Abstract

While host-country relationships are known to help new ventures internationalize, we know little about how a firm’s home-country relationships affect its subsequent internationalization. We develop new theoretical arguments by combining social capital theory with reference group theory, to suggest that internationalization is in general adversely affected by home-country relationships, but facilitated by a specific networking strategy viz. of joining an aspirational local industry group in the home market. Based on a mixed-method study, with quantitative analysis of 102 Indian software firms and a longitudinal study of four firms, we find support for our arguments. Our process-based qualitative findings provide useful insights into the way new venture founders actually make sense of their relationship-building activities in the pursuit of international growth. A particularly novel facet here is the aspiration-building part of the process that is suggested by reference group theory, which has not been previously analyzed in the international business context.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is considerable research interest in understanding the international growth of young entrepreneurial firms and so-called “born global” firms that do not conform to the traditional models of internationalization (Hashai 2011; Knight and Cavusgil 2004; Lamb et al. 2011; Lu and Beamish 2001; Oviatt and McDougall 2005). Many perspectives have been used to understand the international growth of new ventures, but an increasingly influential approach (and the one we build on here) is to focus on the relational capital that firms build with other firms as a way of creating the opportunities and capabilities to allow them to grow beyond their home market. Research has shown how relationships with organisations outside the home market provide the initial information and contacts that make international growth possible (Agndal et al. 2008; Coviello 2006; Ellis 2000; Yli-Renko et al. 2002), and also how such relationships enable the capability development and adaptation needed for enduring success (Jones and Coviello 2005; Oviatt and McDougall 2005; Yu et al. 2011).

However, while we know that host-country relationships are important, we know remarkably little about the nature and type of relationships in the home market that either help or hinder firms in moving overseas (Fernhaber et al. 2008). Some studies have suggested that strong home-country relationships have a positive impact on a firm’s international growth and competitiveness (Boethe 2013), some have found that certain home-country relationships may suppress international growth (Milanov and Fernhaber 2014), while others have found no significant effect (Yu et al. 2011). In this study we develop new theoretical arguments to shed light on why these various studies have ended up with different findings. Understanding the differential effects of home-country relationships on the internationalization of young firms is important to increasing the precision in understanding of the role of networks which, notwithstanding the felicitous ring to terms such as “social capital”, may not always be positive.

We ask: Under what circumstances are certain home-country relationships more likely to contribute to higher levels of internationalization? Footnote 1 The empirical context for our study is the Indian information technology (IT) sector, which is appropriate because it has a large number of recently-formed firms that actively pursue international expansion but exhibit significant variation in their capacity to internationalize (Contractor et al. 2005; Kim et al. 2011; Terjesen et al. 2008), and because it is frequently argued that relationships are vital in emerging Asian economy settings (Ellis 2000; Zhou et al. 2007). Our dependent variable is international intensity (foreign/total sales), which is commonly used in studies of this type (e.g., Autio et al. 2000; Lu and Beamish 2001; Preece et al. 1999; Qian and Li 2003), and is especially important in an emerging economy context where the domestic market may be underdeveloped and less lucrative than international markets (Filatotchev et al. 2009; Lopez et al. 2009).

Furthermore, Gaur and Kumar (2009, p. 174) observe that typically emerging economy firms do not internationalize from a position of strength. Such firms are likely to be especially reliant on network relationships; indeed, Elango and Pattnaik (2007, p. 542) have argued that one of the “critical institutional contexts of emerging markets…[is] the influence of external network members on firm internationalization”. This is illustrated by research on business groups, which serve the role of strategic networks to member-firms (Chari and David 2012; Chittoor et al. 2009). Affiliation to internationally diversified business groups can be a valuable relational resource to offset the accentuated liability of foreignness that emerging economy firms face (Lamin 2014). For Indian new ventures outside of business groups, the criticality of network relationships and the challenge of building appropriate ties are arguably greater, given their resource-poverty. Prashantham (2008, p. 12) observes that “there are greater challenges to overcome… [and therefore] reliance on network relationships is likely to be particularly high”.

Based on a study of 102 Indian software firms our central argument is that the international intensity of young firms will be lower when they have developed strong home-country ties with small- and medium-sized enterprises (SME) and multinational subsidiaries, whereas it will be higher when they have joined a local industry “networking” group. We arrive at these predictions by combining insights from social capital theory (Nahapiet and Ghoshal 1998) and reference group theory (Greve 1998; Massini et al. 2005; Merton 1968) to argue that a firm’s relationships play a number of different roles in facilitating or impeding international growth. It is widely recognized that relationships provide the structural and relational dimensions of social capital that facilitate action and capability development (Nahapiet and Ghoshal 1998). In addition, we argue that they also provide a set of normative cues that shape the aspiration levels of firms, which in turn influences how they behave (Greve 1998). By considering these theoretical arguments in combination, we suggest that the impact of home-country ties on international growth will vary depending on their nature.

Our study contributes to theory by providing an integrative perspective on the ways different types of relationships affect young firm internationalization, and by highlighting the important role of reference-group behaviour in early-stage internationalization. Showing the specific positive benefits of aspirational industry groups and the general negative effects of other home-country relationships helps clarify why other studies have had mixed results (Boethe 2013; Yu et al. 2011). In particular, by showing that in an emerging economy context, where internationalization capabilities are still immature, home-country relationships in general impede internationalization we provide credence to Milanov and Fernhaber’s (2014) suggestion that home-country relationships with internationally inexperienced partners can be detrimental. We go further by adding the novel dimension that relationships with multinational enterprise (MNE) affiliates may also not be conducive to supporting internationalization in a lucrative emerging economy because, even if valuable learning accrues (Prashantham and Dhanaraj 2015), the locus of joint activity will likely be firmly embedded in the focal firm’s home-country. Taken together, we thus provide an important practical insight, namely that firms should “choose their friends carefully” in the home-country, as some relationships will facilitate international growth, while others will suppress it.

2 Theoretical Background

An important perspective for understanding international growth is social capital theory. In its general form, social capital theory explains how firms generate value from the network of relationships in which they are embedded (Nahapiet and Ghoshal 1998). In an international business context, it is used to understand how firms utilise their international relationships to enable overseas expansion (Coviello 2006; Jones et al. 2011; Prashantham and Dhanaraj 2010; Yli-Renko et al. 2002; Zain and Ng 2006). Two mechanisms have been identified. First, relationships provide the tangible links to customers and others with whom the firm might do business, as well as the intangible dimensions of trust and goodwill between actors that increase the motivation to share resources (Elango and Pattnaik 2007; Hitt et al. 2006). Second, a network of relationships facilitates capability building and learning. Repeated interaction facilitates knowledge creation and transfer by lowering the barriers to combining and exchanging intellectual resources (Nahapiet and Ghoshal 1998). The learning that ensues creates value for both parties, and helps the focal actor to become more of an “insider” in the market it is entering (Johanson and Vahlne 2009).

This body of research has given little attention to the role of home-country relationships and the part they might play in enhancing or suppressing international growth. And yet such relationships are likely to be important. At a general level, Porter (1990) and others (e.g., Sakakibara and Porter 2001) have discussed how a strong local “cluster” of competing and complementary actors sharpens a firm’s competitiveness. In the narrower context of research on international growth, Fernhaber et al. (2008) show how an internationalizing venture’s local milieu affects its ease of access to—as well as the intensity of competition for—resources that facilitate internationalization. Although it is recognized that the local milieu yields valuable networks (Chetty and Agndal 2008; Zahra 2005; Zhou et al. 2007), research on the effect of home-country relationships on young firm internationalization is scarce although interest in this topic is growing. Milanov and Fernhaber (2014) find in a United States (US) context that domestic alliances can help the focal firm to internationalize if the partner is internationally experienced but, although not formally hypothesized, that internationally inexperienced partners impede the focal actor’s internationalization. In a study of Brazilian furniture manufacturers, Boethe (2013) suggests that industry group membership—albeit in a standard industry association as opposed to one that triggers aspirations to internationalize—can induce a propensity to export but not actually lead to internationalization. Domestic collaborations are found to do so, but no distinction is made in the study between different types of partners. Thus even these two recent studies, while very welcome additions to the literature, underline the fact that what little research there has been on home-country relationships indicates mixed findings.

To make sense of the role of home-country relationships in influencing international growth, we augment social capital theory by drawing on insights from reference group theory. This body of theory has roots in social psychology (Hyman 1942; Merton 1968) and argues that individuals often look up to significant others (i.e., a reference group) for normative guidance. The reference group provides information, directly and indirectly, that guides individual sense-making and behaviour. Reference group theory has also been used at an organizational level of analysis, for example to predict that firms will make changes when performance falls short of an aspiration level determined by comparison with a reference group (Greve 1998; Massini et al. 2005; Mol and Birkinshaw 2009). Reference groups, such as intra-industry peers, can serve as a reference point to guide a firm’s strategic alignment between the external environment and internal capabilities (Fiegenbaum et al. 1996; Fiegenbaum and Thomas 1995). In the context of the current study, then, the theory suggests that a firm’s network of relationships has the potential to act as a “reference group” that shapes the way its managers make sense of the firm’s opportunities, and thereby shapes their future actions.

We believe reference group theory provides a useful complement to social capital theory in helping us to understand the different ways in which a young firm’s network of ties facilitates or suppresses its international growth. Social capital theory highlights the importance of relationship building (how a firm’s ties help it to build commercial relationships) and capability building (how a firm’s ties help it to learn and develop over time). Reference group theory suggests a third and complementary mechanism, aspiration building, which is how a firm’s ties provide the normative cues that inspire those in the firm to work harder and to make changes in direction.

Unfortunately, these three mechanisms are not easily disentangled in practice. This is why we elected to do a two-part study. In the first part we developed and tested formal hypotheses by considering the collective effect of these three mechanisms on ties with partners in the host and home countries. In the second part, we conducted a process study that focused specifically on the aspiration building mechanism suggested by reference group theory.

3 Hypotheses

Prior research using a social capital perspective has shown that relationships with customers, suppliers and partners in the host-country has a positive effect on its international intensity by providing new relationship-building opportunities (Agndal et al. 2008; Coviello 2006; Yli-Renko et al. 2002; Oviatt and McDougall 2005; Zhou et al. 2007) and facilitating the development of internationalization capability i.e. skills to overcome the barriers to working internationally (Eriksson et al. 1997; Johanson and Vahlne 2009).

In addition to the above, reference group theory suggests that host-country ties potentially act as a source of inspiration to the firm—they provide a sense of what is possible, and they encourage it to seek out opportunities for international growth. In our empirical analysis we control for this established relationship, and we develop hypotheses about the relationship between home country ties and international intensity.

3.1 Home-Country Ties

Home-country ties include relationships with customers, suppliers and partners that are physically located in the focal firm’s home market—they may include ties with indigenous firms and with the local affiliates of MNEs. Taken as a group, we expect these home-country ties to have a net negative influence on the international growth of the focal firm, for the following reasons.

Considering social capital theory first, home-country ties are—by definition—bounded by the domestic market and so they are unlikely to help a firm with relationship building beyond that market. Moreover, when the primary locus of activity in relationship-building is in the domestic market, this displaces time and effort invested in internationalization activities for young, resource-constrained firms (Sapienza et al. 2005). Indeed, to the extent that the firm has limited relationship-building capacity, a stronger set of home-country ties could potentially drive out the host-country ties that are helpful for international growth. This is particularly true of partners with limited experience of international markets (Milanov and Fernhaber 2014) and immature internationalization routines (Prashantham and Floyd 2012), which are often characteristic of young firms in emerging economies (Filatotchev et al. 2009).

Does this same logic apply to MNE affiliates based in the home-country (e.g., Microsoft India)? While such ties could potentially lead to host-country relationships (e.g., with the corporate parent), anecdotal evidence from our empirical setting suggests this occurs very rarely (Prashantham and Birkinshaw 2008), largely because MNE affiliates in India tend to be overwhelmingly focused on domestic opportunities. We therefore expect the primary default locus of activity between an MNE affiliate and a young Indian software firm to be the Indian market, leading to further home-country rather than host-country ties.Footnote 2

In terms of capability-building, it is generally accepted that strong home-country relationships have the potential to enhance competitiveness and productivity (Porter 1990) but only when there is a dynamic “cluster” of leading-edge firms operating in close physical proximity. The more likely scenario, especially in less developed institutional settings such as India, is that the home-country peers with which the firm interacts are not a credible source of learning about internationalization (Filatotchev et al. 2009). This will likely deprive the focal firm from the sustained exposure to internationalization that leads to “transparency of cause–effect relationships between organizing processes and outcomes” (Autio et al. 2011, p. 24). Again, the expectations are slightly different with regard to ties with MNE affiliates, as they will typically have stronger capabilities than indigenous firms. However, learning from such entities is unlikely to find immediate application in joint activities that are oriented away from the domestic market,Footnote 3 and the number of such ties is likely to be outweighed by ties to domestic peers. (Note that in our empirical analysis we separate out our questions towards indigenous domestic firms and MNE affiliates, so these assertions can be tested). In aggregate, then, we expect home-country ties to have a very limited, and perhaps even negative, influence on the international growth of the young firm.

In terms of the expectations from reference group theory, strong ties with domestically-oriented peers are likely to have a significant negative effect on the internationalization aspirations of the focal firm. To the extent that these local peers are viewed as referents, their preoccupation with the domestic market will provide the normative cues that shape behaviour in the focal firm, and thereby dampen their otherwise ambitious goals (Bingham 2009). For example, Prashantham and Dhanaraj (2010) showed that when a young firm has strong home-country networks, it tends to get drawn into predominantly domestic business opportunities, despite international opportunities being potentially more lucrative, because its partners set their sights low. In sum, for resource-constrained young firms, a strong home-country focus is likely to draw attention away from host-country opportunities, which will adversely affect internationalization (Sapienza et al. 2005). Thus we argue:

Hypothesis 1: The stronger the firm’s home-country ties, the lower its international intensity.

There is a caveat to this hypothesis. Some young firms lacking the capability to internationalize could plausibly make a rational choice to focus more on relationship-building in the home-country. Our empirical setting was chosen in part because such firms are relatively few in number. Young Indian software firms are well-known for their desire to internationalize (Kundu and Katz 2003). It seems more likely that the firms in our study desire international growth, but succeed to varying degrees.

3.2 Industry Group Membership

While our general expectation is that home-country ties will suppress international growth, we focus now on one subset of home-country ties, namely so-called “industry groups” that firms can choose to join (Chetty and Agndal 2008). This represents a more discriminating approach to network building—within the focal actor’s given industry—in the home-country, as distinct from the more general orientation towards home-country firms referred to in Hypothesis 1. That is, there is a distinction between the general population of peers and the subset of high-aspirants—and when the latter constitute the focal actor’s reference group then that triggers behaviors to enrol in certain networks (here, industry groups). Such firms constitute a reference group when the focal actor perceives this to be the case (Merton 1968), and acts on this perception by enrolling into industry groups associated with these firms which are likely to enhance the focal firm’s propensity to internationalize (Boethe 2013).

Considering the expectations from social capital theory first, we expect industry groups to have a small but positive impact on relationship-building for the member firm, through the occasional visits by overseas delegations and speakers. Taking advantage of relationship-building opportunities is of course largely contingent upon actors’ proactiveness, but these industry groups are more naturally oriented to international activity as opposed to the more general case, described earlier in our arguments for H2, where the tendency is towards home-country activity and relationships.

We anticipate industry groups will have a negligible direct impact on capability-building for the member firm, simply because the amount of time spent interacting with others in these groups is so small. However, these industry groups could potentially foster relationships with like-minded firms, from whom the focal firm could learn, with indirect and positive consequences for their internationalization capabilities.

In terms of reference group theory, we expect the aspiration-building effect of industry groups on firm internationalization to be strongly positive. In other words, the other members of the industry group can be viewed as an aspirational reference group to the focal firm (Greve 1998; Massini et al. 2005). By being exposed to the showcasing of exemplar companies in international markets and by listening to the “war stories” of successful entrepreneurs, the managers of the young firm are more likely to set their sights on international growth, even though it may be more risky than staying focused on the domestic market (Oviatt and McDougall 2005).

In the context of our study, we focus on two groups that we observed (during our qualitative research) to be well-regarded. The first is membership of the Software Technology Parks of India (STPI) scheme introduced by the Indian government to foster export development for Indian software companies through activities such as technology assessments, market analysis, and events (e.g., workshops and exhibitions), with two events every quarter. The second is membership of The Indus Entrepreneurs (TIE), a not-for-profit networking organization started by Indian technologists in Silicon Valley with local chapters all over India. Members typically meet once a month within each local chapter to discuss topics of mutual interest (e.g., start-up finance) and have the opportunity to attend annual national and international conferences. While the members of these groups are all domestic,Footnote 4 they provide access to new relationships through, for instance, exposure to visiting trade delegations (in the case of STPI) and access to global member-directories (in the case of TIE). We conceptualize the effects of the two Indian industry groups to be not only positive but also additive, such that being a member of both groups is better than joining one or the other. This is because one of them is government-driven (STPI) while the other a private initiative (TIE). Thus a focal actor who is part of both industry groups is likely to experience diverse stimuli that facilitate its internationalization in slightly different ways. Taking all of the above into account, we argue:

Hypothesis 2: Industry group membership is positively associated with firm international intensity.

Finally, we consider the potential interaction between these three types of relationships for firm international intensity. For a young and growing firm, the time and attention of the top managers is a scarce and critical resource. So while we have emphasized the ways relationships with other firms can help the focal firm to grow its business, all investments in such activities have an opportunity cost. Thus, given all the other activities top managers are also involved in, it seems likely that there are diminishing returns to investing in the development of relational capital.

More specifically, we argued that both relationship-building and aspiration-building for international growth are gained through two mechanisms—ties with host-country firms and membership of industry groups. If diminishing returns to effort are observed, we would not expect the positive effect of these two different sets of relationships to be entirely additive (Agndal et al. 2008). Instead, they will act as partial substitutes for one another. This suggests that the hypothesized positive effect of industry group membership on international intensity is likely to be less significant in cases where the firm already has strong host-country ties. More formally:

Hypothesis 3: The effect of industry group membership on firm international intensity is mitigated by the strength of its host-country ties.

The hypotheses suggest some important ways home-country ties can influence a young firm’s early internationalization efforts. However, the nature of our firm-level data made it impossible to separate out the mechanisms through which these effects transpire. To shed further light on these issues we also conducted a qualitative study, focusing on how the managers of the focal firms interacted with home-country partners, and in particular on the extent to which aspiration-building (as implied by reference group theory) was an important part of the process. Our guiding questions here were: How do firms seeking to internationalize interact with other firms in their home country? And how do these interactions shape the subsequent actions of the focal firms?

4 Methodology

To test the hypotheses, we conducted a survey of Indian software firms. The choice of software firms is a popular one in internationalization research because of their proclivity to internationalize and leverage network relationships (Coviello 2006; Lopez et al. 2009). India was an attractive setting because of the high export orientation of its software industry; 80 % of all revenues accrue through international business. The focus on a single county and industry mitigates concerns about non-measured variance associated with extraneous heterogeneity.

Data collection in an emerging economy can be a challenge (Filatotchev et al. 2009). To identify a sample, a single reliable database was used viz. the directory of the software trade body, Nasscom. It yielded a list of 351 software services firms younger than 12 years oldFootnote 5 and with fewer than 250 employeesFootnote 6 across Bangalore, Chennai, Hyderabad, Mumbai and greater New Delhi. The questionnaire was pre-tested on a 50-firm sample from a different population. Adjustments were then made, to improve the clarity of phraseology. After two rounds of mailings, we ended up with 107 responses, of which 102 were usable. The response rate (29 %) compares favorably with other similar studies (e.g., Yli-Renko et al. 2002). Respondents were the chief executive officer (CEO) or a top manager. ANOVA tests for bias showed no significant demographic differences between respondents and non-respondents, and between respondents in each wave.

4.1 Measures

The dependent variable, International Intensity, was measured as the ratio of foreign to total salesFootnote 7 (Preece et al. 1999). This data was obtained from Nasscom at two points in time: immediately after the survey and 2 years later. This allowed us to use both the 2-year lagged measure and the change in international intensity as different operationalizations of our dependent variable.

As for the independent variables, Home-country ties (H1) was measured using a five-item scale adapted from previous studies, particularly Kale et al. (2000) and Yli-Renko et al. (2001)—see “Appendix”—which yield an aggregated perceptual measure taking into account an overall set of relationships (Cronbach’s α 0.96). The items were measured separately in relation to home-country SME tiesFootnote 8 and MNE affiliate ties and then aggregated, given our interest in home-country ties in general.

Industry group membership (H2) was measured as the sum of responses to two questions: (a) Are you a member of Software Technology Parks of India? (b) Are you a member of The Indus Entrepreneurs? (0 = member of neither, 1 = member of one or other, 2 = member of both).

Host-country ties (H3 interaction) was measured using the same set of questions as above but focused on host-country relationships (Cronbach’s α 0.97). See “Appendix”. Respondents were asked to separately evaluate their relationships with ethnic and non-ethnic actors, and the resultant scores were aggregated, given our interest in host-country ties in general.

A range of controls were also used: Firm age and firm size. The logarithm of the number of years since founding and the logarithm of the number of full-time employees, respectively, were used to control for demographic variance (Knight and Cavusgil 2004; Lu and Beamish 2001).

Knowledge intensity More knowledge-intensive firms often have a greater proclivity to internationalize and learn, and benefit from legitimacy and reputation effects (Autio et al. 2000). A four-item scale adapted from Autio et al. (2000) was used (Cronbach’s α 0.85); see “Appendix”.

Activity scope Firms may vary in the scope of their offering which in turn influences their internationalization trajectory (Oviatt and McDougall 2005). The number of software activities carried out was used as a proxy measure.

Early internationalization SMEs that internationalize early in their life-cycle are more likely to develop high levels of international intensity (Preece et al. 1999). We therefore controlled for internationalization speed using a dichotomous dummy variable (1 = internationalized within 6 years of founding; else 0) (Zahra 2005).Footnote 9

Internationalization capability Firms with knowledge about internationalizing have a greater proclivity to do so (Johanson and Vahlne 1977; Knight and Cavusgil 2004; Prashantham 2005). We measured internationalization capability using a three-item Likert-type scale (Cronbach’s α 0.86) based on Eriksson et al. (1997).

4.2 Modeling Issues

There were two analytical challenges in testing our hypotheses that are common in research of this type, namely the risks of reverse causality and self-selection. To address the causality issue, we used Nasscom data on international intensity (i.e., from a different source) collected immediately after the questionnaire and also 2 years later. This allowed us to test our hypotheses using (a) a lagged measure of international intensity and (b) the change in international intensity over the 2 years following the survey. In terms of self-selection bias, the risk is that unobserved characteristics of our sample companies are causing them to self-select into more internationally-oriented and more locally-oriented subgroups, thereby inflating the strength of our findings. We mitigated this risk in two ways. First, by using the Nasscom list we explicitly selected a group of firms that were already motivated to internationalize (Athreye 2007). Indeed, there were no purely domestic firms in the study: all had between 5 and 100 % of their sales overseas. Second, we attempted to correct for the unobservable heterogeneity in our sample by performing a two-stage least squares (2SLS) estimation. In the first stage, instrumental variables that were correlated to the explanatory variables but not the error terms were used to predict the explanatory variables along with the exogenous explanatory variables from the main regressions. In the second stage, these estimated values were used in place of the suspected endogenous explanatory variables.

For our measure of home-country ties, the chosen instrument was a perceptual question asking about the firm’s awareness of potential partners (“we are aware of potential alliance partners in our domestic market”), and for our measure of industry group membership the instrument was a factual question about whether the firm was headquartered in Bangalore or Hyderabad. We recognize that these are not ideal instruments, but in the context of our cross-sectional survey design they were the best available and were guided by some social capital researchers’ suggestion that the focal actor’s perceptions of the environment and characteristics could serve as instruments (Gächter et al. 2010). Sargan test results (Chi square of 3.533, p value = 0.17 and Chi square of 2.497, p value = 1.325, respectively) fail to reject the null hypotheses of the validity of the instruments. Partial F-statistics exceeded 10 in all three casesFootnote 10 to reject the null hypotheses of weak instruments, and the maximal IV size at 10 % (home-country ties instruments) or 15 % confidence levels (the other two instruments), which is a limitation (Staiger and Stock 1997; Stock and Yogo 2005).

We also performed a range of standard tests to enhance reliability and validity.

Multiple-item scales were used to measure constructs, and distributed across the survey-instrument. A post hoc Harman’s one-factor test did not yield a single dominant factor. Regression results remained stable when the first principle component was included as a control to account for co-variance from a single survey instrument. Principal factor analyses were performed on all measurement items which loaded onto the expected factors, suggesting discriminant validity. All composite reliability (Cronbach’s α) scores exceeded 0.85, indicating convergent validity. Follow-up interviews with a sub-sample (10 %) provided assurance of the validity of the survey data.Footnote 11 To rule out multicollinearity, variance inflation factor scores were computed; these were less than 2 (Hair et al. 1998).

4.3 Qualitative Data Collection and Analysis

With help from the Confederation of Indian Industry, we gained access to four small software firms in Bangalore that were selected to ensure a reasonable variance in the initial social capital stocks across the domestic and international setting.

We used a multi-method design to collect data on the four firms, specifically a combination of archival data, in-depth interviews, and participant observation. The archival data consisted of media stories and online materials, approximately 25 items per firm, as well as internal firm records such as emails and minutes of meetings. Forty in-depth interviews were conducted by the first author during four field visits to Bangalore over a 3 year period. Each interview lasted between 30 and 90 min and was transcribed.

The primary interviewee was the entrepreneur, and questions focused on: (1) founding circumstances; (2) international growth aspirations, internationalization patterns and future plans; and (3) network portfolio and its role in driving internationalization (Coviello 2006; Yli-Renko et al. 2002). Interviews also were conducted with other managers, associates and industry experts. In terms of participant observation, the first author attended several meetings, including a live business pitch to a prospective overseas client (Alpha), an informal Sunday morning gathering of employees (Beta), informal meals in the cafeteria (Gamma), and work in the office over the course of a day (Delta).

We analyzed the qualitative data using the iterative logic proposed by Eisenhardt (1989) and Miles and Huberman (1994), i.e. looking for general patterns in the data, then reconciling those patterns with existing theory, then returning to the data again to flesh out the emergent ideas. More specifically, we first built a case history for each venture which we discussed with the firm CEOs to verify factual accuracy. We then analyzed each one individually and on a comparative basis (Miles and Huberman 1994; Yin 1994). The analysis was facilitated by NVivo software, a text analysis program that aids the coding of data and the organization of emergent themes. Other steps taken to ensure rigor included the use of a theory-led interview guide (Eisenhardt 1989), development of a retrievable case study database (Yin 1994), verification by respondents of case-study write-ups and peer feedback (Miles and Huberman 1994).

5 Results

5.1 Quantitative Analysis

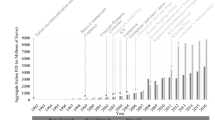

In our sample of 102 firms, the average firm was 8 years old, had 137 employees and obtained 62.2 % of revenues through international business. Correlations are shown in Table 1. To test the hypotheses, hierarchical ordinary least square (OLS) regression was used since the dependent variable is continuous (Hair et al. 1998). The results are reported in Table 2. In Models 1–3 the dependent variable is the (two-year) lagged measure of international intensity. Model 1 shows coefficients for the controls; adjusted R 2 was 0.184. The two independent variables were then introduced in Model 2. Both were strongly significant, in the expected direction, and the adjusted R 2 increased to 0.260. The interaction term (host-country ties × industry group membership) was introduced in Model 3 and was significantly negative. All three hypotheses were therefore supported.

In Model 4 the dependent variable is the change in international intensity in the 2 years following the survey. This is essentially a stricter test of our arguments, and it reveals that we continue to see support for the three direct effects (H1 and H2), while the interaction effect (H3) becomes non-significant. Interestingly, in this model the control variable internationalization capability is significant and negative. We interpret this as meaning that the more a firm internationalizes, the more it learns about what it does not know, and the more realistic it is about its relative strengths in this area. While not a major part of our story here, this is nonetheless an interesting insight (Table 3).

To correct for the risk of unobserved heterogeneity, we also tested the hypotheses using a 2SLS estimation. In the first stage regressions (Models 5–7) instrumental variables have the expected significant results vis-à-vis the corresponding predictor but are not significantly associated with international intensity (Model 8). The second stage regression for international intensity (Model 9) produces qualitatively similar results to Model 3, and that for change in international intensity (Model 10), while weaker, is consistent with Model 4. These results are therefore consistent with those in the OLS estimation (Table 4).

As a further robustness test, we used a perceptual measure of firm satisfaction with international growth collected 1 year after the original survey. While the response rate to this follow up survey was low (n = 42), we found this satisfaction measure correlated significantly and positively with host-country ties (r = 0.336, p = 0.018) and industry group membership (r = 0.322, p = 0.009), providing further support for our arguments. The correlation with home-country ties was not significant (r = 0.045, p = 0.655).

5.2 Qualitative Analysis

The four case-study firms were followed for 3 years. Two of them were very successful at growing their international revenues: Alpha was founded by a graduate returnee from the US, with 90 % of its revenues coming from overseas by the end of study-period; Beta was also founded by a US returnee, after a decade working there, and after 3 years 100 % of his revenues were coming from outside India. The other two firms were less successful in their international growth: Gamma was founded by a former Motorola India employee, and despite his target of 90 % international revenue he ended up with a figure of just 20 %; Delta was founded by a graduate from an Indian engineering institution, and again despite his lofty ambitions ended up with only 5 % of his revenues coming from outside India by the end of our study period. Detailed descriptions of the internationalization efforts of these four firms are available from the authors on request.

The overall internationalization story was consistent with the findings from our quantitative study, i.e. that home-country ties generally hindered international growth while industry group membership generally helped. In this section we consider the effect of these two different sets of ties separately. We use reference group theory (Merton 1968) to organize our insights, by considering: (a) how information was obtained; (b) how entrepreneurs made sense of this information; and (c) their subsequent behaviors.

5.2.1 Home-Country Ties

These hindered international sales growth as follows:

(a) Obtaining information—through home-country firms The firms that were less successful in internationalizing (Gamma and Delta) spent a considerable amount of time gaining information from home-country contacts, partly through choice and partly through ease of access. This information took many forms. Some of it was about potential business activities: for example, Delta’s founder was approached repeatedly by a home-country company with a strongly domestic focus, whose CEO was known to his family. As he explained: “Every time they had some opportunities for me they immediately got in touch. I thought this would last only for a short while but it kept happening again and again…these people are well known to us [the family]. I couldn’t say no.”

A second form of information was about how to conduct business in the home country market, for example, an increased understanding of the Indian market and know-how embedded in everyday routines such as employee relations and customer service. As Gamma’s entrepreneur commented: “Our MNE partner [HP] showed great commitment to making sure it did things in a way that worked in the Indian market…our people imbibed a lot just by being around their premises while executing the project”.

A third form of information was more structured, especially in relation to dealings with MNE affiliates through training sessions, information seminars and process-related documents. Between Gamma and Delta, the former benefited more significantly from such information flows. However, while the “theory” of the disseminated information reflected the mature routines of a large international organization, the “application” of the information was firmly grounded in the Indian context. Thus, literature on direct marketing campaigns provided by an MNE affiliate which Gamma found beneficial was focused on how to succeed in the Indian context.

(b) Sensemaking—domestically-oriented narrow thinking The information gained by Delta and Gamma through their home-country contacts led to a narrow and domestically-oriented sense-making process. Although the entrepreneurs running the two firms gained insights, these were largely in relation to dealings in the home country market. It became apparent that several of the indigenous firms they encountered had a mindset oriented towards domestic success, and lacked sensitivity to international market opportunities. Therefore these home-country engagements did not generate novel insights into the different requirements of succeeding in advanced Western markets. For example, when Delta was struggling to break into the Australian market, it could draw little from its burgeoning experience of serving India-based clients. Gamma’s relationship with HP India might have been expected to provide it with an understanding of how international companies operate, but in reality HP India was highly India-focused.

The net result was that Gamma and Delta struggled to think in novel ways about internationalization, and increasingly their frame of reference became the Indian market.

(c) Behavior—displaced internationalization As a consequence, Gamma and Delta gradually placed more effort on growing their business in the domestic market. Their scarce managerial attention was displaced from focusing on international revenues, and the much lower revenue-per-hour these firms gained in India (compared to advanced Western markets) accentuated the problem. By contrast, Alpha’s CEO was keen to reduce his early reliance on domestic business: “If I only have Indian clients, then I cannot make payroll”.

Gamma and Delta, in other words, became deeply enmeshed in home-country networks, and consequently reduced their efforts to gain new international clients, which in turn stunted the learning of capabilities relevant to internationalization. A key element in the internationalization process is the development of experiential knowledge (Johanson and Vahlne 1977), and essentially we saw this process happening in reverse with Gamma and Delta, as their capacity for internationalization atrophied. Delta had initially sought to expand into Australia, but when this did not seem to be working, the founder began to scale back his ambition: “We have not been able to build momentum. But we do want to grow internationally…Maybe we will try to target easier markets like South Africa or Zimbabwe, but not the US…”. By the end of the period of study, he conceded: “We aren’t really making active international sales efforts right now”. Gamma built a key relationship with HP India, but this created a false hope as its “pull of gravity” was clearly towards India. Perhaps as a result, Gamma appeared increasingly inept in its dealings with host-country ties. Its founder complained about one contact in the US: “He couldn’t get me even one qualified lead—not even one qualified lead!” When we spoke to that individual, he observed: “They [Gamma] were so one-dimensional in their approach. Constantly harping on sales, sales. I don’t have the time to do their selling. But if I was asked for an in-depth discussion to explain nuances of market segments in the US they might have got a lot more out of me.”

5.2.2 Industry Group Ties

These had a positive influence on international sales growth as follows:

(a) Obtaining information—a source of fresh ideas Alpha and Beta gained information through their involvement with the industry groups (TIE and STPI) in three ways. First, talks by industry leaders during events provided advice on how to internationalize and the potential payoffs available. There were also talks by senior government officials spelling out policy measures to aid international growth. Second, the entrepreneurs were active in break-time “chit-chat” with fellow-members, leading to nuggets of advice or insights about mistakes others had made. For example, Beta’s founder recalled conversations about failing to do adequate homework prior to market entry, and underestimating differences between certain markets. Third, the entrepreneurs interacted with visitors to these forums. For instance, STPI hosted a trade delegation from the UK, and this included a party from Scotland, which provided Alpha’s entrepreneur with information about a sub-national market in Scotland that he had not been previously aware of. Beta’s entrepreneur had the opportunity to speak to visitors from North America in the healthcare segment and became aware of a potential niche market.

(b) Sensemaking—reinforcement of internationalization goals Industry group activities reinforced the importance of selling internationally. In the case of STPI, the focus was the government’s perception of the desirability of international business, and in the case of TIE, the emphasis was on the prospect of entrepreneurial success and wealth creation. The events helped Alpha and Beta’s founders to reinforce their personal commitment to internationalization, as it was one shared by a multitude of Indian firms and represented a “higher goal” in the national interest. For example, at a point when Alpha’s founder was frustrated by his lack of success in converting overseas prospects into sales, he attended an STPI talk where the speaker, a government official, urged entrepreneurs to not give up in the face of setbacks. As he commented: “I was a bit discouraged when it took a long time to actualize some of our goals…but [after the talk] I kept going. In the end things worked out. It felt great.”

In addition, they were reassured that the day-to-day challenges they faced were commonly experienced by other Indian software entrepreneurs seeking international revenue. For example, Alpha’s founder was exposed to insights about differences between the US and UK markets, which he had previously assumed would be near-identical. He felt that the novel thinking he was exposed to helped him “understand better what they [British companies] want” and avoid blundering when dealing with prospective UK clients because he “toned down the aggression”. Beta’s founder found similar benefits in gaining insight into differences between Northern and Southern European countries, which helped him gain business from Sweden and Spain. He observed: “We got sensitized to differences between markets in Europe. I understood the US pretty well but the differences between the US and other Western markets—and even among those markets—came as a bit of a surprise.”

(c) Behavior—more and better internationalization activity As a consequence of this sense-making process, Alpha and Beta both invested a lot of effort in pushing their international growth. First, they worked hard on gaining international clients, by widening their set of host-country ties. For example, Beta’s entrepreneur was able to cultivate European contacts through visiting trade delegations to STPI. As he observed: “You can reach the limits of what your own contacts can do for you sooner than you expect…then you need more contacts”. Second, the two ventures introduced new “tricks” into their repertoire of internationalization routines: Beta introduced European language translations of the website, while Alpha’s entrepreneur pursued a TIE-instigated mentoring relationship to help him transition from a US focus to one that included Europe. “Having him [the mentor] on board made me feel like a kite that was flying high but being firmly guided by a string…he didn’t get me fish, but he taught me how to fish”.

Finally, they initiated ways to understand and exploit potential opportunities more readily. For instance, Alpha’s entrepreneur persuaded an existing weak tie in the UK to become a strong tie to provide him with mentoring advice, and sought to make contacts at overseas chapters of TIE through its global directory: “In general fellow-Indians extend the hand of friendship when approached…they are a great door-opener”.

5.3 Integrating the Quantitative and Qualitative Findings

These process-based findings provided useful insights into the way young firm founders actually made sense of their relationship building activities as they sought international growth. Recall that our review of the literature suggested three linked mechanisms for international growth. The well-established social capital perspective puts the spotlight on relationship-building and capability-building, and both were observed in our case-study firms. The importance of relationship-building, for example, was manifested in the way industry group ties can sometimes open up links to potential allies in international markets, while the importance of capability-building was underlined in those cases (Gamma and Delta) where learning about internationalization was disrupted and never recovered.

The real focus of our case study analysis, however, was the aspiration-building part of the process that is suggested by reference group theory, because this has not been previously analyzed in the international business context. As the analysis of common themes above makes clear, important parts of the process were driven by either the positive effect of industry group members, or by the negative effect of home-country peers, as referents to whom the focal firms oriented themselves.

Figure 1 summarizes our findings, using the framing of reference-group theory. We view this as a four stage process. First, the firm founder selects a reference group, on the basis of prior experience and available information. Second, the firm founder gains information from that reference group, sometimes through direct communication and sometimes through observation. Third, the firm founder interprets and makes sense of this information, alongside whatever other sources he or she has available. Fourth, the firm founder takes action. This process is then repeated periodically, as a function of whatever additional information comes to light.

The quantitative analysis conducted in the first part of this paper (i.e., testing Hypotheses 1 and 2) is consistent with this process framework, and focuses on the link between stages 1 and 4. The qualitative analysis, as summarized in Fig. 1, articulates the mechanisms linking stages 1 and 4 together. It says, in a nutshell, that an important aspect of young firm internationalization is the way founders obtain and make sense of information from prospective referents in their home-country markets. This argument does not detract at all from the established wisdom that host-country ties are critical to the success of internationalizing firms. Rather, our focus on home country ties complements the prior literature and helps to provide a more complete picture.

6 Summary and Conclusions

Our study of Indian software firms provides important insights into the way a young firm’s set of home-country relationships affects its level of international growth. We showed that strong home-country ties are negatively linked to international intensity (H1), while industry group membership (within the home country) is positively linked to international intensity (H2). Our qualitative analysis helped to explain the mechanisms through which these relationships transpire.

6.1 Contributions

Our findings extend international entrepreneurship research in two ways. First, we enhance understanding of the role of relationships in stimulating international growth: not only are they a conduit for connections and for the development of capabilities, they are also a source of aspiration and inspiration. More specifically, we augmented the standard arguments from social capital theory with insights from reference group theory, suggesting that the way a firm defines its “referents” and uses them as a source of inspiration can have an important bearing on its internationalization efforts. We then explored these ideas in our qualitative study, which allowed us to play out exactly how these referents help young firms to make sense of their options and thereby commit to a particular course of action. We found that industry group membership often helped young firms to internationalize by raising their aspirations, whereas home-country ties often had the opposite effect by taking attention and effort away from international growth.

These reference group arguments are a useful complement to the existing literature on young firm internationalization in a number of ways (Agndal et al. 2008; Coviello 2006; Ellis 2000; Prashantham and Dhanaraj 2010; Yli-Renko et al. 2002; Yu et al. 2011; Zhou et al. 2007). For example, the extant emphasis on resource acquisition and learning via networks emphasizes close two-way communication between actors. By contrast, aspiration-building may also occur through one-way communication (e.g., a talk by an inspirational leader who a focal entrepreneur identifies with), and low-intensity two-way communication (e.g., casual break-time conversations among entrepreneurs with shared ambitions to succeed internationally). This suggests there are potential payoffs from building even very modest links with peers who have aspirations to grow internationally (Agndal et al. 2008; Coviello 2006; Zahra 2005).

Second, our results help to explain how home-country ties affect international growth, an under-researched area in international entrepreneurship. Prior studies had revealed mixed findings for this relationship (Boethe 2013; Milanov and Fernhaber 2014; Yu et al. 2011). By separating out the type of home-country tie, especially in terms of its aspiration-building potential, we are able to reconcile these different perspectives. In so doing we build upon studies that explicitly distinguish among host- and home-country ties (e.g., Yu et al. 2011). Our work makes a nuanced distinction between home-country ties in general and a discriminating set of industry group ties with an explicit focus on internationalization. Overinvesting in the former can be detrimental to international growth, and thus underlines the potential constraining effects on internationalization, a notion that is under-examined (Coviello and Munro 1997).

Thus our research underlines the importance of relational capital in enabling firm growth, but also provides a more nuanced view than is often seen in the literature. Some studies have suggested, implicitly, that relational capital is an unalloyed good—that more is better. Our findings show that it matters a great deal what types of partners a firm builds ties with: too much investment in home-country relationships can actually be counter-productive for international growth. Our work extends prior research (e.g., Coviello 2006; Prashantham and Dhanaraj 2010; Yli-Renko et al. 2002) that helpfully highlights the value of network relationships but does not investigate differential effects of relational capital sources.

6.2 Limitations and Future Research

By using a mixed-method approach, we mitigated the usual trade-off between depth and breadth in research design. However, there were of course limitations to both parts of the research that should be acknowledged. For the quantitative study, one limitation was the relatively small sample size, which was of course a function of the small population (internationalizing Indian software firms) under investigation. Future researchers could collect and use data from multiple industries with varying degrees of international visibility from one or multiple countries, including more advanced economies. Another limitation was our use of international intensity as a measure of international growth. While it continues to be used widely, future research should also consider other measures. Finally, we acknowledge that our instrumental variables were not perfect, and we therefore cannot fully rule out the possibility that our findings were driven by unobserved variables, such as personal attributes of the founders of these small firms. It would be useful for future research to take such factors into account, and to see if stronger instrumental variables (for example, changes in policy on currency control) can be found. In terms of the qualitative study, we were able to document the process of obtaining information, sense-making, and action in real time, but unfortunately we did not get a clear sense of how the firm founders selected their reference group in the first place (i.e., stage 1 in Fig. 1), nor did we shed light on how the process gets revisited over time, as additional information is collected. These are both interesting potential avenues for further research.

6.3 Practitioner Implications

This study suggests that who young firms know may matter more than how much relational capital they have per se, and this is not only theoretically illuminating but also practically relevant. The overarching practical insight from this study is that it is prudent for ambitious, internationally-oriented young firms to be discriminating about the relationships that they cultivate and leverage—in other words, to choose their friends carefully. The study suggests that a young firm seeking to grow internationally might search for relationships with overseas firms, and not to get too deep into relationships with home-country firms, else they risk setting their sights too low or cutting themselves off from international opportunities. By the same token, they might also set their sights high by finding local reference groups that can help them stay focused on international opportunities.

Notes

We conceptualize relationships at the interorganizational level. In young firms, however, in reality, the entrepreneur’s relationships and the firm’s relationships are often effectively interchangeable.

To illustrate, the Microsoft India website articulates that MNE affiliate’s mission as follows: In India, as the country moves towards a leadership position in the global knowledge economy, Microsoft works closely with the government, the IT industry, academia and the local developer community to partner in India's growth.

While MNE affiliates certainly have the potential to be a source of internationalization capability learning to indigenous ventures (Prashantham and Dhanaraj 2015), when it comes to actual internationalization, they often exert a “gravitational” pull (cf., Cantwell and Mudambi 2011) towards the domestic market in important emerging economies like India. Consequently the translation of learning outcomes into actual internationalization for Indian ventures is potentially thwarted. How this pull towards the domestic market can be overcome represents an interesting question but is beyond our scope (however see Prashantham and Dhanaraj 2015 for a discussion of this issue).

In the Indian software industry context there are large Indian IT firms—such as TCS and Infosys—which might be included in this reference group of high-aspirants (more specifically, in these case, high-achievers) since such firms are often well represented in industry groups.

The 12-year threshold represents relative youth in an Asian context. Though higher than some US-based studies, it is justified by ventures’ lower availability of early-stage equity funding and typically longer maturation process. The study’s results remained stable at lower age cut-offs (less than 10 and 8 years).

The most common employee cut-offs in international entrepreneurship research are 250 and 500 employees (Jones et al. 2011). In this study the former was chosen because of the nascent empirical setting.

The core business of the population of firms we studied is software development. Call centres were thus excluded. The main source of international revenue for the firms in the study is outsourced software development. Revenues are deemed international if payment is made by clients in an overseas market. We are inattentive to entry mode, so they may or may not have a physical presence in the host market, and to market diversity. Our measure of internationalization is admittedly narrow but was the only dimension on which we could obtain reliable data from a secondary source. We therefore traded off measurement breadth for measurement rigor (in relation to avoiding common method variance concerns).

We focused on peers (fellow-SMEs) rather than large Indian firms (e.g., TCS) because in our early fieldwork, Indian software entrepreneurs bemoaned the lack of engagement by large Indian firms with domestic young firms. Therefore, we reasoned that the positive role that such firms might play would be as aspirational referents in industry networks.

We also used age at internationalization as an alternative control but got highly consistent results.

Although a control variable in terms of main effects, we instrumented host-country ties as well using the corresponding perceptual measure that we used for home-country ties (“we are aware of potential alliance partners in our lead international market”). Sargan test results failed to reject the null hypothesis of validity.

Ideally every questionnaire would have been completed by multiple respondents but often this is not feasible in smaller Asian firms (Filatotchev et al. 2009); hence the follow-up to confirm survey data.

References

Agndal, H., Chetty, S., & Wilson, H. (2008). Social capital dynamics and foreign market entry. International Business Review, 17(6), 663–675.

Athreye, S. (2007). Industry associations and technology based growth in India. European Journal of Development Research, 19(1), 156–173.

Autio, E., George, G., & Alexy, O. (2011). International entrepreneurship and capability development: qualitative evidence and future research directions. Entrepreneurship Theory and Practice, 35(1), 11–37.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909–924.

Bingham, C. B. (2009). Oscillation improvisation: how entrepreneurial firms create success in foreign market entries over time. Strategic Entrepreneurship Journal, 3(4), 321–345.

Boethe, D. (2013). Collaborate at home to win abroad: how does access to local networks influence export behavior. Journal of Small Business Management, 51(2), 167–182.

Cantwell, J. A., & Mudambi, R. (2011). Physical attraction and the geography of knowledge sourcing in multinational enterprises. Global Strategy Journal, 1(3/4), 206–232.

Chari, M. R., & David, P. (2012). Sustaining superior performance in an emerging economy: an empirical test in the Indian context. Strategic Management Journal, 33(2), 217–229.

Chetty, S., & Agndal, H. (2008). Role of inter-organizational networks and interpersonal networks in an industrial district. Regional Studies, 41(2), 1–13.

Chittoor, R., Sarkar, M. B., Ray, S., & Aulakh, P. S. (2009). Third-world copycats to emerging multinationals: institutional changes and organizational transformation in the Indian pharmaceutical industry. Organization Science, 20(1), 187–205.

Contractor, F. J., Hsu, C.-C., & Kundu, S. K. (2005). Aspects of the internationalization process in smaller firms. Management International Review, 45(3), 83–110.

Coviello, N. E. (2006). Network dynamics of international new ventures. Journal of International Business Studies, 37(5), 713–731.

Coviello, N. E., & Munro, H. (1997). Network relationships and the internationalization process of small software firms. International Business Review, 6(4), 361–386.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532–550.

Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: a study of Indian firms. Journal of International Business Studies, 38(4), 541–555.

Ellis, P. D. (2000). Social ties and foreign market entry. Journal of International Business Studies, 31(3), 443–469.

Eriksson, K., Johanson, J., Majkgård, A., & Sharma, D. (1997). Experiential knowledge and cost in the internationalization process. Journal of International Business Studies, 28(2), 337–360.

Fernhaber, S. A., Gilbert, B. A., & McDougall, P. P. (2008). International entrepreneurship and geographic location: an empirical examination of new venture internationalization. Journal of International Business Studies, 39(2), 267–290.

Fiegenbaum, A., Hart, S., & Schendel, D. (1996). Strategic reference point theory. Strategic Management Journal, 17(3), 219–235.

Fiegenbaum, A., & Thomas, H. (1995). Strategic groups as reference groups: theory, modeling and empirical examination of industry and competitive strategy. Strategic Management Journal, 16(6), 461–476.

Filatotchev, I., Liu, X., Buck, T., & Wright, M. (2009). The export orientation and export performance of high-technology SMEs in emerging markets: the effects of knowledge transfer by returnee entrepreneurs. Journal of International Business Studies, 40(6), 1005–1021.

Gächter, M., Savage, D. A., & Torgler, B. (2010). The role of social capital in reducing negative health outcomes among police officers. International Journal of Social Inquiry, 3(1), 141–161.

Gaur, A. S., & Kumar, V. (2009). International diversification, firm performance and business group affiliation: empirical evidence from India. British Journal of Management, 20(2), 172–186.

Greve, H. R. (1998). Performance, aspirations, and risky organizational change. Administrative Science Quarterly, 43(1), 58–86.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1998). Multivariate data analysis. Upper Saddle River: Prentice-Hall.

Hashai, N. (2011). Sequencing the expansion of geographic scope and foreign operations by “born global” firms. Journal of International Business Studies, 42(8), 995–1015.

Hitt, M. A., Bierman, L., Uhlenbruck, K., & Shimizu, K. (2006). The importance of resources in the internationalization professional service firms: the good, the bad, and the ugly. Academy of Management Journal, 49(6), 1137–1157.

Hyman, H. H. (1942). The psychology of status. Archives of Psychology, 38(269), 94.

Johanson, J., & Vahlne, J.-E. (1977). The internationalization process of the firm: a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8(1), 23–32.

Johanson, J., & Vahlne, J.-E. (2009). The Uppsala internationalization process model revisited: from liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9), 1411–1431.

Jones, M. V., & Coviello, N. E. (2005). Internationalisation: conceptualising an entrepreneurial process of behaviour in time. Journal of International Business Studies, 36(3), 284–303.

Jones, M. V., Coviello, N. E., & Tang, Y. K. (2011). International entrepreneurship research (1989–2009): a domain ontology and thematic analysis. Journal of Business Venturing, 26(6), 632–659.

Kale, P., Singh, H., & Perlmutter, H. (2000). Learning and protection of proprietary assets in strategic alliances: building relational capital. Strategic Management Journal, 21(3), 217–237.

Kim, D., Basu, C., Naidu, G. M., & Cavusgil, E. (2011). The innovativeness of born-globals and customer orientation: learning from Indian born-globals. Journal of Business Research, 64(8), 879–886.

Knight, G. A., & Cavusgil, S. T. (2004). Innovation, organizational capabilities, and the born-global firm. Journal of International Business Studies, 35(4), 124–141.

Kundu, S. K., & Katz, J. (2003). Born-international SMEs: BI-level impacts of resources and intentions. Small Business Economics, 20(1), 25–47.

Lamb, P., Sandberg, J., & Liesch, P. W. (2011). Small firm internationalisation unveiled through phenomenography. Journal of International Business Studies, 42(5), 672–693.

Lamin, A. (2014). Business group as an information resource: an investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56(5), 1487–1509.

Lopez, L. E., Kundu, S. K., & Ciravegna, L. (2009). Born global or born regional? Evidence from an exploratory study in the Costa Rican software industry. Journal of International Business Studies, 40(7), 1228–1238.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal, 22(6/7), 565–586.

Massini, S., Lewin, A. Y., & Greve, H. R. (2005). Innovators and imitators: organizational reference groups and adoption of organizational routines. Research Policy, 34(10), 1550–1569.

Merton, R. K. (1968). Social theory and social structure. New York: Free Press.

Milanov, H., & Fernhaber, S. A. (2014). When do domestic alliances help ventures abroad? Direct and moderating effects from a learning perspective. Journal of Business Venturing, 29(3), 377–391.

Miles, M. B., & Huberman, A. M. (1994). Qualitative data analysis. London: Sage.

Mol, M. J., & Birkinshaw, J. (2009). The sources of management innovation: when firms introduce new management practices. Journal of Business Research, 62(12), 1269–1280.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital, and the organizational advantage. Academy of Management Review, 23(2), 242–266.

Oviatt, B. M., & McDougall, P. P. (2005). The internationalization of entrepreneurship. Journal of International Business Studies, 36(1), 2–8.

Porter, M. E. (1990). The competitive advantage of nations. New York: Free Press.

Prashantham, S. (2005). Toward a knowledge-based conceptualization of internationalization. Journal of International Entrepreneurship, 3(1), 37–52.

Prashantham, S. (2008). The internationalization of small firms: a strategic entrepreneurship perspective. London: Routledge.

Prashantham, S., & Birkinshaw, J. (2008). Dancing with gorillas: how small companies can partner effectively with MNCs. California Management Review, 51(1), 6–23.

Prashantham, S., & Dhanaraj, C. (2010). The dynamic influence of social capital on the international growth of new ventures. Journal of Management Studies, 47(5), 967–994.

Prashantham, S., & Dhanaraj, C. (2015). MNE ties and new venture internationalization: exploratory insights from India. Asia Pacific Journal of Management Studies (in press).

Prashantham, S., & Floyd, S. W. (2012). Routine microprocesses and capability learning in international new ventures. Journal of International Business Studies, 43(6), 544–562.

Preece, S. B., Miles, G., & Baetz, M. C. (1999). Explaining the international intensity and global diversity of early-stage technology-based firms. Journal of Business Venturing, 14(3), 259–281.

Qian, G., & Li, L. (2003). Profitability of small- and medium-sized enterprises in high-tech industries: the case of the biotechnology industry. Strategic Management Journal, 24(9), 881–887.

Sakakibara, M., & Porter, M. (2001). Competing at home to win abroad: evidence from Japanese industry. Review of Economics and Statistics, 83(2), 310–322.

Sapienza, H. J., De Clercq, D., & Sandberg, W. R. (2005). Antecedents of international and domestic learning effort. Journal of Business Venturing, 20(4), 437–457.

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65(3), 557–586.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in IV regression. In D. W. K. Andrews & J. H. Stock (Eds.), Identification and inference for econometric models: a Festschrift in honor of Thomas Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

Terjesen, S., O’Gorman, C., & Acs, Z. J. (2008). Intermediated mode of internationalization: new software ventures in Ireland and India. Entrepreneurship & Regional Development, 20(1), 89–109.

Yin, R. K. (1994). Case study research: design and methods. London: Sage.

Yli-Renko, H., Autio, E., & Sapienza, H. J. (2001). Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strategic Management Journal, 22(6/7), 587–613.

Yli-Renko, H., Autio, E., & Tontti, V. (2002). Social capital, knowledge and the international growth of technology-based new firms. International Business Review, 11(3), 279–304.

Yu, J., Gilbert, B. A., & Oviatt, B. M. (2011). Effects of alliances, time, and network cohesion on the initiation of foreign sales by new ventures. Strategic Management Journal, 32(4), 424–446.

Zahra, S. A. (2005). A theory of international new ventures: a decade of research. Journal of International Business Studies, 36(1), 20–28.

Zain, M., & Ng, S. I. (2006). The impacts of network relationships on SMEs’ internationalization process. Thunderbird International Business Review, 48(2), 183–205.

Zhou, L., Wu, W., & Luo, X. (2007). Internationalization and the performance of born-global SMEs: the mediating role of social networks. Journal of International Business Studies, 38(4), 673–690.

Acknowledgments

An earlier version of this paper was presented at the 2012 Strategic Management Society conference where it was nominated for the Best Paper Award for Practice Implications. The manuscript has benefited from helpful comments from Erkko Autio, Charles Dhanaraj, Yiannis Ioannou and Stephen Young. We are grateful to Nana Kufuor for his patient and insightful guidance on the econometric analyses. Financial support from the Carnegie Trust for the Universities of Scotland is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Measurement items and validity assessment

Construct | Items 1 = completely disagree; 7 = completely agree | Composite reliability (α) | Literature | Source |

|---|---|---|---|---|

International intensity (%) | (International revenues) × 100 (total revenues) | n/a | Lu and Beamish (2001) | Nasscom |

Strength of host-country ties With respect to (a) firms run by fellow-Indians and (b) other firms in your lead international market… [Scores for (a) and (b) aggregated] | (1) We actively utilize these relationships in our business (2) These relationships are characterized by close interactions (3) These relationships are characterized by mutual trust (4) These relationships are highly reciprocal (5) These relationships have ‘opened new doors’ for us | 0.98 | Survey | |

Strength of home-country ties With respect to (a) other SMEs and (b) MNC subsidiaries (e.g., Microsoft India) in the home market… [Scores for (a) and (b) aggregated] | (1) We actively utilize these relationships in our business (2) These relationships are characterized by close interactions (3) These relationships are characterized by mutual trust (4) These relationships are highly reciprocal (5) These relationships have ‘opened new doors’ for us | 0.96 | Survey | |

Knowledge-intensity | (1) We have a strong reputation for technological excellence (2) Technological innovation is a primary goal for us (3) There is a strong knowledge component in our products/services (4) Most of our employees have strong technical skills | 0.85 | Survey | |

Activity scope | Overall problem definition, conceptual design, physical system design, programming, testing and reviewing, maintenance and support, and documentation | n/a | Generated through pre-survey interviews | Survey |

Internationalization capability | (1) We are knowledgeable about international business strategy (2) We are competent at identifying international business opportunities (3) We are competent at international marketing | 0.86 | Eriksson et al. (1997) | Survey |

Rights and permissions

About this article

Cite this article

Prashantham, S., Birkinshaw, J. Choose Your Friends Carefully: Home-Country Ties and New Venture Internationalization. Manag Int Rev 55, 207–234 (2015). https://doi.org/10.1007/s11575-015-0244-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-015-0244-9