “estimation of otherwise unavailable data” (McIntyre 1982, p. 17) for marketing models. Specifically, it provides a survey-based method for obtaining values of model parameters through managerial judgments.

Drawing on this method, we conducted a large-scale survey. Through pre-study interviews with 20 executives and five academics, we pre-tested and improved a draft of the questionnaire with respect to understandability, relevance to managers’ experience, clarity of terminology, and appropriateness of response formats. Appendix C contains a list of items used for model calibration and validation. Subsequently, we identified 1,091 firms in manufacturing/processing industries (machinery, metal works, electronic, automotive) with at least 200 employees and annual revenues of not less than $50 million. For 1,020 firms, we were able to identify an executive with marketing, sales, and/or general management responsibility. We contacted these individuals by telephone and conducted 358 interviews (with an average duration of 16 min), resulting in a response rate of 35.1%.

To obtain the values for calibrating the model parameters, we asked respondents to assess with one question each the probabilities of successful competitor deterrence and shakeout (in the case of zero investment and maximal investment) and of successful competitor influencing (in the case of the current amount of investment). Also, with one item each, respondents indicated the expected length in years of the PLC as well as the functional relationship between the amount of defense investment and corresponding returns. A transformation of these responses yielded values that are subsequently used for P and q. To validate the model’s appropriateness for providing practical recommendations, we also asked respondents to rate their firm’s actual amount of investment in different generic defense strategies (two items) and their firm’s respective market defense success (two items).

In addition to pre-testing and improving our questionnaire, we took several further measures to ensure the validity of responses. For example, at the end of the interviews, we asked respondents to rate the questions in terms of understandability, relevance to managers’ experience, clarity of terminology, and appropriateness of response formats. Moreover, we asked respondents to indicate how competent they felt to answer the questions, how strongly they were personally involved in market defense activities, and how much experience they had gained in this regard. Results further enhanced our confidence in the appropriateness of the survey.

To further ensure the validity of responses, we discarded all questionnaires in which at least one of the questions related to competence, involvement, and experience, respectively, was answered with a value lower than 4 (on a 5-point scale). As a result, our final sample included 315 cases. Compared to the original sample, we found no differences with respect to respondent position, firm industry membership, and firm size, providing no evidence for non-response bias. Respondents were mostly general managers (54%) or sales managers (39%). The firms in the final sample were mostly from the electronic industry (36%), followed by the machinery (26%), metal works (21%), and automotive (17%) industries. The average firm size was 752 employees, with average annual revenues of $411 million. Tests showed that information bias and common method bias were not a problem with these data.Footnote 7,Footnote 8

Finally, we randomly partitioned the final sample into an estimation (n = 210) and a holdout sample (n = 105) (Blattberg et al. 2008). The estimation sample was used to obtain parameter values for the applications of the model, whereas the holdout sample was applied for some of our robustness tests.

Applications of the model

To analyze and compare a deterrence strategy with a shakeout strategy, we drew on two corresponding scenarios. In Scenario I, the firm invests in a deterrence strategy, thereby affecting the probability of successful competitor deterrence \( 1 - g = 1 - \eta /{u_O} \) (see Eq. 4). To simplify the notation, we used the complementary probability g (of failed competitor deterrence). In Scenario II, the firm invests in a shakeout strategy, thereby affecting the probability of successful competitor shakeout ρ. Specifically, g and ρ are positively influenced by defense investments x \( \in \)[0; 1] as follows:

The parameters g 0 and g 1 reflect the probability of failed competitor deterrence with zero (x = 0) and maximal (x = 1) investment, respectively. Our empirical study yielded a value of 4.44 for zero investment and 2.60 for maximal investment (on a 5-point scale with 1 = very low and 5 = very high). These values correspond to g 0 = 0.86, with a standard error (SE) of 0.015, and g 1 = 0.40 (SE = 0.023), as 1 = very low equals a probability of 0, and 5 = very high a probability of 1. It is worth mentioning that g 0 is less than 1 because of structural barriers to entry, such as capital requirements or lack of distribution access (Han et al. 2001), and that g 1 is greater than 0 because even large investments in deterrence cannot completely rule out competitor market entry (Porter 1985).

The parameters ρ 0 and ρ 1 denote the probability of successful competitor shakeout in the case of zero (x = 0) and maximal (x = 1) investment, respectively. Our empirical study yielded a value of 1.20 for zero investment and of 1.55 for maximal investment (on a 5-point scale with 1 = very low and 5 = very high). Applying the previous logic, these values correspond to ρ 0 = 0.05 (SE = 0.007) and ρ 1 = 0.14 (SE = 0.011). The parameter ρ 0 is greater than 0 because an entrant may leave the market even if the incumbent does not invest in shakeout due to factors not caused by the incumbent, such as a shift in customer needs (Porter 1985), and ρ 1 is less than 1 owing to structural barriers to exit, such as specific investments or contractual agreements (Karakaya 2000).

The parameter q determines the shape of g(x) and ρ(x)—that is, the functional relationship between defense investments and corresponding returns (success probabilities g and ρ). In our survey, managers stated that additional defense investments of their firm typically result in decreasing returns (4.09 on a 5-point scale with 1 = strongly increasing, 3 = proportional, and 5 = strongly decreasing). Thus, we assume q = 0.50 (SE = 0.028),Footnote 9 which is also in line with other marketing studies that assume decreasing marginal returns of defense investments (Gatignon et al. 1989; Hauser and Shugan 1983). Moreover, for the expected length of the PLC, which is reflected by 1/(1 - P), we obtained a value of 29.6 years. Inserting into \( {\text{PLC}} = {1}/\left( {{1} - P} \right) \) and solving for P results in P = 0.97 (SE = 0.001). Finally, for the probability of successful competitor influencing, our survey yielded a value of 4.36 (on a 5-point scale with 1 = very low and 5 = very high), resulting in σ = 0.84 (SE = 0.012).

On the basis of the theoretical model and the empirically calibrated model parameters, we now subsequently address our research questions on the effectiveness (Step 1), efficiency (Step 2), and superiority (Step 3) of a deterrence strategy and a shakeout strategy (see Fig. 1).

Effectiveness of deterrence strategy and shakeout strategy (Step 1)

In this subsection, we analyze how and to what extent a deterrence strategy (Scenario I) and a shakeout strategy (Scenario II) differ in terms of effectiveness. In the context of our study, effectiveness relates to the incumbent’s market defense success in the long run, which is reflected by the firm’s long-term market structure, especially by its long-term proportion of monopoly (u M ) and regained monopoly (u RM ) markets, as opposed to its long-term proportion of oligopoly (u O ) markets.

Deterrence strategy (Scenario I)

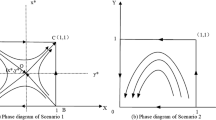

To examine the influence of investments in a deterrence strategy (x D ) on a firm’s long-term proportion of monopoly (u M ), regained monopoly (u RM ), and oligopoly (u O ) markets, we draw on the calibrated model parameters presented above. Consequently, we obtain ρ = 0.05, σ = 0.84, P = 0.97, and the function (6) \( g({x_D}) = 0.86 + (0.40 - 0.86){x_D}^{{1/2}} \) (i.e., q = 0.50, g 0 = 0.86, and g 1 = 0.40). The equations describing u M , u RM , and u O are presented in Appendix A (see Eq. A.7). Results are shown on the left side of Fig. 2.

With no investments in deterrence, an incumbent’s proportion of monopoly markets reaches a minimum. An increase in investments enhances the probability of deterrence and thus raises the proportion of monopoly markets and decreases the proportion of oligopoly markets. A diminishing proportion of oligopoly markets, in turn, reduces the number of possible competitor shakeouts and thus decreases the proportion of markets in which the incumbent can regain its monopoly.

Shakeout strategy (Scenario II)

To analyze how investments in a shakeout strategy (x S ) affect the firm’s market structure in the long run, we again draw on the calibrated model parameters. Thus, we receive g = 0.86, σ = 0.84, P = 0.97, and the function (7) \( \rho ({x_S}) = 0.05 + (0.14 - 0.05){x_S}^{{1/2}} \) (i.e., q = 0.50, ρ 0 = 0.05, and ρ 1 = 0.14). Results are presented on the right side of Fig. 2.

If no investments are made in a shakeout, the proportion of oligopoly markets reaches a maximum. The direct impact of increasing shakeout investments is reflected in a decrease in the proportion of oligopoly markets and an increase in the proportion of regained monopoly markets. The indirect impact of higher shakeout investments is represented by an increase in the proportion of monopoly markets. As discussed, a shakeout of rivals and the resulting low proportion of oligopoly markets indicate to potential entrants that the firm is a fierce competitor, creating reputational effects which deter competitor market entry. Interestingly, the slope reflecting the rise of the proportion of regained monopoly markets is relatively flat. This result is mainly due to reputational effects; as these effects promote competitor deterrence, they simultaneously reduce the proportion of oligopoly markets and thus the proportion of markets in which an incumbent may actually regain its monopoly.

Efficiency of deterrence strategy and shakeout strategy (Step 2)

Subsequently, we examine to what extent and how a deterrence strategy (Scenario I) and a shakeout strategy (Scenario II) differ in terms of efficiency. In the context of our study, efficiency refers to the incumbent’s amount of investment required to maximize the firm’s market success and probability of long-term survival. This optimal amount of defense investment takes into consideration that a firm has limited available resources and accounts for the fact that defense investments also have negative consequences, as they reduce short-term profits and thus resources available for new market development, leading to a decrease in the growth rates of the number of new markets.

Consequently, to derive the optimal amount of investment, our model needs to also consider this inverse relationship between defense investments and growth rates of the number of new markets generated by short-term profits from monopoly (F M ), oligopoly (F O ), and regained monopoly (F RM ) markets, respectively. For Scenario I, in which the firm pursues a deterrence strategy to prevent competitor market entry, we assume that defense investments only decrease F M . This assumption rests on the fact that monopoly markets are characterized by a particularly high need to prevent competitor market entry and thus investments in deterrence are prototypical for such markets. Consequently, we assume that deterrence investments reduce the short-term profits only from monopoly markets, leading to a decrease in the corresponding growth rate F M . Analogously, for Scenario II, in which the firm invests in a shakeout strategy to squeeze competitors out of the market, we assume that defense investments diminish only F O . This assumption is reasonable because investments in shakeout are only made in oligopoly markets. Thus, we assume these investments exclusively reduce the short-term profits from oligopoly markets and in turn the corresponding growth rate F O .

To model the trade-off between defense investments and growth rates (and thus account for a firm’s resource constraints), we parameterize the amount of defense investment x such that it corresponds to the proportion of growth rates F M (for Scenario I) and F O (for Scenario II) lost owing to defense investments. F 1, F 2, and F 3 denote the maximum achievable growth rates (generated by short-term profits from monopoly, oligopoly, and regained monopoly markets, respectively) that are obtained if no defense investments are made. Overall, we propose the following relationships:

Deterrence strategy (Scenario I)

In this scenario, the firm’s investments affect the probability g (see Eq. 4). Given Eq. 8, Eq. 5 thus simplifies to:

After inserting ζ* (derived from Eq. A.5 calculated in Appendix A) as well as v (see Appendix B.4) and u (see Appendix A.4), we obtain in terms of the basic parameters:

Inserting Function 6 in Eq. 11 and solving for x D determines the optimal amount of deterrence investment x D *. Given the calibrated model parameters P = 0.97, ρ = 0.05, σ = 0.84, q = 0.50, g 0 = 0.86, and g 1 = 0.40, we find x D * = 0.79. By investing this amount, the incumbent achieves a proportion of monopoly markets of u M = 0.52, a proportion of oligopoly markets of u O = 0.20, and a proportion of regained monopoly markets of u RM = 0.28. Therefore, the firm has a total proportion of successfully defended markets u DM of 0.80 (i.e., u M + u RM ).

The calculation of the optimal amount of deterrence investment is based on the probability of failed competitor deterrence, which is affected by issues such as structural entry barriers and competitor view of the incumbent (Han et al. 2001; Prabhu and Stewart 2001). However, when a firm is deciding on the optimal amount of deterrence investment, not only incumbent and competitor characteristics can play an important role, but also contingency factors such as product and market characteristics. With respect to the latter category, the expected length of the PLC may be particularly important, as it represents the lifespan and thus the attractiveness of product markets. Figure 3 (left side) shows how the length of the PLC influences the optimal amount of deterrence investment x D *. In the case of a long PLC, the firm is more motivated to protect its market to secure future profits. In contrast, in the case of a short PLC, a low amount of investment is optimal. Also, Fig. 3 reveals that the optimal amount of deterrence investment rises at a decreasing rate \( [({\partial^2}{x_D}^{*}/{\partial^2}(1/1 - P)) < 0] \). This finding seems intuitive, as our calibration study led us to assume a decreasing return on investment (q = 0.50). However, as the discussion of Scenario II will show, it does not hold true for a shakeout strategy; in this case, we find the optimal amount of investment to rise at an increasing rate.

In Fig. 4 (left side), we examine the impact of the probability of competitor influencing σ on the optimal amount of deterrence investment x D *. It indicates that the more likely an incumbent is to cause entrants to pursue less threatening goals and activities after market entry, the lower its motivation to invest in deterrence before market entry. Also, Fig. 4 depicts how the length of the PLC affects the impact of the probability of competitor influencing on the optimal amount of deterrence investment. Findings indicate that, ceteris paribus, an increasing length of the PLC leads to higher optimal investments. This finding is intuitively appealing because the length of the PLC reflects market attractiveness and thus an incumbent’s motivation for market defense. Interestingly, as Fig. 4 shows, the described impact of the length of the PLC diminishes with increasing values, as the distance between the curves for PLC = 10 and PLC = 30 is larger than between the curves for PLC = 30 and PLC = 50. This result is in line with our finding that the length of the PLC has a decreasing positive effect on the optimal amount of deterrence investment (see Fig. 3).

Shakeout strategy (Scenario II)

In this scenario, the firm’s investments influence the probability ρ. Therefore, and given Eq. 9, Eq. 5 boils down to:

After inserting ζ* and v, we derive in terms of the basic parameters:

Analogous to Scenario I, we derive the optimal amount of shakeout investment x S * by calculating the intersection point of Function 13 and the derivative of Function 7. Given the calibrated model parameters P = 0.97, g = 0.86, σ = 0.84, q = 0.50, ρ 0 = 0.05, and ρ 1 = 0.14, we obtain x S * = 0.56. This amount of investment leads to a proportion of monopoly markets of u M = 0.34, a proportion of oligopoly markets of u O = 0.16, and a proportion of regained monopoly markets of u RM = 0.50. Hence, the incumbent has a total proportion of successfully defended markets u DM of 0.84 (i.e., u M + u RM ).

By contrasting the optimal amount of shakeout investment x S * = 0.56 and its resulting total proportion of successfully defended markets (i.e., 0.84) with the optimal amount of deterrence investment x D * = 0.79 (see Scenario I) and its respective market defense success (i.e., 0.80), we are able to compare a deterrence strategy with a shakeout strategy in terms of efficiency. Interestingly, this comparison shows that in order to gain an approximately equal total proportion of defended markets, significantly lower investments in competitor shakeout are required than in competitor deterrence. This finding also holds true for other values of this proportion and thus suggests that, in general, a shakeout strategy is more efficient than a deterrence strategy. This finding is further supported by additional analyses showing that a given amount of investment leads to a higher total proportion of successfully defended markets with a shakeout strategy than with a deterrence strategy. More precisely, deterrence investments x D of 0.25, 0.50, 0.75 and 1.00 yield a total proportion of defended markets u DM of 0.73, 0.76, 0.79, and 0.82, respectively. In contrast, shakeout investments x S of 0.25, 0.50, 0.75, and 1.00 lead to a total proportion of defended markets u DM of 0.80, 0.84, 0.86, and 0.87, respectively.

With respect to the contingency factors, similar to Scenario I (see Fig. 3, left side), the length of the PLC also increases the optimal amount of defense investment in this scenario (see Fig. 3, right side). However, while the optimal amount of deterrence investment grows at a decreasing rate, the optimal amount of shakeout investment rises at an increasing rate \( [({\partial^2}{x_S}^{*}/{\partial^2}(1/1 - P)) > 0] \) . Obviously, since shakeout investments contribute to squeezing competitors out of the market, the resulting discouraging effect on potential entrants that tends to last throughout the entire PLC seems to outweigh the effect of a decreasing return on investment (q = 0.50).

Next, we examine how the probability of competitor influencing σ affects the optimal amount of shakeout investment x S *. Results reveal an inverse U-shaped relationship (see Fig. 4, right side). In this context, two situations are particularly interesting. In the first situation, the incumbent faces a dominant entrant that cannot be influenced to pursue less threatening goals and activities (see low values of σ in Fig. 4, right side). As discussed, the entrant is thus soon likely to endanger the incumbent’s position, so that the latter may be forced to exit the market in the long run. In this situation, shakeout investments have little prospect of success (as with small values of σ, the incumbent’s risk of being forced to exit the market 1 – σ is significantly higher than its chance to squeeze the entrant out of the market ρ). Instead, resources may be saved for short-term profit maximization (see Porter 1985). In the second situation, the incumbent is very likely to effectively influence the entrant’s strategy (see high values of σ in Fig. 4, right side). In this case, it does not face a strong need for investment in shakeout, as the entrant poses no significant threat in the future. Thus, in this situation, too, a relatively small amount of shakeout investment is optimal.

As in Scenario I (see Fig. 4, left side), the length of the PLC also raises the optimal amount of defense investment in this scenario (see Fig. 4, right side). However, this effect now disproportionally increases with the length of the PLC (i.e., the distance between the curves for PLC = 10 and PLC = 30 is smaller than between the curves for PLC = 30 and PLC = 50). This effect is in line with our finding that the length of the PLC has an increasing positive effect on the optimal amount of shakeout investment (see Fig. 3, right side).

Superiority of deterrence strategy and shakeout strategy (Step 3)

In a final step, we examine whether—depending on the two important contingency factors examined (the length of the PLC and the probability of competitor influencing)—an incumbent should either focus on a deterrence strategy or a shakeout strategy.

Specifically, for different lengths of the PLC (i.e., 50, 30, and 10), we compared both strategies, thereby assuming that for each strategy, managers tap the full potential (i.e., use the optimal amount of investment x*) (see Table 1). Results show that in terms of market defense success (put in relation to the amount of investment) u DM /x*, a deterrence strategy is likely to outperform a shakeout strategy in the case of a rather long PLC (i.e., 50), whereas a shakeout strategy seems to be superior in the case of a medium to short PLC (i.e., 30 and 10).

The superiority of a deterrence strategy in the case of a longer PLC can be explained by the greater leverage of deterrence investments compared to shakeout investments. More precisely, from our calibration study we obtained a range for the probability of failed competitor deterrence of g 0 = 0.86 and g 1 = 0.40. Thus, in each period the probability of successful competitor deterrence is (1 - g 0) = 0.14 (in the case of zero investment) and (1 – g 1) = 0.60 (in the case of maximal investment). In comparison, in each period the probability of successful competitor shakeout is significantly smaller, i.e., ρ 0 = 0.05 (in the case of zero investment) and ρ 1 = 0.14 (in the case of maximal investment). Hence, the larger the number of periods (i.e., the longer the PLC), the more strongly a deterrence strategy benefits from this greater leverage as compared to a shakeout strategy, resulting in a superior u DM /x* in the case of PLC = 50. However, any comparison of these strategies must also consider the deterring impact of reputational effects induced by a shakeout strategy and the resulting increase in the total proportion of defended markets u DM . While this impact does not completely compensate for the greater leverage of deterrence investments in the case of a rather long PLC (i.e., 50), it yields a higher u DM /x* for a shakeout strategy in the case of a medium to short PLC (i.e., 30 and 10).

Moreover, for different probabilities of competitor influencing (i.e., 0.99, 0.84, 0.01), we again compared both strategies (see Table 1). Findings indicate that a shakeout strategy seems to outperform a deterrence strategy in the case of high to above average probabilities (i.e., σ = 0.99 and σ = 0.84), while a deterrence strategy is likely to be superior to a shakeout strategy in the case of a low probability of competitor influencing (i.e., σ = 0.01).

The superiority of a shakeout strategy in the case of high to above average probabilities of competitor influencing (i.e., σ = 0.99 and σ = 0.84) results from the fact that in such situations, investments in shakeout have a reasonable prospect of success (as in the case of large values of σ, the incumbent’s opportunity to squeeze an entrant out of the market ρ is similar to or even significantly greater than the incumbent’s risk of being dropped out of the market 1 – σ). Through this process, the deterring impact of reputational effects resulting from competitor shakeout can unfold its potential, leading to a significant increase in the total proportion of defended markets u DM . In contrast, in the case of a low probability of competitor influencing (i.e., σ = 0.01), a shakeout strategy is not promising (as in the case of low values of σ, the incumbent’s chance of squeezing the entrant out of the market ρ is significantly lower than the incumbent’s risk of being dropped out of the market 1 – σ). Instead, in such a situation managers are well advised to completely prevent competitor market entry by pursuing a deterrence strategy.

Robustness tests of study findings

We checked the robustness of our findings through a comprehensive exploration of parameter space. For this examination, we calculated the confidence interval (confidence level = 99.99%) for each of the calibrated parameters (Triola 2007). As a result, for each of these parameters, we obtained a relatively broad interval in which the true value of the respective parameter lies with a confidence of 99.99%. Using the values that correspond to the lower and/or upper bounds of these intervals, we then again applied our model to explore whether and to what extent the findings of Step 1, Step 2, and Step 3 deviate from those of our previous analyses, which are based on the calibrated values.

With regard to Step 1, results remain essentially stable: for both scenarios, the impact of defense investments on the proportion of monopoly, oligopoly, and regained monopoly markets, respectively, slightly increases or decreases but retains the same direction as in Fig. 2. With regard to Step 2, results also remain largely robust: although the optimal amounts of deterrence investment and of shakeout investment naturally differ somewhat from our prior results, our key finding of a generally higher efficiency of a shakeout strategy is still valid. Also, the slopes of the relationship between the contingency factors and the optimal amount of deterrence investment and the optimal amount of shakeout investment, respectively, slightly deviate from our previous results. However, the functional form of these relationships does not significantly differ from the slopes shown in Figs. 3 and 4. With regard to Step 3, results also closely correspond to those of previous analyses: our key finding remains valid that in the case of a relatively short PLC and a high probability of competitor influencing, a shakeout strategy seems to be superior, whereas in the opposite case, a deterrence strategy may be preferable.Footnote 10

We also tested the robustness of our findings by means of our holdout sample (n = 105) (Blattberg et al. 2008). Drawing on this sample, we re-estimated parameters and then again applied our model. In this case as well, results with regard to Step 1, Step 2, and Step 3 remain stable.

Empirical validation of the model

As discussed, our empirical study also aims to validate whether the model does, in fact, provide useful recommendations for managers. For this purpose, depending on the firms’ market defense success, we split our sample into two groups to obtain one group of “successful incumbents” and one group of “unsuccessful incumbents.” Subsequently, we compared the actual amount of defense investment of each group with the corresponding optimal amount of defense investment recommended by the model. Analogous to our previous approach, this procedure was carried out for both a deterrence strategy (Scenario I) and a shakeout strategy (Scenario II).

Accordingly, with regard to Scenario I, we split our sample into two groups depending on deterrence success. Firms with a success higher than 3 (on a 5-point scale) were classified as successful, and those with a success lower than 3 were classified as unsuccessful. For both groups, on the basis of the model and the calibrated parameters, we then calculated firms’ optimal amount of deterrence investment and compared it to firms’ actual amount of deterrence investment obtained from our survey. Analogously, with regard to Scenario II, we generated two groups depending on firms’ shakeout success. Again, for both groups, we then computed firms’ optimal amount of shakeout investment and compared it to firms’ actual amount of shakeout investment.

Table 2 indicates that in both scenarios, the group of successful incumbents shows an actual amount of defense investment that is significantly closer to the optimal amount of defense investment than does the group of unsuccessful incumbents. Thus, in both scenarios, the group of successful incumbents follows the recommendations of the model more closely than the group of unsuccessful incumbents. This provides support that the model can also be used to derive normative statements.

Discussion

Research issues

This paper contributes to the marketing literature in both theoretical and methodological respects. In theoretical respects, unlike previous studies, our study does not limit its analysis to a single generic defense strategy but examines and compares multiple generic defense strategies a firm can pursue in different phases of the competitor market entry process (pre-entry vs. post-entry phase). Specifically, it advances academic understanding of defense strategies by analyzing whether and how a deterrence strategy (pursued before competitor market entry) and a shakeout strategy (pursued after competitor market entry) differ in effectiveness and efficiency. Addressing this research question has yielded a number of interesting findings.

The first interesting finding relates to communalities and differences of both strategies on their effectiveness (i.e., the proportion of defended markets u DM = u M + u RM ). Results (i.e., the two rising slopes of the proportion of monopoly markets u M ,, see Fig. 2) indicate that not only may a deterrence strategy have a significant discouraging effect on potential entrants but also a shakeout strategy (which actually focuses on squeezing competitors out of the market). This fact arises from reputational effects, as potential entrants interpret a competitor shakeout by an incumbent to be a sign of the incumbent’s strength—an interpretation that decreases entrants’ expectation of successful market entry and thus their probability of attempting market entry. With respect to effectiveness, we also find that, compared to the impact of a deterrence strategy on its primary performance indicator (i.e., the proportion of monopoly markets u M , see left side of Fig. 2), the impact of a shakeout strategy on its primary performance indicator (i.e., the proportion of regained monopoly markets u RM , see right side of Fig. 2) is considerably smaller. At first glance, this difference may lead to the erroneous conclusion that shakeout investments are only moderately effective. However, it is worth emphasizing that to a certain extent this result arises from the fact that shakeout investments also discourage competitor market entry, which reduces the proportion of oligopoly markets u O and thus of markets u RM in which a firm may actually regain its monopoly.

Another interesting finding is related to our comparison of a deterrence strategy and a shakeout strategy in terms of efficiency. Our results indicate that, in general, a shakeout strategy is more efficient than a deterrence strategy. First, we find that in order to achieve a similar proportion of defended markets, the use of a shakeout strategy seems to require a smaller amount of investment than does the use of a deterrence strategy. For example, at their respective optimum, both strategies yield a similar proportion of defended markets (u DM (S) = 0.84 and u DM (D) = 0.80). However, the optimal amount of investment is significantly smaller with a shakeout strategy than with a deterrence strategy (x S * = 0.56 and x D * = 0.79). The latter also suggests that a shakeout strategy requires less investment to tap its full potential. Second, we find that a given amount of investment tends to result in a higher proportion of defended markets using a shakeout strategy than when a deterrence strategy is used. For example, in the case of a shakeout strategy, investments of 0.25 and 0.75 yield a proportion of defended markets u DM of 0.80 and 0.86, respectively, whereas in the case of a deterrence strategy, these investments lead to only a proportion of defended markets u DM of 0.73 and 0.79, respectively.

In terms of efficiency, our study also shows that contingency factors (i.e., the length of the PLC and the probability of competitor influencing) differently influence the optimal amount of investment in the two generic defense strategies. Specifically, with respect to the length of the PLC, the optimal amount of deterrence investment rises at a decreasing rate, whereas the optimal amount of shakeout investment grows at an increasing rate (see Fig. 3). This difference can be explained by the fact that reputational effects induced by competitor shakeout last for the entire length of the PLC. Hence, their impact (and thus of shakeout investments) increases with the length of the PLC, outweighing the effect of a decreasing return on investment (q = 0.50) (predominating in the case of deterrence investments). Our study also reveals that the two strategies differ in how their optimal amount of investment is affected by the probability of successfully pursuing another generic defense strategy—a competitor influencing strategy. More precisely, we find that the optimal amount of deterrence investment decreases with the probability with which the firm manages to influence entrants to pursue less threatening goals and activities. In contrast, we find the optimal amount of shakeout investment to be high in the case of a medium to above average probability of competitor influencing and to be low in the case of both a low and a very high probability of competitor influencing (see Fig. 4).

Further, our study advances academic understanding of defense strategies by examining the conditions under which it is best to focus on either a deterrence strategy (thus acting before competitor market entry) or a shakeout strategy (thus acting after competitor market entry). Addressing this research question on the superiority of one of these strategies has led to interesting additional findings.

On a general level, we find that neither strategy is always superior to the other. Instead, important product characteristics (i.e., the length of the PLC) and market characteristics (i.e., the probability of competitor influencing) determine the superiority of one or the other of these strategies. Specifically, our study indicates that a deterrence strategy outperforms a shakeout strategy in the case of a rather long PLC and a low probability of competitor influencing. In contrast, a shakeout strategy is likely to be superior in the case of a medium to short PLC and a high to above average probability of competitor influencing. Besides providing these insights, analyzing the impact of these conditions also helps address the lack of research on the role of contingency factors in the context of defense strategies.

Our paper also contributes to the marketing literature in methodological respects. First, we are the first to use an evolutionary approach to study incumbents’ defense strategies. In contrast to traditional game theory, which allows only a single or specific number of contests to identify the optimal defense reaction against only a limited set of clearly defined competitors, this approach permits numerous contests in the presence of current and future competitors. Thus, unlike previous research, we were able to identify the defense reaction that maximizes the incumbent’s long-term survival. Second, our study introduces evolutionary game theory to the marketing discipline. To the best of our knowledge, this theory has not been used previously for analyzing marketing issues. This is surprising and unfortunate, as it is particularly suitable for modeling individual decision making. Specifically, unlike traditional game theory that rests on the unrealistic assumption of perfectly rational and thus fully informed decision makers, evolutionary game theory assumes actors to be only partly knowledgeable so that corresponding models require a significantly smaller amount of information. This benefit accounts for the fact that managers typically have only incomplete information about the subject of decision.

Limitations and avenues for future research

First, since our model and its findings are based on specific values of parameters, firms should treat our study conclusions with some caution. Specifically, several of the model parameters are not easily to measure, which may raise concerns about the validity of their empirically calibrated values. Also, these values, together with their confidence intervals (see the “Robustness tests of study findings” section), cover the most common conditions prevalent in business practice but cannot account for very specific firm, product, and market conditions. Finally, parameter values were empirically calibrated on the basis of an industrial goods sample. As our model is also applicable to a consumer goods setting, future studies could recalibrate model parameters on the basis of a corresponding sample and examine which of our findings also hold true in that setting.

Second, to reduce complexity, our model does not explicitly include several factors that may be promising avenues for future research. For example, with respect to firm characteristics, we only indirectly consider incumbent capabilities to defend against competitors (see Footnote 5). Our model also does not account for firm history and culture. Specifically, experiences with the use of a specific type of defense strategy and organizational values and norms, such as proactiveness, aggressiveness, and cautiousness, may influence (in a descriptive, but not necessarily in a normative sense) the firm’s decision for either a deterrence strategy or a shakeout strategy. Hence, future studies that, unlike our study, do not aim to derive normative implications for market defense but to explain on a descriptive basis why incumbents choose a particular strategy for market defense should certainly consider these factors. Further, when analyzing defense strategies, our study focuses on the intensity of use (i.e., amount of investment) but not on the timing of use. Finally, our model does not directly account for the number of competitors and therefore the degree of competition, but it does so indirectly by means of the probability of successful competitor shakeout (negatively affected by these factors). Further studies might explicitly include the number of competitors in the model.

Third, our study analyzes and compares two scenarios in which a firm is constrained to invest either in deterrence (Scenario I) or in shakeout (Scenario II). While this approach keeps model complexity at a reasonable level, it does not allow for explicit analysis of the combined use of both strategies. Examination of this issue would require a fundamentally different model, e.g., in terms of the objective function and the type and number of parameters used. However, it represents a fruitful avenue for future research.

Managerial implications

Our study reveals both interesting differences and some commonalities between two fundamental types of defense strategies—a deterrence strategy and a shakeout strategy. These findings offer a basis for recommendations on how to best protect a firm’s markets against current and future competitors.

First, in terms of effectiveness, our findings indicate that both strategies are viable options for market defense. Interestingly, although a shakeout strategy primarily aims at squeezing actual entrants out of the market, we find that the use of this type of defense strategy indicates that the incumbent is a fierce competitor and thus also exerts a significant discouraging effect on potential entrants. In addition, contrary to the consequences of a deterrence strategy, such reputational effects develop their impact on a rather broad number of potential entrants and thus provide a “high broadcast value” (Henrich and Henrich 2006, p. 238). Hence, managers should take into account that this positive side effect of a shakeout strategy can, to some extent, replace or complement the discouraging effect on potential entrants of a deterrence strategy. Nevertheless, they should also be aware that to prevent competitor market entry, a shakeout strategy can only complement, but not substitute for, a deterrence strategy.

Second, in terms of efficiency, our findings show that a shakeout strategy is more efficient than a deterrence strategy. When deciding on the appropriate type of defense strategy, managers need to consider that a shakeout strategy tends to require a smaller amount of investment to achieve a similar market defense success and that a given amount of investment is likely to result in a larger market defense success with a shakeout strategy than with a deterrence strategy. Also, a shakeout strategy seems to require a smaller amount to tap the full potential of the strategy. Besides reputational effects, the higher efficiency of a shakeout strategy can also be attributed in part to its greater accuracy of use, as it is mostly targeted at specific actual competitors rather than at all actual and possible competitors, as in the case of a deterrence strategy. Moreover, managers should also be aware that compared to a deterrence strategy, a shakeout strategy is usually more easily read by and is more credible to competitors (Robertson et al. 1995).

However, despite the benefits of a shakeout strategy, managers must also pay attention to a potential rise in competitors’ exit barriers after having entered the market, which may increase the costs of this strategy (Porter 1985). Also, our findings related to the benefits of a shakeout strategy must not lead to the conclusion that firms should pursue only a shakeout strategy. Instead, firms are well advised to pursue, to some extent, both generic defense strategies. Our findings do suggest, however, that managers may put a somewhat stronger focus on shakeout in light of prevalent resource constraints. Yet there are also situations in which more emphasis should be placed on deterrence (see below).Footnote 11

Based on our findings, we strongly advise managers to consider product and market characteristics (i.e., the length of the PLC and the probability of competitor influence) when deciding on the amount and type of defense investment. In terms of the amount of defense investment, as length of the PLC increases, a firm should devote more resources to defending its markets against competition. This finding holds true for both a deterrence strategy and a shakeout strategy. In terms of the type of defense investment, our study provides some evidence that with a relatively short PLC, managers may be better off investing in a shakeout strategy to squeeze entrants out of the market in order to skim the limited amount of future profits. In contrast, with a relatively long PLC, they may be better advised to follow a deterrence strategy by building barriers to entry to secure long-term future profits.

With respect to the probability of competitor influencing, managers applying a deterrence strategy may be well advised to invest a considerably larger amount if the firm is not likely to provoke entrants to pursue less threatening goals and activities after market entry. In contrast, managers applying a shakeout strategy may invest heavily in the case of a medium to above average probability of competitor influencing. Instead, they are well advised to forgo large investments in shakeout if the entrant is very likely be influenced (and thus poses no serious threat to the incumbent in the future), or may hardly be influenced at all (and thus soon undermines the incumbent’s position, which forces the incumbent to, sooner or later, exit the market). This advice is in line with Porter’s advice that if “a firm’s position is not ultimately sustainable …, the best defensive strategy is to ‘take the money and run.’ This means that the firm generates as much cash as possible, knowing that [competitor] entry … will ultimately erode its position” (1985, p. 512). In terms of the type of defense investment, our study shows that with a low probability of influencing entrants to pursue less threatening goals and activities, managers may be well advised to follow a deterrence strategy, whereas with a high corresponding probability, they may be better off pursuing a shakeout strategy. In other words, the less likely the firm is to successfully compete against entrants in an oligopoly market, the more appropriate is a deterrence strategy in comparison to a shakeout strategy.

Finally, empirical validation shows that our model can provide useful recommendations to managers and thus may serve as the basis for a decision support system. Similar to our calibration procedure, managers could enter into the system assessments about both their firm and their firm’s competitors and products, and in turn derive specific guidelines for optimal defense reactions (see Fig. 1). This approach would enhance the speed and quality of corresponding decision making and lead to improved market defense activities.

Notes

The need to focus on one of these strategies mainly arises due to established firms’ resource constraints. However, theoretically, these strategies could also be used consecutively and thus are not entirely mutually exclusive.

This assumption is a reasonable premise, because in this case, the incumbent lacks sufficient strength to withstand competitive forces and thus to ensure its survival in the long run (Gatignon et al. 1997; Porter 1985). For such a situation, research in economics and industrial organization (Agrarwal and Gort 1996), in organization theory (Madsen and Walker 2007), as well as in marketing and strategic management (Aaker 1988; Karakaya 2000) predicts or recommends an established firm’s market exit in the long run.

In the long run (i.e., when considering multiple periods), the probability that the product still exists after n periods is described by the probability distribution of the number n of Bernoulli trials (with (1 – P) as “success” probability). The convolution of n independent Bernoulli trials is given by the geometric distribution, which reflects the probability distribution of the number b of Bernoulli trials required to get one “success” (in our study: the end of the PLC). Overall, the expected value of a geometrically distributed variable b (in our study: the expected length of the PLC) is 1 divided by the corresponding ‘success’ probability (1 – P) (for mathematical details, see Freedman et al. 1998).

It is worth mentioning that unlike “monopoly markets” (markets without competitors), our study’s notion of “oligopoly markets” refers to markets with competitors. As this distinction does not account for the specific number of competitors, our use of “oligopoly markets” somewhat differs from the common understanding of this term as markets with only few competitors.

These probabilities also account for differences in firm-level capabilities between the incumbent and (current and future) competitors (Ramaswami et al. 2009). Specifically, higher levels of incumbent capabilities are associated with a lower probability of failed competitor deterrence η and a higher probability of successful competitor shakeout ρ and of successful competitor influencing σ (Jayachandran and Varadarajan 2006) Analogous, higher levels of competitor capabilities go along with a higher probability of failed competitor deterrence η and a lower probability of successful competitor shakeout ρ and of successful competitor influencing σ.

This approach is similar to approaches of a significant number of studies in the fields of population ecology and population genetics (e.g., Caswell 2001; Cushing et al. 1996; Ginzburg 1986; Henson 1998; Parayre and Hurry 2001; van Boven and Weissing 2004), analyzing the conditions under which organisms emerge, grow, and die. In the context of incumbents’ defense strategies, the long-term growth rate of a firm’s total number of markets λ is a suitable parameter for identifying the optimal amount of investment (which maximizes the probability of long-term survival), as it is a good indicator for the firm’s ability to defend its markets against current and future competitors (i.e., for the firm’s environmental fitness). Also, this rate is closely and inherently associated with a firm’s long-term survival (i.e., the higher the long-term growth rate, the more likely is a firm to survive in the long run). In this context, it needs to be mentioned that in our model, by means of the normalization factor ζ, the long-term growth rate λ equals 1 (in case of the optimal amount of investment) and is otherwise less than 1 (in case of a suboptimal amount of investment) (for details, see Appendix A). Hence, the optimal amount of investment enables the firm to defend its markets against current and future competitors, thus preventing the firm’s number of markets from decreasing in the long run and thus securing long-term survival. By contrast, in case of a suboptimal amount of investment, the firm is not able to defend its markets against current and future competitors, which results in a reduction of the firm’s number of markets in the long run and thus in a serious threat to long-term survival.

Although we believed that collecting data from one carefully selected key informant per firm would be sufficient, we performed a test for possible informant bias. For this purpose, we asked each respondent to name another executive within their firm who is also strongly involved in market defense activities. 213 managers agreed to provide the requested information. Subsequently, we contacted the potential secondary informants by telephone and asked them to participate in an interview (to complete a shortened version of the questionnaire). This resulted in a total of 115 responses of secondary informants. After discarding 11 questionnaires of inappropriate respondents (Kumar et al. 1993), we compared the responses of the primary and secondary informant of each firm on a subset of 11 items of our original questionnaire. Inter-informant correlations range between 0.62 and 0.74 and are all highly significant (p < 0.01). This result provides further confidence in using the primary responses and that respondents had a similar interpretation of the key terms in mind when answering the questionnaire.

To validate our model’s appropriateness for providing managerial recommendations, we asked managers in our survey to rate their firm’s actual amount of investment in different generic defense strategies and their firm’s respective market defense success. As responses on both amount of investment and success were obtained from the same source (the same manager), these responses may be subject to common-method variance. Although this issue affects only our empirical validation of model appropriateness, not our empirical calibration of model parameters and resulting findings with respect to our research questions, we nevertheless performed a corresponding test. For this purpose, we again performed the empirical validation procedure, this time also drawing on the responses of the secondary informant. Specifically, in a first step, we carried out the procedure using the responses on amount of investment of the secondary informant and the responses on success of the primary informant. In a second step, we carried out the procedure using the responses on amount of investment of the primary informant and the responses on success of the second informant. In both cases, the findings closely parallel the findings reported in Table 2, indicating that common-method bias is not a notable problem in our study.