Abstract

This paper investigates whether an incumbent has an incentive to introduce corporate social responsibility (CSR) activities only as a response to entry by a competitor, i.e., the incumbent would eschew CSR if left uncontested. We assume that the entrant cannot provide CSR at least at the outset for two reasons: (1) it would not be credible due to its lack of recognition and (2) due to high fixed cost to pay e.g., for licensing. More precisely, this paper shows that monopolistic firms can have indeed the incentive to introduce CSR activities only as a response to entry. Therefore, increased competition can turn a firm “green”, providing a “win–win” for business as well as for the environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Without doubt, corporate social responsibility (CSR) is the most visible aspect of firms’ attempts to include ethical aspects in their decisions and is currently one of the hottest management issues. This topic is covered widely and extensively in many academic journal articles, in the public media in serious papers (e.g., several special issues in The Economist) as well as in tabloids, on TV, online blogs etc. Many consultants, among them most prominently Michael Porter, have been praising the profitability (“win–win”) of socially and in particular environmentally responsible behavior for quite a long time, e.g., already in Porter and van der Linde (1995).

A survey of the academic literature, which is huge and mostly empirical, is here eschewed. Bénabou and Tirole (2010) give an overview of the recent developments in the economics of prosocial behavior and link it to CSR. Kitzmueller and Shimshack (2012) explore why CSR exists. We review here only the few related papers that address strategic aspects, which gets short shrift in the CSR literature. Kopel (2009) is one of the few papers accounting for firms’ strategic interactions in the context of CSR (allowing for first mover advantages). Another one is Lambertini and Tampieri (2011) that considers a static duopoly game where firms can choose between profit seeking or CSR and their emphasis is to characterize a mixed outcome (one profit seeking, the other CSR), which is stable for low impact of pollution and CSR sensitivity. Another way of exploiting CSR strategically is to use it as product differentiation device. Rodríguez-Ibeas (2006) sets up a model of standard vertical product differentiation where some consumers have preferences towards the environmental quality of a product. He then analyzes welfare and environmental effects when the population of environmental conscious consumers increase. Manasakis et al. (2007) also consider a duopoly market where each firm produces one brand of a differentiated good and consumers have identical preferences regarding the physical characteristics of the good but are heterogeneous in valuing the firms’ CSR activities. They then analyze the incentives of firms’ owners to hire social responsible managers. Becchetti et al. (2005) examine the case of a horizontal product differentiation model where consumers differ in their degree of social responsibility. To the best knowledge of the authors’, the current literature on strategic CSR has not yet tackled CSR as a device for an incumbent to respond to entry.

This paper investigates how entry changes an incumbent’s evaluation of CSR, i.e., whether an incumbent introduces CSR activities only as a response to an entering competitor. We assume that the entrant cannot provide CSR at least at the outset for two reasons: firstly, CSR is typically associated with cleaner production, better treatment of workers, local sourcing, etc. In essence, these are all credence good attributes since a consumer is unable to verify them even after consumption. Therefore there is no rationale why consumers should believe CSR claims of a newcomer lacking consumer recognition; admittedly, the entry of a well known firm into a new market need not fit our scenario. Secondly, due to high fixed cost to pay e.g., for certifications from ISO 1400 or EU Eco-Management and Audit Scheme. Related (but different) is the idea in McWilliams and Siegel (2001) to link CSR to experience goods. The reason why these goods are more likely to be associated with CSR is that consumers view CSR activity as a signal about the attributes of the private good. Siegel and Vitaliano (2007) expand the connection by also including credence goods. They provide empirical evidence that firms offering experience or credence goods are more likely to engage in CSR activities than firms selling search goods. Also Heyes (2005) and Goyal (2006) suggests signaling as motive for CSR.

2 Model

Consumers have unit demand for a good at the value \(v\) that is known and normalized, \(v=1\). In addition, they exhibit unknown willingness to pay \(\theta\) over and above \(v\) for a product produced by a firm with active and visible CSR contributions. The willingness to pay increment for CSR, \(\theta\), is the consumers’ private information. However, the firm knows its distribution, i.e., the density \(f\) and cumulative distribution function \(F\). For reasons of simplicity we assume a uniform distribution with support \(\left[ 0,\overline{\theta }\right]\). CSR is a one and all feature, i.e., the firm can choose or leave it. Furthermore, CSR activities require fixed costs \(\left( \varphi \right)\) for set up (e.g., for certification fees and installing a reporting scheme) and the CSR produced good has higher unit costs \(c>0\), where the cost of traditional production are normalized to zero. Moreover, we assume the unit cost to be lower than the total maximum willingness to pay for the CSR version of the good, i.e., \(c<1+\overline{\theta }\). A potential entrant produces the same good at higher costs than the incumbent, \(v>k>0\), but without the CSR option and engages in price competition.

2.1 Incumbent monopoly

The incumbent monopoly has two options: to use CSR or not. Assuming no CSR (identified by the superscript \(0\)), the optimal policy is to charge the willingness to pay, i.e., \(p^{0}=v\), that induces the profit (using the normalization \(v=1\)),

Engaging in CSR implies for the monopoly’s optimal price policy and implied profit,

For a price \(p>v=1\) only the types \(\theta \ge p-v\) will buy, while the others abstain. Of course, charging below the above monopoly price, \(p^{0}=v\), yet to spend on CSR is clearly suboptimal. Therefore, the above maximization implies in the case of the uniform distribution and for an interior solution (not necessarily optimal and therefore the hat indicates that this solution is only a candidate since the firm can still eschew CSR and the superscript \(s\) refers to this socially responsible policy),

A first and necessary but not sufficient condition for profitable CSR is that \(\hat{p}^{s} > 1\), because \(\hat{p}^{s}<1\) is clearly dominated by \(p = v = 1\) and no CSR that saves costs. Assuming that the monopoly applies CSR, its profit is

Therefore, accounting for all options, the optimal monopolistic profit \(\left( \pi ^{m}\right)\) is given by, \(\pi ^{m}=\max \left\{ \pi ^{0},\pi ^{s}\right\}\) if supported by the correspondingly optimal strategy either to provide CSR or not. The uncontested monopoly will engage in CSR if and only if \(\pi ^{s}>\pi ^{0}=1.\)

Proposition 1

The following conditions are sufficient that an incumbent monopoly eschews CSR even if that allows to raise the price, i.e., \(\hat{p}^{s} > 1 \Longleftrightarrow \overline{\theta } > 1 - c\) \((\)otherwise CSR is suboptimal anyway\()\), first for the cost parameter \(c,\)

and then for the maximum willingness to pay for the CSR upgrade,

Proof

See "Appendix". \(\square\)

Given these conditions it is very easy to find parameters where the monopoly’s optimal action is to eschew CSR. Consider a simple example for the first condition about CSR costs assuming \(\overline{\theta } = 1\) (i.e., the maximal willingness to pay for CSR is equal to the value of the standard product) and \(\varphi = 0\), then any \(c > 0\) meets the feasibility \(\hat{p}^{s} > 1\) yet rules out CSR for an uncontested monopoly (see Eq. 4); similarly assume negligible costs for CSR, \(c = \epsilon > 0,\varphi = 0\), then any \(\overline{\theta } < 1 - \epsilon\) rules out monopolistic CSR but here because it would require to lower the price, \(\hat{p}^{s} < 1\) (see Eq. 3). In words, even assuming (1) that consumers are willing to pay up to twice the price for a CSR-good compared with the standard good and (2) that the costs of CSR (fixed and variable) are negligible, CSR is unprofitable for an uncontested incumbent. Summarizing, a monopoly will introduce CSR only under very favorable conditions, i.e., for low costs and a (very) large willingness to pay. This can also be seen in Fig. 1 which contains the feasible parameter space in terms of CSR cost \(c\) and maximum willingness to pay \(\overline{\theta }\) for no fixed cost \(\varphi =0\). The dark gray area shows parameter combinations where CSR activities are profitable while the much larger light gray area defines parameter values where the uncontested monopoly does not engage in CSR.

2.2 Incumbent monopoly faces an entrant

Now given the incumbent monopoly’s reluctance to engage in CSR—a reminder of Hicks’ claim that a monopoly secures the best of all profits, a quiet life—how does that attitude change with an entrant? In this case, the incumbent, has the following options:

-

1.

The incumbent sets its price infinitesimally below the cost of the entrant, i.e., \(p = k\) and thereby deters entry by pricing.

-

2.

The incumbent permits entry and still eschews CSR. Given Bertrand competition and the homogeneous good characteristic, the equilibrium price is infinitesimally above the cost of the entrant, i.e., \(p = k\). This however, cannot be an equilibrium, because the incumbent has then to share the revenues which lowers its profit. Hence, the incumbent will strictly prefer the above option 1 of entry deterrence.

-

3.

Entry deterrence via CSR. The incumbent offers its CSR-upgraded product coupled with a price \(p^{i}\) that leaves no residual demand for the entrant who charges only for his costs, i.e., \(F\left( p^{i}-k\right) =0\). Given the full support of the distribution (i.e., a very small \(\theta\) has positive probability, which holds of course for the assumed uniform distribution) entry deterrence requires \(p^{i} = k\) (again infinitesimally above). That policy is again clearly dominated by standard entry deterrence as in point 1 by yielding the same revenue but saving all CSR expenditures.

-

4.

The incumbent permits entry but introduces simultaneously CSR.

Since option 2 and 3 are dominated by option 1, we elaborate on the conditions under which option 4 dominates option 1.

The entrant, which cannot provide CSR chooses the price \(p^{e}\) and the incumbent \(p^{i}\). Therefore, a type \(\theta\) buys from the incumbent if and only if

and for the given prices \(\left( p^{i},p^{e}\right)\), the demands are: for the entrant

and the incumbent

where \(p^{i}\ge p^{e}+\overline{\theta }\) implies zero demand by the nature of the cumulative distribution function \(\left( F=1\right) .\)

An interior Nash equilibrium with the incumbent providing now the CSR-upgraded product and the entrant the brown no-frills product results from solving the two profit maximization problems simultaneously,

Focusing on interior outcomes with entry, the equilibrium prices are,

that imply for the monopoly’s and entrant’s profit,

Note, that in order to have positive demand left for the entrant and therefore to ensure an interior solution \(p^e = \frac{2k + c + \overline{\theta }}{3} \le 1 = v \Longleftrightarrow c \le 3 - \overline{\theta } - 2k.\) Furthermore, \(c < 2 \overline{\theta } + k\), otherwise the per unit profit of the incumbent, \(p^i - c\), would be negative (see Eq. 11).

Therefore, the crucial conditions for CSR as response to entry is that CSR is only unprofitable in an uncontested monopoly, i.e.,

but preferred to entry deterrence when facing an entrant,

Proposition 2

Given the following conditions on costs,

or on maximum willingness to pay

CSR is only optimal as a response to entry and it is preferred (strictly) to entry deterrence.

Proof

See "Appendix". \(\square\)

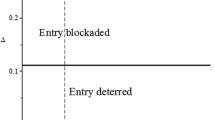

Therefore intermediate costs for CSR as well as significant but not too high maximum willingness to pay for CSR render purely strategic use of CSR optimal. In Fig. 2 we show the feasible parameter space in terms of CSR cost \(c\) and maximum willingness to pay \(\overline{\theta }\) (gray areas) for no fixed cost, \(\varphi = 0\), the entrant’s cost \(k = 0.1\), which determines also the outside option for the incumbent, i.e., the profit when deterring entry via pricing. According to Proposition 2, the light gray area displays the parameter combinations of \(\overline{\theta }\) and \(c\) where CSR is a profitable answer to entry, while the gray area represents the space where entry deterrence via pricing is preferred. Parameters belonging to the dark gray area make CSR already in the monopoly case profitable.

Given the conditions in Proposition 2, it is very simple to construct examples and Fig. 3 shows corresponding ones by varying the operating costs for CSR (\(c\)). The willingness to pay for the standard good is set to one by assumption which allows to relate this willingness to pay to the cost of CSR and the maximum willingness to pay for the CSR good relative to the willingness to pay of the normalized standard good. In this example we set the maximum willingness to pay for the CSR good equal to one, which implies a 100 % increase in maximum valuation of the CSR adjusted good compared to the standard good. Using this normalization, the CSR upgrade costs 10 % (the fixed cost element \(\varphi\)) of the consumers’ valuation of the standard good. The crucial point is the comparison of profits. Figure 3 shows that an incumbent monopoly will not engage in CSR, no matter how cheap its operating costs are (\(\pi ^{0} > \pi ^{s}\), and in this example not even for the case of no fixed costs). However, in case of entry in the industry, using CSR as a profitable response to entry dominates entry deterrence by limit pricing for even quite substantial CSR costs, up to \(c < 0.76\) (\(\pi ^{i} > \pi ^{k} = k\)). The corresponding sales and prices can be seen in Fig. 4 in the "Appendix".

3 Conclusion and topics for future research

This paper has shown that entry can induce incumbents to use CSR only as strategic instrument. Therefore, the recent wave of CSR pursued primarily by incumbents can have less noble reasons than claimed (e.g., the ads of many oil companies, BP = “beyond petroleum”, and in particular, by Chevron with its claims “that oil companies should support the communities and small business”) by being a response to increased competition due to market liberalizations and globalization. However, it provides also another possibility of Porter’s claim of a “win–win” for business and environment. The difference is that it needs an increase in competition as a trigger.

Our analysis relies on the assumption that only the incumbent can provide CSR. This seems a plausible assumption in many cases, because of the credence good nature of CSR (on credence goods see the fine survey of Dulleck and Kerschbamer , 2006). The incumbent’s CSR-strategy is much more credible because of its strong incentive to stay in the market which is hard to belief for entrants. In particular, the entrant may be a ‘flight by night’ firm only skimming a profit opportunity. A recent paper, Hockerts and Wüstenhagen (2010), argues the opposite that often small “emerging Davids” initiate the diffusion of sustainable products that are only in a later stage copied by “greening Goliaths”. This alternative hypothesis is of particular interest for empirical testing. More precisely, this could be done by analyzing particular industries which have gone through a transition process induced by liberalization (e.g., the electricity industry). Our intuition is that the outcome depends on industries: Organic food may support the hypothesis of Hockerts and Wüstenhagen (2010) while most ‘big’ industries (oil, energy, automobiles) fall into the category we investigated in this paper. Of course, the assumption of a ‘monopoly’ is presumably a far-fetched description for most if not all non-competitive markets such that the actions of always existing fringe firms, the “Davids”, is ignored. Of course this suggests to investigate how far this analysis can be extended to oligopolistic markets, inside and outside, and may include also a competitive fringe. Oligopolistic CSR markets but without entry are treated in e.g., Lambertini and Tampieri (2011) and Wirl (2014) within a dynamic game. Studying the dynamics of CSR is another possible direction for extending our model (compare also Wirl et al. 2013).

References

Becchetti L, Giallonardo L, Tessitore ME (2005) Corporate social responsibility and profit maximizing behaviour. Working paper 219, Tor Vergata University, CEIS

Bénabou R, Tirole J (2010) Individual and corporate social responsibility. Economica 77(305):1–19

Dulleck U, Kerschbamer R (2006) On doctors, mechanics, and computer specialists: the economics of credence goods. J Econ Lit 44(1):5–42

Goyal A (2006) Corporate social responsibility as a signalling device for foreign direct investment. Int J Econ Bus 13(1):145–163

Heyes AG (2005) A signaling motive for self-regulation in the shadow of coercion. J Econ Bus 57(3):238–246

Hockerts K, Wüstenhagen R (2010) Greening Goliaths versus emerging Davids—theorizing about the role of incumbents and new entrants in sustainable entrepreneurship. J Bus Ventur 25(5):481–492

Kitzmueller M, Shimshack J (2012) Economic perspectives on corporate social responsibility. J Econ Lit 50(1):51–84

Kopel M (2009) Strategic CSR, spillovers, and first-mover advantage. Working paper. http://ssrn.com/abstract=1408632

Lambertini L, Tampieri A (2011) On the stability of mixed oligopoly equilibria with CSR firms. Tech. Rep. wp768, Dipartimento Scienze Economiche, Universitá di Bologna. http://ideas.repec.org/p/bol/bodewp/wp768.html

Manasakis C, Mitrokostas E, Petrakis E (2007) Corporate social responsibility in oligopoly. Working paper, bE.NE.TeC. Working Paper Series

McWilliams A, Siegel D (2001) Corporate social responsibility: a theory of the firm perspective. Acad Manag Rev 26(1):117–127

Porter ME, van der Linde C (1995) Toward a new conception of the environment–competitiveness relationship. J Econ Perspect 9(4):97–118

Rodríguez-Ibeas R (2006) Environmental product differentiation and environmental awareness. Environ Resour Econ 36(2):237–254

Siegel DS, Vitaliano DF (2007) An empirical analysis of the strategic use of corporate social responsibility. J Econ Manag Strategy 16(3):773–792

Wirl F (2014) Dynamic corporate social responsibility (CSR) strategies in oligopoly. OR Spectr 36(1):229–250

Wirl F, Feichtinger G, Kort PM (2013) Individual firm and market dynamics of CSR activities. J Econ Behav Organ 86:169–182

Acknowledgments

The authors would like to thank two anonymous referees for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Proposition 1

It suffices to show that the profit of the monopolist when engaging in CSR activities \(\pi ^s\) is smaller than the profit eschewing CSR even if the monopolist could charge a price \(\hat{p}^s > 1 \Longleftrightarrow c > 1 - \overline{\theta }\). Calculating the threshold levels from

for the critical cost parameter yields two roots

Note that \(c^m_1 > 1 + \overline{\theta }\) and therefore this root is dominated by the necessary condition \(c < 1 + \overline{\theta }\). It follows that the monopoly engages in CSR activities if \(0 < c < c_2^m = c^m, \forall \overline{\theta }^m > 1 + 2 \varphi + 2 \sqrt{(1 + \varphi ) \varphi }\), and eschews CSR activities if \(1 + \overline{\theta } > c > \max {\ \left\{ 1 - \overline{\theta }, c^m \right\} }.\)

Analogously, the condition for the maximum willingness to pay can be derived. \(\square\)

1.2 Proof of Proposition 2

It suffices to show that the profit of the incumbent when engaging in CSR activities \(\pi ^i\) is larger than the profit of the incumbent deterring entry by limit pricing \(\pi ^k\). Furthermore, eschewing CSR in the uncontested monopoly is necessary, otherwise the introduction of CSR as a strategy would be obsolete anyway. Calculating the threshold levels from

for the critical cost parameter yields two roots

Note that \(2\overline{\theta } + k < c_1, \forall k > 0\), therefore this root can be ignored. It follows that CSR is a profitable strategy to entry if \(c^m < c < c_2 = \overline{c}\).

Analogously, the condition for the maximum willingness to pay can be derived. \(\square\)

1.3 Example

Figure 4 depicts the corresponding sales and prices from the example discussed in Sect. 2.2. In particular panel b, the one about prices shows that the entrant hits the upper price limit for very high costs, \(c = 1.8\), of CSR thus \(p^{e} = 1\) and \(p^{i} = \hat{p}^{s}\) for \(c > 1.8\), without covering all sales.

Rights and permissions

About this article

Cite this article

Graf, C., Wirl, F. Corporate social responsibility: a strategic and profitable response to entry?. J Bus Econ 84, 917–927 (2014). https://doi.org/10.1007/s11573-014-0739-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-014-0739-z