Abstract

Have IMF lending programs undermined political democracy in borrowing countries? Building on the extensive literature on conditional lending, we outline several pathways through which IMF program participation might affect the levels of democracy in borrowing countries - including a new variant that suggests the possibility of a positive association between lending program participation and democracy scores. In order to test the argument we assemble annual data from 120 low- and middle-income countries observed (at maximum) in each year between 1971 and 2007. We use three strategies - genetic matching, instrumental variables, and difference-in-differences estimation - to better estimate the direction and size of the statistical association between participation in IMF lending programs and the level of democracy. We find evidence for modest but definitively positive conditional differences in the democracy scores of participating and non-participating countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Do IMF lending programs undermine democracy in borrowing countries? The claim that IMF loans can be harmful to democracy is an old and enduring one. Nearly 40 years ago Cheryl Payer famously linked “IMF programmes, combined with promises of foreign aid, to the overthrow of a democratic government which was, perhaps, all too responsive to the will of the electorate” (1974, 45). In 1961 the Economist referred to the IMF’s lending arrangements in Latin America as “Mr. Krushchev’s secret weapon,” worrying that “if restrictive monetary policies are adopted without social safeguards, the countries run the risk of serious social eruption” (James 1996, 142). During the heyday of structural adjustment lending in sub-Saharan Africa three OECD economists observed: “many media, political parties, pressure groups (for example, trade unions, churches, NGOs) have regularly reproached the IMF for causing or increasing political instability…the IMF often stands accused in discussions on adjustment programs” (Morrisson et al. 1994, 129).

Several episodes seem to support the claim that IMF loans are hazardous to the health of democracies. In December 1971 Prime Minister Kofi Abrefa Busia and his economic policy team announced that Ghana and the IMF had come to terms on a standby program intended to stabilize the economy and pave the way for adjustment. The program included a 44 percent devaluation of the cedi; the prices of imported goods skyrocketed, widespread rioting commenced, and within 3 weeks Ghanaian military officials seized power in a coup (Acemoglu and Robinson 2012, 17–18). In Turkey the democratically elected Demirel government signed a 3-year IMF program in June 1980 to deal with the country’s balance of payments problems. Social unrest, particularly within the labor movement, worsened in the wake of the announcement, and by September the military had “dissolved parliament and suspended all civilian political institutions” (Kirkpatrick and Onis 1991, 14). The 1980 episode was the most recent in a series of IMF-linked political crises that put Turkish democracy at risk: payments crises and IMF loan agreements in 1960 and 1971 had also led to military interventions (Celasun and Rodrik 1989, 194).

Others dispute the claim that IMF programs have been detrimental to levels of democracy in developing and emerging countries. The association between the IMF and democracy was, for example, a contentious point for the members of the International Financial Institution Advisory Commission (better known as the Meltzer Commission), which issued a detailed report to the U.S. Congress on the activities and efficacy of the IMF. The four members of the commission who dissented from the report offered the following view: “…the report repeatedly argues that the IFIs [International Financial Institutions] undermine democracy…The report is particularly critical of the Fund’s role in Latin America, where virtually every country has become democratic during the very period when the IMF has been most active there. IMF conditionality is obviously not a roadblock to democracy. The allegations of the report simply fail to square with the facts of history” (2000, 113).

We ask whether the evidence from a large sample of low- and middle-income countries comports with either of the competing claims about the relationship between IMF program participation and countries’ democracy scores. While there is a vibrant literature on the relationship between international organizations and democratization more generally (c.f., Pevehouse 2002; Mansfield and Pevehouse 2006; Poast and Urpelainen 2015), existing evidence on the link between IMF lending program participation and measures of democracy is scant, and the research that has been produced to this point does not supply a very clear or convincing answer to the question motivating this article. While some recent empirical studies find that IMF programs are associated with increased levels of social and political instability, thus negatively affecting the level of democracy in borrowing countries (Gary 2013; Barro and Lee 2005; Brown 2009; Hartzell et al. 2010; Stroup and Zissimos 2013), other studies suggest the opposite: the IMF’s lending arrangements are actually associated with improvements in countries’ democracy scores (Abouharb and Cingranelli 2007; Birchler et al. forthcoming; Limpach and Michaelowa 2010).

This article makes three main contributions to the nascent literature on how participation in the IMF’s conditional lending arrangements impacts the institutions, procedures, and practices that distinguish democratically governed regimes. Because one possible pathway (IMF program participation → painful macroeconomic and structural adjustment → rising social instability/protest → violent repression by the ruling government) has tended to dominate theorizing about the empirical link between IMF programs and broad measures of democracy, much of the existing work starts with the expectation of a negative association between the variables. One of the article’s contributions involves laying out a fuller range of theoretical arguments about how IMF programs might impact borrowers’ democracy scores. Building on the extensive literature on conditional lending, we outline several possible mechanisms linking IMF program participation with the level of democracy in borrowing countries – including a new variant that suggests a positive association between lending program participation and indicators of the level of democracy.

Since the mechanisms yield different predictions about the direction of the effect of IMF program participation on countries’ democracy scores, we regard the question of the IMF loan-democracy link as primarily an empirical issue. To that end, we assemble annual data from 120 countries observed (at maximum) in each year between 1971 and 2007.Footnote 1 We examine the impact of IMF program participation alongside other important covariates on the two most widely used continuous measures of countries’ democracy levels – the Polity and Freedom House scores. A second contribution of the article thus lies in its empirical scope: the statistical tests are based on more comprehensive data than previous efforts to estimate the size and direction of the partial correlation between IMF loans and levels of democracy, and we also devote significant attention to the inferential problems generated by the kind of observational data with which we are working.

Identifying the direction and size of the statistical relationship between IMF program participation and democracy is complicated by the way in which adjustment programs are distributed. Program participants are not randomly selected. If the factors increasing the propensity to participate (such as the onset of severe balance of payments crises) are themselves correlated with countries’ levels of democracy, then it can become difficult to identify the impact of participation on the domestic political outcome of interest (variation in countries’ democracy scores). The correlation between IMF loans and democracy scores may simply be an artifact of the failure to properly take into account the conditions in which countries find themselves under the supervision of the Fund in the first place.

The third contribution of the article, in turn, lies in the strategies we use to assess the link between IMF program participation and democracy scores. In each of the tests we address the inferential problems posed by the non-random distribution of IMF lending programs. In the first set of tests, we use genetic matching to pair “treated” cases (countries under IMF programs) with observably similar “control” cases that did not participate in lending arrangements. Having pre-processed our data using a genetic matching algorithm, we then generate estimates of the partial correlations between IMF program participation and countries’ democracy scores.

In the second strategy we instrument for IMF program participation. We employ a unique instrument based on average interest rates in the Northern financial centers, weighted by developing countries’ external debt profiles, which overcomes the limits of some of the most commonly used instruments for IMF program participation (foreign aid, similarity of countries’ United Nations General Assembly voting profiles to votes cast by the IMF’s most powerful members, countries’ shares of the total number of IMF staff members, and the presence of elections).

Finally, we follow an empirical strategy pioneered by Giavazzi and Tabellini (2005) to construct a difference-in-differences estimator that compares changes in the democracy scores of the “treatment” group (which we define as countries that experienced lengthy episodes under IMF conditional lending arrangements) to the democracy scores in the group of developing and emerging market countries that had little to no engagement with the IMF’s conditional lending programs.

The results from all three sets of statistical tests point in the same general direction, leading us to conclude that the average impact of IMF program participation on borrowers’ levels of democracy has been modest but positive. The main implication of the evidence amassed in the article is not that IMF conditional lending arrangements have been transformative engines of democratization in low- and middle-income countries over the past 40 years. Rather, the modest but positive conditional associations between democracy scores and IMF programs detected in the statistical analyses should shift the burden back to those who, in line with the conventional wisdom, believe that the Fund’s lending programs have put downward pressure on borrowing countries’ measurable levels of political democracy.

The article proceeds as follows. In the first section we describe three possible pathways linking participation in IMF programs to the level of democracy in recipient countries. Next, we discuss the selection problems endemic to studying the impact of IMF lending. In the third section we discuss in more detail our strategies for addressing the methodological challenges, followed by the presentation of the results from three sets of statistical tests. In the final section, we conclude by discussing the implications of our findings, and we suggest several avenues for future research on the political consequences of IMF program participation.

2 The domestic political consequences of IMF programs

There is a sizeable literature on how international organizations (IOs) affect democracy. While critics of the system of global governance pointed to the ways in which “distant, elitist, and technocratic” IOs could “undermine domestic democratic processes,” others mounted a spirited defense of the democracy-enhancing features of IO membership (Keohane et al. 2009, 1). Indeed, evidence for the democracy-promoting qualities of IOs is impressive: engagement with institutions as wide-ranging as NATO, regional organizations, and the WTO has been linked to improvements in the quality and durability of democracy (Aaronson and Abouharb 2011; Cameron 2007; Epstein 2005; Pevehouse 2002).

It is striking, then, that the IMF is often considered an outlier among its IO peers. Arguments over the Fund’s democracy-retarding effects are rooted in two main claims regarding the negotiation and implementation of IMF programs. First, the terms of IMF conditional loans are typically hammered-out in closed-door meetings between the borrowing country’s top economic policymakers and the IMF’s staff members. Legislators, civil society groups, and members of the mass public have historically had very little input on the design of IMF loan agreements (Stiglitz 2003). As Kapur and Naim (2005, 91) remark, “By their very nature, IMF conditions arise not from debate and discussion within a society, but come rather from unelected foreign experts.” Less transparency and greater centralization of decision making undermine the potential for input from a broader range of societal stakeholders. The gap between the public and ruling authorities, in turn, widens, and the measurable quality of democracy diminishes.

Second, the implementation of IMF programs involves limiting borrowers’ macroeconomic policy discretion and consequently has the potential to produce harmful distributional consequences. Governments have to make hard choices about which societal groups will face uncompensated adjustment costs. Facing daunting changes in their economic circumstances just at the moment when the government’s ability to mitigate adjustment costs is most constrained, individual citizens and organized societal groups may consequently respond with violence, directed at other societal groups or at the state itself (Hartzell et al. 2010, 344).

Some scholars argue that IMF program-related social discontent triggers repression by the state’s security forces. As Morrisson et al. put it, “the conditionality imposed by the IMF obliges the government to reduce expenditures in favor of certain groups; consequently support for the government decreases and disturbances may break out, and this can lead to repression” (1994, 130). A number of studies document an association between IMF program participation and the likelihood of social and political conflict and instability (Abouharb and Cingranelli 2007; Auvinen 1996; Casper 2015; Franklin 1997; Gary 2013; Hartzell et al. 2010; Sidell 1988; Snider 1990; Stroup and Zissimos 2013; Walton and Ragin 1990).Footnote 2 As a result of austerity-induced societal conflict, participation in IMF arrangements can increase the likelihood of major government crises, which could in turn be expected to place particular strain on fragile (perhaps nascent democratic) regimes.Footnote 3 Indeed, some studies find evidence that participation in IMF conditional lending programs was associated with reductions in at least some borrowers’ levels of democracy (Barro and Lee 2005; Brown 2009).

An alternative claim is that IMF loans can stabilize governments that are in economic distress and have to make difficult decisions about the pace and degree of adjustment. In this view the crucial question is what would have happened to the borrower had it not sought the Fund’s support. Given that by the time the modal borrower signs on to the loan agreement the country’s economic circumstances have deteriorated, some degree of destabilizing social and political conflict would almost be assured regardless of the Fund’s involvement with the country. The resources provided by the IMF and its role as a convenient scapegoat can actually help to diffuse some of the pressure on the government (Dreher and Gassebner 2012, 331–32; Vreeland 1999). The implication is that, on average, IMF-led adjustment programs strengthen incumbent governments and enhance political stability in borrowing countries (Nowzad 1981). It is worth noting, however, that this argument does not distinguish between regime types; if the stabilization argument applies equally to regimes spanning the continuum between autocratic and democratic, then the average effect of program participation on democracy scores will depend on the distribution of different regime types across the sample.

The literature on conditional lending suggests a third pathway through which IMF loans may positively affect democracy scores. The argument for why we might observe a positive conditional difference in the level of democracy between participant and non-participant countries has to do with the different ways in which political regimes respond to the tighter budget constraint imposed by IMF lending arrangements. The “classical” IMF arrangement involves the provision of resources in exchange for policy commitments by a member country facing a current account adjustment problem (Ghosh et al. 2005). The IMF’s approach to adjustment is built on the assumption that “balance of payments deficits stem from an excess of domestic absorption over income” (IMF 2003, 23). An increase in private investment, a fall in private savings, or an increase in the budget deficit can each produce external imbalance.

A current account imbalance is unsustainable when it becomes too costly for the deficit country to continue to borrow savings from the rest of the world. The IMF’s role is to provide a short-term infusion of currency to enable the borrower to meet its external payments obligations and to limit the damage of the forced adjustment (by helping to preserve an exchange rate target, enabling the government to bail out nearly-insolvent financial institutions, etc.). Since the 1980s many conditional lending programs have also included “structural” conditions designed to remove policy distortions, which (in theory) should increase economic efficiency and raise the level of borrowers’ economic output in the medium- to long-term. Yet the core of the “classical” IMF loan involves short-run measures to reduce domestic absorption and improve the current account balance by “as much as is required to maintain solvency” (Ghosh et al. 2005, 27).Footnote 4

A program of internal adjustment under the auspices of the IMF almost invariably means that a borrower’s fiscal budget constraint tightens. The IMF defines the economy-wide budget constraint as G = Y – CA – C, where G is government spending, Y is the country’s total domestic output (gross domestic product), CA is the current account surplus, and C is private domestic consumption (IMF 1999). Turning around a current account deficit implies an overall reduction in government spending – a target that the IMF enforces using the binding conditions attached to its programs. Going to the IMF for a conditional loan in the midst of a payments crisis makes it harder for governments to use other policy tools, such as exchange controls and trade restrictions, that can potentially be useful short-run ways of dealing with balance of payments deficits. All IMF loans include a binding commitment on the part of the borrower to refrain from implementing policies that conflict with Article VIII of the institution’s founding charter, which precludes members from using current account restrictions.

The important issue for the question at the heart of this article is how countries participating in IMF programs choose to distribute the fiscal costs of Fund-enforced macroeconomic adjustment. Military spending is often on the chopping block when countries seek IMF loans: Gupta et al. (2001), for example, present evidence of a robust negative relationship between IMF program participation and military spending. In their view, the finding is consistent with the IMF’s long-standing focus on “the composition of government expenditures in favor of programs with higher productivity” (2001, 764).Footnote 5

More recent work on the pattern of adjustment under IMF programs indicates that there are systematic differences in how democracies and autocracies have distributed the costs of IMF-imposed restraints on government spending. In particular, evidence shows that autocracies under IMF arrangements tend to shift resources away from military expenditures in favor of proportionately greater spending on social programs (Nooruddin and Simmons 2006). This pattern of spreading the pain of fiscal adjustment can undermine authoritarian governments’ capacities to tightly repress political competition, since it weakens the coercive apparatus that is responsible for controlling opposition forces.Footnote 6 Political scientists have shown that, when facing hard economic times, autocratic governments have been more likely to collapse than their democratic counterparts (Gasiorowski 1995), and that the post-exit fates of deposed autocrats are far worse than for democratic leaders forced from office (Goemans 2008). We hypothesize that because non-democratic regimes under IMF programs have less capacity to repress the opposition at the same time that their rule is more fragile, autocratic regimes have incentives to allow moderately greater levels of political competition when they are under conditional lending arrangements. The observable implication of the argument is that participation in IMF programs should be associated with higher democracy scores, on average.

In sum, contradictory claims and ambiguous findings are evident in existing studies of the impact of IMF programs on democracy. In order to provide a clearer picture of the empirical relationship between the IMF’s conditional loans and democracy, we employ methods that more carefully consider the inferential problems posed by observable differences between recipients and non-recipients of Fund programs.

3 Selection problems and the matching approach

We turn in the remaining sections to estimating the conditional difference in the levels of democracy between countries under IMF lending arrangements and non-borrowers. This is no easy task. In each year a set of countries are observed under IMF agreements. If we could access a parallel universe in which those same countries were not under IMF agreements, then it would be simple to establish the difference in democracy levels associated with IMF lending arrangements: we would just compare the level of democracy for those countries in the two universes. Our task is made more difficult by the fact that we have to compare country-year units under and not under IMF agreements in this universe. There may be confounding factors that distinguish the two populations and which make it appear that the IMF intervention is the cause of the observed differences in outcomes (in our case, democracy scores), when, in reality, any difference was driven by the pre-existing conditions of those countries that turn to the IMF in the first place.

Attention to possible confounders and how IMF borrowers may differ in systematic ways from other developing countries points to the need to think seriously about two sets of counterfactuals for evaluating the IMF-democracy link. First, what would have happened in borrowing countries had they not received loans and subjected themselves to the strictures of IMF conditionality? Second, what would have happened to those countries that did not fall under the purview of the IMF if they had instead become involved in IMF agreements?

We can explain in slightly more formal terms the problem of assessing the conditional association between IMF program participation and the level of democracy. The i th country that participates in a conditional lending program is referred to as a “treatment” case (Ti = 1) and the i th non-participant is a “control” case (Ti = 0). The outcome that we are interested in explaining is the democracy score; let Y1,i denote the democracy score in “treated” units in the sample and Y0,i denote the outcome in the units (countries) that were not under IMF arrangements.

The quantity that we want to estimate is the average effect of the treatment on the treated units (ATT), given by the expression E[Y 1,j – Y 0,j | T i = 1], which can be rewritten as E[Y 1,j | T i = 1] – E[Y 0,j | T i = 1]. The ATT is given by subtracting the (unobservable) average democracy level in the non-participant cases had they been under IMF programs from the (observable) average level of democracy in the IMF program participant cases.

In this framework we need a suitable set of control cases to which we can compare the average democracy level of the treated cases. The problem, as we noted, is that “untreated” units – country-years in which the government was not under an IMF arrangement – might be different and exhibit confounding characteristics that distinguish them from the treated units. The separate effects of the distribution of the covariates of democracy scores and the assignment of the treatment (participation in IMF loans) are thus confounded and cannot be empirically distinguished.

Matching is a procedure that creates more balanced datasets in which treated units are paired with observationally similar “control” units.Footnote 7 Matching assumes that confounding (due to associations between the assignment of treatment variable and the observed values of theoretically relevant covariates) can be reduced by balancing the distribution of the values of the covariates across the treatment and control groups, such that T ⊥ X, where T is the treatment and X is the observed set of confounding covariates. Matching is achieved by defining the propensity score, π(X i ), that captures the conditional probability for an observation’s assignment to the treatment condition given the pretreatment covariates (Diamond and Sekhon 2013, 933). The expression π(X i ) ≡ Pr(T i = 1 | X i ) = E(T i | X i ) describes the propensity score as the likelihood that the treatment (in our case, an IMF conditional lending program) was assigned to the i th unit given i th’s values on the observable covariates (X). By conditioning on the propensity score we can, in principle, achieve conditional independence of the treatment assignment and the observed covariates: X ⊥ T | π(X).

To bring the discussion back to the question motivating the inquiry, matching balances the distributions of the observed confounders for the association between the treatment (IMF programs) and the outcome (level of democracy) between the two groups. By reducing imbalance the matching procedure reduces the risk that any observed conditional difference in democracy scores between the participant and non-participant units is generated by the non-random assignment of the treatment to the units.

The goal of matching is to minimize the observed differences in confounding variables between the treatment and control groups in the sample (Ho et al. 2007). We use a recently developed multivariate matching method – genetic matching – that is designed to maximize the overall balance for observed baseline covariates between matched and treated observations (Diamond and Sekhon 2013, 933; see also Sekhon 2011). More details on how genetic matching works are provided in the next section. The measure of balance that we use in the article shows that matching dramatically reduces the differences in the distributions of the covariates of IMF lending arrangements.

Matching, in contrast to multi-stage selection models, assumes that selection occurs on observable covariates. The choice of whether to use matching, which assumes that balancing removes confounding from both observed and unobserved variables, or a parametric selection model, which does not require this assumption, cannot be made solely on the basis of the qualities of the methods (Diamond and Sekhon 2013). The theoretical expectations about how IMF programs work should drive the choice of technique used to estimate the quantity of interest. In estimating the impact of IMF programs on economic growth, for example, Bas and Stone (2014) argue that the IMF’s interaction with its borrowers is better understood as an adverse selection problem. Analogous to Akerlof’s famous used car example, the prospective borrowers are the sellers, offering to carry out economic reforms in order to get the buyer, the IMF, to provide financing. Prospective borrowers (like dealers of used cars) have significant informational advantages over the IMF, and the institution’s ability to screen out the uncommitted to make sure that only committed types of government receive loans is limited. Thus the pool of prospective borrowers might be skewed toward the uncommitted, “low-quality” type, and failing to account for the selection mechanism, which in Bas and Stone’s (2014) framework involves an unobservable factor (“commitment to economic reform”), will lead analysts to make incorrect estimates of the effect of program participation on growth.Footnote 8

For our research question the issue of selection on unobservables is less of a concern. Promoting economic growth by removing policy distortions that generated the loan request is an explicit goal of the IMF; since prospective borrowers know that the “price” of borrowing is the “degree of conditionality imposed in the adjustment program,” there are obvious incentives for governments to try to mask their true “type” (Bas and Stone 2014). The IMF does not, on the other hand, include democracy promotion as one its goals. The principle of neutrality—the IMF makes funds available to any kind of government, provided it can credibly demonstrate a financing need—is enshrined in the Articles of Agreement that define the institution’s mandate. The historical record shows that the IMF has signed numerous agreements with repressive autocratic regimes in the developing world. One former top IMF official, Vito Tanzi (who joined the organization in 1974 and served as the director of the Fiscal Affairs department), acknowledged that “the economists working at the Fund were not encouraged to get involved in, or even to become knowledgeable about, political issues…As long as a government was firmly in power, the Fund was expected to be indifferent to its political nature” (quoted in Kedar 2013, 138).

There is little evidence in the studies of the determinants of program participation to suggest that either the IMF screens prospective borrowers on the basis of their level of democracy, or that more democratic countries are more likely to seek IMF support. We identified 22 statistical studies of the determinants of IMF program participation that included an indicator for regime type as a covariate (the individual studies are summarized in Table C1 in the online supporting information). Only 3 of the 22 studies reported a positive and significant partial correlation between the indicator of program participation and the democracy measure.Footnote 9 We conclude that there is little reason to believe that countries that are predisposed, for reasons that cannot be observed, to becoming more or less democratic are systemically selecting themselves into the pool of potential IMF program participants.

In the next section we describe the covariates we use to construct the matched samples. We then adjust for any imbalance that remains after the matching procedure by analyzing the data with a parametric (in our case OLS) model. Of course, matching is far from a cure-all, and even proponents readily acknowledge the inferential limits associated with this set of methods (Morgan and Winship 2007, 121–122; Rubin 2006, 217). While matching methods improve analyses of observational data by balancing observed covariates, we thus hesitate to call the estimates we report in the next section “causal effects.” In order to definitively establish the true causal effect of IMF loans on democracy levels, we would have to identify the complete and correct set of conditioning variables. There is no clear way to solve this problem, which applies to every study using observational data, and pursuing the issue is far beyond the scope of the article. Consequently, we refer to the estimates from the matching procedure as conditional associations or, following Roberts, Seawright, and Cyr (2012), as conditional differences rather than causal effects. In later sections, however, we describe additional tests that increase the confidence we have in the findings revealed by the matched analysis.

4 Sample and covariates in the analysis

Our sample consists of 120 low- and middle-income countries observed between 1971 and 2007.Footnote 10 Our main outcome of interest is the democracy score for each country in each given year of the sample. There is a longstanding debate in the social sciences over the best ways to conceptualize and measure democracy (Schmitter and Karl 1991). One strand of the literature offers a “procedural” understanding of democracy centered on the presence or absence of democratic electoral and legislative institutions (Przeworski 1999; Schumpeter 1950, 269). Other scholars of democracy emphasize the protection of individual civil and political liberties that extend beyond the institutions that govern the selection of the country’s leadership (Dahl 1971, 1–4). Alternative conceptualizations of democracy might also consider informal avenues by which officials are held accountable by citizens, the equitability of the distribution of income and assets, and the inclusivity of deliberative institutions and engagement of the citizenry.Footnote 11 In this article, however, our attention is focused on the empirical relationship between IMF program participation and the measurable levels of political democracy.

We rely on two different continuous indicators of the level of democracy in the analysis: the Polity2 and Freedom House scores. The Polity2 score is closer in spirit to the procedural conceptualization of democracy. The indicator combines information on the competitiveness of political participation, the extent of constraints on the power of the regime’s leader, and the openness and competitiveness of the process by which leaders are selected. The Polity2 measure is constructed by examining various attributes related to the competitiveness of participation and constraints on the executive to construct annual scores for countries that range from −10 (least democratic) to +10 (most democratic).

During “interregnum” and “transition” periods in which it was difficult for coders to measure the level of democracy in a country, the original Polity2 measure records a zero. Plümper and Neumayer (2010) show that this coding rule can produce misleading inferences; consequently, in the analysis below we use an amended version of the Polity2 variable that linearly interpolates values during the troublesome “interregnum” and “transition” periods.

The Freedom House score is a composite of two indexes, one that measures respect for civil liberties and the other that measures political rights. We transform the composite Freedom House score so that it runs from 0 (least democratic) to 12 (most democratic). The Freedom House score is available from 1972 onward.

Both the Polity2 and Freedom House scores have been criticized as measures of political democracy (e.g., Giannone 2010; Gleditsch and Ward 1997; Munck and Verkuilen 2002). However, they remain the two most widely used continuous indicators in quantitative studies of the determinants and consequences of democracy.Footnote 12 In our discussion of the possible pathways through which IMF program participation may affect democracy scores we do not distinguish between the procedural (better captured by the Polity2 variable) and “liberal” (reflected in the construction of the Freedom House score) elements of democracy; consequently we choose to examine both indicators separately. Further, despite the fact that the two indicators are highly correlated (r = 0.85), previous research has demonstrated the potential for instability of results across highly correlated continuous measures of democracy (Casper and Tufis 2003), which suggests that it is good practice to examine the covariates of the Polity and Freedom House scores separately.

Our key explanatory variable is the presence of a conditional IMF lending arrangement in country i in year t.Footnote 13 For the 1971 to 2000 period we drew the IMF program indicator from Vreeland (2003). To update the indicator to 2007 we used the IMF’s MONA database and the IMF’s online archives.Footnote 14 We provide a full list of countries and years under IMF lending arrangements in the supplementary appendices.Footnote 15

We do not distinguish between the types of programs in the baseline analysis presented in the next section.Footnote 16 We note that some scholars analyze the effects of concessional loans, which are multi-year programs offering a lower repayment cost to the least developed member countries, separately from non-concessional loans (Dreher and Gassebner 2012; Hutchison 2003; Joyce and Noy 2008). In the baseline models we ask whether there are conditional differences in the level of democracy in participating countries without distinguishing between the types of programs. Concessional and non-concessional IMF loans do not differ much in terms of their fundamental objectives (Oberdabernig 2013). Further, matching can only be performed when some units are identified as “treated” and other units are coded as control cases, along the dimension of a single binary treatment. As a robustness check, however, we exclude non-concessional loans from the analysis to see if there are differences in the estimated effect of concessional loans on the level of democracy in borrowing countries, and find that the effects remain substantially the same.

Our approach focuses on the short-term impact of the presence of lending arrangements on the level of democracy in borrowing countries. As Bas and Stone point out, “the point of IMF lending is to help in the very short run” (2014, 2). Conditional IMF programs enable member states to purchase currency, repaid over time at an interest rate that is usually well below what the country would pay to borrow from private lenders, in order to replenish its reserves, recapitalize its banking system, and remain solvent. The conditions attached to the purchase target the sources of the imbalance that forced the recipient country to seek the institution’s support. We want to know whether the tranches of emergency financing and attendant policy conditions are associated or not with the level of democracy. Estimating the effect of program participation on democracy is challenging. Determining the medium- to long-term consequences of program participation is even more daunting. Finding that there is no difference in democracy levels for countries in the years or decades after they graduated from the lending arrangement could indeed indicate that IMF loans do not matter for democracy scores; alternatively, the finding could also mean that after countries exit from lending arrangements they simply reverse IMF-imposed policy measures that mattered for democracy scores during the duration of the program. Further, identifying countries’ “graduation dates” from IMF lending is not straightforward: some developing countries enter one program after another for years on end.Footnote 17 For these reasons, the main quantity that we want to estimate is the conditional difference in participating and non-participating countries’ democracy scores.

We select a set of variables that are likely to be (positively or negatively) correlated with the probability that a country is under an IMF program and also likely to influence the level of democracy. One possible confounding factor is the nature of the regime. While political scientists have spilled much ink distinguishing between varieties of democratic regimes – presidential or parliamentary, for example – far less attention has been paid to differences between types of dictatorships (c.f., Geddes 1999; Weeks 2008). Not all dictatorships are alike, which has consequences for both foreign and domestic policies.

Cheibub et al. (2009) distinguish between three types of autocratic rule: monarchic, military, and civilian. If we think of regime type as a continuum spanning the most repressive dictatorship to the fullest democracy, monarchic and military autocracies are generally closer to the most repressive pole than civilian dictatorships.Footnote 18 Above, we discussed how IMF loans might erode the repressive capacity of autocrats. Given that autocratic regimes headed by monarchs or military leaders tend to be highly repressive, these regimes have the most to lose from going to the IMF should constraints on their coercive capabilities result from participation in the adjustment program. Our inferences about the association between IMF loans and democracy scores would be biased if the bulk of the autocratic regimes that signed IMF programs were less repressive, civilian-headed governments. We draw two indicators (military autocracy and monarchic autocracy) from Cheibub et al.’s six-fold classification of regime types.

We also include a variable that records the sum of previous transitions to autocracy from 1946 to year t (Cheibub et al. 2009). We add the previous transitions variable because countries with a track record of unsettled, volatile political systems may be forced to seek out a disproportionate number of IMF programs and may also have lower (or higher) democracy scores on average.

Oil-rich countries are prone to boom and bust cycles, but they are less likely to obtain IMF loans than countries with little exportable oil. For instance, the least frequent users of IMF resources in the developing world are countries in the Middle East and North Africa. Many scholars argue that reliance on oil is inimical to democracy (Ross 2001). We include a dichotomous indicator that takes a value of one if a country is a major oil exporter.Footnote 19

We use four variables to account for potentially confounding economic factors. The level of reserves is an indicator of a country’s economic health. It is well known that falling reserves increase the likelihood that a country will seek to borrow from the IMF (Sturm et al. 2005); in addition, the health of the economy is likely to have an impact on the level of democracy, particularly in fragile, “unconsolidated,” democratizing regimes (Przeworski et al. 1996). We measure the ratio of international reserves to gross national income (GNI) (reserves); the data are constructed from the World Bank’s International Debt Statistics and World Development Indicators databases. A country’s average income per person and the size (as well as the direction) of the annual change in per capita wealth are expected to influence both the probability that a country is under an IMF program (the relatively rich and fast-growing do not have much need to draw on the IMF’s resources) and the prospects for democracy (the relatively poor and slow-growing countries are less likely to see increases in their democracy scores). The measures of real GDP per capita and real per capita GDP growth come from the Penn World Tables version 6.3. All of the economic indicators in the pre-matched datasets are lagged by 1 year.

Countries that seek IMF funding are in many (if not most) cases experiencing severe economic distress. We have to account for the crisis conditions that brought the country to the IMF in the first place, since currency crises have been linked to the breakdown of both democratic and autocratic regimes (Pepinsky 2009). Consequently we use a measure of exchange market pressure (currency crash) which, following Frankel and Rose’s (1996) widely-used definition, takes a value of one for years in which a country experiences a nominal devaluation in its exchange rate of at least thirty percent that is also at least a ten percent hike in the rate of depreciation compared to the previous year.

Countries that are wracked by severe internal violence or engaged in intense cross-border conflicts are less likely to be able to muster the resources to formulate a credible reform program in consultation with the IMF; in the worst episodes, the state may wither to the point that key economic policy positions in the finance ministry and/or central bank are vacant. The IMF cannot send a mission to a country that does not have the basic infrastructure to support loan negotiations. We are unlikely to see many episodes of IMF loans signed by governments in failed or failing states, and democracy is similarly unlikely to flourish in these environments. We include an index of political violence that records the intensity of annual episodes of intra- and interstate conflict (Marshall 2010). The political violence indicator ranges from 0 to 13.

We account for neighborhood effects by including regional variables. Economic crises often spill across borders into neighboring countries; we speculate that the presence of an IMF program in country i raises the probability that country i’s neighbors will also end up with IMF programs, either as a precautionary measure to reassure market actors or as an attempt to restore stability once the crisis has spread. In addition, there is convincing evidence of regional dynamics in the spread of democracy (Brinks and Coppedge 2006; Gleditsch and Ward 2006). We place countries into one of six regional classifications: Middle East and North Africa, Latin America and the Caribbean, East Asia and Pacific, Post-Communist, sub-Saharan Africa, and South Asia.

We also match on the year in which a unit is observed to minimize the likelihood that any results are a function of differences in the temporal periods for matched versus unmatched units. If countries were – for perhaps unrelated reasons – more likely to be under IMF programs during waves of democratization, we might mistake a coincidental positive correlation between IMF programs and democracy levels for a causal relationship. By matching a unit under an IMF program to a control case in the same or a proximate year we are able to control for the secular upward global trend in democracy scores.

5 Estimating the association between IMF programs and democracy levels with matched data

We used Sekhon’s genetic matching routine (GenMatch) to generate balanced subsamples for both measures of democracy.Footnote 20 Recall that the key property of interest in the matching approach is the degree of covariate balance. Genetic matching utilizes an iterative algorithm that optimizes balance by checking and re-checking balance to properly specify the propensity score and remove any conditional bias. In determining which cases can be matched, we need a “distance” metric that specifies how similar the pairs must be before they can be compared. The GenMatch algorithm uses a generalized version of Mahalonobis distance to obtain the set of cases that optimizes postmatching covariate balance.Footnote 21 Each treated case is paired with a control case via one-to-one nearest neighbor matching with replacement.Footnote 22 The matches were created using all of the confounding covariates described in the previous section. Figures 1 and 2 report a widely used descriptive measure of balance, the standardized mean difference between treatment and control cases, for each of the covariates before and after matching (Rosenbaum 2010, 187–88; Steiner and Cook 2013).Footnote 23 Positive (negative) values denote that the average observed value on the covariate when country-year units were under an IMF program was greater (lower) than the average for non-IMF program cases.

The figures reveal that there are dramatic differences in the distributions of the covariates between the IMF program participant (treatment) cases and the non-participant (control) cases. In the unmatched data we have assembled, treated cases are less likely to be military or monarchical autocracies, are less likely to depend on revenues from oil exports, are more likely to have a history of reversions to autocracy, are poorer and less economically healthy (based on mean values of the level of reserves scaled to GNI, as well as real per capita GDP growth), and have lower levels of political violence than control cases. The treated cases tended to cluster in later years than the non-IMF loan control cases, as well.Footnote 24 By almost every measure the two groups significantly differ in ways that are likely consequential for the level of democracy.

The genetic matching procedure does an impressive job of reducing imbalances across the treatment and control groups for both samples. For the baseline Polity2 sample, the average reduction in the standardized mean difference among covariate means across the treated and control cases was 89.47 percent.Footnote 25 The mean difference was reduced, on average, by 90.15 percent for the covariates in the Freedom House sample. In both samples the genetic matching procedure improved balance for every covariate.

We start with the analysis of the amended Polity2 measure of democracy. The original number of observations in the pre-matched dataset is 3,397; the GenMatch procedure yields a sample of 1,622 treated and 1,622 control cases. The estimated average treatment effect of IMF program participation is positive (0.348) but falls just under standard levels of statistical significance (t-stat. = 1.515, p = 0.13).Footnote 26

In order to further reduce imbalance we estimate parametric models using the matched samples with the confounding variables included in the models – though it should be noted that one of the benefits of matching is that it reduces model dependence, meaning the results for our main question of interest concerning the role of IMF program participation should be less sensitive to the inclusion (or exclusion) of particular explanatory variables in alternative specifications (Ho et al. 2007, 223).

In Table 1 we report results when the amended Polity2 score is regressed on the covariates after the data have been pre-processed by genetic matching.Footnote 27 The IMF program participation indicator is positive and significantly associated with the democracy score. The estimate from the matched sample reveals that the conditional difference between countries under and not under IMF programs is below a half point, which represents a small but statistically significant positive association. We report the coefficient estimates for the other indicators in Table 1, but do not discuss them in detail since they were used as the covariates on which we constructed the matches.

We find a stronger positive association between IMF program participation and the transformed Freedom House score. The GenMatch procedure yields 1,616 treated observations paired to 1,616 control cases. The ATT of IMF program participation on the Freedom House measure is 0.293, and the estimated effect is statistically significant (t-stat. = 2.479, p = 0.01).Footnote 28 The conditional positive difference in democracy scores between countries under IMF programs and non-borrowers is confirmed when we regress the Freedom House indicator on the IMF program variable and the other confounding covariates using the post-matched sample. The regression results are reported in Table 2. Again, since our interest lies in estimating the impact of IMF program participation on democracy scores, we do not devote space to discussion of the other results from the regressions, most of which are consistent with previous research.Footnote 29 The key finding in this article is that there is a difference in the democracy scores of IMF program participants compared to the matched non-participating cases. The estimates reveal that after conditioning on a set of observed covariates that tend to affect both the level of democracy and the likelihood of being under an IMF program, there remains a positive association between the IMF’s lending arrangements and democracy scores in developing countries.

6 Robustness checks

In this section we discuss how the findings from the matched datasets change when we augment the baseline models with additional covariates. The full sets of robustness checks are provided in the supplementary appendices that accompany the article.

We matched on indicators for five covariates (oil producer, reserves, real GDP per capita, real GDP per capita growth, and currency crash) that account for how variation in countries’ economic vulnerability might affect both their likelihood of participating in IMF lending programs and their levels of democracy. We added two other economic covariates that may be confounding factors: the current account balance as a proportion of GDP, and total trade (exports plus imports) as a share of GDP. Both indicators have been used in other research as predictors of IMF program participation (e.g., Oberdabernig 2013).Footnote 30 The current account balance indicator was drawn from the World Development Indicators and the IMF’s World Economic Outlook database; the trade openness indicator comes from the World Development Indicators. Both covariates are lagged by 1 year in the pre-matched datasets.

An indicator of countries’ United Nations General Assembly (UNGA) voting proximity with the IMF’s most powerful principals (particularly the United States) is, as Dreher and Gassebner state, “a standard measure employed in the recent literature” (2012, 336). The UNGA voting measures are used as proxies for potential borrowers’ affinity with, and strategic importance to, powerful members, and there is evidence suggesting that countries that are closer to the United States benefit from preferential treatment by the IMF (Dreher and Jensen 2007). Countries that share a geopolitical affinity with the U.S. may also have higher democracy scores. Consequently we include a new measure of foreign policy closeness with the U.S., based on UNGA voting profiles, as a covariate. The indicator (UNGA ideal point) comes from Bailey et al. (2015). The indicator recovers countries’ foreign policy preferences from their UNGA voting records. The variable measures each country’s unidimensional foreign policy “ideal point” in each year, interpreted as the country’s position toward the U.S.-led “liberal” international order.

Due to missing data the addition of these three covariates reduces the sample size by nine percent. We match on the baseline covariates plus the current account, trade openness, and UNGA ideal point variables, and regress our democracy indicators on the IMF program variable and the confounding covariates. We still find positive conditional associations between IMF program participation and the democracy scores, but the estimated IMF program coefficient when the Polity2 score is the outcome is halved and loses statistical significance. By contrast, the IMF program indicator remains highly significant when the Freedom House score is the outcome of interest.

We matched on different measures of political conflict and social instability, as well. We generated two new matched datasets in which the political violence index used in the baseline models was replaced by dichotomous indicators of the presence of international and intrastate wars. The four additional indicators were taken from the Correlates of War (COW) and Peace Research Institute Oslo (PRIO) datasets, respectively. The models with the alternative measures of conflict yielded mixed results. Regressing the democracy scores on the IMF program indicator and the confounding covariates plus the COW variables, we find again that the conditional association between IMF participation and the amended Polity2 score loses significance, but the coefficient on the IMF indicator nearly doubles (and is highly significant) when the Freedom House score is the measure of the level of democracy. When we use the PRIO indicators of the presence or absence of inter- and intrastate conflict, by contrast, the IMF program coefficient is large and highly significant regardless of whether the Polity2 or Freedom House score is used.

In addition, we tried specifications in which we included different measures of social and political instability. We drew three indicators (strikes, government crises, and riots) from the widely used Databanks International database (2013). Matching on these covariates (plus all of the covariates from the baseline model with the exception of the political violence index) and regressing the democracy scores on the covariates after matching yielded positive – and highly statistically significant – conditional associations between IMF program participation and both measures of democracy.

We also checked for the robustness of the positive estimates for the IMF program participation indicator when we include a measure of foreign aid inflows as a covariate of countries’ democracy scores. There is a very large literature on the foreign aid-democratization nexus; in one of the recent contributions, Kersting and Kilby (2014) provide evidence showing a positive and significant relationship between foreign aid inflows from the OECD Development Assistance Committee (DAC) members and recipient countries’ Freedom House and Polity2 scores. We added Kersting and Kilby’s DAC foreign aid indicator (measured as a proportion of nominal GDP, and lagged by 1 year), constructed another matched dataset using the baseline covariates plus the foreign aid measure, and regressed the measures of democracy on the baseline covariates plus the foreign aid indicator. In the additional specifications (reported in Supplementary Appendix H) the IMF program participation variable remained positive and significantly associated with the democracy scores.

Finally, we constructed matched samples after excluding all observations in which countries were under a non-concessional IMF program.Footnote 31 We wanted to see whether one type of IMF program was driving the results that we reported in the previous section. In both the matched Polity2 and Freedom House samples the estimated effect of IMF program participation (limited to concessional loans) was positive; in both samples the estimated IMF program coefficient was larger, though it was only significant at the ten percent level in the Polity2 model.

7 Instrumenting for IMF program participation

The matching approach generated a set of results suggesting that, on average, IMF program participation has been positively associated with democracy scores in borrowing countries. The robustness checks indicated that the positive relationship between IMF loans and democracy is durable, but our confidence in that finding would increase if evidence from different kinds of tests yielded similar results. The challenge in generating other corroborating evidence for the argument lies in designing tests that can address the selection problem laid out earlier in the article. In this and the following section we lay out two other strategies for testing the IMF loan-democracy relationship.

One way to identify the direction of the association between IMF program participation and democracy scores is to use an instrument that is highly correlated with the endogenous variable (IMF loans) but has no direct link to the outcome (democracy). When an instrument is valid, we can be confident any effect of the instrument on the outcome that we detect in the statistical models must have come through the endogenous variable.

Good instruments are hard to find, however, as has been highlighted in the broader foreign aid literature.Footnote 32 The extensive literature on the effects of IMF programs supplies several possibilities, but as we briefly noted in the introductory section, the most commonly used instruments for IMF loans are unlikely, in the context of our study, to meet two important criteria. The first hurdle a valid instrument must pass is the exclusion restriction: the impact of the variable has to come exclusively through its effect on the likelihood of program participation. If the instrument has a direct link to the outcome, then it fails this restriction. Second, valid instruments also have to meet the “ignorability” (or conditional independence) assumption: the variation in the instrument has to be plausibly independent of the potential outcomes.

The fact that our outcome of interest is variation in the level of democracy makes our task of identifying a valid instrument even more difficult. The changes in domestic political institutions and practices that translate into swings in countries’ observed democracy scores often lead to changes in foreign policies that violate the second criterion for the validity of an instrument. For example, the proximity of developing countries’ voting profiles to the votes of the powerful states in the UN General Assembly have been used in several prominent studies as instruments for IMF programs (Barro and Lee 2005; Dreher 2006), but evidence shows that democratizers in the developing world tend to shift their UNGA votes to bring them in line with the votes cast by the United States and other powerful states (Carter and Stone 2015).

We instead propose an instrument that more likely has no direct link to countries’ democracy scores, which cannot be directly controlled by the decisions of governments in poor and middle-income countries, and which is a substantively important determinant of participation in IMF programs. The instrument is the weighted average of the short-term interest rates in the Northern financial centers (the U.S., UK, Germany, France, Japan, and Switzerland). Berg and Pattillo (1999) compiled this debt-weighted Northern interest rate variable.Footnote 33 The measure varies both over time (reflecting the impact of market forces and decisions by the Northern countries’ monetary authorities to adjust interest rates) and it varies by country, because the measure weights the six Northern countries’ interest rates by the fraction of the external debt contracted by each country in the sample that is denominated in foreign, “hard” currencies.

Advanced countries’ interest rates, in Pepinsky’s words, “have a clear relationship with currency crises [in developing and emerging countries] throughout the 1970s, 1980s, and early 1990s, as uncovered in a number of studies” (2012, 549). Historically, the weighted foreign interest rate measure was also a good predictor of the likelihood that a low- or middle-income country would be involved in an IMF conditional lending program.Footnote 34 Some illustrative evidence for the relationship is shown in Fig. 3. In Fig. 3 we observe a positive relationship between the share of countries in the sample that are under an IMF arrangement in a given year and the sample-average weighted Northern interest rate in the years for which we have data.

Our proposed instrument would, however, fail the exclusion restriction if it could be directly linked to variation in countries’ democracy scores. Neither existing theory nor any empirical evidence suggests that there is any direct effect of the debt-weighted average of Northern interest rates on developing and emerging countries’ democracy scores. Moreover, we can account for the possibility of an indirect link between the instrument and the outcome – higher Northern interest rates, for example, may lead to capital outflows and destabilizing currency crises in low- and middle-income countries that systematically affect democracy scores – by controlling for economic conditions (including currency collapses) in the models.

Data availability is the main drawback of the instrument: the measure is only available for the years between 1972 and 1992. However, the limited time coverage drawback is in our view far outweighed by the plausible exogeneity of the variable, and the results of the instrumental variable analysis should be viewed as just one of a set of tests for the relationship between IMF loans and democracy.Footnote 35

The IV results are reported in Table 3. We estimated the models using two-stage least squares.Footnote 36 In addition to the battery of baseline covariates, the models include country fixed effects to control for time-invariant country characteristics that might affect the level of democracy and the likelihood of program participation, year fixed effects to pick up common time trends, and region-year fixed effects.

The 2SLS results are consistent with the positive conditional association between IMF program participation and democracy scores that we identified with the matching procedure. We find a positive and significant coefficient on the (instrumented) IMF program variable in each of the specifications reported in Table 3. While the coefficients from the IV analysis are larger than in previously reported models, the confidence intervals around the point estimate are larger, as well.

Test statistics suggest that the weighted Northern interest rate instrument is not particularly strong.Footnote 37 Put in the context of the results that we reported in the previous section, however, the findings reported in Table 3 give us no reason to think that our primary conclusion– that IMF programs have been modestly but positively associated with borrowers’ democracy scores – is at odds with the evidence. Yet the limited time coverage of our instrument (and its relatively low power) suggested that another test using a different instrument would build confidence in the finding. An alternative instrumental variable, recently proposed by Lang (2015), gives us the opportunity to again test the strength of the positive link between IMF programs and democracy scores that we detected in the other statistical analyses.Footnote 38

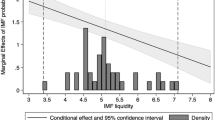

Lang suggests that the interaction between a measure of the IMF’s loanable resources – the (logged) liquidity ratio, defined as the amount of liquid resources available to the IMF in a given year divided by its liquid liabilities – and the likelihood that a country in year t is under an IMF arrangement is a plausibly exogenous instrument for IMF program participation. When the liquidity ratio is high, the Fund is more generous, and the liquidity ratio itself is driven by organizational factors that have nothing to do with borrowing country characteristics.

To construct an excludable instrument for IMF programs that can also accommodate country and year fixed effects, Lang follows an empirical approach developed by Nunn and Qian (2014).Footnote 39 Nunn and Qian deal with the selection problem in their study (which explores the effect of US food aid on civil conflict in recipient countries) by instrumenting for US food aid with (lagged) US wheat production. (Wheat production in the US is unaffected by the intensity of civil conflict in aid-recipient countries, and it has a strong correlation with the amount of food aid given to needy countries.) US wheat production varies over time but not by country; since all of the variation in the indicator is temporal, it is perfectly collinear with year fixed effects. To generate an instrument that varies over time and varies by country, Nunn and Qian interact (lagged) US wheat production with an indicator of countries’ propensities to receive food aid from the US (the share of years across their 36-year sample period in which the country received any food aid from the US).

Following the strategy used by Nunn and Qian and Lang, we constructed an instrument by interacting the IMF liquidity ratio variable (which we logged and lagged by 1 year) with a time-varying measure of countries’ propensities to enter into IMF programs.Footnote 40 The probability of program participation is calculated as the share of years between 1972 and year t in which a country was under an IMF arrangement. (For countries that became independent at any point after 1972 or were independent before 1972 but did not join the IMF until a later date, we calculate the probability using the fraction of years from the date of independence or date of IMF membership to year t.) When we substituted the new interacted instrument for our original instrument for IMF program participation (debt-weighted average Northern interest rates), we found sizeable, positive, and highly statistically significant associations between IMF loans and the democracy scores. Further, test statistics showed that the interacted instrument (logged IMF liquidity ratiot-1 × probability of IMF program participation) had considerable power.Footnote 41

8 Difference-in-differences approach

In this section we describe a third way we test for the relationship between IMF program participation and democracy, the results of which are consistent with the positive conditional differences that we found using, first, the genetic matching algorithm as a pre-processing step in the data analysis, and, second, valid instruments for IMF program participation. We follow an approach devised by Giavazzi and Tabellini (2005), who in their study examined the effect of democracy on market-oriented policy change by defining the “treatment” group as the subset of countries that experienced a discrete democratization episode during the observation period.Footnote 42 The difference-in-differences setup examines the IMF-democracy link from a different angle than the tests in the previous sections. Instead of testing whether, after conditioning on a set of covariates known to affect measures of the level of democracy, IMF program participation had an average positive or negative association with countries’ democracy scores, this approach asks: did the democracy score change more in the average long-term program participant country (the treatment group) than in the country that was a less frequent participant in lending programs (the control group)?Footnote 43

The difference estimator gives us another way to test for the association between IMF program participation and democracy scores, but it requires a method for distinguishing the treatment and control groups.Footnote 44 In the context of IMF lending, the treatment has to be conceptualized as a sufficiently extensive period of experience under the IMF’s conditional lending arrangements that it can be expected to have the possibility of impacting the domestic political environment in a way that could affect the country’s democracy score, and one which enough countries did not experience during the sample period so that we have a “control” group to which we can compare the “treated” units. We try two ways of dividing countries into the “treatment” and “control” groups. First, we code any country that was under IMF lending arrangements for a minimum of four consecutive (uninterrupted) years as part of the treated group from that initial episode to the end of the sample period. This simple way of partitioning the sample into long-term and short- (or non-) participants in IMF programs is similar to the approach used in Mumssen et al. (2013) to distinguish the subset of longer-term prolonged users of IMF lending facilities.Footnote 45 This treatment variable (which we call Extensive IMF Participation) takes the value of one in all years after the country’s treatment episode. It takes a value of zero for treated countries before the initial “treatment” episode, and is always zero for the “control” countries (the countries in the sample that were never under IMF lending arrangements for a minimum of four consecutive years).

Figures 4 and 5 provide simple illustrations of the differences in democracy scores for the countries that experienced extensive engagement with the IMF and the shorter-term (or nonparticipating) subset of countries. Figure 4 tracks the average annual (amended) Polity2 score for the two subsets after dividing the sample into extensive and non-extensive IMF participant countries. Figure 5 displays the average rescaled Freedom House scores for the two groups. The plotted data suggests that after the onset of the developing world’s sovereign debt crisis in the early 1980s the upward climb in democracy scores for the group of extensive IMF program participants was both smoother and steeper than the change for the countries that did not participate in an IMF lending program for (at minimum) four consecutive years during the observation period. The positive difference made by the longer-term IMF engagement suggested by the plots is confirmed in the statistical results, which we report below.

We also tried a second way to differentiate the treatment and control groups for the difference-in-differences estimator. In this construction, we allowed for the possibility that countries which had at some point in the window of analysis come under the influence of IMF lending programs for a significantly lengthy period eventually exited the merry-go-round of signing consecutive loans for years on end. Thus we restricted the treatment group in the second version to only those countries that were at some point in the sample period enrolled in IMF lending arrangement for four consecutive years and which experienced only short-term interruptions in program participation after that initial episode (defined as an interruption of no more than two consecutive years).

The results presented in Table 4 are within-estimators; we regress the democracy indicators on the treatment variable and the other covariates alongside year and country fixed effects. Recall that the difference-in-difference method is intended to capture the impact of IMF program participation by comparing the difference in democracy scores before and after the onset of the treatment episode in the treated countries to the levels of democracy in the control group (the subsample of countries that did not meet the coding criteria for extensive experience with IMF conditional lending arrangements). The positive coefficients on both versions of the IMF treatment indicator are further evidence that there is no reason, based on the data at hand, to conclude that participation in IMF lending arrangements is associated with lower levels of democracy (as captured by the two widely used indicators that we rely on in this study). The results from our analysis can support a modest (yet still surprising, given the widespread belief that IMF programs are inimical to democracy) claim that there has been a small but positive association (on average) between the IMF’s conditional lending programs and the level of democracy in the many developing and emerging countries that made use of the institution’s lending facilities over the past four decades.

9 Conclusion

The impact of IMF loans on the measurable level of democracy is a longstanding concern for both scholars and policymakers. In June 1984 the Argentine government bypassed IMF staff members and submitted a confidential Letter of Intent outlining the contours of a condition-free rescue program directly to top IMF management. They justified the breach of protocol by appealing to the fragility of the country’s newly democratic regime, installed in December 1983: “…we must avert undesirable distortions both in the level of activity and employment and in relative prices and income. The Argentine government is convinced that social stability is essential for the validation and strengthening of democracy…Argentine history in recent decades testifies to the repeated failure of economic policies which, for the sake of an ultimate objective of stability and progress, caused enormous distortions in the economic and social fabric.”Footnote 46

The findings presented here suggest that fears about the deleterious impact of the IMF’s lending arrangements on democracy scores are misplaced. The evidence from our statistical analysis fits with an argument that Karen Remmer (1986, 21) advanced in the wake of the Latin American sovereign debt crisis: “to charge the IMF with undermining democracy is to engage in hyperbole.” Relying on data from up to 120 developing and emerging countries observed between 1971 and 2007, and making use of three different empirical strategies to more credibly estimate the conditional difference between borrowers and non-borrowers in their levels of democracy (genetic matching, instrumental variables, and difference-in-differences estimators), we found that the IMF’s lending arrangements have not been associated with lower democracy scores in the short run. Instead, we find evidence of a modest but positive relationship between program participation and democracy scores. For the reasons we describe above, the contradictory findings about the IMF’s impact on democracy may be driven by the less-than-reliable statistical fixes employed by scholars to solve the nonrandom assignment problem that troubles quantitative research on the domestic political consequences of engagement with international organizations.

Our results have implications for future work on the domestic politics of IMF lending. Despite the importance of the IMF’s lending activities in developing countries, specialists in the study of international organizations have a rather small body of evidence about the domestic political consequences of the Fund’s conditional loans from which to draw. The knotty inferential issues involved in studying the association between IMF lending and domestic political outcomes serves as a deterrent to researchers. The approaches in this article, imperfect as they may be, can nonetheless be used to reexamine other common claims about the domestic political consequences of IMF programs, including the links to social protest and human rights abuses.

The analysis centered on whether IMF program participation affected conditional differences in countries’ democracy scores. The baseline expectation for many scholars interested in the IMF-democracy relationship was that, putting the selection issue to the side, if there was any observed link it would be a negative one. We contested this expectation by, first, proposing an alternative theoretical pathway and, second, discussing a series of tests of the empirical relationship between IMF programs and levels of political democracy. For our purposes, the broad measures of democracy provided by the Polity2 and Freedom House indicators are very useful. In future work, however, scholars may disaggregate the dimensions of democracy that are collapsed in the broad indices used here in order to tease out the different ways in which IMF lending programs may affect these dimensions. In the much more extensive literature on the foreign aid-democracy link this kind of unpacking of the elements of democracy in order to test more fine-grained mechanisms is underway (e.g., Dietrich and Wright 2015).

Ultimately, expanding and improving the empirical literature on the social and political consequences of participation in IMF lending arrangements would give scholars of IOs a stronger body of research upon which to draw when trying to understand the problems of efficacy and legitimacy of one of our key institutions of global economic governance.

Notes