Abstract

In this perspective, I make a case for entrepreneurs and academics alike to focus on what I have referred to elsewhere as Contextual Intelligence, the ability to understand the limits of our knowledge, and to adapt that knowledge to a context different from the one in which it was developed. As befits this special issue on India, my work was originally motivated by the observation that some patterns, derived from analysis and introspection of data from a small sample of (typically OECD) countries were being presented as being valid ‘out of sample’, that is, applicable more universally, but these did not accord with my own intuition, largely shaped by Indian examples. I review how confronting such anomalies led to the articulation of the idea of institutional voids. This framework helps understand enduring differences in how economies are structured, and in the nature of the entrepreneurial opportunities and pitfalls they present. Superimpose on such enduring but underestimated differences the idea that mental models often persist unaltered, and the case for contextual intelligence becomes clear.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In this short ‘perspective’ essay, my agenda is to make a case for greater contextual intelligence in research in international business and, implicitly, in what we teach and how we teach it (though I will not address pedagogy directly). This might seem odd. What, after all, is ‘international’ if not about context and its variation? Nevertheless, my claim is that the mental models that have anchored research and have helped our field’s extant progress, are nonetheless limited in the extent to which they can help us deal with the interesting research issues of the proximate future.

The empirical signatures of a demand for such rethinking are ubiquitous—strategies may not easily transfer across geographies, the same ‘industry’ is rarely structured similarly across disparate geographies, and much, if not the vast majority of, economic activity in the newly emergent world occurs outside the mesh of the formal structures that we take for granted in the countries where much research is currently conducted.

One commonly used conventional summary statistic for “context”—industry structure—has given me much food for thought in the past years.Footnote 1 The so-called standard industrial classification (SIC) originated in the US in the 1920s and has been adapted somewhat over the years (http://www.naics.com/info.htm).

Subsequently, Porter (1979) provided his now classic bargaining ‘five forces’ framework to help understand how rents are divided among the different participants in the collective he called an ‘industry.’ The SIC codes provided the empirical setting within which his model was applied by generations of executives and students.

By studying members of the OECD group of countries—where data were easily available—scholars of industrial organization (the sub-field of economics from which Porter’s work emerged) concluded that similar industries tended to display similar structures and deliver similar economic returns (Caves 1992). This led to an established “wisdom” that a cement plant is a cement plant, and the cement industry is organized just-so, no matter where.

However, anecdotal comparisons of industries in the three countries that I knew best as a scholar—the United States, and the emerging markets of China and India—certainly suggested that the same industry is not quite structured the same way across geographies. It followed that some other aspects of context seemed to matter.

Some years ago, Jan Rivkin and I found that we could not replicate the statistical results from the OECD sample of countries if we used data from the world-at-large and spanning multiple countries on which data have become available (Khanna and Rivkin 2001; reprinted with permission in Khanna 2014a). It turns out that, in a statistical sense, knowing something about the performance of a particular industry in one country gave you virtually no confidence that you could predict its performance elsewhere. This is a significant result, one reacted to by our students—MBAs, doctoral students and executives—with consternation. I hypothesized that it is not that industry structure does not matter, far from it, but industry structure itself arises endogenously, driven by some more fundamental primitives.

To see why, consider the cement industry. It is true that the technology transforming clinker to cement is the same everywhere but it is also true that the cement plant is embedded in a much broader array of contextual variables. Think of a common problem in many developing countries of corrupt material suppliers adulterating the mixtures that go into making cement, think of unions that support or impede the operation of the plants, and think of whether the finished cement is sold to institutional builders or to people buying individual bags of cement. These contextual variables appear more important than the unifying effect of a common “technology”—that is, the broader context matters more. A cement-plant manager moving to an unfamiliar setting would indeed have a leg up on someone who had never managed such a plant before but not by nearly as much as she might think.

Here, one can see the point that industry structure of course matters, but it is endogenously determined. Even though the technology for the cement plant is the same over time and space, the way the rents in the industry are split depends on a number of institutional factors besides the underlying technology. It depends on the relative bargaining power of buyers and suppliers, which in turn are influenced by what I have referred to in my earlier work as institutional voids. For example, suppose that new potential buyers of cement cannot enter the industry for want of access to capital, in turn caused by lack of specialized intermediaries in the capital markets. Then, these capital-accumulation voids, so to speak, allow the perpetuation of the power of incumbent buyers, and the ability of the cement firms to capture their rents is limited.

So, our earlier reassurance that the “technology” trumps all may be unfounded.Footnote 2 This conclusion was based on the empirical invariance of industry structure across a small set of somewhat homogenous countries, mostly part of the OECD. We focused on this subset because the data were available, not because it was a more representative sample of humanity at large. In a sense, it was a version of the insidious “principle of the drunkard’s search”—the drunkard searches for his ring under the street-lamp because that’s where the light is, even though he lost it somewhere else.

The array of factors that might affect the ways in which the cement industry participants comport themselves is bewilderingly large. So the task at hand is to develop a framework that allows us to intelligently account for this contextual complexity, to render it analytically tractable and empirically meaningful. As I have defined it elsewhere (Khanna 2014a, b), contextual intelligence is the ability to understand the limits of our knowledge, and to adapt that knowledge to a context different from the one in which it was developed. Until we understand better how to develop and apply contextual intelligence, failure rates for cross-border businesses will remain high, our ability to learn from experiments unfolding around the world will remain limited, and the promise of healthy growth that includes all parts of the world will remain unfulfilled.

2 Elaborating the Importance of the Contextual Environment

Early in my academic career, I puzzled over the robust denunciation of so-called unrelated-diversified enterprises in US data, and the vast preponderance of exactly such diversified entities all over the developing world (and in many developed countries), the so called business houses of India, the grupos economicos of Latin America, the chaebol of Korea etcetera. The unconditional vilification of these as rent-seeking devices, or the result purely of corruption, did not square with the reputations many of them had, not with academics who were blissfully conditioned by the repeated exposure to journal articles based on US data, but with managers and people-on-the-ground in country after country. That is, some of the best, and best-regarded, enterprises in developing countries embraced the idea of unrelated diversification, almost universally criticized by academics professionally centered in the US.

My first publications validated my intuition, in the usual formal ways, using novel data that I had to hunt down, in those days, from Mumbai and Santiago. Over the years, my various coauthors and I then explored the extent and contours of this diversification premium more formally in over a dozen emerging markets, showing that diversification is not unconditionally bad, and that it should always be evaluated relative to a counterfactual. The standard counterfactual of course is that of the reasonably well-functioning markets of the developed world where we academics had traditionally done our work. In those situations, transactions mediated within the diversified entities, by non-price mechanisms, did not do as well as the arms-length, price-mediated transactions of the market. However, in most parts of the world, the market mechanism did not work nearly as well, or at all. There, the internal mediation of the business groups did much better.

Sceptics thought that the premium we documented was transient, and that the unrelated diversification we observed was an anachronism. But we found not only that the premia took a long time to atrophy—decades—as more efficient markets developed (and as theory predicted) (Khanna and Palepu 2000), but that, in response to some liberalization and deregulation, the groups became even more diversified, and did so profitably (Ghemawat and Khanna 1998). Had the groups been the result of corruption, one might have expected the dismantling of unproductive regulation to signal the death-knell of such enterprises; as it were, the liberalization also brought in its wake new opportunities, and the more efficient internal markets of the groups (than the slow to develop external markets) made them the only game in town able to exploit the new opportunities. That is, it was precisely their ability to manage (even more) unrelated diversification well that allowed them to continue to diversify profitably, even as economies developed (these ideas were reviewed in Khanna and Yafeh 2007).

So, there was a straightforward explanation for the unrelated-diversification-premium that used our existing theoretical paradigm but had a different empirical outcome from that which obtained in developed market settings. Nor was this purely ‘academic’. Our students were being taught ‘diversification is bad’ and more often than not, in my experience, were not given the wherewithal to introspect on the boundary conditions of that admonition in different contextual settings. That was our function as pedagogues, and we were not fulfilling it.

To specify the boundary conditions, we had to create a conceptual apparatus. So, we asked, what did these groups actually do? Like ‘normal’ firms in the west, they too had their challenges with deciding how to compete and how to position themselves. Here, it is useful to distinguish between the competitive position a group chooses to occupy, and that occupied by its affiliated firms. Whereas particular companies within a group—say the mining arm of a Chilean group, or the software arm of an Indian group—competed as a mining or software company anywhere else might, the groups in question added value through group-specific capabilities. Whereas one group might be known for the particular group brand that it developed (that might be a byword for quality in an institutional context where information to validate quality is not available, nor are redress mechanisms to adjudicate quality disputes), another might be known for its internal allocation of talent to its best possible uses (in a context where it is difficult for talented youth to locate the best employment opportunity).

Note that these group-level attributes are not necessarily, or even particularly, industry specific. So in a sense, a group might be very ‘focused’, but not on a conventionally defined industry, but on a way of adding value to its constituent firms, for example, by managing talent, or by projecting a credible brand value, and so on. As academics, we were imprisoned by the rhetoric of focus only being applied to ‘industries’, as opposed to along other dimensions as well. That is, we were prisoners of our own mental models.

As I discussed in Dhanaraj and Khanna (2011), academics (Craik 1943; Argyris 1991) have known that such mental models powerfully condition how we analyze complex situations (Gentner and Stevens 1983). Peter Senge (1991) describes these as “deeply held internal images of how the world works, images that limit us to familiar ways of thinking and acting” and says that often, “we are not consciously aware of our mental models or the effects they have on our behavior.” If the models are obsolete, so will be the derived action (Gavetti 2012). So what is an appropriate mental model for emerging markets?

3 Institutional Voids

Our answer started with taking the two words in the phrase ‘emerging markets’ seriously. Markets are simply institutional arrangements that allow buyers and sellers to come together. The ‘emerging’ refers to the incompleteness of such arrangements.

Over time, and inductively, we developed a taxonomy of the various impediments to buyers and sellers coming together. These institutional limitations are our ‘voids’. McMillan (2007) points to a related idea when he says that in developed economies, when markets work well, “the market-supporting institutions are almost invisible”, but when markets work poorly—as in most emerging economies—“the absence of institutions is conspicuous”. In turn, of course, our work builds on North’s Nobel Prize winning work on the very nature of institutions—as he put it, the ‘rules of the game’—and of institutional change. This framework, highlighting the pernicious outcomes that obtain in the face of such limitations, has become a staple of our writings and that of several others’ (Khanna and Palepu 1997, 2010).

As an example of a particular kind of specialized intermediation, consider the intellectual property regime in a country needed to bring buyers and sellers of ‘ideas’ together. It consists of the patent laws that define the property rights of the inventor, an elaborate network of patent attorneys, an underlying system of education that supports the creation and maintenance of the property rights, and finally a court and arbitration system that enforces the rights of the patent owner. Along with these formal institutions, the intellectual property regime thrives on a culture of respect for intellectual property by individuals and organizations, aided by a social stigma for counterfeits. Institutions thus serve to create the “rules of the game” that govern the behavior.

Brazil had many, but not all, of the supporting intermediaries needed for the development of intellectual property. My student, Santiago Mingo (2013), pointed out that Brazil had one of the highest rates of science-related PhDs. But these skilled scientists almost exclusively worked in university settings. They did not feel confident that they could build companies with their expertise, since there was no credible way for them to be reliably paid for their intellectual property in the face of uncertain demand. This is where business groups, with access to other cash flow streams could come in. Votorantim, in particular, was able in many instances to provide a credible guarantee of cash flow ‘security’ that allowed scientists to direct their career towards technology-based startups, affiliated with that business group (Mingo 2013). Here, in my parlance, Votorantim filled some of the institutional voids in the market for intellectual property.

It is not just business groups’ actions that have to respond to the institutional context thus. So must all entrepreneurs. Consider India’s iconic dairy cooperative, Amul, ostensibly the world’s largest producer of milk. In the parlance of this essay, Amul has filled a lot of the institutional voids that prevented individual dairy farmers from credibly reaching individual consumers of milk and milk products. To my mind, most importantly, Amul’s brand, perhaps one of India’s most recognized, acts as a guarantor of credibility, reassuring consumers that they will not suffer from milk that has been surreptitiously diluted or, worse, contaminated. Similarly, Smillie’s (2009) recounting of the history of Bangladesh’s BRAC, the world’s biggest NGO, can be interpreted as the progressive and sequential filling of the myriad institutional voids that prevented the rural citizens of a destitute country from finding a market for their myriad (agricultural and animal husbandry) wares.

Multinationals might respond to institutional voids as well. They might alter their business model to adjust to institutional voids. Dusseldorf based Metro Cash and Carry—a sort of Costcos for businesses, offering one-stop wholesaling for retailers, caterers and such with no credit and no delivery services—had to rethink of itself as being in the wholesale-delivery business to similar classes of customers in some Asian countries, partly to adjust to the absence of physical infrastructure that prevented self-carrying away by customers of inventory from the stores. At the same time, its access to its managerial talent pool that had built the cash-and-carry business in several emerging markets in Eastern Europe was a big advantage in markets with inadequate relevant management talent. That is, its internal markets for talent compensated for the poorly functioning external talent markets. Like Votorantim in Brazil, Metro Cash and Carry compensated for such institutional voids in China and India.

Our contribution in working with this framework, detailed most recently in Khanna and Palepu (2010), was to collapse the complexity of missing institutions into an easy-to-assimilate taxonomy of six different classes of institutional voids. Figure 1 reproduces from prior work the typical categories of voids that give rise to intermediary institutions. These voids might exist in markets for outputs (products, services), as well as markets for inputs (labor and capital markets). Being aware of which institutional voids characterize a situation at a point in time can allow managers to form a mental map of exactly how the context differs from others with which they might be familiar, and therefore permit the identification of a meaningful adaptation of strategy and the formulation of a resultant action plan.Footnote 3

A taxonomy of institutional voids (Khanna and Palepu 2010)

This, then, is our candidate mental model for thinking of emerging markets.

4 Conclusion

I summarize my academic adventures thus. There is nothing wrong with the rather powerful ways of reasoning that social scientists working in schools of management have advanced and developed over decades. However, the assumption that the forms of reasoning result in the same conclusions in different contextual settings is logically and empirically suspect.

When I first started publishing in the mid-1990s, using data from India and Chile, these were discounted and rejected as suspect and weird. So it was with bemusement that I came across a recent working paper from some psychologists drawing attention to exactly the same pathology in their field – that of assuming that results from US data automatically applied to the rest of the world (Henrich et al. 2010). As they put it, the US data are WEIRD - Western, Educated, Industrialized, Rich and Democratic societies – and conventionally used US datasets were, by their reckoning, among the least representative populations upon which to base generalizable findings. Academics interested in management principles should exercise similar caution, as my findings over past two decades suggest.

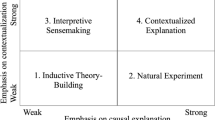

The rise of emerging markets poses interesting challenges and opportunities to researchers—to identify which of our insights about management transfer – and to use the new research environments to identify some fundamental issues more cleanly (Khanna 2014a).

It is not that the mental model is a direct substitute for such contextual intelligence. Far from it. But a robust mental model provides a structure around which knowledge can be systematically transferred. It reduces the familiar behavioral biases that otherwise get in the way of our decision making, e.g. anchoring on familiar findings, and mistaking the rate of change of context.Footnote 4

So far, I have mostly emphasized the need for caution in generalizing what we think we know from one contextual setting to another. But having an appropriate mental model in place through which to study emerging markets has another, perhaps equally interesting, benefit as well to researchers, that of finding newer research settings within which to ask intriguing questions of relevance to all (of course, the admonition of care of generalizability would apply equally to findings from such emerging market settings as well!).

For example, several phenomena have come into relief in India’s recent evolution. The rise of India’s software companies (TCS and Infosys for example)—initially focusing on offshoring and outsourcing of many of the lower end tasks for Western corporations and lately focusing on more value-added services—focused attention on the divisibility of high-end knowledge work, that is, particular knowledge tasks could be partially done in one country, and partially in others. On a very different part of the economic canvas, the continued disenfranchisement of India’s downtrodden—the so-called lower caste members of society—raised an interesting setting within which to examine how social schisms acted as barriers to entrepreneurship (Iyer et al. 2013). Both these issues—global value chain of knowledge work, and social stratification and the locus of economic activity—could of course also be studied in many other settings, but the Indian ones were certainly (perhaps especially) conducive to large scale empirical analysis. In both these cases, I submit that the institutional voids framework allows us to ask relevant and pointed questions. This, after all, is the task of useful cognitive schema. It suggests that academics must, like managers and entrepreneurs, display contextual intelligence in identifying appropriate research settings.

In summary, my contention is two-fold. First, our academic community must expand our academic canvas to encompass more than the usual geographies. Second, we should collectively be cognizant of the extent to which our findings, whatever their origin, have external validity. There is a case to be made for contextual intelligence.

Notes

There are other influential ways of thinking of context. For example frameworks emerging from W. R. Scott’s institutional theories and Hofstede’s ways of thinking about the cultures of different locations come readily to mind. The industries which Porter’s model deals with are amenable to changes over shorter-time horizon than the more immutable constructs of Hofstede or Scott, and are also subject to being influenced by managers, entrepreneurs and policymakers.

Of course, the idea that technology does not wholly determine outcomes is hardly new. The context matters. Concretely (not to play on cement!), the historian Beatty (2003) showed how technology imported into Mexico from the West, as this country pulled ahead economically, had to undergo substantial local adaptation. The fingerprints of the needs for such adaptation are also visible in Comin and Hobijn’s (2010) econometric exploration of diffusion lags for technology adoption, using data over two centuries for fifteen technologies across 166 countries. In their data, on average, countries take 45 years to adopt a technology after it is invented!

It is possible to complicate the model further. Thus, institutional voids are themselves influenced by the openness of society to the outside that might, for example, permit managers to access institutions from outside the emerging market in question. When capital markets are insufficiently developed, one might raise capital, to some extent, in overseas markets. When local patent systems don’t enforce intellectual property rights, one might file for patents in the US or Europe, etcetera. See Dhanaraj and Beamish (2008) and Khanna and Palepu (2010) for such elaborations.

In Khanna (2014a), for example, I discuss how hyperbole surrounding hypercompetition, and a public discussion that is anchored around some contextual changes that have been especially rapid (notably, rise of the internet and mobile telephony) has caused us perhaps to inadvertently generalize and assume a greater rate of change of other constructs that, in fact, change glacially in comparison, for example, social structures, political arrangements, etcetera.

References

Argyris, C. (1991). Teaching smart people how to learn. Harvard Business Review, 69(3), 99–109.

Beatty, E. (2003). Approaches to technology transfer in history and the case of nineteenth century Mexico. Comparative Technology Transfer and Society, 1(2), 167–200.

Caves, R. (1992). Industrial efficiency in six nations. Cambridge: MIT Press.

Comin, D., & Hobijn, B. (2010). An exploration of technology diffusion. American Economic Review, 100(5), 2031–2059.

Craik, K. (1943). The nature of explanation. Cambridge: Cambridge University Press.

Dhanaraj, C., & Beamish, P. W. (2009). Institutional environment and subsidiary survival. Management International Review, 49(3), 291–312.

Dhanaraj, C., & Khanna, T. (2011). Exemplary contribution: transforming mental models on emerging markets. Academy of Management Learning & Education, 10(4), 684–701.

Gavetti, G. (2012). Toward a behavioral theory of strategy. Organization Science, 23(1), 267–285.

Gentner, D., & Stevens, A. L. (1983). Mental models. Hillsdale: Erlbaum.

Ghemawat, P., & Khanna, T. (1998). The nature of diversified business groups: a research design and two case studies. Journal of Industrial Economics, 46(1), 35–61.

Henrich, J., Heine, S. J., & Norenzayan, A. (2010). The weirdest people in the world? Working Paper Series des Rates für Sozial- und Wirtschaftsdaten, No. 139.

Iyer, L., Khanna, T., & Varshney, A. (2013). Caste and entrepreneurship in India. Economic & Political Weekly, 48(6), 52–60.

Khanna, T. (2014a). Contextual intelligence. Harvard Business Review, 92(5), 58–68.

Khanna, T. (2014b). Entrepreneurship in emerging markets: contextual intelligence for the study of two-thirds of the world’s population. In J. J. Boddewyn (Ed.), Multidisciplinary insights from new AIB fellows (Research in Global Strategic Management, Vol. 16, pp. 223–240). Bingley: Emerald Group.

Khanna, T., & Palepu, K. G. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Khanna, T., & Palepu, K. G. (2000). The future of business groups in emerging markets: long-run evidence from Chile. Academy of Management Journal, 43(3), 268–285.

Khanna, T., & Rivkin, J. W. (2001). The structure of profitability around the world. Unpublished manuscript, Harvard Business School.

Khanna, T., & Palepu, K. G. (with R. Bullock) (2010). Winning in emerging markets: a road map for strategy and execution. Boston: Harvard Business Press.

Khanna, T., & Yafeh, Y. (2007). Business groups in emerging markets: paragons or parasites? Journal of Economic Literature, 45(2), 331–372. (Reprinted and adapted as Chapter 20 in A. A. Colplan et al. (Eds.), The Oxford handbook of business groups. Oxford: Oxford University Press, July 2010).

McMillan, J. (2007). Market institutions. In L. Blume & S. Durlauf (Eds.), The new Palgrave dictionary of economics (2nd ed., pp. 24–38). London: Palgrave.

Mingo, S. (2013). Entrepreneurial ventures, institutional voids, and business group affiliation: the case of two Brazilian start-ups, 2002–2009. Academia Revista Latinoamericana de Administración, 26(1), 61–76.

Porter, M. E. (1979). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

Senge, P. M. (1991). The fifth discipline: the art and practice of the learning organization. New York: Doubleday.

Smillie, I. (2009). Freedom from want: the remarkable success story of BRAC, the global grassroots organization that’s winning the fight against poverty. Boulder: Kumarian Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

Invited Perspective

Rights and permissions

About this article

Cite this article

Khanna, T. A Case for Contextual Intelligence. Manag Int Rev 55, 181–190 (2015). https://doi.org/10.1007/s11575-015-0241-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-015-0241-z