Abstract

-

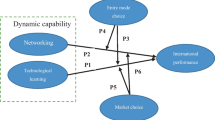

This study uses a dynamic capabilities perspective to illustrate how global configurations of value chain activities are able to contribute to a firm’s capability development through foreign direct investment.

-

Using Taiwanese firms as an empirical sample, we develop testable hypotheses regarding the impact of global configuration in terms of entry timing, entry location, and completeness of value chain activities.

-

Results indicate that foreign investment made by a multinational corporation (MNC) at an earlier time will enable a higher level of technological and manufacturing capability development than that made at a later time. We also find that MNCs are likely to make foreign investment in developed countries for the development of technological and marketing capabilities, and in less developed countries for the development of manufacturing capabilities. In addition, we discover that the more complete an MNC’s value chain configuration is, the higher the level of capability development the MNC is likely to achieve.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Understanding the role of foreign direct investment (FDI) in sustaining competitive advantages has a long history in the international business (IB) literature. Following this stream of research, the traditional perspective generally assumes that firms should possess certain types of proprietary resources to exploit in a host country (e.g., Caves 1971, Hymer 1976). Recently, most studies have recognized that firms invest in a host country not only to exploit existing firm-specific resources, but also to acquire necessary resources (e.g., Chang 1995, Almeida 1996, Shan/Song 1997, Chen/Chen 1998, Frost 2001, Makino/Lau/Yeh 2002). Taking a perspective of dynamic capabilities in international expansion (Luo 2000), exploitative FDI is viewed as the transfer of a firm’s specific advantage across borders (capability exploitation), while explorative FDI is regarded as a means to acquire strategic resources in a host country (capability development). Expanding this line of research, we argue below that the global configuration of value chain activities is able to contribute to a firm’s capability development through FDI. This issue has received much less attention from IB researchers.

Following the dynamic capabilities perspective, firms will try to integrate, build, and reconfigure their internal and external competences to address rapidly changing environments (Teece/Pisano/Shuen 1997). A firm is required to fully utilize existing resources and to develop new capabilities simultaneously. More importantly, a firm’s competitive advantage is resting on distinctive processes, shaped by the firm’s asset positions, and the evolution paths it had adopted (Teece/Pisano/Shuen 1997). Eisenhardt and Martin (2000) conceptualize dynamic capabilities as the firm’s distinctive processes relating to the transformation of resource reconfiguration to cope with environmental change. In summary, the dynamic capabilities perspective has made theoretical contribution by addressing the evolutionary nature of firm resources and capabilities in relation to environmental changes and enabling identification of firm- or industry-specific processes that are critical to firm evolution (Wang/Ahmed 2007). The aim of this study is to examine these distinctive processes involving the transformation of resource reconfiguration and their relation to the global configuration of value chain activities across borders.

We attempt to address the importance of the global configuration of value chain activities through FDI. We theorize and examine the importance of this global configuration of value chain activities and its association with firms’ capability development. Several studies support the argument of dynamic capabilities whereby a firm is enhanced through the integration, building, and reconfiguration of its resources and through continuous learning in the areas of technological capability (Figueiredo 2003), project capability (Brady/Davies 2004), organizational capability (Sako 2004), service capability (Athreye 2005), and integrative capability (Woiceshyn/Daellenbach 2005). Following in the same spirit, we develop three hypotheses regarding the impact on capability development of global configuration in terms of entry timing, entry location, and completeness of value chain activities.

We believe the empirical study we are presenting here is an interesting and valuable one, in that it may help to fill gaps in the general understanding of dynamic capabilities. A sample of Taiwanese firms, studied from 2000 to 2005, is used to conduct this research. Taiwanese multinational firms offer an interesting case for study since Taiwan is poorly endowed with natural resources, and, as such, FDI by Taiwanese multinationals is seen as a means of enlarging their resource pool. In addition to facing natural resource constraints, Taiwanese firms endure higher labor costs than those in less developed countries such as China, and Vietnam, giving rise to a high tendency for offshore manufacturing. Like most developing countries, Taiwan lacks marketing and technology know-how (Hsu/Chen/Jen 2008), therefore firms also have ample motivation to engage in FDI to developed countries in order to make gains in these areas.

This study is organized as follows. In the next section, the current literature and state of theoretical background are discussed, and three hypotheses are formulated. This is followed by descriptions of the methodology and data used in the empirical study. Additionally, a presentation of the results is given. Finally, the study concludes with a discussion of the empirical findings and their implications for future research.

2 Theoretical Background

From a dynamic capability perspective, a firm’s extant resource configuration is regarded as an evolutionary outcome of its past experience and actions with regard to resource accumulation. Eisenhardt and Martin’s (2000) investigation on the nature of dynamic capability demonstrates that dynamic capabilities can be functionally defined by organizational routines, and can also be used to either enhance existing or build new resource configurations in the pursuit of competitive advantages. Based on these considerations, it is evident that a firm’s dynamic capabilities can be analyzed by capturing how the firm manages its process of resource configuration. However, little is known about the nature of resource configuration and to what extent resource configuration affects a firm’s capability development. We theorize and examine this deficit by investigating the characteristics of firms’ global configurations in terms of entry timing, entry location, and completeness of value chain configuration, and determining their impact on capability development.

Capability development is an essential element in the evolutionary development of sustainable advantages, and in creating new bundles of resources. Each of these capabilities is a necessary condition for sustained success in today’s economy, which is characterized by increasing technological advancement and business globalization. The phenomena of industrial deregulation, reduction of trade barriers, increase in buyer bargaining power, and especially technological advancement, may cause a firm to lose a monopolistic position which it may have enjoyed in the past. This is why, today, the continuous development of critical capabilities is more important than ever before.

The importance of development of dynamic capabilities has been demonstrated in the recent IB literature on international expansion research (e.g., Madhok/Osegowitsch 2000, Griffith/Harvey 2001, Luo 2003, Uhlenbruck 2004, Al-Laham/Amburgey 2005, Zhan/Luo 2008). For example, in their survey of the international biotechnology industry, Madhok and Osegowitsch (2000) show that the dynamic capabilities perspective and its variant, the technology accumulation perspective, offer a persuasive explanation of the organizational form and international flows of technology. This study also finds that knowledge acquisition and deployment are essential for inter-firm competition.

Most recent studies of foreign acquisition in transition economies also examine the firm’s dynamic capabilities in international expansion. In his investigation of MNC subsidiaries in China, Luo (2003) found that market-seeking subsidiaries in an emerging market are more likely to perform better when they possess a higher level of local responsiveness and control flexibility. In examining the nature of foreign acquisitions in Central and Eastern Europe, Uhlenbruck (2004) suggested that an MNC’s dynamic capabilities, which build on foreign acquisition and regional business experience, are important to subsidiary development. The above findings confirm a key notion in the dynamic capabilities perspective, which holds that an MNCs’ dynamic capabilities, specifically those building on market opportunity identification and country-specific resource acquisition, are critical to international expansion.

In a similar line of research, FDI has been viewed as a preferred way of organizing such international expansion (e.g., Madhok/Osegowitsch 2000, Song 2002, Andersson/Forsgren/Holm 2002). More recently, Song (2002) studied Japanese electronic firms’ FDI in East Asia from 1988 to 1994 and found that sequential FDI can be viewed as a firm-specific evolutionary process and that such sequential FDI decisions may serve as a platform for future upgrading of activities. Additionally, in their study of international plant configuration strategies, Belderbos and Sleuwaegen (2005) found that location characteristics, as well as firm and industry competitive drivers, have a strong impact on choices regarding specific spatial configuration of plants. From an empirical study in Poland, Hungary and Slovenia, Fahy and his colleagues (2003) found that foreign investment was found to significantly impact on resource accumulation with implications for the development of strategic capabilities and competitive advantage.

In short, the dynamic capabilities perspective highlights the need for firms to build the kinds of resource configuration that provide sustainable advantages in the marketplace. The MNCs that intend to build dynamic capabilities through FDI therefore have a natural incentive to implement a global configuration, which has the effect of pushing multinational firms to configure and coordinate value chain activities on a global basis.

3 Hypotheses Development

In this section, we develop testable hypotheses regarding how firms may have used foreign direct investment to reconfigure their value chain activities and support capability development. Our hypotheses focus specifically on entry timing, entry location, and completeness of value chain configuration.

3.1 Entry Timing and Capability Development

Luo (1998) argued that the importance of timing in affecting FDI decisions is as significant as that of internalization, ownership, or location factors. The global configuration of an MNC’s foreign subsidiaries is crucial to the creation of value in the global marketplace, and is particularly important for firms intending to internationalize their operations. However, research on the timing of global configuration has received little attention in the field of international business research (Rivoli/Salorio 1996). There is, on the other hand, a substantial body of literature on the effects of entry timing on firm performance. The prevalent view is that early movers enjoy enduring advantages over late entrants (e.g., Caves/Porter 1977, Lambkin 1988, Mitchell 1991, Robinson/Fornell/Sullivan 1992). De Castro and Chrisman (1995) highlight economic, preemptive, technological, and behavioral factors as important determinants of early-mover advantages. Such advantages are explored in the market entry literature which suggests that foreign operations that were established at an earlier time perform better than those that were established consequently (e.g., Luo 1998, Pan/Chi 1999).

While early entry may allow firms to capture first-mover advantages, we also need to understand the rationale for the relationship between entry timing and capability development. Firstly, the longer period of time early movers enjoy in a market allows them to benefit from not only the accumulation of knowledge about a local market (Kogut/Zander 1993), but also from the acquisition of superior resources and capabilities (Fuentelsaz/Gomez/Polo 2002). Early movers often enjoy preemptive resources and can limit or prevent later entrants from gaining access to local customers and markets (De Castro/Chrisman 1995, Pan/Li/Tse 1999). Secondly, early movers can regard initial FDI as a platform for obtaining rights to future opportunities (Kogut/Kulatilaka 1994). Under such circumstances, early movers would be able to take advantage of preemptive opportunities to develop capabilities for foreign operations. Thus, we would expect that early movers are more likely to achieve enhanced capabilities than later entrants. Thus we have the following hypothesis:

Hypothesis 1: The earlier an MNC enters a foreign market compared to their competitors, the higher the level of capability development they are likely to achieve.

3.2 Entry Location and Capability Development

In addition to entry timing, the location choice of foreign investment is another fundamental decision for a firm to make. Prior research indicated that the most recognized reason for firms to conduct FDI is that they possess unique capabilities that can be deployed abroad (Chung/Alcacer 2002). Therefore, through FDI, firms are seen to obtain the highest possible value by keeping their firm-specific capabilities internal to the firm. However, several recent studies suggest that firms expand abroad in search of capabilities that are not available in their home country (e.g., Cantwell 1989, Kogut/Zander 1992, Chang 1995). Cantwell (1989) pointed out that location-specific factors determine the differences in technology across different foreign locations. As a consequence, firms may enhance their existing capabilities by international expansion to access new knowledge or technology, behavior known as “technology seeking” (Cantwell 1989, Chung/Alcacer 2002) or “knowledge sourcing” (Almeida 1996). MNCs are recognized not only as capability exploiters, but also as capability explorers in international expansion (Madhok 1997).

Most empirical studies of knowledge seeking as a motive for international expansion shows that firms sometimes invest in developed countries to access new technologies. For example, Kogut and Chang (1991) examined Japanese FDI in the U.S. and found that Japanese firms tended to form joint ventures with U.S. firms to acquire new technological knowledge. Chang (1995) investigated Japanese sequential FDI in the U.S. during the period 1976 to 1989 and indicated that such sequential entry enabled Japanese firms to develop their capabilities. More recently, a number of other studies have also examined inward FDI by foreign firms in the U.S. and note that these firms have engaged in knowledge seeking FDI (e.g., Kuemmerle 1999, Serapio/Dalton 1999, Chung/Alcacer 2002).

Firms may also seek resources in less developed countries, though typically the motivation is different. For example, Makino and his colleagues (2002) found that Newly Industrializing Economy (NIE) firms tended to invest in less developed countries (LDCs) when they had efficiency-seeking motivations and developed countries (DCs) when they had strategic asset-seeking and market-seeking motivations. Resource linkages created for either purpose can enhance capability development and affect profitability, just as Chung and Alcacer proposed (2002), by stating that knowledge seeking firms tend to locate close to their source of knowledge to maximize their profitability. After studying trends in the flow of FDI, Sethi et al. (2003) argued that US MNEs are making increasing FDI into developing countries in order to benefit from increased efficiency achieved through decreased production costs and economies of scale (Chen/Chen/Ku 2004). Thus, we expect firms with emphases on technology and marketing capability development to be more attracted to locations with advanced technology and market access, and firms with an emphasis on manufacturing capability development to be more attracted to locations where a higher efficiency of operations can be achieved. Thus we can construct the following hypotheses:

Hypothesis 2a: Firms seeking to enhance technological capabilities through foreign investment in R&D activities are more likely to direct their investment towards developed countries.

Hypothesis 2b: Firms seeking to enhance manufacturing capabilities through foreign investment in manufacturing activities are more likely to direct their investment towards less developed countries.

Hypothesis 2c: Firms seeking to enhance marketing capabilities through foreign investment in marketing activities are more likely to direct their investment towards developed countries.

3.3 Value Chain Activity and Capability Development

As Dunning (1981) points out, MNCs globally expand their operations to gain advantages in ownership, location, and internalization. To ensure worldwide success, MNCs have to configure their value chain activities across borders (Porter 1986). MNCs can gain transactional competitive advantage by achieving geographic dispersion of various value chain activities on the one hand, and location expansion of each of the value chain activities on the other. Here, great importance is to be attached to the location-specific advantages that result from advanced technology, higher efficiency of operations, and higher market demand. Hence, a real concern for MNCs is how does the pattern of value chain activities affect the capability development of the firm?

A number of researchers have examined how particular value chain activities are configured across national borders. Existing empirical studies can be grouped into three categories involving investigations into the configuration of: R&D activities (e.g., Archibugi/Iammarino 2002, Fisch 2003), manufacturing activities (DuBois/Toyne/Oliff 1993, Pontrandolfo/Okogbaa 1999), and marketing activities (Zou/Cavusgil 2002, Lim/Acito/Rusetski 2006). Several other studies have focused on the impact of the entire configuration of value chain activities as a whole (e.g., Roth 1992, Kim/Park/Prescott 2003, Holtbrugge 2005, Asmussen/Pedersen/Petersen 2007). For example, using U.S. integrated global manufacturing industries as an empirical setting, Kim and his colleagues (2003) found that effective global configuration of value chain activity has a positive impact on business performance. Holtbrugge (2005) studied 66 foreign subsidiaries of large German MNCs and indicated that German MNCs possessed a 70 percent degree of completeness of value chain activity and brought to light the significant impact of the use of coordination mechanisms in MNCs. Recently, in order to ascertain a degree of firm globalization, Asmussen and his colleagues (2007) introduced a global specialization index to measure how firms configure their global value chains. They found that global specialization, which refers to MNCs relocating value chain activities in globally specialized units to exploit location-specific advantages, measures a different dimension of internationalization to that of previous investigations. This index highlights the extent of MNCs’ global value chain configuration and further explores inherent advantages of internationalization (e.g., Kogut 1985, Yip 1989).

Each value chain activity has different characteristics, operational requirements, and performance implications for international expansion (Porter 1986). In order to arbitrage comparative advantages among countries, however, MNCs should locate each value chain activity according to unique local resources. We therefore cannot explore this issue without asking to what extent an MNCs’ value chain activities are truly globally configured. From the above interpretation, we can expect that firms will enhance their existing capabilities by completely configuring the three respective value chain activities (R&D, marketing and manufacturing) worldwide. Thus we have the following hypothesis:

Hypothesis 3: The more complete an MNC’s value chain configuration is, the higher the level of capability development the MNC is likely to achieve.

4 Method

4.1 Data Collection and Sample

In order to test the hypotheses posed above, the raw data for this paper was taken from a secondary data collection conducted by the authors that targeted Taiwanese high-tech firms with FDI experience. The sample list was drawn from the companies listed in the Electronics and Information Technologies (EIT) category on the Taiwan Stock Exchange (TSE). As of 2004, 466 firms were listed in this category. 213 firms were excluded due to incomplete data in foreign investment, making for a final sample size of 253 firms. FDI data for the TSE-listed high-tech firms were collected primarily from year-end annual reports. In addition, some financial data was collected from the Taiwan Economic Journal (TEJ) Data Bank, a reputable data bank similar to the internationally recognized Compustat database. To include information from all 253 companies, the time frame for investigating firms covered the six years from 2000 to 2005.

4.2 Regression Model Specification

This study specified an empirical model to incorporate the hypothesized determinants of an MNC’s capability development for the purposes of empirical testing, as shown in the following equation:

Capability Development i,t = α + Xi,tβ + εi,t

Where i indicates the individual number of the firm taken from our sample and t represents the year investigated, Capability Development I,t represents the firm-level capability development of the parent company i in the year t, and εit is the disturbance term. The Xi,t term is a vector of the independent variables (entry timing, location choice, and completeness of value-chain activities) and control variables. We introduced a one-year lag into our independent variables to assess how the explanatory variables in year t-1 impacted the focal firm’s capabilities development in year t. The subscripts indicate time lags within the theoretical variables and are used here to point out concerns regarding potential retardation effects in cross-sectional models.

From the model specification, we tested our hypotheses with random-effects models to ensure that error due to serial correlation in our panel data set was specified and analyzed (Erez/Bloom/Wells 1996). In this study, we had three different dependent variables to proxy the MNC’s capability development, including technological, manufacturing, and marketing capabilities. This study operationalizes an MNC’s technological capability development as a count variable of each firm’s patent number. Random-effects negative binomial regression was used to estimate the coefficients for all explanatory variables in a model where technological capability development is regarded as a dependent variable. Such a negative binomial regression method overcomes distribution problems and over-dispersion for our panel data (e.g., Frome/Kutner/Beauchamp 1973). Moreover, this study measures an MNC’s manufacturing and marketing capability development as a censored outcome variable. Therefore, the random-effects generalized least squares (GLS) regression is appropriate for coefficient estimation.

4.3 Variables and Measurements

4.3.1 Dependent Variables

Technological Capability

Technological capability of an MNC is measured by a count of the number of times a patent has been cited in particular year. As Stuart (1999) indicated, the quality of a patent can be measured by how often others cite it. Similarly, there are several examples of recent studies which offer empirical support and conclude that highly cited patents not only represent the focal firm’s technological innovations, but also serve as a good proxy for its quality (e. g. Gittelman/Kogut 2003, Phene/Almeida 2008, Song/Shin 2008). A patent citation allows researchers to trace the technology development over time by providing a record of the patent base upon which existing patents have been developed (Coombs/Bierly III 2006). Along this logic, this study expects that firms with greater technological capability will exhibit greater patent citation.

Manufacturing Capability

Manufacturing capability of an MNC is calculated by the number of countries in which a firm had foreign manufacturing subsidiaries divided by the total amount of countries in which a firm had foreign investment in a given year (Lu/Beamish 2004, Chung/Lu/Beamish 2008). This refers to the degree of manufacturing capability mainly at the output stage. The main reason a firm scales up its businesses is to economize on costs of operation. Therefore, a high number of countries in which a firm had foreign manufacturing subsidiaries therefore reflects a high degree of manufacturing capability.

Marketing Capability

The last dependent variable is marketing capability. This variable is calculated by taking 1 minus the sum of the squared sales percentage of each external sale region or country, thereby providing an evaluation of the MNC’s market diversity. The concept is similar to the Hirschman-Herfindahl index used for measuring market concentration. It stands to reason that a firm that develops marketing capabilities by formulating relevant adaptive marketing strategies will be able to create customer value and generate good profits globally. Recent studies have suggested that firms possessing an extensive amount of intangible assets (e. g. marketing capability) tend to succeed in their international business expansion if the global market is not saturated with global players (Mitchell/Shaver/Yeung 1993, Morck/Yeung 1991). Thus, it is reasonable for one to expect that an MNC with a high level of market diversity most certainly faces a high degree of diversity in the various market structures it services, and therefore this reflects the high level of marketing capability of that firm.

4.3.2 Independent Variables

Building on the dynamic capabilities perspective, this study will focus on the effects of global configuration at the functional level with regard to capabilities development of a parent company.

Entry Timing

Each MNC’s entry timing was measured according to the number of years of investment history the firm had in its host country. Entry timing values were measured for three different categories; R&D activity, manufacturing activity, and marketing activity. Thus, the greater the number of years, or higher the entry timing value, the earlier the resource configuration had been employed by an MNC in a particular value chain activity.

Entry Location

In order to capture each firm’s arrangement of value chain activities around the world, we classify countries in North America, Western Europe, Northeast Asia, Australia, and New Zealand as comprising the DC category, and countries in Central America, South America, ASEAN countries, and Africa as members of the LDC category. For entry location of R&D subsidiaries and marketing subsidiaries, we calculate the number of R&D and marketing subsidiaries each firm had in DC countries. In contrast, for manufacturing subsidiaries, we calculate the number of manufacturing subsidiaries each firm had in LDC countries.

Completeness of Value Chain Configuration

In order to calculate a value of each firm’s completeness of global value chain configuration, we take the number of value chain activities a firm had around the world in a given year divided by the three different kinds of value chain activities. The measure of variable ranges from zero to one, with one representing the highest level of completeness in global value chain configuration.

4.3.3 Control Variables

Five firm-level control variable sources are specified because of their potential impact on an MNC’s capability development. First, as suggested by many studies investigating firm performance (Ravenscraft 1983), this study includes a firm size variable, measured as the natural logarithm of the number of employees in the sample firm. Second, firm age, calculated by measuring the number of years since parent firm foundation, indicates the level of an MNC’s experience in capability development. Third, R & D intensity, calculated by taking the amount of research and development expenditures as a percentage of a firm’s total sales revenue, indicates the level of an MNC’s efforts in technological capability building. Fourth, advertising intensity, calculated by taking the amount of advertising and promotion expenditures as a percentage of a firm’s total sales revenue, indicates the level of an MNC’s efforts in marketing capability building. Finally, we also control the level of a firm’s capability development with a one year lag. The organizational learning literature has emphasized the experiential nature of innovation and suggested that an organization’s past (development experience) may influence its future capability development (Mezias/Glynn 1993). Specifically, we lagged all of these control variables to control for the influence the variable might have on a firm’s capability development in the following year and also to help control for correlated error terms in our panel data (Young/Smith/Grimm 1996).

5 Empirical Results

Table 1 provides descriptive statistics and a correlation matrix for all variables involved in this study. For entry timing, Taiwanese firms deployed marketing activity earlier than R&D and manufacturing activities in global configuration. As evidenced by these statistics, the sample firms prefer to make FDI in LDCs, especially China. As Luo’s (2003) investigation suggests, China today is still the largest emerging market and fastest growing economy in the world. These firms invested 3 percent of their revenue in R&D activities, and almost 4 percent of their revenue in advertising and promotional activities.

The regression results, using technological capability, manufacturing capability, and marketing capability as separate dependent variables, are given in Tables 2, 3, and 4 respectively. Model 1 is the baseline model and Models 2, 3 and 4 incorporate the effects of entry timing, entry location, and completeness of value chain activities, respectively. Model 5 represents a comprehensive model with all the variables. The Wald statistic suggests that the addition of our independent variables contributes to increased explanatory power (for example, in Table 2, the Wald statistic increases from 201.52 in Model 1 to 354.22 in Model 5). In addition, the problem of multicollinearity is checked by testing the VIF values of all independent and control variables in one model. The test results (1.27-1.56) suggest the absence of multicollinearity.

Hypothesis 1 stated that foreign investments made by an MNC at an earlier time would give rise to a higher level of capability development than those starting at a later time. Looking at Model 2 in Tables 2 and 3, our findings indicate that foreign investment in manufacturing and R&D made by Taiwanese firms at an earlier time enabled a higher level of technological capability and manufacturing capability development than that made at a later time. This evidence can also be found in Table 4 which indicates that early entry timing of marketing subsidiaries carries a positive impact on marketing capability development, but not at a statistically significant level. Hypothesis 1 is therefore partially supported.

In Hypothesis 2, we proposed that firms are more likely to engage in FDI through R&D and marketing activities in developed countries in order to further develop technological and marketing capabilities, while the FDI made by those firms seeking to enhance manufacturing capability development is more likely to be directed to less developed countries in the form of manufacturing activities. The results of Model 3 in Tables 2, 3, and 4, indicate that a positive relationship exists between a firm’s entry location and its capability development, and this is at a statistically significant level. Hypotheses 2a, 2b, and 2c are thus fully supported in our empirical model.

In Hypothesis 3, we suggested that the completeness of a firm’s value chain configuration will be positively associated with its capability development. Our findings for Model 4 in Tables 2, 3, and 4, indicate that a positive relationship does in fact exist between the completeness of a firm’s value chain configuration and its capability development, and this is at a statistically significant level. Hence, Hypothesis 3 is fully supported by our empirical model.

6 Discussion and Conclusions

6.1 Theoretical and Managerial Implications

This research offers dynamic insight into MNC capability development by investigating the global configuration of value chain activities. We present readers with three distinct findings from this study, based on an empirical study of Taiwanese firms. Our first finding relates to the effect of entry timing on capability development. To our best knowledge, this is the first time that entry timing has been studied in the context of global configuration of value chain activities. We confirm the advantage of being an early mover into a foreign market by showing that when it comes to FDI, earlier execution leads to higher levels of capability development. Our findings offer a different perspective to the many previous studies on entry timing, which tend to focus on profitability and performance. This paper contributes to a better understanding of the impact of entry timing on capability development.

Secondly, our study indicates that firms are more likely to direct FDI – in the form of R&D and marketing activities – to developed countries in order to achieve further development of technological and marketing capabilities, while firms seeking further development in manufacturing capability are more likely to engage in FDI – in the form of manufacturing activities – in less developed countries. It is possible that higher levels of capability development come from country-specific factors in host countries. Our evidence shows that a firm’s choice of location is influenced significantly by the firm’s value chain activities.

Finally, one of the key findings in our investigation is that the completeness of a firm’s value chain configuration and capability development share a positive relationship at a statistically significant level. This evidence provides a relevant answer for the question of why MNCs are motivated to invest around the world. In supporting capability development, MNCs have to gain access to complementary country-specific assets in different host countries.

In terms of theory, we believe this study may contribute to the body of research on the dynamic capabilities of MNCs. Prior investigations explore the motives of FDI from diverse perspectives, and this study extends the literature by introducing another theoretical angle, dynamic capability.

Important practical implications for managers arise when one takes into account the finding that capability development of an MNC is dependent on it managing its global configuration of value chain activities in a synergistic manner. Firstly, the global configuration of an MNC, particularly with complex forms of value chain activities, must be addressed by the MNC manager. Regarding this issue, it is important to take into account that MNCs must identify distinctive resources, particularly those which are located in the host countries, to facilitate global configuration. Second, the MNC’s dynamic capabilities, specifically those building on global configuration and deployment of value chain activities through making FDI, are important to capability development. Overall, this study provides a unique contribution in terms of both theoretical development and managerial implications by investigating the relationship between FDI and capability development, as well as integrating the three value chain activities (manufacturing, R&D, and marketing) with the aspects of global configuration (entry timing, entry location, and completeness of value chain activities) into a single model under the framework of dynamic capabilities.

6.2 Limitations and Future Research

We would like to acknowledge the inherent limitations of some measurements due to the exploratory nature of this research design. The first point of note is that the measurement used to determine a firm’s efforts in maximizing its manufacturing capability was based upon the number of countries in which a firm had foreign manufacturing subsidiaries divided by the total amount of countries in which the firm had foreign investment in a given year. But due to the fact that the firms comprising the Information Technology industry in Taiwan are characterized by higher geographic scope together with higher contractual manufacturing ratios for OEM suppliers, especially for firms with a high degree of internationalization, the present study may not capture the real manufacturing capability within this context of geographic expansion.

Secondly, we would like to mention that we draw on the use of the dynamic capabilities approach as well as an empirical test of the extent of global configuration and its impact on a firm’s capability development. However, we endure a limitation in that the findings of this study are based on the parent firm perspective. It is noticeable that IB researchers have evolved away from their traditional interest in location choice and entry mode selection, and have recently focused on the co-evolution between a parent company and its overseas subsidiaries (e.g., Birkinshaw 1996, Birkinshaw/Hood 1998, Hewett/Roth/Roth 2003). As Birkinshaw (1996) proposed, subsidiary growth in the MNC is powered by a subsidiary’s distinctive capabilities and the effectiveness of a mandate built on those capabilities. For this reason, future research may employ data collected from foreign subsidiaries. The dynamic co-evolution between parent company and foreign subsidiary is worth exploring in future research.

Finally, this research may also suffer from all the limitations usually associated with single-country and single-industry category analysis. Since multinational expansion is a dominant strategy of operation in many industries, such as the textile, chemical, and shoemaking industries, future research may extend application of our conceptualization to other industries. Looking closely at industry heterogeneity may provide more insights regarding a variety of different degrees of global configuration and capability development within the context of multinational corporations. In other words, future research that applies the current logic to other industries may prove to be fruitful in identifying both opportunities and constraints for FDI research, and this will no doubt have significant implications for a firm’s strategy formulation.

References

Al-Laham, A./Amburgey, T. L., Knowledge Sourcing in Foreign Direct Investments: An Empirical Examination of Target Profiles, Management International Review, 45, 3, 2005, pp. 247–275.

Almeida, P., Knowledges Sourcing by Foreign Multinationals: Patent Citation Analysis in the U.S. Semiconductor Industry, Strategic Management Journal, 17, Winter, 1996, pp. 155–165.

Andersson, U./Forsgren, M./Holm, U., The Strategic Impact of External Networks: Subsidiary Performance and Competence Development in the Multinational Corporation, Strategic Management Journal, 23, 11, 2002, pp. 979–996.

Archibugi, D./Iammarino, S., The Globalization of Technological Innovation: Definition and Evidence, Review of International Political Economy, 9, 1, 2002, pp. 98–122.

Asmussen, C. G./Pedersen, T./Petersen, B., How Do We Capture “Global Specialization” when Measuring Firm’s Degree of Globalization?, Management International Review, 47, 6, 2007, pp. 791–813.

Athreye, S. S., The Indian Software Industry and Its Evolving Service Capability, Industrial and Corporate Change, 14, 3, 2005, pp. 393–418.

Belderbos, R./Sleuwaegen, L., Competitive Drivers and International Plant Configuration Strategies: A Product-level Test, Strategic Management Journal, 26, 6, 2005, pp. 577–593.

Birkinshaw, J., How Multination Subsidiary Mandates Are Gained and Lost, Journal of International Business Studies, 27, 3, 1996, pp. 467–495.

Birkinshaw, J./Hood, N., Multinational Subsidiary Evolution: Capability and Charter Change in Foreign-owned Subsidiary Companies, Academy of Management Review, 23, 4, 1998, pp. 773–795.

Brady, T./Davies, A., Building Project Capabilities: From Exploratory to Exploitative Learning, Organization Studies, 25, 9, 2004, pp. 1601–1621.

Cantwell, J., Technological Innovation and Multinational Corporations, Oxford, United Kingdom: Basil Blackwell 1989.

Caves, R. E., International Corporations: The Industrial Economics of Foreign Investment, Economica, 38, 149, 1971, pp. 1–27.

Caves, R. E./Porter, M. E., From Entry Barriers to Mobility Barriers: Conjectural Decisions and Contrived Deterrence to New Competition, Quarterly Journal of Economics, 91, 2, 1977, pp. 241–262.

Chang, S.-J., International Expansion Strategy of Japanese Firms: Capability Building through Sequential Entry, Academy of Management Journal, 38, 2, 1995, pp. 383–407.

Chen, H./Chen, T.-J., Network Linkage and Location Choice in Foreign Direct Investment, Journal of International Business Studies, 29, 3, 1998, pp. 445–467.

Chen, T.-J./Chen, H./Ku, Y. H., Foreign Direct Investment and Local Linkages, Journal of International Business Studies, 35, 4, 2004, pp. 320–333.

Chung, W./Alcacer, J., Knowledge Seeking and Location Choice of Foreign Direct Investment in the United States, Management Science, 48, 12, 2002, pp. 1534–1554.

Chung, C. C./Lu, J. W./Beamish, P. W., Multinational Networks During Times of Economic Crisis versus Stability, Management International Review, 48, 3, 2008, pp. 279–295.

Coombs, J. E./Bierly III, P. E., Measuring Technological Capability and Performance, R&D Management, 36, 4, 2006, pp. 421–438.

De Castro, J. O./Chrisman, J. J., Order of Market Entry, Competitive Strategy, and Financial Performance, Journal of Business Research, 33, 2, 1995, pp. 165–177.

DuBois, F./Toyne, B./Oliff, M. D., International Manufacturing Strategies of US Multinationals: A Conceptual Framework Based on a Four Industry Study, Journal of International Business Studies, 24, 2, 1993, pp. 307–333.

Dunning, J. H., International Production and the Multinational Enterprise, London: George Allen and Unwin 1981.

Eisenhardt, K. M./Martin, J. A., Dynamic Capabilities: What Are They?, Strategic Management Journal, 21, 10/11, 2000, pp. 1105–1121.

Erez, A./Bloom, M. C./Wells, M. T., Using Random rather than Fixed Effects Models in Meta-analysis: Implications for Situational Specificity and Validity Generalization, Personnel Psychology, 49, 2, 1996, pp. 275–306.

Fahy, J. et al., Privatisation and Sustainable Competitive Advantage in the Emerging Economies of Central Europe, Management International Review, 43, 4, 2003, pp. 407–428.

Figueiredo, P. N., Learning, Capability Accumulation and Firms Differences: Evidence from Latecomer Steel, Industrial and Corporate Change, 12, 3, 2003, pp. 607–643.

Fisch, J. H., Optimal Dispersion of R&D Activities in Multinational Corporations with a Genetic Algorithm, Research Policy, 32, 8, 2003, pp. 1381–1396.

Frome, E. L./Kutner, M. H./Beauchamp, J. J., Regression Analysis of Poisson-distributed Data, Journal of American Statistical Association, 68, 344, 1973, pp. 935–940.

Frost, T. S., The Geographic Sources of Foreign Subsidiaries’ Innovations, Strategic Management Journal, 22, 2, 2001, pp. 101–123.

Fuentelsaz, L./Gomez, J./Polo, Y., Followers’ Entry Timing: Evidence from the Spanish Banking Sector after Deregulation, Strategic Management Journal, 23, 3, 2002, pp. 245–264.

Gittelman, M./Kogut, B., Does Good Science Lead to Valuable Knowledge? Biotechnology Firms and the Evolutionary Logic of Patent Citations, Management Science, 49, 4, 2003, pp. 366–395.

Griffith, D. A./Harvey, M. G., A Resource Perspective of Global Dynamic Capabilities, Journal of International Business Studies, 32, 3, 2001, pp. 597–606.

Hewett, K./Roth, M. S./Roth, K., Conditions Influencing Headquarters and Foreign Subsidiary Roles in Marketing Activities and Their Effects on Performance, Journal of International Business Studies, 34, 6, 2003, pp. 567–585.

Holtbrügge, D., Configuration and Co-ordination of Value Activities in German Multinational Corporations, European Management Journal, 23, 5, 2005, pp. 564–575.

Hsu, C. W./Chen, H./Jen, L., Resource Linkages and Capability Development, Industrial Marketing Management, 37, 6, 2008, pp. 677–685.

Hymer, S. H., The International Operations of National Firms: A Study of Direct Foreign Investment, Cambridge, Massachusetts: MIT Press 1976.

Kim, K./Park, J.-H./Prescott, J. E., The Global Integration of Business Functions: A Study of Multinational Businesses in Integrated Global Industries, Journal of International Business Studies, 34, 4, 2003, pp. 327–344.

Kogut, B., Designing Global Strategies: Comparative and Competitive Value-added Chains, Sloan Management Review, 26, 4, 1985, pp. 15–28.

Kogut, B./Chang, S.-J., Technological Capabilities and Japanese Foreign Direct Investment in the United States, Review of Economics and Statistics, 73, 3, 1991, pp. 401–413.

Kogut, B./Kulatilaka, N., Operating Flexibility, Global Manufacturing, and the Option Value of a Multinational Network, Management Science, 40, 1, 1994, pp. 123–139.

Kogut, B./Zander, U., Knowledge of the Firm, Combinative Capabilities, and the Replication of Technology, Organization Science, 3, 3, 1992, pp. 383–397.

Kogut, B./Zander, U., Knowledge of the Firm and the Evolutionary Theory of the Multinational Corporation, Journal of International Business Studies, 24, 4, 1993, pp. 625–645.

Kuemmerle, W., The Drivers of Foreign Direct Investment into Research and Development: An Empirical Investigation, Journal of International Business Studies, 30, 1, 1999, pp. 1–24.

Lambkin, M., Order of Entry and Performance in New Market, Strategic Management Journal, 9, Summer, 1988, pp. 127–140.

Lim, L. K. S./Acito, F./Rusetski, A., Development of Archetypes of International Marketing Strategy, Journal of International Business Studies, 37, 4, 2006, pp. 499–524.

Lu, J./Beamish, P., International Diversification and Firm Performance: An S-curve Hypothesis, Academy of Management Journal, 47, 4, 2004, pp. 598–609.

Luo, Y., Timing of Investment and International Expansion Performance in China, Journal of International Business Studies, 29, 2, 1998, pp. 391–408.

Luo, Y., Dynamic Capabilities in International Expansion, Journal of World Business, 35, 4, 2000, pp. 355–378.

Luo, Y., Market-seeking MNEs in an Emerging Market: How Parent-subsidiary Links Shape Overseas Success, Journal of International Business Studies, 34, 3, 2003, pp. 290–309.

Madhok, A., Cost, Value and Foreign Market Entry Mode: The Transaction and the Firm, Strategic Management Journal, 18, 1, 1997, pp. 39–61.

Madhok, A./Osegowitsch, T., The International Biotechnology Industry: A Dynamic Capabilities Perspective, Journal of International Business Studies, 31, 2, 2000, pp. 325–335.

Makino, S./Lau, C. M./Yeh, R. S., Asset Exploitation versus Asset Seeking: Implications for Location Choice of Foreign Direct Investment, Journal of International Business Studies, 33, 3, 2002, pp. 403–421.

Mezias, S. J./Glynn, M. A., The Three Faces of Corporate Renewal: Institution, Revolution, and Evolution, Strategic Management Journal, 14, 2, 1993, pp. 77–161.

Mitchell, W., Dual Clocks: Entry Order Influences on Incumbent and Newcomer Market Share and Survival when Specialized Assets Retain their Value, Strategic Management Journal, 12, 2, 1991, pp. 85–100.

Mitchell, W./Shaver, J. M./Yeung, B., Performance Following Changes of International Presence in Domestic and Transition Industries, Journal of International Business Studies, 24, 4, 1993, pp. 647–669.

Morck, R./Yeung, B., Why Investors Value Multinationality?, Journal of Business, 64, 2, 1991, pp. 165–187.

Pan, Y./Chi, S. K., Financial Performance and Survival of Multinational Corporations in China, Strategic Management Journal, 20, 4, 1999, pp. 359–374.

Pan, Y./Li, S./Tse, D. K., The Impact of Order and Mode of Market Entry on Profitability and Market Share, Journal of International Business Studies, 30, 1, 1999, pp. 81–104.

Phene, A./Almeida, P., Innovation in Multinational Subsidiaries: The Role of Knowledge Assimilation and Subsidiary Capabilities, Journal of International Business Studies, 39, 5, 2008, pp. 901–919.

Pontrandolfo, P./Okogbaa, O. G., Global Manufacturing: A Review and Framework for Planning in a Global Corporation, International Journal of Production Research, 37, 1, 1999, pp. 1–19.

Porter, M. E., Changing Patterns of International Competition, California Management Review, 28, 2, 1986, pp. 9–40.

Ravenscraft, D. J., Structure-profit Relationships at the Line of Business and Industry Level, Review of Economics and Statistics, 65, 1, 1983, pp. 22–31.

Rivoli, P./Salorio, E., Foreign Direct Investment and Investment Under Uncertainty, Journal of International Business Studies, 27, 2, 1996, pp. 335–358.

Robinson, W. T./Fornell, C./Sullivan, M., Are Market Pioneers Intrinsically Stronger than later Entrants?, Strategic Management Journal, 13, 8, 1992, pp. 609–624.

Roth, K., International Configuration and Coordination Archetypes for Medium-sized Firms in Global Industries, Journal of International Business Studies, 23, 3, 1992, pp. 533–549.

Sako, M., Supplier Development at Honda, Nissan, and Toyota: Comparative Case Studies of Organizational Capability Enhancement, Industrial and Corporate Change, 13, 2, 2004, pp. 281–308.

Serapio, M./Dalton, D., Globalization of Industrial R&D: An Examination of Foreign Direct Investment in R&D in the United States, Research Policy, 28, 2/3, 1999, pp. 303–316.

Sethi, D. et al., Trends in Foreign Direct Investment Flows: A Theoretical and Empirical Analysis, Journal of International Business Studies, 34, 4, 2003, pp. 315–326.

Shan, W./Song, J., Foreign Direct Investment and the Sourcing of Technological Advantage: Evidence from the Biotechnology Industry, Journal of International Business Studies, 28, 2, 1997, pp. 267–284.

Song, J., Firm Capabilities and Technology Ladders: Sequential Foreign Direct Investments of Japanese Electronics Firms in East Asia, Strategic Management Journal, 23, 3, 2002, pp. 191–210.

Song, J./Shin, J., The Paradox of Technological Capabilities: A Study of Knowledge Sourcing From Host Countries of Overseas R&D Operations, Journal of International Business Studies, 39, 2, 2008, pp. 291–303.

Stuart, T. E., A Structural Perspective on Organizational Innovation, Industrial and Corporate Change, 8, 4, 1999, pp. 745–775.

Teece, D. J./Pisano, G./Shuen, A., Dynamic Capabilities and Strategic Management, Strategic Management Journal, 18, 7, 1997, pp. 509–533.

Uhlenbruck, K., Developing Acquired Foreign Subsidiaries: The Experience of MNEs in Transition Economies, Journal of International Business Studies, 35, 2, 2004, pp. 109–123.

Wang, C. L./Ahmed, P. K., Dynamic Capabilities: A Review and Research Agenda, International Journal of Management Reviews, 9, 1, 2007, pp. 31–51.

Woiceshyn, J./Daellenbach, U., Integrative Capability and Technology Adoption: Evidence From Oil Firm, Industrial and Corporate Change, 14, 2, 2005, pp. 307–342.

Yip, G. S., Global Strategy in a World of Nations?, Sloan Management Review, 31, 1, 1989, pp. 29–41.

Young, G./Smith, K. G./Grimm, C. M., “Austrian” and Industrial Organizational Perspectives on Firm-level Competitive Activity and Performance, Organization Science, 7, 3, 1996, pp. 243–254.

Zhan, W./Luo, Y., Performance Implications of Capability Exploitation and Upgrading in International Joint Ventures, Management International Review, 48, 2, 2008, pp. 227–253.

Zou, S./Cavusgil, S. T., The GMS: A Broad Conceptualization of Global Marketing Strategy and its Effect on Firm Performance, Journal of Marketing, 66, 4, 2002, pp. 40–56.

Acknowledgements

The authors are indebted to Professor Michael-Jörg Oesterle and two anonymous reviewers for very thoughtful and constructive comments. This research was supported by grants from the National Science Council in Taiwan (NSC-96-2416-H-004-MY3).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hsu, CW., Chen, H. Foreign Direct Investment and Capability Development. Manag Int Rev 49, 585–605 (2009). https://doi.org/10.1007/s11575-009-0012-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-009-0012-9