Abstract

The development of foreign markets can be considered as a strategic key factor in times of globalisation. However, past empirical research could not detect a “universal” relationship between corporate multinationality and performance. There exist fundamental doubts whether the contextual condition of internationalisation of one empirical setting can be easily transferred to another setting for investigating the relationship between multinationality and performance. For instance, potentials for realising economies of scale in the home market and abroad, the degree of integration of neighbouring countries, as well as the accumulated internationalisation experience, can differ significantly from each other between countries. Taking into account the contextual conditions of internationalisation of stock-listed German firms in the time period from 1990 to 2006, this paper analyses the performance effects of firms’ multinationality. Firms of this sample can benefit from multinationality even in early internationalisation stages and are able to manage high degrees of complexity in later internationalisation stages successfully. Firm-specific advantages in the field of intangible assets with long-term (short-term) effects moderate the relationship between multinationality and future-oriented (past-oriented) performance positive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The development of foreign markets has increased substantially since the Second World War. This fact is impressively demonstrated by the progressive growth of the world trade volume and the worldwide stock of foreign direct investments. Thus the world trade volume grew from 59 billion US-Dollars in the year 1948 to 18.4 trillion US-Dollars in 2012 (UNCTAD 2013b). Similarly the worldwide stock of foreign direct investments increased from 699 billion US-Dollars in the year 1980 to 22.8 trillion US-Dollars in 2012 (UNCTAD 2013). However, from a microeconomic point of view this raises the question whether these activities of firms abroad make sense for them in economic terms. How does the development of foreign markets affect firm performance? When and under what conditions can activities abroad influence firm performance in a positive manner? Researchers in the field of international business and other disciplines have developed numerous arguments and theories that make a link between multinationality (M) and firm performance (P). Initial studies in the 1970s investigated a linear positive MP-relationship (e.g., Vernon 1971). In contrast, for instance Click and Harrison (2000) found a linear negative MP-relationship. Later studies identified a U-shaped (e.g., Lu and Beamish 2001; Ruigrok and Wagner 2003) as well as an inverted U-shaped MP-relationship (e.g., Gomes and Ramaswamy 1999). More recent analyses attempted to integrate divergent approaches by a three-stage model (S-curve model), the so called “General Theory” (Contractor et al. 2003). In turn, current investigations discovered an inverted S-shaped MP-relationship (e.g., Ruigrok et al. 2007). Summing up, it can be said that the empirical findings are contradictory. On this occasion Hennart (2007) argued that no systematic MP-relationship exists. Instead the MP-relationship is firm-specific and dependent on moderation effects and their embeddedness in the context. Glaum and Oesterle (2007) and Verbeke and Forootan (2012) reminded us to focus more on the context of the particular sample as well as on the role of moderating factors.

The main contributions of this paper to fill existing research gaps are following:

First, with reference to Ruigrok et al. (2007) and to the meta-analysis of Kirca et al. (2012), which explicitely consider the role of contextual factors for the analysis of the MP-relationship, this study attempts to take up the criticism of Verbeke and Forootan (2012) by considering contextual conditions of firm internationalisation and their impact on firm performance. Second, the conceptual paper of Verbeke and Forootan (2012) emphasised the important role of firm-specific advantages in the field of intangible assets for the MP-relationship. Nevertheless, in contradiction to the theory of firm-specific advantages and interalisation theory the meta-analysis of Kirca et al. (2011) could not indicate a significant positive moderating impact for every category of intangible assets on the MP-relationship. However, meta-analysis and single empirical studies have insufficiently considered the time-dependent effectiveness of firm-specific advantages in regard to the time-dependent sensitivity of performance measures. For this reason we measured the moderating effect of intangible assets appropriate to its time-dependent effectiveness by employing past-oriented based accounting as well as future-oriented capital market based performance measures. Finally, regarding the relevance of different economic regions of the world, the current state of the art revealed a systematic overrepresentation of MP-studies with samples of firms from the United States and a lack of studies for firms from Europe. To resolve this shortcoming, this study focus on German firms, which represents the leading economy of Europe.

The paper is organised as follows: In Chapter 2 we describe the state of the art. Afterwards, Chapter 3 presents the hypotheses. Chapter 4 introduces the methodology. Subsequently, Chapter 5 depicts the results. The paper concludes with a discussion in Chapter 6 and summary in Chapter 7.

2 State of the Art

2.1 Theory and Empiricism of the MP-Relationship Independent of the Explicit Consideration of Contextual Conditions

2.1.1 Theories and Empiricism Focusing on the Benefits of Internationalisation

Since the 1970s the question about the MP-relationship concerns the focus of IB-research (e.g., Vernon 1971). Costs of operating in foreign markets are faced with revenues that occur in varying degrees during the different stages of the internationalisation process. In the following section we introduce the most important theories and arguments that link firms’ operation abroad with performance as well as the corresponding empiric results. To limit the depiction of the theoretical arguments, we restrict our consideration on those arguments that are able to accomodate the dynamic of the internationalisation process and can explain the role of contextual conditions for the MP-relationship of German firms. Initially, we will introduce theories and arguments that focus on the benefits of internationalisation followed theories and arguments that focus on the costs of internationalisation.

The theory of firm-specific advantages (Kindleberger 1969; Caves 1971; Hymer 1976) assumes that a firm’s internationalisation has a positive performance effect if MNCs possess firm-specific advantages. These advantages exist due to imperfections in product and/or factor markets and are often based on intangible assets (e.g., in technologies, products, or brands) or economies of scale. Operations abroad seem to be beneficial if a firm is in charge of firm-specific advantages. Closely linked to this argument is the assumption derived from internalisation theory: multinationality induces positive performance effects if a firm is in charge of intangible assets (Buckley and Casson 1976; Hennart 2007; Kirca et al. 2011). The meta-analysis of Bausch and Krist (2007) as well as those of Kirca et al. (2011) revealed a positive moderating effect of intangible assets in the field of research and development (R&D) on the MP-relationship. However, Kirca et al. (2011) could not find a positive moderating effect of intangible assets in the field of marketing. Both meta-analysis differentiated insufficiently between past- and future-oriented performance measures. The incorporation of the time dimension is essential for the analysis of the performance effect of intangible assets, as outlined later in Sect. 3.2.

A further argument, which is often linked with a positive MP-relationship, concerns economies of scale (e.g., Lu and Beamish 2004; Ruigrok et al. 2007): firms that exhibit a high level of fixed-costs can benefit from economies of scale by operating in foreign countries. Ruigrok et al. (2007) highlighted that specifically firms with small home markets are dependent on operating abroad. However, the majority of studies investigated the performance effect of economies of scale independent of foreign operations (e.g., Click and Harrison 2000; Fauver et al. 2004).

In the context of different environmental conditions, MNCs in contrast to purely domestic firms dispose over additional arbitrage opportunities. Furthermore MNCs possess a greater bargaining and market power than their domestic counterparts due to their size and their international presence (Kogut 1985; Hennart 2007). These issues increase the scope of action and hence their operational flexibility. Yet, the empirical results are mixed. Whereas the majority of contributions discovered a positive relationship (Pantzalis 2001; Lee and Makhija 2009; Fisch and Zschoche 2011a), some studies detected a negative relationship (Christophe and Pfeiffer 2002).

2.1.2 Theories and Empiricism Focusing on the Costs of Internationalisation

In contrast to the preceding explanations, some arguments focus on the costs of internationalisation. Firms that operate in foreign countries are faced with different cultural, legal, and economic conditions than in their home markets. The costs of adaptation to the heterogeneous environment the so-called liabilities of foreignness appear particularly in the case of a first entry into a foreign market or a certain foreign region (Hymer 1976; Zaheer 1995). The adaptation to the new environment can be interpreted as an organisational learning process, where new routines have to be developed and initially serious costs burden can occur. Authors who investigated samples with firms in early internationalisation stages found a U-shaped MP-relationship, with a decreasing performance effect of multinationality in the first stage due to liabilities of foreignness and an increasing performance after a successful learning process in the second stage (e.g., Lu and Beamish 2001; Capar and Kotabe 2003; Ruigrok and Wagner 2003).

Moreover, an increasing degree of multinationality, which is frequently combined with geographic diversification and a replication of the value chain (Porter 1986), induces the necessity of cross-border coordination processes and hence a growing degree of complexity. As a result of the increasing geographic and cultural distance between different locations, coordination costs rise (Lu and Beamish 2004). Especially, contributions that regard MNCs in advanced internationalisation stages could detect inverted U-shaped MP-relationships (Hitt et al. 1997; Gomes and Ramaswamy 1999).

2.1.3 Theories and Empiricism Focusing on the Overall Performance Effect of Multinationality

Besides the foregoing arguments and theories, further approaches exist that explain more complex and dynamic MP-relationships. Previous research focused on considering either a single effect, for instance a moderating effect, and/or described the overall effect of multinationality. This section will describe the empirical results of the overall performance effect of multinationality. Studies that identified a linear positive MP-relationship emphasised the benefits of internationalisation (e.g., Morck and Yeung 1991), whereas investigations that found a linear negative MP-relationship highlighted the costs of internationalisation (e.g., Click and Harrison 2000). While linear studies insinuated a time-indifferent impact of the diverse performance effects of internationalisation, curvilinear analyses accentuated the dynamic effects. Thus, for instance Lu and Beamish (2001) reasoned for a U-shaped MP-relationship wherein firms in early internationalisation stages are faced with significant liabilities of foreignness that could be overcome successfully only after a process of organisational learning. In contrast, researchers who detected an inverted U-shaped MP-relationship (e.g., Gomes and Ramaswamy 1999) argued that with the exceeding of a critical threshold of multinationality increasing coordination costs caused by high complexity dominate. The proponents of a S-shaped MP-relationship (e.g., Contractor et al. 2003) integrated the approaches of a U-shaped and an inverted U-shaped MP-relationship by introducing a three-stage-model that claims to be a “general theory” for the MP-relationship (Contractor 2007, p. 453). The first stage is characterised by a decreasing performance caused by liabilities of foreignness. In the second stage positive performance effects predominate after a successful adaptation process. Finally, in the last stage performance is again decreasing because of an extensive degree of complexity due to high levels of multinationality. Although the three-stage-model of Contractor et al. (2003) integrates different theoretical arguments in a dynamic perspective, the model can validate these arguments only as explanatory constructs by the function curve. Glaum (2007) and Oesterle and Richta (2013) noted that the empirical test of the three-stage model requires both a long-term investigations that cover all internationalisation stages and an empirical continuous internationalisation process. Ruigrok et al. (2007) found an inverted S-shaped MP-relationship for a sample of Swiss firms. The authors argued that the positive contextual conditions for an internationalisation of Swiss firms, like multilingualism and the access to the European Union, outweigh costs caused by liabilities of foreignness. It is remarkable that Swiss firms can realise again an increasing performance after a reorganisation process even during very high degrees of multinationaliy, which are accompanied by high levels of complexity and hence high coordination costs.

The development of linear towards curvilinear MP-relationships included an integration of static and dynamic aspects. Hennart (2007) took these inconsistent and contradictory empirical results after 40 years of research on MP-relationship as a reason to claim that no systematic MP-relationship exists. He argued that from the perspective of transaction and internalisation theory, internationalisation activities can be handled via the market or within the firm by various value activities. Following the “bundling model” of Hennart (2009), potential performance effects are dependent on the resources of the firm, complementary resources outside of the firm, and the nature of the markets for purchase and sale of certain resources. The interaction of these three factors in the case of an operation in foreign countries is rather firm-specific, if not even transaction-specific. According to Hennart (2007), generalisable statements on the MP-relationship based on quantitative empirical investigations are not convincing. Oesterle and Richta (2013) criticised that after 40 years of research endeavors, with Hennart (2007) and Contractor (2007) two opposing approaches face each other. Similar to Glaum and Oesterle (2007) and Verbeke and Forootan (2012), Oesterle and Richta (2013) claimed a better integration of contextual conditions for the analysis of the MP-relationship to reconcile contradictory results.

2.2 Empirical Studies on the Influence of Contextual Conditions on the MP-Relationship

As one of the first researchers, Wan and Hoskisson (2003) considered the influence of contextual conditions in the home country for the MP-relationship. In their sample of 16 Western European countries they differentiated between countries with less and more munificent home country environments. The study showed evidence that firms from countries with more munificent home environments benefit from operating abroad, whereas firms from the other group exhibited no significant performance effects of internationalisation. Fauver et al. (2004) investigated the performance effects of firms from the United States, Great Britain, and Germany. They found that firms from the United States showed a significant negative performance effect, while firms from Great Britain and Germany possessed no significant effect of internationalisation. The authors traced back these results for firms from Great Britain and Germany on low internationalisation costs due to the European integration. Elango and Sethi (2007) examined the influence of the home country effect on the MP-relationship by comparing a sample of firms from small countries with extensive foreign trade with a sample of firms from large countries with moderate foreign trade. The results revealed a linear positive MP-relationship for firms from small countries with extensive foreign trade and an inverted U-shaped MP-relationship for firms from large countries with moderate foreign trade.

Sieler (2008) compared a sample of pharmaceutical firms and food producers from the United States with a sample of the same industries from European countries in Germany, which was dominated by German firms. He detected no significant performance effects of multinationality for the joint sample of both continents and industries. If he separates the joint sample by continents, he identified a linear positive performance effect of multinationality of European firms but a linear negative effect for firms from the United States. For a sample of firms originating from different European countries Bobillo et al. (2010) demonstrated a significant effect of the institutional environment of the home country on firm’s internal and external resources. However, the MP-relationships for the samples with different resource endowments did not distinguish from each other. All models disclosed a S-shaped MP-relationship. Kirca et al. (2012) picked up this subject in their meta-analysis and differentiated between firm-, industry- and countrylevel contextual factors. The meta-analysis, encompassing 152 samples from 141 studies, revealed that a higher breadth of multinationality has a higher performance effect than a higher depth of multinationality. Manufacturing firms benefited more from internationalisation than service firms. Similarly, firms from developed countries profited more from internationalisation than firms from developing countries. Even if these contextual factors differ from each other between the various introduced studies, we can state, except for the study of Bobillo et al. (2010), that contextual factors had a significant influence on the MP-relationship. In contrast to the previously presented studies, the analysis of Ruigrok et al. (2007) considered not multiple countries, but focused on contextual conditions for internationalisation of Swiss firms. As one of the first they found a inverted S-shaped MP-relationship. Ruigrok et al. argued that the performance increase during the early internationalisation stage is due to the small home market. To achieve economies of scale, Swiss firms are forced to internationalise. Because of the trilingualism, the geographic and cultural proximity of the neighbouring countries, and finally the free economic access to the countries of the European Union, learning and transaction costs are very low. Nevertheless, firms are faced with an increasing complexity and rising coordination costs during medium levels of multinationality. The performance is decreasing. By adjustments of routines, reorganisation, and implementation of new management techniques, firms can handle successfully even high degrees of multinationality in late stages of internationalisation. At the end firms reach a critical threshold of multinationality that is associated with such a high level of complexity that further internationalisation revenues reach is limited. Subsuming, the small amount of existing single studies that integrate contextual conditions reveal the relevance of considering the context for investigating the MP-relationship. However, despite the meta-analysis of Kirca et al. (2012), a detailed pattern of the influence of contextual conditions does not exist in works published to date.

2.3 Geographic Focus of MP-Studies

Taking into consideration the relevance of contextual conditions for the investigation of the MP-relationship, it is seems to be interesting to distinguish those regions/countries that were in the focus of past research and those that were not. In addition to the lack of involvement of contextual factors, the distorted geographic focus of MP-studies is another shortcoming of past research. Taking into account the relevance of the economic region, analyses with samples of firms from Europe are distinctly underrepresented. Thus, Bausch and Krist (2007) identified in their 36 studies encompassing meta-analysis, only 6 studies investigating exclusively European samples (that corresponds to a percentage of 16.7 %) but 16 studies examining samples stemming exclusively from the United States (that corresponds to a percentage of 44.4 %). This shortcoming was confirmed by later analyses and reviews. The review conducted by Li (2007) encompassing 45 papers disclosed a percentage of 17.8 for European firms but for firms from the United States a percentage of 51.1. In the most comprehensive meta-analysis on the MP-relationship of Kirca et al. (2011), which comprised 111 studies, only 15.3 % of them investigated European firms but 52.3 % investigated firms from the United States. The disproportion will be even more apparent when considering the meta-analysis of Yang and Driffield (2012), where the share of firms from the United States accounted for 68.5 % and the share of firms from Europe merely 13.0 %. If we compare this with contribution of the United States to the world GDP in the year 2010 in the amount of 22.0 % and of 23.2 % for the European Union (UNCTAD 2013a), the underrepresentation of research efforts on European firms becomes clear.

Besides the lack of analyses on European firms and the dominance of studies with samples of firms from the United States, there exist fundamental doubts, as mentioned in Chapter 2.2, whether the contextual conditions of internationalisation of one country can be easily transferred to another country for investigating the MP-relationship. Hence, the contextual conditions of internationalisation will be included for hypotheses development.

2.4 State of the art for German Firms

As noticed in Chapter 2.3, MP-studies for firms located in Europe are underrepresented. Hence, we focus our investigation on German firms, which represent the leading economy of Europe and the former export world champion. To depict the state of the art for German firms, hereinafter we present contributions in journals as well as PhD theses that consider explicitly German firms. Table 1 summarises the state of the art on the MP-relationship of German firms.

Prior to the reunification of East and West Germany, Bühner (1987) investigated the MP-relationship of firms from West Germany. He found a positive linear effect of the foreign sales ratio on different accounting based measures. Only after a 12-year interruption Gerpott and Walter (1999) resumed the research efforts. For a sample of large industrial firms they could identify significant effects of the foreign sales ratio on diverse accounting based measures. Ruigrok and Wagner (2003) and Wagner (2004) analysed a joint sample of listed manufacturing firms. Ruigrok and Wagner (2003) discovered a U-shaped relationship between the foreign sales ratio and the return on assets. Building on these results, Wagner (2004) detected an inverted U-shaped relationship between internationalisation speed and cost efficiency. Like Ruigrok and Wagner (2003), Capar and Kotabe (2003) also found a U-shaped MP-relationship for an sample of service firms. The last three studies draw on the theory of organisational learning and could confirm it. Due to the necessity of adaption to local consumers and the larger regulation intensity, Capar and Kotabe (2003) emphasized the high level of liabilities of foreignness in early internationalisation stages for service firms. By contrast, Singh et al. (2010) detected an inverted U-shaped relationship between the foreign sales ratio and return on assets for a sample of small and medium sized firms. They highlighted the role of high transactions costs in later internationalisation stages for this kind of firms. The authors argued that the absence of high learning costs in early internationalisation stages is due to the internationalisation of small and medium sized firms in cultural close countries. Eckert et al. (2010) proved a positive linear effect of the foreign sales and the foreign assets ratio on Tobin’s Q. Furthermore they discovered significant moderating effects of intangible assets on the MP-relationship. The direction of the effects depended on the selected indicator of multinationality. Based on the concept of operational flexibility, Fisch and Zschoche (2011a) investigated the effect of international relocations of production facilities on the accounting based performance of foreign production networks of German firms. The utilisation of factor arbitrage opportunities by foreign production networks had a positive influence on performance. Fisch and Zschoche (2011a) documented a positive influence of breadth and depth of internationalisation on performance. Soon afterwards Fisch and Zschoche (2011b) discovered a S-shaped relationship between the spread of foreign direct investment (FDI) and the accounting based performance of the network of foreign subsidiaries of German firms. Following the information cost approach of Casson (1999), performance decreased in early internationalisation stages due to high liabilities of foreignness. In the next stage, performance increased and decreased again in the third stage because of high costs due to complexity. In addition, Fisch and Zschoche (2011b) identified a positive impact of the foreign sales ratio and a negative impact of increasing network of foreign subsidiaries on performance. In contrast to the studies presented so far, both Fisch and Zschoche (2011a) and Fisch and Zschoche (2011b) did not consider the performance of the whole group but the success of the entire network of foreign subsidiaries of a group. Besides the introduced analyses in journals, a number of PhD theses exist that make an important contribution to the field. Jansen (2006) could not detect a significant influence of multinationality on the capital market based performance measure Excess Equity Value for a sample of German stock-listed firms. It is important to note that Jansen (2006) used only dummy variables to measure the degree of firms internationalisation. For a similar sample, Kreye (2007) found a positive linear impact of the foreign sales ratio on the capital market based measure Excess Value. Moreover, he discovered a positive moderating effect of intangible assets in the field of R&D on the MP-relationship. Likewise, Krist (2009) investigated a sample of German stock-listed firms and focused his analysis on the role of intangible assets on the MP-relationship. Thereby, he could identify a positive influence of intangible assets in the field of primary value activities but a negative influence of intangible assets in the field secondary value activities. As one of the first he demonstrated an inverted S-shaped MP-relationship. Richter (2010) examined a sample of firms from the manufacturing industry. Like Singh et al. (2010) she detected an inverted U-shaped MP-relationship. Fisch et al. (2012) suspected the use of different performance measures as a reason of contradictory empiric results. They discussed in detail the differences between accounting based and capital market based performance measures. Contrary to their expectations they could not identify differences between these two groups. Both for the return on equity ratio and the market to book value ratio they discovered a S-shaped relationship for the spread of FDI. Fisch et al. (2012) argued that this is due to the insufficient consideration of risk factors of internationalisation by investors in capital markets. Also, they found a positive linear influence of the foreign sales ratio. Nevertheless they neither investigated curvilinear MP-relationships for the foreign sales ratio nor the role of moderating factors.

In conclusion, the previous presented contributions provided no consistent picture. The results for the overall MP-effect range from positive linear, U-shaped, inverted U-shaped, S-shaped, and inverted S-shaped almost over the complete spectrum of potential MP-relationships (see Table 1). Solely a negative linear relationship was not observed. The reasons for these inconsistent results are manifold. Thus, there are different perspectives (whole group versus the network of foreign subsidiaries), sample periods (particularly in the progress of European integration), range of industries (single industry versus samples with a broad range of industries), and firm size (SMEs versus large stock-listed firms). In addition, studies used diverse indicators of multinationality (e.g., foreign sales ratio versus foreign assets ratio) and performance (accounting based versus capital market based measures). The considered moderating effects deviated significantly from each other in the studies, too. The majority of analyses focused at a single measure of multinationality as well as a single measure of performance. However, it can be expected that different kinds of development of foreign markets and firm-specific advantages exhibit divergent effects on accounting based and capital market based performance measures. Furthermore none of the studies explicitly took account for the link between the heterogeneous time-dependent effectiveness of intangible assets and the different time-dependent sensitivity of performance measures. To identify the MP-relationship with the best fit, it is a striking fact that with the exception of Krist (2009), Fisch and Zschoche (2011b), and Fisch et al. (2012) the majority of studies tested linear or single selected curvilinear but not the complete range of potential MP-relationships. In contrast to Ruigrok et al. (2007), which examined Swiss firms, the studies on German firms only partially or insufficiently considered the contextual conditions of firm internationalisation for the purpose of hypothesis development.

3 Hypotheses

3.1 Contextual Conditions of Internationalisation for German Firms

Independent of the test of single theory-based effects, the question of the overall effect of internationalisation for German firms arises. The depiction in Chapter 2.2 illustrates that the consideration of contextual conditions of internationalisation is advisable for the analysis of the MP-relationship. For this reason, we will discuss hereafter the contextual conditions of internationalisation for German firms of our specific sample. Thus, the sample studied focusses on large stock-listed firms from a broad range of industries that exhibit already a high degree of internationalisation. The observed average firm generated 52 % of its sales abroad and owned 33 % of its assets outside of Germany (see Table 2). The fact that firms of our sample are highly internationalised indicates that it seems to be unlikely to observe significant performance declines due to strong levels of liabilities of foreignness. Glaum (2007) as well as Oesterle and Richta (2013) noted that the empirical test of the three-stage model (S-curve), which comprises in the first stage a performance decline due to liabilities of foreignness, requires long-term investigations that cover all internationalisation stages. Ruigrok et al. (2007), who investigated a sample of Swiss firms, which were also already strong internationalised and integrated economically in the European market, found an inverted S-shaped MP-relationship (without stages with significant performance declines due to liabilities of foreignness) for a sample of Swiss firms. Therefore we have to exclude MP-relationships such as U-shaped and S-shaped that cover also early internationlisation stages with high levels of foreignness. Recent studies on German firms with a broad range of industries presented in Chapter 2.4 support this assertion [see e.g., the studies of Krist (2009) and Richter (2010) in Table 7]. Nonetheless, we could expect to observe performance declines due to liabilities of foreignness in the past, but not in a sufficient scale for our current sample. Thus, Capar and Kotabe (2003) as well as Ruigrok and Wagner (2003) (see Table 1) could detect for their samples of German firms in the 90s a U-shaped MP-relationship.

The following information refers to the contextual conditions of internationalisation of our analysed sample that may have a considerable influence on the overall performance effect of multinationality. Opportunities to realise economies of scale facilitate the optimisation of revenues. This requires sufficiently large sales markets. With a GDP of 2.3 trillion Euro and a population of 82 million inhabitants at the end of sample period in the year 2006 (Eurostat a; Eurostat b; Worldbank b), Germany had in terms of the GDP the third largest home market of the world and the largest in the European Union. As a result of the large home market, German firms possess over immense potential to realise economies of scale in their domestic market. Beyond this, the internal market of the European Union with a GDP of 11.6 trillion Euro and a population of 464 million inhabitants (Eurostat a; Eurostat b) represents the largest integrated market in the world. As a result of the geographic location, Germany is surrounded by numerous neighbor countries, excepting Switzerland, that are integrated completely or partially in an economic and monetary union. The geographical and cultural proximity of the neighbor countries as well as their deep economic integration are beneficial for an internationalisation of German firms inside of Europe and are linked with low levels of liabilities of foreignness. As a consequence, German exports inside the European Union accounted for nearly two-thirds of total exports in 2006 (Eurostat 2010). A further advantage is the long-term internationalisation experience. As export world champion in 2006, Germany export goods and services in the amount of 46 % of its GDP (Worldbank a). A similar pattern was observed for foreign direct investments. German firms possessed foreign direct investments in an amount of 1.331 trillion US-Dollars, which accounts for 37 % of the GDP (UNCTAD 2013; Worldbank b). This fact was supported on microeconomic perspective by the high level of internationalisation of the sample (see Table 2). The high level of internationalisation experience of German firms can decrease transaction and learning costs and enables firms to manage high degrees of complexity successfully. On the basis of the facts that firms of our sample are already strongly internationalised and the most important foreign target markets represented by the member states of the European Union are highly integrated and constitute the largest integrated market of the world with immense potentials to realise economies of scales, we have to exclude MP-relationships that integrate internationalisation stages with performance declines due to liabilities of foreignness (U-shaped and S-shaped MP-relationship). Likewise, based on the arguments of opportunities to realise economies of scale, low levels of liabilities of foreignness and the long-term internationalisation experience we have to discard a negative linear MP-relationship that shows a negative effect through all phases of internationalisation. Nevertheless, we can expect a high cost burden caused by high degrees of complexity in later internationalisation stages, which is represented by the inverted U-shaped and the S-shaped as well as the already excluded S-shaped MP-relationship. However, we should differentiate between the development of foreign markets by exports or direct investments. We expect that coordination costs caused by high levels of complexity in advanced internationalisation stages are higher for a development of foreign markets by direct investments than for exports. Foreign subsidiaries are embedded more directly into the environment abroad and have to be coordinated by the headquarters over geographic, cultural, and economic boarders. Contrary to this, foreign operations by exports are faced with lower costs. For a development of foreign markets by exports we assume therefore a positive linear MP-relationship. Due to high cost burdens in later internationalisation stages we expect decreasing performance for foreign direct investments. Regardless, the opportunity exists that firms can even manage successfully high degrees of multinationality accompanied by high levels of complexity after a stage of reorganisation. Hence, we assume for foreign operations by direct investments an inverted U-shaped or inverted S-shaped MP-relationship.

Hypothesis 1a: The relationship between foreign operations by direct investments and performance is inverted U-shaped or inverted S-shaped for German firms.

Hypothesis 1b: The relationship between foreign operations by exports and performance is positive linear for German firms.

3.2 Moderating effects

3.2.1 Firm-Specific Advantages in the Field of Intangible Assets

Besides the analysis of the overall performance effect of multinationality, many researchers investigated single theory-based moderating effects (Li 2007; Kirca et al. 2011). Their primary focus was the examination of the effect of firm-specific advantages in the field of intangible assets that refer to the theory of firm-specific advantages (Kindleberger 1969; Caves 1971; Hymer 1976) and the internationalisation theory (Buckley and Casson 1976; Hennart 2007; Kirca et al. 2011). Firms that operate abroad are faced with a heterogeneous environment. Occuring liabilities of foreignness have to be compensated. Firm-specific advantages in the field of intangible assets enable firms to overcome the costs of internationalisation and compete successfully with local firms (Kindleberger 1969; Caves 1971; Hymer 1976) that are familiar with their domestic environment. Morck and Yeung (1991) consider intangible assets as “[largely] based on proprietary information and thus cannot be exchanged at arm’s length for a variety of reasons arising from the economics of information as well as from their public goods properties” (pp. 165–166). The meta-analysis of Kirca et al. (2011) demonstrated that single studies mainly focus on two types of intangible assets: R&D intensity, as a proxy for technology assets such as technological know-how and patents; and advertising intensity, as a proxy for marketing assets, such as brand name, reputation, and goodwill. Due to the intangible character of most of firm-specific advantages and the associated high transaction costs in the case of a sale to third parties, the internal use is preferable (Buckley and Casson 1976; Hennart 2007; Kirca et al. 2011). The development of additional markets abroad represents an ideal option to amortise investments in intangible assets, whose creation is associated with high costs. Foreign markets with growth potentials provide a suitable opportunity. As mentioned in Chapter 2.1.1 the empirical results on the moderating effect of firm-specific advantages in the field of intangible assets on the MP-relationship provide no consistent support for every kind of intangible assets (Kirca et al. 2011). Even though the meta-analysis on the impact of intangible assets on the MP-relationship of Kirca et al. (2011) discovered a positive moderating effect of intangible assets in the field of R&D, it provided no support for a positive moderating effect of intangible assets in the field of marketing on the MP-relationship. The picture of inconsistent results corresponds to many single empiric studies that could not detect a positive moderating effect of intangible assets for both types of intangible assets (e.g., Lu and Beamish 2004; Eckert et al. 2010). Inspired by the discussion of Rugman and Oh (2010), who discussed the advantages and disadvantages of accounting and capital market based performance measures, we propose to dissolve existing contradictions, and to consider the time-dependent effectiveness of firm-specific advantages in the field of intangible assets and the corresponding time-dependent sensitivity of performance measures. The creation of intangible assets causes high expenses in the present. However, the amortisation of intangible assets can frequently be expected short-term to long-term in the future and depends on the kind of intangible assets. The creation of intangible assets in the field of marketing causes high expenses in the present, but we can expect a rather prompt and short-term amortisation. In contrast to this, we can expect for intangible assets in the field of R&D a rather medium to long-term amortisation. If we investigate the moderating performance effect of intangible assets we have to consider their different time-dependent effectiveness. Otherwise, with respect to the time-dependent effectiveness of success factors we have also to take into account the time-dependent sensitivity of performance measures. Past research utilised either accounting based performance measures, which are past-oriented, or capital market based performance measures, which are future-oriented. As a consequence, a positive performance effect of intangible assets, which become effective promptly and short-term in the future (e.g., intangible assets in the field marketing), could be measured most appropriately by past-oriented performance measures. Complementary to this, performance effects of intangible assets, which become effective expected medium to long-term (e.g., intangible assets in the field R&D), could be measured most appropriate by future-oriented performance measures. Hence, we expect a negative (positive) moderating effect of intangible assets in the field of R&D on the relationship between multinationality and past-oriented accounting based (future-oriented capital market based) performance measures and a positive (negative) moderating impact of intangible assets in the field of marketing on the relationship between multinationality and past-oriented accounting based (future-oriented capital market based) performance measures.

Hypothesis 2a: Intangible assets in the field of R&D moderate the relationship between multinationality and the accounting based performance negatively.

Hypothesis 2b: Intangible assets in the field of R&D moderate the relationship between multinationality and the capital market based performance positively.

Hypothesis 2c: Intangible assets in the field of marketing moderate the relationship between multinationality and the accounting based performance positively.

Hypothesis 2d: Intangible assets in the field of marketing moderate the relationship between multinationality and the capital market based performance negatively.

3.2.2 Economies of Scale, Growth Opportunities and Operational Flexibility

The development of additional markets abroad by exports or direct investments facilitates the realisation of economies of scale and growth opportunities outside of the home market (e.g., Lu and Beamish 2004; Ruigrok et al. 2007). If we consider the high location costs of Germany, for instance the high level of labor costs and taxes (e.g., Schröder 2009; Worldbank c), in an international comparison, foreign direct investments enable firms to take up arbitrage opportunities and increase their operational flexibility (Kogut 1985; Fisch and Zschoche 2011a). While investments combined with a development of foreign markets by exports can generate revenues through economies of scale, investments combined with a development of foreign markets by direct investments offer the opportunities to benefit from operational flexibility. Analogous to the approach with intangible assets, we consider the time-dependent effectiveness for the analysis of the moderating role of investments on the MP-relationship. Investments, operationalised by capital expenditures (e.g., Fauver et al. 2004; Eckert et al. 2010), cause initially high expenses in the present and amortise medium- to long-term in subsequent periods. Thus we expect a negative effect of investments on past-oriented accounting based performance measures but a positive impact on future-oriented capital market based measures.

Hypothesis 3a: Investments moderate the relationship between multinationality and the accounting based performance negatively.

Hypothesis 3b: Investments moderate the relationship between multinationality and the capital market based performance positively.

Hypothesis 3c: The moderating effect of investments on the relationship between multinationality and the capital market based performance is higher for foreign direct investments than exports.

4 Methodology

4.1 Sample

In 2006 (the end of the sample period) Germany was in terms of the GDP the third largest economy of the world and the largest economy in Europe (UNCTAD 2013a). To test our hypotheses we raised a sample of German stock-listed firms. The time period covered the years from 1990 to 2006 and outbalanced the sample periods of the reference studies (see Table 1). The reunification of West and East Germany in 1990 constituted our starting point. Due to the emergence of the world economic and financial crisis, which was linked with a strong downturn in capital markets and real economies, we restrict our sample to 2006 as the final year of consideration. We collected our capital market data from the financial database Datastream Advance and added further information from the balance-sheet database Worldscope. Based on the Industrial Classification Benchmark (ICB) System, the sample comprised firms of all industries. However, following previous research (e.g., Jansen 2006; Kreye 2007; Krist 2009), we excluded firms from the financial industry. Industrial (25.2 %) and technology firms (25.1 %) constituted the majority of firms followed by firms in the fields of consumer goods (16.1 %), health care (14.2 %), basic materials (10.2 %), consumer services (3.6 %), utilities (2.6 %), oil and gas (2.2 %), and telecommunications (0.8 %). Dependent on the included variables in the different model groups (see Tables 3, 4) the samples contain up to 1527 firm year observations. The samples are unbalanced panels. The main reason for this was the poor availability of data particularly for the internationalisation variables, followed by the variables for intangible assets. Other reasons for a non-continuous consideration were bankruptcy, merger, or the exclusion from the stock exchange.

4.2 Variables

4.2.1 Performance

As variables for performance we employed return on assets (ROA) as well as Tobin’s Q. The meta-analysis of Kirca et al. (2011) demonstrated that return on assets is the most commonly used variable of accounting based measures and Tobin’s Q of capital market based measures. According to Chung and Pruitt (1994) we calculated Tobin’s Q from the quotient of the sum of market value of equity and the book value of debt and the sum of book value of equity and the book value of debt. We computed the market value of equity by the multiplication of the number of shares with the stock value of share at the end of the year. Under the assumption of information-efficient capital markets the market value of equity reflects the expectation of investors on the basis of the published information. In contrast to the previous reference studies we applied a past-oriented accounting based as well as a future-oriented capital market based performance measures. The literature discussed in depth the advantages and disadvantages of both kinds of measures (Thomas and Eden 2004; Contractor 2007; Rugman and Oh 2010; Verbeke and Forootan 2012). A major criticism of accounting based performance measures was their manipulability by the management. In the context of accounting policy options, the asset, financial, and profit situation can be actively managed. Furthermore, extraordinary effects and the application of various accounting standards can complicate the interpretation of performance measures. By comparison, capital market performance measures are difficult to influence by the management. Another argument for the consideration of both kinds of performance measures is their different time-dependent sensitivity to success factors. While accounting based performance indicators consider the short-term performance in the past reporting period, capital market based indicators reflect the medium- to long-term expectations for future success. It is thus possible, for example, that firms have a high (low) return on assets and yet exhibit a low (high) Tobin’s Q due to pure (good) future prospects. Moreover, the different time-dependent sensitivity of both kinds of performance measures takes account of the heterogeneous time-dependent effectiveness of intangible assets. Rugman and Oh (2010) trace the different and thereby apparently paradoxical performance effects of internationalisation on accounting based and capital market based performance variables to their time-dependent sensitivity. Irrespective of the advantage of non-manipulability and long-term and future orientation, the measurement of performance by capital market based measures is based on their continuous information efficiency (Fama 1970). Richard et al. (2009) discussed this issue, which was used in many studies with capital market based measures largely uncritically (Grigoleit 2011). On the one hand, Richard et al. (2009) emphasise on the partially asymmetric distribution of information among capital market participants; otherwise psychological aspects during the formation of future expectation and transaction on capital markets play a crucial role and can lead to irrational behavior (Richard et al. 2009). Röder (2000) could document significant information inefficiencies for German firms below the DAX-segment. In spite of potential distortions caused by information inefficiencies on the German capital market, we select Tobin’s Q as a capital market performance measure, because Tobin’s Q as a future-oriented performance measure takes better account for the effectiveness of firm-specific advantages in the field of intangible assets than past-oriented accounting based measures.

4.2.2 Multinationality

In contrast to the majority of past studies on German firms (see Table 1), we do not consider only the foreign sales ratio (FSTS) but also the foreign assets ratio (FATA) in separate models. While the foreign assets ratio can be assigned unambiguously to foreign direct investments and foreign production presence, the foreign sales ratio encompasses exports and sales of foreign subsidiaries and is linked to foreign market penetration. Since the geographic segment reporting in accordance with IAS 14 and SFAS 131 discloses revenues only by geographic areas and does not provide an insight into export revenues, we select the foreign sales ratio as a contrastive internationalisation variable following previous research (Bausch and Krist 2007; Li 2007; Oesterle and Richta 2013).

4.2.3 Other independent variables

To test our hypotheses 2a, 2b, 2c and 2d on the moderating role of firm-specific advantages in the field of intangible assets, we selected the two categories that were usually utilised in past research (Kirca et al. 2011). We applied firm-specific advantages in the field of R&D by the ratio of expenses for R&D to total sales (RDS), firm-specific advantages in the field of marketing by the ratio of selling, general, and administrative expenses to total sales (SAS) and advantages in economies of scale, growth opportunities, and operational flexibility by the quotient between capital expenditures and total sales (CETS).

Following past research (e.g., Bausch and Krist 2007; Kirca et al. 2011), we incorporated leverage operationalised by the ratio of total debt to total assets (TDTA) and the natural logarithm of total assets (lnTA) as an indicator for firm size as control variables. In order to control for product diversification, we integrated a dummy variable that took the value 1, if the firm operates in at least two segments with different SIC-codes on a two-digit-level, and the value 0 if such is not the case (DummyISeg). The “Standard Industrial Classification Code” (SIC) is an industry classification system that was developed for firms from the United States. In the models with Tobin’s Q as dependent variable we utilise the indicator of earnings before interests and taxes to sales (EBITS) to control for the current accounting based performance. We included in all models industry dummies. According to the structure of the Industrial Classification Benchmark (ICB) system we integrated 10 industry dummies on the firm level. We also comprised year dummies to control for time effects. For the purpose of clarity we do not depict the industry and year dummies in the tables.

4.3 Model

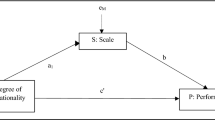

In order to analyse our hypotheses we developed several regression models. In a first step we tested the influence of multinationality independent of moderating effects (H 1a, H 1b). The following formula presents our model:

To test curvilinear MP-relationships we introduced stepwise a squared and cubic term of multinationality. Furthermore we extended our model with the interaction terms to test hypotheses H 2a, H 2b, H 2c, H 2d, H 3a, H 3b and H 3c. The final model is:

Performance was operationalised either by the return on assets or natural logarithm of Tobin’s Q. Multinationality was operationalised either by the foreign assets ratio or the foreign sales ratio. Altogether these results in 4 model groups (see Tables 3, 4). In models 1–6 (models 13–18) we investigated the influence of the foreign assets ratio (foreign sales ratio). In a similar manner the models 7–12 (models 19–24) analysed the impact of the foreign assets ratio (foreign sales ratio) on Tobin’s Q. In those models, which applied Tobin’s Q as the dependent variable, we additionally included the control variable earnings before interests and taxes to sales (EBITS).

To check the model assumption several tests were implemented. The variance-inflation factors showed, with the exception of the squared and cubic internationalisation variables, no values above the critical threshold of 10 (O’Brien 2007). In order to test the indication of the autocorrelation of residues we conducted the Wooldridge test (Wooldridge 2002). While models 1–6 showed no autocorrelation, models 7–24 indicated the autocorrelation of residues. The Breusch-Pagan test detected the presence of heteroskedasticity in all models. As a consequence of these violations of assumptions we employed heteroskedasticity and autocorrelation robust (HAC) estimators in accordance with Newey and West (1987).

5 Results

5.1 Descriptive Results

Table 2 depicts the descriptive statistics. The median performance of all model groups was positive. The median of return on assets for the model group with the foreign assets ratio (models 1–6) was 4.5 % and for the model group with the foreign sales ratio (models 13–18) was 4.1 %. A median firm exhibited a capital market performance, represented by the natural logarithm of Tobin’s Q with 0.28 (0.24) for models 7–12 (models 19–24). Values that are greater than 0, indicate a relation where the market value is higher than the book value. All model groups showed a high level internationalisation. The foreign sales ratio was 55.1 % for models 13–18 and 56.4 % for models 19–24. Almost one-third of assets were invested abroad (models 1–6 and 7–12).

5.2 Multivariate Results

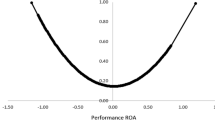

Tables 3 and 4 depict the results of multivariate regressions. Hypothesis 1a assumed an inverted U-shaped or an inverted S-shaped relationship between the foreign assets ratio and performance. As expected, we found an inverted S-shaped relationship between the foreign assets ratio and return on assets in model 5. In contrast, for the relationship between the foreign assets ratio and Tobin’s Q we could support hypothesis 1a only partially. Model 7 showed a positive linear and model 11 a weak significant inverted U-shaped relationship. The cubic internationalisation variable failed the necessary significance level of 10 % with a p value of 14.5 %. Thus, an inverted S-curve cannot be constituted.

Hypothesis 1b insinuated a positive linear relationship between the foreign sales ratio and performance. Both for the relationship between the foreign sales ratio and return on assets (models 13 and 17) and the relationship between the foreign sales ratio and Tobin’s Q (model 20) hypothesis 1b were supported. Although in the models 19, 21 and 23 no significant positive linear effect appeared, model 20, which considered moderating effects, showed a significant positive linear effect. In model 21 the squared internationalisation variable was positive significant, indicating a strong progressive performance effect of internationalisation.

Hypothesis 2a asserted a negative moderating effect of intangible assets in the field of R&D on the relationship between multinationality and the accounting based performance. This assertion could be confirmed for the model group with the foreign sales ratio as internationalisation variable (models 14, 26 and 18). However, for the model group with the foreign assets ratio the moderation effect was negative but insignificant (models 2, 4, and 6).

Hypothesis 2b argued that intangible assets in the field of R&D exhibited a positive moderating effect on the relationship between multinationality and capital market performance. We found support for this hypothesis for the model group with the foreign assets ratio (models 8, 10 and 12). The moderation effect for the model group with foreign sales ratio (models 20, 22 and 24) showed a positive but insignificant effect.

Hypothesis 2c predicated a positive moderating effect of intangible assets in the field of marketing on the relationship between multinationality and accounting based performance. We could acknowledge this hypothesis for both model groups by significant positive effects (models 2, 4, and 6; as well as models 14, 16, and 18).

Hypothesis 2d supposed a negative moderating effect of intangible assets in the field of marketing on the relationship between multinationality and the capital market based performance. The results for the model group with the foreign sales ratio supported hypothesis 2d (models 20, 22, and 24). Contrary to our expectations, we could not identify a significant effect for the model group with the foreign assets ratio (model 8, 10, and 12).

Hypothesis 3a implied a negative moderating effect of investments on the relationship between multinationality and accounting based performance. Indeed we discovered a negative effect for both model groups (models 2, 4, and 6; as well as models 14, 16, and 18). However, this effect was insignificant so that hypothesis 3a was not supported.

Hypothesis 3b assumed a positive moderating effect of investments on relationship between multinationality and capital market based performance. We found strong support for both model groups (models 8, 10, and 12; as well as models 20, 22, and 24).

Finally, hypothesis 3c insinuated that the moderating effect of investments on the relationship between multinationality and the capital market based performance is higher for foreign direct investments than exports. As expected, the size of the moderating effect is more positive for the foreign assets ratio than for the foreign sales ratio (about four times larger).

6 Discussion

Analogous to the presentation of the results of the regressions in Tables 3 and 4, the main results concerning the hypotheses were represented in Table 5. Despite the differentiation in the hypotheses, a detailed inspection in Table 5 reveals that the verification of hypotheses depends on the selected variables for internationalisation and performance. In spite of the fact that some hypotheses did not find full support, it is important to note that none of them were refuted, in the sense that a significant contrary result was detected. Most of the not supported results showed the expected effect direction but failed the required level of significance. The positive overall performance effect of multinationality in early stages of internationalisation (hypotheses 1a and 1b) was explained with considerable potentials to realise economies of scale on the internal market of the European Union, low levels of liabilities of foreignness due to the deep integration into the economic and monetary union and the high degree of internationalisation experience. Nevertheless, we assumed increasing coordination costs caused by high degrees of complexity for high levels of foreign direct investments, which results at least temporarily in decreasing performance. Our results supported a S-shaped relationship between the foreign assets ratio and the return on assets. Model 5 revealed an increasing return on assets up to a first optimum of 32.0 % of foreign assets ratio. Then performance is decreasing up to a minimum of 57.3 % of foreign assets ratio, only to rise again after. A critical threshold, where in the view of high degrees of multinationality, coordination costs outweigh all potential advantages of internationalisation, does not exist. Instead, firms with a decreasing performance during increasing levels of foreign direct investments could generate increasing performance again. This may be attributed to the fact that the firms of the sample are able to reorganise their activities abroad and handle even high degrees of complexity successfully. A further advantage might be the high degree of internationalisation experience. The geographic location and the cultural and economic proximity of Germany to its strong integrated neighbour countries support the generation of economies of scale and low transaction costs during early stages of internationalisation. Our results confirmed the findings of Ruigrok et al. (2007) for Swiss firms and of Krist (2009) for German firms, who also observed an inverted S-shaped relationship between multinationality and accounting based performance. Proponents of an inverted S-shaped relationship explained an increasing performance at high degrees of multinationality with the proactive role of management (Ruigrok et al. 2007). Initially, our results contradict the findings of Fisch and Zschoche (2011b), who noticed an S-shaped relationship between the spread of foreign direct investment (FDI) and the accounting based performance. However, their sample included also non-listed medium-sized firms, which exhibited a lower degree of multinationality than our sample. Besides, Fisch and Zschoche (2011b) investigated the performance of the network of foreign subsidiaries. Indicating a positive linear as well as a weak significant inverted U-shaped relationship between the foreign assets ratio and Tobin’s Q, the results did not match the results of the previous discussed model group, but confirmed also hypothesis 1a. As already mentioned in Sect. 5.2, the cubic term of internationalisation failed narrowly the necessary significance level. If this would be not the case an inverted S-curve occurred.

Hypothesis 1b suggested a positive linear relationship between the foreign sales ratio and performance. This reasoning was based on the arguments that exports are linked with lower cost burdens due to a lower need of integration into environment abroad than a development of foreign markets by direct investments. For the relationship between the foreign sales ratio and the accounting based performance we could find strong support for hypothesis 1b. By contrast, we identified for the relationship between the foreign sales ratio and the accounting based performance only in the model with consideration of moderating effects (model 20) a positive linear effect. Model 21 even revealed a progressive relationship. An increase of a development of foreign markets by exports was associated both with an increasing accounting based and a capital market based performance. Apart from the low burdens by transaction costs, no temporary declines of performance existed.

Hypotheses 2a, 2b, 2c, and 2d investigated the moderating effect of firm-specific advantages in the field of intangible assets on the MP-relationship. Beyond the previous research effort, we considered the time-dependent effectiveness of intangible assets. Hypothesis 2a (2b) supposed that intangible assets in the field of R&D, which increase performance in the long-term, offer a negative (positive) moderating effect on the relationship between multinationality and past-oriented accounting-based (future-oriented capital market based) performance. For the internationalisation variable foreign sales ratio hypothesis 2a could be supported. The moderation effect with the foreign asset ratio showed the expected direction but was insignificant. Hypothesis 2b was supported for the model group with foreign asset ratio but was insignificantly positive for the model group with foreign sales ratio. The positive moderating effect of intangible assets in the field of R&D on the relationship between multinationality and capital market performance was confirmed by previous research on German firms (Kreye 2007; Eckert et al. 2010). Rugman and Oh (2010) observed for firms from the United States also a negative (positive) moderating effect of intangible assets in the field of R&D on the relationship between multinationality and accounting-based (capital market based) performance. However, Krist (2009) for German firms as well as Bausch and Krist (2007) and Kirca et al. (2011) in their meta-analysis could not verify these directions of effects. A possible reason for the deviation of results in the meta-analysis could be the absence of differentiation between past-oriented accounting based and future-oriented capital market performance measures. Both meta-analysis used a broad mixture of diverse performance measures of the underlying primary studies, but these were dominated by accounting based measures. However, results of this study indicated that performance measures with different time-dependent sensitivity respond different on success factors with heterogeneous time-dependent effectiveness. Furthermore both meta-analysis compared more and less R&D-intensive firms, instead of analysing a continuous variable.

Analogous to the hypotheses 2a and 2b, hypotheses 2c and 2d examined the moderating effects of intangible assets in the field of marketing on the MP-relationship.

Hypothesis 2c (2d) insinuated that intangible assets in the field of marketing, which are able to influence performance promptly and short-term, will show a positive (negative) moderating effect on the relationship between multinationality and past-oriented accounting based (future oriented capital market based) performance. Hypothesis 2c was supported for both internationalisation variables. For the model group with foreign sales ratio hypothesis 2d was confirmed. Against our expectation the model group with foreign assets ratio revealed a positive but insignificant effect. Eckert et al. (2010) also discovered for German firms a negative moderating effect of intangible assets in the field of marketing on the relationship between the foreign sales ratio and the capital market based performance. Rugman and Oh (2010) found for firms from the United states a positive (negative) moderating effect of intangible assets in the field of marketing on the relationship between multinationality accounting based (capital market based) performance, too. The meta-analysis of Kirca et al. (2011), where primary studies with accounting based performance measure were predominant, could not detect a positive moderating effect of intangible assets in the field of marketing.

The argument of firm specific advantages, the internalisation theory, and thus the relevance of intangible assets for the success of internationalising firms were validated by the present study. It is crucial, however, to consider the time-dependent effectiveness of intangible assets as well as the time-dependent sensitivity of different performance measures. The positive performance effect of intangible assets, which become effective promptly and short-term, could be measured most appropriately by past-oriented performance measures. Complementary to this, performance effects of intangible assets, which become effective expected medium to long-term, could be measured most appropriately by future-oriented performance measures. An alternative solution to cope with time-dependent relationships is the incorporation of a time lag. For instance, if we would consider intangible assets in the field of R&D that are generated distinctly before the regarded recent accounting-based performance, we could capture a positive moderating effect on the MP-relationship. But the revenues from amortisation of intangible assets are less predictable concerning its volume and temporal presence. Due to a complex bundle of numerous intangible assets in large firms it seems difficult to detect a causal relationship between intangible assets in the field of R&D and the relationship between multinationality and the accounting based performance on the firm-level, even with knowledge and the consideration of a time-delayed effect of single projects. However, it can be expected that capital market participants evaluate the impact of expenses for R&D positive after its announcement because they anticipate performance increasing revenues in the future.

Hypotheses 3a, 3b, and 3c regarded the moderating effect of investments on the MP-relationship. Hypothesis 3a assumed that the moderating effect of investments on the relationship between multinationality and the accounting based performance is negative. We discovered for both model groups a negative, but insignificant effect; whereas hypothesis 3b, which implied a positive moderating effect of investments on the relationship between multinationality and capital market based performance, was confirmed clearly for both model groups. Eckert et al. (2010) could find also such an effect for a sample of German firms. A high degree of investments in conjunction with international operations of firms can be considered by capital market participants as a prerequisite to achieve economies of scale, growth opportunities abroad, a higher operational flexibility, and accordingly a higher performance in the future. Similar to the moderating effect of intangible assets, the decision about the appropriate performance measure is crucial.

Hypothesis 3c predicated that moderating effects of investments on the relationship between multinationality and the capital market based performance are higher for foreign direct investments than exports. The empiric results verified this hypothesis. Development of foreign markets by direct investments, occurring in respect of high location costs in Germany, is particularly beneficial. International production networks help German firms to take up arbitrage opportunities and benefit from operational flexibility. Thus, Fisch and Zschoche (2011a) discovered a positive influence of international operations, if firms exploited arbitrage opportunities abroad by shifting their production. Investments that are associated with international operations enable firms to realize economies of scales. But if they are especially connected with foreign direct investments they can generate additional advantages due to an increased operational flexibility.

7 Conclusion

After 40 years of research on the MP-relationship the empirical results remain contradictory (Hennart 2007). The majority of papers focused on firms from the United States. Firms from Europe and Germany are distinctly underrepresented. This contribution considered German firms, which represent the largest economy in Europe, and included explicitly the contextual conditions of internationalisation to explain the MP-relationship for the analysed sample. Important economic prerequisites for internationalisation, such as potentials to realise economies of scale in the home market and abroad, the degree of integration of neighbouring countries as well as the accumulated internationalisation experience, can differ significantly between countries. Furthermore, the context of internationalisation depends on the analysed observation period, the industry, and the size of firms. Because of these reasons a universal MP-relationship independent of the context cannot be expected. This investigation focused on large stock-listed German firms with a broad range of industries that exhibited already a high degree of multinationality. Beyond the previous research efforts on German firms we explored the performance effects of development of foreign markets by exports as well as direct investments. Besides, we measure for the first time the moderating effect of intangible assets appropriate to its time-dependent effectiveness by employing past-oriented accounting based as well as future-orientated capital market based performance measure. Additionally, we have tested all potential linear and curvilinear MP-relationships.

The results revealed that firms of the sample benefit from an increasing internationalisation independent of the kind of foreign market development and temporal effects. As a result of the advanced internationalisation process of German firms and the thereby accompanying internationalisation experience, firms of the sample showed no decrease of performance due to liabilities of foreignness. Independent of the selected indicator of performance and the kind of foreign market development, all models revealed an increasing performance in early internationalisation stages. The proceeding MP-relationship depended crucially on the selected kind of foreign market development respectively on the indicator of performance. For the relationship between foreign direct investments and the accounting based performance we found an inverted S-shaped relationship. Performance has been increased even in early stages of internationalisation, caused by high level of internationalisation experience, high potential of economies of scale, and low transaction costs of operations in the countries of the European Union. Thus, the accounting based performance was decreasing in the case of foreign direct investments due to high levels of complexity and the thereby associated need of coordination by the direct integration of foreign units from the heterogeneous environment. The decrease of performance was only temporary and firms can realise after a period of reorganisation increasing performance due to internationalisation again. Though not significant by conventional standards, we could detect an inverted S-shaped relationship between foreign direct investments and the capital market performance. In view of the results, managers should explicitely take into consideration the micro- and macroeconomic contextual conditions of internationalisation. If a firm has only a low degree of multinationality and potential foreign target markets are not deeply integrated economically and exhibit high transaction costs for a foreign market entry, managers should be aware of significant performance declines due to liabilities of foreignness in early internationalisation stages. In contrast to this managers of firms with an already high degree of multinationality should care about the reorganisation of internationalisation activities in the presence of high coordination costs due to high levels of complexity in advanced internationalisation stages.

However, the relationship between a foreign market development by exports and the accounting based performance was positive linear. The low degree of integration into the heterogeneous environment abroad, accompanied by a low complexity and a low need of coordination, causes lower transactions costs in comparison to a foreign market development by direct investments. Hence, no temporal performance decrease was observed.

Also the relationship between a foreign market development by exports and the capital market performance revealed a linear positive as well as a progressive function. As the results demonstrated, the MP-relationship was dependent on the manner of foreign market development. A foreign market development by exports was associated with lower transaction costs due to a lower integration into the heterogeneous environment compared to a foreign market development by direct investments. In summary, it can be concluded that firms of the analysed sample benefit from internationalisation. German firms possess the advantage that they dispose not only of the greatest home market in Europe but also with the neighbouring countries in the European Union of the greatest integrated market in the world. The intensive integration by the economic, the monetary union, and the high degree of internationalisation experience reduce the transaction costs especially for further internationalisation steps in the home region. As a consequence managers should be aware that different kinds of foreign market developments have a different impact on performance. Especially for foreign market development by exports, managers can expect a more constant impact on performance and do not have to be afraid of temporary performance declines due to high levels of complexity.