Abstract

This paper explores the response to risk of smallholder agricultural producers in the face of variable and changing climate in Cameroon. The low rainfall distribution in some regions of the country and the high inter-seasonal variability of rainfall makes crop production, on which the livelihood of rural inhabitants is based, a risky enterprise. Women farmers in Cameroon are an important group for whom risk aversion influences production outcomes and welfare. This study identifies and analyses the effect of climate risks on the productive activities and the management options of male and female farmers. Women-owned farms, on average, record profits of US$ 620 per hectare to about US$ 935 for crop enterprises across the different agroecological zones. Comparatively static results indicate that increases in climate variability and the uncertainty of climate conditions have an explicit impact on farm profit. The impacts of increased uncertainty in climate and risk aversion are ambiguous depending on the agroecology. Ex-ante and ex-post risk management options reveal that female-owned farms in the northern Sahel savannah zone rely on more sophisticated strategies to reduce the impact of shocks. While adapting to uncertain climate positively influences profit levels, risk measured as the variance of rainfall or temperature per unit variation in profit is significant. This analysis stresses the increased importance of climate risk management as a prelude to the panoply of adaptation choice in response to expected climatic change.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

For Cameroon, like most countries in sub-Saharan Africa, agriculture is truly important. Agriculture and forestry sectors provide employment for the majority of the population. About 80% of the country’s poor live in rural areas, and work primarily in agriculture. About 35% of Cameroon’s GDP originates in agriculture and related activities, with close to 70% of the national labour force employed in agriculture. Cameroon’s economy is therefore predominantly agrarian and the exploitation of agricultural and other natural resources remains the driving force for the country’s economic development. Small-holder farmers produce 98% of food consumed. The crop and production practices are based on their local knowledge and experience that has been developed over the years.

In rural Cameroon, crop production is the major source of income for households. Three-quarters of the food-crop farmers are women. Women work the fields for long hours, in off- and on-seasons, to supply homes, markets and community with food. The subsistence farming practised is aimed mainly at stabilising production (Fonchingong 1999). The evolution of the sector and the adoption of modern practices is low, and this constraint is reinforced by the increasing involvement of female-headed households in the sector as female farmers owners and managers. However, while Cameroon’s agriculture is on a long march to productivity, the food crop sector, which is dominated by women, is still highly dependent on basic inputs, with climate (rainfall, temperature, etc.), light and water the main drivers of crop growth. Local farmers have developed several management and coping mechanisms to reduce the risks of crop production and to ensure productivity under varying environmental conditions.

The key uncertainty for agriculture outlook in the country is the weather. Despite relative improvements in technology and yield potential, the weather is still inherently an important factor in Cameroonian agriculture. The low rainfall distribution in some regions of the country and the high inter-seasonal variability of rainfall makes crop production, on which the livelihood of rural inhabitants is based, a risky enterprise (Molua 2002). Extreme inter-annual variability of rainfallFootnote 1 in the northern drier regions of the country is not uncommon, inducing droughts or floods and often creating serious repercussions for agricultural and nonagricultural commodities. Increased soil erosion and nutrient depletion associated with climatic variability and environmental change present a threat to food security and the sustainability of agricultural production in parts of sub-Saharan African, with government and development agencies already investing resources to promote soil conservation practices as part of an effort to improve environmental conditions and reduce poverty (Kassie et al. 2008). While, for instance, Mueller and Osgood (2009) suggest a link between large precipitation shocks in rural areas and urban poverty, de Haen and Hemrich (2007) also demonstrate how extreme conditions and natural disasters could have significant implications and challenges for food security.

Given the pronouncements of climate studies on the evidence of global warming (Molua 2003, 2006; Kurukulasuriya et al. 2006; Stern 2006; IPCC 2007), there is concern that climatic impacts on food production and its costs will be exacerbated in Cameroon and beyond the Central African sub-region due to global warming, with its potential for affecting the climatic regimes of the entire region. Current climate variation is already altering the types, frequencies, and intensities of crop and livestock pests and diseases, the availability and timing of irrigation water supplies, and the severity of soil erosion (Molua 2009). Income diversification is a major risk-reducing ex-ante strategy employed by many farmers in the country and in large parts of sub-Saharan Africa (Seo 2010; Seo and Mendelsohn 2008; Maddison 2007).

The subsistence farmers’ remedy for climatic variability in the context of rain-fed agriculture has often been to establish, on a trial by error basis, a farming system that is largely conservative and provides a minimum return even in less favourable seasons. Faced with uncertainties caused by climate, economic and political events, these farmers’ risk aversion is reinforced. Under these circumstances, and in the absence of insurance markets, most farmers use ex-ante risk-minimising strategies to reduce vulnerability (Maddison 2007; Mapp et al. 1979), especially to climatic risks.

A review of climate research and the observations associated with climate variability in Cameroon, raises some pertinent questions pertaining to the response of producers to changing climatic conditions: (1) what is the farm-level agricultural risk associated with climate variation and change?Footnote 2 (2) What is the impact of climate uncertainty on agricultural profitability? This paper seeks answers to these questions by comparing the exposure of women-owned and men-owned farms to production risk induced by climate variation. The rationale for this research is that agriculture is the mainstay of the economy, supported by subsistence female farmers, contributing up to 60% of total value of exports, with farming depending entirely on the quality of the rainy season.

The paper is organised as follows. The section “Climate and gender related production: a theoretical nexus” presents a review of the interrelationship of climate and gender-related production activities. “Methodology” examines the analytical framework of uncertainty under risk aversion. The data and application to female producers are discussed in the section “Nature and source of data”. The empirical findings are presented in “Empirical findings and discussion”. This latter section shows how female farm profits have been affected by uncertain climate and the choice of farm management options. This research adds to the existing body of knowledge by employing gender analysis to demonstrate the impact of climate and attendant consequences on vulnerable groups.

Climate and gender-related production: a theoretical nexus

The risks faced by agriculture have often been classified into such categories as production, marketing, financial, legal and human risks. Farming is a financially risky occupation. On a daily basis, farmers are confronted with an ever-changing landscape of possible price, yield, and other outcomes that affect their financial returns and overall welfare. The consequences of decisions or events are often not known with certainty until long after those decisions or events occur, so outcomes may be better or worse than expected. Climate variability, measured as the annual variation in the level of precipitation, which may fluctuate around particular trends or cyclical long-run patterns, impacts on farm production activities. In certain years, rainfall supply is beyond or below specified average conditions. Climate variability is particularly critical for agricultural production when moisture availability drops below the optimal level required for biomass growth during different stages of the agricultural cycle, resulting in reduced yields. In Cameroon, farming cuts across the different climate regimes shown in Fig. 1. Ground station and Satellite estimate of rainfall show strong regional variations in the country with increasing dryness from the southern humid region of the country to the northern Sahelian zone; with possibility of strong interannual and inter-seasonal variations within each region (FAO 2010). Climate variability becomes critical in the country when shortfall in water availability in a given region is beyond the recurrent seasonal rainfall pattern that farmers consider the benchmark for selecting their cropping system and activity pattern. As a result, farm household livelihoods become more vulnerable to shocks and stress. Variability in rainfall is thus a major cause of risk that threatens livelihoods in households where income is strongly dependent on rain-fed agricultural production.

Interpolated estimated dekadal distribution in different regions of Cameroon (Source: NOAA/FEWSNet, http://www.cpc.ncep.noaa.gov/products/fews/; FAO/NRCB-Agrometeorology Group, http://www.fao.org)

Farmers respond to climate risks in varying ways, depending whether they are risk neutral or risk averse. The implications of rainfall variability become visible at three different levels: (1) changes in yield, (2) changes in prices, and (3) adjustments in (disposable) income.Footnote 3 The risk-aversion literature holds that farmers tend to use fewer inputs than would have done if they maximized expected profit due to risk aversion. There is wide acceptance that farmers only partially adopt or do not adopt at all even when the new technologies may provide higher returns to land and labour than the traditional technologies. Such new technologies are not costless. Risk averse farmers are similarly weary of associated costs of new technologies that may impinge on their income levels both in the short-run and long-run. This perception is particularly significant in climate dependent agricultural production in rural Africa associated with imperfect or missing credit markets and the absence of a formal weather-indexed insurance market. Morduch (1992), Rosenzweig and Binswanger (1993) and Dercon (1996) provide some illumination on the economic behaviour and response of risk-aversion farmers make in production decisions. de Janvry (2000) reports that households can reduce exposure to consumption risk through risk management (interventions which are ex-ante relative to income realizations) and through risk coping (ex-post relative to income), and there is hence a trade-off between the two. Since risk management has an opportunity cost on expected income, improved access to risk coping instruments may allow households to take higher risks in production and achieve higher expected incomes (Seo and Mendelsohn 2008; Maddison 2007; Binswanger and Rosenzweig 1993; Morduch 1992; Binswanger 1980). Access to risk coping instruments, such as flexible credit, by the poor has been used as a way of raising expected incomes.

Female producers in Cameroon are an important group for whom risk aversion influences production outcomes and welfare. A subgroup that is seriously constrained and on whom policy choices must be addressed is the female-headed household and female farm-owners. A significant body of literature has focussed on the disadvantages faced by women producer groups (Fonchingong and Fonjong 2002; Buvinic and Gupta 1997; Appleton 1996; Bindlish and Evenson 1993; Jones 1986; Guyer 1984). The challenges faced in the farm-fields of women producers cannot be dissociated from the communal and intra-household power relations that determine access to assets and productive resources. More so, the power of traditional gender structures as rooted in the legal environment perpetuates a disincentive for ownership of assets and productive resources that may be needed to overcome climatic challenges.

The dynamic nature of contemporary African farming and the changing traditional gender-specific nature of farming patterns has resulted in a steady rise in the number of women de facto farm managers. This trend is most prominent in the African region, with nearly three times as many women-headed households in rural areas than in other regions (Jazairy et al. 1992). Not only do women outnumber men in the agricultural labour force, but they also work more hours in agriculture than men in Kenya and Nigeria (Saito et al. 1994). The average daily hours in agricultural and non-agricultural economic activities by gender for Burkina Faso, Kenya, Nigeria and Zambia show that women farmers work on average 4–6 h longer per day, excluding the hours that women spend on their reproductive tasks such as fetching fuelwood and water, cooking, cleaning and otherwise taking care of family members and children (Saito et al. 1994). This implies that either as farm owners, managers or labourers, rural women account for a significant proportion of farm labour––almost 60% of the agricultural labour force (Jazairy et al. 1992)––requiring the tools and assets to be productive.

Risk is a central part of livelihoods in agrarian households in sub-Saharan Africa. Risky returns occur in female-owned farms because either the yields or prices or both are uncertain. Often, uncertainties arise from the influence of uncontrolled variables whose levels are unknown. If the probability of distribution of a return relative to the uncontrolled variables can be specified only conditionally on controlled variables, the choice and level of controlled variables will influence the distribution of the return. Therefore, in such a case, the choice and levels of controlled inputs should allow for risk effects.Footnote 4 Therefore, in response to recurrent drought and commodity price shocks, households respond with sophisticated strategies to manage or reduce risk ex-ante and ex-post to cope with the consequences of risk once shocks occur (Morduch 1995; Dercon 1996, 2002). Siegel and Alwang (1999) developed a taxonomy of risk-coping strategies for rural households facing risk, noting that household assets are the stock of wealth used to generate wellbeing—usually divided into tangible and intangible wealth, with tangible wealth encompassing natural, human (e.g. education and health status), physical (e.g. land, equipment, work animals, jewelry) and financial (e.g. cash, savings, and access to Credit) capital. Intangible assets result from the interaction of members within households as well as from households with each other inside the community and beyond. These include gender relations, social ties and networks, including participation in associations and organisations, and intra-household relations (Siegel and Alwang 1999). Some other researchers have explored the outcome of these strategies in greater detail. Morduch (1995) and Dercon (2002) identify some ex-ante strategies to include activity and asset diversification, migration patterns and specialisation into low-risk activities and ex-post coping strategies through the use of ‘self-insurance’ via precautionary savings or using informal community or network-based risk-sharing arrangements. While these strategies have been observed to influence consumption and income, shocks are not fully insured, leading to variations in welfare outcomes (Just and Pope 1979; Rosenzweig and Binswanger 1993; Dercon 2004). In high risk environments such as arid zones, economic behaviour, performance of producer groups and household welfare are affected for many years after the shock (Udry 1994; Morduch 1995; Townsend, 1995; Dercon 2002; Fafchamps 2003; Dercon et al. 2005).

However, many strategies are unavailable or prove ineffective for the poor, especially when the risks are covariate. Households living on very low incomes and limited wealth become highly risk adverse since even a small disruption in income flows can have devastating effects. Such risk aversion retards the development process by limiting household incentives to adopt productivity-enhancing technologies and to specialise in activities where comparative advantages exist. Such risks also affect the credit-worthiness of rural households and constrain credit markets. The empirical expositions of Seo and Mendelsohn (2008), Maddison (2007), Bar-shira et al. (1997) and Baker et al. (1993) indicate that farm risk management involves the identification, evaluation, and implementation of strategies to reduce uncertainty in the revenue flow. Implementing risk-reducing strategies comes at a cost, and these costs have to be weighed against potential benefits. For instance, while hedging generally results in reduced risk, it also often significantly reduces profits, which reflects a trade-off between risk and return.

Given the nature of risk for farm households, it is quite logical to expect rural households to diversify their sources of income. Recent literature has reemphasised the role of diversification in development.Footnote 5 Seo (2010), Ellis (2000) and Hardaker et al. (1998) indicate that diversification may be used both under conditions of economic improvement as well as economic decline, especially in the agriculture sector. It is intuitive to expect small landowners to have limited opportunities for income from farming. These households use their labour resources in a variety of ways. Working on other farms in the community for either direct income or in-kind payments is common among the rural poor. Even jobs that do not involve farm work may be directly related to agricultural production in some fashion (e.g. food processing, transportation, or input supply for farming). By the same token, the well being of the farming sector can have a direct bearing on jobs that are not tied directly to agriculture.

Methodology

We focus on an ex-ante analysis at planting time, when the farmer does not know the weather conditions during the growing season. In this context, crop yield is treated as a random variable, conditional on decisions made at planting time. We analyze the effects of crop profitability and farm income. Evaluated ex-ante at planting time, crop yield, profit and farm income are random variables that depend on weather patterns during the growing season. Thus, there is a need to specify and estimate their distribution function, conditional on technology, climate, and the choice of crops (Chavas et al. 2001; Antle and Goodger 1984; Antle 1983). Econometric methods can be used to estimate the distribution function (see e.g. Nelson and Preckel 1989; Kaylen et al. 1992; Gallagher 1986; Goodwin and Ker 1998; Ramirez 1997). The following section provides the framework for estimating conditional means and conditional variances of the relevant variables over time and at different ecological zones in Cameroon.

Decision making under uncertainty

Decision making under uncertainty has been modelled and studied by Antle (1983, 1987), Chavas and Holt (1996) and Chavas et al. (2001). Relying on the analytical exposition of Chavas et al. (2001), we assume farms in Cameroon are producing under uncertainty. Under technology t, farm profit is represented by the stochastic function π (x, t, e), where x is a (n × 1) vector of inputs and e is a vector of uncontrollable factors that are not known to the decision maker at the time when x is chosen. The vector e is treated as a random vector with a given probability distribution G. It includes the unpredictable effects of weather on farm production. In this context, the influence of input choice x on farm profit depends on both weather effects e and technology t. Assume that inputs are chosen to maximise the expected utility of profit:

where E is the expectation operator based on the information available at the time decisions are made. The von Neumann-Morgenstern utility function U(π) represents the risk preferences of the decision maker, with ∂U/∂π > 0. Thus, we assume that farm decision-making is represented by the following optimisation problem:

Making Eq. 2 empirically tractable requires information about the expected utility EU(π). A convenient approach is to rely on the moments of stochastic profit π. Let:

where dG(e) is the mean profit or first moment of profit. Then, assuming differentiability, expanding U(π) in an m-th order Taylor series about μ1π and taking expectation gives

where μiπ(x, t) = E[(π(x, t, e) − μ1π(x, t))i] is the i-th central moment of π, i = 2, …, m. As Chavas et al. (2001) note, Eq. 4 shows how expected utility depends on mean profit μ1π(x, t), on the variance of profit μ2π(x, t), on the skewness of profit μ3π(x, t), etc. In turn, each moment of profit depends on the input decision x and on technology t. Equation 4 applies under very general conditions. It requires only that the first m moments of π are finite. As such, it allows for many probability distribution functions for the random variables e, thus providing a flexible representation of the uncertainty. Under risk neutrality, the utility function U(π) is linear and maximising Eq. 4 reduces to maximising expected profit μ1π(x, t) = Eπ(x, t, e).

However, there is strong empirical evidence that most farmers are risk averse (e.g. Seo and Mendelsohn 2008; Chavas and Holt 1996; Saha et al. 1994; Young 1979). If rainfall, per se, declines (or increases) are perceived at acceptable levels and the expectant damage to crop is low enough, it does not pay to take control measures and invest in time, effort and money to control for the perceived effects. However, as declines (or excesses) continue towards possibly a hydrological drought (or floods) it reaches a point where the perceived damage would justify taking control measures (see Maddison et al. 2007). As shown in Fig. 2 below, risk averse farmer may accommodate some risk. The level of risk that can be tolerated at a particular time and place without a resultant economic crop loss is noted as the economic threshold; and the economic damage level is that point at which the incremental cost of climate control is equal to the incremental return resulting from the climate control. Farmers, especially with experience, intuitively tend to have report a feel/perception of some kind threshold rainfall levels their croplands can tolerate.

Technically, therefore, under risk aversion, ∂2 U/∂π2 < 0 means that the variance of profit μ2π becomes relevant in Eq. 1. This suggests a need to estimate the moments of profit µiπ(x, t), i = 1, 2,… This can be done by specifying a parametric form for each μiπ and estimating the corresponding parameters. Let µiπ = f i (x, t, β i ), where β i is a vector of parameters representing the effects of x and t on the i-th moment of profit µiπ, i = 1, 2,… Then, consider the econometric model:

where v 1π is an error term distributed with zero mean, E(v 1π) = 0. Assume that we obtain a sample of observations on profit π and on the variables (x, t). Then, treating (x, t) as exogenous variables, Eq. 5 is a standard regression model where the parameters β i can be consistently estimated by the least squares method. Let β e i be the least squares estimator of β i in Eq. 3, giving v e1π = π − f 1(x, t, β e i ) as the least squares residual. β e i being a consistent estimator of β i , it follows that v e1π is a consistent estimator of v 1π. Using (5), we obtain E[(v 1π)i] = E[(π − μ1π)i] = μiπ. It follows that:

where v iπ is an error term distributed with mean zero, E(v iπ) = 0, i ≥ 2. This suggests the following model specification:

Again, assuming a sample of observations on profit π and on the exogenous variables (x, t), consider Eq. 7 as a regression model and let β e i be the least squares estimator of β i in Eq. 7. Because v e1π is a consistent estimator of v 1π, it follows that β e i is a consistent estimator of β i in Eq. 7, i ≥ 2 (see Antle 1983). Thus, the least squares estimation of Eqs. 6 and 7 gives consistent estimates of the central moments of profit, including mean profit μ1π = f 1(x, t, β e i ) and the variance of profit μ2π = f 2(x, t, β e i ). This provides a framework for the empirical investigation of the distribution of profit as it changes with technology t and the input choices x.

Under risk neutrality, expression Eq. 2 implies that the input choice x would be chosen so as to maximize expected profit E(π) = f 1(x, t, β e i ). Alternatively, under risk aversion, production decisions in Eq. 2 would take into consideration both mean profit f 1(x, t, β e i ), and the variance of profit f 2(x, t, β e i ). If we restrict our attention only to these first two moments, then risk aversion will imply some trade-off between expected profit and the variance of profit (e.g. Meyer 1987). As noted in Fig. 2, under risk aversion, the decision maker will always choose to obtain the highest possible expected profit for a given variance, or the smallest possible variance for a given expected profit (e.g. Anderson et al. 1977). In line with the assertions in the seminal works of Markowitz (1959) and Milgrom and Roberts (1992), this defines the “mean–variance frontier”, or equivalently a “mean–standard deviation” frontier. Without information on the exact risk preferences of the decision maker, the optimal decision in Eq. 2 will be a point on this frontier (Chavas et al. 2001). Under risk neutrality, it would correspond to the point where the expected profit is the largest possible. Under extreme risk aversion, it would correspond to the point where the variance (or standard deviation) of profit is the smallest possible (which is typically associated with lower expected profit). Under intermediate situations, it would trade off increases in expected profit with decreases in variance (or standard deviation) depending on the degree of risk aversion of the decision maker.Footnote 6

Nature and source of data

To understand the impact of climate on agriculture, we purposefully study agrarian households in Cameroon. Primary data is thus employed. The data is obtained from the nationwide field survey conducted under the GEF/World Bank-sponsored survey on climate and African agriculture, coordinated by the Centre for Economic and Environmental Policy (CEEPA). The objective of the household survey is threefold, viz. (1) to generate reliable representative sample quantitative data on netput prices costs, net revenue, farmland values, and other socioeconomic determinants of agricultural performance in Cameroon; (2) to generate qualitative information on farmer perceptions concerning the nature of long-term changes in temperature and rainfall in farm locations, and the short and long-term adaptation strategies farmers employ to mitigate potential adverse effects of climate; (3) to achieve substantial variation in the data set, covering all the agro-ecological zones in the country, as well as the major and minor crops, rain-fed and irrigated agriculture, small and large scale production, and traditional and improved technology-based agriculture. All the selected divisions and villages/towns were covered during the survey in eight agro-ecological zones.Footnote 7 A sample comprising of 800 households was interviewed from 50 out of the then 58 administrative divisions in Cameroon. In the current study we purposefully disaggregate from the dataset, households headed by women, i.e. with no male figure in the decision-making process, and households that are male-headed. This gives a sample of 362 female-owned farms and 438 male-owned farms across three major agroecologies in the south, west and northern regions of the country. These three regions are studied for their spatial importance as poles of agriculture in the country supplementing agricultural supplies to neighbouring regions and zones. The ecology and socioeconomic characteristics of the study sites are described in Molua and Lambi (2006). The current study is delimited to examine the effects of rainfall and temperature on farming activity. While global climate change is embodied in temperature, rainfall, carbon dioxide, run-off and their interaction, in tropical agriculture rainfall and temperature are, however, significant limiting conditions that determine the carrying capacity of the biosphere to produce enough food for the human population and domesticated animals (see Reilly et al. 1996; Rosenzweig and Liverman 1992; Parry et al. 1988; Thompson 1975). This study therefore assesses the balance of the effects of rainfall and temperature on agricultural holdings in Cameroon. The data on rainfall and temperature is generated from the Africa rainfall and temperature evaluation system (ARTES),Footnote 8 and regional area average extrapolated with use of ArcGIS (Lokupitiya et al. 2007; Satti and Jacobs 2003).

Empirical findings and discussions

Risk management options

About 92% of farmers employ more than one form of risk-management and risk-coping strategy to maximise profits and protect production activities from adverse climatic conditions. Primarily, about 80% of female farmers diversify production and income alternatives to minimise the effects of climate risks or maximise use of all resources available to households. A wide variety of crops are grown across the different ecological zones in the country. This allows farmers to choose among differing combinations of inputs and crop outputs when responding to rainfall variations. Female farmers, however, tend to shift to crop mixes that require less labour and capital, away from some field crops in response to rainwater reductions. The high water requirements of several field crops lead to movement away from field crops to fruits, nuts and vegetables. The shift in crop mix appears to have significant impacts on the demand for farm inputs for both male and female farmers.

However, a gender-based difference in accessing production resources is observed. Though in male-headed households, men and women are observed to have complementary roles, sharing or dividing tasks in farm production, in some cases, women and men have distinctly different tasks and responsibilities with varying access to production inputs and support services. As shown in Table 1, women generally have much less access to resources than men. In reporting their access to farming information, financial capital and farmland, 25.6, 23.2 and 29.7% of women living in male-headed households attested to having access to these resources. In terms of decision making, 43.5, 39.8, 55.4 and 32.3% of women make decisions on the type of crop to cultivate, when to harvest, where to sell and how to spend farm income. The causes of the low proportion of women having access to productive resources are rooted in discriminatory traditions and attitudes and women’s inadequate access to decision-making. Some studies have shown that throughout Cameroon, women have insufficient access to land, credit, agricultural inputs and technology, training and extension, and formal marketing services. While the national law gives women equitable access to land and productive assets, in practice such access is more often through male heads of households, and many rural women are not aware of their rights and obligations. Such lack of ownership or access to production resources may have implications on output and farm returns. And as the production environment changes and efforts to adapt intensify, these differences become even more important for ex-post and ex-ante risk management strategies.

As shown in Table 2, ex-ante and ex-post risk management options differ among the different agroecologies in the country, with female farming households in the northern Sahel savannah zone developing more sophisticated strategies to reduce the impact of shocks. In the other zones, risk management in the crop systems involve the farmers tailoring their farming decisions to the season ahead, by adopting some practices that are flexible, such as choosing certain soils, crops and varieties, and varying their proportions in mixed/inter-cropping systems; altering the area planted by crop and location; using genotypes of varying maturity, e.g. planting early maturing short-duration varieties; adjusting sowing time and sequence; applying or withholding suitable soil amendments, fertilizers and pesticides; varying seeding rates, plant spacing and row orientation to match seasonal expectations; adjusting water conservation practices depending on soil moisture status and climate. In addition to farming options, farming households also undertake a range of consumption, investment, or income generation strategies to cope with expected shortages, such as migrate to seek employment; undertake non-farm economic activities; disinvest household and personal assets; avoid selling remaining food stocks; and reduce non-food expenditures.

As revealed in Table 2, about 55% of women farmers in the humid forest zone rely on soil amendments such as farmyard manure, as opposed to 63 and 76% of farmers in the high savannah and Sahel savannah, respectively. The use of fertiliser as a response option to climate variability is corroborated in Alem et al. (2010), who find evidence that fertiliser use responds to rainfall variability, with the intensity of current year’s fertiliser use positively associated with higher rainfall levels experienced in the previous year. The inaccessibility to fertilizer means that producers rely on alternatives such as mulching and increased multiple crop. For instance, 85% of women farmers in the moist humid zone employ multiple cropping as a coping mechanism, whilst 78 and 32% of farmers in the High and Sahel savannah, respectively, adopt multiple cropping as a crop management option to adapt to variable climatic conditions. An important observation is that, in farm practice adjustments that require extensive use of resources, such as changing farm site or rainwater harvesting, male farmers show a greater response rate than female farmers. This may account for the different levels in the profitability of the holdings.

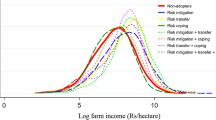

Measuring farm profit as revenue minus cost on per hectare basis and computed for all the three zones studied,Footnote 9 Fig. 3 shows that in the milder climatic regions of the humid forest and high savannah male producers record higher returns than females, while in the harsh drier regions females observe higher profits than males, reaching an annual maximum of about US$ 842 and US$ 526, respectively. That female profit levels in the humid south are higher than male returns in the drier north could be explained by socio-cultural and environmental differences in the practice of cropland agriculture.

In addition to the farm management choices noted in Table 2, risk-coping strategies for both groups are observed to involve self-insurance (through precautionary savings) and informal group-based risk-sharing. During periods of long dry-seasons, there is attempt to earn additional income through a reallocation of labour, including temporary migration, earning income from collecting wild foods (for own consumption) and gathering activities (such as increased firewood collection). About 5% of women farmers compared to 12% of men farmers in the moist humid zone consider migration as an option to cope with climate risks. Similarly, about 11% of female farmers compared to 16% males in the High savannah, and 17% females as against 21% of males in the Sahel savannah, report to have moved from another location as an adaptation to changing climatic stress.

On the whole, ex ante, the risks in the production process and the need for ‘income smoothing’ are ensured through income diversification. Some farmers combine activities with low positive covariance and income-skewing, i.e. taking up low risk activities even at the cost of low return. Some households are involved in a variety of activities, including farm and off-farm activities, use seasonal migration to diversify or focus on low risk activities even at the cost of a low return. Interestingly, formal credit appears to contribute only little to reducing income risk and its consequences. Where accessibility is ensured, formal loans from microfinance programmes serve investment and consumption purposes via their fungibility. Formal insurance markets for agriculture is typically absent. Informal credit and informal insurance, however incomplete, help in mitigating uncertainty and allow some producers to cope with risky incomes. While traditional credit systems (rotating savings) often include a lending possibility, which is used for consumption purposes, informal credit markets also appear to adjust to high-risk environments. For instance, accessibility to credit possibly accounts for the observed disparity in the study regions in the use of fertilizer, and as Alem et al. (2010) note abundant rainfall in the previous year could depict relaxed liquidity constraints and increased affordability of fertilizer, which makes rainfall availability critical in severely credit-constrained environments.

Analysis of the mean and variance of profit

Not only do male farmers observe higher returns than females, with men-owned farms recording on average US$ 550 per hectare and women-owned farms observe average returns of US$ 480 per hectare, there is significant variation in farm return within groups across the zones. Women-owned farms record profits in the range of US$ 620 per hectare per household to about US$ 840 for crop enterprises across the different agroecological zones. As shown in Table 3, a comparative analysis of the three agroecologies, reveals higher profits accruing to farmers, especially males, in the High Savannah zone.

The zonal variation in revenue and profits is possibly explained by climatic fluctuations, market price fluctuations and social conditions. Areas with high inter-annual variability of rainfall, which are located on the northern Sahel savannah zone, observe consistently higher price levels for staples such as sorghum, millet and rice. However, since the examined commodities are tradeable across the national territory, price changes are not likely to be a problem for producers as regional gains and losses in production offset each other for a small net change in national output. Changes in exogenous factors, e.g. climate, impacting the biological output and yield are more likely to be a problem. This is in line with observations in Mainardi (2010), who studied the determinants of yields and prices of local crops and find that most crop yields are found to be weakly price-responsive, with seasonal rainfall elasticities, suggesting that staple food crops have slight price margins and relative resilience to rainfall shortages. To account for such marginal changes, however, producers in Cameroon diversify their production options and income sources as households become increasingly exposed to both price and climate risks. For instance, about 65% of all household incomes in the northern Sahel come from non-cropping sources, against 45% in the rainforest region. In the High Savannah region, non-crop incomes are more diversified in terms of sectors and less co-variant with the food crop economy, thus insulating the household better against climatic fluctuations.

Relationship between profit and climate risk

Exploring the implications of climate risk on expected farm profit, we employ the maximum likelihood estimation procedure with profit as the dependent variable and climatic factors as the independent variables. Risk is measured in three forms: (1) variance of climate variables, (2) variance of non-farm income, and (3) variance of climate variables per unit variation of non-farm income. The non-farm income (NFI) variable captures two effects: the impact of economic factors (e.g. tangible wealth) on farm profit, as well as the impact of social factors (i.e. intangible wealth). Rainfall (temperature) is the anomaly of farming season rain (temperature) measured as deviation of farming season mean from annual mean for each of the farming communities within the three zones studied. These deviations (anomalies) from their mean, which account for the unreliability and variability of climatic variables, are subjected to econometric tests to ascertain their impact on farm profit. And by estimating profit, account is inherently made on the direct effects of climate on the yields of different crops as well as the indirect substitution of different inputs, the introduction of different activities and other potential farm adjustments to different climates. Hence, the analysis is guided by the assumption that, to varying degrees, farms trade-off profitability and risk when making decisions, preferring less uncertainty in ultimate profits for any given level of expected profits.Footnote 10

As Fig. 1 posits, farmers in different regions and ecological zones are associated with different levels of climate and hence varying risk, and Table 2 shows that they respond differently to the risks they face. As anticipated under risk aversion and yield uncertainty, the regression coefficients for climate variance are significant in all three ecological zones. Table 4 shows that risk measured as variations in rainfall has a positive significant impact on both expected profits and variance in profits. Rainfall and temperature anomaly are significant across all zones having a priori an expected negative sign, while their squared terms are highly significant. The latter reveal that in Southern Cameroon mean profit decreases by 11.2% in female-managed farms for a 1 standard deviation (SD) of rainfall from the mean value. Temperature anomaly similarly decreases profit by 1.8% for a 1SD of temperature from the mean value. Furthermore, the impact on profit increases significantly with the squared terms. The impacts are stronger in the drier Sahelian regions. The squared terms being strongly significant implies that the observed relationships are non-linear. The squared term for rainfall is negative, implying that further deviations may lead to negative outcomes. More importantly, the negative influence of the squared terms highlight that the price effect resulting from declines in output level may not be sufficient to cushion declines in farm earnings. Temperature variations exhibit similar effects, albeit with lower significance. These findings confirm the a priori expectation that tropical rainfall acts more of a limiting factor in crop production than temperature in the region. However, the low significant influence of temperature could be reinforced by long-term global warming, with negative consequences since most crops in the region, especially cereals, are already operating at their temperature optimum.

The results in upper part of Table 4 enable us to examine these relationships by gender. For each zone, we estimate the variation of climatic factors that maximizes expected income. For male-managed farms in Southern Cameroon, variations in rainfall, temperature and non-farm income tend to lower expected farm profits by 9.2, 1.2 and 2%, respectively. The respective values for expected farm profit in female-managed farms in the same zone are 11.2, 1.8 and 2.2%. As seen in the lower part of Table 4, variations in climatic variables reinforce the variations in farm profit, with returns to female-managed farms consistently more impacted than that of their male counterparts. And as one moves further north to the drier parts of the country, the variations are more significant for both male and female-managed farms and the expected profits are maximised under larger variations in climatic factors. Risk measured as the variance of rainfall or temperature per unit variation in non-farm income is also significant and positive.

The positive sign across all agroecologies and farming groups indicates the resilience of adaptation choices in cushioning against profit declines. This informs that the potential for adaptation to alleviate income vulnerability may not be influenced solely by cultural practices, but also by historical experiences in changing environmental conditions. As such, farmers in the High Savannah zone show a relatively large trade-off between expected return and risk, whereas the trade-off is less pronounced under the Sahel savannah zone and relatively less pronounced in the Humid Moist Forest zone. This means that, for farming in the Sahel zone, risk can be reduced without much reduction in expected profit by employing farm practices and adopting crops that are tolerant to prevailing and projected climatic conditions. This would imply that a moderately risk-averse farmer chooses a drought-tolerant crop to avoid risk while not sacrificing much in expected profit.

On the other hand, for farms in both the High Savannah and Humid Forest zones, the mean profit-risk trade-off is more significant and the choice of crop and farming practices would depend on farmers’ risk preferences. For example, a risk-averse farmer has incentive to harvest and store rainwater, but a risk-neutral farmer would choose to grow early maturing crops because this may increase expected profit. These differences among farms in different ecological zones emanate from the costs incurred and different options employed in adapting to varying and changing climate. In particular, when the adaptation costs are minimal, planting a high yielding variety produces both higher expected profit and higher risk. Alternatively, when adaptation cost becomes significant, using a high yielding hybrid has only a modest effect on expected net return while significantly increasing risk exposure. This highlights the importance of technology and associated costs. On investigating the linkages between technological change and production risk, Kim and Chavas (2003) find that technological progress contributes to reducing the exposure to risk, with the effect varying across sites. The Cameroonian experience with technology and regional variations is similar to observations in other parts of the continent. For instance, Kassie et al. (2008) investigate the impact of stone bunds on the value of crop production per hectare in low and high rainfall areas of the Ethiopian and find that plots with stone bunds are more productive than those without such technologies in semi-arid areas but not in higher rainfall areas, apparently because the moisture conserving benefits of this technology are more beneficial in drier areas. This indicates that the performance of stone bunds varies by agro-ecology type, suggesting the need for designing and implementing appropriate site-specific technologies. This corroborates the observation of Olsson et al. (2005) that the increasing vegetation greenness across the Sahel in recent times could be due to improved land management as an adaptation choice.

Implications, recommendations and conclusion

While farm-level adaptation brings benefits associated with decreased yield variability, farm activities that are undertaken to increase crop protection increase income volatility in the short-run, creating a disincentive to adapt for more risk-averse farmers. As a result, to stabilise income, a significantly greater proportion of female farmers than male farmers opt for low cost adaptation methods such as mulching and mixed cropping, which impact less on farm earnings yet positively contribute to yield stabilisation. In general, profit and income levels are observed to increase, in the short-run, in the drier areas with certain climatic conditions. However, when drier conditions are reinforced, profits decline. Hence, female farmers in milder zones tend to be more reactive in adopting conservation and protective methods than proactive farmers in already harsh climatic zones. Risk coping strategies are thus observed to be insufficient in milder zones. The estimate of the contributory effect of farm management options in influencing revenue levels highlights their role in poverty alleviation in a setting in which farming is the predominant source of sustenance income. The employment of periodic migration in the harsher regions may be an insufficient response to enhance a households’ long-term wellbeing, for, as noted by Mueller and Osgood (2009), large short-term rainfall shocks may damage the long-term income of households that have permanently migrated from rural to urban areas. This outcome is consistent with the behaviour of credit-constrained rural households who are willing to accept lower long-term income in urban areas following the depletion of their productive assets during an adverse shock.

In essence, therefore, climate variability undermines agricultural development, by further impoverishing low-income farm households, reducing agricultural yields and incomes, and reducing productivity in rain-fed farming systems. Government crop commodity programs can help female farmers reduce the variability in overall profit. There is a need to institute commodity programs for basic food and cash crops such as corn, groundnut, soybean, rice and cotton, to remove both the yield risk and the market risk by ensuring a farmer a target price for a guaranteed quantity on each hectare enrolled in the program. This will allow farmers to grow important nutrient field crops that appear to have a lower expected return than other crops. This must be combined with formal or informal insurance and credit transfers, which will have to merge with extension service effort to stabilise food and income levels.

In addition, the observed climatic risks could be managed through agro-biodiversity and agri-environmental policies as highlighted in the variation and stability between farmers in the humid forest zone and those of the drier Sahelian region. According to Baumgartner and Quaas (2010) agro-biodiversity can provide natural insurance to risk-averse farmers by reducing the variance of crop yield, and to society at large by reducing the uncertainty in the provision of public-good ecosystem services. With the empirical results from Cameroon showing regional disparities in farm returns, risk management strategies need therefore to be adapted to both the location, type and ownership of farm. These options seem particularly relevant in a context where global warming contributes to increasing weather uncertainty.

Notes

Climate variability in this paper refers to seasonal rainfall or temperature variation measured as the deviation of the monthly mean from the seasonal mean of temperature and rainfall as measured in weather stations across the country.

Climate change here refers to change in national precipitation and temperature over time due to variability. It is measured as the statistical deviation of annual seasonal means from the 50-year seasonal mean as measured in regional weather observatories.

The latter effect refers directly to the availability of purchasing power to ensure household welfare. Changes in yields and prices can partly compensate each other.

An individual is said to be risk neutral if the utility of the expected value is equal to the expected utility. In such cases, the individual is said to have a linear utility function. An individual is said to be risk averse if his or her von Neumann–Morgenstern (NM) utility function is strictly concave, i.e. if the utility of the expected value is greater than the expected utility. Similarly, an individual is said to be a risk lover if his or her NM utility function is strictly convex (Takayama 1994).

Since many of the sources of the diversified portfolio of income remain tied to the well being of farming in the community, any shocks that hurt the local agricultural output can place the diversified income of the rural poor in jeopardy. For example, a wide-spread natural disaster (drought or flood) that creates significant yield loss for crops and damages grassing lands for livestock can have a devastating impact on all sources of income. Thus, even a well-diversified portfolio of income for the rural poor may still be vulnerable to a significant covariate risk: natural disasters.

While least square estimation provides a consistent estimate of the parameters of the conditional moments [e.g. in Eqs. 6 and 7], it will be of interest to test hypotheses about these parameters. In general, the conditional moment specifications suggest the presence of heteroscedasticity (e.g. Just and Pope 1979; Yang et al. 1992). This must be taken into consideration in conducting hypothesis testing. We examine this by implementing the procedure proposed by White (1980), which gives consistent estimates of the standard errors in the presence of general heteroscedasticity.

These are the Sahel, Sudan savanna, Low savanna, High savanna (savanna-montane), Forest-savanna ecotone, Guinea savanna, Humid equatorial and Littoral moist equatorial forest. This classification is based on the variability in precipitation, average temperature, vegetation, relative humidity, reference evapotranspiration, wind speed and total solar radiation.

The Artes (Africa Rainfall and Temperature Evaluation System) published by the World Bank in collaboration with climate centers, provides basic statistics of rainfall and temperature for the continent of Africa based on NOAA’s Gridded Africa Rainfall and Temperature Climatological Dataset. Two basic series were provided by NOAA, one is the daily rainfall and temperature from 1 January 1977 to 31 December 2000. The other is the monthly precipitation from January 1948 to December 2001. This is complemented with recent NOAA/FAO satellite information. The precipitation data measures the amount of rainfall in millimetres per unit of area. The temperature is measured in degrees Celsius.

Information on input and output prices with sufficient variation across farms in the different study regions are accounted for in the profit and income estimations. Hence, with producers being price-takers in all the markets, prices are endogenous to the estimation, with market prices and access to the market accounting for profit levels.

To ensure marginal price changes do not mitigate the welfare effects, we compute and use marginal changes in the expected profit. Thus, the marginal impact of a single climate variable, e.g. rainfall RFi, on profit is evaluated on the extent of variation of that variable \( E\left[ {\partial \pi /\delta \sigma_{{{\text{RF}}_{i} }} } \right] \). The obtained marginal change in profit is hence the marginal welfare effect of the change in the variation of the exogenous climate variables. This approach controls for the overestimation of the welfare effects due to price variation.

References

Alem Y, Bezabih M, Kassie M, Zikhali P (2010) Does fertilizer use respond to rainfall variability? Panel data evidence from Ethiopia. Agric Econ 41(2):165–175

Anderson JR, Dillon J, Hardaker B (1977) Agricultural decision analysis. Iowa State University Press, Ames

Antle JM (1983) Testing the stochastic structure of production: a flexible moment-based approach. J Business Econ Statist 1:192–201

Antle JM (1987) Econometric estimation of producers’ risk attitudes. Am J Agric Econ 69:509–522

Antle JM, Goodger WJ (1984) Measuring stochastic technology: the case of Tulare milk production. Am J Agric Econ 66:342–350

Appleton S (1996) Women-headed households and household welfare: an empirical deconstruction for Uganda. World Dev 24(12):1811–1827

Baker DG, Rushy DL, Skaggs RH (1993) Agriculture and recent ‘benign climate’ in Minnesota. Bull Am Meteorol Soc 74:1035–1040

Bar-Shira Z, Just R, Zilberman D (1997) Estimation of farmers’ risk attitude: an econometric approach. Agric Econ 17:211–222

Baumgartner S, Quaas MF (2010) Managing increasing environmental risks through agrobiodiversity and agrienvironmental policies. Agric Econ 41(5):483–496

Bindlish V, Evenson R (1993) Evaluation of the performance of T&V extension in Kenya. Agriculture and rural development series 7. World Bank, Washington, DC

Binswanger HP (1980) Attitudes toward risk: experimental measurement in rural India. Am J Agric Econ 62:395–407

Binswanger HP, Rosenzweig C (1993) Wealth, weather risk and the composition and profitability of agricultural investments. Econ J 103:56–78

Buvinic M, Gupta G (1997) Women-headed households and women-maintained families: are they worth targeting to reduce poverty? Econ Dev Cult Chang 42(2):259–280

Chavas JP, Holt M (1996) Economic behavior under uncertainty: a joint analysis of risk preferences and technology. Rev Econ Statist 78:329–335

Chavas JP, Kim K, Lauer JG, Klemme RM, Bland WL (2001) An economic analysis of corn yield, corn profitability, and risk at the edge of the Corn Belt. J Agric Resourc Econ 26(1):230–247

de Haen H, Hemrich G (2007) The economics of natural disasters: implications and challenges for food security. Agric Econ 37(s1):31–45. doi:10.1111/j.1574-0862.2007.00233.x

de Janvry A (2000) The logic of peasant household behavior and the design of rural development interventions. Manlio Rossi-Doria Lecture, 2000. La Questione Agraria (4):7–38

Dercon S (1996) Risk, crop choice and savings: evidence from Tanzania. Econ Dev Cult Change 44(3):385–514

Dercon S (2002) Income risk, coping strategies and safety nets’. World Bank Res Observ 17:141–166

Dercon S (2004) Growth and Shocks: evidence from Rural Ethiopia. J Dev Econ 74–2:309–329

Dercon S, Hoddinott J, Woldehanna T (2005) Vulnerability and shocks in 15 Ethiopian villages, 1999–2004. J Afr Econ 14(4):559–585

Ellis F (2000) Rural livelihoods and diversity in developing countries. Oxford University Press, Oxford

Fafchamps M (2003) Rural poverty, risk and development. Elgar Publishing, Cheltenham

FAO (2010) Interpolated estimated Dekadal distribution in different regions of Cameroon. In: Quantitative estimate of rainfall combining METEOSAT derived Cold Cloud Duration imagery and data on observed rainfall (GTS-Global Telecommunication System by the NOAA Climate Prediction Centre), Food and Agricultural Organisation, Rome

Fonchingong CC (1999) Structural adjustment, women, and agriculture in Cameroon. In: Gender and development. Oxfam, Oxford, pp 73–79

Fonchingong CC, Fonjong L (2002) The concept of self-reliance in community development initiative in the Cameroon Grass fields. GeoJournal 57(1–2):3–13

Gallagher P (1986) U.S. corn yield capacity and probability: estimation and forecasting with non-symmetric disturbances. North Central J Agric Econ 8:109–122

Goodwin BK, Ker AP (1998) Nonparametric estimation of crop yield distributions: implications for rating group-risk crop insurance contracts. Am J Agric Econ 80:139–153

Guyer J (1984) Family and farm in southern Cameroon. African Research Studies 15. Boston University African Studies Center, Boston

Hardaker JB, Huirne RBM, Anderson JR (1998) Coping with risk in agriculture. CAB International, Wallingford

IPCC (2007) Climate change: the scientific basis. Report of Working Group I of the Intergovernmental Panel on Climate Change, Geneva

Jazairy I, Alamgir M, Pannuccio T (1992) The state of world poverty. IFAD, Rome

Jones C (1986) Intra-household bargaining in response to the introduction of new crops: a case study from North Cameroon. In: Lewinger Moock J (ed) Understanding Africa’s rural households and farming systems. Westview, Boulder, pp 105–123

Just RE, Pope RD (1979) Production function estimation and related risk considerations. Am J Agric Econ 61:277–284

Kassie M, Pender J, Yesuf M, Kohlin G, Bluffstone R, Mulugeta E (2008) Estimating returns to soil conservation adoption in the northern Ethiopian highlands. Agric Econ 38(2):213–232

Kaylen MS, Wade JW, Frank DB (1992) Stochastic trend, weather and US corn yield variability. Appl Econ 24:513–518

Kim K, Chavas JP (2003) Technological change and risk management: an application to the economics of corn production. Agric Econ 29(2):125–142

Kurukulasuriya P, Mendelsohn R, Hassan R, Benhin J, Molua E et al (2006) Will African agriculture survive climate change? World Bank Econ Rev 20(2006):367–388

Lokupitiya E, Breidt FJ, Lokupitiya R, Williams S, Paustian K (2007) Deriving comprehensive county-level crop yield and area data for U.S. cropland. Agron J 99:673–681. doi:10.2134/agronj2006.0143

Maddison D (2007) The perception of and adaptation to climate change in Africa. The World Bank Policy Research Working Paper No. 4308, Washington, DC http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2007/08/06/000158349_20070806150940/Rendered/PDF/wps4308.pdf

Maddison D, Manley M, Kurukulasuriya P (2007) The impact of climate change on African agriculture: a ricardian approach. The World BankPolicy Research Working Paper No. 4306, Washington, DC, http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2007/08/06/000158349_20070806141653/Rendered/PDF/wps4306.pdf

Mainardi S (2010) Cropland use, yields, and droughts: spatial data modeling for Burkina Faso and Niger. Agric Econ. doi:10.1111/j.1574-0862.2010.00465.x

Mapp HP Jr, Hardin ML, Walker OL, Persaud T (1979) Analysis of risk management strategies for agricultural producers. Am J Agric Econ 61:1071–1077

Markowitz H (1959) Portfolio selection. Wiley, New York

Meyer J (1987) Two-moment decision models and expected utility maximization. Am Econ Rev 77:421–430

Milgrom J, Roberts P (1992) Economics, organization and management. Prentice-Hall, New Jersey, pp 246–247

Molua EL (2002) Climate variability, vulnerability and effectiveness of farm-level adaptation options: the challenges and implications for food security in rural Cameroon. J Environ Dev Econ 7(3):529–545

Molua EL (2003) Global climate change and Cameroon’s agriculture: evaluating the economic impacts. Cuvillier, Goettigen. ISBN 3-89873-824-8

Molua EL (2006) Climate trends in Cameroon: implications for agricultural management. Clim Res 30:255–262

Molua EL (2009) An empirical assessment of the impact of climate change on smallholder agriculture in Cameroon. Global Planet Chang 67:205–208

Molua EL, Lambi CM (2006) Assessing the impact of climate on crop water use and crop water productivity: the Cropwat analysis of three districts in Cameroon. CEEPA discussion paper no. 37. In: Special series on climate change and agriculture in Africa ISBN 1-920160-17-7, Centre for Environmental Economics and Policy in Africa, University of Pretoria, South Africa

Morduch J (1992) Risk production, and saving: theory and evidence from Indian households. Mimeo, Harvard University

Morduch J (1995) Income smoothing and consumption smoothing. J Econ Perspect 9:103–114

Mueller VA, Osgood DE (2009) Long-term consequences of short-term precipitation shocks: evidence from Brazilian migrant households. Agric Econ 40(5):573–586

Nelson CH, Preckel PV (1989) The conditional beta distribution as a stochastic production function. Am J Agric Econ 71:370–378

Olsson L, Eklundh L, Ardo J (2005) A recent greening of the Sahel—trends, patterns and potential causes. J Arid Environ 63:556–566

Parry ML, Carter TR, Konijn NT (eds) (1988) The impact of climatic variations on agriculture, vol 1: assessments in semi-arid regions. Kluwer, Dordrecht

Ramirez OA (1997) Estimation and use of a multivariate parametric model for simulating heteroskedastic, correlated, nonnormal random variables: the case of corn belt corn, soybean, and wheat yields. Am J Agric Econ 79:191–205

Reilly J, Baethgen W, Chege RE, van de Geijn SC, Erda L, Iglesias A, Kenny G, Patterson D, Rogasik J, Rötter R, Rosenzweig C, Sombroek W, Westbrook J (1996) Agriculture in a changing climate: Impacts and adaptation. In: Changing climate: impacts and response strategies, Report of Working Group II of the Intergovernmental Panel on Climate Change, Chap 13. Cambridge University Press, Cambridge

Rosenzweig M, Binswanger H (1993) Wealth, weather risk and the composition and profitability of agricultural investments. Econ J 103–416:56–78

Rosenzweig C, Liverman D (1992) Predicted effects of climate change on agriculture: a comparison of temperate and tropical regions. In: Majumdar SK (ed) Global climate change: implications, challenges, and mitigation measures. The Pennsylvania Academy of Sciences, PA, pp 342–361

Saha A, Shumway CR, Talpaz H (1994) Jointly estimating risk preferences and technology using an expo-power utility. Am J Agric Econ 76:173–184

Saito AK et al (1994) Raising the productivity of women farmers in sub-Saharan Africa. World Bank Discussion Papers, Africa Technical Department Series, No 230, Washington, DC

Satti SR, Jacobs JM (2003) A GIS-based model to estimate the regionally distributed drought water demand. Agric Water Manage 62(2):37–66

Seo SN (2010) Is an integrated farm more resilient against climate change? A micro-econometric analysis of portfolio diversification in African agriculture. Food Policy 35(1):32–40

Seo SN, Mendelsohn RO (2008) An analysis of crop choice: adapting to climate change in South American farms. Ecol Econ 67(1):109–116

Siegel PB, Alwang J (1999) An asset-based approach to social risk management: a conceptual framework. The World Bank, Washington, DC

Stern N (2006) The stern review: the economics of climate change. Cambridge University Press, Cambridge

Takayama A (1994) Analytical methods in economics. University of Michigan Press, Ann Arbor

Thompson LM (1975) Weather variability, climate change and food production. Science 188:534–541

Townsend RM (1995) Consumption insurance: an evaluation of risk-bearing systems in low-income economies. J Econ Perspect 9:83–102

Udry C (1994) Risk and insurance in a rural credit market: an empirical investigation of northern Nigeria. Rev Econ Stud 61(3):495–526

White H (1980) Heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Yang SR, Koo WW, Wilson WW (1992) Heteroskedasticity in crop yield models. J Agric Resour Econ 17:103–109

Young DL (1979) Risk preferences of agricultural producers: their use in extension and research. Am J Agric Econ 61:1063–1070

Author information

Authors and Affiliations

Corresponding author

Additional information

Edited by Fukuya Iino, United Nations Industrial Development Organization (UNIDO), Austria.

Rights and permissions

About this article

Cite this article

Molua, E.L. Farm income, gender differentials and climate risk in Cameroon: typology of male and female adaptation options across agroecologies. Sustain Sci 6, 21–35 (2011). https://doi.org/10.1007/s11625-010-0123-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11625-010-0123-z