Abstract

Game-theoretic analyses of distribution channels have generated six widely held beliefs (we call them Channel Hypotheses) whose universal soundness has not been examined. To assess the validity of these Hypotheses, we develop a general, linear-demand model in which distributors face heterogeneity in demand, heterogeneity in costs, and any degree of intensity of inter-distributor competition. For ease of comparison, we nest the bilateral-monopoly model and the identical-distributors model within our general model. Our analysis reveals that the Channel Hypotheses do not generalize beyond the specific game-theoretic models from which they were derived. This lack of generality is critical, because these beliefs have led to intuitively appealing (but inadvertently misleading) strategic advice for managers and modeling advice for game theorists. From our general, linear-demand model, we derive six Channel Propositions that correct these accumulated errors of conceptualization and that generate a richer, more broadly applicable set of managerial and modeling implications. We also present a Channel-Modeling Proposition that we believe will help modelers avoid the errors of conceptualization described in this paper.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Game-theoretic analyses have been applied to distribution channels for more than twenty years,Footnote 1 largely because the rigorous abstractness of mathematical logic has given game theory the potential to provide insights that transcend the temporal, locational, and industrial limitations that are inherent in empirical studies of distribution. We stress “potential” because mathematical logic is certainly not immune to errors of conceptualization (i.e., how a question is modeled). When conceptual errors occur, they can dramatically shape the nature of knowledge gained from a model and the way in which new models are framed.

Although properly conceptualized mathematical models do allow generalizations, careful analysis reveals that much of the received wisdom in the analytical channels literature does not generalize beyond the specific game-theoretic models from which the insights were derived. In this paper we assess a set of widely held beliefs that are valid within specific contexts, but whose validity does not extend to more general contexts. This lack of generality is critical because these beliefs have led to intuitively appealing (but inadvertently misleading) strategic advice for managers and modeling advice for game theorists. We will demonstrate that these widely held but erroneous beliefs are the consequence of accumulated errors of conceptualization in game-theoretic models of distribution channels. We will also show that a properly conceptualized analytical model generates a richer, more broadly applicable set of managerial and modeling implications.

A careful assessment of the analytical channels literature reveals that game-theoreticians hold six basic beliefs that we term Channel Hypotheses:

-

1.

Dyadic-Coordination Hypothesis: Both members of a decentralized channel dyad prefer a wholesale price that leads to the maximization of total dyadic profits.

-

2.

Double-Marginalization Hypothesis: Dyadic coordination cannot be achieved when both members of a channel dyad set positive per-unit margins.

-

3.

Fixed-Cost Hypothesis: Fixed distribution costs do not affect Channel Performance.

-

4.

Channel-Breadth Hypothesis: The number of distributors in a decentralized channel does not affect the manufacturer-optimal wholesale-price strategy.

-

5.

Channel-Participation Hypothesis: Every distribution outlet in a vertically integrated system would voluntarily participate in a decentralized, coordinated channel.

-

6.

The Competitive-Substitutability Hypothesis: The cross-price parameter of a linear-demand curve measures the change in the degree of competition between distributors.

The first Channel Hypothesis asserts that both members of a channel dyadFootnote 2 can earn more than they could in the absence of profit maximization. This Hypothesis, which was developed in the context of a bilateral-monopoly model by Jeuland and Shugan (1983),Footnote 3 reflects the Pareto-optimality principle that a larger pie can be divided to benefit everyone. Marketing scientists use the term coordinated to denote a channel that maximizes its total profit.

The second Channel Hypothesis states that dyadic coordination requires that one channel member have a zero margin. It is well known that the manufacturer can coordinate a bilateral-monopoly channel by setting the wholesale price equal to its marginal production cost (Jeuland & Shugan, 1983; Moorthy, 1987). Thus, marketing scientists say that double marginalization (positive per-unit margins by both dyadic members) precludes coordination.Footnote 4 The third Hypothesis, which is also derived from the bilateral-monopoly model, is that fixed distribution costs do not affect the manufacturer-optimal wholesale price, so they have no impact on Channel Performance (distributors’ prices and quantities, channel profit, and the distribution of net revenue between manufacturer and distributors). We show the third Hypothesis’ origin in “Origins of the channel hypotheses.”

According to the fourth Hypothesis, a manufacturer’s optimal wholesale-price strategy is independent of the number of distributors. The fifth Hypothesis states that outlets that participate in a vertically-integrated system would participate in a decentralized, coordinated channel. We show in “Origins of the channel hypotheses” that these Hypotheses originated in a model of N identical, non-competing distributors.Footnote 5 The sixth Channel Hypothesis defines how to measure a change in competition; it was developed in an identical-competitors model (McGuire & Staelin, 1983, 1986).

The first and fifth Hypotheses are linked. The Dyadic-Coordination Hypothesis says that, in a decentralized dyad, every channel member prefers a wholesale price that induces the distributor to set the same retail price as would be set if the dyad were vertically integrated. The Channel-Participation Hypothesis states that the same distributors participate in a coordinated, decentralized channel as take part in a vertically integrated system. In combination, these Hypotheses define what marketing scientists refer to as a Coordinated Channel: a channel that makes the same profit that would be earned by a vertically integrated system because it contains the same distribution outlets and because these outlets behave in the same way.Footnote 6 When demand is linear, there is a unique price/quantity combination associated with channel coordination.Footnote 7

We distinguish between Channel Profit, Channel Performance, and Channel Coordination. In addition to channel profit, channel performance includes the prices charged, the units sold, and the share of channel revenue earned by each distributor that participates in the channel. Moreover, channel performance is distinct from channel coordination. Regardless of whether a decentralized channel is coordinated, it has a level of channel performance.

The six Channel Hypotheses have managerial and modeling implications. Managerially, the channel leader (for ease of exposition, the manufacturer) (a) should coordinate each dyad; this enables all channel participants to be made better off. To achieve this end, the manufacturer (b) should sell at marginal cost (and use a multi-part tariff to obtain its share of dyadic profit). Channel Performance (c) should be unaffected by fixed costs. Channel breadth (d) should not influence the manufacturer’s wholesale-price policy. Channel participation (e) should not be affected by the channel’s legal form of organization (vertically integrated or decentralized), provided organizational structure does not affect demands or costs. The effect of a change in inter-distributor competition (f) should be assessed by a partial derivative of the demand curve.

From a modeling perspective, these Channel Hypotheses suggest that game-theorists can ignore fixed costs, assume a wholesale-price strategy that is channel coordinating, assume a constant channel breadth, and assume that the demand curve contains all the information that is necessary to assess the effect of changes in the degree of competition. The derivation of these Channel Hypotheses raises two additional implications that we state as Modeling Hypotheses:

-

7.

Bilateral-Monopoly Modeling Hypothesis: A bilateral-monopoly model depicts the Channel Performance of more complex channel models.

-

8.

Identical-Distributors Modeling Hypothesis: An identical-distributors model depicts the Channel Performance of a heterogeneous-distributors model.

We believe these eight intuitively appealing Hypotheses accurately reflect beliefs that are widely held by game-theoretic modelers of distribution channels. We will demonstrate that some of these Hypotheses are accurate only under well-defined channel structures; others are valid only for specific parametric values, and one is unintentionally misleading.

We make four major contributions to the literature. First, we provide an introduction to game-theoretic analysis of distribution that is (relatively) user-friendly for non-mathematicians; to this end we do not use formal mathematical proofs but provide examples to convey our key points.Footnote 8 Second, our examples show the origins of the Channel Hypotheses. Third, our vignettes illustrate the limited validity of these Hypotheses. Fourth, we present Channel Propositions that strictly define the conditions under which each Channel Hypothesis is valid.

This paper proceeds in the following steps. In “Assumptions and nested models” we explicate a general linear-demand model that is original to this paper and that encompasses all linear-demand systems, with or without competition. All our analyses flow from this model. In “Origins of the channel hypotheses” we trace the origins of the first five Channel Hypotheses to two models: the bilateral-monopoly model and a model of identical, non-competing distributors. In “The heterogeneous-distributors model” we develop a general model of heterogeneous demand and costs that contains as special cases models of heterogeneous competitors, identical competitors, heterogeneous non-competitors, identical non-competitors, and bilateral monopoly. We use our general model to solve for the Channel Performance of a vertically integrated system as well as the Channel Performance of a decentralized channel when it is coordinated and when it is uncoordinated. In “The channel hypotheses when distributors are heterogeneous” we demonstrate that the first five Channel Hypotheses are valid in specific contexts, but that they do not apply in a general, linear-demand model; we detail specific limits to their validity in five Channel Propositions. In “Competitive substitutability” we describe the Competitive-Substitutability Hypothesis and show that it leads to intuitively unappealing deductions for any linear-demand curve. We then introduce a competitive-substitutability measure that has desirable properties. In “Discussion and conclusion” we summarize our findings, we elaborate on the bases of the two Channel-Modeling Hypotheses, and we develop a single Channel-Modeling Proposition to rectify the weaknesses inherent in these Hypotheses. We also discuss implications for future research. In a Technical Appendix, we derive our general, linear-demand curve from the utility function of a representative consumer. We also report the Channel Performance formulae for any number of distributors, over any degree of competition.

Assumptions and nested models

In this Section we summarize our assumptions and define a general, linear-demand system that nests any degree of inter-distributor competition; hence, it incorporates much of the extant literature as special cases. Our assumptions reflect the need to balance the twin goals of representativeness and tractability. The challenge is to identify those dimensions of reality that can be simplified (to ensure tractability) without changing a theory’s implications. In subsequent Sections we will show that over-simplification (ignoring key dimensions of reality) lies at the heart of the errors of conceptualization that limit the validity of the Channel Hypotheses.

Assumptions

We begin a discussion of our model with seven substantive assumptions:

-

1.

We assume that a manufacturer sells through at least one distributor.

-

2.

We assume that the manufacturer determines its own channel breadth.

-

3.

We assume that the manufacturer treats its distributors comparably; that is, it offers all of them the same wholesale-price terms. The alternative, separate deals with each distributor, is problematic because (1) the Robinson–Patman ActFootnote 9 requires comparable treatment of competing distributors (Moorthy, 1987); and (2) administrative, bargaining, and contract-development costs make separate deals for each distributor prohibitively expensive Lafontaine (1990; see also Battacharyya & Lafontaine, 1995).Footnote 10

-

4.

For three interrelated reasons, we assume that the manufacturer acts as a Stackelberg leader relative to its decentralized distributors. (A Stackelberg leader knows how its follower will react to its actions; for example, in a two-stage game, the manufacturer selects its wholesale price with knowledge of the distributors’ “reaction functions” that define what retail price they will set and how much they will purchase from the manufacturer in the second stage of the game, given the wholesale price that they pay.) Our interrelated reasons are:

-

(1)

Bargaining between channel members is necessary to achieve coordination in a Nash game (Jeuland & Shugan, 1983). (In a Nash game, the manufacturer and its distributors simultaneously set their wholesale and retail prices; there is no leader and no followers.)

-

(2)

In a multiple-distributor channel, bargaining implies separate deals between the manufacturer and each distributor.

-

(3)

A vertical Nash game is incompatible with comparable treatment (Assumption 3) while a vertical Stackelberg game is consistent with this principle.Footnote 11

-

(1)

-

5.

We assume that there are constant, non-negative variable costs of production (C) for the manufacturer and distribution (c k ) for the kth distributor (k ∈ (1,2,...N)).

-

6.

We assume that there are non-negative fixed costs of production (F) and distribution (f k ).

-

7.

We assume that each channel member maximizes its own profit.

Assumptions 5 and 6 allow each distributor to confront different cost conditions; this is sufficient to generate heterogeneity between distributors. At any time in our analysis we may equalize demand and costs across distributors. When demands and costs are equal, identical distributors are embedded in our heterogeneous-distributors model. Because we allow the possibility of a single distributor, the bilateral-monopoly model is also embedded in our model.

For tractability, we make three mathematical assumptions:

-

8.

We assume that the manufacturer sells a single product. This simplifying assumption is sufficient to establish the Channel Hypotheses and their limits. (We know of no Channel Hypotheses that pivot on the number of products; however, modeling multiple products might permit the identification of additional widely held beliefs that are only valid under the assumption of a single product. We return to this topic in “Discussion and conclusion.”)

-

9.

We assume that each channel member has full information on demand and costs (that is, parameters and functional forms are known with certainty).Footnote 12

-

10.

We assume that each distributor faces a downward-sloping, linear-demand curve:

$$ Q_{k} \equiv A_{k} - bp_{k} + \theta {\sum\limits_{^{{m = 1}}_{{m \ne k}} }^N {p_{m} .} } $$(1)In the Technical Appendix we derive this demand curve from the utility function of a representative consumer. For the special case of bilateral monopoly, we set N = 1 and θ = 0. Demand heterogeneity is modeled as A i ≠ A j , i, j∈(1,N), so distributors are heterogeneous even if they face identical costs (Betancourt, 2004).Footnote 13

To determine an optimal channel breadth requires demand curves that are logically consistent with changes in the number of distributors. We start with Eq. 1 and determine the price that sets the sales of one distributor (say the Nth) to zero. Using this information reveals that, when there are (N−1) distributors, demand for the kth distributor is:

$$ \left. {Q_{k} } \right|_{{N - 1}} = {{\left[ {{\left( {bA_{k} + \theta A_{N} } \right)} - {\left( {b^{2} - \theta ^{2} } \right)}p_{k} + \theta {\left( {b + \theta } \right)}{\sum\limits_{^{{m = 1}}_{{m \ne k}} }^{N - 1} {p_{m} } }} \right]}} \mathord{\left/ {\vphantom {{{\left[ {{\left( {bA_{k} + \theta A_{N} } \right)} - {\left( {b^{2} - \theta ^{2} } \right)}p_{k} + \theta {\left( {b + \theta } \right)}{\sum\limits_{^{{m = 1}}_{{m \ne k}} }^{N - 1} {p_{m} } }} \right]}} b}} \right. \kern-\nulldelimiterspace} b $$(2)A more common presentation of this equation is

$$ \left. {Q_{k} } \right|_{{N - 1}} = \alpha _{k} - \beta p_{k} + \gamma {\sum\limits_{^{{m = 1}}_{{m \ne k}} }^{N - 1} {p_{m} } } $$(3)where \(\alpha _{k} \equiv {{\left( {bA_{k} + \theta A_{N} } \right)}} \mathord{\left/ {\vphantom {{{\left( {bA_{k} + \theta A_{N} } \right)}} b}} \right. \kern-\nulldelimiterspace} b,\quad \beta \equiv {{\left( {b^{2} - \theta ^{2} } \right)}} \mathord{\left/ {\vphantom {{{\left( {b^{2} - \theta ^{2} } \right)}} {b,\quad {\text{and}}\quad \gamma \equiv \theta {{\left( {b + \theta } \right)}} \mathord{\left/ {\vphantom {{{\left( {b + \theta } \right)}} b}} \right. \kern-\nulldelimiterspace} b}}} \right. \kern-\nulldelimiterspace} {b,\quad {\text{and}}\quad \gamma \equiv \theta {{\left( {b + \theta } \right)}} \mathord{\left/ {\vphantom {{{\left( {b + \theta } \right)}} b}} \right. \kern-\nulldelimiterspace} b}\). Demand curve (3) is only valid when \( p_{N} \geqslant {{\left( {A_{N} + \theta {\sum\limits_{m = 1}^{N - 1} {p_{m} } }} \right)}} \mathord{\left/ {\vphantom {{{\left( {A_{N} + \theta {\sum\limits_{m = 1}^{N - 1} {p_{m} } }} \right)}} b}} \right. \kern-\nulldelimiterspace} b \) because Q N = 0 at these p N -values.

Nested models

Our assumptions generate a set of nested, mathematically tractable models that enable us to generalize the results obtained by previous researchers. Due to the intricacy of competitive models, we now concentrate on a two-competitor model (the ith and jth). Our nested models are:

-

Distribution with Competition. Demand for the kth distributor is given by Eq. 1. Our linear-demand system with heterogeneous-competitors is:Footnote 14

$$ Q{\kern 1pt} _{i} = A_{i} - bp_{i} + \theta p_{j} \;{\text{and}}\;Q_{j} = A_{j} - bp_{j} + \theta p_{i} $$(4)Inequality of A i and A j is sufficient for heterogeneity; we increase the generalizability of our results by also allowing retail costs to differ. The restrictive case of identical competitors requires A i = A j ≡A as well as equal costs. Our identical-demand system is:

$$ Q_{i} = A - bp_{i} + \theta p_{j} \;{\text{and}}\;Q_{j} = A - bp_{j} + \theta p_{i} $$(5)To analyze channel breadth (one competitor or two?) requires a logically consistent demand curve. We start with Eq. 4 to determine the price that sets the sales of the jth competitor to zero. This price yields the following demand curve for the ith retailer:Footnote 15

$$ Q^{{{\text{One}}}}_{i} \begin{array}{*{20}l} {{ = {{\left[ {{\left( {bA_{i} + \theta A_{j} } \right)} - {\left( {b^{2} - \theta ^{2} } \right)}p_{i} } \right]}} \mathord{\left/ {\vphantom {{{\left[ {{\left( {bA_{i} + \theta A_{j} } \right)} - {\left( {b^{2} - \theta ^{2} } \right)}p_{i} } \right]}} {b \equiv \alpha _{i} - \beta p_{1} }}} \right. \kern-\nulldelimiterspace} {b \equiv \alpha _{i} - \beta p_{1} }} \hfill} \\ {{\forall p_{j} \geqslant {{\left( {A_{j} + \theta p_{i} } \right)}} \mathord{\left/ {\vphantom {{{\left( {A_{j} + \theta p_{i} } \right)}} {b \Rightarrow Q_{j} = 0}}} \right. \kern-\nulldelimiterspace} {b \Rightarrow Q_{j} = 0}} \hfill} \\ \end{array} $$(6)where \( \alpha _{i} \equiv {{\left( {bA_{i} + \theta A_{j} } \right)}} \mathord{\left/ {\vphantom {{{\left( {bA_{i} + \theta A_{j} } \right)}} b}} \right. \kern-\nulldelimiterspace} b\quad {\text{and}}\quad \beta \equiv {{\left( {b^{2} - \theta ^{2} } \right)}} \mathord{\left/ {\vphantom {{{\left( {b^{2} - \theta ^{2} } \right)}} b}} \right. \kern-\nulldelimiterspace} b \). Equation 6 is only valid when the jth competitor is priced out of the market.Footnote 16

Expanding distribution (i.e., moving from one distributor to two distributors) has an impact on aggregate quantity that is easy to measure (i.e., it changes from \( Q^{{{\text{One}}}}_{i} \) to (Q i + Q j )):

$$ {\left\{ {{\left( {Q_{i} + Q_{j} } \right)} - Q^{{{\text{One}}}}_{i} } \right\}} = {\left[ {1 - {\left( {\theta \mathord{\left/ {\vphantom {\theta b}} \right. \kern-\nulldelimiterspace} b} \right)}} \right]}Q_{j} > 0 $$(7)It is also easy to calculate the effect on the initial competitor’s demand:

$$ {\left\{ {Q_{i} - Q^{{{\text{One}}}}_{i} } \right\}} = - {\left[ {\theta \mathord{\left/ {\vphantom {\theta b}} \right. \kern-\nulldelimiterspace} b} \right]}Q_{j} < 0 $$(8)A second distributor increases aggregate demand (7) while diminishing the first distributor’s demand (8). As competitors become more interchangeable in the eyes of consumers, the cannibalization effect (θ/b) increases. In the limit, as θ→b, aggregate demand becomes unaffected by channel breadth because demand for one competitor is perfectly displaced by demand for the other. In the antipodal case of θ→0, the addition of the second competitor expands channel sales without having an impact on the sales of the first competitor.

-

Distribution without Competition. Demand for the kth (non-competing) distributor can be derived from Eq. 2 by setting θ = 0:

$$ q_{k} = A_{k} - bp_{k} ;\quad k \in {\left( {1,N} \right)} $$(9)Equation 9 is the general, linear-demand formulation without competition. An even more restrictive model is identical demand (A k ≡ A) and equal costs (c k ≡ c and f k ≡ f ∀k). In the most restrictive case (bilateral monopoly), there is one demand equation:

$$ q_{1} = A_{1} - bp_{1} $$(10)For distribution with (without) competition, we write quantity demanded with a large Q (small q) and we refer to distributors as competitors (retailers).

Origins of the channel hypotheses

In this Section we explore models of distribution channels without competition. We start with the bilateral-monopoly model, using it to explain the origins of the widely held beliefs that (a) coordination is beneficial for channel members, (b) double marginalization is incompatible with coordination, and (c) fixed costs are (almost) irrelevant. We then introduce an identical-retailers model and use it to demonstrate the origin of the beliefs that (d) channel breadth does not affect the manufacturer’s wholesale-price strategy and (e) channel participation is unaffected by the legal form of channel organization. Careful consideration of these Channel Hypotheses leads to two Modeling Hypotheses on how game-theorists tend to model distribution channels.

Bilateral monopoly

In this subsection we use linear-demand curve (10) to derive the Channel Performance of the vertically integrated and decentralized, Stackelberg-leadership channel structures. We also describe the wholesale-price policy that induces coordination in the decentralized channel.

Bilateral monopoly: a vertically integrated system

A vertically integrated system (VIS) maximizes system profit.Footnote 17 It is straightforward to show that its optimal quantity is precisely one-half what it would be with marginal-cost pricing (\( q^{*}_{{_{1} }} = {{\left\{ {A_{1} - b{\left( {c_{1} + C} \right)}} \right\}}} \mathord{\left/ {\vphantom {{{\left\{ {A_{1} - b{\left( {c_{1} + C} \right)}} \right\}}} 2}} \right. \kern-\nulldelimiterspace} 2 \)). The optimal channel margin is \( \mu ^{ * }_{1} = {q^{ * }_{1} } \mathord{\left/ {\vphantom {{q^{ * }_{1} } b}} \right. \kern-\nulldelimiterspace} b \) and total system profit is:

\( R^{ * }_{1} \) denotes net revenue (total revenue minus total variable cost). A bilateral-monopoly channel with price as the sole element of the marketing mix cannot earn more than \( \Pi ^{ * }_{1} \).

To illustrate a bilateral-monopoly model that is organized as a VIS, we use the parametric values A 1 = 100 and b = 1. We equalize per-unit costs at c 1 = $10 = C and set fixed costs at the retail and manufacturer levels to f 1 = $100 and F = $500. These values lead to an optimal channel price (\( p^{ * }_{1} = \$ 60 \)), quantity (\( q^{ * }_{1} = 40 \)), margin (\( \mu ^{ * }_{1} = \$ 40 \)), net revenue (\( R^{ * }_{1} = \$ 1,600 \)), and profit (\( \Pi ^{ * }_{1} = \$ 1,000 \)). These results (\( p^{ * }_{1} ,q^{ * }_{1} ,\mu ^{ * }_{1} ,R^{ * }_{1} ,\Pi ^{ * }_{1} \)) are a benchmark for assessing the Channel Performance of non-VIS channels. A decentralized channel that generates VIS-Profit is said to be coordinated. A decentralized channel that does not replicate VIS-Profit is said to be uncoordinated.

Bilateral monopoly: an uncoordinated, decentralized channel

A Stackelberg leader maximizes its profit by selecting a wholesale price (W 1), subject to its follower’s quantity-reaction function. The manufacturer and retailer maximands are:

In Eq. 12, M 1 (m 1) is the manufacturer’s (retailer’s) per-unit margin.Footnote 18 In the game’s first stage the manufacturer sets a per-unit wholesale price (W 1); in the second stage the retailer selects its optimal price (p 1).Footnote 19 It is easy to prove that the manufacturer’s optimal margin is \( \widehat{M}_{1} = \mu ^{ * }_{1} \) while the distributor’s optimal margin is \( \widehat{m}_{1} = {\mu ^{ * }_{1} } \mathord{\left/ {\vphantom {{\mu ^{ * }_{1} } 2}} \right. \kern-\nulldelimiterspace} 2 \) (a caret “^” denotes a Stackelberg variable). Because the resulting channel margin is greater than in VIS (\( \widehat{\mu }_{1} = {3\mu ^{ * }_{1} } \mathord{\left/ {\vphantom {{3\mu ^{ * }_{1} } 2}} \right. \kern-\nulldelimiterspace} 2 \)), unit sales are lower (\( \widehat{q}_{1} = {q^{ * }_{1} } \mathord{\left/ {\vphantom {{q^{ * }_{1} } 2}} \right. \kern-\nulldelimiterspace} 2 \)) as is net revenue (\(fs \widehat{R}_{1} = {3R^{ * }_{1} } \mathord{\left/ {\vphantom {{3R^{ * }_{1} } 4}} \right. \kern-\nulldelimiterspace} 4 \)). This revenue shortfall occurs because both channel members have positive margins; that is, there is double marginalization.

To illustrate, we use the same parametric values featured in the VIS example to obtain quantity (\( \widehat{q}_{1} = 20 \)), price (\( \widehat{p}_{1} = \$ 80 \)), distributor margin (\( \widehat{m}_{1} = \$ 20 \)), manufacturer margin (\( \widehat{M}_{1} = \$ 40 \)), channel margin (\( \widehat{\mu }_{1} = \$ 60 \)), channel net revenue (\( \widehat{R}_{1} = \$ 1,200 \)), manufacturer profit (\( \widehat{\Pi }_{1} = \$ 300 \)), retailer profit (\( \widehat{\pi }_{1} = \$ 300 \)), and channel profit (\( \widehat{\Pi }_{{C1}} = \$ 600 \)).

Bilateral monopoly: a coordinated, decentralized channel

A Stackelberg follower sets its price equal to the VIS-price only if the wholesale price meets the coordinating marginal-cost condition: the follower’s full marginal cost (W 1 + c 1) must equal the channel’s marginal cost (C + c 1); that is, the manufacturer must set a wholesale price that yields a zero margin (W 1 = C).Footnote 20 Coordination is achievable with a quantity-discount schedule (Jeuland & Shugan, 1983) or a two-part tariff Footnote 21 (Moorthy, 1987); for simplicity of presentation, we focus on a two-part tariff: \( {W_{1} + \phi _{1} } \mathord{\left/ {\vphantom {{W_{1} + \phi _{1} } {Q_{1} }}} \right. } {Q_{1} } \). Since W 1 = C generates no income for the manufacturer, it must rely on a fixed fee (ϕ 1) paid by the retailer. The channel-coordinating two-part tariff \( {\left( {{C + \phi _{1} } \mathord{\left/ {\vphantom {{C + \phi _{1} } {Q_{1} }}} \right. } {Q_{1} }} \right)} \) yields the following profits for manufacturer and retailer:

Summing these profits shows that the channel is coordinated: \( {\left( {\widehat{\Pi }^{ * }_{1} + \widehat{\pi }^{ * }_{1} } \right)} = R^{{VI^{ * } }}_{1} - f_{1} - F = \Pi ^{{VI^{ * } }}_{1} \).

It is worthwhile to discuss briefly the concept of a two-part tariff. It is well-known that manufacturers sometimes pay a fixed fee to retailers; one example is a slotting allowance. Customers also pay two-part tariffs in some situations; an example is a health club membership: monthly dues are a fixed fee that is independent of usage, while a per-unit (an hourly) fee may be charged to use a tennis court. Two-part tariffs are also common in franchising, with an initial fixed fee as well as an ongoing per-unit or percentage fee. Less well-known is that some 6–7% of franchisors require a weekly or monthly fixed payment (Lafontaine, 1992; Lafontaine & Shaw 1999). It is also true that a quantity-discount schedule can be expressed as a two-part tariff (Ingene & Parry, 2004). A two-part tariff is mathematically more tractable than a quantity-discount schedule, yet it leads to similar results. For these reasons, we assume that the manufacturer utilizes a two-part tariff wholesale-price policy.

Equation 13 leads to the first Channel Hypothesis.

-

Dyadic-Coordination Hypothesis: Both members of a decentralized channel prefer a wholesale price that leads to the maximization of total dyadic profits.

In our ongoing illustration, the coordinated channel is $400 better off than is the uncoordinated channel. The fixed fee (\( \widehat{{\phi _{1} }} \)) may take on any value compatible with both channel members being at least as well off as they would be in the absence of coordination; here \( 0 \leqslant \widehat{\phi }_{1} \leqslant \$ 400 \).

The coordination requirement W 1 = C illustrates the Double-Marginalization Hypothesis.

-

Double-Marginalization Hypothesis: Channel coordination cannot be achieved when both members of a channel dyad set positive per-unit margins.

Both these Hypotheses are deduced from the analysis of a bilateral-monopoly model that dates back to Edgeworth (1897) and that was reintroduced by Spengler (1950).

Equation 13 also leads to a widely held belief on the irrelevance of fixed costs.

-

Fixed-Cost Hypothesis: Fixed distribution costs do not affect Channel Performance.

This Hypothesis holds in a bilateral-monopoly model because the sole retailer’s fixed costs do not enter the first-order conditions; therefore they do not affect the wholesale price (\( \widehat{W}^{ * } = C \) no matter the value of f 1) nor do they affect Channel Performance (if W is unaffected, the retail price remains the same, as does quantity and net revenue earned).Footnote 22 It is the generalized inference (fixed costs never affect the wholesale price) that we have stated as a Channel Hypothesis. However, fixed costs do affect each channel member’s participation constraint (a refusal to participate in the channel at a loss). In terms of our illustration, a coordinated channel will not exist for any combination of \( {\left( {F + f} \right)} > \$ 1,600 \), nor will an uncoordinated channel exist for \( {\left( {F + f} \right)} > \$ 1,200 \).

Identical retailers

Identical, non-competing retailers are firms that operate with the same business format, face the same demand and costs, and have exclusive territories. Outlets in a franchised system obviously have the same business format; and in many cases, they have exclusive territories. Whether firms in different locations can have the same costs and demand seems problematic.

In a model of N identical, non-competing retailers, we obtain the same wholesale and retail prices (and thus the same margins) as in a bilateral-monopoly model. At the dyadic level, if one retailer cannot cover its costs, no identical retailer can do so: the channel cannot exist. But if one retailer is profitable, all N are equally profitable and all of them will participate in the channel. The wholesale price that is optimal to charge one retailer is optimal to charge all N of them, and a manufacturer that earns positive net revenue by selling to one retailer will earn N times the net revenue by selling to N identical retailers.Footnote 23

These observations lead to the next two Hypotheses.

-

Channel-Breadth Hypothesis: The number of distributors in a decentralized channel does not affect the manufacturer-optimal wholesale-price strategy.

-

Channel-Participation Hypothesis: Every distribution outlet of a vertically integrated system would voluntarily participate in a decentralized, coordinated channel.

These Hypotheses hold in an identical-retailers model for the simple reason that “all identical retailers behave in the same way, so they are all treated in the same manner.” This argument is the basis of the two generalized inferences (channel breadth never affects the wholesale price, and channel participation is invariant with legal organization of the channel) that we have stated as Channel Hypotheses.

Modeling hypotheses

The preceding discussion spotlights two of the three models that dominate the game-theoretic literature on distribution channels: the bilateral-monopoly and the identical-retailers models.Footnote 24 Few modelers genuinely think that manufacturers commonly deal with (a) only one distributor or (b) distributors who face equal demands and costs. However, these assumptions are thought to be reasonable simplifications of reality. We state these apparently widely held beliefs as two Modeling Hypotheses.

-

Bilateral-Monopoly Modeling Hypothesis: A bilateral-monopoly model depicts the Channel Performance of more complex channel models.

-

Identical-Distributors Modeling Hypothesis: An identical-distributors model depicts the Channel Performance of a heterogeneous-distributors model.

We will assess the validity of these Hypotheses in “Discussion and conclusion.”

The heterogeneous-distributors model

In this Section we analyze a general model in which distributors face heterogeneous demands and costs. Embedded within our model are the heterogeneous-competitors model, the identical-competitors model, the non-competing, heterogeneous-retailers model, the non-competing, identical-retailers model, and the bilateral-monopoly model. Embedding these models allow us to ascertain the limits under which each Channel Hypothesis is valid.

We begin by assessing a vertically integrated system’s Channel Performance. In the second subsection we develop channel-coordinating tariffs; then we discuss a manufacturer’s profit-maximizing tariff that does not force coordination (we call it a “sophisticated Stackelberg” two-part tariff). Each subsection is focused on the heterogeneous-competitors model (the mathematical complexity of this model causes us to concentrate on two competitors). Channel Performance in the heterogeneous, non-competing retailers model can be deduced from the heterogeneous-competitors model by setting θ = 0. (We expand on the latter model for N local monopolists in our Technical Appendix.) In this sub-Section we use demand system (4).

Heterogeneous demand and costs: a vertically integrated system

A vertically integrated system (VIS) that sells through a pair of competing distribution outlets selects the channel-profit maximizing retail price for each outlet. Its maximand is:

The quantity sold by the ith VIS-outlet is one-half the quantity sold under marginal-cost pricing: \( Q^{ * }_{i} = {{\left[ {A_{i} - b{\left( {c_{i} + C} \right)} - \theta {\left( {c_{j} + C} \right)}} \right]}} \mathord{\left/ {\vphantom {{{\left[ {A_{i} - b{\left( {c_{i} + C} \right)} - \theta {\left( {c_{j} + C} \right)}} \right]}} 2}} \right. } 2 \) (reversing subscripts gives the jth outlet’s unit sales).Footnote 25 Because outlets are heterogeneous in demand (A k , k∈(i, j)) and in variable cost (c k , k∈(i, j)), each outlet sells a different quantity and generates a different channel margin:

Total profit of the vertically integrated system, given that it employs two outlets, is:

Should a VIS only employ a single outlet (say the ith)? If it did, system profit would be:

Comparing profit Eqs. 16 and 17 gives the marginal profit of a second outlet:Footnote 26

We have deduced a simple decision rule: open an outlet that generates enough net revenue (gross revenue less variable costs) to cover its fixed cost. Note that adding a second outlet cannibalizes \( {\left( {\theta \mathord{\left/ {\vphantom {\theta b}} \right. } b} \right)}Q^{ * }_{j} \) in unit sales from the first outlet while expanding the market by (\( {\left( {b - \theta } \right)}{Q^{ * }_{j} } \mathord{\left/ {\vphantom {{Q^{ * }_{j} } b}} \right.} b \)) units.

To illustrate, we use parametric values A i = 150, A j = 100, b = 1, and θ = 1/2; we equate variable costs c i = c j = $10 = C; and set fixed costs of production and distribution to F = $500 and f i = f j = $100. The only difference between outlets is that the ith has 50% greater base demand (A i = 150 vs. A i = 100). This parametric set generates the following Channel Performance results with one outlet (VI,One*) or two (VI,Two*):

The second distributor augments profit by $1,925 (a $2,025 increase in net revenue minus a $100 increase in fixed distribution cost). Our parametric-value choices affect the numbers obtained, but the basic messages here and in later illustrations are unaffected by our parametric values.

Heterogeneous demand and costs: a channel-coordinating menu of tariffs

When retailers are heterogeneous, channel coordination (i.e., exactly reproducing the results generated by a vertically integrated channel) requires the use of different wholesale prices for each competitor (Ingene & Parry, 1995b):

These margins ensure that retail prices are channel coordinating. The competitors’ margins are:

Counter to the Double-Marginalization Hypothesis, coordination of a heterogeneous-competitors channel requires double marginalization (the manufacturer and its retailers set positive margins).

Achieving coordination is generally not “free” for the Stackelberg leader, because comparable treatment requires that three conditions be met when competitors are not identical. (1) A unique tariff must be designed for each competitor (see Eq. 19). (2) The manufacturer must offer both tariffs to each competitor. (3) Each competitor must choose the tariff that is intended for it. Because \( W^{ * }_{i} \ne W^{ * }_{j} \), both competitors will select the tariff with the smaller wholesale price unless the lower price is paired with a higher fixed fee (φ). If \( W^{ * }_{i} < W^{ * }_{j} \), then \( \phi ^{ * }_{i} > \phi ^{ * }_{j} \) is required. A menu of two-part tariffs can always be designed (\( \tau ^{ * } \equiv {\left[ {\tau ^{ * }_{i} ,\tau ^{ * }_{j} } \right]} \equiv {\left[ {{\left\{ {W^{ * }_{i} ,\phi ^{ * }_{i} } \right\}},{\left\{ {W^{ * }_{j} ,\phi ^{ * }_{j} } \right\}}} \right]} \)) so that the competitors’ defection and participation constraints are satisfied. A properly designed menu allows the kth competitor (k∈(i,j)) to earn more from selecting \( \tau ^{ * }_{k} \) than it would from selecting the tariff intended for its rival (otherwise it would defect to the “wrong” tariff) and also to earn non-negative profit from selecting \( \tau ^{ * }_{k} \) (necessary to ensure channel participation).Footnote 27

Table 1 summarizes the Channel Performance of the coordinating menu of tariffs under the same parametric values employed in our earlier examples. We also report results for several values of the ith competitor’s fixed cost (f i ); this will help us to compare a coordinating menu of tariffs with an alternative, non-coordinating tariff developed below.Footnote 28 Rows in Table 1 denote fixed cost (f i ), units sold by each competitor (\( Q^{ * }_{k} \), k∈(i,j)), prices at wholesale (\( W^{ * }_{k} \)) and retail (\( p^{ * }_{k} \)), competitors’ profits (\( \pi ^{ * }_{k} \)), fixed fees (\( \phi ^{ * }_{k} \)), manufacturer profit (\( \Pi ^{ * }_{M} \)), channel profit (\( \Pi ^{ * }_{C} \)), and the manufacturer’s profit share (\( {\Pi ^{ * }_{M} } \mathord{\left/ {\vphantom {{\Pi ^{ * }_{M} } {\Pi ^{ * }_{c} }}} \right. } {\Pi ^{ * }_{C} } \)). The columns are a vertically-integrated system evaluated at f i = $2,500 and a menu assessed at f i -levels $2,100, $2,300, $2,500, and $2,700. These fixed costs represent three zones that have different profit implications for the manufacturer and its competing outlets. In Zone \( Z^{{{\text{Menu}}^{{\text{*}}} }}_{j} \) (defined by $0.00 ≤f i <$2,445.68) the jth competitor nets zero profit. In Zone \( Z^{{{\text{Menu}}^{{\text{*}}} }}_{{ij}} \) ($2,445.68 ≤f i ≤$2,609.88) neither competitor has positive earnings. In Zone \( Z^{{{\text{Menu}}^{{\text{*}}} }}_{i} \) (f i >$2,609.88) the ith competitor nets zero profit.

The manufacturer obtains all profit in Zone \( Z^{{{\text{Menu}}^{{\text{*}}} }}_{{ij}} \) but not in the other Zones. Although the channel is coordinated at all fixed-cost levels, the illustrative $600 rise in the ith competitor’s fixed cost from $2,100 to $2,700 has the following profit effects: (a) channel profit falls by $600, (b) the ith firm’s profit falls by $345.68, (c) the jth competitor’s profit rises by $90.12, and (d) the manufacturer’s profit falls by $344.44. These results reflect fixed-fee adjustments to prevent defection or non-participation by a competitor (\( \phi ^{ * }_{i} \) falls by $254.32 and \( \phi ^{ * }_{j} \) slips by $90.12).

Heterogeneous demand and costs: a manufacturer’s profit-maximizing tariff

The fact that a channel-coordinating menu of two-part tariffs τ * exists does not mean that τ * is in all channel members’ interest. To determine if coordination is Pareto optimal requires that we investigate the best non-coordination alternative: the sophisticated Stackelberg two-part tariff. The sophisticated Stackelberg simultaneously selects a wholesale price and a fixed fee, subject to the followers’ quantity-reaction functions (Ingene & Parry, 1998); it coordinates a bilateral-monopoly or an identical-competitors channel, but it cannot coordinate a heterogeneous-competitors channel. In contrast, a naïve Stackelberg tariff—which entails choosing a wholesale price (\( \widehat{W} \)) without considering its impact on the fixed fee—cannot coordinate any channel. We illustrate the sophisticated Stackelberg tariff numerically, using the same parametric values listed above. We allow the fixed cost of the ith competitor to vary over a substantial f i -range (similar results can be obtained by varying f j ).

Table 2 summarizes the Channel Performance of a sophisticated Stackelberg tariff for the parametric values used in Table 1. Performance columns are the vertically integrated system evaluated at f i = $2,500 (included for comparative purposes), the naïve Stackelberg tariff at f i = $2,500 (also for comparison),Footnote 29 and the sophisticated Stackelberg tariff at f i -levels that correspond to three Zones. In Zone \( Z^{{SS^{ * } }}_{j} \) (defined by $0.00 ≤f i <$2,200.00) the jth competitor nets zero profit. In Zone \( Z^{{SS^{ * } }}_{{ij}} \) ($2,200.00 ≤f i <$2,600.00) neither competitor earns a profit, and in Zone \( Z^{{SS^{ * } }}_{i} \) (f i >$2,600.00) the ith competitor nets zero profit. Rows are defined as in Table 1. We also report coordinated channel profit (\( \Pi ^{{VI^{ * } }}_{C} \)) and the difference between the total profit of a coordinated channel and the actual profit with the sophisticated Stackelberg tariff (\( \Pi ^{{VI^{ * } }}_{C} - \Pi _{C} \)). Notice that a positive fixed fee (φ > 0) is paid to the manufacturer by the distributors, while a negative a fixed fee (φ < 0) is paid by the manufacturer to the distributors (e.g., slotting fees or end-of-period rebates).

The key points from Table 2 relate to profits and prices. First, a $600 rise in the ith competitor’s fixed cost, from $2,100 to $2,700, (a) lowers channel profit by $600, (b) decreases the ith firm’s profit by $100, (c) raises the jth competitor’s profit by $100, and (d) diminishes the manufacturer’s profit by $600. Second, the per-unit wholesale price is constant (at $82.50) throughout Zone \( Z^{{SS^{ * } }}_{j} \), linearly declines in Zone \( Z^{{SS^{ * } }}_{{ij}} \), and levels out at $52.50 per-unit in Zone \( Z^{{SS^{ * } }}_{i} \). This example illustrates how changes in the ith competitor’s fixed cost can affect prices and quantities and can alter the distribution of channel profit.

The channel hypotheses when distributors are heterogeneous

In this Section we demonstrate that (a) coordination need not benefit the Stackelberg leader, (b) coordination requires double marginalization when distributors compete, (c) fixed distribution costs can affect the manufacturer’s optimal wholesale-price strategy, (d) channel breadth can affect the manufacturer’s optimal wholesale-price strategy, and (e) participation in a decentralized channel is generally narrower than it is in a vertically integrated system. In brief, we demonstrate that when a manufacturer sells to multiple, non-identical distributors, four Channel Hypotheses do not hold and one Hypothesis is valid only in the absence of competition.

Our approach is to repeat each Hypothesis, discuss the evidence, and set forth a Channel Proposition that defines the limits to the validity of the Hypothesis. We term our deductions Channel Propositions rather than calling them Channel Theorems because we recognize that more refined distinctions might arise from an even more general model than the one we have employed. More general models might include multiple products, non-price elements of the marketing mix, or upstream competition between manufacturers. However, we stress that to the best of our knowledge, our Channel Propositions are fully general.

Analysis of the dyadic-coordination hypothesis

This Hypothesis asserts that “both members of a decentralized channel dyad prefer a wholesale price that leads to the maximization of total dyadic profits.” This Hypothesis is trivially true in a bilateral monopoly or when the distributors are identical. But when distributors face heterogeneous demand and/or costs, the evidence is counter to the Hypothesis. To show this, we contrast manufacturer profit under the coordinating menu (Table 1) and the non-coordinating, sophisticated Stackelberg tariff (Table 2). We find that at f i = $2,300 the manufacturer earns more without coordination, while it earns more with coordination at f i = $2,500 and f i = $2,700. A detailed assessment shows that the manufacturer prefers the non-coordinating, sophisticated Stackelberg tariff to the channel-coordinating menu for 0 ≤f i < $2,434.39. This occurs because, under comparable treatment, coordination requires the manufacturer to manipulate the menu’s fixed fees (a) to preclude “defection” of one retailer to the tariff that is designed for its competitor and (b) to prevent channel non-participation by either competitor. Defection would destroy coordination, while non-participation would lower channel breadth. The potential for all channel members to benefit from coordination is limited by the need for fixed-fee manipulations that are defection-preventing and participation-maintaining.

Since there are well-defined parametric values for which the sophisticated Stackelberg tariff is manufacturer-preferred to the channel-coordinating menu (Ingene & Parry, 2000), Tables 1 and 2 illustrate a general phenomenon: when there is inter-distributor competition, there are fixed-cost values for which the manufacturer prefers non-coordination to coordination.

This basic result also holds when distributors are local monopolists. In the Technical Appendix we provide details along with an example in which, for a range of fixed distribution costs, non-coordination generates a higher channel profit as well as greater manufacturer profit relative to the coordinated solution.

We now state our deductions in the form of a Channel Proposition:

-

Dyadic-Coordination Proposition: Independent of the level of inter-distributor competition, there is a range of fixed distribution costs for which the Stackelberg leader prefers dyadic non-coordination when distributors are heterogeneous.

We conclude that the widely held Dyadic-Coordination Hypothesis is only valid in models of identical distributors or bilateral monopoly. Given that managers commonly deal with heterogeneous distributors, the Dyadic-Coordination Proposition suggests that managers should determine whether channel coordination is in their own interest. This Proposition should also motivate modelers to endogenously determine if coordination is optimal for the channel leader.

Analysis of the double-marginalization hypothesis

This Hypothesis states that “coordination cannot be achieved when both members of a channel dyad set positive per-unit margins.” The evidence is counter to this Hypothesis when distributors compete. Table 1 reveals that the channel-coordinating wholesale margins are \( M^{ * }_{i} = \$ 53.33 \) and \( M^{ * }_{j} = \$ 61.67 \) (per-unit wholesale prices minus the production cost of $10 per-unit) and competitors’ channel-coordinating margins are \( m^{ * }_{i} = \$ 70.00 \) and \( m^{ * }_{j} = \$ 45.00 \) (retail prices less the per-unit distribution costs and the wholesale prices). Equations 19 and 20 clarify the limits to the validity of the widely held belief about double marginalization:

-

Double-Marginalization Proposition: Double marginalization is required for channel coordination in the presence of inter-distributor competition (θ > 0); however, double marginalization precludes channel coordination in the absence of inter-distributor competition (θ = 0).

We conclude that the widely held Double-Marginalization Hypothesis is only valid when distributors do not compete.

Analysis of the fixed-cost hypothesis Footnote 30

This Hypothesis asserts that “fixed distribution costs do not affect Channel Performance.” The evidence is counter to this Hypothesis. Table 2 shows that with sophisticated Stackelberg pricing, the ith competitor’s fixed cost affects the manufacturer-optimal, per-unit wholesale price: it declines continually in Zone \( Z^{{SS^{ * } }}_{{ij}} \) ($2,200.00≤f i <$2,600.00). Thus in this Zone a positive fixed distribution cost affects Channel Performance (similar results hold for changes in f j ). We have already shown that the manufacturer prefers non-coordination for all f i -values in the interval 0≤f i <$2,434.39; we now see that the ith retailer’s fixed distribution cost also affects prices and quantities when the channel is uncoordinated. Rigorous analysis has proven that there are always parametric values for which the sophisticated Stackelberg tariff is manufacturer-preferred to the channel-coordinating menu (Ingene & Parry, 2000).

We state this in the form of a Channel Proposition:

-

Fixed-Cost Proposition: Independent of the level of inter-distributor competition, there is a range of fixed distribution costs that affect Channel Performance when distributors are heterogeneous.

We conclude that the widely held Fixed-Cost Hypothesis is only valid in models of identical distributors or bilateral monopoly. Given that managers commonly deal with heterogeneous distributors who incur fixed costs, the Fixed-Cost Proposition suggests managers should set wholesale prices in light of their dependence on fixed costs. This Proposition should also inspire game theorists to evaluate the impact of positive fixed costs on their models.

Analysis of the channel-breadth hypothesis

This Hypothesis asserts that the “the number of distributors in a decentralized channel does not affect the manufacturer-optimal wholesale-price strategy.” The evidence is counter to this Hypothesis, as we show by relaxing our assumption that a manufacturer must serve two outlets. A one-distributor manufacturer coordinates the channel by setting W = C; it can extract all channel profit with a fixed fee. With two competitors the manufacturer can coordinate the channel, but to do so it must set W i >C and W j >C (see Eq. 19); moreover, the coordinating prices permit the manufacturer to extract all profit only at some parametric values.

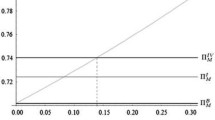

Most importantly, there are parametric values for which the manufacturer prefers not to coordinate a two-competitor (or a multiple-retailer) channel. The core question is whether the Stackelberg leader is better served by distributive breadth without coordination or by narrow distribution with coordination. Figure 1, which reflects our previous parametric values, investigates the effect of breadth on the manufacturer’s wholesale-price strategy.

Figure 1 shows that, depending on the f i -value, the manufacturer may prefer to have one distributor or it may prefer to have two distributors. With two distributors it may apply the sophisticated Stackelberg tariff or the channel-coordinating menu of tariffs. The decision rule is:

-

If f i ≤$383.33, only employ the ith distributor;

-

If $383.33≤f i ≤$2,434.39, serve both distributors with a non-coordinating, sophisticated Stackelberg two-part tariff;

-

If $2,434.39 ≤f i ≤$3,754.94,serve both distributors with a channel-coordinating menu; and

-

If f i ≥$3754.94, only employ the jth distributor.

Over the range $383.33≤f i ≤$3,754.94, expanding from one to two distributors raises manufacturer profit; thus, channel breadth pivots on the level of fixed distribution costs. The optimal wholesale price is also dependent on channel breadth over part of the f i -range. The same fundamental deduction follows from the (non-competing) heterogeneous-retailers model, although that decision rule leads to (a) use the ith retailer, (b) serve both retailers with the non-coordinating, sophisticated Stackelberg tariff, or (c) employ the jth retailer (see the Technical Appendix). Thus channel breadth can affect the manufacturer-optimal wholesale-price policy when distributors compete and when they do not. We state this in the form of a Channel Proposition:

-

Channel-Breadth Proposition: The number of distributors in a decentralized channel can affect the manufacturer-optimal wholesale-price policy; hence it can affect distributor prices and quantities, independent of the degree of competition.

We conclude that the widely held Channel-Breadth Hypothesis is only valid in a world of identical distributors. Since managers have some control over channel breadth, this Proposition suggests managers should set wholesale prices while accounting for the dependency of these prices on channel breadth. This Proposition should also prompt modelers to ascertain optimal channel breadth endogenously.

Analysis of the channel-participation hypothesis

This Hypothesis states that “every distribution outlet of a vertically integrated system would voluntarily participate in a decentralized, coordinated channel.” The evidence is counter to this Hypothesis. A vertically integrated system (VIS) opens any outlet that generates net additional revenue (R) that is sufficient to cover its fixed costs (f). In contrast, a manufacturers’ income in a decentralized channel comes (at least in part) from a fixed fee (ϕ). The VIS rule is R > f; the decentralized rule is \( R > f + \phi \). These expressions are equal only in the very special case of a zero fixed fee. Tables A3 and A4 of the Technical Appendix provide illustrative values for a heterogeneous-retailers channel. In that example the VIS uses 80 (61) retail outlets when the fixed distribution cost per outlet is $0 ($100). A coordinated channel uses 27 (25) independent retailers, and a non-coordinated channel employs 32 (28) retailers.Footnote 31

This example illustrates that, with multiple distributors, a decentralized channel cannot duplicate all the results of a VIS because a positive fixed fee affects the distributors’ participation constraints. The decentralized channel sells fewer units and earns less profit than does a vertically integrated system. We state these observations as a Channel Proposition:

-

Channel-Participation Proposition: Independent of the level of competition, a vertically integrated system generally sells through more distribution outlets than does a decentralized channel, even when the decentralized channel is coordinated.

We conclude that the Channel-Participation Hypothesis is only valid in a bilateral monopoly or when there are no fixed distribution costs. This deduction reinforces the importance of treating channel breadth as an endogenous managerial decision and assuming positive fixed costs.

Competitive substitutability

The Competitive-Substitutability Hypothesis asserts that a change in the cross-price parameter (θ) of a linear-demand curve measures the change in the degree of inter-distributor competition. In this Section we derive the implications of using θ as a measure of competitive substitutability and show that this measure leads to consequences that violate economic intuition. We then introduce an alternative measure (competitive substitutability, denoted by T) that generates intuitively appealing results: an increase in T increases price sensitivity and lowers aggregate demand. We summarize our findings with a Competitive-Substitutability Proposition.

A Change in the cross-price term as a measure of competitive substitutability

We begin by writing aggregate demand (the sum of the individual demands) for the heterogeneous-competitors model from Eq. 4:

Demand becomes perfectly inelastic as θ→b in Eq. 21. The consequence is that an increase in θ increases units sold, margins, and profit; these are results that lack face validity. To illustrate this effect, we use the identical-competitors model with our ongoing parametric values. We let θ range from almost complete differentiation (θ = 0.001) to almost perfect substitutability (θ = 0.999).

Table 3 presents Channel Performance highlights for identical, coordinated competitors (A i = A j ≡ A in Eq. 21). The values reported in Table 3 clearly indicate that assuming θ denotes the degree of competitive substitutability leads to channel profit and channel margin (therefore retail prices) that rise to infinity as θ→b. The key feature here is that as θ increases, prices do not decrease—they increase to infinity! As a practical matter, this suggests that two retailers, located adjacent to each other, open the same hours, offering the same service, selling the same products for the same prices, can earn infinite profits. But in reality, if two stores were identical in all respects, they would not expand the market and they would be unable to drive prices “through the roof;” instead, they would split the market and drive prices down. We infer that the widely held belief summarized in the Competitive-Substitutability Hypothesis is misplaced. Yet it is one matter to state that θ is a poor measure; it is another matter to offer a good measure. We now turn to this task.

The theoretically appropriate measure of competitive substitutability

We rely on first principles by using the utility function of a representative consumer. In the Technical Appendix we illustrate how this utility function generates the linear-demand system (4). In the consumer’s utility function,Footnote 32 competitive substitutability is indicated by the substitutability parameter (T). As T increases (as competitors become more similar), utility declines. In practice, the substitutability parameter may reflect competitive differences in location, store design, or other factors that cannot be optimized in the short-run by managers.

A change in T impacts all parameters of demand system (4):

In summary, a rise in substitutability (T) raises own-price (b) and cross-price (θ) sensitivities and shifts the base levels of demand. The effect of a change in T on the output of a coordinated channel is:

An increase in consumer willingness to substitute purchases from the ith competitor for goods from the jth competitor leads to lower total sales. This result does not affect the rivals equally. Three possibilities exist: the ith competitor may gain sales at the expense of its rival; the jth competitor may gain while the ith loses; or both competitors may lose sales.Footnote 33 Despite this ambiguity, the impact of a change in T on channel profit is unambiguously negative:

An increase in inter-retailer substitutability (T) raises price sensitivity (22) while lowering aggregate sales (23) and channel profit (24). This leads to our final Channel Proposition:

-

Competitive-Substitutability Proposition: The appropriate measure of competitive substitutability is the substitutability parameter (T) of the representative consumer’s utility function.

Do changes in the substitutability parameter T lead to plausible results? We believe that they do. Consider a thought experiment in which the competitors are perfectly interchangeable initially but differentiate themselves over time with their marketing mixes. As differentiation increases (say on the basis of perceived image) customers at each store become less sensitive to changes in the rival store’s price. Mathematically, we should observe that as T declines, b decreases and total sales rise. This is precisely what we observe in Eqs. 22 and 23, and it is the opposite of what is predicted by using the change in the cross-price parameter θ. We conclude that the widely-held Competitive-Substitutability Hypothesis (which involves the cross-price parameter θ) leads to results that violate intuition, but that the competitive-substitutability parameter T generates insights that are logically robust and intuitively appealing.

Discussion and conclusion

In “Origins of the channel hypotheses” we derived a set of literature-based Channel Hypotheses. We showed that their appeal is due to their validity in the context of their generative models. Then we developed a generalized model of heterogeneous distributors and used it to derive Channel Propositions that highlight deficiencies in the Channel Hypotheses. We now summarize our findings, using Table 4 to categorize the validity/invalidity of six Channel Hypotheses across two dimensions: (1) the homogeneity/heterogeneity of distributors and (2) the presence/absence of inter-distributor competition. Distributors are homogeneous (i.e., identical) if and only if they face the same demand and the same costs; in this special situation, they charge the same prices, sell the same quantity, and earn the same net revenue.

The Dyadic-Coordination Hypothesis (coordination benefits both members of the dyad) and the Fixed-Cost Hypothesis (fixed costs are irrelevant for decision-making) are valid in the bilateral-monopoly and identical-distributors models but are of “limited validity” in models with heterogeneous distributors.Footnote 34 By limited validity we mean that there are specific parametric values for which the Hypothesis is valid, but that for most of parameter space the Hypothesis is invalid. For example, with heterogeneous retailers the Dyadic-Coordination Hypothesis is valid in the special case of the least profitable retailer selling precisely the same quantity as the average retailer in the channel. (Note that a retailer in a bilateral monopoly is both “average” and “least profitable;” the same observations hold for identical retailers).

The Channel-Breadth Hypothesis (channel breadth is irrelevant for decision-making) is valid in identical-distributors models but is of limited validity in models with heterogeneous distributors. The Double-Marginalization Hypothesis (positive per-unit margins for both channel members preclude coordination) is only valid without competition. The Channel-Participation Hypothesis (decentralization does not affect distributor participation) is trivially valid in the bilateral-monopoly model, but it does not hold when there are multiple distributors, regardless of whether they compete or not. The Competitive-Substitutability Hypothesis is invalid.

Occam’s principles and the channel modeling hypotheses

Occam espoused the principles of simplicity (when competing theories produce the same predictions, the simpler theory should be used) and reality (theories should be based on facts). No one genuinely believes that the bulk of consumer-goods distribution is characterized by bilateral monopoly, for only the most exclusive manufacturers sell through a single vendor; nor does anyone really believe that all distributors face the same demands and costs. Because the bilateral-monopoly and identical-distributors models are unrepresentative of reality, their legitimacy must rest on the simplicity principle; indeed, the Bilateral-Monopoly and Identical-Distributors Hypotheses express this principle (“these models accurately depict the Channel Performance of more complex channel models”). Of course, the bilateral-monopoly and identical-distributors models are also simple in a very different sense: they are highly tractable.

The critical question is the impact of simplicity on “the generality of results” (Moorthy, 1993, p. 102). We have shown that simplifying from heterogeneous distributors to homogeneous distributors, or from multiple distributors to a single distributor, fundamentally alters the conclusions drawn from these models. Table 4 indicates that the use of bilateral-monopoly models and identical-distributors models in game-theoretic analyses of distribution have led scholars to at least five deductions that are of limited or no generality. Given the widespread use of these models in the literature, we offer a Channel-Modeling Proposition:

-

Channel-Modeling Proposition: Game-theoretic models of distribution channels should model multiple, heterogeneous distributors; alternatively, the modeler should explicitly recognize that conclusions drawn from a bilateral-monopoly model or an identical-distributors model may not generalize to more realistic depictions of distribution.

This Proposition is critical to the value of the preceding Propositions. To illustrate, in a bilateral-monopoly model there is no reason to consider non-coordination, because any non-coordinating pricing strategy will be dominated by a coordinating strategy. It is only when modelers move beyond the bilateral-monopoly model (and the identical-retailers model) that the Dyadic-Coordination Proposition has value. The same fundamental message applies to the Double-Marginalization, Fixed-Cost, Channel-Breadth, and Channel-Participation Propositions.

The Channel-Modeling Proposition calls for a shift toward realism at the expense of ease of analysis—a call that is justified by Moorthy’s assessment of why we use models: “the main purpose of theoretical modeling is pedagogy—teaching us how the real world works” (1993, p. 103). The widely utilized bilateral-monopoly and identical-distributors models have encouraged modelers to simplify the number of (and variations between) distributors and have discouraged modelers from evaluating the impact of these simplifications on the generalizability of their conclusions. Neither the bilateral-monopoly model nor the identical-distributors model teaches “us how the real world works.”

Directions for future research

Much has been learned from mathematical models of distribution channels in the past two decades, but our knowledge is constrained by the lack of cross-model comparisons. Although marketing scientists offer intuitive explanations for results that differ from those of prior research, their analyses often are based on models that do not embed earlier models as special cases; thus it can be difficult to determine whether the explanations are supported by the underlying mathematics. We believe that new models should nest at least one existing model to facilitate cross-model comparisons (Moorthy, 1993). For example, future models that explore the impact of multiple products, multiple manufacturers, or multiple marketing-mix elements should (if possible) contain models that simplify these aspects of marketing reality. In particular, we know that our heterogeneous-distributors model with one product, one manufacturer, and one marketing-mix element is a special case of more general models. What we cannot know without a detailed analysis is if our model distorts the results that would be obtained from more general models; only nesting can tell us that.

A second direction for future research involves models that cannot be nested. For example, Moorthy and Fader (1988) found dramatic Channel Performance differences under linear demand versus constant elasticity of demand. Neither demand formulation can be embedded within the other, so nesting cannot help researchers to choose between them. Taking a different approach, Lee and Staelin (1997) showed that linear demand implied vertical-strategic substitutability (VSS) while constant-elasticity of demand implied vertical-strategic complementarity (VSC).Footnote 35 Because real-world channel relationships are believed to exhibit VSS, researchers have concluded that linear demand is a more reasonable modeling assumption than is constant-elasticity of demand. There are undoubtedly many other situations where empirical research can help marketing scientists choose between competing modeling assumptions that cannot be nested.

A third path for future research involves the impact of external or internal restrictions on managerial choice. The results presented here are critically dependent on the assumption of comparable treatment—an assumption that reflects an external (legal) constraint and self-imposed, internal constraints (due to administrative, bargaining and contract development costs, Lafontaine, 1990). If the manufacturer can treat each distributor differently (by offering each a unique price schedule), then the manufacturer’s optimization problem devolves to the trivial bilateral-monopoly advice: offer each distributor a two-part tariff that extracts all of the distributor’s profit. It is the requirement of comparable treatment that generates the complexities and surprising results discussed in this paper.

Perhaps other constraints on managerial decisions have similar dramatic implications for channel performance. For example, antitrust concerns prompt manufacturers to make comparable promotional offers to competitors. What is the impact of this constraint on the efficiency of these offers? How do geographically contingent distribution requirements impact manufacturers’ marketing-mix decisions? How do segment-specific communication restrictions (e.g., advertising to children) affect marketing-mix decisions? If manufacturers respond to these constraints by expanding their product lines, then a multi-product model would be appropriate—and might generate different results than a single-product model.

In summary, the analyses summarized in this paper have important implications for both managers and marketing scientists. We hope that our results will motivate marketing scientists to move beyond the bilateral-monopoly and identical-distributors models. We believe that such a move will accelerate academic understanding of channel decisions and will augment the value of insights that practicing managers can obtain from game-theoretic models of distribution channels.

Notes

There are three generating models in the game-theoretic literature on distribution: inter-channel competition (e.g., McGuire & Staelin, 1983), inter-manufacturer competition (e.g., Choi, 1991), and inter-retailer competition (e.g., Ingene & Parry, 1995b, 2004). Choi (1996) combined the latter two models for the case of identical manufacturers and retailers. The bilateral-monopoly model (e.g., Edgeworth, 1881; Jeuland & Shugan, 1983) is embedded within each of these models. The seminal articles were by Jeuland and Shugan (1983) and McGuire and Staelin (1983).

A channel dyad comprises firms upstream (a “manufacturer”) and downstream (a “retailer”). In a decentralized channel, the manufacturer and the retailer are independent; in a vertically integrated system they are jointly owned.

A bilateral-monopoly channel comprises one manufacturer selling to one retailer; in turn, the retailer buys exclusively from that manufacturer (Edgeworth, 1881). The marketing science literature has concentrated on two-level channels.

Profit sharing between retailer and manufacturer is necessary for a dyadic member to accept a zero margin; negotiation between channel members is one method of profit sharing (Jeuland & Shugan, 1983).

Because marketing scientists are concerned with number of distributors, not differences between them, they typically assume that distributors are identical; that is, distributors are modeled with equal demands and equal costs.

Gerstner and Hess (1995) provide a clear statement of the belief that a vertically integrated system maximizes total channel profit.

This unique mapping would break down if demand was a rectangular hyperbola—which generates the same total revenue at all price levels.

We stress that all our examples are derived from rigorous game-theoretic analyses.

Section 2(a) of the Robinson–Patman Act “...prohibits sellers from charging different prices to different buyers for similar products where the effect might be to injure, destroy, or prevent competition, in either the buyers’ or sellers’ markets” (Monroe, 1990, p. 394).

In practice, a manufacturer may have a small set of wholesale-price schedules; what is important for our analysis is that multiple distributors face a common schedule.

Choi (1991) has shown that price, quantity and the distribution of channel profit are invariant with respect to who occupies the leader’s role in a bilateral monopoly. We distinguish between net revenue and profit (net revenue minus fixed cost); Choi did not make this distinction because he assumed zero fixed cost.

Desiraju and Moorthy (1997) have addressed informational asymmetry.

The symbol “∈” is defined as “an element of.” Thus i,j∈(1,N) is read as “the values of i and j are elements of the integers from 1 to N.” In simple English, i is an integer between 1 and N, and j is an integer between 1 and N.

This demand system was introduced to marketing by McGuire and Staelin (1983).

The symbol ∀ is defined as “for all.” Thus Eq. 6 is merely a statement that “for all values of p j greater than or equal to \( {{\left( {A_{j} + \theta p_{i} } \right)}} \mathord{\left/ {\vphantom {{{\left( {A_{j} + \theta p_{i} } \right)}} b}} \right. \kern-\nulldelimiterspace} b \), the value of \( Q^{{{\text{One}}}}_{i} \,is\,\alpha _{i} - \beta p_{1} \) and the value of Q j is 0.”

We believe that this definition of logically consistent demand first appeared in Ingene and Parry (2004).

Profit is \( \Pi = {\left( {p_{1} - c_{1} - C} \right)}q_{1} - f_{1} - F \); it is maximized by solving for the optimal value of p 1.

The symbol “≡” means “is defined as;” a trivial example is the high school formula for area (Area≡WL).

The model is solved by backward induction: first the π1-equation is optimized over p1 to obtain the retailer’s quantity-reaction function, then the Π1-equation is optimized over W 1, given the retailer’s quantity-reaction function. This approach is called Stackelberg maximization in honor of its originator (Stackelberg, 1934); we refer to it as naïve Stackelberg maximization for reasons that will become clear in sub-Section Heterogeneous Demand and Costs: a Manufacturer’s Profit-Maximizing Tariff.

An alternative that is rarely discussed in the literature is for the manufacturer to set its margin at \( \widehat{M}^{ * } = \mu ^{ * }_{1} \) and pay the distributor a fixed fee (say φ) not to markup its merchandise (i.e., \( \widehat{m}^{ * }_{1} = 0 \)); this will also lead to coordination. This alternative approach reinforces our central point that double marginalization is incompatible with coordination.

A two-part tariff consists of a per-unit fee and a lump-sum payment (a fixed fee).

Fixed costs affect the participation constraint that determines the allowable set of fixed fees: \( {\left( {R^{{VI^{ * } }}_{1} - f_{1} } \right)} \geqslant \widehat{\phi }_{1} \geqslant F \).

There are a minimal number of identical retailers (\( \underline{N} \)) needed to generate sufficient revenue to cover the manufacturer’s fixed costs. The channel cannot exist if \( N < \underline{N} \).

We address the third popular model, the identical-competitors model, in “Competitive substitutability” below.

Formula (14), and equivalence of output with marginal-cost pricing, generalizes to any number of outlets.

Expanding a VIS to a third outlet would generate the same conclusion as shown in Eq. 18.

Similar results can be obtained by varying f j .

A negative fixed fee (a payment from manufacturer to retailers) occurs for all f i ≥ $1,633.33.

Although the non-coordinated channel has more outlets than the coordinated channel in this example, this is not a general principle. It is a function of the specific demand curve that has been chosen.

\( U \equiv {\sum\limits_{k = 1}^N {{\left( {A_{k} Q_{k} - {BQ^{2}_{k} } \mathord{\left/ {\vphantom {{BQ^{2}_{k} } 2}} \right. \kern-\nulldelimiterspace} 2} \right)} - T{\sum\limits_{k = 1}^N {Q_{k} } }{\sum\limits_{^{{m = 1}}_{{m > k}} }^N {Q_{m} } }} } \); we develop utility-based demand in the Technical Appendix.

In the special case of identical competitors we have (A i = A j ≡ A) implies \( {{\text{d}}A} \mathord{\left/ {\vphantom {{{\text{d}}A} {{\text{d}}T}}} \right. \kern-\nulldelimiterspace} {{\text{d}}T} = - {\left( {b - \theta } \right)}A < 0 \).

We use the nomenclature that identical, non-competing distributors are “identical retailers” and that identical, competing distributors are “identical competitors;” the term “identical distributors” encompasses both identical retailers and identical competitors.