Abstract

This paper studies the performance consequences of the speed of SME internationalization. The authors identify three research gaps: few studies treat speed as an independent variable; most studies analyze speed only until internationalization starts; and, finally, studies have paid little attention to the multidimensionality of the speed concept. The authors seek to address these gaps and to contribute to the literature on the dynamics of internationalization by developing three measures of internationalization speed, which capture its multidimensionality. Building on the theories of learning advantage of newness and time compression diseconomies, the study presents three hypotheses on speed’s effect on performance, and the theoretically derived research model is tested on a sample of 183 SMEs visited on site. The analysis demonstrates that the speed of a firm’s increase in the breadth of its international markets has a positive but curvilinear effect on firm performance. It also demonstrates that the speed of a firm’s increase in commitment of foreign resources has a negative but curvilinear effect on the performance of the firm. These results have implications both for scholars interested in the dynamics of firm internationalization and for SME managers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper explores the relationship between speed of international expansion and performance of small and medium-sized enterprises (SMEs). Recently, the speed at which SMEs expand internationally has received increased research attention (Casillas and Acedo 2013; Casillas and Moreno-Menéndez 2014; Acedo and Jones 2007; McDougall et al. 2003) and has come to occupy a central position in the debate on whether traditional models are still valid or whether firm internationalization should be viewed in new ways. Traditional models view internationalization as a risk-reducing (De-Lemos et al. 2011) and incremental process (Cavusgil 1980; Johanson and Vahlne 1977). Firms commit resources to international operations when they have sufficient experience to reduce uncertainties, but as the accumulation of experience takes time, internationalization represents a time-consuming and therefore slow process. Recent research, in contrast, argues that internationalization can occur more rapidly. International new ventures (INVs) challenge the validity of the traditional models (Oviatt and McDougall 1994). INVs operate internationally from their inception and internationalize faster than traditional models predict (Chetty and Campbell-Hunt 2004; Knight and Cavusgil 1996). In light of this background, this paper addresses three research gaps in the literature on the speed of SME internationalization.

First, most studies of SME internationalization speed focus on the amount of time that elapses from a firm’s inception until it starts internationalizing; less is known about continued SME internationalization after this point. In the reported research, a short time between a firm’s inception and its first foreign entry is treated as indicating rapid internationalization. This means that there are no studies of the manner and speed with which SMEs spread their operations beyond the first step abroad. Most studies analyze only the starting phase, in fact studying only the time it takes an SME to start activity in its first foreign markets.

Second, articles tend to view SME internationalization as a unidimensional activity, comprising mainly exports. This means that several important dimensions of SME internationalization, especially beyond the inception of the firm and its start of internationalization, are neglected. Building on Casillas and Acedo (2013), we develop a measure of three dimensions of SME internationalization speed: speed of increasing breadth of international markets, speed of increasing international commercial intensity, and speed of increasing commitment of resources to foreign activity.

Third, most research on SME internationalization speed has sought to address the determinants of rapid internationalization; less is known about the consequences of such speed. We address this shortcoming by outlining a conceptual model with three hypotheses anchored in research on the learning advantage of newness (LAN) (Autio et al. 2000) and time compression diseconomies (TCDs) (Dierickx and Cool 1989), and we view internationalization as a process of capability development (Jiang et al. 2014).

The remainder of this paper is structured as follows. First, we present our theoretical background by anchoring the study in internationalization process theory and the international entrepreneurship school. After this, we review the literature on internationalization speed and explore the targeted research gaps in more detail. We then define the concept of speed and develop the speed–performance relationship and generate the hypotheses. Next, the methodology is presented, followed by the data analysis. The results of the hypothesis tests are discussed and the conclusions are then presented. The final section of the paper presents the theoretical and managerial implications of this research.

2 Theoretical Background

2.1 Speed in Internationalization Models

Regarding firm internationalization, two main research streams are dominant, and both internationalization process theory (Bilkey and Tesar 1977; Cavusgil 1980; Johanson and Vahlne 1977) and the INV stream (Oviatt and McDougall 1994) view internationalization as a process that occurs over time. These streams try to explain the dynamics of the process by developing temporal concepts. Internationalization process theory predicts that internationalization is an incremental process by which a firm gradually expands its international operations over time (Johanson and Vahlne 1977; Johanson and Wiedersheim-Paul 1975). Starting in the early 1990s, observations of INVs called for alternative explanations (Oviatt and McDougall 1994). INVs are seen as resulting from more global market conditions, for example, because of market homogenization (Oviatt and McDougall 1994), the increasing role of global niche markets (Knight 1997), and advances in technology and communication (Cavusgil 1994). Researchers applying these ideas (e.g., Bell 1995; Cavusgil 1994) argue that the incremental models are no longer valid for newly started firms. But other researchers (e.g., Bloodgood et al. 1996; Madsen and Servais 1997) claim that the classical models are valid for INVs if their founders’ experience is taken into account. Though these views have partly different foci, both schools recognize time as a concept that affects internationalization, but they have different time-related emphases. Internationalization speed refers to the degree of internationalization that a firm achieves during a specific period (Casillas and Acedo 2013). INV theory suggests that, while internationalization has conventionally occurred slowly, INVs have internationalized rapidly; however, other than a study by Khavul et al. (2010), there are no empirical studies of the speed of internationalization, but several on how long it takes before SMEs start to internationalize.

2.2 Gaps in Research on the Speed of SME Internationalization

As outlined in the introduction, the concept of internationalization speed has recently been increasingly researched, though we claim that there are gaps in the extant research. Our reviewFootnote 1 (see Table 1) found that the literature could be analyzed along four dimensions: the international market(s), the period of international market entry, the internationalization activity, and internationalization speed as a dependent or independent variable.

2.2.1 Temporal Perspective and Speed as a Variable

The period analyzed in most articles starts from firm inception and extends to the start of internationalization, a short period between these events representing a high internationalization speed. The period after internationalization starts is studied in five articles (Chetty et al. 2014; Hilmersson 2014; Lin 2012; Morgan-Thomas and Jones 2009; Zhou 2007), but only three of them have a long-term perspective on speed (Chetty et al. 2014; Hilmersson 2014; Morgan-Thomas and Jones 2009). This indicates that there is limited knowledge of internationalization speed in the medium and long terms. This means that, instead of examining the speed at which an SME spreads its activities internationally, these studies examine the time it takes before the SME starts to internationalize. Thus, along the lines argued by Casillas and Acedo (2013), we question whether the introduced measures are valid measures of the speed of internationalization. Actually, they seem to be better indicators of the speed of beginning internationalization. Consequently, the concept of speed suffers from the lack of a common definition in the internationalization context, so an agreed-upon measure is also lacking.

Most research on speed, in turn, concerns the antecedents to or determinants of the speed at which firms internationalize. In the literature review, only the studies by Chetty et al. (2014), Hilmersson (2014) and Khavul et al. (2010) treats speed as an independent variable. Thus, several researchers have studied the factors affecting the amount of elapsed time (in years) between the year a firm is founded and its first international venture; however, less is known about the consequences of speed. From existing research, we know that language competence positively affects speed (Musteen et al. 2010), that firms entering markets with lower levels of regulatory hazard internationalize faster (Coeurderoy and Murray 2008), that firms with a great deal of international experience internationalize faster, and that the degree of risk perception regarding international operations is negatively associated with speed (Acedo and Jones 2007). Moreover, Zucchella et al. (2007) found that firms belonging to an industrial district, pursuing a niche strategy, and possessing various types of prior experience of international activity internationalize at a high speed. Pla-Barber and Escribá-Esteve (2006) found that a proactive attitude among the management team and marketing differentiation advantages lead to faster internationalization, whereas Luo et al. (2005) observed that, among Internet firms, top management experience and firm strengths in innovation and marketing are positively associated with high speed.

Consequently, our knowledge about the factors influencing the speed at which SMEs start internationalizing is relatively well developed, an area treated in INV theory, whereas our understanding of the consequences of internationalization speed, both from firm inception to start of internationalization and from that point onward, is rudimentary, indicating a significant lack of research.

2.2.2 Entry Modes and Foreign Markets

There is a relatively well-defined and established view of the speed components of internationalization. Internationalization is mainly defined in two dimensions: how firms enter foreign markets and the number of foreign markets entered. Most studies treat internationalization as comprising simply international sales and exports. This view is likely a consequence of the short-term view of internationalization and because resource constraints mean that SMEs usually start internationalization by exporting. Only one of the studies (Lin 2012) measures internationalization by the number of legal entities established in foreign markets, while four articles use more general measures of internationalization. For instance, Coeurderoy and Murray (2008) use the term “market entry,” while Jörgensen (2014) analyzes “international activity”, Luo et al. (2005) study “international expansion activity,” and Musteen et al. (2010) refer to “international ventures.” The majority of the empirical studies takes a unidimensional view of internationalization and discusses only one entry mode or one type of international activity. The only exception is Chetty et al. (2014), who view as a construct consisting of internationally learning and international commitment.

Most studies analyze how long it takes SMEs to enter their first foreign markets, meaning that the focus is on foreign market entry. They do not analyze the international markets into which the SMEs extend their operations after the first foreign market is entered, nor the order in which those markets are entered. Nor are they interested in specific country markets: any foreign market can be in focus as long as it is the first. This means that relatively few studies are interested in “real” internationalization, that is, not only the first market entered, but subsequent markets as well. This also means that no studies examine how quickly firms spread their activities to other markets after the first foreign market has been entered.

Without specifically or necessarily studying entries into more than one foreign market, three articles indirectly follow SME operations in several foreign markets. Lin (2012) measures the number of subsidiaries established during a specific period, which opens up several foreign markets to examination, while Morgan-Thomas and Jones (2009) also observe operations in more than one market, since they follow international sales development after a firm enters its first foreign market. Zhou (2007), by taking a somewhat longer-term perspective and looking beyond the start of internationalization, examines more than one market, as the period analyzed ends when the firm achieves 20 % of international sales in relation to total turnover. In this respect, Chetty et al. (2014), Hilmersson (2014) and Trudgen and Freeman (2014) stand out, as they incorporate the number of foreign markets entered into the internationalization dimension of the speed concept.

This means that most of the reviewed articles examine the interval from the start of sales to the first foreign market entered, while Morgan-Thomas and Jones (2009) and Zhou (2007) analyze sales to potentially more than one market. Luo et al. (2005) and Musteen et al. (2010) view internationalization as the establishment of a legal entity in one foreign market. Taken together, this review indicates that internationalization into more than one market and internationalization activities other than sales are under-researched.

This review demonstrates that, despite the growing body of studies of SME internationalization speed, several research gaps remain to be filled. In this study, we address three of them:

-

1.

We define and empirically measure speed, taking a long-term perspective, beginning from inception and continuing until after internationalization starts.

-

2.

We treat speed as an independent variable and take the first step in analyzing the consequences of internationalization speed for firm performance.

-

3.

We consider internationalization a process by which a firm extends its activities internationally; as the degree of internationalization is a multidimensional concept, we also consider speed of internationalization to be multidimensional.

3 The Speed Concept

In physics, speed is defined as an object’s change of position or movement during a specific period, meaning that speed is the time taken to travel a specific distance (Chetty et al. 2014). We build on this understanding, defining internationalization speed as the time it takes a firm to reach a certain degree of internationalization. This definition is similar to one recently proposed by Casillas and Acedo (2013), who suggest a multidimensional concept comprising three dimensions that capture the SME’s international expansion: the speed of change in breadth of a firm’s international markets, the speed of growth in a firm’s international commercial intensity, and the speed of a firm’s commitment of resources abroad. These dimensions differ in nature, so they likely do not have the same antecedents or lead to the same outcomes. Based on this definition and in line with Chetty et al. (2014), we provide a measure of internationalization speed that accounts for the average expansion covered in each time unit. This refers to speed as the firm’s average rate of international expansion. Whereas previously developed measures are valid for capturing the speed to begin SME internationalization, speed of internationalization should be measured as the international expansion occurring over time. Therefore, the time unit is the denominator and the three dimensions of degree of internationalization are the numerators. These three constructs would then capture the speed at which the firm has internationally expanded its activities rather than the time it took to start this process.

4 The Mechanism of Speed and Performance

Internationalization is a process of capability and routine development (Jiang et al. 2014). The capabilities and routines developed are important for the firm to handle the liabilities of foreignness and network outsidership. The efficiency of the capability development process determines the internationalization process of the firm (Autio et al. 2000). SMEs with the capability to absorb, integrate, and transform experience into useful knowledge are likely to display stronger performance than those lacking this ability. In addition, the gained experiential knowledge is important, as the structures and routines developed in the SME result from this knowledge (Nelson and Winter 1982).

To establish the mechanism linking internationalization speed and performance, we build on two main theories of capability development. Research on INVs has demonstrated the importance of LAN, while research on the speed of multinational corporation (MNC) expansion has demonstrated the importance of TCD. Both theories build on Penrose’s (1959) resource heterogeneity assumption where experiential knowledge is a central resource. Resources and capabilities based on experiential knowledge are difficult to imitate, substitute, and transfer. The more heterogeneous they are, the more costly to implement. This also means that internationalization is a process where heterogeneous resources and capabilities are developed and integrated into the firm. The performance consequences are a result of four characteristics of the development process: The magnitude of the heterogeneous capabilities developed, the complexity of the heterogeneous capabilities developed, the integration of the developed capabilities needed, and the time it takes to develop the capabilities. A large magnitude, high complexity, and difficult integration, taking place during a short period of time, are more costly than the opposite. Thus, depending on the capabilities needed for various dimensions, the consequences vary.

Research on LAN (e.g., Autio et al. 2000; Prashantham and Young 2011; Sapienza et al. 2006) leads us to expect that internationalization speed positively influences firm performance. This line of research suggests that young firms are less constrained by the past and are therefore in a position to more effectively develop capabilities from foreign activities. A firm that begins to internationalize early, when it usually lacks rigid routines and organizational structures, tends to develop routines that are consequences of operating internationally. Less rigid routines promote the transformation of experience into experiential knowledge, which is the case at the beginning of a rapid internationalization process (Sapienza et al. 2006).

In contrast, firms that begin to internationalize late, first develop a structure and routines that fit home market operations, which means that these SMEs must make bigger changes when they begin to internationalize. Internationalization requires adaptation of the routines to the conditions in the foreign market, and SMEs that stay longer in the home market, irrespectively of their age, are likely to be forced to make more extensive adaptations of their structure and routines when they begin to enter foreign markets than those that begin to enter foreign markets at younger age (Autio et al. 2000). Thus, the longer a firm stays solely in its home market, the more rigid and inflexible its routines, which have to be dismantled to enter foreign markets. SMEs that continuously enter new foreign markets stay flexible and avoid becoming entrenched in routines developed from their existing operations. Thus, SMEs that internationalize at a high speed are likely to have a more flexible structure and routines, making their decision-making processes shorter and simpler than those of slow-internationalizing firms. We expect the LAN arguments also to be relevant to the ongoing international expansion of SMEs. SMEs internationalizing rapidly are less entrenched in their routines, are not as constrained by inertia, and are more progressive and expansion-oriented than their slower-expanding counterparts. Consequently, we argue that SMEs that internationalize rapidly are better equipped to nurture their international capabilities.

Research on TCD (e.g., Dierickx and Cool 1989; Jiang et al. 2014; Knott et al. 2003), in contrast, leads us to expect that high speed of internationalization negatively affects performance, as the faster the capabilities needed for internationalization are developed and integrated, the higher the cost of this process. Since the dimensions differ in complexity and magnitude, different capabilities may be needed, which, in turn influences the process of developing and integrating them. The consequences of speed are likely to be reinforced by compressing this development of these heterogeneous capabilities in time. Inefficiencies arise when things are done faster, so when the capability development process is accelerated, its costs increase (Dierickx and Cool 1989). If internationalization is seen as a process of capability development, then TCD would hold that rapid internationalization degrades performance. Jiang et al. (2014) recently applied TCD to examine the speed–performance relationship in MNCs, demonstrating that performance declines if the speed at which it establishes a second foreign subsidiary increases.

We thus have theoretical suggestions pointing in different directions, which is in line with Casillas and Acedo (2013), who argue that the three dimensions of speed need not necessarily move performance in the same direction. Sorting out these theoretical suggestions arguably requires examining the complexity of the firm’s international operations and having a finer-grained account of the mechanism and performance concepts.

First, internationalization comprises several dimensions, such as exports, imports, subsidiaries, and number of markets. The complexity of internationalization is a product of the character and number of these dimensions. Traditional internationalization theories argue that the more complex the international entry, the more uncertainty prevails. This means that the accumulation of experiential knowledge is contingent on the complexity of the foreign operations. Absorbing and transforming experience into experiential knowledge tends to be more difficult the more complexity prevails, as more pieces and fragments of information must be integrated and understood. We accordingly argue that the more complex the internationalization dimension, the stronger the effects of TCD.

Second, to examine the mechanism of the internationalization speed–performance relationship, we also need a finer-grained view of the performance concept. Performance refers to how the firm uses its resources, and efficient resource use takes account of both the revenues earned and the costs of earning them. Thus, we need to examine how speed affects the revenue side as well as the cost side of the performance concept. Against this background on the mechanism of the speed–performance relationship, the next section develops the three dimensions of the speed concept in relationship to firm performance.

5 Hypothesis Development

5.1 Speed of Increase in the Breadth of International Markets and Performance

Research has found that an increase in the breadth of international markets exposes the firm to new institutional and cultural environments. By being active in several foreign markets, the firm expands its general experience base (Johanson and Vahlne 1977). Consequently, the more markets a firm enters, the more diversified its experiences. Research on internationalization has demonstrated that the greater the diversity of a firm’s operations, the more valid the firm’s experiential knowledge is for any market (Eriksson et al. 1997).

General internationalization knowledge is not market-specific but can reduce the costs of entry in markets other than where it was gained (Eriksson et al. 1997). In addition, since foreign markets are varied, the greater an SME’s internationalization, the more heterogeneous its knowledge base; this in turn means that the knowledge can be used where it is most valued. Each new market entry therefore implies using old knowledge, making later market entries less costly than earlier ones. A learning advantage comes from the fact that experience and knowledge can be shared between a firm’s units in different markets (Eriksson et al. 1997), meaning that the need for learning decreases along the process. These findings go hand in hand with arguments from the resource-based view of strategy theory, which emphasizes that a firm’s growth and performance can be traced to its experiential knowledge base (Helfat and Peteraf 2003; Wernerfelt 1984). Moreover, it has been demonstrated that experiential knowledge is an inimitable resource that makes a valuable contribution to a globalizing firm’s competitive advantage (Oviatt and McDougall 2005).

Previous research on the dynamics of the international capability development process (Autio et al. 2000; Sapienza et al. 2006) argues that firms internationalizing at an early stage will imprint a dynamic capability. Consequently, it was argued that the earlier a firm starts to internationalize, the better equipped it is to exploit future international opportunities. We propose that this argument is also valid for the continued international expansion of firms. A firm constantly and rapidly increasing its breadth of international markets nurtures its international capabilities. A firm slowly increasing its breadth of international markets, in contrast, faces challenges of rigidity and is not equally equipped to reconfigure its resources and capabilities in order to seize international opportunities.

The earlier and faster an SME can begin the ongoing exposure of its products to international markets, the faster it can learn from these markets, forcing it to adapt and develop routines and an organizational structure suited for international operations (Autio et al. 2000), which is likely to positively affect performance. Thus, we expect that the speed of increase in breadth of international markets positively influences the performance of the SME. Still, however, based on research on TCD, we expect that, if the speed of breadth of international markets increases considerably, then TCDs are likely to occur, as managers of the firm suffer from their limitations in information processing. If the firm entered too many markets at the same time, then we expect that the managers of the firm would be unable to integrate the experiences and develop routines based on them. Thus, if the international capability development process drastically accelerates, we expect that the performance effect suffers as the costs increase (Dierickx and Cool 1989). We therefore posit that:

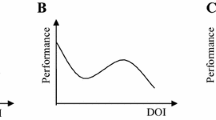

H1: The speed of SME increase in the breadth of international markets has a curvilinear effect on SME performance (inverted U-shaped).

5.2 Speed of Growth of International Commercial Intensity and Performance

Whereas the speed at which international operations increase in breadth directly addresses the speed at which SMEs enter new foreign markets, the speed of growth of international commercial intensity addresses how important international sales are for the firm. Speed of internationalization measured as exports and international sales has been analyzed in several studies (Morgan-Thomas and Jones 2009; Pla-Barber and Escribá-Esteve 2006; Zhou 2007), but the focus has been on how long it takes to begin to export to foreign markets. The speed at which this develops and its performance consequences have been less researched.

An SME that slowly increases its international commercial intensity is likely to develop a structure and routines based on home market experiences. Over time, these experiences and routines are institutionalized in the firm. We know from research on absorptive capacities that organizational learning is maximized if new experience is close to the capabilities already possessed by the firm (Cohen and Levinthal 1990). Adaptation to foreign markets is essential during internationalization (e.g., Cavusgil et al. 1993; Dow 2006), and to sell abroad, SMEs usually must adapt their offerings to fit the foreign market’s needs. This means that the more rigid the firm’s routines and capabilities, the more difficult it is to change and modify the export strategy for each market. Consequently, the firm’s ability to absorb new export experiences is determined by its prior experience. Firms slowly increasing their international commercial intensity are therefore expected to be in a position in which capabilities are developed based on home market experience. When they increase their international commercial intensity, they face a situation in which they first need to develop new resources and capabilities and then need to unlearn their old routines (Barkema and Vermeulen 1998).

An SME that rapidly increases its international commercial intensity, on the other hand, is expected to develop its routines based on international experiences. We argue that when the speed of increase in international commercial intensity is high, the advantages of smallness and newness (Autio et al. 2000) are especially obvious. Such an SME does not have to dismantle existing routines and structures, but can focus on building capability for export growth. Consequently, we believe that firms with a high speed of increase in international commercial intensity leads to a situation where the capabilities of the SME are cultivated at a relatively low cost. Based on the TCD argument however, we expect that the relationship is curvilinear. Thus, if the speed of increase in international commercial intensity is dramatically accelerated, TCDs are likely to kick in, reducing the positive performance effect. Consequently, we posit that:

H2: The speed of SME growth in international commercial intensity has a curvilinear effect on SME performance (inverted U-shaped).

5.3 Speed of Increase in Commitment of Resources to Foreign Activities and Performance

By establishing subsidiaries in foreign markets, an SME increases its international involvement and commits resources to operations that do not concern the home market. Foreign investments do not in themselves generate revenue, but constitute a tool with which to access new markets. This also implies that the lead-time from making the investment to realizing its effects is longer and more risky than in the two previous dimensions. Such commitments to international operations, whether tangible or intangible (De-Lemos et al. 2011), entail increased operating costs.

An SME that quickly commits resources to foreign markets promptly gains a platform from which to develop relationships with agents, distributors, and customers in some markets, while starting up production subsidiaries or sales organizations in others. If this investment is made rapidly, then the firm’s costs increase rapidly with no guarantee of increased sales. It takes time for international investments to yield dividends. Establishing a subsidiary in a foreign market is more complex than simply exporting or being present in several markets, as various functions, such as purchasing, sales, distribution, marketing, human resources, legal aspects, and production, usually must not only be carried out, but also integrated and coordinated. This, in turn, is likely to force the SME to develop more rigid and formal routines for the new market, thereby eroding some of the advantages of being small and new.

Studies on MNC internationalization demonstrate that the rapid establishment of subsidiaries in foreign markets can negatively affect firm performance (Jiang et al. 2014; Vermeulen and Barkema 2002). Obviously, the rigid routines and structure of MNCs, as they tend to be large and old, together with substantial TCDs, mean that the speed of resource commitment negatively affects performance. This is explained by the logic of TCDs (Dierickx and Cool 1989), namely, the greater the knowledge to be absorbed over a short period, the greater the cost of doing so. While the traditional approach to time compression diseconomy effects on performance (e.g., Jiang et al. 2014) considers only costs, we maintain that absent revenues also account for the negative effects on performance, i.e., revenues are more uncertain and more difficult to obtain when the learning time is compressed. The complexity and magnitude of the resource commitment compared with other dimensions of speed mean that great capacity is likely required to rapidly absorb the knowledge gained in order to reap the benefits (Cohen and Levinthal 1990). Similarly, the advantage of rapidly developed flexible routines and capabilities designed for internationalization cannot compensate for the increased time compression diseconomies. Thus, we expect that the speed of resource commitment initially have a negative effect on SME performance. If the speed drastically is accelerated, however, we expect diminishing negative effects. There are two main reasons for this. First SMEs are unlikely to make significant investments during short periods of time unless any returns can be foreseen. Second, SMEs that commit resources to foreign activities from inception, will suffer less from relocation costs compared to SMEs that start their commitment to the domestic market. Consequently, we postulate that:

H3: The speed of SME increase in commitment of resources to foreign activities has a curvilinear effect on SME performance (U-shaped).

6 Method

6.1 Sample and Data

Our hypotheses are confronted with data collected at different times from different sources. The data used to calculate a firm’s speed of international expansion were collected in 2007 in an on-site survey of 203 SMEs, and the objective performance data were collected in 2012 from official statistics. Unlike recent publications on the speed of international MNC expansion (e.g., Casillas and Moreno-Menéndez 2014; Chang and Rhee 2011; Jiang et al. 2014), we collected primary data on site—a necessity in order to access such information for SME research. For MNCs, such information is accessible in annual reports or publicly available documents. For SMEs, however, such data can rarely be accessed from secondary sources, so primary data must be collected from the responding firms via interviews or surveys. The subsequent section presents our methodological strategies in more detail.

6.2 The Sample

The sample consists of the most internationally experienced SMEs in southern Sweden, a region well known for its many entrepreneurial and manufacturing SMEs. We used the EU definition of an SME as having fewer than 250 employees as our first sampling condition. We also set a lower limit of annual total exports of at least SEK 10 million to ensure international activity among the sampled firms.

Data for the sampling procedure were ordered from Statistics Sweden. The sample identification followed two distinct steps. First, the secondary data for each firm were evaluated in relation to the criteria. Second, firms were contacted and evaluated over the phone, to exclude firms not representative of the population. After these two steps, the sample consisted of 277 firms. Of these, 203 firms filled in the questionnaire, resulting in a response rate of 73 %. Seventy-four SMEs did not participate in the survey: some were unreachable after four attempts; others declined to complete the questionnaire due to policies of not participating in surveys, lack of interest in this research, or lack of time to participate.

6.3 Data Collection

The first step of data collection, which occurred in 2007–2008, was part of a larger study in which data were collected through an on-site survey. This strategy was rather labor- and cost-intensive, but offered ensured respondent commitment, standardization of the data collection process, and accessible research team support. The 203 SMEs were each visited on site for 1–1.5 h. The strategy guaranteed data reliability by ensuring that the right person was interviewed in each case and that the whole standardized questionnaire was completed. A template was set for the visits, and the interview situation was standardized. The person responsible for, or with the greatest experience of, the firm’s international activities was seen as the most reliable source. To identify this person, intra-firm snowball sampling was conducted. Of the interviewed persons, 55 % were CEOs, 17 % marketing/sales managers, 8 % area sales/marketing managers, and the remaining 20 % a mixture of, for example, business development, key account, and product managers. As our approach entailed potential biases related to single respondents, we followed the recommendations of Podsakoff et al. (2003) and handled the various sections of the questionnaire separately. The main bias relating to single respondents, however, arises when the respondent responds to both the independent and dependent variables of the tested model, which was not the case in our research.

The second step of the data collection procedure occurred in spring 2012. To enable us to test the effects of different internationalization strategies on performance, data on all 203 SMEs visited in 2007 were collected from official Swedish registers. We were able to access performance data on 183 of the original 203 firms. This means that we managed to cover 89 % of the original database, corresponding to a response rate of 65 % of the original sample.

Following up on the 20 SMEs not included in the final dataset revealed that the mean values of our independent measures were not significantly different from the values for the original sample. In addition, no significant differences were identified regarding the number of employees or the turnover of these SMEs. Thus, we found no major factors disturbing our continued analysis. This examination also revealed why no performance data could be collected on these 20 firms in the second step: six of the firms had filed for bankruptcy and were out of business, five had been acquired by other firms, four had merged with other firms, and the fate of the remaining five could not be determined. After assessing the 20 missing firms, we were confident that their absence would not harm the subsequent analysis, as no noteworthy differences from the included firms could be identified. An overview of the industries and response rates of the sample is provided in Table 2.

6.4 Measures

In line with Casillas and Acedo (2013), we view the independent variable, internationalization speed, as comprising three dimensions. As we define internationalization speed as the time it takes to reach a certain degree of each of the three internationalization dimensions, we need to determine both the period and how to measure each dimension. We measure the speed of change in the breadth of the firm’s international markets by dividing the number of markets exported to by time. We measure the speed of a firm’s increasing international commercial intensity by dividing the relationship between exports and total sales by time. We measure the speed of change in the firm’s commitment of foreign resources by dividing the proportion of the firm’s assets held abroad by time. The denominator, time, is measured as the time elapsed from firm inception to the date of data collection.Footnote 2 This is in line with how research on SME internationalization usually measures time (for an overview, see Table 1), i.e., starting from inception. By doing this, we achieve the mean speed of the three dimensions. For instance, an SME that entered 20 foreign markets and has existed for 10 years has a mean speed of change in breadth of international markets of 2, while an SME that has existed for 5 years and has entered 20 foreign markets has a mean speed of 4.

The dependent variable, firm performance, was measured in stage two of this research project. Official information was downloaded for each firm to be used in the regression. To have a valid representation of the performance, we decided to use each firm’s return on total assets (ROTA), which indicates how effectively the SME uses its assets. As it is important to avoid biases related to annual fluctuations, the ROTA measure represents the average ROTA of the SMEs between 2007 and 2011.

Nine control variables are included in our hypothesis tests. First, we control for firm size by including a measure of the number of employees (which is very strongly and significantly correlated with firm turnover). Second, we control for firm age, as previous research (e.g., Autio et al. 2000) has demonstrated that firm age influences SMEs’ international behavior. Third, we include a dummy variable to control for potential industry effects. Though the sample comprises relatively homogeneous manufacturing SMEs, we nevertheless divide this group into two classes: firms listed as mainly manufacturing firms and those listed as having multiple activities (e.g., manufacturing, trade, and wholesale). Fourth, international business research (e.g., Rugman and Verbeke 2004) has demonstrated that firms often regionalize rather than globalize. Consequently, we sought to control for such effects by developing a proxy variable. For this purpose, we developed a dummy variable in which we divided the sample into two groups: the first group comprises firms with sales in 15 or fewer markets, and the second comprises firms with wider international exposure. Our logic is that regionalizing SMEs in Sweden are internationalizing to the old EU-15 countries, as indicated by SOU:90 (2008). Fifth, inspired by Lu and Beamish (2006), we control for firm growth. It is reasonable to expect that, in their early stages of evolution, SMEs might emphasize growth over profitability. This might understate their actual performance, distorting the relationship between internationalization speed and actual performance. We therefore included in the analysis a control for the growth in turnover of the sampled firms. Sixth and seventh, building on Holzmüller and Kasper (1990) as well as Nummela et al. (2004), we control for the international orientation and international priorities of the firm. Two constructs with alpha values above 0.8 are created. First the indicators: “within our firm we (a) continuously search for international opportunities, (b) we actively search for foreign customers” represent the international orientation of the firm. Second, the indicators “within our firm we (a) consider the European market rather than the Swedish as our home market, (b) we perceive ourselves as a global firm, (c) we prioritize the Swedish market before international markets” represent the international priorities of the firm. This is in line with previous research stating that management and firm mindset affects performance. Eight, we control for firm ownership, as previous research (e.g., Fernández and Nieto 2006; George et al. 2005) has demonstrated that this might influence firm performance. For this control, we create a dummy variable with family-owned SMEs versus other types of ownership. Ninth, previous research (e.g. Autio et al. 2000; Zhou and Wu 2014) on internationalization speed has found that the speed to begin internationalization positively affects performance. Thus, we can expect that the shorter the time between firm inception and first exports, the stronger the firm performance.

6.5 Data Analysis

6.5.1 Descriptive Statistics

Table 3 presents the descriptive statistics and the correlation matrix for all variables except the dummy variables used as controls. As seen in Table 3, the sampled firms display heterogeneous performance extending from −33.25 % to 46.5 % over the studied period. The average performance was 10.34 %. An interesting heterogeneity can also be seen in the three dimensions of internationalization speed. This heterogeneity circles the mean values, which indicates that, since inception, the average firm entered one new market per year, increased its international intensity 2 % per year, and reallocated its resources to international activities at a rate of 0.2 % per year.

6.5.2 Hypothesis Tests

The next step of our analysis was to test whether the variation in the dimensions of internationalization speed can explain the variation in performance among the sampled firms. To test the hypotheses, a multiple regression was performed in SPSS. The result of the analysis is presented in Table 4, Model 1 includes the control variables and Models 2–4 add the independent variables representing the dimensions of a firm’s internationalization speed. Model 5 presents the linearity tests.

In Model 2, we test the effect of speed of increase in international breadth. Thus, we include all the control variables and, in addition, the variable for speed of increasing international breadth. Model 2 reveals that the speed of increasing the breadth of international operations positively and significantly (**) affects firm performance. The change in the R 2 value is also positive and significant.

In Model 3, we add the speed of increasing international intensity. This variable did not return with significant results, indicating that there is no support for the claim that rapidly increasing international intensity affects firm performance.

In Model 4, we include all three independent variables, so we entered the measure of a firm’s speed of increasing commitment to international activities into the regression. This test indicates that the speed of increasing international commitment significantly (**) and negatively affects firm performance. The change in the R 2 value is also positive and significant.

Model 5 is our test of linearity. For this model, the independent variables were squared and tested on firm performance; the result of this analysis revealed that the speed of increase in breadth of international markets (*) and the speed of commitment of resources (*) have curvilinear relationships with firm performance. Thus, Model 5 gives support for hypotheses H1 and H3. The relationship between the speed of increase in international breadth and performance is shown to be curvilinear, as an inverted U-shaped relationship is revealed. Thus, we find support for H1. As for the relationship between the speed of increasing international intensity and performance, significance is not attained. Thus, we find no support for H2. The third squared variable, however, the speed of increasing commitment to international activities, returned a result significant confirming that the relationship with performance is U-shaped. Thus, H3 is supported.

When testing the curvilinearity by including a linear term and its squared expression, there is a risk of multicollinearity, particularly if there is noteworthy correlation between the independent variables. In the analysis of linear relationships, all VIF values were below 2.540. In the curvilinearity test, they increased to values just below 10. Based on these values, we further controlled for its effects on the results. We therefore ran a regression with mean-centered variables to reduce potential multicollinearity. In this analysis, all values were below 5; however, this analysis still returned with support for H1 and H3. No support was found for H2. Thus, we are confident that multicollinearity is not a major factor disturbing the results.

7 Discussion

7.1 Speed of SME Internationalization: A Multidimensional Concept

By viewing speed as a multidimensional concept and by defining and empirically measuring speed, the study has addressed two gaps identified at the outset. We have empirically validated the measures suggested by Casillas and Acedo (2013). These measures capture the speed at which a firm extends its international activities after the start of internationalization in terms of the three dimensions: speed of increasing international breadth, speed of increasing export intensity, and speed of increasing commitment of resources to foreign operations. These findings have two implications.

Firstly, they mean that SMEs are following different strategies, with some seeking to reach international markets quickly, as predicted by INV theorists, and others engaging in a gradual expansion predicted by traditional models. The descriptive statistics on the sample indicate that firms are increasing their international operations to an increasing number of country markets at different speeds. On one hand, we find the fast “internationalizers” that have entered up to nine countries per year since inception; on the other, we find the slow “internationalizers” that have entered only one country every 20 years since inception. In addition, we see heterogeneous strategies of speed of increase of export intensity. On average, the firms increase their export intensity by 2 % per year, whereas the individual values range from below 1 % for the slowest firms to 25 % per annum for firms that very quickly increase their export intensity. Finally, we find an interesting heterogeneity in how fast the SMEs increase the commitment of foreign resources and, furthermore, we find a pattern confirming the claim that SMEs make only moderate investments abroad. The fastest “internationalizer” is increasing its foreign resources at an average rate of 7 % per year, whereas the slowest firms have not yet made any foreign investments.

Secondly, the findings demonstrate that speed of internationalization cannot be treated as a unidimensional concept, and that the natures of the three dimensions differ. It can be assumed that the speed of increase in commercial intensity increases the revenues whereas the speed of increase in breadth of international operations and the speed of increase in commitment of resources to foreign activities adds to the costs in terms of investment in assets like machines, equipment, and employees. There are no guarantees that they give returns, and if they come, there is likely to be a lead-time from when the investments are made to the moment of revenues. Moreover, the capability needed for each of them varies. While commercial intensity is likely to require the capability to see market opportunities and then transform them to growing business relationships, that is, to go from taking the firm from outsidership to inside position in the network, international breadth having the capability to reduce the liability of foreignness by managing cultural and institutional distance. This is another kind of complexity than selling products to the customers. Committing resources abroad does, in turn, soon mean dealing with production, employees, sourcing, etc.

7.2 Speed of Internationalization as an Antecedent of SME Performance

By advancing speed as an independent variable, this study addressed the third research gap identified at the outset. To test the relationship between speed and performance, we theoretically derived three hypotheses. The tests demonstrated that the different speed dimensions have heterogeneous performance consequences. The theoretical discussion based on the analysis indicates that the arguments seem to have different explanatory values for the three hypotheses, indicating that, besides the need for new empirical studies of different types of speed, there is a need to develop a dynamic theory of internationalization.

The first hypothesis (H1), which predicted an inverted U-shaped relationship between the speed of increasing breadth and performance, was supported. The analysis supports the arguments that SMEs that rapidly extend their international activities to additional countries gain experience of different cultural and institutional environments; experience that can be absorbed and transformed into capabilities, which can be used in other foreign markets. This argument seems important mainly for two reasons. First, we believe that general internationalization knowledge is relatively extensive compared with other types of knowledge. The SME can transfer this knowledge from market to market, and the closer in time between two new market entries, the more likely it is that the SME still has the appropriate knowledge and the capability to use it. Mistakes can thereby be avoided and the strategy can be repeated; thus, internationalization routines are developed. Second, an alternative interpretation is that this partly gives evidence to the market homogenization put forward by Oviatt and McDougall (1994). The experience gained can be accumulated, transformed into capabilities, and shared within the firm; thus, the higher the speed, the less time to gain a specific body of experience, but too high speed may negatively influence performance. Consequently, the LAN argument seems to be valid for this relationship, but only up to a certain speed. After this, our data indicate that, when the speed of increase in breadth of international markets drastically is accelerated, then the performance outcome is reduced. Thus, TCDs are central in the internationalization speed–performance relationship. Consequently, when the capability development process is subject to time compression, then inefficiencies occur, as managers and organizations are constrained in their ability to intuit, interpret, integrate, and institutionalize experiences (Jiang et al. 2014). As a consequence, the capability development process becomes more costly and inefficient.

The second hypothesis (H2), predicted an inverted U-shaped relationship between speed of increasing international intensity and performance, was not supported. We explain this with the different nature of the dimensions. Potentially, this means that important financial advantages may result more from the speed at which operations spread between markets than from the speed at which the importance of the home market declines as a proportion of sales. Based on our theoretical reasoning, learning from and with customers is more complex and therefore more time-consuming than is learning generally about foreign markets. This may be strengthened by the idea that we have over the last 20 years been observing a homogenization of markets, which means that SMEs can use the same capabilities and routines for several markets, but that customers and the sales processes are more heterogeneous.

The third hypothesis (H3), which predicted a U-shaped relationship between the speed of increasing commitment of foreign resources and performance, was supported. The analysis demonstrates that the speed at which such investments are made negatively affects performance, a high speed tending to lead to a too-rapid increase in the complexity and magnitude of international operations, which require a lot of capabilities. The firm is exposed to the new conditions for a short period of time, resulting in a large body of experience, but this advantage might be lost, as the time is too brief to transform the experience gained into useful experiential knowledge, which is consistent with the results of similar studies of speed and performance involving MNCs (Vermeulen and Barkema 2002; Wagner 2004). Commitment of resources implies setting up organizations and engaging in activities other than sales, which requires, for instance, capabilities to scale up production and distribution, which is difficult to do rapidly. Consequently, the learning advantages of newness are eroded when the SME increases its commitment of resources to foreign activities at a high speed. Instead, the SME has to develop capabilities and routines, which is a process likely to take time. The complexity and magnitude of the heterogeneous capabilities and resources needed to make commitment to foreign markets strengthen the TCD effect. This relationship is curvilinear. This finding indicates that the negative effect on performance of a rapid increase in resource commitment is mitigated if the speed is significantly higher, i.e., it seems as though a very rapid increase in resource commitment to international operations positively affects performance. Our interpretation of this is that SMEs that start international operations at inception make more efficient use of their resources than firms starting domestically and relocating their investments later in their development.

8 Conclusions and Implications

This article has addressed three shortcomings in the literature. In distinction from extant research, we study speed of the internationalization process—not only the time it takes to start the process, but also that speed of internationalization is a multidimensional concept and that speed comes with performance consequences for the firm. The multidimensionality of the speed of this process has consequences for capability development. Speed of increase in breadth of international markets and the speed of increase in international commitment come with different consequences for performance. Speed of increase in breadth of international markets has an inverted U-shaped relationship with performance, whereas speed of increase in international commitment has a U-shaped relationship with performance. As a consequence, our study comes with two suggestions.

First, it underlines that the complexity of the activities internationalized need to be considered in future research on speed of internationalization. Our findings underscore that it might be misleading to draw conclusions on the unidimensional speed discussion in the extant literature as it mainly comprises speed of increase in exports. This means that the dimensions of speed must not only be treated differently, but that one cannot speak of a single concept of internationalization speed. It also means that the three dimensions of speed may be interrelated and may affect each other. As this study clearly demonstrates, internationalization speed is a more multifaceted and sophisticated concept than has been acknowledged to date.

In the speed concept, time is the denominator and internationalization is the numerator. We developed three “numerators” of speed, underlining the multidimensionality of the concept. These numerators capture the core of traditional internationalization, but since speed is apparently a heterogeneous concept, the literature offers other internationalization dimensions that may also be important for SMEs and relevant to internationalization theory. Sourcing and number of employees abroad are two such dimensions, but even more interesting would be to develop dimensions capturing the core of the internationalization of new types of service firms and knowledge-intensive firms, such as hotels and restaurants, as well as media firms or firms in the computer game industry. The time unit used is years, and we analyze the mean speed; however, in the same way as internationalization is a multidimensional activity, one could also assume that speed does not remain constant over the years in the three dimensions. Different phases of the process and different markets and countries may imply changing speeds. This matter, about which we currently know little, is of great academic interest and is an issue of strategic importance for practitioners as well.

Second, our study indicates that time compression diseconomies can help to explain the internationalization of SMEs. Along with research by Jiang et al. (2014) on MNCs, the paper demonstrates that there is a risk for SMEs to be misled by arguments for high speed of international expansion. Our findings point to the fact that the relationship is curvilinear and that too high a speed of increase in breadth of internationalization negatively influences firm performance. Our explanation of this is that inefficiencies occur in the capability development process when it is subject to time compression.

For managers, the speed at which activities are spread internationally needs to be carefully balanced. In contrast to what can be assumed from findings on INVs, high speed does not necessarily catalyze the performance of the firm, as the relationship between speed of internationalization and performance is curvilinear, which indicates that firms might internationalize at too high a speed. If that is the case, then TCDs kick in, leading to diminishing rates of return on efforts for international expansion. Managers therefore need to balance the speed at which the activities are spread internationally. Our data on Swedish manufacturing SMEs indicate that optimal performance is reached at a speed where the firm enters one new market per year after inception of the firm.

9 Limitations of the Study

The present findings have some limitations for which future research could compensate. First, as is the case with many other studies of firm internationalization, the dataset consists mainly of successful, or at least surviving, SMEs. Therefore, the analysis excludes firms that completely failed or became bankrupt during the period analyzed. One benefit of the two measurement points, however, is that they let us identify firms that went bankrupt between 2007 and 2011. Six of the original 203 firms were identified as having gone bankrupt; among these, speed was low (all were below the sample average), which at least does not contradict the findings. This first limitation calls for future research on the relationship between the speed of internationalization and the failure rate among firms. An important first step would probably be to analyze this question in depth using qualitative case studies.

A second and related limitation of this paper relates to potential endogeneity (e.g., Bascle 2008) among the concepts under examination. It is reasonable to expect the speed of internationalization to be somewhat influenced by the firm’s past performance. In this paper, we sought to control for such problems by including a control variable for firm growth. Future studies, however, could further compensate for potential endogeneity bias by including more measurement points of the variables. An alternative idea would be to conduct further in-depth qualitative research on internationalization speed. Such approaches would also be highly relevant in addressing an interesting avenue for future research on changes in the speed of firm internationalization: After this research, it would be interesting to examine the determinants and consequences of the acceleration or deceleration of both multidimensional measures of internationalization as well as potentially aggregated measures.

Notes

We reviewed the literature using Web of Science and searched for empirical articles from 1994 to 2014. We used the following keywords to capture internationalization speed: rapid, accelerated, pace, and speed; these were combined with keywords such as foreign market entry, international expansion, and internationalization. As the focus is on SME internationalization, articles on firms other than SMEs were excluded.

For five of the cases we could not access reliable data on the foundation year. When testing the hypotheses we performed analyses both with the ‘replace with mean’ alternative and the ‘delete listwise’ alternative. In the manuscript we report on former results. The reason is that the ‘delete listwise’ alternative returned with significance levels at 5.2 and 5.3 % for the curvilinearity tests.

References

Acedo, F. J., & Jones, M. V. (2007). Speed of internationalization and entrepreneurial cognition: insights and a comparison between international new ventures, exporters and domestic firms. Journal of World Business, 42(3), 236–252.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 902–906.

Barkema, H. G., & Vermeulen, F. (1998). International expansion through start up or acquisition: a learning perspective. Academy of Management Journal, 41(1), 7–26.

Bascle, G. (2008). Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization, 6(3), 285–327.

Bell, J. (1995). The internationalization of small computer software firms: a further challenge to “stage” theories. European Journal of Marketing, 29(8), 60–75.

Bilkey, W. J., & Tesar, G. (1977). The export behavior of smaller Wisconsin manufacturing firms. Journal of International Business Studies, 8(1), 93–98.

Bloodgood, J. M., Sapienza, H. J., & Almeida, J. G. (1996). The internationalization of new high-potential U.S. ventures: antecedents and outcomes. Entrepreneurship Theory and Practice, 20(4), 61–76.

Casillas, J. C., & Acedo, F. J. (2013). Speed in the internationalization process of the firm. International Journal of Management Reviews, 15(1), 15–29.

Casillas, J. C., & Moreno-Menéndez, A. M. (2014). Speed of the internationalization process: the role of diversity and depth in experiential learning. Journal of International Business Studies, 45(1), 85–101.

Cavusgil, S. T. (1980). On the internationalization process of firms. European Research, 8(6), 273–281.

Cavusgil, S. T. (1994). A quiet revolution in Australian exporters. Marketing News, 28(11), 18–21.

Cavusgil, S. T., Zou, S., & Naidu, G. M. (1993). Product and promotion adaptation in export ventures. Journal of International Business Studies, 24(3), 479–506.

Chang, S.-J., & Rhee, J. H. (2011). Rapid FDI expansion and firm performance. Journal of International Business Studies, 42(8), 979–994.

Chetty, S., & Campbell-Hunt, C. (2004). A strategic approach to internationalization: a traditional versus a “born-global” approach. Journal of International Marketing, 12(1), 57–81.

Chetty, S., Johanson, M., & Martin Martin, O. (2014). Speed of internationalization: conceptualization, measurement and validation. Journal of World Business, 49(4), 633–650.

Coeurderoy, R., & Murray, G. (2008). Regulatory environments and the location decision: evidence from the early foreign market entries of new-technology-based firms. Journal of International Business Studies, 39(4), 670–687.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

De-Lemos, F., Johanson, J., & Vahlne, J.-E. (2011). Risk management in the internationalization process of the firm: a note on the Uppsala model. Journal of World Business, 46(2), 143–153.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511.

Dow, D. (2006). Adaptation and performance in foreign markets: evidence of systematic under-adaptation. Journal of International Business Studies, 37(2), 212–226.

Eriksson, K., Johanson, J., Majkgård, A., & Sharma, D. D. (1997). Experiential knowledge and cost in the internationalization process. Journal of International Business Studies, 28(2), 337–360.

Fernández, Z., & Nieto, M. J. (2006). Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37(3), 340–351.

Freeman, S., Edwards, R., & Schroder, B. (2006). How smaller born-global firms use networks and alliances to overcome constraints to rapid internationalization. Journal of International Marketing, 14(3), 33–63.

George, G., Wiklund, J., & Zahra, S. A. (2005). Ownership and the internationalization of small firms. Journal of Management, 31(2), 210–233.

Helfat, C. E., & Peteraf, M. A. (2003). The dynamic resource-based view: capability lifecycles. Strategic Management Journal, 24, 997–1010.

Hilmersson, M. (2014). Small and medium-sized enterprise internationalization strategy performance in times of market turbulence. International Small Business Journal, 32(4), 386–400.

Holzmüller, H. H., & Kasper, H. (1990). The decision-maker and export activity: a cross-national comparison of the foreign market orientation of Austrian managers. Management International Review, 30(3), 217–230.

Jiang, R. J., Beamish, P. W., & Makino, S. (2014). Time compression diseconomies in foreign expansion. Journal of World Business, 49(1), 114–121.

Johanson, J., & Vahlne, J.-E. (1977). The internationalization process of the firm. Journal of International Business Studies, 8(Spring/Summer), 23–32.

Johanson, J., & Wiedersheim-Paul, F. (1975). The internationalization of the firm: four Swedish cases. Journal of Management Studies, 12(3), 305–322.

Jörgensen, E. (2014). Internationalisation patterns of border firms: speed and embeddedness perspectives. International Marketing Review, 31(4), 438–458.

Khavul, S., Pérez-Nordtvedt, L., & Wood, E. (2010). Organizational entrainment and the internationalization of new ventures from emerging markets. Journal of Business Venturing, 25(1), 104–119.

Knight, G. A. (1997). Emerging paradigm for international marketing: The born global firm. Doctoral dissertation, Michigan State University.

Knight, G. A., & Cavusgil, S. T. (1996). The born global firm: A challenge to traditional internationalization theory. In S. T. Cavusgil & T. K. Madsen (Eds.), Advances in international marketing (8) (pp. 11–26). London: JAI Press.

Knott, A. M., Bryce, D. J., & Posen, H. (2003). On the strategic accumulation of intangible assets. Organization Science, 14(2), 192–207.

Lin, W.-T. (2012). Family ownership and internationalization processes: internationalization pace, internationalization scope, and internationalization rhythm. European Management Journal, 30(1), 47–56.

Lu, J. W., & Beamish, P. W. (2006). SME internationalization and performance: growth vs. profitability. Journal of International Entrepreneurship, 4(1), 27–48.

Luo, Y., Zhao, J. H., & Du, J. (2005). The internationalization speed of e-commerce companies: an empirical analysis. International Marketing Review, 22(6), 693–709.

Madsen, T. K., & Servais, P. (1997). The internationalization of born globals: an evolutionary process? International Business Review, 6(6), 561–583.

McDougall, P. P., Oviatt, B. M., & Shrader, R. C. (2003). A comparison of international and domestic new ventures. Journal of International Entrepreneurship, 1(1), 59–82.

Morgan-Thomas, A., & Jones, M. V. (2009). Post-entry dynamics: differences between SMEs in the development speed of their international sales. International Small Business Journal, 27(1), 71–97.

Musteen, M., Francis, J., & Datta, D. K. (2010). The influence of international networks on internationalization speed and performance: a study of Czech SMEs. Journal of World Business, 45(3), 197–205.

Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Cambridge, MA: Harvard University Press.

Nummela, N., Saarenketo, S., & Puumalainen, K. (2004). A global mindset—a prerequisite for successful internationalization. Canadian Journal of Administrative Sciences., 21(1), 51–64.

Oviatt, B. M., & McDougall, P. P. (1994). Toward a theory of international new ventures. Journal of International Business Studies, 25(1), 45–64.

Oviatt, B. M., & McDougall, P. P. (2005). Defining international entrepreneurship and modeling the speed of internationalization. Entrepreneurship Theory and Practice, 29, 537–553.

Penrose, E. (1959). The theory of the growth of the firm. New York: John Wiley and Sons.

Pla-Barber, J., & Escribá-Esteve, A. (2006). Accelerated internationalisation: evidence from a late investor country. International Marketing Review, 23(3), 255–278.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Prashantham, S., & Young, S. (2011). Post-entry speed of international new ventures. Entrepreneurship Theory and Practice, 35(2), 275–292.

Ramos E., Acedo F., & Gonzalez R. (2011). Internationalization speed and technological patterns: a panel data study on Spanish SMEs. Technovation, 31(10–11), 560–572.

Rugman, A. M., & Verbeke, A. (2004). A perspective on regional and global strategies of multinational enterprises. Journal of International Business Studies, 35, 3–18.

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. (2006). A capabilities perspective on the effects of early internationalization on firm survival and growth. Academy of Management Review, 31(4), 914–933.

SOU (2008). Svensk export och internationalisering: Utveckling, utmaningar, företagsklimat och främjande. SOU:90.

Trudgen, R., & Freeman, S. (2014). Measuring the performance of born-global firms throughout their development process: the roles of initial market selection and internationalization speed. Management International Review, 54(4), 551–579.

Vermeulen, F., & Barkema, H. (2002). Pace, rhythm, and scope: process dependence in building a profitable multinational corporation. Strategic Management Journal, 23(7), 637–653.

Wagner, H. (2004). Internationalization speed and cost efficiency: evidence from Germany. International Business Review, 13(4), 447–463.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180.

Zhou, L. (2007). The effects of entrepreneurial proclivity and foreign market knowledge on early internationalization. Journal of World Business, 42(3), 281–293.

Zhou, L., & Wu, A. (2014). Earliness of internationalization and performance outcomes: exploring the moderating effects of venture age and international commitment. Journal of World Business, 49, 132–142.

Zucchella, A., Palamara, G., & Denicolai, S. (2007). The drivers of the early internationalization of the firm. Journal of World Business, 42(3), 268–280.

Acknowledgments

The authors would like to express their gratitude to Jan Wallanders and Tom Hedelius research funds for their financial support for the data collection. The authors also would like to thank Susanne Sandberg for her support in the data collection process. The anonymous reviewers in Management International Review have significantly improved the paper thanks to their insightful and constructive comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hilmersson, M., Johanson, M. Speed of SME Internationalization and Performance. Manag Int Rev 56, 67–94 (2016). https://doi.org/10.1007/s11575-015-0257-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-015-0257-4