Abstract

Though rates of foreclosure are at a historic high, relatively little is known about the link between foreclosure and health. We performed a case–control study to examine health conditions and health care utilization in the time period prior to foreclosure. Homeowners who received a home foreclosure notice from 2005 to 2008 were matched (by name and address) to a university hospital system in Philadelphia and compared with controls who received care from the hospital system and who lived in the same zip code as cases. Outcome measures included prevalent health conditions and visit history in the 2 years prior to foreclosure. We found that people undergoing foreclosure were similar to controls with regard to age, gender, and insurance status but significantly more likely to be African American. Rates of hypertension and renal disease were significantly higher among cases after adjustment for sociodemographic characteristics. In the 2 years prior to foreclosure, cases were more likely to visit the emergency department, have an outpatient visit, and have a no-show appointment. Cases were less likely to have a primary care physicians (PCP) visit in the 6 months immediately prior to the receipt of a foreclosure notice. The results suggest changes in health care utilization in the time period prior to foreclosure. Policies designed to decrease the incidence of home foreclosure and support people during the process should consider its association with poor health and changes in health care utilization.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Foreclosure filings were reported on 2.9 million properties in 2010,1 and with 9.6% of households behind on mortgage payments but not yet in foreclosure, the rates of foreclosure are expected to continue to increase.2 Higher rates of foreclosure have been reported among minority homeowners who were more likely to receive subprime and Alt-A loans, be victims of predatory lending,3,4 and experience higher rates of unemployment.5

Foreclosure is sign of cumulative financial strain frequently due to loss of employment, increases in mortgage payments, and subprime and predatory lending in the setting of the current economic recession.6,7 Foreclosure may also result from poor health and high health care expenses; studies indicate that poor health is the primary cause of between 7% and 20%8,9 of all foreclosures, and a contributing factor in nearly half.9 Financial strain has been linked to higher mortality, increased psychological distress, earlier disability, increased blood pressure, and mortality.10–16 Studies of people undergoing foreclosure reported higher rates of cost-related health care non-adherence and of certain rates of chronic diseases compared to the general population.8,17 However, previous studies of home foreclosure have relied on self-reported health measures and cross-sectional data.

Building on these findings, we performed a case–control study using computerized medical record data to explore health status and health care utilization in the time period prior to foreclosure. We hypothesized that people who undergo foreclosure may be in poor health compared to control subjects and may be more likely to experience reductions in their health care utilization prior to receiving a notice of foreclosure.

Methods

Selection of Cases and Controls

Home foreclosure is a legal process that starts when a bank sends a notice of default indicating that a person is behind on their mortgage payment; over time, it may result in the loss of that individual’s home. When the foreclosure proceeding is initiated, information on the property subject to foreclosure enters the public record. Cases were selected from a dataset created by linking public data on mortgage foreclosure filings with billing claims and electronic medical record data from the University of Pennsylvania Hospital System (UPHS). A listing of all properties undergoing foreclosure in the city and county of Philadelphia between January 2005 and April 2008 was obtained from RealtyTrac, Inc., a private company that aggregates public foreclosure records.

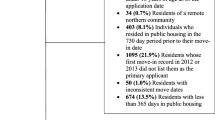

We received information including the property address, the owner’s first and last name, and the date on which a foreclosure notice was filed, for a total of 20,495 properties. Properties with owners listed as banks, investment corporations, funds, partnerships, and the US government were excluded from further analyses (N = 16,755 remaining properties). We were able to match the addresses of 10,440 of these properties to addresses contained in UPHS’s medical records database. UPHS patients are asked to update their address at each visit, and both current and historical addresses were employed in the matching process. The dataset was limited to records matching the foreclosure data on both first and last name (N = 2,258), and to people who were at least 18 years old at the earliest time of data collection, 2 years prior to foreclosure (n = 2,110). Of these, 1,016 had at least one visit with any UPHS provider in the 2 years prior to foreclosure, and 404 had at least one outpatient visit to a UPHS-affiliated primary care provider (PCP) during this period. These 404 records comprise the cases. The dataset was limited to people with a primary care visit at UPHS because, compared to patients whose primary care provider is outside of the UPHS system, those who receive primary care within the system are more likely also to receive specialty and hospital care within it. For properties in the sample that received more than one foreclosure notice, the earliest date of notice was used as the reference date.

For each case, up to 5 controls were selected from patients in the UPHS system. Controls were required to have at least one primary care appointment in the 2 years prior to the matched case’s date of foreclosure, to be at least 20 years old at the reference date (and over 18 years old 2 years prior to the reference date), and to reside in the same zip code as cases. Zip codes were used in matching to help ensure that cases and controls were reasonably similar with regard to unmeasured neighborhood socioeconomic characteristics. Cases were from 37 different zip codes, with a median of 6 cases per zip code (range 1–82). Given the large pool of potential controls, controls were only matched with a single case and were not resampled.

Property Data

Data on estimated property values, loan amounts, and the type of foreclosure notice (notice of default, auction notice, and notice of bank repossession) for each property were obtained from RealtyTrac, Inc. In Philadelphia County, a notice of default can be issued 2 months after the homeowner misses a mortgage payment. An auction notice indicates that a date has been set for the property to be sold at auction, which can occur 6 months after the first missed mortgage payment. A notice of bank repossession signals that the property has been reclaimed by the bank, marking the completion of the foreclosure process. We used data on the earliest filing available for each property. Property data were available for all cases as well as for properties that did not match to the UPHS.

Demographic and Medical Data

UPHS computerized medical records provided demographic characteristics (age at foreclosure, gender, and race/ethnicity), insurance status, information about cases’ and controls’ utilization of medical care, and co-morbidities. For each case and control, we constructed a visit history that indicated whether the individual had an outpatient primary care visit, an obstetrics/gynecology visit (females only), any other outpatient visit (excluding primary care and obstetrics/gynecology), a canceled appointment, a missed appointment, an inpatient hospitalization, or an emergency department visit in the 2 years prior to foreclosure. Visits were classified into 2 “windows.”

The window from 24 to 6 months prior to receipt of the foreclosure notice (–24 months to –6 months) is the pre-foreclosure period. Observing the health and health care utilization of cases and controls during this period allows us to test the hypothesis that poor health and high health care utilization are associated with an increased risk of home foreclosure. The window from −6 months to foreclosure, on the other hand, represents the peri-foreclosure period. Here, cases will have already fallen behind on their mortgage payments, and cases with a notice of auction or bank repossession may have already received a notice of default in the peri-foreclosure window. In this window, we hypothesize that poor health status or change in health care utilization may either be the cause of, or result from, the foreclosure process.

Insurance status was classified using the primary insurance that was billed during the patient’s first visit in the 2 years prior to receipt of a foreclosure notice. Insurance was classified as public insurance (Medicaid or Medicare), private insurance, or uninsured/self-pay. Individuals who had bills that were unpaid (either by insurance or by the patients themselves) were classified as uninsured.

Patient clinical conditions over the 2 years prior to foreclosure were classified using ICD-9 codes and the Clinical Classification System Multi-Level Diagnoses,18 as grouped into modified categories. A Charlson Comorbidity Index was calculated for each patient. The results are based on data from the entire time period to increase the sensitivity of the measure derived from hospital system data.

Statistical Analyses

Demographic characteristics of cases are compared to those of controls using first bivariate analyses (chi-square statistics for categorical variables and t tests for continuous variables). The prevalence of clinical conditions in cases and controls was compared using conditional logistic regression, adjusted for age, gender, race/ethnicity, and insurance status in the 2 years prior to foreclosure. Visit history, adjusted for age, gender, race/ethnicity, insurance status, and Charlson comorbidity index, was examined in the 2 years prior to foreclosure using conditional logistic regression analyses.

In order to assess the generalizability of the cases with respect to other foreclosed properties in the city during the time period under study, we conducted bivariate analyses (Wilcoxon rank sum and chi-square tests) to compare property characteristics of cases to those of all properties that received foreclosure notices in Philadelphia County. The study was approved by the University of Pennsylvania’s Institutional Review Board.

Results

Table 1 presents the demographic characteristics of the cases and controls. There were no significant age or gender differences between cases and controls. People undergoing foreclosure were more likely than controls to be members of a racial/ethnic minority group (84.4% black in the cases versus 71.6% in the controls). There were no significant differences in insurance status.

Our analysis of prevalent health conditions in the full 2-year time period leading up to foreclosure indicated some significant differences in the health of people undergoing foreclosure and the control population, after controlling for multiple confounders (Table 2). People undergoing foreclosure had significantly higher prevalence of hypertension (adjusted odds ratio [AOR] 1.40, 95% confidence interval [CI] 1.08–1.81, p = 0.01), renal disease (AOR 1.83, 95% CI 1.09–3.06, p = 0.02), and Charlson comorbidity indices (AOR 1.07, 95% CI 1.00–1.14, p = 0.04). Differences in the rates of cerebrovascular disease also neared statistical significance (p < 0.10). No significant differences were noted for a number of other conditions, including psychiatric conditions (depression, bipolar disorder, and anxiety disorder) or drug or alcohol use. Women undergoing foreclosure were significantly less likely than controls to have a pregnancy-related code in the 2 years prior to foreclosure (AOR 0.20, 95%CI 0.08–0.50, p = 0.001). Results were similar in sensitivity analyses in which we excluded the −6 to 0 months window.

Cases and controls were selected into the study if they had at least one visit to a PCP in the 2 years prior to the date of the case’s foreclosure notice (Table 3). The distribution of these visits was different between cases and controls, with both equally likely to see a PCP in the pre-foreclosure (−24 to −6 months) window, but with cases significantly less likely to have a PCP visit in the peri-foreclosure period (−6 to 0 months; AOR 0.78, 95%CI 0.63–0.98, p = 0.03). People undergoing foreclosure were more likely to have had an outpatient (non-PCP) visit in the pre-foreclosure window, but this gap did not persist into the peri-foreclosure window. Similarly, cases were more likely to be seen in the emergency department in the pre-foreclosure but not the peri-foreclosure window. There were no significant differences between cases and controls in the rates of hospital visits or canceled appointments in either window. People undergoing foreclosure were, however, significantly more likely to have missed a scheduled appointment in the pre-foreclosure period (AOR 1.47, 95%CI 1.17–1.86, p = 0.001).

Compared to foreclosed properties in Philadelphia that were not included in the final sample, matched properties tended to have lower median loan amounts ($52,662 versus $57,170, p = 0.005) and lower median values ($80,000 versus $90,000, p = 0.04).

Discussion

This study adds to the growing evidence suggesting important links between foreclosure, health status, and health care utilization. Rates of chronic conditions between the homeowners who experience foreclosure and controls were similar, although those undergoing foreclosure had significantly higher rates of hypertension, renal disease, and Charlson comorbidity indices. People undergoing foreclosure were more likely to have had an emergency department and outpatient visit in the 2 years prior to foreclosure, potentially signaling a higher burden of illness among cases than controls. Despite these findings, during the time period immediately prior to foreclosure, cases were not more likely than controls to have an emergency department or outpatient visit; and in fact were less likely to have a PCP visit during this period.

The changing patterns of visits over time could be explained in multiple ways. The observed pattern of visits could occur if, shortly before the date of foreclosure, people undergoing foreclosure begin receiving care for ongoing medical conditions in settings outside of the UPHS network. Since unemployment is the leading cause of foreclosure7 and may also precipitate the loss of medical insurance, it seems plausible that some people undergoing foreclosure may seek medical care from alternative sources due to changes in health insurance status. Reports indicate that community health centers have seen an increase in new patients during the current economic recession.19,20 People experiencing foreclosure may also move to a different area, and would hence drop out of the UPHS records. Under either of these interpretations, continuity of care, which is valued by patients,21 is likely disrupted.

It is also possible that homeowners undergoing foreclosure have fewer visits in the peri-foreclosure period as compared to cases because they are foregoing necessary care. People undergoing foreclosure may make difficult trade-offs between spending on health care, making mortgage payments, and paying for other expenses. Consistent with this interpretation, previous research has found high rates of cost-related pharmacy and health care non-adherence among people undergoing foreclosure that may, over time, harm health.8

It has been postulated that, for some individuals, the foreclosure process may contribute to poor health.8,22 Financial strain in general has been linked to worse health10,11,15,23 and job loss—itself a cause of foreclosure—is associated with increased rates of depressive symptoms.24 In a study utilizing screening questions, people undergoing foreclosure have been found to have high rates of depression.8 Our analysis of medical records data does not indicate that people undergoing foreclosure had higher rates of diagnosed depression than controls, even in the peri-foreclosure window (results not shown). It is unknown whether this reflects under-detection of depression in the health care system, which is common in primary care settings.25,26

The study provides limited evidence to support or refute existing surveys showing poor health as a cause of foreclosure.7–9 Though there were differences in utilization and rates of certain chronic diseases between cases and controls, it is uncertain that these differences were of a sufficient magnitude to cause foreclosure among particular homeowners. We were unable to measure the amount of health care-related debt. Further, we could not examine other household members whose health status and health care utilization may have affected the likelihood of a family undergoing foreclosure. If these household members were included in the control population, it would bias our results towards the null.

Foreclosure may also be expected to exacerbate racial and socioeconomic disparities. Consistent with previous studies,8,27 we found that black patients were more likely to undergo foreclosure compared to the control group. In addition, the study found higher rates of hypertension and renal disease among homeowners experiencing foreclosure. This may, in part, reflect the higher prevalence of these conditions among black populations, though models control for race/ethnicity.

Study Limitations

This study had many limitations. First, because we were only able to examine care received within UPHS, we limited our sample to those with a PCP visit. Though patients who see a UPHS PCP may also be more likely to also use the emergency department or inpatient services, patients may nevertheless choose to receive care outside the system. People undergoing foreclosure may move away from their homes prior to the actual “foreclosure date,” which would tend to bias any relationship between foreclosure and increased health care utilization towards the null. Second, the timing of the foreclosure process is highly variable depending on a range of homeowner-, mortgage counseling-, and bank-related factors; caution should be used in interpreting the time-periods. Third, our study may have been underpowered to detect smaller but policy-relevant differences in health status between people undergoing foreclosure and the general UPHS population.

Fourth, though we matched based on zip code as a way to control for unmeasured socioeconomic factors, we were not able to match at smaller, less heterogeneous geographic areas like census tracts or block groups,28 and we could not control for individual-level socioeconomic variables, including the housing status of patients in the control population. The tendency of foreclosures to cluster in particular neighborhoods within zip codes also leads to conservative estimates of effect sizes. Related to this, the lack of individual-level socioeconomic status information on both the cases and controls (e.g., employment status) means that we are unable to isolate the impact of the foreclosure itself from the impact of the financial strain that may both lead to and result from the foreclosure process. Nonetheless, as homeowners are confronting a broad range of issues, the focus on their health and health care utilization in the broader socioeconomic context is important for public policy and public health practice.

Finally, this study reflects the population of patients seen at a single institution; findings may not be generalizable to other institutions and regions of the country where differences exist in the structure of the housing and health care markets. The homeowners in our sample tended to have statistically significantly lower median loan amounts and home values than the universe of foreclosed properties in Philadelphia, suggesting that the sample in our study may have been somewhat poorer. This may reflect the University health system’s catchment area in a relatively low-income section of Philadelphia and/or patients’ choice of providers. The 2008 home ownership rate for the Philadelphia metropolitan area (71.8%) is higher than the national average for large metropolitan areas (67.8%)29 and rates of foreclosure have been lower than in many states.

Conclusion and Implications

This case–control study is the first to use hospital system records to show an increased likelihood of having an emergency department visit and higher rates of certain chronic disease among homeowners experiencing foreclosure. More research is necessary to further delineate the health trajectories and patterns of health care utilization among people experiencing home foreclosure. Interventions should be tested that attempt to assist individuals undergoing foreclosure by linking mortgage counseling and medical and social services. For example, mortgage counselors may be trained to screen homeowners for health insurance and for cost-related medical non-adherence and direct them to free and low-cost health care options. This may be beneficial, as our study found homeowners experiencing foreclosure had higher rates of certain chronic diseases that may require active monitoring and management. Similarly, the medical system may screen individuals who are potentially at increased risk of foreclosure, for example those who have high cost medical encounters (e.g., emergency department visits as found in the study) or who are behind on medical payments, for housing strain. At-risk homeowners may be directed to free, government-sponsored mortgage counseling programs that may assist with loan modification and financial counseling. It is plausible that by reducing financial strain, mortgage counseling programs may help mitigate health care discontinuities and trade-offs that individuals undergoing foreclosure may make. Fostering connections between mortgage counseling and health care professionals may offer people facing foreclosure an opportunity to promote health.

References

RealtyTrac. Record 2.9 million U.S. properties receive foreclosure filings in 2010 despite 30-month low in December. http://www.realtytrac.com/content/press-releases/record-29-million-us-properties-receive-foreclosure-filings-in-2010-despite-30-month-low-in-december-6309. Accessed 5 Apr 2011.

Mortgage Bankers Association. Delinquencies, foreclosure starts increase in latest MBA National Delinquency Survey, 2010. http://www.mortgagebankers.org/NewsandMedia/PressCenter/72906.htm. Accessed 27 May 2010.

Joint Center for Housing Studies, The State of the Nation’s Housing 2009. Cambridge, MA: Harvard University; 2009: 3.

Majority Staff of the Joint Economic Committee. The subprime lending crisis 2007. Washington, DC: US Senate. http://www.jec.senate.gov/Documents/Reports/10.25.07OctoberSubprimeReport.pdf. Accessed 16 June 2009.

Bureau of Labor Statistics. Employment situation summary, 2010. http://www.bls.gov/news.release/empsit.nr0.htm. Accessed 14 Jan 2009.

Joint Center for Housing Studies. The State of the Nation’s Housing 2010. Cambridge, MA: Harvard University; 2010: 1–3, 18–19.

NeighborWorks America, National Foreclosure Mitigation Counseling Program Congressional Update Activity through January 31, 2010. http://www.nw.org/network/nfmcp/documents/CongressionalReportandAppendices.pdf. Accessed 10 June 2010.

Pollack CE, Lynch J. Health status of people undergoing foreclosure in the Philadelphia Region. Am J Public Health. 2009; 99: 1833–9.

Robertson CT, Egelhof R, Hoke M. Get sick, get out: the medical caues of home mortgage foreclosures. Health Matrix. 2008; 18: 65–105.

Steptoe A, Brydon L, Kunz-Ebrecht S. Changes in financial strain over 3 years, ambulatory blood pressure, and cortisol responses to awakening. Psychosom Med. 2005; 67(2): 281–7.

Szanton SL, Allen JK, Thorpe RJ Jr, Seeman T, Bandeen-Roche K, Fried LP. Effect of financial strain on mortality in community-dwelling older women. J Gerontol B Psychol Sci Soc Sci. 2008; 63(6): S369–74.

Kahn JR, Pearlin LI. Financial strain over the life course and health among older adults. J Health Soc Behav. 2006; 47(1): 17–31.

Ferraro K, Su Y. Financial strain, social relations, and psychological distress among older people: a cross-cultural analysis. J Gerontol B Psychol Sci Soc Sci. 1999; 54(1): S3–15.

Matthews RJ, Smith LK, Hancock RM, Jagger C, Spiers NA. Socioeconomic factors associated with the onset of disability in older age: a longitudinal study of people aged 75 years and over. Soc Sci Med. 2005; 61(7): 1567–75.

Blazer DG, Sachs-Ericsson N, Hybels CF. Perception of unmet basic needs as a predictor of mortality among community-dwelling older adults. Am J Public Health. 2005; 95(2): 299–304.

Lantz PM, House JS, Mero RP, Williams DR. Stress, life events, and socioeconomic disparities in health: results from the Americans’ changing lives study. J Health Soc Behav. 2005; 46(3): 274–88.

Pollack CE, Lynch J, Alley DE, Cannuscio C. Foreclosure and health status. LDI Issue Brief. 2010; 15(2): 1–4.

HCUP CCS. Healthcare Cost and Utilization Project (HCUP). January 2011. Agency for Healthcare Research and Quality, Rockville, MD, http://www.hcupus.ahrq.gov/toolssoftware/ccs/ccs.jsp. Accessed 18 March 2011.

National Association of Community Health Centers. Recession brings more patients to community health centers 2009. http://www.nachc.com/client/documents/rising_patient_%20demand_093.pdf. Accessed 21 April 2010.

Villegas, A. Community health centers strained by recession, face bigger caseloads under reform. Kaiser Health News 2009. http://www.kaiserhealthnews.org/Stories/2009/August/07/Community-health-centers.aspx. Accessed 21 April 2010.

Nutting PA, Goodwin MA, Flocke SA, Zyzanski SJ, Stange KC. Continuity of primary care: to whom does it matter and when? Ann Fam Med. 2003; 1(3): 149–55.

Bennett GG, Scharoun-Lee M, Tucker-Seeley R. Will the public’s health fall victim to the home foreclosure epidemic? PLoS Med. 2009; 6(6): e1000087.

Drentea P, Lavrakas PJ. Over the limit: the association among health, race and debt. Soc Sci Med. 2000; 50(4): 517–29.

Wilson SH, Walker GM. Unemployment and health: a review. Public Health. 1993; 107(3): 153–62.

Simon GE, VonKorff M. Recognition, management, and outcomes of depression in primary care. Arch Fam Med. 1995; 4(2): 99–105.

Wells KB, Schoenbaum M, Unützer J, Lagomasino IT, Rubenstein LV. Quality of care for primary care patients with depression in managed care. Arch Fam Med. 1999; 8(6): 529–36.

Kaplan DH, Sommers GG. An analysis of the relationship between housing foreclosures, lending practices, and neighborhood ecology: evidence from a distressed county. Prof Geogr. 2009; 61(1): 101–20.

Krieger N, Williams DR, Moss NE. Measuring social class in US public health research: concepts, methodologies, and guidelines. Annu Rev Public Health. 1997; 18: 341–78.

US Census Bureau. Homeownership rates for the 75 largest MSAS: 2005 to 2008. http://www.census.gov/hhes/www/housing/HVS/annual08/ann08ind.html. Accessed 19 May 2010.

Acknowledgments

The authors would like Katrina Armstrong for her advice. This work was presented at the American Public Health Association annual meeting, Philadelphia, PA, United States on November 11, 2009 and the Society of General Internal Medicine annual meeting, Minneapolis, MN, United States on May 1, 2010.

Funding

Funding was provided by the Leonard Davis Institute of Health Economics, the Robert Wood Johnson Foundation Clinical Scholars Program and the Philadelphia VA Medical Center, at the University of Pennsylvania.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pollack, C., Kurd, S.K., Livshits, A. et al. A Case–Control Study of Home Foreclosure, Health Conditions, and Health Care Utilization. J Urban Health 88, 469–478 (2011). https://doi.org/10.1007/s11524-011-9564-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11524-011-9564-7