Abstract

Entrepreneurial orientation (EO) describes a firm’s attitude towards entrepreneurial activity; however, it does not measure the specific behaviors likely to contribute to high growth. This research applies the resource-based and dynamic capabilities views to propose a mediation model between EO and high growth. The theoretical framework is drawn from the strategic management and entrepreneurship literature. Competing models are tested against a sample of Canadian SMEs to validate the proposed explanation for the presence of high-growth firms among the population. The study finds that the relationship between EO and high growth is perfectly mediated by innovation performance, a behavioral measure of innovation. This research contributes to firm growth theory while providing further insight into the drivers of high growth useful to policy makers endeavoring to stimulate, and overcome barriers to, entrepreneurship and innovation. Determining the factors associated with firm growth can have implications for management as well as policy. If a firm’s goal is to grow it must be able to focus its limited resources using a strategy appropriate for growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

High-growth firms have a disproportionally large impact on the economy, as observed by Birch and Medoff (1994). Their research found that recently formed high-growth firms, or Gazelles, create most new jobs despite their rarity. The entrepreneurship literature cites high-growth firms as an important source of net new jobs and knowledge through research and development, innovation, and technology spill-over (e.g., Schreyer, 2000; OECD, 2007). For these reasons firm growth has long been considered an important topic in the economics, entrepreneurship, and strategic management literatures. Despite the apparent importance of high-growth firms to the economy, there has been little research to explain their origin. While there is an extensive body of literature on firm growth in general, few studies specifically explain the determinants of high-growth firms (Coad et al., 2014; Monteiro, 2019).

Penrose (1959) considered the growth capacity of a firm to be related to its internal resources as well as to the entrepreneurial capabilities of its managers. The early strategic management literature explores the concept of entrepreneurship from a content perspective, emphasizing the importance of what business to enter. The focus then shifts to how, taking a process perspective in analyzing the “methods, practices, and decision-making styles managers use to act entrepreneurially” (Lumpkin & Dess, 1996, p. 136). A firm may now be characterized as entrepreneurial if it “engages in product market innovation, undertakes somewhat risky ventures, and is first to come up with proactive innovations, beating competitors to the punch” (Miller, 1983, p. 771). Miller considers three key entrepreneurial processes—proactiveness, risk taking, and innovativeness—that comprise a firm’s entrepreneurial orientation (EO). The dimensions of EO are later linked to performance (Zahra, 1991; Zahra & Covin, 1995) although Lumpkin and Dess (1996) provided a framework for future studies and encourage researchers to investigate contingencies when explaining the relationship between EO and performance metrics, including growth.

The framework proposed by Lumpkin and Dess (1996) however may not adequately address the role of innovation. Although innovativeness is one dimension of the multi-dimensional EO construct, it “reflects a firm's tendency to engage in and support new ideas, novelty, experimentation, and creative processes that may result in new products, services, or technological processes” (p. 181; emphasis added). The key point is that this tendency may or may not result in actual innovation. In fact, I argue that proactiveness and risk taking are also desirable characteristics when it comes to the task of creating innovative new products, services, or processes. Baker and Sinkula (2009), using a sample of 88 small US firms, tested competing models of the direct and indirect effects of EO on firm profitability to find that innovation performance perfectly mediates this relationship.

Later studies indicate that entrepreneurially oriented firms meet the needs of customers and the market through innovation. Boso et al. (2012, 2013) examined the complimentary effects of entrepreneurial and market orientations on innovation performance. In their study of British exporters, they found that export new product performance could be improved through the combination of these firm orientations, particularly in a context of high levels of competitive intensity. The second study of Ghanaian exporters reinforced these findings, indicating the importance of EO on product innovation success. Aljanabi and Mohd Noor (2015) offered further support for the relationship between EO and innovation through their study of 249 SMEs in Iraq.

More recent research focuses on the interactions of strategic orientations with innovation and the subsequent effect on firm performance. In their study of SMEs in Turkey, Kocak et al. (2017) found that not only is EO directly related to performance, but it is medicated by both incremental and radical innovation. Arunachalam et al., 2018 had similar findings in a study of 190 Indian manufacturing firms, noting the pathway from EO to performance via innovation. Given the findings in the literature linking strategic orientation with firm performance, I propose that that a complete model of the relationship between EO and high-growth firms must include a measure of innovation performance.

This study investigates whether firms with a strong EO are more likely to experience high growth. I then determine whether innovation performance is in fact a key mediator of the effect of this strategic orientation on high growth. In additional, I gauge the impact of both internal resource availability and level of dynamism in the competitive environment. Using data collected from a survey of 251 small-to-medium enterprises, I categorized these firms according to the OECD (2008) definition of high growth as having achieved at least twenty percent average annual growth in sales or employment over the last three years of operation. Using a probit structural equation model, I tested the direct and indirect relationships between the hypothesized latent predictor variables and a dichotomous outcome variable indicating a high-growth firm.

Theory and hypotheses

The resource-based view would lead me to believe that high-growth firms must possess a unique combination of resources and capabilities that affords them a strategic competitive advantage over other firms in their industry. Bundles of resources and capabilities allow firms to react to opportunities and threats in their environment more effectively than their competitors (e.g., Barney, 1991; Conner & Prahalad, 1996; Lippman & Rumelt, 1982; Penrose, 1959; Peteraf, 1993; Wernerfelt, 1984). While the resource-based view has been criticized for being vague in explaining the mechanisms behind maintaining competitive advantage (Williamson, 1999), dynamic capabilities theory fills the gap by describing the processes and procedures that allow companies to operate efficiently in times of rapid change. According to the dynamic capabilities view, a firm relies on its ability to creatively redeploy existing resources and develop innovative products and services to meet evolving demands (Teece et al., 1997).

Strategic orientations are known to help build dynamic capabilities in organizations (Zhou & Li, 2010). Capabilities and competence-based theory explains how strategic orientations enable the firm to dynamically recombine and reconfigure resources within the organization to develop new capabilities, drive innovation, and achieve a sustainable competitive advantage which influences the firm’s performance and growth (e.g., Eisenhardt & Martin, 2000; Leonard-Barton, 1992; Teece et al., 1997). Strategic orientations and capabilities guide the firm’s interaction with the environment and its tendency to be entrepreneurial (Lumpkin & Dess, 1996). The contributions of Dess et al. (2003), Jantunen et al. (2005) and Ferreira et al., 2020 underscore the importance of dynamic capabilities development and EO as well as describe their relationship with performance.

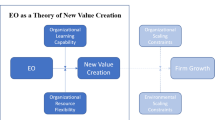

I propose a model of high-growth firms that includes the individual dimensions of the entrepreneurial strategic orientation described by Miller (1983) with innovation performance as a mediating factor. Considering the resource-based and dynamic capabilities views, I include the concepts of slack resources and environmental dynamism for a more complete model of high growth as they act to influence innovation and growth strategies. The next section explains each of these relationships in more detail. See conceptual model, Fig. 1.

Direct effects of entrepreneurial orientation

Before considering the hypothesized mediation effect, it is necessary to establish that a direct effect exists between the EO and the outcome variable high growth. Hitt et al. (2001) argued that EO, technological capabilities and financial resources are the main predictors of firm growth. It is reasonable to expect that a proactive strategic posture and innovativeness can create first mover advantages leading to increased sales, as found by Zahra and Covin (1995). While ongoing exposure to high levels of risk may be considered detrimental, risk taking is as important to firm performance as the other two dimensions of EO (Rauch et al., 2009).

Most prior research has studied the effect of EO on financial performance, which could include measures of profitability or growth. It is interesting to note however that in a meta-analysis of EO-performance studies, Rauch et al. (2009) found no significant difference between the magnitude of effect of EO on profitability and its effect on growth. They did note, however, that empirical results are mixed when reporting the relationship between EO and performance or growth. In a study of 285 SME’s, Neneh and Van (2017) however report that the proactiveness and innovativeness dimensions of EO had a positive effect on sales growth, while the risk-taking dimension was associated with employment growth. I therefore propose that the findings related to the effects of the dimensions of EO on financial performance provide support to the proposed hypotheses involving growth. By classifying firms as either high-growth or not, this research tests the following hypothesis:

Hypothesis 1

A high level of entrepreneurial orientation is positively associated with high growth in firms.

Innovation performance as a mediator

Product-market or technological innovation is a proactive process by which companies pursue entrepreneurial opportunities (Lumpkin & Dess, 1996) which, by definition, requires innovativeness and normally involves significant risk in terms of resource and financial commitment.

Barringer et al. (2005) suggested that firm growth is stimulated by both innovation and R&D. In an analysis of service firms, Cainelli et al. (2006) found that innovation has a positive influence on growth and productivity. In fact, the productivity enhancement acts as a self-reinforcing mechanism to encourage more innovation. Covin et al. (2000, 2001) and Manu and Sriram (1996) argued that innovation does not necessarily lead to growth or firm survival as the result depends on the type of innovation, marketing and financial aspects, and the timeframe. The lack of a clear relationship between innovation and growth may be since most empirical studies have developed models based on normally distributed growth rates. Coad and Rao (2008), using a quantile regression analysis of high-technology sector firms, found innovation to be critical to a small number of “superstar” fast-growth firms.

March (1991) explored the constructs of exploration and exploitation in the context of organizational learning and firm performance. March suggests that the right-hand tail of the performance distribution curve is determined how a firm manages knowledge, balancing exploration for new markets, ideas, or relations with the exploitation of existing ones. Building on this premise, Kollman and Stöckmann (2014) found that exploratory and exploitative innovation mediate the EO − performance relationship. They conclude that while EO measures entrepreneurial disposition which is critical for the success of the firm, innovation (both incremental and radical) is the mediating entrepreneurial behaviour that leads to improved performance, including sales growth.

I thereby build on prior empirical studies (e.g., Baker & Sinkula, 2009; Boso et al., 2012; Boso et al., 2013; Aljanabi & Modh Noor, 2015; Kocak et al., 2017; Arunachalam et al., 2018; Ferreira et al., 2020) to propose that innovation performance is a key mediator of EO as it represents the culmination of the efforts of the most entrepreneurial firms, as defined by their level of proactiveness, risk taking and innovativeness, as expressed in the following hypothesis:

Hypothesis 2

Innovation performance mediates the positive association between entrepreneurial orientation and high growth in firms.

Moderating effects

Wang (2008) acknowledged the importance of EO to the success of the firm with the caveat that examining its direct effect on performance may not give a complete picture. Regardless of the lack of consistent empirical evidence I maintain that EO, in combination with innovation performance and other organizational or environmental factors, has an important role in firm value creation.

Ahuja and Lampert (2001) discussed the possible existence of the “virtuous circle of corporate entrepreneurship” (p. 540) in which firms that pursue novel, innovative technologies create breakthrough inventions resulting in access to wealth and surplus, or slack, resources which in turn can be used to explore further innovation in the next cycle. This was thought to explain the large variance between firms with respect to innovation strategy and performance, and specifically high growth (Sheppard, 2020).

Ensley et al. (2006) examined the impact of environmental dynamism, the level of unpredictability or change in the competitive environment, on new venture performance. Their study finds that entrepreneurs benefit from transformation, rather than transactional, leadership in dynamic environments. Transformational leadership is operationalized in their study as a style that provides vision, encourages opportunity thinking, encourages teamwork, and challenges the status quo. I argue that this style of leadership and the associated behaviours would not only be associate with firm performance, but with innovation performance.

Lumpkin and Dess (1996) proposed a relationship between EO and performance measures, including growth, which is context-specific depending on environmental and organizational factors. With respect to overall firm strategy, both resource availability and the nature of the competitive environment influence the ability to translate strategic orientations (strategy process) into product/service innovation performance (strategy content) resulting in high growth.

Environmental dynamism, with rapid change in technologies and customer preferences combined with short product life cycles, would be more likely to lead to innovation performance than would environmental hostility. Calantone et al. (1997) in their survey of senior product development managers found that, although environmental hostility increases the impact of new product development proficiency, performance is contingent on a firm’s ability to adapt. Cassia and Minola (2012), in their study on the mediating role of environment, proposed that the “EO construct captures entrepreneurial behaviours of hyper-growth firms; high levels of EO, though, positively impact hyper-growth only in the context of hostile and dynamic environments”. They went on to suggest that “The extraordinary degree of access to resources is the main dimension which significantly distinguishes hyper-growth firms from other firms” (p.190) and this was later supported by empirical findings in Minola et al. (2017) as well as by Gaikwad (2022) in a systematic review of the literature on high-growth firms. This leads me to propose the following hypotheses:

Hypothesis 3a

The EO − innovation performance − high-growth relationship is stronger for firms with more slack resources.

Hypothesis 3b

The EO − innovation performance − high-growth relationship is stronger for firms in a more dynamic competitive environment.

Methods

Sample and data collection

A cross-sectional sample of Canadian companies was obtained from various industries in order that the results of the study may be generalized. The survey, using a structured questionnaire, allowed the exploration of the nature of the relationships between several latent or observed variables and growth in sales and employment. From a total of 1,665 responses, I selected 336 firms for use in this study based on the criterion of at least 10 employees at the beginning of the measurement period and up to 250 at the end. This was done to maintain compatibility with the OECD (2008) definition of high-growth and gazelle firms. The OECD proposes measuring the growth of SME’s (those firms having between 10 and 250 employees) over a three-year period. Firms with an average annual growth rate of at least 20 percent are considered high-growth firms, while gazelles were firms achieved these growth rates within five years of founding.

This dataset was cleansed of obvious data entry errors including the misinterpretation of the units requested for the dependent variables, that is annual percentage growth of sales and employment. I examined the remaining data for missing values for the key latent constructs. If a response contained no values for the items that comprise either the outcome or predictor variables, then it was eliminated from the final dataset. After cleansing, 251 firms remained in the dataset for analysis. Tables 1 and 2 summarize the sample characteristics.

Measures

The proposed model of high-growth firms comprises the individual dimensions of entrepreneurial orientation (EO) with innovation performance as a mediating factor. I include the concepts of slack resources and environmental dynamism for a more complete model of high growth as they act to influence innovation and growth strategies.

The dimensions of EO are normally operationalized as subjective, or attitudinal, measures. In this study, the dimensions of EO were measured using seven-point Likert scales while the innovation performance construct was derived from objective, though self-reported, scalar values. Basing the construct on measures of the firm’s commitment to innovation and its innovation performance—such as, the number of new or significantly improved products or services introduced onto the market during the last three calendar years—allowed me to model the effect of the entrepreneurial strategic postures of proactiveness, innovativeness, and risk taking on actual innovation outcomes.

Empirical studies normally measure growth on a continuum from negative, low to high (e.g., Audretsch, 2002; Covin et al., 2000, 2001; Lumpkin & Dess, 2001; Mata, 1994; Sarkar et al., 2001; Wagner, 1992; Walter et al., 2006). Coad (2022) notes the importance in recognizing discontinuities in firm growth, rather than viewing it as a smooth and continuous process. Also, standard regression models are used to capture the effect of independent variables on a normally distributed growth rate, however high-growth firms are outliers. It is these outliers that are of interest, rather than the average firm, which requires a non-standard statistical approach. Coad and Rao (2008) noted this methodological challenge in their study of the effect of innovation on firm growth, for which they employed quantile regression to model the heavy-tailed distribution. There are, however, disadvantages to these techniques including difficulties in interpretation. As a general model of firm growth cannot necessarily predict high growth, the use of a dichotomous, rather than continuous, outcome variable allowed me to use standard statistical techniques to model the relationships with predictor variables. The estimation methods are described in more detail later in this section. Table 3 summarized the names and definitions of those variables used in the study.

Model specification

I employed covariance-based structural equation modeling (SEM) techniques to test the hypotheses. SEM is suited for confirmatory studies such as this and requires a sound basis in theory as well as a relatively large sample size (Gefen et al., 2000). Complex relationships between multiple independent and dependent variables can be modeled simultaneously whereas multiple regression modeling would require numerous iterations to analyze all paths. SEM is also capable of combining the analysis of the measurement model with the structural model thereby eliminating the need to perform a separate factor analysis. The main point in its favor over individual regression models is that SEM can eliminate the effect of random measurement error on the analysis (Bollen, 1989).

In this study, Mplus (Muthén & Muthén, 1998) was used to simultaneously test the measurement and structural models. Overall fit was evaluated based on guidelines (e.g., Hu & Bentler, 1999) that specify the model should have a non-significant chi-square statistic, CFI ≥ 0.96, TLI ≥ 0.95, RMSEA ≤ 0.05 and WRMR ≤ 1.0. Nested models were compared using the Mplus DIFFTEST command, a robust chi-square difference test with mean and variance adjusted statistics (Asparouhov & Muthén, 2006).

Measurement model

I adapted the scales from prior studies, except for that comprising the innovation performance construct; therefore, a confirmatory rather than exploratory approach was appropriate when determining validity and reliability. Confirmatory factor analysis (CFA) is used to study the relationships between observed values and latent constructs that comprise the measurement model portion of a structural equation model (Bollen, 2002). The dependent variables in the measurement model are referred to as factor items while the reflective latent variables are the factors. The items are dependent variables as they are caused by the factors. Bollen (2002) described the measurement model as the relationship between the factors and items as a series of linear regression equations. The measurement model in this study consists of eighteen items comprising six factors—innovativeness, proactiveness, risk taking, innovation performance, slack resources, and environmental dynamism—and the outcome variable, high growth. See Table 4 for descriptive statistics of the items.

The next step involved analyzing the item loadings to determine if they were in fact good indicators of the latent factors. There does not seem to be an agreed-upon standard cutoff value however Hair et al. (1998) considered loadings above 0.6 to be high and loadings below 0.4 low. The environmental dynamism and slack resources factors had items with loadings below 0.4 that were dropped. I retained all other items in the model as they were significant with loading greater than 0.4 and each was theoretically relevant to the construct.

After I eliminated low loading items (though all items were significant) from the measurement model, I then calculated several metrics to determine internal consistency. Factors are considered to have convergent validity, or reliability, with a construct (composite) reliability score of 0.7 or more (Nunnally, 1978). An AVE score of greater than 0.5 implies that measurement error associated with the construct is outweighed by the variance extracted through its indicators (Fornell & Larcker, 1981). I used both factor loading and the factor-level metrics to determine whether an item or factor should be included in the measurement model. The results of the reliability analysis are summarized in Table 5.

I tested discriminant validity of the latent constructs in the measurement model by comparing the average variance extracted (AVE) with the square of the correlation with other factors, as suggested by Gefen et al. (2000). A correlation between two constructs that exceeds the AVE of either construct indicates poor discriminant validity. All latent variables displayed sufficient discriminant validity to justify inclusion in the measurement model. Relatively low loading on some items in the innovation performance and environmental dynamism factors resulted in correspondingly low AVE ratios. Though this may point to potential multicollinearity problems between the factors, there is no reason to suspect that these constructs would be measuring the same thing. In fact, more recent evidence indicates that AVE cannot in fact detect model misspecification (Evermann & Tate, 2010) while fit and modification indices can be used to analyze discriminant validity of the overall model. See Table 6 for a summary of the validity analysis.

A further test was recommended by Muthén and Muthén (1998) to address this issue. This involved running a chi-square difference test of the factor model against another version of the model with the correlations between pairs of latent variables fixed to a value of one. This test compares the chi-square values and degrees of freedom of the two models to determine if there is a significant difference. If no difference is found one can assume that the paired constructs are equivalent. The result in this case (a p-value of 0.000 for the chi-square difference) however was a significant difference between the unconstrained and constrained models indicating that the measurement model demonstrates discriminant validity.

Modeling a dichotomous outcome variable

The measure of high growth is associated with a methodological challenge however, as it corresponds to a relatively rare occurrence in the population. By examining high-growth firms I are investigating the outliers of a normal distribution of growth rates in the overall population of firms. The aim of statistical modeling techniques is to demonstrate general relationships rather than idiosyncratic ones. Significant problems can occur when attempting to fit models for non-normal distributions using maximum likelihood (ML) estimation. The approach taken by this study therefore was to collapse the continuous measure of growth into the dichotomous variable high growth whereby a firm is either high-growth or not according to OECD (2008) thus mitigating the issues normally associated with modeling outliers. The Mplus program (Muthén & Muthén, 1998) implements robust weighted least squares estimation (WLSMV) which provides unbiased parameter estimates for models of non-normal distributions of ordered categorical or dichotomous variables. WLSMV estimation corrects for inconsistency and bias in models involving non-normal data and polychoric correlations, as is the case when dichotomous or categorical variables are involved (Flora & Curran, 2004). WLSMV produces more reliable estimation of fit for models with dichotomous variables as compared to ML (Muthén & Satorra, 1995).

Structural models

Having confirmed the reliability and validity of the measurement model, as described in the previous section, the structural models could now be assessed. I approached this in a stepwise manner beginning with a model of the direct relationship between EO and high growth. Next, I examined the mediation effect of innovation performance by comparing a nested model in which the direct path from EO was constrained to zero to a model in which direct and indirect paths were allowed to vary freely. Finally, I fit the mediation model with samples split on low versus high levels of both environmental dynamism and slack resources to determine their respective moderating effects on the EO − innovation performance − high-growth relationship.

Results

The results of the analysis indicate support for a direct relationship between entrepreneurial orientation and high growth in firms, as well as an indirect relationship mediated by innovation performance. Neither environmental dynamism nor slack resources appear to have a moderating effect on this relationship. Addition tests for common method variance and random variance implied no reliability issues. See Table 7 for model fit and comparison statistics.

Direct effects

Using the latent predictor variable EO defined in the measurement model, I examined the direct relationships between entrepreneurial orientation and high growth. The direct effects model had a non-significant chi-square statistic, thereby rejecting the null hypothesis that it is the same as the baseline model, a model in which all the structural paths are assumed to be zero. Values for RMSEA, CFI, TLI, and WRMR were all within the cutoff limits recommended for the sample size by Hu and Bentler (1999). The model demonstrated significant positive relationships on the path between EO and high growth. I therefore accepted Hypothesis 1, concluding that a high level of entrepreneurial orientation is positively associated with high growth in firms.

Mediation

Given the evidence of a direct relationship between EO and high growth, I proceed to test the mediating effect of innovation performance using parameter-nested models of perfect and partial mediation as described by Baron and Kenny (1986). Both the direct and indirect paths between EO and high growth were free to vary in the partial mediation model (2F). The nested perfect mediation model (2C) had the parameter estimate constrained to zero for the direct path between EO and high growth, while the indirect path via innovation performance was free to vary. The Asparouhov and Muthén (2006) test then allowed me to compare the mean and variance adjusted chi-square difference between the nested models. I found no significant difference between the models, indicating that the partial mediation model offered no improvement in fit over the more parsimonious perfect mediation model with fewer parameters.

The mediation model had a non-significant chi-square statistic, thereby rejecting the null hypothesis that it is the same as the baseline model. Values for RMSEA, CFI, TLI, and WRMR were all within the cutoff limits recommended for the sample size by Hu and Bentler (1999). The model demonstrated significant positive relationships on the paths between EO, innovation performance and high growth. I therefore accepted Hypotheses 2, concluding that innovation performance mediates the positive association between entrepreneurial orientation and high growth in firms.

Moderation

Fitting the mediation model (2C) with the sample split into two groups according to level of environmental dynamism (ED) allowed me to test the moderating effect of ED on the relationships between EO and high growth. Using the MODEL TEST command described in Muthén and Muthén (1998), I examined the effects on parameter estimates and model fit of low and high levels of ED.

As this test does not involve nested models, I could not directly compare the fit statistics with those of the final model tested against the entire sample. Instead, I compared the degree of fit of the model between the low ED and high ED groups using the Wald test of parameter constraints (Muthén & Muthén, 1998). This involved constraining the hypothesized paths between factors to be equal between groups, while simultaneously fitting the model across the two groups. This model demonstrated good fit with the data, however the chi-square between-group difference of 2.04 (2 df) was not significant therefore I could not reject the null hypothesis that the paths were equal across the two groups.

The same test was performed with the sample split into two groups according to level of slack resources (SR) to test the moderating effect of SR on the relationships between EO and high growth. This test demonstrated marginally poor model fit as indicators fell slightly below the recommended cutoff limits. The chi-square between-group difference of 1.96 (2 df) was not significant.

The results of the moderation tests were therefore inconclusive and did not provide support for Hypothesis 3a or 3b.

Reliability

Common-method variance

This study implemented remedies for common-method variance to the extent that it was practical and did not interfere with the goals of the research. Podsakoff et al. (2003) proposed several strategies to reduce potential bias whereby the appropriate method is determined by: (1) whether predictor and criterion values come from different sources; (2) if these values can be measured in different contexts; (3) whether method bias sources can be identified; and (4) if these biases can be measured. The design limitations of this research narrow the choice of remedies to the use of a single common-method factor. Podsakoff explains that this method is a more conclusive test of common-method variance than Harman’s one-factor test. It involves the creation of a single latent method factor with all indicator variables loading onto it equally. Including this factor in the model controls for any systematic variance associated with the method (Podsakoff et al., 2003;). It does not however identify the cause of the method bias, nor does it capture possible interactions between the method factor and other constructs in the model (Bagozzi et al., 1991).

A method factor was added to the model used to test hypotheses 2 and 3 onto which the indicators for all factors were double loaded. The method factor was regressed on high growth in the full model (3F), while the nested model (3C) had the parameter estimates for this path’s constrained to zero. Using a chi-square difference test, as described by Satorra and Bentler (2001), I did not find any improvement in fit for full model. All paths that were significant in the original model remained significant, with similar estimated weights and directions. This indicates that inclusion of the method factor did not add explanatory power; therefore common-method variance appears to have had no significant impact in this study.

Random variance

A random split of the sample into two equal groups allowed me to do further invariance testing of parameter estimates. The model demonstrated a high degree of fit, all paths remained significant for both sub-samples, and the Wald test of parameter constraints indicated no difference in parameter estimates between groups as expected.

Discussion

The test of the direct effects model showed the latent predictor variable representing level of entrepreneurial orientation (EO) to have a direct positive relationship with high growth, in support of Hypothesis 1. This provides further evidence to complement the Rauch et al. (2009) meta-analysis of the positive effects of EO on firm performance in general. Given that the dependent variable in this study is a measure of either high growth in terms of sales or employment, it also provides further support to Neneh and Van (2017) assertion that the individual dimensions of EO affect both sales and employment growth.

Finding a significant relationship between EO and high growth was a prerequisite condition for mediation testing and later moderation tests. Results of the analysis of the nested mediation models (2F and 2C) suggest that innovation performance is in fact a mediator of the effect of EO on high growth, in support of Hypothesis 2. This relationship meets the criteria for perfect mediation as described by Baron and Kenny (1986) given that the introduction of innovation performance as a mediator caused the direct path from EO to become non-significant. Random variance and common method bias tests further supported the reliability of this model. This result builds on the work of Arunachalam et al., 2018 in confirming the mediating role of innovation. It is important, however, to consider the possibility that EO may also modify the relationship between innovation and performance, or growth, as observed by Ferreira et al., 2020.

The mediation model was used as the basis for testing the moderating effect of the levels of environmental dynamism (ED) and slack resources (SR) on the relationship between EO and high growth in firms, for which no effect was found. This was a somewhat surprising outcome, particularly in the case of ED, given the role of dynamic capabilities that would allow companies to reconfigure existing resources, including slack, in response to the evolving demands of a dynamic environment (Teece et al., 1997). Correspondingly, Zhang et al. (2020) noted the relationship between network ties and innovation performance, as mediated by EO, were stronger in more dynamic environments. The sub-samples split on ED, however, demonstrated somewhat higher levels of fit when compared with sub-samples split at random as well as a high level of overall fit (Chi-P = 0.35, CFI = 0.99, TLI = 0.99, RMSEA = 0.02, and WRMR = 0.69). This test was later performed on subsamples by industry, or according to whether the firm derived more sales from products or services, however the results were inconclusive due to the reduced sample size. Although the results do not provide direct support for hypothesis 3b, I would recommend further research on the effects of environmental dynamism on innovation performance and high growth.

Conclusions

The purpose of this study was to establish and test an empirical model of the antecedents of high-growth firms based on theory of the firm, sustainable competitive advantage, strategic orientations, and dynamic capabilities literatures.

Using structural equation modeling (SEM), I examined the relationships between entrepreneurial orientation (EO) and the dichotomous outcome variable high growth. A high-growth firm was defined as having greater than 20% annual growth in sales or employment over a period of three years. The data showed that the hypothesized predictor variable was positively associated with high-growth firms. The study highlights the importance of innovation performance with the observation that it acts as a mediator for the positive effects of EO on high growth. Availability of slack resources appears not to affect this relationship. I believe, however, that the impact of environmental dynamism calls for further empirical validation.

The results imply that high-growth firms tend to be more innovative and adopt a proactive and risk-taking strategic posture, as measured by their level of EO. Whereas innovativeness is a key characteristic of these firms, this dimension may not be an accurate measure of firm behavior with respect to innovation, though it would seem to be related. A unique contribution of this study is therefore to propose that innovation performance in fact mediates the positive relationship between EO and high growth in firms. Although the qualities associated with these strategic orientations are associated with entrepreneurial ideation as well as opportunity identification and exploitation (Covin & Slevin, 1989), they would not necessarily lead directly to firm growth. I maintain however that an EO contributes to a firm’s ability to create innovative products or services which, in turn, drive its engine of growth.

Implications for practice and theory

Determining the factors associated with firm growth can have implications for management as well as policy. Strategic management involves making changes to critical aspects of the business that affect its future growth and profitability (Ansoff, 1985). If a firm’s goal is to grow it must be able to focus its limited resources using a strategy appropriate for growth. High-growth entrepreneurship is recently viewed as the key to future economic success in Canada. This paper provides an explanation for the drivers of high growth which would be useful to policy makers attempting to stimulate, and overcome barriers to, entrepreneurship and innovation.

It is important to note, however, that growth in sales or employment does not guarantee the success or stability of the firm in the long term. Growth in sales does not necessarily imply profitability, nor does an increase in the number of employees. In addition, the perceived value of each of these measures of firm growth varies according to the stakeholder. While increased employment may be a valid goal for policymakers, increased sales and profitability may be the primary motivation of the entrepreneur.

This study contributes to the entrepreneurship and strategic management literature by continuing the exploration of the relationship between strategic orientations, innovation performance, and growth. Although these findings make an incremental contribution to the literature, particularly with respect to the focus on high growth SMEs, they should be interpreted as tentative considering the limitations of the study.

Limitations and future research

While it is hoped that this study makes a useful contribution to entrepreneurship and strategic management theory and practice, I acknowledge its limitations. Selection bias must be considered in that firms with fewer than ten employees at the start of the measurement period were eliminated to be compatible with the OECD (2008) study of firm growth. The sample does not reflect the entire population of Canadian SME’s, perhaps under-representing the smaller service-based firms, thereby limiting its generalizability. The use of a single method to gather the data, for both independent and dependent variables, may also have contributed to bias in the results however this was not found to be an issue in the common method variance (CMV) test. CMV has the potential to profoundly skew the results of non-experimental studies (Williams et al., 2010) and should be addressed a priori, if possible, but it may be controlled for post hoc. The latter approach was taken for this study in which I found no evidence of CMV. It may however be important for future research to investigate a priori methods of reducing CMV to add further validity to empirical studies of this type.

In addition to the potential biases associated with data gathering, there are some issues surrounding the measurement of the dependent variable that may have an impact on the generalizability of this research. A study by Shepherd and Wiklund (2008) found that the various measures of firm growth (sales, employment, profitability, assets, and equity) are not necessarily correlated. Further complication is introduced when comparing relative with absolute measures, and growth over different time periods. In this study, a firm is a high-growth firm if it has experienced at least a 20% annualized increase in sales or employment over a three-year period, as per the OECD (2008) definition. These two relative measures of growth, according to Shepherd and Wiklund’s findings, have a moderate correlation (0.336) for a one-year time span. Not all combination of measures and time periods were compared, however based on the one-year findings, it is likely that there is at least moderate correlation between relative employment and sales growth over a three-year period. It may however be beneficial to perform separate analyses on firms categorized as high growth by virtue of employment or sales.

Future research is required to attempt to replicate these results, perhaps in a different population using multiple methods, as well as to explore additional drivers that may provide a more complete explanation for the phenomenon of high-growth firms. In addition, a longitudinal study could be performed on growth outcomes over time to establish causal direction. For example, it is important to determine whether innovation performance causes high growth, or if it is a result of re-investment after a period of intense growth and profitability, or perhaps increased availability of slack resources to devote to R&D.

References

Ahuja, G., & Lampert, C. M. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6–7), 521–543.

Aljanabi, A. R. A., & Mohd Noor, N. A. (2015). The mediating role of market orientation on entrepreneurial orientation, absorptive capacity and technological innovation capabilities. Asian Social Science, 11(5), 219–234.

Ansoff, H. I. (1985). Conceptual underpinnings of systematic strategic management. European Journal of Operational Research, 19(1), 2–19.

Arunachalam, S., Ramaswami, S. N., Herrmann, P., & Walker, D. (2018). Innovation pathway to profitability: The role of entrepreneurial orientation and marketing capabilities. Journal of the Academy of Marketing Science, 46(4), 744–766.

Asparouhov, T., Muthén, B., & Muthén, B. O. (2006). Robust chi square difference testing with mean and variance adjusted test statistics. Matrix, 1(5), 1–6.

Atuahene-Gima, K., Slater, S. F., & Olson, E. M. (2005). The contingent value of responsive and proactive market orientations for new product program performance. Journal of Product Innovation Management, 22(6), 464–482.

Audretsch, D. B. (2002). The dynamic role of small firms: Evidence from the US. Small Business Economics, 18(1–3), 13–40.

Bagozzi, R. P., Yi, Y., & Phillips, L. W. (1991). Assessing construct validity in organizational research. Administrative Science Quarterly, 421–458.

Baker, W. E., & Sinkula, J. M. (2009). The complementary effects of market orientation and entrepreneurial orientation on profitability in small businesses. Journal of Small Business Management, 47(4), 443–464.

Barringer, B. R., Jones, F. F., & Neubaum, D. O. (2005). A quantitative content analysis of the characteristics of rapid-growth firms and their founders. Journal of Business Venturing, 20(5), 663–687.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182.

Boso, N., Cadogan, J. W., & Story, V. M. (2012). Complementary effect of entrepreneurial and market orientations on export new product success under differing levels of competitive intensity and financial capital. International Business Review, 21(4), 667–681.

Boso, N., Cadogan, J. W., & Story, V. M. (2013). Entrepreneurial orientation and market orientation as drivers of product innovation performance: A study of exporters from a developing economy. International Small Business Journal, 31(1), 57–81.

Birch, D., & Medoff, J. (1994). Gazelles. Westview Press.

Bollen, K. (2002). Latent variables in psychology and the social sciences. Annual Review of Psychology, 53, 605–634.

Bollen, K. A. (1989). Structural equations with latent variables. Wiley.

Cainelli, G., Evangelista, R., & Savona, M. (2006). Innovation and economic performance in services: A firm-level analysis. Cambridge Journal of Economics, 30(3), 435–458.

Calantone, R. J., Schmidt, J. B., & Di Benedetto, C. A. (1997). New product activities and performance: The moderating role of environmental hostility. Journal of Product Innovation Management, 14(3), 179–189.

Cassia, L., & Minola, T. (2012). Hyper-growth of SMEs: Toward a reconciliation of entrepreneurial orientation and strategic resources. International Journal of Entrepreneurial Behaviour & Research, 18(2), 179–197.

Coad, A. (2022). Lumps, Bumps and Jumps in the Firm Growth Process. Foundations and Trends in Entrepreneurship, 18(4), 212–267.

Coad, A., Daunfeldt, S. O., Hölzl, W., Johansson, D., & Nightingale, P. (2014). High-growth firms: Introduction to the special section. Industrial and Corporate Change, 23(1), 91–112.

Coad, A., & Rao, R. (2008). Innovation and Firm Growth in High-Tech Sectors: A quantile regression approach. Research Policy, 37(4), 633–648.

Conner, K. R., & Prahalad, C. K. (1996). A resource-based theory of the firm: Knowledge versus opportunism. Organization Science, 7(5), 477–501.

Covin, J. G., & Slevin, D. P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75–87.

Covin, J. G., Slevin, D. P., & Heeley, M. B. (2000). Pioneers and Followers: Competitive Tactics, Environment, and Firm Growth. Journal of Business Venturing, 15(2), 175–210.

Covin, J. G., Slevin, D. P., & Heeley, M. B. (2001). Strategic decision making in an intuitive vs. technocratic mode: Structural and environmental considerations. Journal of Business Research, 52(1), 51–67.

Dess, G., Ireland, R., Zahra, S., Janney, J., & Floyd, S. (2003). Emerging issues in corporate entrepreneurship. Journal of Management, 29(3), 351–378.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121.

Ensley, M. D., Pearce, C. L., & Hmieleski, K. M. (2006). The moderating effect of environmental dynamism on the relationship between entrepreneur leadership behavior and new venture performance. Journal of Business Venturing, 21(2), 243–263.

Evermann, J., & Tate, M. (2010). Testing models or fitting models? Identifying Model Misspecification in PLS. ICIS 2010.

Ferreira, J., Coelho, A., & Moutinho, L. (2020). Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation, 92, 102061.

Flora, D. B., & Curran, P. J. (2004). An empirical evaluation of alternative methods of estimation for confirmatory factor analysis with ordinal data. Psychological Methods, 9(4), 466.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Gaikwad, P. (2022). Catching Up with Gazelles: A systematic literature review of high growth antecedents. The Promises and Properties of Rapidly Growing Companies: Gazelles, 7–38.

Gefen, D., Straub, D., & Boudreau, M. (2000). Structural equation modelling and regression: Guidelines for research practice. Communications of the Association for Information Systems, 4(7), 1–78.

Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate Data Analysis. Prentice Hall.

Hitt, M. A., Ireland, R. D., Camp, S. M., & Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strategic Management Journal, 22(6–7), 479–491.

Hu, L., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1–55.

Jantunen, A., Puumalainen, S., Saarenketo, S., & Kyläheiko, K. (2005). Entrepreneurial orientation, dynamic capabilities, and international performance. Journal of International Entrepreneurship, 3(3), 222–243.

Kocak, A., Carsrud, A., & Oflazoglu, S. (2017). Market, entrepreneurial, and technology orientations: impact on innovation and firm performance. Management Decision.

Kollmann, T., & Stöckmann, C. (2014). Filling the entrepreneurial orientation–performance gap: The mediating effects of exploratory and exploitative innovations. Entrepreneurship Theory and Practice.

Leonard-Barton, D. (1992). Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(S1), 111–125.

Lippman, S., & Rumelt, R. (1982). Uncertain Imiitability - an analysis of Interfirm Differences in Efficiency under Competition. Bell Journal of Economics, 13(2), 418–438.

Lumpkin, G., & Dess, G. (1996). Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance. Academy of Management Review, 21(1), 135–172.

Lumpkin, G. T., & Dess, G. G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of Business Venturing, 16(5), 429–451.

Manu, F. A., & Sriram, V. (1996). Innovation, marketing strategy, environment, and performance. Journal of Business Research, 35(1), 79–91.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87.

Mata, J. (1994). Firm growth during infancy. Small Business Economics, 6(1), 27–39.

Miller, D. (1983). The correlates of entrepreneurship in three types of firms. Management Science, 29, 770–791.

Minola, T., Cogliati, G. M., Cassia, L., & Paleari, S. (2017). Are hyper-growth firms inherently different? Preliminary evidence from a sample of fast-growing European SMEs. International Journal of Entrepreneurial Venturing, 9(2), 122–159.

Monteiro, G. F. A. (2019). High-growth firms and scale-ups: A review and research agenda. RAUSP Management Journal, 54, 96–111.

Muthen, B. O., & Satorra, A. (1995). Complex sample data in structural equation modeling. Sociological Methodology, 25, 267–316.

Muthén, L. K., & Muthén, B. O. (1998). Mplus User’s Guide Seventh Edition, Muthén & Muthén, Los Angeles, CA.

Neneh, B. N., & Van, Z. J. (2017). Entrepreneurial orientation and its impact on firm growth amongst SMEs in South Africa. Problems and Perspectives in Management, 15(3), 166–178.

Nunnally, J. (1978). Psychometric Theory. McGraw-Hill.

OECD. (2007). High-growth SMEs, Innovation, Intellectual Assets and Value Creation: Literature Review. OECD, Paris.

OECD. (2008). Measuring Entrepreneurship: A digest of indicators. OECD.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879.

Penrose, E. (1959). The Theory of the Growth of the Firm, in. Blackwell.

Peteraf, M. (1993). The cornerstones of competitive advantage: A resource-based view. Strategic Management Journal, 14(3), 179–191.

Rauch, A., Wiklund, J., Lumpkin, G., & Frese, M. (2009). Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrepreneurship Theory and Practice, 33(3), 761–787.

Sarkar, M. B., Echambadi, R. A. J., & Harrison, J. S. (2001). Alliance entrepreneurship and firm market performance. Strategic Management Journal, 22(6–7), 701–711.

Satorra, A., & Bentler, P. M. (2001). A scaled difference chi-square test statistic for moment structure analysis. Psychometrika, 66(4), 507–514.

Schreyer, P. (2000). High-Growth Firms and Employment. OECD Science, Technology and Industry Working Papers. OECD Publishing.

Shepherd, D., & Wiklund, J. (2008). Are we comparing apples with apples or apples with oranges? Appropriateness of knowledge accumulation across growth studies. Entrepreneurship: Theory and Practice, 33(1), 105–123.

Sheppard, M. (2020). The relationship between discretionary slack and growth in small firms. International Entrepreneurship and Management Journal, 16(1), 195–219.

Siguaw, J. A., Simpson, P. M., & Enz, C. A. (2006). Conceptualizing innovation orientation: A framework for study and integration of innovation research. Journal of Product Innovation Management, 23(6), 556–574.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Wagner, J. (1992). Firm Size, Firm Growth, and Persistence of Chance - Testing Gibrats Law with Establishment Data from Lower Saxony, 1978–1989. Small Business Economics, 4(2), 125–131.

Walter, A., Auer, M., & Ritter, T. (2006). The impact of network capabilities and entrepreneurial orientation on university spin-off performance. Journal of Business Venturing, 21(4), 541–567.

Wang, C. L. (2008). Entrepreneurial Orientation, Learning Orientation, and Firm Performance. Entrepreneurship Theory and Practice, 32(4), 635–657.

Wernerfelt, B. (1984). A Resource-based View of the Firm. Strategic Management Journal, 5(2), 171–180.

Williams, L. J., Hartman, N., & Cavazotte, F. (2010). Method variance and marker variables: A Review and Comprehensive CFA Marker Technique. Organizational Research Methods, 13(3), 477–514.

Williamson, O. (1999). Strategy research: Governance and competence perspectives. Strategic Management Journal, 20(12), 1087–1108.

Zahra, S. A. (1991). Predictors and financial outcomes of corporate entrepreneurship: An exploratory study. Journal of Business Venturing, 6(4), 259–285.

Zahra, S. A., & Covin, J. G. (1995). Contextual Influences on the Corporate Entrepreneurship Performance Relationship – a Longitudinal Analysis. Journal of Business Venturing, 10(1), 43–58.

Zhang, J. A., O’Kane, C., & Chen, G. (2020). Business ties, political ties, and innovation performance in Chinese industrial firms: The role of entrepreneurial orientation and environmental dynamism. Journal of Business Research, 121, 254–267.

Zhou, K. Z., & Li, C. B. (2010). How strategic orientations influence the building of dynamic capability in emerging economies. Journal of Business Research, 63(3), 224–231.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sheppard, M. The behavioural gap between entrepreneurial SME’s and high growth: evidence from Canada. Int Entrep Manag J 19, 427–449 (2023). https://doi.org/10.1007/s11365-023-00832-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-023-00832-x