Abstract

Numerous examples of online retailers that have internationalized shortly after their foundation indicate that they internationalize faster than and different from traditional brick-and-mortar retailers. This paper identifies and analyzes various influence factors on internationalization speed of online retailers and their impact on individual internationalization steps. Grounded in the resource-based view, the paper examines the effects of imitability of an online shop, the presence of venture capitalists, the scope of the country portfolio and distance and diversity within the country portfolio on the internationalization speed of online retailers. A Cox proportional hazards model is used to explore the effects on speed and their variations over time. Drawing on a sample of 150 online retailers (1110 market entries in 47 country markets over 19 years), this study shows significant curvilinear effects of the imitability of an online shop, as well as of the diversity and scope of the existing country portfolio and linear effects of the distance of new country markets on the length of time until the next internationalization step.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The globalization of markets and limited possibilities for growth in national markets have increasingly caused retailers to internationalize their operations; managing operations in diverse country markets has become a critical task (Assaf et al. 2012; Hoenen and Kostova 2014). This trend has been shown in the literature for store-based retailers, but it is even more relevant for online retailers that appear to internationalize more rapidly and different from brick-and-mortar retailers. There is widespread agreement that the internet is providing firms with new ways to conduct business (Loane et al. 2004). It significantly reduces psychic barriers and makes early internationalization a more viable and cost-effective option (Buckley 2011; Sinkovics and Penz 2005; Wen et al. 2001). In previous years, online retailers have shown remarkable efforts in opening new sales markets in foreign countries. Many online retailers pursued a ‘get-big-fast’ strategy to intensively develop their customer base as a significant source of increasing returns (Oliva et al. 2003) which highlights the importance of internationalization speed for online retailer’s strategies. More than in most other industries, the quick rise of online shops has dramatically changed the retail industry over the last decade (Gartner Industry Research 2012) and is nowadays a serious competition for traditional retail channels. E-commerce has become an important influence on the European economy and accounts for 2.2 % (EUR 361bn) of European GDP and approximately 10 % of the total retail turnover in many Western European countries and the USA (E-Commerce Europe 2014, 2015).

Examining internationalization processes, researchers identified three basic dimensions: speed, extent (e.g., the percentage of foreign sales) and scope (e.g., the number of foreign markets) (Hagen and Zucchella 2014; Zahra and George 2002). Whereas extent and scope have been in focus of IB research for decades, speed was only introduced to the literature in the 1990s by the international entrepreneurship research. A rapid internationalization and a rapid exploration of foreign markets have been shown to have several advantages, e.g., performance and growth advantages (Oviatt and McDougall 2005; Powell 2014b), learning advantages (Autio et al. 2000; Zhou and Wu 2014), and first- or early-mover advantages (Oviatt and McDougall 1994, 2005). It has become an important topic for researchers (Jones and Coviello 2005; Oviatt and McDougall 1994; Sharma and Blomstermo 2003a; Trudgen and Freeman 2014; Zahra and George 2002). The majority of studies conceptualize internationalization speed as uniform throughout the entire internationalization process (i.e., in a single figure) or merely focus on the length of time from inception to the first internationalization step (Casillas and Acedo 2013; Madsen 2013; Zhou and Wu 2014). The development of the internationalization process over time and changes in speed have been scarcely researched, and “very little research has sought to explain the speed of the process once it is under way” (Casillas and Acedo 2013, p. 26). In addition, IB research mainly focuses on the internationalization processes of multinational enterprises (MNEs), but not on retailers in general (Elsner 2014) or online retailers in particular. The same holds true for international entrepreneurship research, in which online retailers as a kind of digital start-ups are also not in the center of research.

Following various authors (e.g., Casillas and Acedo 2013; Fuentelsaz et al. 2002; Powell 2014b), the objective of this paper is to investigate and empirically test the factors influencing internationalization speed in the online retail sector. Thereby, we acknowledge the fact that the internationalization speed of a company changes over time and that its antecedents may also not stay uniform over time. We examine the effects of imitability, country diversity and geographic scope that generally have a negative connotation, and we argue that their effects have a curvilinear shape, i.e., are positive within a certain range and negative in another range and that the effects change in the internationalization process. Moreover, linear effects of the variables age, distance to the home country as well as added distance are taken into account and effects of the categorical variable product category and home country and the binary variables multi-channel retailer or pure online retailer and presence of a venture capitalist.

This paper is organized as follows. First, the theoretical background of our study is presented, and the hypotheses are developed from a resource-based perspective, followed by details regarding the research design and method. The results section contains the hypothesis testing with a Cox regression model using time-varying data from the internationalization paths of 150 online retailers (1110 market entries over 19 years) from a geographically diversified country sample. Then, the results are presented. Finally, conclusions are drawn, limitations of the study are discussed, and implications and suggestions for further research are provided.

2 Theory and Hypotheses

We base our conceptual framework (see Fig. 1) on the resource-based view (RBV) in general and on dynamic capabilities. To ensure successful international expansion, firms must have appropriate resources (Hitt et al. 2006). The RBV grounds on resources regarded as bundles of tangible and intangible assets (Penrose 1959; Wernerfelt 1984). Firms develop resources and capabilities that are valuable, rare, heterogeneous, imperfectly mobile and inimitable; these can be applied in foreign markets, or firms can use foreign markets as a source for acquiring them to achieve resource-based advantages, resulting in superior performance (Barney 1991; Brouthers and Hennart 2007; Costa et al. 2013). Capabilities that include skill acquisition, knowledge and learning are intimately tied to firms’ expansion paths (Teece 2007; Teece et al. 1997) and firms can benefit from the positive effects of capabilities that may emerge from diversity (Zahra et al. 2000). Our framework identifies and tests resource-based factors that may influence the internationalization speed of online retailers. Understood as a dynamic process, the internationalization speed of a firm is not considered uniform throughout the internationalization process; rather, this study investigates every individual internationalization step to emphasize the path-dependency of internationalization processes in which past actions may influence future operations in international markets.

2.1 Speed and Time in the Internationalization Process of Online Retailers

In traditional approaches, internationalization is regarded as a slow, gradual and path-dependent step-by-step process, as described in the Uppsala internationalization process model by Johanson and Vahlne (1977), based on uncertainty and limited rationality. Although time is an important determinant in the internationalization process and increasingly viewed as an important factor and scarce resource for internationalizing firms to manage, it has rarely been considered a primary conceptual dimension (Chetty et al. 2014; Jones and Coviello 2005; Sharma and Blomstermo 2003a). However, since Oviatt and McDougall (1994) placed time on the agenda in entrepreneurship theory, time is a central issue in the internationalization process of firms and frequently used as a predictor of knowledge accumulation (Acedo and Jones 2007; Morgan-Thomas and Jones 2009; Prashantham and Young 2011; Sharma and Blomstermo 2003a).

Speed is a time-based indicator of “how many foreign expansions a firm undertakes in a certain period of time” (Vermeulen and Barkema 2002, p. 643). Three different views of speed can be identified in the IB literature. First, an often used conceptualization is that of time elapsing between a company’s foundation and the first international activity (Zahra and George 2002). This view focuses mainly on pre-internationalization. The second view is an overall observation (Mathews and Zander 2007) using, e.g., the average number of foreign markets per year (Vermeulen and Barkema 2002). The third view is the most thorough concept for gaining a deeper understanding of how internationalization processes develop: the time elapsing between two consecutive events in different stages within the internationalization process (Casillas and Acedo 2013).

Rapid internationalization and a rapid exploration of foreign markets typically provide performance and growth advantages for firms (Autio et al. 2000; Oviatt and McDougall 1994; Powell 2014b). An early entry may provide via first-mover or early-mover advantages the basis for the acquisition of superior resources and capabilities in a market, e.g., a well-developed customer base, and pioneers may preempt competitors in a physical, technological, or consumer perceptual space (Fuentelsaz et al. 2002; Lieberman and Montgomery 1998). In the retail sector, internationalization is an important trend (Dawson and Mukoyama 2014); anecdotal evidence shows that online retailers are quite active in their internationalization efforts and internationalize differently and much faster than traditional brick-and-mortar retailers. For example, only six years after its foundation, the German online retailer Zalando has already been active in 15 countries.

2.2 Imitability as Driver of Online Retailers’ Internationalization Speed

As the RBV argues, the more difficult a resource is to imitate, the more sustainable the resulting advantage is: the effects of valuable resources that are easily imitable should dissipate quickly (Barney 1991; Crook et al. 2008). Imitability is hereby “the ease with which a firm’s technology can be learned or replicated by outsiders” (Autio et al. 2000, p. 914).

At first glance, many online shops do not appear to fulfill the abovementioned criteria for resources; Ferguson et al. (2005, p. 5) note that “innovative electronic commerce projects are most likely seen […] as easily replicable, and consequently have little, if any, competitive advantage period.” The functionality and technical components of an online shop can be easily identified by competitors and in this specific industry, other firms often imitate the actions of rivals (Kuettner and Schubert 2012).

Hence, instead of the visible and easily imitable resources like shop design or product offer, other resources, among them reputation, customer databases and lock-in effects for customers, appear to create the sustainable competitive advantage for online retailers (Hall 1992; Park et al. 2004). Hence, online retailers focus on expanding and retaining their customer base (Amit and Zott 2001). Quick internationalization is one way to create first- and early-mover advantages through the development of brand awareness, reputation and a customer base in the new country market (e.g., Autio et al. 2000; Teece et al. 1997).

From a resource-based perspective, building a loyal customer base transforms the rather temporary advantage of an online retailer (i.e., a shortly unique online shop that may be quickly imitated by competitors) into a more sustainable resource (i.e., the customer base) by using first-mover or early-mover advantages.

We expect that a certain level of imitability of an online shop will intensify the need to quickly transform the current advantage of the online shop into a customer base because of a lack of strong inimitable resources. By contrast, when the imitability level of an online shop is low, a firm is not under pressure to quickly internationalize but can first exploit the full potential of the home market. Contrary to common reasoning of the RBV that solely non-substitutable and inimitable resources create sustainable value and are a basis for internationalization (e.g., Barney 1991; Dierickx and Cool 1989; Johanson and Vahlne 2009; Peteraf 1993), we argue that a higher level of imitability of an online shop initially drives internationalization speed. However, beyond a certain level of imitability, an adverse effect on internationalization speed can be expected: if imitability is too high, then internationalization is likely to be decelerated. This reasoning follows the logic that a company must possess firm-specific advantages to overcome the liability of foreignness in a new, unknown market in order to successfully compete with incumbents who are more familiar with this market (Hymer 1976; Johanson and Vahlne 2009; Zaheer 1995) and that online-shops that are very easily imitable do not have such sustainable firm-specific advantages. Instead, these companies would risk being immediately copied by potential competitors in the new market before sustainable competitive advantages from internationalization can be developed. Therefore, firms with a very high level of imitability should be slower in internationalization than firms with a medium level of imitability. Thus, we propose the following:

Hypothesis 1: The imitability of an online shop has a curvilinear influence on internationalization speed (inverted U shape).

2.3 Networks and Venture Capitalists

The INV literature further emphasizes the role of networks in rapid internationalization (Casillas and Acedo 2013; Musteen et al. 2010). Research on social network theory emphasizes the importance of inter-firm ties in accumulating and utilizing knowledge; hence, social as well as business networks are active channels of knowledge flows (Casillas et al. 2009; Gulati 1995; Yu et al. 2011) and can influence both patterns and speed of internationalization (Loane et al. 2004). SMEs face obstacles to internationalization because of a lack of resources. Their limited financial resources, as well as limited market knowledge, constitute an important barrier to internationalization. Resource constraints can be overcome using networks (Laanti et al. 2007; Spence et al. 2011). In high-tech and dot-com industries such as online retailing, the involvement of venture capital (VC) firms to overcome resource restrictions is common (Gabrielsson et al. 2004). Within the network, VCs provide two important resources to SMEs: In addition to necessary financial resources, cooperation with VCs may provide an online-retailer with expertise in areas in which knowledge is lacking (Gabrielsson et al. 2004; Laanti et al. 2007; Sharma and Blomstermo 2003b) which may include internationalization knowledge. Martin (1999) and Zook (2005, p. 3) emphasize that VCs can therefore be characterized as knowledge brokers “who acquire and create intelligence through personal (and generally local) networks about industries, market conditions, entrepreneurs, and companies through a constant process of interaction and observation.” We therefore expect a positive effect on online retailers’ internationalization speed:

Hypothesis 2: The participation of a venture capitalist in an online shop has a positive influence on internationalization speed.

2.4 Distance and Diversity of International Expansion and their Relation to Online Retailers’ Speed

International expansion causes firms to confront substantial challenges, and in essence, “international management is management of distance” (Zaheer et al. 2012, p. 19). Distance occupies a central role in IB research and is usually defined as the perceived difference between two countries. The general assumption of distance is that the more different a foreign country is compared to a firms’ home country, the more difficult will it be to collect, analyze and use information about it and hence, the higher are the uncertainties and difficulties of doing business there (Håkanson and Ambos 2010).

Distance has been conceptualized along different dimensions (Berry et al. 2010; Dow and Karunaratna 2006). Ghemawat (2001) emphasizes that the distance between two countries exists not only geographically but also in the cultural, administrative-institutional, and economic dimensions. These four dimensions are the cornerstone for Ghemawat’s CAGE framework which has gained wide acceptance as an overall measure of distance between two countries in the IB literature (Hutzschenreuter et al. 2014). When establishing operations abroad, firms are confronted with liability of foreignness because of their unfamiliarity with local market conditions (Hymer 1976; Nachum 2010; Shenkar 2001), e.g., for online retailers, different legal regulations may act as market entry barriers (Huang and Sternquist 2007). Hence, firms need time to absorb experience and market knowledge and to fit into an international setting (Nohria and Ghoshal 1994; Vermeulen and Barkema 2002), and more distant markets are associated with greater challenges in managing the expansion step (Björkman et al. 2007; Hutzschenreuter and Horstkotte 2013).

Distance therefore has been argued to have a decelerating effect on internationalization (Hutzschenreuter et al. 2014); entering new markets with a smaller distance to the home market should be faster than entering markets that are more distant (O’Grady and Lane 1996; Williams and Grégoire 2015). Hence, we propose:

Hypothesis 3a: The distance between the newly entered market and the home country has a negative influence on internationalization speed.

Besides the distance between the newly entered market and the home country of the online retailer, the added distance may influence internationalization decisions: Added distance characterizes the shortest possible distance between a newly entered market and all other markets in which the company is already active (Hutzschenreuter and Voll 2008; Hutzschenreuter et al. 2011).

In their Uppsala internationalization process model, Johanson and Vahlne (1977) explain the characteristics of the internationalization process of firms, in which internationalization is viewed as a gradual, step-by-step and path-dependent process based on the establishment chain and on a psychic distance chain, defined as the factors that make it difficult to understand foreign environments and to address the liability of foreignness. In their argumentation, the experience that a company gains during the internationalization process will influence the entry into further markets. Also, Tung and Verbeke (2010, p. 1268) note, “what matters in the case of a new entry is not so much the distance between the home country A and the host country B, but between the newly entered host country B and the host country C, where the firm already has substantial experience and that shows the lowest distance to the newly entered country B.” Added distance creates unfamiliarity; thus, before more distance is added by an internationalization step, internationalization speed is decelerated to give the firm time to address this added unfamiliarity (Hutzschenreuter and Voll 2008; Hutzschenreuter et al. 2011). Hence, we propose:

Hypothesis 3b: The added distance of a new market to the existing country portfolio has a negative influence on internationalization speed.

While the concept of distance focuses on one specific new country at a time, the overall portfolio of countries in which a company is active exerts another influence on managerial decisions. In this respect, the geographic scope and the diversity of the country portfolio may influence the further internationalization speed.

A firm’s geographic scope refers to the number of country markets a company is selling in (Hennart 2011; Zahra and George 2002). The expansion of geographic scope is central to extant internationalization theories (Hashai 2011; Oviatt and McDougall 1994; Zahra et al. 2000). For online retailers, it is assumed that being active in a certain number of country markets will positively influence internationalization speed because countries can be used as hubs to enter neighboring countries more easily with less effort. For instance, it is possible to use existing logistics bases for the entry into neighboring countries to provide efficient delivery and return logistics without investing in specific logistics infrastructure in the new target market which would be more time consuming and expensive. Hence, it can be argued that firms can benefit from greater country scope for even further expansion (Allen and Pantzalis 1996).

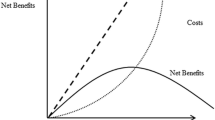

However, when a certain number of countries in the portfolio is attained, internationalization speed is likely to decelerate. Beyond a certain number of countries in the portfolio, the marginal utility of a new country for the overall portfolio, e.g., as a logistics hub, will decrease, and the internationalization speed will also decelerate as a result. Moreover, saturation effects arise (Tihanyi et al. 2005). After a number of internationalization steps, it will become increasingly difficult for a firm to discover other similarly attractive countries, slowing down further internationalization. Thus, we posit a curvilinear relationship between geographic scope and internationalization speed:

Hypothesis 3c: The geographic scope of the country portfolio has a curvilinear influence on internationalization speed (inverted U shape).

While the geographic scope refers merely to the number of countries, the characteristics of the countries in the portfolio should also be considered. Diversity refers to the heterogeneity or variety of countries in which an online retailer is already present (Ellis 2007; Hutzschenreuter et al. 2011). Firms managing a number of widely different countries within their portfolio must consider more varied types of national systems, customers, political frameworks, institutions as well as rules and norms (Casillas and Moreno-Menéndez 2014; Zhang et al. 2010).

It is generally expected that increased diversity may enhance complexity, lead to managerial and organizational challenges and negatively affect further international expansion (Hutzschenreuter et al. 2011). Contrary to this prevalent problem-focused view of diversity in the international expansion literature, which highlights potential constraints based on country differences, greater diversity within a country portfolio may also be viewed as an opportunity and an asset for firms (e.g., Ely and Thomas 2001; Stevens et al. 2008). Experience is a prime source of learning in organizations (Penrose 1959), and learning is fostered by diversity in experience (Barkema and Vermeulen 1998; Powell 2014a; Zellmer-Bruhn and Gibson 2006). The ability to learn from experience obtained in diverse countries may be the most important advantage of multinationality (Powell and Rhee 2013). Learning and gaining experience in different markets may assist online retailers in recognizing trends or acquiring customer insights (Auh and Menguc 2005; March 1991; Raisch and Birkinshaw 2008). Different host countries can stimulate the creation of dynamic capabilities in a firm with non-location-bound and semi-location-bound firm-specific advantages in the sense of a broader knowledge base on which the firm can build (Lohr 2013; Rugman and Verbeke 2007; Stahl et al. 2010). Thus, we expect that for an online retailer, greater diversity in the portfolio of its country markets will generate a higher level of capabilities for the firm and therefore positively influence the speed of internationalization.

By contrast, Contractor et al. (2003) suggest that the benefits of further international expansion do not necessarily need to be positive and that firms can over-expand beyond a preferable optimum level. Beyond an optimum level of country diversity, coordination and growth costs may exceed the benefits of further expansion for complexity reasons. In particular, a number of culturally, administratively, geographically and economically heterogeneous markets in which a firm is active will likely increase transaction and government costs (Ghemawat 2001; Gomes and Ramaswamy 1999). For instance, an online retailer must manage a broad range of different payment methods, and a greater amount of country-specific adaptation of assortments increases complexity. Moreover, the capacity of managers to successfully cope with greater complexity within a portfolio may be limited. Thus, beyond a certain level of diversity, further diversity may slow expansion (Grant 1987). Hence, we propose the following hypothesis:

Hypothesis 3d: The level of diversity within the country portfolio has a curvilinear influence on internationalization speed (inverted U shape).

3 Methodology

3.1 Sample

To test the hypotheses, we created a longitudinal database with observations of foreign market entries of 150 online retailers over a 19-year period (1995–2014). The average duration between two market entries of an online retailer is 395.59 days. For our sample, we considered online retailers that are active in their home markets and active in at least one foreign country, focusing on companies originating in Central Europe and North America. The company selection is based on the “Internet Retailer Europe 500” ranking (Internet Retailer 2013) as well as of Top100 rankings of online retailers of the 15 biggest internet markets in Europe (E-Commerce Europe 2014). Firms of which the expansion path was not fully reconstructable were excluded. Online retailers that only have a domestic website and merely offer international shipping were not considered. Moreover, our sample contains only online retailers selling physical goods; online retailers selling solely digital goods, e.g., software or music downloads, were as well excluded.

The sample contains the complete internationalization paths of 150 online retailers from 13 different home countries (c.f. Table 1) responsible for 1110 market entries (ø 7.4 market entries per online retailer) in 47 host countries. Company data were collected from the Internet Retailer Europe 500 database, firm websites, published articles and timelines, platforms such as Xing and LinkedIn, and interviews with company executives. Country data were collected from the OECD and World Bank databases as well as Ghemawat’s CAGE database.

3.2 Measurement and Characteristics

Given that the objective of this investigation is to analyze the factors influencing the speed of the internationalization process, the speed of entry into a new country market is the dependent variable. We followed Shneor and Flaten (2008, p. 46), who conceptualize a market entry for the internet-enabled internationalization as “‘market-specific shops’, serving markets based on idiosyncratic adaptations to local language, content, format, style preferences, etc.”. Thus, we characterize an internationalization step of an online retailer as the launch of a country-specific website, identified, e.g., through country-specific language, currency or domain. In most cases, such a step is explicitly announced by the online retailer itself, e.g., in press releases. We followed Casillas and Moreno-Menéndez (2014) and captured speed dynamically based on the number of days between two entries into a firm’s new country markets because of the longitudinal character of our analysis. For the interpretation of the results, it must be noted that duration in days is the inverse of speed.

The measurements of the variables of diversity, HM distance (distance from the host country to the home market) and added distance refer to the CAGE framework of Ghemawat (2001) and the corresponding database in which the different dimensions of distances between country pairs are calculated. For diversity, we followed Hutzschenreuter et al. (2011) and calculated the sum of the CAGE distances between all country pairs in the country portfolio (including the home market) prior to each new internationalization step. For HM distance, we calculated the CAGE distance from the home market to the newly established market. For added distance, we followed Hutzschenreuter and Voll (2008): for every newly established international operation, the CAGE distances of all operations within the consisting country portfolio to the new operation were compared and the smallest of these distances was chosen.

Geographic scope relates to the expansion process and was dynamically measured as the number of countries in which a firm has established international operations prior to each new expansion step (Vermeulen and Barkema 2002).

To measure the imitability of an online shop, an own operationalization was developed; to the best of our knowledge, no established measure of online shop imitability exists. Eleven e-commerce experts from Belgium, Denmark, Germany, Italy, Spain and Switzerland were asked to carefully examine the online shops of the 150 retailers and to assess their imitability with three items (cf. Table 2).Footnote 1 To verify the index formation, we calculated the means of the rates per item and conducted a factor analysis that showed all items loading on one single factor. The Kaiser–Meyer–Olkin measure verified the sampling adequacy for the analysis (KMO = 0.72). Bartlett’s test of sphericity indicated that the correlations between items were sufficiently large (χ2 (3) = 384.452, p < 0.001). To check for measurement consistency, we observed that the Cronbachs α (=0.918) and the inter-item correlations (all >0.7) were adequate (Ariño 2003; Field 2009). We also checked for inter-rater reliability and analyzed the intra-class correlation coefficients (Gisev et al. 2013), which demonstrated sufficient inter-rater reliability (α > 0.7). In addition to the creation of one factor value for the level of shop imitability, we also calculated an average measure for online shop imitability based on the three items and all raters. In our final model both the factor value and the average measure showed the same results. Therefore, for ease of interpretation, we used the average as measure of imitability.

A dichotomous measurement was applied for the variable presence of VC to indicate whether a VC invested venture capital in the online shop. Within the sample, VCs are involved in 52.6 % of the firms.

A number of control variables were included in our analysis. First, more homogeneous customer demand across countries could imply faster internationalization. This homogeneity is likely to differ between product categories (Cloninger and Oviatt 2007; Pedersen and Shaver 2011). However, we do not elaborate on these differences but rather controlled for the product category following the categorization of Internet Retailer (2013), which resulted in categorizing online retailers in 16 different product categories. Second, we controlled with a categorical variable for possible effects of the home country market of the online retailer and whether the home country may affect internationalization speed. Both categorical variables are imputed in our model as a series of dummy variables. Third, to control for any systematic age effects over time, our variable age determined the number of years that a firm has been active in online selling at the time of every internationalization step (Powell 2014b). To consider the influence of other existing channels, the dichotomous variable multi-channel retailer (MC) captures whether other sales channels apart from the online shop exist; within the sample, multi-channel retailers account for 46 % of the firms. In our dataset, the variables imitability, category, home country, multi-channel retailer and venture capitalist are measured statically at one point in time, whereas all other variables in our dataset were measured dynamically for every new internationalization step.

4 Method

Given the longitudinal nature of our data, event history analysis with a Cox proportional hazards model was used for hypothesis testing. This model is the most commonly used regression model for the analysis of survival data and provides several advantages compared with common regression models: (1) good flexibility and capacity to include events at different moments in time, (2) no requirement for the specification of any underlying distribution and (3) appropriateness for data with a temporal bias and independent variables that vary over time (Fuentelsaz et al. 2002; Yu et al. 2011). This takes the characteristics of our dataset into account and explicitly considers the variations of the independent variables over time. The model analyses the chance or ‘hazard’ that a defined event will occur with respect to the unit of interest (e.g., a firm) after a given time period (Allison 2004). We define the event as an online retailer’s entry into a new country market and assume that the chance of the event’s occurrence is influenced by the covariates in our model. The Cox proportional hazards model attempts to explain the occurrence of an event (e.g., entry into a new country market) as a function of several explanatory variables (Casillas and Moreno-Menéndez 2014):

where h 0 (t) is the baseline hazard function, x is the covariate values, and β is the regression parameter. To adapt the model to our research, we used a Cox proportional hazard model with multiple-record data and multiple events, considering that a firm experiences several consecutive events (entries into country markets) within the considered time span of our analysis.

5 Results and Discussion

Table 3 presents the descriptive statistics and the correlation matrix for the independent variables. Among the independent variables, no correlation exceeds 0.7, and no serious risk of multicollinearity is evident (Anderson et al. 2014). To further test for multicollinearity, the variance inflation factors (VIFs) were estimated (Diamantopoulos and Winklhofer 2001); no indicator revealed a multicollinearity problem (VIF <2.3 for all indicators).

Table 4 presents the statistical results of the hypothesis testing. The hazard ratios represent the proportional change in the hazard rate for a one-unit increase in the respective independent variable. We applied a multiple-step approach that included a comparison between different models. Before computing the model, we mean-centered all variables to avoid multicollinearity (Cohen et al. 2003). To test for curvilinear effects, squared variables were used. The categorical variables product category as well as home country and their effects are considered as single indicator variables in our models. To provide a better readability of the results with focus on the main hypotheses, we do not display the coefficients for the indicator variables and present them in the additional Table 5 instead. The first model is the baseline model and includes only control variables. Model 2 includes all control and independent variables except the squared variables. Model 3 serves to test whether a model which includes also quadratic terms for the two variables for which we posited only linear effects (distance and added distance) performs better or worse than our proposed model (model 4). The fit for model 3 is inferior to that of model 4, indicating linear effects for distance and added distance. Finally, model 4 contains all variables, including the squared variables for the variables where curvilinear effects were posited. The inclusion of both linear and curvilinear effects significantly improves the predictive power of the model as compared to model 2, as the R 2 values show, as well as the model fit, as the log-likelihood ratio tests show; hence, the final model provides a more thorough test of the expected effects (Bowen and Wiersema 2004).

Some of our control variables show a significant and consistent influence on speed. Age, as measured in the number of years in which a firm is active in online selling, shows a significant and negative influence on internationalization speed. A similar result is observed by Powell (2014b), who finds that younger firms may be more interested in quickly exploiting international opportunities. A potential reason is that more recently founded online retailers face higher competitive pressure in their home markets, which drives them to internationalize and to quickly obtain a larger customer base. The product category also shows an influence on internationalization speed. In our sample, online retailers in the categories apparel/accessories/shoes and jewelry were showing a high internationalization speed while opticians and sporting goods internationalized rather slowly. Due to the largely different sample sizes for these categories, the findings should be interpreted with caution, though. The home country, capturing the influence of different home countries and therefore varying general conditions, shows an effect, whereby some home countries (e.g., the UK) seem to lead to a higher internationalization speed. However, given the largely different sample sizes (see Table 1), these findings are not interpreted in more detail. The existence of other channels in terms of a multi-channel approach shows no significant effect in the final model.

Hypothesis 1 posits a curvilinear influence of online shop imitability on internationalization speed. The final model supports H1, with a significant negative effect of imitability (h.r. = 207.736, p < 0.001) and a significant positive effect for the squared imitability (h.r. = 0.6972, p < 0.001). Figure 2 shows the relationship between imitability and the time between two consecutive new country market entries. When the level of imitability is low, firms internationalize slowly; with higher levels of imitability, the speed of internationalization increases and reduces the number of days between two market entries. Beyond a certain threshold of imitability, further increasing imitability reduces the speed of internationalization.

Following the network approach, Hypothesis 2 posits a positive influence of the presence of a VC on internationalization. None of our models showed a significant effect, and H2 must therefore be rejected. This result implies that VCs in the case of an online shop do not seem to push a company towards faster internationalization or that online retailers can find other sources for the necessary resources if they want to quickly internationalize.

Hypothesis 3a posits that a greater distance between a newly entered country market and the home country has a negative influence on speed. H3a is supported by all models, with a significant negative effect of HM distance (h.r. > 1, p < 0.001).

Hypothesis 3b posits a negative influence of greater added distance on speed. Contrary to our expectation, the effect on speed in the sample was positive and significant (h.r. = 0.9998, p < 0.001 in the final model 4). Therefore, H3b must be rejected. We do not have a conclusive explanation for this effect, which has also been argued inversely in other studies, e.g., Hutzschenreuter et al. (2011).

Hypothesis 3c posits a curvilinear relationship between geographic scope and the speed of internationalization. Model 4 supports H3c. The effect of geographic scope is significant and negative (h.r. = 1.6892, p < 0.001), the effect of geographic scope squared is significant and positive (h.r. = 0.9798, p < 0.001). As Fig. 2 shows, greater geographic scope initially accelerates the speed of internationalization and reduces the number of days between two market entries; however, beyond a certain number of countries, further internationalization is decelerated.

Hypothesis 3d posits a curvilinear relationship between diversity and internationalization speed and finds support in model 4 with a negative significant effect of diversity (h.r. = 1.0002; p < 0.001) and a positive significant effect of diversity squared (h.r. = 0.9988; p < 0.01). Figure 2 shows the relationship between diversity and internationalization speed. Increasing diversity initially increases internationalization speed and reduces the number of days between two market entries, as a result of the higher levels of international knowledge, but beyond a certain point, the complexity of international operations in diverse markets decelerates further internationalization.

Table 6 presents an overview of the results of the hypotheses tests.

6 Conclusion, Limitations and Implications

The aim of this paper is to examine possible factors influencing the internationalization speed of online retailers following various calls from researchers to explain speed based on factors at the individual, organizational and supra-organizational levels, to identify timing decisions in the retail sector and to examine internationalization speed in a geographically diversified country sample (e.g., Casillas and Acedo 2013; Fuentelsaz et al. 2002; Powell 2014b). Consistent with current literature, online retailers’ internationalization is viewed as a dynamic, path-dependent process (Casillas and Acedo 2013; Hutzschenreuter et al. 2007). Moreover, we methodically focus on a step-by-step observation of internationalization speed to observe changes in the relevance of the influencing factors during the internationalization process and over time. Based on the RBV, we were able to identify and empirically test factors at the three mentioned levels that influence the internationalization speed of online retailers.

The imitability of an online shop can be highlighted as the most important factor influencing the internationalization speed of an online retailer, as it shows the strongest effect. Low imitability permits an online retailer to internationalize slowly after exploiting the market potential in the home country and sequentially in each entered host market. Very high imitability does not give an online retailer the firm-specific advantages that are required to be successful in a foreign market and therefore also slows internationalization. In between the two extremes, moderately high levels of imitability provide a firm with the necessary advantages to internationalize and the pressure to do so quickly to transform the temporary advantage of the online shop into a more sustainable advantage, namely, a large customer base in different countries.

The distance to newly entered countries as well as scope and diversity of the country portfolio significantly influence an online retailer’s internationalization speed. The distance from a newly entered country to the home country slows down this internationalization step because the farther a country is from the home country, the more difficult it is to use the advantages the online retailer has gained in the home country. With regard to the scope of international activities, our study demonstrates the existence of a threshold beyond which the internationalization process is decelerated. In our sample, this threshold is at 12 countries. This result implies that after entering a certain number of countries, the marginal advantage of entering an additional country market is lowered, and the most attractive countries are already entered; thus, further internationalization is decelerated. Before this threshold is met, the increasing scope of countries improves the basis for further expansion and accelerates internationalization. Increasing diversity in the country portfolio initially has a positive effect as a basis for experiential learning and knowledge accumulation (Nachum et al. 2008). Until a certain level of diversity is reached, online retailers appear to employ rapid internationalization, learning from the exploration of new capabilities accumulated as a result of diversity. However, beyond a certain level of diversity, the complexity gets too high, decelerating further internationalization.

Despite its findings, our work obviously entails some limitations, which suggest implications for future research. First, with the CAGE measure of Ghemawat (2001) for distance and diversity, we employed a well-accepted, however aggregated measurement as a proxy. For future research, it would be interesting to provide a systematic, in-depth analysis of the different elements of distance to gain a deeper understanding of which aspects of distance are the most important ones in the case of online retailers. Such an analysis could be based on the framework of Berry et al. (2010) who propose nine dimensions of distance. Furthermore, we were not able to capture imitability in a dynamic way. Instead, we only have one static measure for imitability for each online shop. Although we expect that the imitability of an online shop does usually not change drastically over time, this limitation should be addressed in future research. Our variable venture capitalist was due to data availability as well only captured at present and therefore only at one static point in time and not in a dynamic way. Though anecdotal evidence shows that venture capitalists are often engaged from the early stages of internationalization of an online shop, if present at all, this is a further limitation and should be taken into account in future studies.

Our paper focuses on the determinants of speed within the internationalization process and uses market characteristics as determinants but does not investigate market selection itself. Thus, there is room for future research to explicitly investigate which factors determine the choice and order of country selection within the internationalization process of online retailers. A final implication for future research is the examination of the relationship between the internationalization speed and performance of online retailers to expand this research from a purely explicative approach to a normative approach. This relationship may be assumed because online retailers often pursue a ‘get-big-fast’ internationalization strategy and it has been found in IB literature for INV’s (e.g., Powell 2014b; Zhou and Wu 2014). However, an examination of internationalization speed on performance was not possible in our case for online retailers due to data restrictions.

In summary, our findings indicate that the speed of internationalization of online retailers is path-dependent and does not only depend on the next entered country but also changes with the extant country portfolio. The investigated variables based on the RBV are of relevance to explain internationalization speed in the online retailing industry.

Notes

Experts were asked, if possible, to evaluate the level of imitability at the time of the first internationalization attempt of a company. The year of that first internationalization step was provided in the questionnaire. Although we are aware that this method of capturing imitability only at one point in time is a weakness of the measurement, we expect that the imitability of an online shop does usually not change drastically over time.

References

Acedo, F. J., & Jones, M. V. (2007). Speed of internationalization and entrepreneurial cognition: insights and a comparison between international new ventures, exporters and domestic firms. Journal of World Business, 42(3), 236–252.

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies, 27(4), 633–653.

Allison, P. (2004). Event history analysis. In M. Hardy & A. Bryman (Eds.), Handbook of data analysis (pp. 369–386). London: Sage.

Amit, R., & Zott, C. (2001). Value creation in E-business. Strategic Management Journal, 22(6/7), 493–520.

Anderson, D., Sweeney, D., & Williams, T. (2014). Statistics for business and economics (12th ed.). Mason: South-Western.

Ariño, A. (2003). Measures of strategic alliance performance: an analysis of construct validity. Journal of International Business Studies, 34(1), 66–79.

Assaf, A., Josiassen, A., Ratchford, B., & Barros, C. (2012). Internationalization and performance of retail firms: a Bayesian dynamic model. Journal of Retailing, 88(2), 191–205.

Auh, S., & Menguc, B. (2005). Balancing exploration and exploitation: the moderating role of competitive intensity. Journal of Business Research, 58(12), 1652–1661.

Autio, E., Sapienza, H., & Almeida, J. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909–924.

Barkema, H., & Vermeulen, F. (1998). International expansion through start-up or acquisition: a learning perspective. Academy of Management Journal, 41(1), 7–26.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Berry, H., Guillén, M. F., & Zhou, N. (2010). An institutional approach to cross-national distance. Journal of International Business Studies, 41(9), 1460–1480.

Björkman, I., Stahl, G. K., & Vaara, E. (2007). Cultural differences and capability transfer in cross-border acquisitions: the mediating roles of capability complementarity, absorptive capacity, and social integration. Journal of International Business Studies, 38(4), 658–672.

Bowen, H. P., & Wiersema, M. F. (2004). Modeling limited dependent variables: methods and guidelines for researchers in strategic management. Research Methodology in Strategy and Management, 1, 87–134.

Brouthers, K., & Hennart, J.-F. (2007). Boundaries of the firm: insights from international entry mode research. Journal of Management, 33(3), 395–425.

Buckley, P. J. (2011). International integration and coordination in the global factory. Management International Review, 51(2), 269–283.

Casillas, J. C., & Acedo, F. J. (2013). Speed in the internationalization process of the firm. International Journal of Management Reviews, 15(1), 15–29.

Casillas, J. C., Moreno, A. M., Acedo, F. J., Gallego, M. A., & Ramos, E. (2009). An integrative model of the role of knowledge in the internationalization process. Journal of World Business, 44(3), 311–322.

Casillas, J. C., & Moreno-Menéndez, A. M. (2014). Speed of the internationalization process: the role of diversity and depth in experiential learning. Journal of International Business Studies, 45(1), 85–101.

Chetty, S., Johanson, M., & Martín, O. (2014). Speed of internationalization: conceptualization, measurement and validation. Journal of World Business, 49(4), 633–650.

Cloninger, P., & Oviatt, B. (2007). Service content and the internationalization of young ventures: an empirical test. Entrepreneurship Theory and Practice, 31(2), 233–256.

Cohen, J., Cohen, P., & West, S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences (3rd ed.). Mahwah: Erlbaum.

Contractor, F. J., Kundu, S. K., & Hsu, C.-C. (2003). A three-stage theory of international expansion: the link between multinationality and performance in the service sector. Journal of International Business Studies, 34(1), 5–18.

Costa, L., Cool, K., & Dierickx, I. (2013). The competitive implications of the deployment of unique resources. Strategic Management Journal, 34(4), 445–463.

Crook, T. R., Ketchen, D. J., Combs, J. G., & Todd, S. Y. (2008). Strategic resources and performance: a meta-analysis. Strategic Management Journal, 29(11), 1141–1154.

Dawson, J., & Mukoyama, M. (2014). Future directions of retailer internationalization. In J. Dawson & M. Mukoyama (Eds.), Global strategies in retailing: Asian and European experiences (pp. 227–238). NY: Routledge.

Diamantopoulos, A., & Winklhofer, H. (2001). Index construction with formative indicators: an alternative to scale development. Journal of Marketing Research, 38(2), 269–277.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511.

Dow, D., & Karunaratna, A. (2006). Developing a multidimensional instrument to measure psychic distance stimuli. Journal of International Business Studies, 37(5), 578–602.

E-Commerce Europe. (2014). European B2C E-commerce Report 2014. Brussels.

E-Commerce Europe. (2015). European B2C E-Commerce Report 2015. Brussels.

Ellis, P. D. (2007). Distance, dependence and diversity of markets: effects on market orientation. Journal of International Business Studies, 38(3), 374–386.

Elsner, S. (2014). Retail internationalization—analysis of market entry modes, format transfer and coordination of retail activities. Wiesbaden: Springer Fachmedien.

Ely, R., & Thomas, D. (2001). Cultural diversity at work: the effects of diversity perspectives on work group processes and outcomes. Administrative Science Quarterly, 46(2), 229–273.

Ferguson, C., Finn, F., & Hall, J. (2005). Electronic commerce investments, the resource-based view of the firm, and firm market value. International Journal of Accounting Information Systems, 6(1), 5–29.

Field, A. (2009). Discovering Statistics using SPSS (3rd ed.). London: Sage.

Fuentelsaz, L., Gomez, J., & Polo, Y. (2002). Followers’ entry timing: evidence from the Spanish banking sector after deregulation. Strategic Management Journal, 23(3), 245–264.

Gabrielsson, M., Sasi, V., & Darling, J. (2004). Finance strategies of rapidly-growing Finnish SMEs: born internationals and born globals. European Business Review, 16(6), 590–604.

Gartner Industry Research. (2012). E-commerce and M-commerce: Increase investment in retail store technology. http://my.gartner.com/portal/server.pt?open=512&objID=270&mode=2&PageID=3862698&docCode=231851&ref=docDisplay. Accessed 23 September 2015.

Ghemawat, P. (2001). Distance still matters. The hard reality of global expansion. Harvard Business Review, 79(8), 137–147.

Gisev, N., Bell, J., & Chen, T. (2013). Interrater agreement and interrater reliability: key concepts, approaches, and applications. Research in Social and Administrative Pharmacy, 9(3), 330–338.

Gomes, L., & Ramaswamy, K. (1999). An empirical examination of the form of the relationship between multinationality and performance. Journal of International Business Studies, 30(1), 173–187.

Grant, R. (1987). Multinationality and performance among british manufacturing companies. Journal of International Business Studies, 18(3), 79–89.

Gulati, R. (1995). Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances. The Academy of Management Journal, 38(1), 85–112.

Hagen, B., & Zucchella, A. (2014). Born global or born to run? The long-term growth of born global firms. Management International Review, 54(4), 497–525.

Håkanson, L., & Ambos, B. (2010). The antecedents of psychic distance. Journal of International Management, 16(3), 195–210.

Hall, R. (1992). The strategic analysis of intangible resources. Strategic Management Journal, 13(2), 135–144.

Hashai, N. (2011). Sequencing the expansion of geographic scope and foreign operations by “born global” firms. Journal of International Business Studies, 42(8), 995–1015.

Hennart, J.-F. (2011). A theoretical assessment of the empirical literature on the impact of multinationality on performance. Global Strategy Journal, 1(1–2), 135–151.

Hitt, M., Bierman, L., Uhlenbruck, K., & Shimizu, K. (2006). The importance of resources in the internationalization of professional service firms: the good, the bad, and the ugly. Academy of Management Journal, 49(6), 1137–1157.

Hoenen, A. K., & Kostova, T. (2014). Utilizing the broader agency perspective for studying headquarters-subsidiary relations in multinational companies. Journal of International Business Studies, 46(1), 104–113.

Huang, Y., & Sternquist, B. (2007). Retailers’ foreign market entry decisions: an institutional perspective. International Business Review, 16(5), 613–629.

Hutzschenreuter, T., & Horstkotte, J. (2013). Managerial services and complexity in a firm’s expansion process: an empirical study of the impact on the growth of the firm. European Management Journal, 31(2), 137–151.

Hutzschenreuter, T., Kleindienst, I., & Lange, S. (2014). Added psychic distance stimuli and mne performance: performance effects of added cultural, governance, geographic, and economic distance in mnes’ international expansion. Journal of International Management, 20(1), 38–54.

Hutzschenreuter, T., Pedersen, T., & Volberda, H. W. (2007). The role of path dependency and managerial intentionality: a perspective on international business research. Journal of International Business Studies, 38(7), 1055–1068.

Hutzschenreuter, T., & Voll, J. (2008). Performance effects of “added cultural distance” in the path of international expansion: the case of German multinational enterprises. Journal of International Business Studies, 39(1), 53–70.

Hutzschenreuter, T., Voll, J., & Verbeke, A. (2011). The impact of added cultural distance and cultural diversity on international expansion patterns: a Penrosean perspective. Journal of Management Studies, 48(2), 305–329.

Hymer, S. (1976). The international operations of national firms: A study of direct foreign investment. Cambridge: MIT Press.

Internet Retailer. (2013). Internet Retailer Europe 500: Business Data Profiles, Rankings and Analysis of Europe’s 500 Largest Retail Web Sites.

Johanson, J., & Vahlne, J.-E. (1977). The internationalization process of the firm: a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8(1), 23–32.

Johanson, J., & Vahlne, J.-E. (2009). The Uppsala internationalization process model revisited: from liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9), 1411–1431.

Jones, M. V., & Coviello, N. E. (2005). Internationalisation: conceptualising an entrepreneurial process of behaviour in time. Journal of International Business Studies, 36(3), 284–303.

Kuettner, T., & Schubert, P. (2012). IT-based competitive advantage: a cross-case comparison of business software usage. Procedia Technology, 5, 181–189.

Laanti, R., Gabrielsson, M., & Gabrielsson, P. (2007). The globalization strategies of business-to-business born global firms in the wireless technology industry. Industrial Marketing Management, 36(8), 1104–1117.

Lieberman, M., & Montgomery, D. (1998). First-mover (dis)advantages: retrospective and link with the resource-based view. Strategic Management Journal, 19(12), 1111–1125.

Loane, S., McNaughton, R., & Bell, J. (2004). The internationalization of internet-enabled entrepreneurial firms: evidence from Europe and North America. Canadian Journal of Administrative Sciences, 21(1), 79–96.

Lohr, N. (2013). Subsidiary internationalization and cross-border subsidiary mandates. Wiesbaden: Springer.

Madsen, T. (2013). Early and rapidly internationalizing ventures: similarities and differences between classifications based on the original international new venture and born global literatures. Journal of International Entrepreneurship, 11(1), 65–79.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87.

Martin, R. (1999). The new economy geography of money. In R. Martin (Ed.), Money and the space economy (pp. 3–28). Chichester: Wiley.

Mathews, J. A., & Zander, I. (2007). The international entrepreneurial dynamics of accelerated internationalisation. Journal of International Business Studies, 38(3), 387–403.

Morgan-Thomas, A., & Jones, M. V. (2009). Post-entry internationalization dynamics: differences between SMEs in the development speed of their international sales. International Small Business Journal, 27(1), 71–97.

Musteen, M., Francis, J., & Datta, D. (2010). The influence of international networks on internationalization speed and performance: a study of Czech SMEs. Journal of World Business, 45(3), 197–205.

Nachum, L. (2010). When is foreignness an asset or a liability? Explaining the performance differential between foreign and local firms. Journal of Management, 36(3), 714–739.

Nachum, L., Zaheer, S., & Gross, S. (2008). Does it matter where countries are? Proximity to knowledge, markets and resources, and MNE location choices. Management Science, 54(7), 1252–1265.

Nohria, N., & Ghoshal, S. (1994). Differentiated fit and shared values: alternatives for managing headquarters-subsidiary relationships. Strategic Management Journal, 15(6), 491–502.

O’Grady, S., & Lane, H. (1996). The psychic distance paradox. Journal of International Business Studies, 27(2), 309–333.

Oliva, R., Sterman, J., & Giese, M. (2003). Limits to growth in the new economy: exploring the ‘get big fast’ strategy in e-commerce. System Dynamics Review, 19(2), 83–117.

Oviatt, B., & McDougall, P. (1994). Toward a theory of international new ventures. Journal of International Business Studies, 25(1), 45–64.

Oviatt, B., & McDougall, P. (2005). Defining international entrepreneurship and modeling the speed of internationalization. Entrepreneurship Theory and Practice, 29(5), 537–554.

Park, N., Mezias, J., & Song, J. (2004). A resource-based view of strategic alliances and firm value in the electronic marketplace. Journal of Management, 30(1), 7–27.

Pedersen, T., & Shaver, M. (2011). Internationalization revisited: the big step hypothesis. Global Strategy Journal, 1(3–4), 263–274.

Penrose, E. (1959). The theory of the growth of the firm. London: Blackwell.

Peteraf, M. A. (1993). The cornerstones of competitive advantage: a resource-based view. Strategic Management Journal, 14(3), 179–191.

Powell, K. S. (2014a). From M-P to MA-P: multinationality alignment and performance. Journal of International Business Studies, 45(2), 211–226.

Powell, K. S. (2014b). Profitability and speed of foreign market entry. Management International Review, 54(1), 31–45.

Powell, K. S., & Rhee, M. (2013). Experience in different institutional environments and foreign subsidiary ownership structure. Journal of Management,

Prashantham, S., & Young, S. (2011). Post-entry speed of international new ventures. Entrepreneurship: Theory and Practice, 35(2), 275–292.

Raisch, S., & Birkinshaw, J. (2008). Organizational ambidexterity: antecedents, outcomes, and moderators. Journal of Management, 34(3), 375–409.

Rugman, A. M., & Verbeke, A. (2007). Liabilities of regional foreignness and the use of firm-level versus country-level data: a response to Dunning et al. (2007). Journal of International Business Studies, 38(1), 200–205.

Sharma, D. D., & Blomstermo, A. (2003a). A critical review of time in the internationalization process of firms. Journal of Global Marketing, 16(4), 53–71.

Sharma, D. D., & Blomstermo, A. (2003b). The internationalization process of born globals: a network view. International Business Review, 12(6), 739.

Shenkar, O. (2001). Cultural distance revisited: towards a more rigorous conceptualization and measurement of cultural differences. Journal of International Business Studies, 32(3), 519–535.

Shneor, R., & Flaten, B.-T. (2008). The Internet-enabled internationalization process: a focus on stages and sequences. Journal of e-Business, 8(1–2), 45–52.

Sinkovics, R., & Penz, E. (2005). Empowerment of SME websites: development of a web-empowerment scale and preliminary evidence. Journal of International Entrepreneurship, 3(4), 303–315.

Spence, M., Orser, B., & Riding, A. (2011). A comparative study of international and domestic new ventures. Management International Review, 51(1), 3–21.

Stahl, G. K., Maznevski, M. L., Voigt, A., & Jonsen, K. (2010). Unraveling the effects of cultural diversity in teams: a meta-analysis of research on multicultural work groups. Journal of International Business Studies, 41(4), 690–709.

Stevens, F., Plaut, V., & Sanchez-Burks, J. (2008). Unlocking the benefits of diversity: all-inclusive multiculturalism and positive organizational change. The Journal of Applied Behavioral Science, 44(1), 116–133.

Teece, D. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350.

Teece, D., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Tihanyi, L., Griffith, D. A., & Russell, C. J. (2005). The effect of cultural distance on entry mode choice, international diversification, and MNE performance: a meta-analysis. Journal of International Business Studies, 36(3), 270–283.

Trudgen, R., & Freeman, S. (2014). Measuring the performance of born-global firms throughout their development process: the roles of initial market selection and internationalisation speed. Management International Review, 54(4), 551–579.

Tung, R. L., & Verbeke, A. (2010). Beyond Hofstede and GLOBE: improving the quality of cross-cultural research. Journal of International Business Studies, 41(8), 1259–1274.

Vermeulen, F., & Barkema, H. (2002). Pace, rhythm, and scope: process dependence in building a profitable multinational corporation. Strategic Management Journal, 23(7), 637–653.

Wen, H. J., Chen, H.-G., & Hwang, H.-G. (2001). E-commerce web site design: strategies and models. Information Management & Computer Security, 9(1), 5–12.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180.

Williams, D. W., & Grégoire, D. A. (2015). Seeking commonalities or avoiding differences? Re-conceptualizing distance and its effects on internationalization decisions. Journal of International Business Studies, 46(3), 253–284.

Yu, J., Gilbert, B., & Oviatt, B. (2011). Effects of alliances, time, and network cohesion on the initiation of foreign sales by new ventures. Strategic Management Journal, 32(4), 424–446.

Zaheer, S. (1995). Overcoming the liability of foreignness. The Academy of Management Journal, 38(2), 341–363.

Zaheer, S., Schomaker, M. S., & Nachum, L. (2012). Distance without direction: restoring credibility to a much-loved construct. Journal of International Business Studies, 43(1), 18–27.

Zahra, S., & George, G. (2002). International entrepreneurship: The current status of the field and future research agenda. In M. Hitt, R. D. Ireland, S. M. Camp, & D. L. Sexton (Eds.), Strategic entrepreneurship (pp. 255–288). Oxford: Blackwell.

Zahra, S., Ireland, D., & Hitt, M. A. (2000). International expansion by new venture firms: international diversity, mode of market entry, technological learning, and performance. Academy of Management Journal, 43(5), 925–950.

Zellmer-Bruhn, M., & Gibson, C. (2006). Multinational organization context: implications for team learning and performance. Academy of Management Journal, 49(3), 501–518.

Zhang, Y., Li, H., Li, Y., & Zhou, L.-A. (2010). FDI spillovers in an emerging market: the role of foreign firms’ country origin diversity and domestic firms’ absorptive capacity. Strategic Management Journal, 31(9), 969–989.

Zhou, L., & Wu, A. (2014). Earliness of internationalization and performance outcomes: exploring the moderating effects of venture age and international commitment. Journal of World Business, 49(1), 132–142.

Zook, M. A. (2005). The geography of the internet industry. Oxford: Blackwell Publishing Ltd.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Schu, M., Morschett, D. & Swoboda, B. Internationalization Speed of Online Retailers: A Resource-Based Perspective on the Influence Factors. Manag Int Rev 56, 733–757 (2016). https://doi.org/10.1007/s11575-016-0279-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-016-0279-6